Shareholder Report

|

6 Months Ended |

|

Mar. 31, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

| Document Type |

N-CSRS

|

| Amendment Flag |

false

|

| Registrant Name |

Perpetual Americas Funds Trust

|

| Entity Central Index Key |

0001830437

|

| Entity Investment Company Type |

N-1A

|

| Document Period End Date |

Mar. 31, 2025

|

| C000224746 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

JOHCM Emerging Markets Opportunities Fund

|

| Class Name |

Advisor Shares

|

| Trading Symbol |

JOEIX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the JOHCM Emerging Markets Opportunities Fund (the “Fund”) for the period of October 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at connect.rightprospectus.com/JOHCM/. You can also request this information by contacting us at 866-260-9549 (toll free) or 312-557-5913.

|

| Additional Information Phone Number |

866-260-9549 (toll free) or 312-557-5913

|

| Additional Information Website |

connect.rightprospectus.com/JOHCM/

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Cost of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

JOHCM Emerging Markets Opportunities Fund

(Advisor Shares) |

$56 |

1.13% |

|

| Expenses Paid, Amount |

$ 56

|

| Expense Ratio, Percent |

1.13%

|

| Net Assets |

$ 1,117,286,730

|

| Holdings Count | Holding |

58

|

| Investment Company Portfolio Turnover |

9.28%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets |

$1,117,286,730 |

| Total number of portfolio holdings |

58 |

| Portfolio turnover rate as of the end of the reporting period |

9.28% |

|

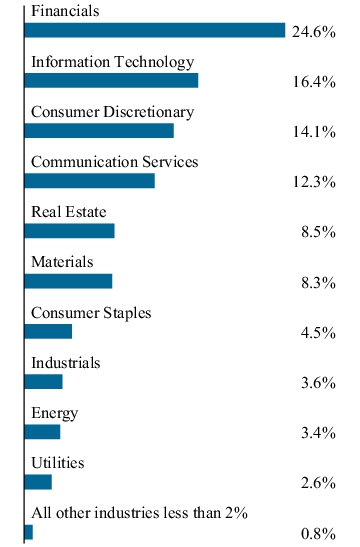

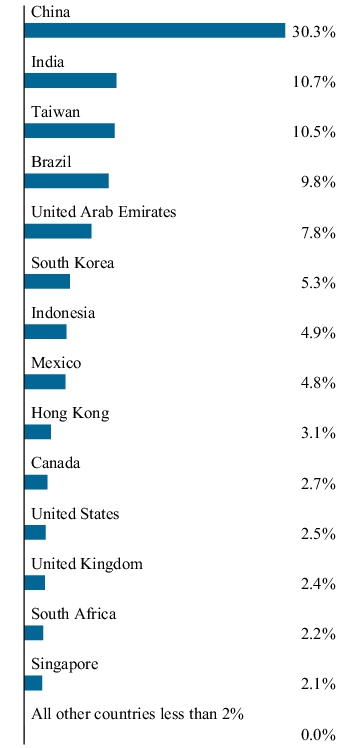

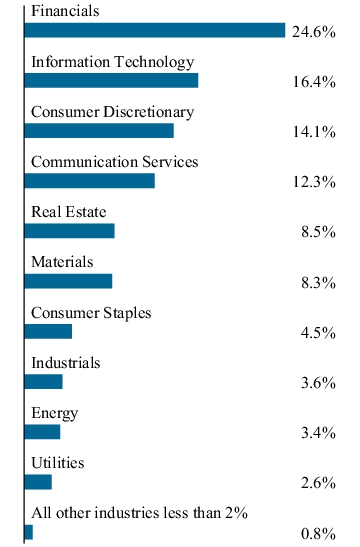

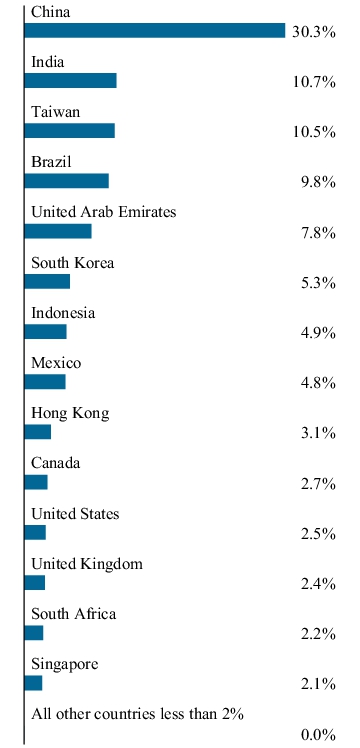

| Holdings [Text Block] |

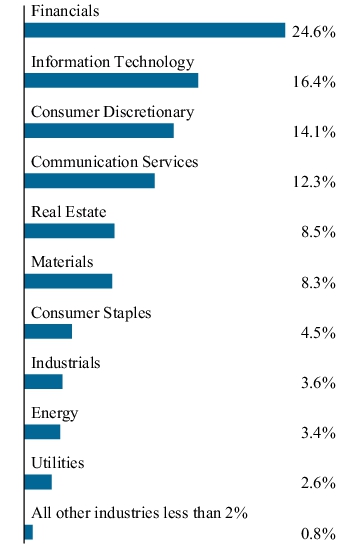

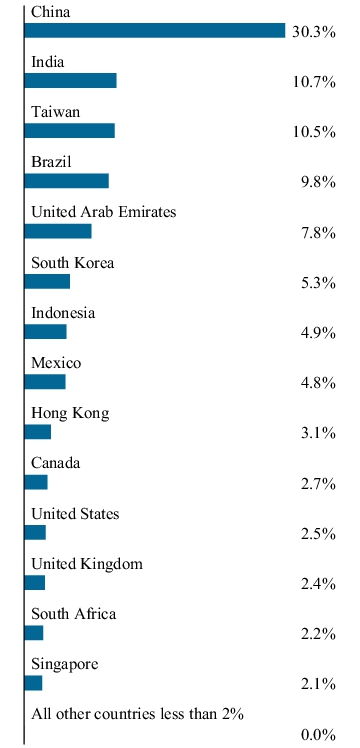

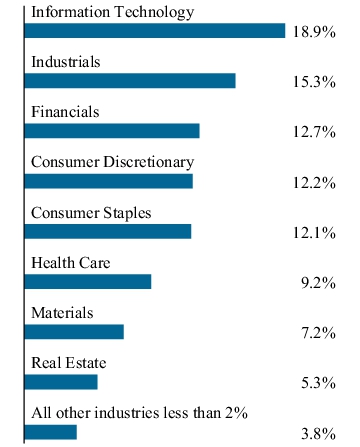

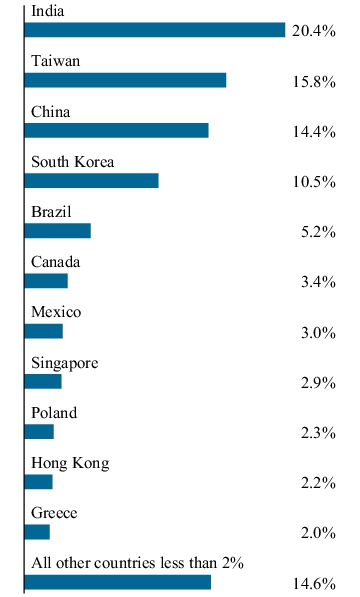

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, excluding short-term investments, represented as a percentage of the total net assets of the Fund.

TOP TEN HOLDINGS

| Tencent Holdings Ltd. |

9.2% |

| Taiwan Semiconductor Manufacturing Co. Ltd. |

7.6% |

| Meituan - Class B |

4.9% |

| Emaar Properties PJSC |

4.1% |

| Trip.com Group Ltd. |

4.0% |

| Hong Kong Exchanges & Clearing Ltd. |

3.1% |

| Itau Unibanco Holding S.A. - ADR |

2.9% |

| HDFC Bank Ltd. - ADR |

2.8% |

| Aldar Properties PJSC |

2.8% |

| Barrick Gold Corp. |

2.7% |

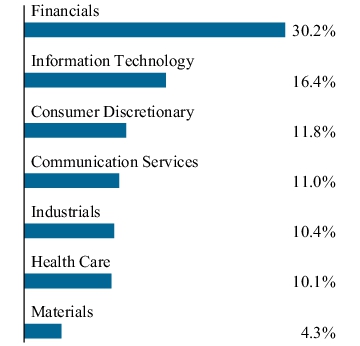

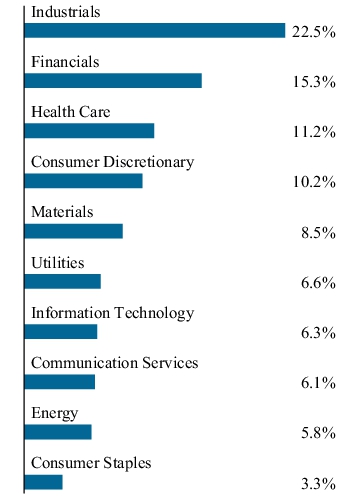

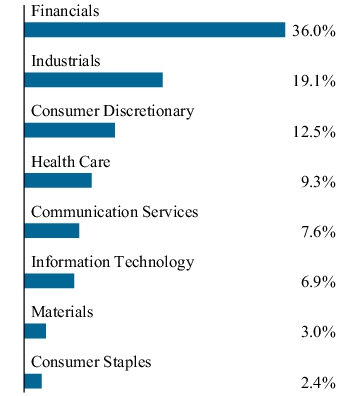

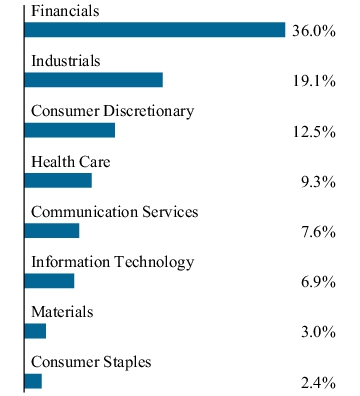

SECTOR ALLOCATION

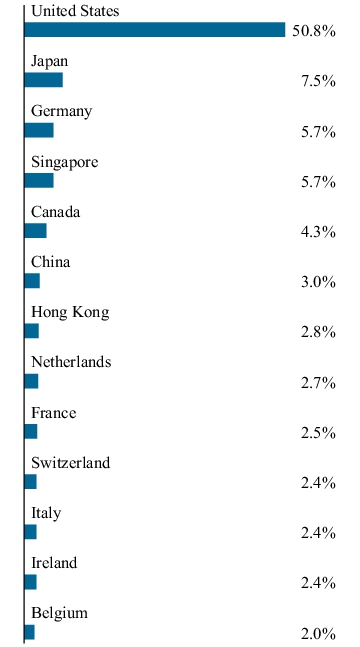

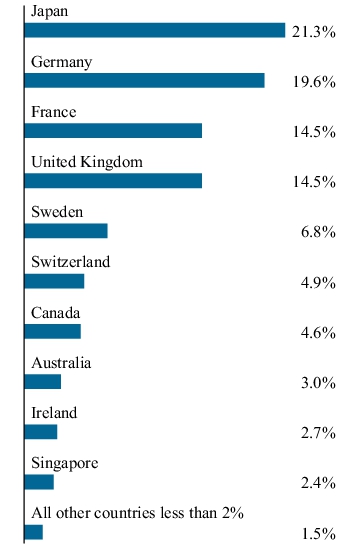

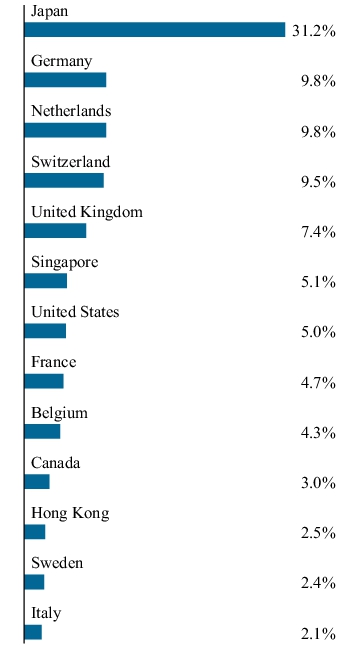

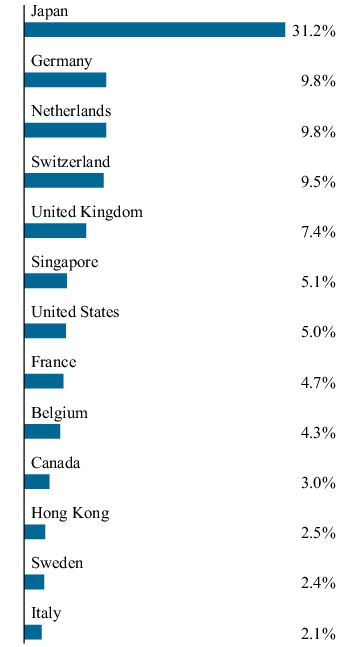

GEOGRAPHICAL ALLOCATION

|

| Largest Holdings [Text Block] |

TOP TEN HOLDINGS

| Tencent Holdings Ltd. |

9.2% |

| Taiwan Semiconductor Manufacturing Co. Ltd. |

7.6% |

| Meituan - Class B |

4.9% |

| Emaar Properties PJSC |

4.1% |

| Trip.com Group Ltd. |

4.0% |

| Hong Kong Exchanges & Clearing Ltd. |

3.1% |

| Itau Unibanco Holding S.A. - ADR |

2.9% |

| HDFC Bank Ltd. - ADR |

2.8% |

| Aldar Properties PJSC |

2.8% |

| Barrick Gold Corp. |

2.7% |

|

| C000224744 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

JOHCM Emerging Markets Opportunities Fund

|

| Class Name |

Institutional Shares

|

| Trading Symbol |

JOEMX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the JOHCM Emerging Markets Opportunities Fund (the “Fund”) for the period of October 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at connect.rightprospectus.com/JOHCM/. You can also request this information by contacting us at 866-260-9549 (toll free) or 312-557-5913.

|

| Additional Information Phone Number |

866-260-9549 (toll free) or 312-557-5913

|

| Additional Information Website |

connect.rightprospectus.com/JOHCM/

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Cost of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

JOHCM Emerging Markets Opportunities Fund

(Institutional Shares) |

$51 |

1.04% |

|

| Expenses Paid, Amount |

$ 51

|

| Expense Ratio, Percent |

1.04%

|

| Net Assets |

$ 1,117,286,730

|

| Holdings Count | Holding |

58

|

| Investment Company Portfolio Turnover |

9.28%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets |

$1,117,286,730 |

| Total number of portfolio holdings |

58 |

| Portfolio turnover rate as of the end of the reporting period |

9.28% |

|

| Holdings [Text Block] |

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, excluding short-term investments, represented as a percentage of the total net assets of the Fund.

TOP TEN HOLDINGS

| Tencent Holdings Ltd. |

9.2% |

| Taiwan Semiconductor Manufacturing Co. Ltd. |

7.6% |

| Meituan - Class B |

4.9% |

| Emaar Properties PJSC |

4.1% |

| Trip.com Group Ltd. |

4.0% |

| Hong Kong Exchanges & Clearing Ltd. |

3.1% |

| Itau Unibanco Holding S.A. - ADR |

2.9% |

| HDFC Bank Ltd. - ADR |

2.8% |

| Aldar Properties PJSC |

2.8% |

| Barrick Gold Corp. |

2.7% |

SECTOR ALLOCATION

GEOGRAPHICAL ALLOCATION

|

| Largest Holdings [Text Block] |

TOP TEN HOLDINGS

| Tencent Holdings Ltd. |

9.2% |

| Taiwan Semiconductor Manufacturing Co. Ltd. |

7.6% |

| Meituan - Class B |

4.9% |

| Emaar Properties PJSC |

4.1% |

| Trip.com Group Ltd. |

4.0% |

| Hong Kong Exchanges & Clearing Ltd. |

3.1% |

| Itau Unibanco Holding S.A. - ADR |

2.9% |

| HDFC Bank Ltd. - ADR |

2.8% |

| Aldar Properties PJSC |

2.8% |

| Barrick Gold Corp. |

2.7% |

|

| C000224745 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

JOHCM Emerging Markets Opportunities Fund

|

| Class Name |

Investor Shares

|

| Trading Symbol |

JOEAX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the JOHCM Emerging Markets Opportunities Fund (the “Fund”) for the period of October 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at connect.rightprospectus.com/JOHCM/. You can also request this information by contacting us at 866-260-9549 (toll free) or 312-557-5913.

|

| Additional Information Phone Number |

866-260-9549 (toll free) or 312-557-5913

|

| Additional Information Website |

connect.rightprospectus.com/JOHCM/

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Cost of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

JOHCM Emerging Markets Opportunities Fund

(Investor Shares) |

$63 |

1.28% |

|

| Expenses Paid, Amount |

$ 63

|

| Expense Ratio, Percent |

1.28%

|

| Net Assets |

$ 1,117,286,730

|

| Holdings Count | Holding |

58

|

| Investment Company Portfolio Turnover |

9.28%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets |

$1,117,286,730 |

| Total number of portfolio holdings |

58 |

| Portfolio turnover rate as of the end of the reporting period |

9.28% |

|

| Holdings [Text Block] |

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, excluding short-term investments, represented as a percentage of the total net assets of the Fund.

TOP TEN HOLDINGS

| Tencent Holdings Ltd. |

9.2% |

| Taiwan Semiconductor Manufacturing Co. Ltd. |

7.6% |

| Meituan - Class B |

4.9% |

| Emaar Properties PJSC |

4.1% |

| Trip.com Group Ltd. |

4.0% |

| Hong Kong Exchanges & Clearing Ltd. |

3.1% |

| Itau Unibanco Holding S.A. - ADR |

2.9% |

| HDFC Bank Ltd. - ADR |

2.8% |

| Aldar Properties PJSC |

2.8% |

| Barrick Gold Corp. |

2.7% |

SECTOR ALLOCATION

GEOGRAPHICAL ALLOCATION

|

| Largest Holdings [Text Block] |

TOP TEN HOLDINGS

| Tencent Holdings Ltd. |

9.2% |

| Taiwan Semiconductor Manufacturing Co. Ltd. |

7.6% |

| Meituan - Class B |

4.9% |

| Emaar Properties PJSC |

4.1% |

| Trip.com Group Ltd. |

4.0% |

| Hong Kong Exchanges & Clearing Ltd. |

3.1% |

| Itau Unibanco Holding S.A. - ADR |

2.9% |

| HDFC Bank Ltd. - ADR |

2.8% |

| Aldar Properties PJSC |

2.8% |

| Barrick Gold Corp. |

2.7% |

|

| C000224748 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

JOHCM Emerging Markets Discovery Fund

|

| Class Name |

Advisor Shares

|

| Trading Symbol |

JOMEX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the JOHCM Emerging Markets Discovery Fund (the “Fund”) for the period of October 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at connect.rightprospectus.com/JOHCM/. You can also request this information by contacting us at 866-260-9549 (toll free) or 312-557-5913.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

866-260-9549 (toll free) or 312-557-5913

|

| Additional Information Website |

connect.rightprospectus.com/JOHCM/

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Cost of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

JOHCM Emerging Markets Discovery Fund

(Advisor Shares) |

$63 |

1.34% |

|

| Expenses Paid, Amount |

$ 63

|

| Expense Ratio, Percent |

1.34%

|

| Material Change Date |

Feb. 01, 2025

|

| Net Assets |

$ 51,107,573

|

| Holdings Count | Holding |

118

|

| Investment Company Portfolio Turnover |

65.47%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets |

$51,107,573 |

| Total number of portfolio holdings |

118 |

| Portfolio turnover rate as of the end of the reporting period |

65.47% |

|

| Holdings [Text Block] |

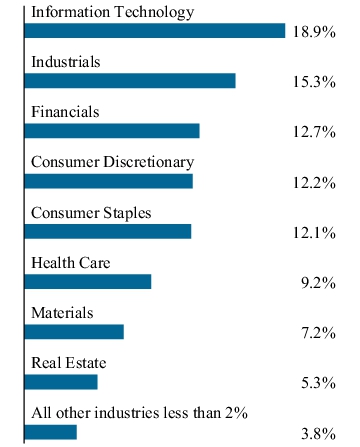

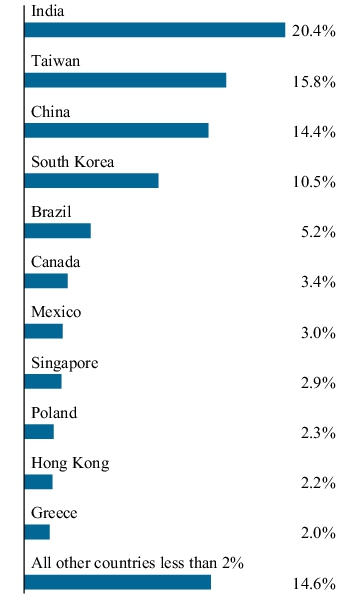

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, excluding short-term investments, represented as a percentage of the total net assets of the Fund.

TOP TEN HOLDINGS

| Phoenix Mills (The) Ltd. |

2.1% |

| PharmaResearch Co. Ltd. |

2.0% |

| Narayana Hrudayalaya Ltd. |

2.0% |

| Arcadyan Technology Corp. |

1.7% |

| Varun Beverages Ltd. |

1.5% |

| Alior Bank S.A. |

1.4% |

| Mrs Bectors Food Specialities Ltd. |

1.4% |

| Pan American Silver Corp. |

1.4% |

| Federal Bank Ltd., Issued by CLSA Global Markets Pte. Ltd., Maturity Date 10/25/27, 0.00%, 10/25/27 |

1.4% |

| Elite Material Co. Ltd. |

1.3% |

SECTOR ALLOCATION

GEOGRAPHICAL ALLOCATION

|

| Largest Holdings [Text Block] |

TOP TEN HOLDINGS

| Phoenix Mills (The) Ltd. |

2.1% |

| PharmaResearch Co. Ltd. |

2.0% |

| Narayana Hrudayalaya Ltd. |

2.0% |

| Arcadyan Technology Corp. |

1.7% |

| Varun Beverages Ltd. |

1.5% |

| Alior Bank S.A. |

1.4% |

| Mrs Bectors Food Specialities Ltd. |

1.4% |

| Pan American Silver Corp. |

1.4% |

| Federal Bank Ltd., Issued by CLSA Global Markets Pte. Ltd., Maturity Date 10/25/27, 0.00%, 10/25/27 |

1.4% |

| Elite Material Co. Ltd. |

1.3% |

|

| Material Fund Change [Text Block] |

Material Fund Changes

Effective February 1, 2025, to comply with recent Securities and Exchange Commission rule amendments relating to a fund's name, the Fund modified its investment policy as follows:

The Fund invests, under normal circumstances, at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in equity securities issued by companies that meet the portfolio managers’ “discovery criteria” and that are located in emerging markets, including frontier markets.

A more detailed explanation of how the Fund defines “emerging markets” and “discovery criteria” can be found in the Fund's prospectus. In order to satisfy notice requirements related to an investment policy change, the Fund continued to comply with both its old and new investment policies concurrently through May 1, 2025, after which time only the new investment policy applied.

This is a summary of certain changes to the Fund since October 1, 2024. For more complete information, you may review the Fund's prospectus dated February 1, 2025, at connect.rightprospectus.com/JOHCM/ or upon request at 866-260-9549 (toll free) or 312-557-5913.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the Fund since October 1, 2024. For more complete information, you may review the Fund's prospectus dated February 1, 2025, at connect.rightprospectus.com/JOHCM/ or upon request at 866-260-9549 (toll free) or 312-557-5913.

|

| Updated Prospectus Phone Number |

866-260-9549 (toll free) or 312-557-5913

|

| Updated Prospectus Web Address |

connect.rightprospectus.com/JOHCM/

|

| C000224749 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

JOHCM Emerging Markets Discovery Fund

|

| Class Name |

Institutional Shares

|

| Trading Symbol |

JOMMX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the JOHCM Emerging Markets Discovery Fund (the “Fund”) for the period of October 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at connect.rightprospectus.com/JOHCM/. You can also request this information by contacting us at 866-260-9549 (toll free) or 312-557-5913.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

866-260-9549 (toll free) or 312-557-5913

|

| Additional Information Website |

connect.rightprospectus.com/JOHCM/

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Cost of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

JOHCM Emerging Markets Discovery Fund

(Institutional Shares) |

$58 |

1.24% |

|

| Expenses Paid, Amount |

$ 58

|

| Expense Ratio, Percent |

1.24%

|

| Material Change Date |

Feb. 01, 2025

|

| Net Assets |

$ 51,107,573

|

| Holdings Count | Holding |

118

|

| Investment Company Portfolio Turnover |

65.47%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets |

$51,107,573 |

| Total number of portfolio holdings |

118 |

| Portfolio turnover rate as of the end of the reporting period |

65.47% |

|

| Holdings [Text Block] |

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, excluding short-term investments, represented as a percentage of the total net assets of the Fund.

TOP TEN HOLDINGS

| Phoenix Mills (The) Ltd. |

2.1% |

| PharmaResearch Co. Ltd. |

2.0% |

| Narayana Hrudayalaya Ltd. |

2.0% |

| Arcadyan Technology Corp. |

1.7% |

| Varun Beverages Ltd. |

1.5% |

| Alior Bank S.A. |

1.4% |

| Mrs Bectors Food Specialities Ltd. |

1.4% |

| Pan American Silver Corp. |

1.4% |

| Federal Bank Ltd., Issued by CLSA Global Markets Pte. Ltd., Maturity Date 10/25/27, 0.00%, 10/25/27 |

1.4% |

| Elite Material Co. Ltd. |

1.3% |

SECTOR ALLOCATION

GEOGRAPHICAL ALLOCATION

|

| Largest Holdings [Text Block] |

TOP TEN HOLDINGS

| Phoenix Mills (The) Ltd. |

2.1% |

| PharmaResearch Co. Ltd. |

2.0% |

| Narayana Hrudayalaya Ltd. |

2.0% |

| Arcadyan Technology Corp. |

1.7% |

| Varun Beverages Ltd. |

1.5% |

| Alior Bank S.A. |

1.4% |

| Mrs Bectors Food Specialities Ltd. |

1.4% |

| Pan American Silver Corp. |

1.4% |

| Federal Bank Ltd., Issued by CLSA Global Markets Pte. Ltd., Maturity Date 10/25/27, 0.00%, 10/25/27 |

1.4% |

| Elite Material Co. Ltd. |

1.3% |

|

| Material Fund Change [Text Block] |

Material Fund Changes

Effective February 1, 2025, to comply with recent Securities and Exchange Commission rule amendments relating to a fund's name, the Fund modified its investment policy as follows:

The Fund invests, under normal circumstances, at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in equity securities issued by companies that meet the portfolio managers’ “discovery criteria” and that are located in emerging markets, including frontier markets.

A more detailed explanation of how the Fund defines “emerging markets” and “discovery criteria” can be found in the Fund's prospectus. In order to satisfy notice requirements related to an investment policy change, the Fund continued to comply with both its old and new investment policies concurrently through May 1, 2025, after which time only the new investment policy applied.

This is a summary of certain changes to the Fund since October 1, 2024. For more complete information, you may review the Fund's prospectus dated February 1, 2025, at connect.rightprospectus.com/JOHCM/ or upon request at 866-260-9549 (toll free) or 312-557-5913.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the Fund since October 1, 2024. For more complete information, you may review the Fund's prospectus dated February 1, 2025, at connect.rightprospectus.com/JOHCM/ or upon request at 866-260-9549 (toll free) or 312-557-5913.

|

| Updated Prospectus Phone Number |

866-260-9549 (toll free) or 312-557-5913

|

| Updated Prospectus Web Address |

connect.rightprospectus.com/JOHCM/

|

| C000224751 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

JOHCM Global Select Fund

|

| Class Name |

Advisor Shares

|

| Trading Symbol |

JOGEX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the JOHCM Global Select Fund (the “Fund”) for the period of October 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at connect.rightprospectus.com/JOHCM/. You can also request this information by contacting us at 866-260-9549 (toll free) or 312-557-5913.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

866-260-9549 (toll free) or 312-557-5913

|

| Additional Information Website |

connect.rightprospectus.com/JOHCM/

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Cost of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

JOHCM Global Select Fund

(Advisor Shares) |

$53 |

1.11% |

|

| Expenses Paid, Amount |

$ 53

|

| Expense Ratio, Percent |

1.11%

|

| Material Change Date |

Feb. 01, 2025

|

| Net Assets |

$ 21,404,876

|

| Holdings Count | Holding |

37

|

| Investment Company Portfolio Turnover |

54.31%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets |

$21,404,876 |

| Total number of portfolio holdings |

37 |

| Portfolio turnover rate as of the end of the reporting period |

54.31% |

|

| Holdings [Text Block] |

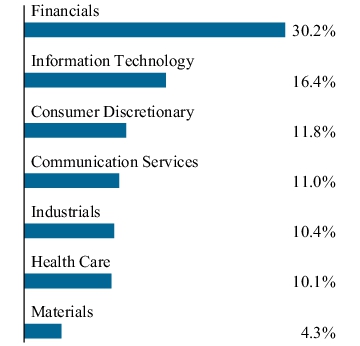

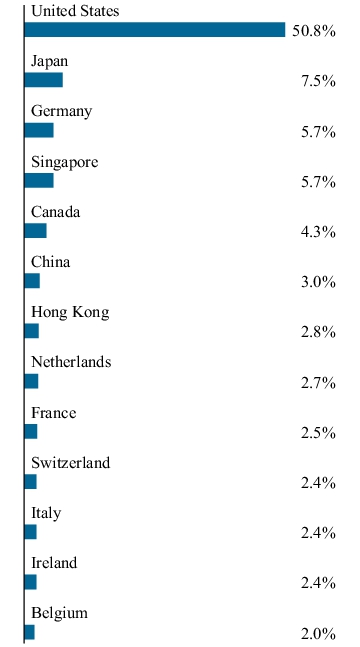

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, excluding short-term investments, represented as a percentage of the total net assets of the Fund.

TOP TEN HOLDINGS

| NVIDIA Corp. |

3.6% |

| SAP S.E. |

3.1% |

| Alphabet, Inc. - Class A |

3.1% |

| Trip.com Group Ltd. |

3.0% |

| Amazon.com, Inc. |

3.0% |

| S&P Global, Inc. |

2.9% |

| MercadoLibre, Inc. |

2.9% |

| Intercontinental Exchange, Inc. |

2.9% |

| Grab Holdings Ltd. - Class A |

2.9% |

| Sea Ltd. - ADR |

2.8% |

SECTOR ALLOCATION

GEOGRAPHICAL ALLOCATION

|

| Largest Holdings [Text Block] |

TOP TEN HOLDINGS

| NVIDIA Corp. |

3.6% |

| SAP S.E. |

3.1% |

| Alphabet, Inc. - Class A |

3.1% |

| Trip.com Group Ltd. |

3.0% |

| Amazon.com, Inc. |

3.0% |

| S&P Global, Inc. |

2.9% |

| MercadoLibre, Inc. |

2.9% |

| Intercontinental Exchange, Inc. |

2.9% |

| Grab Holdings Ltd. - Class A |

2.9% |

| Sea Ltd. - ADR |

2.8% |

|

| Material Fund Change [Text Block] |

Material Fund Changes

Effective February 1, 2025, JOHCM (USA) Inc, the Fund's investment adviser, contractually agreed to a reduction in management fees to 0.87% of average daily net assets of the Fund and to limit fund operating expenses to 1.06% of average daily net assets of the Fund through February 1, 2026.

This is a summary of certain changes to the Fund since October 1, 2024. For more complete information, you may review the Fund's prospectus dated February 1, 2025, at connect.rightprospectus.com/JOHCM/ or upon request at 866-260-9549 (toll free) or 312-557-5913.

|

| Material Fund Change Expenses [Text Block] |

Effective February 1, 2025, JOHCM (USA) Inc, the Fund's investment adviser, contractually agreed to a reduction in management fees to 0.87% of average daily net assets of the Fund and to limit fund operating expenses to 1.06% of average daily net assets of the Fund through February 1, 2026.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the Fund since October 1, 2024. For more complete information, you may review the Fund's prospectus dated February 1, 2025, at connect.rightprospectus.com/JOHCM/ or upon request at 866-260-9549 (toll free) or 312-557-5913.

|

| Updated Prospectus Phone Number |

866-260-9549 (toll free) or 312-557-5913

|

| Updated Prospectus Web Address |

connect.rightprospectus.com/JOHCM/

|

| C000224754 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

JOHCM Global Select Fund

|

| Class Name |

Institutional Shares

|

| Trading Symbol |

JOGIX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the JOHCM Global Select Fund (the “Fund”) for the period of October 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at connect.rightprospectus.com/JOHCM/. You can also request this information by contacting us at 866-260-9549 (toll free) or 312-557-5913.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

866-260-9549 (toll free) or 312-557-5913

|

| Additional Information Website |

connect.rightprospectus.com/JOHCM/

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Cost of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

JOHCM Global Select Fund

(Institutional Shares) |

$48 |

1.01% |

|

| Expenses Paid, Amount |

$ 48

|

| Expense Ratio, Percent |

1.01%

|

| Material Change Date |

Feb. 01, 2025

|

| Net Assets |

$ 21,404,876

|

| Holdings Count | Holding |

37

|

| Investment Company Portfolio Turnover |

54.31%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets |

$21,404,876 |

| Total number of portfolio holdings |

37 |

| Portfolio turnover rate as of the end of the reporting period |

54.31% |

|

| Holdings [Text Block] |

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, excluding short-term investments, represented as a percentage of the total net assets of the Fund.

TOP TEN HOLDINGS

| NVIDIA Corp. |

3.6% |

| SAP S.E. |

3.1% |

| Alphabet, Inc. - Class A |

3.1% |

| Trip.com Group Ltd. |

3.0% |

| Amazon.com, Inc. |

3.0% |

| S&P Global, Inc. |

2.9% |

| MercadoLibre, Inc. |

2.9% |

| Intercontinental Exchange, Inc. |

2.9% |

| Grab Holdings Ltd. - Class A |

2.9% |

| Sea Ltd. - ADR |

2.8% |

SECTOR ALLOCATION

GEOGRAPHICAL ALLOCATION

|

| Largest Holdings [Text Block] |

TOP TEN HOLDINGS

| NVIDIA Corp. |

3.6% |

| SAP S.E. |

3.1% |

| Alphabet, Inc. - Class A |

3.1% |

| Trip.com Group Ltd. |

3.0% |

| Amazon.com, Inc. |

3.0% |

| S&P Global, Inc. |

2.9% |

| MercadoLibre, Inc. |

2.9% |

| Intercontinental Exchange, Inc. |

2.9% |

| Grab Holdings Ltd. - Class A |

2.9% |

| Sea Ltd. - ADR |

2.8% |

|

| Material Fund Change [Text Block] |

Material Fund Changes

Effective February 1, 2025, JOHCM (USA) Inc, the Fund's investment adviser, contractually agreed to a reduction in management fees to 0.87% of average daily net assets of the Fund and to limit fund operating expenses to 0.96% of average daily net assets of the Fund through February 1, 2026.

This is a summary of certain changes to the Fund since October 1, 2024. For more complete information, you may review the Fund's prospectus dated February 1, 2025, at connect.rightprospectus.com/JOHCM/ or upon request at 866-260-9549 (toll free) or 312-557-5913.

|

| Material Fund Change Expenses [Text Block] |

Effective February 1, 2025, JOHCM (USA) Inc, the Fund's investment adviser, contractually agreed to a reduction in management fees to 0.87% of average daily net assets of the Fund and to limit fund operating expenses to 0.96% of average daily net assets of the Fund through February 1, 2026.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the Fund since October 1, 2024. For more complete information, you may review the Fund's prospectus dated February 1, 2025, at connect.rightprospectus.com/JOHCM/ or upon request at 866-260-9549 (toll free) or 312-557-5913.

|

| Updated Prospectus Phone Number |

866-260-9549 (toll free) or 312-557-5913

|

| Updated Prospectus Web Address |

connect.rightprospectus.com/JOHCM/

|

| C000224756 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

JOHCM International Opportunities Fund

|

| Class Name |

Institutional Shares

|

| Trading Symbol |

JOPSX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the JOHCM International Opportunities Fund (the “Fund”) for the period of October 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at connect.rightprospectus.com/JOHCM/. You can also request this information by contacting us at 866-260-9549 (toll free) or 312-557-5913.

|

| Additional Information Phone Number |

866-260-9549 (toll free) or 312-557-5913

|

| Additional Information Website |

connect.rightprospectus.com/JOHCM/

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Cost of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

JOHCM International Opportunities Fund

(Institutional Shares) |

$25 |

0.50% |

|

| Expenses Paid, Amount |

$ 25

|

| Expense Ratio, Percent |

0.50%

|

| Net Assets |

$ 80,190,629

|

| Holdings Count | Holding |

41

|

| Investment Company Portfolio Turnover |

32.02%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets |

$80,190,629 |

| Total number of portfolio holdings |

41 |

| Portfolio turnover rate as of the end of the reporting period |

32.02% |

|

| Holdings [Text Block] |

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, excluding short-term investments, represented as a percentage of the total net assets of the Fund.

TOP TEN HOLDINGS

| Deutsche Boerse A.G. |

4.2% |

| Shell PLC |

4.1% |

| National Grid PLC |

3.7% |

| Siemens A.G. - REG |

3.6% |

| Merck KGaA |

3.6% |

| Thales S.A. |

3.4% |

| Sanofi S.A. |

3.4% |

| SoftBank Corp. |

3.3% |

| Daifuku Co. Ltd. |

3.2% |

| Ebara Corp. |

3.1% |

SECTOR ALLOCATION

GEOGRAPHICAL ALLOCATION

|

| Largest Holdings [Text Block] |

TOP TEN HOLDINGS

| Deutsche Boerse A.G. |

4.2% |

| Shell PLC |

4.1% |

| National Grid PLC |

3.7% |

| Siemens A.G. - REG |

3.6% |

| Merck KGaA |

3.6% |

| Thales S.A. |

3.4% |

| Sanofi S.A. |

3.4% |

| SoftBank Corp. |

3.3% |

| Daifuku Co. Ltd. |

3.2% |

| Ebara Corp. |

3.1% |

|

| C000224759 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

JOHCM International Select Fund

|

| Class Name |

Institutional Shares

|

| Trading Symbol |

JOHIX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the JOHCM International Select Fund (the “Fund”) for the period of October 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at connect.rightprospectus.com/JOHCM/. You can also request this information by contacting us at 866-260-9549 (toll free) or 312-557-5913.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

866-260-9549 (toll free) or 312-557-5913

|

| Additional Information Website |

connect.rightprospectus.com/JOHCM/

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Cost of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

JOHCM International Select Fund

(Institutional Shares) |

$47 |

0.97% |

|

| Expenses Paid, Amount |

$ 47

|

| Expense Ratio, Percent |

0.97%

|

| Material Change Date |

Feb. 01, 2025

|

| Net Assets |

$ 3,457,880,531

|

| Holdings Count | Holding |

42

|

| Investment Company Portfolio Turnover |

48.97%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets |

$3,457,880,531 |

| Total number of portfolio holdings |

42 |

| Portfolio turnover rate as of the end of the reporting period |

48.97% |

|

| Holdings [Text Block] |

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, excluding short-term investments, represented as a percentage of the total net assets of the Fund.

TOP TEN HOLDINGS

| Sea Ltd. - ADR |

2.6% |

| Sony Group Corp. |

2.6% |

| NEC Corp. |

2.5% |

| ORIX Corp. |

2.5% |

| UBS Group A.G. - REG |

2.5% |

| Spotify Technology S.A. |

2.5% |

| Argenx S.E. |

2.5% |

| Zalando S.E. |

2.5% |

| Hong Kong Exchanges & Clearing Ltd. |

2.5% |

| Wise PLC - Class A |

2.5% |

SECTOR ALLOCATION

GEOGRAPHICAL ALLOCATION

|

| Largest Holdings [Text Block] |

TOP TEN HOLDINGS

| Sea Ltd. - ADR |

2.6% |

| Sony Group Corp. |

2.6% |

| NEC Corp. |

2.5% |

| ORIX Corp. |

2.5% |

| UBS Group A.G. - REG |

2.5% |

| Spotify Technology S.A. |

2.5% |

| Argenx S.E. |

2.5% |

| Zalando S.E. |

2.5% |

| Hong Kong Exchanges & Clearing Ltd. |

2.5% |

| Wise PLC - Class A |

2.5% |

|

| Material Fund Change [Text Block] |

Material Fund Changes

Effective February 1, 2025, JOHCM (USA) Inc, the Fund's investment adviser, contractually agreed to a reduction in management fees to 0.84% of average daily net assets of the Fund and to limit fund operating expenses to 0.95% of average daily net assets of the Fund through February 1, 2026.

This is a summary of certain changes to the Fund since October 1, 2024. For more complete information, you may review the Fund's prospectus dated February 1, 2025, at connect.rightprospectus.com/JOHCM/ or upon request at 866-260-9549 (toll free) or 312-557-5913.

|

| Material Fund Change Expenses [Text Block] |

Effective February 1, 2025, JOHCM (USA) Inc, the Fund's investment adviser, contractually agreed to a reduction in management fees to 0.84% of average daily net assets of the Fund and to limit fund operating expenses to 0.95% of average daily net assets of the Fund through February 1, 2026.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the Fund since October 1, 2024. For more complete information, you may review the Fund's prospectus dated February 1, 2025, at connect.rightprospectus.com/JOHCM/ or upon request at 866-260-9549 (toll free) or 312-557-5913.

|

| Updated Prospectus Phone Number |

866-260-9549 (toll free) or 312-557-5913

|

| Updated Prospectus Web Address |

connect.rightprospectus.com/JOHCM/

|

| C000224761 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

JOHCM International Select Fund

|

| Class Name |

Investor Shares

|

| Trading Symbol |

JOHAX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the JOHCM International Select Fund (the “Fund”) for the period of October 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at connect.rightprospectus.com/JOHCM/. You can also request this information by contacting us at 866-260-9549 (toll free) or 312-557-5913.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

866-260-9549 (toll free) or 312-557-5913

|

| Additional Information Website |

connect.rightprospectus.com/JOHCM/

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Cost of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

JOHCM International Select Fund

(Investor Shares) |

$58 |

1.20% |

|

| Expenses Paid, Amount |

$ 58

|

| Expense Ratio, Percent |

1.20%

|

| Material Change Date |

Feb. 01, 2025

|

| Net Assets |

$ 3,457,880,531

|

| Holdings Count | Holding |

42

|

| Investment Company Portfolio Turnover |

48.97%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets |

$3,457,880,531 |

| Total number of portfolio holdings |

42 |

| Portfolio turnover rate as of the end of the reporting period |

48.97% |

|

| Holdings [Text Block] |

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, excluding short-term investments, represented as a percentage of the total net assets of the Fund.

TOP TEN HOLDINGS

| Sea Ltd. - ADR |

2.6% |

| Sony Group Corp. |

2.6% |

| NEC Corp. |

2.5% |

| ORIX Corp. |

2.5% |

| UBS Group A.G. - REG |

2.5% |

| Spotify Technology S.A. |

2.5% |

| Argenx S.E. |

2.5% |

| Zalando S.E. |

2.5% |

| Hong Kong Exchanges & Clearing Ltd. |

2.5% |

| Wise PLC - Class A |

2.5% |

GEOGRAPHICAL ALLOCATION

|

| Largest Holdings [Text Block] |

TOP TEN HOLDINGS

| Sea Ltd. - ADR |

2.6% |

| Sony Group Corp. |

2.6% |

| NEC Corp. |

2.5% |

| ORIX Corp. |

2.5% |

| UBS Group A.G. - REG |

2.5% |

| Spotify Technology S.A. |

2.5% |

| Argenx S.E. |

2.5% |

| Zalando S.E. |

2.5% |

| Hong Kong Exchanges & Clearing Ltd. |

2.5% |

| Wise PLC - Class A |

2.5% |

|

| Material Fund Change [Text Block] |

Material Fund Changes

Effective February 1, 2025, JOHCM (USA) Inc, the Fund's investment adviser, contractually agreed to a reduction in management fees to 0.84% of average daily net assets of the Fund and to limit fund operating expenses to 1.18% of average daily net assets of the Fund through February 1, 2026.

This is a summary of certain changes to the Fund since October 1, 2024. For more complete information, you may review the Fund's prospectus dated February 1, 2025, at connect.rightprospectus.com/JOHCM/ or upon request at 866-260-9549 (toll free) or 312-557-5913.

|

| Material Fund Change Expenses [Text Block] |

Effective February 1, 2025, JOHCM (USA) Inc, the Fund's investment adviser, contractually agreed to a reduction in management fees to 0.84% of average daily net assets of the Fund and to limit fund operating expenses to 1.18% of average daily net assets of the Fund through February 1, 2026.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the Fund since October 1, 2024. For more complete information, you may review the Fund's prospectus dated February 1, 2025, at connect.rightprospectus.com/JOHCM/ or upon request at 866-260-9549 (toll free) or 312-557-5913.

|

| Updated Prospectus Phone Number |

866-260-9549 (toll free) or 312-557-5913

|

| Updated Prospectus Web Address |

connect.rightprospectus.com/JOHCM/

|