This press release may not be published, distributed or diffused in the United States of America.

This press release is not an extension into the United States of the tender offer mentioned herein.

Please see the important notice at the end of this press release.

(Translation)

June 3, 2025

| Company name: | Toyota Motor Corporation | |||

| Name of representative: | Koji Sato, President | |||

| (Securities code: 7203; Prime Market of the Tokyo Stock Exchange and Premier Market of the Nagoya Stock Exchange) | ||||

| Inquiries: | Yoshihide Moriyama, General Manager, Capital Strategy & Affiliated Companies Finance Div. | |||

| Tel: +81-(0)###-##-####) |

Notice Concerning the Planned Tender Offer for Own Shares and Determination of Matters Relating to the Repurchase of Shares and the Retirement of Treasury Shares

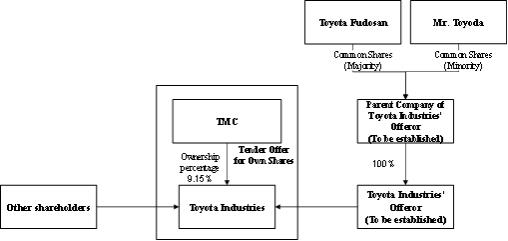

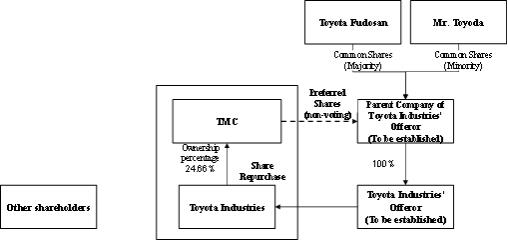

Toyota Motor Corporation (the “Company” or “TMC”) has decided that it intends to conduct a share repurchase, and a tender offer as the specific method for such repurchase (the “Tender Offer for Own Shares”), pursuant to Article 156, Paragraph 1 of the Companies Act (Act No. 86 of 2005, as amended; the “Companies Act”) as applied by replacing certain terms under Article 165, Paragraph 3 of the Companies Act, and the provisions of the Company’s Articles of Incorporation of TMC, by way of a written resolution dated June 3, 2025 in lieu of a resolution of the board of directors pursuant to Article 370 of the Companies Act and the provisions of the Company’s Articles of Incorporation.

In addition, the Company has determined matters relating to the share repurchase through the Tender Offer for Own Shares and has decided to retire its treasury shares pursuant to Article 178 of the Companies Act by way of the aforementioned written resolution, as detailed below.

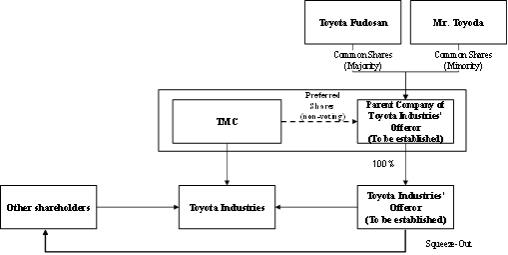

I. Planned Tender Offer for Own Shares

The Tender Offer for Own Shares is scheduled to be conducted in relation to a tender offer for the share certificates of Toyota Industries Corporation (“Toyota Industries”) (such share certificates, the “Toyota Industries Shares”) (such tender offer, the “Tender Offer for Toyota Industries”) by a stock company (“Toyota Industries’ Offeror”) whose issued shares will be fully owned by a stock company to be established by Toyota Fudosan Co., Ltd. (“Toyota Fudosan”), an affiliated company of the Company, (such stock company, the “Parent Company of Toyota Industries’ Offeror”), as described in the “Notice Concerning Planned Commencement of Tender Offer for the Share Certificates, Etc. of Toyota Industries Corporation (Securities Code: 6201)” announced today by Toyota Fudosan (the “Press Release of Toyota Industries’ Offeror”), and the Company has executed a master agreement dated today with Toyota Fudosan (the “Master Agreement”). (For details of the Master Agreement, please refer to “(ii) Execution of the Master Agreement” in “(7) Other matters” in “3. Outline of the Tender Offer” below.)