Exhibit 4.5

PROS HOLDINGS, INC.

2021 EQUITY INDUCEMENT PLAN

(As Amended June 2, 2025)

1.PURPOSE. The purpose of this Plan is to provide incentives to attract, retain and motivate eligible persons whose present and potential contributions are important to the success of the Company, and any Parents, Subsidiaries and Affiliates that exist now or in the future, by offering them an opportunity to participate in the Company’s future performance through the grant of Awards. Capitalized terms not defined elsewhere in the text are defined in Section 20. This Plan is intended to meet the “inducement grant” requirements of Listed Company Manual Rule 303A.08 of the New York Stock Exchange (“NYSE”). The Plan originally became effective on the Effective Date. The Plan terms as set forth herein are effective June 2, 2025.

2.SHARES SUBJECT TO THE PLAN.

2.1 Number of Shares Available. Subject to Section 2.4 and Section 13 and any other applicable provisions hereof, the total number of Shares reserved and available for grant and issuance pursuant to this Plan is 1,121,180 Shares.

2.2 Lapsed Awards. Shares subject to Awards, and Shares issued under the Plan under any Award, will again be available for grant and issuance in connection with subsequent Awards under this Plan to the extent such Shares are subject to Awards granted under this Plan that otherwise terminate without such Shares being issued.

2.3 Minimum Share Reserve. At all times the Company will reserve and keep available a sufficient number of Shares as will be required to satisfy the requirements of all outstanding Awards granted under this Plan.

2.4 Adjustment of Shares. If the number of outstanding Shares is changed by a stock dividend, extraordinary dividend or distribution (whether in cash, shares or other property, other than a regular cash dividend), recapitalization, stock split, reverse stock split, subdivision, combination, consolidation, reclassification, spin-off or similar change in the capital structure of the Company, without consideration, then the number and class of Shares subject to outstanding Awards will be proportionately adjusted, subject to any required action by the Board or the stockholders of the Company and in compliance with applicable securities laws; provided that fractions of a Share will not be issued.

If, by reason of an adjustment pursuant to this Section 2.4, a Participant’s Award Agreement or other agreement related to any Award or the Shares subject to such Award covers additional or different shares of stock or securities, then such additional or different shares, and the Award Agreement or such other agreement in respect thereof, will be subject to all of the terms, conditions and restrictions which were applicable to the Award or the Shares subject to such Award prior to such adjustment.

3.ELIGIBILITY. Awards may be granted only to persons who are being hired by the Company or any Subsidiary as an Employee and such Award is a material inducement to such person being hired, in accordance with NYSE Listed Company Manual Rule 303A.08.

4.ADMINISTRATION.

4.1.Committee Composition; Authority. This Plan will be administered by the Committee or by the Board acting as the Committee. With respect to the grant of Awards, such Awards shall be approved by an

independent compensation committee or a majority of the Company’s independent directors (as determined under NYSE Listed Company Manual Rule 303A.02) in order to comply with the exemption from the stockholder approval requirement for “inducement grants” provided under NYSE Listed Company Manual Rule 303A.08. Subject to the general purposes, terms and conditions of this Plan, and to the direction of the Board, the Committee will have full power to implement and carry out this Plan. The Committee will have the authority to:

(a) construe and interpret this Plan, any Award Agreement and any other agreement or document executed pursuant to this Plan;

(b) prescribe, amend and rescind rules and regulations relating to this Plan or any Award;

(c) select persons to receive Awards;

(d) determine the form and terms and conditions, not inconsistent with the terms of the Plan, of any Award granted hereunder. Such terms and conditions include, but are not limited to, the time or times when Awards may vest and be settled, any vesting acceleration or waiver of forfeiture restrictions, the method to satisfy tax withholding obligations or any other tax liability legally due and any restriction or limitation regarding any Award or the Shares relating thereto, based in each case on such factors as the Committee will determine;

(e) determine the number of Shares or other consideration subject to Awards;

(f) determine the Fair Market Value in good faith and interpret the applicable provisions of this Plan and the definition of Fair Market Value in connection with circumstances that impact the Fair Market Value, if necessary;

(g) determine whether Awards will be granted singly, in combination with, in tandem with, in replacement of, or as alternatives to, other Awards under this Plan or any other incentive or compensation plan of the Company or any Parent, Subsidiary or Affiliate;

(h) grant waivers of Plan or Award conditions;

(i) determine the vesting, settlement and payment of Awards;

(j) correct any defect, supply any omission or reconcile any inconsistency in this Plan, any Award or any Award Agreement;

(k) determine whether an Award has been vested and/or earned;

(l) adopt terms and conditions, rules and/or procedures (including the adoption of any subplan under this Plan) relating to the operation and administration of the Plan to accommodate requirements of local law and procedures outside of the United States or to qualify Awards for special tax treatment under laws of jurisdictions other than the United States;

(m) make all other determinations necessary or advisable for the administration of this Plan; and

(n) delegate any of the foregoing to a subcommittee or to one or more executive officers pursuant to a specific delegation as permitted by applicable law.

4.2.Committee Interpretation and Discretion. Any determination made by the Committee with respect to any Award will be made in its sole discretion at the time of grant of the Award or, unless in

contravention of any express term of the Plan or Award, at any later time, and such determination will be final and binding on the Company and all persons having an interest in any Award under the Plan. Any dispute regarding the interpretation of the Plan or any Award Agreement will be submitted by the Participant or Company to the Committee for review. The resolution of such a dispute by the Committee will be final and binding on the Company and the Participant. The Committee may delegate to one or more executive officers the authority to review and resolve disputes with respect to Awards held by Participants who are not Insiders, and such resolution will be final and binding on the Company and the Participant.

4.3.Section 16 of the Exchange Act. Awards granted to Participants who are subject to Section 16 of the Exchange Act must be approved by two or more “non-employee directors” (as defined in the regulations promulgated under Section 16 of the Exchange Act).

4.4.Documentation. The Award Agreement for a given Award, the Plan and any other documents may be delivered to, and accepted by, a Participant or any other person in any manner (including electronic distribution or posting) that meets applicable legal requirements.

5.RESTRICTED STOCK UNITS. A Restricted Stock Unit (“RSU”) is an award to an eligible Employee covering a number of Shares that will be settled by issuance of those Shares (which may consist of restricted Shares). All RSUs shall be made pursuant to an Award Agreement.

5.1.Terms of RSUs. The Committee will determine the terms of an RSU including, without limitation: (a) the number of Shares subject to the RSU; (b) the vesting terms and conditions of the RSU, which may include performance vesting conditions approved by the Committee, including but not limited to share price performance vesting conditions, (c) the time or times during which the RSU may be settled; and (d) the effect of the Participant’s termination of Service on each RSU;.

5.2.Form and Timing of Settlement. Payment of earned RSUs shall be made as soon as practicable after the date(s) determined by the Committee and set forth in the Award Agreement. The Committee, in its sole discretion, may settle earned RSUs in cash, Shares, or a combination of both.

5.3.Termination of Service. Except as may be set forth in the Participant’s Award Agreement and Section 13 of this Plan, vesting ceases on such date Participant’s Service terminates (unless determined otherwise by the Committee).

6.WITHHOLDING TAXES.

6.1.Withholding Generally. Whenever Shares are to be issued in satisfaction of Awards granted under this Plan or a taxable or tax-withholding event occurs, the Company may require the Participant to remit to the Company, or to the Parent, Subsidiary or Affiliate, as applicable, to which the Participant provides services, an amount sufficient to satisfy applicable U.S. federal, state, local income tax, social insurance liability, payroll tax fringe benefits, tax payment on account or other tax-related items related to the Participant’s participation in the Plan and legally applicable to the Participant (the “Tax-Related Items”) required to be withheld from the Participant. Whenever payments in satisfaction of Awards granted under this Plan are to be made in cash, such payment will be net of an amount sufficient to satisfy applicable withholding obligations for Tax-Related Items, provided, however, that any Tax-Related Items may also be withheld by other methods. Unless otherwise required by applicable law or determined by the Committee, the Fair Market Value of the Shares will be determined as of the date that the taxes are required to be withheld and such Shares will be valued based on the value of the actual trade or, if there is none, the Fair Market Value of the Shares as of the trading day.

6.2.Withholding Methods. The Committee, or its delegate(s), as permitted by applicable law, in its sole discretion and pursuant to such procedures as it may specify from time to time and to limitations of local law, may require or permit a Participant to satisfy any withholding obligations for such Tax-Related Items in

whole or in part by (without limitation) (a) paying cash, (b) having the Company withhold otherwise deliverable cash or Shares having a Fair Market Value equal to the Tax-Related Items to be withheld, (c) delivering to the Company already-owned shares having a Fair Market Value equal to the Tax-Related Items required to be withheld or (d) having the Company withhold from the proceeds of the sale of Shares acquired pursuant to an Award either through a voluntary sale or through a mandatory sale arranged by the Company (including by payment through a broker-assisted sale in accordance with procedures permitted by Regulation T of the Federal Reserve Board). The Company may withhold or account for these Tax-Related Items by considering applicable statutory withholding rates or other applicable withholding rates, including up to (but not in excess of) the maximum permissible statutory tax rate for the applicable tax jurisdiction, to the extent consistent with applicable laws.

7. TRANSFERABILITY. Unless determined otherwise by the Committee, an Award may not be sold, pledged, assigned, hypothecated, transferred, or disposed of in any manner (other than by will or by the laws of descent or distribution). If the Committee makes an Award transferable, including, without limitation, by instrument to an inter vivos or testamentary trust in which the Awards are to be passed to beneficiaries upon the death of the trustor (settlor) or by gift or by domestic relations order to a Permitted Transferee, such Award will contain such additional terms and conditions as the Committee deems appropriate. All Awards will be exercisable: (a) during the Participant’s lifetime only by the Participant, or the Participant’s guardian or legal representative; (b) after the Participant’s death, by the legal representative of the Participant’s heirs or legatees; and (c) in the case of all awards by a Permitted Transferee.

8. PRIVILEGES OF STOCK OWNERSHIP; RESTRICTIONS ON SHARES. No Participant will have any of the rights of a stockholder with respect to any Shares until the Shares are issued to the Participant, except for any Dividend Equivalent Rights permitted by an applicable Award Agreement. On the date that the Company pays a cash dividend to holders of Shares generally, the Participant shall be credited with a number of additional whole Dividend Equivalent Units determined by dividing (a) the product of (i) the dollar amount of the cash dividend paid per Share on such date and (ii) the sum of the total number of RSUs and the number of Dividend Equivalent Units previously credited to the Participant pursuant to the Award and which have not been settled or forfeited, by (b) the Fair Market Value per Share on such date. Any resulting fractional Dividend Equivalent Unit shall be rounded to the nearest whole number. Such additional Dividend Equivalent Units shall be subject to the same terms and conditions and shall be settled or forfeited in the same manner and at the same time as the RSUs originally subject to the Award with respect to which they have been credited. After Shares are issued to the Participant, the Participant will be a stockholder and have all the rights of a stockholder with respect to such Shares, including the right to vote and receive all dividends or other distributions made or paid with respect to such Shares. Such Dividend Equivalent Rights, if any, will be credited to the Participant in the form of additional whole Shares as of the date of payment of such cash dividends on Shares.

9. CERTIFICATES. All Shares or other securities whether or not certificated, delivered under this Plan will be subject to such stock transfer orders, legends and other restrictions as the Committee may deem necessary or advisable, including restrictions under any applicable U.S. federal, state or foreign securities law, or any rules, regulations and other requirements of the SEC or any stock exchange or automated quotation system upon which the Shares may be listed or quoted and any non-U.S. exchange controls or securities law restrictions to which the Shares are subject.

10. ESCROW; PLEDGE OF SHARES. To enforce any restrictions on a Participant’s Shares, the Committee may require the Participant to deposit all certificates representing Shares, together with stock powers or other instruments of transfer approved by the Committee, appropriately endorsed in blank, with the Company or an agent designated by the Company to hold in escrow until such restrictions have lapsed or terminated, and the Committee may cause a legend or legends referencing such restrictions to be placed on the certificates. Any Participant who is permitted to execute a promissory note as partial or full consideration for the purchase of Shares under this Plan will be required to pledge and deposit with the Company all or part of the Shares so purchased as collateral to secure the payment of the Participant’s obligation to the Company under the promissory note; provided, however, that the Committee may require or accept other or additional

forms of collateral to secure the payment of such obligation and, in any event, the Company will have full recourse against the Participant under the promissory note notwithstanding any pledge of the Participant’s Shares or other collateral. In connection with any pledge of the Shares, the Participant will be required to execute and deliver a written pledge agreement in such form as the Committee will from time to time approve. The Shares purchased with the promissory note may be released from the pledge on a pro rata basis as the promissory note is paid.

11. SECURITIES LAW AND OTHER REGULATORY COMPLIANCE. An Award will not be effective unless such Award is in compliance with all applicable U.S. and foreign federal and state securities and exchange control laws, rules and regulations of any governmental body, and the requirements of any stock exchange or automated quotation system upon which the Shares may then be listed or quoted, as they are in effect on the date of grant of the Award and also on the date of settlement or other issuance. Notwithstanding any other provision in this Plan, the Company will have no obligation to issue or deliver certificates for Shares under this Plan prior to: (a) obtaining any approvals from governmental agencies that the Company determines are necessary or advisable; and/or (b) completion of any registration or other qualification of such Shares under any state or federal or foreign law or ruling of any governmental body that the Company determines to be necessary or advisable. The Company will be under no obligation to register the Shares with the SEC or to effect compliance with the registration, qualification or listing requirements of any foreign or state securities laws, exchange control laws, stock exchange or automated quotation system, and the Company will have no liability for any inability or failure to do so.

12. NO OBLIGATION TO EMPLOY. Nothing in this Plan or any Award granted under this Plan will confer or be deemed to confer on any Participant any right to continue in the employ of, or to continue any other relationship with, the Company or any Parent, Subsidiary or Affiliate or limit in any way the right of the Company or any Parent, Subsidiary or Affiliate to terminate Participant’s employment or other relationship at any time.

13. CHANGE IN CONTROL. In the event of a Change in Control, outstanding Awards will be subject to the definitive agreement entered into by the Company in connection with the Change in Control. Subject to the requirements and limitations of Section 409A, if applicable, the Committee may provide for any one or more of the following:

(a)Accelerated Vesting. In its discretion, the Committee may provide in the grant of any Award or at any other time may take such action as it deems appropriate to provide for acceleration of the exercisability, vesting and/or settlement in connection with a Change in Control of each or any outstanding Award or portion thereof and shares acquired pursuant thereto upon such conditions, including termination of the Participant’s Service prior to, upon, or following the Change in Control, and to such extent as the Committee determines.

(b)Assumption, Continuation or Substitution. In the event of a Change in Control, the surviving, continuing, successor, or purchasing corporation or other business entity or parent thereof, as the case may be (the “Acquiror”), may, without the consent of any Participant, assume or continue the Company’s rights and obligations under each or any Award or portion thereof outstanding immediately prior to the Change in Control or substitute for each or any such outstanding Award or portion thereof a substantially equivalent award with respect to the Acquiror’s stock, as applicable. For purposes of this Section, if so determined by the Committee in its discretion, an Award denominated in shares of Stock will be deemed assumed if, following the Change in Control, the Award confers the right to receive, subject to the terms and conditions of the Plan and the applicable Award Agreement, for each Share subject to the Award immediately prior to the Change in Control, the consideration (whether stock, cash, other securities or property or a combination thereof) to which a holder of a Share on the effective date of the Change in Control was entitled (and if holders were offered a choice of consideration, the type of consideration chosen by the holders of a majority of the outstanding Shares); provided, however, that if such consideration is not solely common stock of the Acquiror, the Committee may, with the consent of the Acquiror, provide for the consideration to be

received upon the settlement of the Award, for each Share subject to the Award, to consist solely of common stock of the Acquiror equal in Fair Market Value to the per share consideration received by holders of Shares pursuant to the Change in Control. Any Award or portion thereof which is neither assumed or continued by the Acquiror in connection with the Change in Control nor settled as of the time of consummation of the Change in Control will become immediately vested in full and settled effective immediately prior to the time of consummation of the Change in Control, as applicable.

(c)Cash-Out of Outstanding Awards. The Committee may, in its discretion and without the consent of any Participant, determine that, upon the occurrence of a Change in Control, each or any Award or portion thereof outstanding immediately prior to the Change in Control and not previously settled shall be canceled in exchange for a payment with respect to each vested Share (and each unvested share, if so determined by the Committee) subject to such canceled Award in (i) cash, (ii) stock of the Company or of a corporation or other business entity a party to the Change in Control, or (iii) other property which, in any such case, will be in an amount having a Fair Market Value equal to the Fair Market Value of the consideration to be paid per Share in the Change in Control. Payment pursuant to this Section (reduced by applicable withholding taxes, if any) will be made to Participants in respect of the vested portions of their canceled Awards as soon as practicable following the date of the Change in Control and in respect of the unvested portions of their canceled Awards in accordance with the vesting schedules applicable to such Awards.

14. FEDERAL EXCISE TAX UNDER SECTION 4999 OF THE CODE.

(a)Excess Parachute Payment. If any acceleration of vesting pursuant to an Award and any other payment or benefit received or to be received by a Participant would subject the Participant to any excise tax pursuant to Section 4999 of the Code due to the characterization of such acceleration of vesting, payment or benefit as an “excess parachute payment” under Section 280G of the Code, then, provided such election would not subject the Participant to taxation under Section 409A, the Participant may elect to reduce the amount of any acceleration of vesting called for under the Award in order to avoid such characterization.

(b)Determination by Tax Firm. To aid the Participant in making any election called for under Section 14(a), no later than the date of the occurrence of any event that might reasonably be anticipated to result in an “excess parachute payment” to the Participant as described in Section 13.3(a), the Company shall request a determination in writing by the professional firm engaged by the Company for general tax purposes, or, if the tax firm so engaged by the Company is serving as accountant or auditor for the Acquiror, the Company will appoint a nationally recognized tax firm to make the determinations required by this Section (the “Tax Firm”). As soon as practicable thereafter, the Tax Firm shall determine and report to the Company and the Participant the amount of such acceleration of vesting, payments and benefits which would produce the greatest after-tax benefit to the Participant. For the purposes of such determination, the Tax Firm may rely on reasonable, good faith interpretations concerning the application of Sections 280G and 4999 of the Code. The Company and the Participant shall furnish to the Tax Firm such information and documents as the Tax Firm may reasonably request in order to make its required determination. The Company shall bear all fees and expenses the Tax Firm charges in connection with its services contemplated by this Section.

15. ADOPTION. This Plan will be adopted by the Board.

16. TERM OF PLAN/GOVERNING LAW. Unless earlier terminated as provided herein, this Plan originally became effective on the Effective Date and will terminate ten (10) years from the last date of Board approval of an amendment to the Plan to increase to the share reserve of the Plan. This Plan and all Awards granted hereunder will be governed by and construed in accordance with the laws of the State of Texas (excluding its conflict of laws rules).

17. AMENDMENT OR TERMINATION OF PLAN. The Board may at any time terminate or amend this Plan in any respect, including, without limitation, amendment of any form of Award Agreement or instrument to be executed pursuant to this Plan; provided, however, that a Participant’s Award will be governed by the version of this Plan then in effect at the time such Award was granted. Notwithstanding the foregoing, shareholder approval shall be obtained for any amendment to the Plan, to the extent required by applicable law, regulation or stock exchange rule. No termination or amendment of the Plan or any outstanding Award may adversely affect any then outstanding Award without the consent of the Participant, unless such termination or amendment is necessary to comply with applicable law, regulation or rule.

18. NONEXCLUSIVITY OF THE PLAN. Neither the adoption of this Plan by the Board, nor any provision of this Plan will be construed as creating any limitations on the power of the Board to adopt such additional compensation arrangements as it may deem desirable, including, without limitation, the granting of stock awards and bonuses otherwise than under this Plan, and such arrangements may be either generally applicable or applicable only in specific cases.

19. INSIDER TRADING POLICY. Each Participant who receives an Award will comply with any policy adopted by the Company from time to time covering transactions in the Company’s securities by Employees, officers and/or Directors of the Company, as well as with any applicable insider trading or market abuse laws to which the Participant may be subject.

20. ALL AWARDS SUBJECT TO COMPANY CLAWBACK OR RECOUPMENT POLICY. All Awards, subject to applicable law, shall be subject to clawback or recoupment pursuant to any compensation clawback or recoupment policy adopted by the Board or required by law during the term of Participant’s employment or other service with the Company that is applicable to Employees, Directors or other service providers of the Company, and in addition to any other remedies available under such policy and applicable law, may require the cancellation of outstanding Awards and the recoupment of any gains realized with respect to Awards.

21. SHAREHOLDER APPROVAL. It is expressly intended that approval of the Company’s shareholders not be required as a condition of the effectiveness of the Plan, and the Plan’s provisions shall be interpreted in a manner consistent with such intent for all purposes. Specifically, NYSE Listed Company Manual Rule 303A.08 generally requires shareholder approval for equity-compensation plans adopted by companies whose securities are listed on the NYSE pursuant to which stock awards or stock may be acquired by officers, directors, employees or consultants of such companies. NYSE Listed Company Manual Rule 303A.08 provides an exemption in certain circumstances for “employment inducement” awards (within the meaning of NYSE Listed Company Manual Rule 303A.08). Notwithstanding anything to the contrary herein, the Awards under the Plan may only be made to employees who are being hired by the Company or a Participating Company (including through merger or acquisition) and, in each case as an inducement material to the employee’s entering into employment with the Company or a Participating Company. Accordingly, pursuant to NYSE Listed Company Manual Rule 303A.08, the issuance of Awards and the Shares issuable upon vesting of such Awards pursuant to the Plan are not subject to the approval of the Company’s shareholders.

22. DEFINITIONS. As used in this Plan, and except as elsewhere defined herein, the following terms will have the following meanings:

22.1 “Affiliate” means (i) a parent entity, other than a Parent, that directly, or indirectly through one or more intermediary entities, controls the Company or (ii) a subsidiary entity, other than a Subsidiary, that is controlled by the Company directly or indirectly through one or more intermediary entities. For this purpose, the terms “parent,” “subsidiary,” “control” and “controlled by” have the meanings assigned such terms for the purposes of registration of securities on Form S-8 under the Securities Act.

22.2 “Award” means an award of Restricted Stock Units under the Plan.

22.3 “Award Agreement” means, with respect to each Award, the written or electronic agreement between the Company and the Participant setting forth the terms and conditions of the Award which will be in substantially a form (which need not be the same for each Participant) that the Committee (or in the case of Award agreements that are not used for Insiders, the Committee’s delegate(s)) has from time to time approved, and will comply with and be subject to the terms and conditions of this Plan.

22.4 “Board” means the Board of Directors of the Company.

22.5 “Cause” means, unless such term or an equivalent term is otherwise defined by the applicable Award Agreement or other written agreement between a Participant and a Participating Company applicable to an Award, any of the following: (i) the Participant’s theft, dishonesty, willful misconduct, breach of fiduciary duty for personal profit, or falsification of any Participating Company documents or records; (ii) the Participant’s material failure to abide by a Participating Company’s code of conduct or other policies (including, without limitation, policies relating to confidentiality and reasonable workplace conduct); (iii) the Participant’s unauthorized use, misappropriation, destruction or diversion of any tangible or intangible asset or corporate opportunity of a Participating Company (including, without limitation, the Participant’s improper use or disclosure of a Participating Company’s confidential or proprietary information); (iv) any intentional act by the Participant which has a material detrimental effect on a Participating Company’s reputation or business; (v) the Participant’s repeated failure to perform any reasonable assigned duties after written notice from a Participating Company of, and a reasonable opportunity to cure, such failure; (vi) any material breach by the Participant of any employment, service, non-disclosure, non-competition, non-solicitation or other similar agreement between the Participant and a Participating Company, which breach is not cured pursuant to the terms of such agreement; or (vii) the Participant’s conviction (including any plea of guilty or nolo contendere) of any criminal act involving fraud, dishonesty, misappropriation or moral turpitude, or which impairs the Participant’s ability to perform his or her duties with a Participating Company.

22.6 “Change in Control” means the occurrence of any one or a combination of the following:

(i)any “person” (as such term is used in Sections 13(d) and 14(d) of the Exchange Act) becomes the “beneficial owner” (as such term is defined in Rule 13d‑3 under the Exchange Act), directly or indirectly, of securities of the Company representing more than fifty percent (50%) of the total Fair Market Value or total combined voting power of the Company’s then‑outstanding securities entitled to vote generally in the election of Directors; provided, however, that a Change in Control shall not be deemed to have occurred if such degree of beneficial ownership results from any of the following: (A) an acquisition by any person who on the Effective Date is the beneficial owner of more than fifty percent (50%) of such voting power, (B) any acquisition directly from the Company, including, without limitation, pursuant to or in connection with a public offering of securities, (C) any acquisition by the Company, (D) any acquisition by a trustee or other fiduciary under an employee benefit plan of a Participating Company or (E) any acquisition by an entity owned directly or indirectly by the stockholders of the Company in substantially the same proportions as their ownership of the voting securities of the Company; or

(ii)an Ownership Change Event or series of related Ownership Change Events (collectively, a “Transaction”) in which the stockholders of the Company immediately before the Transaction do not retain immediately after the Transaction direct or indirect beneficial ownership of more than fifty percent (50%) of the total combined voting power of the outstanding securities entitled to vote generally in the election of Directors or, in the case of an Ownership Change Event described in Section 20.21(iii) the entity to which the assets of the Company were transferred (the “Transferee”), as the case may be; or

(iii)a date specified by the Committee following approval by the stockholders of a plan of complete liquidation or dissolution of the Company; provided, however, that a Change in Control shall be

deemed not to include a transaction described in subsections (i) or (ii) of this Section 22.6 in which a majority of the members of the board of directors of the continuing, surviving or successor entity, or parent thereof, immediately after such transaction is comprised of Incumbent Directors.

For purposes of the preceding sentence, indirect beneficial ownership includes, without limitation, an interest resulting from ownership of the voting securities of one or more corporations or other business entities which own the Company or the Transferee, as the case may be, either directly or through one or more subsidiary corporations or other business entities. The Committee shall determine whether multiple events described in subsections (i), (ii) and (iii) of this Section 22.6 are related and to be treated in the aggregate as a single Change in Control, and its determination shall be final, binding and conclusive.

22.7 “Code” means the United States Internal Revenue Code of 1986, as amended, and the regulations promulgated thereunder.

22.8 “Committee” means the Compensation and Leadership Development Committee and such other committee or subcommittee of the Board, if any, duly appointed to administer the Plan and having such powers in each instance as specified by the Board. If, at any time, there is no committee of the Board then authorized or properly constituted to administer the Plan, the Board must exercise all of the powers of the Committee granted herein, and, in any event, the Board may in its discretion exercise any or all of such powers.

22.9 “Company” means PROS Holdings, Inc., a Delaware corporation, or a successor corporation thereto.

22.10 “Consultant” means a person engaged to provide consulting or advisory services (other than as an Employee or a Director) to a Participating Company, provided that the identity of such person, the nature of such services or the entity to which such services are provided would not preclude the Company from offering or selling securities to such person pursuant to the Plan in reliance on registration on Form S‑8 under the Securities Act.

22.11 “Director” means a member of the Board.

22.12 “Disability” means unless such term or an equivalent term is otherwise defined by the applicable Award Agreement or other written agreement between the Participant and a Participating Company applicable to an Award, the permanent and total disability of the Participant, within the meaning of Section 22(e)(3) of the Code.

22.13 “Dividend Equivalent Right” means the right of a Participant, granted at the discretion of the Committee or as otherwise provided by the Plan, to receive a credit for the account of such Participant in an amount equal to the cash, stock or other property dividends in amounts equivalent to cash, stock or other property dividends for each Share represented by an Award held by such Participant.

22.14 “Effective Date” means the date the Plan is adopted by the Board.

22.15 “Employee” means any person, including officers and Directors, providing services as an employee to the Company or any Parent, Subsidiary or Affiliate. Neither service as a Director nor payment of a director’s fee by the Company will be sufficient to constitute “employment” by the Company.

22.16 “Exchange Act” means the United States Securities Exchange Act of 1934, as amended.

22.17 “Fair Market Value” means, as of any date, the value of a Share or other property as determined by the Committee, in its discretion, or by the Company, in its discretion, if such determination is expressly allocated to the Company herein, subject to the following:

(i)Except as otherwise determined by the Committee, if, on such date, the Shares are listed or quoted on a national or regional securities exchange or quotation system, the Fair Market Value will be the closing price of a Share as quoted on the national or regional securities exchange or quotation system constituting the primary market for the Stock, as reported in The Wall Street Journal or such other source as the Company deems reliable. If the relevant date does not fall on a day on which the Shares have traded on such securities exchange or quotation system, the date on which the Fair Market Value is established will be the last day on which the Shares were so traded or quoted prior to the relevant date, or such other appropriate day as determined by the Committee, in its discretion.

(ii)Notwithstanding the foregoing, the Committee may, in its discretion, determine the Fair Market Value of a Share on the basis of the opening, closing, or average of the high and low sale prices of a Share on such date or the preceding trading day, the actual sale price of a Share received by a Participant, any other reasonable basis using actual transactions in Shares as reported on a national or regional securities exchange or quotation system, or on any other basis consistent with the requirements of Section 409A. The Committee may vary its method of determination of the Fair Market Value as provided in this Section for different purposes under the Plan to the extent consistent with the requirements of Section 409A.

(iii)If, on such date, the Shares are not listed or quoted on a national or regional securities exchange or quotation system, the Fair Market Value of a Share must be determined by the Committee in good faith without regard to any restriction other than a restriction which, by its terms, will never lapse, and in a manner consistent with the requirements of Section 409A.

22.18. “Incumbent Director” means a Director who either (i) is a member of the Board as of the Effective Date or (ii) is elected, or nominated for election, to the Board with the affirmative votes of at least a majority of the Incumbent Directors at the time of such election or nomination (but excluding a Director who was elected or nominated in connection with an actual or threatened proxy contest relating to the election of Directors of the Company).

22.19. “Insider” means an officer or Director of the Company or any other person whose transactions in the Company’s common stock are subject to Section 16 of the Exchange Act.

22.20. “IRS” means the United States Internal Revenue Service.

22.21 “Ownership Change Event” means the occurrence of any of the following with respect to the Company: (i) the direct or indirect sale or exchange in a single or series of related transactions by the stockholders of the Company of securities of the Company representing more than fifty percent (50%) of the total combined voting power of the Company’s then outstanding securities entitled to vote generally in the election of Directors; (ii) a merger or consolidation in which the Company is a party; or (iii) the sale, exchange, or transfer of all or substantially all of the assets of the Company (other than a sale, exchange or transfer to one or more subsidiaries of the Company).

22.22 “Parent” means any present or future “parent corporation” of the Company, as defined in Section 424(e) of the Code.

22.23 “Participant” means a person who holds an Award under this Plan.

22.24 “Participating Company” means the Company or any Parent, Subsidiary or Affiliate.

22.25. “Participating Company Group” means collectively the Company and any Parent, Subsidiary or Affiliate.

22.26. “Permitted Transferee” means any child, stepchild, grandchild, parent, stepparent, grandparent, spouse, former spouse, sibling, niece, nephew, mother-in-law, father-in-law, son-in-law, daughter-in-law, brother-in-law, or sister-in-law (including adoptive relationships) of the Employee, any person sharing the Employee’s household (other than a tenant or employee), a trust in which these persons (or the Employee) have more than 50% of the beneficial interest, a foundation in which these persons (or the Employee) control the management of assets, and any other entity in which these persons (or the Employee) own more than 50% of the voting interests.

22.27. “Plan” means this PROS Holdings, Inc. 2021 Equity Inducement Plan.

22.28. “Restricted Stock Unit” means an Award as defined in Section 5 and granted under the Plan.

22.29. “SEC” means the United States Securities and Exchange Commission.

22.30. “Section 409A Regulations” mean the Treasury Regulations issued pursuant to Section 409A.

22.31 “Securities Act” means the United States Securities Act of 1933, as amended.

22.32 “Separation from Service” has the meaning set forth in Section 409A.

22.33 “Service” means a Participant’s employment or service with the Participating Company Group, whether as an Employee, a Director or a Consultant. Unless otherwise provided by the Committee, a Participant’s Service shall not be deemed to have terminated merely because of a change in the capacity in which the Participant renders Service or a change in the Participating Company for which the Participant renders Service, provided that there is no interruption or termination of the Participant’s Service. Furthermore, a Participant’s Service shall not be deemed to have been interrupted or terminated if the Participant takes any military leave, sick leave, or other bona fide leave of absence approved by the Company. However, unless otherwise provided by the Committee, if any such leave taken by a Participant exceeds ninety (90) days, then on the ninety-first (91st) day following the commencement of such leave the Participant’s Service shall be deemed to have terminated, unless the Participant’s right to return to Service is guaranteed by statute or contract. Notwithstanding the foregoing, unless otherwise designated by the Company or required by law, an unpaid leave of absence shall not be treated as Service for purposes of determining vesting under the Participant’s Award Agreement. A Participant’s Service shall be deemed to have terminated either upon an actual termination of Service or upon the business entity for which the Participant performs Service ceasing to be a Participating Company. Subject to the foregoing, the Company, in its discretion, shall determine whether the Participant’s Service has terminated and the effective date of and reason for such termination.

22.34. “Shares” means shares of the common stock of the Company.

22.35. “Subsidiary” means any present or future “subsidiary corporation” of the Company, as defined in Section 424(f) of the Code.

22.36. “Treasury Regulations” means regulations promulgated by the United States Treasury Department.

| | | | | | | | | | | | | | |

PROS HOLDINGS, INC.

2021 EQUITY INDUCEMENT PLAN

NOTICE OF RESTRICTED STOCK UNIT AWARD |

Unless otherwise defined herein, the terms defined in the PROS Holdings, Inc. (the “Company”) 2021 Equity Inducement Plan (the “Plan”) will have the same meanings in this Notice of Restricted Stock Unit Award and the electronic representation of this Notice of Restricted Stock Unit Award established and maintained by the Company or a third party designated by the Company (this “Notice”). |

| Name: | Jeffrey B. Cotten |

| Address: | |

You (“Participant”) have been granted an award of Restricted Stock Units (“RSUs”) under the Plan subject to the terms and conditions of the Plan, this Notice and the attached Restricted Stock Unit Award Agreement (the “Agreement”). |

| Number of RSUs: | _________ |

| Date of Grant: | 6/3/2025 |

| Vesting Commencement Date: | 6/2/2025 |

| Expiration Date: | The earlier to occur of: (a) the date on which settlement of all RSUs granted hereunder occurs or (b) if Participant’s Service terminates earlier, as described in the Agreement. |

| Vesting Schedule: | Subject to your continuing to remain in Service with the Company or a Parent, Subsidiary or Affiliate through the applicable vesting dates, your RSUs will vest on the following dates and for the following percentages of the total number of RSUs: |

| Vesting Date | Vesting Percentage |

| 1st anniversary of Vesting Commencement Date 5th quarter following Vesting Commencement Date 6th quarter following Vesting Commencement Date 7th quarter following Vesting Commencement Date 8th quarter following Vesting Commencement Date 9th quarter following Vesting Commencement Date 10th quarter following Vesting Commencement Date 11th quarter following Vesting Commencement Date 12th quarter following Vesting Commencement Date 13th quarter following Vesting Commencement Date 14th quarter following Vesting Commencement Date 15th quarter following Vesting Commencement Date 16th quarter following Vesting Commencement Date

| 25.00%

6.25%

6.25%

6.25%

6.25%

6.25%

6.25%

6.25%

6.25%

6.25%

6.25%

6.25%

6.25%

|

| The RSUs may earlier vest as specified in the Agreement. Once vested, the RSUs shall be settled via an issuance of Shares on the applicable dates as set forth in Section 1 of the Agreement. |

| | | | | | | | | | | | | | |

| By accepting (whether in writing, electronically or otherwise) the RSUs, Participant acknowledges and agrees to the following: |

| (1) Participant understands that Participant’s Service with the Company or a Parent or Subsidiary or Affiliate is for an unspecified duration, can be terminated at any time (i.e., is “at-will”), except where otherwise prohibited by applicable law, and that nothing in this Notice, the Agreement or the Plan changes the nature of that relationship. Subject to the terms of the Agreement, Participant acknowledges that the vesting of the RSUs pursuant to this Notice is subject to Participant’s continuing Service as an Employee, Director or Consultant. To the extent permitted by applicable law, Participant agrees and acknowledges that the Vesting Schedule may change prospectively in the event that Participant’s Service status changes between full- and part-time and/or in the event Participant is on a leave of absence, in accordance with Company policies relating to work schedules and vesting of Awards or as determined by the Committee. |

| (2) This grant is made under and governed by the Plan, the Agreement and this Notice, and this Notice is subject to the terms and conditions of the Agreement and the Plan, both of which are incorporated herein by reference. Participant has read the Notice, the Agreement and the Plan. The Participant acknowledges that copies of the Plan, the Agreement and the prospectus for the Plan are available on the Company’s internal web site and may be viewed and printed by the Participant for attachment to the Participant’s copy of this Notice. |

| (3) Participant has read the Company’s Insider Trading Policy, and agrees to comply with such policy, as it may be amended from time to time, whenever Participant acquires or disposes of the Company’s securities. |

| (4) By accepting the RSUs, Participant consents to electronic delivery and participation as set forth in the Agreement. |

| |

| | | | | | | | |

| | |

PARTICIPANT Signature:

By:

______________________________ Jeffrey B. Cotten | | PROS HOLDINGS, INC. Signature:

By:

______________________________ [First Name Last Name, Title] |

| | |

| | |

PROS HOLDINGS, INC.

2021 EQUITY INDUCEMENT PLAN

RESTRICTED STOCK UNIT AWARD AGREEMENT

Unless otherwise defined in this Restricted Stock Unit Award Agreement (this “Agreement”), any capitalized terms used herein will have the same meaning ascribed to them in the PROS Holdings, Inc. 2021 Equity Inducement Plan (the “Plan”).

Participant has been granted Restricted Stock Units (“RSUs”) subject to the terms, restrictions and conditions of the Plan, the Notice of Restricted Stock Unit Award (the “Notice”) and this Agreement. In the event of a conflict between the terms and conditions of the Plan and the terms and conditions of the Notice or this Agreement, the terms and conditions of the Plan shall prevail.

1.Settlement. Settlement of RSUs will be in Shares. No fractional RSUs or rights for fractional Shares shall be created pursuant to this Agreement. Settlement of RSUs will be made on a date selected by the Company that is within 30 days following the applicable date of vesting (as determined under the Vesting Schedule set forth in the Notice or upon any earlier vesting of the RSUs as set forth in this Agreement (such applicable date of vesting of the RSUs (the “Vesting Date”) and such applicable settlement date selected by the Company, the “Original Issuance Date”); provided, however, that if the Original Issuance Date falls on a date that is a weekend or a U.S. Federal holiday, the Original Issuance Date will instead be the next following day that is not a weekend or a U.S. Federal holiday. In addition, to the extent applicable at a Vesting Date when the Shares are registered under the Securities Act, if:

(i) the Original Issuance Date does not occur (1) during an “open window period” applicable to Participant, as determined by the Company in accordance with the Company’s then-effective Insider Trading Policy and, or (2) on a date when Participant is otherwise permitted to sell Shares on an established stock exchange or stock market (including but not limited to under a previously established written trading plan that meets the requirements of Rule 10b5-1 under the Exchange Act and was entered into in compliance with the Company’s Insider Trading Policy and 10b5-1 Trading Plan Policy (a “10b5-1 Arrangement”)), and

(ii) either (1) no Tax-Related Items apply, or (2) the Company decides, prior to the Original Issuance Date, (A) not to satisfy the Tax-Related Items by withholding Shares otherwise due to be issued on the Original Issuance Date, to Participant under the RSUs, (B) not to permit Participant to enter into a “same day sale” voluntary or mandatory sale commitment with a broker-dealer pursuant to Section 10 below (including but not limited to a commitment under a 10b5-1 Arrangement), and (C) not to permit Participant to pay the Tax-Related Items in cash,

(iii) then the Shares that would otherwise be issued to Participant on the Original Issuance Date will not be issued on such Original Issuance Date and will instead be issued on the first business day when Participant is not prohibited from selling Shares in the open public market, but in no event later than (I) December 31 of the calendar year in which the Original Issuance Date occurs (that is, the last day of Participant’s taxable year in which the Original Issuance Date occurs), or (II) if and only if permitted in a manner that complies with Treasury Regulations Section 1.409A-1(b)(4), no later than the date that is the 15th day of the third calendar month of the year immediately following the year in which the Shares otherwise issuable on the Original Issuance Date are no longer subject to a “substantial risk of forfeiture” within the meaning of Treasury Regulations Section 1.409A-1(d).

2.No Stockholder Rights. Unless and until such time as Shares are issued in settlement of vested RSUs, Participant will have no ownership of the Shares allocated to the RSUs and will have no rights to dividends or to vote such Shares.

3.Dividend Equivalents. Dividend Equivalent Rights, if any, will be credited to Participant subject to the terms set forth in the Plan.

4.Non-Transferability of RSUs. The RSUs and any interest therein will not be sold, assigned, transferred, pledged, hypothecated, or otherwise disposed of in any manner other than by will or by the laws of descent or distribution or court order or unless otherwise permitted by the Committee on a case-by-case basis.

5.Termination. Except as set forth in Section 6 of this Agreement in the event of the Participant’s termination of Service due to the Participant’s Qualifying Termination, death, or in connection with the Participant becoming Disabled, if Participant’s Service terminates for any reason, all then unvested RSUs will be forfeited to the Company forthwith, and all rights of Participant to such RSUs will immediately terminate without payment of any consideration to Participant. Participant’s Service will be considered terminated (regardless of the reason for such termination and whether or not later found to be invalid or in breach of employment laws in the jurisdiction where Participant is employed or the terms of Participant’s employment agreement, if any) as of the date Participant is no longer actively providing services and Participant’s Service will not be extended by any notice period. Participant acknowledges and agrees that the Vesting Schedule may change prospectively in the event Participant’s Service status changes between full- and part-time and/or in the event Participant is on a leave of absence, in accordance with Company policies relating to work schedules and vesting of awards or as determined by the Committee. In case of any dispute as to whether and when a termination of Service has occurred, the Committee will have sole discretion to determine whether such termination of Service has occurred and the effective date of such termination (including whether Participant may still be considered to be actively providing Services while on a leave of absence).

6.Termination, Death or Disabled. In the event of the Participant’s termination of Service pursuant to the circumstances described in either Section 5(b) or Section 5(c) of the Participant’s Executive Employment Agreement dated April 28, 2025 (the “Employment Agreement”), the terms of the Employment Agreement shall apply to any potential accelerated vesting of RSUs, including the Participant’s required compliance with Section 6(a) of the Employment Agreement as a condition to such accelerated vesting. In the event that the Participant dies or becomes Disabled (without regard to whether or not the Participant has experienced a Separation from Service), the RSUs will immediately fully vest upon the date of the Participant’s death or the date the Participant becomes Disabled. For such purposes, the following terms have the following meanings:

(a)Disabled. “Disabled” means, unless otherwise permitted by the Section 409A Regulations, that the Participant has been determined by the Company to be either: (i) unable to engage in any substantial gainful activity by reason of any medically determinable physical or mental impairment that can be expected to result in death or can be expected to last for a continuous period of not less than 12 months; or (ii) by reason of any medically determinable physical or mental impairment that can be expected to result in death or can be expected to last for a continuous period of not less than 12 months, receiving income replacement benefits for a period of not less than three months under an accident and health plan covering employees of the Participant’s employer.

(b)Section 409A Regulations. “Section 409A Regulations” mean the Treasury Regulations issued pursuant to Section 409A of the Code.

7.Taxes.

(a)Responsibility for Taxes. Participant acknowledges that, to the extent permitted by applicable law, regardless of any action taken by the Company or a Parent, Subsidiary or Affiliate employing or retaining Participant (the “Employer”), the ultimate liability for all income tax, social insurance, payroll tax, fringe benefits tax, payment on account or other tax-related items related to Participant’s participation in the Plan and legally applicable to Participant (“Tax-Related Items”) is and remains Participant’s responsibility and may exceed the amount actually withheld by the Company or the Employer, if any. Participant further acknowledges that the Company and/or the Employer (i) make no representations or undertakings regarding the treatment of any Tax-Related Items in connection with any aspect of the RSUs, including, but not limited to, the grant, vesting or settlement of the RSUs and the subsequent sale of Shares acquired pursuant to such settlement and the receipt of any dividends, and (ii) do not commit to and are under no obligation to structure the terms of the grant or any aspect of the RSUs to reduce or eliminate Participant’s liability for Tax-Related Items or achieve any particular tax result. Further, if Participant is subject to Tax-Related Items in more than one jurisdiction, Participant acknowledges that the Company and/or the Employer (or former employer, as applicable) may be required to withhold or account for Tax-Related Items in more than one jurisdiction.

(b)Withholding. Prior to any relevant taxable or tax withholding event, as applicable, to the extent permitted by applicable law, Participant agrees to make arrangements satisfactory to the Company and/or the Employer to fulfill all Tax-Related Items. In this regard, Participant authorizes the Company and/or the Employer, or their respective agents, at their discretion, to satisfy any withholding obligations for Tax-Related Items by one or a combination of the following:

(i)withholding from Participant’s wages or other cash compensation paid to Participant by the Company and/or the Employer or any Parent, Subsidiary or Affiliate; or

(ii)withholding from proceeds of the sale of Shares acquired upon settlement of the RSUs either through a voluntary sale or through a mandatory sale arranged by the Company (on Participant’s behalf pursuant to this authorization and without further consent); or

(iii)withholding Shares to be issued upon settlement of the RSUs, provided the Company only withholds the number of Shares necessary to satisfy no more than the maximum statutory withholding amounts; or

(iv)Participant’s payment of a cash amount (including by check representing readily available funds or a wire transfer); or

(v)any other arrangement approved by the Committee and permitted under applicable law;

all under such rules as may be established by the Committee and in compliance with the Company’s Insider Trading Policy and 10b5-1 Trading Plan Policy, if applicable; provided however, that if Participant is a Section 16 officer of the Company under the Exchange Act, then the Committee (as constituted in accordance with Rule 16b-3 under the Exchange Act) shall establish the method of withholding from alternatives (i) - (v) above, and the Committee shall establish such method prior to the Tax-Related Items withholding event.

Depending on the withholding method, the Company may withhold or account for Tax-Related Items by considering applicable statutory withholding rates or other applicable withholding rates, including up to the maximum permissible statutory rate for Participant’s tax jurisdiction(s) in which case Participant will have no entitlement to the equivalent amount in Shares and may receive a refund of any over-withheld amount in cash in accordance with applicable law. If the obligation for Tax-Related Items is satisfied by withholding in Shares, for tax purposes, Participant is deemed to have been issued the full number of Shares subject to the vested RSUs, notwithstanding that a number of the Shares are held back solely for the purpose of satisfying the withholding obligation for Tax-Related Items.

Finally, Participant agrees to pay to the Company or the Employer any amount of Tax-Related Items that the Company or the Employer may be required to withhold or account for as a result of Participant’s participation in the Plan that cannot be satisfied by the means previously described. The Company may refuse to issue or deliver the Shares or the proceeds of the sale of Shares, if Participant fails to comply with Participant’s obligations in connection with the Tax-Related Items.

8.Nature of Grant. By accepting the RSUs, Participant acknowledges, understands and agrees that:

(a)the Plan is established voluntarily by the Company, it is discretionary in nature and it may be modified, amended, suspended or terminated by the Company at any time, to the extent permitted by the Plan;

(b)the grant of the RSUs is exceptional, voluntary and occasional and does not create any contractual or other right to receive future grants of RSUs, or benefits in lieu of RSUs, even if RSUs have been granted in the past;

(c)all decisions with respect to future RSUs or other grants, if any, will be at the sole discretion of the Company;

(d)Participant is voluntarily participating in the Plan;

(e)the RSUs and Participant’s participation in the Plan will not create a right to employment or be interpreted as forming or amending an employment or service contract with the Company, the Employer or any Parent, Subsidiary or Affiliate and shall not interfere with the ability of the Company, the Employer or any Parent, Subsidiary or Affiliate, as applicable, to terminate Participant’s employment or service relationship (if any);

(f)the RSUs and the Shares subject to the RSUs, and the income from and value of same, are not intended to replace any pension rights or compensation;

(g)the RSUs and the Shares subject to the RSUs, and the income from and value of same, are not part of normal or expected compensation for any purpose, including, but not limited to, calculating any severance, resignation, termination, redundancy, dismissal, end-of-service payments, bonuses, long-service awards, pension or retirement or welfare benefits or similar payments;

(h)unless otherwise agreed with the Company, the RSUs and the Shares subject to the RSUs, and the income from and value of same, are not granted as consideration for, or in connection with, the service Participant may provide as a director of a Parent, Subsidiary or Affiliate;

(i)the future value of the underlying Shares is unknown, indeterminable and cannot be predicted with certainty;

(j)no claim or entitlement to compensation or damages will arise from forfeiture of the RSUs resulting from Participant’s termination of Service (regardless of the reason for such termination and whether or not later found to be invalid or in breach of employment laws in the jurisdiction where Participant is employed or the terms of Participant’s employment agreement, if any); and

9.No Advice Regarding Grant. The Company is not providing any tax, legal or financial advice, nor is the Company making any recommendations regarding Participant’s participation in the Plan, or Participant’s acquisition or sale of the underlying Shares. Participant acknowledges, understands and agrees he or she should consult with his or her own personal tax, legal and financial advisors regarding his or her participation in the Plan before taking any action related to the Plan.

10.Imposition of Other Requirements. The Company reserves the right to impose other requirements on Participant’s participation in the Plan, on the RSUs and on any Shares acquired under the Plan, to the extent the Company determines it is necessary or advisable for legal or administrative reasons, and to require Participant to sign any additional agreements or undertakings that may be necessary to accomplish the foregoing.

11.Acknowledgement. The Company and Participant agree that the RSUs are granted under and governed by the Notice, this Agreement and the provisions of the Plan (incorporated herein by reference). Participant: (a) acknowledges receipt of a copy of the Plan and the Plan prospectus, (b) represents that Participant has carefully read and is familiar with their provisions, and (c) hereby accepts the RSUs subject to all of the terms and conditions set forth herein and those set forth in the Plan and the Notice.

12.Entire Agreement; Enforcement of Rights. This Agreement, the Plan and the Notice constitute the entire agreement and understanding of the parties relating to the subject matter herein and supersede all prior discussions between them. Any prior agreements, commitments or negotiations concerning the purchase of the Shares hereunder are superseded. No adverse modification of or adverse amendment to this Agreement, nor any waiver of any rights under this Agreement, will be effective unless in writing and signed by the parties to this Agreement (which writing and signing may be electronic). The failure by either party to enforce any rights under this Agreement will not be construed as a waiver of any rights of such party.

13.Compliance with Laws and Regulations. The issuance of Shares will be subject to and conditioned upon compliance by the Company and Participant with all applicable state, federal and foreign laws and regulations and with all applicable requirements of any stock exchange or automated quotation system on which the Company’s Shares may be listed or quoted at the time of such issuance or transfer. Participant understands that the Company is under no obligation to register or qualify the Shares with any state, federal or foreign securities commission or to seek approval or clearance from any governmental authority for the issuance or sale of the Shares. Further, Participant agrees that the Company shall have unilateral authority to amend the Plan and this RSU Agreement without Participant’s consent to the extent necessary to comply with securities or other laws applicable to issuance of Shares. Finally, the Shares issued pursuant to this RSU Agreement shall be endorsed with appropriate legends, if any, determined by the Company.

14.Severability. If one or more provisions of this Agreement are held to be unenforceable under applicable law, then such provision will be enforced to the maximum extent possible given the intent of the parties hereto. If such clause or provision cannot be so enforced, then (a) such provision will be excluded from this Agreement, (b) the balance of this Agreement will be interpreted as if such provision were so excluded and (c) the balance of this Agreement will be enforceable in accordance with its terms.

15.Governing Law and Venue. This Agreement and all acts and transactions pursuant hereto and the rights and obligations of the parties hereto will be governed, construed and interpreted in accordance with the laws of the State of Texas, without giving effect to such state’s conflict of laws rules.

16.No Rights as Employee, Director or Consultant. Nothing in this Agreement will affect in any manner whatsoever any right or power of the Company, or a Parent, Subsidiary or Affiliate, to terminate Participant’s Service, for any reason, with or without Cause.

17.Consent to Electronic Delivery of All Plan Documents and Disclosures. By Participant’s acceptance of the Notice (whether in writing or electronically), Participant and the Company agree that the RSUs are granted under and governed by the terms and conditions of the Plan, the Notice and this Agreement. Participant has reviewed the Plan, the Notice and this Agreement in their entirety, has had an opportunity to obtain the advice of counsel prior to executing this Notice and Agreement, and fully understands all provisions of the Plan, the Notice and this Agreement. Participant hereby agrees to accept as binding, conclusive and final all decisions or interpretations of the Committee upon any questions relating to the Plan, the Notice and this Agreement. Participant further agrees to notify the Company upon any change in Participant’s residence address. By acceptance of the RSUs, Participant agrees to participate in the Plan through an on-line or electronic system established and maintained by the Company or a third party designated by the Company and consents to the electronic delivery of the Notice, this Agreement, the Plan, account statements, Plan prospectuses required by the SEC, U.S. financial reports of the Company, and all other documents that the Company is required to deliver to its security holders (including, without limitation, annual reports and proxy statements) or other communications or information related to the RSUs and current or future participation in the Plan. Electronic delivery may include the delivery of a link to the Company intranet or the internet site of a third party involved in administering the Plan, the delivery of the document via e-mail or such other delivery determined at the Company’s discretion. Participant acknowledges that Participant may receive from the Company a paper copy of any documents delivered electronically at no cost if Participant contacts the Company by telephone, through a postal service or electronic mail. Participant further acknowledges that Participant will be provided with a paper copy of any documents delivered electronically if electronic delivery fails; similarly, Participant understands that Participant must provide on request to the Company or any designated third party a paper copy of any documents delivered electronically if electronic delivery fails. Also, Participant understands that Participant’s consent may be revoked or changed, including any change in the electronic mail address to which documents are delivered (if Participant has provided an electronic mail address), at any time by notifying the Company of such revised or revoked consent by telephone, postal service or electronic mail.

18.Insider Trading Restrictions/Market Abuse Laws. Participant acknowledges that, depending on Participant’s country of residence, the broker’s country, or the country in which the Shares are listed, Participant may be subject to insider trading restrictions and/or market abuse laws in applicable jurisdictions, which may affect Participant’s ability to directly or indirectly, accept, acquire, sell or attempt to sell or otherwise dispose of Shares, or rights to Shares (e.g., RSUs), or rights linked to the value of Shares, during such times as Participant is considered to have “inside information” regarding the Company (as defined by the laws or regulations in the applicable jurisdiction). Local insider trading laws and regulations may prohibit the cancellation or amendment of orders Participant placed before possessing the inside information. Furthermore, Participant may be prohibited from (i) disclosing the inside information to any third party, including fellow employees (other than on a “need to know” basis) and (ii) “tipping” third parties or causing them to otherwise buy or sell securities. Any restrictions under these laws or regulations are separate from and in addition to any restrictions that may be imposed under any applicable Company insider trading policy. Participant acknowledges that it is Participant’s responsibility to comply with any applicable restrictions and understands that Participant should consult his or her personal legal advisor on such matters. In addition, Participant acknowledges that he or she read the Company’s Insider Trading Policy, and agrees to comply with such policy, as it may be amended from time to time, whenever Participant acquires or disposes of the Company’s securities.

19.Code Section 409A. This Agreement and the RSUs (including Dividend Equivalent Rights) granted hereunder are intended to fit within the “short-term deferral” exemption from Section 409A of the Code as set forth in Treasury Regulation Section 1.409A-1(b)(4). For purposes of this Agreement, a termination of employment will be determined consistent with the rules relating to a “separation from service” as defined in Section 409A of the Internal Revenue Code and the regulations thereunder (“Section 409A”). Notwithstanding anything else provided herein, to the extent any payments provided under this RSU Agreement in connection with Participant’s termination of employment constitute deferred compensation subject to Section 409A, and Participant is deemed at the time of such termination of employment to be a “specified employee” under Section 409A, then such payment shall not be made or commence until the earlier of (i) the expiration of the six-month and one day period measured from Participant’s separation from service from the Company or (ii) the date of Participant’s death following such a separation from service; provided, however, that such deferral shall only be effected to the extent required to avoid adverse tax treatment to Participant including, without limitation, the additional tax for which Participant would otherwise be liable under Section 409A(a)(1)(B) in the absence of such a deferral. To the extent any payment under this RSU Agreement may be classified as a “short-term deferral” within the meaning of Section 409A, such payment shall be deemed a short-term deferral, even if it may also qualify for an exemption from Section 409A under another provision of Section 409A. Payments pursuant to this section are intended to constitute separate payments for purposes of Section 1.409A-2(b)(2) of the Treasury Regulations.

20.Award Subject to Company Clawback or Recoupment. The RSUs shall be subject to clawback or recoupment pursuant to any compensation clawback or recoupment policy adopted by the Board or required by law during the term of Participant’s employment or other Service that is applicable to Participant. In addition to any other remedies available under such policy, applicable law may require the cancellation of Participant’s RSUs (whether vested or unvested) and the recoupment of any gains realized with respect to Participant’s RSUs.

BY ACCEPTING THIS AWARD OF RSUS, PARTICIPANT AGREES TO ALL OF THE TERMS AND CONDITIONS DESCRIBED ABOVE AND IN THE PLAN.

| | | | | | | | | | | | | | | | | |

PROS HOLDINGS, INC.

2021 EQUITY INDUCEMENT PLAN

NOTICE OF MARKET STOCK UNIT AWARD |

Unless otherwise defined herein, the terms defined in the PROS Holdings, Inc. (the “Company”) 2021 Equity Inducement Plan (the “Plan”) will have the same meanings in this Notice of Market Stock Unit Award and the electronic representation of this Notice of Market Stock Unit Award established and maintained by the Company or a third party designated by the Company (this “Notice”). |

| Name: | | Jeffrey B. Cotten | | | |

| Address: | | |

| | | | | |

You (“Participant”) have been granted an award of Restricted Stock Units which are eligible to vest subject to satisfaction of the service and performance vesting conditions as set forth herein (the “MSUs” or “Units”) under the Plan subject to the terms and conditions of the Plan, this Notice and the attached Market Stock Unit Award Agreement (the “Agreement”). |

| | | | | |

| Date of Grant: | | 6/3/2025 | | | |

| | | | | |

| Target Number of MSUs: | | __________ | | | |

| | | | | |

| Maximum Number of MSUs: | | __________, which is 200% of the Target Number of Units, subject to adjustment as provided by the Agreement |

| | | | | |

| Performance Period: | | Beginning June 2, 2025 and ending June 1, 2028, subject to Section 9 of the Agreement. |

| | | | | |

| Service Vesting Date: | | 7/1/2028 |

| | | | | |

| Performance Measure: | | Relative TSR Percentile, as defined in Appendix A. |

| | | | | |

| Earned Units: | | The number of Units (rounded up to the nearest whole Unit), if any (not to exceed the Maximum Number of Units), equal to the product of (i) the Target Number of Units multiplied by (ii) the Relative TSR Multiplier, subject to adjustment as provided in Appendix A. |

| | | | | |

| Expiration Date: | | The earlier to occur of: (a) the date on which settlement of all MSUs granted hereunder occurs and (b) if Participant’s Service terminates earlier, as described in the Agreement. |

| | | | | |

| Settlement of MSUs: | | To the extent they vest and become Earned Units, the MSUs shall be settled via an issuance of Shares on the applicable dates as set forth in Section 2 of the Agreement. |

| | | | | |

| By accepting (whether in writing, electronically or otherwise) the MSUs, Participant acknowledges and agrees to the following: |

| | | | | |

| 1) Participant understands that Participant’s Service with the Company or a Parent or Subsidiary or Affiliate is for an unspecified duration, can be terminated at any time (i.e., is “at-will”), except where otherwise prohibited by applicable law, and that nothing in this Notice, the Agreement or the Plan changes the nature of that relationship. Subject to the terms of the Agreement, Participant acknowledges that the vesting, earning and settlement of the MSUs pursuant to this Notice is subject to Participant’s continuing Service as an Employee, Director or Consultant. |

| | | | | |

| | | | | | | | | | | | | | | | | |

| 2) This grant is made under and governed by the Plan, the Agreement and this Notice, and this Notice is subject to the terms and conditions of the Agreement and the Plan, both of which are incorporated herein by reference. Participant has read the Notice, the Agreement and the Plan. The Participant acknowledges that copies of the Plan, the Agreement and the prospectus for the Plan are available on the Company’s internal web site and may be viewed and printed by the Participant for attachment to the Participant’s copy of this Notice. |

| | | | | |

| 3) Participant has read the Company’s Insider Trading Policy, and agrees to comply with such policy, as it may be amended from time to time, whenever Participant acquires or disposes of the Company’s securities. |

| | | | | |

| 4) By accepting the MSUs, Participant consents to electronic delivery and participation as set forth in the Agreement. |

| | | | | | | | |

| | |

PARTICIPANT Signature:

By:

______________________________ Jeffrey B. Cotten | | PROS HOLDINGS, INC. Signature:

By:

______________________________ [First Name Last Name, Title] |

| | |

| | |

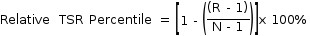

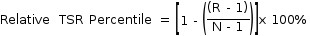

APPENDIX A

Performance Measure and Performance Multiplier

Applicable to Market Stock Unit Award Granted on January 15, 2025