| Energy Fuels Inc. | Bullfrog Project | May 9, 2025 |

| Technical Report | SLR Project No.: 123.V02544.00008 |

Technical Report, Bullfrog Project, Garfield County, Utah, USA

SLR Project No.: 123.V02544.00008

Prepared by

SLR International Corporation

1658 Cole Blvd, Suite 100

Lakewood, CO 80401

for

Energy Fuels Inc.

225 Union Blvd., Suite 600

Lakewood, CO 80229

USA

Effective Date - December 31, 2024

Signature Date - May 9, 2025

| Prepared by: Stuart Collins, P.E. Jeffrey L. Woods, MMSA QP Lee (Pat) Gochnour, MMSA (QP) Mark B. Mathisen, C.P.G. Grant Malensek, M.Eng., P.Eng. Tedros Tesfay, Ph.D, SME (RM). Peer Reviewed by: Murray Dunn, P.Eng. Grant Malensek, M.Eng., P.Eng. |

Approved by: Project Manager Mark B. Mathisen, C.P.G. Project Director Grant Malensek, M.Eng., P.Eng. |

|

| Energy Fuels Inc. | Bullfrog Project | May 9, 2025 |

| Technical Report | SLR Project No.: 123.V02544.00008 |

Table of Contents

| 1.0 Summary | 1-1 |

| 1.1 Executive Summary | 1-1 |

| 1.2 Economic Analysis | 1-8 |

| 1.3 Technical Summary | 1-15 |

| 2.0 Introduction | 2-1 |

| 2.1 Sources of Information | 2-2 |

| 2.2 List of Abbreviations | 2-4 |

| 3.0 Reliance on Other Experts | 3-1 |

| 3.1 Reliance on Information Provided by the Registrant | 3-1 |

| 4.0 Property Description and Location | 4-1 |

| 4.1 Location | 4-1 |

| 4.2 Land Tenure | 4-1 |

| 4.3 Required Permits and Status | 4-12 |

| 4.4 Royalties | 4-12 |

| 4.5 Other Significant Risks | 4-12 |

| 5.0 Accessibility, Climate, Local Resources, Infrastructure and Physiography | 5-1 |

| 5.1 Accessibility | 5-1 |

| 5.2 Vegetation | 5-1 |

| 5.3 Climate | 5-1 |

| 5.4 Local Resources | 5-1 |

| 5.5 Infrastructure | 5-1 |

| 5.6 Physiography | 5-1 |

| 6.0 History | 6-1 |

| 6.1 Prior Ownership | 6-1 |

| 6.2 Exploration and Development History | 6-2 |

| 6.3 Past Production | 6-3 |

| 7.0 Geological Setting and Mineralization | 7-1 |

| 7.1 Regional Geology | 7-1 |

| 7.2 Local Geology | 7-1 |

| 7.3 Mineralization | 7-7 |

| 8.0 Deposit Types | 8-1 |

| 9.0 Exploration | 9-1 |

| 9.1 Hydrogeology | 9-1 |

| i |  |

| Energy Fuels Inc. | Bullfrog Project | May 9, 2025 |

| Technical Report | SLR Project No.: 123.V02544.00008 |

| 10.0 Drilling | 10-1 |

| 10.1 Historical Bullfrog Drilling | 10-1 |

| 10.2 Core Drilling | 10-1 |

| 11.0 Sample Preparation, Analyses, and Security | 11-1 |

| 11.1 Sample Preparation, Analyses, and Security | 11-1 |

| 11.2 Sample Security | 11-4 |

| 11.3 Quality Assurance and Quality Control | 11-4 |

| 11.4 Conclusions | 11-5 |

| 12.0 Data Verification | 12-1 |

| 12.1 RPA Henry Mountain Complex Data Review (2012) | 12-1 |

| 12.2 EFR-AMEC Bullfrog Deposit Data Review (2016) | 12-2 |

| 12.3 SLR Data Verification (2021) | 12-3 |

| 12.4 SLR Data Verification (2024) | 12-3 |

| 12.5 Limitations | 12-4 |

| 13.0 Mineral Processing and Metallurgical Testing | 13-1 |

| 13.1 Metallurgical Testing | 13-1 |

| 13.2 Opinion of Adequacy | 13-2 |

| 14.0 Mineral Resource Estimates | 14-1 |

| 14.1 Summary | 14-1 |

| 14.2 Resource Database | 14-2 |

| 14.3 Geological Interpretation | 14-3 |

| 14.4 Exploratory Data Analysis | 14-8 |

| 14.5 Treatment of High-Grade Assays | 14-8 |

| 14.6 Compositing | 14-8 |

| 14.7 Trend Analysis | 14-10 |

| 14.8 Bulk Density | 14-12 |

| 14.9 Block Model | 14-13 |

| 14.10 Search Strategy and Grade Interpolation Parameters | 14-13 |

| 14.11 Reasonable Prospects for Eventual Economic Extraction for Mineral Resources | 14-15 |

| 14.12 Classification | 14-18 |

| 14.13 Estimation Validation | 14-20 |

| 14.14 Grade Tonnage Sensitivity | 14-25 |

| 14.15 Mineral Resource Reporting | 14-28 |

| 15.0 Mineral Reserve Estimates | 15-1 |

| ii |  |

| Energy Fuels Inc. | Bullfrog Project | May 9, 2025 |

| Technical Report | SLR Project No.: 123.V02544.00008 |

| 16.0 Mining Methods | 16-1 |

| 16.1 Mine Design | 16-1 |

| 16.2 Mining Method | 16-13 |

| 16.3 Life of Mine Plan | 16-17 |

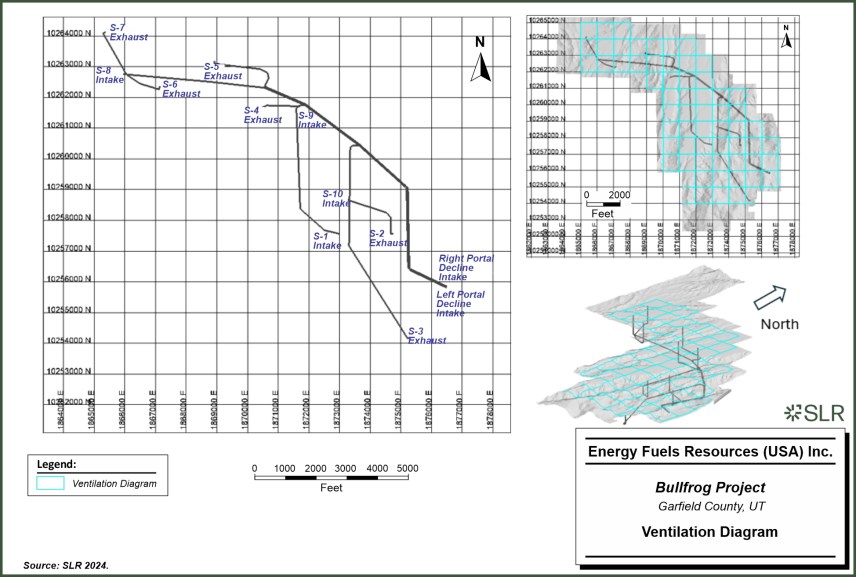

| 16.4 Mine Ventilation | 16-24 |

| 16.4.1 Radon Gas | 16-24 |

| 16.4.2 Stope Access and Ventilation Sequencing | 16-24 |

| 16.5 Mine Infrastructure | 16-27 |

| 16.6 Mine Equipment | 16-30 |

| 17.0 Recovery Methods | 17-1 |

| 17.1 Introduction | 17-1 |

| 17.2 Ore Receiving | 17-1 |

| 17.3 Grinding | 17-1 |

| 17.4 Leaching | 17-1 |

| 17.5 Counter Current Decantation | 17-2 |

| 17.6 Solvent Extraction | 17-2 |

| 17.7 Precipitation, Drying and Packaging | 17-3 |

| 17.8 Mill Upgrades | 17-7 |

| 17.9 Process Design Criteria | 17-7 |

| 17.10 Mill Water Supply | 17-7 |

| 17.11 Power | 17-7 |

| 18.0 Project Infrastructure | 18-1 |

| 18.1 Mine Access Roads | 18-1 |

| 18.2 Power | 18-1 |

| 18.3 Water | 18-1 |

| 18.4 Accommodation Camp | 18-1 |

| 19.0 Market Studies and Contracts | 19-1 |

| 19.1 Markets | 19-1 |

| 19.2 Contracts | 19-3 |

| 20.0 Environmental Studies, Permitting, and Social or Community Impact | 20-1 |

| 20.1 Environmental Studies | 20-1 |

| 20.2 Project Permitting | 20-5 |

| 20.3 Social or Community Requirements | 20-7 |

| 20.4 Mine Closure Requirements | 20-8 |

| iii |  |

| Energy Fuels Inc. | Bullfrog Project | May 9, 2025 |

| Technical Report | SLR Project No.: 123.V02544.00008 |

| 20.5 QP Opinion | 20-8 |

| 21.0 Capital and Operating Costs | 21-1 |

| 21.1 Capital Costs | 21-1 |

| 21.2 Operating Costs | 21-3 |

| 22.0 Economic Analysis | 22-1 |

| 22.1 Base Case - Indicated and Inferred Resources | 22-1 |

| 22.2 Alternative Case - Indicated Only | 22-6 |

| 23.0 Adjacent Properties | 23-1 |

| 23.1 Tony M Property | 23-1 |

| 23.2 Frank M Deposit | 23-1 |

| 23.3 Lucky Strike 10 Deposit | 23-2 |

| 24.0 Other Relevant Data and Information | 24-1 |

| 25.0 Interpretation and Conclusions | 25-1 |

| 25.1 Geology and Mineral Resources | 25-1 |

| 25.2 Mining and Mineral Reserves | 25-1 |

| 25.3 Mineral Processing | 25-2 |

| 25.4 Infrastructure | 25-3 |

| 25.5 Environment | 25-3 |

| 25.6 Capital and Operating Costs | 25-4 |

| 26.0 Recommendations | 26-1 |

| 26.1 Geology and Mineral Resources | 26-1 |

| 26.2 Mining and Mineral Reserves | 26-2 |

| 26.3 Mineral Processing | 26-2 |

| 26.4 Infrastructure | 26-2 |

| 26.5 Environment | 26-3 |

| 26.6 Capital and Operating Costs | 26-3 |

| 27.0 References | 27-1 |

| 28.0 Date and Signature Date | 28-1 |

| 29.0 Certificate of Qualified Person | 29-1 |

| 29.1 Grant A. Malensek | 29-1 |

| 29.2 Mark B. Mathisen | 29-3 |

| 29.3 Stuart Collins, P.E. | 29-4 |

| 29.4 Jeffrey L. Woods | 29-6 |

| 29.5 Lee (Pat) Gochnour | 29-8 |

| iv |  |

| Energy Fuels Inc. | Bullfrog Project | May 9, 2025 |

| Technical Report | SLR Project No.: 123.V02544.00008 |

| 29.6 Tedros Tesfay | 29-9 |

| 30.0 Appendix | 30-1 |

Tables

| Table 1-1: Proposed Energy Fuels 2025 Budget - Bullfrog Project | 1-5 |

| Table 1-2: Base Case After-Tax Cash Flow Summary | 1-9 |

| Table 1-3: Alternative Case After-Tax Cash Flow Summary | 1-12 |

| Table 1-4: Summary of Mineral Resources - Bullfrog Project - December 31, 2024 | 1-17 |

| Table 1-5: Key Bullfrog Life of Mine Production Statistics | 1-20 |

| Table 1-6: LOM Capital Cost Summary | 1-22 |

| Table 1-7: LOM Operating Unit Costs Summary | 1-22 |

| Table 2-1: Summary of QP Responsibilities | 2-2 |

| Table 4-1: List of Claims held by Energy Fuels | 4-2 |

| Table 7-1: Naming Convention of the Mineralized Sands for the Henry Mountains Complex | 7-7 |

| Table 7-2: Minor Element Concentrations of Various Rock Composites | 7-9 |

| Table 11-1: Plateau Disequilibrium Study | 11-3 |

| Table 11-2: Statistics for Project and Twin Database Holes | 11-5 |

| Table 13-1: Comparison of Composite Head Analyses with Calculated Head Grade Analyses | 13-1 |

| Table 14-1: Summary of Mineral Resources as at December 31, 2024 | 14-2 |

| Table 14-2: Summary of Drill Hole Data used in Mineral Resource Estimation | 14-3 |

| Table 14-3: Assays for Bullfrog (% eU3O8) | 14-8 |

| Table 14-4: Summary of Uranium Composite Data by Area | 14-9 |

| Table 14-5: Variogram Values | 14-10 |

| Table 14-6: Summary of Block Model Setup | 14-13 |

| Table 14-7: Summary of Block Model Variables | 14-13 |

| Table 14-8: Sample Selection Parameters Employed in the Estimation by Domain | 14-14 |

| Table 14-9: Stope Optimization Parameters | 14-15 |

| Table 14-10: Assumptions for Underground RPEEE | 14-15 |

| Table 14-11: Mean Composite Grades Compared to the Mean Block Estimates | 14-20 |

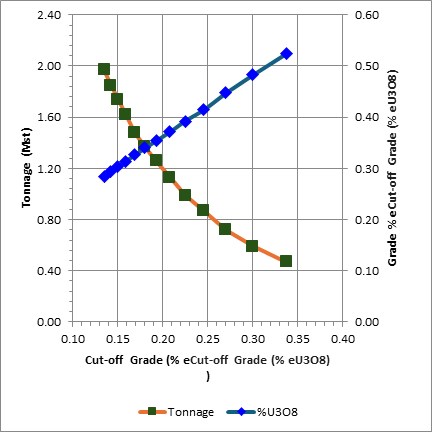

| Table 14-12: Indicated Mineral Resource Grade versus Tons at Various Cut-Off Grades | 14-26 |

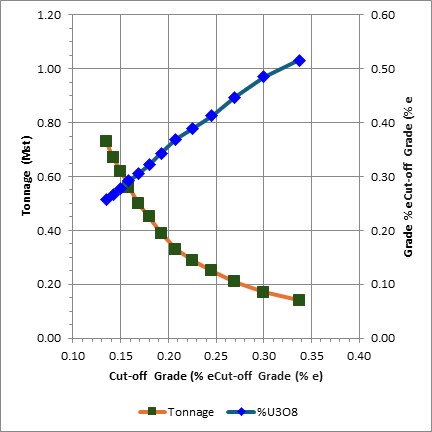

| Table 14-13: Inferred Mineral Resource Grade versus Tons at Various Cut-Off Grades | 14-27 |

| Table 14-14: Summary of Mineral Resources - Bullfrog Project -December 31, 2024 | 14-29 |

| v |  |

| Energy Fuels Inc. | Bullfrog Project | May 9, 2025 |

| Technical Report | SLR Project No.: 123.V02544.00008 |

| Table 16-1: Maximum Allowable Hydraulic Radius For Unsupported And Supported Open Rooms For Various Strength Roof Rocks | 16-6 |

| Table 16-2: Recommended Rock Bolt Parameters in Low Strength Ground Conditions | 16-6 |

| Table 16-3: Summary of Ground Support Parameters for Long-Term Primary and Stope Access Development | 16-11 |

| Table 16-4: Assumed Distribution Of Anticipated Ground Condition For Different Operational Conditions | 16-12 |

| Table 16-5: Summary Cycle Time for 12-ft x 12-ft Heading (Single-Face Decline) | 16-15 |

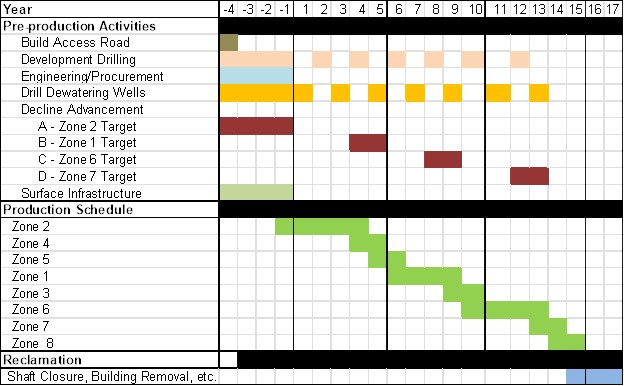

| Table 16-7: Base Case LOM Mining Schedule | 16-20 |

| Table 16-8: Alternative Case LOM Mining Schedule | 16-23 |

| Table 16-9: Mine Surface Infrastructure Space Requirements - Buildings/Areas | 16-27 |

| Table 16-10: Bullfrog Mine Equipment Summary | 16-30 |

| Table 17-1: Principal Process Operation Criteria | 17-7 |

| Table 17-3: White Mesa Mill Operating Load Rating | 17-8 |

| Table 20-1: Federally Listed Potential Threatened and Endangered Species Which May Impact the Bullfrog Mine | 20-2 |

| Table 20-2: State of Utah, Garfield County, Sensitive Species with Potential Habitat in the Project Area | 20-4 |

| Table 21-1: LOM Direct Capital Cost Summary | 21-2 |

| Table 21-2: LOM Capital Cost Summary | 21-2 |

| Table 21-3: LOM Operating Unit Costs Summary | 21-4 |

| Table 21-4: Staff Requirements | 21-4 |

| Table 22-1: Base Case After-Tax Cash Flow Summary | 22-2 |

| Table 22-2: Base Case After-Tax Sensitivity Analyses | 22-5 |

| Table 22-3: Alternative Case After-Tax Cash Flow Summary | 22-7 |

| Table 22-4: Alternative Case (Indicated Only) After-Tax Sensitivity Analyses | 22-10 |

| Table 26-1: Proposed Energy Fuels 2025 Budget - Bullfrog Project | 26-1 |

Figures

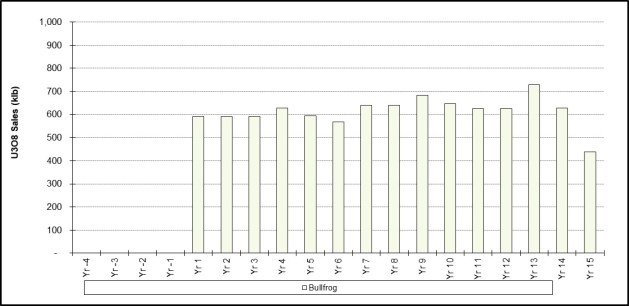

| Figure 1-1: Base Case Payable U3O8 | 1-11 |

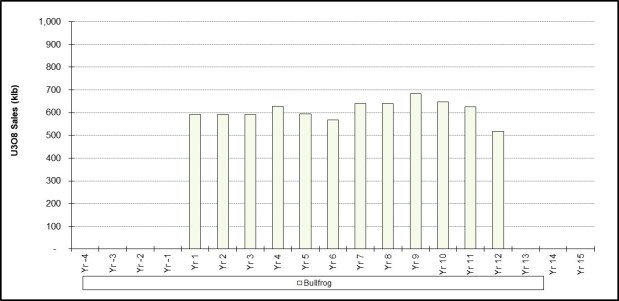

| Figure 1-2: Alternative Case Payable U3O8 | 1-15 |

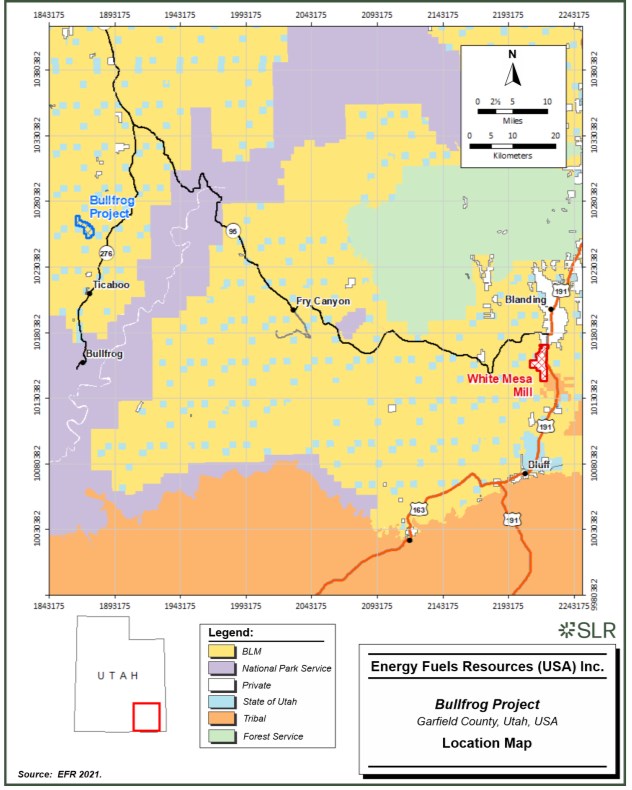

| Figure 4-1: Location Map | 4-10 |

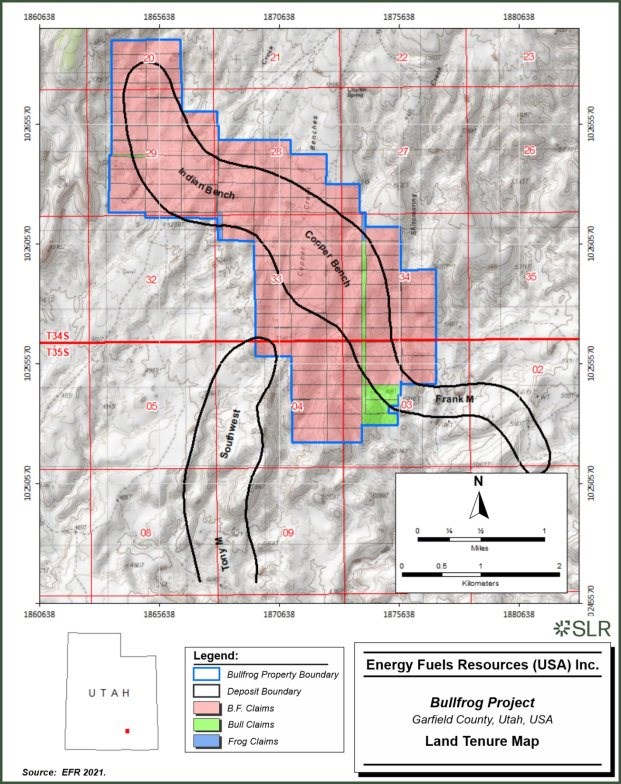

| Figure 4-2: Land Tenure Map | 4-11 |

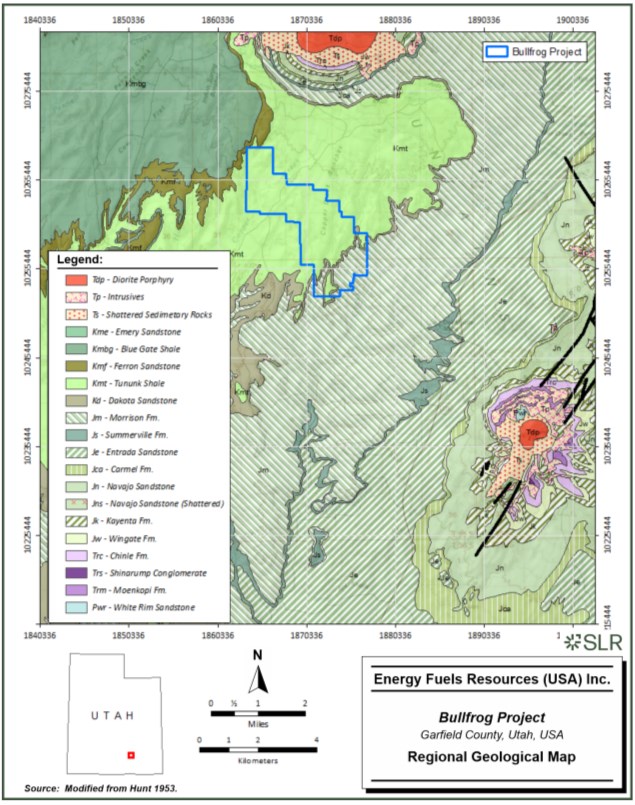

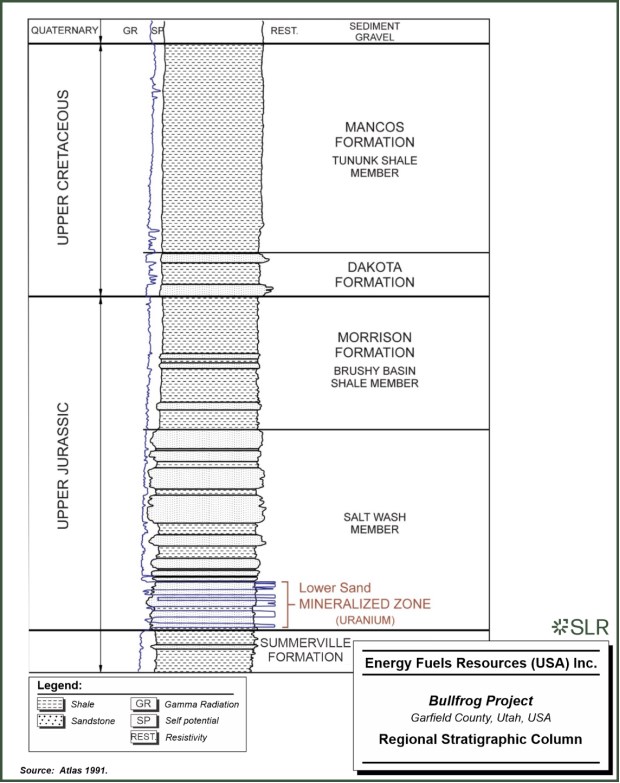

| Figure 7-1: Regional Geologic Map | 7-4 |

| Figure 7-2: Regional Stratigraphic Column | 7-5 |

| vi |  |

| Energy Fuels Inc. | Bullfrog Project | May 9, 2025 |

| Technical Report | SLR Project No.: 123.V02544.00008 |

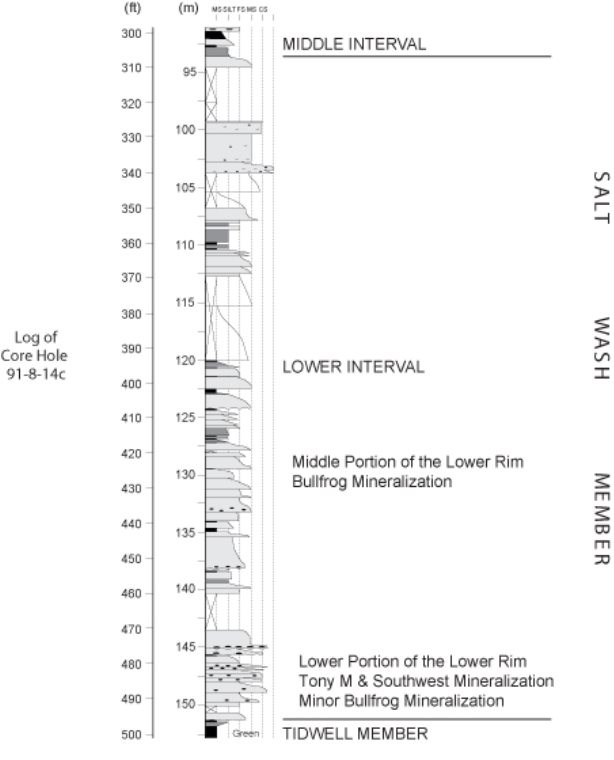

| Figure 7-3: Detail of the Lower Portion of the Lower Rim of the Salt Wash Member | 7-6 |

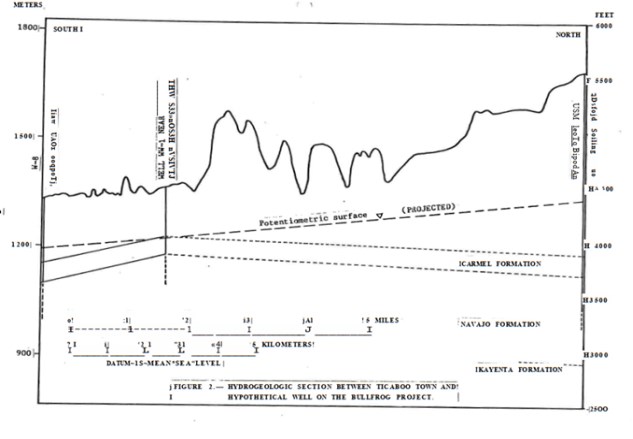

| Figure 9-1: Potentiometric Surface of the Navajo Sandston | 9-4 |

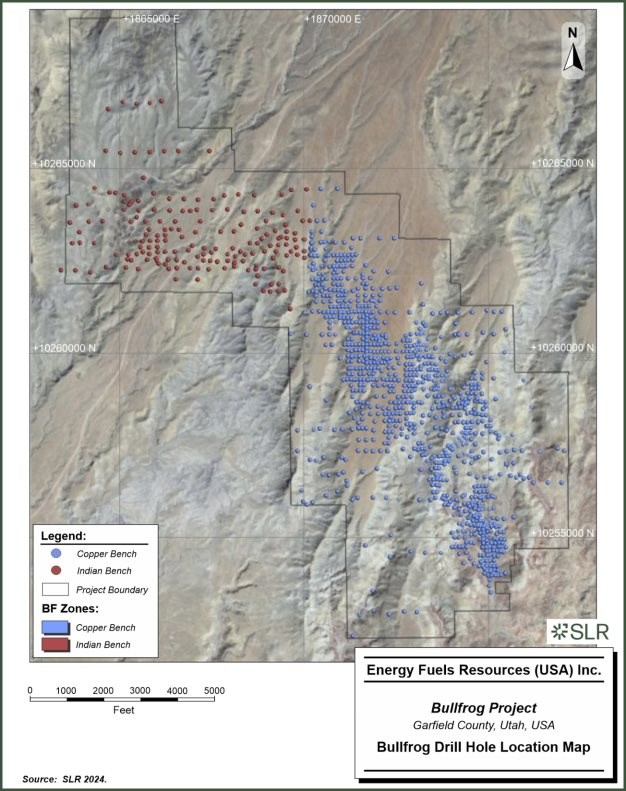

| Figure 10-1: Bullfrog Drill Hole Location Map | 10-2 |

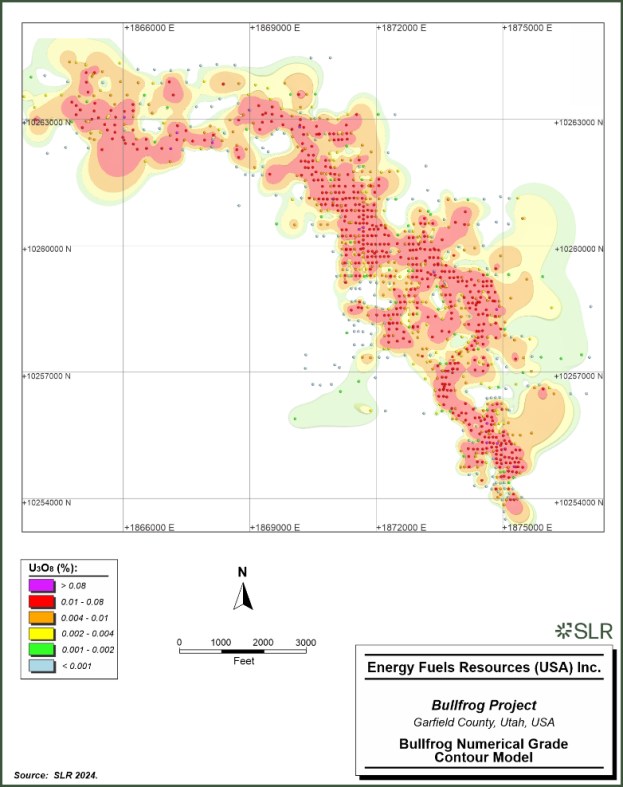

| Figure 14-1: Bullfrog Numerical Grade Contour Model | 14-4 |

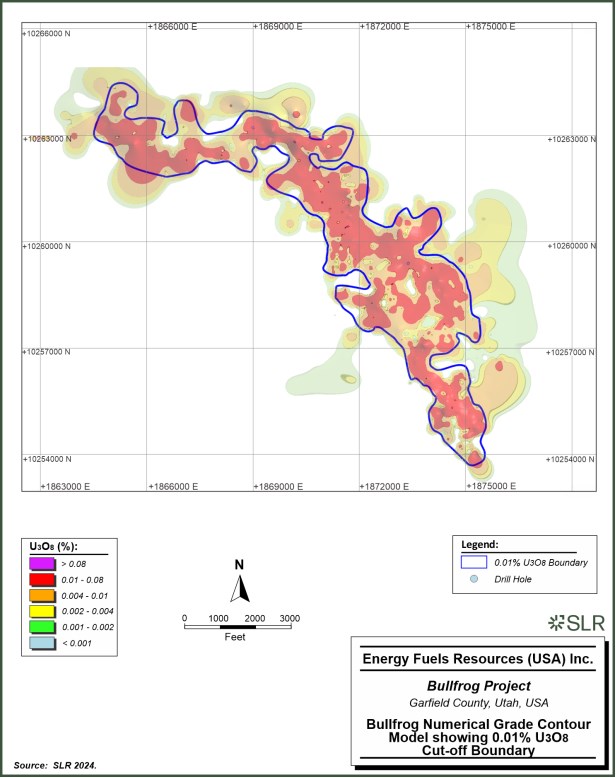

| Figure 14-2: Bullfrog Numerical Grade Contour Model showing 0.01% U3O8 Cut-off Boundary | 14-5 |

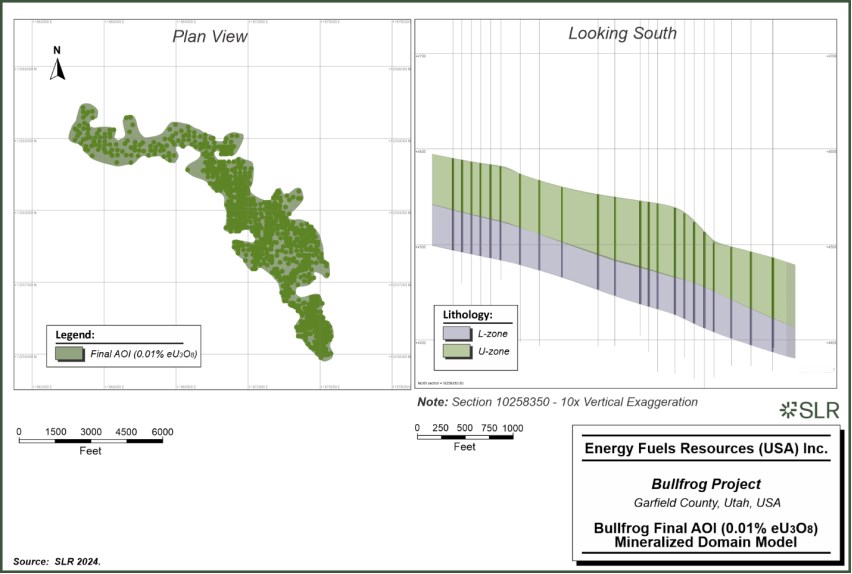

| Figure 14-3: Bullfrog Final AOI (0.01% eU3O8) Mineralized Domain Model | 14-7 |

| Figure 14-4: Bullfrog Histogram of Sample Lengths in the Estimation Domains | 14-9 |

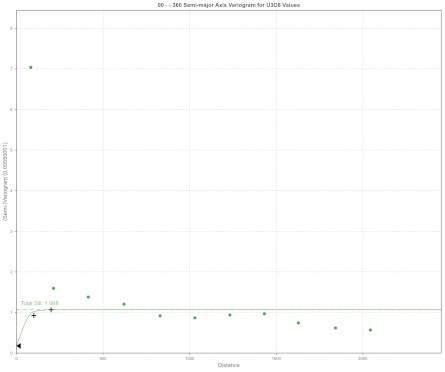

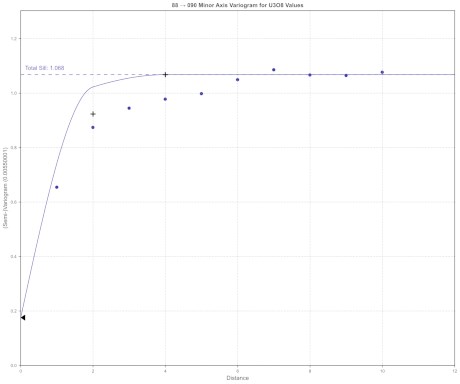

| Figure 14-5: Major Axis Variogram | 14-11 |

| Figure 14-6: Semi-Major Axis Variogram | 14-11 |

| Figure 14-7: Minor Axis Variogram | 14-12 |

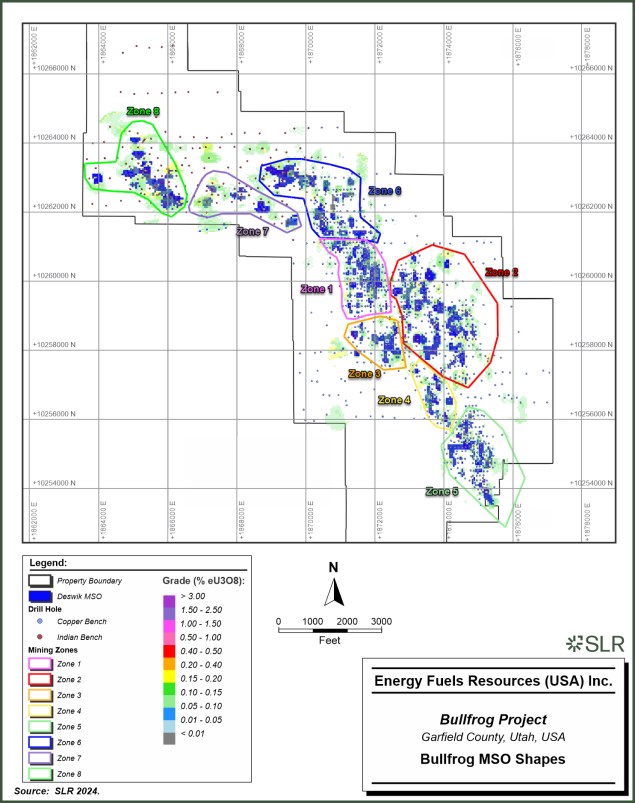

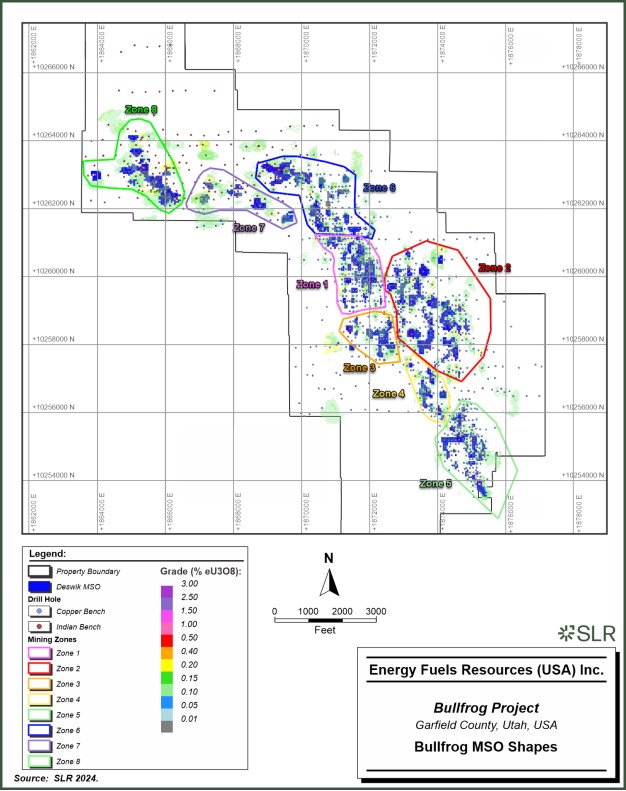

| Figure 14-8: Bullfrog MSO Shapes | 14-17 |

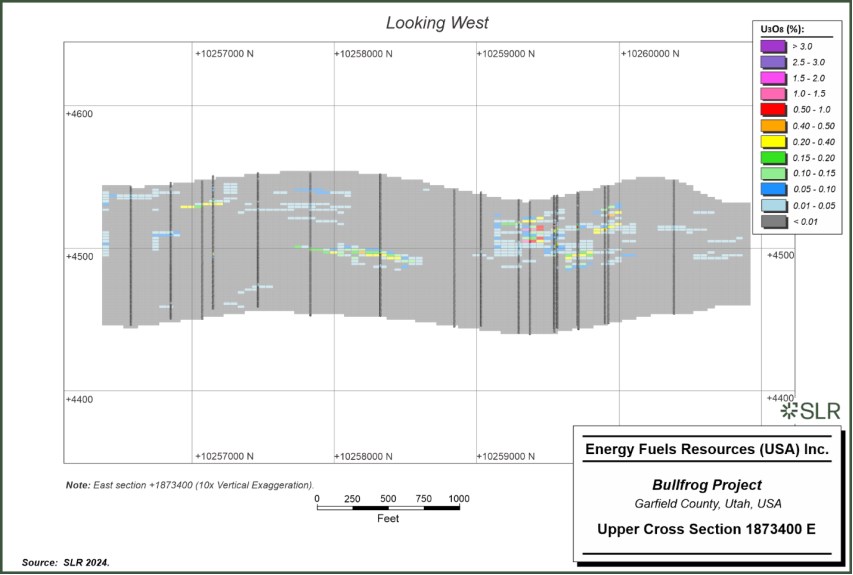

| Figure 14-9: Upper Cross Section 1873400 E | 14-21 |

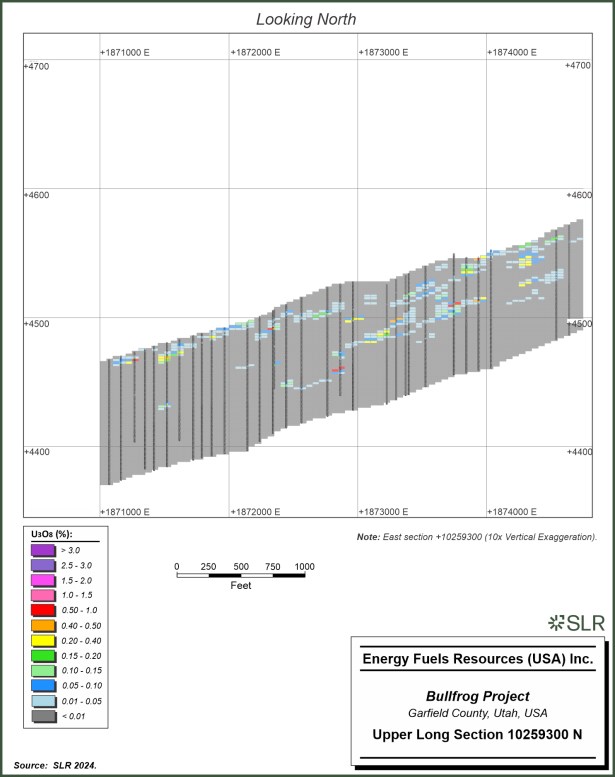

| Figure 14-10: Upper Long Section 10259300 N | 14-22 |

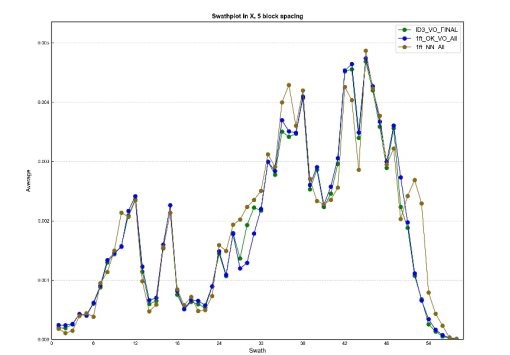

| Figure 14-11: Trend Plot X (East) Direction | 14-23 |

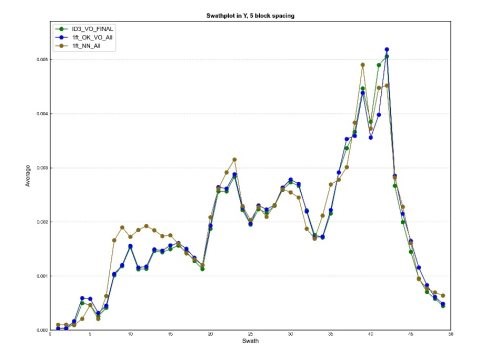

| Figure 14-12: Trend Plot Y (North) Direction | 14-24 |

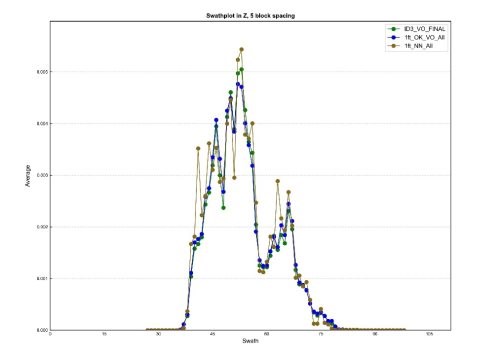

| Figure 14-13: Trend Plot Z (Vertical) Direction | 14-24 |

| Figure 14-14: Indicated Grade versus Tonnage | 14-26 |

| Figure 14-15: Inferred Grade versus Tonnage | 14-27 |

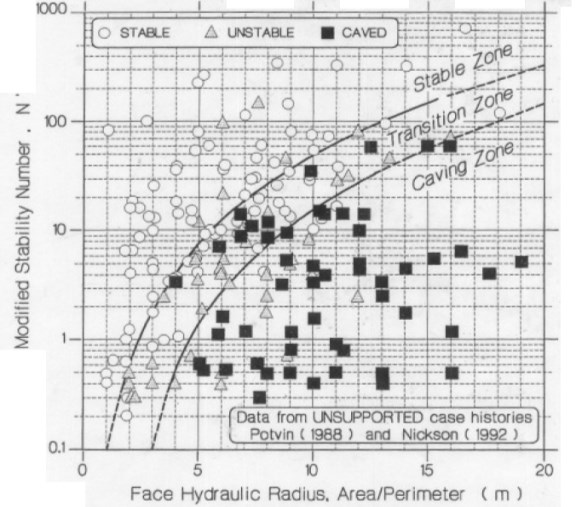

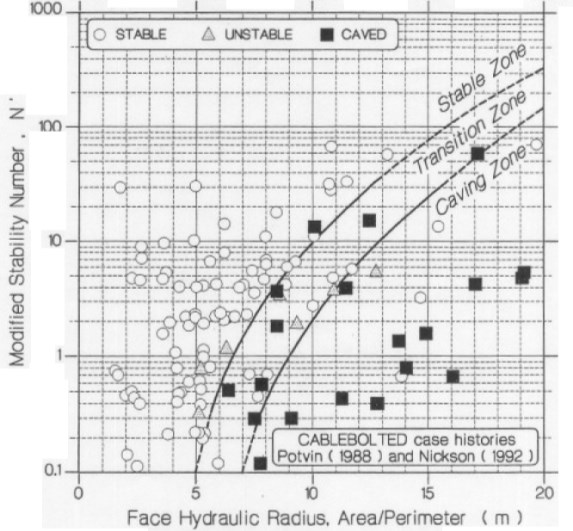

| Figure 16-1: Hydraulic Radius versus Modified Stability Number (N′) for Unsupported Case Histories | 16-4 |

| Figure 16-2: Hydraulic Radius versus Modified Stability Number (N′) for Supported Case Histories | 16-5 |

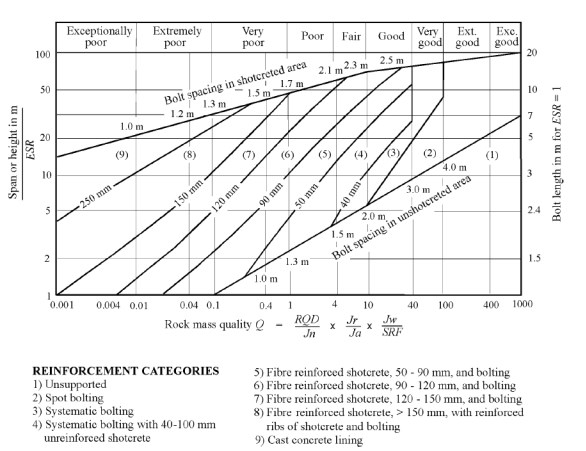

| Figure 16-3: Estimated Support Categories Based on the Tunnelling Quality Index Q | 16-8 |

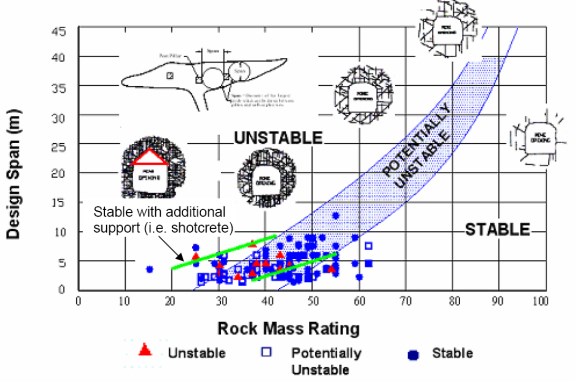

| Figure 16-4: Critical Span Curve for Weak Rock Mass | 16-9 |

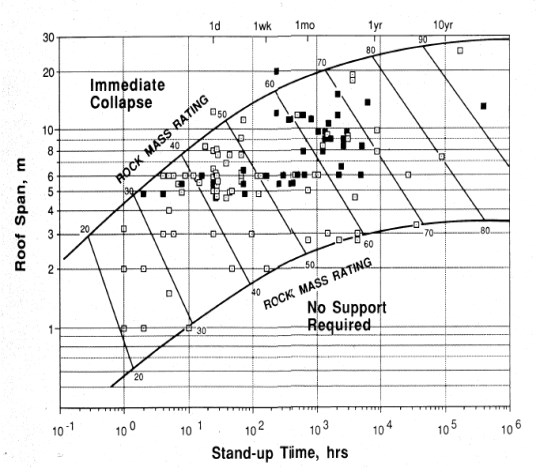

| Figure 16-5: Relationship Between Stand-up Time, Span and RMR Classification | 16-10 |

| Figure 16-6: Bullfrog MSO Shapes | 16-19 |

| Figure 16-7: Base Case LOM Schedule of Activities | 16-22 |

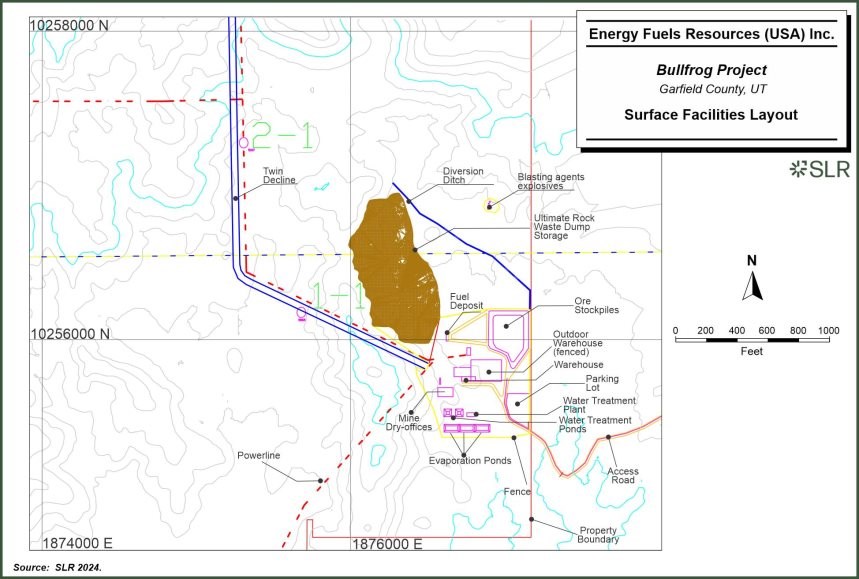

| Figure 16-9: Surface Facilities Layout | 16-29 |

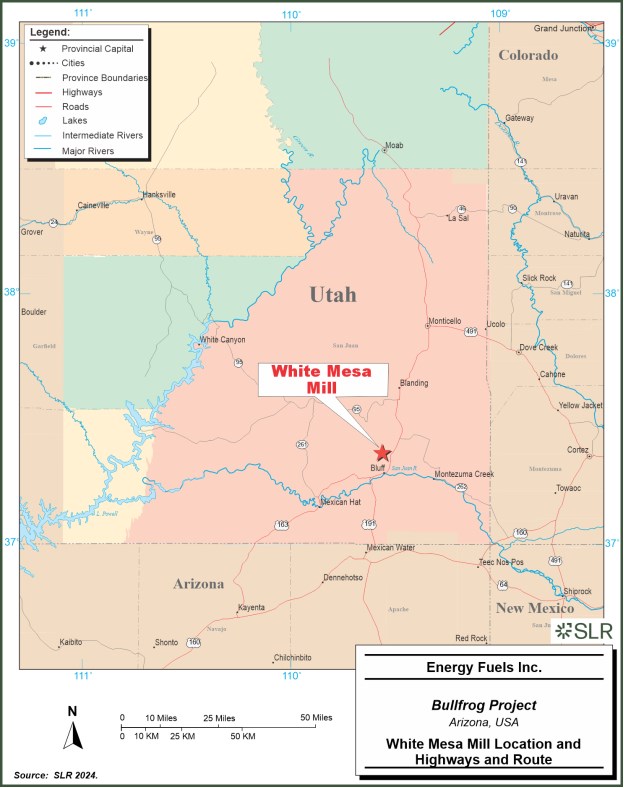

| Figure 17-1: White Mesa Mill Location | 17-4 |

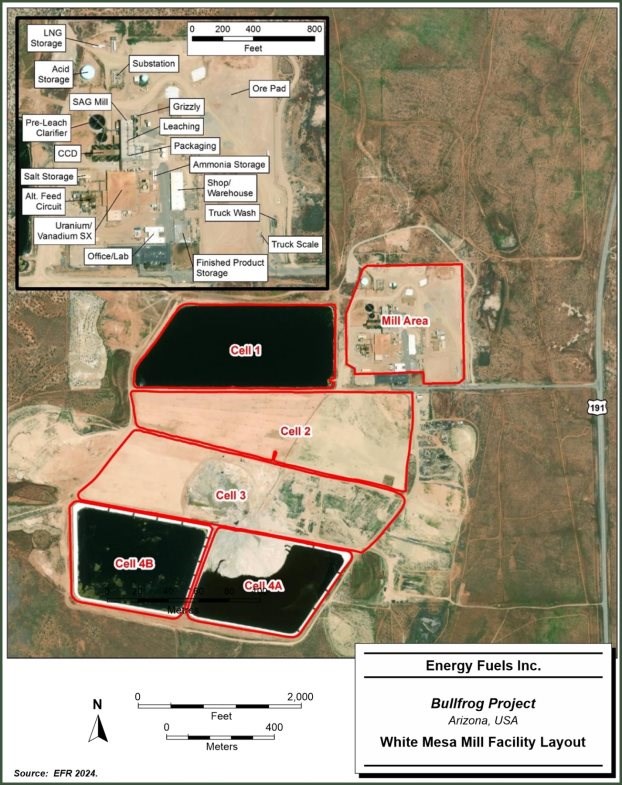

| Figure 17-2: White Mesa Mill Facility Layout | 17-5 |

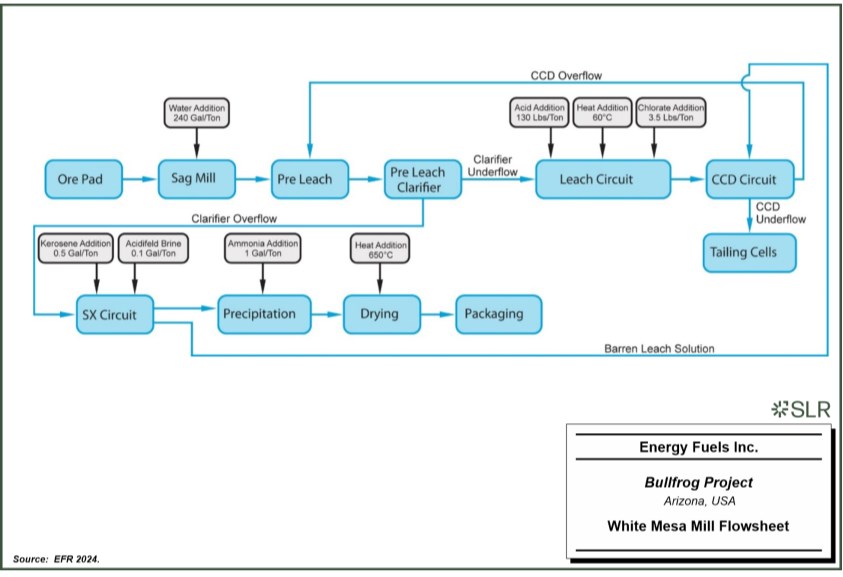

| Figure 17-3: White Mesa Mill Flowsheet | 17-6 |

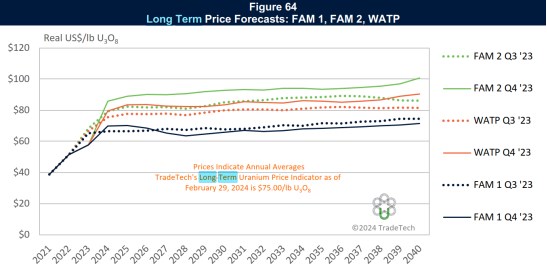

| Figure 19-1: Long Term Uranium Price Forecast | 19-2 |

| Figure 22-1: Base Case Payable U3O8 | 22-3 |

| Figure 22-2: Base Case After-Tax Sensitivity Analysis | 22-6 |

| vii |  |

| Energy Fuels Inc. | Bullfrog Project | May 9, 2025 |

| Technical Report | SLR Project No.: 123.V02544.00008 |

| Figure 22-3: Alternative Case Payable U3O8 | 22-9 |

| Figure 22-4: Alternative Case After-Tax Sensitivity Analysis | 22-11 |

Appendix Tables

| Table 30-1: Base Case After-Tax Cash Flow Summary | 30-2 |

| Table 30-2: Alternative Case After-Tax Cash Flow Summary | 30-4 |

| viii |  |

| Energy Fuels Inc. | Bullfrog Project | May 9, 2025 |

| Technical Report | SLR Project No.: 123.V02544.00008 |

1.0 Summary

1.1 Executive Summary

SLR International Corporation (SLR) was retained by Energy Fuels Inc. (Energy Fuels) to prepare an independent Technical Report on the Bullfrog Project (Bullfrog or the Project), located in Garfield County, Utah, USA. Energy Fuels is the parent company of Energy Fuels Resources (USA) Inc. (EFR), which owns 100% of the Project. EFR is a US-based uranium and vanadium exploration and mine development company. Energy Fuels is listed on the NYSE American Stock Exchange (symbol: UUUU) and the Toronto Stock Exchange (symbol: EFR).

This Technical Report satisfies the requirements of Canadian National Instrument 43-101 Standards of Disclosure for Mineral Projects (NI 43-101) and United States Securities and Exchange Commission's (SEC) Modernized Property Disclosure Requirements for Mining Registrants as described in Subpart 229.1300 of Regulation S-K, Disclosure by Registrants Engaged in Mining Operations (S-K 1300) and Item 601 (b)(96) Technical Report Summary.

The purpose of this report is to disclose the results of a Preliminary Economic Assessment (PEA). The term PEA is used throughout this Technical Report and is consistent with an Initial Assessment (IA) under S-K 1300.

This report was prepared by Stuart Collins, P.E., Jeffrey L. Woods, MMSA QP, Lee (Pat) Gochnour, MMSA QP, Mark B. Mathisen, C.P.G., Grant A. Malensek, M.Eng., P.Eng., and Tedros Tesfay, SME (RM), all of whom are Qualified Persons (QP) within the meaning of both S-K 1300 and NI 43-101 (SLR QP). Messrs. Mathisen, Miranda, and Collins visited the Project on July 15 to 18, 2024.

Bullfrog consists of two contiguous sandstone-type uranium deposits, Copper Bench and Indian Bench, within the Colorado Plateau physiographic province in southwestern Utah. The Colorado Plateau has been a relatively stable structural province since the end of the Precambrian. During the Paleozoic and Mesozoic eras, the Colorado Plateau was a stable shelf without major geosynclinal areas of deposition, except during the Pennsylvanian when several thousand feet of black shales and evaporates accumulated in the Paradox Basin of southwestern Colorado and adjacent Utah.

The Project is situated in the southeastern flank of the Henry Mountains Basin, a subprovince of the Colorado Plateau physiographic province. The Henry Mountains Basin is an elongate north-south trending doubly plunging syncline in the form of a closed basin. It is surrounded by the Monument Uplift to the southeast, Circle Cliffs Uplift to the southwest, and the San Rafael Swell to the north.

The Project is currently being developed in preparation for production as an underground operation, from which the mineralized material will be processed based on a toll milling agreement at Energy Fuels' White Mesa Mill, located near Blanding, Utah, approximately 127 road miles (mi) south of the Project. Environmental permitting and compliance activities are being developed to start mining operations.

| Energy Fuels Inc. | Bullfrog Project | May 9, 2025 |

| Technical Report | SLR Project No.: 123.V02544.00008 |

1.1.1 Conclusions

The SLR QPs offer the following conclusions by area:

1.1.1.1 Geology and Mineral Resources

• The Bullfrog deposit is considered a tabular sandstone hosted uranium deposit.

• The Project is an advanced exploration stage property, 100% owned by EFR. The Project is in a region with a well-developed mining industry and is close to necessary infrastructure and resources.

• As of the effective date of this Technical Report, historical records of EFR predecessors indicate that approximately 1,694 drill holes have been completed on the Bullfrog deposit. Of the 1,694 drill holes, 949 drill holes totaling 910,780 ft of drilling were used in this Mineral Resource estimate Historical surface holes missing collar information, lithology information, or corresponding radiometric logs, i.e., assay data, were excluded.

• In the SLR QP's opinion, the drill hole logging and sampling procedures meet industry standards and are adequate for Mineral Resource estimation. The SLR QP is not aware of any drilling, sampling, or recovery factors that could materially impact the accuracy and reliability of the results.

• Mineral Resources have been classified in accordance with the definitions for Mineral Resources in S-K 1300, which are consistent with Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards for Mineral Resources and Mineral Reserves dated May 10, 2014 (CIM, 2014) definitions which are incorporated by reference in NI 43-101.

• In the SLR QP's opinion, the assumptions, parameters, and methodology used for the Bullfrog Mineral Resource estimate is appropriate for the style of mineralization and mining methods.

• The SLR QP considers the estimation procedures employed at Bullfrog, including compositing, top-cutting, variography, block model construction, and interpolation to be reasonable and in line with industry standard practice.

• The SLR QP is of the opinion the block models are adequate for public disclosure and to support mining activities. The effective date of the Mineral Resource estimate is December 31, 2024.

• The SLR QP considers that the knowledge of the deposit setting, lithologies, structural controls on mineralization, and the mineralization style and setting, is sufficient to support the MRE to the level of classification assigned.

• The SLR QP considers that the resource cut-off grade and mining shapes used to identify those portions of the Mineral Resource that meet the requirement for the reasonable prospects for economic extraction to be appropriate for this style of uranium deposit and mineralization.

1.1.1.2 Mining and Mineral Reserves

• There are no current Mineral Reserves at the Project.

• Mineralization is hosted in the relatively flat laying Salt Wash Member of the Westwater formation at depths below the surface of 500 ft to 1,200 ft.

| Energy Fuels Inc. | Bullfrog Project | May 9, 2025 |

| Technical Report | SLR Project No.: 123.V02544.00008 |

• The Bullfrog Project is composed of the Copper Bench (southeast) and the Indian Bench (northwest) mining areas.

• The mining areas will be accessed by a 13,520-ft long adit decline to the underground mine.

• The mine life comprises a four-year pre-production period and a 15-year active mine life (Base Case) across eight intertwined mining zones (zone 1 through zone 8). The Alternative Case active mine life is 12 years.

• The primary mining methods to employed at Bullfrog will be room and pillar, drift and fill, and split-shot. EFR is acutely aware of the need to keep dilution low given the high cost of transportation and treatment. EFR has many mines with similar geological and mining attributes to Bullfrog. EFR has employed the above-mentioned mining methods at their other underground operations.

• A minimum mining thickness of four feet was applied to two-foot-thick mining blocks.

• Stope dilution was calculated to be 28%.

• An 85% mining recovery was applied to the Mineral Resource mining stopes.

• Groundwater inflow to the mine workings is expected to be between 20 gallons per minute (gpm) to 50 gpm; further hydrogeological modelling and analysis is required to confirm this. The SLR QP has accounted for dewatering wells for depressurization of the mine workings in the capital and operating costs.

• The Base Case mine plan includes 1.8 million tons (Mton) at an average grade of 0.28% eU3O8, containing 9.7 million pounds (Mlb) of eU3O8. Approximately 20% of the tonnage included in the Base Case is categorized as Inferred Resources. The Alternative Case, which comprises Indicated Resources only, includes 1.5 Mton at an average grade of 0.27 eU3O8, containing 7.7 Mlb of eU3O8.

• It is envisioned that Bullfrog will supply approximately 10,000 tons of mineralized material a month (120,000 tons per year (tpa)) to EFR's White Mesa Mill located six miles south of Blanding, Utah, approximately 127 miles south of the Bullfrog mine. The White Mesa Mill is the only active, operating uranium mill in the United States.

1.1.1.3 Mineral Processing

• The Bullfrog mineralized material will be toll milled at the existing White Mesa Mill in Utah. Mineralized material will be transported by haul trucks to the White Mesa Mill.

• The Mill has been in operation since 1981 and is equipped with the required equipment using a proven process for the production of uranium oxide (U3O8) product, called "yellowcake". In addition, although it is not part of the production schedule in this Technical Report, the Mill also has the capacity to produce vanadium pentoxide (V2O5).

• Mill operations can receive run-of-mine (ROM) material from the Bullfrog Project and various other EFR mines. Material will be dumped from trucks onto a mineralized material pad at the Mill and stockpiled by type to be blended as needed. Material will be weighed, sampled, and probed for uranium grade. The mineralized material pad area has an approximate capacity of 450,000 tons.

| Energy Fuels Inc. | Bullfrog Project | May 9, 2025 |

| Technical Report | SLR Project No.: 123.V02544.00008 |

• The Mill utilizes agitated hot acid leach and solvent extraction to recover uranium. Historical metallurgical tests and Mill production records on similar mineralized material confirm this processing method will recover 95% of the contained uranium.

• The Mill has historically run on a campaign basis and processes uranium bearing materials as they become available.

1.1.1.4 Infrastructure

• The Project will have diesel-generated electric power for the underground operation, ventilation fans, surface infrastructure, and dewatering wells.

• Water for the Project will be supplied from dewatering wells, which are needed to depressurize the underground mine.

• The primary surface infrastructure buildings and areas that are required to efficiently operate the Bullfrog mine include the following:

o Underground mine equipment maintenance shop

o Equipment wash bay

o Warehouse facilities

o Mine dry for the workers,

o Offices

o Emergency Medical Services (EMS) facilities

o Guard shack and parking

o Water treatment plant and evaporation ponds

o Fuel depot

o Waste storage facilities

o Ore stockpile area

o Explosive storage facilities

o Underground communications

o Dewatering wells

o Ventilation shafts and fans

o Electrical generators, substation, and site distribution powerlines

o Project access road and site roads

o Fencing

1.1.1.5 Environment

• EFR has a comprehensive understanding of regulatory requirements, permits, authorizations, and the applicable agencies for each. They have initiated select environmental baseline gathering for select disciplines to comply with these requirements.

• The environmental baseline studies that have been performed for the Project area were established between 2014 and 2016 to support permitting. This baseline serves as an excellent benchmark for documenting existing site conditions (and changes that have occurred since) and can be used to assess success of proposed reclamation practices.

• The Project is in a regulatory jurisdiction that has recent experience in permitting similar project activities.

| Energy Fuels Inc. | Bullfrog Project | May 9, 2025 |

| Technical Report | SLR Project No.: 123.V02544.00008 |

1.1.1.6 Capital and Operating Costs

The initial direct capital cost estimate is estimated to be US$36 million. Indirect costs and Owner's costs are estimated to total 20% of direct costs. The contingency has been estimated at 25% of direct, indirect, and Owner's costs. Total initial capital costs over the four year pre-production period are estimated to be US$55 million.

The initial capital cost estimate has an accuracy of +50% / -50%.

Sustaining capital costs are estimated to be US$38 million. Permitting and closure costs are estimated to be US$4 million.

The average life of mine operating costs is estimated to be US$307.63 per ton milled.

1.1.2 Recommendations

SLR has proposed a two-phase exploration program with a total budget of approximately US$2,203,000 to advance the Project, beginning in 2025 (Table 1-1). Phase 2 is contingent on the successful completion of Phase 1.

Table 1-1: Proposed Energy Fuels 2025 Budget - Bullfrog Project

| Category | Budget (US$) |

| Phase 1 | |

| Surface Delineation Drilling | 418,500 |

| Downhole Radiometrics | 279,000 |

| Update Mineral Resource Estimate | 60,000 |

| Phase 1 Subtotal | 757,500 |

| Contingency (10%) | 75,750 |

| Phase 1 Total | 833,250 |

| Phase 2 | |

| Engineering Studies | 307,500 |

| Geotechnical Holes | 232,500 |

| Hydrogeology Study | 75,000 |

| Mine Zone Developmental Drilling | 248,000 |

| Environmental Studies | 250,000 |

| Prepare PFS | 440,000 |

| Update Mine Plan | 20,000 |

| Investigate Alternative Mining Methods | 20,000 |

| PFS | 400,000 |

| Phase 2 Subtotal | 1,245,500 |

| Contingency (10%) | 124,550 |

| Phase 2 Total | 1,370,050 |

| Energy Fuels Inc. | Bullfrog Project | May 9, 2025 |

| Technical Report | SLR Project No.: 123.V02544.00008 |

| Category | Budget (US$) |

| Sub-Total Phase 1 + Phase 2 | 2,003,000 |

| Contingency (10%) | 200,300 |

| Total Phase 1 + Phase 2 | 2,203,300 |

The objectives of the exploration program are summarized below.

1.1.2.1 Geology and Mineral Resources

The SLR QP offers the following recommendations related to the geology and Mineral Resources aspects of the Project:

Phase 1: Development Drilling Program

1 Conduct a 20 to 30 drill hole development drilling program aiming to upgrade Inferred Resources to Indicated Resource and verify historical reported equilibrium values. Average depth per hole is projected to be approximately 930 ft.

2 Utilize Prompt Fission Neutron (PFN) drill hole geophysical logging as an alternative to collecting core to save costs on equilibrium analysis. PFN logging has proven to be a reliable methodology for equilibrium analysis and has a strong performance record on similar uranium deposits in the USA.

3 Update the Mineral Resource estimate for the Project using Deswik Stope Optimizer (Deswik.SO) shape optimization.

The SLR QP estimated costs per drill foot is US$25/ft, which includes the equilibrium analysis costs using the PFN tool.

Phase 2: Updated Resource Estimate and Pre-Feasibility Study

1 Following the Phase 1 drilling and Mineral Resource update, complete a Prefeasibility Study (PFS) of the Project.

1.1.2.2 Mining and Mineral Reserves

1 As part of a PFS, conduct the necessary work to estimate Mineral Reserves. The following tasks, included in the work program budget, will need to be part of the PFS.

o Conduct development drilling of the first mining zones to be encountered.

o Conduct drilling and analysis of geotechnical holes in the first mining zones to be encountered and along the decline route to support ground control design.

o Conduct a hydrology study to quantify the amount of mine depressurization and dewatering needed for the Project.

o Update the mine plan designs and schedule, including equipment and site service requirements to support the target production rates.

2 Investigate the alternative mining methods, like the use of roadheaders in soft ground.

| Energy Fuels Inc. | Bullfrog Project | May 9, 2025 |

| Technical Report | SLR Project No.: 123.V02544.00008 |

1.1.2.3 Mineral Processing

1 Continue the White Mesa Mill intermittent operations with maintenance program.

2 Evaluate historical operating data to determine possible flowsheet improvements or modifications to improve the mill production rate/economics and make these changes before commencing production.

3 Conduct bench tests on the Bullfrog mineralized material to define process parameters.

1.1.2.4 Infrastructure

1 Design and estimate costs for a surface infrastructure to support future mining activities, including Project access road, surface facilities, water treatment plant, settling ponds, and evaporation ponds.

1.1.2.5 Environment

Hydrology

1 Given the absence of site-specific boring logs, monitoring wells, and data on transmissivity and storage, install wells to improve understanding of the groundwater system beneath the proposed Project site. Pumping tests should also be conducted to determine extraction rates, as well as the transmissivity and storage coefficient of the Navajo Sandstone aquifer near the production wells.

2 Using site-specific boring logs and permeability data, develop 3D geologic models, followed by numerical models, to verify the water budget of the Navajo Sandstone and assess its hydraulic connectivity, both laterally and vertically, with adjacent formations. Mine inflow estimates for the underground workings should be confirmed through the groundwater monitoring program, incorporating seepage water collection and the numerical modeling process for the Project.

Baseline Studies, Permits, Reclamation.

1 Review and document the previous environmental baseline studies, supplement or update these studies as required for current and anticipated permitting efforts, and document changes in the baseline since initial permitting efforts.

2 Complete additional studies for the socio-economic impacts, air quality, and meteorology.

3 Track (and where appropriate participate in) new legislation that may have impact(s) on permitting and environmental requirements for the Project.

4 As Permits are applied for and secured, begin development of an environmental management system that captures and describes environmental plans and requirements.

5 Even though opportunity may be limited, look for opportunities for concurrent reclamation to minimize financial obligation(s) during mining and at closure.

6 Once construction is complete, stabilize new disturbances with mulch, surface armoring and/or and vegetation to minimize erosion.

7 Develop revegetation test plots to finalize reclamation seed mix(es).

| Energy Fuels Inc. | Bullfrog Project | May 9, 2025 |

| Technical Report | SLR Project No.: 123.V02544.00008 |

1.1.2.6 Capital and Operating Costs

1 For the next phase of study, complete detailed capital cost estimates based on PFS-level designs.

1.2 Economic Analysis

1.2.1 Base Case - Indicated and Inferred Resources

The economic analysis contained in this Technical Report is based, in part, on Inferred Mineral Resources, and is preliminary in nature. Inferred Mineral Resources are considered too geologically speculative to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves. There is no certainty that economic forecasts on which this PEA is based will be realized. Inferred Mineral Resource tonnage represents approximately 20% of the Mineral Resources used in this Base Case economic analysis. It is important to note that, unlike Mineral Reserves, Mineral Resources do not have demonstrated economic viability.

An after-tax Cash Flow Projection has been generated from the Life of Mine production schedule and capital and operating cost estimates. A summary of the key criteria is provided below.

1.2.1.1 Economic Criteria

Revenue

• Total mill feed processed: 1,765 kt

• Percent of Inferred Mineral Resource tonnage in LOM: 20%

• Average head grade: 0.28% eU3O8

• Average mining rate: 10,000 tons per month mining from underground (120,000 tons per year).

• Cut-off grade of 0.15% applied to diluted stope shapes.

• eU3O8 is sold at 100% payable.

• All prices are in US dollars, the Project is located in Utah, and all products produced are sold domestically.

• Metal Price: US$90/lb eU3O8.

• Net Smelter Return includes refining, transport, and insurance costs.

• Revenue is recognized at the time of production.

• Average mill recovery: 95%

• Total Recovered U3O8: 9,226 llb

Costs

Pre-production period: four years (Year -4 through Year -1).

Mine life: 15 years.

| Energy Fuels Inc. | Bullfrog Project | May 9, 2025 |

| Technical Report | SLR Project No.: 123.V02544.00008 |

Mine life capital totals $97 million, initial capital totals $55 million, permitting and closure totals $4 million, and sustaining capital totals $38 million.

Average operating cost over the mine life is $307.63 per ton milled.

Taxation and Royalties

There are no royalties on the Bullfrog production other than the state of Utah has a 2.6% Severance mineral tax. Income tax assumptions include a 21% Federal Income tax rate and a Utah Income tax rate of 4.50%. Unit of Production (UoP) depreciation was used along with percentage depletion of 22% versus cost depletion.

1.2.1.2 Cash Flow Analysis

Considering the Project on a stand-alone basis, the undiscounted after-tax cash flow totals $147 million over the mine life, and simple payback occurs approximately 5.8 years from start of production. The after-tax Net Present Value (NPV) at an 8% discount rate is $31 million, and the after-tax Internal Rate of Return (IRR) is 14%.

The amount of Inferred Mineral Resources included in this study represents approximately 20% of the total Mineral Resources tons. Inferred Mineral Resources are geologically speculative, and there is no certainty that economic forecasts on which this PEA is based will be realized.

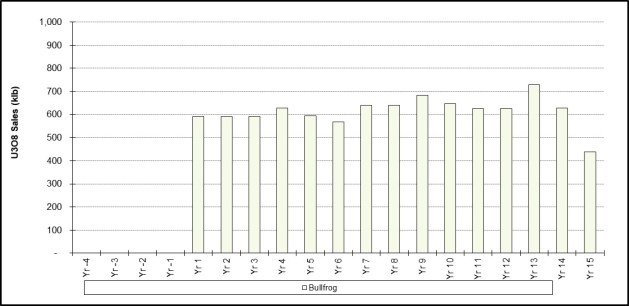

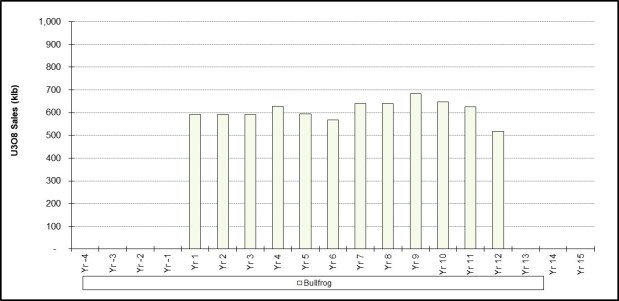

A summary of the after-tax cash flow is provided in Table 1-2. Figure 1-1 presents the payable metal by year.

Table 1-2: Base Case After-Tax Cash Flow Summary

| Description | US$ million |

| Realized Market Prices | |

| U3O8 ($/lb) | $90 |

| Payable Metal | |

| U3O8 (klb) | 9,226 |

| Total Gross Revenue | 830 |

| Mining Cost | (238) |

| Mill Feed Transport Cost | (53) |

| Process Cost | (194) |

| Surface Facility Maintenance Cost | 0 |

| G & A Cost | (58) |

| Product Transport to Market | 0 |

| Royalties | 0 |

| Severance Tax | (20) |

| Total Operating Costs | (563) |

| Operating Margin (EBITDA) | 267 |

| Operating Margin % | 32% |

| Corporate Income Tax | (23) |

| Energy Fuels Inc. | Bullfrog Project | May 9, 2025 |

| Technical Report | SLR Project No.: 123.V02544.00008 |

| Description | US$ million |

| Working Capital* | 0 |

| Operating Cash Flow | 245 |

| Development Capital | (55) |

| Exploration | 0 |

| Sustaining Capital | (38) |

| Closure/Reclamation | (4) |

| Total Capital | (97) |

| Pre-tax Free Cash Flow | 169.8 |

| Pre-tax NPV @ 5% | 72.5 |

| Pre-tax NPV @ 8% | 40.5 |

| Pre-tax NPV @ 12% | 14.0 |

| Pre-tax IRR | 15.6% |

| After-tax Free Cash Flow | 147.6 |

| After-tax NPV @ 5% | 59.8 |

| After-tax NPV @ 8% | 31.2 |

| After-tax NPV @ 12% | 7.6 |

| After-tax IRR | 14.0% |

| Notes: *Includes Working Capital of $24.7 million through first two years of production |

|

Figure 1-1: Base Case Payable U3O8

| Energy Fuels Inc. | Bullfrog Project | May 9, 2025 |

| Technical Report | SLR Project No.: 123.V02544.00008 |

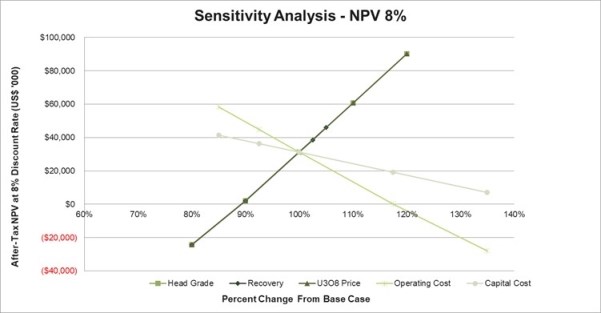

1.2.1.3 Sensitivity Analysis

Project risks can be identified in both economic and non-economic terms. Key economic risks were examined by running cash flow sensitivities:

• eU3O8 price

• Mill Recovery

• Head grade

• Operating costs

• Pre-production capital costs

• Mine life

The sensitivity analysis reveals the variations in key economic factors-such as metal prices, operating costs, and recovery rates-that can significantly impact the Project's net present value (NPV) and internal rate of return (IRR). Understanding these sensitivities is crucial for effective risk management and strategic decision-making.

1.2.2 Alternative Case - Indicated Only

The SLR QP also undertook an analysis of an alternative case that considers only Indicated Mineral Resources, which account for approximately 1.42 million tons, or 80%, of the 1.76 million tons in the base case production schedule. The Project has no estimated Measured Resource. The SLR QP has determined that a stand-alone alternative case with only Indicated Mineral Resource tonnage is economic using the assumptions and inputs outlined in the Base Case at an Internal Rate of Return of approximately 12%. The SLR QP notes that while the alternative case does not contain Inferred Mineral Resources, Indicated Mineral Resources are not Reserves and do not have demonstrated economic viability. There is no certainty that economic forecasts included in this PEA will be realized.

EFR plans to conduct additional definition drilling of the known mineralized material to convert the Inferred Mineral Resources to Indicated Mineral Resources.

1.2.2.1 Economic Criteria

Revenue

• Total mill feed processed: 1,419 kt

• Average head grade: 0.27% eU3O8

• Average mining rate: 10,000 tons per month mining from underground (120,000 tons per year).

• Cut-off grade of 0.15% applied to diluted stope shapes.

• eU3O8 is sold at 100% payable.

• All prices are in US dollars, the Project is located in Utah, and all products produced are sold domestically.

• Metal Price: US$90/lb eU3O8.

• Net Smelter Return includes refining, transport, and insurance costs.

| Energy Fuels Inc. | Bullfrog Project | May 9, 2025 |

| Technical Report | SLR Project No.: 123.V02544.00008 |

• Revenue is recognized at the time of production.

• Average mill recovery: 95%

• Total Recovered U3O8: 7,324 llb

Costs

Pre-production period: four years (Year -4 through Year -1).

Mine life: 12 years.

Mine life capital totals $97 million, initial capital totals $55 million, permitting and closure totals $4 million, and sustaining capital totals $38 million.

Average operating cost over the mine life is $307.63 per ton milled.

Taxation and Royalties

There are no royalties on the Bullfrog production other than the state of Utah has a 2.6% Severance mineral tax. Income tax assumptions include a 21% Federal Income tax rate and a Utah Income tax rate of 4.50%. Unit of Production (UoP) depreciation was used along with percentage depletion of 22% versus cost depletion.

1.2.2.2 Cash Flow Analysis

Considering the Project on a stand-alone basis, the undiscounted after-tax cash flow totals $97.6 million over the mine life, and simple payback occurs approximately 5.7 years from start of production. The after-tax Net Present Value (NPV) at an 8% discount rate is $18.7 million, and the after-tax Internal Rate of Return (IRR) is 12.4%.

The cash flow analysis for the Alternative Case is summarized in Table 1-3. Figure 1-2 presents the payable metal by year.

Table 1-3: Alternative Case After-Tax Cash Flow Summary

| Description | US$ million |

| Realized Market Prices | |

| U3O8 ($/lb) | $90 |

| Payable Metal | |

| U3O8 (klb) | 7,324 |

| Total Gross Revenue | 659 |

| Mining Cost | (190) |

| Mill Feed Transport Cost | (42) |

| Process Cost | (156) |

| Surface Facility Maintenance Cost | 0 |

| G & A Cost | (47) |

| Product Transport to Market | 0 |

| Royalties | 0 |

| Energy Fuels Inc. | Bullfrog Project | May 9, 2025 |

| Technical Report | SLR Project No.: 123.V02544.00008 |

| Description | US$ million |

| Severance Tax | (16) |

| Total Operating Costs | (452) |

| Operating Margin (EBITDA) | 207 |

| Operating Margin % | 31% |

| Corporate Income Tax | (15) |

| Working Capital* | 0 |

| Operating Cash Flow | 192 |

| Development Capital | (55) |

| Exploration | 0 |

| Sustaining Capital | (35) |

| Closure/Reclamation | (4) |

| Total Capital | (94) |

| Pre-tax Free Cash Flow | 112.7 |

| Pre-tax NPV @ 5% | 48.4 |

| Pre-tax NPV @ 8% | 25.8 |

| Pre-tax NPV @ 12% | 6.4 |

| Pre-tax IRR | 13.9% |

| After-tax Free Cash Flow | 97.8 |

| After-tax NPV @ 5% | 39.2 |

| After-tax NPV @ 8% | 18.8 |

| After-tax NPV @ 12% | 1.4 |

| After-tax IRR | 12.4% |

| Notes: *Includes Working Capital of $24.7 million through first two years of production |

|

| Energy Fuels Inc. | Bullfrog Project | May 9, 2025 |

| Technical Report | SLR Project No.: 123.V02544.00008 |

Figure 1-2: Alternative Case Payable U3O8

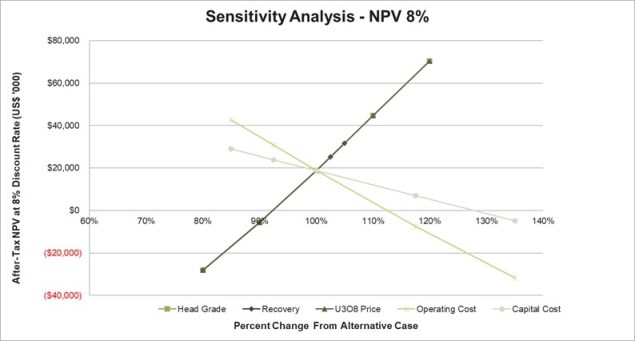

1.2.2.3 Sensitivity Analysis

Project risks can be identified in both economic and non-economic terms. Key economic risks were examined by running cash flow sensitivities:

• eU3O8 price

• Mill Recovery

• Head grade

• Operating costs

• Pre-production capital costs

• Mine life

The sensitivity analysis reveals the variations in key economic factors-such as metal prices, operating costs, and recovery rates—that can significantly impact the Project's net present value (NPV) and internal rate of return (IRR). Understanding these sensitivities is crucial for effective risk management and strategic decision-making.

1.3 Technical Summary

1.3.1 Property Description and Location

The Bullfrog Project consists of two separate contiguous deposits, also known as Copper Bench and Indian Bench. The Project is located in eastern Garfield County, Utah, 17 mi north of Bullfrog Basin Marina on Lake Powell and approximately 40 mi south of the town of Hanksville, Utah. It is situated three miles west of Utah State Highway 276 and approximately five miles north of Ticaboo, Utah.

The approximate center of the of the Project has the following coordinates:

• Universal Transverse Mercato (UTM): 526,649.08 mE, 4,184861.5m N zone 12S

| Energy Fuels Inc. | Bullfrog Project | May 9, 2025 |

| Technical Report | SLR Project No.: 123.V02544.00008 |

• Geographic: 37°48'38.71"N latitude and110°41'50.09"W longitude (decimal degrees 37.810753, -110.697247)

• State Plane 1983 Utah South FIPS 4303 (US feet) system: 1,872,319.926 E, 10,260,078.280 N

1.3.2 Land Tenure

EFR's property position at the Project consists of 168 unpatented mining claims located on U.S. Bureau of Land Management (BLM) land, encompassing approximately 2,344 acres. Surface access to conduct exploration, development and mining activities on unpatented mining claims is granted by the BLM if National Environmental Protection Act (NEPA) regulations are met. The Project is 100% owned by EFR and all claims are in good standing.

1.3.3 History

During World War I, vanadium was mined from small deposits outcropping in Salt Wash exposures on the eastern and southern flanks of the Henry Mountains. In the 1940s and 1950s, interest increased in both vanadium and uranium, and numerous small mines developed along the exposed Salt Wash outcrops.

In the late 1960s, Gulf Minerals (Gulf) acquired a significant land position southwest of the Henry Mountains Complex property and drilled approximately 70 holes with little apparent success. In 1970 and 1971, Rioamex Corporation conducted a 40-hole drilling program in an east-west zone extending across the southerly end of the Bullfrog property and the northerly end of the Tony M-Frank M property. Some of these holes intercepted significant uranium mineralization.

The ownership history of the Bullfrog and Southwest deposits and the Tony M deposit evolved independently from the mid-1970s until early 2005. The Bullfrog and Southwest deposits were initially explored by Exxon Minerals Company (Exxon), while the Tony M deposit was explored and developed by Plateau, a subsidiary of Consumers Power Company (Consumers) of Michigan. In 2005, International Uranium Corporation (IUC) combined the three deposits into a larger land package. In 2021, EFR divested of the Tony M property and Southwest deposit, retaining the mineral claims associated with the Bullfrog deposits (Copper Bench and Indian Bench).

Exxon conducted reconnaissance in the area in 1974 and 1975, resulting in staking of the first "Bullfrog" claims in 1975 and 1976. The first drilling program in 1977 resulted in the discovery of what became the Southwest deposit. Additional claims were subsequently staked, and drilling continued, first by Exxon's Exploration Group, and then by its Pre-Development Group. Several uranium and vanadium zones were discovered in the Southwest and Copper Bench areas, and mineralization exhibiting potential economic grade was also discovered in the Indian Bench area. With the declining uranium markets of the early 1980s, Exxon prepared a prefeasibility report and then discontinued development of the property. Subsequently, Exxon offered the property to Atlas Minerals Corporation (Atlas) in January 1982.

Atlas entered into an agreement to purchase the Bullfrog property from Exxon in July 1982. From July 1982 to July 1983, Atlas completed 112 drill holes delineating the Southwest and Copper Bench deposits on approximately 100 ft centers. In August 1983, Atlas commissioned Pincock, Allen and Holt, Inc. (PAH), to conduct a feasibility study for development of the Southwest and Copper Bench deposits. From July 1983 to March 1984, Atlas completed a core drilling program throughout the Bullfrog property, as well as a rotary drill hole program to delineate the Indian Bench deposit. In November 1983, Atlas renamed the Bullfrog deposits as the "Edward R. Farley Jr. Deposit", but that name is no longer used.

| Energy Fuels Inc. | Bullfrog Project | May 9, 2025 |

| Technical Report | SLR Project No.: 123.V02544.00008 |

Atlas continued to hold the Bullfrog property until 1990 when a corporate decision was made to consider its sale. During that year, Mine Reserves Associates, Inc. (MRA) of Tucson, Arizona, was retained to prepare mineral inventory and mineable reserve estimates for the Indian Bench deposit and incorporate the results into a project-wide reserve base. Steve Milne of Milne and Associates (Milne), a principal engineer for the PAH study, was engaged in November 1990 to update the PAH feasibility study and to complete an optimization study on selected mining/milling scenarios. The completed Milne study was submitted to Atlas in December 1990.

Atlas did not sell the Bullfrog property, and in 1991 returned it to Exxon. In late 1992, Energy Fuels Nuclear Inc. (EFNI), no relation to EFR, acting through its subsidiary Energy Fuels Exploration Company, purchased the property from Exxon. EFNI conducted a geologic review and internal economic analysis of the Bullfrog property. In 1997, IUC became the owner of the Bullfrog property as part of an acquisition in which IUC acquired all of EFNI's assets. IUC performed no exploration activities on the properties.

On December 1, 2006, IUC combined its operations with those of Denison Mines Inc. (DMI) and DMI became a subsidiary of IUC. IUC was then renamed Denison.

In June 2012, Energy Fuels acquired 100% of the Henry Mountains Complex through the acquisition of Denison and its affiliates' U.S. Mining Division.

In October 2021, EFR divested of the Tony M property and Southwest deposit to Consolidated Uranium, Inc. (CUR), retaining the mineral claims associated with the Bullfrog (Copper Bench and Indian Bench) Deposits.

1.3.4 Geology and Mineralization

The Copper Bench and Indian Bench Deposits are classified as sandstone hosted uranium deposits. Sandstone-type uranium deposits typically occur in fine to coarse grained sediments deposited in a continental fluvial environment. The uranium may be derived from a weathered rock containing anomalously high concentrations of uranium, leached from the sandstone itself or an adjacent stratigraphic unit. It is then transported in oxygenated groundwater until it is precipitated from solution under reducing conditions at an oxidation-reduction interface. The reducing conditions may be caused by such reducing agents in the sandstone as carbonaceous material, sulfides, hydrocarbons, hydrogen sulfide, or brines.

Uranium mineralization on the Bullfrog property is hosted by favorable sandstone horizons in the lowermost portion of the Salt Wash Member of the Jurassic age Morrison Formation, where detrital organic debris is present. Mineralization primarily consists of coffinite, with minor uraninite, which usually occurs in close association with vanadium mineralization. Uranium mineralization occurs as intergranular disseminations, as well as coatings and/or cement on and between sand grains and organic debris. Vanadium occurs as montroseite (hydrous vanadium oxide) and vanadium chlorite in primary mineralized zones located below the water table.

The vanadium content of the Henry Mountains Basin deposits is relatively low compared to many other Salt Wash hosted deposits on the Colorado Plateau. Furthermore, the Henry Mountains Basin deposits occur in broad alluvial sand accumulations, rather than in major sandstone channels as is typical of the Uravan Mineral Belt deposits of western Colorado. The Henry Mountains Basin deposits do, however, have the same general characteristic geochemistry of the Uravan deposits, and are therefore classified as Salt Wash type deposits.

| Energy Fuels Inc. | Bullfrog Project | May 9, 2025 |

| Technical Report | SLR Project No.: 123.V02544.00008 |

1.3.5 Exploration Status

Energy Fuels has carried out no exploration work on the Project since acquiring the Bullfrog property in 2012.

1.3.6 Mineral Resources

Mineral Resources have been classified in accordance with SEC S-K 1300 definitions, which are consistent with the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards for Mineral Resources and Mineral Reserves dated May 10, 2014 (CIM (2014) definitions), which are incorporated by reference in NI 43-101.

The Mineral Resource estimate was completed using a conventional block modeling approach. The general workflow used by SLR included the construction of a geological or stratigraphic model representing the Jurassic Morrison Formation (Jm) in Seequent's Leapfrog Geo (Leapfrog Geo) from mapping, drill hole logging, and sampling data, which was used to define discrete domain and surfaces representing the upper and lower zones uranium mineralization contacts of the middle portion of the lower Salt Wash Sandstone Member (Jms). The geologic models were then used to constrain resource estimation completed using Seequent's Leapfrog Edge (Leapfrog Edge) software. The resource estimate used a regularized, unrotated whole block approach, inverse distance cubed (ID3) methodology, and 1.0 ft, uncapped composites to estimate the equivalent uranium (eU3O8) grade in a three-pass search approach. Hard boundaries were used with ellipsoidal search ranges, and search ellipse orientation was informed by geology and mineralization wireframing. Density values were assigned based on historical bulk density records.

Estimates were validated using standard industry techniques including statistical comparisons with composite samples and parallel inverse distance squared (ID2), ordinary kriging (OK) and nearest neighbor (NN) estimates, swath plots, and visual reviews in cross section and plan. A visual review comparing blocks to drill holes was completed after the block modeling work was performed to ensure general lithologic and analytical conformance and was peer reviewed prior to finalization.

Table 1-4 summarizes the Mineral Resource estimate based on a $90/lb uranium price using a cut-off grade of 0.150% eU3O8, with an effective date of December 31, 2024.

Table 1-4: Summary of Mineral Resources - Bullfrog Project - December 31, 2024

| Classification | Grade Cut-off (% eU3O8) |

Tonnage (Mton) |

Grade (% eU3O8) |

Contained Metal (Mlb eU3O8) |

EFR Basis (%) |

Recovery U3O8 (%) |

| Indicated | 0.150 | 1.74 | 0.303 | 10.51 | 100 | 95 |

| Inferred | 0.150 | 0.61 | 0.279 | 3.42 | 100 | 95 |

| Notes: 1. SEC S-K 1300 definitions were followed for all Mineral Resource categories. These definitions are also consistent with CIM (2014) definitions in NI 43-101. 2. Cut-off grade is 0.150% eU3O8 3. Cut-off grade is calculated using a metal price of $90/lb U3O8. 4. No minimum mining width was used in determining Mineral Resources. 5. Mineral Resources based on a tonnage factory of 15.0 ft3/ton (Bulk density 0.0667 ton/ft3 or 2.13 t/m3). 6. Mineral Resources have not been demonstrated to be economically viable. 7. Metallurgical recovery is 95%. 8. Totals may not add due to rounding. 9. Mineral Resources are 100% attributable to EFR and are in situ. |

||||||

| Energy Fuels Inc. | Bullfrog Project | May 9, 2025 |

| Technical Report | SLR Project No.: 123.V02544.00008 |

The SLR QP is of the opinion that with consideration of the recommendations summarized in Sections 1 and 26 of this report, any issues relating to all relevant technical and economic factors likely to influence the prospect of economic extraction can be resolved with further work. There are no other known environmental, permitting, legal, social, or other factors that would affect the development of the Mineral Resources.

Based on the similarity of the Bullfrog deposit to other past producing uranium deposits in the Colorado Plateau and the Henry Mountain Mining District, the proposed mining methods at Bullfrog will include a combination of random room and pillar operation with pillar extraction by a retreat system, split shot, and drift and fill.

While the estimate of Mineral Resources is based on the SLR QP's judgment that there are reasonable prospects for eventual economic extraction, no assurance can be given that Mineral Resources will eventually convert to Mineral Reserves.

1.3.7 Mineral Reserves

There are no current Mineral Reserves at the Project.

1.3.8 Mining Method

The Salt Wash Member, which hosts the mineralized horizons, is comprised primarily of sandstones with interbedded shales and mudstones. The Copper Bench and Indian Bench horizons are located in the Upper area of the Salt Wash Member.

It is proposed that the deposit will be developed and mined by two methods: 1) modified room-and-pillar methods using ground support during development to ensure roof stability, especially in weak ground conditions, and 2) drift and fill (DF) for areas of poor rock quality.

Room-and-pillar mining is a simple, low-capital cost mining method in which mining recoveries of 70% to 90% can be expected, dependent upon the rock strengths and geological structures encountered. Although pillars are anticipated to remain unmined, even with tight backfilling and artificial support, the method is sufficiently flexible to achieve required production rates, control cut-off grades, and maintain safe working conditions. The operational sequence must be modified when mining heights are high (>12 ft) since multi-cuts and stacked pillars (low width-to-height ratios) are required and backfilling must be used to ensure pillar stability. This method becomes a hybrid of the cut-and-fill method in areas where the mineralization is thick (12 ft to 16 ft high), because slender pillars are ineffective for roof support and strong global backfill support must enhance local roof support.

With the wide range of mineralized zone stope thicknesses (from 4 ft to 16 ft) and dips/plunges (from flat to 15°), one of the mining methods selected for the Project for this study is step room and pillar (SRP). Permanent pillars will be left in a pre-designed pattern and cemented rockfill (CRF) will be placed in mined-out areas as backfill. This method, recommended for the lower grade mineralized lenses, allows for mobile equipment to be used effectively in the range of dips/plunges encountered at Bullfrog.

Drift and Fill (DF) mining methods are well suited for selective precision mining in variable-grade areas and are quite flexible, resulting in high extraction ratios. The volume of open ground at any one time is small since drifts are mined and immediately backfilled before adjacent drifts are mined. The development can be placed in the mineralized areas, minimizing waste rock. This method is not well suited for high production rates, unless many stopes are simultaneously opened, which requires a laterally extensive mineralized zone. The cost of local support (roof cabling through multi-cuts) is high because all cuts must be fully supported. DF mining is recommended for the higher-grade mineralized lenses at Bullfrog, where maximum recovery is desired. This method is widely used in other mines with similar ground conditions and will result in higher mining recoveries as the need to leave permanent pillars will be significantly reduced. This method, however, requires a high quality, high strength engineered backfill in order to be successful. For the DF method, a high-strength CRF will be placed in the mined-out areas.

| Energy Fuels Inc. | Bullfrog Project | May 9, 2025 |

| Technical Report | SLR Project No.: 123.V02544.00008 |

Bulk mining methods were investigated, particularly for the thick (up to 20 ft) zones. One method considered involved mining of the thick zones in staggered primary and secondary panels using engineered cemented backfill. After the evaluation, this method was considered inapplicable due to the weak rock conditions. The low rock strengths and limited stand-up time made this method impractical given the relatively high stope walls, which would be exposed during the benching process.

The minimum thickness used in the development of the Mineral Resource estimate was three feet. The mineralized zones range exceeding thickness of 3 ft to 16 ft, the Deswik.SO used conservative 4 ft height stopes. Mineralized zones with thicknesses from 3 ft to 8 ft will be mined in one pass. Mineralized zones exceeding 12 ft in thickness will be mined in two sequential overhand cuts with each cut being approximately one-half of the overall zone thickness.

In both the Copper Bench and Indian Bench, the mineralized horizons will be further defined using longhole drills from a dedicated drilling horizon located below the mineralized zones.

The proposed Life of Mine (LOM) schedule was developed based on initiating development from the production decline located adjacent to the mineralized mining zones. The mining areas in Copper Bench and Indian Bench will be connected by means of a 5,400 ft twin decline haulage way. The last section of the decline will become a single haulage way.

Secondary development connecting the shaft to the various mineralized zones (including the twin decline) will be driven 10 ft wide by 12 ft high with 10 ft rounds. Production development connecting the primary development to the mining areas will be individual stopes and will be driven 10 ft wide by 8 ft high with 10 ft rounds.

The mining sequence in each of the eight mining zones is dependent upon the development schedule. Generally, the extraction schedule is sequenced to prioritize the mining of the largest and highest-grade zones in each section of the mine. Where mineralized zones are stacked, they will be mined in a top-down sequence.

Stope mining begins approximately four years after the start of construction and the operating mine life spans 15 years. The production rate averages approximately 10,000 short tons per month over the life of the mine, assuming 350 operating days per year.

Depressurization of the three main aquifers in the mine area will be accomplished using 11 depressurization wells and underground longholes that will supply water to a couple of underground pumping stations that will ultimately feed water to the Copper Bench sump pumps located in one of the declines. It has been estimated that the mine will discharge a nominal 20 gpm of water at temperatures between 70°F and 80°F. An additional 100 gpm will be produced by surface wells, resulting in a total discharge rate as high as 150 gpm.

The deposit will be developed and mined based on single-pass ventilation using a series of separate and independent intake and exhaust networks. The design requires a total of 10 ventilation raises and the twin declines. Intake air will be sourced from the two declines and two of the seven ventilation raises; the fresh air intake raise in Indian Bench will be equipped with emergency evacuation hoisting equipment. The decline to and along the mineralization is approximately 13,500-ft long.

| Energy Fuels Inc. | Bullfrog Project | May 9, 2025 |

| Technical Report | SLR Project No.: 123.V02544.00008 |

The LOM statistics for the Project are summarized in Table 1-5.

Table 1-5: Key Bullfrog Life of Mine Production Statistics

| Area | Heading Dimensions (ft x ft x ft) |

Units | Life of Mine Quantity |

| Development - Primary | 12 x 12 x 8 | ft 000 | 27.04 |

| Secondary Development | 10 x 12 x 8 | ft 000 | 21.65 |

| Production Development - Stope Access | 10 x 8 x 8 | ft 000 | 13.70 |

| Vertical Development - Ventilation Shafts | 8-ft dia. | ft 000 | 8.67 |

| Stope Mineralization Recovered | 8 x 10 x 6 | 000 tons | 1,765 |

| Total Waste | 8 x 10 x 6 | 000 tons | 679 |

| Total Production | 000 tons | 2,444 | |

| Approximate Backfill Required | % | 90% | |

| Preproduction Period | yr | 4 | |

| Mine Life | yr | 15 | |

| Total U3O8 Pounds Mined | Mlb | 9.711 | |

| Notes: Tables may not add due to rounding. |

|||

1.3.9 Mineral Processing

The White Mesa Mill is currently on a reduced operating schedule processing materials as they become available.

The Mill uses a Semi Autogenous (SAG) mill operating in closed circuit with vibratory screens for comminution. Mill feed is fed to the comminution circuit via front end loader. The nameplate production rate for the circuit is 150 short tons per hour (stph).

The Mill uses an atmospheric hot acid leach followed by counter current decantation (CCD) and a clarifier stage to remove suspended solids. Clarified pregnant leach solution (PLS) reports to the solvent extraction (SX) circuit where uranium and vanadium are extracted from the aqueous solution to an organic phase. Salt and sulfuric acid are then used to strip the uranium from the organic phase.

After stripping of the uranium from the organic in SX, uranium is precipitated with anhydrous ammonia, dissolved, and re-precipitated to improve product quality. The resulting precipitate is then washed and dewatered using centrifuges to produce a final U3O8 product called "yellowcake". The yellowcake is dried in a multiple hearth dryer and packaged in drums weighing approximately 800 lb to 1,000 lb for shipping to uranium converters.

Tailings from the acid leach plant are stored in permitted 40 acre tailing cells located in the southwest and southern portion of the mill site. Spent process solutions are stored in the evaporation cells for reuse with excess solutions allowed to evaporate.

| Energy Fuels Inc. | Bullfrog Project | May 9, 2025 |

| Technical Report | SLR Project No.: 123.V02544.00008 |

1.3.10 Project Infrastructure

The Project is currently a 'Greenfield' site, i.e., there currently exists no mine infrastructure. Required infrastructure for the site will include surface facilities to support mining operations, such as warehouses, fuel depot, explosive storage facilities, and offices; ventilation shafts and fans; a water treatment plant and evaporation ponds; dewatering wells; mineralized material stockpiles; and waste rock storage facilities. It is planned that electricity will be supplied by an on-site diesel generator, and a substation will be required. Water for the site will be supplied from on site dewatering wells.

Cellular telephone coverage and Starlink satellite services are currently available at the Project.

A 3-mi long access road from Utah Highway 76 west to the Project will be required.

1.3.11 Market Studies

Uranium does not trade on the open market, and many of the private sales contracts are not publicly disclosed since buyers and sellers negotiate contracts privately. Spot prices are generally driven by current inventories and speculative short-term buying. Monthly long-term industry average uranium prices based on the month-end prices are published by Ux Consulting, LLC, and Trade Tech, LLC. An accepted mining industry practice is to use Consensus Forecast Prices obtained by collating commodity price forecasts from credible sources.

Consensus forecasts collected by SLR show long-term averages of approximately $80.00/lb. General industry practice is to use a consensus long-term forecast price for estimating Mineral Reserves, and 10% to 20% higher prices for estimating Mineral Resources.

For Mineral Resource estimation and cash flow projections, the SLR QP selected a U3O8 price of $90.00/lb, on a Cost, Insurance, and Freight (CIF) basis to customer facility, based on independent forecasts. The SLR QP considers this price to be reasonable and consistent with industry practice based on independent long-term forecasts and a mark-up for use with Mineral Resource estimation.

Currently, EFR has not entered into any long-term agreements for the provision of materials, supplies, or labor for the Project. The construction and operations will require negotiation and execution of a few contracts for the supply of materials, services, and supplies.

1.3.12 Environmental, Permitting and Social Considerations

EFR has performed select environmental studies of the Project area, starting in 2014 and supplemented in 2015 and 2016. The methods and scope of work for these efforts were defined by EFR in coordination with the U.S. Bureau of Land Management (BLM) and the Utah Department of Natural Resources, Division of Oil, Gas and Mining (DOGM). The baseline studies serve as an excellent benchmark for documenting existing site conditions.

Permitting of the proposed Project will require approvals from federal, state and local (county) agencies. These approvals include:

• Plan of Operation and reclamation bond from the BLM

• Notice of Intention and reclamation bond from the Utah DOGM

• Conditional Use Permit from Garfield County

| Energy Fuels Inc. | Bullfrog Project | May 9, 2025 |

| Technical Report | SLR Project No.: 123.V02544.00008 |

• Various other approvals from state agencies including an air quality permit, ground water and surface water discharge permits, pond construction and operating permits, a septic permit and water right(s).

A Memorandum of Understanding (MOU) has been developed between the BLM and the DOGM to facilitate a coordinated review and approval process where responsibilities overlap. EFR has a comprehensive understanding of regulatory requirements, permits, authorizations, and the applicable agencies for each.

The land encompassing the Project area is currently designated as multiple use and is used mostly for livestock grazing, wildlife habitat, and recreation (primarily off-road vehicles). Reclamation will return disturbed areas of the Project to the same pre-mining land use(s). Reclamation plans and performance bonds will be required and in place prior to the startup of mining in accordance with state and federal requirements.

1.3.13 Capital and Operating Cost Estimates

The life of mine (LOM) capital cost estimate is summarized in Table 1-6.

Table 1-6: LOM Capital Cost Summary

| Capital Cost Item | Initial Capital Preproduction Yr-4 to Yr-1 ($ 000) |

Sustaining Capital Mine Production Yr1 to Yr15 ($ 000) |

LOM Totals ($ 000) |

| Direct Capital Costs | $36,443 | $38,256 | $74,698 |

| Other Costs (20% of Direct) | $7,289 | 0 | 7,289 |

| Total Direct + Other Costs | $43,731 | 38,256 | $81,988 |

| Contingency (25%) | $10,933 | $10,933 | |

| Permitting and Closure | 4,322 | ||

| Total Capital Costs | $54,664 | $38,256 | $97,242 |

The LOM average operating cost, summarized in Table 1-7, includes mining, general and administration, freight of the product to a point of sale (White Mesa Mill), toll milling costs at White Mesa Mill, and various royalties and severance taxes. The Project operating costs were estimated in 2023 US dollars basis.

Table 1-7: LOM Operating Unit Costs Summary

| Unit Operating Cost Summary | Units | LOM Unit Operating Cost |

| Underground Mining Cost | $/ton milled | $135.05 |

| Milling & Processing | $/ton milled | $110.00 |

| G&A | $/ton milled | $32.733 |

| Transportation (Bullfrog Mine to White Mesa Mill; 127 miles) | $/ton milled | $29.85 |

| Total | $307.63 |

| Energy Fuels Inc. | Bullfrog Project | May 9, 2025 |

| Technical Report | SLR Project No.: 123.V02544.00008 |

2.0 Introduction

SLR International Corporation (SLR) was retained by Energy Fuels Inc. (Energy Fuels) to prepare an independent Technical Report on the Bullfrog Project (Bullfrog or the Project), located in Garfield County, Utah, USA. Energy Fuels is the parent company of Energy Fuels Resources (USA) Inc. (EFR), which owns 100% of the Project. EFR is a US-based uranium and vanadium exploration and mine development company. Energy Fuels is listed on the NYSE American Stock Exchange (symbol: UUUU) and the Toronto Stock Exchange (symbol: EFR).

This Technical Report satisfies the requirements of Canadian National Instrument 43-101 Standards of Disclosure for Mineral Projects (NI 43-101) and United States Securities and Exchange Commission's (SEC) Modernized Property Disclosure Requirements for Mining Registrants as described in Subpart 229.1300 of Regulation S-K, Disclosure by Registrants Engaged in Mining Operations (S-K 1300) and Item 601 (b)(96) Technical Report Summary.

The purpose of this report is to disclose the results of a Preliminary Economic Assessment (PEA). The term PEA is used throughout this Technical Report and is consistent with an Initial Assessment (IA) under S-K 1300.

This report was prepared by Stuart Collins, P.E., Jeffrey L. Woods, MMSA QP, Lee (Pat) Gochnour, MMSA QP, Mark B. Mathisen, C.P.G., Grant A. Malensek, M.Eng., P.Eng., and Tedros Tesfay, SME (RM), all of whom are Qualified Person (QP) within the meaning of both S-K 1300 and NI 43-101 (SLR QP). Messrs. Mathisen, Miranda, and Collins visited the Project on July 15 to 18, 2024.

Bullfrog consists of two contiguous sandstone-type uranium deposits, Copper Bench and Indian Bench, within the Colorado Plateau physiographic province in southwestern Utah. The Colorado Plateau has been a relatively stable structural province since the end of the Precambrian. During the Paleozoic and Mesozoic, the Colorado Plateau was a stable shelf without major geosynclinal areas of deposition, except during the Pennsylvanian when several thousand feet of black shales and evaporates accumulated in the Paradox Basin of southwestern Colorado and adjacent Utah.

The Project is situated in the southeastern flank of the Henry Mountains Basin, a sub province of the Colorado Plateau physiographic province. The Henry Mountains Basin is an elongate north-south trending doubly plunging syncline in the form of a closed basin. It is surrounded by the Monument Uplift to the southeast, Circle Cliffs Uplift to the southwest, and the San Rafael Swell to the north.

The Project originally formed part of the Henry Mountains Complex, which consisted of the Tony M mine and deposit, collectively known as the Tony M property, and the Southwest, Copper Bench, and Indian Bench deposits, collectively known as the Bullfrog property. In October 2021, IsoEnegy Ltd. (formerly Consolidated Uranium Inc. (CUR)) acquired the Tony M property and Southwest deposit from EFR. The remaining deposits (Copper Bench and Indian Bench) that occur to the north as part of the historical Bullfrog property remain under EFR ownership.

The Project is currently being developed in preparation for production. Environmental permitting and compliance activities are being developed to start operations. EFR envisages an underground operation in which the mineralized material will be processed based on a toll milling agreement at Energy Fuels' White Mesa Mill, 127 road miles (mi) away in Blanding, Utah. The Mill has historically run on a campaign basis and processes uranium bearing materials as they become available.

| Energy Fuels Inc. | Bullfrog Project | May 9, 2025 |

| Technical Report | SLR Project No.: 123.V02544.00008 |

2.1 Sources of Information

Sources of information and data contained in this Technical Report or used in its preparation are from publicly available sources in addition to private information owned by EFR, including that of past property owners.

This Technical Report was prepared by the SLR QPs with assistance from Yenlai Chee, M.Sc., SLR Senior Resource Geologist, and Hugo M. Miranda, M.Eng., MBA, SME(RM), SLR Principal Mining Engineer. The independent SLR QPs Mathisen and Collins, accompanied by Mr. Miranda, visited the Project under care and maintenance on July 15 to 18, 2024. The SLR QPs toured various parts of the Project, drill hole locations, and infrastructure, and conducted discussions with EFR Project personnel on current and future operations.

Table 2-1 presents a summary of the QP responsibilities for this Technical Report.

Table 2-1: Summary of QP Responsibilities

| Qualified Person | Company | Title/Position | Section |

| Grant A. Malensek, M.Eng., P. Eng. | SLR | Senior Principal Mining Engineer | 1.2, 22, 30 |

| Mark B. Mathisen, C.P.G. | SLR | Principal Geologist | 1.1, 1.1.1.1, 1.1.2.1, 1.3.1 to 1.3.6, 1.3.11, 2, 3, 4 excluding 4.3, 5 to 8, 9 excluding 9.1, 10 to 12, 14, 19, 23, 24, 25.1, 26.1 |

| Stuart Collins, P.E. | SLR | Principal Mining Engineer | 1.1.1.2, 1.1.1.4, 1.1.1.6, 1.1.2.2, 1.1.2.4, 1.1.2.6, 1.3.7, 1.3.8, 1.3.10, 1.3.13, 15, 16, 18, 21, 25.2, 25.4, 25.6, 26.2, 26.4, 26.6 |

| Jeffrey L. Woods, MMSA QP. | Woods Process Services | Principal Consulting Metallurgist | 1.1.1.3, 1.1.2.3, 1.3.9, 13, 17, 25.3, 26.3 |

| Lee (Pat) Gochnour, MMSA (QP) | Gochnour & Associate, Inc. | Associate Principal Environmental Specialist | 1.1.1.5, 1.1.2.5, 1.3.12, 4.3, 20, 25.5, 26.5.2 |

| Tedros Tesfay, Ph.D, SME (RM) | SLR | Senior Hydrogeologist | 9.1 and related disclosure in 1.1.2.5, and 26.5.2 |

| All | - | - | 27 |

During the preparation of this Technical Report, discussions were held with personnel from EFR:

• Daniel Kapostasy, P.G., Vice President, Technical Services, Energy Fuels Resources (USA) Inc.

• Race Fisher, Director of Conventional Mining, Energy Fuels Resources (USA) Inc.

• Scott Bakken, P.G., Vice President Regulatory Affairs, Energy Fuels Resources (USA) Inc.

| Energy Fuels Inc. | Bullfrog Project | May 9, 2025 |

| Technical Report | SLR Project No.: 123.V02544.00008 |

This Technical Report supersedes the previous Technical Report completed by SLR, dated February 22, 2022 (the 2022 Technical Report).

The documentation reviewed, and other sources of information, are listed at the end of this Technical Report in Section 27 References.

| Energy Fuels Inc. | Bullfrog Project | May 9, 2025 |

| Technical Report | SLR Project No.: 123.V02544.00008 |

2.2 List of Abbreviations

The U.S. System for weights and units has been used throughout this Technical Report. Tons are reported in short tons (ton) of 2,000 lb unless otherwise noted. All currency in this Technical Report is US dollars (US$) unless otherwise noted.

| μ | micron | L | liter |