|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Amplify AI Powered Equity ETF

|

$37

|

0.75%

|

|

Net Assets

|

$101,350,823

|

|

Number of Holdings

|

156

|

|

Portfolio Turnover

|

492%

|

|

30-Day SEC Yield

|

0.58%

|

|

30-Day SEC Yield Unsubsidized

|

0.58%

|

|

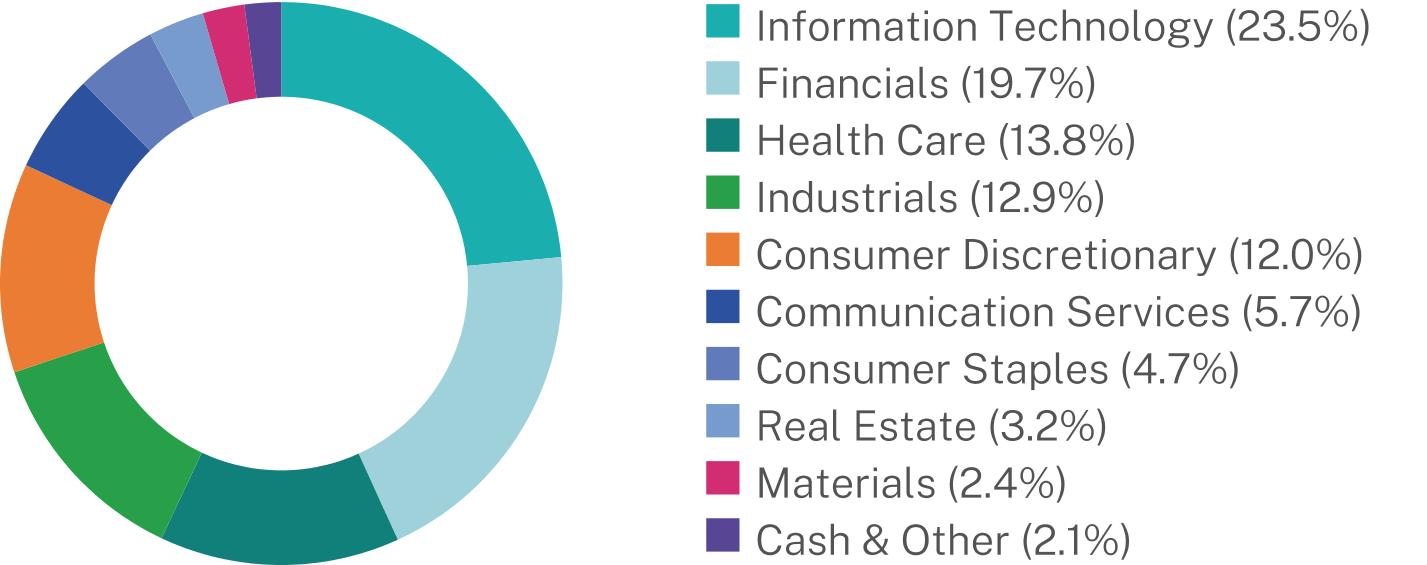

Top Holdings

|

(%)

|

|

General Motors Co.

|

7.4%

|

|

MicroStrategy, Inc. - Class A

|

7.3%

|

|

AppLovin Corp. - Class A

|

7.1%

|

|

Newmont Corp.

|

4.8%

|

|

Carvana Co.

|

3.9%

|

|

Monolithic Power Systems, Inc.

|

3.7%

|

|

Edison International

|

3.3%

|

|

FMC Corp.

|

3.0%

|

|

Air Lease Corp.

|

2.9%

|

|

Coca-Cola Co.

|

2.8%

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Amplify Alternative Harvest ETF

|

$15

|

0.41%

|

|

Net Assets

|

$112,431,430

|

|

Number of Holdings

|

12

|

|

Portfolio Turnover

|

61%

|

|

30-Day SEC Yield

|

36.56%

|

|

30-Day SEC Yield Unsubsidized

|

36.08%

|

|

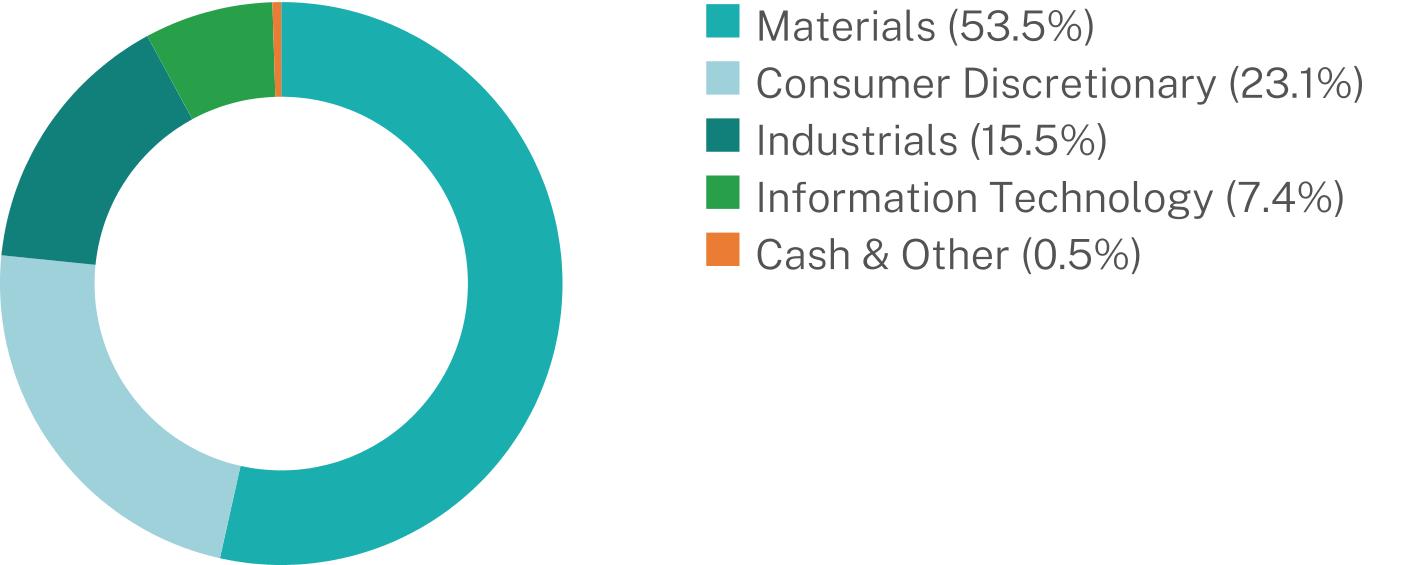

Top Holdings

|

(%)

|

|

Amplify Seymour Cannabis ETF

|

53.1%

|

|

First American Government Obligations Fund - Class X

|

32.9%

|

|

Tilray Brands, Inc.

|

14.1%

|

|

SNDL, Inc.

|

8.6%

|

|

Cronos Group, Inc.

|

8.3%

|

|

Aurora Cannabis, Inc.

|

5.6%

|

|

High Tide, Inc.

|

3.2%

|

|

Canopy Growth Corp.

|

3.1%

|

|

Organigram Holdings, Inc.

|

2.1%

|

|

Village Farms International, Inc.

|

1.4%

|

|

•

|

MJ completed a 1-for-12 reverse share split effective February 21, 2025

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Amplify BlackSwan Growth & Treasury Core ETF

|

$24

|

0.49%

|

|

Net Assets

|

$247,869,802

|

|

Number of Holdings

|

14

|

|

Portfolio Turnover

|

25%

|

|

30-Day SEC Yield

|

3.45%

|

|

30-Day SEC Yield Unsubsidized

|

3.45%

|

|

Top Holdings

|

(%)

|

|

United States Treasury Note/Bond

|

9.4%

|

|

United States Treasury Note/Bond

|

9.3%

|

|

United States Treasury Note/Bond

|

9.3%

|

|

United States Treasury Note/Bond

|

9.3%

|

|

United States Treasury Note/Bond

|

9.2%

|

|

United States Treasury Note/Bond

|

9.2%

|

|

United States Treasury Note/Bond

|

9.2%

|

|

United States Treasury Note/Bond

|

9.2%

|

|

United States Treasury Note/Bond

|

9.2%

|

|

United States Treasury Note/Bond

|

9.1%

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Amplify BlackSwan ISWN ETF

|

$24

|

0.49%

|

|

Net Assets

|

$29,979,406

|

|

Number of Holdings

|

13

|

|

Portfolio Turnover

|

18%

|

|

30-Day SEC Yield

|

3.42%

|

|

30-Day SEC Yield Unsubsidized

|

3.42%

|

|

Top Holdings

|

(%)

|

|

United States Treasury Note/Bond

|

9.3%

|

|

United States Treasury Note/Bond

|

9.2%

|

|

United States Treasury Note/Bond

|

9.2%

|

|

United States Treasury Note/Bond

|

9.2%

|

|

United States Treasury Note/Bond

|

9.1%

|

|

United States Treasury Note/Bond

|

9.1%

|

|

United States Treasury Note/Bond

|

9.1%

|

|

United States Treasury Note/Bond

|

9.0%

|

|

United States Treasury Note/Bond

|

9.0%

|

|

United States Treasury Note/Bond

|

9.0%

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Amplify Bloomberg AI Value Chain ETF

|

$28

|

0.60%

|

|

Net Assets

|

$21,445,553

|

|

Number of Holdings

|

47

|

|

Portfolio Turnover

|

105%

|

|

30-Day SEC Yield

|

0.44%

|

|

30-Day SEC Yield Unsubsidized

|

0.44%

|

|

Top Holdings

|

(%)

|

|

Alibaba Group Holding Ltd.

|

4.1%

|

|

International Business Machines Corp.

|

2.9%

|

|

Intel Corp.

|

2.9%

|

|

Samsung Electronics Co. Ltd.

|

2.8%

|

|

SK Hynix, Inc.

|

2.8%

|

|

Super Micro Computer, Inc.

|

2.7%

|

|

First American Government Obligations Fund - Class X

|

2.7%

|

|

Qualcomm, Inc.

|

2.6%

|

|

Micron Technology, Inc.

|

2.5%

|

|

MediaTek, Inc.

|

2.5%

|

|

•

|

Index Provider change to: Bloomberg Index Services Limited. Index change to: Bloomberg AI Value Chain Index

|

|

•

|

Management fee change to: 0.59%

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Amplify Bloomberg U.S. Treasury 12% Premium Income ETF

|

$13

|

0.30%

|

|

Net Assets

|

$9,530,872

|

|

Number of Holdings

|

4

|

|

Portfolio Turnover

|

108%

|

|

30-Day SEC Yield

|

4.08%

|

|

30-Day SEC Yield Unsubsidized

|

4.08%

|

|

Top 10 Issuers

|

(%)

|

|

iShares 20+ Year Treasury Bond ETF

|

62.9%

|

|

United States Treasury Note/Bond

|

36.8%

|

|

Invesco Government & Agency Portfolio

|

0.1%

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Amplify BlueStar Israel Technology ETF

|

$38

|

0.75%

|

|

Net Assets

|

$85,572,333

|

|

Number of Holdings

|

57

|

|

Portfolio Turnover

|

9%

|

|

30-Day SEC Yield

|

-0.15%

|

|

30-Day SEC Yield Unsubsidized

|

-0.15%

|

|

Top Holdings

|

(%)

|

|

Check Point Software Technologies, Ltd.

|

9.8%

|

|

CyberArk Software, Ltd.

|

8.5%

|

|

Elbit Systems Ltd.

|

8.2%

|

|

Amdocs, Ltd.

|

7.1%

|

|

Monday.com Ltd.

|

7.0%

|

|

Nice Ltd.

|

6.8%

|

|

Wix.com, Ltd.

|

4.8%

|

|

SentinelOne, Inc. - Class A

|

3.8%

|

|

Nova Ltd.

|

3.1%

|

|

First American Government Obligations Fund - Class X

|

3.1%

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Amplify Cash Flow Dividend Leaders ETF

|

$0

|

0.00%

|

|

Net Assets

|

$20,831,243

|

|

Number of Holdings

|

61

|

|

Portfolio Turnover

|

86%

|

|

30-Day SEC Yield

|

2.55%

|

|

30-Day SEC Yield Unsubsidized

|

2.16%

|

|

Top Holdings

|

(%)

|

|

HCA Healthcare, Inc.

|

2.7%

|

|

Matador Resources Co.

|

2.6%

|

|

Fidelity National Financial, Inc.

|

2.6%

|

|

eBay, Inc.

|

2.5%

|

|

NRG Energy, Inc.

|

2.5%

|

|

Genpact Ltd.

|

2.5%

|

|

Molson Coors Beverage Co. - Class B

|

2.5%

|

|

CF Industries Holdings, Inc.

|

2.4%

|

|

Owens Corning

|

2.4%

|

|

FedEx Corp.

|

2.4%

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Amplify COWS Covered Call ETF

|

$32

|

0.65%

|

|

Net Assets

|

$10,020,838

|

|

Number of Holdings

|

121

|

|

Portfolio Turnover

|

225%

|

|

30-Day SEC Yield

|

1.95%

|

|

30-Day SEC Yield Unsubsidized

|

1.95%

|

|

Top Holdings

|

(%)

|

|

HCA Healthcare, Inc.

|

2.7%

|

|

Matador Resources Co.

|

2.6%

|

|

Fidelity National Financial, Inc.

|

2.6%

|

|

eBay, Inc.

|

2.6%

|

|

NRG Energy, Inc.

|

2.5%

|

|

Genpact Ltd.

|

2.5%

|

|

Molson Coors Beverage Co. - Class B

|

2.5%

|

|

CF Industries Holdings, Inc.

|

2.5%

|

|

Owens Corning

|

2.5%

|

|

FedEx Corp.

|

2.5%

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Amplify CWP Enhanced Dividend Income ETF

|

$27

|

0.54%

|

|

Net Assets

|

$4,058,402,641

|

|

Number of Holdings

|

31

|

|

Portfolio Turnover

|

40%

|

|

30-Day SEC Yield

|

1.77%

|

|

30-Day SEC Yield Unsubsidized

|

1.76%

|

|

Top Holdings

|

(%)

|

|

Visa, Inc. - Class A

|

5.3%

|

|

CME Group, Inc.

|

5.2%

|

|

Amplify Samsung SOFR ETF

|

5.0%

|

|

Caterpillar, Inc.

|

5.0%

|

|

JPMorgan Chase & Co.

|

4.9%

|

|

Honeywell International, Inc.

|

4.9%

|

|

American Express Co.

|

4.8%

|

|

Goldman Sachs Group, Inc.

|

4.7%

|

|

Home Depot, Inc.

|

4.7%

|

|

Microsoft Corp.

|

4.7%

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Amplify CWP Growth & Income ETF

|

$28

|

0.55%

|

|

Net Assets

|

$31,236,081

|

|

Number of Holdings

|

55

|

|

Portfolio Turnover

|

155%

|

|

30-Day SEC Yield

|

0.37%

|

|

30-Day SEC Yield Unsubsidized

|

0.37%

|

|

Top Holdings

|

(%)

|

|

NVIDIA Corp.

|

9.2%

|

|

Apple, Inc.

|

8.9%

|

|

Microsoft Corp.

|

7.3%

|

|

Amazon.com, Inc.

|

5.8%

|

|

Meta Platforms, Inc. - Class A

|

5.7%

|

|

Alphabet, Inc. - Class A

|

5.6%

|

|

Netflix, Inc.

|

4.0%

|

|

Tesla, Inc.

|

4.0%

|

|

Broadcom, Inc.

|

3.1%

|

|

Visa, Inc. - Class A

|

3.0%

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Amplify CWP International Enhanced Dividend Income ETF

|

$33

|

0.65%

|

|

Net Assets

|

$206,833,922

|

|

Number of Holdings

|

66

|

|

Portfolio Turnover

|

52%

|

|

30-Day SEC Yield

|

1.96%

|

|

30-Day SEC Yield Unsubsidized

|

1.96%

|

|

Top Holdings

|

(%)

|

|

First American Government Obligations Fund - Class X

|

10.8%

|

|

Tencent Holdings Ltd.

|

5.1%

|

|

Agnico Eagle Mines Ltd.

|

4.1%

|

|

Barclays PLC

|

4.0%

|

|

SAP SE

|

3.7%

|

|

RELX PLC

|

3.6%

|

|

Enbridge, Inc.

|

3.3%

|

|

Wheaton Precious Metals Corp.

|

3.2%

|

|

Siemens AG

|

3.1%

|

|

Mitsubishi UFJ Financial Group, Inc.

|

3.1%

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Amplify Cybersecurity ETF

|

$31

|

0.60%

|

|

Net Assets

|

$1,931,437,870

|

|

Number of Holdings

|

25

|

|

Portfolio Turnover

|

15%

|

|

30-Day SEC Yield

|

0.17%

|

|

30-Day SEC Yield Unsubsidized

|

0.17%

|

|

Top Holdings

|

(%)

|

|

Broadcom, Inc.

|

7.7%

|

|

Cisco Systems, Inc.

|

6.9%

|

|

Northrop Grumman Corp.

|

6.2%

|

|

General Dynamics Corp.

|

6.0%

|

|

Palo Alto Networks, Inc.

|

5.7%

|

|

Crowdstrike Holdings, Inc. - Class A

|

5.5%

|

|

Fortinet, Inc.

|

5.1%

|

|

Okta, Inc.

|

4.9%

|

|

Check Point Software Technologies, Ltd.

|

4.6%

|

|

Zscaler, Inc.

|

4.6%

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Amplify Digital Payments ETF

|

$38

|

0.75%

|

|

Net Assets

|

$268,740,836

|

|

Number of Holdings

|

39

|

|

Portfolio Turnover

|

18%

|

|

30-Day SEC Yield

|

-0.22%

|

|

30-Day SEC Yield Unsubsidized

|

-0.22%

|

|

Top Holdings

|

(%)

|

|

First American Government Obligations Fund - Class X

|

6.9%

|

|

Visa, Inc. - Class A

|

6.6%

|

|

Mastercard, Inc. - Class A

|

6.5%

|

|

Fiserv, Inc.

|

6.2%

|

|

American Express Co.

|

6.0%

|

|

PayPal Holdings, Inc.

|

5.7%

|

|

Fidelity National Information Services, Inc.

|

5.3%

|

|

Corpay, Inc.

|

4.7%

|

|

Global Payments, Inc.

|

4.7%

|

|

Wise PLC - Class A

|

4.7%

|

|

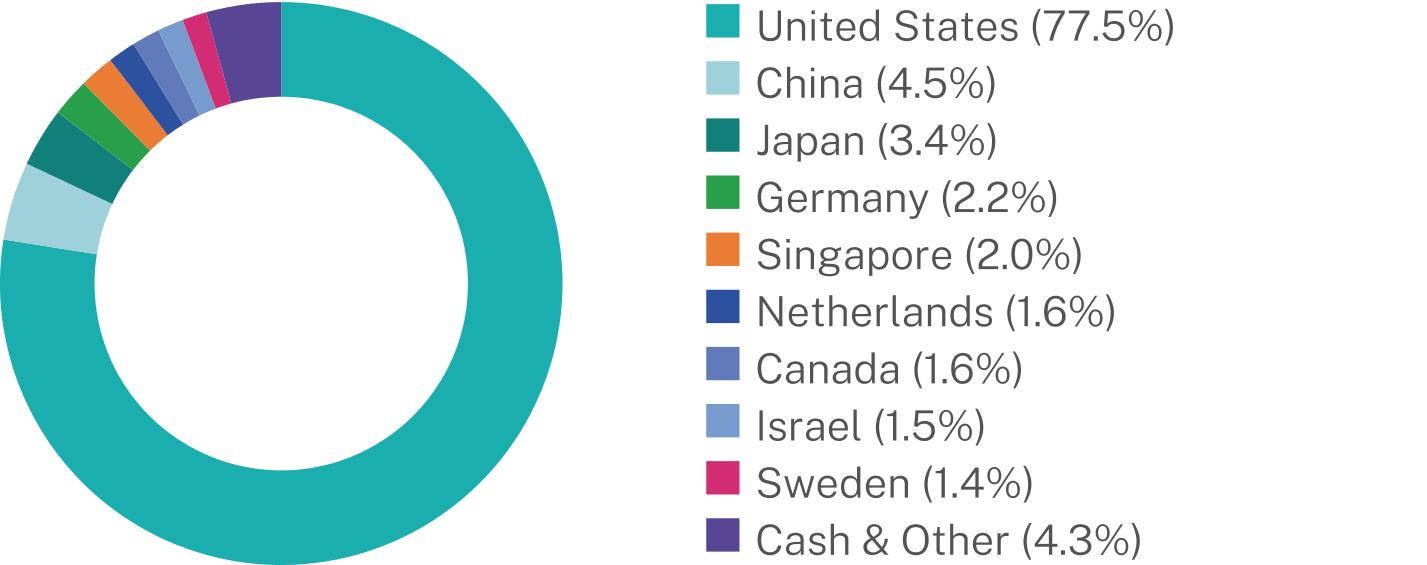

Top Ten Countries

|

(%)

|

|

United States

|

89.5%

|

|

United Kingdom

|

5.0%

|

|

Netherlands

|

4.0%

|

|

Brazil

|

2.4%

|

|

Italy

|

1.8%

|

|

Japan

|

1.5%

|

|

Puerto Rico

|

0.8%

|

|

Australia

|

0.8%

|

|

France

|

0.8%

|

|

Cash & Other

|

-6.6%

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Amplify Etho Climate Leadership U.S. ETF

|

$22

|

0.45%

|

|

Net Assets

|

$151,191,007

|

|

Number of Holdings

|

287

|

|

Portfolio Turnover

|

2%

|

|

30-Day SEC Yield

|

1.09%

|

|

30-Day SEC Yield Unsubsidized

|

1.09%

|

|

Top Holdings

|

(%)

|

|

First American Government Obligations Fund - Class X

|

1.2%

|

|

Sprouts Farmers Market, Inc.

|

0.9%

|

|

InterDigital, Inc.

|

0.7%

|

|

Alnylam Pharmaceuticals, Inc.

|

0.7%

|

|

Bloom Energy Corp. - Class A

|

0.7%

|

|

Protagonist Therapeutics, Inc.

|

0.6%

|

|

Liquidity Services, Inc.

|

0.6%

|

|

T-Mobile US, Inc.

|

0.6%

|

|

Twilio, Inc. - Class A

|

0.6%

|

|

Exelixis, Inc.

|

0.6%

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Amplify High Income ETF

|

$25

|

0.50%

|

|

Net Assets

|

$541,936,262

|

|

Number of Holdings

|

63

|

|

Portfolio Turnover

|

27%

|

|

30-Day SEC Yield

|

11.83%

|

|

30-Day SEC Yield Unsubsidized

|

11.83%

|

|

Top Holdings

|

(%)

|

|

abrdn Healthcare Opportunities Fund

|

3.5%

|

|

CBRE Global Real Estate Income Fund

|

3.4%

|

|

Western Asset Diversified Income Fund

|

3.2%

|

|

Nuveen Floating Rate Income Fund

|

3.2%

|

|

NYLI CBRE Global Infrastructure Megatrends Term Fund

|

3.2%

|

|

abrdn Income Credit Strategies Fund

|

3.1%

|

|

BlackRock Health Sciences Term Trust

|

3.1%

|

|

BlackRock ESG Capital Allocation Term Trust

|

3.1%

|

|

Aberdeen Asia-Pacific Income Fund, Inc.

|

3.1%

|

|

abrdn Total Dynamic Dividend Fund

|

3.0%

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Amplify Junior Silver Miners ETF

|

$35

|

0.69%

|

|

Net Assets

|

$1,098,941,659

|

|

Number of Holdings

|

55

|

|

Portfolio Turnover

|

37%

|

|

30-Day SEC Yield

|

-0.17%

|

|

30-Day SEC Yield Unsubsidized

|

-0.17%

|

|

Top Holdings

|

(%)

|

|

First Majestic Silver Corp.

|

10.6%

|

|

Hecla Mining Co.

|

8.9%

|

|

Coeur Mining, Inc.

|

7.2%

|

|

Wheaton Precious Metals Corp.

|

6.9%

|

|

Endeavour Silver Corp.

|

5.6%

|

|

Fortuna Mining Corp.

|

4.6%

|

|

Osisko Gold Royalties Ltd.

|

3.9%

|

|

KGHM Polska Miedz SA

|

3.7%

|

|

Industrias Penoles SAB de CV

|

3.6%

|

|

Cia de Minas Buenaventura SAA

|

3.6%

|

|

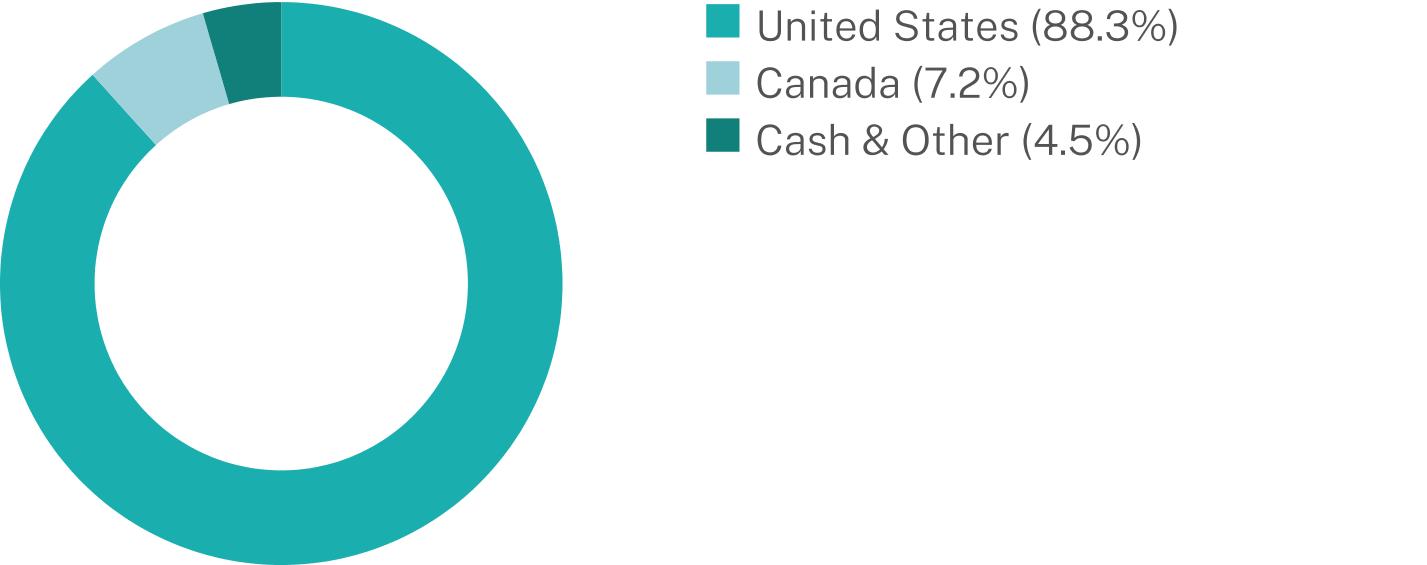

Top Ten Countries

|

(%)

|

|

Canada

|

62.5%

|

|

United States

|

22.3%

|

|

Peru

|

5.6%

|

|

Mexico

|

4.2%

|

|

Poland

|

3.7%

|

|

United Kingdom

|

1.2%

|

|

Sweden

|

1.1%

|

|

Australia

|

0.5%

|

|

Cash & Other

|

-1.1%

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Amplify Lithium & Battery Technology ETF

|

$28

|

0.59%

|

|

Net Assets

|

$55,979,962

|

|

Number of Holdings

|

53

|

|

Portfolio Turnover

|

50%

|

|

30-Day SEC Yield

|

1.60%

|

|

30-Day SEC Yield Unsubsidized

|

1.60%

|

|

Top Holdings

|

(%)

|

|

First American Government Obligations Fund - Class X

|

8.6%

|

|

Contemporary Amperex Technology Co. Ltd. - Class A

|

7.2%

|

|

BHP Group Ltd.

|

7.0%

|

|

BYD Co. Ltd. - Class H

|

6.9%

|

|

Freeport-McMoRan, Inc.

|

4.8%

|

|

Tesla, Inc.

|

3.9%

|

|

Grupo Mexico SAB de CV - Class B

|

3.4%

|

|

NAURA Technology Group Co. Ltd. - Class A

|

3.2%

|

|

TDK Corp.

|

2.5%

|

|

Li Auto, Inc.

|

2.1%

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Amplify Natural Resources Dividend Income ETF

|

$30

|

0.59%

|

|

Net Assets

|

$13,038,305

|

|

Number of Holdings

|

41

|

|

Portfolio Turnover

|

76%

|

|

30-Day SEC Yield

|

7.57%

|

|

30-Day SEC Yield Unsubsidized

|

7.57%

|

|

Top Holdings

|

(%)

|

|

First American Government Obligations Fund - Class X

|

7.9%

|

|

Petroleo Brasileiro SA

|

5.1%

|

|

Dorchester Minerals LP

|

3.9%

|

|

B2Gold Corp.

|

3.7%

|

|

FLEX LNG Ltd.

|

3.7%

|

|

Alliance Resource Partners LP

|

3.4%

|

|

Black Stone Minerals LP

|

3.3%

|

|

Delek Logistics Partners LP

|

3.3%

|

|

Genesis Energy LP

|

3.2%

|

|

CVR Energy, Inc.

|

3.1%

|

|

Geographic Breakdown

|

(%)

|

|

United States

|

77.4%

|

|

Canada

|

14.5%

|

|

Brazil

|

8.1%

|

|

Norway

|

3.6%

|

|

United Kingdom

|

2.2%

|

|

Italy

|

1.9%

|

|

Cash & Other

|

-7.7%

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Amplify Online Retail ETF

|

$32

|

0.65%

|

|

Net Assets

|

$152,986,254

|

|

Number of Holdings

|

79

|

|

Portfolio Turnover

|

18%

|

|

30-Day SEC Yield

|

0.03%

|

|

30-Day SEC Yield Unsubsidized

|

0.03%

|

|

Top Holdings

|

(%)

|

|

Liquidity Services, Inc.

|

3.5%

|

|

Hims & Hers Health, Inc.

|

3.4%

|

|

eBay, Inc.

|

3.0%

|

|

First American Government Obligations Fund - Class X

|

3.0%

|

|

Chewy, Inc. - Class A

|

3.0%

|

|

DoorDash, Inc. - Class A

|

2.9%

|

|

Copart, Inc.

|

2.8%

|

|

BigCommerce Holdings, Inc.

|

2.8%

|

|

Uber Technologies, Inc.

|

2.7%

|

|

Expedia Group, Inc.

|

2.7%

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Amplify Samsung SOFR ETF

|

$10

|

0.20%

|

|

Net Assets

|

$284,428,914

|

|

Number of Holdings

|

4

|

|

Portfolio Turnover

|

0%

|

|

30-Day SEC Yield

|

4.22%

|

|

30-Day SEC Yield Unsubsidized

|

4.22%

|

|

Top Holdings

|

(%)

|

|

SOF REPO 04/01/25 4.45%

|

42.2%

|

|

SOF REPO 04/01/25 4.45%

|

29.7%

|

|

SOF REPO 04/01/25 4.45%

|

28.1%

|

|

Invesco Government & Agency Portfolio - Class Institutional

|

0.0%

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Amplify Seymour Cannabis ETF

|

$27

|

0.75%

|

|

Net Assets

|

$69,711,144

|

|

Number of Holdings

|

39

|

|

Portfolio Turnover

|

17%

|

|

30-Day SEC Yield

|

3.07%

|

|

30-Day SEC Yield Unsubsidized

|

2.87%

|

|

Top Holdings**

|

(%)

|

|

United States Treasury Bill

|

51.1%

|

|

Invesco Government & Agency Portfolio - Class Institutional

|

17.0%

|

|

Curaleaf Holdings, Inc.

|

8.1%

|

|

TerrAscend Corp.

|

4.9%

|

|

WM Technology, Inc.

|

4.3%

|

|

United States Treasury Bill

|

3.6%

|

|

Innovative Industrial Properties, Inc.

|

2.7%

|

|

First American Government Obligations Fund - Class X

|

1.5%

|

|

GrowGeneration Corp.

|

1.2%

|

|

Tilray Brands, Inc.

|

0.9%

|

|

•

|

CNBS completed a 1-for-12 reverse share split effective February 21, 2025

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Amplify Small-Mid Cap Equity ETF

|

$25

|

0.60%

|

|

Net Assets

|

$1,156,321

|

|

Number of Holdings

|

58

|

|

Portfolio Turnover

|

20%

|

|

30-Day SEC Yield

|

0.48%

|

|

30-Day SEC Yield Unsubsidized

|

0.48%

|

|

Top 10 Issuers

|

(%)

|

|

Watsco, Inc.

|

4.7%

|

|

Pinnacle Financial Partners, Inc.

|

3.6%

|

|

Eagle Materials, Inc.

|

3.5%

|

|

BJ’s Wholesale Club Holdings, Inc.

|

3.4%

|

|

Tyler Technologies, Inc.

|

3.1%

|

|

Devon Energy Corp.

|

3.1%

|

|

Markel Group, Inc.

|

2.6%

|

|

EastGroup Properties, Inc.

|

2.6%

|

|

American Financial Group, Inc.

|

2.5%

|

|

NVR, Inc.

|

2.5%

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Amplify Transformational Data Sharing ETF

|

$36

|

0.70%

|

|

Net Assets

|

$664,198,000

|

|

Number of Holdings

|

53

|

|

Portfolio Turnover

|

24%

|

|

30-Day SEC Yield

|

0.09%

|

|

30-Day SEC Yield Unsubsidized

|

0.09%

|

|

Top Holdings

|

(%)

|

|

First American Government Obligations Fund - Class X

|

12.8%

|

|

Robinhood Markets, Inc. - Class A

|

4.9%

|

|

MicroStrategy, Inc. - Class A

|

4.8%

|

|

Coinbase Global, Inc. - Class A

|

4.0%

|

|

Metaplanet, Inc.

|

3.8%

|

|

International Business Machines Corp.

|

3.6%

|

|

PayPal Holdings, Inc.

|

3.2%

|

|

Cleanspark, Inc.

|

3.2%

|

|

Block, Inc.

|

3.1%

|

|

Galaxy Digital Holdings Ltd.

|

3.1%

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Amplify Travel Tech ETF

|

$37

|

0.75%

|

|

Net Assets

|

$50,541,894

|

|

Number of Holdings

|

32

|

|

Portfolio Turnover

|

21%

|

|

30-Day SEC Yield

|

0.26%

|

|

30-Day SEC Yield Unsubsidized

|

0.26%

|

|

Top Holdings

|

(%)

|

|

Trip.com Group Ltd.

|

4.7%

|

|

MakeMyTrip Ltd.

|

4.7%

|

|

Booking Holdings, Inc.

|

4.7%

|

|

Uber Technologies, Inc.

|

4.6%

|

|

Tongcheng Travel Holdings Ltd.

|

4.6%

|

|

TravelSky Technology Ltd. - Class H

|

4.4%

|

|

TripAdvisor, Inc.

|

4.3%

|

|

Airbnb, Inc. - Class A

|

4.2%

|

|

Lyft, Inc. - Class A

|

4.1%

|

|

Despegar.com Corp.

|

4.1%

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Amplify Video Game Leaders ETF

|

$34

|

0.69%

|

|

Net Assets

|

$36,642,524

|

|

Number of Holdings

|

22

|

|

Portfolio Turnover

|

97%

|

|

30-Day SEC Yield

|

0.07%

|

|

30-Day SEC Yield Unsubsidized

|

0.07%

|

|

Top Holdings

|

(%)

|

|

Advanced Micro Devices, Inc.

|

10.5%

|

|

Microsoft Corp.

|

9.9%

|

|

Tencent Holdings, Ltd.

|

9.8%

|

|

Meta Platforms, Inc. - Class A

|

9.8%

|

|

Invesco Government & Agency Portfolio - Class Institutional

|

6.2%

|

|

NetEase, Inc.

|

5.0%

|

|

Sony Group Corp.

|

4.8%

|

|

Sea, Ltd.

|

4.8%

|

|

NVIDIA Corp.

|

4.7%

|

|

Nintendo Co. Ltd.

|

4.5%

|

|

•

|

Index provider change to VettaFi LLC. Index change to: VettaFi Video Game Leaders Index

|

|

•

|

Effective March 26, 2025, the Fund is reducing the size of Creation Units from 50,000 Shares to 10,000 Shares.

|

|

•

|

Management fee change to: 0.59%

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

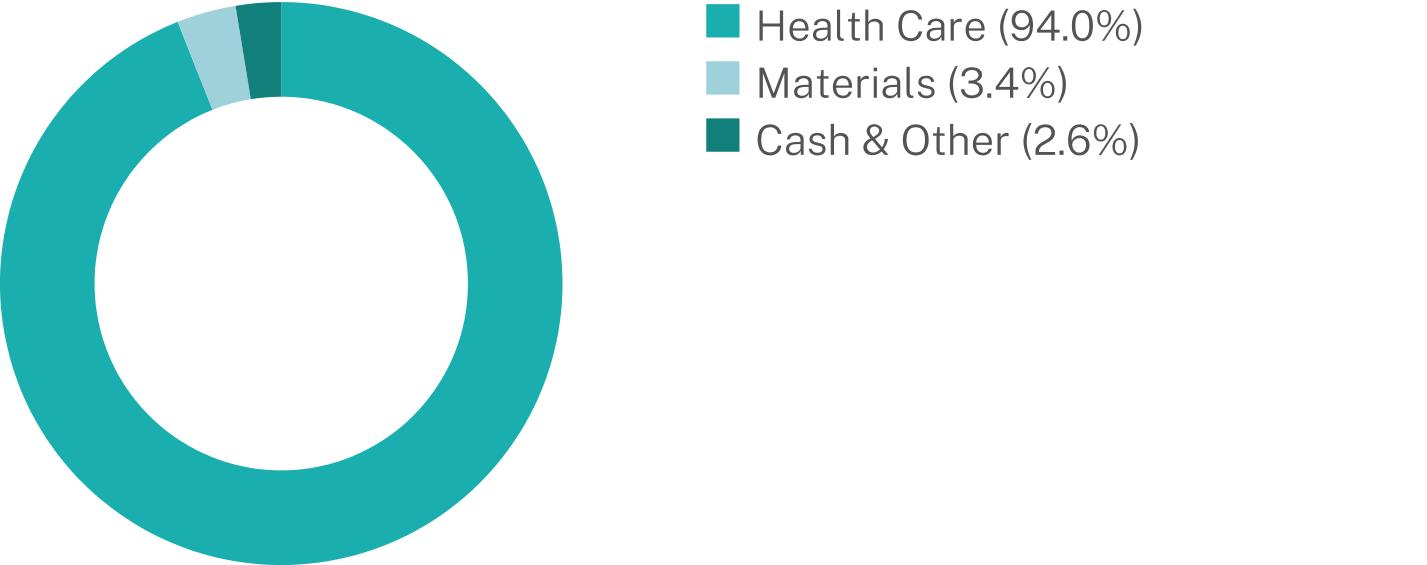

Amplify Weight Loss Drug & Treatment ETF

|

$27

|

0.59%

|

|

Net Assets

|

$3,871,107

|

|

Number of Holdings

|

27

|

|

Portfolio Turnover

|

22%

|

|

30-Day SEC Yield

|

1.33%

|

|

30-Day SEC Yield Unsubsidized

|

1.33%

|

|

Top Holdings

|

(%)

|

|

Eli Lilly & Co.

|

15.8%

|

|

Novo Nordisk AS

|

14.0%

|

|

First American Government Obligations Fund - Class X

|

13.9%

|

|

West Pharmaceutical Services, Inc.

|

5.1%

|

|

Chugai Pharmaceutical Co. Ltd.

|

5.1%

|

|

Thermo Fisher Scientific, Inc.

|

5.0%

|

|

Merck & Co., Inc.

|

4.8%

|

|

Amgen, Inc.

|

4.7%

|

|

Innovent Biologics, Inc.

|

4.7%

|

|

Pfizer, Inc.

|

4.7%

|

| [1] |

|

||

| [2] |

|

||

| [3] |

|

||

| [4] |

|

||

| [5] |

|

||

| [6] |

|

||

| [7] |

|

||

| [8] |

|

||

| [9] |

|

||

| [10] |

|

||

| [11] |

|

||

| [12] |

|

||

| [13] |

|

||

| [14] |

|

||

| [15] |

|

||

| [16] |

|

||

| [17] |

|

||

| [18] |

|

||

| [19] |

|

||

| [20] |

|

||

| [21] |

|

||

| [22] |

|

||

| [23] |

|

||

| [24] |

|

||

| [25] |

|

||

| [26] |

|

||

| [27] |

|

||

| [28] |

|