Exhibit 99.1

1 B Li INVESTOR PRESENTATION June 2, 2025 : IONR www.ioneer.com ASX : INR Rhyolite Ridge Project Reserve & Economics

Update

Disclaimer INVESTOR PRESENTATION June 2025 : IONR ASX : INR www.ioneer.com 4 This presentation has been prepared as a summary

only and does not contain all information about ioneer Ltds (ioneer or the Company) assets and liabilities, financial position and performance, profits and losses, prospects, and the rights and liabilities attaching to ioneer’s securities. The

securities issued by ioneer are considered speculative and there is no guarantee that they will make a return on the capital invested, that dividends will be paid on the shares or that there will be an increase in the value of the shares in the

future. ioneer does not purport to give financial or investment advice. No account has been taken of the objectives, financial situation or needs of any recipient of this presentation. Recipients of this presentation should carefully consider

whether the securities issued by ioneer are an appropriate investment for them in light of their personal circumstances, including their financial and taxation position. Investors should make and rely upon their own enquiries before deciding to

acquire or deal in the Company's securities. Forward Looking Statements Various statements in this presentation constitute statements relating to intentions, future acts and events which are generally classified as “forward looking

statements”. These forward-looking statements are not guarantees or predictions of future performance and involve known and unknown risks, uncertainties and other important factors (many of which are beyond the Company’s control) that could

cause those future acts, events and circumstances to differ materially from what is presented or implicitly portrayed in this presentation. For example, future reserves described in this presentation may be based, in part, on market prices

that may vary significantly from current levels. These variations may materially affect the timing or feasibility of particular developments. Words such as “anticipates”, “expects”, “intends”, “plans”, “believes”, “seeks”, “estimates”,

“potential” and similar expressions are intended to identify forward-looking statements. ioneer cautions security holders and prospective security holders to not place undue reliance on these forward- looking statements, which reflect the

view of ioneer only as of the date of this presentation. The forward-looking statements made in this presentation relate only to events as of the date on which the statements are made. Except as required by applicable regulations or by law,

ioneer does not undertake any obligation to publicly update or review any forward-looking statements, whether as a result of new information or future events. Past performance cannot be relied on as a guide to future performance. Competent

Persons Statement In respect of Mineral Resources and Ore Reserves referred to in this presentation and previously reported by the Company in accordance with JORC Code 2012, the Company confirms that it is not aware of any new information or

data that materially affects the information included in the public reports titled “February 2025 Mineral Resource Estimate” dated 5 March 2025 and “Ore Reserve Quadruples; Reaffirms Robust Project Economics” dated 2 June 2025, released on ASX.

Further information regarding the Mineral Resource estimate and Ore Reserve can be found in those reports. All material assumptions and technical parameters underpinning the estimates in the reports continue to apply and have not materially

changed. In respect of production targets referred to in this presentation, the Company confirms that it is not aware of any new information or data that materially affects the information included in the public report titled “Ore Reserve

Quadruples; Reaffirms Robust Project Economics” dated 2 June 2025. Further information regarding the production estimates can be found in that report. All material assumptions and technical parameters underpinning the estimates in the report

continue to apply and have not materially changed. No offer of securities Nothing in this presentation should be construed as either an offer to sell or a solicitation of an offer to buy or sell ioneer securities in any jurisdiction or be

treated or relied upon as a recommendation or advice by ioneer. Reliance on third party information The views expressed in this presentation contain information that has been derived from publicly available sources that have not been

independently verified. No representation or warranty is made as to the accuracy, completeness or reliability of the information. This presentation should not be relied upon as a recommendation or forecast by ioneer. Lithium Carbonate

Equivalent The formula used for the Lithium Carbonate Equivalent (LCE) values quoted in this presentation is: LCE = (lithium carbonate tonnes produced + lithium hydroxide tonnes produced * 0.880 Note All $’s in this presentation are US$’s

except where otherwise noted.

Rhyolite Ridge Project Update A unique lithium-boron deposit of strategic importance to the U.S. Rhyolite Ridge Ore Reserve more

than quadrupled from 60 to 247 million tonnes underpinning a mine life of 95 years All-in sustaining cash cost places the Project in the bottom quartile of the global lithium cost curve Large, Long-life Resource with verified expansion

potential De-Risked Project that is permitted, shovel ready, with Off-takes, and US$996 million in low-cost debt 2 Updated economics confirm strength and resilience of Project at prevailing weak lithium prices 3 4 5 6 Partnering Process

begun to advance development of Project 1 INVESTOR PRESENTATION June 2025 : IONR ASX : INR www.ioneer.com 4

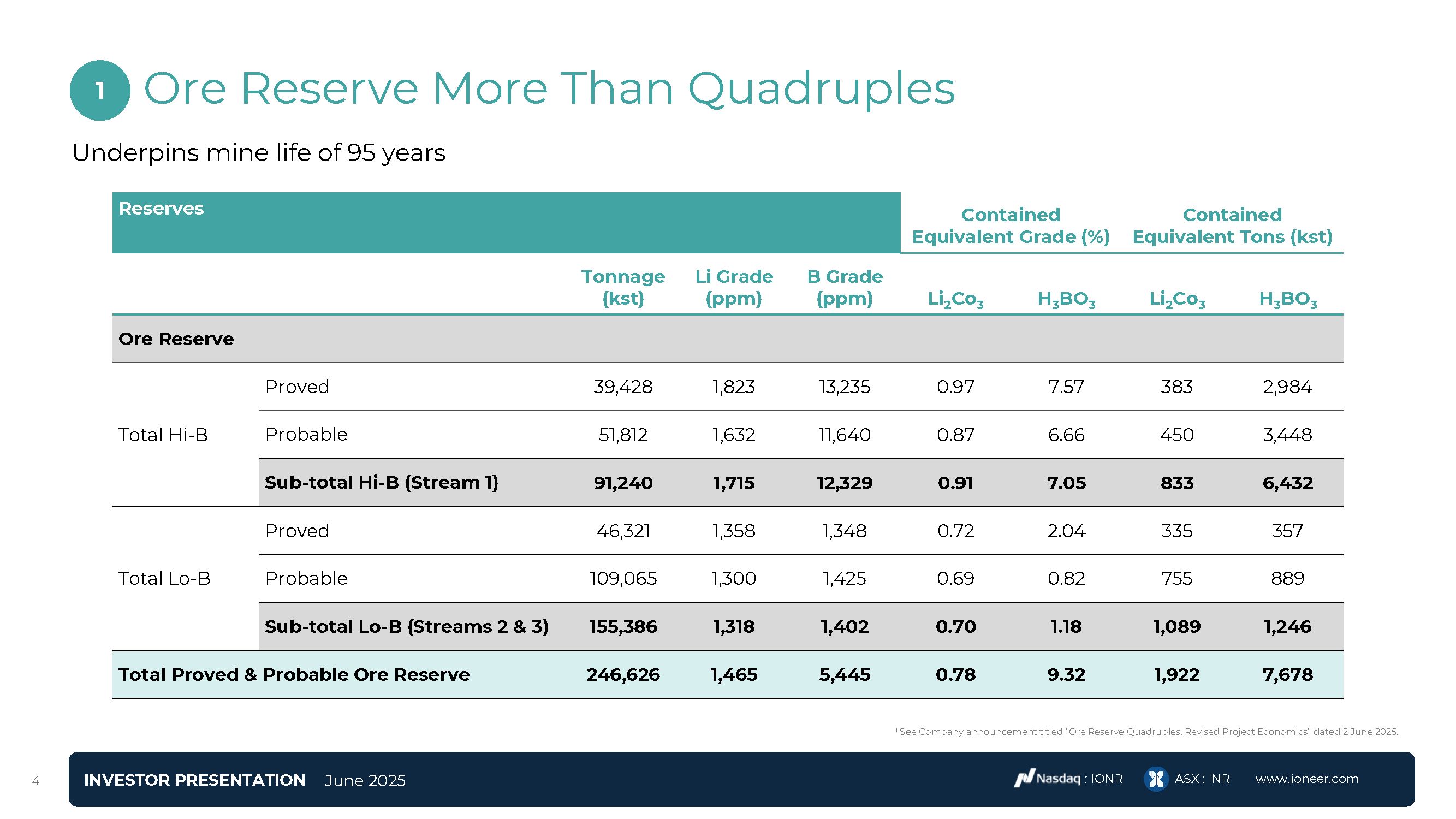

Ore Reserve More Than Quadruples 1 See Company announcement titled “Ore Reserve Quadruples; Revised Project Economics” dated 2 June

2025. Reserves Contained Equivalent Grade (%) Contained Equivalent Tons (kst) Tonnage (kst) Li Grade (ppm) B Grade (ppm) Li2Co3 H3BO3 Li2Co3 H3BO3 Ore Reserve Proved 39,428 1,823 13,235 0.97 7.57 383 2,984 Total

Hi-B Probable 51,812 1,632 11,640 0.87 6.66 450 3,448 Sub-total Hi-B (Stream 1) 91,240 1,715 12,329 0.91 7.05 833 6,432 Proved 46,321 1,358 1,348 0.72 2.04 335 357 Total

Lo-B Probable 109,065 1,300 1,425 0.69 0.82 755 889 Sub-total Lo-B (Streams 2 & 3) 155,386 1,318 1,402 0.70 1.18 1,089 1,246 Total Proved & Probable Ore

Reserve 246,626 1,465 5,445 0.78 9.32 1,922 7,678 1 INVESTOR PRESENTATION June 2025 : IONR ASX : INR www.ioneer.com 4 Underpins mine life of 95 years

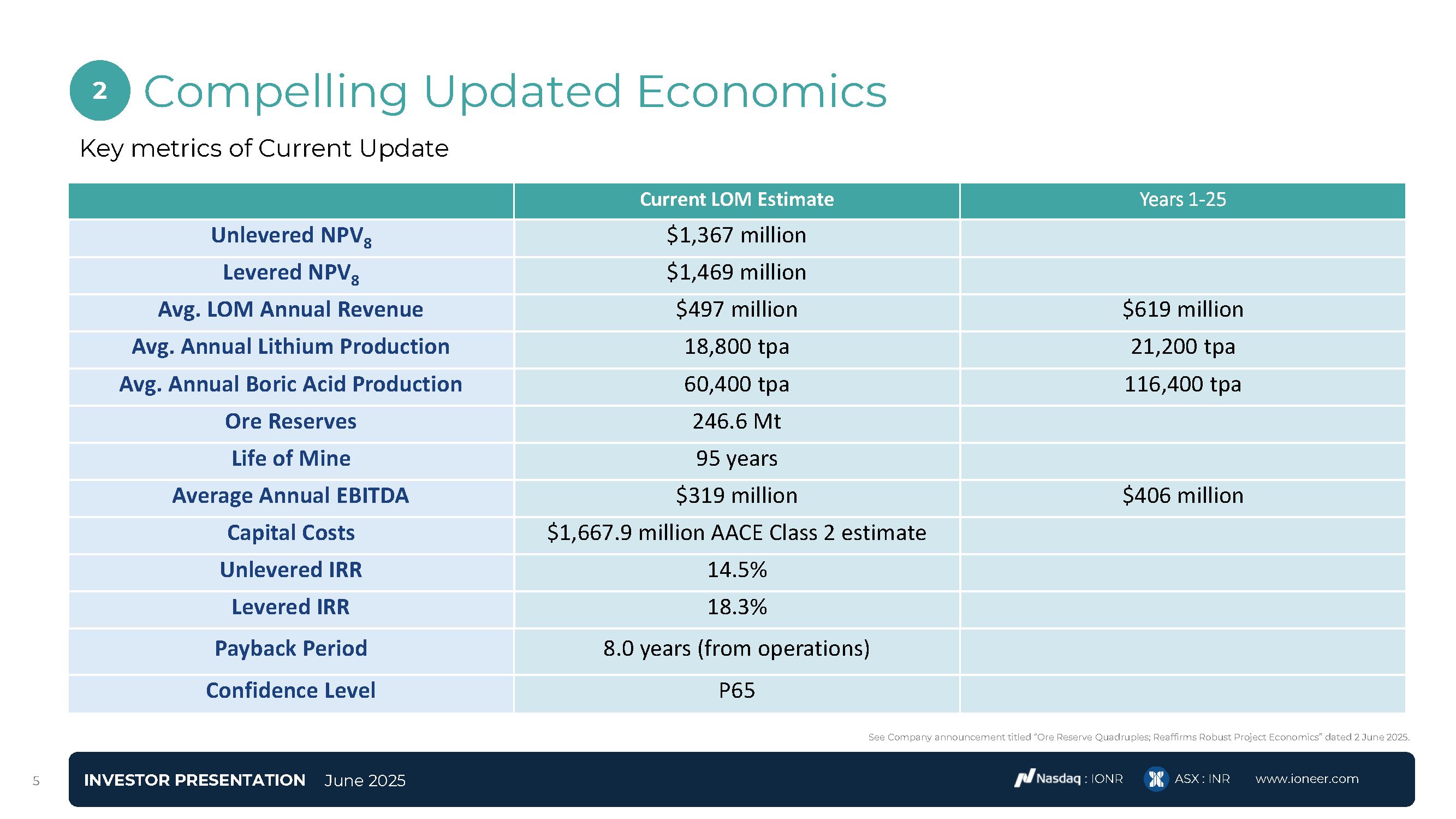

Compelling Updated Economics 2 INVESTOR PRESENTATION June 2025 : IONR ASX : INR www.ioneer.com 4 Key metrics of Current

Update Current LOM Estimate Years 1-25 Unlevered NPV8 $1,367 million Levered NPV8 $1,469 million Avg. LOM Annual Revenue $497 million $619 million Avg. Annual Lithium Production 18,800 tpa 21,200 tpa Avg. Annual Boric Acid

Production 60,400 tpa 116,400 tpa Ore Reserves 246.6 Mt Life of Mine 95 years Average Annual EBITDA $319 million $406 million Capital Costs $1,667.9 million AACE Class 2 estimate Unlevered IRR 14.5% Levered IRR 18.3% Payback

Period 8.0 years (from operations) Confidence Level P65 See Company announcement titled “Ore Reserve Quadruples; Reaffirms Robust Project Economics” dated 2 June 2025.

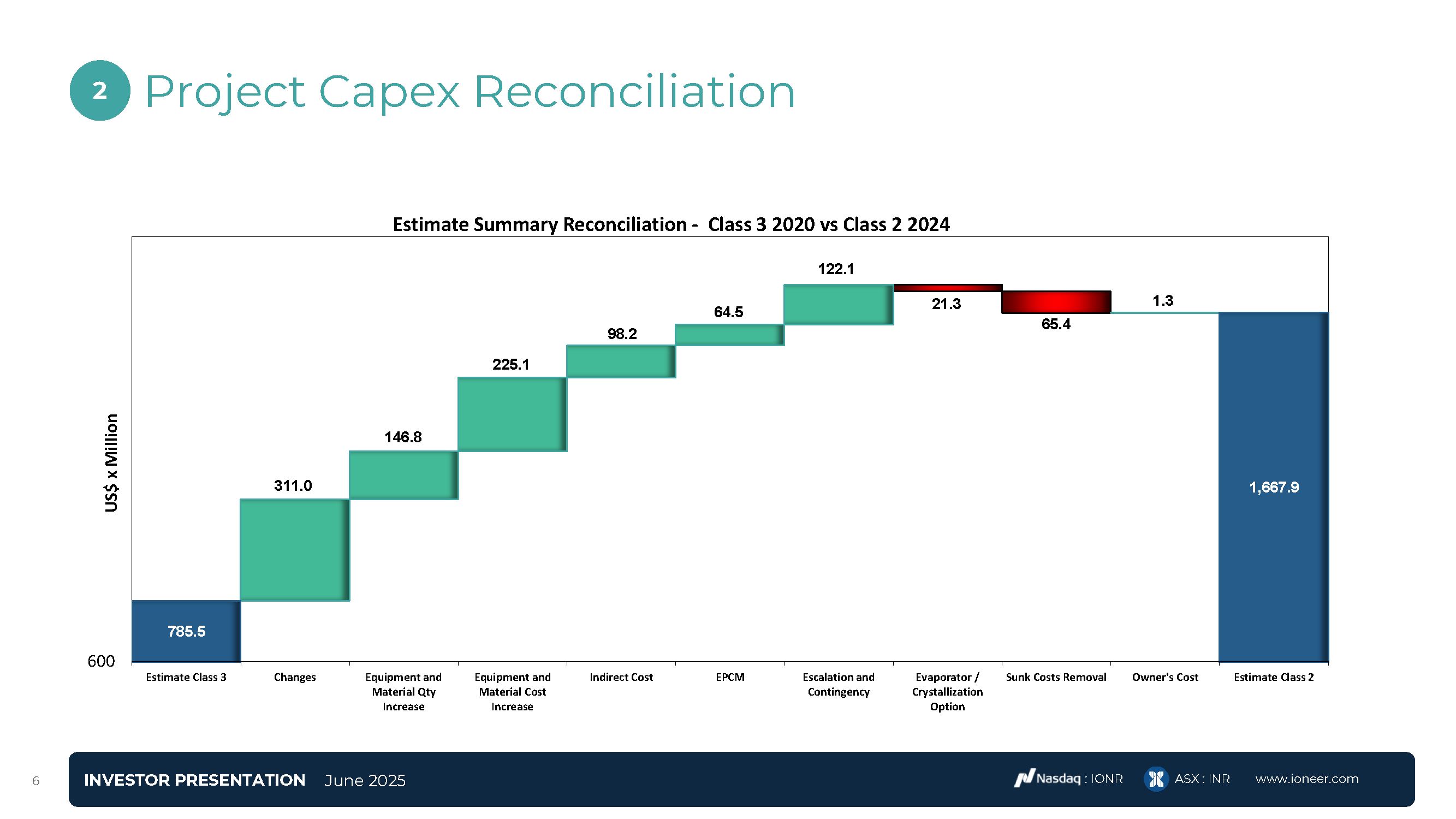

Project Capex Reconciliation 2 21.3 INVESTOR PRESENTATION June 2025 : IONR ASX :

INR www.ioneer.com 4 65.4 311.0 146.8 225.1 98.2 64.5 1.3 1,667.9 785.5 600 Estimate Class 3 Estimate Summary Reconciliation - Class 3 2020 vs Class 2 2024 122.1 Changes Equipment and Material Qty Increase Equipment and

Material Cost Increase Indirect Cost EPCM Escalation and Contingency Evaporator / Crystallization Option Sunk Costs Removal Owner's Cost Estimate Class 2 US$ x Million

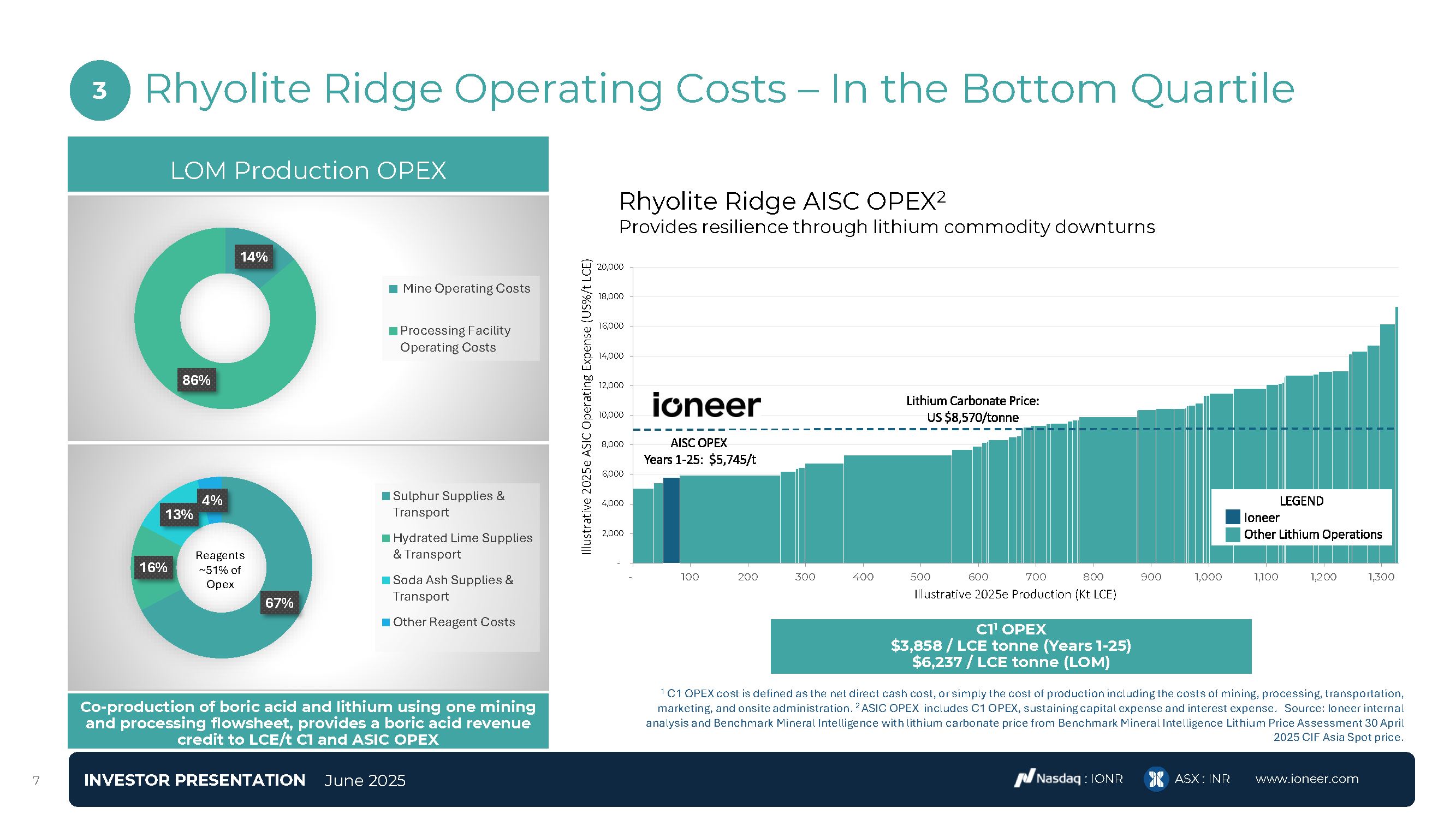

Rhyolite Ridge Operating Costs – In the Bottom Quartile 3 LOM Production OPEX 14% Mine Operating Costs Processing Facility

Operating Costs 86% 4% Sulphur Supplies & 13% Transport Hydrated Lime Supplies Reagents & Transport 16% ~51% of Opex Soda Ash Supplies & 67% Transport Other Reagent Costs Co-production of boric acid and lithium using one

mining and processing flowsheet, provides a boric acid revenue credit to LCE/t C1 and ASIC OPEX Rhyolite Ridge AISC OPEX2 Provides resilience through lithium commodity downturns 1 C1 OPEX cost is defined as the net direct cash cost, or

simply the cost of production including the costs of mining, processing, transportation, marketing, and onsite administration. 2 ASIC OPEX includes C1 OPEX, sustaining capital expense and interest expense. Source: Ioneer internal analysis and

Benchmark Mineral Intelligence with lithium carbonate price from Benchmark Mineral Intelligence Lithium Price Assessment 30 April 2025 CIF Asia Spot

price. - 2,000 4,000 6,000 8,000 10,000 20,000 18,000 16,000 14,000 12,000 - 100 200 300 400 500 600 700 800 Illustrative 2025e Production (Kt LCE) 900 1,000 1,100 1,200 1,300 Lithium Carbonate Price: US

$8,570/tonne AISC OPEX Years 1-25: $5,745/t LEGEND Ioneer Other Lithium Operations Illustrative 2025e ASIC Operating Expense (US%/t LCE) C11 OPEX $3,858 / LCE tonne (Years 1-25) $6,237 / LCE tonne (LOM) INVESTOR PRESENTATION June

2025 : IONR ASX : INR www.ioneer.com 4

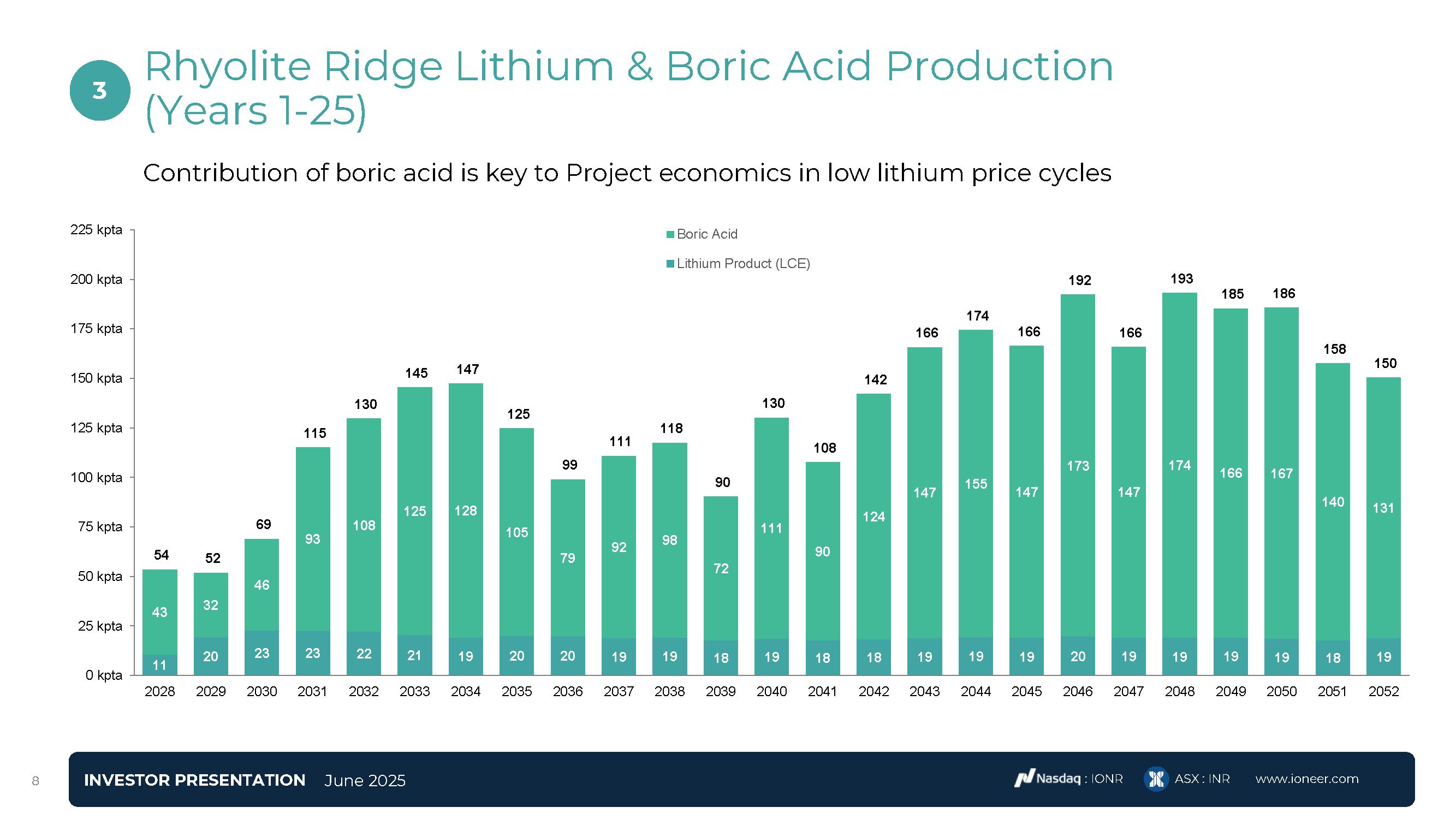

Rhyolite Ridge Lithium & Boric Acid Production (Years

1-25) 3 11 20 23 23 22 21 19 20 20 19 19 18 19 18 18 19 19 19 20 19 19 19 19 18 19 43 32 46 93 108 125 128 105 79 92 98 72 111 90 124 147 155 147 173 147 174 166 167 140 131 54 52 69 115 130 145 147 125 99 111 118 90 130 108 142 166 174 166 192 166 193 185 186 158 150 0

kpta 25 kpta 50 kpta 75 kpta 100 kpta 125 kpta 150 kpta 175 kpta 200 kpta 225 kpta 2028 2029 2030 2031 2032 2033 2034 2035 2036 2037 2038 2039 2040 2041 2042 2043 2044 2045 2046 2047 2048 2049 2050 2051 2052 Boric Acid Lithium

Product (LCE) INVESTOR PRESENTATION June 2025 : IONR ASX : INR www.ioneer.com 4 Contribution of boric acid is key to Project economics in low lithium price cycles

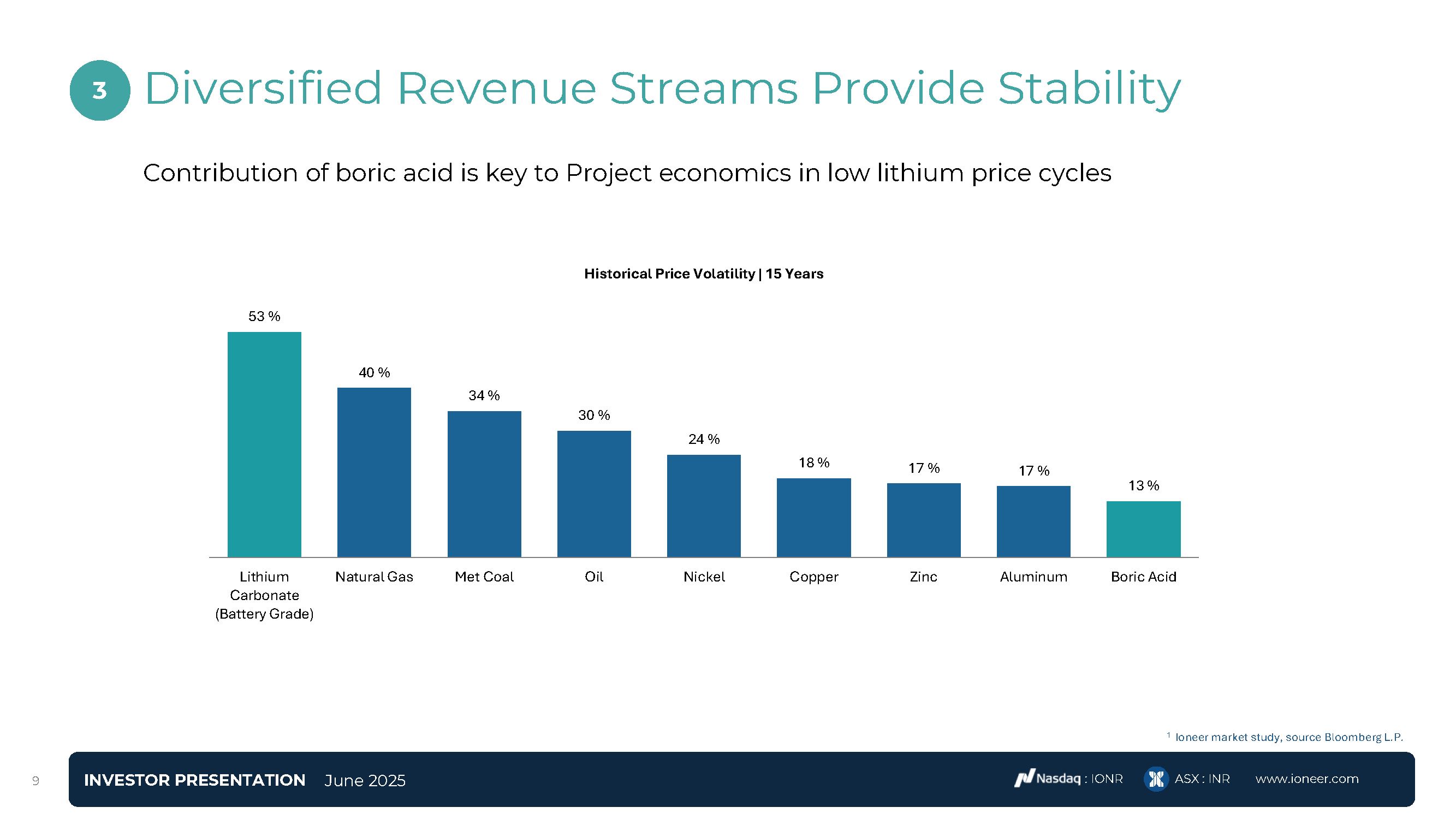

Diversified Revenue Streams Provide Stability 3 1 Ioneer market study, source Bloomberg L.P. Contribution of boric acid is key to

Project economics in low lithium price cycles 53 % 40 % 34 % 30 % 24 % INVESTOR PRESENTATION June 2025 : IONR ASX : INR www.ioneer.com 10 18 % 17 % 17 % 13 % Lithium Carbonate (Battery Grade) Natural Gas Met

Coal Oil Nickel Copper Zinc Aluminum Boric Acid Historical Price Volatility | 15 Years

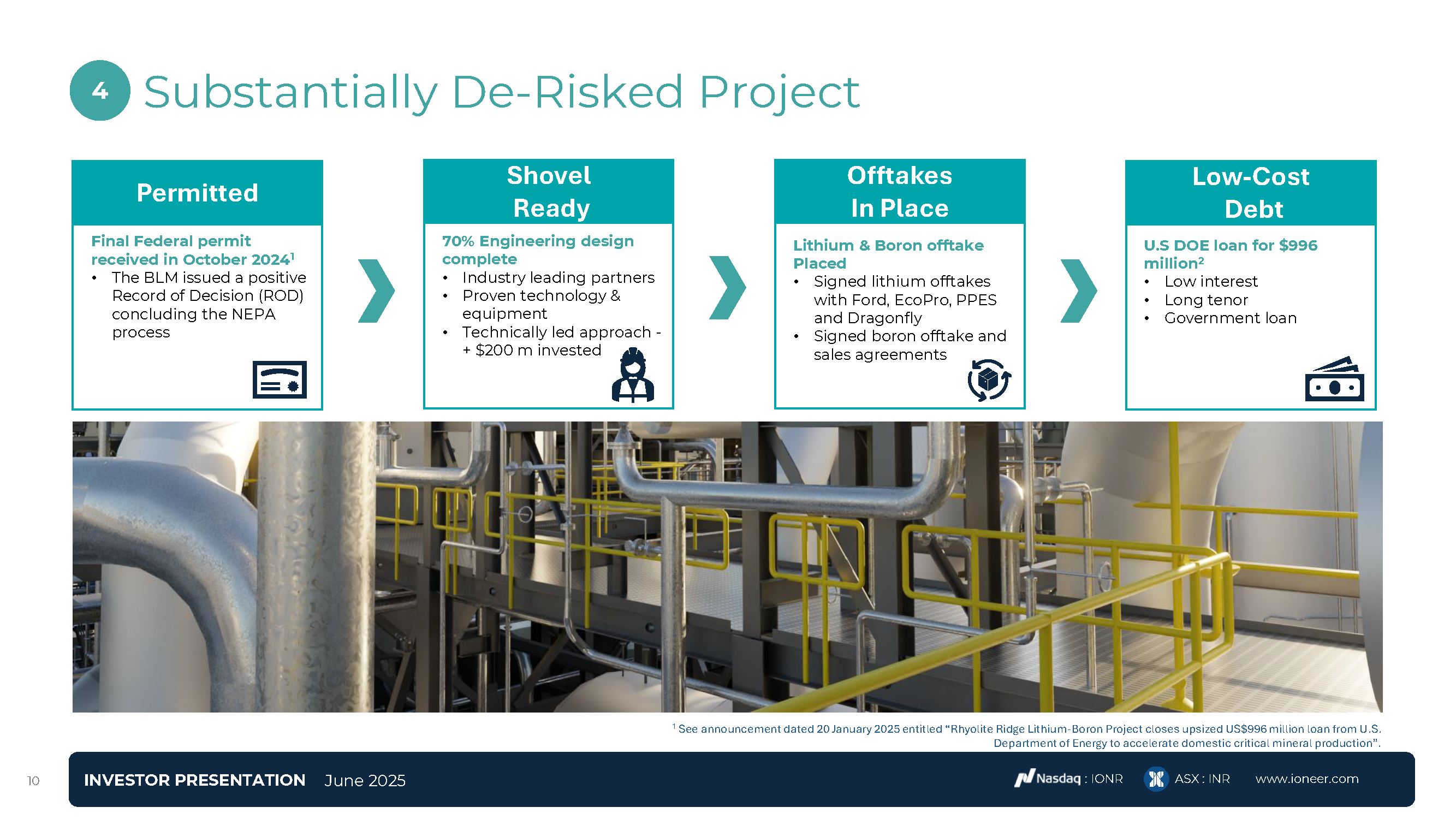

Substantially De-Risked Project 1 See announcement dated 20 January 2025 entitled “Rhyolite Ridge Lithium-Boron Project closes

upsized US$996 million loan from U.S. Department of Energy to accelerate domestic critical mineral production”. Permitted Shovel Ready Offtakes In Place Low-Cost Debt 70% Engineering design complete Industry leading partners Proven

technology & equipment Technically led approach - + $200 m invested Lithium & Boron offtake Placed Signed lithium offtakes with Ford, EcoPro, PPES and Dragonfly Signed boron offtake and sales agreements U.S DOE loan for $996

million2 Low interest Long tenor Government loan Final Federal permit received in October 20241 The BLM issued a positive Record of Decision (ROD) concluding the NEPA process 4 INVESTOR PRESENTATION June 2025 : IONR ASX :

INR www.ioneer.com 10

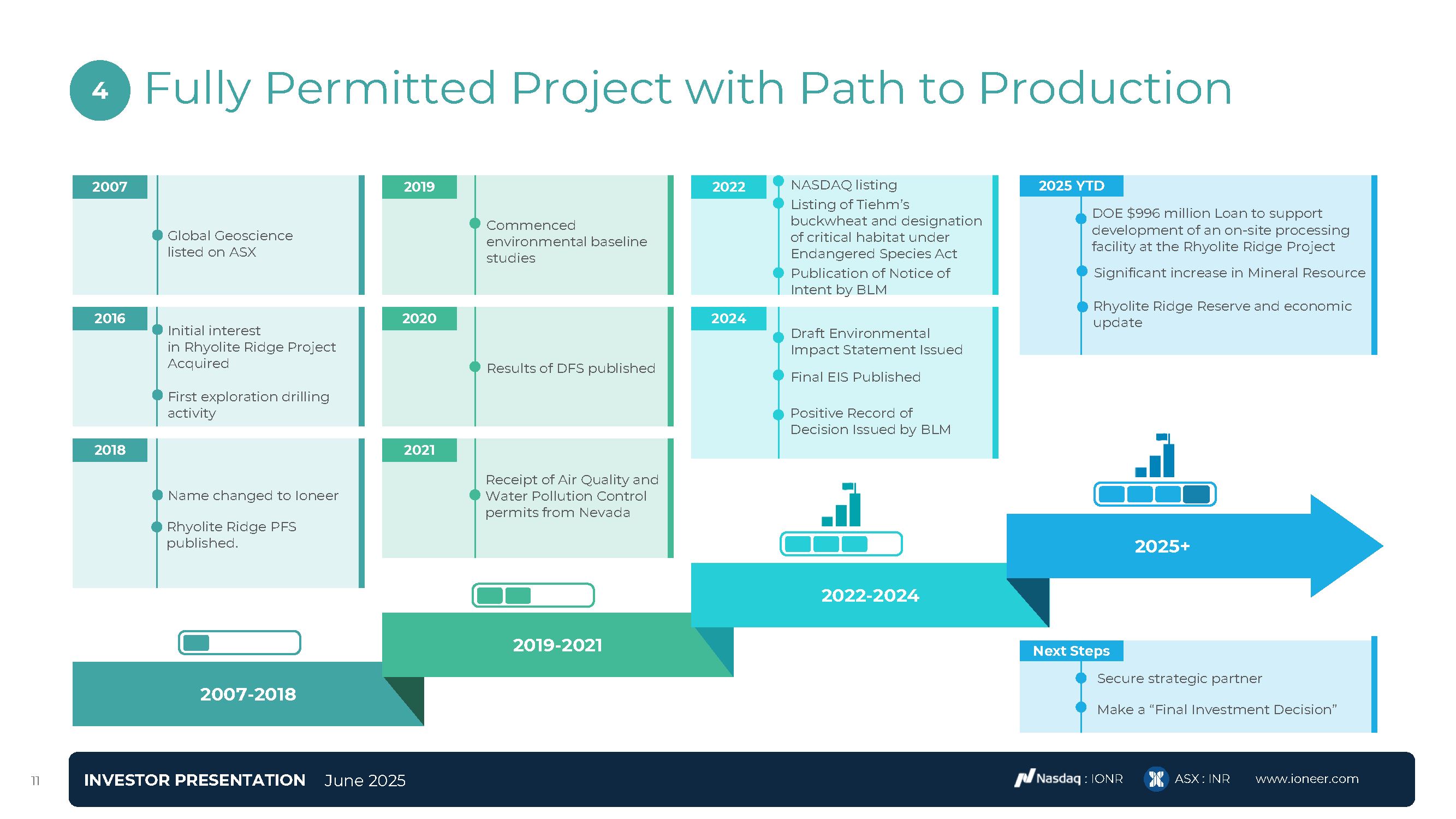

Fully Permitted Project with Path to Production 2007-2018 2019-2021 2022-2024 2016 2018 2007 Global Geoscience listed on

ASX Initial interest in Rhyolite Ridge Project Acquired First exploration drilling activity Name changed to Ioneer Rhyolite Ridge PFS published. 2019 Commenced environmental baseline studies 2020 Results of DFS published 2021 Receipt

of Air Quality and Water Pollution Control permits from Nevada 2022 2024 NASDAQ listing Listing of Tiehm’s buckwheat and designation of critical habitat under Endangered Species Act Publication of Notice of Intent by BLM Draft

Environmental Impact Statement Issued Final EIS Published Positive Record of Decision Issued by BLM 2025+ 2025 YTD Next Steps Secure strategic partner Make a “Final Investment Decision” 4 DOE $996 million Loan to support development of

an on-site processing facility at the Rhyolite Ridge Project Significant increase in Mineral Resource Rhyolite Ridge Reserve and economic update INVESTOR PRESENTATION June 2025 : IONR ASX : INR www.ioneer.com 10

Rhyolite Ridge - a U.S. Shovel Ready Project Over 70% Engineering Design Complete 4 INVESTOR PRESENTATION June 2025 : IONR ASX

: INR www.ioneer.com 10

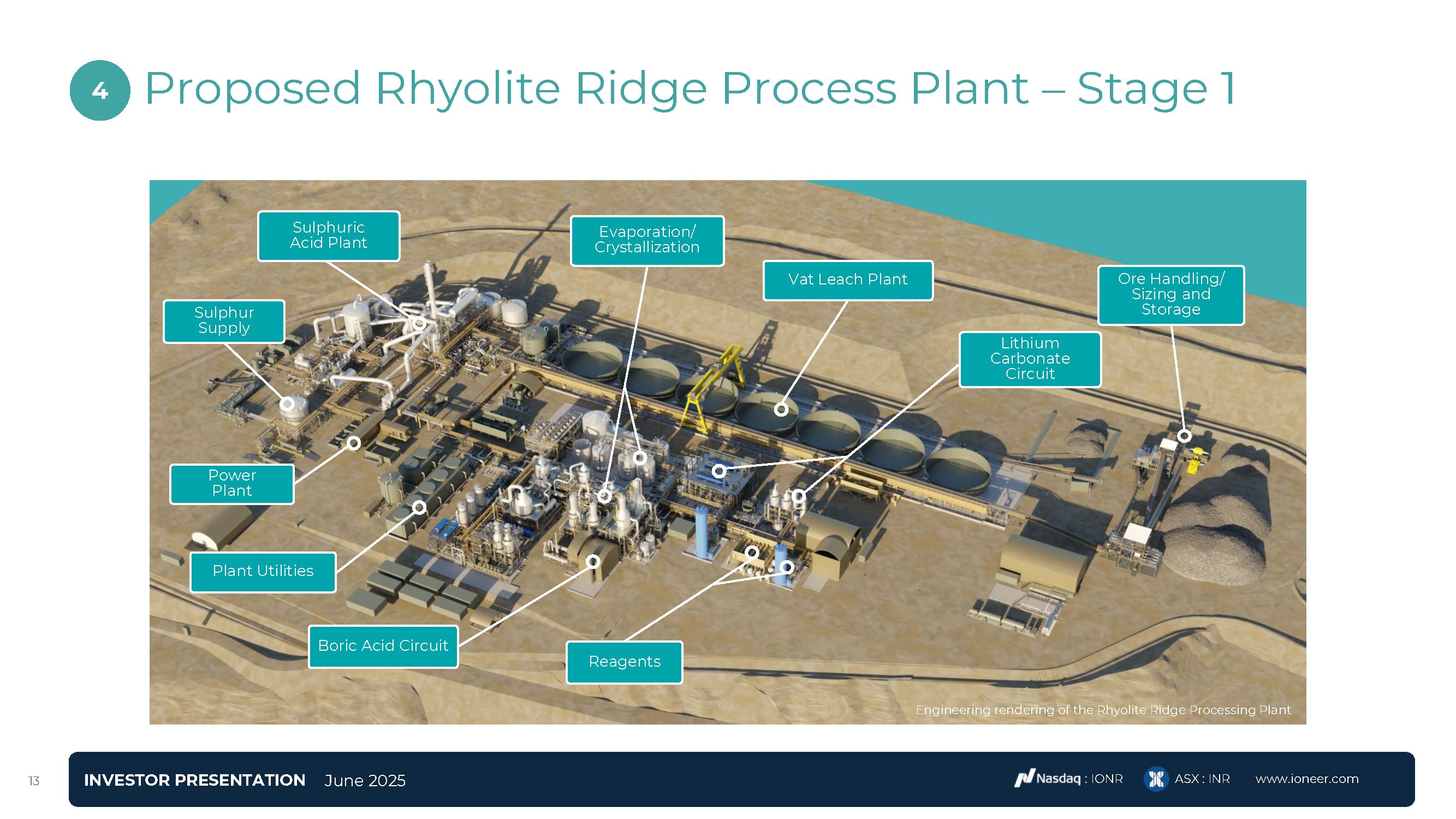

Proposed Rhyolite Ridge Process Plant – Stage 1 Ore Handling/ Sizing and Storage Sulphuric Acid Plant Vat Leach Plant Sulphur

Supply Power Plant Plant Utilities Boric Acid Circuit Reagents Lithium Carbonate Circuit Evaporation/ Crystallization Engineering rendering of the Rhyolite Ridge Processing Plant 4 INVESTOR PRESENTATION June 2025 : IONR ASX :

INR www.ioneer.com 10

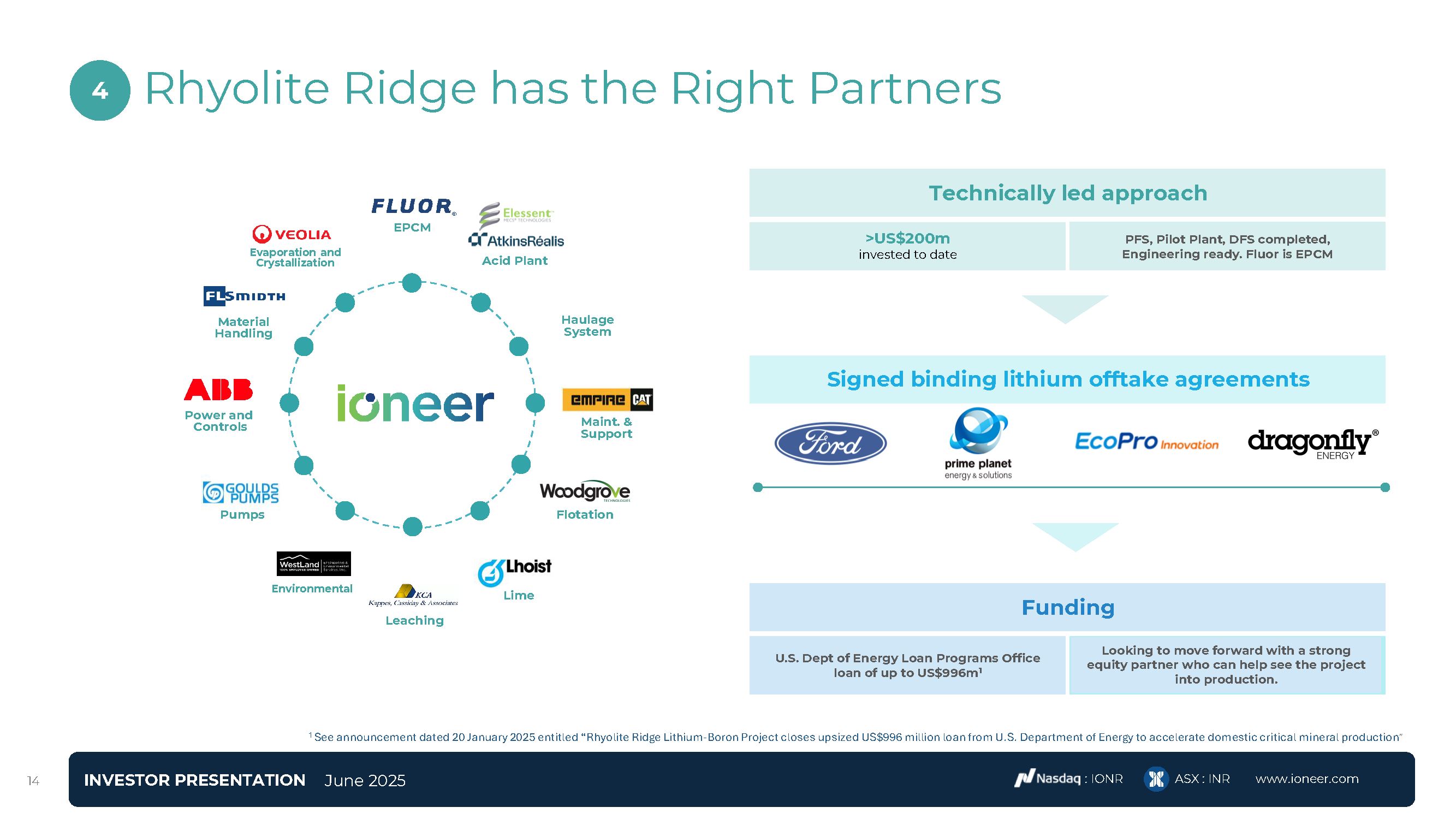

Rhyolite Ridge has the Right Partners Technically led approach EPCM Acid Plant Maint. &

Support Lime Leaching Pumps Haulage System Evaporation and Crystallization Material Handling Power and Controls Environmental Flotation >US$200m invested to date PFS, Pilot Plant, DFS completed, Engineering ready. Fluor is

EPCM Signed binding lithium offtake agreements Funding U.S. Dept of Energy Loan Programs Office loan of up to US$996m1 Looking to move forward with a strong equity partner who can help see the project into production. 1 See announcement

dated 20 January 2025 entitled “Rhyolite Ridge Lithium-Boron Project closes upsized US$996 million loan from U.S. Department of Energy to accelerate domestic critical mineral production” 4 INVESTOR PRESENTATION June 2025 : IONR ASX :

INR www.ioneer.com 10

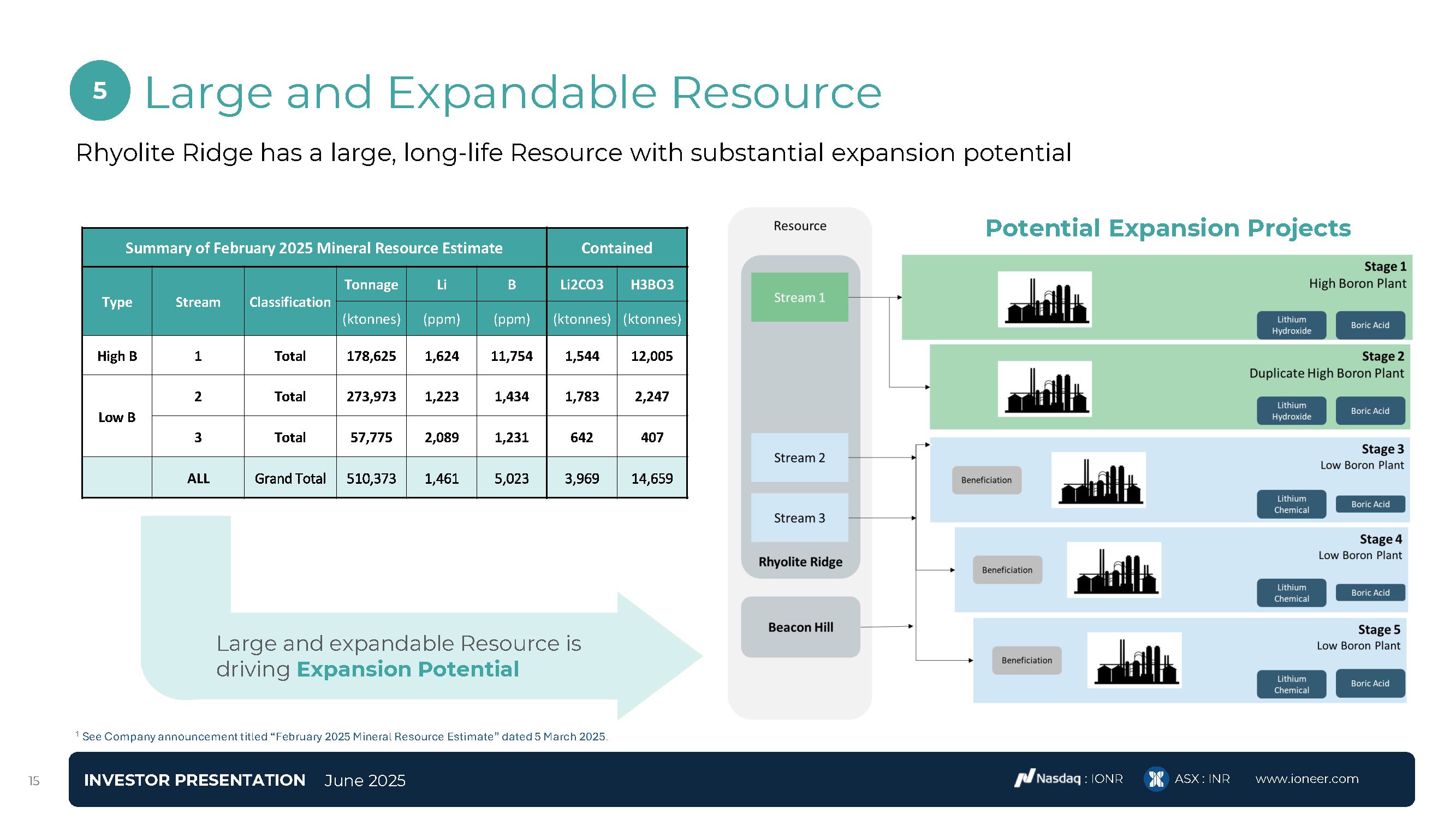

Large and Expandable Resource 1 See Company announcement titled “February 2025 Mineral Resource Estimate” dated 5 March

2025. Rhyolite Ridge has a large, long-life Resource with substantial expansion potential Potential Expansion Projects Large and expandable Resource is driving Expansion Potential Summary of February 2025 Mineral Resource

Estimate Contained Type Stream Classification Tonnage Li B Li2CO3 H3BO3 (ktonnes) (ppm) (ppm) (ktonnes) (ktonnes) High B 1 Total 178,625 1,624 11,754 1,544 12,005 Low

B 2 Total 273,973 1,223 1,434 1,783 2,247 3 Total 57,775 2,089 1,231 642 407 ALL Grand Total 510,373 1,461 5,023 3,969 14,659 5 INVESTOR PRESENTATION June 2025 : IONR ASX : INR www.ioneer.com 10

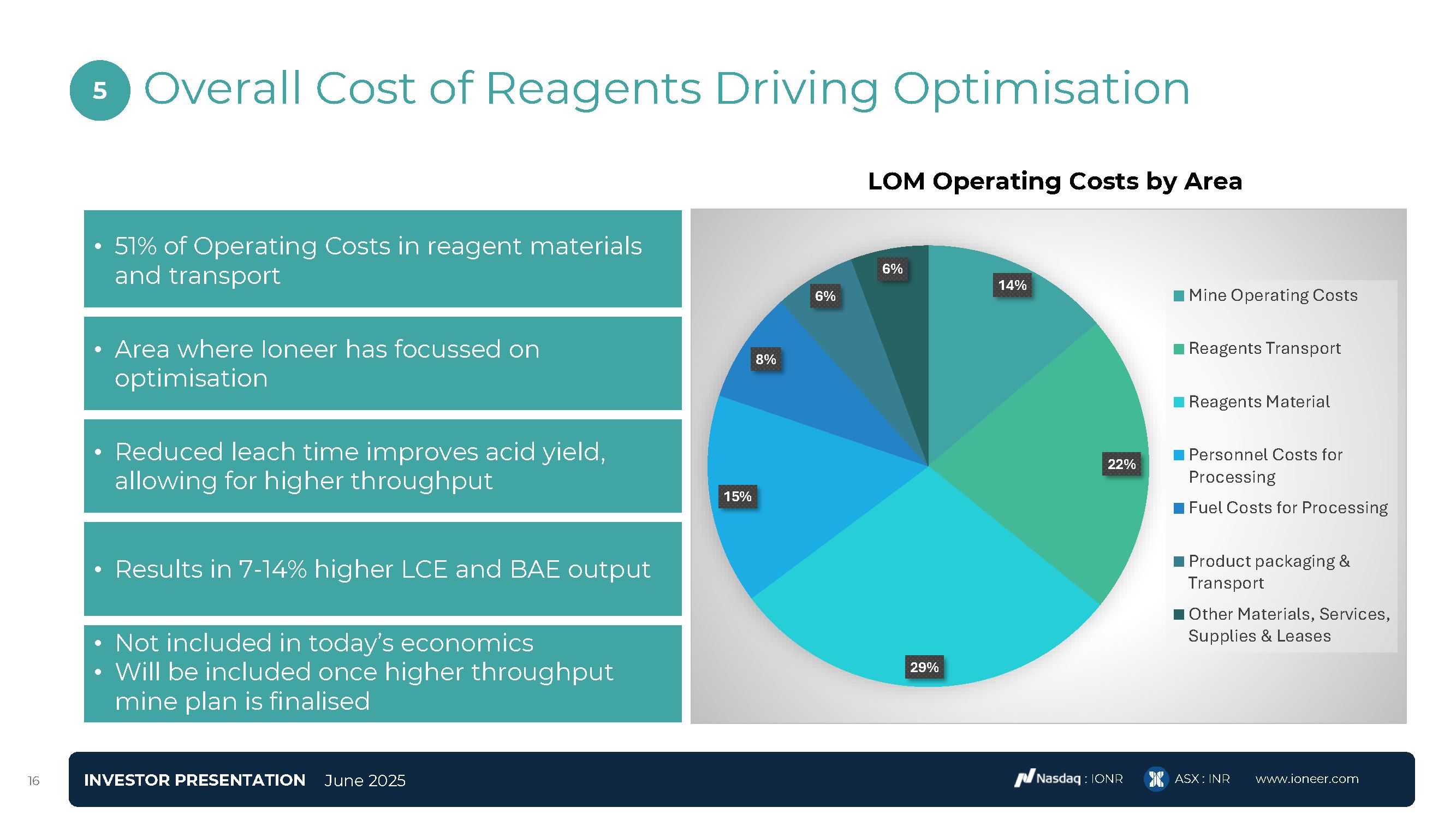

Overall Cost of Reagents Driving Optimisation 5 51% of Operating Costs in reagent materials and transport Area where Ioneer has

focussed on optimisation Reduced leach time improves acid yield, allowing for higher throughput Results in 7-14% higher LCE and BAE output Not included in today’s economics Will be included once higher throughput mine plan is finalised LOM

Operating Costs by Area 14% 22% 29% 15% 8% 6% 6% Mine Operating Costs Reagents Transport Reagents Material Personnel Costs for Processing Fuel Costs for Processing Product packaging & Transport Other Materials,

Services, Supplies & Leases INVESTOR PRESENTATION June 2025 : IONR ASX : INR www.ioneer.com 10

Status of Partnering Process 6 Planning for a Strategic Partnering Process has begun INVESTOR PRESENTATION June 2025 :

IONR ASX : INR www.ioneer.com 10 Goldman Sachs engaged to assist with the formal Strategic Partnering process We have relaunched a strategic partnering process in search of a partner who can help accelerate the development of Rhyolite

Ridge Activities to date have included updating a data room and preparing materials. Outreach is expected to commence in Q2 2025 The process will be thorough and is expected to take a minimum of 4 months. Shareholders will be kept informed of

progress on the process

Rhyolite Ridge Next steps INVESTOR PRESENTATION June 2025 : IONR ASX : INR www.ioneer.com 10 1 All future dates subject to

change without notice Secure equity financing to sit alongside U.S. Government debt ($996 M) Final Investment Decision once equity and debt are in place Construction Phase. Expected to take approximately 36 months (including long lead

items) First Production – 36 months from FID1 Pathway to future growth

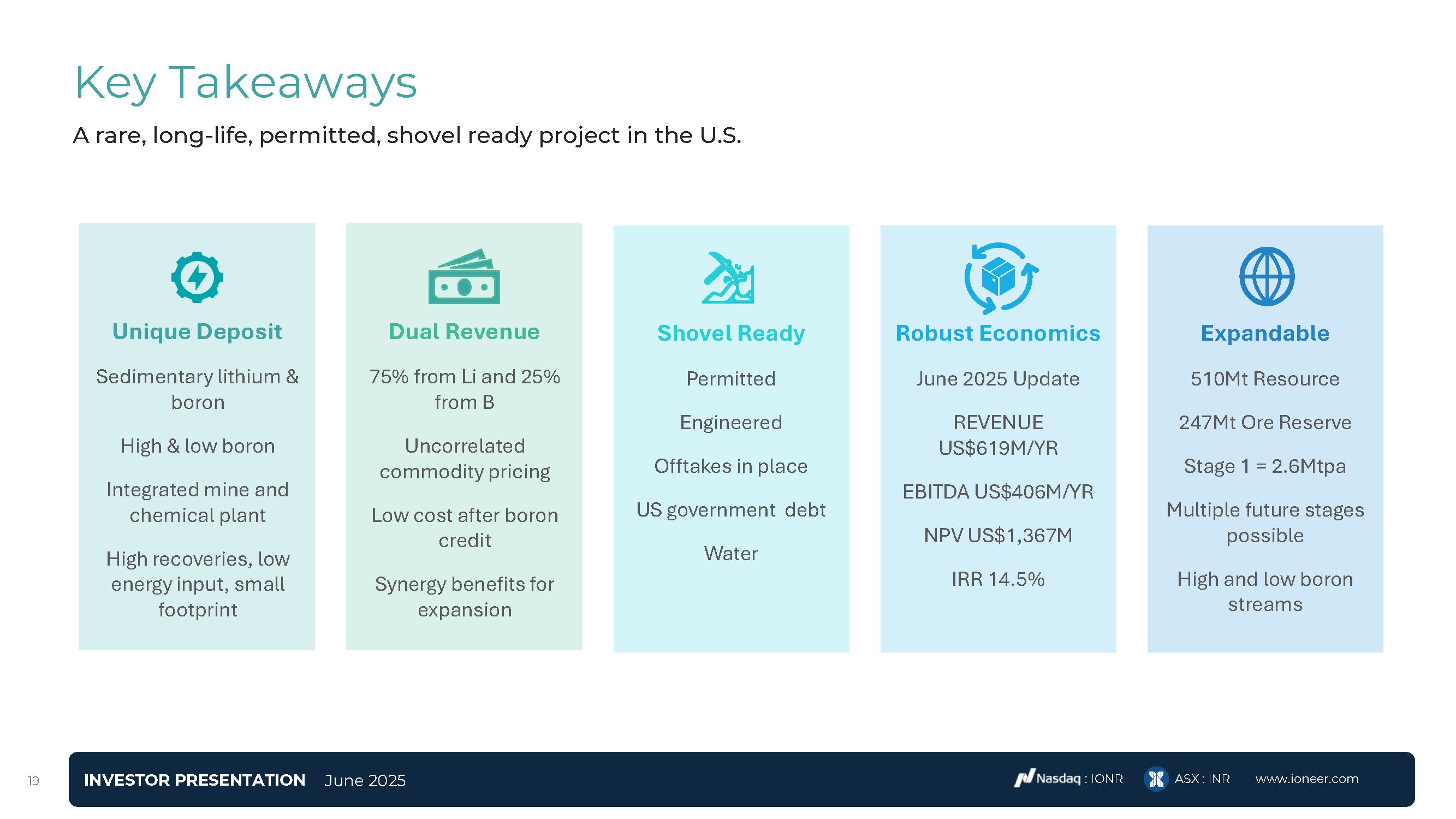

Key Takeaways Shovel Ready Permitted Engineered Offtakes in place US government debt Water Expandable 510Mt Resource 247Mt Ore

Reserve Stage 1 = 2.6Mtpa Multiple future stages possible High and low boron streams Robust Economics June 2025 Update REVENUE US$619M/YR EBITDA US$406M/YR NPV US$1,367M IRR 14.5% Dual Revenue 75% from Li and 25% from B Uncorrelated

commodity pricing Low cost after boron credit Synergy benefits for expansion Unique Deposit Sedimentary lithium & boron High & low boron Integrated mine and chemical plant High recoveries, low energy input, small footprint A

rare, long-life, permitted, shovel ready project in the U.S. INVESTOR PRESENTATION June 2025 : IONR ASX : INR www.ioneer.com 10

20 www.ioneer.com. ir@ioneer.com Questions Future U.S. Lithium & Boron Producer

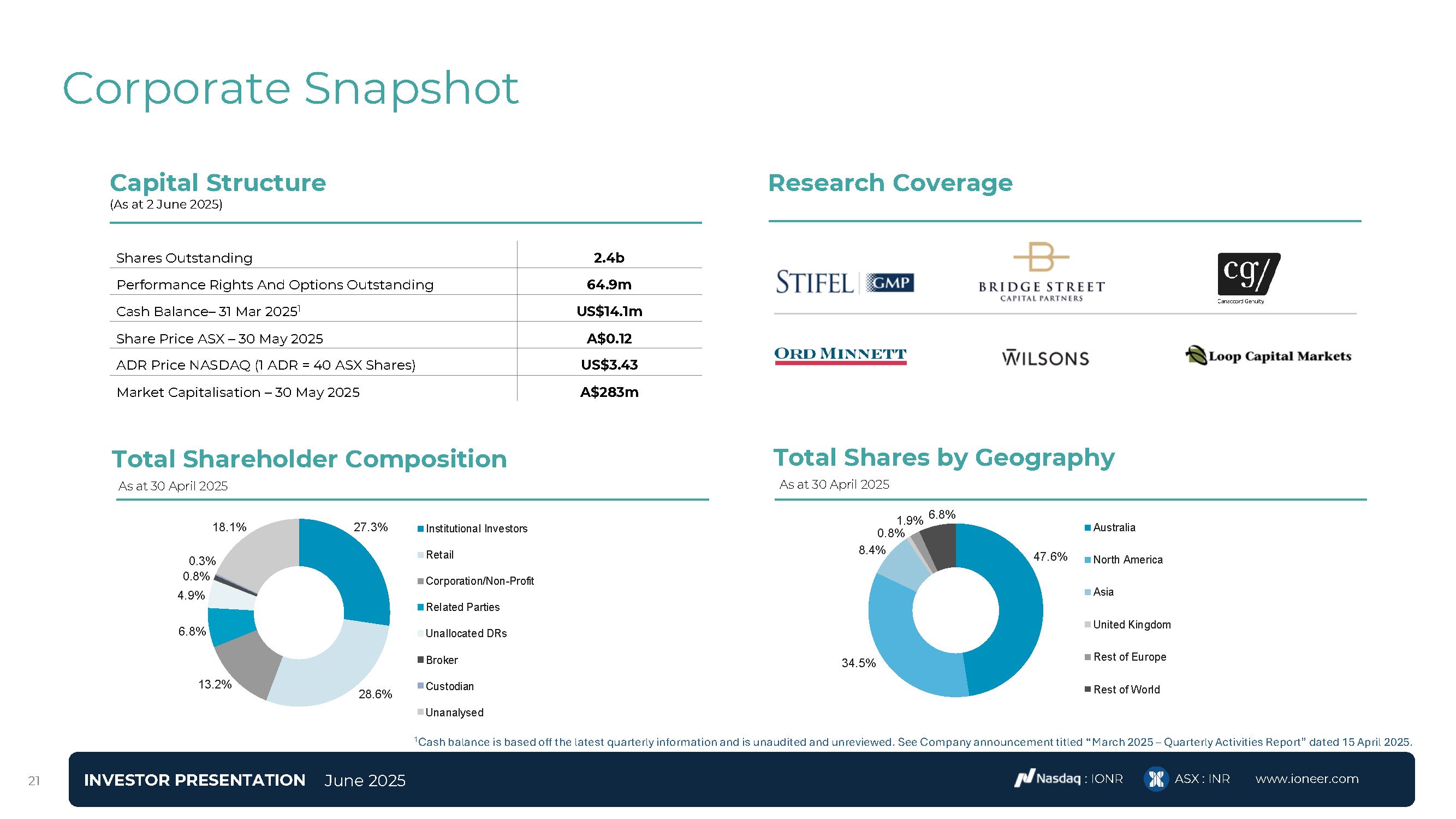

Corporate Snapshot Capital Structure (As at 2 June 2025) Shares Outstanding 2.4b Performance Rights And Options

Outstanding 64.9m Cash Balance– 31 Mar 20251 US$14.1m Share Price ASX – 30 May 2025 A$0.12 ADR Price NASDAQ (1 ADR = 40 ASX Shares) US$3.43 Market Capitalisation – 30 May 2025 A$283m Research Coverage Total Shareholder

Composition As at 30 April 2025 Total Shares by Geography As at 30 April 2025 27.3% 28.6% 13.2% 6.8% 0.3% 0.8% 4.9% 18.1% Institutional Investors Retail Corporation/Non-Profit Related Parties Unallocated

DRs Broker Custodian Unanalysed 1Cash balance is based off the latest quarterly information and is unaudited and unreviewed. See Company announcement titled “March 2025 – Quarterly Activities Report” dated 15 April 2025. 47.6% 34.5% 1.9%

6.8% 0.8% 8.4% Australia North America Asia United Kingdom Rest of Europe Rest of World INVESTOR PRESENTATION June 2025 : IONR ASX : INR www.ioneer.com 22

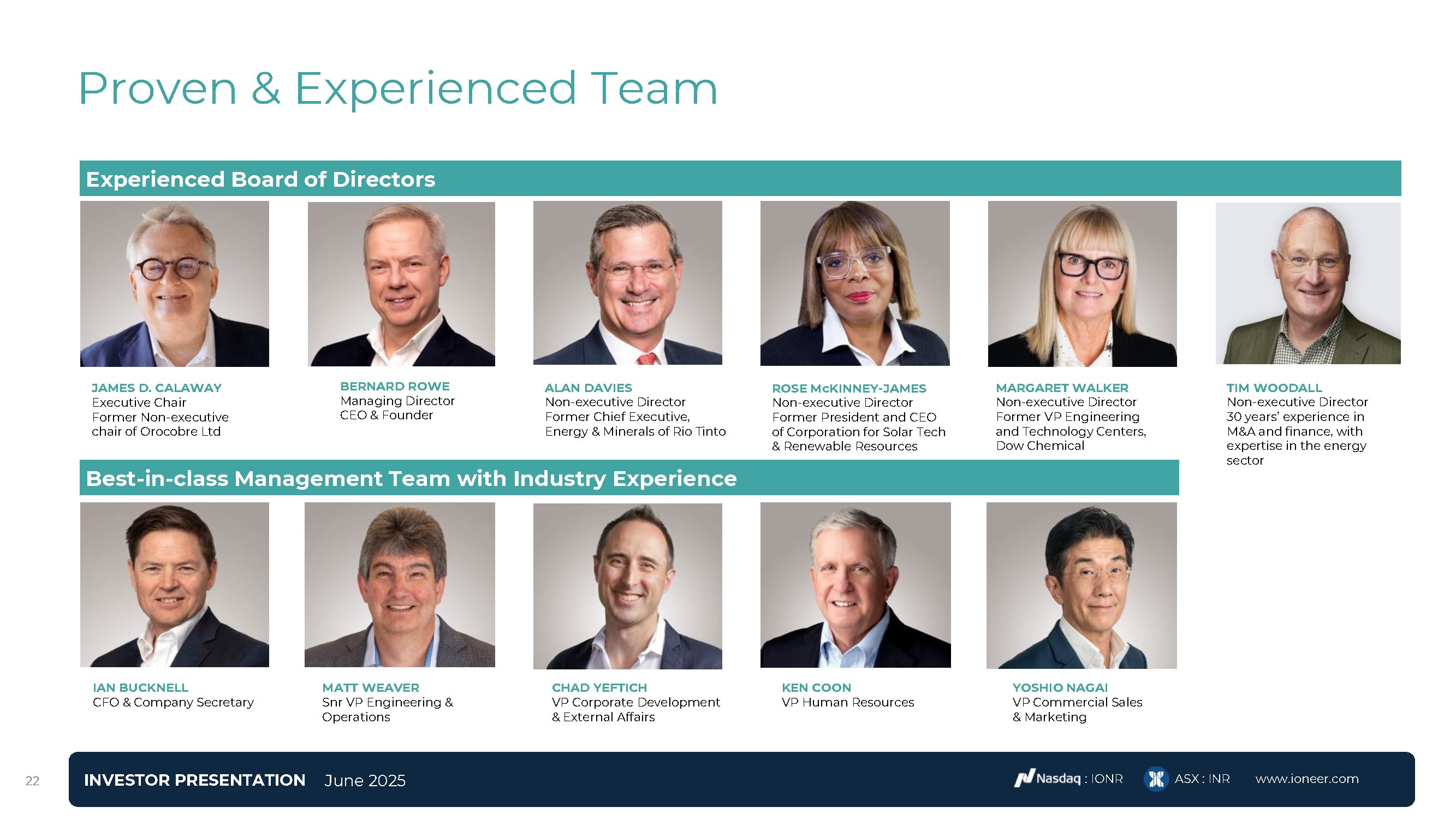

Proven & Experienced Team Experienced Board of Directors ALAN DAVIES Non-executive Director Former Chief Executive, Energy

& Minerals of Rio Tinto ROSE McKINNEY-JAMES Non-executive Director Former President and CEO of Corporation for Solar Tech & Renewable Resources JAMES D. CALAWAY Executive Chair Former Non-executive chair of Orocobre Ltd MARGARET

WALKER Non-executive Director Former VP Engineering and Technology Centers, Dow Chemical TIM WOODALL Non-executive Director 30 years’ experience in M&A and finance, with expertise in the energy sector BERNARD ROWE Managing Director CEO

& Founder Best-in-class Management Team with Industry Experience IAN BUCKNELL CFO & Company Secretary MATT WEAVER Snr VP Engineering & Operations CHAD YEFTICH VP Corporate Development & External Affairs KEN COON VP

Human Resources YOSHIO NAGAI VP Commercial Sales & Marketing INVESTOR PRESENTATION June 2025 : IONR ASX : INR www.ioneer.com 22

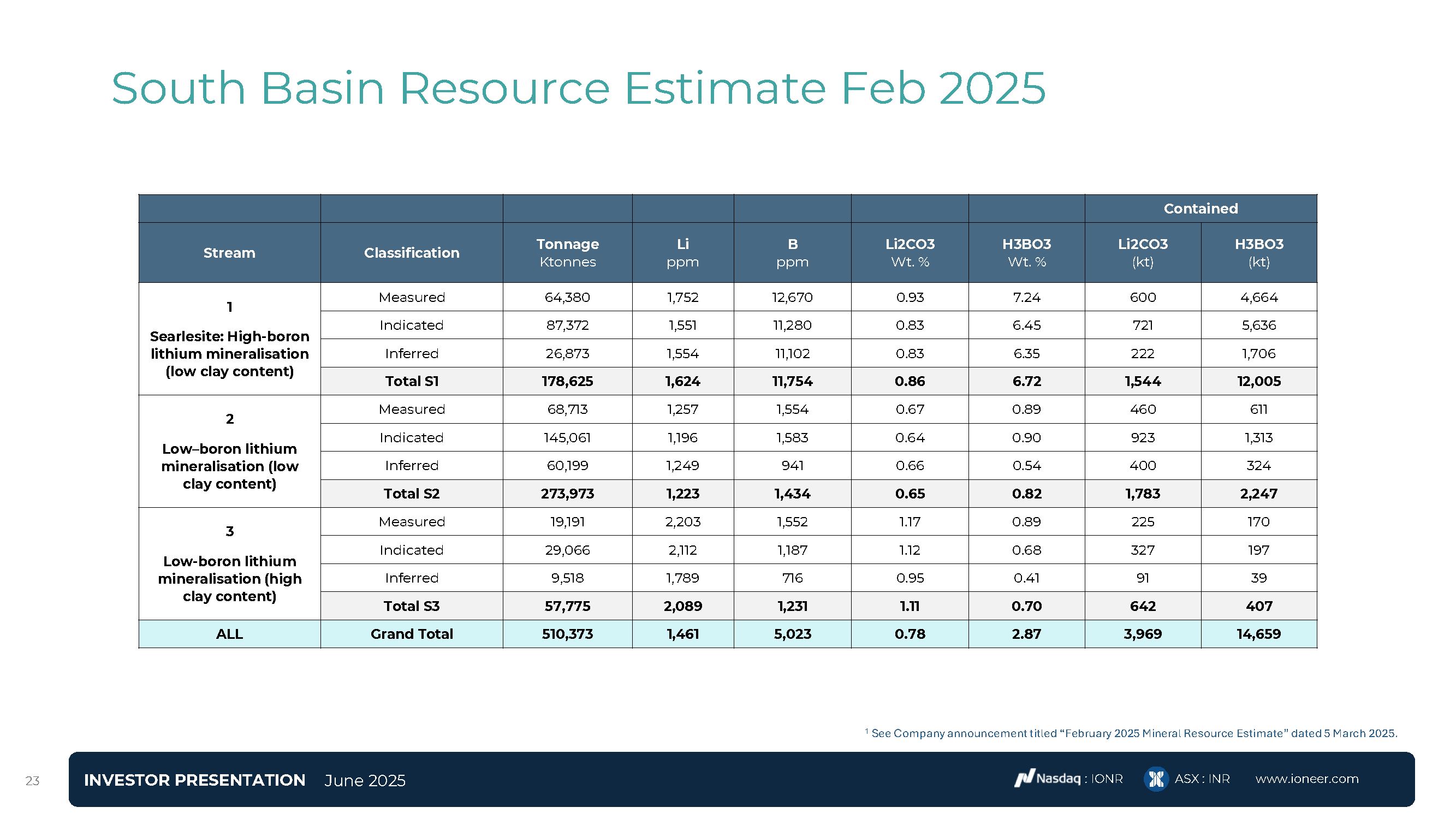

South Basin Resource Estimate Feb 2025 INVESTOR PRESENTATION June 2025 : IONR ASX :

INR www.ioneer.com 22 Contained Stream Classification Tonnage Ktonnes Li ppm B ppm Li2CO3 Wt. % H3BO3 Wt. % Li2CO3 (kt) H3BO3 (kt) 1 Searlesite: High-boron lithium mineralisation (low clay

content) Measured 64,380 1,752 12,670 0.93 7.24 600 4,664 Indicated 87,372 1,551 11,280 0.83 6.45 721 5,636 Inferred 26,873 1,554 11,102 0.83 6.35 222 1,706 Total

S1 178,625 1,624 11,754 0.86 6.72 1,544 12,005 2 Low–boron lithium mineralisation (low clay

content) Measured 68,713 1,257 1,554 0.67 0.89 460 611 Indicated 145,061 1,196 1,583 0.64 0.90 923 1,313 Inferred 60,199 1,249 941 0.66 0.54 400 324 Total

S2 273,973 1,223 1,434 0.65 0.82 1,783 2,247 3 Low-boron lithium mineralisation (high clay

content) Measured 19,191 2,203 1,552 1.17 0.89 225 170 Indicated 29,066 2,112 1,187 1.12 0.68 327 197 Inferred 9,518 1,789 716 0.95 0.41 91 39 Total S3 57,775 2,089 1,231 1.11 0.70 642 407 ALL Grand

Total 510,373 1,461 5,023 0.78 2.87 3,969 14,659 1 See Company announcement titled “February 2025 Mineral Resource Estimate” dated 5 March 2025.