Exhibit 99.1 Investor Presentation June 2025 For Investor Relations Purposes Only

I N V E S T O R P R E S E N T A T I O N | J U N E 2 0 2 5 Important Cautionary Statement Regarding Forward-looking Statements This presentation contains certain statements that are forward-looking. Forward-looking statements include, among other things, express and implied statements regarding expected future cash flows; the Company’s financial guidance including operating and profit margins for 2025 and its medium- and long-term growth outlook; expected future savings; expected future growth and expectations for sales levels for particular products; expected future product launches in particular markets; expected growth in LAI usage, the prescriber base, payor access, and the number of patients treated with our products; our product development pipeline and potential future products, the timing of clinical trials, expectations regarding regulatory approval of such product candidates, the timing of such approvals, and the timing of commercial launch of such products or product candidates, and eventual annual revenues of such future products; patent applications the potential future issuance of patents; and other statements containing the words believe, anticipate, plan, expect, intend, estimate, forecast, “strategy,” “target,” “guidance,” “outlook,” “potential,” project, priority, may, will, should, would, could, guidance, the negatives thereof, and variations thereon and similar expressions. By their nature, forward-looking statements involve risks and uncertainties as they relate to events or circumstances that may or may not occur in the future. c Actual results may differ materially from those expressed or implied in these forward-looking statements due to a number of factors, including: lower than expected future sales of our products; greater than expected impacts from competition; failure to achieve market acceptance of OPVEE; unanticipated costs including the effects of potential tariffs and potential retaliatory tariffs; whether we are able to identify efficiencies and fund additional investments that we expect to generate increased revenues, and the timing of such actions; and other unanticipated events. For additional information about some of the risks and important factors that could affect our future results and financial condition, see Risk Factors in Indivior's Annual Report on Form 10-K for the fiscal year 2024 filed March 3, 2025 and its other filings with the U.S. Securities and Exchange Commission. Forward-looking statements speak only as of the date that they are made and should be regarded solely as our current plans, estimates and beliefs. Except as required by law, we do not undertake and specifically decline any obligation to update or revise forward-looking statements to reflect future events or circumstances or to reflect the occurrences of unanticipated events. 1

I N V E S T O R P R E S E N T A T I O N | J U N E 2 0 2 5 Founded to Help Address the Opioid Crisis Leading with Science Financial Strength • Leading in discovery and commercialization of buprenorphine evidence-based • $1,188m total net revenue (NR) (FY2024) medicines for opioid dependence for over 30 years 4 • $320m Non-GAAP operating income (FY2024) • 10-year company history of bringing science-based, life-transforming treatments c • Ability to leverage revenue growth and create to tackle the opioid crisis, one of the largest and most urgent U.S. public health durable cash generation emergencies of our time • $400m in cash and investments (as of Q1 2025) • SUBLOCADE® is a first-in-class monthly subcutaneous long-acting injectable (LAI) medication for the treatment of moderate to severe opioid use disorder (OUD) 5 • ~1.0x adjusted leverage ratio (excluding legal settlements) SUBLOCADE Positioned to be a Durable Growth Driver U.S. Commercial Portfolio Recovery Rescue • No. 1 prescribed LAI in the U.S., with over 350k lives treated, supporting OUD recovery • Formulated to deliver sustained buprenorphine concentrations of >2ng/mL 1,2,3 throughout dosing intervals to block opioid-rewarding effects • The only once monthly LAI with rapid initiation on day 1 • Strong IP management with patents to 2031-2038 1 2 3 Laffont CM, et al. Front Pharmacol. 2022;13:105213. doi:10.3389/fphar.2022.105213. Nasser AF, et al. Clin Pharmacokinet. 2014;53(9):813-824. doi:10.1007/s40262-014-0155-0. Jones AK, et al. Clin Pharmacokinet. 4 5 2 2021;60(4):527- 540. doi:10.1007/s40262- 020- 00957- 0 See Non-GAAP Financial Measures in the Appendix for reconciliation; Defined as Total Debt at December 31, 2024 divided by FY 2024 Non-GAAP EBITDA; For a discussion of additional obligations, see Note 12 in form 10-K filed with the SEC on March 3, 2025; See Non-GAAP Financial Measures in the Appendix for reconciliation

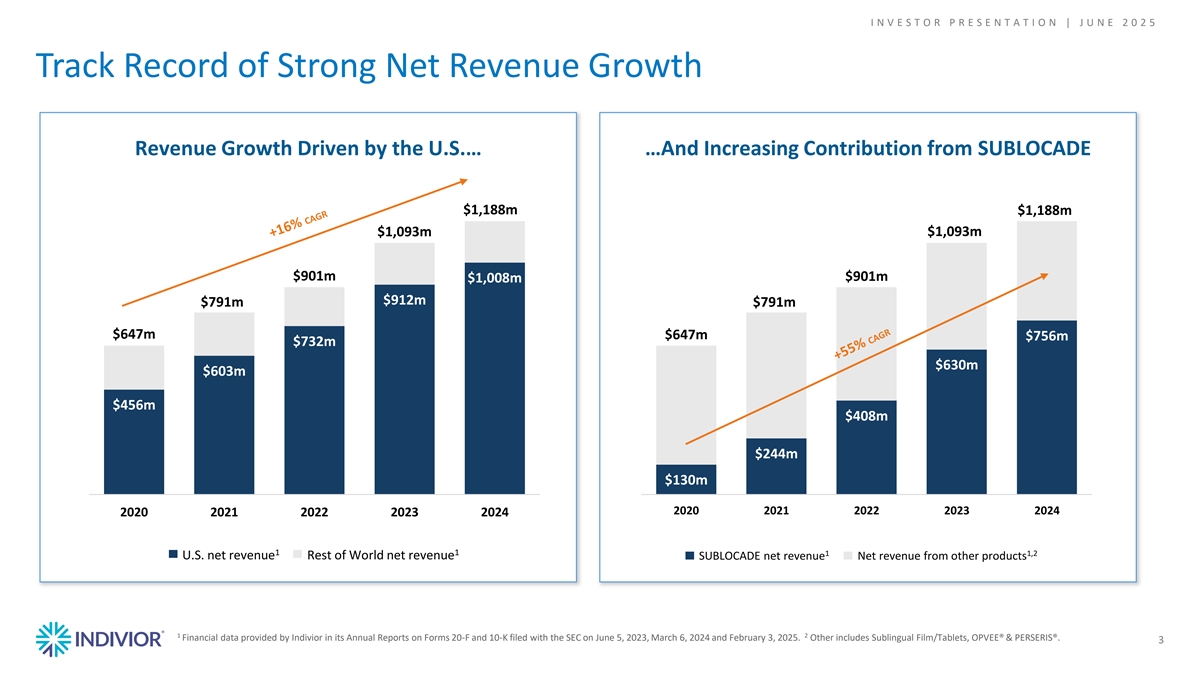

I N V E S T O R P R E S E N T A T I O N | J U N E 2 0 2 5 Track Record of Strong Net Revenue Growth Revenue Growth Driven by the U.S.… …And Increasing Contribution from SUBLOCADE $1,188m $1,188m $1,093m $1,093m $901m $901m $1,008m $912m $791m $791m $647m $647m $756m $732m $630m $603m $456m $408m $244m $130m 2020 2021 2022 2023 2024 2020 2021 2022 2023 2024 1 1 1 1,2 U.S. net revenue Rest of World net revenue SUBLOCADE net revenue Net revenue from other products 1 2 Financial data provided by Indivior in its Annual Reports on Forms 20-F and 10-K filed with the SEC on June 5, 2023, March 6, 2024 and February 3, 2025. Other includes Sublingual Film/Tablets, OPVEE® & PERSERIS®. 3

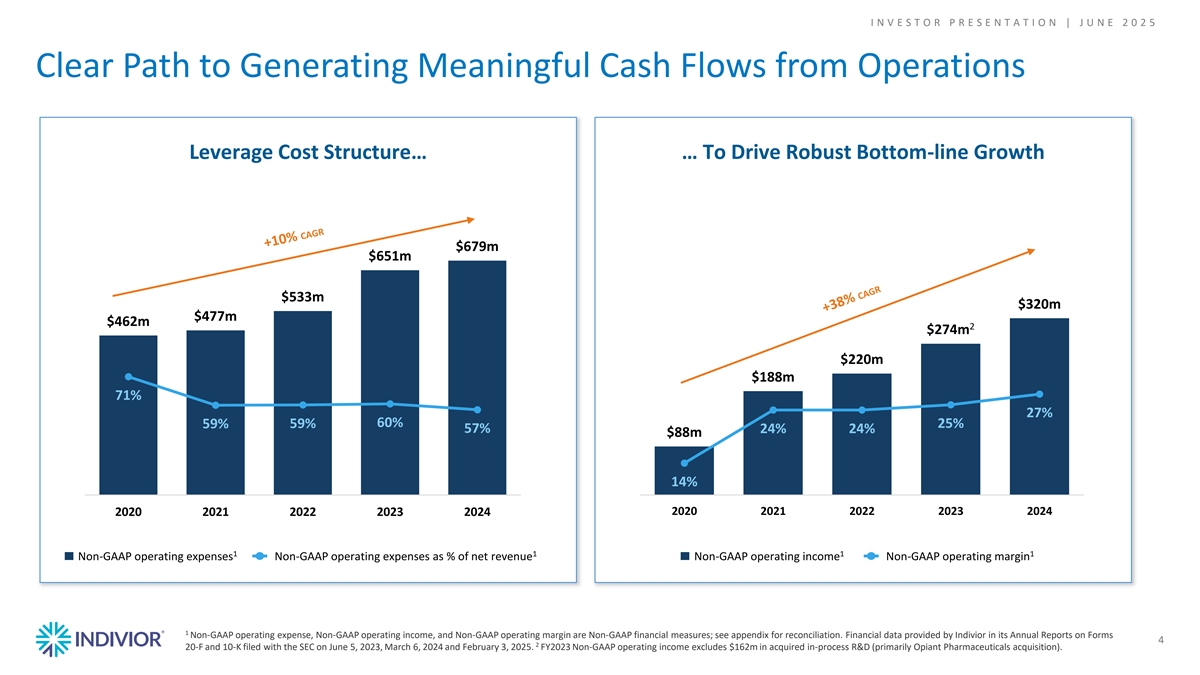

I N V E S T O R P R E S E N T A T I O N | J U N E 2 0 2 5 Clear Path to Generating Meaningful Cash Flows from Operations Leverage Cost Structure… … To Drive Robust Bottom-line Growth $679m $651m $533m $320m $477m $462m 2 $274m $220m $188m 71% 27% 60% 25% 59% 59% 57% 24% 24% $88m 14% 2020 2021 2022 2023 2024 2020 2021 2022 2023 2024 1 1 1 1 Non-GAAP operating expenses Non-GAAP operating expenses as % of net revenue Non-GAAP operating income Non-GAAP operating margin 1 Non-GAAP operating expense, Non-GAAP operating income, and Non-GAAP operating margin are Non-GAAP financial measures; see appendix for reconciliation. Financial data provided by Indivior in its Annual Reports on Forms 4 2 20-F and 10-K filed with the SEC on June 5, 2023, March 6, 2024 and February 3, 2025. FY2023 Non-GAAP operating income excludes $162m in acquired in-process R&D (primarily Opiant Pharmaceuticals acquisition).

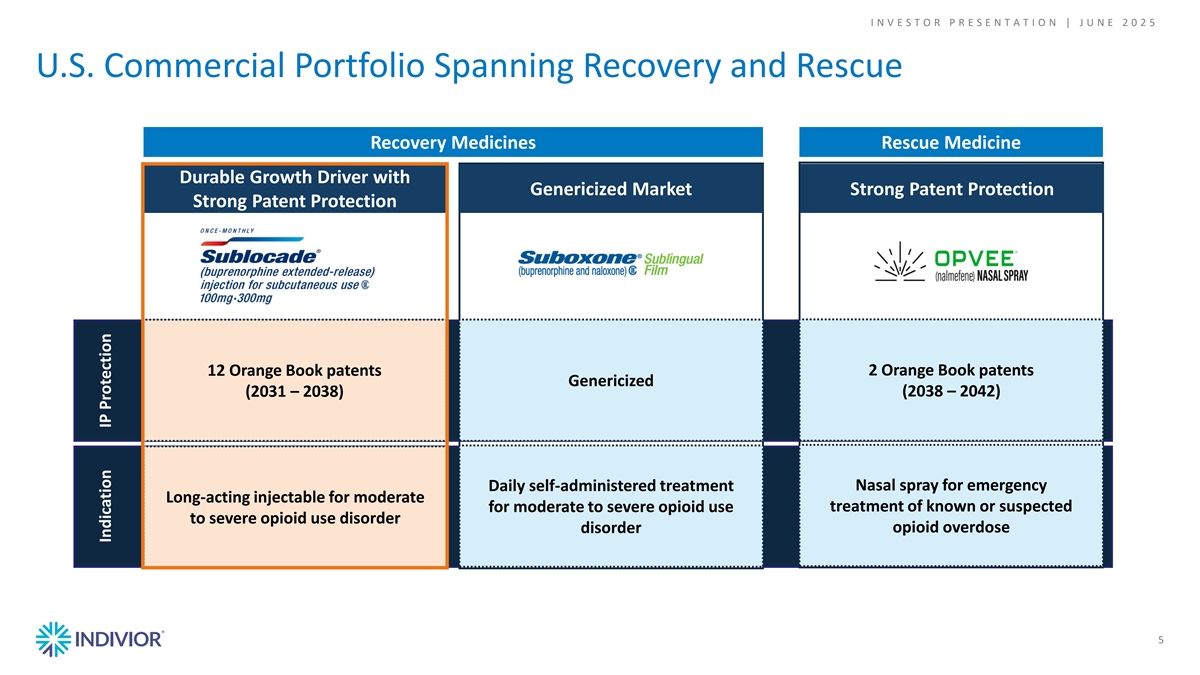

I N V E S T O R P R E S E N T A T I O N | J U N E 2 0 2 5 U.S. Commercial Portfolio Spanning Recovery and Rescue Recovery Medicines Rescue Medicine Durable Growth Driver with Genericized Market Strong Patent Protection Strong Patent Protection 12 Orange Book patents 2 Orange Book patents Genericized (2038 – 2042) (2031 – 2038) Daily self-administered treatment Nasal spray for emergency Long-acting injectable for moderate treatment of known or suspected for moderate to severe opioid use to severe opioid use disorder opioid overdose disorder 5 Indication IP Protection

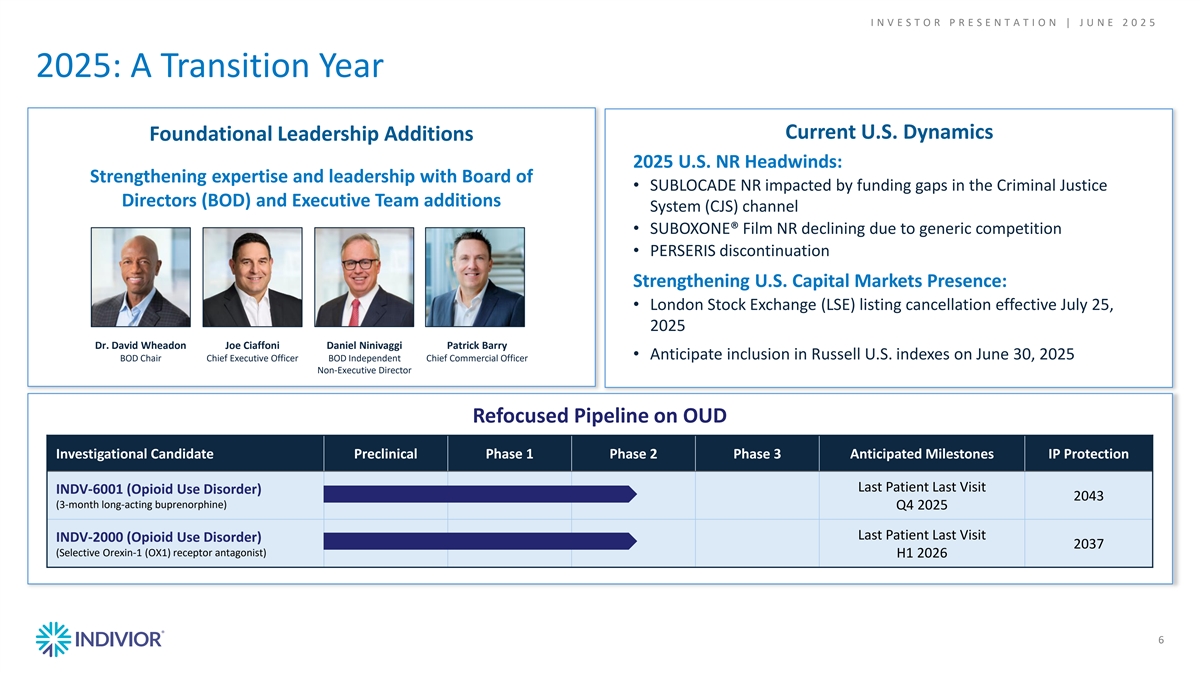

I N V E S T O R P R E S E N T A T I O N | J U N E 2 0 2 5 2025: A Transition Year Current U.S. Dynamics Foundational Leadership Additions 2025 U.S. NR Headwinds: Strengthening expertise and leadership with Board of • SUBLOCADE NR impacted by funding gaps in the Criminal Justice Directors (BOD) and Executive Team additions System (CJS) channel • SUBOXONE® Film NR declining due to generic competition • PERSERIS discontinuation Strengthening U.S. Capital Markets Presence: • London Stock Exchange (LSE) listing cancellation effective July 25, 2025 Dr. David Wheadon Joe Ciaffoni Daniel Ninivaggi Patrick Barry • Anticipate inclusion in Russell U.S. indexes on June 30, 2025 BOD Chair Chief Executive Officer BOD Independent Chief Commercial Officer Non-Executive Director Refocused Pipeline on OUD Investigational Candidate Preclinical Phase 1 Phase 2 Phase 3 Anticipated Milestones IP Protection Last Patient Last Visit INDV-6001 (Opioid Use Disorder) 2043 (3-month long-acting buprenorphine) Q4 2025 Last Patient Last Visit INDV-2000 (Opioid Use Disorder) 2037 (Selective Orexin-1 (OX1) receptor antagonist) H1 2026 6

I N V E S T O R P R E S E N T A T I O N | J U N E 2 0 2 5 Transition Year Focus Deliver 2025 Operating Plan Grow SUBLOCADE Advance the OUD Pipeline Strengthen the Balance Sheet 7

® SUBLOCADE

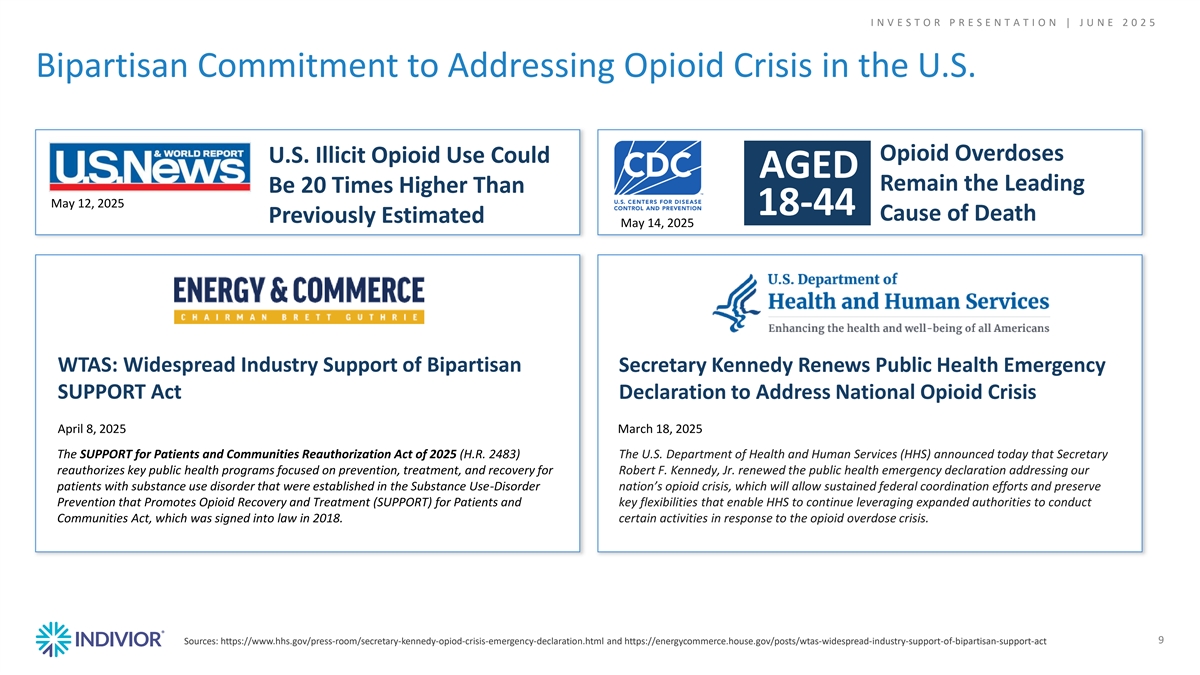

I N V E S T O R P R E S E N T A T I O N | J U N E 2 0 2 5 Bipartisan Commitment to Addressing Opioid Crisis in the U.S. Opioid Overdoses U.S. Illicit Opioid Use Could AGED c c Remain the Leading Be 20 Times Higher Than May 12, 2025 18-44 Cause of Death Previously Estimated May 14, 2025 WTAS: Widespread Industry Support of Bipartisan Secretary Kennedy Renews Public Health Emergency SUPPORT Act Declaration to Address National Opioid Crisis c c April 8, 2025 March 18, 2025 The SUPPORT for Patients and Communities Reauthorization Act of 2025 (H.R. 2483) The U.S. Department of Health and Human Services (HHS) announced today that Secretary reauthorizes key public health programs focused on prevention, treatment, and recovery for Robert F. Kennedy, Jr. renewed the public health emergency declaration addressing our patients with substance use disorder that were established in the Substance Use-Disorder nation’s opioid crisis, which will allow sustained federal coordination efforts and preserve Prevention that Promotes Opioid Recovery and Treatment (SUPPORT) for Patients and key flexibilities that enable HHS to continue leveraging expanded authorities to conduct Communities Act, which was signed into law in 2018. certain activities in response to the opioid overdose crisis. 9 Sources: https://www.hhs.gov/press-room/secretary-kennedy-opiod-crisis-emergency-declaration.html and https://energycommerce.house.gov/posts/wtas-widespread-industry-support-of-bipartisan-support-act

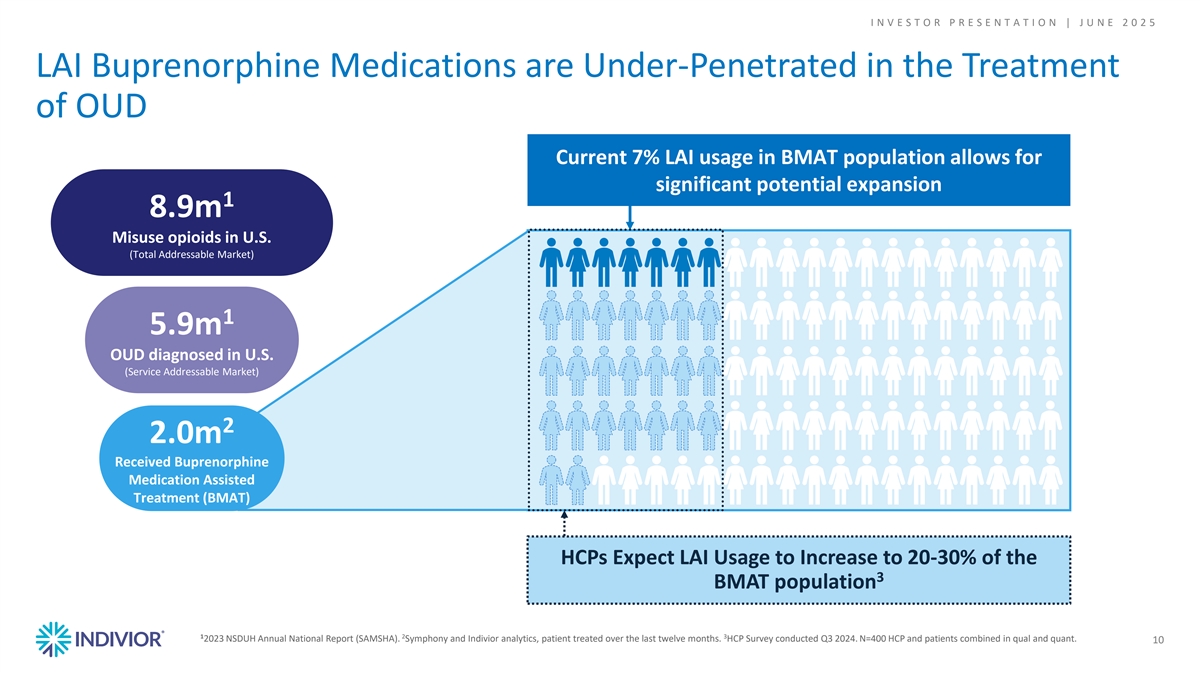

I N V E S T O R P R E S E N T A T I O N | J U N E 2 0 2 5 LAI Buprenorphine Medications are Under-Penetrated in the Treatment of OUD Current 7% LAI usage in BMAT population allows for significant potential expansion 1 8.9m Misuse opioids in U.S. (Total Addressable Market) 1 5.9m OUD diagnosed in U.S. (Service Addressable Market) 2 2.0m Received Buprenorphine Medication Assisted Treatment (BMAT) HCPs Expect LAI Usage to Increase to 20-30% of the 3 BMAT population 1 2 3 2023 NSDUH Annual National Report (SAMSHA). Symphony and Indivior analytics, patient treated over the last twelve months. HCP Survey conducted Q3 2024. N=400 HCP and patients combined in qual and quant. 10

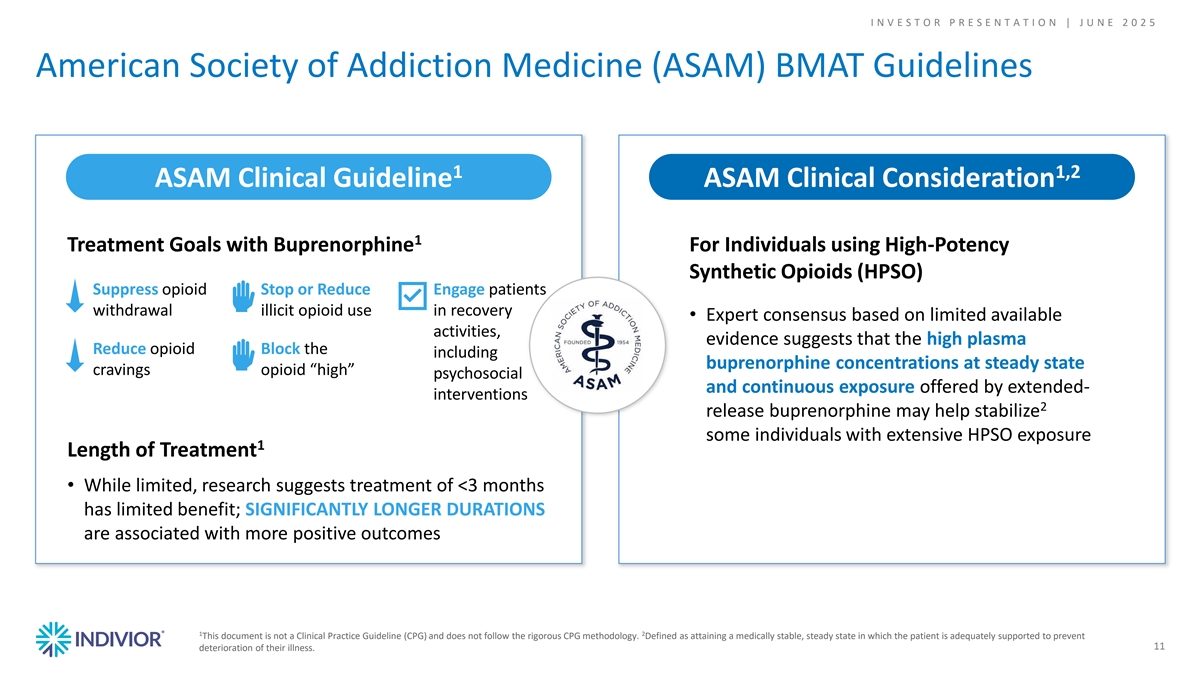

I N V E S T O R P R E S E N T A T I O N | J U N E 2 0 2 5 American Society of Addiction Medicine (ASAM) BMAT Guidelines 1 1,2 ASAM Clinical Guideline ASAM Clinical Consideration 1 Treatment Goals with Buprenorphine For Individuals using High-Potency Synthetic Opioids (HPSO) Suppress opioid Stop or Reduce Engage patients withdrawal illicit opioid use in recovery • Expert consensus based on limited available activities, evidence suggests that the high plasma Reduce opioid Block the including buprenorphine concentrations at steady state cravings opioid “high” psychosocial and continuous exposure offered by extended- interventions 2 release buprenorphine may help stabilize some individuals with extensive HPSO exposure 1 Length of Treatment • While limited, research suggests treatment of <3 months has limited benefit; SIGNIFICANTLY LONGER DURATIONS are associated with more positive outcomes 1 2 This document is not a Clinical Practice Guideline (CPG) and does not follow the rigorous CPG methodology. Defined as attaining a medically stable, steady state in which the patient is adequately supported to prevent 11 deterioration of their illness.

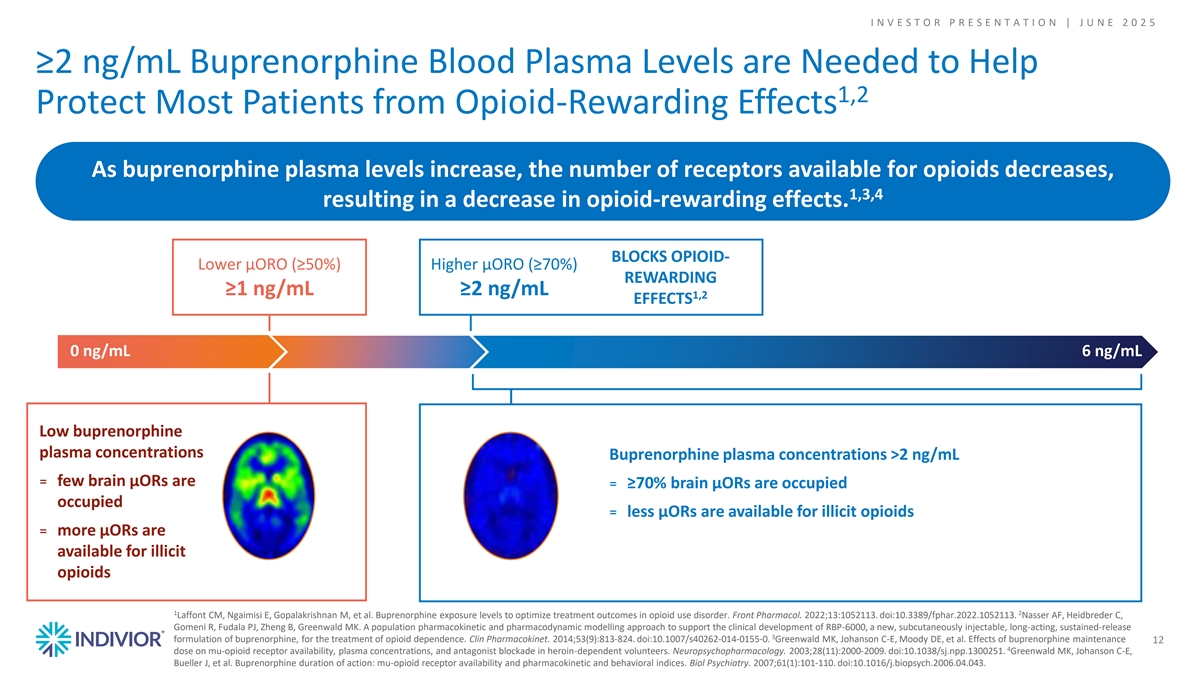

I N V E S T O R P R E S E N T A T I O N | J U N E 2 0 2 5 ≥2 ng/mL Buprenorphine Blood Plasma Levels are Needed to Help 1,2 Protect Most Patients from Opioid-Rewarding Effects As buprenorphine plasma levels increase, the number of receptors available for opioids decreases, 1,3,4 resulting in a decrease in opioid-rewarding effects. BLOCKS OPIOID- Lower μORO (≥50%) Higher μORO (≥70%) REWARDING ≥1 ng/mL ≥2 ng/mL 1,2 EFFECTS 0 ng/mL 6 ng/mL Low buprenorphine plasma concentrations Buprenorphine plasma concentrations >2 ng/mL ꓿ few brain μORs are ꓿ ≥70% brain μORs are occupied occupied ꓿ less μORs are available for illicit opioids ꓿ more μORs are available for illicit opioids 1 2 Laffont CM, Ngaimisi E, Gopalakrishnan M, et al. Buprenorphine exposure levels to optimize treatment outcomes in opioid use disorder. Front Pharmacol. 2022;13:1052113. doi:10.3389/fphar.2022.1052113. Nasser AF, Heidbreder C, Gomeni R, Fudala PJ, Zheng B, Greenwald MK. A population pharmacokinetic and pharmacodynamic modelling approach to support the clinical development of RBP-6000, a new, subcutaneously injectable, long-acting, sustained-release 3 formulation of buprenorphine, for the treatment of opioid dependence. Clin Pharmacokinet. 2014;53(9):813-824. doi:10.1007/s40262-014-0155-0. Greenwald MK, Johanson C-E, Moody DE, et al. Effects of buprenorphine maintenance 12 4 dose on mu-opioid receptor availability, plasma concentrations, and antagonist blockade in heroin-dependent volunteers. Neuropsychopharmacology. 2003;28(11):2000-2009. doi:10.1038/sj.npp.1300251. Greenwald MK, Johanson C-E, Bueller J, et al. Buprenorphine duration of action: mu-opioid receptor availability and pharmacokinetic and behavioral indices. Biol Psychiatry. 2007;61(1):101-110. doi:10.1016/j.biopsych.2006.04.043.

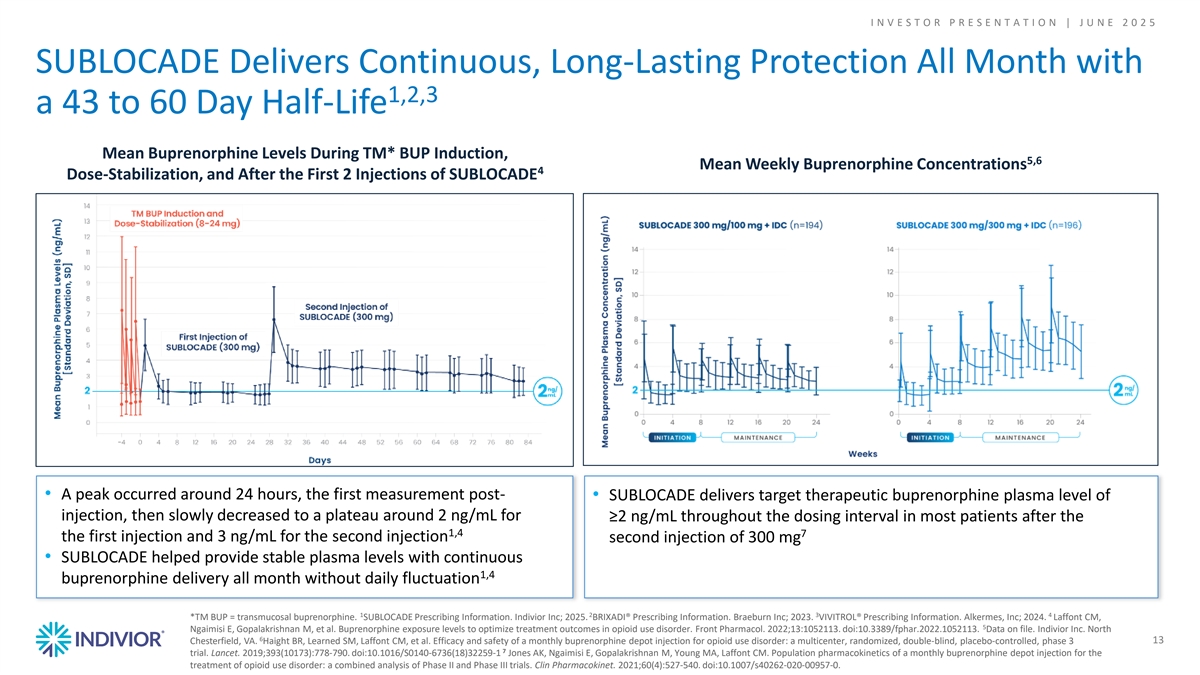

I N V E S T O R P R E S E N T A T I O N | J U N E 2 0 2 5 SUBLOCADE Delivers Continuous, Long-Lasting Protection All Month with 1,2,3 a 43 to 60 Day Half-Life Mean Buprenorphine Levels During TM* BUP Induction, 5,6 Mean Weekly Buprenorphine Concentrations 4 Dose-Stabilization, and After the First 2 Injections of SUBLOCADE • A peak occurred around 24 hours, the first measurement post- • SUBLOCADE delivers target therapeutic buprenorphine plasma level of injection, then slowly decreased to a plateau around 2 ng/mL for ≥2 ng/mL throughout the dosing interval in most patients after the 1,4 7 the first injection and 3 ng/mL for the second injection second injection of 300 mg • SUBLOCADE helped provide stable plasma levels with continuous 1,4 buprenorphine delivery all month without daily fluctuation 1 2 3 4 *TM BUP = transmucosal buprenorphine. SUBLOCADE Prescribing Information. Indivior Inc; 2025. BRIXADI® Prescribing Information. Braeburn Inc; 2023. VIVITROL® Prescribing Information. Alkermes, Inc; 2024. Laffont CM, 5 Ngaimisi E, Gopalakrishnan M, et al. Buprenorphine exposure levels to optimize treatment outcomes in opioid use disorder. Front Pharmacol. 2022;13:1052113. doi:10.3389/fphar.2022.1052113. Data on file. Indivior Inc. North 6 Chesterfield, VA. Haight BR, Learned SM, Laffont CM, et al. Efficacy and safety of a monthly buprenorphine depot injection for opioid use disorder: a multicenter, randomized, double-blind, placebo-controlled, phase 3 13 7 trial. Lancet. 2019;393(10173):778-790. doi:10.1016/S0140-6736(18)32259-1 Jones AK, Ngaimisi E, Gopalakrishnan M, Young MA, Laffont CM. Population pharmacokinetics of a monthly buprenorphine depot injection for the treatment of opioid use disorder: a combined analysis of Phase II and Phase III trials. Clin Pharmacokinet. 2021;60(4):527-540. doi:10.1007/s40262-020-00957-0.

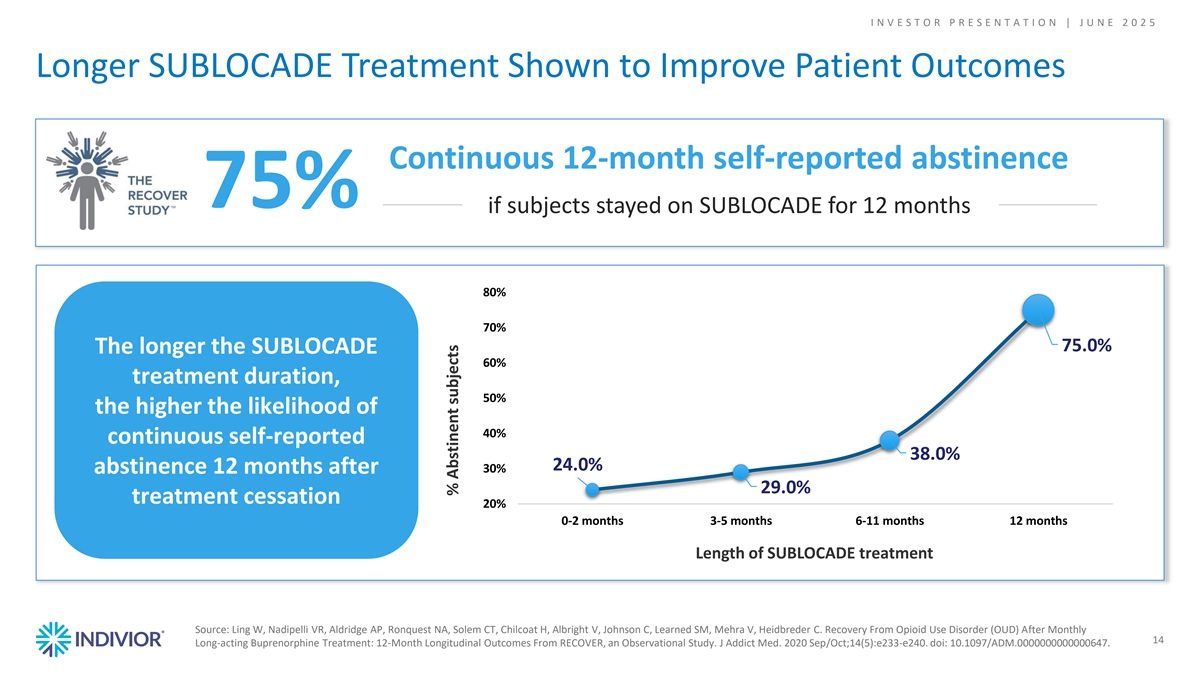

I N V E S T O R P R E S E N T A T I O N | J U N E 2 0 2 5 Longer SUBLOCADE Treatment Shown to Improve Patient Outcomes Continuous 12-month self-reported abstinence 75% if subjects stayed on SUBLOCADE for 12 months 80% 70% 75.0% The longer the SUBLOCADE 60% treatment duration, 50% the higher the likelihood of 40% continuous self-reported 38.0% 24.0% 30% abstinence 12 months after 29.0% treatment cessation 20% 0-2 months 3-5 months 6-11 months 12 months Length of SUBLOCADE treatment Source: Ling W, Nadipelli VR, Aldridge AP, Ronquest NA, Solem CT, Chilcoat H, Albright V, Johnson C, Learned SM, Mehra V, Heidbreder C. Recovery From Opioid Use Disorder (OUD) After Monthly 14 Long-acting Buprenorphine Treatment: 12-Month Longitudinal Outcomes From RECOVER, an Observational Study. J Addict Med. 2020 Sep/Oct;14(5):e233-e240. doi: 10.1097/ADM.0000000000000647. % Abstinent subjects

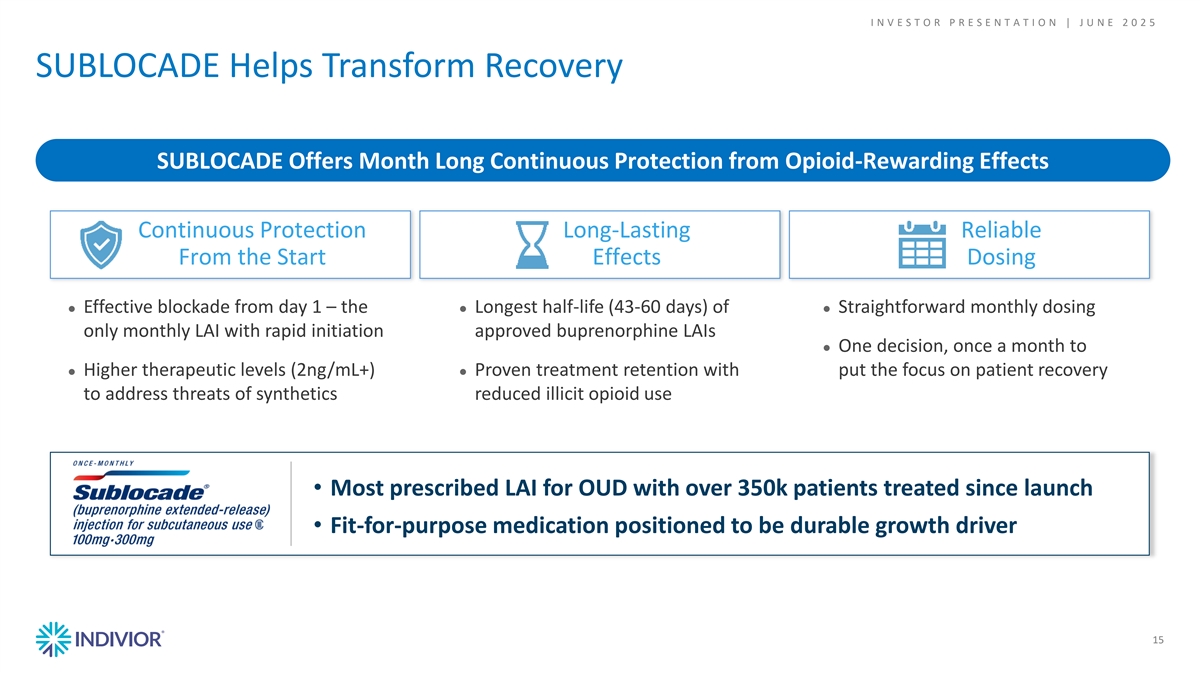

I N V E S T O R P R E S E N T A T I O N | J U N E 2 0 2 5 SUBLOCADE Helps Transform Recovery SUBLOCADE Offers Month Long Continuous Protection from Opioid-Rewarding Effects Continuous Protection Long-Lasting Reliable From the Start Effects Dosing ● Effective blockade from day 1 – the ● Longest half-life (43-60 days) of ● Straightforward monthly dosing only monthly LAI with rapid initiation approved buprenorphine LAIs ● One decision, once a month to ● Higher therapeutic levels (2ng/mL+) ● Proven treatment retention with put the focus on patient recovery to address threats of synthetics reduced illicit opioid use • Most prescribed LAI for OUD with over 350k patients treated since launch • Fit-for-purpose medication positioned to be durable growth driver 15

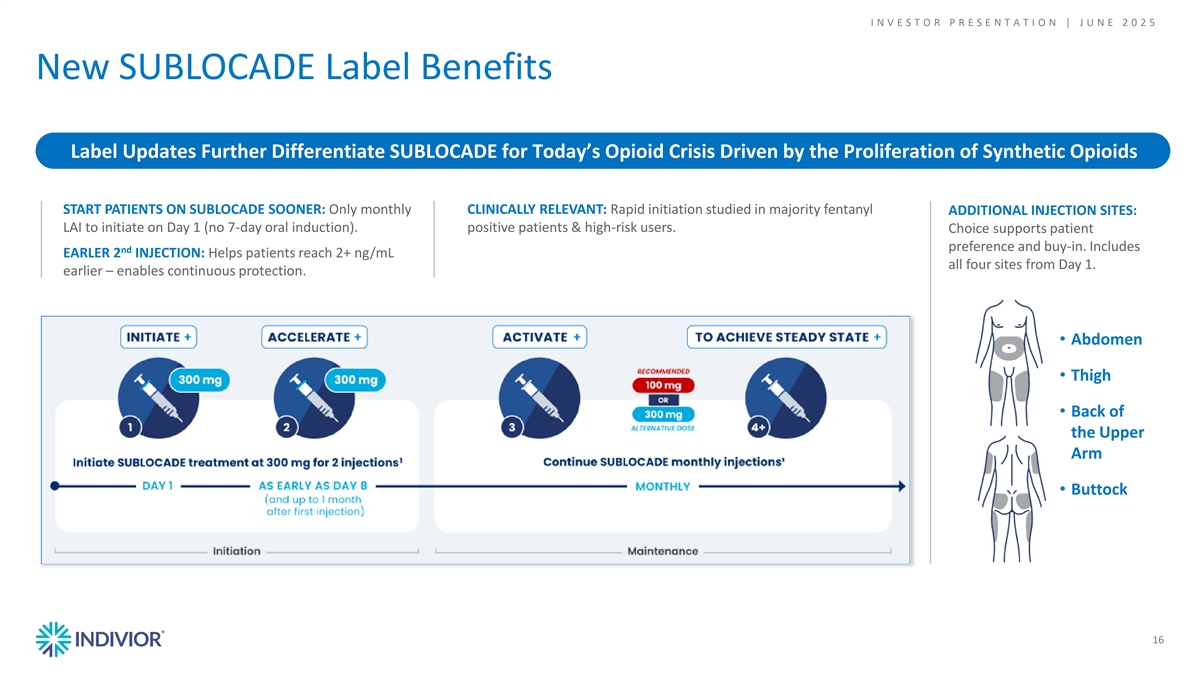

I N V E S T O R P R E S E N T A T I O N | J U N E 2 0 2 5 New SUBLOCADE Label Benefits Label Updates Further Differentiate SUBLOCADE for Today’s Opioid Crisis Driven by the Proliferation of Synthetic Opioids START PATIENTS ON SUBLOCADE SOONER: Only monthly CLINICALLY RELEVANT: Rapid initiation studied in majority fentanyl ADDITIONAL INJECTION SITES: LAI to initiate on Day 1 (no 7-day oral induction). positive patients & high-risk users. Choice supports patient preference and buy-in. Includes nd EARLER 2 INJECTION: Helps patients reach 2+ ng/mL all four sites from Day 1. earlier – enables continuous protection. • Abdomen 16 • Thigh • Back of the Upper Arm • Buttock 16

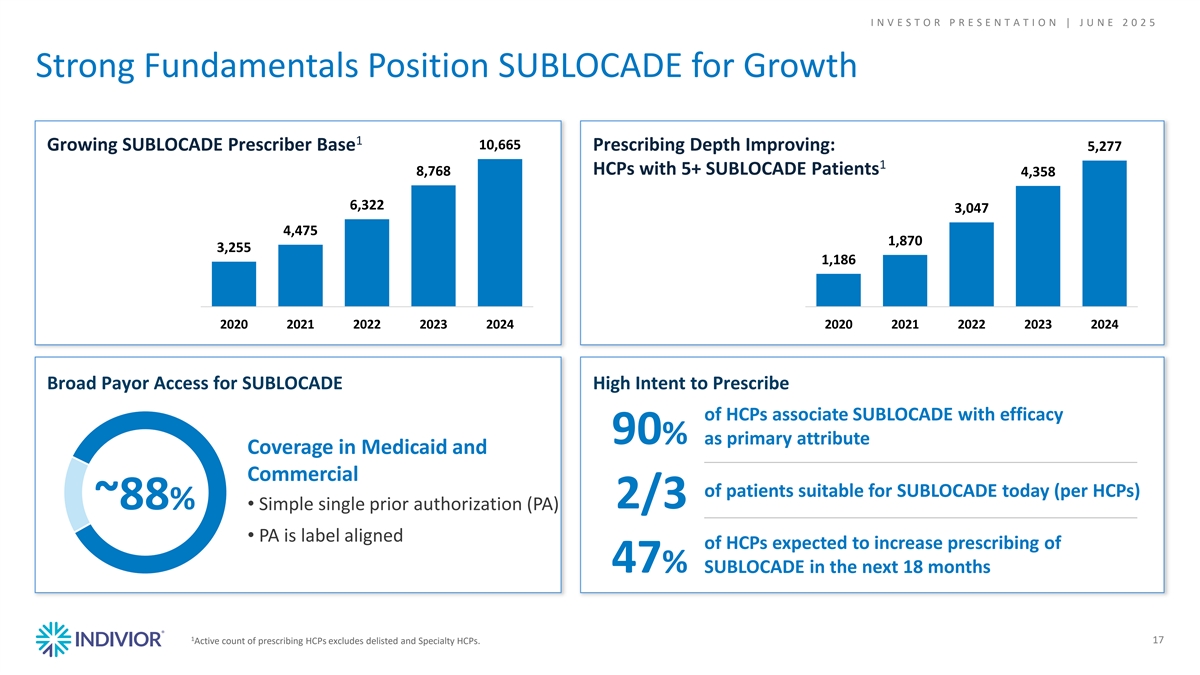

I N V E S T O R P R E S E N T A T I O N | J U N E 2 0 2 5 Strong Fundamentals Position SUBLOCADE for Growth 1 10,665 Growing SUBLOCADE Prescriber Base Prescribing Depth Improving: 5,277 1 HCPs with 5+ SUBLOCADE Patients 8,768 4,358 6,322 3,047 4,475 1,870 3,255 1,186 2020 2021 2022 2023 2024 2020 2021 2022 2023 2024 Broad Payor Access for SUBLOCADE High Intent to Prescribe of HCPs associate SUBLOCADE with efficacy 90% as primary attribute Coverage in Medicaid and Commercial of patients suitable for SUBLOCADE today (per HCPs) 2/3 ~88%• Simple single prior authorization (PA) • PA is label aligned of HCPs expected to increase prescribing of 47% SUBLOCADE in the next 18 months 1 Active count of prescribing HCPs excludes delisted and Specialty HCPs. 17

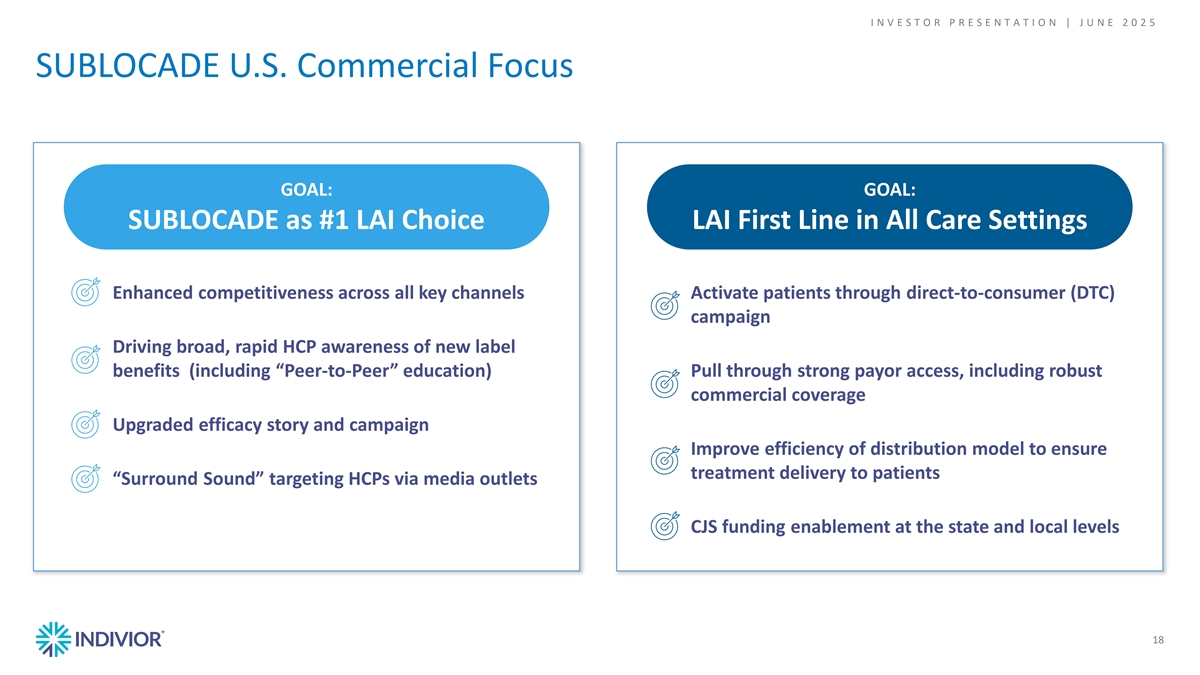

I N V E S T O R P R E S E N T A T I O N | J U N E 2 0 2 5 SUBLOCADE U.S. Commercial Focus GOAL: GOAL: SUBLOCADE as #1 LAI Choice LAI First Line in All Care Settings Enhanced competitiveness across all key channels Activate patients through direct-to-consumer (DTC) campaign Driving broad, rapid HCP awareness of new label benefits (including “Peer-to-Peer” education) Pull through strong payor access, including robust commercial coverage Upgraded efficacy story and campaign Improve efficiency of distribution model to ensure treatment delivery to patients “Surround Sound” targeting HCPs via media outlets CJS funding enablement at the state and local levels 18

® OPVEE

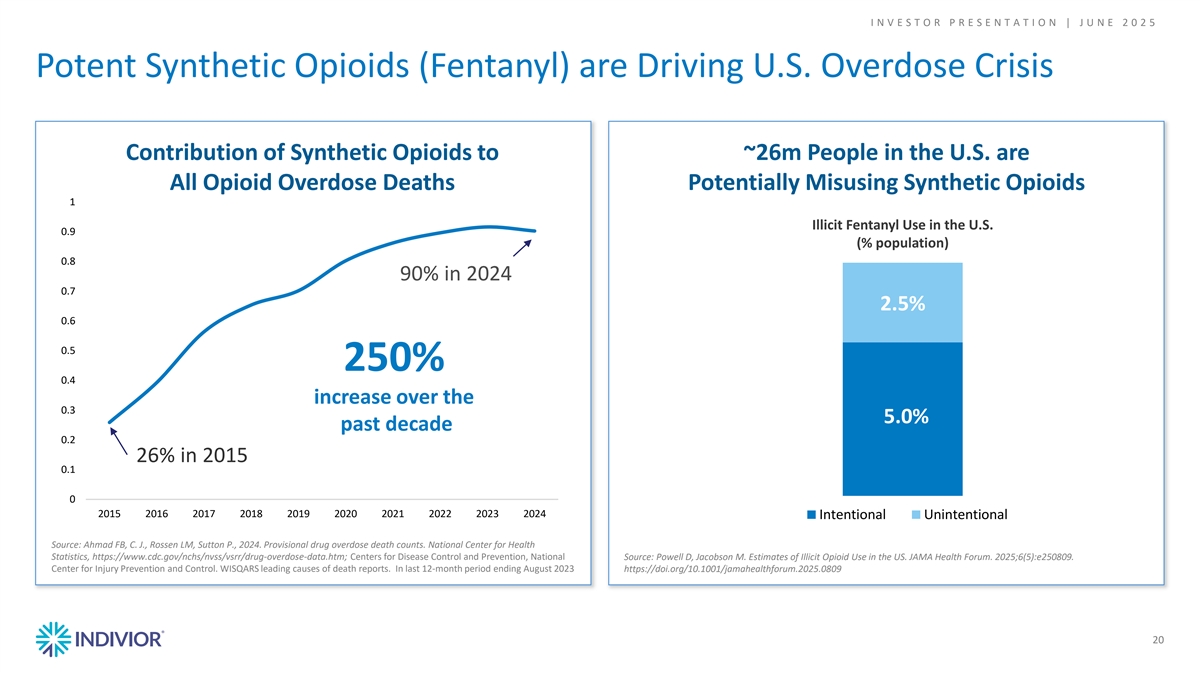

I N V E S T O R P R E S E N T A T I O N | J U N E 2 0 2 5 Potent Synthetic Opioids (Fentanyl) are Driving U.S. Overdose Crisis Contribution of Synthetic Opioids to ~26m People in the U.S. are All Opioid Overdose Deaths Potentially Misusing Synthetic Opioids 1 Illicit Fentanyl Use in the U.S. 0.9 (% population) 0.8 90% in 2024 0.7 2.5% 0.6 0.5 250% 0.4 increase over the 0.3 5.0% past decade 0.2 26% in 2015 0.1 0 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 Intentional Unintentional Source: Ahmad FB, C. J., Rossen LM, Sutton P., 2024. Provisional drug overdose death counts. National Center for Health Statistics, https://www.cdc.gov/nchs/nvss/vsrr/drug-overdose-data.htm; Centers for Disease Control and Prevention, National Source: Powell D, Jacobson M. Estimates of Illicit Opioid Use in the US. JAMA Health Forum. 2025;6(5):e250809. Center for Injury Prevention and Control. WISQARS leading causes of death reports. In last 12-month period ending August 2023 https://doi.org/10.1001/jamahealthforum.2025.0809 20

I N V E S T O R P R E S E N T A T I O N | J U N E 2 0 2 5 OPVEE Provides Rapid, Potent, Long-Lasting Reduction of Respiratory 1 Depression to Address the Current Wave of Synthetic Opioid Overdoses Triple Threat of Synthetic Opioid Rapid Potent Long-Lasting Pharmacology such as Fentanyl 2 BARDA Contract • The first and only nasal rescue medicine specifically indicated for • OPVEE development supported through synthetic opioids, like fentanyl, as well as non-synthetic opioids 3 federal grants from BARDA and NIDA 4 • 10-year BARDA contract of up to $110M • Developed for rapid absorption by incorporating Intravail® into its formulation and using a proven nasal spray device OPVEE Patent Estate • Regulatory Exclusivity to May 2026 • Differentiated by a higher affinity at μ opioid receptors • Two Orange Book Patents ✓ 11,458,091 (July 2038) • Data indicates fast, strong and long-lasting reduction of ✓ 12,290,596 (August 2042) • Two patents pending respiratory depression in a stimulated opioid overdose 1 2 The Journal of Clinical Pharmacology Authors: Mark Ellison PhD, Emily Hutton, MSci, Lynn Webster, MD, and Phil Skolnick PhD, DSc (hon.). BARDA: Biomedical Advanced Research and 21 3 4 Development Authority. NIDA: National Institute on Drug Abuse. Amount includes potential future sales to BARDA and expense reimbursement to conduct clinical studies and real-world evidence studies.

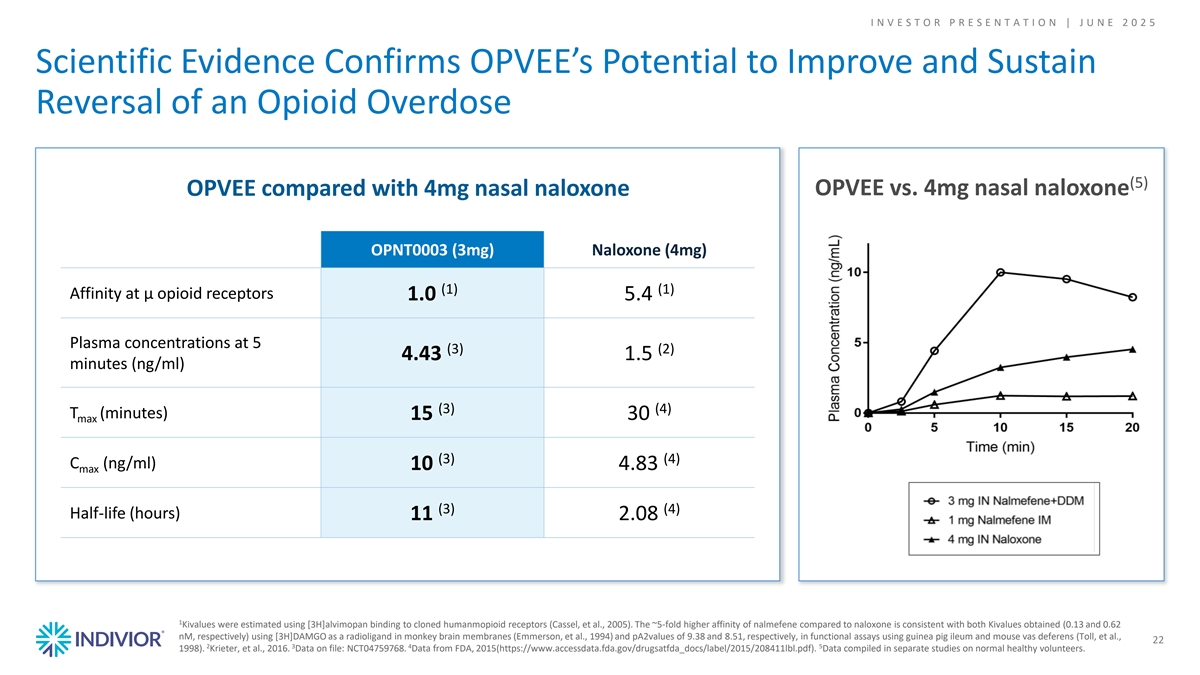

I N V E S T O R P R E S E N T A T I O N | J U N E 2 0 2 5 Scientific Evidence Confirms OPVEE’s Potential to Improve and Sustain Reversal of an Opioid Overdose (5) OPVEE vs. 4mg nasal naloxone OPVEE compared with 4mg nasal naloxone OPNT0003 (3mg) Naloxone (4mg) (1) (1) Affinity at μ opioid receptors 1.0 5.4 Plasma concentrations at 5 (3) (2) 4.43 1.5 minutes (ng/ml) (3) (4) T (minutes) 15 30 max (3) (4) C (ng/ml) 10 4.83 max (3) (4) Half-life (hours) 11 2.08 1 Kivalues were estimated using [3H]alvimopan binding to cloned humanmopioid receptors (Cassel, et al., 2005). The ~5-fold higher affinity of nalmefene compared to naloxone is consistent with both Kivalues obtained (0.13 and 0.62 nM, respectively) using [3H]DAMGO as a radioligand in monkey brain membranes (Emmerson, et al., 1994) and pA2values of 9.38 and 8.51, respectively, in functional assays using guinea pig ileum and mouse vas deferens (Toll, et al., 22 2 3 4 5 1998). Krieter, et al., 2016. Data on file: NCT04759768. Data from FDA, 2015(https://www.accessdata.fda.gov/drugsatfda_docs/label/2015/208411lbl.pdf). Data compiled in separate studies on normal healthy volunteers.

Pipeline

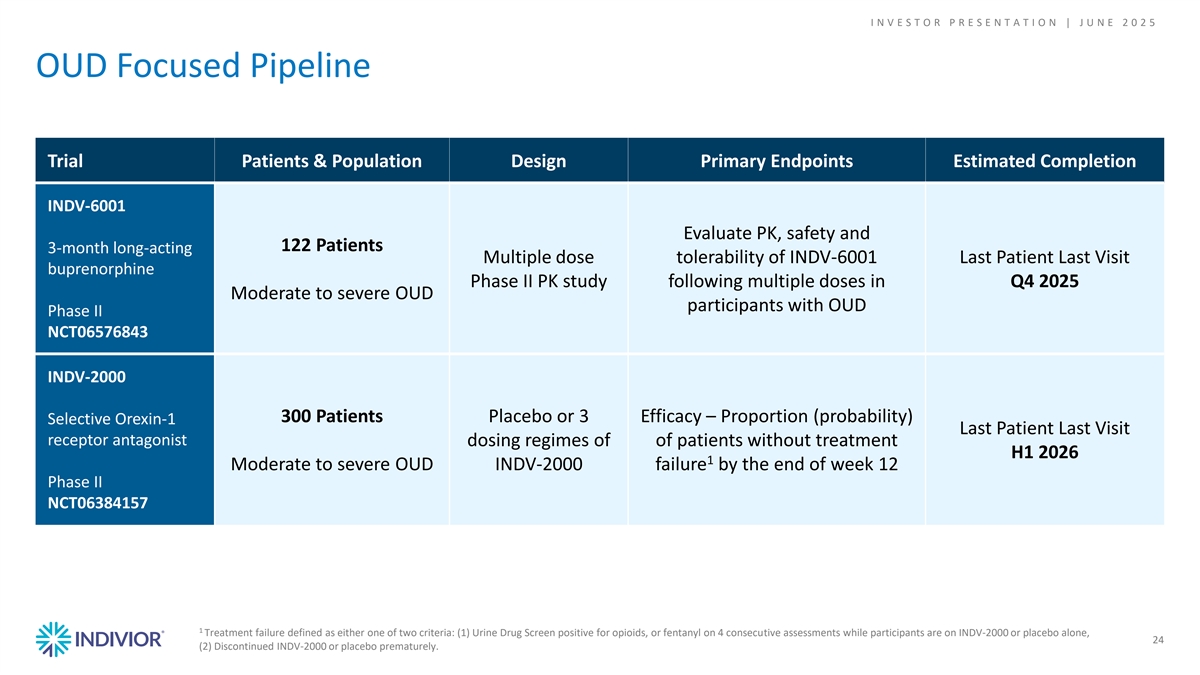

I N V E S T O R P R E S E N T A T I O N | J U N E 2 0 2 5 OUD Focused Pipeline Trial Patients & Population Design Primary Endpoints Estimated Completion INDV-6001 Evaluate PK, safety and 122 Patients 3-month long-acting Multiple dose tolerability of INDV-6001 Last Patient Last Visit buprenorphine Phase II PK study following multiple doses in Q4 2025 Moderate to severe OUD participants with OUD Phase II NCT06576843 INDV-2000 300 Patients Placebo or 3 Efficacy – Proportion (probability) Selective Orexin-1 Last Patient Last Visit receptor antagonist dosing regimes of of patients without treatment H1 2026 1 Moderate to severe OUD INDV-2000 failure by the end of week 12 Phase II NCT06384157 1 Treatment failure defined as either one of two criteria: (1) Urine Drug Screen positive for opioids, or fentanyl on 4 consecutive assessments while participants are on INDV-2000 or placebo alone, 24 (2) Discontinued INDV-2000 or placebo prematurely.

Financials

I N V E S T O R P R E S E N T A T I O N | J U N E 2 0 2 5 Capital Markets Footprint to Align with U.S. Focused Business Transition from London Stock Exchange (LSE) to Nasdaq rd May 23 th th nd th June 30 July 25 June 2 July 24 Russell U.S. Equity Indexes All Trading on Nasdaq Under Anticipate Inclusion in Russell U.S. LSE Delisting Announcement Last Day of Trading on LSE Preliminary Inclusion Announcement Ticker INDV Equity Indexes Context & Expected Benefits Net Revenue by Geography U.S. Net Revenue Progression • U.S. NR makes up 85% of total NR for FY 2024, with U.S. % anticipated growth 15% FY 24 $1,188m 85% • Over 70% of Indivior’s shareholders based in the U.S. FY 23 $912m 84% $1,188m • Majority of stock trading volume conducted through FY 22 $731m 81% FY 2024 Nasdaq listing $603m 76% FY 21 • Reduces the costs and complexities of maintaining a 85% FY 20 $456m 70% secondary listing U.S. Rest of World • Potential for further U.S. index inclusion in the future 26

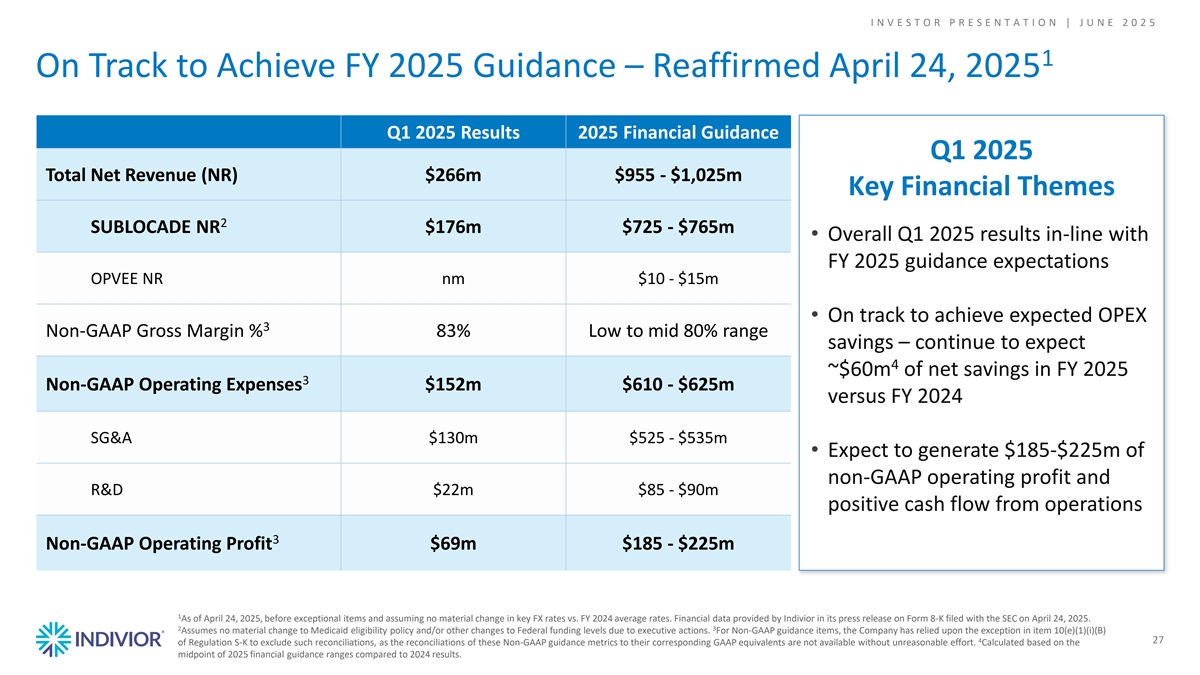

I N V E S T O R P R E S E N T A T I O N | J U N E 2 0 2 5 1 On Track to Achieve FY 2025 Guidance – Reaffirmed April 24, 2025 Q1 2025 Results 2025 Financial Guidance Q1 2025 Total Net Revenue (NR) $266m $955 - $1,025m Key Financial Themes 2 SUBLOCADE NR $176m $725 - $765m • Overall Q1 2025 results in-line with FY 2025 guidance expectations OPVEE NR nm $10 - $15m • On track to achieve expected OPEX 3 Non-GAAP Gross Margin % 83% Low to mid 80% range savings – continue to expect 4 ~$60m of net savings in FY 2025 3 Non-GAAP Operating Expenses $152m $610 - $625m versus FY 2024 SG&A $130m $525 - $535m • Expect to generate $185-$225m of non-GAAP operating profit and R&D $22m $85 - $90m positive cash flow from operations 3 Non-GAAP Operating Profit $69m $185 - $225m 1 As of April 24, 2025, before exceptional items and assuming no material change in key FX rates vs. FY 2024 average rates. Financial data provided by Indivior in its press release on Form 8-K filed with the SEC on April 24, 2025. 2 3 Assumes no material change to Medicaid eligibility policy and/or other changes to Federal funding levels due to executive actions. For Non-GAAP guidance items, the Company has relied upon the exception in item 10(e)(1)(i)(B) 4 27 of Regulation S-K to exclude such reconciliations, as the reconciliations of these Non-GAAP guidance metrics to their corresponding GAAP equivalents are not available without unreasonable effort. Calculated based on the midpoint of 2025 financial guidance ranges compared to 2024 results.

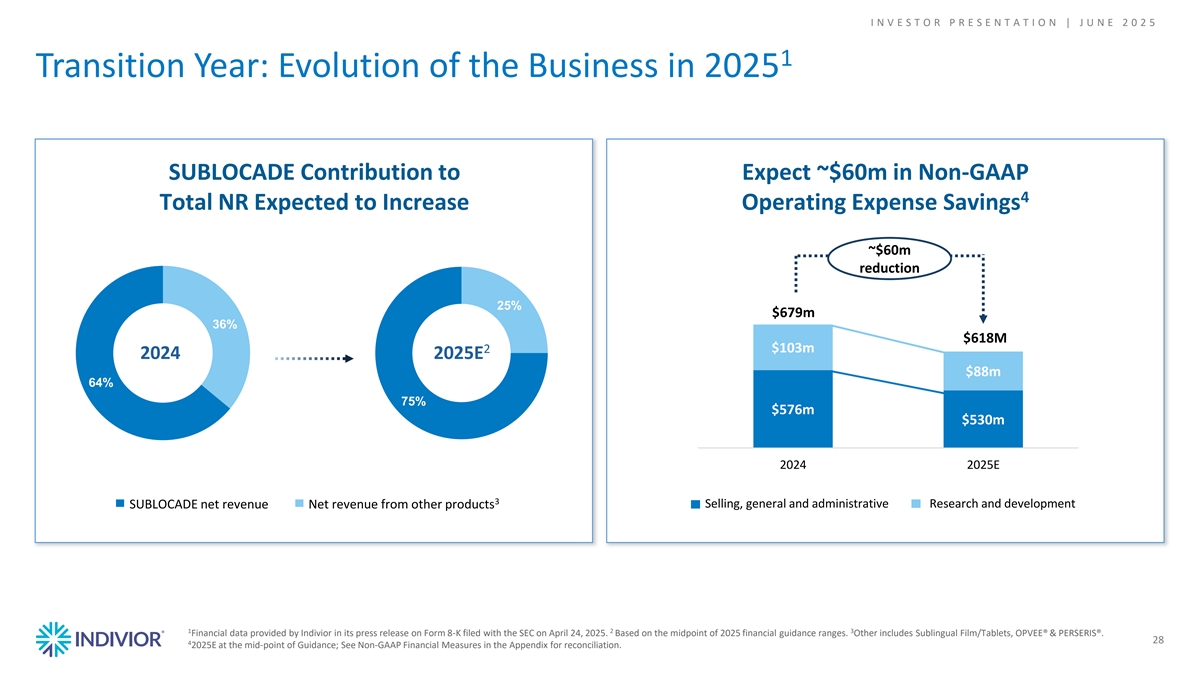

I N V E S T O R P R E S E N T A T I O N | J U N E 2 0 2 5 1 Transition Year: Evolution of the Business in 2025 SUBLOCADE Contribution to Expect ~$60m in Non-GAAP 4 Total NR Expected to Increase Operating Expense Savings ~$60m reduction 25% $679m 36% $618M $103m 2 2024 2025E $88m 64% 75% $576m $530m 2024 2025E 3 Selling, general and administrative Research and development SUBLOCADE net revenue Net revenue from other products 1 2 3 Financial data provided by Indivior in its press release on Form 8-K filed with the SEC on April 24, 2025. Based on the midpoint of 2025 financial guidance ranges. Other includes Sublingual Film/Tablets, OPVEE® & PERSERIS®. 28 4 2025E at the mid-point of Guidance; See Non-GAAP Financial Measures in the Appendix for reconciliation.

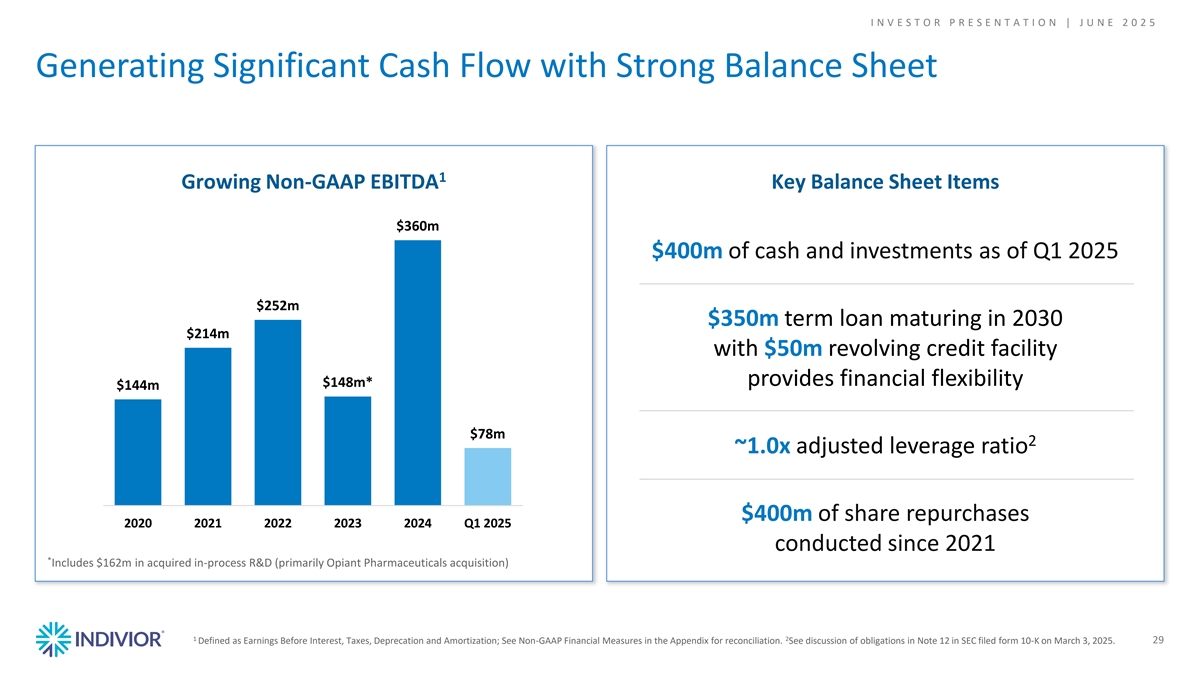

I N V E S T O R P R E S E N T A T I O N | J U N E 2 0 2 5 Generating Significant Cash Flow with Strong Balance Sheet 1 Growing Non-GAAP EBITDA Key Balance Sheet Items $360m $400m of cash and investments as of Q1 2025 $252m $350m term loan maturing in 2030 $214m with $50m revolving credit facility provides financial flexibility $148m* $144m $78m 2 ~1.0x adjusted leverage ratio $400m of share repurchases 2020 2021 2022 2023 2024 Q1 2025 conducted since 2021 * Includes $162m in acquired in-process R&D (primarily Opiant Pharmaceuticals acquisition) 1 2 Defined as Earnings Before Interest, Taxes, Deprecation and Amortization; See Non-GAAP Financial Measures in the Appendix for reconciliation. See discussion of obligations in Note 12 in SEC filed form 10-K on March 3, 2025. 29

I N V E S T O R P R E S E N T A T I O N | J U N E 2 0 2 5 Transition Year Focus Deliver 2025 Operating Plan Grow SUBLOCADE Advance the OUD Pipeline Strengthen the Balance Sheet 30

Appendix Latosha Regional Head of U.S.Medical Affairs-West, Indian Health Services Medical Lead

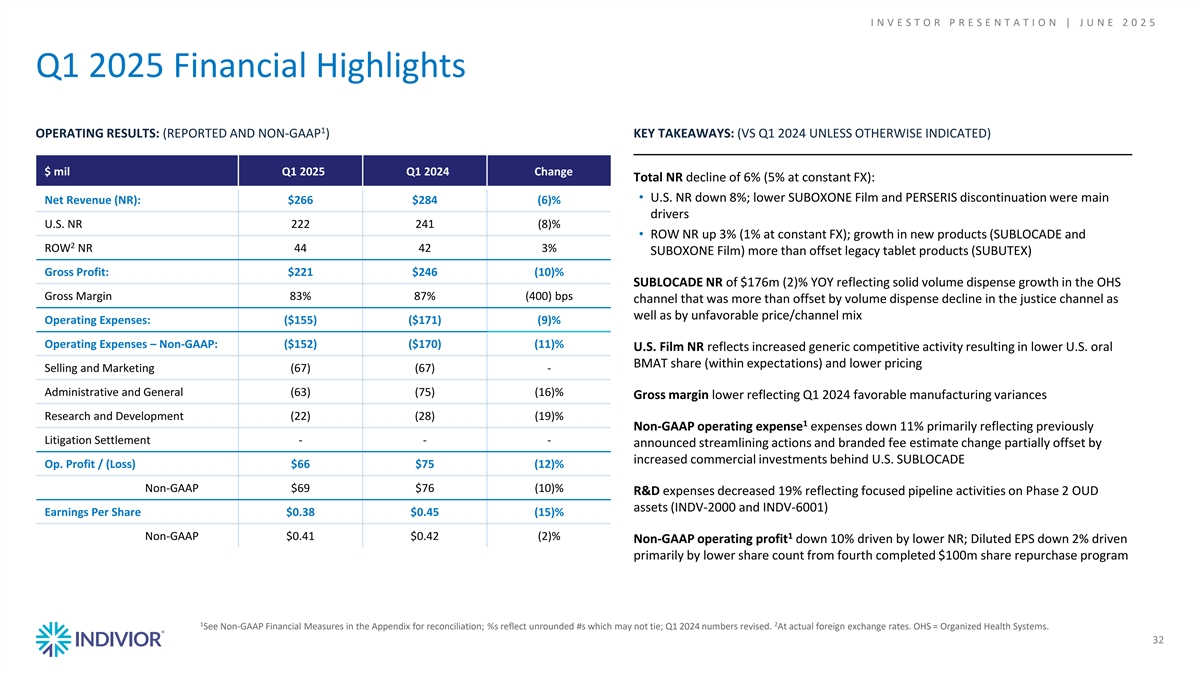

I N V E S T O R P R E S E N T A T I O N | J U N E 2 0 2 5 Q1 2025 Financial Highlights 1 OPERATING RESULTS: (REPORTED AND NON-GAAP ) KEY TAKEAWAYS: (VS Q1 2024 UNLESS OTHERWISE INDICATED) $ mil Q1 2025 Q1 2024 Change Total NR decline of 6% (5% at constant FX): • U.S. NR down 8%; lower SUBOXONE Film and PERSERIS discontinuation were main Net Revenue (NR): $266 $284 (6)% drivers U.S. NR 222 241 (8)% • ROW NR up 3% (1% at constant FX); growth in new products (SUBLOCADE and 2 ROW NR 44 42 3% SUBOXONE Film) more than offset legacy tablet products (SUBUTEX) Gross Profit: $221 $246 (10)% SUBLOCADE NR of $176m (2)% YOY reflecting solid volume dispense growth in the OHS Gross Margin 83% 87% (400) bps channel that was more than offset by volume dispense decline in the justice channel as well as by unfavorable price/channel mix Operating Expenses: ($155) ($171) (9)% Operating Expenses – Non-GAAP: ($152) ($170) (11)% U.S. Film NR reflects increased generic competitive activity resulting in lower U.S. oral BMAT share (within expectations) and lower pricing Selling and Marketing (67) (67) - Administrative and General (63) (75) (16)% Gross margin lower reflecting Q1 2024 favorable manufacturing variances Research and Development (22) (28) (19)% 1 Non-GAAP operating expense expenses down 11% primarily reflecting previously Litigation Settlement - - - announced streamlining actions and branded fee estimate change partially offset by increased commercial investments behind U.S. SUBLOCADE Op. Profit / (Loss) $66 $75 (12)% Op. Profit / (Loss) – Non-GAAP $69 $76 (10)% R&D expenses decreased 19% reflecting focused pipeline activities on Phase 2 OUD assets (INDV-2000 and INDV-6001) Earnings Per Share $0.38 $0.45 (15)% 1 Op. Profit / (Loss) – Non-GAAP $0.41 $0.42 (2)% Non-GAAP operating profit down 10% driven by lower NR; Diluted EPS down 2% driven primarily by lower share count from fourth completed $100m share repurchase program 1 2 See Non-GAAP Financial Measures in the Appendix for reconciliation; %s reflect unrounded #s which may not tie; Q1 2024 numbers revised. At actual foreign exchange rates. OHS = Organized Health Systems. 32

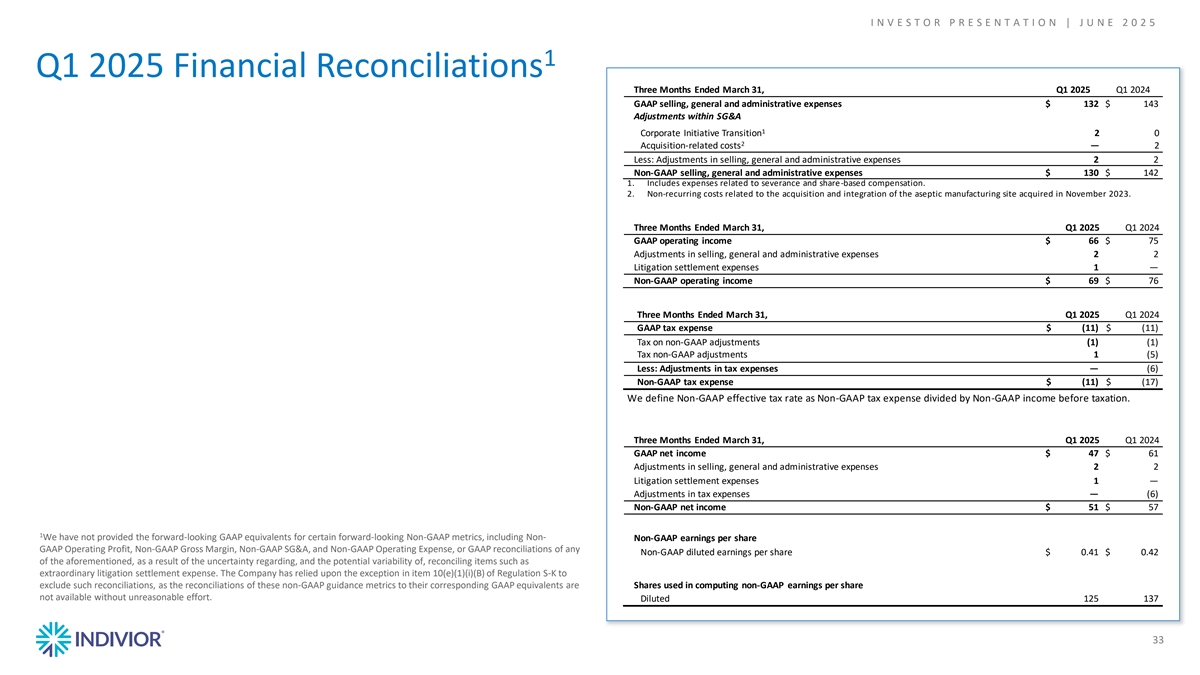

I N V E S T O R P R E S E N T A T I O N | J U N E 2 0 2 5 1 Q1 2025 Financial Reconciliations Three Months Ended March 31, Q1 2025 Q1 2024 GAAP selling, general and administrative expenses $ 132 $ 143 Adjustments within SG&A 1 Corporate Initiative Transition 2 0 2 Acquisition-related costs — 2 Less: Adjustments in selling, general and administrative expenses 2 2 Non-GAAP selling, general and administrative expenses $ 130 $ 142 1. Includes expenses related to severance and share -based compensation. 2. Non-recurring costs related to the acquisition and integration of the aseptic manufacturing site acquired in November 2023. Three Months Ended March 31, Q1 2025 Q1 2024 GAAP operating income $ 66 $ 75 Adjustments in selling, general and administrative expenses 2 2 Litigation settlement expenses 1 — Non-GAAP operating income $ 69 $ 76 Three Months Ended March 31, Q1 2025 Q1 2024 GAAP tax expense $ (11) $ (11) Tax on non-GAAP adjustments (1) (1) Tax non-GAAP adjustments 1 (5) Less: Adjustments in tax expenses — (6) Non-GAAP tax expense $ (11) $ (17) We define Non-GAAP effective tax rate as Non-GAAP tax expense divided by Non-GAAP income before taxation. Three Months Ended March 31, Q1 2025 Q1 2024 GAAP net income $ 47 $ 61 Adjustments in selling, general and administrative expenses 2 2 Litigation settlement expenses 1 — Adjustments in tax expenses — (6) Non-GAAP net income $ 51 $ 57 1 We have not provided the forward-looking GAAP equivalents for certain forward-looking Non-GAAP metrics, including Non- Non-GAAP earnings per share GAAP Operating Profit, Non-GAAP Gross Margin, Non-GAAP SG&A, and Non-GAAP Operating Expense, or GAAP reconciliations of any Non-GAAP diluted earnings per share $ 0.41 $ 0.42 of the aforementioned, as a result of the uncertainty regarding, and the potential variability of, reconciling items such as extraordinary litigation settlement expense. The Company has relied upon the exception in item 10(e)(1)(i)(B) of Regulation S-K to exclude such reconciliations, as the reconciliations of these non-GAAP guidance metrics to their corresponding GAAP equivalents are Shares used in computing non-GAAP earnings per share not available without unreasonable effort. Diluted 125 137 33

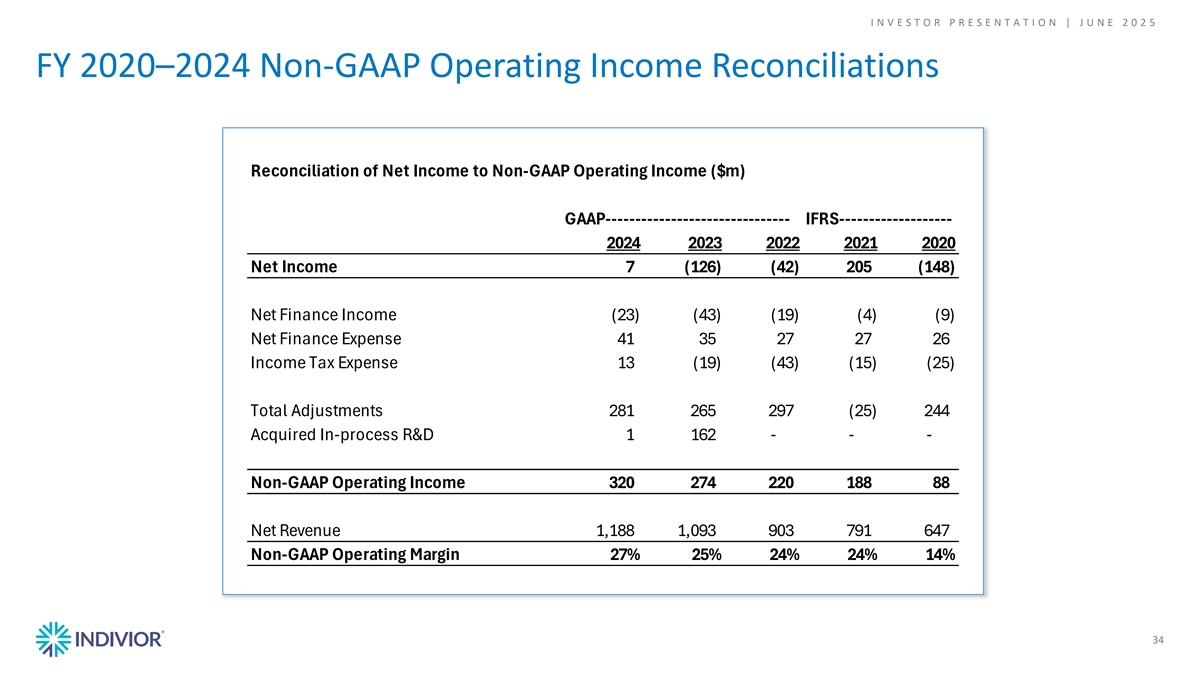

I N V E S T O R P R E S E N T A T I O N | J U N E 2 0 2 5 FY 2020–2024 Non-GAAP Operating Income Reconciliations Reconciliation of Net Income to Non-GAAP Operating Income ($m) GAAP------------------------------- IFRS------------------- 2024 2023 2022 2021 2020 Net Income 7 ( 126) (42) 205 ( 148) Net Finance Income (23) (43) (19) (4) (9) Net Finance Expense 41 35 27 27 26 Income Tax Expense 13 (19) (43) (15) (25) Total Adjustments 281 265 297 (25) 244 Acquired In-process R&D 1 162 - - - Non-GAAP Operating Income 320 274 220 188 88 Net Revenue 1 ,188 1,093 903 791 647 Non-GAAP Operating Margin 27% 25% 24% 24% 14% 34

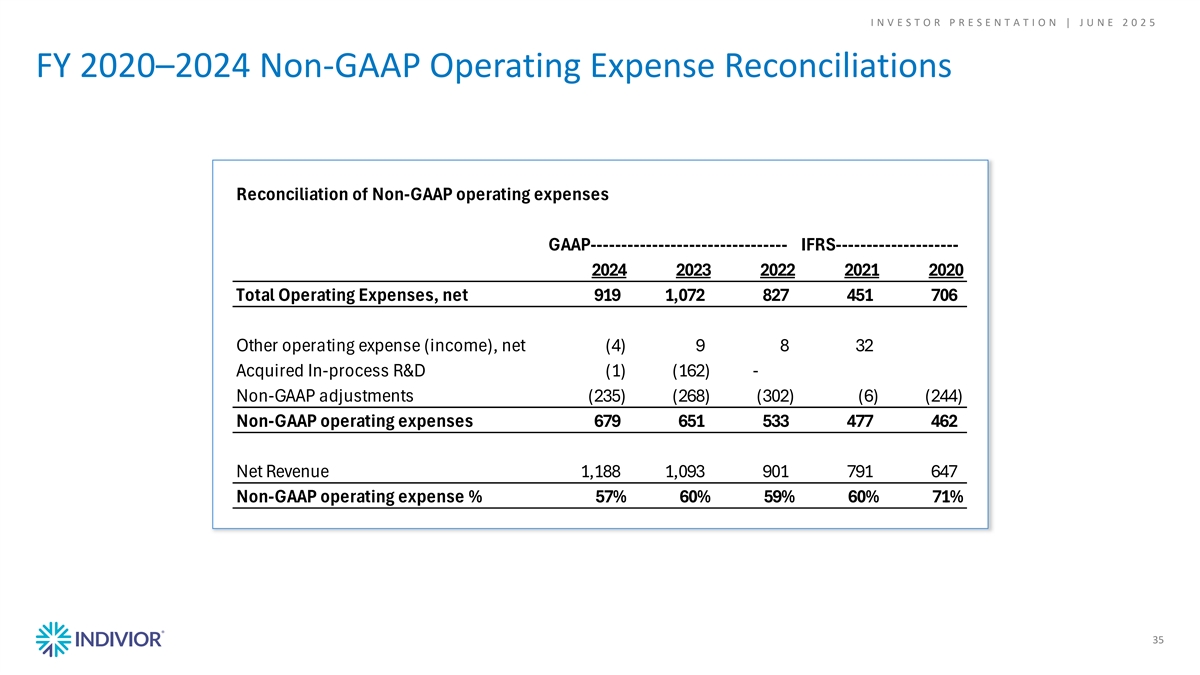

I N V E S T O R P R E S E N T A T I O N | J U N E 2 0 2 5 FY 2020–2024 Non-GAAP Operating Expense Reconciliations Reconciliation of Non-GAAP operating expenses GAAP-------------------------------- IFRS-------------------- 2024 2023 2022 2021 2020 Total Operating Expenses, net 919 1,072 827 451 706 Other operating expense (income), net (4) 9 8 32 Acquired In-process R&D (1) (162) - Non-GAAP adjustments (235) (268) (302) (6) (244) Non-GAAP operating expenses 679 651 533 477 462 Net Revenue 1,188 1,093 901 791 647 Non-GAAP operating expense % 57% 60% 59% 60% 71% 35

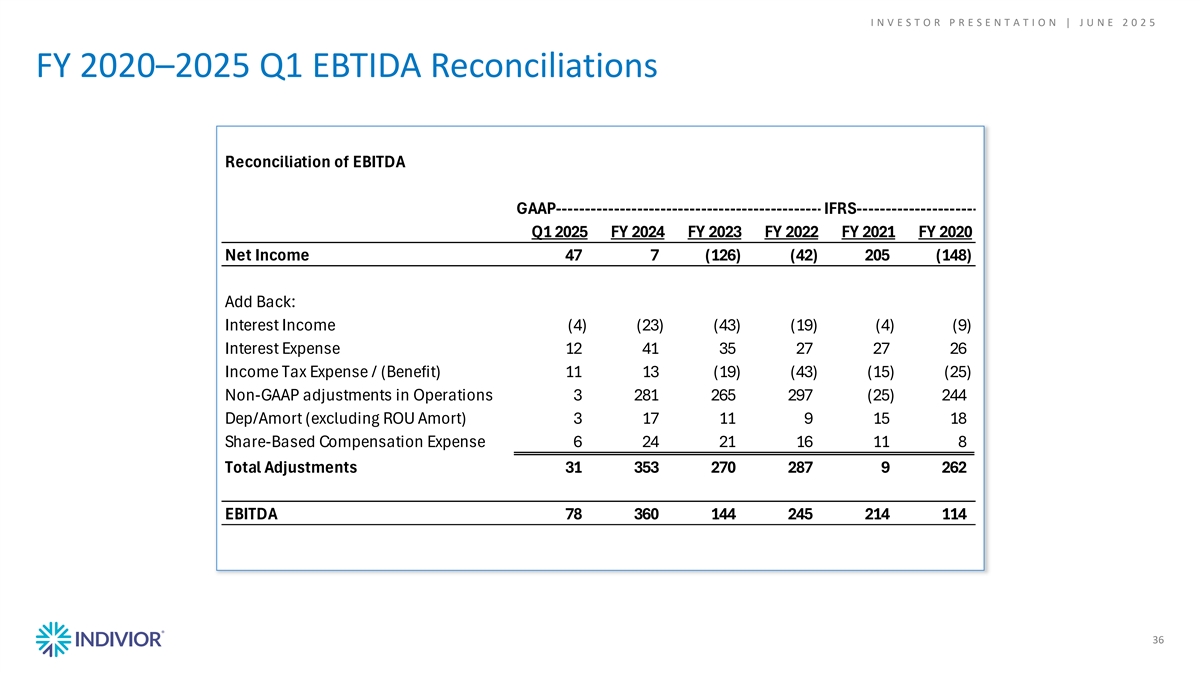

I N V E S T O R P R E S E N T A T I O N | J U N E 2 0 2 5 FY 2020–2025 Q1 EBTIDA Reconciliations Reconciliation of EBITDA GAAP----------------------------------------------- IFRS--------------------- Q1 2025 FY 2024 FY 2023 FY 2022 FY 2021 FY 2020 Net Income 47 7 (126) (42) 205 (148) Add Back: Interest Income (4) (23) (43) (19) (4) (9) Interest Expense 12 41 35 27 27 26 Income Tax Expense / (Benefit) 11 13 (19) (43) (15) (25) Non-GAAP adjustments in Operations 3 281 265 297 (25) 244 Dep/Amort (excluding ROU Amort) 3 17 11 9 15 18 Share-Based Compensation Expense 6 24 21 16 11 8 Total Adjustments 31 353 270 287 9 262 EBITDA 78 360 144 245 214 114 36

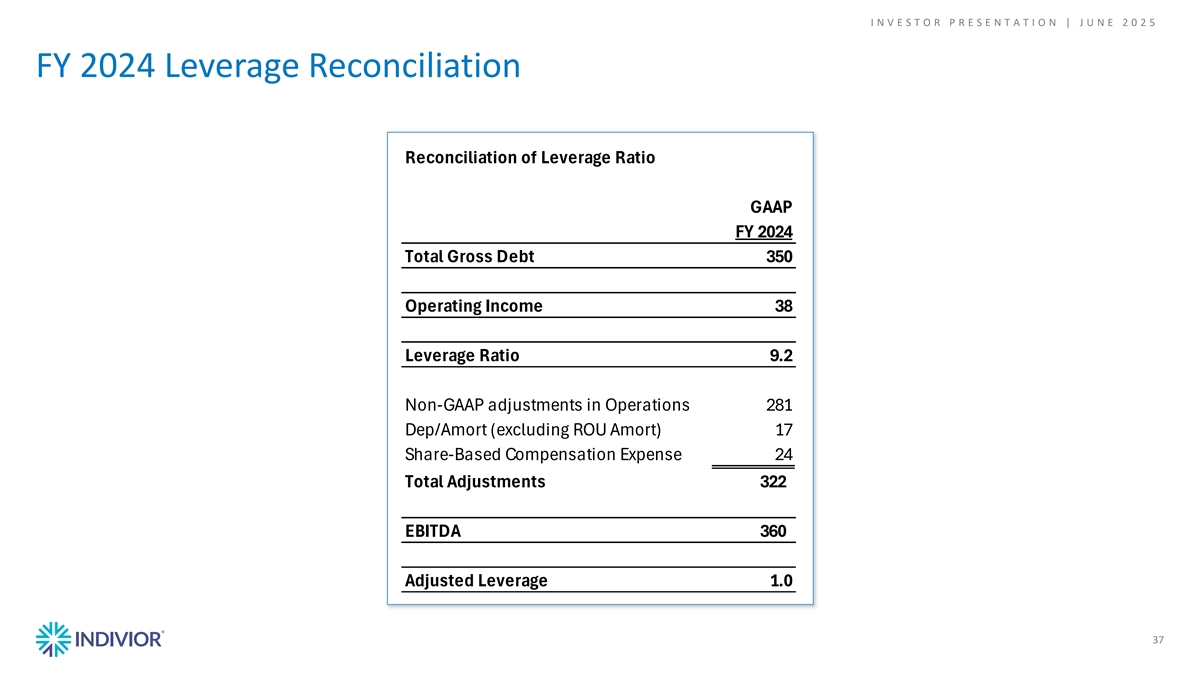

I N V E S T O R P R E S E N T A T I O N | J U N E 2 0 2 5 FY 2024 Leverage Reconciliation Reconciliation of Leverage Ratio GAAP FY 2024 Total Gross Debt 350 Operating Income 38 Leverage Ratio 9.2 Non-GAAP adjustments in Operations 281 Dep/Amort (excluding ROU Amort) 17 Share-Based Compensation Expense 24 Total Adjustments 322 EBITDA 360 Adjusted Leverage 1.0 37

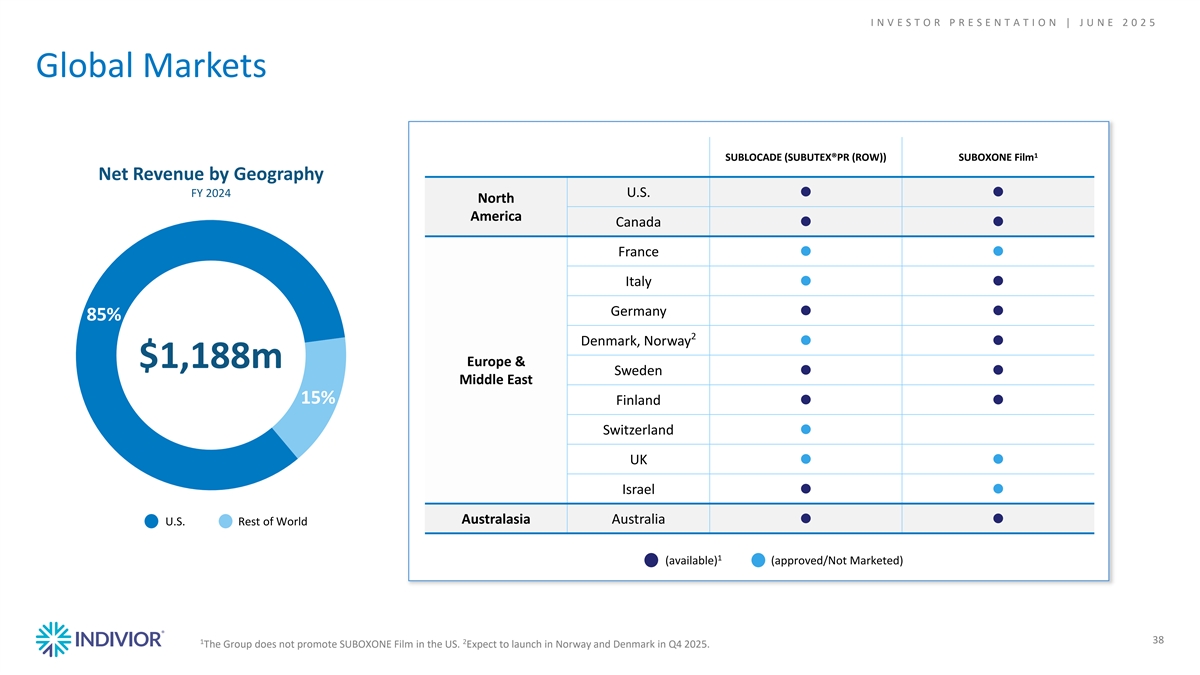

I N V E S T O R P R E S E N T A T I O N | J U N E 2 0 2 5 Global Markets 1 SUBLOCADE (SUBUTEX®PR (ROW)) SUBOXONE Film Net Revenue by Geography FY 2024 U.S. ●● North America Canada ●● France ●● Italy ●● Germany ●● 85% 2 Denmark, Norway●● Europe & $1,188m Sweden ●● Middle East 15% Finland ●● Switzerland ● UK●● Israel ●● Australasia Australia U.S. Rest of World●● 1 (available) (approved/Not Marketed) 1 2 38 The Group does not promote SUBOXONE Film in the US. Expect to launch in Norway and Denmark in Q4 2025. 38 38

I N V E S T O R P R E S E N T A T I O N | J U N E 2 0 2 5 SUBLOCADE® (buprenorphine extended-release) injection, for subcutaneous use (CIII) INDICATION SUBLOCADE is indicated for the treatment of moderate to severe opioid use disorder in patients who have initiated treatment with a single dose of a transmucosal buprenorphine product or who are already being treated with buprenorphine. SUBLOCADE should be used as part of a complete treatment plan that includes counseling and psychosocial support. HIGHLIGHTED SAFETY INFORMATION WARNING: RISK OF SERIOUS HARM OR DEATH WITH INTRAVENOUS ADMINISTRATION; SUBLOCADE RISK EVALUATION AND MITIGATION STRATEGY See full prescribing information for complete boxed warning. • Serious harm or death could result if administered intravenously. • SUBLOCADE is only available through a restricted program called the SUBLOCADE REMS Program. Healthcare settings and pharmacies that order and dispense SUBLOCADE must be certified in this program and comply with the REMS requirements. CONTRAINDICATIONS Hypersensitivity to buprenorphine or any other ingredients in SUBLOCADE. WARNINGS AND PRECAUTIONS Addiction, Abuse, and Misuse: SUBLOCADE contains buprenorphine, a Schedule III controlled substance that can be abused in a manner similar to other opioids. Monitor patients for conditions indicative of diversion or progression of opioid dependence and addictive behaviors. Respiratory Depression: Life threatening respiratory depression and death have occurred in association with buprenorphine. Warn patients of the potential danger of self-administration of benzodiazepines or other CNS depressants while under treatment with SUBLOCADE. Risk of Serious Injection Site Reactions: Likelihood of may increase with inadvertent intramuscular or intradermal administration. Evaluate and treat as appropriate. The most common injection site reactions are pain, erythema and pruritus with some involving abscess, ulceration and necrosis. Neonatal Opioid Withdrawal Syndrome: Neonatal opioid withdrawal syndrome (NOWS) is an expected and treatable outcome of prolonged use of opioids during pregnancy. Adrenal Insufficiency: If diagnosed, treat with physiologic replacement of corticosteroids, and wean patient off the opioid. Risk of Opioid Withdrawal With Abrupt Discontinuation: If treatment with SUBLOCADE is discontinued, monitor patients for several months for withdrawal and treat appropriately. Risk of Hepatitis, Hepatic Events: Monitor liver function tests prior to and during treatment. Risk of Withdrawal in Patients Dependent on Full Agonist Opioids: Verify that patients have tolerated transmucosal buprenorphine before injecting SUBLOCADE. Treatment of Emergent Acute Pain: Treat pain with a non-opioid analgesic whenever possible. If opioid therapy is required, monitor patients closely because higher doses may be required for analgesic effect. ADVERSE REACTIONS Adverse reactions commonly associated with SUBLOCADE (in ≥5% of subjects) were constipation, headache, nausea, injection site pruritus, vomiting, increased hepatic enzymes, fatigue, and injection site pain. For more information about SUBLOCADE, the full Prescribing Information including BOXED WARNING, and Medication Guide, visit www.sublocade.com. 39 39 39

I N V E S T O R P R E S E N T A T I O N | J U N E 2 0 2 5 OPVEE® (nalmefene) nasal spray INDICATION AND USAGE OPVEE nasal spray is an opioid antagonist indicated for the emergency treatment of known or suspected overdose induced by natural or synthetic opioids in adults and pediatric patients aged 12 years and older, as manifested by respiratory and/or central nervous system depression. OPVEE nasal spray is intended for immediate administration as emergency therapy in settings where opioids may be present. OPVEE nasal spray is not a substitute for emergency medical care. HIGHLIGHTED SAFETY INFORMATION CONTRAINDICATIONS Hypersensitivity to nalmefene or to any of the other ingredients. WARNINGS AND PRECAUTIONS Risk of Recurrent Respiratory and Central Nervous System Depression: While the duration of action of nalmefene is as long as most opioids, a recurrence of respiratory depression is possible, therefore, keep patient under continued surveillance and administer repeat doses of OPVEE using a new nasal spray with each dose, as necessary, while awaiting emergency medical assistance. Limited Efficacy with Partial Agonists or Mixed Agonist/Antagonists: Reversal of respiratory depression caused by partial agonists or mixed agonists/antagonists, such as buprenorphine and pentazocine, may be incomplete. Larger or repeat doses may be required. Precipitation of Severe Opioid Withdrawal: Use in patients who are opioid dependent may precipitate opioid withdrawal. In neonates, opioid withdrawal may be life-threatening if not recognized and properly treated. Monitor for the development of opioid withdrawal. Risk of Cardiovascular (CV) Effects: Abrupt postoperative reversal of opioid depression may result in adverse CV effects. These events have primarily occurred in patients who had preexisting CV disorders or received other drugs that may have similar adverse CV effects. Monitor these patients closely in an appropriate healthcare setting after use of nalmefene hydrochloride. Risk of Opioid Overdose from Attempts to Overcome the Blockade: Attempts to overcome opioid withdrawal symptoms caused by opioid antagonists with high or repeated doses of exogenous opioids may lead to opioid intoxication and death. ADVERSE REACTIONS Most common adverse reactions (incidence at least 2%) are nasal discomfort, headache, nausea, dizziness, hot flush, vomiting, anxiety, fatigue, nasal congestion, throat irritation, rhinalgia, decreased appetite, dysgeusia, erythema, and hyperhidrosis. For more information about OPVEE and the full Prescribing Information visit www.opvee.com 40 40