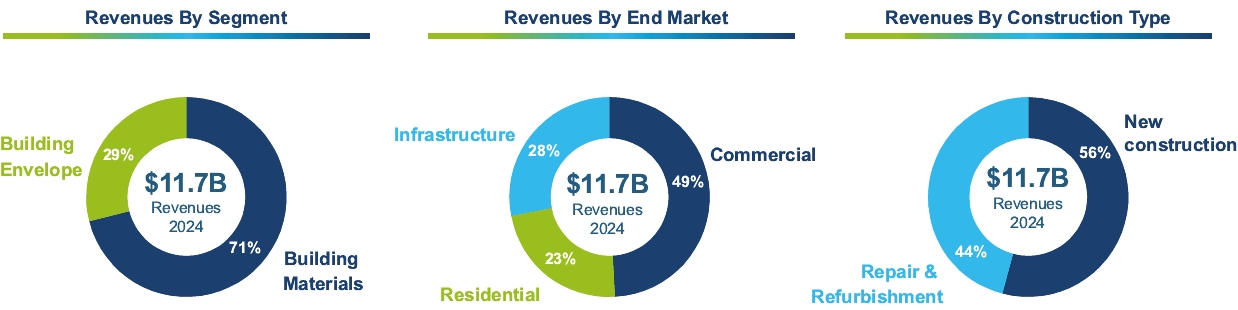

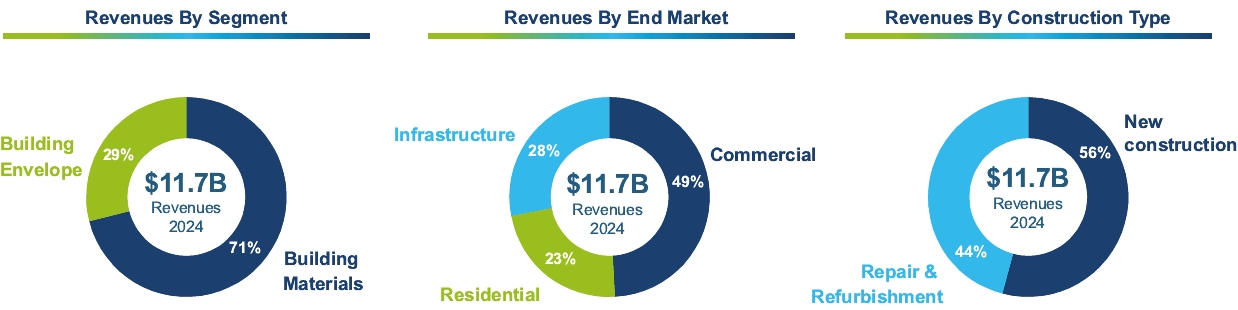

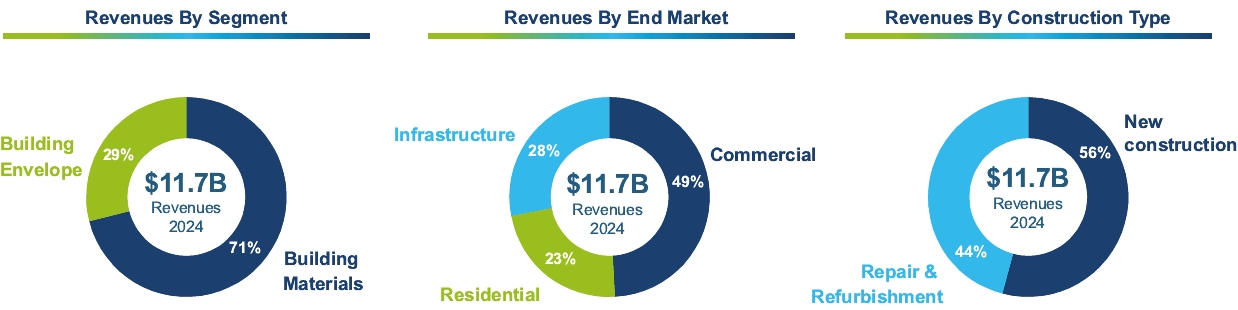

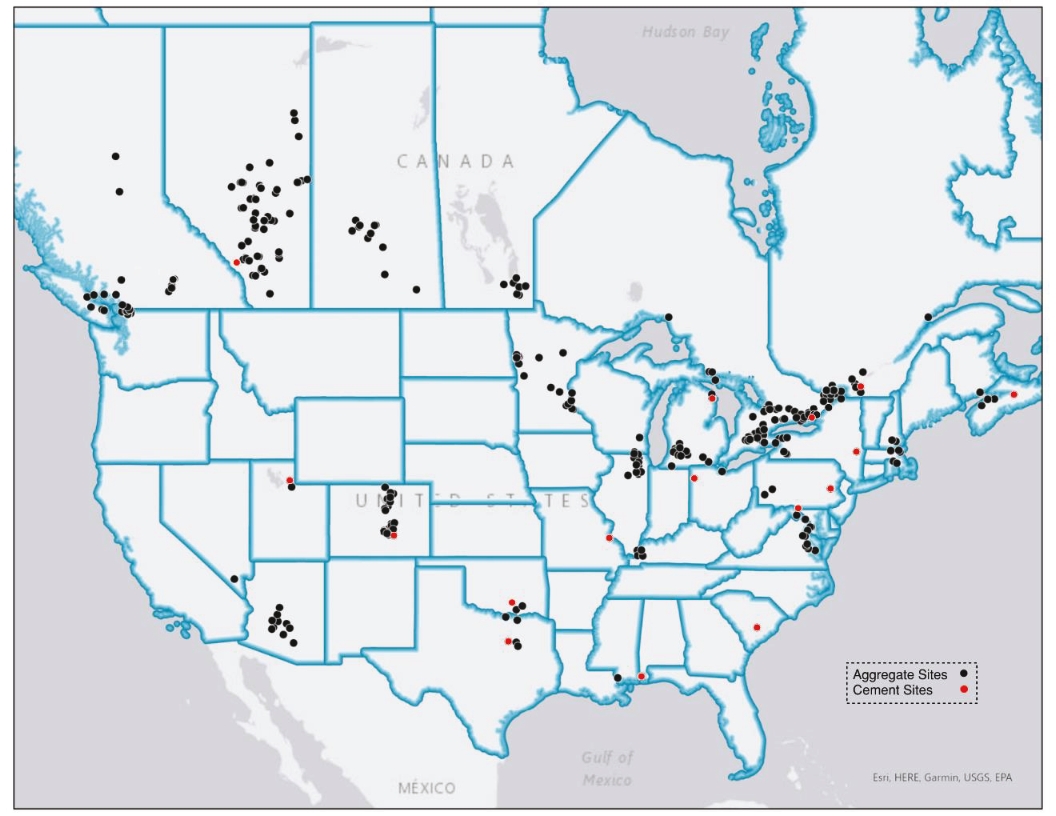

• | Our Building Materials segment offers a range of branded and unbranded solutions delivering high-quality products for a wide range of applications across North America. Key product offerings of this segment include cement and aggregates, as well as a variety of downstream products and solutions such as ready-mix concrete, asphalt and other construction materials. Our operating footprint includes 18 cement plants, 141 terminals, 55 cementitious product operations, 269 ready-mix concrete plants, 462 aggregates operations, 35 concrete product sites and 50 asphalt operations. Our Building Materials segment generated $8.3 billion of revenues during the year ended December 31, 2024. |

• | Our Building Envelope segment offers advanced roofing and wall systems, including single-ply membranes, insulation, shingles, sheathing, waterproofing and protective coatings, along with adhesives, tapes and sealants that are critical to the application of roofing and wall systems. Products are sold individually or in warranted systems for new construction or R&R in commercial and residential projects. Products for commercial projects are primarily sold under the Elevate and Duro-Last brands, while products for residential projects are primarily sold under the Malarkey brand. These products are sold either directly to contractors or through authorized distributors or a network of sales representatives in North America. Our Building Envelope segment generated $3.4 billion of revenues during the year ended December 31, 2024. |

• | Positioned in the most attractive markets to service our North American customers: Population growth, urbanization, climate change, onshoring and investments in infrastructure are shaping the future of construction and driving demand for advanced solutions in key markets. We believe we are well positioned to capitalize on these trends by leveraging our leading footprint and our advanced solutions. |

• | Comprehensive range of building solutions powering growth opportunities: Through our comprehensive product offering, we aim to provide our customers with a full suite of advanced building solutions from foundation to rooftop, offering the most advanced solutions that address their most sophisticated needs and enable them to meet their ambitious goals across the whole building lifecycle. |

• | Deeply embedded performance culture and dedication to employee safety: We aim to continue growing our revenues and profitability through empowered leadership of our more than 125 local market leaders across the United States and Canada. Our performance-based culture drives customer-focused decision-making and superior financial performance, while maintaining a rigorous commitment to protecting the health and safety of our people. |

• | Value accretive and disciplined acquisitions: With a track record of disciplined and value-focused acquisitions, we have established ourselves as a leader in commercial roofing and advanced wall systems, creating a platform for further organic and inorganic growth in the Building Envelope segment. We also pursue an active strategy of synergistic bolt-on acquisitions in the highly fragmented construction materials market, particularly for aggregates and ready-mix concrete. We have completed 35 acquisitions since 2018, which we expect to generate more than $3.8 billion in annual revenue going forward based on 2024 revenue. Across these transactions, we have created significant synergies, lowering the average enterprise value/Adjusted EBITDA multiple from 12x to 8x including synergies. |

• | Committed to driving shareholder value: We strive to maintain a conservative capital structure based on an investment grade credit rating. Our capital allocation strategy includes investing in our business to drive sustainable growth, pursuing strategic acquisitions in fragmented markets in line with our segment ambitions, and returning capital to shareholders. |

• | Emphasis on innovation: Through our research and development engine, we seek to drive cutting-edge innovation to address our customers’ greatest ambitions. Our experts span all building fields, from masons and engineers to material scientists and experts in artificial intelligence and data mining. We also partner with leading construction sector startups to scale up new technologies across our operations. We have six portfolio companies across North America, including Sublime Systems, a disruptive cement technology startup which uses renewable electricity and carbon-free raw materials for cement production. |

• | Economic conditions, including inflation, have affected and may continue to adversely affect our business, financial condition, liquidity and results of operations. |

• | We are affected by the level of demand in the construction industry. |

• | We and our customers participate in cyclical industries and regional markets, which are subject to industry downturns. |

• | Changes in the cost and/or availability of raw materials required to run our business, including related supply chain disruptions, could have a material adverse effect on our business, financial condition and results of operations. |

• | High energy and fuel costs have had and may continue to have a material adverse effect on our operating results. |

• | The development and introduction of new products and technologies, or the failure to do so, could have a material adverse effect on our business, financial condition, liquidity and results of operations. |

• | We operate in a highly competitive industry with numerous players employing different competitive strategies and if we do not compete effectively, our revenues, market share and results of operations may be adversely affected. |

• | Activities in our business can be hazardous and can cause injury to people or damage to property in certain circumstances. |

• | We are subject to the laws and regulations of the countries where we operate and do business and non-compliance, any material changes in such laws and regulations and/or any significant delays in assessing the impact and/or adapting to such changes in laws and regulations may have an adverse effect on our business, financial condition, liquidity and results of operations. |

• | We or our third-party suppliers may fail to maintain, obtain or renew or may experience material delays in obtaining requisite governmental or other approvals, licenses and permits for the conduct of our business. |

• | We cannot be certain that an active trading market for Company Shares will develop or be sustained after the Distribution. Following the Distribution, our share price may fluctuate significantly. |

• | Any sales of substantial amounts of Company Shares in the public market, or the perception that such sales might occur, may cause the market price of Company Shares to decline. |

• | Holders of Company Shares may not be able to exercise certain shareholder rights if they are not registered as shareholders of record. |

• | We may not achieve some or all of the expected benefits of the Spin-off, and the Spin-off may adversely impact our business. |

• | The Spin-off might not be completed or not be completed within the envisaged time frame and the non-recurring and recurring costs of the Spin-off may be greater than we expected. |

• | The Spin-off or any of the related transactions may not qualify as tax-free transactions for U.S. federal income tax purposes or as a tax-neutral restructuring for Swiss tax purposes. |

• | greater strategic focus of financial resources and management’s efforts; |

• | direct and differentiated access to capital resources; |

• | value creation by offering separate investment opportunities; |

• | improved ability to use stock as an acquisition currency; and |

• | improved management incentives, recruitment and retention. |

• | potential costs and disruptions to the Amrize Business as a result of the Spin-off; |

• | risks of being unable to achieve the benefits expected from the Spin-off; |

• | increased significance of certain costs and contingent liabilities; |

• | the decreased capital available for investment; |

• | the reaction of Parent’s shareholders to the Spin-off; |

• | the potential loss of purchasing power and higher cost structure; |

• | the risk that the Spin-off might not be completed or not be completed within the envisaged time frame and the non-recurring and recurring costs of the Spin-off may be greater than we expected; and |

• | the risk that the Separation, Distribution or any of the related transactions does not qualify as tax-free for U.S. federal income tax purposes or as a tax-neutral restructuring for Swiss tax purposes. |

• | The SEC will have declared effective the registration statement of which this information statement is a part, and no stop order relating to the registration statement will be in effect, and no proceedings for that purpose will be pending before or threatened by the SEC. |

• | NYSE will have approved the listing of Company Shares, and SIX will have approved the additional listing of Company Shares subject to technical deliverables as customarily required. |

• | The registration statement, of which this information statement is a part, will have been approved by the SIX Prospectus Office for the purpose of the Swiss listing in accordance with Article 54 of the Swiss Federal Act on Financial Services dated June 15, 2018 (SR 950.1) (“FinSA”). |

• | Parent will have received the Tax Opinion (as further described in “Material U.S. Federal Income Tax Consequences of the Distribution—Tax Opinion and IRS Ruling”). |

• | All actions, filings, permits, registrations and consents necessary or appropriate under applicable federal, state or other securities laws or “blue sky” laws and the rules and regulations thereunder with respect to the Company will have been taken or made and, where applicable, become effective or accepted. |

• | No order, injunction or decree issued by any court or governmental authority of competent jurisdiction or other legal restraint or prohibition preventing the consummation of the Separation, Distribution or any of the related transactions will be in effect, and no other event outside the control of Parent shall have occurred or failed to occur that prevents the consummation of the Spin-off. |

• | No event or development shall have occurred or exist as of the Ex-Dividend Date that, in the reasonable judgment of the Parent Board of Directors, would result in the Separation, the Distribution or the other related transactions having a material adverse effect (including, but not limited to, material adverse tax consequences or risks) on Parent or its shareholders. |

Pro Forma | Historical | ||||||||||||||||||||

Three Months Ended March 31, | Fiscal Year Ended December 31, | Three Months Ended March 31, | Fiscal Year Ended December 31, | ||||||||||||||||||

(In millions, except per share data) | 2025 | 2024 | 2025 | 2024 | 2024 | 2023 | 2022 | ||||||||||||||

(Unaudited) | (Unaudited) | (Audited) | |||||||||||||||||||

Revenues | $2,081 | $11,704 | $2,081 | $2,166 | $11,704 | $11,677 | $10,726 | ||||||||||||||

Cost of revenues | (1,859) | (8,634) | (1,859) | (1,894) | (8,634) | (8,908) | (8,254) | ||||||||||||||

Gross profit | 222 | 3,070 | 222 | 272 | 3,070 | 2,769 | 2,472 | ||||||||||||||

Selling, general and administrative expenses | (244) | (967) | (239) | (213) | (944) | (898) | (752) | ||||||||||||||

Gain on disposal of long-lived assets | 1 | 71 | 1 | 1 | 71 | 32 | 36 | ||||||||||||||

Loss on impairments | — | (2) | — | — | (2) | (15) | (57) | ||||||||||||||

Operating (loss) income | (21) | 2,172 | (16) | 60 | 2,195 | 1,888 | 1,699 | ||||||||||||||

Interest expense, net | (71) | (299) | (118) | (120) | (512) | (549) | (248) | ||||||||||||||

Other non-operating income (expense), net | 1 | (55) | 1 | 4 | (55) | (36) | 9 | ||||||||||||||

(Loss) income before income tax expense and income from equity method investments | (91) | 1,818 | (133) | (56) | 1,628 | 1,303 | 1,460 | ||||||||||||||

Income tax benefit (expense) | 36 | (414) | 46 | 11 | (368) | (361) | (366) | ||||||||||||||

Income from equity method investments | — | 13 | — | 1 | 13 | 13 | 13 | ||||||||||||||

Net (loss) income | (55) | 1,417 | (87) | (44) | 1,273 | 955 | 1,107 | ||||||||||||||

Net loss attributable to noncontrolling interests | — | 1 | — | — | 1 | 1 | 1 | ||||||||||||||

Net (loss) income attributable to the Company | $(55) | $1,418 | $(87) | $(44) | $1,274 | $956 | $1,108 | ||||||||||||||

Unaudited pro forma (loss) earnings per Company Share | |||||||||||||||||||||

Basic | $(0.10) | $2.57 | |||||||||||||||||||

Diluted | $(0.10) | $2.57 | |||||||||||||||||||

Weighted-average number of Company Shares outstanding | |||||||||||||||||||||

Basic | 552.7 | 552.7 | |||||||||||||||||||

Diluted | 552.7 | 552.7 | |||||||||||||||||||

Pro Forma | Historical | |||||||||||

(In millions) | As of March 31, 2025 | As of March 31, 2025 | As of December 31, 2024 | As of December 31, 2023 | ||||||||

(Unaudited) | (Unaudited) | (Audited) | ||||||||||

Cash and cash equivalents | $40 | $574 | $1,585 | $1,107 | ||||||||

Total assets | $22,306 | $23,194 | $23,805 | $23,047 | ||||||||

Total liabilities | $9,838 | $13,444 | $13,891 | $13,844 | ||||||||

Total equity | $12,468 | $9,750 | $9,914 | $9,203 | ||||||||

Historical | |||||||||||||||

Three Months Ended March 31, | Fiscal Year Ended December 31, | ||||||||||||||

(In millions) | 2025 | 2024 | 2024 | 2023 | 2022 | ||||||||||

(Unaudited) | (Audited) | ||||||||||||||

Net cash (used in) provided by operating activities | $(856) | $(597) | $2,282 | $2,036 | $1,988 | ||||||||||

Net cash used in investing activities | $(60) | $(83) | $(1,208) | $(2,025) | $(2,521) | ||||||||||

Net cash (used in) provided by financing activities | $(97) | $(109) | $(537) | $734 | $497 | ||||||||||

What is Amrize and why is Holcim separating the Amrize Business and distributing Company Shares? | As of the date of this information statement, the Company is a wholly-owned subsidiary of Parent. Following the Spin-off, the Company will hold the assets and liabilities related to the Amrize Business. The Separation and the Distribution are intended to provide you with equity investments in two independent, publicly traded companies, each of which will be able to focus on its respective businesses. We and Holcim believe that the Spin-off will result in enhanced long-term performance of each business for the reasons discussed in the section of this information statement entitled “The Separation and Distribution—Reasons for the Spin-off.” | ||

Why are you receiving this document? | Parent is making this document available to you because you are a holder of Parent Shares. This document will help you understand how the Spin-off will affect your investment in Parent and the value of your Company Shares after the Spin-off. | ||

How will the Spin-off work? | To effect the Spin-off, Holcim will undertake a series of internal reorganization transactions that will result in the Company owning and operating the Amrize Business and Parent continuing to own and operate the Holcim Business. Parent will then cause UBS AG, as the Swiss settlement agent, to effect the Distribution by distributing Company Shares to holders of Parent Shares on a pro rata basis as a dividend-in-kind. Immediately following the completion of the Spin-off, the Company will be an independent, publicly traded company holding the Amrize Business, and Parent will not own any Company Shares. For a more detailed description, see the section of this information statement entitled “The Separation and Distribution.” | ||

Why is the Spin-off structured as a Distribution? | Parent believes that the Distribution, together with certain internal reorganization transactions undertaken in anticipation of the Distribution, which Parent intends to be tax-free to holders of Parent Shares for U.S. federal income tax purposes and tax-neutral to holders of Parent Shares for Swiss tax purposes, is an efficient way to separate the Amrize Business in a manner that is expected to create long-term benefits and value for Parent, the Company and their respective shareholders. Following the Spin-off, Parent will not retain any ownership interest in us. | ||

What will be distributed in the Distribution? | Each holder of Parent Shares (other than Parent) will receive one Company Share for each Parent Share held by such holder as of the close of business on the Cum-Dividend Date. Any excess Company Shares held by Parent which will not be distributed to holders of Parent Shares as set forth in the preceding sentence will be contributed by Parent to the Company in connection with the Separation prior to the Spin-off and will be held by the Company at the time of the Spin-off. Following the completion of the Spin-off, Parent will not own any Company Shares. Your proportionate interest in Parent will not change as a result of the Distribution. For a more detailed description, see the section of this information statement entitled “The Separation and Distribution.” | ||

What is the Cum-Dividend Date for the Distribution? | The Cum-Dividend Date for the Distribution is June 20, 2025. | ||

When will the Distribution occur? | The Ex-Dividend Date is June 23, 2025. We expect that Company Shares will commence trading on a standalone basis on NYSE at 9:30 a.m., New York City time, and on SIX at 9:00 a.m., Zurich time, on the Ex-Dividend Date. If you hold your Parent Shares in book-entry form with a custodian bank or broker through SIX SIS, we expect that your bank or broker will credit your custody account with the number of Company Shares you are entitled to | ||

receive in the Distribution on or after the Ex-Dividend Date, at which time you should be able to commence trading your Company Shares. However, no assurance can be provided as to the timing of the Distribution or that all conditions to the Distribution will be satisfied. | |||

Is a shareholder vote required to approve the Spin-off? | Yes. Approval of certain matters required for the Distribution was sought, and obtained, from the holders of Parent Shares at the Holcim Annual General Meeting 2025. In connection with the Holcim Annual General Meeting 2025, Parent published the Holcim Shareholder Meeting Materials on April 14, 2025. The Holcim Shareholder Meeting Materials describe the procedures for voting Parent Shares and other details regarding the Holcim Annual General Meeting 2025. As a result, this information statement does not contain a proxy and is not intended to constitute solicitation material under the U.S. federal securities laws. | ||

What do shareholders need to do to participate in the Distribution? | You will not be required to make any payment or surrender or exchange your Parent Shares or take any other action to receive Company Shares, except as described in “The Separation and Distribution—When and How You Will Receive Company Shares—Holders of Parent Shares in Physical Certificated Form” with respect to holders of physical certificates representing Parent Shares. However, you are urged to read this entire information statement carefully. | ||

Will you receive physical certificates representing Company Shares following the Spin-off? | No. All holders of physical certificates representing Parent Shares duly registered in the Parent Share Register (as defined in “The Separation and Distribution—Registration in the Company Share Register”) who have previously provided a valid mailing address to Parent will be sent a notice with instructions on how to receive Company Shares in the Distribution. See “The Separation and Distribution—When and How You Will Receive Company Shares—Holders of Parent Shares in Physical Certificated Form.” | ||

How many Company Shares will you receive in the Distribution? | Each holder of Parent Shares (other than Parent) will receive one Company Share for each Parent Share held by such holder as of the close of business on the Cum-Dividend Date. Immediately following the Spin-off, we expect to have 566,875,513 Company Shares issued and approximately 552,735,960 Company Shares outstanding. See “The Separation and Distribution—Results of the Spin-off.” | ||

Will the Company issue fractional shares in the Distribution? | No. The Company will not issue fractional Company Shares in the Distribution. | ||

What are the conditions to the Distribution? | Under Swiss law and Parent’s articles of incorporation, the approval of holders of a majority of Parent Shares represented at the Holcim Annual General Meeting 2025 is required to effect the Distribution. The resolution proposed at the Holcim Annual General Meeting 2025, as set forth in the Holcim Shareholder Meeting Materials, requires that the following conditions are satisfied or waived by the Parent Board of Directors prior to consummation of the Distribution: • The SEC will have declared effective the registration statement of which this information statement is a part, and no stop order relating to the registration statement will be in effect, and no proceedings for that purpose will be pending before or threatened by the SEC. • NYSE will have approved the listing of Company Shares, and SIX will have approved the additional listing of Company Shares subject to technical deliverables as customarily required. • The registration statement, of which this information statement is a part, will have been approved by the SIX Prospectus Office for the purpose of | ||

the Swiss listing in accordance with Article 54 of the FinSA. • Parent will have received the Tax Opinion. • All actions, filings, permits, registrations and consents necessary or appropriate under applicable federal, state or other securities laws or “blue sky” laws and the rules and regulations thereunder will have been taken or made and, where applicable, become effective or accepted. • No order, injunction or decree issued by any court of competent jurisdiction or other legal restraint or prohibition preventing the consummation of the Separation, Distribution or any of the related transactions will be in effect, and no other event outside the control of Parent shall have occurred or failed to occur that prevents the consummation of the Spin-off. • No event or development shall have occurred or exist as of the Ex-Dividend Date that, in the reasonable judgment of the Parent Board of Directors, would result in the Separation, the Distribution or the other related transactions having a material adverse effect (including, but not limited to, material adverse tax consequences or risks) on Parent or its shareholders. Neither we nor Parent can assure you that any or all of these conditions will be satisfied. While the Parent Board of Directors does not currently intend to waive any of the conditions to the Distribution described in this information statement, the Parent Board of Directors may waive any conditions to the Distribution to the extent legally permissible if such waiver is, in the judgment of the Parent Board of Directors, in the best interest of Parent and its shareholders. | |||

Can Parent decide to cancel the Distribution even if all the conditions have been met? | No. Under Swiss law, the power and authority to authorize the distribution of a dividend falls within the sole competence of the shareholders of the relevant company acting pursuant to a shareholders’ meeting and may not be delegated to a company’s board of directors. The Distribution was approved by holders of a majority of Parent Shares represented at the Holcim Annual General Meeting 2025, and assuming the conditions to the Distribution set forth in the resolution of the Holcim Annual General Meeting 2025 are satisfied or waived by the Parent Board of Directors, Parent will be obligated to effect the Distribution. See “The Separation and Distribution—Conditions to the Distribution.” | ||

What if you want to sell your Parent Shares or Company Shares? | You should consult with your financial advisors, such as your stockbroker, bank or tax advisor. | ||

Will there be any “when-issued” trading of Company Shares or any “ex-distribution” trading of Parent Shares? | There will not be any trading of Company Shares on a “when-issued” basis or any “ex-distribution” trading of Parent Shares before the Ex-Dividend Date. This means that Company Shares will not trade separately from Parent Shares prior to the Ex-Dividend Date and any Parent Shares purchased or sold up to the close of business on the Cum-Dividend Date will include the right to receive Company Shares in the Distribution. See “The Separation and Distribution—No When-Issued Trading or Ex-Distribution Trading.” | ||

Where will you be able to trade Company Shares? | We have received approval to list Company Shares on NYSE under the symbol “AMRZ.” We have also received approval to list Company Shares on SIX subject to technical deliverables as customarily required. We expect that Company Shares will commence trading on a standalone basis on NYSE at 9:30 a.m., New York City time, and on SIX at 9:00 a.m., Zurich time, on the Ex-Dividend Date. | ||

In which currency will the Company Shares trade? | Company Shares will trade in U.S. dollars on NYSE and in Swiss francs on SIX. You are free to choose to trade Company Shares on either stock exchange in the respective currency, subject to the arrangements with your bank or broker. | ||

What will happen to the listing of Parent Shares? | Parent Shares will continue to trade on SIX under the symbol “HOLN.” | ||

Will the number of Parent Shares that you own change as a result of the Distribution? | No. The number of Parent Shares that you own will not change as a result of the Distribution. | ||

What are the U.S. federal income tax consequences of the Spin-off? | So long as the Distribution, together with certain internal reorganization transactions undertaken in anticipation of the Distribution, qualifies as a tax-free transaction under Section 355, Section 368(a)(1)(D) and related provisions of the Internal Revenue Code, no gain or loss will be recognized by you for U.S. federal income tax purposes, and no amount will be included in your income for U.S. federal income tax purposes, upon the receipt of Company Shares pursuant to the Distribution. Parent has requested and received the IRS Ruling. The IRS Ruling does not address all of the requirements relevant to the qualification of the Distribution, together with certain internal reorganization transactions undertaken in anticipation of the Distribution, as tax-free for U.S. federal income tax purposes. For more information regarding the potential U.S. federal income tax consequences to us, to Parent and to you, see the section of this information statement entitled “Material U.S. Federal Income Tax Consequences of the Distribution.” You should consult your tax advisor as to the particular consequences of the Distribution to you, including the applicability and effect of any U.S. federal, state and local, Swiss and any foreign, tax laws. | ||

What are the Swiss tax consequences of the Spin-off? | The Swiss Federal Tax Administration and the tax administration of the Canton of Zug have considered the tax consequences of the Separation, the Distribution and certain related transactions under applicable Swiss tax law and provided written confirmations that the Separation, the Distribution and certain related transactions generally qualify as a tax-neutral restructuring. Accordingly, as long as the conditions in the Swiss Tax Rulings are satisfied, the Distribution will not be subject to Swiss withholding tax and should generally be tax-neutral for the purposes of Swiss federal, cantonal and communal income tax. See “Material Swiss Tax Consequences of the Spin-off—Swiss Withholding Tax” and “Material Swiss Tax Consequences of the Spin-off—Swiss Income Taxes.” | ||

What are the material state or local income tax consequences of the Distribution? | Neither the Tax Opinion nor the IRS Ruling addresses the state or local income tax consequences of the Distribution. You should consult your tax advisor about the particular state and local tax consequences of the Distribution to you, which consequences may differ from those described in the sections of this information statement entitled “Material U.S. Federal Income Tax Consequences of the Distribution” and “Material Swiss Tax Consequences of the Spin-off.” Neither the Tax Opinion nor the IRS Ruling addresses any tax consequences of the Distribution other than U.S. federal income tax consequences. | ||

How will you determine your tax basis in the Company Shares you receive in the Distribution? | Assuming that the Distribution is tax-free to holders of Parent Shares for U.S. federal income tax purposes, your aggregate tax basis for U.S. federal income tax purposes in your Parent Shares held by you immediately prior to the Distribution will be allocated between your Parent Shares and Company Shares that you receive in the Distribution in proportion to the relative fair market values of each immediately following the Distribution. Holcim will provide you with | ||

information to enable you to compute your tax basis in both Parent Shares and Company Shares. This information will be posted on Holcim’s website following the Ex-Dividend Date. You should consult your tax advisor about the particular consequences of the Spin-off to you, including a situation where you have purchased Parent Shares at different times or for different amounts and the application of state, local, Swiss and other foreign tax laws. For a more detailed description, see the sections of this information statement entitled “Material U.S. Federal Income Tax Consequences of the Distribution.” | |||

What will our relationship be with Holcim following the Spin-off? | Following the completion of the Spin-off, Parent and the Company will be independent, publicly traded companies. Parent will not own any Company Shares, and we expect that the relationship between Amrize and Holcim will be governed by, among others, a Separation and Distribution Agreement and Ancillary Agreements. These agreements will provide for the allocation between us and Holcim of Holcim’s and our assets, employees, liabilities and obligations (including with respect to employee benefits and tax-related assets and liabilities) attributable to periods prior to, at and after the Spin-off, and govern the relationship between Amrize and Holcim for certain commercial matters (including manufacturing, supply and insurance) following the Spin-off. For additional information regarding these agreements, see the sections of this information statement entitled “Risk Factors—Risks Relating to the Spin-off” and “Certain Relationships and Related Person Transactions.” | ||

Will you have appraisal rights in connection with the Distribution? | No. Holders of Parent Shares are not entitled to appraisal rights in connection with the Distribution. | ||

Are there risks associated with owning Company Shares? | Yes. Ownership of Company Shares is subject to both general and specific risks relating to the Amrize Business, the industry in which we operate, our ongoing contractual relationships with Holcim and our status as an independent, publicly traded company. Ownership of Company Shares is also subject to risks relating to the Spin-off, including that following the Spin-off, the Amrize Business will be less diversified than Holcim’s business prior to the Spin-off. These risks are described in the section of this information statement entitled “Risk Factors.” You are encouraged to read that section carefully. | ||

Who will manage Amrize after the Spin-off? | Following the Spin-off, we will be led by Jan Philipp Jenisch, who will be our Chief Executive Officer and Chairman. For more information regarding our expected executive officers and other members of our management team, see the section of this information statement entitled “Management.” | ||

What will Amrize’s dividend policy be after the Spin-off? | While we expect to pay dividends, it will (within the boundaries of Swiss law) fall within the discretion of our Board of Directors to propose to shareholders the timing and amount of any future dividends on Company Shares. There can be no assurance that we will pay or declare dividends in the future. See “Dividend Policy.” | ||

What will happen to Parent Equity Awards in connection with the Spin-off? | The Employee Matters Agreement (as defined in “Certain Relationships and Related Person Transactions”) will provide for the treatment of performance-based restricted share units (“PSUs”) and performance-based vesting stock options (“PSOs”) that are outstanding on the Ex-Dividend Date. For each holder of PSUs granted under Parent’s Performance Share Plan (“Parent PSUs”) and PSOs granted under Parent’s Share Option Plan (“Parent PSOs” and, together | ||

with Parent PSUs, “Parent Equity Awards”), the intent is to maintain the economic value of that holder’s Parent Equity Awards before and after the Ex-Dividend Date. For individuals employed by Amrize on the Ex-Dividend Date (“Amrize Employees”), the Parent Equity Awards will be converted into equity awards denominated in Company Shares. For individuals employed by Parent or any of its affiliates (excluding the Company and its subsidiaries) on the Ex-Dividend Date, the Parent Equity Awards will remain Parent Equity Awards, except that certain changes to the evaluation of the performance-based vesting conditions will apply from and after the Ex-Dividend Date. See “The Separation and Distribution—Treatment of Parent Equity Awards.” | |||

Will the Distribution affect the market price of Parent Shares? | As a result of the Distribution, we expect the trading price of Parent Shares to be different from the trading price of Parent Shares immediately prior to the Distribution because the trading price of Parent Shares will no longer reflect the combined value of the businesses. Furthermore, until the market has fully analyzed the value of Parent without the Amrize Business, the price of Parent Shares may fluctuate. There can be no assurance that, following the Spin-off, the combined value of Parent Shares and Company Shares (adjusting for the Distribution Ratio) will equal or exceed what the value of Parent Shares would have been in the absence of the Distribution. | ||

Will Amrize incur any debt prior to or at the time of the Distribution? | Yes. In connection with the Spin-off, we have entered into certain financing arrangements including a revolving credit facility, a bridge loan facility, a commercial paper program and bond issuances. For more information, see “The Separation and Distribution—Debt Financing Transactions” and “Description of Certain Indebtedness.” We have also launched a series of debt-for-debt exchange offers. See “Description of Certain Indebtedness—Debt-for-Debt Exchange Offers.” There is no certainty that we will be able to consummate the debt-for-debt exchange offers prior to the completion of the Spin-off, or at all, or the extent to which holders of the subject debt securities will tender such securities. | ||

Who will be the transfer agent and registrar for Company Shares? | UBS AG will serve as the Swiss settlement agent in connection with the Distribution. Computershare Trust Company, N.A. (“Computershare USA”) will serve as the transfer agent and registrar for Company Shares following the Distribution. For questions relating to Company Shares after the Distribution, you should contact the transfer agent and registrar at: Computershare Trust Company, N.A. 150 Royall St Canton, MA 02021 Phone: +1 (877) 373-6374 Website: www-us.computershare.com/investor/contact | ||

Where can you find more information about Holcim and us? | If you have any questions relating to Parent, you should contact: Holcim Investor Relations General Inquiries Grafenauweg 10, 6300 Zug, Switzerland | ||

Phone: +41 (0) 58 858 87 87 Email: investor.relations@holcim.com Website: https://www.holcim.com/investors | |||

After the Distribution, our shareholders who have any questions relating to us should contact us through any means set forth below, or at the phone numbers or email addresses posted on our website: www.amrize.com. | |||

Amrize Investor Relations 8700 W. Bryn Mawr Ave, Suite 300 Chicago, IL 60631 | |||

Phone: +1 (773) 355 4404 Email: northamerica.ir@holcim.com | |||

• | our business profile, market capitalization or capital allocation policies may not fit the investment objectives of Parent’s current shareholders, causing a shift in our investor base; |

• | Company Shares may not be included in indices in which Parent Shares are included and may not be included in U.S. indices such as the Standard and Poor’s 500 or the Russell 1000 Index, causing certain holders to sell their shares; |

• | the failure of securities analysts to regularly publish reports on Company Shares after the Distribution; |

• | the localization of the trading of Company Shares on either NYSE or SIX; |

• | actual or anticipated fluctuations in our operating results; |

• | changes in earnings estimates by securities analysts or our ability to meet those estimates; |

• | our ability to meet our forward looking guidance; |

• | the operating and share price performance of other comparable companies; |

• | overall market fluctuations and domestic and worldwide economic conditions; |

• | regulatory or legal developments in the United States, Switzerland and other countries; |

• | changes in tax laws; and |

• | other factors described in these “Risk Factors” and elsewhere in this information statement. |

• | prepare and distribute periodic reports, proxy statements and other shareholder communications in compliance with the U.S. federal securities laws and rules as well as Swiss laws and SIX requirements; |

• | have our own Board of Directors and committees thereof, which comply with U.S. federal securities laws and rules and NYSE requirements, as well as Swiss corporate law; |

• | maintain an internal audit function; |

• | institute our own financial reporting and disclosure compliance functions; |

• | institute our own non-financial reporting and disclosure compliance functions; |

• | establish an investor relations function; and |

• | establish internal policies, including those relating to trading in our securities and disclosure controls and procedures. |

• | greater strategic focus of financial resources and management’s efforts; |

• | direct and differentiated access to capital resources; |

• | value creation by offering separate investment opportunities; |

• | improved ability to use stock as an acquisition currency; and |

• | improved management incentive tools. |

• | requiring a substantial portion of our cash flow from operations to make interest payments on this debt; |

• | making it more difficult for us to satisfy debt and other obligations; |

• | increasing the risk of a future credit ratings downgrade of our debt, which could increase future debt costs and limit the future availability of debt financing; |

• | increasing our vulnerability to general adverse economic and industry conditions; |

• | reducing the cash flow available to fund capital expenditures and grow our business; |

• | limiting our flexibility in planning for, or reacting to, changes in our business and industry; |

• | placing us at a competitive disadvantage relative to our competitors that may not be as highly leveraged with debt; and |

• | limiting our ability to pay cash dividends or repurchase Company Shares. |

• | Greater strategic focus of financial resources and management’s efforts. The Amrize Business historically exhibited different financial and operating characteristics than the Holcim Business. In particular, unlike the Holcim Business, we generate substantially all of our revenues from the United States and Canada. Owing to this and other factors, we and Holcim’s other businesses employ different capital expenditure and acquisition strategies. Consequently, Parent has determined that its current structure may not be optimized to design and implement the distinct strategies necessary to operate its businesses in a manner that maximizes the long-term value of each business. The Company and Parent believe that our respective management resources would be more efficiently utilized if Parent’s management concentrated solely on the Holcim Business and our management concentrated solely on the Amrize Business. The Spin-off will result in dedicated, independent management for each of the businesses and enable the respective management teams to adopt strategies and pursue objectives specific to their respective businesses and better focus on both strengthening their respective core businesses and operations and unlocking new growth opportunities. Both Parent and we expect to more efficiently use management and financial resources as a result of having board and management teams solely focused on our respective businesses. We believe the Spin-off will allow us to better align our management’s attention, compensation and resources to pursue opportunities for long-term growth in the markets that we serve and to manage our cost structure more actively. Parent similarly expects to benefit from its management’s ability to focus on the operation of its businesses. |

• | Direct and differentiated access to capital resources. After the Spin-off, we will no longer need to compete with other businesses conducted by Holcim for capital resources. As a business with operations in the Amrize Territories, the Amrize Business has financial and operating characteristics that differ from the Holcim Business. The Company and Parent believe that direct and differentiated access to capital resources will allow us to better optimize the amounts and terms of the capital needed for our respective businesses, aligning financial and operational characteristics with investor and market expectations applicable to |

• | Value creation by offering separate investment opportunities. The Separation will result in two more focused businesses with different strategies that are more aligned with the markets in which they operate. We believe that after the Spin-off, investors will be better positioned to evaluate our financial performance and strategy within the context of our markets and peer groups, and that the ability to value us against a comparable peer set will enhance the likelihood that we achieve an appropriate market valuation. Parent’s management and financial advisors believe that our investment characteristics may appeal to types of investors who differ from Parent’s current investors. We expect that, as a result of the Spin-off, our management will be better positioned to target these investors by implementing goals and evaluating strategic opportunities in light of investor expectations within the context of the markets we serve. |

• | Improved ability to use stock as an acquisition currency. The Spin-off will provide each of Parent and Amrize with its own distinct equity currency that relates solely to its business to use in pursuing certain financial and strategic objectives, including acquisitions. For example, each of Parent and Amrize will be able to pursue strategic acquisitions in which potential sellers would prefer equity or to raise cash by issuing equity to public or private investors. We expect that we will be able to more easily facilitate potential future transactions with similar businesses through the use of Company Shares as consideration. |

• | Improved management incentives, recruitment and retention. We expect to use our equity to compensate current and future employees. It is more difficult for conglomerates such as Holcim to structure equity incentives that reward managers in a manner directly related to the performance of their geographic and product lines. By granting stock linked to a specific business, we will be able to better align our equity compensation structures and targets with the underlying business, thus offering our managers equity compensation that is linked more directly to their work product than Holcim’s current equity compensation. The Company and Parent believe that improved alignment of equity incentives will allow each of Parent and Amrize to more effectively recruit, retain and motivate employees. |

• | Potential costs and disruptions to the Amrize Business as a result of the Spin-off. Some of our current and prospective customers and suppliers may believe that our financial stability on an independent basis does not satisfy their requirements for doing business with us. If our customers, prospective customers or suppliers are not satisfied with our financial stability, we may not be successful in acquiring new business or retaining existing business. |

• | Risks of being unable to achieve the benefits expected from the Spin-off. By separating from Holcim, we may become more susceptible to, among other things, market fluctuations and other adverse events; actual or anticipated fluctuations in our operating results due to factors related to the Amrize Business; and competitive pressures from new or existing competitors. |

• | Increased significance of certain costs and contingent liabilities. Certain costs and contingent liabilities that were less material to Holcim as a whole will be more material for us as an independent company. |

• | The decreased capital available for investment. We have relied upon Holcim for working capital requirements and other cash requirements. Subsequent to the Spin-off, Holcim will not be providing us with funds to finance our working capital or other cash requirements. Given our smaller size relative to Holcim prior to the Spin-off, our access to and cost of debt financing after the Spin-off may be different from our access to and cost of debt financing as a part of Holcim. See “Risk Factors—Risks Relating to the Spin-off—After the Spin-off, we will not be able to rely on the earnings, assets or cash flows of Holcim and Holcim will not provide funds to finance our working capital or other cash requirements, which may impact the interest rate charged to us on debt financings, the amounts of indebtedness, types of financing structures and debt markets that may be available to us, and our ability to make payments on and to refinance any indebtedness.” |

• | The reaction of Parent’s shareholders to the Spin-off. The market price of Company Shares may fluctuate widely, depending on many factors, many of which will be beyond our control, including the sale of Company Shares by Parent shareholders after the Spin-off because our business profile and market capitalization may not fit their investment objectives. See “Risk Factors—Risks Relating to the Ownership of Company Shares—Any sales of substantial amounts of Company Shares in the public market, or the perception that such sales might occur, may cause the market price of Company Shares to decline.” |

• | The potential loss of purchasing power and higher cost structure. As a part of Holcim prior to the Spin-off, we take advantage of Holcim’s size and purchasing power in procuring certain goods, services and other resources. After the Spin-off, as a separate, independent, publicly traded company, we may be unable to obtain such resources at prices or on terms as favorable to us as those we obtained prior to the Spin-off. Our costs for functions previously performed by or paid for by Holcim, such as accounting, tax, legal, human resources and other general and administrative functions, may be higher than the amounts reflected in our financial statements, which could cause our profitability to decrease. See “Risk Factors—Risks Relating to the Spin-off—We have no history operating as an independent, publicly traded company, and our financial information in this information statement is not necessarily representative of the results that we would have achieved as a separate, publicly traded company and therefore may not be a reliable indicator of our future results.” |

• | The risk that the Spin-off might not be completed or not be completed within the envisaged time frame and the non-recurring and recurring costs of the Spin-off may be greater than we expected. There are risks and uncertainties relating to the execution of the Spin-off, including the timing and certainty of the completion of the Separation and the timing and certainty of the satisfaction or waiver of the conditions to the Distribution. See “Risk Factors—Risks Relating to the Spin-off—The Spin-off might not be completed or not be completed within the envisaged time frame and the non-recurring and recurring costs of the Spin-off may be greater than we expected.” In addition, we will incur substantial costs in connection with the transition to being an independent publicly traded company. See “Risk Factors—Risks Relating to the Ownership of Company Shares—The obligations associated with being a standalone public company will require significant resources and management attention.” These costs, whether incurred before or after the Spin-off, may be greater than anticipated and could have a negative effect on our financial position, results of operations and cash flows. |

• | The risk that the Spin-off or any of the related transactions may not qualify as tax-free transactions for U.S. federal income tax purposes or as a tax-neutral restructuring for Swiss tax purposes. If the Separation, Distribution or any of the related transactions is determined to be taxable for U.S. federal income tax purposes and/or Swiss tax purposes, a holder of Parent Shares that has received Company Shares in the Distribution could incur significant U.S. federal and/or Swiss income tax liabilities. Further, we and Holcim could incur significant U.S. federal income tax, Swiss corporate income tax, Swiss withholding tax, Swiss stamp duty and capital tax obligations, whether under applicable law or under the Tax Matters Agreement. See “Material U.S. Federal Income Tax Consequences of the Distribution” and “Material Swiss Tax Consequences of the Spin-off.” |

• | The SEC will have declared effective the registration statement of which this information statement is a part, and no stop order relating to the registration statement will be in effect, and no proceedings for that purpose will be pending before or threatened by the SEC. |

• | NYSE will have approved the listing of Company Shares, and SIX will have approved the additional listing of Company Shares subject to technical deliverables as customarily required. |

• | The registration statement, of which this information statement is a part, will have been approved by the SIX Prospectus Office for the purpose of the Swiss listing in accordance with Article 54 of the FinSA. |

• | Parent will have received the Tax Opinion. |

• | All actions, filings, permits, registrations and consents necessary or appropriate under applicable federal, state or other securities laws or “blue sky” laws and the rules and regulations thereunder with respect to the Company will have been taken or made and, where applicable, become effective or accepted. |

• | No order, injunction or decree issued by any court or governmental authority of competent jurisdiction or other legal restraint or prohibition preventing the consummation of the Separation, Distribution or any of the related transactions will be in effect, and no other event outside the control of Parent shall have occurred or failed to occur that prevents the consummation of the Spin-off. |

• | No event or development shall have occurred or exist as of the Ex-Dividend Date that, in the reasonable judgment of the Parent Board of Directors, would result in the Separation, the Distribution or the other related transactions having a material adverse effect (including, but not limited to, material adverse tax consequences or risks) on Parent or its shareholders. |

• | Cycle 2025 PSUs will be converted into a number of PSUs denominated in Company Shares having an equivalent value assuming target levels of performance. |

• | The performance goals applicable to the portion of the three-year performance cycle on and after the Ex-Dividend Date will be reset in connection with the Ex-Dividend Date (based on a continuation of the performance goals relative to the pro forma starting financials for the Amrize Business). |

• | The satisfaction of performance-based vesting conditions will be evaluated at the end of the three-year performance cycle using a weighted average of (i) the performance achieved by the combined Holcim Business and Amrize Business for the portion of the three-year performance cycle prior to the Ex-Dividend Date and (ii) the performance achieved by just the Amrize Business for the portion of such performance cycle on and after the Ex-Dividend Date. |

• | Cycle 2026 PSUs will be converted into a number of PSUs denominated in Company Shares having an equivalent value assuming target levels of performance. |

• | New performance goals applicable to the entire three-year performance cycle will be established in connection with the Ex-Dividend Date (with such goals being set relative to the pro forma starting financials of the Amrize Business from the beginning of the three-year performance period, and using goal-setting principles that are similar to those which were previously established for the Cycle 2026 PSUs (based on a continuation of the performance goals relative to the pro forma starting financials for the Amrize Business) |

• | The satisfaction of performance-based vesting conditions will be evaluated at the end of 2026. |

• | Parent PSOs which have performance cycles in progress as of the Ex-Dividend Date will be converted into a number of PSOs denominated in Company Shares having an equivalent value assuming attainment of the applicable performance metrics at (x) the maximum level of performance for those PSOs that remain subject to the attainment of performance metrics immediately prior to the Ex-Dividend Date or (y) the actual level of performance for those PSOs that are no longer subject to the attainment of performance metrics immediately prior to the Ex-Dividend Date. |

• | At or prior to the Ex-Dividend Date, Parent’s total shareholder return for the portion of such PSO’s performance cycle prior to the Ex-Dividend Date will be used to calculate performance against the original comparator group during such portion of the performance cycle. |

• | As of the Ex-Dividend Date, the value of the Holcim Business will be treated as a reinvested dividend for purposes of determining the Company’s total shareholder return (the “Reinvested Holcim Business Dividend”). |

• | The Company’s actual total shareholder return during the portion of such PSO’s performance cycle on and after the Ex-Dividend Date (including the Reinvested Holcim Business Dividend) will be used to calculate performance against the original comparator group during such portion, and to determine the final number of PSOs earned. |

• | an individual who is a citizen or a resident of the United States; |

• | a corporation, or other entity taxable as a corporation for U.S. federal income tax purposes, created or organized under the laws of the United States or any state thereof or the District of Columbia; |

• | an estate, the income of which is subject to U.S. federal income taxation regardless of its source; or |

• | a trust, if (i) a court within the United States is able to exercise primary supervision over the administration of the trust and one or more U.S. persons have the authority to control all substantial decisions of the trust, or (ii) the trust has a valid election in effect to be treated as a U.S. person. |

• | brokers, dealers or traders in securities or currencies; |

• | tax-exempt entities; |

• | regulated investment companies or real estate investment trusts; |

• | banks, financial institutions or insurance companies; |

• | persons who acquired Parent Shares pursuant to the exercise of employee stock options or otherwise as compensation; |

• | shareholders who own, or are deemed to own, at least 10% or more, by voting power or value, of Parent equity; |

• | shareholders owning Parent Shares as part of a position in a straddle or as part of a hedging, conversion or other risk reduction transaction for U.S. federal income tax purposes; |

• | taxpayers subject to special tax accounting rules; |

• | certain former citizens or long-term residents of the United States; |

• | holders who are subject to the alternative minimum tax; or |

• | persons that own Parent Shares through partnerships or other pass-through entities. |

• | a U.S. Holder will not recognize any income, gain or loss as a result of the receipt of Company Shares in the Distribution; |

• | a U.S. Holder’s holding period for Company Shares received in the Distribution will include the period for which such U.S. Holder’s Parent Shares were held; and |

• | a U.S. Holder’s aggregate tax basis for Company Shares received in the Distribution will be determined by allocating to such Company Shares, on the basis of the relative fair market values of Company Shares and Parent Shares at the time of the Distribution, a portion of the U.S. Holder’s tax basis in its Parent Shares. A U.S. Holder’s tax basis in its Parent Shares will be decreased by the portion allocated to Company Shares. |

• | a Swiss tax resident individual who holds Parent Shares as private assets; |

• | a Swiss tax resident individual or a non-Swiss tax resident individual who is subject to Swiss income tax for reasons other than residency, who holds Parent Shares as business assets or qualifies as a professional securities dealer for Swiss tax purposes; or |

• | a legal entity tax resident in Switzerland or a non-Swiss tax resident legal entity who holds Parent Shares as part of a Swiss permanent establishment or fixed place of business. |

• | tax-exempt entities; |

• | banks, financial institutions or insurance companies; |

• | persons who acquired Parent Shares pursuant to an employment share plan or otherwise as compensation; or |

• | persons who own Parent Shares through partnerships or other pass-through entities. |

• | on a historical basis as reflected in our unaudited historical condensed combined financial statements included elsewhere in this information statement; and |

• | on a pro forma basis to give effect to the adjustments described in the section of this information statement entitled “Unaudited Pro Forma Condensed Combined Financial Information.” |

As of March 31, 2025 | ||||||

Historical | Pro Forma | |||||

(In millions) | ||||||

Cash and cash equivalents(1) | $574 | $40 | ||||

Debt(1) | ||||||

Current portion of long-term debt | 5 | 5 | ||||

Current portion of related-party notes payable | 122 | — | ||||

Long-term debt | 981 | 5,036 | ||||

Related-party notes payable | 7,540 | — | ||||

Equity | ||||||

Company Shares | — | 6 | ||||

Additional paid-in capital | — | 13,051 | ||||

Net parent investment | 10,339 | — | ||||

Accumulated other comprehensive loss | (589) | (589) | ||||

Total Equity attributable to the Company | 9,750 | 12,468 | ||||

Total capitalization | $18,398 | $17,509 | ||||

(1) | The pro forma figures reflect incurrence of indebtedness through the issuance of Senior Unsecured Notes and the expected incurrence of indebtedness through the Debt-for-Debt Exchange Offers and the USPP Debt Assumption. In April 2025, we issued Senior Unsecured Notes in an aggregate principal amount of $3.4 billion. On May 19, 2025, we launched the Debt-for-Debt Exchange Offers pursuant to which we are offering to exchange certain outstanding series of senior bonds issued by subsidiaries of Parent for new senior bonds of a corresponding series issued by FinanceCo with the same interest rate, interest payment dates and maturity date. We also expect FinanceCo and the Company to undertake the USPP Debt Assumption, pursuant to which FinanceCo and the Company will assume the rights and obligations (as the new issuer and guarantor, respectively) of $50.0 million of bonds due in 2031 issued by a subsidiary of Parent. We assume for purposes of this table the Debt-for-Debt Exchange Offers and the USPP Debt Assumption will result in the issuance by FinanceCo of approximately $1.7 billion aggregate principal amount of senior bonds. In addition, in March 2025, we entered into the Revolving Credit Facility with commitments of $2.0 billion and the Bridge Loan with commitments of $5.1 billion (which was permanently reduced to $1.7 billion on April 8, 2025). The Revolving Credit Facility cannot be drawn prior to the completion of the Spin-off, while the Bridge Loan is not expected to be utilized. The Bridge Loan will be terminated if the Spin-off is consummated without any amounts being drawn. We expect that the Debt-for-Debt Exchange Offers and the USPP Debt Assumption will be completed prior to the consummation of the Distribution. However, no assurance can be given whether these transactions will occur in the anticipated time frame on favorable terms, or at all. See “Description of Certain Indebtedness” and “Unaudited Pro Forma Combined Financial Information.” |

• | differences between our unaudited historical condensed combined balance sheet prepared on a carve-out basis and assets and liabilities expected to be contributed by Parent to us; |

• | the effect of our anticipated post-Separation capital structure, including (i) a share split changing the capital structure of the Company from 1,000 registered shares with a nominal amount (par value) of $1,000 per share to 100,000,000 Company Shares with a nominal amount (par value) of $0.01 per Company Share, (ii) an ordinary share capital increase of $4,668,755.13 with the issuance of 466,875,513 additional Company Shares, resulting in an aggregate of 566,875,513 issued Company Shares with a nominal amount (par value) of $0.01 per Company Share, (iii) the entry into the Revolving Credit Facility, the Bridge Loan and the Commercial Paper Program, (iv) the issuance of the Senior Unsecured Notes and (v) the Debt-for-Debt Exchange Offers and the USPP Debt Assumption; |

• | the non-recurring costs expected to be incurred as an autonomous entity that are specifically related to the Spin-off; |

• | the impact of the transactions contemplated by the agreements described under “Certain Relationships and Related Person Transactions—Agreements with Parent”; and |

• | other adjustments as described in the accompanying notes to the unaudited pro forma condensed combined financial statements. |

(In millions, except share data) | Historical | Transaction Accounting Adjustments | Notes | Autonomous Entity Adjustments | Notes | Pro Forma | ||||||||||||

Assets | ||||||||||||||||||

Current Assets: | ||||||||||||||||||

Cash and cash equivalents | $574 | $(534) | (a), (c) | $ — | $40 | |||||||||||||

Accounts receivable, net | 1,324 | 45 | (i) | — | 1,369 | |||||||||||||

Due from related-party | 45 | (45) | (i) | — | — | |||||||||||||

Inventories | 1,604 | — | — | 1,604 | ||||||||||||||

Related-party notes receivable | 359 | (359) | (a) | — | — | |||||||||||||

Prepaid expenses and other current assets | 209 | — | — | 209 | ||||||||||||||

Total current assets | 4,115 | (893) | — | 3,222 | ||||||||||||||

Property, plant and equipment, net | 7,567 | — | — | 7,567 | ||||||||||||||

Goodwill | 8,932 | — | — | 8,932 | ||||||||||||||

Intangible assets, net | 1,799 | — | — | 1,799 | ||||||||||||||

Operating lease right-of-use assets, net | 577 | — | — | 577 | ||||||||||||||

Other noncurrent assets | 204 | 5 | (e) | — | 209 | |||||||||||||

Total Assets | $23,194 | $(888) | $— | $22,306 | ||||||||||||||

Liabilities and Equity | ||||||||||||||||||

Current Liabilities: | ||||||||||||||||||

Accounts payable | $1,092 | $167 | (i) | $— | $1,259 | |||||||||||||

Due to related-party | 167 | (167) | (i) | — | — | |||||||||||||

Current portion of long-term debt | 5 | — | — | 5 | ||||||||||||||

Current portion of related-party notes payable | 122 | (122) | (a) | — | — | |||||||||||||

Operating lease liabilities | 150 | — | — | 150 | ||||||||||||||

Other current liabilities | 521 | — | — | 521 | ||||||||||||||

Total current liabilities | 2,057 | (122) | — | 1,935 | ||||||||||||||

Long-term debt | 981 | 4,055 | (a), (c) | — | 5,036 | |||||||||||||

Related-party notes payable | 7,540 | (7,540) | (a) | — | — | |||||||||||||

Deferred income tax liabilities | 937 | 1 | (e) | — | 938 | |||||||||||||

Noncurrent operating lease liabilities | 428 | — | — | 428 | ||||||||||||||

Other noncurrent liabilities | 1,501 | — | — | 1,501 | ||||||||||||||

Total Liabilities | 13,444 | (3,606) | — | 9,838 | ||||||||||||||

Commitments and contingencies | ||||||||||||||||||

Equity: | ||||||||||||||||||

Company Shares, $0.01 par value (566,875,513 issued and 552,735,960 outstanding) | — | 6 | (g) | — | 6 | |||||||||||||

Additional paid-in capital | — | 13,051 | (h), (e) | — | 13,051 | |||||||||||||

Net parent investment | 10,339 | (10,339) | (f) | — | — | |||||||||||||

Accumulated other comprehensive loss | (589) | — | — | (589) | ||||||||||||||

Total Equity attributable to the Company | 9,750 | 2,718 | — | 12,468 | ||||||||||||||

Noncontrolling interests | — | — | — | — | ||||||||||||||

Total Equity | 9,750 | 2,718 | — | 12,468 | ||||||||||||||

Total Liabilities and Equity | $23,194 | $(888) | $— | $22,306 | ||||||||||||||

(In millions, except per share data) | Historical | Transaction Accounting Adjustments | Notes | Autonomous Entity Adjustments | Notes | Pro Forma | |||||||||||||||

Revenues | $2,081 | $— | $— | $2,081 | |||||||||||||||||

Cost of revenues | (1,859) | — | — | (1,859) | |||||||||||||||||

Gross profit | 222 | — | — | 222 | |||||||||||||||||

Selling, general and administrative expenses | (239) | (5) | (e) | — | (k) | (244) | |||||||||||||||

Gain on disposal of long-lived assets | 1 | — | — | 1 | |||||||||||||||||

Operating loss | (16) | (5) | — | (21) | |||||||||||||||||

Interest expense, net | (118) | 47 | (b), (d) | — | (71) | ||||||||||||||||

Other non-operating income, net | 1 | — | — | 1 | |||||||||||||||||

Loss before income tax benefit and income from equity method investments | (133) | 42 | — | (91) | |||||||||||||||||

Income tax benefit | 46 | (10) | (j) | — | (l) | 36 | |||||||||||||||

Income from equity method investments | — | — | — | — | |||||||||||||||||

Net loss | (87) | 32 | — | (55) | |||||||||||||||||

Net loss attributable to noncontrolling interests | — | — | — | — | |||||||||||||||||

Net loss attributable to the Company | $(87) | $32 | $— | $(55) | |||||||||||||||||

Unaudited pro forma loss per Company Share | |||||||||||||||||||||

Basic | $(0.10) | (m) | |||||||||||||||||||

Diluted | $(0.10) | (n) | |||||||||||||||||||

Weighted-average number of Company Shares outstanding | |||||||||||||||||||||

Basic | 552.7 | (m) | |||||||||||||||||||

Diluted | 552.7 | (n) | |||||||||||||||||||

(In millions, except per share data) | Historical | Transaction Accounting Adjustments | Notes | Autonomous Entity Adjustments | Notes | Pro Forma | |||||||||||||||

Revenues | $11,704 | $— | $— | $ 11,704 | |||||||||||||||||

Cost of revenues | (8,634) | — | — | (8,634) | |||||||||||||||||

Gross profit | 3,070 | — | — | 3,070 | |||||||||||||||||

Selling, general and administrative expenses | (944) | (20) | (e) | (3) | (k) | (967) | |||||||||||||||

Gain on disposal of long-lived assets | 71 | — | — | 71 | |||||||||||||||||

Loss on impairments | (2) | — | — | (2) | |||||||||||||||||

Operating income | 2,195 | (20) | (3) | 2,172 | |||||||||||||||||

Interest expense, net | (512) | 213 | (b), (d) | — | (299) | ||||||||||||||||

Other non-operating expense, net | (55) | — | — | (55) | |||||||||||||||||

Income before income tax expense and income from equity method investments | 1,628 | 193 | (3) | 1,818 | |||||||||||||||||

Income tax expense | (368) | (47) | (j) | 1 | (l) | (414) | |||||||||||||||

Income from equity method investments | 13 | — | — | 13 | |||||||||||||||||

Net income | 1,273 | 146 | (2) | 1,417 | |||||||||||||||||

Net loss attributable to noncontrolling interests | 1 | — | — | 1 | |||||||||||||||||

Net income attributable to the Company | $1,274 | $146 | $(2) | $1,418 | |||||||||||||||||

Unaudited pro forma earnings per Company Share | |||||||||||||||||||||

Basic | $2.57 | (m) | |||||||||||||||||||

Diluted | $2.57 | (n) | |||||||||||||||||||

Weighted-average number of Company Shares outstanding | |||||||||||||||||||||

Basic | 552.7 | (m) | |||||||||||||||||||

Diluted | 552.7 | (n) | |||||||||||||||||||

(a) | Adjustment reflects the issuance of the Senior Unsecured Notes in April 2025 in an aggregate principal amount of $3.4 billion and related deductions for discounts and debt issuance costs of $13.0 million. The discounts and debt issuance costs will be amortized to Interest expense, net over the terms of the Senior Unsecured Notes and are reflected as a reduction to Long-term debt. The Senior Unsecured Notes have maturities ranging from two years to ten years with a weighted-average interest rate of approximately 4.96%, excluding debt issuance costs. See “Description of Certain Indebtedness—Senior Unsecured Notes.” |

(b) | In March 2025, we entered into the Revolving Credit Facility with commitments of $2.0 billion and the Bridge Loan with commitments of $5.1 billion (which was permanently reduced to $1.7 billion on April 8, 2025). Total debt issuance costs associated with the Revolving Credit Facility and Bridge Loan are recorded in Prepaid expenses and other current assets in our unaudited historical condensed combined balance sheet as of March 31, 2025. A pro forma adjustment has been recorded to Interest expense, net to reflect the impact of the amortization of debt issuance costs associated with the Revolving Credit Facility and Bridge Loan. The Revolving Credit Facility cannot be drawn prior to the completion of the Spin-off, while the Bridge Loan is not expected to be utilized. The Bridge Loan will be terminated if the Spin-off is consummated without any amounts being drawn. See “Description of Certain Indebtedness—Revolving Credit Facility” and “Description of Certain Indebtedness—Bridge Loan.” |

(c) | Prior to the completion of the Spin-off, we expect that FinanceCo, a future wholly owned subsidiary of the Company, will consummate the Debt-for-Debt Exchange Offers (as defined in “Description of Certain Indebtedness—Debt-for-Debt Exchange Offers”) pursuant to which it is offering to exchange certain outstanding series of senior bonds issued by subsidiaries of Parent for new senior bonds of a corresponding series with the same interest rate, interest payment dates and maturity date. See “Description of Certain Indebtedness—Debt-for-Debt Exchange Offers.” There is no certainty that we will be able to consummate the Debt-for-Debt Exchange Offers prior to the completion of the Spin-off, or at all, or the extent to which holders of the Original Exchange Notes (as defined in “Description of Certain Indebtedness—Debt-for-Debt Exchange Offers”) will tender such Original Exchange Notes. However, for illustrative purposes, we have assumed for purposes of the unaudited pro forma condensed combined financial statements that holders of 20% of each series of the Original Exchange Notes (except for the bonds due in 2033) will not accept the Debt-for-Debt Exchange Offers (and that holders of 80% of each series of the Original Exchange Notes (except for the bonds due in 2033) will accept the Debt-for-Debt Exchange Offers). We also expect FinanceCo and the Company to undertake the USPP Debt Assumption, pursuant to which FinanceCo and the Company will assume the rights and obligations (as the new issuer and guarantor, respectively) of $50.0 million of bonds due in 2031, originally issued by a subsidiary of Parent in a private placement transaction. For illustrative purposes, we have assumed that holders of 100% of the $50.0 million of bonds due in 2031 will consent to the USPP Debt Assumption. |

(In millions) | As of March 31, 2025 | ||

Issuance of the Senior Unsecured Notes net of discounts and debt issuance costs (refer to pro forma footnote (a)) | $3,387 | ||

Intercompany debt repayment (refer to pro forma footnote (a)) | (4,948) | ||

Receipt from settlement of cash pool (refer to pro forma footnote (a)) | 359 | ||

Cash proceeds from Debt-for-Debt Exchange Offers and USPP Debt Assumption, net of fees (refer to pro forma footnote (c)) | 668 | ||

Total pro forma adjustment to Cash and cash equivalents | $(534) | ||

(In millions) | As of March 31, 2025 | ||

Issuance of the Senior Unsecured Notes net of discounts and debt issuance costs (refer to pro forma footnote (a)) | $3,387 | ||

Long-term debt from Debt-for-Debt Exchange Offers and USPP Debt Assumption, net of fees (refer to pro forma footnote (c)) | 668 | ||

Total pro forma adjustment to Long-term debt | $4,055 | ||

(d) | Adjustment reflects estimated interest expense and amortization charges related to the treasury adjustments described in pro forma footnotes (a), (b) and (c) above. Interest expense was calculated assuming constant debt levels throughout the period. Assuming the treasury adjustments described in pro forma footnote (a) and pro forma footnote (b) remain constant, a 5% change to the assumed Debt-for-Debt Exchange Offer acceptance rate described in pro forma footnote (c) would change Interest expense, net by approximately $1.4 million and $5.5 million for the three months ended March 31, 2025 and the year ended December 31, 2024, respectively. |

(In millions) | For the three months ended March 31, 2025 | For the year ended December 31, 2024 | ||||

Interest expense on issuance of the Senior Unsecured Notes (refer to pro forma footnote (a)) | $(42) | $(169) | ||||

Amortization of discounts and deferred debt issuance costs related to issuance of the Senior Unsecured Notes (refer to pro forma footnote (a)) | (1) | (3) | ||||

Net interest expense on Debt-for-Debt Exchange Offers and USPP Debt Assumption (refer to pro forma footnote (c)) | (12) | (54) | ||||

Net amortization on Debt-for-Debt Exchange Offers and USPP Debt Assumption (refer to pro forma footnote (c)) | (1) | 4 | ||||

Interest expense on Revolving Credit Facility and Bridge Loan (refer to pro forma footnote (b)) | — | (2) | ||||

Amortization of debt issuance costs related to Revolving Credit Facility and Bridge Loan (refer to pro forma footnote (b)) | — | (2) | ||||

Interest expense on intercompany debt to be repaid or contributed by Parent as equity (refer to pro forma footnote (a)) | 108 | 454 | ||||

Interest income on intercompany debt to be contributed by Parent as equity (refer to pro forma footnote (a)) | (5) | (15) | ||||

Total pro forma adjustment to Interest expense, net | $47 | $213 | ||||

(e) | In connection with the completion of the Spin-off, Parent expects to transfer to the Company certain employees who historically operated within specific corporate functions of Parent. The unaudited historical condensed combined statement of operations for the three months ended March 31, 2025 and the audited historical combined statement of operations for the year ended December 31, 2024 included expense allocations for these employees. This adjustment reflects an incremental increase in costs of $5.1 million and $20.3 million recorded to Selling, general and administrative expenses for the three months ended March 31, 2025 and the year ended December 31, 2024, respectively, due to the Company bearing the full costs of these employees upon completion of the Spin-off. These costs primarily relate to salaries, bonuses, insurance and allowances. Current and noncurrent liabilities associated with these employee-related obligations as of March 31, 2025 are not expected to have a material impact on the unaudited pro forma condensed combined balance sheet. |

(f) | Adjustment reflects the reclassification of Parent’s net investment in Amrize to Additional paid-in capital. |

(g) | Immediately following the Spin-off, we expect to have 566,875,513 Company Shares issued. This calculation is based on 579,124,606 Parent Shares issued as of March 31, 2025, less 12,249,093 Parent Shares held in treasury and expected to be cancelled, all of which were purchased by Parent under the Parent share buyback program announced in March 2024 and completed in December 2024. We expect Parent to distribute approximately 552,735,960 Company Shares in the Distribution and we expect to have approximately 552,735,960 Company Shares outstanding immediately following the Spin-off. We anticipate the number of excess Company Shares not distributed in the Distribution, and therefore the number of Company Shares held by the Company in treasury following the Spin-off, to be approximately 14,139,553 Company Shares. Adjustment reflects the distribution of 552,735,960 Company Shares, with a nominal amount (par value) of $0.01 per share, pursuant to the Separation and Distribution Agreement. The actual number of Company Shares to be distributed will not be known until the Cum-Dividend Date and will depend on the number of Parent Shares outstanding as of the Cum-Dividend Date. |

(h) | The Additional paid-in capital adjustments are summarized below: |

(In millions) | As of March 31, 2025 | ||

Net parent investment reclassification (refer to pro forma footnote (f)) | $10,339 | ||

Net impact of employee obligations transferred to the Company (refer to pro forma footnote (e)) | 4 | ||

Company Share issuance (refer to pro forma footnote (g)) | (6) | ||

Net impact of issuance of the Senior Unsecured Notes and intercompany debt repayment (refer to pro forma footnote (a)) | 2,714 | ||

Total pro forma adjustment to Additional paid-in capital | $13,051 | ||