Shareholder Report

|

12 Months Ended |

|

Mar. 31, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

| Document Type |

N-CSR

|

| Amendment Flag |

false

|

| Registrant Name |

EUPAC Fund

|

| Entity Central Index Key |

0000719603

|

| Entity Investment Company Type |

N-1A

|

| Document Period End Date |

Mar. 31, 2025

|

| EuroPacific Growth Fund® - Class A [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

EuroPacific Growth Fund®

|

| Class Name |

Class A

|

| Trading Symbol |

AEPGX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about EuroPacific Growth Fund (the "fund") for the period from April 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-A (800) 421-4225 .

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the fund that occurred during the reporting period.

|

| Additional Information Phone Number |

(800) 421-4225

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-A

|

| Expenses [Text Block] |

What were the fund costs for the last year ? (based on a hypothetical $10,000 investment) Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | | Class A | $ 83 | 0.83 % |

|

| Expenses Paid, Amount |

$ 83

|

| Expense Ratio, Percent |

0.83%

|

| Factors Affecting Performance [Text Block] |

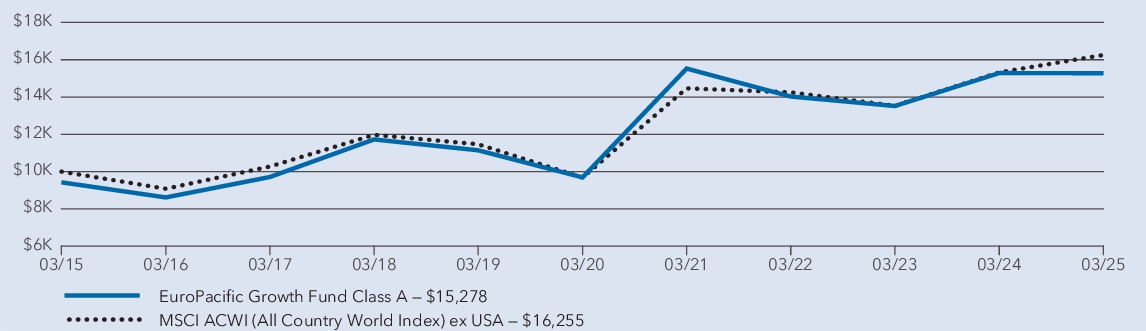

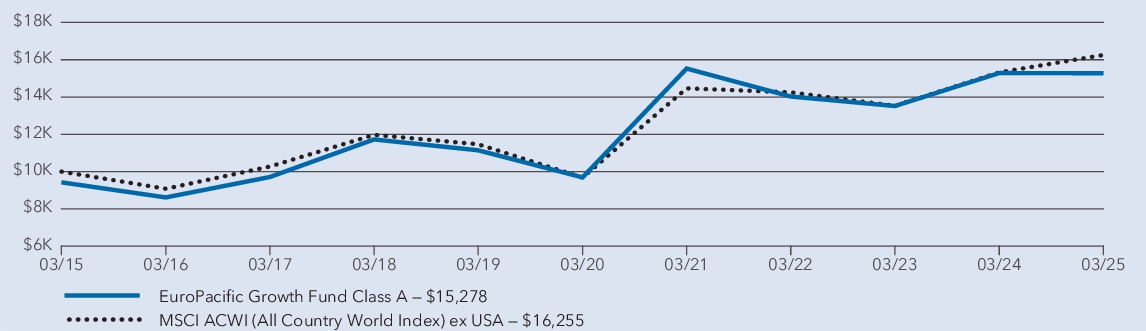

Management's discussion of fund performance The fund’s Class A shares lost 0.05% for the year ended March 31, 2025. That result compares with a 6.09% gain for the MSCI ACWI (All Country World Index) ex USA. For information on returns for additional periods, including the fund lifetime, please refer to capitalgroup.com/mutual-fund-returns-A . What factors influenced results European stocks rose, aided by looser monetary policy as economic growth remained sluggish. U.K. markets advanced amid slight growth in gross domestic product and persistent inflation. Japanese stocks fell modestly as economic growth remained frail and the Bank of Japan nudged up interest rates. Stocks in China surged, fueled by government stimulus and enthusiasm for the technology sector. India saw a slight positive return in a year marked by weakening economic growth. Holdings in most equity sectors produced positive returns for the fund, with communication services, financials and utilities particularly additive. Likewise, consumer staples, industrials and real estate saw returns surpassing those of the overall portfolio. Geographically, investments in companies based in the eurozone and the U.K. were significant contributors to absolute returns. Conversely, the fund’s holdings in the health care, energy and materials sectors detracted from returns. Likewise, holdings in Japan and other European regions had negative returns overall.

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a predictor of its future performance.

|

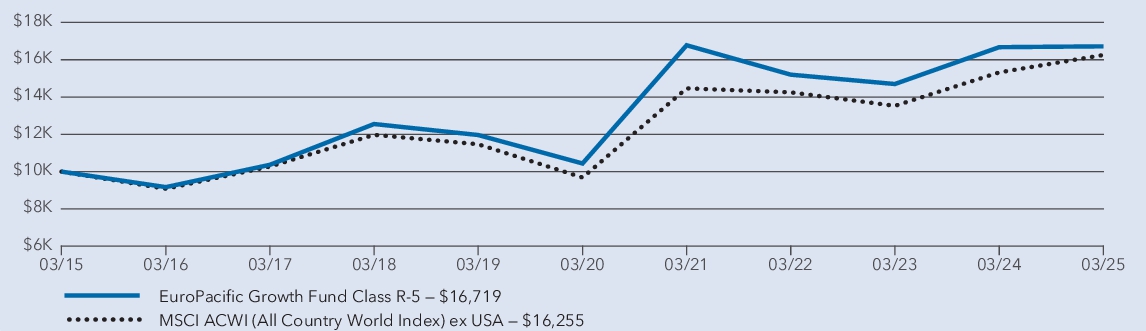

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average annual total returns | 1 year | 5 years | 10 years | | EuroPacific Growth Fund — Class A (with sales charge) | (5.80 ) % | 8.24 % | 4.33 % | | EuroPacific Growth Fund — Class A (without sales charge) | (0.05 ) % | 9.53 % | 4.95 % | | MSCI ACWI (All Country World Index) ex USA | 6.09 % | 10.92 % | 4.98 % |

* Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, results reflect fee waivers and/or expense reimbursements, without which they would have been lower. † Results assume all distributions are reinvested. Any market index shown is unmanaged, and therefore, has no expenses. Investors cannot invest directly in an index. Source(s): MSCI. |

| No Deduction of Taxes [Text Block] |

The line chart and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Material Change Date |

Apr. 01, 2024

|

| Net Assets |

$ 124,209,000,000

|

| Holdings Count | Holding |

342

|

| Advisory Fees Paid, Amount |

$ 561,000,000

|

| Investment Company, Portfolio Turnover |

35.00%

|

| Additional Fund Statistics [Text Block] |

| Fund net assets (in millions) | $ 124,209 | | Total number of portfolio holdings | 342 | | Total advisory fees paid (in millions) | $ 561 | | Portfolio turnover rate | 35 % |

|

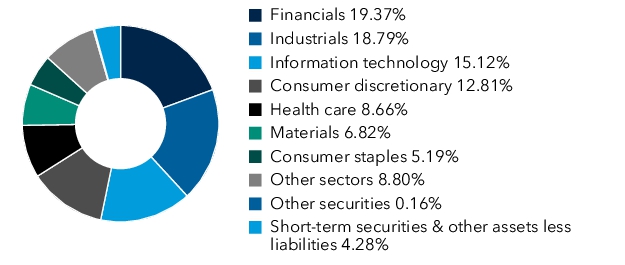

| Holdings [Text Block] |

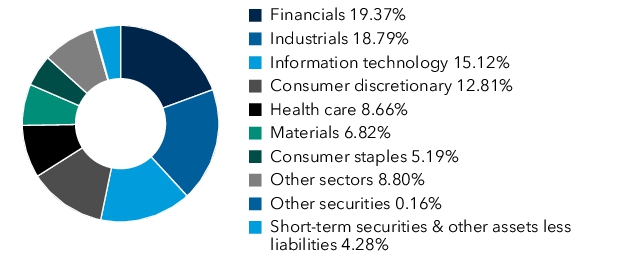

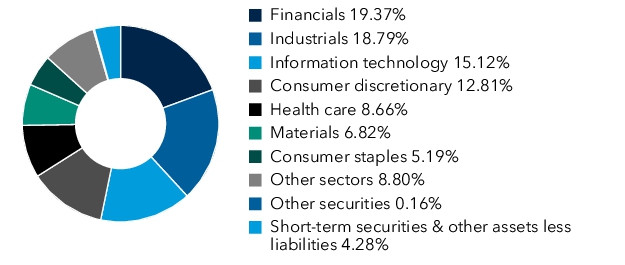

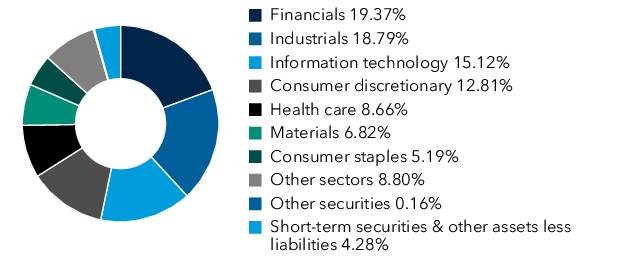

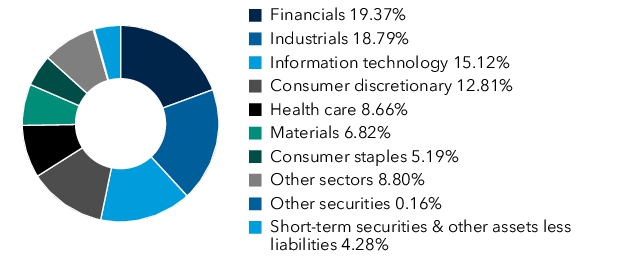

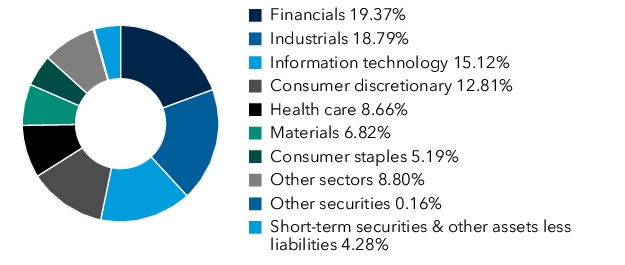

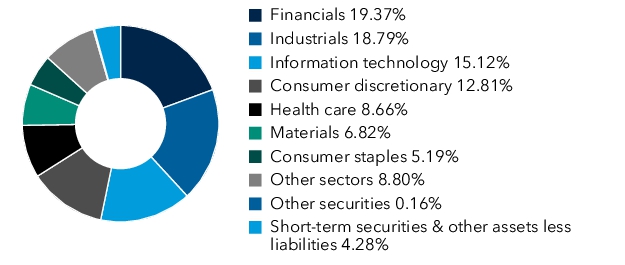

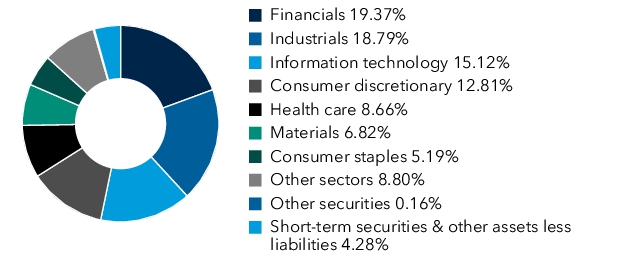

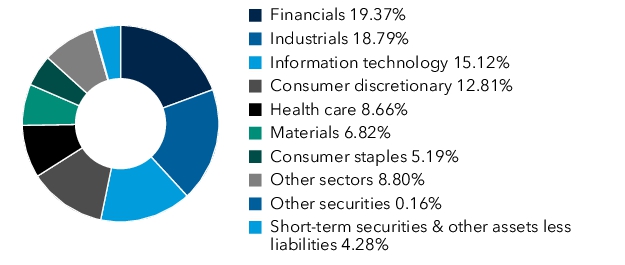

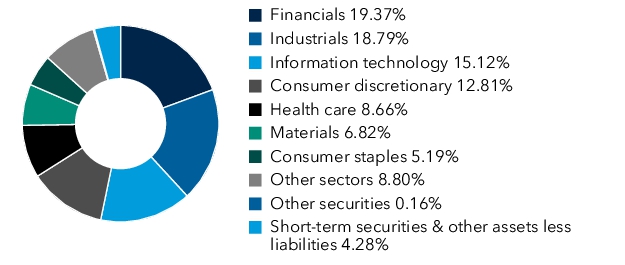

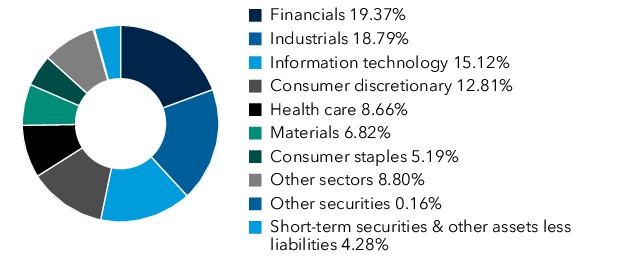

Portfolio holdings by sector (percent of net assets) |

| Material Fund Change [Text Block] |

This is a summary of certain changes to the fund since April 1, 2024. For more complete information, you may review the fund’s next prospectus, which we expect to be available by June 1, 2025 at capitalgroup.com/mutual-fund-literature-A or upon request at (800) 421-4225 . Effective June 1, 2025, the fund name is EUPAC Fund.

|

| Material Fund Change Name [Text Block] |

Effective June 1, 2025, the fund name is EUPAC Fund.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the fund since April 1, 2024. For more complete information, you may review the fund’s next prospectus, which we expect to be available by June 1, 2025 at capitalgroup.com/mutual-fund-literature-A (800) 421-4225 .

|

| Updated Prospectus Phone Number |

(800) 421-4225

|

| Updated Prospectus Web Address |

capitalgroup.com/mutual-fund-literature-A

|

| EuroPacific Growth Fund® - Class C [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

EuroPacific Growth Fund®

|

| Class Name |

Class C

|

| Trading Symbol |

AEPCX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about EuroPacific Growth Fund (the "fund") for the period from April 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-C (800) 421-4225 .

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the fund that occurred during the reporting period.

|

| Additional Information Phone Number |

(800) 421-4225

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-C

|

| Expenses [Text Block] |

What were the fund costs for the last year ? (based on a hypothetical $10,000 investment) Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | | Class C | $ 155 | 1.56 % |

|

| Expenses Paid, Amount |

$ 155

|

| Expense Ratio, Percent |

1.56%

|

| Factors Affecting Performance [Text Block] |

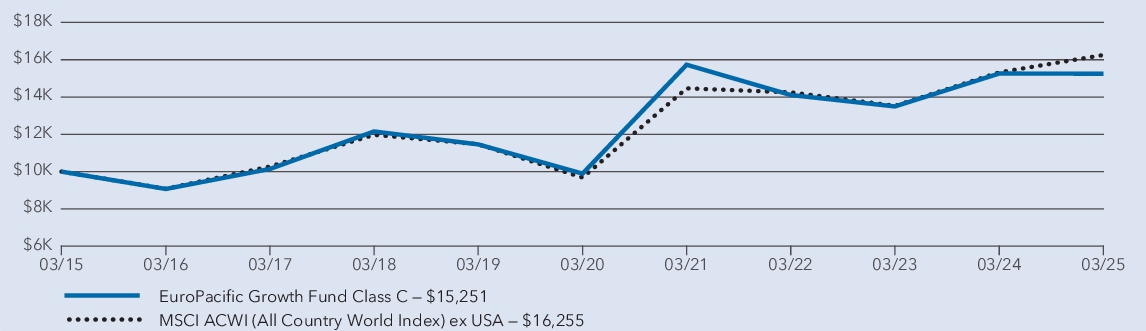

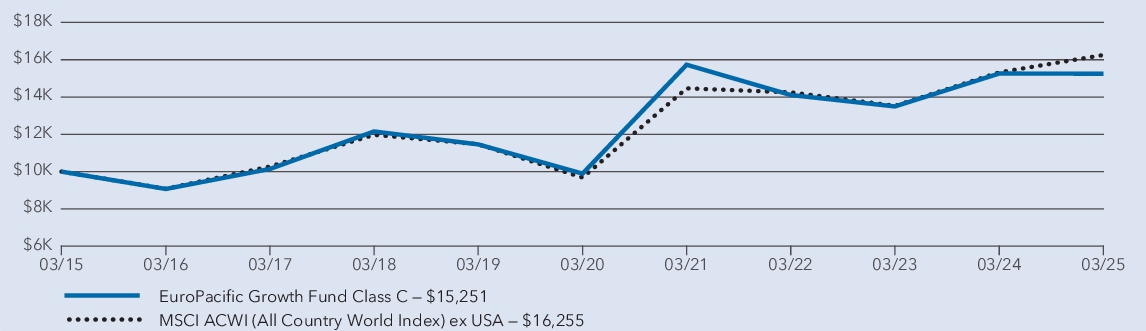

Management's discussion of fund performance The fund’s Class C shares lost 0.78% for the year ended March 31, 2025. That result compares with a 6.09% gain for the MSCI ACWI (All Country World Index) ex USA. For information on returns for additional periods, including the fund lifetime, please refer to capitalgroup.com/mutual-fund-returns-C . What factors influenced results European stocks rose, aided by looser monetary policy as economic growth remained sluggish. U.K. markets advanced amid slight growth in gross domestic product and persistent inflation. Japanese stocks fell modestly as economic growth remained frail and the Bank of Japan nudged up interest rates. Stocks in China surged, fueled by government stimulus and enthusiasm for the technology sector. India saw a slight positive return in a year marked by weakening economic growth. Holdings in most equity sectors produced positive returns for the fund, with communication services, financials and utilities particularly additive. Likewise, consumer staples, industrials and real estate saw returns surpassing those of the overall portfolio. Geographically, investments in companies based in the eurozone and the U.K. were significant contributors to absolute returns. Conversely, the fund’s holdings in the health care, energy and materials sectors detracted from returns. Likewise, holdings in Japan and other European regions had negative returns overall.

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a predictor of its future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average annual total returns | 1 year | 5 years | 10 years | | EuroPacific Growth Fund — Class C (with sales charge) | (1.71 ) % | 8.72 % | 4.31 % | | EuroPacific Growth Fund — Class C (without sales charge) | (0.78 ) % | 8.72 % | 4.31 % | | MSCI ACWI (All Country World Index) ex USA | 6.09 % | 10.92 % | 4.98 % |

* Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, results reflect fee waivers and/or expense reimbursements, without which they would have been lower. † Results assume all distributions are reinvested. Any market index shown is unmanaged, and therefore, has no expenses. Investors cannot invest directly in an index. Source(s): MSCI. |

| No Deduction of Taxes [Text Block] |

The line chart and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Material Change Date |

Apr. 01, 2024

|

| Net Assets |

$ 124,209,000,000

|

| Holdings Count | Holding |

342

|

| Advisory Fees Paid, Amount |

$ 561,000,000

|

| Investment Company, Portfolio Turnover |

35.00%

|

| Additional Fund Statistics [Text Block] |

| Fund net assets (in millions) | $ 124,209 | | Total number of portfolio holdings | 342 | | Total advisory fees paid (in millions) | $ 561 | | Portfolio turnover rate | 35 % |

|

| Holdings [Text Block] |

Portfolio holdings by sector (percent of net assets ) |

| Material Fund Change [Text Block] |

This is a summary of certain changes to the fund since April 1, 2024. For more complete information, you may review the fund’s next prospectus, which we expect to be available by June 1, 2025 at capitalgroup.com/mutual-fund-literature-C or upon request at (800) 421-4225 . Effective June 1, 2025, the fund name is EUPAC Fund.

|

| Material Fund Change Name [Text Block] |

Effective June 1, 2025, the fund name is EUPAC Fund.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the fund since April 1, 2024. For more complete information, you may review the fund’s next prospectus, which we expect to be available by June 1, 2025 at capitalgroup.com/mutual-fund-literature-C (800) 421-4225 .

|

| Updated Prospectus Phone Number |

(800) 421-4225

|

| Updated Prospectus Web Address |

capitalgroup.com/mutual-fund-literature-C

|

| EuroPacific Growth Fund® - Class T [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

EuroPacific Growth Fund®

|

| Class Name |

Class T

|

| Trading Symbol |

TEUPX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about EuroPacific Growth Fund (the "fund") for the period from April 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature (800) 421-4225 .

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the fund that occurred during the reporting period.

|

| Additional Information Phone Number |

(800) 421-4225

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature

|

| Expenses [Text Block] |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | | Class T | $ 58 | 0.58 % |

|

| Expenses Paid, Amount |

$ 58

|

| Expense Ratio, Percent |

0.58%

|

| Factors Affecting Performance [Text Block] |

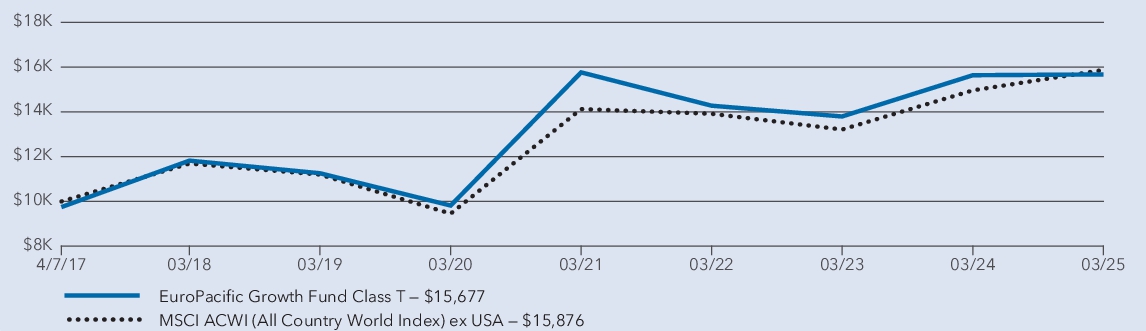

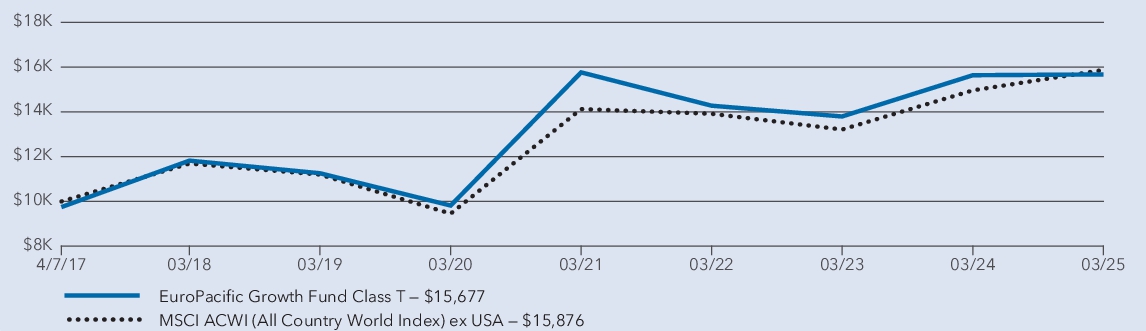

Management's discussion of fund performance The fund’s Class T shares gained 0.22% for the year ended March 31, 2025. That result compares with a 6.09% gain for the MSCI ACWI (All Country World Index) ex USA. What factors influenced results European stocks rose, aided by looser monetary policy as economic growth remained sluggish. U.K. markets advanced amid slight growth in gross domestic product and persistent inflation. Japanese stocks fell modestly as economic growth remained frail and the Bank of Japan nudged up interest rates. Stocks in China surged, fueled by government stimulus and enthusiasm for the technology sector. India saw a slight positive return in a year marked by weakening economic growth. Holdings in most equity sectors produced positive returns for the fund, with communication services, financials and utilities particularly additive. Likewise, consumer staples, industrials and real estate saw returns surpassing those of the overall portfolio. Geographically, investments in companies based in the eurozone and the U.K. were significant contributors to absolute returns. Conversely, the fund’s holdings in the health care, energy and materials sectors detracted from returns. Likewise, holdings in Japan and other European regions had negative returns overall.

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a predictor of its future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average annual total returns | 1 year | 5 years | | | EuroPacific Growth Fund — Class T (with sales charge) | (2.29 ) % | 9.25 % | 5.80 % | | EuroPacific Growth Fund — Class T (without sales charge) | 0.22 % | 9.81 % | 6.13 % | | MSCI ACWI (All Country World Index) ex USA | 6.09 % | 10.92 % | 5.96 % |

1 Class T shares were first offered on April 7, 2017. 2 Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, results reflect fee waivers and/or expense reimbursements, without which they would have been lower. 3 Results assume all distributions are reinvested. Any market index shown is unmanaged, and therefore, has no expenses. Investors cannot invest directly in an index. Source(s): MSCI. |

| Performance Inception Date |

Apr. 07, 2017

|

| No Deduction of Taxes [Text Block] |

The line chart and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Material Change Date |

Apr. 01, 2024

|

| Net Assets |

$ 124,209,000,000

|

| Holdings Count | Holding |

342

|

| Advisory Fees Paid, Amount |

$ 561,000,000

|

| Investment Company, Portfolio Turnover |

35.00%

|

| Additional Fund Statistics [Text Block] |

| Fund net assets (in millions) | $ 124,209 | | Total number of portfolio holdings | 342 | | Total advisory fees paid (in millions) | $ 561 | | Portfolio turnover rate | 35 % |

|

| Holdings [Text Block] |

Portfolio holdings by sector (percent of net assets ) |

| Material Fund Change [Text Block] |

This is a summary of certain changes to the fund since April 1, 2024. For more complete information, you may review the fund’s next prospectus, which we expect to be available by June 1, 2025 at capitalgroup.com/mutual-fund-literature or upon request at (800) 421-4225 . Effective June 1, 2025, the fund name is EUPAC Fund.

|

| Material Fund Change Name [Text Block] |

Effective June 1, 2025, the fund name is EUPAC Fund.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the fund since April 1, 2024. For more complete information, you may review the fund’s next prospectus, which we expect to be available by June 1, 2025 at capitalgroup.com/mutual-fund-literature (800) 421-4225 .

|

| Updated Prospectus Phone Number |

(800) 421-4225

|

| Updated Prospectus Web Address |

capitalgroup.com/mutual-fund-literature

|

| EuroPacific Growth Fund® - Class F-1 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

EuroPacific Growth Fund®

|

| Class Name |

Class F-1

|

| Trading Symbol |

AEGFX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about EuroPacific Growth Fund (the "fund") for the period from April 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-F1 (800) 421-4225 .

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the fund that occurred during the reporting period.

|

| Additional Information Phone Number |

(800) 421-4225

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-F1

|

| Expenses [Text Block] |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | | Class F-1 | $ 86 | 0.86 % |

|

| Expenses Paid, Amount |

$ 86

|

| Expense Ratio, Percent |

0.86%

|

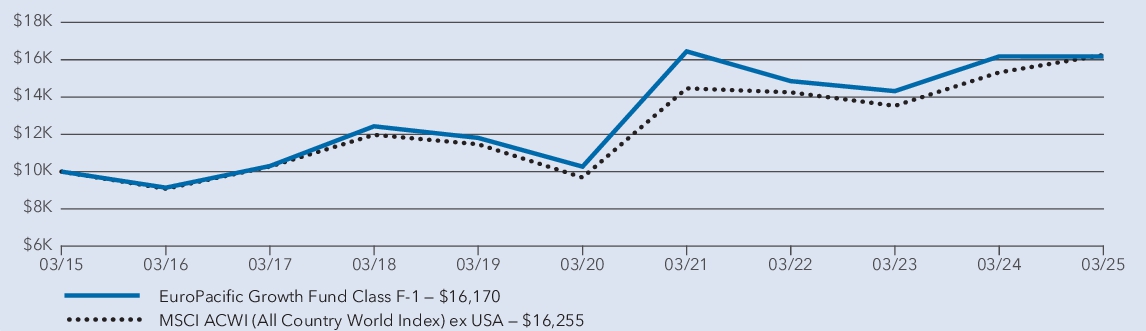

| Factors Affecting Performance [Text Block] |

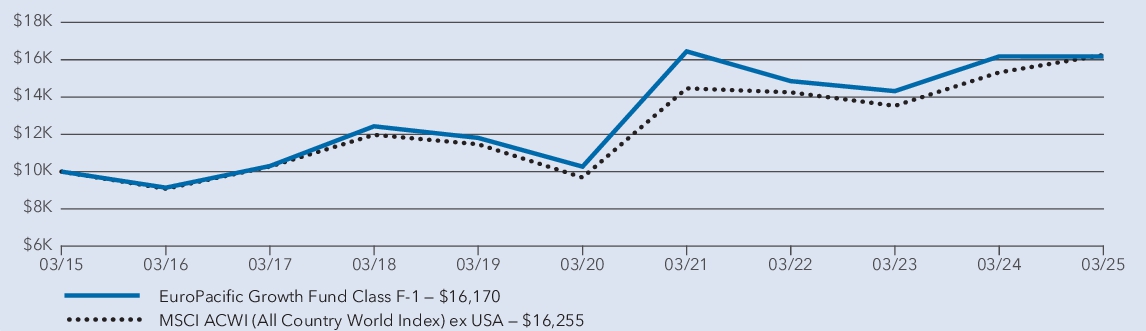

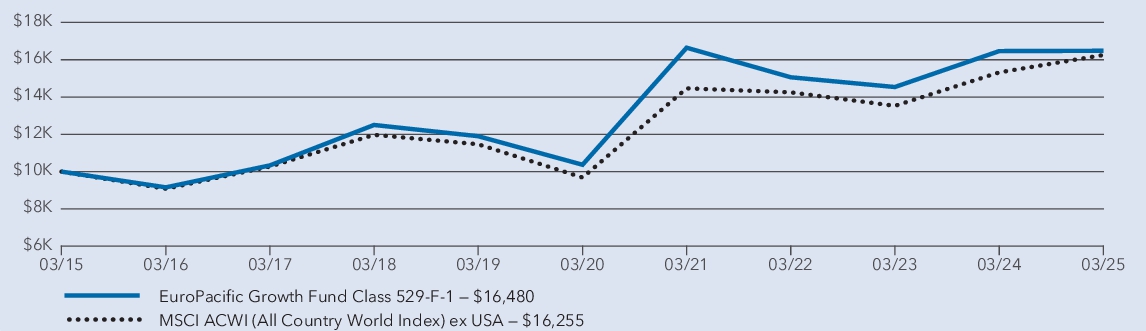

Management's discussion of fund performance The fund’s Class F-1 shares lost 0.07% for the year ended March 31, 2025. That result compares with a 6.09% gain for the MSCI ACWI (All Country World Index) ex USA. For information on returns for additional periods, including the fund lifetime, please refer to capitalgroup.com/mutual-fund-returns-F1 . What factors influenced results European stocks rose, aided by looser monetary policy as economic growth remained sluggish. U.K. markets advanced amid slight growth in gross domestic product and persistent inflation. Japanese stocks fell modestly as economic growth remained frail and the Bank of Japan nudged up interest rates. Stocks in China surged, fueled by government stimulus and enthusiasm for the technology sector. India saw a slight positive return in a year marked by weakening economic growth. Holdings in most equity sectors produced positive returns for the fund, with communication services, financials and utilities particularly additive. Likewise, consumer staples, industrials and real estate saw returns surpassing those of the overall portfolio. Geographically, investments in companies based in the eurozone and the U.K. were significant contributors to absolute returns. Conversely, the fund’s holdings in the health care, energy and materials sectors detracted from returns. Likewise, holdings in Japan and other European regions had negative returns overall.

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a predictor of its future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average annual total returns | 1 year | 5 years | 10 years | | EuroPacific Growth Fund — Class F-1 | (0.07 ) % | 9.51 % | 4.92 % | | MSCI ACWI (All Country World Index) ex USA | 6.09 % | 10.92 % | 4.98 % |

* Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, results reflect fee waivers and/or expense reimbursements, without which they would have been lower. † Results assume all distributions are reinvested. Any market index shown is unmanaged, and therefore, has no expenses. Investors cannot invest directly in an index. Source(s): MSCI. |

| No Deduction of Taxes [Text Block] |

The line chart and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Material Change Date |

Apr. 01, 2024

|

| Net Assets |

$ 124,209,000,000

|

| Holdings Count | Holding |

342

|

| Advisory Fees Paid, Amount |

$ 561,000,000

|

| Investment Company, Portfolio Turnover |

35.00%

|

| Additional Fund Statistics [Text Block] |

| Fund net assets (in millions) | $ 124,209 | | Total number of portfolio holdings | 342 | | Total advisory fees paid (in millions) | $ 561 | | Portfolio turnover rate | 35 % |

|

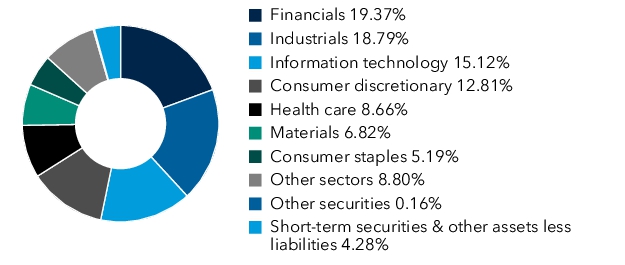

| Holdings [Text Block] |

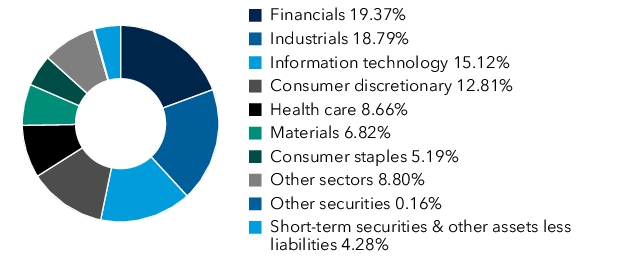

Portfolio holdings by sector (percent of net assets) |

| Material Fund Change [Text Block] |

This is a summary of certain changes to the fund since April 1, 2024. For more complete information, you may review the fund’s next prospectus, which we expect to be available by June 1, 2025 at capitalgroup.com/mutual-fund-literature-F1 or upon request at (800) 421-4225 . Effective June 1, 2025, the fund name is EUPAC Fund.

|

| Material Fund Change Name [Text Block] |

Effective June 1, 2025, the fund name is EUPAC Fund.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the fund since April 1, 2024. For more complete information, you may review the fund’s next prospectus, which we expect to be available by June 1, 2025 at capitalgroup.com/mutual-fund-literature-F1 (800) 421-4225 .

|

| Updated Prospectus Phone Number |

(800) 421-4225

|

| Updated Prospectus Web Address |

capitalgroup.com/mutual-fund-literature-F1

|

| EuroPacific Growth Fund® - Class F-2 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

EuroPacific Growth Fund®

|

| Class Name |

Class F-2

|

| Trading Symbol |

AEPFX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about EuroPacific Growth Fund (the "fund") for the period from April 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-F2 (800) 421-4225 .

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the fund that occurred during the reporting period.

|

| Additional Information Phone Number |

(800) 421-4225

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-F2

|

| Expenses [Text Block] |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | | Class F-2 | $ 57 | 0.57 % |

|

| Expenses Paid, Amount |

$ 57

|

| Expense Ratio, Percent |

0.57%

|

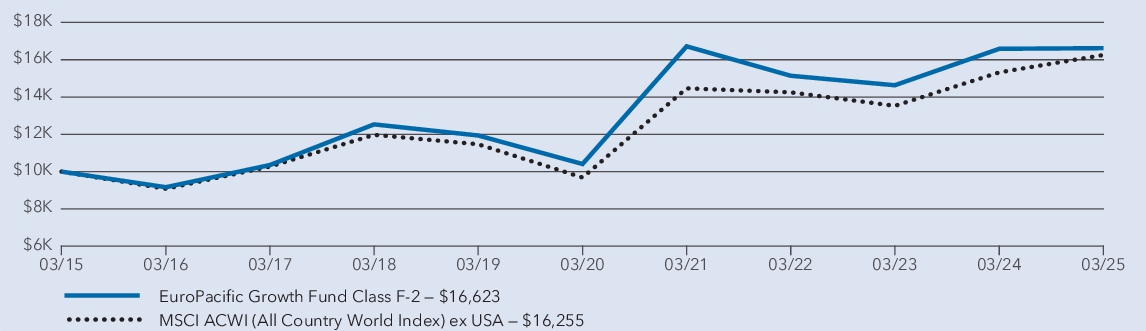

| Factors Affecting Performance [Text Block] |

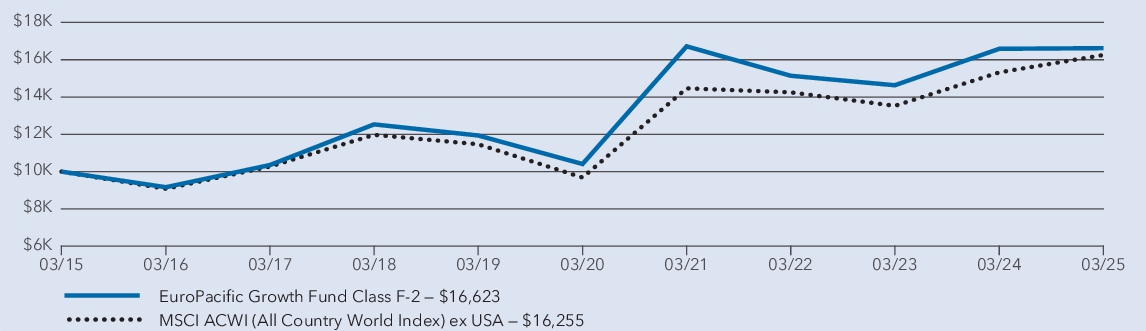

Management's discussion of fund performance The fund’s Class F-2 shares gained 0.22% for the year ended March 31, 2025. That result compares with a 6.09% gain for the MSCI ACWI (All Country World Index) ex USA. For information on returns for additional periods, including the fund lifetime, please refer to capitalgroup.com/mutual-fund-returns-F2 . What factors influenced results European stocks rose, aided by looser monetary policy as economic growth remained sluggish. U.K. markets advanced amid slight growth in gross domestic product and persistent inflation. Japanese stocks fell modestly as economic growth remained frail and the Bank of Japan nudged up interest rates. Stocks in China surged, fueled by government stimulus and enthusiasm for the technology sector. India saw a slight positive return in a year marked by weakening economic growth. Holdings in most equity sectors produced positive returns for the fund, with communication services, financials and utilities particularly additive. Likewise, consumer staples, industrials and real estate saw returns surpassing those of the overall portfolio. Geographically, investments in companies based in the eurozone and the U.K. were significant contributors to absolute returns. Conversely, the fund’s holdings in the health care, energy and materials sectors detracted from returns. Likewise, holdings in Japan and other European regions had negative returns overall.

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a predictor of its future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average annual total returns | 1 year | 5 years | 10 years | | EuroPacific Growth Fund — Class F-2 | 0.22 % | 9.81 % | 5.21 % | | MSCI ACWI (All Country World Index) ex USA | 6.09 % | 10.92 % | 4.98 % |

* Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, results reflect fee waivers and/or expense reimbursements, without which they would have been lower. † Results assume all distributions are reinvested. Any market index shown is unmanaged, and therefore, has no expenses. Investors cannot invest directly in an index. Source(s): MSCI. |

| No Deduction of Taxes [Text Block] |

The line chart and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Material Change Date |

Apr. 01, 2024

|

| Net Assets |

$ 124,209,000,000

|

| Holdings Count | Holding |

342

|

| Advisory Fees Paid, Amount |

$ 561,000,000

|

| Investment Company, Portfolio Turnover |

35.00%

|

| Additional Fund Statistics [Text Block] |

| Fund net assets (in millions) | $ 124,209 | | Total number of portfolio holdings | 342 | | Total advisory fees paid (in millions) | $ 561 | | Portfolio turnover rate | 35 % |

|

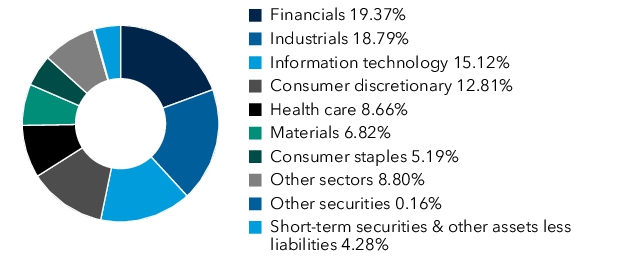

| Holdings [Text Block] |

Portfolio holdings by sector (percent of net assets ) |

| Material Fund Change [Text Block] |

This is a summary of certain changes to the fund since April 1, 2024. For more complete information, you may review the fund’s next prospectus, which we expect to be available by June 1, 2025 at capitalgroup.com/mutual-fund-literature-F2 or upon request at (800) 421-4225 . Effective June 1, 2025, the fund name is EUPAC Fund.

|

| Material Fund Change Name [Text Block] |

Effective June 1, 2025, the fund name is EUPAC Fund.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the fund since April 1, 2024. For more complete information, you may review the fund’s next prospectus, which we expect to be available by June 1, 2025 at capitalgroup.com/mutual-fund-literature-F2 (800) 421-4225 .

|

| Updated Prospectus Phone Number |

(800) 421-4225

|

| Updated Prospectus Web Address |

capitalgroup.com/mutual-fund-literature-F2

|

| EuroPacific Growth Fund® - Class F-3 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

EuroPacific Growth Fund®

|

| Class Name |

Class F-3

|

| Trading Symbol |

FEUPX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about EuroPacific Growth Fund (the "fund") for the period from April 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-F3 (800) 421-4225 .

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the fund that occurred during the reporting period.

|

| Additional Information Phone Number |

(800) 421-4225

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-F3

|

| Expenses [Text Block] |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | | Class F-3 | $ 47 | 0.47 % |

|

| Expenses Paid, Amount |

$ 47

|

| Expense Ratio, Percent |

0.47%

|

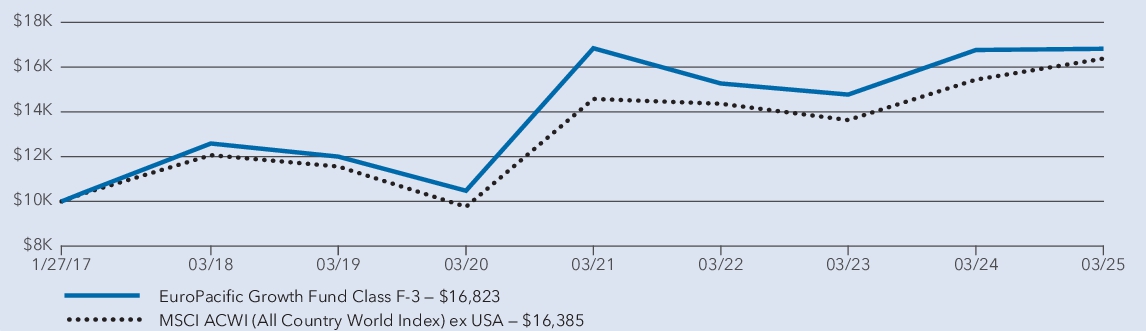

| Factors Affecting Performance [Text Block] |

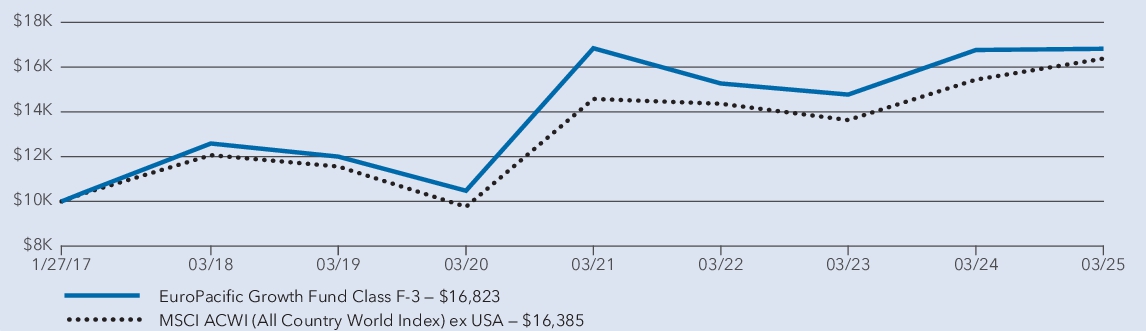

Management's discussion of fund performance The fund’s Class F-3 shares gained 0.31% for the year ended March 31, 2025. That result compares with a 6.09% gain for the MSCI ACWI (All Country World Index) ex USA. For information on returns for additional periods, including the fund lifetime, please refer to capitalgroup.com/mutual-fund-returns-F3 . What factors influenced results European stocks rose, aided by looser monetary policy as economic growth remained sluggish. U.K. markets advanced amid slight growth in gross domestic product and persistent inflation. Japanese stocks fell modestly as economic growth remained frail and the Bank of Japan nudged up interest rates. Stocks in China surged, fueled by government stimulus and enthusiasm for the technology sector. India saw a slight positive return in a year marked by weakening economic growth. Holdings in most equity sectors produced positive returns for the fund, with communication services, financials and utilities particularly additive. Likewise, consumer staples, industrials and real estate saw returns surpassing those of the overall portfolio. Geographically, investments in companies based in the eurozone and the U.K. were significant contributors to absolute returns. Conversely, the fund’s holdings in the health care, energy and materials sectors detracted from returns. Likewise, holdings in Japan and other European regions had negative returns overall.

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a predictor of its future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average annual total returns | 1 year | 5 years | | | EuroPacific Growth Fund — Class F-3 | 0.31 % | 9.93 % | 6.57 % | | MSCI ACWI (All Country World Index) ex USA | 6.09 % | 10.92 % | 6.23 % |

1 Class F-3 shares were first offered on January 27, 2017. 2 Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, results reflect fee waivers and/or expense reimbursements, without which they would have been lower. 3 Results assume all distributions are reinvested. Any market index shown is unmanaged, and therefore, has no expenses. Investors cannot invest directly in an index. Source(s): MSCI. |

| Performance Inception Date |

Jan. 27, 2017

|

| No Deduction of Taxes [Text Block] |

The line chart and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Material Change Date |

Apr. 01, 2024

|

| Net Assets |

$ 124,209,000,000

|

| Holdings Count | Holding |

342

|

| Advisory Fees Paid, Amount |

$ 561,000,000

|

| Investment Company, Portfolio Turnover |

35.00%

|

| Additional Fund Statistics [Text Block] |

| Fund net assets (in millions) | $ 124,209 | | Total number of portfolio holdings | 342 | | Total advisory fees paid (in millions) | $ 561 | | Portfolio turnover rate | 35 % |

|

| Holdings [Text Block] |

Portfolio holdings by sector (percent of net assets) |

| Material Fund Change [Text Block] |

This is a summary of certain changes to the fund since April 1, 2024. For more complete information, you may review the fund’s next prospectus, which we expect to be available by June 1, 2025 at capitalgroup.com/mutual-fund-literature-F3 or upon request at (800) 421-4225 . Effective June 1, 2025, the fund name is EUPAC Fund.

|

| Material Fund Change Name [Text Block] |

Effective June 1, 2025, the fund name is EUPAC Fund.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the fund since April 1, 2024. For more complete information, you may review the fund’s next prospectus, which we expect to be available by June 1, 2025 at capitalgroup.com/mutual-fund-literature-F3 (800) 421-4225 .

|

| Updated Prospectus Phone Number |

(800) 421-4225

|

| Updated Prospectus Web Address |

capitalgroup.com/mutual-fund-literature-F3

|

| EuroPacific Growth Fund® - Class 529-A [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

EuroPacific Growth Fund®

|

| Class Name |

Class 529-A

|

| Trading Symbol |

CEUAX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about EuroPacific Growth Fund (the "fund") for the period from April 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-529A (800) 421-4225 .

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the fund that occurred during the reporting period.

|

| Additional Information Phone Number |

(800) 421-4225

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-529A

|

| Expenses [Text Block] |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | | Class 529-A | $ 85 | 0.85 % |

|

| Expenses Paid, Amount |

$ 85

|

| Expense Ratio, Percent |

0.85%

|

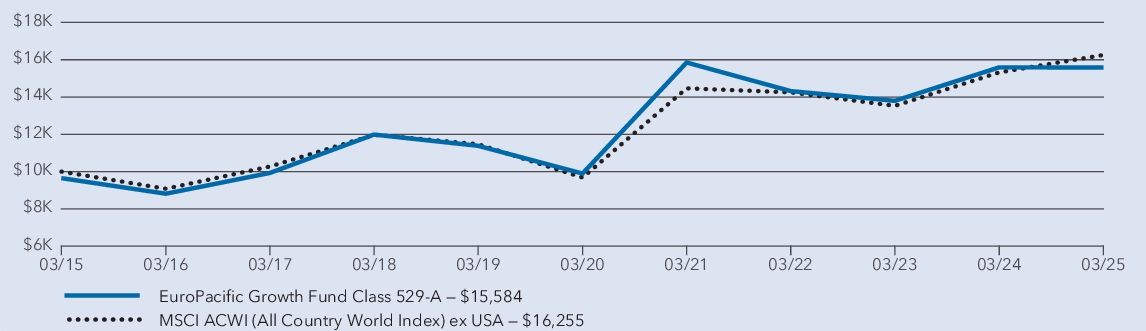

| Factors Affecting Performance [Text Block] |

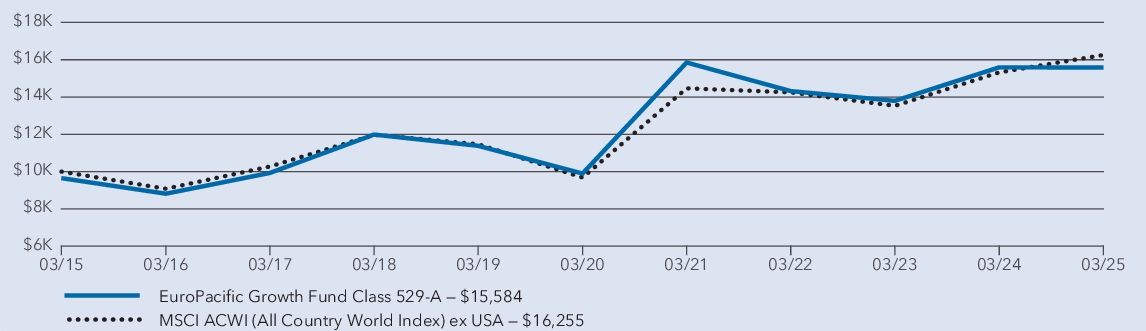

Management's discussion of fund performance The fund’s Class 529-A shares lost 0.06% for the year ended March 31, 2025. That result compares with a 6.09% gain for the MSCI ACWI (All Country World Index) ex USA. For information on returns for additional periods, including the fund lifetime, please refer to capitalgroup.com/mutual-fund-returns-529A . What factors influenced results European stocks rose, aided by looser monetary policy as economic growth remained sluggish. U.K. markets advanced amid slight growth in gross domestic product and persistent inflation. Japanese stocks fell modestly as economic growth remained frail and the Bank of Japan nudged up interest rates. Stocks in China surged, fueled by government stimulus and enthusiasm for the technology sector. India saw a slight positive return in a year marked by weakening economic growth. Holdings in most equity sectors produced positive returns for the fund, with communication services, financials and utilities particularly additive. Likewise, consumer staples, industrials and real estate saw returns surpassing those of the overall portfolio. Geographically, investments in companies based in the eurozone and the U.K. were significant contributors to absolute returns. Conversely, the fund’s holdings in the health care, energy and materials sectors detracted from returns. Likewise, holdings in Japan and other European regions had negative returns overall.

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a predictor of its future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average annual total returns | 1 year | 5 years | 10 years | | EuroPacific Growth Fund — Class 529-A (with sales charge) | (3.56 ) % | 8.73 % | 4.54 % | | EuroPacific Growth Fund — Class 529-A (without sales charge) | (0.06 ) % | 9.51 % | 4.91 % | | MSCI ACWI (All Country World Index) ex USA | 6.09 % | 10.92 % | 4.98 % |

* Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, results reflect fee waivers and/or expense reimbursements, without which they would have been lower. † Results assume all distributions are reinvested. Any market index shown is unmanaged, and therefore, has no expenses. Investors cannot invest directly in an index. Source(s): MSCI. |

| No Deduction of Taxes [Text Block] |

The line chart and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Material Change Date |

Apr. 01, 2024

|

| Net Assets |

$ 124,209,000,000

|

| Holdings Count | Holding |

342

|

| Advisory Fees Paid, Amount |

$ 561,000,000

|

| Investment Company, Portfolio Turnover |

35.00%

|

| Additional Fund Statistics [Text Block] |

| Fund net assets (in millions) | $ 124,209 | | Total number of portfolio holdings | 342 | | Total advisory fees paid (in millions) | $ 561 | | Portfolio turnover rate | 35 % |

|

| Holdings [Text Block] |

Portfolio holdings by sector (percent of net assets) |

| Material Fund Change [Text Block] |

This is a summary of certain changes to the fund since April 1, 2024. For more complete information, you may review the fund’s next prospectus, which we expect to be available by June 1, 2025 at capitalgroup.com/mutual-fund-literature-529A or upon request at (800) 421-4225 . Effective June 1, 2025, the fund name is EUPAC Fund.

|

| Material Fund Change Name [Text Block] |

Effective June 1, 2025, the fund name is EUPAC Fund.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the fund since April 1, 2024. For more complete information, you may review the fund’s next prospectus, which we expect to be available by June 1, 2025 at capitalgroup.com/mutual-fund-literature-529A (800) 421-4225 .

|

| Updated Prospectus Phone Number |

(800) 421-4225

|

| Updated Prospectus Web Address |

capitalgroup.com/mutual-fund-literature-529A

|

| EuroPacific Growth Fund® - Class 529-C [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

EuroPacific Growth Fund®

|

| Class Name |

Class 529-C

|

| Trading Symbol |

CEUCX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about EuroPacific Growth Fund (the "fund") for the period from April 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-529C (800) 421-4225 .

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the fund that occurred during the reporting period.

|

| Additional Information Phone Number |

(800) 421-4225

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-529C

|

| Expenses [Text Block] |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | | Class 529-C | $ 158 | 1.59 % |

|

| Expenses Paid, Amount |

$ 158

|

| Expense Ratio, Percent |

1.59%

|

| Factors Affecting Performance [Text Block] |

Management's discussion of fund performance The fund’s Class 529-C shares lost 0.81% for the year ended March 31, 2025. That result compares with a 6.09% gain for the MSCI ACWI (All Country World Index) ex USA. For information on returns for additional periods, including the fund lifetime, please refer to capitalgroup.com/mutual-fund-returns-529C . What factors influenced results European stocks rose, aided by looser monetary policy as economic growth remained sluggish. U.K. markets advanced amid slight growth in gross domestic product and persistent inflation. Japanese stocks fell modestly as economic growth remained frail and the Bank of Japan nudged up interest rates. Stocks in China surged, fueled by government stimulus and enthusiasm for the technology sector. India saw a slight positive return in a year marked by weakening economic growth. Holdings in most equity sectors produced positive returns for the fund, with communication services, financials and utilities particularly additive. Likewise, consumer staples, industrials and real estate saw returns surpassing those of the overall portfolio. Geographically, investments in companies based in the eurozone and the U.K. were significant contributors to absolute returns. Conversely, the fund’s holdings in the health care, energy and materials sectors detracted from returns. Likewise, holdings in Japan and other European regions had negative returns overall.

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a predictor of its future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average annual total returns | 1 year | 5 years | 10 years | | EuroPacific Growth Fund — Class 529-C (with sales charge) | (1.75 ) % | 8.68 % | 4.51 % | | EuroPacific Growth Fund — Class 529-C (without sales charge) | (0.81 ) % | 8.68 % | 4.51 % | | MSCI ACWI (All Country World Index) ex USA | 6.09 % | 10.92 % | 4.98 % |

* Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, results reflect fee waivers and/or expense reimbursements, without which they would have been lower. † Results assume all distributions are reinvested. Any market index shown is unmanaged, and therefore, has no expenses. Investors cannot invest directly in an index. Source(s): MSCI. |

| No Deduction of Taxes [Text Block] |

The line chart and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Material Change Date |

Apr. 01, 2024

|

| Net Assets |

$ 124,209,000,000

|

| Holdings Count | Holding |

342

|

| Advisory Fees Paid, Amount |

$ 561,000,000

|

| Investment Company, Portfolio Turnover |

35.00%

|

| Additional Fund Statistics [Text Block] |

| Fund net assets (in millions) | $ 124,209 | | Total number of portfolio holdings | 342 | | Total advisory fees paid (in millions) | $ 561 | | Portfolio turnover rate | 35 % |

|

| Holdings [Text Block] |

Portfolio holdings by sector (percent of net assets) |

| Material Fund Change [Text Block] |

This is a summary of certain changes to the fund since April 1, 2024. For more complete information, you may review the fund’s next prospectus, which we expect to be available by June 1, 2025 at capitalgroup.com/mutual-fund-literature-529C or upon request at (800) 421-4225 . Effective June 1, 2025, the fund name is EUPAC Fund.

|

| Material Fund Change Name [Text Block] |

Effective June 1, 2025, the fund name is EUPAC Fund.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the fund since April 1, 2024. For more complete information, you may review the fund’s next prospectus, which we expect to be available by June 1, 2025 at capitalgroup.com/mutual-fund-literature-529C (800) 421-4225 .

|

| Updated Prospectus Phone Number |

(800) 421-4225

|

| Updated Prospectus Web Address |

capitalgroup.com/mutual-fund-literature-529C

|

| EuroPacific Growth Fund® - Class 529-E [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

EuroPacific Growth Fund®

|

| Class Name |

Class 529-E

|

| Trading Symbol |

CEUEX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about EuroPacific Growth Fund (the "fund") for the period from April 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-529E (800) 421-4225 .

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the fund that occurred during the reporting period.

|

| Additional Information Phone Number |

(800) 421-4225

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-529E

|

| Expenses [Text Block] |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | | Class 529-E | $ 108 | 1.08 % |

|

| Expenses Paid, Amount |

$ 108

|

| Expense Ratio, Percent |

1.08%

|

| Factors Affecting Performance [Text Block] |

Management's discussion of fund performance The fund’s Class 529-E shares lost 0.28% for the year ended March 31, 2025. That result compares with a 6.09% gain for the MSCI ACWI (All Country World Index) ex USA. For information on returns for additional periods, including the fund lifetime, please refer to capitalgroup.com/mutual-fund-returns-529E . What factors influenced results European stocks rose, aided by looser monetary policy as economic growth remained sluggish. U.K. markets advanced amid slight growth in gross domestic product and persistent inflation. Japanese stocks fell modestly as economic growth remained frail and the Bank of Japan nudged up interest rates. Stocks in China surged, fueled by government stimulus and enthusiasm for the technology sector. India saw a slight positive return in a year marked by weakening economic growth. Holdings in most equity sectors produced positive returns for the fund, with communication services, financials and utilities particularly additive. Likewise, consumer staples, industrials and real estate saw returns surpassing those of the overall portfolio. Geographically, investments in companies based in the eurozone and the U.K. were significant contributors to absolute returns. Conversely, the fund’s holdings in the health care, energy and materials sectors detracted from returns. Likewise, holdings in Japan and other European regions had negative returns overall.

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a predictor of its future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average annual total returns | 1 year | 5 years | 10 years | | EuroPacific Growth Fund — Class 529-E | (0.28 ) % | 9.26 % | 4.67 % | | MSCI ACWI (All Country World Index) ex USA | 6.09 % | 10.92 % | 4.98 % |

* Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, results reflect fee waivers and/or expense reimbursements, without which they would have been lower. † Results assume all distributions are reinvested. Any market index shown is unmanaged, and therefore, has no expenses. Investors cannot invest directly in an index. Source(s): MSCI. |

| No Deduction of Taxes [Text Block] |

The line chart and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Material Change Date |

Apr. 01, 2024

|

| Net Assets |

$ 124,209,000,000

|

| Holdings Count | Holding |

342

|

| Advisory Fees Paid, Amount |

$ 561,000,000

|

| Investment Company, Portfolio Turnover |

35.00%

|

| Additional Fund Statistics [Text Block] |

| Fund net assets (in millions) | $ 124,209 | | Total number of portfolio holdings | 342 | | Total advisory fees paid (in millions) | $ 561 | | Portfolio turnover rate | 35 % |

|

| Holdings [Text Block] |

Portfolio holdings by sector (percent of net assets) |

| Material Fund Change [Text Block] |

This is a summary of certain changes to the fund since April 1, 2024. For more complete information, you may review the fund’s next prospectus, which we expect to be available by June 1, 2025 at capitalgroup.com/mutual-fund-literature-529E or upon request at (800) 421-4225 . Effective June 1, 2025, the fund name is EUPAC Fund.

|

| Material Fund Change Name [Text Block] |

Effective June 1, 2025, the fund name is EUPAC Fund.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the fund since April 1, 2024. For more complete information, you may review the fund’s next prospectus, which we expect to be available by June 1, 2025 at capitalgroup.com/mutual-fund-literature-529E (800) 421-4225 .

|

| Updated Prospectus Phone Number |

(800) 421-4225

|

| Updated Prospectus Web Address |

capitalgroup.com/mutual-fund-literature-529E

|

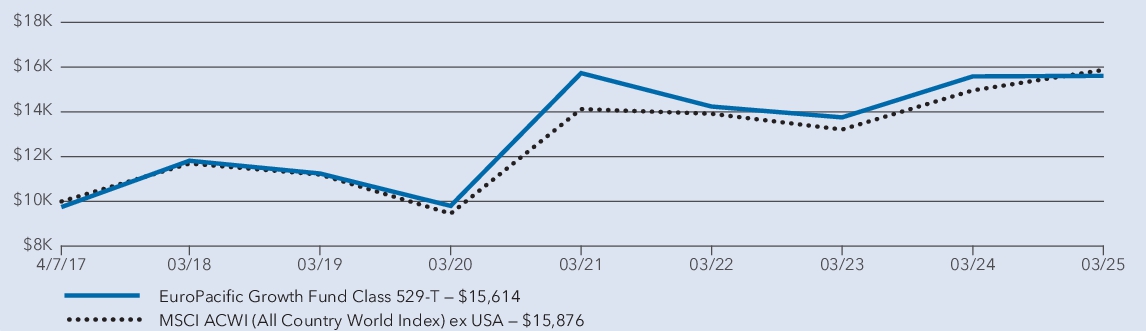

| EuroPacific Growth Fund® - Class 529-T [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

EuroPacific Growth Fund®

|

| Class Name |

Class 529-T

|

| Trading Symbol |

TEUGX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about EuroPacific Growth Fund (the "fund") for the period from April 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature (800) 421-4225 .

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the fund that occurred during the reporting period.

|

| Additional Information Phone Number |

(800) 421-4225

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature

|

| Expenses [Text Block] |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | | Class 529-T | $ 62 | 0.62 % |

|

| Expenses Paid, Amount |

$ 62

|

| Expense Ratio, Percent |

0.62%

|

| Factors Affecting Performance [Text Block] |

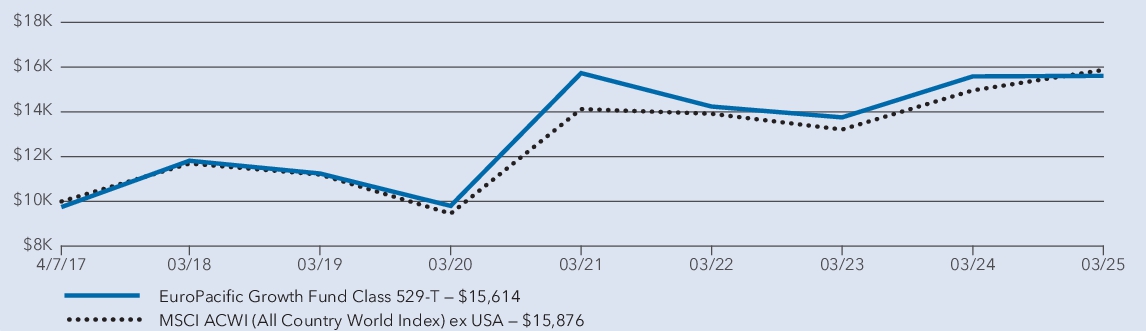

Management's discussion of fund performance The fund’s Class 529-T shares gained 0.15% for the year ended March 31, 2025. That result compares with a 6.09% gain for the MSCI ACWI (All Country World Index) ex USA. What factors influenced results European stocks rose, aided by looser monetary policy as economic growth remained sluggish. U.K. markets advanced amid slight growth in gross domestic product and persistent inflation. Japanese stocks fell modestly as economic growth remained frail and the Bank of Japan nudged up interest rates. Stocks in China surged, fueled by government stimulus and enthusiasm for the technology sector. India saw a slight positive return in a year marked by weakening economic growth. Holdings in most equity sectors produced positive returns for the fund, with communication services, financials and utilities particularly additive. Likewise, consumer staples, industrials and real estate saw returns surpassing those of the overall portfolio. Geographically, investments in companies based in the eurozone and the U.K. were significant contributors to absolute returns. Conversely, the fund’s holdings in the health care, energy and materials sectors detracted from returns. Likewise, holdings in Japan and other European regions had negative returns overall.

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a predictor of its future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average annual total returns | 1 year | 5 years | | | EuroPacific Growth Fund — Class 529-T (with sales charge) | (2.35 ) % | 9.20 % | 5.74 % | | EuroPacific Growth Fund — Class 529-T (without sales charge) | 0.15 % | 9.76 % | 6.08 % | | MSCI ACWI (All Country World Index) ex USA | 6.09 % | 10.92 % | 5.96 % |

1 Class 529-T shares were first offered on April 7, 2017. 2 Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, results reflect fee waivers and/or expense reimbursements, without which they would have been lower. 3 Results assume all distributions are reinvested. Any market index shown is unmanaged, and therefore, has no expenses. Investors cannot invest directly in an index. Source(s): MSCI. |

| Performance Inception Date |

Apr. 07, 2017

|

| No Deduction of Taxes [Text Block] |

The line chart and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Material Change Date |

Apr. 01, 2024

|

| Net Assets |

$ 124,209,000,000

|

| Holdings Count | Holding |

342

|

| Advisory Fees Paid, Amount |

$ 561,000,000

|

| Investment Company, Portfolio Turnover |

35.00%

|

| Additional Fund Statistics [Text Block] |

| Fund net assets (in millions) | $ 124,209 | | Total number of portfolio holdings | 342 | | Total advisory fees paid (in millions) | $ 561 | | Portfolio turnover rate | 35 % |

|

| Holdings [Text Block] |

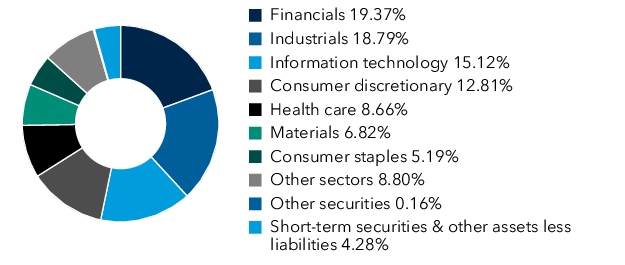

Portfolio holdings by sector (percent of net assets) |

| Material Fund Change [Text Block] |

This is a summary of certain changes to the fund since April 1, 2024. For more complete information, you may review the fund’s next prospectus, which we expect to be available by June 1, 2025 at capitalgroup.com/mutual-fund-literature or upon request at (800) 421-4225 . Effective June 1, 2025, the fund name is EUPAC Fund.

|

| Material Fund Change Name [Text Block] |

Effective June 1, 2025, the fund name is EUPAC Fund.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the fund since April 1, 2024. For more complete information, you may review the fund’s next prospectus, which we expect to be available by June 1, 2025 at capitalgroup.com/mutual-fund-literature (800) 421-4225 .

|

| Updated Prospectus Phone Number |

(800) 421-4225

|

| Updated Prospectus Web Address |

capitalgroup.com/mutual-fund-literature

|

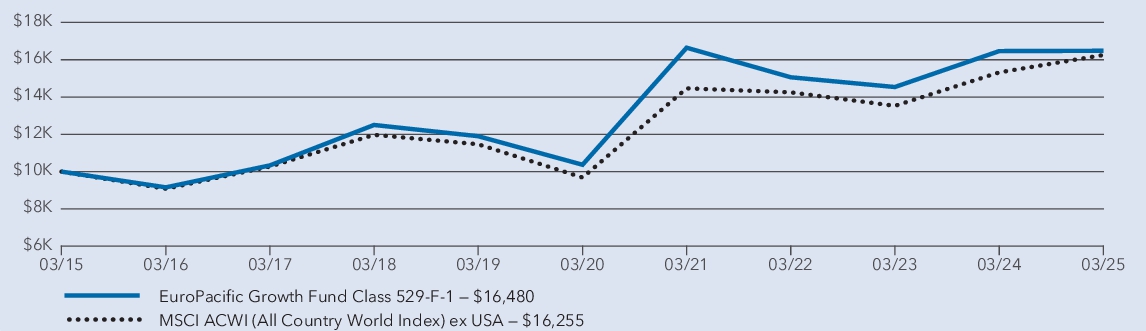

| EuroPacific Growth Fund® - Class 529-F-1 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

EuroPacific Growth Fund®

|

| Class Name |

Class 529-F-1

|

| Trading Symbol |

CEUFX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about EuroPacific Growth Fund (the "fund") for the period from April 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-529F1 (800) 421-4225 .

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the fund that occurred during the reporting period.

|

| Additional Information Phone Number |

(800) 421-4225

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-529F1

|

| Expenses [Text Block] |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | | Class 529-F-1 | $ 67 | 0.67 % |

|

| Expenses Paid, Amount |

$ 67

|

| Expense Ratio, Percent |

0.67%

|

| Factors Affecting Performance [Text Block] |

Management's discussion of fund performance The fund’s Class 529-F-1 shares gained 0.10% for the year ended March 31, 2025. That result compares with a 6.09% gain for the MSCI ACWI (All Country World Index) ex USA. For information on returns for additional periods, including the fund lifetime, please refer to capitalgroup.com/mutual-fund-returns-529F1 . What factors influenced results European stocks rose, aided by looser monetary policy as economic growth remained sluggish. U.K. markets advanced amid slight growth in gross domestic product and persistent inflation. Japanese stocks fell modestly as economic growth remained frail and the Bank of Japan nudged up interest rates. Stocks in China surged, fueled by government stimulus and enthusiasm for the technology sector. India saw a slight positive return in a year marked by weakening economic growth. Holdings in most equity sectors produced positive returns for the fund, with communication services, financials and utilities particularly additive. Likewise, consumer staples, industrials and real estate saw returns surpassing those of the overall portfolio. Geographically, investments in companies based in the eurozone and the U.K. were significant contributors to absolute returns. Conversely, the fund’s holdings in the health care, energy and materials sectors detracted from returns. Likewise, holdings in Japan and other European regions had negative returns overall.

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a predictor of its future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average annual total returns | 1 year | 5 years | 10 years | | EuroPacific Growth Fund — Class 529-F-1 | 0.10 % | 9.71 % | 5.12 % | | MSCI ACWI (All Country World Index) ex USA | 6.09 % | 10.92 % | 4.98 % |

* Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, results reflect fee waivers and/or expense reimbursements, without which they would have been lower. † Results assume all distributions are reinvested. Any market index shown is unmanaged, and therefore, has no expenses. Investors cannot invest directly in an index. Source(s): MSCI. |

| No Deduction of Taxes [Text Block] |

The line chart and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Material Change Date |

Apr. 01, 2024

|

| Net Assets |

$ 124,209,000,000

|

| Holdings Count | Holding |

342

|

| Advisory Fees Paid, Amount |

$ 561,000,000

|

| Investment Company, Portfolio Turnover |

35.00%

|

| Additional Fund Statistics [Text Block] |

| Fund net assets (in millions) | $ 124,209 | | Total number of portfolio holdings | 342 | | Total advisory fees paid (in millions) | $ 561 | | Portfolio turnover rate | 35 % |

|

| Holdings [Text Block] |

Portfolio holdings by sector (percent of net assets) |

| Material Fund Change [Text Block] |

This is a summary of certain changes to the fund since April 1, 2024. For more complete information, you may review the fund’s next prospectus, which we expect to be available by June 1, 2025 at capitalgroup.com/mutual-fund-literature-529F1 or upon request at (800) 421-4225 . Effective June 1, 2025, the fund name is EUPAC Fund. |

| Material Fund Change Name [Text Block] |

Effective June 1, 2025, the fund name is EUPAC Fund.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the fund since April 1, 2024. For more complete information, you may review the fund’s next prospectus, which we expect to be available by June 1, 2025 at capitalgroup.com/mutual-fund-literature-529F1 (800) 421-4225 .

|

| Updated Prospectus Phone Number |

(800) 421-4225

|

| Updated Prospectus Web Address |

capitalgroup.com/mutual-fund-literature-529F1

|

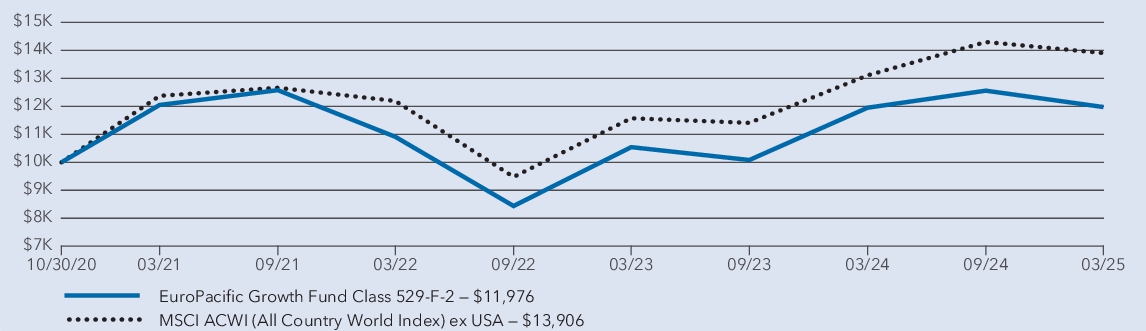

| EuroPacific Growth Fund® - Class 529-F-2 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

EuroPacific Growth Fund®

|

| Class Name |

Class 529-F-2

|

| Trading Symbol |

FUEPX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about EuroPacific Growth Fund (the "fund") for the period from April 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-529F2 (800) 421-4225 .

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the fund that occurred during the reporting period.

|

| Additional Information Phone Number |

(800) 421-4225

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-529F2

|

| Expenses [Text Block] |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | | Class 529-F-2 | $ 59 | 0.59 % |

|

| Expenses Paid, Amount |

$ 59

|

| Expense Ratio, Percent |

0.59%

|

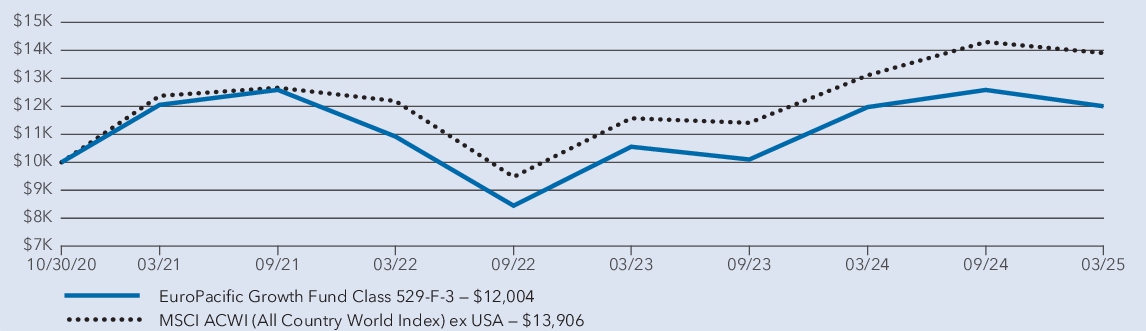

| Factors Affecting Performance [Text Block] |

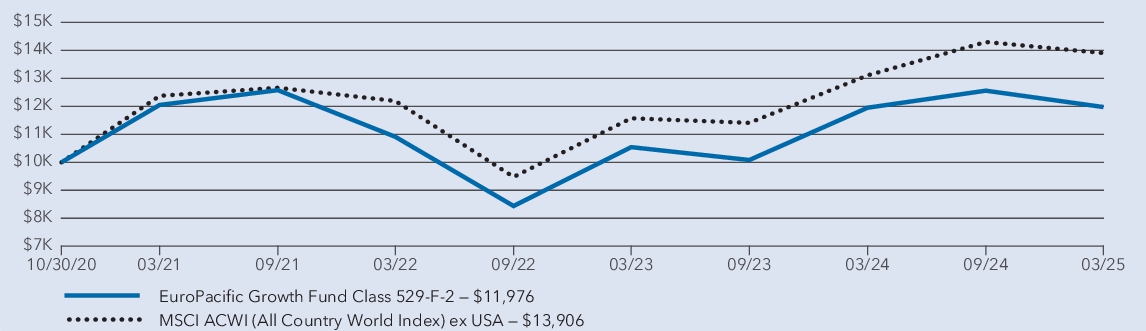

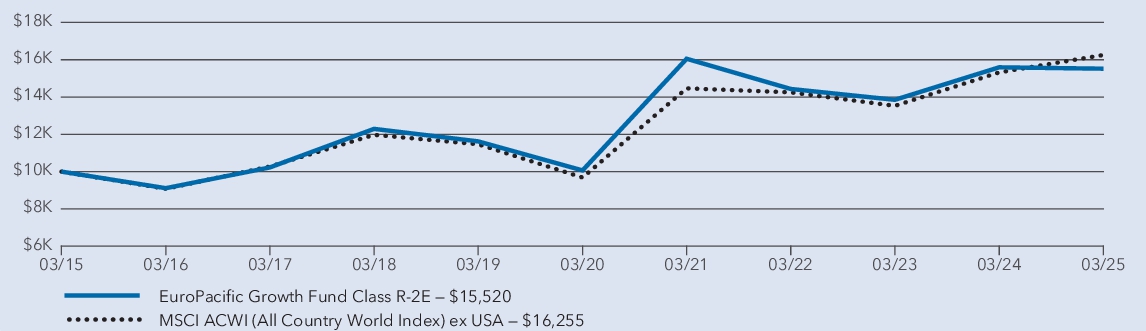

Management's discussion of fund performance The fund’s Class 529-F-2 shares gained 0.21% for the year ended March 31, 2025. That result compares with a 6.09% gain for the MSCI ACWI (All Country World Index) ex USA. For information on returns for additional periods, including the fund lifetime, please refer to capitalgroup.com/mutual-fund-returns-529F2 . What factors influenced results European stocks rose, aided by looser monetary policy as economic growth remained sluggish. U.K. markets advanced amid slight growth in gross domestic product and persistent inflation. Japanese stocks fell modestly as economic growth remained frail and the Bank of Japan nudged up interest rates. Stocks in China surged, fueled by government stimulus and enthusiasm for the technology sector. India saw a slight positive return in a year marked by weakening economic growth. Holdings in most equity sectors produced positive returns for the fund, with communication services, financials and utilities particularly additive. Likewise, consumer staples, industrials and real estate saw returns surpassing those of the overall portfolio. Geographically, investments in companies based in the eurozone and the U.K. were significant contributors to absolute returns. Conversely, the fund’s holdings in the health care, energy and materials sectors detracted from returns. Likewise, holdings in Japan and other European regions had negative returns overall.

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a predictor of its future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average annual total returns | 1 year | | | EuroPacific Growth Fund — Class 529-F-2 | 0.21 % | 4.17 % | | MSCI ACWI (All Country World Index) ex USA | 6.09 % | 7.75 % |

1 Class 529-F-2 shares were first offered on October 30, 2020. 2 Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, results reflect fee waivers and/or expense reimbursements, without which they would have been lower. 3 Results assume all distributions are reinvested. Any market index shown is unmanaged, and therefore, has no expenses. Investors cannot invest directly in an index. Source(s): MSCI. |

| Performance Inception Date |

Oct. 30, 2020

|

| No Deduction of Taxes [Text Block] |

The line chart and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Material Change Date |

Apr. 01, 2024

|

| Net Assets |

$ 124,209,000,000

|

| Holdings Count | Holding |

342

|

| Advisory Fees Paid, Amount |

$ 561,000,000

|

| Investment Company, Portfolio Turnover |

35.00%

|

| Additional Fund Statistics [Text Block] |

| Fund net assets (in millions) | $ 124,209 | | Total number of portfolio holdings | 342 | | Total advisory fees paid (in millions) | $ 561 | | Portfolio turnover rate | 35 % |

|

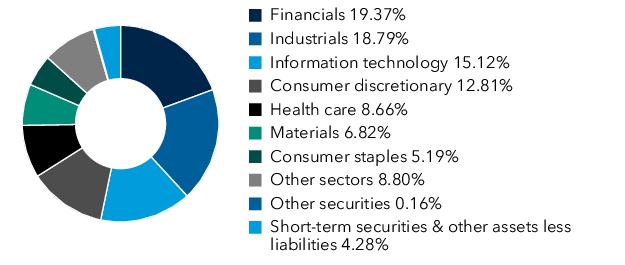

| Holdings [Text Block] |

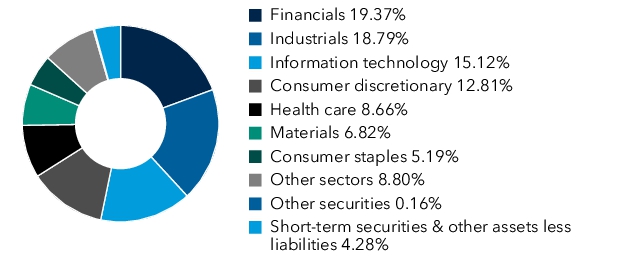

Portfolio holdings by sector (percent of net assets) |

| Material Fund Change [Text Block] |

This is a summary of certain changes to the fund since April 1, 2024. For more complete information, you may review the fund’s next prospectus, which we expect to be available by June 1, 2025 at capitalgroup.com/mutual-fund-literature-529F2 or upon request at (800) 421-4225 . Effective June 1, 2025, the fund name is EUPAC Fund. |

| Material Fund Change Name [Text Block] |

Effective June 1, 2025, the fund name is EUPAC Fund.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the fund since April 1, 2024. For more complete information, you may review the fund’s next prospectus, which we expect to be available by June 1, 2025 at capitalgroup.com/mutual-fund-literature-529F2 (800) 421-4225 .

|

| Updated Prospectus Phone Number |

(800) 421-4225

|

| Updated Prospectus Web Address |

capitalgroup.com/mutual-fund-literature-529F2

|

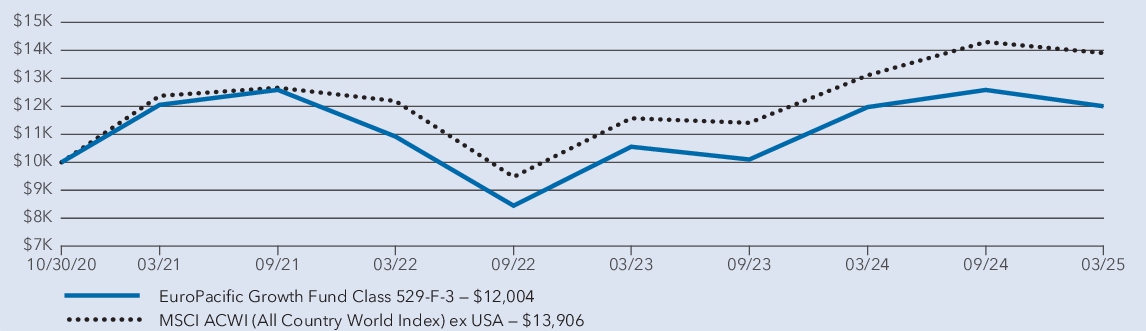

| EuroPacific Growth Fund® - Class 529-F-3 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

EuroPacific Growth Fund®

|

| Class Name |

Class 529-F-3

|

| Trading Symbol |

FEPUX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about EuroPacific Growth Fund (the "fund") for the period from April 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-529F3 (800) 421-4225 .

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the fund that occurred during the reporting period.

|

| Additional Information Phone Number |

(800) 421-4225

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-529F3

|

| Expenses [Text Block] |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | | Class 529-F-3 | $ 52 | 0.52 % |

|

| Expenses Paid, Amount |

$ 52

|

| Expense Ratio, Percent |

0.52%

|

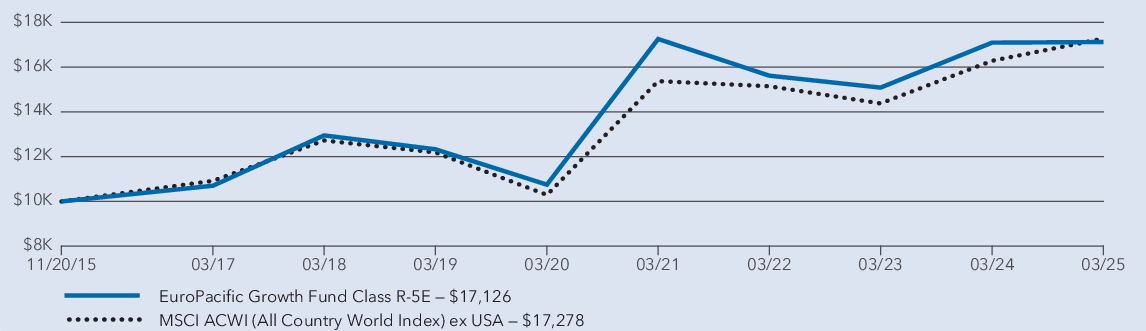

| Factors Affecting Performance [Text Block] |

Management's discussion of fund performance The fund’s Class 529-F-3 shares gained 0.26% for the year ended March 31, 2025. That result compares with a 6.09% gain for the MSCI ACWI (All Country World Index) ex USA. For information on returns for additional periods, including the fund lifetime, please refer to capitalgroup.com/mutual-fund-returns-529F3 . What factors influenced results European stocks rose, aided by looser monetary policy as economic growth remained sluggish. U.K. markets advanced amid slight growth in gross domestic product and persistent inflation. Japanese stocks fell modestly as economic growth remained frail and the Bank of Japan nudged up interest rates. Stocks in China surged, fueled by government stimulus and enthusiasm for the technology sector. India saw a slight positive return in a year marked by weakening economic growth. Holdings in most equity sectors produced positive returns for the fund, with communication services, financials and utilities particularly additive. Likewise, consumer staples, industrials and real estate saw returns surpassing those of the overall portfolio. Geographically, investments in companies based in the eurozone and the U.K. were significant contributors to absolute returns. Conversely, the fund’s holdings in the health care, energy and materials sectors detracted from returns. Likewise, holdings in Japan and other European regions had negative returns overall.

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a predictor of its future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average annual total returns | 1 year | | | EuroPacific Growth Fund — Class 529-F-3 | 0.26 % | 4.23 % | | MSCI ACWI (All Country World Index) ex USA | 6.09 % | 7.75 % |

1 Class 529-F-3 shares were first offered on October 30, 2020. 2 Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, results reflect fee waivers and/or expense reimbursements, without which they would have been lower. 3 Results assume all distributions are reinvested. Any market index shown is unmanaged, and therefore, has no expenses. Investors cannot invest directly in an index. Source(s): MSCI. |

| Performance Inception Date |

Oct. 30, 2020

|

| No Deduction of Taxes [Text Block] |

The line chart and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Material Change Date |

Apr. 01, 2024

|

| Net Assets |

$ 124,209,000,000

|

| Holdings Count | Holding |

342

|

| Advisory Fees Paid, Amount |

$ 561,000,000

|

| Investment Company, Portfolio Turnover |

35.00%

|

| Additional Fund Statistics [Text Block] |

| Fund net assets (in millions) | $ 124,209 | | Total number of portfolio holdings | 342 | | Total advisory fees paid (in millions) | $ 561 | | Portfolio turnover rate | 35 % |

|

| Holdings [Text Block] |

Portfolio holdings by sector (percent of net assets) |

| Material Fund Change [Text Block] |

This is a summary of certain changes to the fund since April 1, 2024. For more complete information, you may review the fund’s next prospectus, which we expect to be available by June 1, 2025 at capitalgroup.com/mutual-fund-literature-529F3 or upon request at (800) 421-4225 . Effective June 1, 2025, the fund name is EUPAC Fund. |

| Material Fund Change Name [Text Block] |

Effective June 1, 2025, the fund name is EUPAC Fund.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the fund since April 1, 2024. For more complete information, you may review the fund’s next prospectus, which we expect to be available by June 1, 2025 at capitalgroup.com/mutual-fund-literature-529F3 (800) 421-4225 .

|

| Updated Prospectus Phone Number |

(800) 421-4225

|

| Updated Prospectus Web Address |

capitalgroup.com/mutual-fund-literature-529F3

|

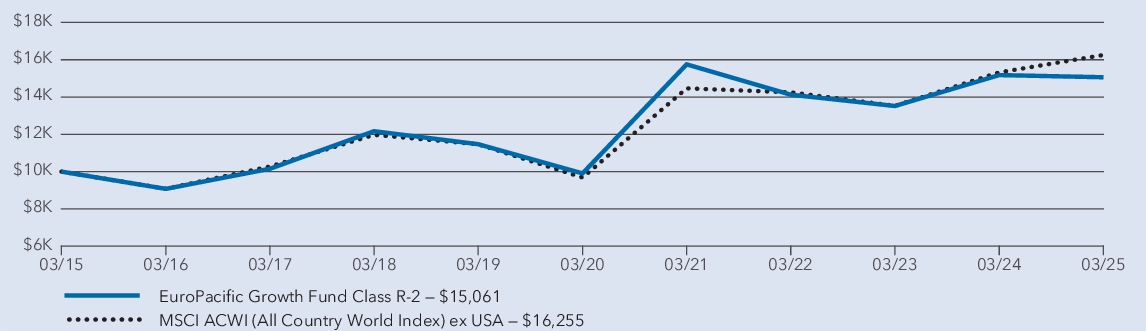

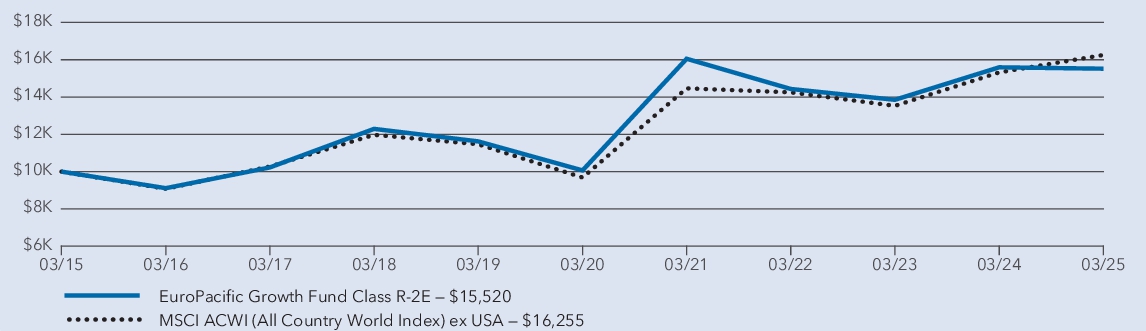

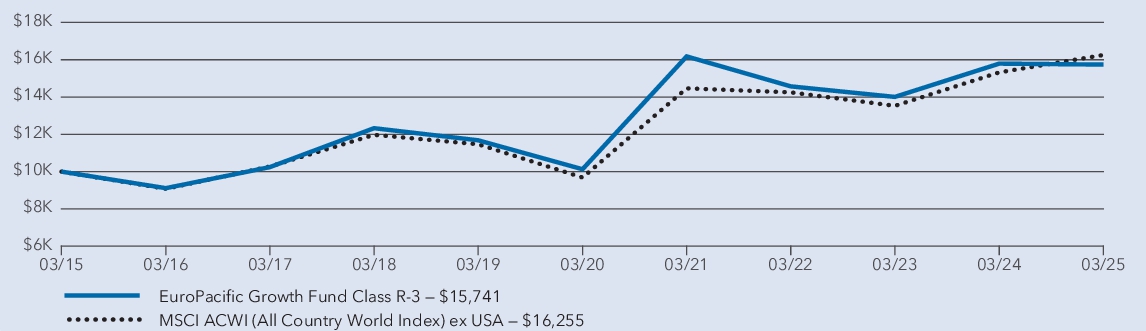

| EuroPacific Growth Fund® - Class R-1 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

EuroPacific Growth Fund®

|

| Class Name |

Class R-1

|

| Trading Symbol |

RERAX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about EuroPacific Growth Fund (the "fund") for the period from April 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-R1 (800) 421-4225 .

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the fund that occurred during the reporting period.

|

| Additional Information Phone Number |

(800) 421-4225

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-R1

|

| Expenses [Text Block] |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | | Class R-1 | $ 155 | 1.56 % |

|

| Expenses Paid, Amount |

$ 155

|

| Expense Ratio, Percent |

1.56%

|

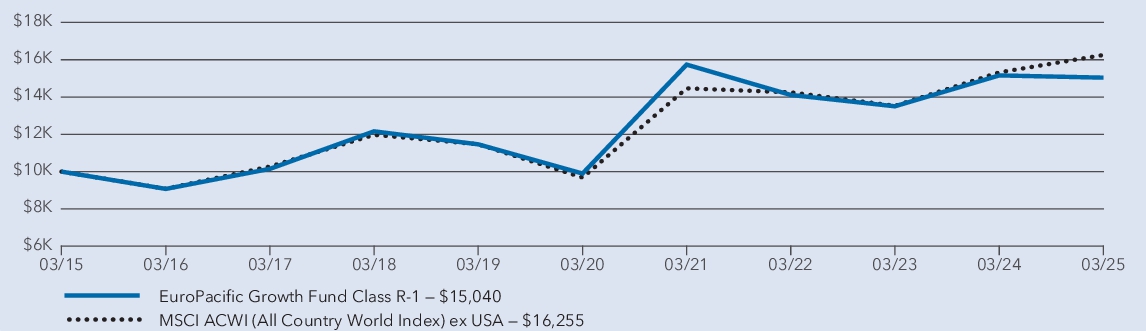

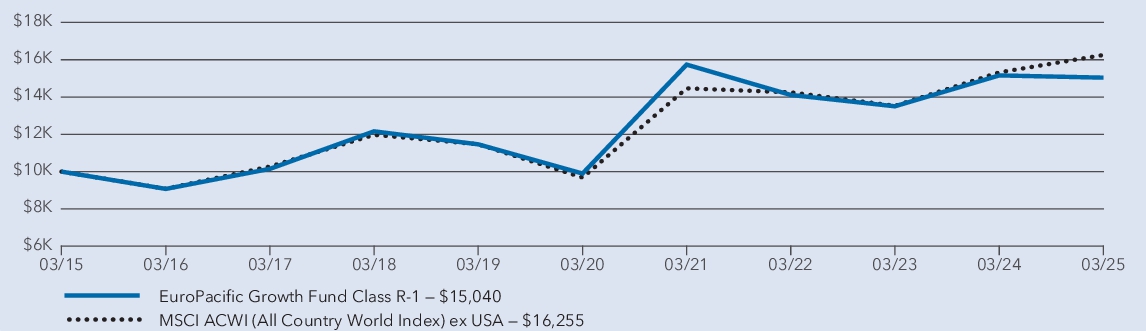

| Factors Affecting Performance [Text Block] |

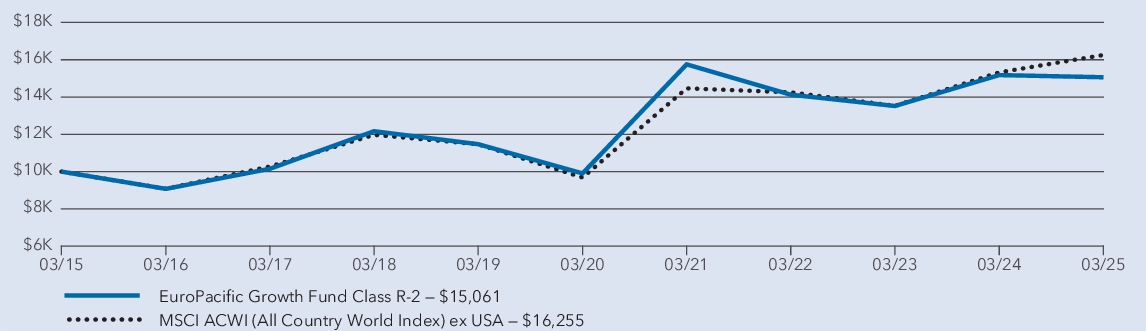

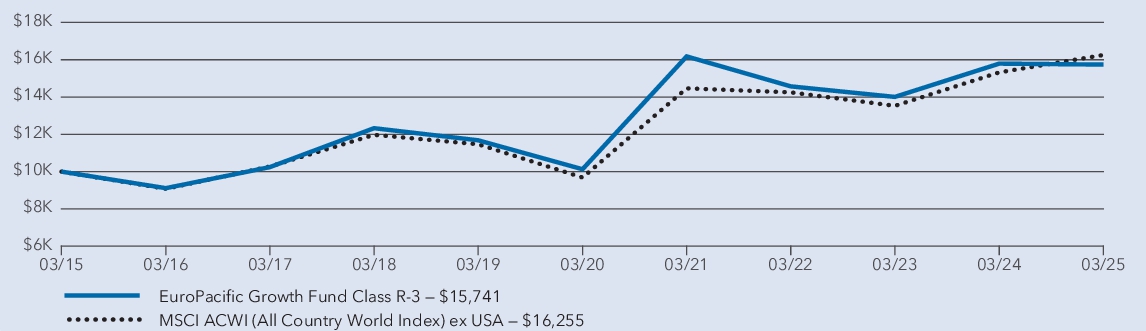

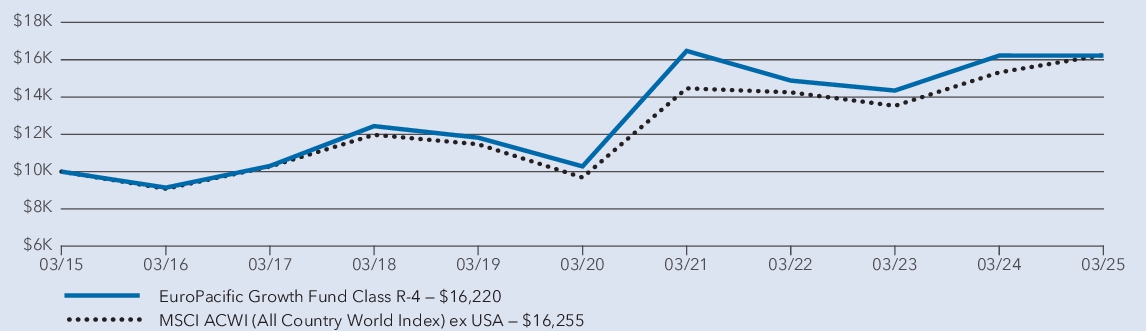

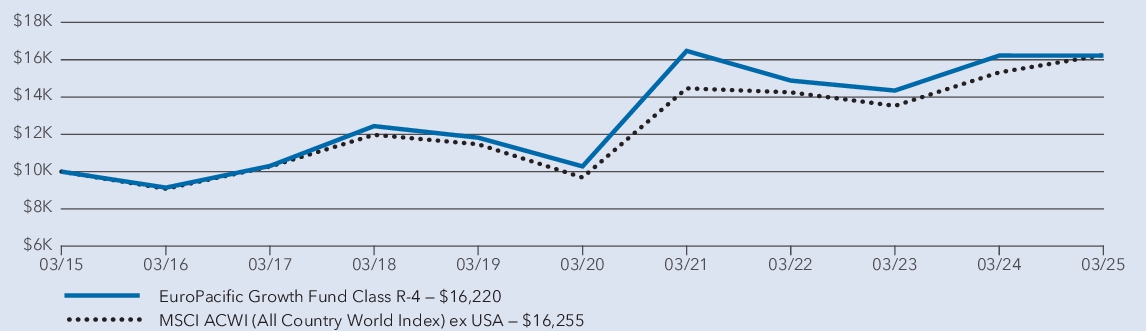

Management's discussion of fund performance The fund’s Class R-1 shares lost 0.78% for the year ended March 31, 2025. That result compares with a 6.09% gain for the MSCI ACWI (All Country World Index) ex USA. For information on returns for additional periods, including the fund lifetime, please refer to capitalgroup.com/mutual-fund-returns-R1 . What factors influenced results European stocks rose, aided by looser monetary policy as economic growth remained sluggish. U.K. markets advanced amid slight growth in gross domestic product and persistent inflation. Japanese stocks fell modestly as economic growth remained frail and the Bank of Japan nudged up interest rates. Stocks in China surged, fueled by government stimulus and enthusiasm for the technology sector. India saw a slight positive return in a year marked by weakening economic growth. Holdings in most equity sectors produced positive returns for the fund, with communication services, financials and utilities particularly additive. Likewise, consumer staples, industrials and real estate saw returns surpassing those of the overall portfolio. Geographically, investments in companies based in the eurozone and the U.K. were significant contributors to absolute returns. Conversely, the fund’s holdings in the health care, energy and materials sectors detracted from returns. Likewise, holdings in Japan and other European regions had negative returns overall.

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a predictor of its future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average annual total returns | 1 year | 5 years | 10 years | | EuroPacific Growth Fund — Class R-1 | (0.78 ) % | 8.73 % | 4.16 % | | MSCI ACWI (All Country World Index) ex USA | 6.09 % | 10.92 % | 4.98 % |

* Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, results reflect fee waivers and/or expense reimbursements, without which they would have been lower. † Results assume all distributions are reinvested. Any market index shown is unmanaged, and therefore, has no expenses. Investors cannot invest directly in an index. Source(s): MSCI. |

| No Deduction of Taxes [Text Block] |

The line chart and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Material Change Date |

Apr. 01, 2024

|

| Net Assets |

$ 124,209,000,000

|

| Holdings Count | Holding |

342

|

| Advisory Fees Paid, Amount |

$ 561,000,000

|

| Investment Company, Portfolio Turnover |

35.00%

|

| Additional Fund Statistics [Text Block] |

| Fund net assets (in millions) | $ 124,209 | | Total number of portfolio holdings | 342 | | Total advisory fees paid (in millions) | $ 561 | | Portfolio turnover rate | 35 % |

|

| Holdings [Text Block] |

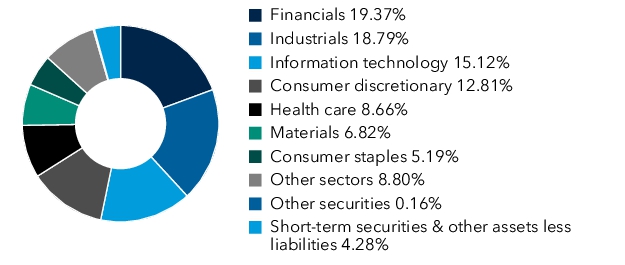

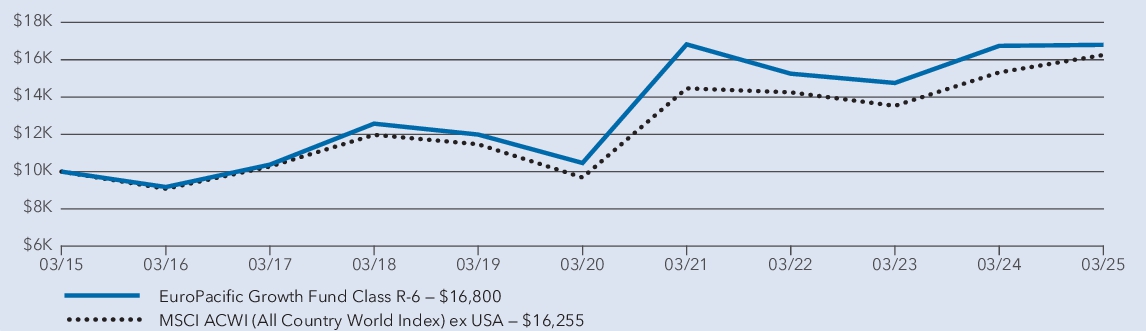

Portfolio holdings by sector (percent of net assets) |

| Material Fund Change [Text Block] |