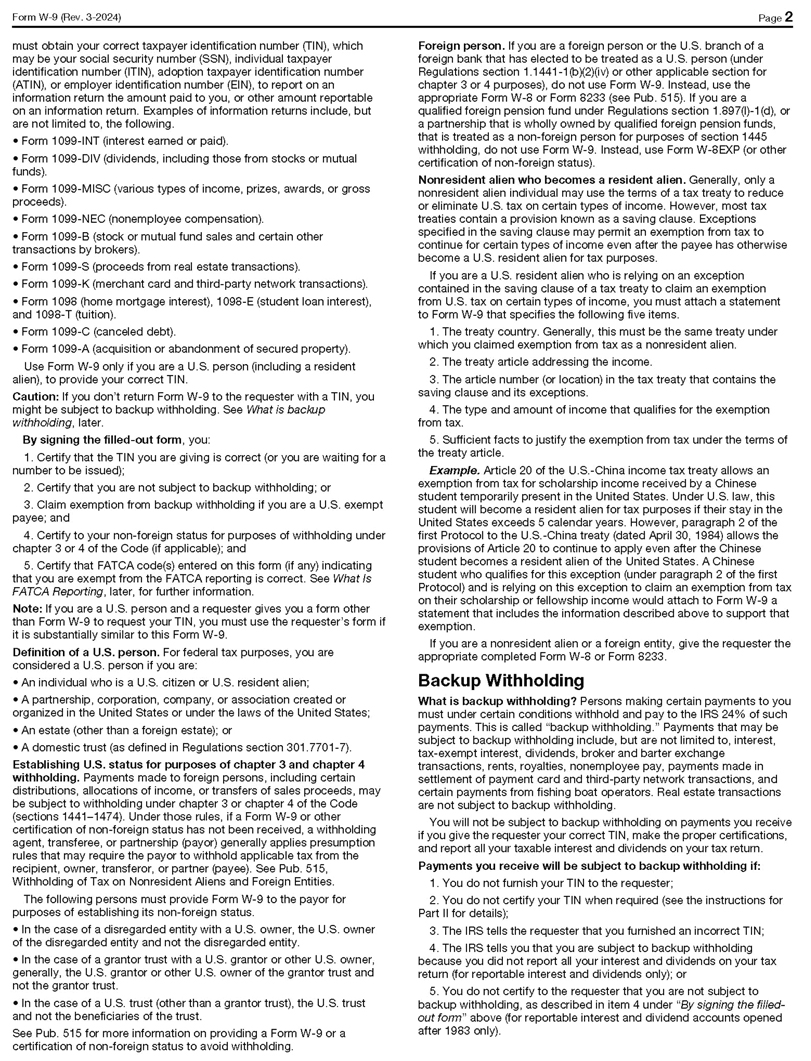

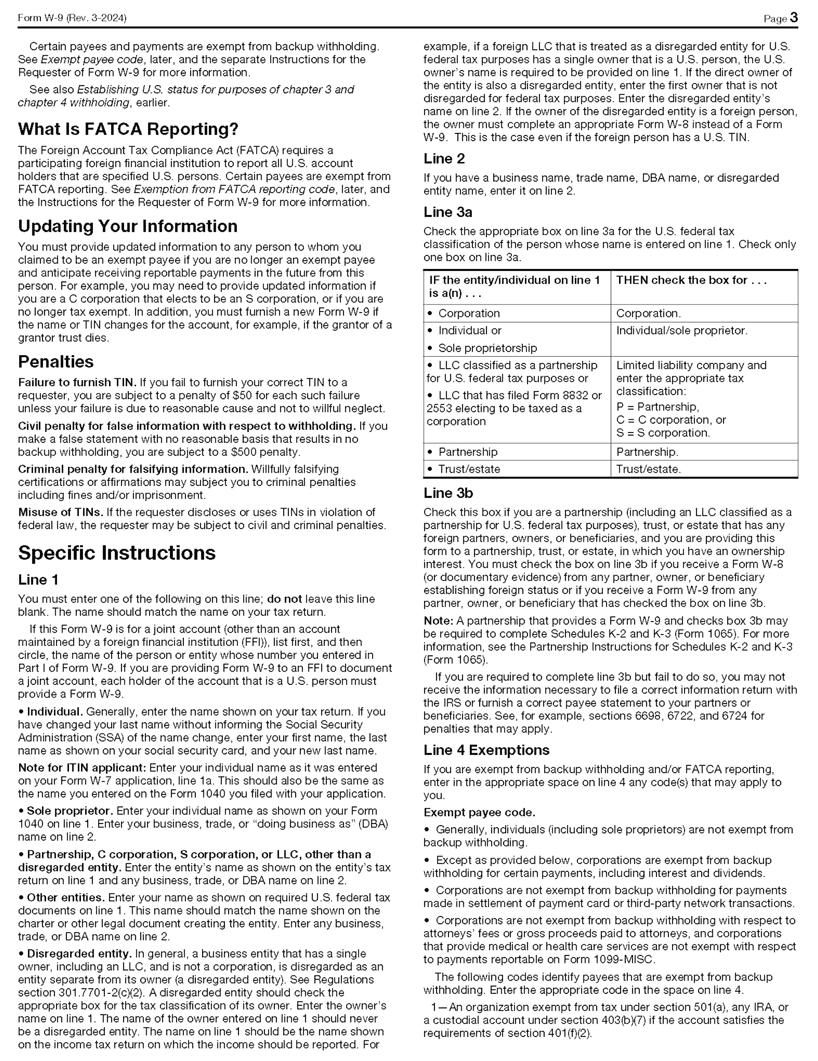

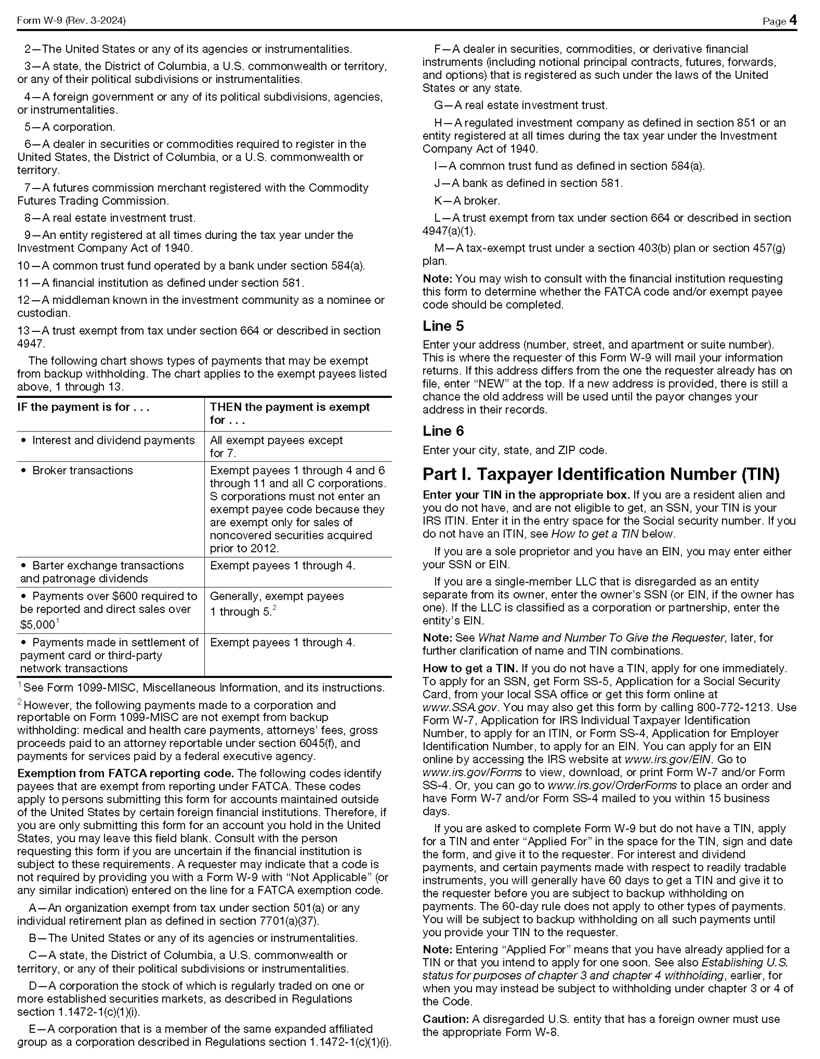

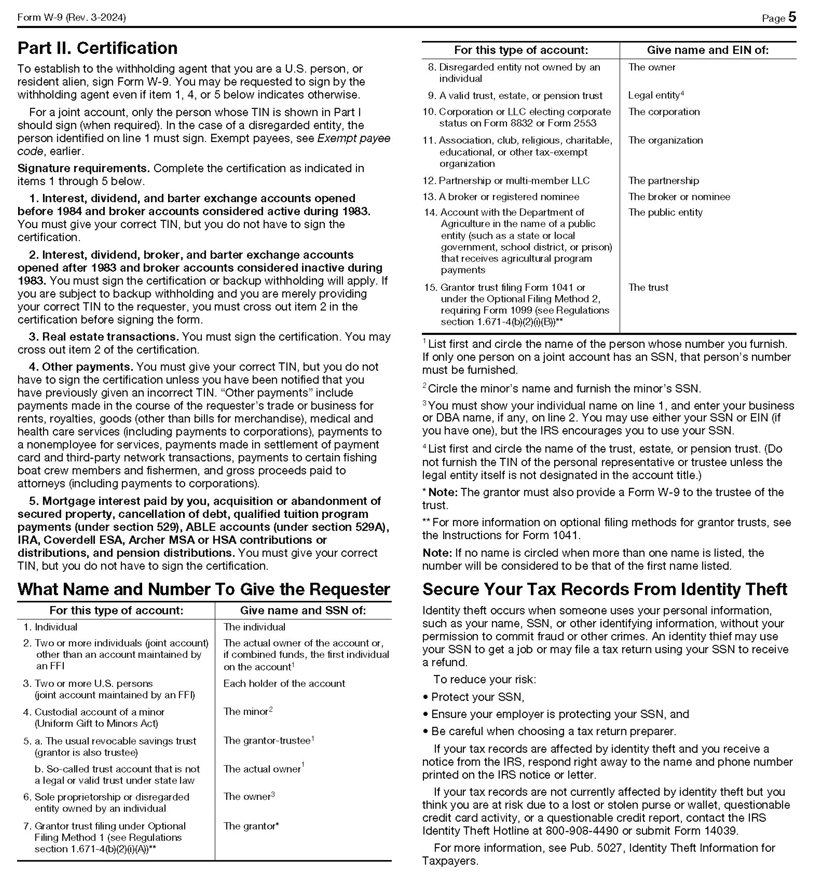

Request for Taxpayer Fcrm W-9 Give form t o the (Rev. March 2024) Identification Number and Certification requester. Do not Department of the Treasury to information. send to t he IRS. Go www.irs.gov/FormW9 for instructions and the latest Internal Revenue Service Before you begin. For guidance related to the purpose of Form W-9 see Putpose ofFonn below 1 Name of entity/individual. M entry is required. (For a sole proprietor or disregarded entity, enter the owner’s name on line 1, and enter the business/disregarded entity ‘s name on line 2 .) 2 Business nam e/disregarded entity nam e, if different from above. .,; 3a Check the appropriate box for federal tax dassification of the entity/individual w hose name is entered on line 1 Check 4 Exemptions (codes apply only to “’ 01 only one of t he following seven boxes. certain entities, not individuals; “- “’ corporation S corporation see instructions on page 3): c D Individual/sole proprietor D C D D Partnership D Trust/estate 0 _., D LLC. Enter the tax classification (C = C corporation, S = S corporation, P = Partnership) Exempt payee code (if any} Q) c: ——— ~S! Note: Check the “LLC” box above and. in the entry space, enter the appropriate code (C, s. or P) lor the tax -t classification of the LLC, unless it is a disregarded entity. A disregarded entity sholid instead check t he appropriate Exemption from Foreign Account Tax 0 2 box fo r the tax classification of its OINTler. Compliance Act (FATCA) repooing -t; Other (see instructions) code (if any) .§ .s D 0 ( ) !E: 3b If on line 3a you checked “Partnership” or “Trust/estate,” or checked “LLC” and entered “P” as its tax classification, (Applies to accounts maintained ~ and you are providing this form to a partnership, trust, or estate in which you have an ownership interest, check outside the United States.) ~ this box if you have any foreign partners, owners, or b eneficiaries. See instructions D <D 5 Address (number, street, and apt. or suite no.). See instructions. Request er’s name and address (optionaQ (j) “’ 6 City, state, and ZIP code 7 List account rumber(s} here (optional) Gliilll Taxpayer Identification Number (TIN) 1 Social security number I Enter your TIN in the appropriate box. The TIN provided must match the name given on line 1 to avoid backup Withholding. For IndiVIduals, th1s IS generally your soc1al secunty number (SSN). However, for a resident alien, sole proprietor, or disregarded entity, see the instructions for Part I, later. For other ITIJ-ITJ-1I I I I entities, it is your employer identification number (EIN). If you do not have a number, see How to get a or TIN, later. Not e: If the account is in more than one name, see the instructions for line 1. See also What Name and Number To Give the Requester lor guidelines on whose number to enter. Certification Under penalties of perjury, I certify that: 1. The number shown on this form is my correct taxpayer identification number (or I am waiting for a number to be issued to me); and 2. I am not subject to backup withholding because (a) I am exempt from backup withholding, or (b) I have not been notified by the Internal Revenue Service (IRS) that I am subject to backup withh~ding as a result of a failure to report all interest or dividends, or (c) the IRS has notified me that I am no longer subject to backup withholding; and 3. I am a U.S. citizen or other U.S. person (defined below); and 4. The FATCA code(s) entered on this form Of any) indicating that I am exempt from FATCA reporting is correct. Certification instructions. You must cross out item 2 abcve if you have been notified by the IRS that you are currently subject to backup withholding because you have failed to report all interest and dividends on your tax return. For real estate transactions, item 2 does not apply. For mortgage interest paid, acquisition or abandonment of secured property, cancellation of debt, contributions to an individual retirement arrangement (IRA), and, generally, payments other than interest and dividends, you are not required to sign the certification, but you must provide your correct TIN. See the instructions for Part II, later. Sign I Signature of Here U.S. per son Date General Instructions New line 3b has been added to this form. A flow-through entity is required to complete this line to indicate that it has direct or indirect Section references are to the Internal Revenue Code unless otherwise foreign partners, owners, or beneficiaries when it provides the Form W-9 noted. to another flow-through entity in which it has an ownership interest. This change is intended to provide a flow-through entity w ith information Future developments. For the latest information about developments regarding the status of its indirect foreign partners, owners, or related to Form W-9 and its instructions, such as legislation enacted beneficiaries, so that it can satisfy any applicable reporting after they were published, go to www.irs.gov/FormW9. requirements. For example, a partnership that has any indirect foreign What’s New partners may be required to complete Schedules K-2 and K-3. See the Partnership Inst ructions for Schedules K-2 and K-3 (Form 1 065). Line 3a has been modified to clarify how a disregarded entity completes this line. An LLC that is a disregarded entity should check the Purpose of Form appropriate box for the tax classification of its owner. Otherwise, it individual or entity (Form W-9 requester) An who is required to file an should check the “LLC” box and enter its appropriate tax classification. information return with the IRS is giving you this form because they Cat. No. 10231X Form W -9 (Rev. 3-2024)