| Value of Initial | ||||||||||||||||||||||||||||||||||||||||

| |

Summary Compensation Table Total for Principal Executive Officer (“PEO”)(1) |

|

|

Compensation Actually Paid to PEO(2) |

|

|

Average Summary Compensation Table Total for Non-PEO |

|

|

Average Compensation Actually Paid to Non-PEO |

|

|

Fixed $100 Investment Based on Total Stockholder |

|

|

Net Income (Loss) |

|

|||||||||||||||||||||||

| Year | James A. Mish | John J. Miller | Lawrence D. Firestone | James A. Mish | John J. Miller | Lawrence D. Firestone | NEOs(1) | NEOs(3) | Return(4) | ($000’s)(5) | ||||||||||||||||||||||||||||||

| 2024 | $ | N/A | $ | N/A | $ | 426,678 | $ | N/A | $ | N/A | $ | 426,678 | $ | 234,702 | $ | (334,676 | ) | $ | 0.01 | $ | (15,164 | ) | ||||||||||||||||||

| 2023 | $ | 706,778 | $ | 221,468 | $ | 32,692 | $ | (529,515 | ) | $ | 25,450 | $ | 32,692 | $ | 707,165 | $ | 425,756 | $ | 0.56 | $ | (140,775 | ) | ||||||||||||||||||

| 2022 | $ | 4,011,094 | $ | N/A | $ | N/A | $ | 1,495,978 | $ | N/A | $ | N/A | $ | 888,087 | $ | 411,232 | $ | 42 | $ | (59,801 | ) | |||||||||||||||||||

| 2021 | $ | 2,534,464 | $ | N/A | $ | N/A | $ | 2,829,984 | $ | N/A | $ | N/A | $ | 1,301,446 | $ | 1,492,488 | $ | 140 | $ | (32,609 | ) | |||||||||||||||||||

| Year | |

PEO | |

Less: Total Equity Compensation |

|

|

Plus: Value Of Awards Granted During Current Year |

|

|

Plus

(Less): Year over Year Change in Fair Value Of Unvested Awards |

|

|

Plus

(Less): Vesting Date Value Of Awards that Vested During Current Year |

|

|

Less:

Value of Awards Forfeited During Current Year |

|

|

Total Adjustments |

|

||||||

| 2024 | Lawrence D. Firestone | $ | $ | $ | $ | $ | $ | |||||||||||||||||||

| 2023 | James A. Mish | $ | (357,904 | ) | $ | $ | $ | (37,677 | ) | $ | (840,712 | ) | $ | (1,236,293 | ) | |||||||||||

| 2023 | John. J. Miller | $ | $ | $ | (191,179 | ) | $ | (4,839 | ) | $ | $ | (196,019 | ) | |||||||||||||

| 2023 | Lawrence D. Firestone | $ | $ | $ | $ | $ | $ | |||||||||||||||||||

| 2022 | James A. Mish | $ | (3,025,989 | ) | $ | 1,272,573 | $ | (650,700 | ) | $ | (111,000 | ) | $ | $ | (2,515,116 | ) | ||||||||||

| 2021 | James A. Mish | $ | (1,440,000 | ) | $ | 1,390,500 | $ | $ | 345,000 | $ | $ | 295,500 | ||||||||||||||

| (3) | The amounts disclosed reflect the adjustments listed in the tables below to the amounts reported in the Summary Compensation Table for our non-PEO NEO’s: |

| Year | |

Less: Total Equity Compensation |

|

|

Plus: Value Of Awards Granted During Current Year |

|

|

Plus

(Less): Year over Year Change in Fair Value Of Unvested Awards |

|

|

Plus

(Less): Vesting Date Value Of Awards that Vested During Current Year |

|

|

Plus: Value of Award Granted and Vested During Current Year |

|

|

Total Adjustments |

|

||||||

| 2024 | $ | $ | $ | $ | $ | (567,378 | ) | $ | (569,378 | ) | ||||||||||||||

| 2023 | $ | (161,568 | ) | $ | 1,140 | $ | (117,994 | ) | $ | (2,987 | ) | $ | $ | (281,409 | ) | |||||||||

| 2022 | $ | (396,380 | ) | $ | 160,417 | $ | (52,056 | ) | $ | (227,908 | ) | $ | 39,072 | $ | (476,855 | ) | ||||||||

| 2021 | $ | (736,317 | ) | $ | 648,900 | $ | 159,275 | $ | 119,184 | $ | $ | 191,042 | ||||||||||||

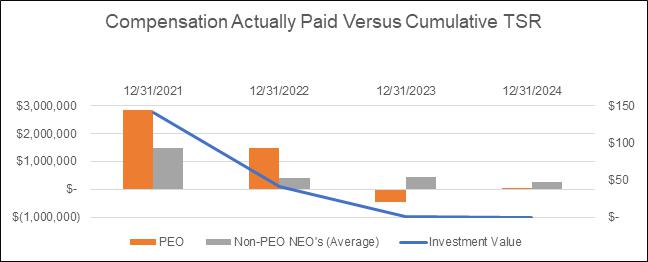

PEO and Non-PEO NEO Compensation Actually Paid and Company Total Stockholder Return (“TSR”)

The following chart sets forth the relationship between Compensation Actually Paid to our PEO, the average of Compensation Actually Paid to our Non-PEO NEOs, and the Company’s TSR over the period covering fiscal years 2021 to 2024. A large component of our executive compensation is equity-based to align compensation with performance, but also includes other appropriate incentives such as cash bonuses that are designed to incentivize our executives to achieve annual corporate goals. We believe the equity-based compensation strongly aligns our PEO and Non-PEO NEOs’ interests with those of our stockholders to maximize long-term value and encourages long-term employment.

Compensation Actually Paid and Net Income (Loss)

Due to the nature of our Company’s consolidated financial statements and primary focus on research and development for utilizing plant technologies to improve health and wellness with reduced nicotine tobacco, our Company has not historically utilized net income (loss) as a performance measure for our executive compensation program. From 2022 to 2024, our net loss increased and the Compensation Actually Paid to our PEO and Non-PEO NEOs decreased between those years.

| [1] | The amounts disclosed reflect the adjustments listed in the tables below to the amounts reported in the Summary Compensation Table for our non-PEO NEO’s: |

| [2] | Total Stockholder Return illustrates the value, as of the last day of the indicated fiscal year, of an investment of $100 in XXII common stock on January 1, 2021. |

| [3] | The dollar amounts reported represent the amount of net income (loss) reflected in our consolidated audited financial statements for the applicable year. |

| [4] | During 2024, Lawrence D. Firestone was our PEO and our non-PEO NEOs were R. Hugh Kinsman, John J. Miller, Daniel A. Otto, Jonathan Staffeldt, Robert Manfredonia and Scott Marion. From January 2022 through July 2023, James A. Mish was our PEO and our non-PEO NEOs for 2023 were R. Hugh Kinsman, John J. Miller, and Peter Ferola. Additionally, from July 2023 through November 2023, John J. Miller served as interim chief executive officer and PEO. For the period December 1, 2023 through December 31, 2023, our PEO was Lawrence D. Firestone. Our non-PEO NEO’s for 2022 were John Franzino, Michael J. Zercher, R. Hugh Kinsman, John J. Miller and Richard Fitzgerald. The amounts disclosed reflect the adjustments listed in the tables below to the amounts reported in the Summary Compensation Table for PEO: |