Exhibit 99.3

| May 20, 2025 Q1 2025 Earnings Results. Live Q&A webcast EXHIBIT 99.3 |

| This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, which involve risks and uncertainties. All statements contained in this presentation other than statements of historical facts, including, without limitation, statements regarding our future financial and business performance, our business and strategy, expected growth, planned investments and capital expenditure, capacity expansion plans, anticipated future financing transactions and expected financial results, are forward-looking statements. The words “anticipate,” “believe,” “continue,” “estimate,” “expect,” “guide,” “intend,” “likely,” “may,” “will” and similar expressions and their negatives are intended to identify forward-looking statements. These forward-looking statements are subject to risks, uncertainties and assumptions, some of which are beyond our control. Actual results may differ materially from the results predicted or implied by such statements, and our reported results should not be considered as an indication of future performance. The potential risks and uncertainties that could cause actual results to differ from the results predicted or implied by such statements include, among others: our ability to build the businesses to the desired scale, competition pressure, technological developments, our ability to secure and retain clients, our ability to secure capital to accommodate the growth of the business, unpredictable sales cycles, potential pricing pressures, as well as those risks and uncertainties related to our continuing businesses included under the captions “Risk Factors” and “Operating and Financial Review and Prospects” in our Annual Report on Form 20-F for the year ended December 31, 2024, filed with the Securities and Exchange Commission (“SEC”) on April 30, 2025, which are available on our investor relations website at https://group.nebius.com/sec-filings and on the SEC website at https://www.sec.gov/. All information and numbers in this presentation is as of March 31, 2025 (unless stated otherwise). The forward-looking statements made in this presentation relate only to events or information as of the date on which the statements are made in this presentation. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this presentation, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain, and investors are cautioned not to unduly rely upon these statements. Forward-looking statements Disclaimer |

| Arkady Volozh Chief Executive Officer Neil Doshi VP, Head of Investor Relations Andrey Korolenko Chief Product & Infrastructure Officer Ophir Nave Chief Operating Officer Daniel Bounds Chief Marketing Officer Tom Blackwell Chief Communications Officer Roman Chernin Chief Business Officer |

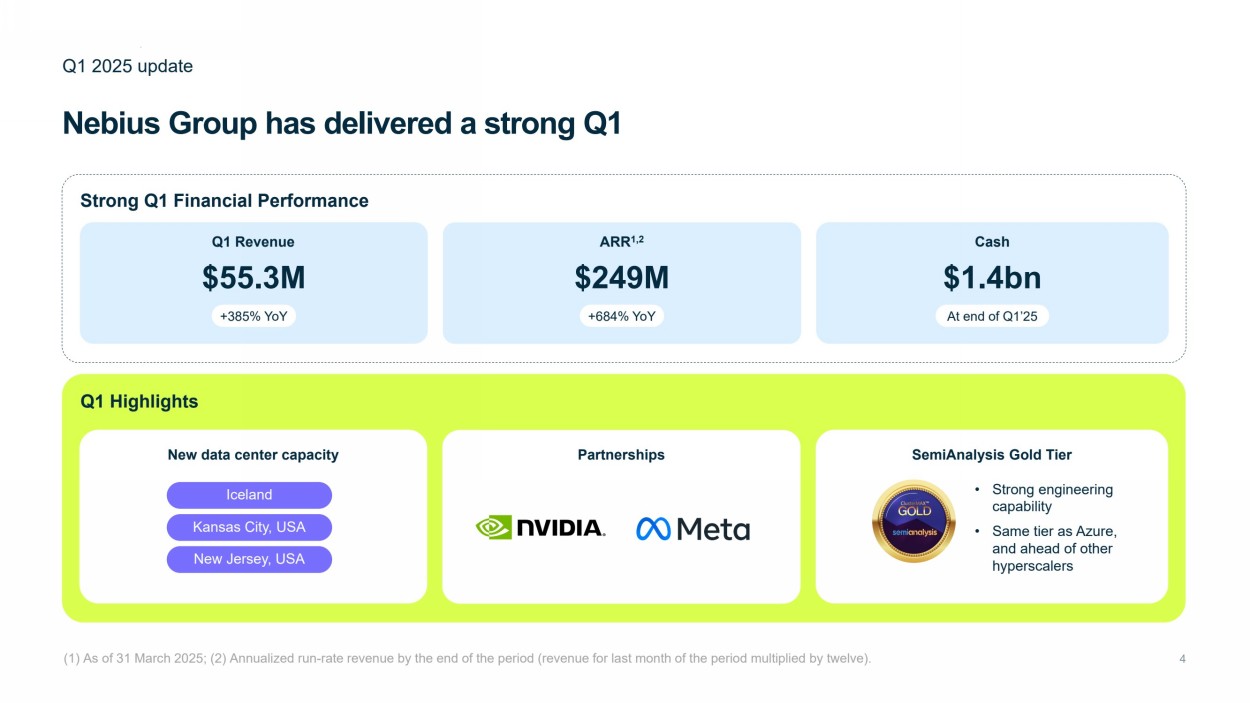

| Nebius Group has delivered a strong Q1 Q1 2025 update (1) As of 31 March 2025; (2) Annualized run-rate revenue by the end of the period (revenue for last month of the period multiplied by twelve). Strong Q1 Financial Performance Q1 Highlights Q1 Revenue $55.3M +385% YoY ARR1,2 $249M +684% YoY Cash $1.4bn At end of Q1’25 New data center capacity Partnerships SemiAnalysis Gold Tier • Strong engineering capability • Same tier as Azure, and ahead of other hyperscalers Iceland Kansas City, USA New Jersey, USA |

| AI Cloud feature enhancements Nebius: AI Stack offering updates Cluster management Compute • Blackwell early access • Last Hoppers deployed • Predictive failure notification • AI/ML-ready images on Kubernetes • Topology-aware training with Slurm • Cluster health checking with Slurm • Node auto-healing with Slurm MLOps tools and applications Storage • Partnerships and integrations (DDN, VAST, WEKA) • Object Storage: all-flash class (private preview) • Shared Filesystem updates • By-default encryption for network disks • Managed MLflow (GA) • Managed Postgres (GA) • JupyterLab notebook (GA) • Container Registry (GA) Integrations Platform • Increased GPU quotas for self-service • Python and Go SDKs • Monitoring and Logging updates • Improved notifications |

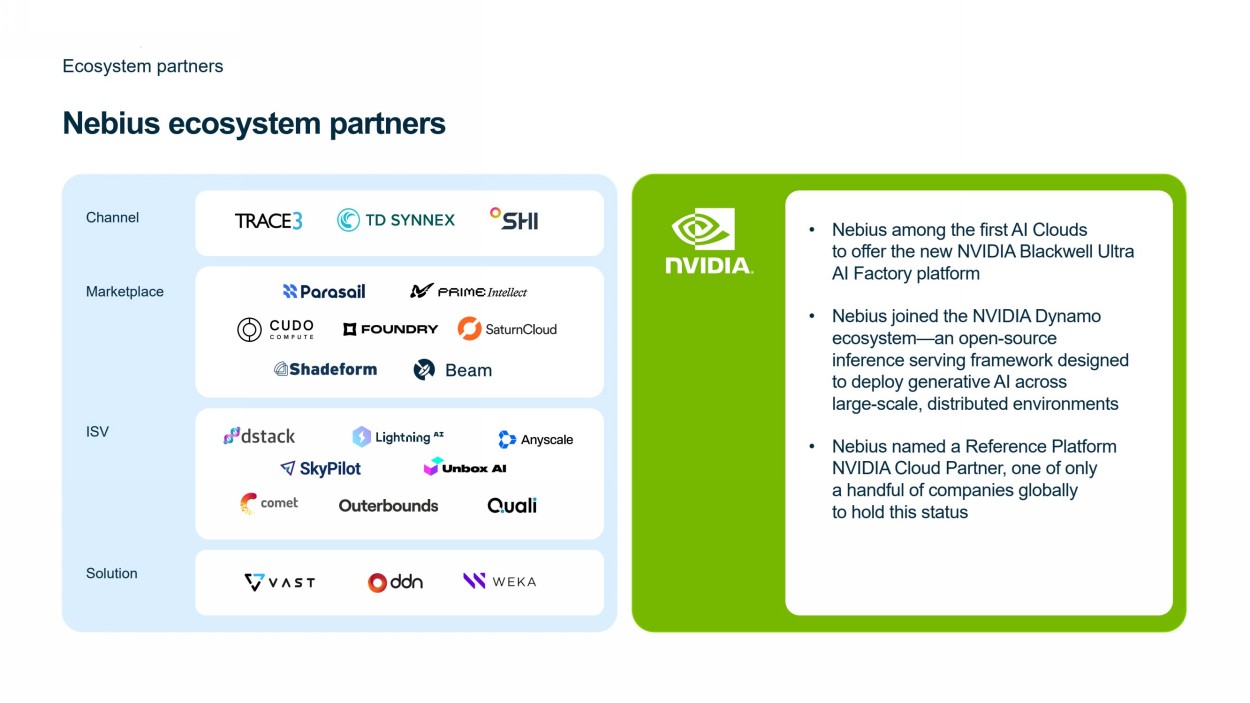

| Nebius ecosystem partners Ecosystem partners • Nebius among the first AI Clouds to offer the new NVIDIA Blackwell Ultra AI Factory platform • Nebius joined the NVIDIA Dynamo ecosystem—an open-source inference serving framework designed to deploy generative AI across large-scale, distributed environments • Nebius named a Reference Platform NVIDIA Cloud Partner, one of only a handful of companies globally to hold this status Channel Marketplace ISV Solution |

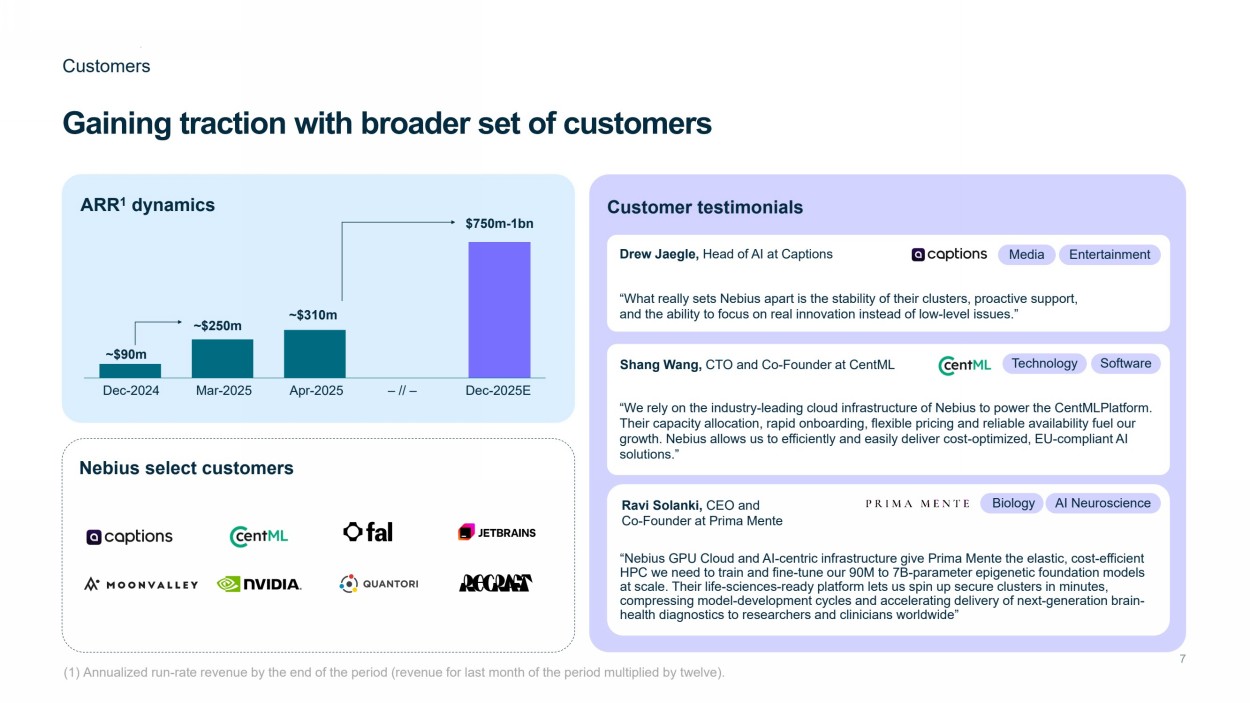

| Gaining traction with broader set of customers Customers Customer testimonials Media Entertainment “What really sets Nebius apart is the stability of their clusters, proactive support, and the ability to focus on real innovation instead of low-level issues.” Dec-2024 Mar-2025 Apr-2025 Dec-2025E ~$90m ~$250m ~$310m $750m-1bn – // – (1) Annualized run-rate revenue by the end of the period (revenue for last month of the period multiplied by twelve). Technology Software “We rely on the industry-leading cloud infrastructure of Nebius to power the CentMLPlatform. Their capacity allocation, rapid onboarding, flexible pricing and reliable availability fuel our growth. Nebius allows us to efficiently and easily deliver cost-optimized, EU-compliant AI solutions.” “Nebius GPU Cloud and AI-centric infrastructure give Prima Mente the elastic, cost-efficient HPC we need to train and fine-tune our 90M to 7B-parameter epigenetic foundation models at scale. Their life-sciences-ready platform lets us spin up secure clusters in minutes, compressing model-development cycles and accelerating delivery of next-generation brain-health diagnostics to researchers and clinicians worldwide” AI Neuroscience ARR1 dynamics Nebius select customers Shang Wang, CTO and Co-Founder at CentML Drew Jaegle, Head of AI at Captions Ravi Solanki, CEO and Co-Founder at Prima Mente Biology |

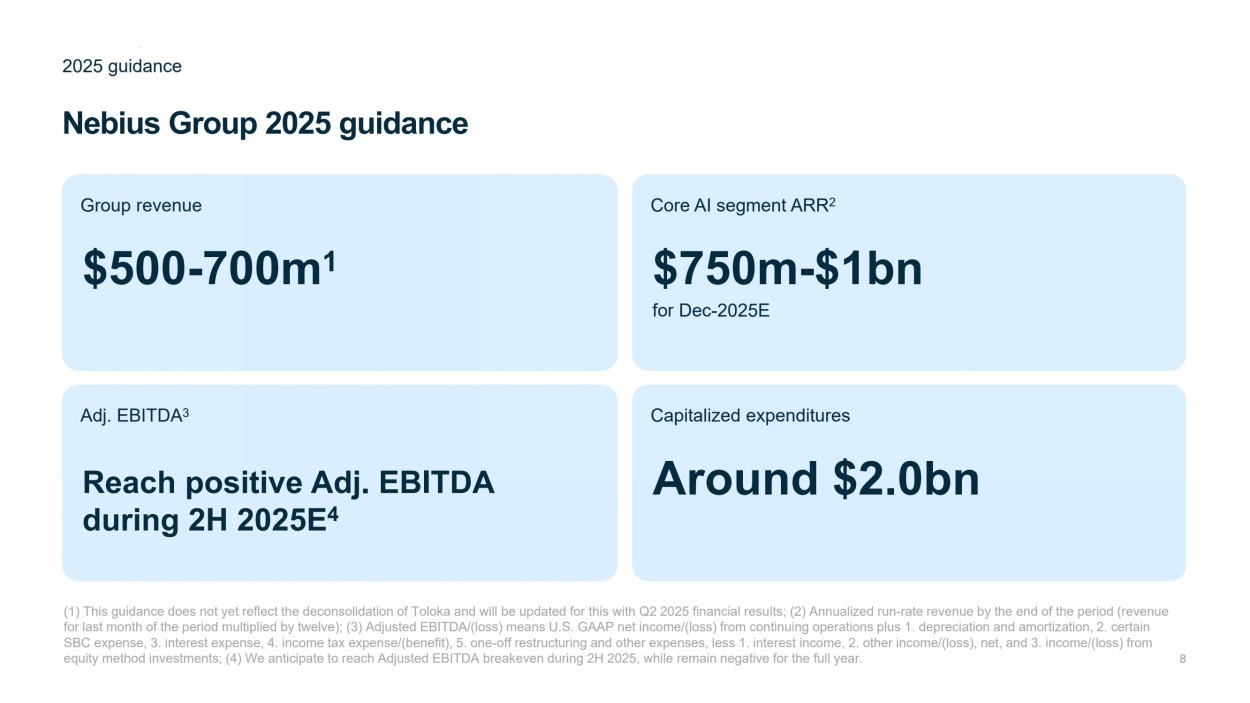

| Nebius Group 2025 guidance 2025 guidance (1) This guidance does not yet reflect the deconsolidation of Toloka and will be updated for this with Q2 2025 financial results; (2) Annualized run-rate revenue by the end of the period (revenue for last month of the period multiplied by twelve); (3) Adjusted EBITDA/(loss) means U.S. GAAP net income/(loss) from continuing operations plus 1. depreciation and amortization, 2. certain SBC expense, 3. interest expense, 4. income tax expense/(benefit), 5. one-off restructuring and other expenses, less 1. interest income, 2. other income/(loss), net, and 3. income/(loss) from equity method investments; (4) We anticipate to reach Adjusted EBITDA breakeven during 2H 2025, while remain negative for the full year. Group revenue $500-700m1 Core AI segment ARR2 $750m-$1bn for Dec-2025E Adj. EBITDA3 Reach positive Adj. EBITDA during 2H 2025E4 Capitalized expenditures Around $2.0bn |

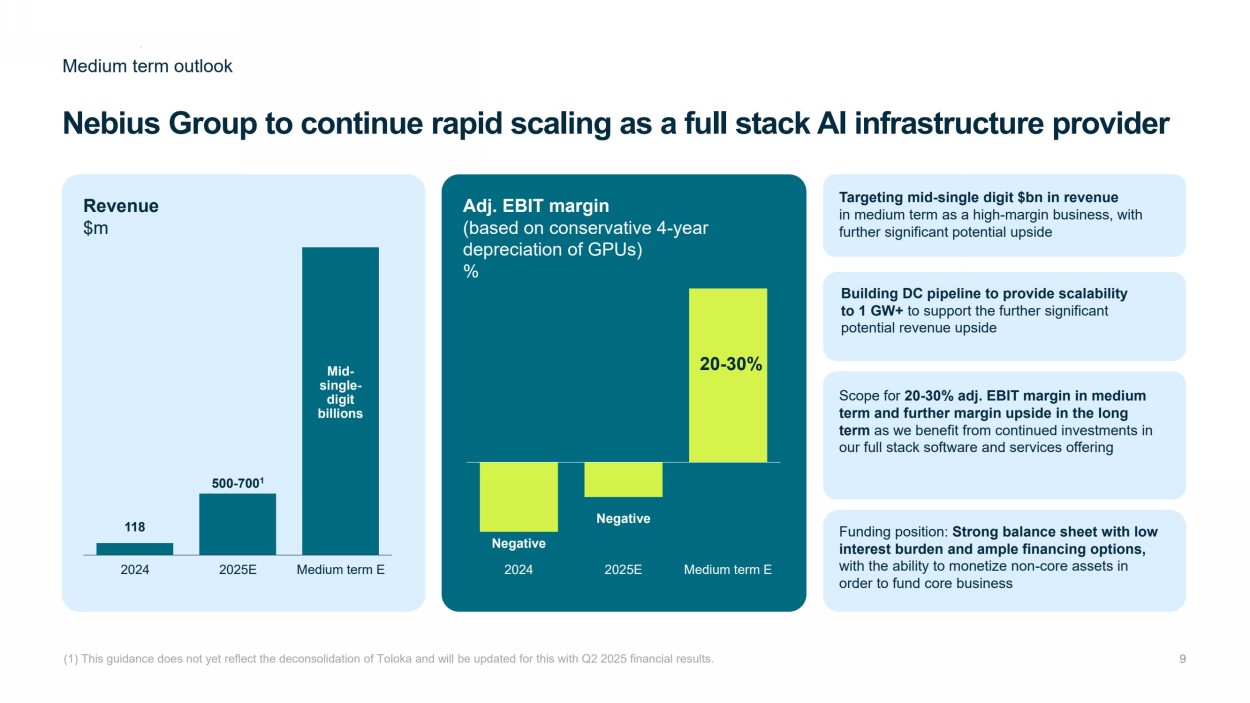

| Targeting mid-single digit $bn in revenue in medium term as a high-margin business, with further significant potential upside Building DC pipeline to provide scalability to 1 GW+ to support the further significant potential revenue upside Scope for 20-30% adj. EBIT margin in medium term and further margin upside in the long term as we benefit from continued investments in our full stack software and services offering Funding position: Strong balance sheet with low interest burden and ample financing options, with the ability to monetize non-core assets in order to fund core business Nebius Group to continue rapid scaling as a full stack AI infrastructure provider Medium term outlook (1) This guidance does not yet reflect the deconsolidation of Toloka and will be updated for this with Q2 2025 financial results. 2024 2025E Medium term E Negative Negative 20-30% Revenue $m 118 2024 2025E Medium term E 500-7001 Mid-single-digit billions Adj. EBIT margin (based on conservative 4-year depreciation of GPUs) % |

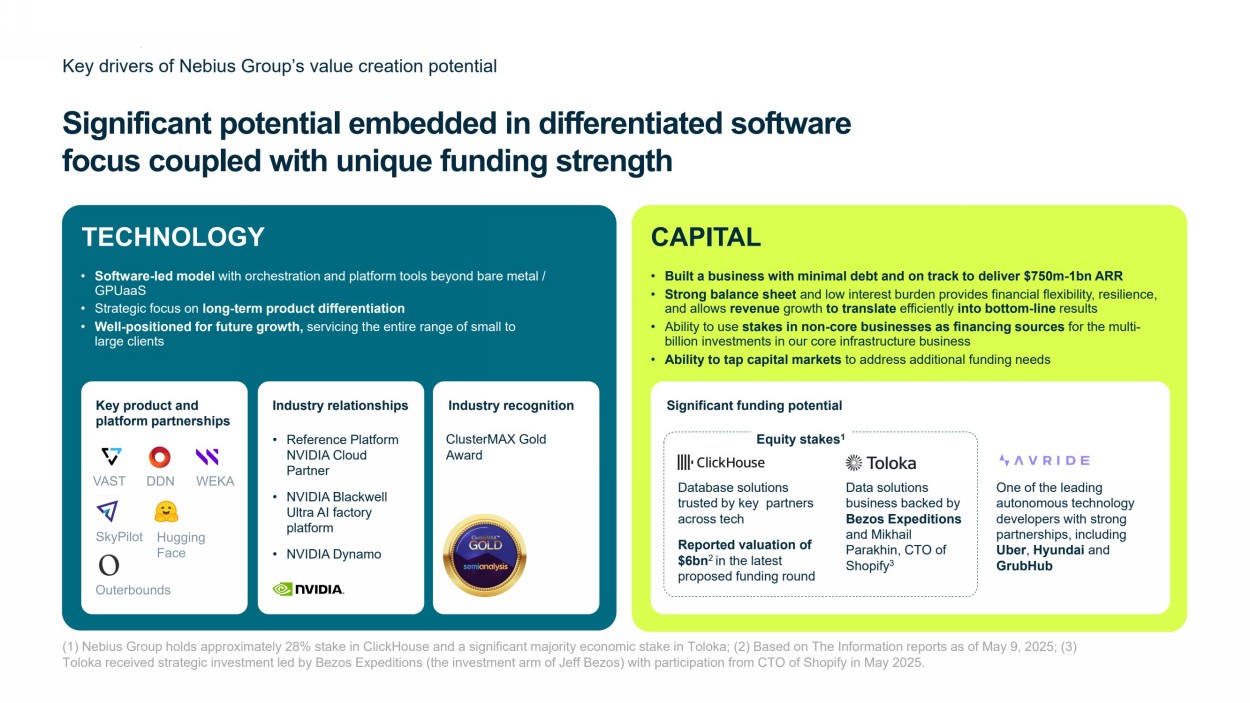

| TECHNOLOGY Key drivers of Nebius Group’s value creation potential (1) Nebius Group holds approximately 28% stake in ClickHouse and a significant majority economic stake in Toloka; (2) Based on The Information reports as of May 9, 2025; (3) Toloka received strategic investment led by Bezos Expeditions (the investment arm of Jeff Bezos) with participation from CTO of Shopify in May 2025. • Software-led model with orchestration and platform tools beyond bare metal / GPUaaS • Strategic focus on long-term product differentiation • Well-positioned for future growth, servicing the entire range of small to large clients Key product and platform partnerships CAPITAL • Built a business with minimal debt and on track to deliver $750m-1bn ARR • Strong balance sheet and low interest burden provides financial flexibility, resilience, and allows revenue growth to translate efficiently into bottom-line results • Ability to use stakes in non-core businesses as financing sources for the multi-billion investments in our core infrastructure business • Ability to tap capital markets to address additional funding needs Significant funding potential Database solutions trusted by key partners across tech Reported valuation of $6bn2 in the latest proposed funding round One of the leading autonomous technology developers with strong partnerships, including Uber, Hyundai and GrubHub Equity stakes 1 Data solutions business backed by Bezos Expeditions and Mikhail Parakhin, CTO of Shopify 3 Industry relationships Industry recognition • Reference Platform NVIDIA Cloud Partner • NVIDIA Blackwell Ultra AI factory platform • NVIDIA Dynamo Significant potential embedded in differentiated software focus coupled with unique funding strength ClusterMAX Gold Award |

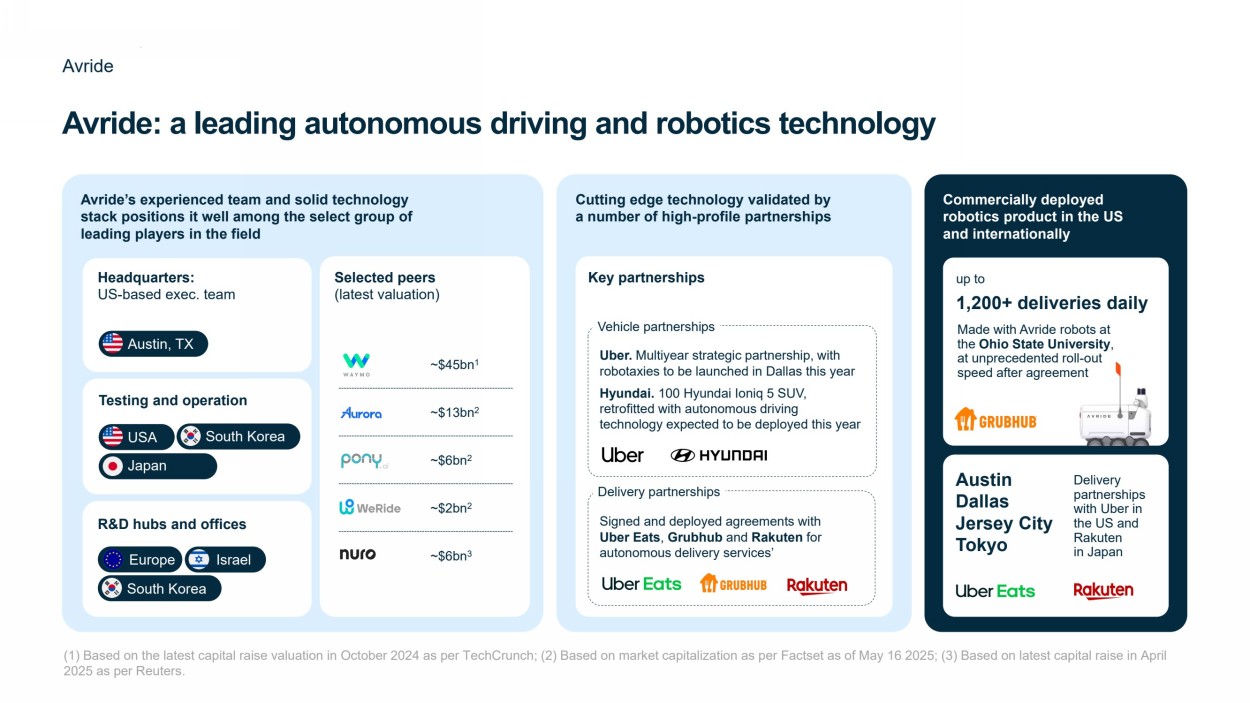

| Avride: a leading autonomous driving and robotics technology Avride (1) Based on the latest capital raise valuation in October 2024 as per TechCrunch; (2) Based on market capitalization as per Factset as of May 16 2025; (3) Based on latest capital raise in April 2025 as per Reuters. Headquarters: US-based exec. team Austin, TX Selected peers (latest valuation) Testing and operation USA Japan South Korea R&D hubs and offices Israel South Korea Avride’s experienced team and solid technology stack positions it well among the select group of leading players in the field Key partnerships Cutting edge technology validated by a number of high-profile partnerships Vehicle partnerships Delivery partnerships Uber. Multiyear strategic partnership, with robotaxies to be launched in Dallas this year Hyundai. 100 Hyundai Ioniq 5 SUV, retrofitted with autonomous driving technology expected to be deployed this year Signed and deployed agreements with Uber Eats, Grubhub and Rakuten for autonomous delivery services’ up to 1,200+ deliveries daily Commercially deployed robotics product in the US and internationally Made with Avride robots at the Ohio State University, at unprecedented roll-out speed after agreement Austin Dallas Jersey City Tokyo Delivery partnerships with Uber in the US and Rakuten in Japan Europe ~$45bn1 ~$13bn2 ~$6bn2 ~$2bn2 ~$6bn3 |

| Solution and potential validated by high profile investors Toloka: the next key data partner for the AI ecosystem Toloka Positioned to address the significant demand for AI data with unmatched quality and scale Trusted partner to leading frontier AI labs, model developers and enterprises Bezos Expeditions led investment in May 2025, supported by Mikhail Parakhin, CTO of Shopify Premium technology Field experts across 50+ knowledge areas High quality human and synthetic data supported by field experts Unparalleled scale, growing rapidly Significant technical moat Few competitors able to compete at same level of quality and scale • Toloka received new funding from a consortium of investors to be used for business scale up • Investment consortium was led by Bezos Expeditions and included Mikhail Parakhin, CTO of Shopify • Nebius Group relinquished voting control in Toloka, while retaining significant majority economic stake To be deconsolidated from Q2 2025 |

| Thank you Main Office Gustav Mahlerlaan 300 Amsterdam, Netherlands Investor Relations Contact askIR@nebius.com |