1. NATURE OF OPERATIONS AND GOING CONCERN

Premium Resources Ltd. and its wholly-owned subsidiaries’ (collectively, the “Company” or “PREM” and formerly Premium Nickel Resources Ltd.) principal business activity is the exploration and evaluation of PREM’s flagship asset, the Selebi nickel-copper-cobalt sulphide mine in Botswana and, separately, the Company’s Selkirk nickel-copper-cobalt-platinum group elements sulphide mine, also in Botswana. The common shares of PREM (“Common Shares”) are listed and posted for trading on the TSX Venture Exchange (the “TSXV”) under the symbol “PREM”. Prior to November 20, 2024, the Company traded on the TSXV under its previous name and symbol, Premium Nickel Resources Ltd. and PNRL, respectively. In addition, the Common Shares are currently quoted on the OTC Pink Open Market under the symbol “PRMLF”.

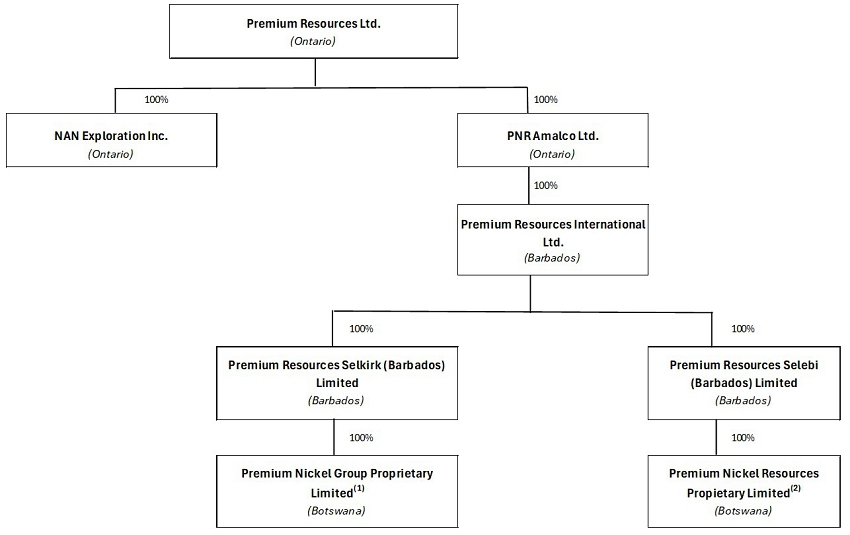

The following corporate structure chart sets out details of the direct and indirect ownership of the principal subsidiaries of the Company:

Notes:

| (1) | Premium Nickel Group Proprietary Limited owns the Selkirk Assets (as defined below). | |

| (2) | Premium Nickel Resources Proprietary Limited owns the Selebi Assets (as defined below). |

The Company’s head and registered office is located at One First Canadian Place, 100 King Street West, Suite 3400, Toronto, Ontario, Canada M5X 1A4.

The principal assets of the Company are the Selebi and Selebi North nickel-copper-cobalt (“Ni-Cu-Co”) mines in Botswana and related infrastructure (together, the “Selebi Mines”), as well as the nickel, copper, cobalt, platinum-group elements (“Ni-Cu-Co-PGE”) Selkirk mine in Botswana, together with associated infrastructure and four surrounding prospecting licences (collectively, the “Selkirk Mine” and together with the Selebi Mines, the “Mines”).

Going Concern

The Company, being in the exploration stage, is subject to risks and challenges similar to companies in a comparable stage of exploration and development. These risks include the challenges of securing adequate capital for exploration and advancement of the Company’s material projects, operational risks inherent in the mining industry, and global economic and metal price volatility, and there is no assurance management will be successful in its endeavors.

These consolidated financial statements have been prepared on the assumption that the Company will continue as a going concern, meaning it will continue in operation for the foreseeable future and will be able to realize assets and discharge liabilities in the ordinary course of operations. The ability of the Company to continue operations as a going concern is ultimately dependent upon achieving profitable operations and its ability to obtain adequate financing. The Company incurred a net loss of $15,228,330 for the three months ended March 31, 2025. To date, the Company has not generated profitable operations from its resource activities and will need to invest additional funds in carrying out its planned evaluation, development and operational activities.

It is not possible to predict whether future financing efforts will be successful or if the Company will attain a profitable level of operations. These material uncertainties cast substantial doubt about the Company’s ability to continue as a going concern. These consolidated financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts and classification of liabilities and the reported expenses and comprehensive loss that might be necessary should the Company be unable to continue as a going concern. These adjustments could be material.

The properties in which the Company currently has an interest are in pre-revenue stage. As such, the Company is dependent on external financing to fund its activities. In order to carry out the planned activities and cover administrative costs, the Company will use its existing working capital and raise additional amounts as needed. Further, the second instalment under the Selebi APA (defined in Note 5) of $35,940,000 (US$25,000,000) is due January 31, 2026.

On March 18, 2025, the Company closed a significant refinancing (Note 8 and Note 10). While this transaction will provide sufficient capital for the Company to fund operations in the near term, the Company will need further funding to support advancement of the Selebi Mines and the Selkirk Mine toward the development stage.

Although the Company has been successful in its past fundraising activities, there is no assurance as to the success of future fundraising efforts or as to the sufficiency of funds raised in the future.