First Quarter 2025 Supplementary Slides May 13, 2025 New

Confidential & Proprietary | Disclaimer Forward Looking Statement This presentation includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1996. The company’s actual results may differ from its expectations, estimates and projections and consequently, you should not rely on these forward-looking statements as predictions of future events. Words such as “expect”, “estimate”, “project”, “budget”, “forecast”, “anticipate”, “intend”, “plan”, “may”, “will”, “could”, “should”, “believes”, “predicts”, “potential”, “continue”, and similar expressions are intended to identify such forward-looking statements. These forward-looking statements include, without limitation, the company’s guidance for fiscal years 2025 and 2026 (including the company’s estimates for revenue and gross margin), the company's expectations regarding its ability to achieve profitability in the first half of 2026, the company’s expectations about future demand, the company's strategic realignment and initiatives, the company’s expectations regarding its liquidity and capital requirements, the company’s expectations regarding its potential cost savings, the company’s expectation about its market strategy and financial and operational position, and the company’s other expectations, hopes, beliefs, intentions or strategies for the future. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. You should carefully consider the risks and uncertainties described in the “Risk Factors” section of the company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024 (the “FY 2024 10-K”) and the other documents filed by the company from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Most of these factors are outside the company’s control and are difficult to predict. Factors that may cause such differences include, but are not limited to: (1) the inability of the company to execute its business plan, which may be affected by, among other things, competition, the ability of the company to grow and manage growth profitably, maintain relationships with customers and suppliers and retain its key employees; (2) the company’s ability to continue as a going concern; (3) the company’s ability to service and comply with its indebtedness; (4) the company’s ability to raise additional capital in the near-term; (5) the possibility that the company may be adversely affected by other economic, business, and/or competitive factors; (6) changes in the applicable laws and regulations, and (7) other risks and uncertainties indicated from time to time described in the FY 2024 10-K, including those under “Risk Factors” therein, and in the company’s other filings with the SEC. The company cautions that the foregoing list of factors is not exclusive and not to place undue reliance upon any forward-looking statements, including projections, which speak only as of the date made. The company does not undertake or accept any obligation to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. * Additional information on the use of Non-GAAP financial information, industry and market data, and trademarks is included in the appendix of this presentation.

Successful Launch of Rapid Production Services (RPS) Rapid Production Solutions Overview Expands addressable market – growing demand for high-quality parts Accelerates path to production – concept / design to printed parts Leverages in-house technology expertise for reliable / consistent part production Provides customers flexible, US-based, production supply chain Revenue model: profitable hourly rate for printing with margined services Expected to account for up to 40% of 2026 revenue Expanded gross margin with moderate machine utilization improvement <1 year ROI for machine CapEx expected Machines installed / operational for revenue generation Officially launched RPS in March 2025, marking a major milestone in transition to a recurring revenue model

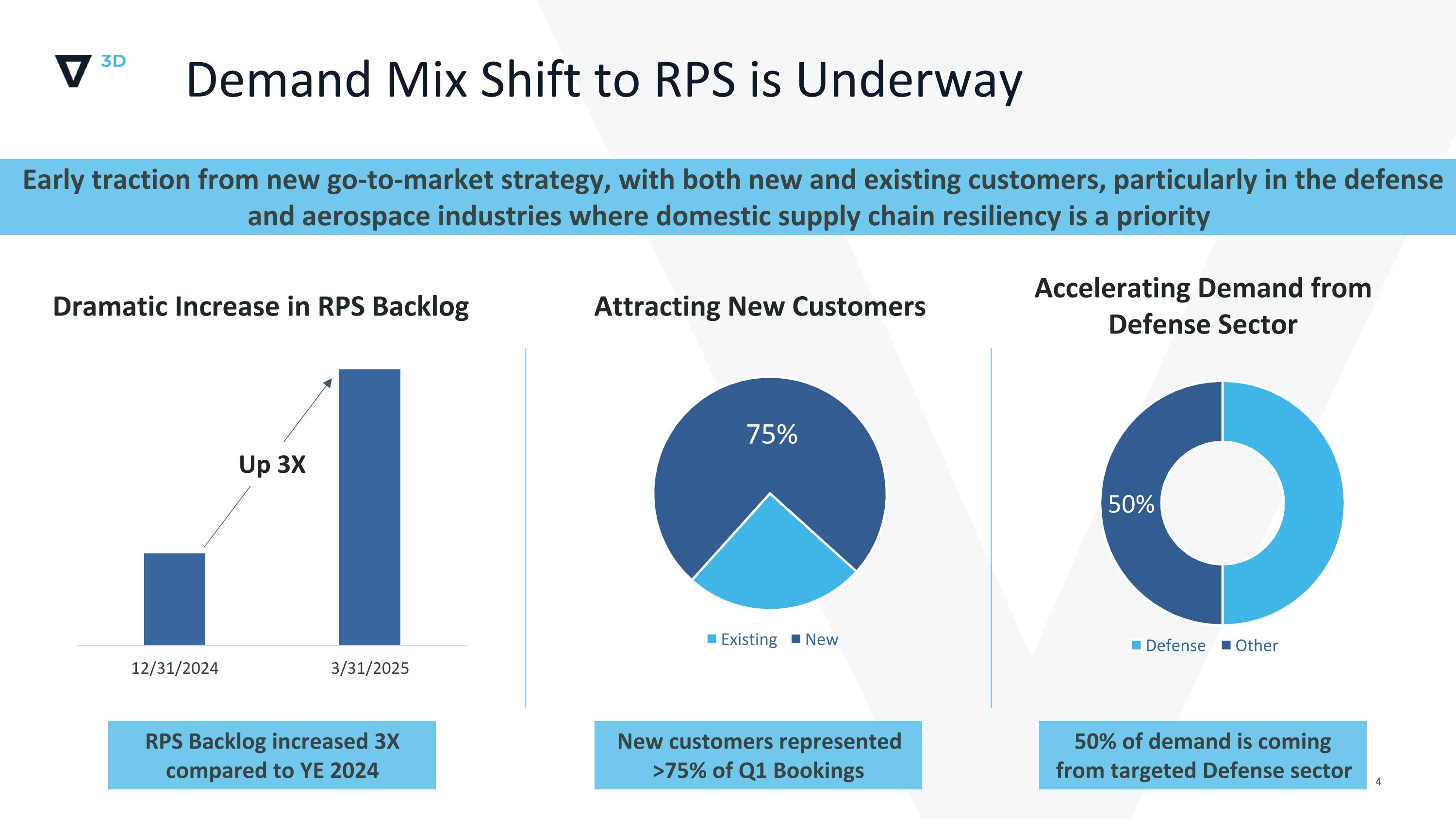

Early traction from new go-to-market strategy, with both new and existing customers, particularly in the defense and aerospace industries where domestic supply chain resiliency is a priority Demand Mix Shift to RPS is Underway Up 3X Dramatic Increase in RPS Backlog Attracting New Customers Accelerating Demand from Defense Sector RPS Backlog increased 3X compared to YE 2024 New customers represented >75% of Q1 Bookings 50% of demand is coming from targeted Defense sector

$15M Master Services Agreement with Momentus, Inc. Delivering production parts through our RPS offering Innovative Partnership Model Payment via combination of Momentus common and convertible preferred stock Velo3D’s stake capped at 9.99% of Momentus’ outstanding shares Benefits & Strategic Impact Accelerated path from design to production qualification Consistent, high-quality, and reliable parts through advanced software and metrology Flexible supply chain options: in-house integration, contract manufacturing, or Velo3D production cells Driving Long-Term Growth Aligns with Velo3D’s growth strategy and unlocks opportunities for mission-critical aerospace and defense projects

Velo3D & Amaero (ASX:3DA) Forge Strategic Alliance to Propel Metal 3D Printing Innovation Five-year exclusive supply agreement aiming to revolutionize metal additive manufacturing Exclusive Supply Amaero will provide Velo3D with Niobium C103, titanium, and other critical refractory alloys Advanced Collaboration Joint development of proprietary print parameters for these alloys on Velo3D's Sapphire printers Strategic Impact Strengthening the U.S. supply chain for mission-critical components in aerospace and defense sectors. This partnership underscores our commitment to advancing metal 3D printing capabilities and supporting the domestic manufacturing renaissance.

Velo3D Teams Up with Ohio Ordnance Works, Inc. for 3D Printed Military Weapons Velo3D to provide engineering and design services to optimize components in additive manufacturing Partnership Partnering with Ohio Ordnance Works to provide engineering, design, and analysis for their 3D Printed Military Weapons Development Project Goals Optimize weapon components for additive manufacturing, accelerating development and ensuring top-tier performance Scope Providing engineering, design and analysis expertise to help Ohio Ordnance Works optimize weapon components for additive manufacturing Impact of the Collaboration Partnership enables both companies to deliver high-performance, precision components to defense customers more quickly and efficiently

New Order for Sapphire XC Metal 3D Printer Mears Machine Corporation enhances its additive manufacturing capabilities with purchase of fourth system Velo3D & Mears Machine Partnership Sale of fourth Velo3D Sapphire XC printer for additive manufacturing Printer configured for nickel super-alloy H282 Supports aerospace, industrial, and defense programs H282 Superalloy Benefits Superior high-temp strength and corrosion resistance vs. Inconel 718 Ideal for gas turbines: liners, vane rings, nozzles Additive manufacturing reduces machining challenges Technology & Impact Large-format printer: 600 mm x 550 mm (up to 1,000 mm) Eight 1-kilowatt lasers for high-capacity production Scalable, repeatable manufacturing across systems Enhances Mears Machine’s ability to meet growing customer demands

Strengthened governance to improve decision-making processes and reinforce oversight of strategic execution Enhancements to Leadership and Governance Appointed Brice Cooper as Vice President of Defense and Government Relations Brings More Than 25 Years of Leadership Experience in the Defense Industry Including Special Operations, Product Management and Congressional Affairs Responsible for Driving Continued Expansion of Defense Industry Business Key Leader for Governmental Programs Appointed Retired Navy Rear Admiral Jason Lloyd to Board of Directors Experience in maritime engineering and design Recognized leader in the U.S. Navy Appointed Kenneth Thieneman to Board of Directors Strong operational and financial experience as CEO of Thieneman Construction Darren Beckett Joins Velo3D as Chief Technology Officer Two decades at Intel Corporation Michelle Sidwell Rejoins Velo3D as Chief Revenue Officer 20 years of experience in technology sales and leadership including Salesloft, Yext and Adobe

Confidential & Proprietary | Financials Overview New

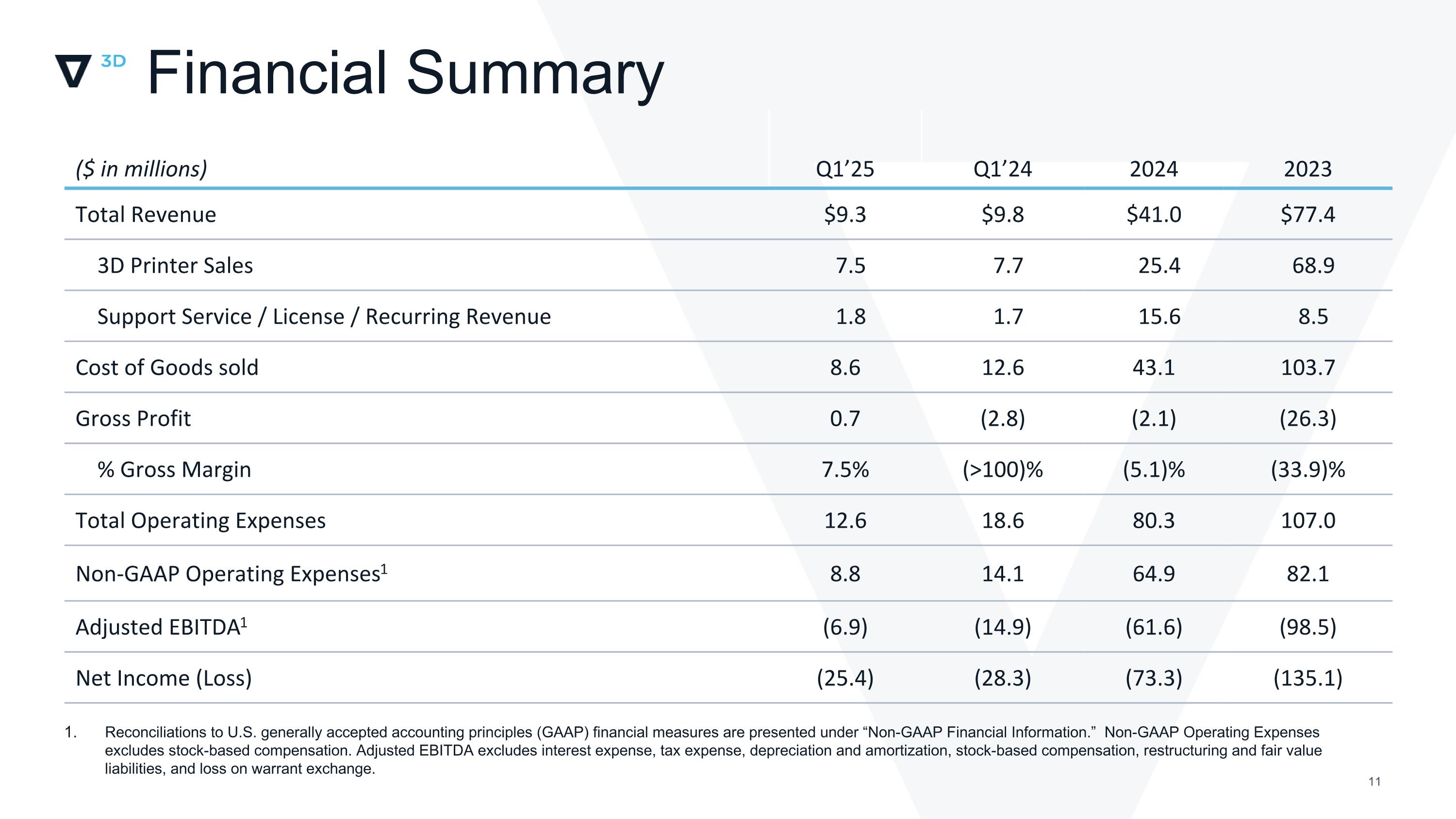

Financial Summary Reconciliations to U.S. generally accepted accounting principles (GAAP) financial measures are presented under “Non-GAAP Financial Information.” Non-GAAP Operating Expenses excludes stock-based compensation. Adjusted EBITDA excludes interest expense, tax expense, depreciation and amortization, stock-based compensation, restructuring and fair value liabilities, and loss on warrant exchange. ($ in millions) Q1’25 Q1’24 2024 2023 Total Revenue $9.3 $9.8 $41.0 $77.4 3D Printer Sales 7.5 7.7 25.4 68.9 Support Service / License / Recurring Revenue 1.8 1.7 15.6 8.5 Cost of Goods sold 8.6 12.6 43.1 103.7 Gross Profit 0.7 (2.8) (2.1) (26.3) % Gross Margin 7.5% (>100)% (5.1)% (33.9)% Total Operating Expenses 12.6 18.6 80.3 107.0 Non-GAAP Operating Expenses1 8.8 14.1 64.9 82.1 Adjusted EBITDA1 (6.9) (14.9) (61.6) (98.5) Net Income (Loss) (25.4) (28.3) (73.3) (135.1)

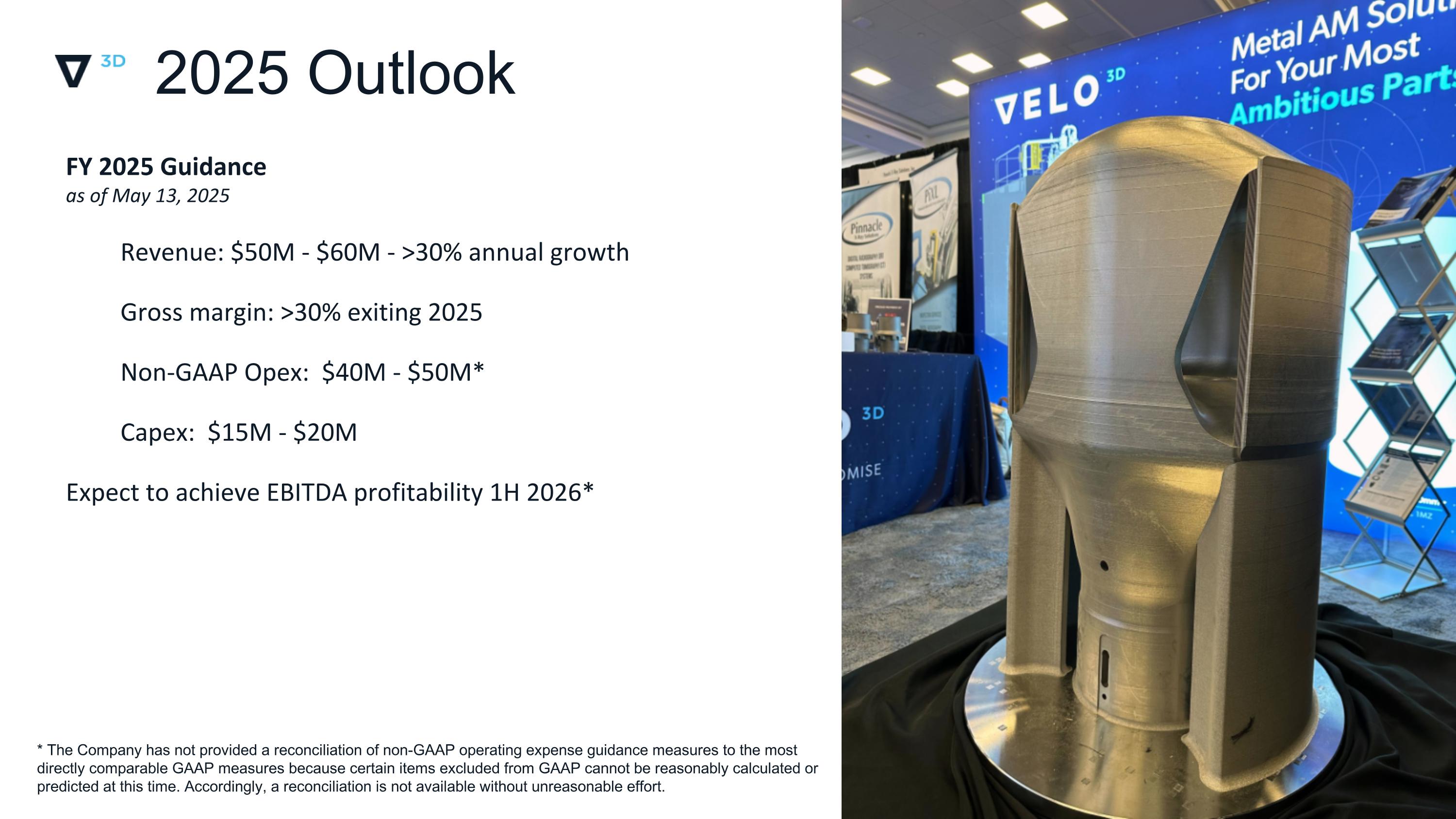

2023 Outlook * Q423 / FY 2023 gross margin ranges excludes impact from non-recurring charges 2025 Outlook FY 2025 Guidance as of May 13, 2025 Revenue: $50M - $60M - >30% annual growth Gross margin: >30% exiting 2025 Non-GAAP Opex: $40M - $50M* Capex: $15M - $20M Expect to achieve EBITDA profitability 1H 2026* * The Company has not provided a reconciliation of non-GAAP operating expense guidance measures to the most directly comparable GAAP measures because certain items excluded from GAAP cannot be reasonably calculated or predicted at this time. Accordingly, a reconciliation is not available without unreasonable effort.

Thank You!

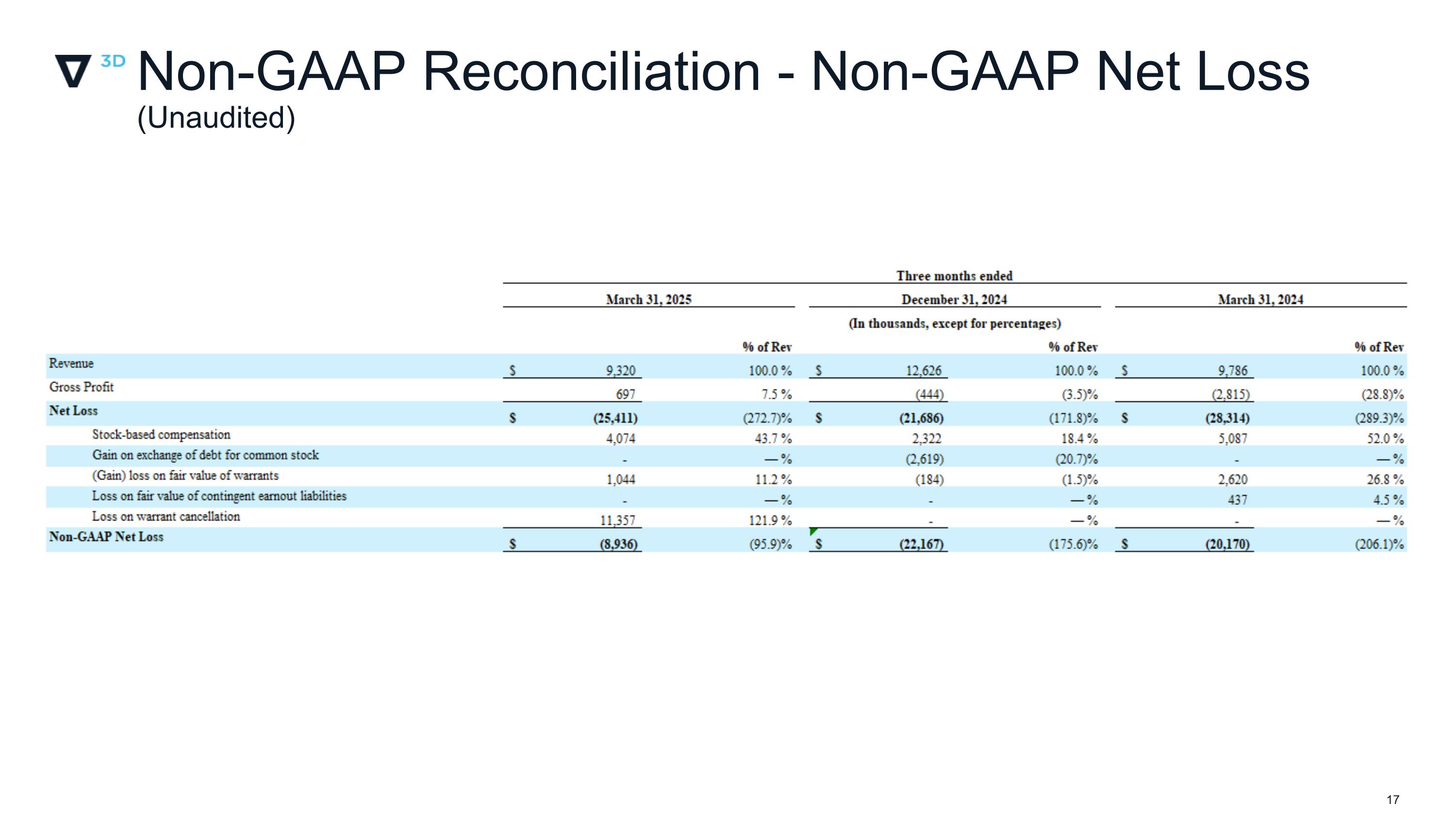

Disclaimer Non-GAAP Financial Information The Company uses non-GAAP financial measures, such as Non-GAAP / Adjusted operating expenses, EBITDA, Adjusted EBITDA, Adjusted EBITDA excluding merger related transactional costs, loss on convertible note modification, and Non-GAAP net (loss), to help it make strategic decisions, establish budgets and operational goals for managing its business, analyze its financial results and evaluate its performance. The Company also believes that the presentation of these non-GAAP financial measures in this presentation provides an additional tool for investors to use in comparing the Company’s core business and results of operations over multiple periods. However, the non-GAAP financial measures presented in this presentation may not be comparable to similarly titled measures reported by other companies due to differences in the way that these measures are calculated. The non-GAAP financial measures presented in this presentation should not be considered as the sole measure of the Company’s performance and should not be considered in isolation from, or as a substitute for, comparable financial measures calculated in accordance with generally accepted accounting principles accepted in the United States (“GAAP”). For reconciliations of these non-GAAP financial measures to the Company’s GAAP financial measures, see Appendix to this presentation. You should review these reconciliations and not rely on any single financial measure to evaluate the Company business. Industry and Market Data In this presentation, the Company relies on and refers to publicly available information and statistics regarding the market in which the Company competes and other industry data. The Company obtained this information and statistics from third-party sources, including reports by market research firms and company filings. While the Company believes such third-party information is reliable, there can be no assurance as to the accuracy or completeness of the indicated information. The Company has not independently verified the information provided by third-party sources. Trademarks This presentation may contain trademarks, service marks, trade names and copyrights of other companies, which are the property of the respective owners. Solely for convenience, some of the trademarks, service marks, trade names and copyrights referred to in this presentation may be listed without the TM, SM, © or ® symbols, but the Company will assert, to the fullest extent under applicable law, the rights of the applicable owners, if any, to these trademarks, service marks, trade names and copyrights.

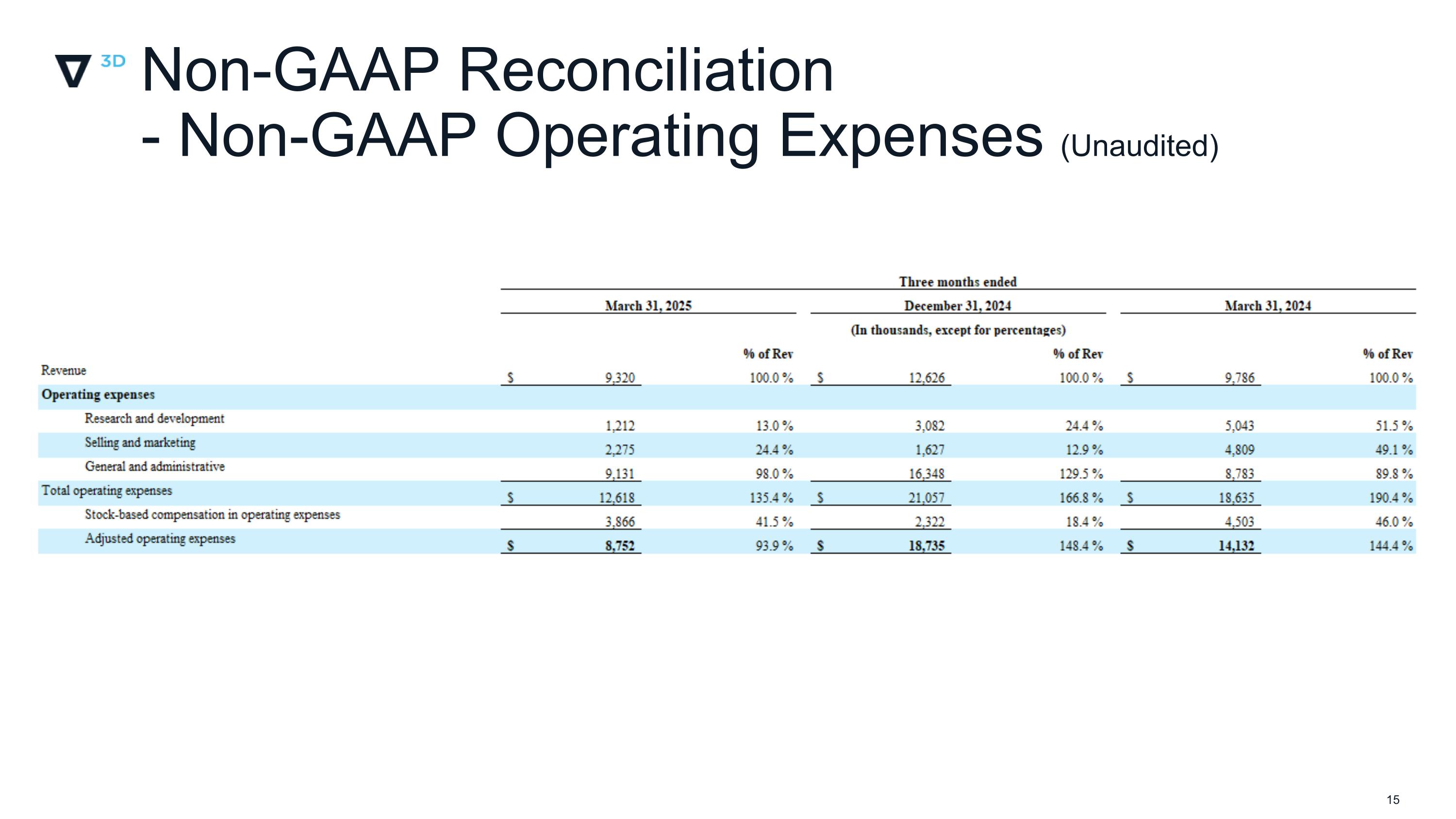

Non-GAAP Reconciliation - Non-GAAP Operating Expenses (Unaudited)

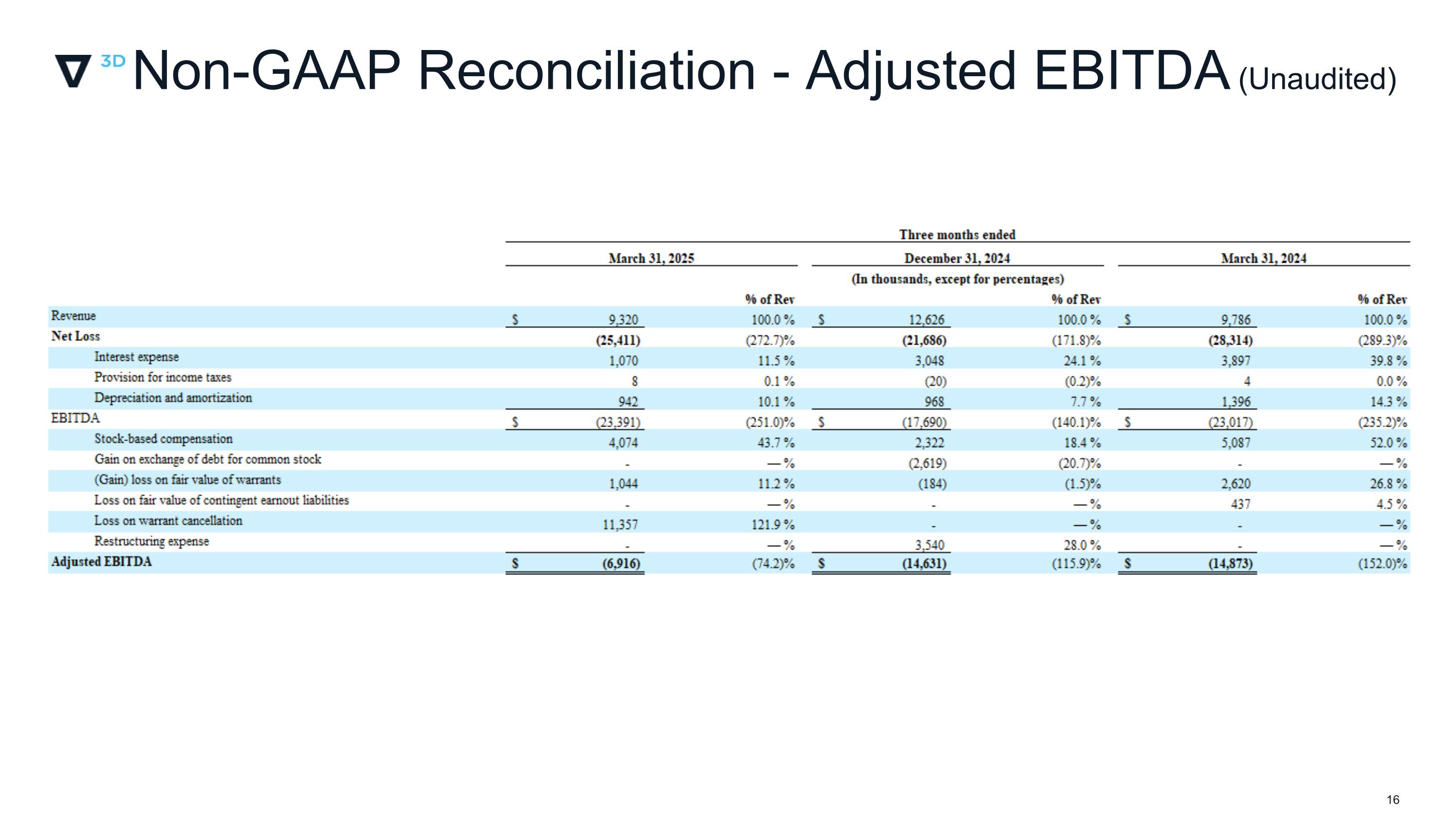

Non-GAAP Reconciliation - Adjusted EBITDA (Unaudited)

Non-GAAP Reconciliation - Non-GAAP Net Loss (Unaudited)