| Annual Shareholders’ Meeting May 8, 2025 |

| ANNUAL MEETING OF SHAREHOLDERS I. Introduction – Robert A. Bull, Chairman II. Call to Order III. Welcome IV. Ascertain Presence of a Quorum – David R. Saracino, Secretary V. Proposal No. 1 – Election of Directors VI. Proposal No. 2 – Ratification of Independent Auditors VII. Management Presentations I. Robert A Bull, Chairman II. Stacy Gordner III. Jack W. Jones VIII. Questions IX. Results of Voting X. Closing Comment/Adjournment |

| First Keystone Corporation Board of Directors ROBERT A. BULL CHAIRMAN JOHN E. ARNDT VICE CHAIRMAN D. MATTHEW BOWER WHITNEY B. HOLLOWAY JACK W. JONES MICHAEL L. JEZEWSKI NANCY J. MARR WILLIAM E. RINEHART DAVID R. SARACINO ELAINE A. WOODLAND |

| First Keystone Corporation Director Emeriti DR. JOSEPH B. JEROME F. FABIAN CONAHAN, JR JOHN G. GERLACH |

| Robert A Bull Chairman of the Board This presentation contains certain forward-looking statements, which are included pursuant to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, and reflect management’s beliefs and expectations based on information currently available. These forward-looking statements are inherently subject to significant risks and uncertainties, including changes in general economic and financial market conditions, the Corporation’s ability to effectively carry out its business plans and changes in regulatory or legislative requirements. Other factors that could cause or contribute to such differences are changes in competitive conditions, and pending or threatened litigation. Although management believes the expectations reflected in such forward-looking statements are reasonable, actual results may differ materially. |

| Stacy Gordner Assistant Vice President, Interim Chief Financial Officer This presentation contains certain forward-looking statements, which are included pursuant to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, and reflect management’s beliefs and expectations based on information currently available. These forward-looking statements are inherently subject to significant risks and uncertainties, including changes in general economic and financial market conditions, the Corporation’s ability to effectively carry out its business plans and changes in regulatory or legislative requirements. Other factors that could cause or contribute to such differences are changes in competitive conditions, and pending or threatened litigation. Although management believes the expectations reflected in such forward-looking statements are reasonable, actual results may differ materially. |

|

|

|

|

|

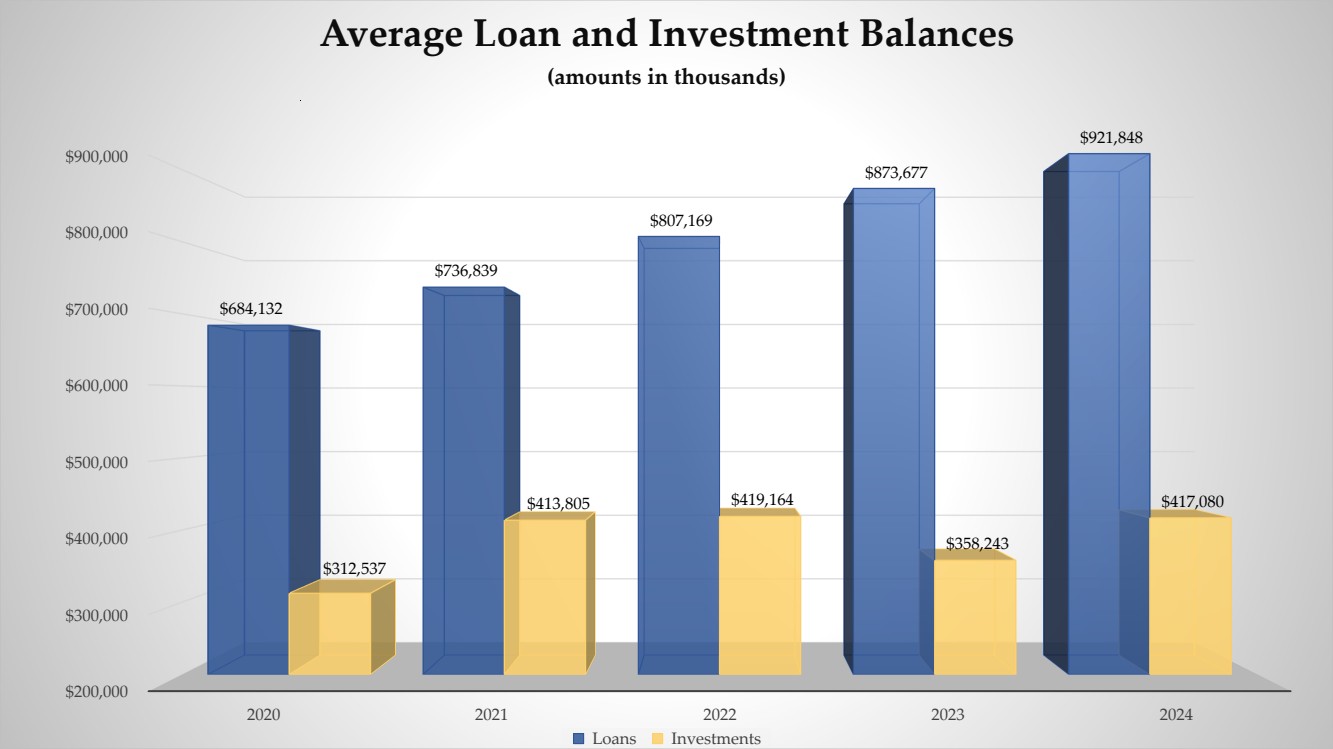

| $200,000 $300,000 $400,000 $500,000 $600,000 $700,000 $800,000 $900,000 2020 2021 2022 2023 2024 $684,132 $736,839 $807,169 $873,677 $921,848 $312,537 $413,805 $419,164 $358,243 $417,080 Loans Investments Average Loan and Investment Balances (amounts in thousands) |

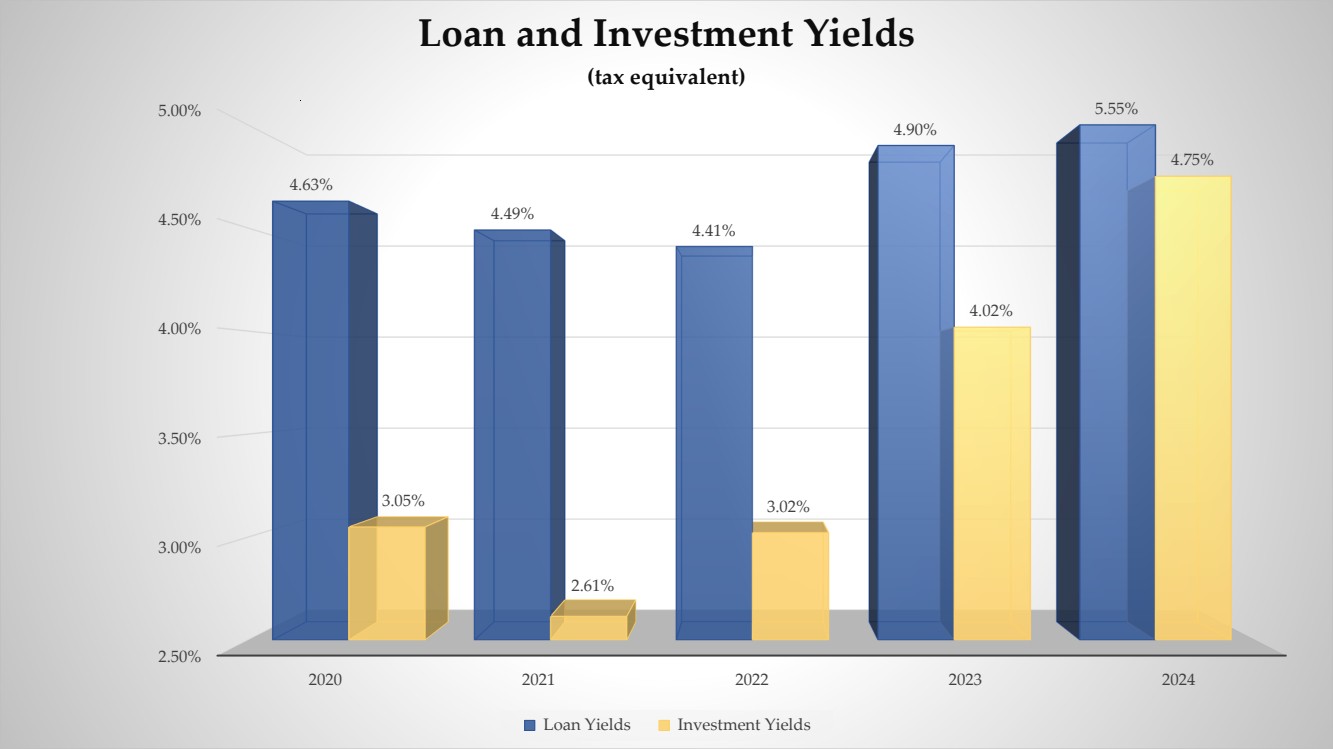

| 2.50% 3.00% 3.50% 4.00% 4.50% 5.00% 2020 2021 2022 2023 2024 4.63% 4.49% 4.41% 4.90% 5.55% 3.05% 2.61% 3.02% 4.02% 4.75% Loan Yields Investment Yields Loan and Investment Yields (tax equivalent) |

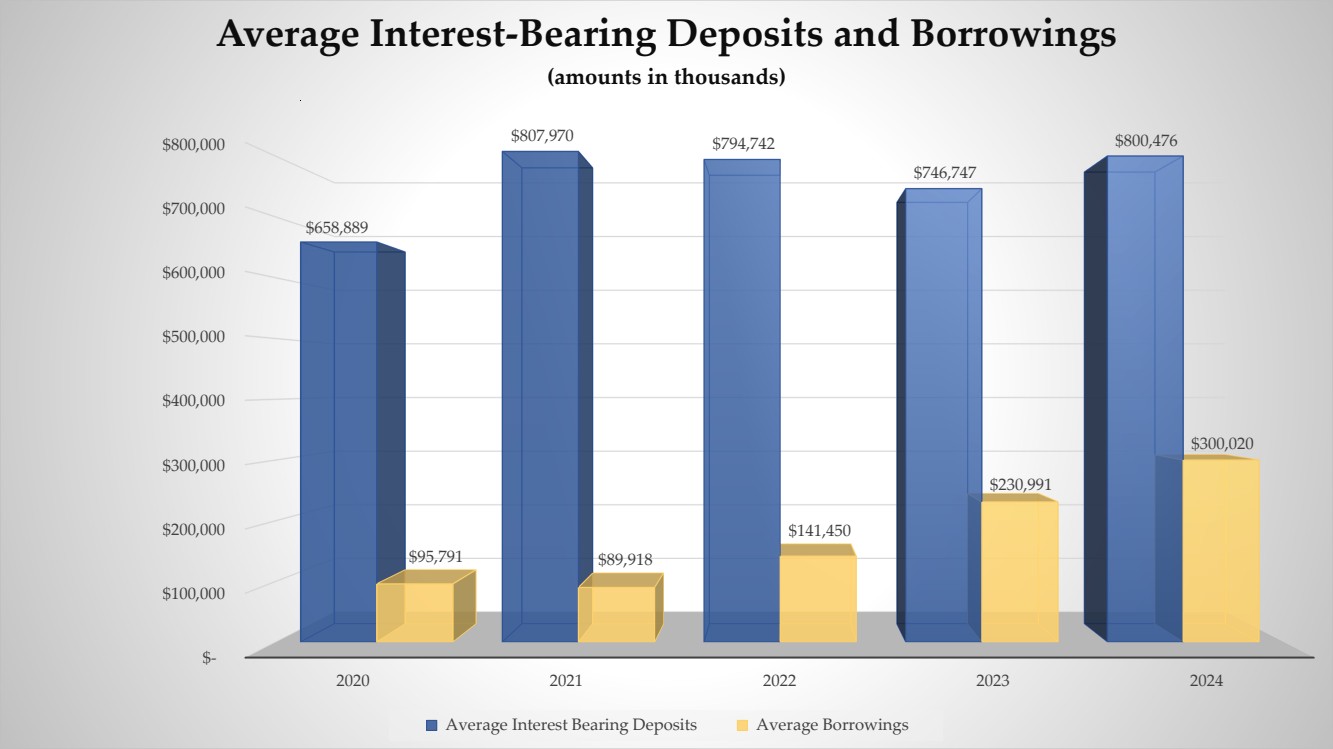

| $- $100,000 $200,000 $300,000 $400,000 $500,000 $600,000 $700,000 $800,000 2020 2021 2022 2023 2024 $658,889 $807,970 $794,742 $746,747 $800,476 $95,791 $89,918 $141,450 $230,991 $300,020 Average Interest Bearing Deposits Average Borrowings Average Interest-Bearing Deposits and Borrowings (amounts in thousands) |

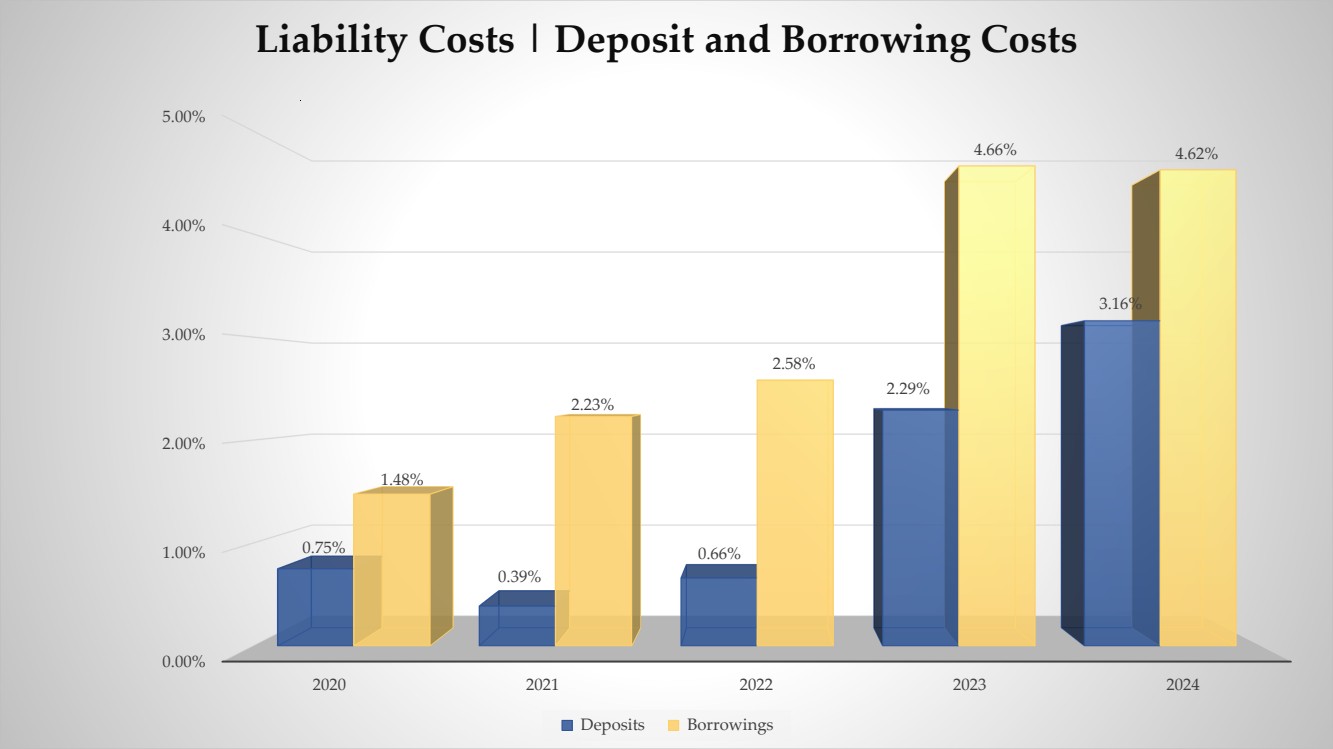

| 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 2020 2021 2022 2023 2024 0.75% 0.39% 0.66% 2.29% 3.16% 1.48% 2.23% 2.58% 4.66% 4.62% Deposits Borrowings Liability Costs | Deposit and Borrowing Costs |

| 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 2020 2021 2022 2023 2024 3.25% 3.08% 2.96% 1.79% 1.74% 3.46% 3.22% 3.19% 2.38% 2.40% Net Interest Spread Net Interest Margin Net Interest Spread and Net Interest Margin (tax equivalent) |

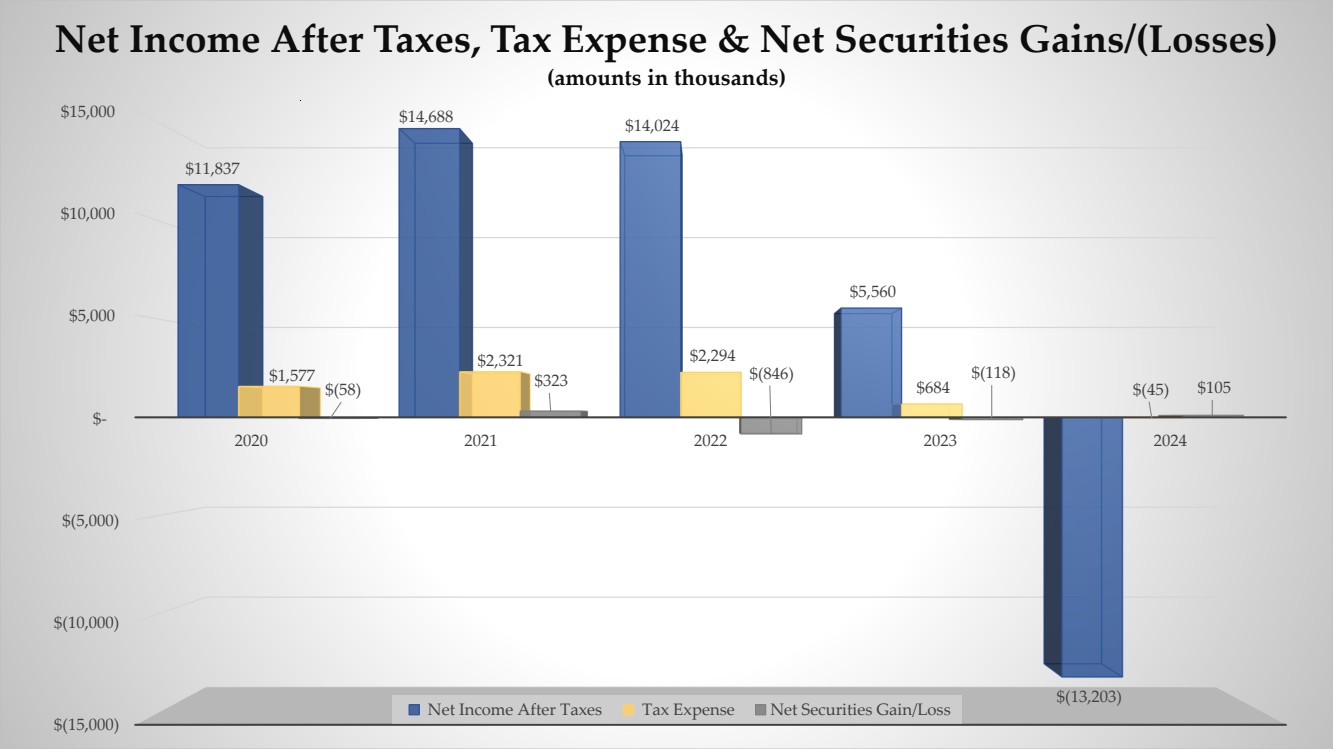

| $(15,000) $(10,000) $(5,000) $- $5,000 $10,000 $15,000 2020 2021 2022 2023 2024 $11,837 $14,688 $14,024 $5,560 $(13,203) $1,577 $2,321 $2,294 $(58) $684 $(45) $323 $(846) $(118) $105 Net Income After Taxes Tax Expense Net Securities Gain/Loss Net Income After Taxes, Tax Expense & Net Securities Gains/(Losses) (amounts in thousands) |

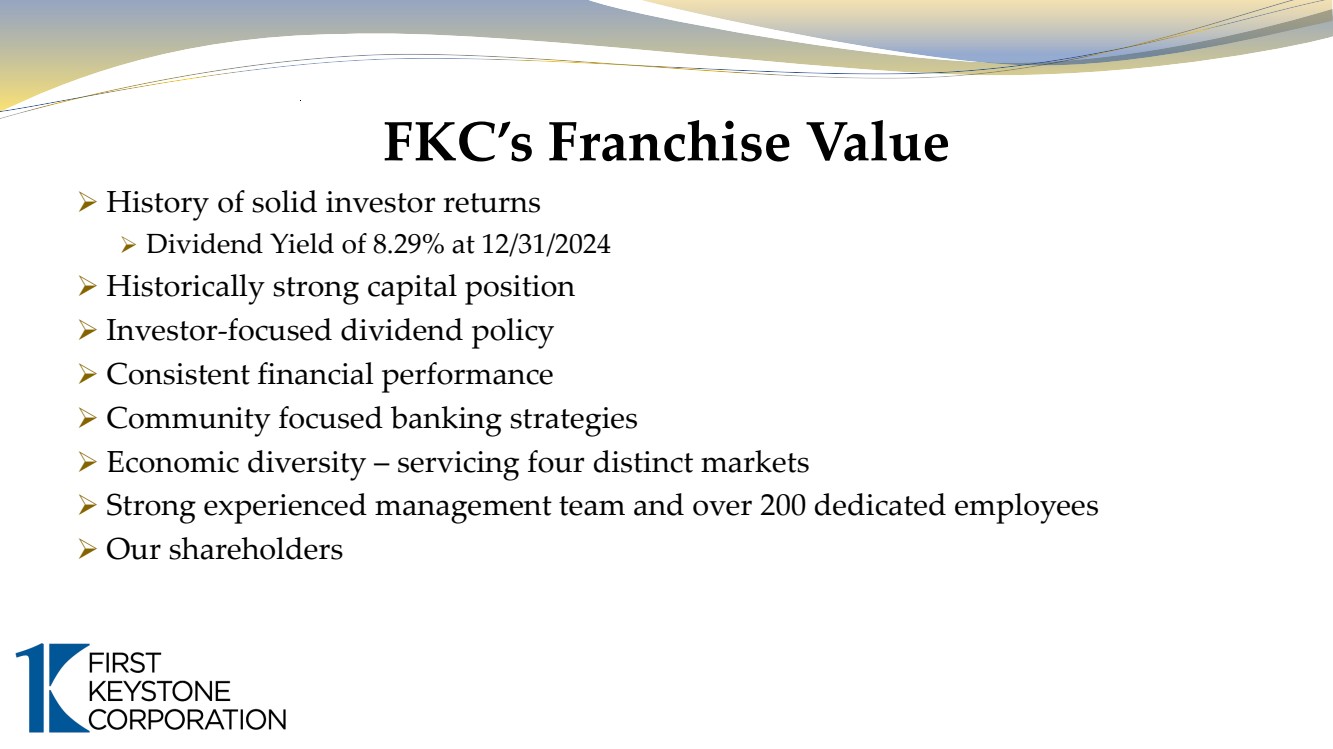

| FKC’s Franchise Value ➢ History of solid investor returns ➢ Dividend Yield of 8.29% at 12/31/2024 ➢ Historically strong capital position ➢ Investor-focused dividend policy ➢ Consistent financial performance ➢ Community focused banking strategies ➢ Economic diversity – servicing four distinct markets ➢ Strong experienced management team and over 200 dedicated employees ➢ Our shareholders |

| Jack Jones This presentation contains certain forward-looking statements, which are included pursuant to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, and reflect management’s beliefs and expectations based on information currently available. These forward-looking statements are inherently subject to significant risks and uncertainties, including changes in general economic and financial market conditions, the Corporation’s ability to effectively carry out its business plans and changes in regulatory or legislative requirements. Other factors that could cause or contribute to such differences are changes in competitive conditions, and pending or threatened litigation. Although management believes the expectations reflected in such forward-looking statements are reasonable, actual results may differ materially. President and CEO |

| Introduction ➢Joined First Keystone Community Bank in January ➢ February 1, became President and CEO after the retirement of Elaine ➢ Thank You Elaine for your 32 years of service to this bank, and I look forward to working with you as a Board Member ➢ Penns Woods Bancorp (PWOD) parent company for Jersey Shore State Bank and Luzerne Bank ➢ Chief Banking Officer ➢ Established loan products while monitoring rates ➢ Determined Deposit specials while keeping rates competitive ➢ Supervised Indirect Loan program at peak more than $220 Million ➢ Expanded footprint organically into new markets |

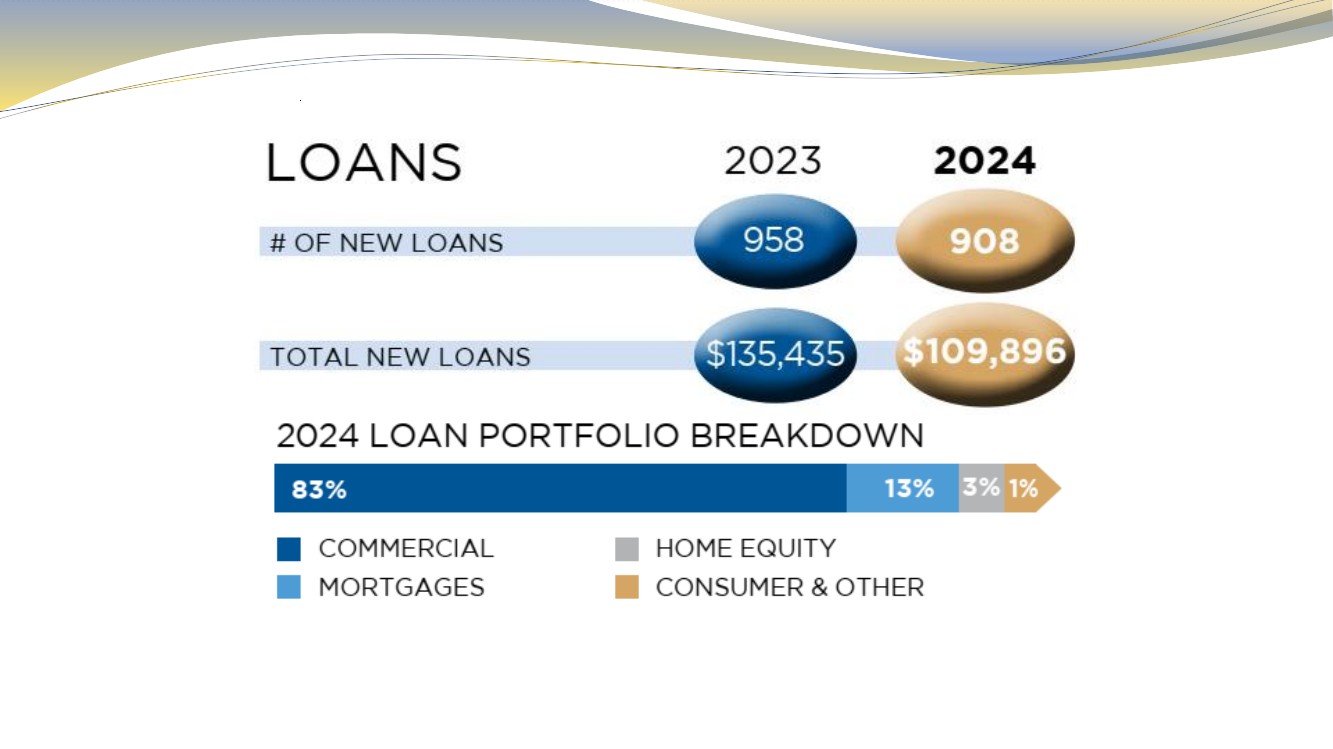

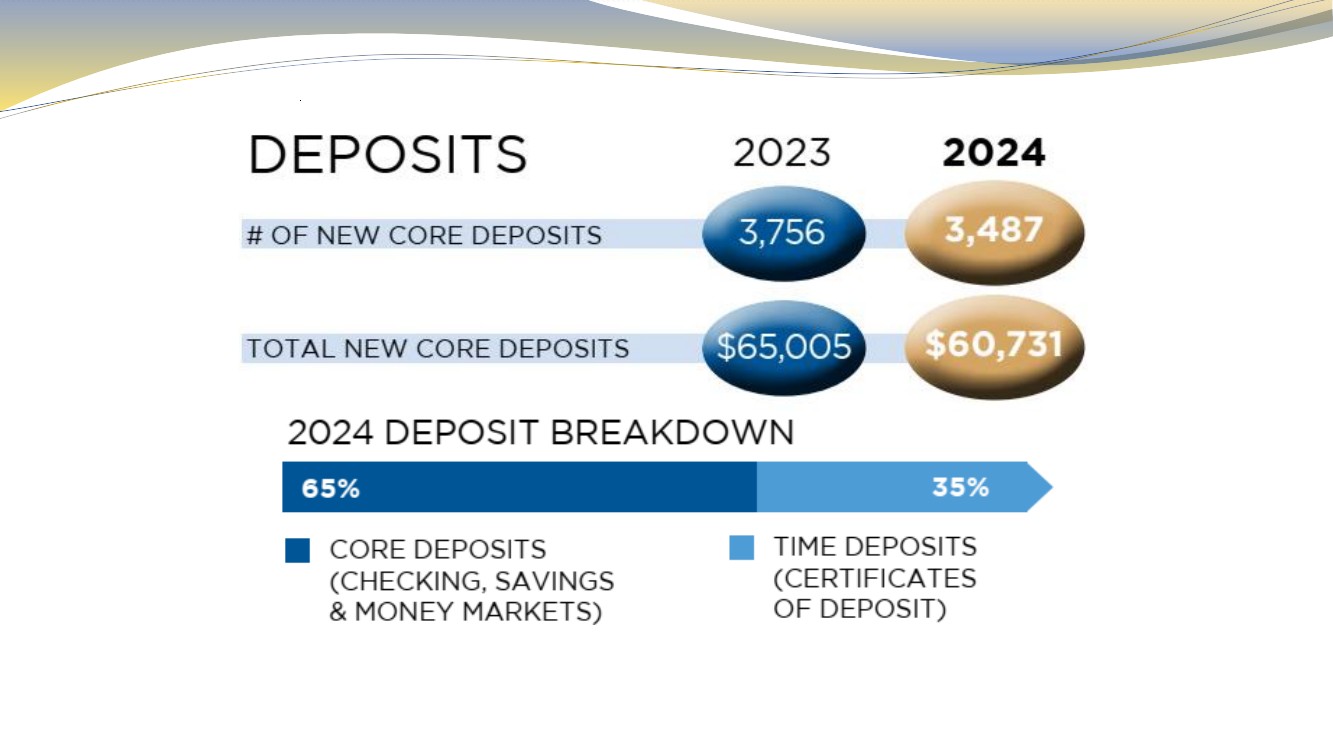

| Future of First Keystone Community Bank ➢To remain an independent community bank ➢Grow the bank in a safe, sound and profitable manner ➢To continue to enhance our franchise and shareholder value ➢ Offer competitive deposit and loan rates ➢ Monitor margins ➢ Grow loan portfolio ➢ Increase Core Deposits ➢ Continue to find funding methods ➢ Remain well capitalized |

| Future of First Keystone Community Bank ➢ Refocus on Retail Banking and Mortgage Lending ➢ Supply Retail staff with the tools necessary to succeed ➢ Enhanced deployment of marketing strategies ➢ Direct mail postcards ➢ Billboards in strategic locations ➢ Market outside the branches to non-customers ➢ New Home Equity Line of Credit promotions ➢ Twice a year with promotional rates ➢ Competitive deposit rates ➢ Money Markets ➢ Certificates of Deposits ➢ Expand our Mortgage Services by offering new competitive products ➢ Through new outlets such as FHLB and PHFA ➢ Remain a Leader in Commercial Lending |

| Future of First Keystone Community Bank ➢Enhanced products ➢ New Online checking/savings account opening ➢ Launched 1st quarter 2025 ➢ New Website (internally designed) ➢ Contactless debit cards ➢ Positive Payee (Fraud Prevention) ➢ New Retail Loan system for branch managers and retail lenders ➢ 4 th quarter 2025 |

| Future of First Keystone Community Bank ➢FKCB will continue to build on it’s legacy of a trusted community bank ➢We will stay true to our core values ➢ Expand offerings to attract a diverse customer base ➢ Remain a leader in customer service, while continuing to grow our presence in the community and foster a workplace that attracts and retains top talent ➢ Be the “Best Place to Work” |

| Future of First Keystone Community Bank ➢ Our Success will evolve because of the core values instilled in our employees and board members ➢ Profitability and growth are primary and competing goals. Encouraging efficiencies throughout the Bank, although needed can sometimes be challenging for employees. These efficiencies need to be thought out, teams encouraged to have input and communicated to be effective. When team members buy in profitability thrives. |

| Commitment to Community ➢ FKCB provided Sponsorships and Donations to various schools and non-profit agencies throughout our communities. ➢ Examples include various fundraising walks and events, arts and food festivals, YMCAs, little leagues and school sports teams, holiday events, economic groups, and United Way. We also supported education through EITC donations. ➢ Total support in 2024 $252,000 to more than 250 non-profits |

| Commitment to Community ➢ We are passionate about giving generously to the communities we serve, in both corporate and individual employee donations. ➢ Throughout the year, our employees donated $9,838 of their own money during Denim Days, supporting various non-profit agencies throughout our markets. ➢ In addition to monetary donations, they donated more than 2,000 hours of volunteer work ➢ They continue to think not only of the Bank, themselves and their families, but others in our community |

| Keys to our Success are expressed in our Mission Statement First Keystone Corporation and First Keystone Community Bank will be the independent financial services provider of choice to its customers and communities that it serves by providing quality, cost effective, customer focused financial services and products through our dedicated bankers and technology. By doing so, we will enhance our value to our shareholders through sustainable profits and dividends. First Keystone Corporation and First Keystone Community Bank recognize and value the contribution of our employees. To them, we pledge to provide opportunity for a high level of job satisfaction and an equitable exchange for their services. |

| Commitment to You ➢ For over 160 years, we have been committed to listening to our customers and Shareholders ➢ That commitment remains true today, and will remain into the future ➢ We remain well-capitalized and compare favorably to all regulatory ratios. ➢ We are now looked at as financial advisors, community leaders, and trusted friends, all of which we have developed through relationships established through First Keystone Community Bank. |

| Commitment to You The Board of Directors, management and the entire staff are firmly focused on increasing value for our customers, our communities and our shareholders. Thank you for your confidence and continued support! |

| Thank you for attending our May 8, 2025 Annual Shareholders’ Meeting! |