Pay vs Performance Disclosure - USD ($)

|

12 Months Ended |

Dec. 31, 2024 |

Dec. 31, 2023 |

Dec. 31, 2022 |

Dec. 31, 2021 |

Dec. 31, 2020 |

| Pay vs Performance Disclosure |

|

|

|

|

|

| Pay vs Performance Disclosure, Table |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | Year | Summary Compensation Table Total for PEO Robert Lisy1 ($) | Compensation Actually Paid to PEO Robert Lisy1,2,3 ($) | Average Summary Compensation Table Total for Non-PEO Named Executive Officers1 ($)

| Average Compensation Actually Paid to Non-PEO Named Executive Officers1,2,3 ($)

| Value of initial fixed $100 investment based on4: | Net

income

(in millions) | Adjusted EBITDA ($)5 (in millions) | Total Shareholder Return ("TSR")

($) | Peer Group Total Shareholder Return

($) | | (a) | (b) | (c) | (d) | (e) | (f) | (g) | (h) | (i) | | 2024 | $ | 6,042,098 | | $ | 2,571,791 | | $ | 1,222,554 | | $ | 724,915 | | $ | 173 | | $ | 68 | | $ | 58.8 | | $ | 121.3 | | | 2023 | $ | 6,127,308 | | $ | 4,372,216 | | $ | 1,217,425 | | $ | 877,054 | | $ | 183 | | $ | 66 | | $ | 59.5 | | $ | 120.0 | | | 2022 | $ | 5,842,214 | | $ | 9,064,926 | | $ | 1,229,430 | | $ | 1,879,209 | | $ | 202 | | $ | 60 | | $ | 57.3 | | $ | 105.2 | | | 2021 | $ | 5,004,460 | | $ | 5,776,170 | | $ | 1,241,362 | | $ | 1,382,164 | | $ | 133 | | $ | 76 | | $ | 46.8 | | $ | 86.7 | | | 2020 | $ | 1,305,197 | | $ | 2,966,300 | | $ | 718,034 | | $ | 942,237 | | $ | 129 | | $ | 89 | | $ | 33.8 | | $ | 68.4 | |

|

|

|

|

|

| Company Selected Measure Name |

Adjusted EBITDA

|

|

|

|

|

| Named Executive Officers, Footnote |

Robert Lisy was our PEO in 2020, 2021, 2022, 2023, and 2024. The individuals constituting the Non-PEO named executive officers for each year presented are listed below: | | | | | | | | | | | | | | | | 2020 | 2021 | 2022 | 2023 | 2024 | | Tony Lauro II | Andras Bende | Andras Bende | Andras Bende | Andras Bende | | Joseph Aguilar | Joseph Aguilar | Joseph Aguilar | Joseph Aguilar | Joseph Aguilar | | Randall D. Nilsen | Randall D. Nilsen | Randall D. Nilsen | Christopher Hunt | Christopher Hunt | | | Ernesto Luciano | Randall D. Nilsen | Robert Pargac | | | | Ernesto Luciano | |

|

|

|

|

|

| Peer Group Issuers, Footnote |

The Peer Group Total Shareholder Return ("TSR") set forth in this table utilizes a group comprising publicly-traded companies in the money remittance and payment industries: MoneyGram, Euronet, Remitly and Western Union. This peer group is also utilized in the stock performance graph required by Item 201(e) of Regulation S-K included in our Annual Report for the year ended December 31, 2024. The comparison assumes $100 was invested for the period starting December 31, 2019, through the end of the listed year in the Company and in the Peer Group, respectively. For the Peer Group, TSR for MoneyGram was calculated through June 1, 2023, the day it became a private company. Historical stock performance is not necessarily indicative of future stock performance.

|

|

|

|

|

| PEO Total Compensation Amount |

$ 6,042,098

|

$ 6,127,308

|

$ 5,842,214

|

$ 5,004,460

|

$ 1,305,197

|

| PEO Actually Paid Compensation Amount |

$ 2,571,791

|

4,372,216

|

9,064,926

|

5,776,170

|

2,966,300

|

| Adjustment To PEO Compensation, Footnote |

Compensation Actually Paid reflects the exclusions and inclusions of certain amounts for the PEO and the Non-PEO named executive officers as set forth below. Equity values are calculated in accordance with FASB ASC Topic 718. Amounts in the Exclusion of Stock Awards column are the totals from the Stock Awards column set forth in the Summary Compensation Table. | | | | | | | | | | | | | | | | Year | Summary Compensation Table Total for Robert Lisy

($) | Exclusion of Stock Awards for Robert Lisy

($) | Inclusion of Equity Values for Robert Lisy

($) | Compensation Actually Paid to Robert Lisy

($) | | | 2024 | $ | 6,042,098 | | $ | 4,200,000 | | $ | 729,693 | | $ | 2,571,791 | | | 2023 | $ | 6,127,308 | | $ | 4,000,000 | | $ | 2,244,908 | | $ | 4,372,216 | | | 2022 | $ | 5,842,214 | | $ | 3,000,000 | | $ | 6,222,712 | | $ | 9,064,926 | | | 2021 | $ | 5,004,460 | | $ | 2,500,013 | | $ | 3,271,723 | | $ | 5,776,170 | | | 2020 | $ | 1,305,197 | | $ | — | | $ | 1,661,103 | | $ | 2,966,300 | |

| | | | | | | | | | | | | | | | Year | Average Summary Compensation Table Total for Non-PEO Named Executive Officers

($) | Average Exclusion of Stock Awards for Non-PEO Named Executive Officers

($) | Average Inclusion of Equity Values for Non-PEO Named Executive Officers

($) | Average Compensation Actually Paid to Non-PEO Named Executive Officers

($) | | | 2024 | $ | 1,222,554 | | $ | 650,000 | | $ | 152,362 | | $ | 724,915 | | | 2023 | $ | 1,217,425 | | $ | 620,000 | | $ | 279,629 | | $ | 877,054 | | | 2022 | $ | 1,229,430 | | $ | 525,000 | | $ | 1,174,779 | | $ | 1,879,209 | | | 2021 | $ | 1,241,362 | | $ | 541,445 | | $ | 682,247 | | $ | 1,382,164 | | | 2020 | $ | 718,034 | | $ | 237,868 | | $ | 462,072 | | $ | 942,237 | |

The amounts in the Inclusion of Equity Values in the tables above are derived from the amounts set forth in the following tables:

| | | | | | | | | | | | | | | | | | | Year | Year-End Fair Value of Equity Awards Granted During Year That Remained Unvested as of Last Day of Year for Robert Lisy

($) | Change in Fair Value from Last Day of Prior Year to Last Day of Year of Unvested Equity Awards for Robert Lisy

($) | Change in Fair Value from Last Day of Prior Year to Vesting Date of Unvested Equity Awards that Vested During Year for Robert Lisy

($) | Fair Value at Last Day of Prior Year of Equity Awards Forfeited During Year for Robert Lisy

($) | Total - Inclusion of

Equity Values for Robert Lisy

($) | | | 2024 | $ | 2,056,567 | | $ | (1,054,087) | | $ | (272,787) | | $ | — | | $ | 729,693 | | | 2023 | $ | 2,613,002 | | $ | (22,719) | | $ | (345,376) | | $ | — | | $ | 2,244,908 | | | 2022 | $ | 3,980,352 | | $ | 2,040,199 | | $ | 202,162 | | $ | — | | $ | 6,222,712 | | | 2021 | $ | 4,223,734 | | $ | (633,177) | | $ | (318,834) | | $ | — | | $ | 3,271,723 | | | 2020 | $ | — | | $ | 1,196,089 | | $ | 465,014 | | $ | — | | $ | 1,661,103 | |

| | | | | | | | | | | | | | | | | | | Year | Average Year-End Fair Value of Equity Awards Granted During Year That Remained Unvested as of Last Day of Year for Non-PEO Named Executive Officers

($) | Average Change in Fair Value from Last Day of Prior Year to Last Day of Year of Unvested Equity Awards for Non-PEO Named Executive Officers

($) | Average Change in Fair Value from Last Day of Prior Year to Vesting Date of Unvested Equity Awards that Vested During Year for Non-PEO Named Executive Officers

($) | Average Fair Value at Last Day of Prior Year of Equity Awards Forfeited During Year for Non-PEO Named Executive Officers

($) | Total - Average Inclusion of

Equity Values for Non-PEO Named Executive Officers

($) | | | 2024 | $ | 319,579 | | $ | (133,063) | | $ | (34,154) | | $ | — | | $ | 152,362 | | | 2023 | $ | 47,325 | | $ | (4,751) | | $ | (62,945) | | $ | — | | $ | 279,629 | | | 2022 | $ | 696,562 | | $ | 445,526 | | $ | 32,692 | | $ | — | | $ | 1,174,779 | | | 2021 | $ | 933,383 | | $ | (189,066) | | $ | (62,070) | | $ | — | | $ | 682,247 | | | 2020 | $ | 280,546 | | $ | 216,787 | | $ | 110,896 | | $ | (146,157) | | $ | 462,072 | |

|

|

|

|

|

| Non-PEO NEO Average Total Compensation Amount |

$ 1,222,554

|

1,217,425

|

1,229,430

|

1,241,362

|

718,034

|

| Non-PEO NEO Average Compensation Actually Paid Amount |

$ 724,915

|

877,054

|

1,879,209

|

1,382,164

|

942,237

|

| Adjustment to Non-PEO NEO Compensation Footnote |

Compensation Actually Paid reflects the exclusions and inclusions of certain amounts for the PEO and the Non-PEO named executive officers as set forth below. Equity values are calculated in accordance with FASB ASC Topic 718. Amounts in the Exclusion of Stock Awards column are the totals from the Stock Awards column set forth in the Summary Compensation Table. | | | | | | | | | | | | | | | | Year | Summary Compensation Table Total for Robert Lisy

($) | Exclusion of Stock Awards for Robert Lisy

($) | Inclusion of Equity Values for Robert Lisy

($) | Compensation Actually Paid to Robert Lisy

($) | | | 2024 | $ | 6,042,098 | | $ | 4,200,000 | | $ | 729,693 | | $ | 2,571,791 | | | 2023 | $ | 6,127,308 | | $ | 4,000,000 | | $ | 2,244,908 | | $ | 4,372,216 | | | 2022 | $ | 5,842,214 | | $ | 3,000,000 | | $ | 6,222,712 | | $ | 9,064,926 | | | 2021 | $ | 5,004,460 | | $ | 2,500,013 | | $ | 3,271,723 | | $ | 5,776,170 | | | 2020 | $ | 1,305,197 | | $ | — | | $ | 1,661,103 | | $ | 2,966,300 | |

| | | | | | | | | | | | | | | | Year | Average Summary Compensation Table Total for Non-PEO Named Executive Officers

($) | Average Exclusion of Stock Awards for Non-PEO Named Executive Officers

($) | Average Inclusion of Equity Values for Non-PEO Named Executive Officers

($) | Average Compensation Actually Paid to Non-PEO Named Executive Officers

($) | | | 2024 | $ | 1,222,554 | | $ | 650,000 | | $ | 152,362 | | $ | 724,915 | | | 2023 | $ | 1,217,425 | | $ | 620,000 | | $ | 279,629 | | $ | 877,054 | | | 2022 | $ | 1,229,430 | | $ | 525,000 | | $ | 1,174,779 | | $ | 1,879,209 | | | 2021 | $ | 1,241,362 | | $ | 541,445 | | $ | 682,247 | | $ | 1,382,164 | | | 2020 | $ | 718,034 | | $ | 237,868 | | $ | 462,072 | | $ | 942,237 | |

The amounts in the Inclusion of Equity Values in the tables above are derived from the amounts set forth in the following tables:

| | | | | | | | | | | | | | | | | | | Year | Year-End Fair Value of Equity Awards Granted During Year That Remained Unvested as of Last Day of Year for Robert Lisy

($) | Change in Fair Value from Last Day of Prior Year to Last Day of Year of Unvested Equity Awards for Robert Lisy

($) | Change in Fair Value from Last Day of Prior Year to Vesting Date of Unvested Equity Awards that Vested During Year for Robert Lisy

($) | Fair Value at Last Day of Prior Year of Equity Awards Forfeited During Year for Robert Lisy

($) | Total - Inclusion of

Equity Values for Robert Lisy

($) | | | 2024 | $ | 2,056,567 | | $ | (1,054,087) | | $ | (272,787) | | $ | — | | $ | 729,693 | | | 2023 | $ | 2,613,002 | | $ | (22,719) | | $ | (345,376) | | $ | — | | $ | 2,244,908 | | | 2022 | $ | 3,980,352 | | $ | 2,040,199 | | $ | 202,162 | | $ | — | | $ | 6,222,712 | | | 2021 | $ | 4,223,734 | | $ | (633,177) | | $ | (318,834) | | $ | — | | $ | 3,271,723 | | | 2020 | $ | — | | $ | 1,196,089 | | $ | 465,014 | | $ | — | | $ | 1,661,103 | |

| | | | | | | | | | | | | | | | | | | Year | Average Year-End Fair Value of Equity Awards Granted During Year That Remained Unvested as of Last Day of Year for Non-PEO Named Executive Officers

($) | Average Change in Fair Value from Last Day of Prior Year to Last Day of Year of Unvested Equity Awards for Non-PEO Named Executive Officers

($) | Average Change in Fair Value from Last Day of Prior Year to Vesting Date of Unvested Equity Awards that Vested During Year for Non-PEO Named Executive Officers

($) | Average Fair Value at Last Day of Prior Year of Equity Awards Forfeited During Year for Non-PEO Named Executive Officers

($) | Total - Average Inclusion of

Equity Values for Non-PEO Named Executive Officers

($) | | | 2024 | $ | 319,579 | | $ | (133,063) | | $ | (34,154) | | $ | — | | $ | 152,362 | | | 2023 | $ | 47,325 | | $ | (4,751) | | $ | (62,945) | | $ | — | | $ | 279,629 | | | 2022 | $ | 696,562 | | $ | 445,526 | | $ | 32,692 | | $ | — | | $ | 1,174,779 | | | 2021 | $ | 933,383 | | $ | (189,066) | | $ | (62,070) | | $ | — | | $ | 682,247 | | | 2020 | $ | 280,546 | | $ | 216,787 | | $ | 110,896 | | $ | (146,157) | | $ | 462,072 | |

|

|

|

|

|

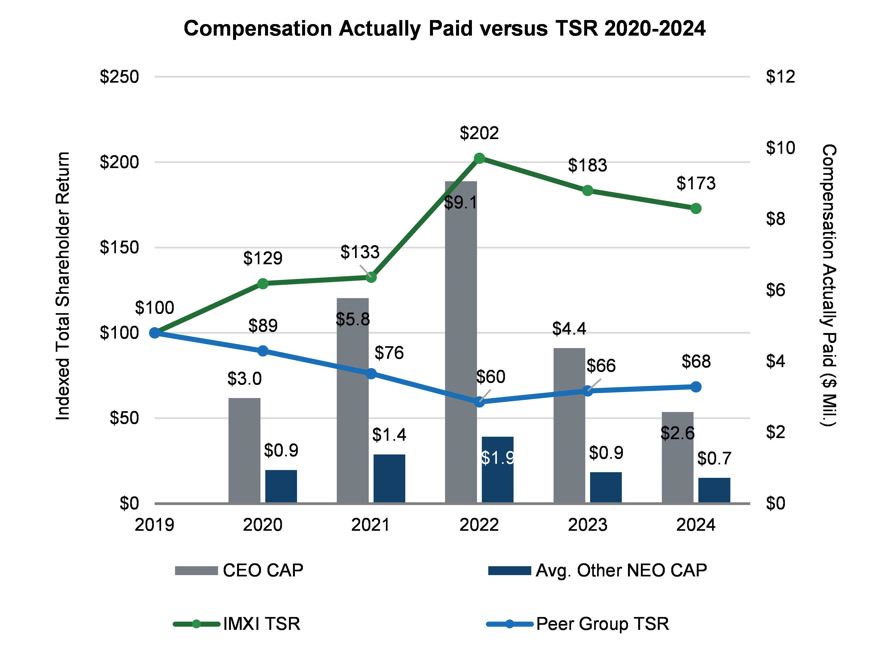

| Compensation Actually Paid vs. Total Shareholder Return |

The following chart sets forth the relationship between Compensation Actually Paid to our PEO, the average of Compensation Actually Paid to our other named executive officers, and the Company’s cumulative TSR over the four most recently completed fiscal years. The chart also provides a comparison of the Company’s TSR and Peer Group TSR.

|

|

|

|

|

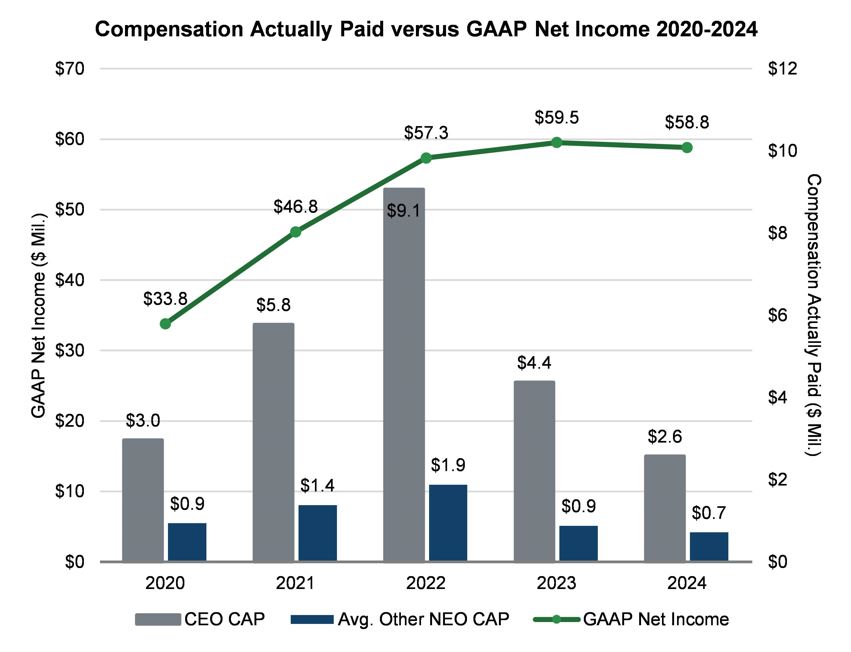

| Compensation Actually Paid vs. Net Income |

The following chart sets forth the relationship between Compensation Actually Paid to our PEO, the average of Compensation Actually Paid to the Non-PEO, and our Net Income during the four most recently completed fiscal years.

|

|

|

|

|

| Compensation Actually Paid vs. Company Selected Measure |

The following chart sets forth the relationship between Compensation Actually Paid to our PEO, the average of Compensation Actually Paid to the Non-PEOs, and Adjusted EBITDA over the four most recently completed fiscal years.

|

|

|

|

|

| Total Shareholder Return Amount |

$ 173

|

183

|

202

|

133

|

129

|

| Peer Group Total Shareholder Return Amount |

68

|

66

|

60

|

76

|

89

|

| Net Income (Loss) |

$ 58,800,000

|

$ 59,500,000

|

$ 57,300,000

|

$ 46,800,000

|

$ 33,800,000

|

| Company Selected Measure Amount |

121,300,000

|

120,000,000.0

|

105,200,000

|

86,700,000

|

68,400,000

|

| PEO Name |

Robert Lisy

|

|

|

|

|

| Additional 402(v) Disclosure |

The amounts shown for Compensation Actually Paid have been calculated in accordance with Item 402(v) of Regulation S-K and do not reflect compensation actually earned, realized, or received by the Company’s named executive officers. These amounts reflect the Summary Compensation Table Total with certain adjustments as described in footnote 3 below.

|

|

|

|

|

| Measure:: 1 |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Name |

•Adjusted EBITDA

|

|

|

|

|

| Non-GAAP Measure Description |

Adjusted EBITDA is as defined and reconciled to the most directly comparable GAAP Measure in the "Non-GAAP Financial Measures" section of Item 7 in our Annual Report on Form 10-K for the year ended December 31, 2024 filed with the SEC on February 28, 2025. We determined Adjusted EBITDA to be the most important financial performance measure used to link Company performance to Compensation Actually Paid to our PEO and Non-PEO NEOs in 2024 because this is the primary metric in our annual incentive program, a key input of adjusted EPS performance which is used in the PSU program and is the metric most strongly correlated to stock price performance. We may determine a different financial performance measure to be the most important financial performance measure in future years.

|

|

|

|

|

| Measure:: 2 |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Name |

•Adjusted Earnings Per Share - Basic

|

|

|

|

|

| PEO | Aggregate Grant Date Fair Value of Equity Award Amounts Reported in Summary Compensation Table |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

$ (4,200,000)

|

$ (4,000,000)

|

$ (3,000,000)

|

$ (2,500,013)

|

$ 0

|

| PEO | Equity Awards Adjustments, Excluding Value Reported in Compensation Table |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

729,693

|

2,244,908

|

6,222,712

|

3,271,723

|

1,661,103

|

| PEO | Year-end Fair Value of Equity Awards Granted in Covered Year that are Outstanding and Unvested |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

2,056,567

|

2,613,002

|

3,980,352

|

4,223,734

|

0

|

| PEO | Year-over-Year Change in Fair Value of Equity Awards Granted in Prior Years That are Outstanding and Unvested |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

(1,054,087)

|

(22,719)

|

2,040,199

|

(633,177)

|

1,196,089

|

| PEO | Change in Fair Value as of Vesting Date of Prior Year Equity Awards Vested in Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

(272,787)

|

(345,376)

|

202,162

|

(318,834)

|

465,014

|

| PEO | Prior Year End Fair Value of Equity Awards Granted in Any Prior Year that Fail to Meet Applicable Vesting Conditions During Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

0

|

0

|

0

|

0

|

0

|

| Non-PEO NEO | Aggregate Grant Date Fair Value of Equity Award Amounts Reported in Summary Compensation Table |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

650,000

|

620,000

|

525,000

|

541,445

|

237,868

|

| Non-PEO NEO | Equity Awards Adjustments, Excluding Value Reported in Compensation Table |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

152,362

|

279,629

|

1,174,779

|

682,247

|

462,072

|

| Non-PEO NEO | Year-end Fair Value of Equity Awards Granted in Covered Year that are Outstanding and Unvested |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

319,579

|

47,325

|

696,562

|

933,383

|

280,546

|

| Non-PEO NEO | Year-over-Year Change in Fair Value of Equity Awards Granted in Prior Years That are Outstanding and Unvested |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

(133,063)

|

(4,751)

|

445,526

|

(189,066)

|

216,787

|

| Non-PEO NEO | Change in Fair Value as of Vesting Date of Prior Year Equity Awards Vested in Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

(34,154)

|

(62,945)

|

32,692

|

(62,070)

|

110,896

|

| Non-PEO NEO | Prior Year End Fair Value of Equity Awards Granted in Any Prior Year that Fail to Meet Applicable Vesting Conditions During Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

$ 0

|

$ 0

|

$ 0

|

$ 0

|

$ (146,157)

|