Exhibit 3.1

COMPANY LIMITED BY SHARES

MEMORANDUM

AND

ARTICLES OF ASSOCIATION

OF

public limited company

Registered in Dublin No. 12965

Arthur Cox LLP

Ten Earlsfort Terrace

Dublin 2

D02 T380

2

No. 12965

Certificate of Incorporation

I HEREBY CERTIFY THAT ROADSTONE, LIMITED is this day incorporated under the

Companies Acts, 1908 to 1924, and that the Company is Limited.

Given under my hand at Dublin, this Twentieth day of June, One Thousand Nine Hundred and Forty-

nine.

Fees and Deed Stamps | ... ... | ... ... £ 52 10s. 0d. |

Stamp Duty on Capital | ... ... | ... ... £1,250 0s. 0d. |

A.K. AUSTIN, | ||

Registrar of Joint Stock Companies |

3

No. 12965

Certificate of Change of Name

I Hereby Certify that

ROADSTONE, LIMITED

having, with the sanction of a Special Resolution of the said Company, and with the approval of the

MINISTER FOR INDUSTRY AND COMMERCE, changed its name, is now called

CEMENT-ROADSTONE HOLDINGS LIMITED

and I have entered such new name on the Register accordingly.

Given under my hand at Dublin, this Twentieth day of October, One Thousand Nine Hundred and

Seventy.

M. SINSEOIN,

for Registrar of Companies

4

Certificate of Incorporation on

Re-registration as a

Public Limited Company

I Hereby Certify that

CEMENT-ROADSTONE HOLDINGS PLC

is this day re-registered under the Companies Acts 1963 to 1983 and that the Company is a Public

Limited Company.

Given under my hand at Dublin, this Twentieth day of January, One Thousand Nine Hundred and

Eighty four.

R. BURKE

for Registrar of Companies

5

Certificate of Incorporation on

Change of Name

I Hereby Certify that

CEMENT-ROADSTONE HOLDINGS PLC

having, by a Special Resolution of the Company, and with the approval of the MINISTER FOR

INDUSTRY AND COMMERCE, changed its name, is now incorporated as a limited company under

the name

CRH public limited company and I have entered such name on the Register accordingly.

Given under my hand this Eighteenth day of May, One Thousand Nine Hundred and Eighty Seven.

R. BURKE

for Registrar of Companies

6

COMPANIES ACT 2014

COMPANY LIMITED BY SHARES

MEMORANDUM OF ASSOCIATION

OF

C R H

public limited company

(as amended 1st May 1975, 5th May 1992, 7th May 2008 and 7th May 2015)

1.The name of the Company is “CRH public limited company”.

2.The Company is a public limited company for the purposes of Part 17 of the Companies Act

2014.

3.The Registered Office of the Company will be situate in Ireland.

4.The objects for which the Company is established are:

(1)To carry on the business of an investment holding company and for that purpose to

acquire and hold either in the name of the Company or in that of any nominee shares,

stocks, debentures, debenture stock, bonds, notes, obligations and securities issued or

guaranteed by any company wherever incorporated or carrying on business and

debentures, debenture stock, bonds, notes, obligations and securities issued or

guaranteed by any Government, Sovereign Ruler, Commissioners, Public Body or

Authority supreme, dependent, municipal, local or otherwise in any part of the world

and to raise money on such terms and conditions as may be thought desirable for any

of the above purposes.

(2)To acquire any such shares, stock, debentures, debenture stock, bonds, notes,

obligations or securities by original subscription, tender, syndicate participation,

purchase, exchange or otherwise, and whether or not fully paid up, and to make

payments thereon as called up or in advance of calls or otherwise, and to hold, sell or

otherwise dispose of any excess thereof, to subscribe for the same either conditionally

or otherwise, and generally to sell, exchange or otherwise to dispose of or turn to

account any of the assets of the Company or any securities or investments of the

Company acquired or agreed so to be and to invest in or to acquire by repurchase or

otherwise any securities or investments of the kind before enumerated and to vary the

securities and investments of the Company from time to time.

(3)To exercise and enforce all rights and powers conferred by or incidental to the

ownership of any such shares, stock, obligations or other securities including without

prejudice to the generality of the foregoing all such powers of veto or control as may

be conferred by virtue of the holding by the Company of some special proportion of

the issued or nominal amount thereof and to provide managerial and other executive

supervisory and consultant services for or in relation to any company in which the

Company is interested upon such terms as may be thought fit.

7

(4)To carry on the business of quarry masters and proprietors, lessees and workers of

quarries, sand and gravel pits, mines and the like generally and for the purposes

thereof or otherwise in relation to the business of the Company to purchase, take on

lease or fee farm grant or in exchange hire or otherwise acquire any real and personal

property and any mines, minerals and mining rights, easements and other rights and

privileges which the Company may deem necessary or convenient for the purposes of

its business.

(5)To carry on the business of miners and quarriers and manufacturers and merchants of

and dealers in rocks, stones, sand, gravel, breeze, shale, slag, rubble, shingle, ballast,

slate, gypsum, marble, coal, coke, turf and other fuels, oils and other mineral

substances.

(6)To carry on the business of road-makers and contractors, building contractors,

builders merchants and providers and dealers in road making and building materials,

timber merchants, sawyers, carpenters, joiners, turners, cabinet makers, shop and

office fitters, polishers, mining, sanitary, electrical, gas and general engineers,

plumbers, glaziers, painters, decorators, general warehousemen and storekeepers,

insurance agents, auctioneers, valuers, surveyors, and house, land and estate agents.

(7)To manufacture, buy, sell and otherwise deal in minerals, chemicals, chemical

products, plant, machinery, implements, conveniences, provisions and things capable

of being used in connection with the operations or business of the Company.

(8)To buy, sell, deal in, search for, quarry, mine, get, win, work, dress, shape, mould and

separate oolitic particles and reform with any cementitious material, hew, polish,

crush, refine, smelt, prepare for market or use stone and minerals of all kinds, slate,

oolitic substances, chalk, sand, gravel, brick, china and other clays, coal, iron,

ironstone, metallic ores, oil and other minerals, metals, materials and substances of all

kinds whether obtainable by underground or surface workings.

(9)To acquire and undertake the whole or any part of the business, property and

liabilities of any person or company carrying on any business which the Company is

authorised to carry on, or possessed of property suitable for the purposes of this

Company.

(10)To amalgamate with any other company having objects similar to the objects of this

Company.

(11)To apply for, purchase or otherwise acquire any patents, brevets d'invention, licences,

concessions and the like, conferring any exclusive or non-exclusive or limited right to

use, or any secret or other information as to any invention which may seem capable of

being used for any of the purposes of the Company, or the acquisition of which may

seem calculated directly or indirectly to benefit the Company and to use, exercise,

develop, or grant licences in respect of, or otherwise turn to account the property,

rights or information so acquired.

(12)To enter into partnership or into any arrangement for sharing profits, union of

interests, co-operation, joint adventure, reciprocal concession, mutual assistance, or

otherwise, with any person or company carrying on or engaged in, or about to carry

on or engage in, any business or transaction which this Company is authorised to

carry on or engage in or any business or transaction capable of being conducted so as

directly or indirectly to benefit this Company and to lend money to guarantee the

contracts of or otherwise assist any such person or company.

(13)To enter into any arrangements with any Governments or authorities supreme,

municipal, local or otherwise, that may seem conducive to the Company's objects or

any of them and to obtain from any such government or authority any rights,

privileges

8

and concessions, and any authorities, permits, licences and registrations required by

law, or which the Company may think it desirable to obtain, and to carry out, exercise

and comply with any such arrangements, rights, privileges, concessions, permits and

licences.

(14)To establish and support, or aid in the establishment and support of associations,

institutions, funds, trusts, and conveniences calculated to benefit employees, or ex-

employees of the Company, or the dependants or connections of such persons, and to

grant pensions and allowances, and to do any acts or things or make any

arrangements or provisions enabling employees of the Company or other persons

aforesaid to become shareholders or depositors in the Company, or otherwise to

participate in the profits of the Company, upon such terms and in such manner as the

Company may think fit, and to make payments towards insurance and to subscribe or

guarantee money for charitable or benevolent objects or for any exhibition or for any

public, general or useful objects, or any other object whatsoever which the Company

may think advisable.

(15)To promote any company or companies for the purpose of acquiring or undertaking

all or any of the property and liabilities of this Company, or for any other purpose

which may seem directly or indirectly calculated to benefit this Company.

(16)To acquire by purchase, lease, exchange or otherwise lands, buildings and

hereditaments of any tenure or description in any estate or interest and any rights over

or connected therewith and to turn the same to account as may seem expedient and in

particular by planting, building, improving, farming, grazing and felling timber and

by leasing, letting and disposing of the same.

(17)To buy, sell, build, charter, hire, acquire, hold, let and use any aircraft, steamers, tugs,

barges, motor boats, ferry or other boats or other water conveyances, railways,

tramways, railway trucks and rolling stock, motors, lorries, motor cars, waggons or

carts of any kind for or in connection with any of the purposes hereby authorised.

(18)To manufacture or produce electric light, gas and other means of illumination, and

steam or electric power and erect machinery or apparatus for applying and turning to

account any wind, water or other power for or in connection with any of the purposes

hereby authorised.

(19)To develop and turn to account any land acquired by the Company, or in which it is

interested, and in particular by laying out and preparing the same for mining purposes

or for building purposes, constructing, altering, pulling down, decorating,

maintaining, fitting-up and improving buildings and conveniences, and by planting,

paving, draining, farming, cultivating, letting on building lease or building agreement,

and by advancing money to and entering into contracts and arrangements of all kinds

with builders, tenants, and others.

(20)To construct, improve, maintain, develop, work, manage, carry out, or control any

roads, ways, tramways, railways, branches or sidings, bridges, reservoirs-

watercourses, wharves, manufactories, warehouses, electric works, shops, stores and

other works and conveniences which may seem calculated directly or indirectly to

advance the Company's interests, and to contribute to, subsidise, or otherwise assist or

take part in the construction, improvement, maintenance, working, management,

carrying out or control thereof.

(21)To lend and advance money or other property or give credit or financial

accommodation to any company or person in any manner either with or without

security and whether with or without the payment of interest and upon such terms and

9

conditions as the Company’s board of directors shall think fit or expedient and to

guarantee, indemnify, grant indemnities in respect of, enter into any suretyship or

joint obligation, or otherwise support or secure, whether by personal covenant,

indemnity or undertaking or by mortgaging, charging, pledging or granting a lien or

other security over all or any part of the Company’s property (both present and

future) or by any one or more of such methods or any other method and whether in

support of such guarantee or indemnity or suretyship or joint obligation or otherwise,

on such terms and conditions as the Company’s board of directors shall think fit, the

payment of any debts or the performance or discharge of any contract, obligation or

actual or contingent liability of any person or company (including, without prejudice

to the generality of the foregoing, the payment of any capital, principal, dividends or

interest on any stocks, shares, debentures, debenture stock, notes, bonds or other

securities of any person, authority or company) including, without prejudice to the

generality of the foregoing, any company which is for the time being the Company’s

holding company as defined in the Companies Act 2014 and in any statutory

modification or re-enactment thereof, or subsidiary (as defined in the Companies Act

2014) of the Company or otherwise associated with the Company, in each case

notwithstanding the fact that the Company may not receive any consideration,

advantage or benefit, direct or indirect, from entering into any such guarantee or

indemnity or suretyship or joint obligation or other arrangement or transaction

contemplated herein.

(22)To borrow or raise or secure the payment of money in such manner as the Company

shall think fit, and in particular by the issue of debentures or debenture stock,

perpetual or otherwise, charged upon all or any of the Company's property, both

present and future, including its uncalled capital, and to purchase, redeem or pay off

any such securities.

(23)To engage in currency exchange and interest rate transactions (whether in connection

with or incidental to any other contract undertaking or business entered into or carried

on by the Company or whether as an independent object or activity) including, but

not limited to, dealings in foreign currency, spot and forward rate exchange

contracts, futures, options, forward rate agreements, swaps, caps, floors, collars and

any other foreign exchange or interest rate hedging arrangements and such other

instruments as are similar to or derive from any of the foregoing whether for the

purpose of making a profit or avoiding a loss or managing a currency or interest rate

exposure or for any other purpose and to enter into any contract for and to exercise

and enforce all the rights and powers conferred by or incidental, directly or indirectly,

to such transactions or termination of any such transactions and to enter into any

contracts, agreements or obligations relating to warrants, bonds, notes, mortgage

backed securities or instruments, bills of exchange, promissory notes, instruments

involving the management or control of currency exchange and/or risks and to enter

into any other agreements relating to synthetic or intangible assets, choses in action

and any other financial instruments whatsoever including instruments with

conversion rights or options of any nature and instruments evidencing or including

debt or equity and all derivatives of those products, invoices, receivables, including

movement of goods, assets represented by any contract for bullion or other metals or

commodity based products and in whatsoever currencies, including contracts

involving packaging and re-packaging of assets of any nature, securitisation,

unitisation, sub-participation of assets, participation, discounting, factoring, credit

sale, instalment sale, conditional sale, leasing or contracts of any other similar or

analogous nature.

(24)To remunerate any person or company for services rendered, or to be rendered, in

placing or assisting to place or guaranteeing the placing of any of the shares in the

Company's share capital or any debentures, debenture stock or other securities of the

10

Company, or in or about the formation or promotion of the Company or the conduct

of its business.

(25)To draw, make, accept, indorse, discount, execute and issue promissory notes, bills of

exchange, bills of lading, warrants, debentures, and other negotiable or transferable

instruments.

(26)To undertake and execute any trusts, the undertaking whereof may seem desirable

and either gratuitously or otherwise.

(27)To sell or dispose of the undertaking of the Company or any part thereof for such

consideration as the Company may think fit, and in particular for shares, debentures,

or securities of any other company having objects altogether or in part similar to those

of this Company.

(28)To adopt such means of making known the products and investments of the Company

as may seem expedient and in particular by advertising through all media, by

purchase and exhibition of works of art or interest, by publication of books and

periodicals, and by granting prizes, rewards, scholarships and donations and by

sponsoring (whether by guarantee or otherwise) sports events, theatrical and

cinematic performances and exhibitions of all descriptions.

(29)To obtain any Provisional Order or Act of the Oireachtas or Ministerial or

Departmental Licence or Order for enabling the Company to carry any of its objects

into effect, or for effecting any modification of the Company's constitution, or for any

other purpose which may seem expedient, and to oppose any proceedings or

applications which may seem calculated directly or indirectly to prejudice the

Company's interests.

(30)To procure the Company to be registered or recognised in any country or place.

(31)To sell, improve, manage, develop, exchange, lease, mortgage, enfranchise, dispose

of, turn to account or otherwise deal with all or any part of the property and rights and

investments of the Company.

(32)To promote freedom of contract, and to resist, insure against, counteract and

discourage interference therewith, to join any lawful Federation, Union or

Association, or do any other lawful act or thing with a view to preventing or resisting

directly or indirectly any interruption of, or interference with the Company's or any

other trade or business, or providing or safeguarding against the same, or resisting or

opposing any strike movement or organisation which may be thought detrimental to

the interests of the Company or its employees, and to subscribe to any association or

fund for any such purposes.

(33)To do all or any of the above things in any part of the world, and as principals, agents,

contractors, trustees, or otherwise, and by or through trustees, agents or otherwise,

and either alone or in conjunction with others.

(34)To distribute any of the property of the Company in specie among the members.

(35)To carry on any other business (whether manufacturing or otherwise), which may

seem to the Company capable of being conveniently carried on in connection with the

above, or calculated directly or indirectly to enhance the value of or render profitable

any of the Company's property or rights.

(36)To do all such other things as the Company may think incidental or conducive to the

attainment of the above objects or any of them.

11

Note: It is hereby declared that the word “company” in this Clause, except where used in

connection with this Company, shall be deemed to include any partnership or other body of

persons, whether incorporated or not incorporated, and whether domiciled in Ireland,

Northern Ireland, Great Britain, or elsewhere, and the intention is that the objects specified in

each paragraph of this Clause shall, except where otherwise expressed in such paragraph, be

independent main objects and shall be in no wise limited or restricted by reference to, or

inference from, the terms of any other paragraph or the name of the Company.

Provided always that the provisions of this Clause shall be subject to the Company obtaining

where necessary for the purpose of carrying any of its objects into effect such licence, permit

or authority as may be required by law.

5.The liability of the members is limited.

6.The capital of the Company is €401,297,940 divided into 150,000 5% Cumulative Preference

Shares of €1.27 each, 872,000 7% “A” Cumulative Preference Shares of €1.27 each and

1,250,000,000 Ordinary Shares of €0.32 each.

The rights and privileges attached to any class of shares in the Company's Share Capital shall

not be modified, commuted, affected, abrogated, or dealt with except by an Agreement

between the Company and any person or persons purporting to contract on behalf of such

class, provided that such agreement is ratified in writing by the holders of three-fourths in

nominal value of the issued shares of such class, or is confirmed by an Extraordinary

Resolution passed at separate General Meetings of the holders of the shares of such class,

such meetings to be summoned and held pursuant to the provisions contained in the

Company's Articles in force for the time being.

12

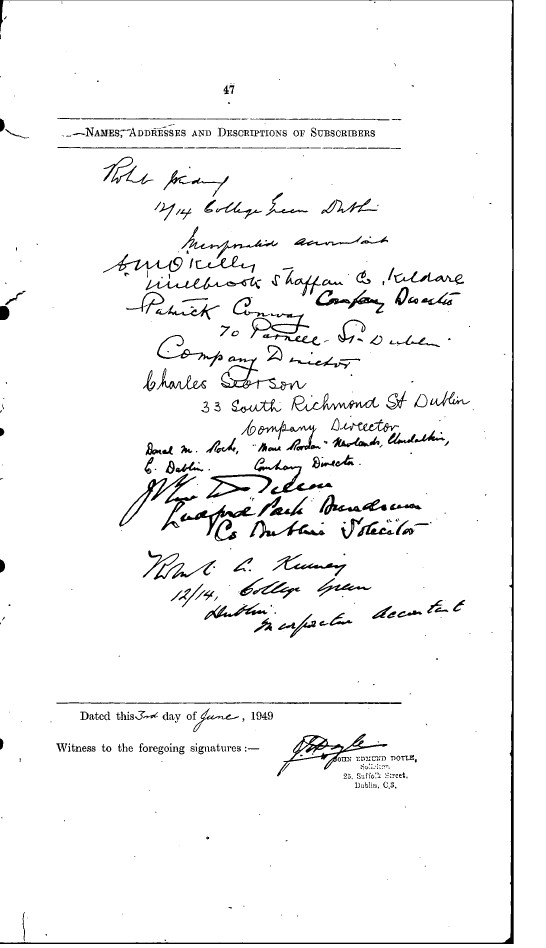

WE, the several persons whose names and addresses are subscribed, are desirous of being formed into

a Company, in pursuance of this Memorandum of Association, and we respectively agree to take the

number of shares in the capital of the Company set opposite our respective names.

NAMES, ADDRESSES AND DESCRIPTIONS OF SUBSCRIBERS | Number of Ordinary Shares taken by each Subscriber |

ROBERT J. KIDNEY, ESQ., 12/14 College Green, Dublin. Incorporated Accountant. | One |

C.M. O'KELLY, ESQ., Millbrook, Straffan, Co. Kildare. Company Director. | One |

PATRICK CONWAY, ESQ., 70 Parnell Street, Dublin. Company Director. | One |

CHARLES SEARSON, ESQ., 33 South Richmond Street, Dublin. Company Director. | One |

DONAL M. ROCHE, ESQ., “Mone Roodan”, Newlands, Clondalkin, Co. Dublin. Company Director. | One |

J. PLUNKETT DILLON, ESQ., Ludford Park, Dundrum, Co. Dublin. Solicitor. | One |

ROBERT A. KIDNEY, ESQ., 12/14 College Green, Dublin. Incorporated Accountant. | One |

Dated this 3rd day of June, 1949.

WITNESS to the above Signatures:

JOHN EDMUND DOYLE,

Solicitor,

25 Suffolk Street, Dublin, C.3.

13

COMPANIES ACT 2014

COMPANY LIMITED BY SHARES

ARTICLES OF ASSOCIATION

OF

C R H

public limited company

The following Articles were adopted by the Company by Special Resolution passed on 7 May 2015 in

lieu of and in substitution for all existing Articles of Association of the Company and include

amendments made by Special Resolution dated 26 April 2018, 9 February 2021, 8 June 2023 and 8

May 2025.

PRELIMINARY

1.Sections 77 to 81, 95(1)(a), 95(2)(a), 96(2) to (11), 124, 125(3), 144(3), 144(4), 148(2),

158(3), 159 to 165, 182(2), 182(5), 183(3), 187, 188, 218(5), 229, 230, 338(5), 338(6),

618(1)(b), 1090, 1092 and 1113 of the Act shall not apply to the Company.

INTERPRETATION

2.In these Articles unless the context otherwise requires:

“Act” | means the Companies Act 2014 and every statutory modification and re-enactment thereof for the time being in force; |

“Acts” | means the Act and all statutory instruments which are to be read as one with, or construed or read together as one with, the Act and every statutory modification and re-enactment thereof for the time being in force; |

“Address” | includes any number or address used for the purposes of communication by way of electronic mail or other electronic communication; |

“Approved Exchange” | means any of the markets or securities exchanges of the London Stock Exchange plc, the New York Stock Exchange (or such body or bodies as may succeed to their respective functions) and any other stock and/or investment exchange(s) on which the shares of the Company may be listed or otherwise authorised for trading from time to time in circumstances where the Directors of the Company have approved such listing or trading; |

“Approved Market” | means any market operated by an Approved Exchange; |

“Articles” | means these Articles of Association as from time to time being in force altered by Resolution of the Company; |

“Auditors” | means the statutory auditors for the time being of the Company (and, to the extent their appointment, re- appointment or |

14

remuneration is required, may be required or is advisable to be approved by the members, any other assurance provider as may be required by the Acts or any other enactment); | |

“Board” | means the Board of Directors of the Company or the Directors present at a duly convened meeting of Directors at which a quorum is present; |

“Business Day” | means a day which is not a Saturday or a Sunday or a bank or public holiday in Dublin, Ireland; |

“Clear Days” | means in relation to the period of notice provided for in these Articles where it specifies Clear Days, that period excluding the day when notice is given or deemed to be given and the day for which it is given or on which it is to take effect, or is deemed to take effect; |

“Close of Business” | means 5:00 p.m., at the principal executive offices of the Company; |

“Company” | means the company whose name appears in the heading to these Articles; |

“Directors” | means the Directors for the time being of the Company or the Directors present at a meeting as the Board of Directors of the Company; |

“Disclosure Notice” | means the notice issued in accordance with Section 1062 of the Act or other applicable law; |

“Electronic Communication” | means information communicated or intended to be communicated to a person, other than its originator, that is generated, communicated, processed, sent, received, recorded, stored or displayed by electronic means or in electronic form but does not include information communicated in the form of speech unless the speech is processed at its destination by an automatic voice recognition system. Any references in this definition, Article 2 or Article 128 to “addressee”, “electronic”, “information”, “originator” or “person” shall have the same meaning as in Section 2 of the Electronic Commerce Act, 2000, or as that section may be amended by subsequent legislation; |

“Exchange Act” | means the US Securities Exchange Act of 1934, as amended; |

“holder” | means in relation to any share, the member whose name is entered in the Register as the holder of the share or, where the context permits, the members whose names are entered in the Register as the joint holders of shares; |

“Month” | means calendar month; |

“Office” | means the registered office for the time being of the Company within the meaning of Section 50 of the Act; |

15

“Person” | means where the context permits an unincorporated body of persons, a partnership, a club or other association as well as an individual and a company which shall be deemed to include a body corporate, whether a company (wherever formed, registered or incorporated), a corporation aggregate, a corporation sole and a national or local government or authority or department or other legal entity or division or constituent thereof; |

“Record Date” | means a date and time specified by the Company for eligibility for voting at a general meeting; |

“Redeemable Shares” | means redeemable shares as defined by Section 64 of the Act; |

“Register” | means the Register of Members required to be kept by Section 169 of the Act; |

“Registrar” | means the person or persons appointed from time to time to maintain the Register; |

“Seal” | means the Common Seal of the Company or where relevant the official seal kept by the Company pursuant to Section 1017 of the Act; |

“Secretary” | means any person appointed to perform the duties of the Secretary of the Company including an Assistant or Deputy Secretary; |

“State” | means Ireland; and |

“Subsidiary” | shall mean a subsidiary as defined in the Act. |

The masculine includes the feminine, and the singular includes the plural, and vice versa.

Expressions referring to writing shall be construed as including references to printing,

lithography, photography, electronic and other modes of representing or of reproducing words

in visible form and cognate words shall be similarly construed.

Unless the contrary intention appears, words or expressions contained in these Articles shall

bear the same meaning as in the Act or in any statutory modification thereof in force at the

date on which these Articles become binding on the Company.

References to Articles of these Articles and any reference in an Article to a paragraph or sub-

paragraph shall be a reference to a paragraph or sub-paragraph of the Articles in which the

reference is contained unless it appears from the contents that a reference to some other

provision is intended. The headings and captions included in these Articles are included for

convenience of reference only and shall not be considered as part of or affect the construction

or interpretation of these Articles.

CONTROL

3.The Company shall be managed and controlled in Ireland.

16

CAPITAL AND SHARES

4.The capital of the Company is €401,297,400 divided into 150,000 5% Cumulative Preference

Shares of €1.27 each, 872,000 7% “A” Cumulative Preference Shares of €1.27 each and

1,250,000,000 Ordinary Shares of €0.32 each.

4A.Subject to the provisions of the Act, an Ordinary Share shall be deemed to be a Redeemable

Share on, and from the time of, the existence or creation of an agreement, transaction or trade

between the Company and any third party pursuant to which the Company acquires or will

acquire Ordinary Shares, or an interest in Ordinary Shares, from such third party. In these

circumstances, the acquisition of such Ordinary Shares or an interest in such Ordinary Shares

by the Company, save where acquired otherwise than for valuable consideration in

accordance with the Act, shall constitute the redemption of a Redeemable Share in

accordance with the Act. No resolution, whether special or otherwise, shall be required to be

passed to deem any ordinary share a Redeemable Share.

5.The said five per cent. (5%) Cumulative Preference Shares shall confer on the holders thereof

the rights and privileges following, that is to say:

(a)the right out of the profits which the Company shall determine to distribute by way of

dividend to a fixed cumulative preferential dividend at the rate of five per cent. (5%)

per annum on the capital for the time being paid up or credited as paid up on the said

shares during the period in respect of which the said dividend is declared;

(b)the right in a winding-up to repayment of the capital paid up or credited as paid up on

the said shares and to payment of all arrears of the said fixed cumulative preferential

dividend (whether earned or declared or not) down to the commencement of the

winding-up in priority to the repayment of the amount of capital paid up or credited

as paid up on any other shares in the capital of the Company.

Subject to the foregoing the said Preference Shares shall not confer any further right to

participate in profits or assets and the holders of the said Preference Shares shall have no right

to receive notice of or to be present or to vote either in person or by proxy at any general

meeting by virtue or in respect of their holdings of such Preference Shares unless their fixed

preferential dividend shall be six months in arrears or unless a Resolution is proposed for the

winding up of the Company or otherwise affecting the rights or privileges of the holders of

such Preference Shares.

6.The following provisions shall have effect in regard to the said seven per cent. (7%) “A”

Cumulative Preference Shares of €1.27 each (hereinafter called ““A” Preference Shares”):

(i)The “A” Preference Shares shall carry the right to a fixed cumulative

preferential dividend at the rate of seven per cent. (7%) per annum on the

capital for the time being paid up or credited as paid up thereon during the

period in which the said dividend is declared.

(ii)The “A” Preference Shares shall rank for such dividend next after the said

150,000 five per cent. (5%). Cumulative Preference Shares and in priority to

the Ordinary Shares for the time being of the Company.

(iii)The “A” Preference Shares shall carry the right in a winding-up to repayment

of capital paid up or credited as paid up thereon and to payment of all arrears

of the said fixed cumulative preferential dividend (whether earned or declared

or not) down to the commencement of the winding-up net after the said

150,000 five per cent. (5%).

17

Cumulative Preference Shares and in priority to the Ordinary Shares

for the time being of the Company.

(iv)Save as aforesaid the “A” Preference Shares shall not confer any further right

to participate in profits or assets.

(v)The “A” Preference Shares shall not confer on the holders thereof the right to

receive notice of or to attend or vote either in person or by proxy at any

general meeting of the Company by virtue or in respect of their holdings

thereof unless:

(A)At the date of the notice convening the meeting the dividend thereon

is six months in arrears and so that for this purpose the dividend on

such Shares shall be deemed to be payable half-yearly on the 5th day

of April and the 5th day of October in each year, or

(B)The business of the meeting includes the consideration of a resolution

for reducing the capital of the Company or for the sale of the

undertaking of the Company, or for the winding-up of the Company,

or for increasing the borrowing powers of the Company, or for

altering its objects, or for varying or abrogating any of the special

rights or privileges attached to any Preference Shares, in which case

they shall only be entitled to vote on any such resolutions.

(vi)That the Company shall be entitled to create further new “A” Preference

Shares ranking in all respects pari passu with the said 872,000 seven per cent.

(7%) “A” Cumulative Preference Shares but not in priority thereto.

7.Subject to the provisions of Section 108 of the Act, the Company shall have the power to

redeem any Preference Shares issued by it prior to the 5th May, 1959.

8.Subject to the provisions of Chapter 6 of Part 3 and Chapter 5 of Part 17 of the Act and the

other provisions of this Article, the Company may:

(a)pursuant to Section 66(4) of the Act, issue any shares of the Company which are to be

redeemed or are liable to be redeemed at the option of the Company or the

shareholder on such terms and in such manner as may be determined by the Company

in general meeting (by Special Resolution of the Company) on the recommendation

of the Directors;

(b)pursuant to Section 105 and Chapter 5 of Part 17 of the Act, purchase any of its own

shares (including any Redeemable Shares and without any obligation to purchase on

any pro rata basis as between shareholders or shareholders of the same class) and may

cancel any shares so purchased or hold them as treasury shares (as defined in

Section 106 of the Act) and may reissue any such shares as shares of any class or

classes;

(c)pursuant to Section 83(3) of the Act, convert any of its shares into Redeemable

Shares.

8A.The Company shall not make a purchase of shares in the Company in accordance with the Act

unless the purchase has first been authorised by an Ordinary Resolution passed in general

meeting. Where the Company has been so authorised to purchase its own shares, the

Company and/or any of its subsidiaries may make such purchases on such terms and

conditions and in such manner as the Directors of the Company or the particular subsidiary of

the Company may from time to time determine but subject to the provisions of the Act and

the authority granted by the Ordinary Resolution of the Company.

18

8B.Where the Company has been authorised by a Special Resolution passed in general meeting to

re-issue treasury shares (as provided for in Section 1078 of the Act) the Company may re-

issue such treasury shares in accordance with such authority and in such manner as the

Directors of the Company may from time to time determine and the Directors may resolve to

permit the re-issue of treasury shares to be paid for in a currency or currencies other than euro

and, in such cases, the payment shall be subject to the conversion rate or rates as may be

determined by the Directors in relation thereto.

9.Without prejudice to any special rights previously conferred on the holders of any existing

shares or class of shares, any share in the Company may be issued with such preferred or

deferred or other special rights or such restrictions, whether in regard to dividend, voting,

return of capital or otherwise, as the Company may from time to time by Ordinary Resolution

determine.

10.The rights and privileges attached to any class or classes of shares in the Company's share

capital may be modified, commuted, affected, abrogated or dealt with in manner provided by

Clause 6 of the Company's Memorandum of Association and all the provisions hereinafter

contained as to general meetings (save Article 61) shall mutatis mutandis apply to every

meeting of the holders of the shares of any class but so that the quorum thereof shall be

persons holding or representing by proxy one third of the nominal amount of the issued shares

of such class.

11.(a)Subject to the provisions of these Articles relating to new shares, the shares shall be at

the disposal of the Directors, and they may (subject to the provisions of the Act) allot, grant

options over or otherwise dispose of them to such persons, on such terms and conditions and

at such times as they may consider to be in the best interest of the Company and its

shareholders, but so that no share shall be issued at a discount, so that in the case of shares

offered to the public for subscriptions, the amount payable on application on each share shall

not be less than twenty-five per cent. (25%) of the nominal amount of the share and the whole

of any premium on it.

(b)Without prejudice to the generality of the powers conferred on the Directors by the

other paragraphs of this Article, the Directors may grant from time to time options to

subscribe for the unallotted Shares in the capital of the Company to Directors and other

persons in the service or employment of the Company or any subsidiary or associate company

of the Company on such terms and subject to such conditions as may be approved from time

to time by the Directors or by any Committee thereof appointed by the Directors for the

purposes of such approval and on the terms and conditions required to obtain the approval of

any statutory authority in any jurisdiction.

(c)The Company may issue warrants to subscribe to any person to whom the Company

has granted the right to subscribe for shares in the Company (other than under a share option

scheme under paragraph (b)) certifying the right of the registered holder to subscribe for

shares in the Company upon such terms and conditions as the right may have been granted.

(d)The Company may at any time and from time to time pass an Ordinary Resolution

referring to this Article 11(d) and authorising the Directors to allot relevant securities (within

the meaning of Section 1021 of the Act) and upon the passing of such an Ordinary

Resolution:

(i)the Directors shall thereupon and without further formality be generally and

unconditionally authorised to allot relevant securities provided that the

nominal amount of such securities where they are shares, and, where such

securities are not shares, the nominal amount of the shares in respect of which

19

such securities confer the right to subscribe or convert, shall not exceed in

aggregate the sum specified in such Ordinary Resolution; and

(ii)any such authority shall (unless otherwise specified in such Ordinary

Resolution or varied or abrogated by Ordinary Resolution passed at an

intervening Extraordinary General Meeting) expire at the conclusion of the

Annual General Meeting of the Company next following the passing of such

Ordinary Resolution, or such later date as may be specified in such Ordinary

Resolution, save that the Company may before such expiry date make an

offer or agreement which would or might require relevant securities to be

allotted after such expiry date and the Directors may allot relevant securities

in pursuance of such offer or agreement as if the authority conferred hereby

had not expired;

and all, if any, previous authorities under Section 1021 of the Act shall thenceforth

cease to have effect.

(e)The Company may at any time and from time to time resolve by a Special Resolution

referring to this Article 11(e) that the Directors be empowered to allot equity securities

(within the meaning of Section 1023 of the Act) for cash and upon such Special Resolution

being passed, or such later date as may be specified in such Special Resolution, the Directors

shall (subject to their being authorised to allot relevant securities in accordance with

Section 1021 of the Act) thereupon and without further formality be empowered to allot

(pursuant to any such authority) equity securities for cash as if Sub-Section 1 of Section 1022

of the Act did not apply to any such allotment provided that such power shall be limited:

(i)to the allotment of equity securities in connection with a rights issue in favour

of Ordinary shareholders where the equity securities respectively attributable

to the interest of all such shareholders are proportionate (as nearly as may be)

to the respective value of shares held by them but subject to such exclusions

or other arrangements as the Directors may deem necessary or expedient to

deal with legal or practical problems in respect of overseas shareholders,

fractional entitlements or otherwise; and

(ii)to the allotment of equity securities pursuant to the terms of any share scheme

for employees approved by the members in General Meeting; and

(iii)to the allotment (otherwise than pursuant to sub-paragraphs (i) or (ii) above)

of equity securities having in the case of relevant shares (within the meaning

of Section 1023 of the Act) a nominal amount or, in case of other equity

securities, giving the right to subscribe for or convert into relevant shares

have a nominal amount not exceeding in aggregate the sum specified in such

Special Resolution;

and such power shall (unless otherwise specified in such Special Resolution or varied

or abrogated by Special Resolution passed at an intervening Extraordinary General

Meeting) expire at the conclusion of the Annual General Meeting of the Company

next following the passing of such Special Resolution, or such later date as may be

specified in such Special Resolution, save that the Company may before such expiry

make an offer or agreement which would or might require equity securities to be

allotted after such expiry date and the Directors may allot equity securities in

pursuance of such offer or agreement as if such power had not expired.

12.The Company may pay commission to any person in consideration of a person

subscribing or agreeing to subscribe, whether absolutely or conditionally, for any

20

shares in the Company or procuring or agreeing to procure subscriptions, whether absolute or

conditional, for any shares in the Company on such terms and subject to such conditions as

the Directors may determine, including, without limitation, by paying cash or allotting and

issuing fully or partly paid shares or any combination of the two. The Company may also, on

any issue of shares, pay such brokerage as may be lawful.

13.Except as required by law, no person shall be recognised by the Company as holding any

share upon any trust, and the Company shall not be bound by or be compelled in any way to

recognise (even when having notice thereof) any equitable, contingent, future or partial

interest in any share or any interest in any fractional part of a share or (except only as by these

Articles or by law otherwise provided) any other rights in respect of any share except an

absolute right to the entirety thereof in the registered holder. This shall not preclude the

Company from requiring the members or the transferee of shares to furnish the Company with

information as to the beneficial ownership of any share when such information is reasonably

required by the Company.

14.(a)The Directors may at any time and in their absolute discretion, if they consider it to

be in the interests of the Company to do so, give to any shareholder or shareholders a notice

(hereinafter referred to as an “Investigation Notice”) requiring such shareholder or

shareholders to notify the Company in writing within the prescribed period of full and

accurate particulars of all or any of the following matters, namely:

(i)his interest in any shares in the Company;

(ii)if his interest in the share does not consist of the entire beneficial interest in

it, the interests of all persons having a beneficial interest in the share

(provided that one joint shareholder of a share shall not be obliged to give

particulars of interests of persons in the share which arise only through

another joint shareholder of the Company); and

(iii)any arrangement (whether legally binding or not) entered into by him or any

person having any beneficial interest in the share whereby it has been agreed

or undertaken or the shareholder of such share can be required to transfer the

share or any interest therein to any person (other than a joint shareholder of

the share) or to act in relation to any meeting of the Company or of any class

of shares of the Company in a particular way or in accordance with the

wishes or directions of any other person (other than a person who is a joint

shareholder of such share).

(b)Where an intermediary receives a Disclosure Notice and is in possession or control of

the information which is required to be provided pursuant to these Articles or applicable law,

it shall as soon as practicable provide the Company with that information. Any intermediary

that receives a Disclosure Notice and is not in possession or control of the information which

is required to be provided pursuant to these Articles or applicable law, shall as soon as

practicable:

(i)inform the Company that it is not in possession or control of the information;

(ii)where the intermediary is part of a chain of intermediaries, transmit the

request to each other intermediary in the chain known to the first mentioned

intermediary as being part of the chain; and

(iii)provide the Company with the details of each intermediary, if any, to which

the request has been transmitted under sub-paragraph (ii).

21

(c)If, pursuant to an Investigation Notice, the person stated to own any beneficial

interest in a share or the person in favour of whom any shareholder (or other person having

any beneficial interest in the share) has entered into any arrangements referred to in

paragraph (a)(iii) is a body corporate, trust, society or any other legal entity or association of

individuals and/or entities, the Directors may in their absolute discretion give a further

Investigation Notice to the shareholders of, and/or any person whom such shareholder has

stated as having any beneficial interest in, such a share requiring them to notify the Company

in writing within the prescribed period of full and accurate particulars of the names and

Addresses of the individuals who control (whether directly or indirectly and through any

number of vehicles, entities or arrangements) the beneficial ownership of all the shares,

interests, units or other measure of ownership of such body corporate, trust, society or other

entity or association wherever the same shall be incorporated, registered or domiciled or

wherever such individuals shall reside provided that if at any stage of such chain of ownership

the beneficial interest in any share shall be established to the satisfaction of the Directors to be

in the ownership of any body corporate any of whose share capital is listed or dealt in on any

bona fide stock exchange, unlisted securities market or over the counter securities market, it

shall not be necessary to disclose details of the individuals ultimately controlling the

beneficial interests in the shares of such body corporate.

(d)Unless otherwise required by applicable law, where a notice is served pursuant to the

terms of this Article on the holder of a share and such holder is a central securities depository

(or its nominee(s)) acting in its capacity as operator of a securities settlement system, the

obligations of the central securities depository (or its nominee(s)) as a holder pursuant to this

Article shall be limited to disclosing to the Company in accordance with this Article such

information relating to the ownership of or interests in the share concerned as has been

recorded by it pursuant to the rules made and practices instituted by the central securities

depository, provided that nothing in this Article shall in any other way restrict the powers of

the Directors under this Article. For the purposes of this Article, a person, other than the

holder of a share, shall be treated as appearing to be or to have been interested in that share if

the holder has informed the Company that the person is, or may be, or has been, or may have

been, so interested, or if the Company (after taking account of any information obtained from

the registered holder or, pursuant to a Disclosure Notice, from anyone else) knows or has

reasonable cause to believe that the person is, or may be, or has been, or may have been, so

interested.

(e)Where any member, or any other person with an interest in shares held by such

member, is deemed by Section 1048 or 1050 of the Act to have an interest in 3% or more of

the issued share capital of the Company, such member or person shall be required to notify

the Company both of the existence of such interest and any event which results in the member

or person ceasing to be so interested. Such notification shall be made in the same manner and

within the same time period as specified in Sections 1052 and 1053 of the Act.

(f)If at any time the Directors are satisfied that:

(i)any member has been served with an Investigation Notice, or

(ii)any member, or any other person appearing to be interested in shares held by

such member, has been served with a Disclosure Notice,

and is in default for the prescribed period in supplying to the Company the

information thereby required, or, in purported compliance with such a notice has

made a statement which is false or inadequate, then the Directors may, in their

absolute discretion at any

22

time thereafter by notice (a “Disenfranchisement Notice”) to such member direct

that in respect of the shares in relation to which the default occurred (the “Default

Shares”) (which expression shall include any further shares which are issued in

respect of such shares) the member shall not be entitled to attend or to vote either

personally or by proxy at a general meeting of the Company or a meeting of the

holders of any class of shares of the Company or to exercise any other rights

conferred by membership in relation to general meetings of the Company or meetings

of the holders of any class of shares of the Company. Where a Disenfranchisement

Notice is served on a central securities depository or its nominee(s) acting in its

capacity as operator of a securities settlement system, the provisions of this Article

shall be treated as applying only to such number of shares as is equal to the number of

Default Shares held by the central securities depository or its nominee(s) and not to

any other shares held by the central securities depository or its nominee(s).

(g)Where the Default Shares represent at least three per cent. (3%) of the issued shares

of that class (or such other percentage as may be determined under the provisions of

Section 1052 of the Act), then the Disenfranchisement Notice may additionally direct that:

(i)any dividend (or part thereof) or other money which would otherwise be

payable in respect of the Default Shares shall be retained by the Company

without any liability to pay interest thereon when such money is finally paid

to the member and/or

(ii)no transfer of any shares held by such member shall be registered unless;

(A)the member is not himself in default as regards supplying the

information required; and

(B)the transfer is part only of the member's holding and when presented

for registration is accompanied by a certificate by the member in a

form satisfactory to the Directors to the effect that after due and

careful enquiry, the member is satisfied that none of the shares, the

subject of the transfer, is a Default Share.

(h)The Company shall send to each other person appearing to be interested in the shares,

the subject of any Disenfranchisement Notice, a copy of the Disenfranchisement Notice but

the failure or omission by the Company to do so shall not invalidate such Disenfranchisement

Notice.

(i)Save as herein provided, any Disenfranchisement Notice shall have effect in

accordance with its terms for so long as the default in respect of which the

Disenfranchisement Notice was issued continues and for a period of one week thereafter

provided that the Directors may at the request of the member concerned reduce or waive such

one week period if they think fit.

(j)Any Disenfranchisement Notice shall cease to have effect in relation to any shares

which are transferred by such member by means of an Approved Transfer (as defined in

Article 14(k)(iii)).

(k)For the purpose of this Article:

(i)a person shall be treated as appearing to be interested in any shares if the

member holding such shares has in response to a Disclosure Notice or

Investigation Notice either:

23

(A)named such person as being so interested; or

(B)fails to establish the identities of those interested in the shares;

and (after taking into account the said response and any other relevant

Disclosure Notice or Investigation Notice) the Company knows or has

reasonable cause to believe that the person in question is or may be interested

in the Shares;

(ii)in the case of both an Investigation Notice and a Disclosure Notice, the

prescribed period is twenty-eight days from the date of service of the notice

except that if the Default Shares represent at least five per cent. (5%) of the

issued shares of that class, the prescribed period is fourteen days from such

date; and

(iii)a transfer of shares is an “Approved Transfer” if, but only if:

(A)it is a transfer of shares to an offeror by way of or in pursuance of an

acceptance of a takeover offer, merger, scheme or arrangement or

consolidation of the Company; or

(B)the Directors are satisfied that the transfer is made pursuant to a sale

of the whole of the beneficial ownership of the shares to a party

unconnected with the member and with other persons appearing to be

interested in such shares; or

(C)the transfer results from a sale made through a recognised stock

exchange.

15.The Company shall not give, whether directly or indirectly and whether by means of a loan,

guarantee, the provisions of security or otherwise, any financial assistance for the purpose of

or in connection with a purchase or subscription made or to be made by any person of or for

any shares in the Company or in its holding company, but this regulation shall not prohibit

any transaction permitted by Section 82 of the Act as amended by Section 1043 of the Act.

CERTIFICATES

16.Save as required by applicable law, no person shall be entitled to a share certificate in respect

of any Ordinary Share held by them in the share capital of the Company, whether such

Ordinary Share was allotted or transferred to them, and the Company shall not be bound to

issue a share certificate to any such person entered in the Register.

THE CLEARING AND SETTLEMENT SYSTEM

17.Notwithstanding anything in these Articles to the contrary and subject to the rules of the

applicable central securities depository, the Directors may permit any class of Shares to be

held, and trades in those Shares to be settled, through a securities settlement system operated

by a central securities depository. Without prejudice to the generality and effectiveness of the

foregoing:

(a)the Directors may make such arrangements or regulations (if any) as they may from

time to time in their absolute discretion think fit for the purpose of implementing and/

or supplementing the provisions of this Article and the facilities and requirements of

the securities settlement system and such arrangements and regulations (as the case

may be) shall have the same effect as if set out in this Article;

24

(b)the Directors may utilise the securities settlement system to the fullest extent

available from time to time in the exercise of the Company’s powers or functions

under the Acts or these Articles or otherwise in effecting any actions;

(c)for the purposes of Article 137, any payment in the case of shares held through a

securities settlement system may be made by means of the securities settlement

system (subject always to the facilities and requirements of the securities settlement

system) or through any agent for on behalf of the Company and without prejudice to

the generality of the foregoing, the making of a payment in accordance with the

facilities and requirements, or through such designated agent, shall be a good

discharge to the Company;

(d)where any class of Shares in the capital of the Company is held through a securities

settlement system and the Company is entitled under any provisions of the Acts, or

the rules made and practices instituted by the central securities depository or under

these Articles, to dispose of, forfeit, enforce a lien or sell or otherwise procure the

sale of any such Shares, such entitlement (to the extent permitted by the Acts and the

rules made and practices instituted by the central securities depository):

(i)shall include the right to require the central securities depository of such

securities settlement system to take such steps as may be necessary to sell or

transfer such Shares and/or to appoint any person to take such other steps in

the name of the central securities depository (or its nominees(s)) as may be

required to effect a transfer of such Shares and such steps shall be as effective

as if they had been taken by the central securities depository (or its

nominee(s)); and

(ii)shall be treated as applying only to such Shares held by the central securities

depository or its nominee(s) and not to any other Shares held by the central

securities depository or its nominee(s).

LIEN

18.The Company shall have a first and paramount lien on every share (not being a fully paid

share) for all moneys (whether immediately payable or not) called or payable at a fixed time

in respect of that share, and the Company shall also have a first and paramount lien on all

shares (other than fully paid shares) standing registered in the name of a single person for all

moneys immediately payable by him or his estate to the Company; but the Directors may at

any time declare any share to be wholly or in part exempt from the provisions of this

regulation. The Company's lien on a share shall extend to all dividends payable thereon.

19.The Company may sell, in such manner as the Directors think fit, any shares on which the

Company has a lien, but no sale shall be made unless a sum in respect of which the lien exists

is immediately payable, nor until the expiration of fourteen days after a notice in writing,

stating and demanding payment of such part of the amount in respect of which the lien exists

as is immediately payable, has been given to the registered holder for the time being of the

share, or the person entitled thereto by reason of his death or bankruptcy.

20.To give effect to any such sale, the Directors may authorise some person to transfer the shares

sold to the purchaser thereof. The purchaser shall be registered as the holder of the shares

comprised in any such transfer, and he shall not be bound to see to the application of the

purchase money, nor shall his title to the shares be affected by any irregularity or invalidity in

the proceedings in reference to the sale.

21.The net proceeds of sale (after payment of all costs) shall be applied in payment of such part

of the amounts in respect of which the lien exists as is immediately payable and the residue, if

25

any, shall, (subject to a like lien for sums not immediately payable as existing upon the shares

before the sale) be paid to the person entitled to the shares at the date of sale upon surrender

(at the option of the Directors) to the Company of a statement issued by the Registrar

confirming their holding of the shares sold.

CALLS ON SHARES

22.The Directors may from time to time make calls upon the members in respect of any moneys

unpaid on their shares (whether on account of the nominal value of the shares or by way of

premium) and not by the conditions of allotment thereof made payable at fixed times,

provided that no call shall be payable at less than one month from the date fixed for the

payment of the last preceding call, and each member shall (subject to receiving at least

fourteen days’ notice specifying the time or times and place of payment) pay to the Company

at the time or times and place so specified the amount called on his shares. A call may be

revoked or postponed as the Directors may determine.

23.A call shall be deemed to have been made at the time when the resolution of the Directors

authorising the call was passed and may be required to be paid by instalments.

24.The joint holders of a share shall be jointly and severally liable to pay all calls in respect

thereof.

25.If a sum called in respect of a share is not paid before or on the day appointed for payment

thereof, the person from whom the sum is due shall pay interest on the sum from the day

appointed for payment thereof to the time of actual payment at such rate not exceeding five

per cent. (5%) per annum, as the Directors may determine, but the Directors shall be at liberty

to waive payment of such interest wholly or in part.

26.Any sum which by the terms of issue of a share becomes payable on allotment or at any fixed

date, whether on account of the nominal value of the share or by way of premium shall, for

the purpose of these Articles, be deemed to be a call duly made and payable on the date on

which, by terms of issue, the same becomes payable, and in case of non-payment of interest

all the relevant provisions of these Articles as to payment of interest and expenses, forfeiture

or otherwise, shall apply as if such sum had become payable by virtue of a call duly made and

notified.

27.The Directors may, on the issue of shares, differentiate between the holders as to the amount

of calls to be paid and the times of payment.

28.The Directors may, if they think fit, receive from any member willing to advance the same, all

or part of the moneys uncalled and unpaid upon any shares held by him, and upon all or any

of the moneys so advanced may (until the same would, but for such advance, become

payable) pay interest at such rate as may be agreed upon between the Directors and the

member paying such sum in advance.

TRANSFER OF SHARES

29.(a)The instrument of transfer of any shares shall be executed by or on behalf of the

transferor, and (in case of a share not fully paid) also by or on behalf of the transferee, and the

transferor shall be deemed to remain the holder of the share until the name of the transferee is

entered in the Register in respect thereof.

(b)In the case of the death of an owner of a share, the survivor or survivors where the

deceased was a joint owner of the share, and the personal representatives of the deceased

where he or she was a sole holder, shall be the only persons recognised by the Company as

the persons entitled to exercise any rights in respect of that share

26

provided that they or the deceased owner have satisfied the requirements in Article 13 or

Article 35 with respect to that share.

(c)The instrument of transfer of any share may be executed for and on behalf of the

transferor by the Secretary or any other party designated by the Board for such purpose, and

the Secretary or any other party designated by the Board for such purpose shall be deemed to

have been irrevocably appointed agent for the transferor of such share or shares with full

power to execute, complete and deliver in the name of and on behalf of the transferor of such

share or shares all such transfers of shares held by the members in the capital of the Company.

Any document which records the name of the transferor, the name of the transferee, the class

and number of shares agreed to be transferred, the date of agreement to transfer shares and the

price per share, shall, once executed by the transferor or the Secretary or any other party

designated by the Board for such purpose as agent for the transferor, be deemed to be a proper

instrument of transfer for the purposes of the Act. The transferor shall be deemed to remain

the member holding the share until the name of the transferee is entered on the Register in

respect thereof, and neither the title of the transferee nor the title of the transferor shall be

affected by any irregularity or invalidity in the proceedings in reference to the sale should the

Directors so determine.

30.Subject to the restrictions of these Articles and other applicable law, and to such of the

conditions of issue as may be applicable, the shares of any member may be transferred by

instrument in writing in any usual or common form or any other form which the Directors

may approve. The Directors may also permit title to any shares in the Company to be

transferred without a written instrument where permitted by the Acts subject to compliance

with the requirements imposed under the relevant provisions of the Acts and any additional

requirements which the Directors may approve.

31.The Directors may, in their absolute discretion and without giving any reason, decline to

register the transfer of, or renunciation of a renounceable letter of allotment, of a share (not

being a fully paid share) to a person of whom they do not approve, and they may also decline

to register the transfer of a share on which the company has a lien and shall not be bound to

give any reason for such refusal, provided that the Directors shall not refuse to register any

transfer or renunciation of partly paid shares which are listed or dealt in on any Approved

Market on the grounds that they are partly paid shares in circumstances where such refusal

would prevent dealings in such shares from taking place on an open and proper basis.

32.The Directors may also decline to recognise any instrument of transfer, or renunciation of a

renounceable letter of allotment, of any share unless:

(a)it (being a transfer or renunciation which is not effected in a manner permitted by

Article 34(a)) is accompanied by such evidence as the Directors may reasonably

require to show the right of the transferor to make the transfer or renunciation;

(b)it is in respect of one class of share only; and

(c)the instrument of transfer is duly stamped if required and it is lodged at the Office or

any other place as the Board may from time to time specify for the purposes,

accompanied by such evidence as the Board may reasonably require to show the right

of the transferor to make the transfer.

33.If the Directors refuse to register a transfer they shall send, within two months after the date

on which the transfer was lodged with the Company, to the transferee notice of the refusal.

34.(a)All instruments of transfer shall upon their being lodged with the Company remain

the property of the Company and the Company shall be entitled to dispose of same as it so

27

desires but any instrument of transfer which the Directors refuse to register shall be returned

to the person lodging it when notice of the refusal is given.

(b)Notwithstanding the provisions of these Articles the Directors shall be entitled to

disapply all or part of the provisions of these Articles so that title to securities (as defined in

Section 1086 of the Act) may be evidenced and transferred without a written instrument in

accordance with the requirements of the Act. The Directors shall have the power to permit

any class of shares to be held in a securities settlement system and to implement any

arrangements they think fit for such evidencing and transfer which accord with the Act and in

particular shall, where appropriate, be entitled to disapply or modify all or part of the

provisions in these Articles with respect to the requirement for written instruments of transfer

and share certificates, in order to give effect the Act.

(c)The Company, at its absolute discretion and insofar as the Acts or any other

applicable law permits, may, or may procure that a subsidiary of the Company shall, pay Irish

stamp duty arising on a transfer of shares on behalf of the transferee of such shares of the

Company. If stamp duty resulting from the transfer of shares in the Company which would

otherwise be payable by the transferee is paid by the Company or any subsidiary of the

Company on behalf of the transferee, then in those circumstances, the Company shall, on its

behalf or on behalf of its subsidiary (as the case may be), be entitled to:

(i)seek reimbursement of the stamp duty from the transferee;

(ii)set off the stamp duty against any dividends payable to the transferee of those

shares; and

(iii)to the extent permitted by Section 1042 of the Act, claim a first and

paramount lien on the shares on which stamp duty has been paid by the

Company or its subsidiaries for the amount of stamp duty paid. The

Company’s lien shall extend to all dividends paid on those shares.

TRANSMISSION OF SHARES

35.In the case of the death of a member, the survivor or survivors where the deceased was a joint

holder, and the personal representatives of the deceased where he was a sole holder, shall be

the only person recognised by the Company as having any title to his interest in the shares;

but nothing herein contained shall release the estate of a deceased joint holder from any

liability in respect of any share which had been jointly held by him with other persons.

36.Any person becoming entitled to a share in consequence of the death or bankruptcy of a

member may, upon such evidence being produced as may from time to time properly be

required by the Directors and subject as hereinafter provided, elect either to be registered

himself as holder of the share or to have some person nominated by him registered as the

transferee thereof, but the Directors shall, in either case, have the same right to decline or

suspend registration as they would have had in the case of a transfer of the share by that

member before his death or bankruptcy, as the case may be.

37.If a person so becoming entitled elects to be registered himself, he shall deliver or send to the

Company a notice in writing signed by him stating that he so elects. If he elects to have

another person registered, he shall testify his election by executing to that person a transfer of

the share.

38.All the limitations, restrictions and provisions of these regulations relating to the right to

transfer and registration of transfers of shares shall be applicable to any such notice or transfer

as aforesaid as if the death or bankruptcy of the member had not occurred and the notice or

transfer were a transfer signed by that member.

28

39.A person becoming entitled to a share by reason of the death or bankruptcy of the holder shall

be entitled to the same dividends and other advantages to which he would be entitled if he

were the registered holder of the share, except that he shall not, before being registered as a

member in respect of the share, be entitled in respect of it to exercise any right conferred by

membership in relation to meetings of the Company, so however, that the Directors may at

any time give notice requiring any such person to elect either to be registered himself or to

transfer the share, and if the notice is not complied with within ninety days the Directors may

thereupon withhold payment of all dividends, bonuses, or other moneys payable in respect of

the share until the requirements of the notice have been complied with.

FORFEITURE OF SHARES

40.If a member or person entitled by transmission fails to pay any call or instalment of a call on

the day appointed for payment thereof, the Directors may, at any time thereafter during such

time as any part of the call or instalment remains unpaid, serve a notice on him requiring

payment of so much of the call or instalment as is unpaid together with any interest which

may have accrued and all expenses incurred by the Company by reason of such non-payment.

41.The notice shall name a further day (not earlier than the expiration of fourteen days from the

date of service of the notice) on or before which the payment required by the notice is to be

made, and shall state that in the event of non-payment at or before the time appointed the

shares in respect of which the call was made will be liable to be forfeited.

42.If the requirements of any such notice as aforesaid are not complied with, any share in respect

of which the notice has been given may at any time thereafter, before the payment required by

the notice has been made, be forfeited by a resolution of the Directors to that effect.

43.A forfeited share may be sold or otherwise disposed of on such terms and in such manner as

the Directors think fit, and at any time before a sale or disposition the forfeiture may be

cancelled on such terms as the Directors think fit.

44.A person whose shares have been forfeited shall cease to be a member in respect of the

forfeited shares, but shall notwithstanding remain liable to pay to the Company all moneys

which, at the date of forfeiture, were payable by him to the Company in respect of the shares,

but his liability shall cease if and when the Company shall have received payment in full of

all such moneys in respect of the shares.