Exhibit 10.1

CERTAIN IDENTIFIED INFORMATION HAS BEEN EXCLUDED FROM THE EXHIBIT BECAUSE IT IS both not material and is the type that the registrant treats as private or confidential.

The terms contained in this DRAFT AGREEMENT are for preliminary commercial discussion purposes only, TERMS ARE SUBJECT TO stusco APPROVAL.

This Crude Oil and Crude Oil Products Supply, Offtake and Processing Agreement (the “Agreement”) is entered into on May 7, 2025 (the “Execution Date”), by and between Shell Trading (US) Company (“STUSCO”) and Integrated Rail & Resource Acquisition Corp. (“IRRX”). STUSCO and IRRX may also be referred to herein individually as a “Party” or collectively as the “Parties.”

RECITALS

IRRX intends to purchase and restore a facility, at its sole cost and risk, located at or near 3550 W 1500 Street; Vernal, Utah, 84078 comprised of the refinery facilities, including an atmospheric distillation unit and associated units, processors, and equipment, and related terminal facilities (the “Facility”) for the purpose of converting certain Crude Oil into Condensate, Distillates, and ATBs (the “Crude Oil Products”); and

Subject to the following terms and conditions, the Parties desire to enter into this Agreement to engage STUSCO to sell and supply Crude Oil to IRRX, which in turn will be processed and converted into Crude Oil Products to be sold to STUSCO.

NOW, THEREFORE, in consideration of the mutual covenants set forth herein and other good and valuable consideration, the receipt and adequacy of which are hereby acknowledged, the Parties agree as follows:

AGREEMENT

DEFINITIONS

Unless otherwise required by the content, or unless defined in the applicable GTCs, the terms defined below shall have, for all purposes of this Agreement, the respective meanings ascribed to such terms.

Acting in concert shall have the meaning set forth in Section 26(c).

Affiliate shall have the meaning as set forth in the GTCs.

Agreement has the meaning set forth in the preamble hereto.

Anti-Corruption Laws shall mean (a) the United States Foreign Corrupt Practices Act of 1977; (b) the United Kingdom Bribery Act 2010; and (c) all applicable national, regional, provincial, state, municipal or local laws and regulations that prohibit tax evasion, money laundering or otherwise dealing in the proceeds of crime or the bribery of, or the providing of unlawful gratuities, facilitation payments, or other benefits to, any government official or any other person.

Arbitrage Adjustment means the feature described in Section 14.

1

Business Day means any day other than a Saturday, Sunday or other day on which commercial banks in Houston, Texas are authorized or required by applicable law to close.

Capital Costs means an amount up to (but not in excess of) those amounts set forth on Annex I attached hereto; The Parties will update Annex I from time to time to adjust the payments to the extent IRRX secures an interest rate that is [Redacted].

Claims shall mean all claims, Losses, damages, costs (including reasonable legal fees), demands, suits, causes of action of any kind, expenses, and liabilities.

Commencement Date means the date on which the Parties’ obligations to buy and sell Crude Oil and Crude Oil Products shall commence, which date will be determined as described in Section 3.

Conditions Precedent shall have the meaning as set forth in Section 4.

Conditions Precedent Completion Date means the date on which the last of the conditions precedent set forth in Section 4 have been met, as determined by STUSCO, and/or waived by STUSCO, in its sole discretion, acting reasonably.

Continued Force Majeure Event shall have the meaning as set forth in Section 10.

Cost Suspension shall have the meaning as set forth in Section 13.c.(ii).

Cross Month Hedging Activity shall mean the hedging activity completed by STUSCO to lock in the economics related to buying Crude Oil in one month and selling Crude Oil Products in a following month.

Crude Oil means the crude oil and hydrocarbon feedstock that is required to run through the distillation unit at the Facility.

Crude Oil Grade means the grade of the applicable Crude Oil, as further described in Section 11.

Crude Oil Products shall mean, collectively, Condensate, Distillates and ATBs or other streams as mutually agreed.

Deficiency Credit shall have the meaning as set forth in Section 15.

Deficiency Credit Threshold shall have the meaning as set forth in Section 13.c.(i).

Delivery Point or Delivery Points are those specified delivery points under Sections 11 and 12 of this Agreement and any other delivery points mutually agreed by the Parties.

Execution Date has the meaning set forth in the preamble thereto.

Extended Suspension shall have the meaning set forth in Section 13.c.(iii).

Facility shall have the meaning as set forth in the recitals.

2

Fixed Operating Cost shall have the meaning as set forth in Section 13.

Force Majeure shall have the meaning set forth in the GTCs.

Force Majeure Extension shall have the meaning as set forth in Section 10.

Government Official shall mean any official or employee of any government, or any agency, ministry, department of a government (at any level), person acting in an official capacity for a government regardless of rank or position, official or employee of an entity wholly or partially controlled by a government (for example, a state-owned oil company), political party and any official of a political party; candidate for political office, officer or employee of a public international organization, such as the United Nations or the World Bank, or immediate family member (meaning a spouse, child, sibling, parent, or household member) of any of the foregoing.

GTCs shall have the meaning as set forth in Section 44.

Initial Indication shall have the meaning set forth in Section 8.

Initial Nomination shall have the meaning as set forth in Section 8.

Initial Term shall have the meaning as set forth in Section 3.

In-Service Date shall have the meaning as set forth in Section 2.

Intended In-Service Date shall have the meaning as set forth in Section 2.

In-Service Deadline is December 31, 2028.

IRRX Change of Control shall have the meaning as set forth in Section 26.

IRRX KYC Notice shall have the meaning as set forth in Section 26.

KYC shall have the meaning as set forth in Sections 4, 23 and 26.

KYC Checks shall have the meaning as set forth in Section 26.

Loan Agreement shall have the meaning as set forth in Section 41.2(i).

Losses shall mean any actual loss, cost, expense, liability, damage, demand, suit, sanction, claim, cause of action, judgment, or lien, including court costs and reasonable attorney’s fees.

Material Contract means any written agreement, including any transportation agreement, storage, and terminalling agreement that has an aggregate value of $100,000 or more.

Merger Agreement means the agreement dated October 12, 2024, by and among Integrated Rail & Resource Acquisition Corp and certain parties set forth therein (as may be amended from time to time, pursuant to which, among other things, IRRX will, directly or indirectly, acquire the Facility at closing.

Minimum Run Rate shall be [Redacted] barrels per day.

Monthly Invoice shall have the meaning as set forth in Section 20.

3

Nameplate Capacity is [Redacted] barrels of Crude Oil per day.

Nomination shall mean collectively the Initial Nomination and the Revised Nomination.

Nominated Volumes shall have the meaning as set forth in Section 15.

Off-Spec Products shall have the meaning as set forth in Section 16.

Off-Spec Products Market Value shall have the meaning as set forth in Section 16.

Oil Products Yield Schedule shall have the meaning as set forth in Section 4.

On-Spec Products shall have the meaning as set forth in Section 16.

On-Spec Products Contract Value shall have the meaning as set forth in Section 16.

Off-Spec Products Market Value shall have the meaning as set forth in Section 16.

Operational Volume shall have the meaning as set forth in Section 11.

Party and Parties have the meanings set forth in the preamble thereto.

Payment Due Date shall have the meanings set forth in Section 19.3.

Performance Assurance shall mean either (i) an irrevocable stand-by letter of credit in a form and for a commercially-reasonable amount acceptable to STUSCO opened or confirmed by a Qualified Institution, or (ii) cash or prepayment in immediately available funds in a commercially-reasonable amount acceptable to the STUSCO, at the option of IRRX.

Personal Data shall have the meaning as set forth in Section 24.

Pre-payment Penalties shall have the meaning as set forth in Section 41.2(i).

Price Adjustment shall have the meaning as set forth in Section 16.

Product Fee shall have the meaning as set forth in Section 12.

Qualified Institution means (i) the U.S. office of a commercial bank or trust company (which is not an Affiliate of either Party) organized under the laws of the United States (or any state or political subdivision thereof), or (ii) the U.S. branch of a foreign bank (which is not an Affiliate of either party), in each case having assets of at least ten billion dollars ($10,000,000,000), and having a credit rating of at least A- by Standard’s & Poor’s and at least A3 by Moody’s, acceptable to STUSCO.

Recoupment Obligation shall have the meaning as set forth in Section 41.3.

Related Party means in relation to a party to a contract or agreement (a) its subsidiaries, directors or employees, contractors, agents; or (b) any other person or entity, including that party’s affiliates (and its subsidiaries, employees, or directors) when acting for or on behalf of a party to a contract or agreement or otherwise involved in the performance of the contract or agreement.

4

Renewal Term shall have the meaning as set forth in Section 3.

Required Crude Oil Specifications shall have the meaning as set forth in Section 11.

Required Crude Oil Products Specifications shall have the meaning as set forth in Exhibit B.

Restricted Jurisdiction means a country, state, territory or region which is subject to comprehensive economic or trade restrictions under Trade Control Laws, which may change from time to time, applicable to either Party to the Agreement.

Restricted Party means any individual, legal person, entity or organization (i) targeted by national, regional or multilateral trade or economic sanctions under Trade Control Laws; or (ii) directly or indirectly owned or controlled or acting on behalf of such persons, entities or organizations and including their directors, officers or employees.

Revised Nomination shall have the meaning as set forth in Section 8.

ROFR Period shall have the meaning as set forth in in Section 6.2.

Run Down shall have the meaning as set forth in Section 10.

Shell General Business Principles shall mean the principles that govern how each of the Shell companies which make up the Shell Group conducts its affairs, available at https://www.shell.com/who-we-are/our-values.html.

Suspension Termination shall have the meaning as set forth in Section 13.

Suspension Termination Payment shall have the meaning as set forth in Section 41.2.(i).

Term shall have the meaning as set forth in Section 3.

Termination Option shall have the meaning as set forth in Section 5.

Termination Window shall have the meaning as set forth in Section 5.

Trade Control Laws means any applicable trade or economic sanctions or embargoes, Restricted Party lists, controls on the imports, export, re-export, use, sale, transfer, trade, or otherwise disposal of goods, services or technology, anti-boycott legislation or similar laws or regulations, rules, restrictions, licenses, orders or requirements in force from time to time, including without limitation those of the European Union, the United Kingdom, the United States of America, and other government laws applicable to a party to the Agreement.

Unsatisfactory IRRX KYC Result shall have the meaning as set forth in Section 26.

| 1. | SCOPE OF AGREEMENT |

This Agreement sets forth the terms and conditions under which STUSCO agrees to sell Crude Oil to IRRX. IRRX, in turn, agrees to process the Crude Oil, in accordance with industry best practices, agreed-upon performance standards, and Shell General Business Principles, converting it into Crude Oil Products to be sold to STUSCO as follows. For illustrative purposes only, a sample timeline for the transactions contemplated by this Agreement is set forth on Annex II, attached hereto.

5

| 2. | FACILITY CONSTRUCTION |

IRRX acknowledges and agrees that the design, engineering, construction, operation, and repair of the Facility, including any required enhancements or additions thereto, to enable IRRX’s performance under this Agreement shall be at IRRX’s sole risk and cost. IRRX shall provide STUSCO with written notice of the anticipated date of Facility In-Service (the “Intended In-Service Date” which is anticipated to be in December 2026) at least one hundred and fifty (150) days prior to Intended In-Service Date, provided that, if such Intended In-Service Date is delayed for any reason, including but not limited to Force Majeure, IRRX shall provide STUSCO with prompt written notice of the delay, and the new Intended In-Service Date, if applicable. Any costs, expenses, and other liabilities incurred by STUSCO as a result of a delay in the declared Intended In-Service Date, except to the extent such delay is solely and exclusively caused by STUSCO’s material breach of the Agreement, shall be accounted for in the Arbitrage Adjustment. Notwithstanding the foregoing, in no event shall IRRX’s revised Intended In-Service Date result in an extension or modification of the In-Service Deadline, unless otherwise agreed in writing by the Parties. As soon as reasonably practicable, IRRX shall provide STUSCO with written notice of the actual In-Service Date.

The In-Service Deadline will be extended (i) at STUSCO’s unilateral option or (ii) by any delay directly and exclusively caused by STUSCO’s actions.

| 3. | COMMENCEMENT DATE; TERM; TERMINATION FEE |

If IRRX declares that the Conditions Precedent set forth in Section 4 have been met before the In-Service Deadline, then IRRX shall provide written notice thereof to STUSCO. Notwithstanding any such written notice from IRRX, on or prior to the In-Service Deadline, STUSCO may independently determine if the Conditions Precedent have been satisfied and/or waived, each in STUSCO’s sole discretion, acting reasonably and in good faith, and STUSCO shall provide IRRX with prompt written notice of the Conditions Precedent Completion Date, if applicable, and the Commencement Date. Unless the Parties mutually agree otherwise, [Redacted]. For greater certainty, neither Party shall have any obligation to purchase or sell Crude Oil or Crude Oil Products under this Agreement unless and until all conditions are satisfied and/or waived, as determined by STUSCO in writing, acting reasonably, in accordance with the terms of this Agreement.

If the Conditions Precedent are not satisfied and/or waived, each as determined by STUSCO in writing, in STUSCO’s sole discretion, acting reasonably, on or before the In-Service Deadline (as may be unilaterally extended by STUSCO as described in Section 2), then STUSCO will have the Termination Option described in Section 5 below, unless the Parties mutually agree in writing to extend the In-Service Deadline. Upon any such termination, the Parties shall be relieved of any liabilities or obligations hereunder (including any obligations to purchase or sell Crude Oil or Crude Oil Products), except for any obligations that accrued prior to the termination.

This Agreement shall be effective as of the Execution Date. The Initial Term shall start on the Commencement Date and shall continue until seven (7) years following the Commencement Date (if applicable) (the “Initial Term”), unless terminated earlier in accordance with the terms set forth herein.

6

After the Initial Term, this Agreement will automatically extend for successive renewal terms of two (2) years each (each a “Renewal Term”) unless STUSCO provides a written notice to cancel the Agreement one hundred eighty (180) days prior to the end of the Initial Term or the then current Renewal Term. The Initial Term and any Renewal Terms shall collectively constitute the “Term” of this Agreement. Notwithstanding anything to the contrary contained herein, the Term shall be automatically extended on a day-to-day basis on the terms and conditions set forth herein () until all Deficiency Credits have been settled or the Parties mutually agree in writing to terminate this Agreement.

The Term of this Agreement may also be extended by a Force Majeure Extension as described in Section 10 below. The Initial Term or any Renewal Terms, if any, shall also be extended on a day for day basis for any days the Facility is not able to accept and process Crude Oil as nominated by STUSCO.

| 4. | CONDITIONS PRECEDENT: |

The commencement of the Parties’ respective obligations contemplated by this Agreement related to the processing of the Crude Oil and the purchase and sale of Crude Oil and Crude Oil Products shall be conditioned on the satisfaction of the following conditions precedent (the “Conditions Precedent”), as determined and/or waived in writing by STUSCO, each in STUSCO’s sole discretion, acting reasonably, on or before the In-Service Deadline:

| (a) | Closing of the transactions contemplated by the Merger Agreement has occurred in accordance with the terms and conditions therein; |

| (b) | IRRX shall have delivered to STUSCO written evidence (to the extent in IRRX’s possession), including as-built plans, facility and performance testing, and completion certificates, that the construction or restoration of the Facility has been completed, including the close-out of any material punch list items; |

| (c) | IRRX shall have delivered to STUSCO written evidence that all material permits, consents, and approvals required for the design, engineering, construction, repair, and operation of the Facility as contemplated by this Agreement have been obtained; |

| (d) | IRRX shall have delivered to STUSCO written evidence (to the extent in IRRX’s possession) that the necessary refurbishment, construction, permitting, and receipt of approvals of or by the Facility have occurred at least thirty (30) days prior to the Intended In-Service Date, such written evidence to include support by IRRX’s contracted EPC partner(s); |

| (e) | The In-Service Date has occurred on or before the In-Service Deadline; |

| (f) | IRRX shall have delivered to STUSCO written evidence that the Facility can receive and [Redacted] barrels of Crude Oil at 12,000 barrels of crude oil per day over a sixty (60) day time frame; |

| (g) | IRRX shall have delivered to STUSCO written evidence that the Facility can (i) measure and receive the Crude Oil that meets the Required Crude Oil Specifications via truck LACT; and (ii) process and deliver Crude Oil Products produced from the Crude Oil that meet the Required Crude Oil Product Specifications, as illustrated in Exhibit B, via truck LACT; |

| (h) | IRRX shall have delivered to STUSCO written evidence that the Facility is able to convert the Crude Oil into Crude Oil Products and make available, and measure for re-delivery or pick up by STUSCO, at a rate of no less than [Redacted] barrels of crude oil per day (in the event return of the Crude Oil becomes necessary due to Force Majeure or otherwise); provided that, the redelivery rate for Crude Oil does not need to meet the Nameplate Capacity; |

| (i) | IRRX shall have delivered to STUSCO an executed subordination agreement in favor of STUSCO and in a form acceptable to STUSCO, in its sole discretion, acting reasonably and in good faith, from each third party with a security interest, pledge, operating interest, lien, encumbrance on, or beneficial interest in any of the Crude Oil or Crude Oil Products to: (A) recognize STUSCO’s rights to net and offset amounts owed by STUSCO with regard to Crude Oil Products to be purchased hereunder against amounts owed by IRRX with regard to Crude Oils to be purchased hereunder and (B) subordinate any such lien to STUSCO’s rights; |

7

| (j) | IRRX shall have delivered to STUSCO an expected oil products yield schedule (the “Oil Products Yield Schedule”), and in good faith provide adjustments to the Oil Products Yield Schedule as soon as IRRX is aware of any changes; |

| (k) | IRRX shall have satisfied STUSCO’s Know-Your-Customer (“KYC”) assurance screening, which will include but not be limited to a KYC review of all of IRRX’s owners, lenders, and shareholders; |

| (l) | IRRX shall have delivered to STUSCO insurance certificates evidencing the effectiveness of all insurance policies and endorsements required by applicable law for the construction, operation, maintenance, and repair of the Facility; |

| (m) | To the knowledge of IRRX, no litigation, investigation, action or proceeding shall have been instituted, nor shall any action, regulation, change in applicable law, order, judgment, or decree have been issued by a governmental authority against IRRX or to set aside, restrain, materially adversely affect, make illegal or prevent the transactions and performance of the obligations contemplated by this Agreement; |

| (n) | The Facility shall not have been affected adversely by any physical loss or damage, whether or not covered by insurance, unless such loss or damage would not reasonably be expected to have a material adverse effect on the usual, regular, and ordinary operations of the Facility; |

| (o) | All representations and warranties of IRRX contained in this Agreement shall be true and correct in all material respects; |

| (p) | IRRX shall have materially complied with all covenants contained in this Agreement; |

| (q) | IRRX shall not: (i) have dissolved; (ii) become insolvent or unable to pay its debts or fail or admit in writing its inability to generally pay its debts as they become due; (iii) have made a general assignment, arrangement, or composition with or for the benefit of its creditors; (iv) be the subject of a bankruptcy, insolvency, or other similar proceeding; (v) otherwise become bankrupt or insolvent (however evidenced); (vi) cause or be subject to any event with respect to which, under the applicable laws of an applicable jurisdiction, has an analogous effect to any of the events described herein; or (vii) take any action in furtherance of, or indicating its consent to, approval of, or acquiescence in, any of the foregoing acts; and |

| (r) | the Facility shall have been built in a good and workmanlike manner in accordance with applicable law and good industry practices. |

From and after the Execution Date, IRRX shall, in good faith, cause, and otherwise use commercially reasonable efforts to cause, each of the above conditions to be satisfied. For greater certainty, if the Conditions Precedent are completed prior to the In-Service Deadline such that the Commencement Date occurs in advance of the In-Service Deadline, then the Conditions Precedent set out in this Section 4 are only required to be true as of such Conditions Precedent Completion Date, and any references in this Section 4 to “In-Service Deadline” shall be references to the “Conditions Precedent Completion Date.”

| 5. | STUSCO RIGHT OF TERMINATION: |

If the Conditions Precedent are not fully met by the In-Service Deadline, then STUSCO has a one-time option to terminate this Agreement without liability to IRRX (the “Termination Option”) by providing IRRX written notice of such termination no later than the date that is ninety (90) days after the In-Service Deadline (such period, the “Termination Window”). The Termination Option will automatically expire if it has not been exercised by STUSCO prior to the expiration of the Termination Window.

8

| 6. | EXCLUSIVITY; EXPANSION CAPACITY ROFR AND LAST LOOK: |

| 6.1. | Except as otherwise permitted in this Agreement or subsequently agreed upon in writing, beginning on the Execution Date, STUSCO will be the sole supplier to the Facility, and the sole purchaser of Crude Oil Products from the Facility, for the length of this Agreement, up to the initial Nameplate Capacity, and for any expansion capacity for which STUSCO contracts. |

| 6.2. | [Redacted] |

| 6.3. | [Redacted] |

| 6.4. | [Redacted] |

| 7. | MOST FAVORED NATION: |

If at any time during the Term, IRRX agrees to provide substantially the same terms to a third party as described in this Agreement for fees or other terms that are more advantageous than STUSCO’s fees or other terms, (i)IRRX shall promptly notify STUSCO of the terms of such agreement, and (ii) STUSCO shall be entitled to an amendment to the terms of this Agreement to match the terms of the agreement with such third party as of the third party’s start date, such adjustment of the terms of this Agreement to be at STUSCO’s sole option; provided, that STUSCO shall have thirty (30) days from receipt of the notice from IRRX contemplated by the foregoing clause (i) to exercise such option, after which period, STUSCO shall be deemed to have waived its matching option). The Parties shall promptly make the necessary amendments to the Agreement to effectuate the terms and conditions of this Section 7.

| 8. | NOMINATIONS: |

Commissioning Nomination

IRRX shall provide to STUSCO ninety (90) days’ prior written notice of the need for Operational Volume (as defined below) for the commissioning of the Facility or satisfaction of the Conditions Precedent. Such Operational Volume will be used for line fill, tank heels, and is not intended to return to the market. Any Operational Volume sold to IRRX by STUSCO for commissioning or satisfaction of the Conditions Precedent shall be sold by IRRX to STUSCO as Crude Oil Products per the terms of this Agreement. All other nominations for Crude Oil will use the nomination process detailed in below.

Initial Indication and Nomination

From and after the Conditions Precedent Completion Date, STUSCO in its sole discretion shall nominate Crude Oil to IRRX in a quantity to be between zero (0) and the Facility’s Nameplate Capacity, expressed in barrels per day. The quality will be subject to the Required Crude Oil Specifications. STUSCO shall submit an “Initial Indication”, to be delivered by the 25th day of M-2 (where M is the month of anticipated delivery to the Facility). STUSCO shall submit an “Initial Nomination” at any time after the 25th of M-2, up until 4:15PM central time of the last Business Day prior to the 16th day of M-1.

Both the Initial Indication and Initial Nomination shall be for a volume that is either zero (0) barrels for the month, or a volume that allows the Facility to operate within a range that is or between the Nameplate Capacity and its Minimum Run Rate. If STUSCO expects a non-ratable delivery schedule to the Facility, STUSCO will supply this information IRRX as part of STUSCO’s Initial Indication and Initial Nomination. Alternatively, STUSCO may provide an Initial Indication and/or an Initial Nomination with a volume that is not zero (0) and outside of the range of the Nameplate Capacity and its Minimum Run Rate, subject to IRRX’s (a) acceptance or rejection, such acceptance or rejection to be delivered to STUSCO in writing within 3 Business Days of STUSCO’s submission of its Initial Indication and/or Initial Nomination and (b) right to decrease throughput to manage Crude Oil inventory in preparation for circulation and/or Facility shutdown.

9

The Crude Oil Products produced by IRRX’s processing of the Crude Oil at the Facility shall be a function of any Nomination by STUSCO and will be the product of the Crude Oil volume provided by STUSCO and the Oil Products Yield Schedule provided by IRRX.

Revised Nominations

STUSCO may submit adjustments to the Initial Nomination (an “Revised Nomination”) on or at any time after the 16h day of M-1 (M being the month of anticipated delivery to the Facility), and IRRX may accept or reject the Revised Nomination in writing and must do so within one (1) Business Day of STUSCO’s submission of any Revised Nomination. IRRX shall use commercially reasonable efforts to accept any Revised Nominations.

| 9. | DELIVERY AND OFFTAKE REQUIREMENTS: |

STUSCO has no minimum volume commitments for delivery of Crude Oil or offtake of Crude Oil Products to be supplied to or purchased from the Facility during the Term. All volume nominations made in any nomination on or prior to the applicable deadline are to be at STUSCO’s sole discretion. STUSCO may amend any nominations prior to the applicable deadlines stated herein, however any amendments made by STUSCO after the applicable deadlines shall be subject to written approval by IRRX, in its sole discretion, acting reasonably. For the sake of clarity, (i) on and after any applicable deadline, any volume commitments made by STUSCO in a nomination will be considered final and (ii) STUSCO has the right to submit nominations of any amount, including zero (0) barrels of Crude Oil in any given month during the Term.

| 10. | FORCE MAJEURE: |

Notwithstanding the Force Majeure provisions of the GTCs, [Redacted]

| (i) | terminate this Agreement(s) upon notice to IRRX without any further obligations or liability to IRRX, including, but not limited to, any Fixed Operating Costs or Capital Costs, subject to the Run-Down process as described below. |

| (ii) | extend the Initial Term by the number of days the Facility is under Force Majeure (a “Force Majeure Extension”). |

If STUSCO elects to extend the Term for a Force Majeure Extension and the Facility remains under Force Majeure for ninety (90) consecutive days from the date of STUSCO’s election (a “Continued Force Majeure Event”), STUSCO shall have the option to terminate the Agreement, exercisable for thirty (30) days after the Continued Force Majeure Event without any further obligations or liability to IRRX, including, but not limited to, any Fixed Operating Costs or Capital Costs, subject to the Run Down process as described below.

[Redacted] (i) IRRX will have no obligation to repair, replace, or continue operations; and (ii) either Party will have the right to terminate the Agreement without notice and without any incremental obligations or other liability to the other Party. For the avoidance of doubt, a termination notice does not release the Parties from existing obligations, including, but not limited to existing Nominations.

In the event STUSCO or IRRX provide notice of termination of the Agreement as a result of the events detailed in this Section, neither Party will have any incremental obligations or other liability to the other Party, including, but not limited to, any Fixed Operating Cost or any Capital Cost, subject to the Run-Down process. In the event STUSCO terminates this Agreement for Force Majeure in accordance with the foregoing, any unused Deficiency Credit balance will be automatically forfeited.

10

In the event STUSCO or IRRX provide notice of termination of the Agreement for any reason, the Parties agree to they will follow a Run-down process (“Run Down”) to close any transactions and maintain certain Hedge Transactions entered into in connection with this Agreement. All transactions related to Hedged Volumes shall continue and not be subject to termination along with this Agreement and physical transfer and Risk and Title, as well as pricing, will be preserved as entered into by the Parties in order to keep the Parties whole and in line with the original intent of the Hedge Volumes. STUSCO shall be entitled to deduct the impact of any logistics transactions entered into by STUSCO in connection with this Agreement from any final settlement amount in connection with the termination of this Agreement.

| 11. | ACTION: STUSCO SALE OF CRUDE OIL TO IRRX |

Crude Oil Grade:

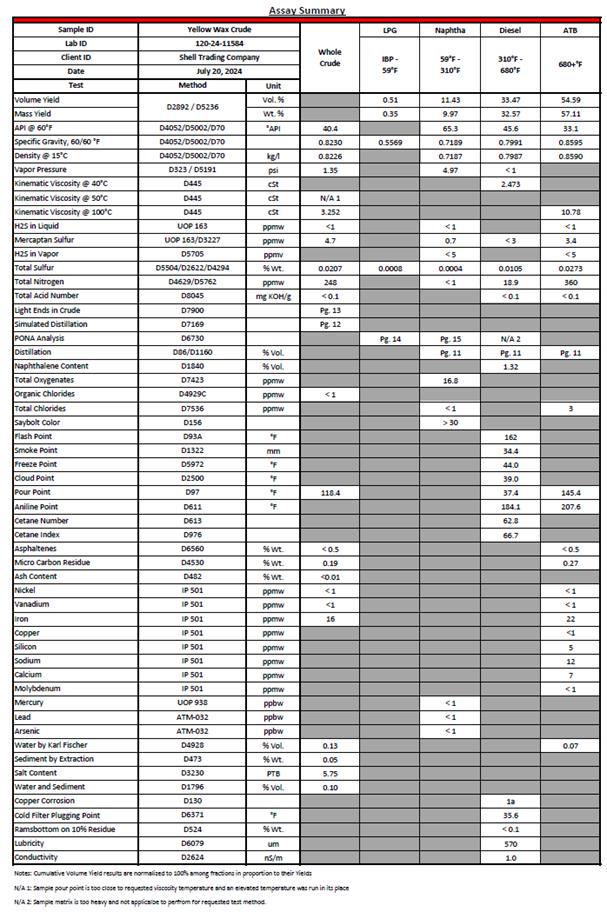

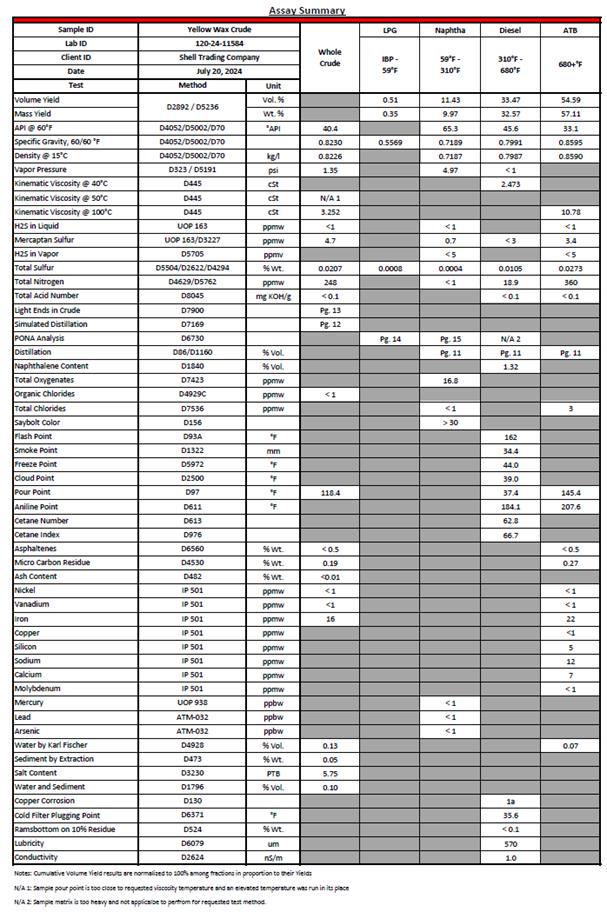

STUSCO intends to supply [Redacted] to the Facility, as typically produced in the Uinta basin (the “Crude Oil Grade”). STUSCO will supply any Crude Oil Grade or mixture of Crude Oil Grades that conform with typical [Redacted] quality, an example of which is shown on Exhibit A attached hereto (such specifications, the “Required Crude Oil Specification”, and such Crude Oil, the “Crude Oil”) or other Crude Oil grades as mutually agreed between the Parties in writing. IRRX may modify specifications at any time by advance notice to STUSCO to the extent required to comply with applicable law or any government permits applicable to the Facility. IRRX will not be obligated to accept into or retain any Crude Oil that does not meet the Required Crude Oil Specifications. If IRRX reasonably determines the Crude Oil does not comply with the Required Crude Oil Specifications, IRRX may reject such Crude Oil which must be removed by STUSCO as soon as practicable using commercially reasonable efforts at STUSCO’s sole cost and expense.

STUSCO may request additional grades or new Crude Oil types; however, the acceptance of any additional Crude Oil types is at the sole discretion of IRRX; the acceptance of a new Crude Oil grade may require new or additional commercial terms to be mutually agreed by the parties.

Crude Oil Delivery, Title and Risk of Loss:

Delivery, title, and risk of loss on Crude Oil shall pass from STUSCO to IRRX as the Crude Oil passes the inlet flange to the Facility or as mutually agreed between the Parties in writing.

Operational Inventory Volume:

IRRX will maintain operational storage, line fill, tank heels, and other necessary inventory of Crude Oil and Crude Oil Products necessary to operate the Facility.

“Operational Volume” is a volume to be defined by IRRX no later ninety (90) days prior to the In-Service Date. The Parties will mutually agree to a set of transactions whereby STUSCO will sell Crude Oil to IRRX, where the volume is to be commensurate with the Operational Volume Declaration at a price determined pursuant to this Agreement for Crude Oil in the month of the In-Service Date. The Parties agree that STUSCO shall re-purchase this volume from IRRX at the end of the Initial Term at a price determined pursuant to this Agreement for Crude Oil in the last month of the Initial Term. If this Agreement is extended for one or more Renewal Terms, the Parties shall renegotiate the value of the Operational Volume to be consistent with the difference in price of Crude Oil as determined pursuant to this Agreement between the start and the end of the Renewal Term(s).

Currency:

All currencies referenced herein are in United States Dollars (USD).

11

Crude Oil Price:

The price for Crude Oil sold by STUSCO and purchased by IRRX shall be [Redacted]:

| (i) | [Redacted] |

| (ii) | [Redacted] |

| 12. | ACTION: IRRX SALE OF CRUDE OIL PRODUCTS TO STUSCO |

Crude Oil Products Grades:

[Redacted]

Crude Oil Products Volumes:

The volume of Crude Oil Products will correlate to the volume of Crude Oil stated in the Nominations (subject to STUSCO’s amendment) pursuant to the Oil Products Yield Schedule. The Parties acknowledge and agree that any STUSCO amendments to Crude Oil Nominations will result in pro rata output of Crude Oil Products in the percentages set forth on Exhibit B.

Crude Oil Products Delivery, Title and Risk of Loss:

Delivery, title and risk of loss on Crude Oil Products shall pass from IRRX to STUSCO (i) as the Crude Oil Product passes the last outlet flange of the Facility into STUSCO’s [Redacted], or (ii) as otherwise mutually agreed between the Parties in writing [Redacted]. For clarity IRRX shall install and maintain meters at the last outlet flange of the Facility.

Currency:

All currencies referenced herein are in United States Dollars (USD).

Crude Oil Products Price:

The price for all Crude Oil Products sold by IRRX and purchased by STUSCO shall be [Redacted]:

| (i) | [Redacted] |

| (ii) | [Redacted] |

| (iii) | [Redacted] |

The Product Fee and the Fixed Operating Cost shall escalate at a rate of 2% after each successive 12-month period following the Facility In-Service Deadline during the Initial Term or Renewal Term(s), if any. [Redacted] If the Parties are unable to agree to a revised Product Fee and Fixed Operating Cost pursuant to this Section, then the dispute will be settled in accordance with Section Y – Dispute Resolution under the 2018 Amends. This will not be considered an “audit” for the purposes of Section 21.

| 13. | Process Service Fees: |

| a. | Fixed Operating Cost |

For all months during the Initial Term, where IRRX, in good faith, accepts STUSCO’s Nomination in accordance with Section 8, STUSCO shall pay IRRX a fixed operating cost equal [Redacted] per month (the “Fixed Operating Cost”).

12

| b. | Capital Cost |

Subject in all respect to Section 13(c), for all months during the Initial Term, STUSCO shall pay IRRX the Capital Cost as set forth on Annex I.

| c. | Suspension of Certain Fees |

| (i) | Subject to Section 10 and this Section 13, and in all months during the Term, STUSCO shall pay the Fixed Operating Cost and Capital Cost to IRRX at all times and as set forth in this Agreement; provided, however, that if IRRX fails to process the Nominated amounts in one or more months during the Term giving rise to Deficiency Credits (as described in Section 15) with a value in excess of [Redacted] worth of [Redacted] (such amount being the “Deficiency Credit Threshold”), IRRX shall reduce STUSCO’s monthly payment obligations by an amount proportionate to the percentage of Nominations accepted and actually processed and delivered during the applicable period. If there are remaining Deficiency Credits after the reduction in payment obligations described above for a particular month, STUSCO may elect to utilize Deficiency Credits to reduce the Arbitrage Adjustment payable to IRRX as described in Section 14 below. For the avoidance of doubt, any modification of payment terms resulting from this Section 13(c) shall cease and be of no further force or effect at times when IRRX has reduced the Deficiency Credits value below the Deficiency Credit Threshold. |

| (ii) | [Redacted] During the Cost Suspension, STUSCO shall not provide Nominations to IRRX. STUSCO shall provide sixty (60) days’ prior written notice to resume Fixed Operating Cost payments and Capital Cost Payments as STUSCO resumes Nominations. Notwithstanding anything to the contrary contained in this Agreement, (i) during any Cost Suspension, IRRX shall be permitted to market any unused capacity to third parties without regard to any exclusivity provisions in this Agreement that would otherwise apply, (ii) STUSCO shall continue to make Capital Cost Payments as set forth in this Section, and (iii) STUSCO’s obligation to make Capital Cost Payments shall be reduced on a dollar for dollar basis for any unused capacity contracted for by third parties. An example of the reduction in Capital Cost payments is shown below: |

This example assumes notice is given at the beginning of month 1.

| [Redacted] | [Redacted] | [Redacted] | [Redacted] (1), (2) | [Redacted] |

| [Redacted] | [Redacted] | [Redacted] | [Redacted] | [Redacted] |

| [Redacted] | [Redacted] | [Redacted] | [Redacted] | [Redacted] |

| [Redacted] | [Redacted] | [Redacted] | [Redacted] | [Redacted] |

| [Redacted] | [Redacted] | [Redacted] | [Redacted] | [Redacted] |

| [Redacted] | [Redacted] | [Redacted] | [Redacted] | [Redacted] |

| [Redacted] | [Redacted] | [Redacted] | [Redacted] | [Redacted] |

| [Redacted] | [Redacted] | [Redacted] | [Redacted] | [Redacted] |

| [Redacted] | [Redacted] | [Redacted] | [Redacted] | [Redacted] |

| [Redacted] | [Redacted] | [Redacted] | [Redacted] | [Redacted] |

| [Redacted] | [Redacted] | [Redacted] | [Redacted] | [Redacted] |

| [Redacted] | [Redacted] | [Redacted] | [Redacted] | [Redacted] |

| [Redacted] | [Redacted] | [Redacted] | [Redacted] | [Redacted] |

| (1) | [Redacted] |

| (2) | [Redacted] |

13

| (iii) | STUSCO shall have the option to continue the Cost Suspension in Section 13(c)(iii) for an additional [Redacted] with sixty (60) days written notice prior to the end of the Cost Suspension (the “Extended Suspension”). During the Extended Suspension, STUSCO shall pay a reduced Fixed Operating Cost of [Redacted] and the Capital Costs as shown on Annex I. STUSCO shall provide sixty (60) days’ prior written notice to resume Capital Cost payments and normal operations as STUSCO resumes nominations. |

In the event a Cost Suspension lasts more than [Redacted], either party may terminate this Agreement by providing thirty (30) days’ prior written notice (the “Suspension Termination”). If STUSCO does not resume nominations at the end of the Extended Suspension, this Agreement will automatically terminate, and such event will be considered a Suspension Termination by STUSCO. To the extent IRRX provides a notice to terminate the agreement, Shell shall be relieved of all of future payment obligations or other obligations, with the exception of the Run Down Process described in Section 10 of this Agreement.

Both Parties recognize that, if specific blending or other services are required, additional fees may apply.

An illustration of the obligations of the parties in various suspension scenarios in this Section 13 is attached hereto as Annex IV.

| 14. | ARBITRAGE ADJUSTMENT: |

The Parties agree to an Arbitrage Adjustment feature, based on market performance, whereby STUSCO shall provide to IRRX, fifty percent (50%) of the “crack spread”, being the value created by buying the Crude Oil from third parties, selling the same Crude Oil to IRRX, buying the Crude Oil Products from IRRX at the agreed Delivery Point in Section 12, selling the same Crude Oil Products and paying all associated costs related to the transfer of the Crude Oil Products from IRRX to STUSCO’s selling counterparties. Costs can include but are not limited to [Redacted]. Notwithstanding the foregoing, or anything else to the contrary contained in this Agreement, Deficiency Credits shall only be settled in the Arbitrage Adjustment to the extent if IRRX’s share of the “crack spread” exceeds [Redacted], and then only to the extent of any such excess, allowing IRRX to retain no less than [Redacted] at each Arbitrage Adjustment if a positive crack spread occurs, for working capital purposes. For the avoidance of doubt, to the extent such excess amount does not fully satisfy the outstanding Deficiency Credits for the applicable Arbitrage Adjustment, or in the event the “crack spread” is less than [Redacted], any outstanding Deficiency Credits shall carry over to the following Arbitrage Adjustment period, until all Deficiency Credits have been settled.

Notwithstanding the above, STUSCO shall retain full discretion over its financial decisions and distributions and will not provide IRRX access to its business financials or competitively sensitive information in accordance with applicable laws, beyond what is necessary to calculate the Arbitrage Adjustment. For illustrative purposes only, a sample Arbitrage Adjustment calculation is attached hereto as Annex III, incorporating all categories of credits and debits to be used in future calculations of the Arbitrage Adjustment during the Term.

| 15. | DEFICIENCY CREDITS |

During the Term, if IRRX fails to receive or process, in or at the Facility, the volumes of Crude Oil specified in any Nomination provided to IRRX by STUSCO and accepted by IRRX in good faith (the “Nominated Volumes”), pursuant to Section 8, for a particular month for any reason, including, without limitation, force majeure or IRRX’s operational difficulties, IRRX’s rejection of STUSCO Nominated Volumes, IRRX notice that STUSCO of reduction of Nominated Volumes, or the inability to accept the Nominated Volumes, then a credit (a “Deficiency Credit”) will be created in the amount equal to the pro rata dollar amount of the Fixed Operating Cost and the Capital Cost for the applicable month during which IRRX fails to receive or process such volumes of Crude Oil.

14

| 16. | OFF-SPEC CRUDE OIL PRODUCTS: |

IRRX shall promptly provide written notice to STUSCO of Crude Oil Products that do not meet the Required Crude Oil Product Specifications required under this Agreement, unless the sole cause of such resulting Off-Spec Crude Oil Products is STUSCO’s gross negligence or the result of STUSCO providing Crude Oil that is non-compliant with the Required Crude Oil Specifications, (collectively, the “Off-Spec Products”). IRRX shall, to the extent known:

| i. | provide details of the variance between the specifications required under this Agreement and the specifications of the Off-Spec Products; and |

| ii. | provide an estimate of the expected duration of the event or circumstances giving rise to the production of Off-Spec Products. |

STUSCO shall use commercially reasonable efforts to find a market for such Off-Spec Products; provided that IRRX may, at its option, use spare capacity at the Facility, if any, to reprocess any Off-Spec Products to be sold to STUSCO pursuant to the terms of this Agreement, without penalty or cost to STUSCO. If STUSCO is able to find a market for such Off-Spec Products, then STUSCO will provide written notice to IRRX of a price adjustment (the “Price Adjustment”), if any, that will apply to the Off-Spec Products to compensate STUSCO for actual and demonstratable losses incurred by STUSCO as a result of IRRX’s delivery of the Off-Spec Products. Such Price Adjustment will be equal to the difference, if any, between (i) the Off-Spec Products Market Value and (ii) the On-Spec Products Contract Value of the equivalent volume of Crude Oil Products under this Agreement. For purposes of this Section, “Off-Spec Products Market Value” shall mean the volume of Off-Spec Products delivered by IRRX multiplied by the market price for an equivalent transaction at the delivery location for a substantially similar quality of Off-spec Products. To ascertain the market price, STUSCO may consider, among other valuations, quotations from brokers, similar sales or purchases and any other bona fide third-party offers, all adjusted for the length of the term, relevant due date or delivery dates, broker fees, volume and differences in transportation costs. STUSCO shall not be required to enter into a replacement transaction in order to determine the Off-Spec Products Market Value. For purposes of this Section, “On-Spec Products Contract Value” shall mean the volume of Crude Oil Products that is equal to the volume of Off-Spec Products, multiplied by the applicable Price(s) specified in Section 12 or Section 13, as applicable.

Notwithstanding anything to the contrary in this Agreement, provided that STUSCO exercises commercially reasonable efforts to communicate to IRRX a Price Adjustment and uses commercially reasonable efforts to find a market for the Off-Spec Products, any delay in lifting/loading or removal of Off-Spec Products or any breach by STUSCO of any contractual requirements to receive delivery of Crude Oil Products will be excused to the extent such delay and/or breach is directly related to IRRX’s production and/or delivery of Off-Spec Products.

15

| 17. | IRRX COVENANTS: |

From and after the Commencement Date and during the Term, in addition to any other covenants contained herein, IRRX covenants and agrees to:

| 17.1. | Operations. Operate and maintain the Facility, including all IRRX-owned pipelines connected to the Facility, personal property, and equipment, in good working order and condition (ordinary wear and tear excepted), consistent with the purposes contemplated by this Agreement, and make all necessary repairs, renewals and replacements so that operations may be conducted in compliance with all applicable laws, permits, consents, and approvals and consistent with prudent industry practices for similar oil and gas facilities at all times. IRRX will provide reasonable advance notice, to the extent possible, to STUSCO ahead of any planned maintenance of the Facility. |

| 17.2. | Insurance. Maintain all insurance required for the operation, maintenance, and repair of the Facility under applicable law. |

| 17.3. | Litigation. Notify STUSCO, in writing, of any litigation or proceeding affecting IRRX or the Facility in which [Redacted] or more in damages (in aggregate for all claims) are claimed and such damages are not covered by insurance. |

| 17.4. | Environmental. In the event of a spill or discharge of Crude Oil, Crude Oil Products or other environmental pollution at the Facility, with diligence, commence containment or clean-up operations as deemed appropriate or necessary by IRRX, or as required by any governmental authorities, and notify STUSCO immediately, in writing, of such spill, discharge, pollution, and operations. |

| 17.5. | Material Contracts. Comply with, preserve, and maintain all Material Contracts, including any transportation, storage, and terminalling agreements, and any loans permitted under this Agreement, such that operations of the Facility may be conducted as contemplated herein such that IRRX can perform its obligations under this Agreement. |

| 17.6. | Compliance with Laws. Comply in all material respects with and ensure that the Facility and any other property owned, leased, or operated by IRRX is in compliance with all applicable laws, including all environmental laws, and all required permits, consents, and approvals. |

| 17.7. | Liens. Not to create, incur, assume or permit to exist, directly or indirectly, any lien on or with respect to the Facility or any portion thereof, without STUSCO’s prior written consent. |

| 18. | IRRX REPRESENTATIONS AND WARRANTIES: |

As of the Commencement Date and during the Term:

| 18.1. | Title. IRRX represents and warrants to STUSCO that: (i) IRRX has good title to and/or control of and good right to sell and deliver such Crude Oil Products; and (ii) all such Crude Oil Products shall, at the applicable Delivery Point, be free and clear from all liens, encumbrances and adverse claims, except for any liens or encumbrances to which STUSCO expressly consents. If STUSCO consents to IRRX granting a lien to a third party, prior to IRRX granting such lien, IRRX agrees to compel and cause such third party to execute, and deliver to STUSCO, a subordination agreement, in a form acceptable to STUSCO, in STUSCO’s sole discretion, acting reasonably, to: (i) recognize STUSCO’s rights to net and offset amounts owed by STUSCO with regard to Crude Oil Products to be purchased hereunder against amounts owed by IRRX with regarding to Crude Oil to be purchased hereunder and (ii) subordinate any such lien to STUSCO’s rights. |

| 18.2. | Power and Authority. Each Party represents and warrants that it has the full power and authority to execute, deliver, and perform all of its obligations under this Agreement. The execution, delivery, and performance of this Agreement does not violate any applicable law, order, or judgment of any applicable governmental authority or any contractual restriction binding on or affecting it or any of its assets. Further, IRRX represents and warrants to STUSCO that IRRX has the right to own, construct, and operate the Facility as contemplated herein. |

16

| 18.3. | Solvency. IRRX represents and warrants to STUSCO that IRRX has not: (i) dissolved; (ii) become insolvent or unable to pay its debts or failed or admitted in writing its inability to generally pay its debts as they become due; (iii) made a general assignment, arrangement, or composition with or for the benefit of its creditors; (iv) become the subject of a bankruptcy, insolvency, or other similar proceeding; (v) otherwise become bankrupt or insolvent (however evidenced); (vi) caused or become subject to any event with respect to which, under the applicable laws of any jurisdiction, has an analogous effect to any of the events described herein; or (vii) taken any action in furtherance of, or indicating its consent to, approval of, or acquiescence in, any of the foregoing acts. |

| 18.4. | Litigation. IRRX represents and warrants to STUSCO that no litigation, investigation, action or proceeding shall have been instituted, nor shall any order, judgment, or decree have been issued by a governmental authority against IRRX that would have the effect of setting aside, restraining, or preventing the transactions and performance of the obligations contemplated by this Agreement and, to the extent such litigation, investigation, action or proceeding becomes known to IRRX during the Term, IRRX represents and warrants to STUSCO that it will use commercially reasonable efforts to mitigate the effects of same. |

| 18.5. | Liens. IRRX represents and warrants to STUSCO that there are no additional debt or liens with the Facility as collateral except for those liens granted by IRRX in connection with the closing of the Merger Agreement or financing related to the Merger Agreement. |

| 19. | PAYMENT & NETTING: |

Payment shall be made in U.S. Dollars by wire transfer, in full without discount or counterclaim, in same day funds, subject to the following.

The Parties agree to net the purchases and sales of the Crude Oil and Crude Oil Products under this Agreement. Further, the Parties agree that the payments between the Parties will be considered as three (3) mutually exclusive transactions as follows:

| 19.1. | Capital Costs |

Pursuant to Section 13, STUSCO will pay IRRX the Capital Cost, when and if the Capital Cost is applicable and payable, [Redacted] during the Initial Term.

| 19.2. | Fixed Operational Cost |

Pursuant to Section 13, STUSCO will pay IRRX the Fixed Operating Cost, when and if the Fixed Operating Cost is applicable and payable, [Redacted] during the Initial Term.

| 19.3. | Monthly Settlements of Crude Oil and Crude Oil Products |

Payment for all monthly Crude Oil and Crude Oil Products purchased and sold during a particular month shall be made on the 20th day of the following month (the “Payment Due Date”). As an example, for all Crude Oil delivered by STUSCO to IRRX, transferring risk and title in calendar month January, and for all Crude Oil Products delivered by IRRX to STUSCO, transferring risk and title in calendar month January, the Parties will net the difference in the value per the terms of this Agreement and the Party owing shall make payment on February 20th.

17

Each settlement performed pursuant to this Agreement will be deemed effective, and (except with respect to disputed sums withheld as described below) payment will be deemed to have been made as of the Payment Due Date of the individual transactions. In the event that a Party fails to make any payment when due, the owed Party shall have the right to charge interest on the amount of the overdue payment at a per annum rate which shall be two percentage points higher than the then-effective prime rate of interest published by the Federal Reserve Bank of New York at http://www.newyorkfed.org on the applicable Payment Due Date, but not to exceed the maximum rate permitted by law.

If a Payment Due Date falls on a Saturday or a weekday (other than a Monday) that is not a Business Day, then payment shall be made on the preceding Business Day. If a Payment Due Date falls on a Sunday or a Monday that is not a Business Day, then payment shall be made on the next Business Day.

| 19.4. | Arbitrage Adjustment |

Payments for Arbitrage Adjustment will be settled on a net basis [Redacted]. For example, for all settlements related to the final calculation of the Arbitrage Adjustment for Crude Oil Product volumes delivered by IRRX to STUSCO at the Delivery Point in [Redacted], STUSCO will make payment to IRRX, subject to the terms in Section 14, on [Redacted].

The Parties recognize that there may be adjustments to the Arbitrage Adjustment calculations that occur after the applicable settlement date and that future payments of the Arbitrage Adjustment will take into account both positive and negative adjustments to a payment of Arbitrage Adjustment.

The Parties further agree that the Parties may include retro-active adjustments to the Arbitrage Adjustment in any settlement of amounts payable for the purchase and sale of Crude Oil and Crude Oil Products.

| 20. | DISPUTED INVOICES: |

Subject to a Party’s audit rights pursuant to Section 21, a Party shall have the right to withhold from payment, and not include in the net settlement process described in this Section, any portion of any invoice to which it objects by written notice to the other Party prior to the applicable due date of such payment and disputes in good faith, but it shall timely pay any undisputed portion thereof (“Monthly Invoice”). Any portion of a Monthly Invoice that is undisputed shall be included in the net settlement process described in this Section 20. Notwithstanding the foregoing, each Party agrees to use every reasonable effort to achieve the objective of timely verification of invoices to permit payment of such invoices pursuant to the terms of this Agreement and no dispute or lack of verification shall excuse participation in the net settlement process described in this Section. The Parties shall promptly work to resolve the disputed portion; provided, however, if it is finally determined that such Party owes any disputed amounts that such Party has withheld, such withholding Party shall promptly pay such amounts to the other Party together with accrued interest thereon (calculated daily at the SOFR rate plus [Redacted] per annum and accrued from the original due date for such amounts but not to exceed the maximum rate permitted by law).

18

| 21. | AUDIT: |

Each Party and its duly authorized representatives shall have the annual right, but never more than once every twelve (12) months, at all reasonable times, and with at least thirty (30) days’ prior written notice, to examine the relevant books and records of the other Party to the extent reasonably necessary to determine compliance with the terms of Sections 6, 7, 13, 14, and 19 and/or the accuracy of any statement, invoice, charge, or computation made pursuant to this Agreement, or any third-party offers agreed to pursuant to this Section 6 of this Agreement. In the case of an audit regarding the accuracy of any statement, invoice, charge, or computation made pursuant to this Agreement, such audit shall be conducted within twelve (12) months after the date of the invoice for the applicable six (6) month period being audited and all discrepancies shall be reported to the Party being audited by the end of such twelve (12) month period. In the case of an audit regarding the accuracy of any third-party offer agreed to pursuant to Section 6 of this Agreement, such audit shall be conducted within twelve (12) months after the date of such offer and all discrepancies shall be reported to the Party being audited by the end of such twelve (12) month period. All statements, charges, and computations made and rendered hereunder shall be conclusively presumed to be true and correct after twelve (12) months after the date of the applicable invoice, unless within said twelve (12) month period either Party takes written exception thereto and makes a claim on the other Party for adjustment. Failure on the part of a Party to make a claim on the other Party for adjustment to any statements, charges, and/or computations within such twelve (12) Month period shall establish the correctness thereof and preclude the filing of exceptions thereto or making claims for adjustments thereof. All such records, books, statements, and accounts shall be maintained for a minimum of twelve (12) months, or the applicable federal or state mandated periods if longer. Each Party shall only be liable for its own internal and external costs resulting from an audit. Audits shall be performed by third party audit or accounting firms that are not an Affiliate of either Party and shall be selected by mutual agreement of the Parties.

| 22. | CONFIDENTIALITY: |

Each Party agrees that it shall maintain all terms and conditions of this Agreement in strictest confidence, and that it shall not cause or permit disclosure of this Agreement, or any provisions contained herein without the prior written consent of the other Party.

Notwithstanding above paragraph, disclosures of any terms and provisions of this Agreement otherwise prohibited may be made by either Party: (i) to the extent necessary for such Party to enforce its rights hereunder against the other Party; (ii) to the extent to which a Party is required by applicable law to disclose all or part of this Agreement, or by order, rule or policy of a governmental authority, or to comply with legal or court process, such as subpoena, summons, interrogatory, request for production of documents, civil investigative demand, or other like process; (iii) to the extent required by the applicable regulations of a securities or commodities exchange; (iv) to a third party in connection with a proposed sale, proposed financing or other proposed transfer of a Party’s interest in this Agreement, provided such third party agrees to be bound by the terms of this Section; (v) to its own directors, officers, managers, partners, members, employees, agents, representatives, advisors, consultants and potential and actual debt and equity financing sources; (vi) to a co-working interest owner or royalty owner of STUSCO’s Crude Oil delivered hereunder; (vii) to the extent such information is delivered to a third party for the sole purpose of calculating a published index; or (viii) if and to the extent such information is or becomes public other than by a violation of the terms of this Section.

If a Party is or becomes aware of a fact, obligation or circumstance that has resulted or may result in a disclosure of any of the terms and conditions of this Agreement in connection with any of the circumstances in the previous paragraph , the disclosing Party will provide the non-disclosing Party with written notice, to the extent legally permissible, as soon as reasonably practicable under the circumstances in order to afford the non-disclosing Party an opportunity to seek an appropriate protective order. If disclosure becomes required, the disclosing Party shall only disclose such information as is reasonably necessary to fully comply with any order, demand or legal process.

The obligations in this Section shall survive the termination of this Agreement for a period of one (1) year.

19

| 23. | TRADE CONTROLS AND BOYCOTTS AND ANTI-CORRUPTION |

| 23.1. | Trade Controls and Boycotts |

The Parties each confirm that they are knowledgeable about Trade Controls Laws applicable to their performance of this Agreement, including the lists of Restricted Parties. The Parties shall comply with all applicable Trade Control Laws in the performance of this Agreement and in particular the Parties shall not, and shall procure that their contractors and agents shall not, do anything which is inconsistent with or which may cause any other Party to be exposed to the risk of any potential fines, penalties, and/or enforcement measures taken by government agencies or national courts under, or be in breach of, Trade Control Laws. IRRX agrees that the laws and regulations of the producing country with respect to the export of Crude Oil apply to this Agreement, except insofar as those laws and regulations are inconsistent with U.S. laws or regulations. If documents are required by STUSCO, or STUSCO’s u(s), IRRX shall provide upon request any relevant documents for the purpose of verifying the final destination of the Crude Oil sold hereunder.

Notwithstanding anything to the contrary herein, nothing in this Agreement is intended, and nothing herein should be interpreted or construed, to induce or require either Party to act or refrain from acting (or agreeing to act or refrain from acting) in any manner which is inconsistent with, penalized or prohibited under Trade Control Laws applicable to the Parties. This Section shall survive expiration or termination of this Agreement.

IRRX shall not directly or indirectly export, re-export, transfer divert, trade, ship, import, transport, store, sell, deliver or re-deliver any of the Crude Oil provided by STUSCO to, or for end-use by, a Restricted Jurisdiction or a Restricted Party unless specifically authorized to do so in writing by STUSCO. IRRX shall not cause STUSCO to be in breach of Trade Control Laws or Restricted Jurisdiction provisions.

Neither Party shall be obliged to perform any obligation under this Agreement, shall not be liable for damages or costs of any kind (including but not limited to penalties) for any delay or non-performance, and shall be entitled to suspend or terminate this Agreement with immediate effect, if either Party determines that such performance would be in violation of, inconsistent with, or would expose that Party to any potential fines, penalties, and/or enforcement measures taken by government agencies or national courts under Trade Control Laws.

Notwithstanding anything to the contrary, if Crude Oil is to be exported from the United States by IRRX or its designee, IRRX shall be the “U.S. Principal Party in Interest” as that term is used by U.S. Customs and/or the Bureau of Industry and Security (“BIS”). IRRX shall comply with all regulations, including but not limited to those relating to licensing, reporting, filing and recordkeeping. In the event IRRX exports Crude Oil from the U.S., IRRX shall indemnify and hold harmless STUSCO from any and all damages, liabilities, penalties, fines, costs, and expenses, including attorneys’ fees, arising out of claims, suit, allegations or charges of IRRX’s failure to comply with the provisions of this Section.

Where STUSCO is the seller, if the Crude Oil is designated for export by IRRX or its designee, IRRX shall indemnify, defend and hold harmless STUSCO for all claims and damages of any nature arising from or related to allegations that the Crude Oil was not ultimately exported, or was comingled with any product not designated for export, in violation of this Agreement. Further, and for the avoidance of doubt, in the event that IRRX resells any Crude Oil domestically that was designated for export, IRRX assumes all liability for any Crude Oil certification required under applicable law and shall provide STUSCO with documentation verifying the final destination of such Crude Oil sold hereunder and any other documentation requested by STUSCO evidencing IRRX’s compliance with this Section.

20

| 23.2. | Anti-Corruption |

IRRX represents, warrants, and covenants that in connection with this Agreement and the business resulting therefrom:

| (i) | it is aware of and will comply with Anti-Corruption Laws. |

| (ii) | whether directly or indirectly, it has not made, offered, authorized, or accepted and will not make, offer, authorize, or accept a bribe, and it has not made, offered, authorized, or accepted and will not make, offer, authorize, or accept a payment, gift, promise, or other advantage, to or for the use or benefit of any Government official or any other person where that payment, gift, promise, or other advantage would comprise a facilitation payment or otherwise violate the Anti-Corruption Laws; |

| (iii) | it has maintained and will maintain adequate written policies or procedures to comply with Anti-Corruption Laws; |

| (iv) | it has maintained and will maintain adequate internal controls, including but not limited to using reasonable efforts to ensure that all transactions are accurately recorded and reported in its books and records to reflect truly the activities to which they pertain, such as the purpose of each transaction, with whom it was entered into, for whom it was undertaken, or what was exchanged; |

| (v) | it will, to its knowledge retain such books and records for the period required by applicable law or a Party’s own retention policies, whichever is longer; |

| (vi) | in the event a Party becomes aware it has breached an obligation in this paragraph, it will promptly notify the other Party, subject to the preservation of legal privilege; |

| (vii) | it has used and will use reasonable efforts to require any IRRX’s or subcontractors, agents, or any other third parties to also comply with the foregoing requirements in this paragraph; |

| (viii) | it will provide information (which unless publicly available will include documentary evidence) in support of the other/requesting Party’s ongoing Know Your Customer (“KYC”) process requirements, about its ownership, officers, and corporate structure (including any changes thereto); and |

| (ix) | only a Party (and not its Affiliates or a third party) shall make payments to the other Party, except with that other Party’s prior written consent. |

| 23.3. | Suspension/Termination |

Without limitation to any other available remedies, where a Party or its Related Party fails to comply with this paragraph, the other Party, acting in good faith, shall have a right to notify of such failure to comply. If a Party is capable of curing the failure, it shall have sixty (60) days to cure the failure to the reasonable satisfaction of the other Party. If the failure is incapable of being cured or has not been cured to the reasonable satisfaction of the other Party such sixty (60) day period, the Party shall have the right to terminate the Agreement on further notice. Nothing in this Agreement shall require a Party to perform any part of this Agreement or take any actions if, by doing so, the Party would not comply with the Anti-Corruption Laws. The obligations in this paragraph shall survive the termination or expiry of this Agreement.

| 23.4. | Indemnity |

IRRX shall indemnify STUSCO for any losses, liabilities (including but not limited to fines and penalties), damages, costs incurred by or claims or proceedings instituted against STUSCO arising from or in connection with IRRX or its Related Parties failure to comply with this clause.

| 24. | Data Privacy |

The parties may provide each other with information related to an identified or identifiable individual (Personal Data) and will process the Personal Data in accordance with applicable data protection laws. This includes ensuring they comply with all obligations to ensure the lawful transfer of Personal Data, and the Parties agree to cooperate with one another in this regard.

21

Each party is a data controller in respect of the Personal Data.

Prior to sharing any Personal Data, the parties will enter into an appropriate controller-to-controller data privacy Agreement that satisfies the sending party’s legal requirements, including for cross border transfers.

The parties may not process, sell, retain, use or disclose the Personal Data for any purpose other than for the specific purpose specified in the Agreement, or as required or permitted by applicable data protection laws. The Agreement is evidence that the parties understand this condition and will comply with it.

| 25. | INDEMNIFICATION AND LIMITATION OF LIABILITY: |

| 25.1. | Indemnity by IRRX. Subject in all respects to the Limitation of Liability below, IRRX is responsible for, and hereby agrees to defend, protect, indemnify and hold harmless STUSCO from, against and in respect of, any Claims caused by or attributable to (in whole or in part): (i) a breach of any of IRRX’s representations, warranties, covenants or obligations in this Agreement; (ii) the storage, transportation, processing, and loading of Crude Oil Products before title transfer and delivery to STUSCO at the applicable Delivery Point(s), regardless of IRRX’s fault; or (iii) the negligence, gross negligence or willful misconduct of IRRX in connection with this Agreement; except in each case to the extent such Claims are caused by or attributable to (in whole or in part) (x) any breach of STUSCO’s representations, warranties, covenants or material obligations in this Agreement, or (y) the gross negligence or willful misconduct of STUSCO or its Affiliates. |

| 25.2. | Indemnity by STUSCO. Subject in all respects to the Limitation of Liability below, STUSCO is responsible for, and hereby agrees to defend, protect, indemnify and hold harmless IRRX from, against, and in respect of, any and all Claims caused by or attributable to (in whole or in part): (i) a breach of any of STUSCO’s representations, warranties, covenants or obligations in this Agreement, and/or (ii) the negligence, gross negligence or willful misconduct of STUSCO in connection with this Agreement; except in each case to the extent such Claims are caused by or attributable to (in whole or in part) (x) any breach of IRRX’s representations, warranties, covenants or obligations in this Agreement, or (y) the gross negligence or willful misconduct of IRRX or its Affiliates. |

| 25.3. | Limitation of Liability. NOTWITHSTANDING ANYTHING TO THE CONTRARY IN THIS AGREEMENT, AND EXCEPT FOR CLAIMS RELATED TO OFF-SPEC PRODUCTS OR THIRD PARTY CLAIMS, AS PROVIDED IN THIS SECTION, THE INDEMNIFYING PARTY’S LIABILITY SHALL BE LIMITED TO DIRECT ACTUAL DAMAGES ONLY. OTHER THAN IN RESPECT OF CLAIMS BY THIRD PARTIES, NO PARTY SHALL BE LIABLE TO ANY OTHER PARTY, ANY SUCCESSORS IN INTEREST, OR ANY BENEFICIARY OR ASSIGNEE OF THIS AGREEMENT, FOR SPECIAL DAMAGES HOWEVER THE SAME MAY BE CAUSED AND REGARDLESS OF SUCH PARTY’S NEGLIGENCE (WHETHER SUCH NEGLIGENCE IS SOLE, JOINT, CONCURRENT, ACTIVE, PASSIVE OR GROSS), FAULT, WILLFUL MISCONDUCT OR LIABILITY WITHOUT FAULT. Claims related to Off-Spec Products or the delivery thereof by IRRX and Claims by unaffiliated third parties that are allocated among the Parties pursuant to this Section (regardless of whether such claims include claims for lost profits, consequential, incidental, indirect, special, or punitive damages) are deemed to be direct damages and not special damages. |

22

| 26. | CHANGE OF CONTROL & DIVESTMENT: |

| (a) | STUSCO may terminate the Agreement or part of the services where a Person ceases to control directly or indirectly IRRX, or any person or group of persons acting in concert gains directly or indirectly control of IRRX (the “IRRX Change of Control”) and the required know-your-counterparty checks and other internal due diligence (collectively the “KYC Checks”) on any company or Person involved in any proposed IRRX Change of Control event have returned incomplete results due to the lack of information provided by IRRX or is unsatisfactory, including but not limited to any “flag” raised (the “Unsatisfactory IRRX KYC Result”), and subsequent to the notice in writing from STUSCO to IRRX with reasonable details thereto (the “IRRX KYC Notice”), the Unsatisfactory IRRX KYC Result is incapable of being cured or is capable of cure and IRRX does not cure the Unsatisfactory IRRX KYC Result within fourteen (14) calendar days from the date of such IRRX KYC Notice or such timeframe as mutually agreed between the parties. For the purpose of the foregoing, the KYC Checks may include but are not limited to ensuring that the envisaged incoming Person (a) is not a Restricted Party and (b) has not been convicted of having made a payment, direct or indirect, to a Government Official or any other person in breach of any applicable Anti-Corruption Laws. |

| (b) | For the purpose of this Section, “control” means: |

| (i) | the power (whether by way of ownership of shares, proxy, contract, agency or otherwise) to: |

| (A) | cast, or control the casting of, more than 50 percent of the maximum number of votes that might be cast at a general meeting of IRRX; |

| (B) | appoint or remove all, or the majority, of the directors or other equivalent officers of IRRX; or |

| (C) | give directions with respect to the operating and financial policies of IRRX with which the directors or other equivalent officers of IRRX are obliged to comply; and/or |

| (ii). | the holding beneficially of more than 50 percent of the issued share capital of IRRX (excluding any part of that issued share capital that carries no right to participate beyond a specified amount in a distribution of either profits or capital) |

| (c) | For the purpose of paragraph (a) above “acting in concert” means a group of persons who, pursuant to an agreement or understanding (whether formal or informal), actively co-operate, through the acquisition directly or indirectly of shares in IRRX by any of them, either directly or indirectly, to obtain or consolidate control of IRRX. |

| 27. | ASSIGNMENT: |

| 27.1. | This Agreement will inure to the benefit of and be binding upon the Parties and their respective successors and permitted assigns; provided, however, IRRX shall not assign this Agreement or any rights herein, in whole or in part, without STUSCO’s prior written consent, which consent may be withheld in STUSCO’s sole discretion, acting reasonably. Without limiting STUSCO’s consent rights, STUSCO may withhold consent if: (i) IRRX desires to assign less than all of its rights and obligations under this Agreement; (ii) an Event of Default by IRRX has occurred and is continuing; (iii) IRRX’s proposed assignee is not approved through STUSCO’s KYC process; (iv) IRRX’s proposed assignee does not assume in writing all of IRRX’s obligations under this Agreement; or (v) IRRX’s proposed assignee does not provide the Performance Assurance required by STUSCO pursuant to the terms of this Agreement. For this Section, an IRRX Change of Control (other than as a result of the transactions contemplated by the Merger Agreement) shall be considered an assignment requiring STUSCO’s prior written consent hereunder. IRRX will provide due diligence information related to the proposed assignee that is reasonably requested by STUSCO. |

23