Management discussion and analysis of financial

condition and results of operations for the

three and nine month periods ended March 31, 2025

TABLE OF CONTENTS

INTRODUCTION

As used in this Management Discussion and Analysis (“MD&A”), unless the context indicates or requires otherwise, all references to the “Company”, “Sangoma”, “we”, “us”, or “our” refer to Sangoma Technologies Corporation, together with our subsidiaries, on a consolidated basis as constituted on March 31, 2025. The MD&A is for the three and nine month periods ended March 31, 2025 as compared to the same periods in the previous year. This MD&A should be read in conjunction with Sangoma’s unaudited condensed consolidated interim financial statements and related notes for the three and nine month periods ended March 31, 2025, and audited annual consolidated financial statements and related notes as at and for the year ended June 30, 2024 (“Financial Statements”), which have been prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS Accounting Standards”). All amounts are in thousands of United States dollars except where otherwise indicated.

Additional information about us, including copies of our continuous disclosure materials, is available on our website at www.sangoma.com, through the EDGAR website at www.sec.gov or through the SEDAR+ website at www.sedarplus.ca.

This MD&A is dated as of May 8, 2025.

NON-IFRS MEASURES

This MD&A contains references to certain non-IFRS financial measures such as Adjusted EBITDA and Free Cash Flow. These measures are used by management to evaluate the performance of the Company and do not have any meaning prescribed by IFRS and therefore may not be comparable to similar measures presented by other reporting issuers. Rather, these measures are provided as additional information to complement those IFRS measures by providing further understanding of our results of operations from management’s perspective should not be considered in isolation nor as a substitute for analysis of our financial information reported under IFRS. These non-IFRS measures are used to provide investors with alternative measures of our operating performance and liquidity and thus highlight trends in our business that may not otherwise be apparent when relying solely on IFRS measures. We also believe that securities analysts, investors and other interested parties frequently use non-IFRS measures to compare issuers. Management also uses non-IFRS measures to facilitate operating performance comparisons from period to period, the preparation of annual operating budgets and forecasts and to determine components of executive compensation. “Adjusted EBITDA” means earnings before income taxes, interest expense (net), share-based compensation, depreciation (including for right-of-use assets), amortization, restructuring and business integration costs, goodwill impairment and change in fair value of consideration payable. “Free Cash Flow” means cash flows from operating activities less cash used for purchases of property and equipment and capitalized development costs. The reconciliation of the closest IFRS measure to the non-IFRS measure is set out on pages 14 and 15 herein.

FORWARD-LOOKING STATEMENTS

This MD&A contains forward-looking statements, including statements regarding the future success of our business, development strategies and future opportunities. Forward-looking statements are provided for the purpose of presenting information about management’s current expectations and plans relating to

the future and readers are cautioned that such statements may not be appropriate for other purposes. Forward-looking statements include, but are not limited to, statements relating to management’s guidance on revenue and Adjusted EBITDA, statements relating to expected inventory levels, statements relating to future lease and interest payments, , statements concerning estimates of expected expenditures, statements relating to expected future production and cash flows, and other statements which are not historical facts. When used in this document, the words such as “could”, “plan”, “estimate”, “will”, “expect”, “intend”, “may”, “potential”, “should” and similar expressions indicate forward-looking statements.

Although Sangoma believes that its expectations reflected in these forward-looking statements are reasonable, such statements involve risks and uncertainties and no assurance can be given that actual results will be consistent with these forward-looking statements. Forward-looking statements are based on the opinions and estimates of management at the date that the statements are made, and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in forward-looking statements.

Readers are cautioned not to place undue reliance on forward-looking statements, as there can be no assurance that the plans, intentions or expectations upon which they are based will occur. By their nature, forward-looking statements involve numerous assumptions, known and unknown risks and uncertainties, both general and specific, that contribute to the possibility that the predictions, forecasts, projections and other events contemplated by the forward-looking statements will not occur. Although Sangoma believes that the expectations represented by such forward-looking statements are reasonable, there can be no assurance that such expectations will prove to be correct as these expectations are inherently subject to business, economic and competitive uncertainties and contingencies. Some of the risks and other factors which could cause results to differ materially from those expressed in the forward-looking statements contained herein include, but are not limited to, risks and uncertainties associated with changes in exchange rate between the Canadian dollar and other currencies (in particular the United States’ (“US”) dollar), changes in technology, changes in the business climate, changes to macroeconomic conditions, including (i) inflationary pressures and potential recessionary conditions, as well as actions taken by central banks and regulators across the world in an attempt to reduce, curtail and address such pressures and conditions, including any increases in interest rates, and (ii) the effects of adverse developments at financial institutions, including bank failures, that impact general sentiment regarding the stability and liquidity of banks, and the resulting impact on the stability of the global financial markets at large, risks related to pandemics or epidemics, our ability to identify and effectively remediate material weaknesses and significant deficiencies in our internal controls, our current level of indebtedness and the ability to incur additional indebtedness in the near- and long-term; changes in the regulatory environment, the imposition of tariffs, the decline in the importance of the PSTN (as hereinafter defined), impairment of goodwill and new competitive pressures, political disturbances, geopolitical instability and tensions, or terrorist attacks, and associated changes in global trade policies and economic sanctions, including, but not limited to, in connection with (x) the ongoing conflict in Ukraine (the “Russo-Ukraine War”) and (y) any impact, effect, damage, destruction and/or bodily harm directly or indirectly relating to the ongoing hostilities in the Middle East, and technological changes impacting the development of our products and implementation of our business needs, including with respect to automation and the use of artificial intelligence (“AI”) and the other risk factors described in our most recently filed Annual Information Form for the fiscal year ended June 30, 2024.

The forward-looking statements contained in this MD&A are expressly qualified by this cautionary statement. Sangoma undertakes no obligation to update forward-looking statements if circumstances or management’s estimates or opinions should change except as required by law.

OVERVIEW

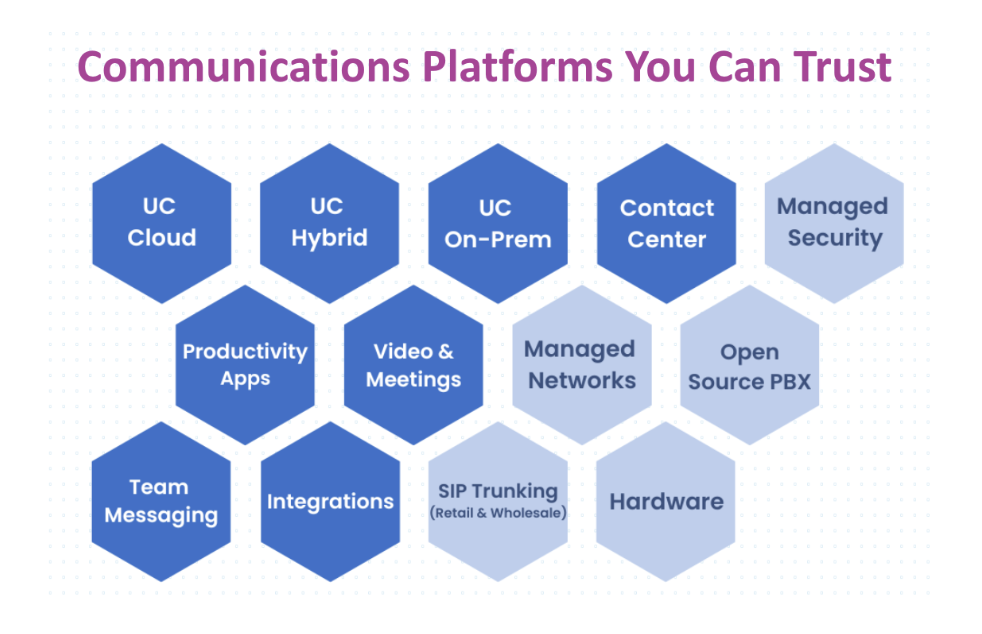

Sangoma is a leading business communications platform provider with solutions that include its award-winning UCaaS, CCaaS, CPaaS, and Trunking technologies. The enterprise-grade communications suite is developed in-house; available for cloud, hybrid, or on-premises deployments. Additionally, Sangoma’s integrated approach provides managed services for connectivity, network, and security. A trusted communications partner with over 40 years on the market, Sangoma has over 2.7 million UC seats across a diversified base of over 100,000 customers. Sangoma has been recognized for nine years in the Gartner UCaaS Magic Quadrant. As the primary developer and sponsor of the open source Asterisk and FreePBX projects, Sangoma is determined to continuously drive innovation in communication technology.

Please refer to the Glossary of Terms for detailed definitions of terms used throughout this MD&A.

Unified Communications

Sangoma’s UC platforms are business communication systems (PBXs with advanced UC features, such as presence/chat, conferencing, mobility, fax, and more) that fully integrate with our phones, soft clients, and network interoperability products.

We build our platforms in-house to provide reliable, affordable Unified Communications services with strong security. This approach reduces third-party vulnerabilities and allows us to swiftly troubleshoot and customize solutions for customers.

Cloud-Based Business Phone Solution (UCaaS)

Sangoma UC Cloud

Our intuitive cloud solutions seamlessly integrate voice, video, messaging, and call center capabilities into a single platform, enhancing productivity and streamlining operations at a fraction of the cost. Experience true white-glove support.

Sangoma UC Hybrid

Our hybrid UCaaS is powered by our unique cloud architecture, which includes our on-premises StarBox® appliance and cloud-based network backbone components. This blend of cloud and on-premises ensures unparalleled scalability, flexibility, and reliability for your business communications. It provides local survivability, multiple failover options (4G LTE / POTS lines) and multi-location flexibility.

On-Premises Business Phone Solution

Sangoma UC Prem

Sangoma also offers the more traditional on-premise UC phone system, giving administrators complete control over updates and integrations, to deploy their business phone system on-premises. Whether deployed on a dedicated appliance or in the customer’s virtual environment, Sangoma provides the power and connectivity customers and partners can trust.

IP DeskPhone, headsets, UC Clients and Softphones

Sangoma offers a variety of IP deskphones and headsets for both cloud and on-premise systems, featuring HD Voice and seamless integration with UC systems. Their headsets support connectivity with phones or computers and allow roaming up to 325 feet. Additionally, Sangoma provides UC Clients and Softphones for making business calls via smartphone or computer, functioning as a primary phone or desk phone extension.

Additional Communications Products

Contact Center as a Service (CCaaS)

Sangoma CX is a cloud-based Contact Center as a Service (CCaaS) solution that enhances customer experience by integrating with UCaaS offerings. It enables businesses to manage inbound interactions across various channels and supports outbound call campaigns. With features like end-to-end encryption, AI automation, and an intuitive interface, it streamlines contact center operations for higher agent productivity and improved customer experience.

Communications Platform as a Service (CPaaS)

Sangoma CPaaS allows developers to create applications with real-time communication features like voice, video, chat, and SMS via the cloud. Sangoma provides a platform for developers and customers to build communication services using voice, APIs, WebRTC, and SMS. To ensure optimal performance, Sangoma offers its own SIP trunking service and sells communication apps based on their CPaaS product.

Video, meetings, and collaboration

Sangoma Meet is our video meetings, cloud-based service accessible from desktop or mobile. It enables file sharing on screen, integrates seamlessly with your calendar, and enables PSTN phone calls. TeamHub is Sangoma’s collaboration platform, which allows users to interact via chatting, calling, and video.

Trunking

SIP trunks provide Internet-based telephony services using existing internet connections, eliminating the need for separate PSTN or digital connections. SIP trunking is increasingly popular for connecting an IP PBX system to a phone company due to cost efficiency and UC features. Sangoma offers two SIP trunking services: Retail SIP Trunking, with predictable monthly costs and easy integration into UC platforms, including a fax service; and Wholesale SIP Trunking, which is usage-based with a larger monthly minimum, suitable for large businesses. Additionally, Sangoma provides FaxStation, a hosted fax service with a telecom appliance for secure fax communication.

MSP Portfolio

Sangoma’s cloud-based Managed Service Provider (MSP) offerings deliver essential communication services that businesses rely on, enhancing our comprehensive suite of Communications as a Service solutions. This MSP product line is founded on a seamlessly integrated, enterprise-grade, end-to-end managed network, all backed by a dedicated 24/7 team of expert network engineers.The current MSP offering includes: SD-WAN, Internet, VPN, 5G, and WiFi access points. Sangoma also provides Managed Security solutions, which include anti-spam & antivirus, VPN, content filtering, data protection, and interaction detection.

Hardware

Sangoma provides network interconnection products that seamlessly link various types of networks. These products enable the connection of VoIP networks to PSTN, mobile networks, or even to other VoIP networks, ensuring versatile and efficient communication.

Sangoma provides solutions for secure and interoperable VoIP network connections, including Session Border Controllers (SBCs) and VoIP gateways. SBCs manage security and connectivity between various networks, available as hardware, software, or hybrid solutions. VoIP gateways facilitate voice traffic between VoIP and traditional PSTN networks. Additionally, Sangoma offers PSTN interface and media processing boards for developers needing to connect to the PSTN, maximizing flexibility and compatibility in various environments. All products have broad interoperability certifications.

Open-Source Software Products

Sangoma is the main developer and sponsor of the Asterisk project, the most widely used open-source communications software, and the FreePBX project, the most popular open-source PBX software. Sangoma also provides revenue-generating products and services beyond these open-source projects. These include software add-ons, IP phones, SIP trunking, cloud-based fax, training, technical support, maintenance, PSTN cards, VoIP gateways, session border controllers, and commercial versions of the PBX/UC software.

OVERALL PERFORMANCE

Operational

Sangoma is a trusted leader in developing technology platforms for essential business communications. Customers include companies in the SMB, mid-market and enterprise spaces looking for all the advantages of cloud-based communications at a fair price. Sangoma offers a wide range of products to complement its services, delivering high-quality solutions through a global network of partners and distributors.

Sangoma has always been operated and managed as a single economic entity. There is one management team that directs the activities of all aspects of the Company and it is managed globally by our executive team. As a result, we believe that we have one reporting segment, being the consolidated Company. Over time, this may change as the Company grows and when this occurs, we will reflect the change in our reporting practice.

Revenue

Sangoma generates revenue from both Services and Products. Our Services revenue is generated primarily from customers entering recurring revenue agreements for services such as our UCaaS platforms and MSP services. Product revenues are comprised of the sale of products and services that generate non-recurring revenue, including our UC on-prem platform and hardware.

Innovation

Sangoma is committed to advancing its AI capabilities by investing in and developing its proprietary AI platform and collaborating with leading third-party AI platforms.

By building on top of our existing CPaaS offerings and leveraging the low code/no code Studio workflow engine, we are delivering innovative Voice AI and Knowledge AI (RAG) Agent solutions that seamlessly integrate with our existing Cloud, Hybrid, and Prem products and services.

This approach ensures that our partners and customers benefit from both our in-house expertise and the broader AI ecosystem, enhancing their operations with cutting-edge, AI-driven services and insights.

Sales and marketing

Over the past year, Sangoma has undergone a transformation in its go-to-market strategy. We’ve embarked on a brand revitalization program with a strong focus on our digital properties, including new company positioning and refined messaging that reflects who we are as a company. We have established continuous education and training programs in collaboration with distributors and partners. Additionally, we have forged robust partnerships with key Technology Services Distributors (TSDs) like Telarus, Avant, App Direct, Intelisys, Jenne, and ScanSource to grow our business nationwide through the channel.

Sales

Sangoma utilizes a 100% channel-driven 'go to market' strategy, collaborating with diverse partners and market influencers. Our network includes individual agents, large technology service distributors (TSDs),

and both national and regional distributors. Our customers span from mid-market enterprises needing distributed solutions to smaller SMBs that rely on our partners for digital infrastructure strategies.

Sangoma thrives in several sectors, notably healthcare, retail, and service providers. Through the Pinnacle Channel Partner Program, we offer extensive support to our partners, enabling them to deliver Sangoma's essential communication platform solutions to their end users. This support includes formal lead registration, training, quoting assistance, co-marketing efforts, and competitive commission structures and incentives.

Marketing

Sangoma's marketing goals are seamlessly aligned with its business objectives, which focus on driving revenue growth and delivering value to stakeholders. We also recognize the importance of increased brand visibility, recognition, and trust within the channel partner community and among end users.

Four key pillars anchor our marketing transformation: brand development and perception, channel marketing and enablement, lead generation, and fostering a culture of innovation and process efficiency.

For brand development, Sangoma has clarified its position as a leader in the communications industry, known for developing essential communication platforms with in-house software for all UC deployment types. This is complemented by offerings such as SIP trunking, hardware, managed services, and managed security.

Channel marketing and enablement are crucial for Sangoma, as we are dedicated to supporting our channel partners and distributors. Our multichannel strategy includes large and small events, webinars, trainings, online advertising, email marketing, public relations, promotional programs, and discounts.

In lead generation, our goal is to deliver more qualified leads to our partners, utilizing both outbound and inbound strategies. These are multichannel efforts targeting our Ideal Customer Profile with key messages about our solutions. Tactics include email, calls, content marketing, online advertising, social media, and public relations.

Lastly, cultivating a strong culture of trust and rapid experimentation, combined with robust CRM and email automation processes, is vital to our marketing transformation.

RESULTS OF OPERATIONS

All amounts are in thousands of United States dollars except where otherwise indicated.

SUMMARY

The following table outlines our unaudited condensed consolidated interim statements of loss and comprehensive loss for the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three month periods ended March 31, | Nine month periods ended March 31, |

| 2025 | 2024 | Change | Change | 2025 | 2024 | Change | Change |

| $ | $ | $ | % | $ | $ | $ | % |

| Revenue | 58,067 | | 61,046 | | (2,979) | | (5)% | 177,330 | | 186,350 | | (9,020) | | (5)% |

| Cost of sales | 18,028 | | 18,046 | | (18) | | —% | 55,622 | | 55,336 | | 286 | | 1% |

| Gross profit | 40,039 | | 43,000 | | (2,961) | | (7)% | 121,708 | | 131,014 | | (9,306) | | (7)% |

| | | | | | | | |

| Expenses | | | | | | | | |

| Sales and marketing | 12,949 | | 13,653 | | (704) | | (5)% | 38,104 | | 44,822 | | (6,718) | | (15)% |

| Research and development | 10,466 | | 10,189 | | 277 | | 3% | 32,131 | | 29,509 | | 2,622 | | 9% |

| General and administration | 8,991 | | 10,652 | | (1,661) | | (16)% | 29,126 | | 32,978 | | (3,852) | | (12)% |

| Amortization of intangible assets | 8,199 | | 8,251 | | (52) | | (1)% | 24,596 | | 24,974 | | (378) | | (2)% |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Interest expense (net) | 871 | | 1,718 | | (847) | | (49)% | 3,354 | | 5,175 | | (1,821) | | (35)% |

| | | | | | | | |

| Restructuring and business integration costs | 272 | | — | | 272 | | 100% | 514 | | 1,491 | | (977) | | (66)% |

| | | | | | | | |

| | | | | | | | |

| Loss on change in fair value of consideration payable | — | | — | | — | | —% | — | | 202 | | (202) | | (100)% |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Loss before income tax | (1,709) | | (1,463) | | (246) | | 17% | (6,117) | | (8,137) | | 2,020 | | (25)% |

| Provision for income taxes | | | | | | | | |

| Current | 1,092 | | 1,135 | | (43) | | (4)% | 2,466 | | 1,799 | | 667 | | 37% |

| Deferred | (1,373) | | (1,330) | | (43) | | 3% | (3,364) | | (2,985) | | (379) | | 13% |

| Net loss | (1,428) | | (1,268) | | (160) | | 13% | (5,219) | | (6,951) | | 1,732 | | (25)% |

| | | | | | | | |

Other comprehensive income (loss) | | | | | | | | |

Items to be reclassified to net income (loss) | | | | | | | | |

Change in fair value of interest rate swaps, net of tax | (112) | | 39 | | (151) | | (387)% | (510) | | (535) | | 25 | | (5)% |

| | | | | | | | |

| Comprehensive loss | (1,540) | | (1,229) | | (311) | | 25% | (5,729) | | (7,486) | | 1,757 | | (23)% |

Loss per share | | | | | | | | |

| Basic and diluted | $ | (0.04) | | $ | (0.04) | | $ | — | | —% | $ | (0.16) | | $ | (0.21) | | $ | 0.05 | | (24)% |

| | | | | | | | |

| Weighted average shares outstanding (thousands) | | | | | | | | |

| Basic and diluted | 33,437 | | 33,157 | | 281 | | 1% | 33,522 | | 33,249 | | 273 | | 1% |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

REVIEW OF OPERATIONS

Revenue

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three month periods ended

March 31, | Three month periods ended December 31, | Nine month periods ended

March 31, |

| 2025 | 2024 | Change | Change | 2024 | Change | Change | 2025 | 2024 | Change | Change |

| $ | $ | $ | % | $ | $ | % | $ | $ | $ | % |

| Service revenues | 48,543 | 50,354 | (1,811) | (4)% | 48,807 | (264) | (1)% | 147,043 | 152,213 | (5,170) | (3)% |

| Percent of total revenues | 84% | 82% | 2.00% | 2% | 83% | 1% | 1% | 83% | 82% | 1% | 1% |

| Product revenues | 9,524 | 10,692 | (1,168) | (11)% | 10,306 | (782) | (8)% | 30,287 | 34,137 | (3,850) | (11)% |

| Percent of total revenues | 16% | 18% | (2.00)% | (11)% | 17% | (1)% | (1)% | 17% | 18% | (1)% | (6)% |

| Total revenues | 58,067 | 61,046 | (2,979) | (5)% | 59,113 | (1,046) | (2)% | 177,330 | 186,350 | (9,020) | (5)% |

Services revenue for the third quarter of fiscal 2025 decreased by 4% to $48,543 compared to $50,354 in the equivalent quarter of the prior year. Service revenue decline was impacted by customer churn and longer sales lead cycles for enterprise customers. Product revenue for the third quarter of fiscal 2025 decreased by 11% to $9,524 compared to $10,692 in the equivalent quarter of the prior year, mainly due to a decrease in third-party product resales. Services revenue represented 84% of total revenues this quarter, up from 82% in the same quarter of the prior year. Total revenues for the third quarter of fiscal 2025 decreased by 5% to $58,067 compared to $61,046 in the equivalent period of the prior year.

For the first three quarters of fiscal 2025, Services revenue decreased by 3% to $147,043 compared to the same period a year ago. Services revenue now represents 83% of total revenues, up 1% from 82% for the same period a year ago. During the same period, the Company saw softer Product sales, with related revenue decreased by 11% to $30,287. Product revenue represented 17% of total revenues compared to 18% a year ago, mainly due to the effects of the current geopolitical and global economics conditions, including uncertainty concerning recent shifts in government spending, tariffs and administrative processes which signal a dramatic shift in historical spending patterns.

On a quarter-over-quarter basis, Services revenue remained relatively flat, declining by less than 1% compared to the second quarter of fiscal 2025, while Product revenue declined by 8% over the same period. As a result, the overall decrease in total revenue quarter over quarter is primarily attributable to the reduction in Product sales. This decline is partially attributed to the Company's ongoing transition away from low-margin third-party product resales, a business the Company is in the process of divesting, as shown by the classification of assets and liabilities held for sale in the financial statements. Management believes this sequential comparison provides a more relevant view of the Company’s current performance than a year-over-year comparison, particularly as the Company exits the comprehensive 15-month transformation phase it has undergone. The transformation has placed significant emphasis on refining the Company’s go-to-market strategy, and early signs of progress are evident in leading revenue indicators, including an increase in the deal pipeline.

Cost of revenue and gross profit

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three month periods ended March 31, | Nine month periods ended March 31, |

| 2025 | 2024 | Change | Change | 2025 | 2024 | Change | Change |

| $ | $ | $ | % | $ | $ | $ | % |

| Cost of sales | 18,028 | 18,046 | (18) | —% | 55,622 | 55,336 | 286 | 1% |

| Gross profit | 40,039 | 43,000 | (2,961) | (7)% | 121,708 | 131,014 | (9,306) | (7)% |

| Gross margin | 69% | 70% | (1)% | (1)% | 69% | 70% | (1)% | (1)% |

The cost of sales for the third quarter of fiscal 2025 remained relatively flat at $18,028 compared to $18,046 in the equivalent quarter of the prior year, and increased by 1% to $55,622 for the first three quarters of fiscal 2025 as compared to $55,336 in the equivalent period of the prior year. The period over period increase in cost of sales was driven primarily by product sales at lower sales prices resulting in lower margins and increased cost pressure in service delivery cost of sales.

Gross profit for the third quarter of fiscal 2025 was $40,039, down 7% from the $43,000 realized in the equivalent quarter of the prior year and was $121,708 for the first three quarters of fiscal 2025, down 7% from the $131,014 realized in the equivalent period of the prior year.

Gross margin for the third quarter of fiscal 2025 was 69% of revenue, down 1% from the 70% in the equivalent quarter of the prior year. Gross margin for the first three quarters of fiscal 2025 was 69% of revenue, down 1% from the 70% in the equivalent period of the prior year. Gross margin for the third quarter and year to date is impacted by the revenue mix, with Services revenue increasing as a percentage of total revenue which partially offset the larger decrease in low margin Product revenue.

On a quarter-over-quarter basis, while revenue declined by approximately $1 million, gross profit decreased by only $0.4 million, resulting in a 1% improvement in gross margin. This reflects improved cost discipline and continued progress in shifting the revenue mix toward higher-margin services, supporting the Company’s strategic focus on margin expansion through operational efficiency and business model transformation.

Expenses

Costs are allocated to four categories as follow:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three month periods ended March 31, | Nine month periods ended March 31, |

| 2025 | 2024 | Change | Change | 2025 | 2024 | Change | Change |

| $ | $ | $ | % | $ | $ | $ | % |

| Sales and marketing | 12,949 | | 13,653 | | (704) | | (5)% | 38,104 | | 44,822 | | (6,718) | | (15)% |

| Research and development | 10,466 | | 10,189 | | 277 | | 3% | 32,131 | | 29,509 | | 2,622 | | 9% |

| General and administration | 8,991 | | 10,652 | | (1,661) | | (16)% | 29,126 | | 32,978 | | (3,852) | | (12)% |

| Amortization of intangible assets | 8,199 | | 8,251 | | (52) | | (1)% | 24,596 | | 24,974 | | (378) | | (2)% |

| | | | | | | | |

| | | | | | | | |

Sales and marketing

Sales and marketing expense was $12,949 for the third quarter of fiscal 2025, down from the $13,653 incurred in the same quarter of fiscal 2024, remaining consistent at 22% of revenue in each period. For the first three quarters of fiscal 2025, it was $38,104 down from the $44,822 in the equivalent period of the prior year, at 21% of revenue compared to 24% of revenue a year ago. The decrease was from the reorganization and merging of sales teams to better provide unified solutions, along with other cost savings initiatives undertaken by the Company in the latter part of the second quarter of fiscal 2024 while the Company reviewed its go-to-market strategy and corresponding marketing efforts.

Research and development

A portion of the Company’s R&D costs are capitalized each period and amortized on a straight-line basis over three years (see the audited consolidated financial statements and related notes for the fiscal year ended June 30, 2024, available at www.sedarplus.ca and www.sec.gov).

The research and development expenses incurred, and the development costs amortized during the third quarter of fiscal 2025 was $10,466 up from the $10,189 incurred in the same quarter of fiscal 2024, at approximately 18% of revenue compared to 17%, respectively. For the first three quarters of fiscal 2025, it was $32,131, up from the $29,509 in the equivalent period of the prior year, at approximately 18% of revenue compared to 16% a year ago. The increase was mainly due to higher amortization of development costs, which is from the capitalization of those costs relating to new products and services.

For the quarter ended March 31, 2025, the Company did not have any significant projects that have not yet generated revenue, nor did it have any products or services that are not fully developed, and which are material to the Company, therefore no impairment was assessed on any projects.

General and administration

Starting in the second quarter of fiscal 2024 the Company removed amortization of intangible assets from the general and administration expense to give a more accurate view of the Company’s hard costs.

During the third quarter of fiscal 2025, general and administration expenses was $8,991, down from the $10,652 incurred in the same quarter of fiscal 2024, at approximately 15% of revenue compared to 17%, respectively. For the first three quarters of fiscal 2025, it was $29,126, down from the $32,978 in the equivalent period of the prior year, at approximately 16% of revenue compared to 18%, respectively. This decrease in the Company’s general and administration spending is primarily a result of the cost management initiatives in major expenses categories partially offset by the investment in the implementation of a new Enterprise Resource Planning ("ERP") system that will improve our business systems architecture, enabling the Company for future organic and inorganic growth.

Amortization of intangible assets

Amortization of intangible assets was $8,199 for the third quarter of fiscal 2025, down from the $8,251 incurred in the same quarter of fiscal 2024, at approximately 14% of revenue compared to 14%, respectively. For the first three quarters of fiscal 2025, it was $24,596, down from the $24,974 in the equivalent period of the prior year, at approximately 14% of revenue compared to 13%, respectively .

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three month periods ended March 31, | Nine month periods ended March 31, |

| 2025 | 2024 | Change | Change | 2025 | 2024 | Change | Change |

| $ | $ | $ | % | $ | $ | $ | % |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Interest expense (net) | 871 | | 1,718 | | (847) | | (49)% | 3,354 | | 5,175 | | (1,821) | | (35)% |

| | | | | | | | |

| Restructuring and business integration costs | 272 | — | 272 | 100% | 514 | | 1,491 | | (977) | | (66)% |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Interest expense (net)

Net interest expense was $871 for the third quarter of fiscal 2025, down 49% from the $1,718 incurred in the same quarter of fiscal 2024. For the first three quarters of fiscal 2025, it was $3,354, down 35% from the $5,175 in the equivalent period of the prior year. The lower interest expense is as a result of lower interest rates and the repayments of $16,175 in the term loans and $8,600 in the revolving credit facility in the first three quarters of fiscal 2025. As at March 31, 2025, the total outstanding debt decreased to $53,050 from $77,825 as at June 30, 2024.

Restructuring and business integration costs

The restructuring cost was $272 for the third quarter of fiscal 2025, up from the $nil incurred in the same quarter of fiscal 2024. For the first three quarters of fiscal 2025, it was $514, down from the $1,491 in the equivalent period of the prior year.

Net loss

Net loss for the third quarter of fiscal 2025 was $1,428 ($0.04 loss per share fully diluted), a decline of 13% compared to a net loss of $1,268 ($0.04 loss per share fully diluted) for the equivalent quarter of the prior year. For the first three quarters of fiscal 2025, it was a net loss $5,219 ($0.16 loss per share fully diluted), an improvement of 25% compared to a net loss of $6,951 ($0.21 loss per share fully diluted), in the equivalent period of the prior year.

Free Cash Flow

The derivation of Free Cash Flow and the reconciliation of net cash from operating activities to Free Cash Flow for the comparable quarter and each fiscal year is shown in the table below.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Unaudited in US $000 | Three month periods ended

March 31, | Nine month periods ended

March 31, |

| 2025 | 2024 | Change | Change | 2025 | 2024 | Change | Change |

| $ | $ | $ | % | $ | $ | $ | % |

| Net cash provided by operating activities | 10,620 | | 15,506 | | (4,886) | | (32)% | 34,660 | | 32,543 | | 2,117 | | 6.5% |

| Purchase of property and equipment | (622) | | (1,061) | | 439 | | (41)% | (1,569) | | (2,695) | | 1,126 | | (41.8)% |

| Development costs | (1,643) | | (1,422) | | (221) | | 16% | (4,938) | | (4,819) | | (119) | | 2.5% |

| Free Cash Flow | 8,355 | | 13,023 | | (4,668) | | (36)% | 28,153 | | 25,029 | | 3,124 | | 12.5% |

Free Cash Flow for the third quarter of fiscal 2025 was $8,355 ($0.25 per share fully diluted), lower than the $13,023 ($0.39 per share fully diluted) incurred in the same quarter of fiscal 2024. For the first three

quarters of fiscal 2025, it was $28,153 ($0.84 per share fully diluted) compared to $25,029 ($0.75 per share fully diluted) in the equivalent period of the prior year.

Adjusted EBITDA

The derivation of Adjusted EBITDA and the reconciliation of net loss to Adjusted EBITDA for the comparable quarter and each fiscal year is shown in the table below.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three month periods ended March 31, | Nine month periods ended March 31, |

| 2025 | 2024 | Change | Change | 2025 | 2024 | Change | Change |

| $ | $ | $ | % | $ | $ | $ | % |

| Net loss | (1,428) | | (1,268) | | (160) | | 13% | (5,219) | | (6,951) | | 1,732 | | (25)% |

| Tax expense (recovery) | (281) | | (195) | | (86) | | 44% | (898) | | (1,186) | | 288 | | (24)% |

| Interest expense (net) | 871 | | 1,718 | | (847) | | (49)% | 3,354 | | 5,175 | | (1,821) | | (35)% |

| Share-based compensation | 517 | | 764 | | (247) | | (32)% | 2,283 | | 2,282 | | 1 | | —% |

| Depreciation of property and equipment | 982 | | 1,169 | | (187) | | (16)% | 3,073 | | 3,292 | | (219) | | (7)% |

| Depreciation of right-of-use assets | 640 | | 716 | | (76) | | (11)% | 1,971 | | 2,206 | | (235) | | (11)% |

| Amortization of intangibles | 8,199 | | 8,251 | | (52) | | (1)% | 24,596 | | 24,974 | | (378) | | (2)% |

| | | | | | | | |

| Restructuring and business integration costs | 272 | | — | | 272 | | 100% | 514 | | 1,491 | | (977) | | (66)% |

| | | | | | | | |

| | | | | | | | |

| Loss on change in fair value of consideration payable | — | | — | | — | | —% | — | | 202 | | (202) | | (100)% |

| | | | | | | | |

| Adjusted EBITDA | 9,772 | | 11,155 | | (1,383) | | (12)% | 29,674 | | 31,485 | | (1,811) | | (6)% |

| Percentage of revenue | 17% | 18% | (1)% | (8)% | 17% | 17% | —% | —% |

QUARTERLY RESULTS OF OPERATIONS

Selected financial information over the prior eight quarters is shown in the table below.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Fourth | First | Second | Third | Fourth | First | Second | Third |

| | quarter | quarter | quarter | quarter | quarter | quarter | quarter | quarter |

| | 2023 | 2024 | 2024 | 2024 | 2024 | 2025 | 2025 | 2025 |

| Revenue | $ | 63,680 | | $ | 63,028 | | $ | 62,276 | | $ | 61,046 | | $ | 60,934 | | $ | 60,150 | | $ | 59,113 | | $ | 58,067 | |

| Gross Profit | $ | 42,241 | | $ | 44,028 | | $ | 43,986 | | $ | 43,000 | | $ | 41,807 | | $ | 41,181 | | $ | 40,488 | | $ | 40,039 | |

Operating Expenses1 | $ | 43,708 | | $ | 45,001 | | $ | 44,537 | | $ | 42,745 | | $ | 41,600 | | $ | 42,056 | | $ | 41,296 | | $ | 40,605 | |

| | | | | | | | |

| Net loss | $ | (23,630) | | $ | (2,444) | | $ | (3,239) | | $ | (1,268) | | $ | (1,708) | | $ | (1,910) | | $ | (1,881) | | $ | (1,428) | |

| Net loss per share | | | | | | | | |

| | | | | | | | |

| Basic and diluted basis | $ | (0.72) | | $ | (0.07) | | $ | (0.10) | | $ | (0.04) | | $ | (0.05) | | $ | (0.06) | | $ | (0.06) | | $ | (0.04) | |

| Free cash flow | $ | 8,246 | | $ | 5,249 | | $ | 6,757 | | $ | 13,023 | | $ | 8,305 | | $ | 10,012 | | $ | 9,786 | | $ | 8,355 | |

| Free cash flow per share (basic & diluted) | $ | 0.25 | | $ | 0.16 | | $ | 0.20 | | $ | 0.39 | | $ | 0.25 | | $ | 0.30 | | $ | 0.29 | | $ | 0.25 | |

| Adjusted EBITDA | $ | 10,860 | | $ | 9,882 | | $ | 10,448 | | $ | 11,155 | | $ | 11,110 | | $ | 9,814 | | $ | 10,088 | | $ | 9,772 | |

| AEBITDA % Revenue | 17 | % | 16 | % | 17 | % | 18 | % | 18 | % | 16 | % | 17 | % | 17 | % |

| change % | | (1) | % | 1 | % | 1 | % | — | % | (2) | % | 1 | % | — | % |

1 Operating Expenses consist of sales and marketing, research and development, general and administration and amortization of intangible assets.

Sales and Net Loss by Quarter

Revenue for the quarter declined over the comparative periods as there has been a hold on capital expenditures by customers due to ongoing macroeconomic pressures, including uncertainties in the political landscape, government spending constraints, and the continued threat of tariffs and reciprocal trade measures. In parallel, the Company recently completed a comprehensive transformation of its go-to-market approach, which, while necessary for long-term scalability, contributed to extended sales cycles—particularly for larger enterprise accounts—and temporarily delayed revenue growth. With this foundational work now complete, the Company is positioned to shift its focus to revenue acceleration and customer acquisition. Services revenue continues to account for the majority of total revenue at 84% this quarter. Operational efficiencies and cost-saving initiatives have helped maintain Adjusted EBITDA margin within a narrow range of 16-18% over the past eight quarters. The Company is beginning to realize the benefits of its revamped sales strategy, as reflected in early revenue indicators such as a growing pipeline.

LIQUIDITY AND CAPITAL RESOURCES

During the three months ended March 31, 2025, the Company determined that VoIP Supply LLC met the criteria for assets held for sale and reclassified the VoIP Supply LLC as assets held for sale as detailed in note 20 of the unaudited condensed consolidated interim financial statements and related notes for the three and nine month periods ended March 31, 2025.

As of March 31, 2025, Sangoma had current assets of $48,357 and current liabilities of $55,724, compared with $57,109 and $60,104 at June 30, 2024, respectively. The decrease in current assets is mainly due to the collection of trade and other receivables, and the sale of inventories , while the decrease in current liabilities is primarily due to the payment of accounts payable and accrued liabilities offset by the increase in the current portion of operating facility and loans.

Cash of $17,291 on March 31, 2025 was 6.53% higher than the $16,231 on June 30, 2024. The Company used a portion of its cash to continue servicing the debts, accounts payable, the full repayment of $8,600 on the revolving credit facility in the first two quarters, and $2,900 of the remaining balance of its first loan in the third quarter, in line with its capital allocation strategy to accelerate the reduction in its debt level throughout Fiscal 2025.

Trade receivables of $9,943 on March 31, 2025, were lower than the $16,025 on June 30, 2024, primarily due to lower sales and the tightening of credit policies and increased focus on collection efforts. As at March 31, 2025, the Company reclassified $1,808 from trade receivables to assets held for sale associated with trade receivables at VoIP Supply LLC as detailed in note 20 of the unaudited condensed consolidated interim financial statements and related notes for the three and nine month periods ended March 31, 2025.

Inventories were $9,716 on March 31, 2025, $5,052 lower than the $14,768 at June 30, 2024 as the Company continues to focus on selling existing inventories first while managing new purchases. As at March 31, 2025, the Company reclassified $2,373 from inventories to assets held for sale associated with inventories at VoIP Supply LLC as detailed in note 20 of the unaudited condensed consolidated interim financial statements and related notes for the three and nine month periods ended March 31, 2025.

The Company’s net cash flows from operating activities in the third quarter of fiscal 2025 was $10,620, down 32% from the $15,506 incurred in the same quarter of fiscal 2024. For the first three quarters of fiscal 2025, it was $34,660, an improvement of 7% from the 32,543 in the equivalent period of the prior year. The year to date substantial increase was primarily due to fiscal 2025 lower reported net loss, and collection of trade receivables, lower inventories by selling existing in-stock inventories and reduced spending on trade payables and vendor management.

Net cash provided by operating activities as a percentage of Adjusted EBITDA for the third quarter of fiscal 2025 was a strong 109%, remaining above 100% and reflecting continued healthy cash conversion from operations. While this represents a decrease from the 139% reported in the same quarter of fiscal 2024, that prior level was not considered sustainable or reflective of our current capital allocation strategy. With a disciplined capital framework now in place, the current level represents a more balanced and strategically aligned cash performance. For the first three quarters of fiscal 2025, the ratio was 117%, up from 103% in the equivalent period of the prior year, further underscoring improved operational efficiency and focus on long-term value creation.

Credit Facility

On October 18, 2019, the Company entered into a new credit agreement (the “Original Credit Agreement”) in favour of its subsidiaries, Sangoma Technologies Inc. and Sangoma US Inc. (the “Borrowers”) with inter alia The Toronto-Dominion Bank and The Bank of Montreal, as lenders (the “Lenders”). Under the terms of the Original Credit Agreement, the Lenders provided the Borrowers with a term loan facility to refinance the Company’s existing credit facilities and to fund part of the purchase of Voip Innovation Acquisition.

On March 31, 2021, the Company entered into an amended and restated credit agreement (the “Amended and Restated Credit Agreement”) which amended and restated the Original Credit Agreement to allow the Company to fund part of the StarBlue Acquisition.

On March 28, 2022, the Company entered into the Second Amended and Restated Credit Agreement (the “Second Amended and Restated Credit Agreement”) which amended and restated the Amended and Restated Credit Agreement to allow the Company to fund part of the NetFortris Acquisition. The Second Amended and Restated Credit Agreement is comprised of: (i) a $6,000 revolving credit facility, (ii) a $21,750 term credit facility, which was used to partially fund the Voip Innovation Acquisition (iii) a $52,500 term credit facility, which was used to partially fund the StarBlue Acquisition, (iv) a $45,000 term credit facility, which was used to partially fund the NetFortris Acquisition (the “Term 3 Facility”), and (v) a $1,500 swingline credit facility.

On June 28, 2022, the Company entered into the first amendment to the Second Amended and Restated Credit Agreement to reflect certain administrative amendments and to amend the amount of the Term 3 Facility quarterly principal installments.

On October 19, 2022 and January 31, 2023 the Company drew down $3,000 and $2,300 from the revolving credit facility, respectively which were fully repaid on June 28, 2024.

On April 6, 2023 the Company entered into a second amendment to the Second Amended and Restated Credit Agreement to reflect certain administrative amendments and to amend the amount of the revolving credit facility from $6,000 to $20,000 and the amount of the swingline credit facility from $1,500 to $5,000. The Company repaid $8,600 on the revolving credit facility in the first two quarters, and $2,900 of the remaining balance of its first loan in the third quarter. As of March 31, 2025, both the first term loan and the the revolving credit facility were fully repaid.

On June 4, 2024, the Company entered into the third amendment to the Second Amended and Restated Credit Agreement to reflect certain administrative amendments.

Under its Second Amended and Restated Credit Agreement with its lenders, the Company must satisfy certain financial covenants, principally in respect of total funded debt to earnings before interest, taxes and amortization, and debt service coverage ratio. As at March 31, 2025, the Company was in compliance with all covenants related to its Credit Agreement.

CONTRACTUAL OBLIGATIONS

The following table shows the movement in contractual liabilities from July 1, 2024 to March 31, 2025:

| | | | | |

| $ |

Opening balance, July 1, 2023 | 14,551 | |

Revenue deferred during the period | 38,500 | |

Deferred revenue recognized as revenue during the period | (40,397) | |

| |

Ending balance, June 30, 2024 | 12,654 | |

Revenue deferred during the period | 27,909 | |

Deferred revenue recognized as revenue during the period | (30,719) | |

| |

Ending balance, March 31, 2025 | 9,844 | |

| |

| Contract liabilities - Current | 7,130 | |

| Contract liabilities - Non-current | 2,714 | |

| 9,844 | |

Commitments

The table below outlines our contractual commitments as of March 31, 2025:

| | | | | | | | | | | | | | | | | |

| within 12 months | 13-24 months | 25-36 months | >37 months | Total |

| $ | $ | $ | $ | $ |

| Accounts payable and accrued liabilities | 19,007 | | — | | — | | — | | 19,007 | |

| Sales tax payable | 4,050 | | — | | — | | — | | 4,050 | |

| | | | | |

| Operating facility and loans | 20,600 | | 20,600 | | 11,850 | | — | | 53,050 | |

| Lease obligations on right of use assets | 2,303 | | 1,792 | | 1,348 | | 4,782 | | 10,225 | |

| Other non-current liabilities | — | | — | | — | | 1,887 | | 1,887 | |

| 45,960 | | 22,392 | | 13,198 | | 6,669 | | 88,219 | |

OFF-BALANCE SHEET ARRANGEMENTS

There are no off-balance sheet arrangements that have, or are reasonably likely to have, a current or future effect on the results of operations or financial condition of Sangoma.

RELATED PARTY TRANSACTIONS

Except as disclosed in the notes to the consolidated financial statements, the Company is not party to any material transactions with related parties.

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

The preparation of our consolidated financial statements in conformity with IFRS requires management to make estimates and assumptions that affect the amounts reported in the consolidated financial statements and accompanying notes. We review these estimates on an ongoing basis based on management’s best

knowledge of current events and actions that we may undertake in the future. Actual results could differ from these estimates. All significant estimates and critical judgments, estimates, and assumptions are described in Note 3 of the Company’s Financial Statements.

FINANCIAL INSTRUMENTS AND OTHER INSTRUMENTS

The fair values of the cash and cash equivalents, trade and other receivables, contract assets, other current assets, accounts payable and accrued liabilities, approximate their carrying values due to the relatively short-term nature of these financial instruments or as these financial instruments are fair valued at each reporting period. The fair values of operating facility and loans approximate their carrying values due to variable interest loans or fixed rate loan, which represent market rate. Derivative assets and liabilities and consideration payable are recorded at fair value. Further details relating to our financial instruments, the risks associated with the financial instruments and how we manage those risks, are described in Note 4 of the Company’s Financial Statements.

Normal Course Issuer Bid

On March 25, 2025, the Company announced its intention to make an Normal Course Issuer Bid (“NCIB”) with respect to its Shares. Pursuant to the NCIB, the Company may, during the 12-month period commencing March 27, 2025 and ending no later than March 26, 2026, purchase up to 1,679,720 shares, representing 5% of the total number of 33,594,409 shares outstanding as of March 17, 2025, through the facilities of the TSX, the Nasdaq Global Select Market or alternative Canadian trading systems.

Under the terms of the NCIB, during the three and nine month periods ended March 31, 2025, the Company purchased a total of 26,558 common shares (March 31, 2024 – nil) at an average price of $4.43 per share (March 31, 2024 - $nil), for total consideration of $118 (March 31, 2024 - $nil). During the nine month period ended March 31, 2025, a total of 17,529 of those common shares were settled and cancelled, and the Company recorded a total reduction of $78 in share capital for the value of share repurchased.

In connection with the NCIB, the Company entered into an automatic share purchase plan ("ASPP") with a designated broker for the purpose of allowing the Company to purchase its common shares under the NCIB during self-imposed trading blackout periods. Under the ASPP, the broker is authorized to repurchase common shares during blackout periods, without consultation with the Company, on predefined terms, including share price, time period and subject to other limitations imposed by the Company and subject to rules and policies of the TSX and applicable securities laws, such as a daily purchase restriction. A liability, representing the maximum amount that the Company could be required to pay the designated broker under the ASPP, was recorded for $949 as at March 31, 2025 in accounts payable and accrued liabilities. The amount was charged to contributed surplus.

OUTSTANDING SHARE INFORMATION

We are currently authorized to issue an unlimited number of common shares. As of the date hereof, 33,505,899 common shares, 383,703 stock options and 1,442,343 share units are issued and outstanding.

GUIDANCE

Guidance for Fiscal 2025

Sangoma is reaffirming and narrowing its revenue guidance from $235 - $240 million to $235 - $238 million and reaffirming its Adjusted EBITDA2 of $40 million to $42 million, at approximately 17% of revenue given the results for the first three quarters of Fiscal 2025.

Our guidance is based on the Company’s assessment of many material assumptions, including:

•The Company’s ability to manage current supply chain constraints, including our ability to secure electronic components and parts, manufacturers being able to deliver ongoing quantities of finished products on schedule, no further material increases in cost for electronic components, and no significant delay or material increases in cost for shipping

•The successful execution of the Company’s go-to-market strategy

•The revenue trends the Company experienced in fiscal 2025 to-date, the trends we expect going forward in fiscal 2025, the impact of our transformation of our go-to-market strategy and the impact of growing economic headwinds globally

•The continuing effects of recent macroeconomic pressures such as inflation, interest rates, recessions, invasions or declarations of war, uncertainties in the political landscape, government spending constraints, and the continued threat of tariffs and reciprocal trade measures

•There being continuing growth in the global UCaaS and cloud communications markets more generally

•There being continuing demand and subscriber growth for our Services and continuing demand as anticipated for our Products

•The impact of changes in global exchange rates on the demand for the Company’s Products and Services

•The ability of the Company’s customers to continue their business operations without any material impact on their requirements for the Company’s Products and Services

•The Company’s forecasted revenue from its internal sales teams and via channel partners will meet current expectations, which is based on certain management assumptions, including continuing demand for the Company’s products and services, no material delays in receipt of products from its contract manufacturers, no further material increase to the Company’s manufacturing, labour or shipping costs

•That the Company is able to attract and retain the employees needed to maintain the current momentum

CONTROLS AND PROCEDURES

Management of the Company, under the supervision of the Chief Executive Officer and Chief Financial Officer, is responsible for establishing and maintaining (i) disclosure controls and procedures, and (ii) adequate internal control over financial reporting (“ICFR”) (as defined under applicable Canadian securities laws and by the United States Securities and Exchange Commission (“SEC”) in Rule 13a-15(e) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) for the company to ensure that (i) material information relating to the Company is made known to management by others,

particularly during the period in which the annual and interim filings are being prepared; and (ii) information required to be disclosed by the Company in its annual and interim filings or other reports filed or submitted under securities legislation is recorded, processed, summarized and reported within the time period specified in securities legislation.

Management, under the supervision and with the participation of our Chief Executive Officer and Chief Financial Officer and oversight of the Board of Directors evaluated the effectiveness of our ICFR as of March 31, 2025 against the criteria set forth in Internal Control – Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission. Based upon the evaluation, management has concluded that the Company’s disclosure controls and procedures and ICFR were effective.

GLOSSARY OF TERMS

Analog

Analog telephony is the telephone system that dates back to the original experiments by Alexander Graham Bell. The voice signal is picked up by a microphone and transmitted to the central office. Voice signals from the central office consist of voltages that drive a headset to produce sound. Analog means that the voice pressure signals are represented by voltages levels on the line.

API

Application Program Interface: An API is a purpose-built interface that allows fourth party software to interact with a particular application. A typical API is the user interface for Windows that allows programmers to write programs for Windows that use all its built-in utilities. APIs do not depend on revealing source code, in general. They are usually well documented and include sample programs that make development easy.

Codec

In the telephony context a codec is a mechanism of digitally encoding voice. On the PSTN a voice channel takes up 64kbps in a codec standard called G.711. Cell phones use a codec called GSM that compresses the voice further so that a GSM call consumes about 24kbps. Other compressed codecs are used in VoIP to conserve bandwidth. These include standards such as G.729, G.723. Most audio codecs are lossy, in that some of the voice quality is degraded by the compression. On the other hand, as bandwidth becomes cheaper, VoIP allows one to use other codecs that in fact use more bandwidth than the PSTN, the so-called broadband codecs that have DVD-like voice quality.

Digital telephony

In the modern PSTN only the “last mile” line to the customer is still analog, all other internal parts of the network are digital. Digital in this case means that at the central office the analog signal from the subscriber’s telephone is sampled digitally, converting the line voltages to a series of numbers that can be easily transmitted error free over long distances. See T1, E1 below.

DID

Direct Inward Dialing (“DID”) is a virtual phone number that uses the existing phone lines to route incoming calls. Callers can connect to a phone extension directly without an operator. This offers convenience for both employees and callers alike. DID offers a cost saving on its own and is less expensive when purchased with a SIP trunk.

Gateway

In the telephony context this is typically a separate unit with its own case and power supply that provides VoIP-to-PSTN services for a VoIP network. Almost all gateway devices use SIP interfaces to the VoIP system over Ethernet and have analog or digital telephony interfaces that connect to the PSTN. VoIP gateways are available from many manufacturers including Audiocodes, Cisco, Grandstream, Patton Electronics and many others.

ISDN

Integrated Services Digital Network (“ISDN”) is a set of communications standards for simultaneous digital transmission of voice, video, data, and other network services over the traditional circuits of the public switched telephone network. Of the many variations of ISDN, Sangoma supports BRI (Basic Rate Interface) which is essentially an all-digital replacement for ordinary analog lines and PRI (Primary Rate Interface) which is used over T1 and E1 lines. BRI is very popular outside of North America. PRI is used worldwide.

IoT

Internet of Things (“IoT”) refers to a system of interrelated, internet-connected objects that are able to collect and transfer data over a wireless network without human intervention.

IP

The Internet Protocol (“IP”) is the primary protocol in the internet layer of the Internet protocol suite, and delivers data packets from the source host to the destination host solely based on the IP address.

ISP

Internet Service Provider

ITSP

Internet Telephony Service Provider who offer telecommunications service including voice over internet type connections.

IVR

Interactive Voice Response: IVR systems use the phone to navigate a menu, for example those used by banks to allow access to customer’s account information. IVR systems have typically been driven by dial tones as the buttons on your phone are pressed, but increasingly they are using voice recognition for navigation.

Open Source

Open Source software is distributed free subject to certain conditions. Open Source licenses usually stipulate that source code must always be distributed or made available, and any improvements in the code have to be donated back to the community. It is possible to have dual licensing: Open Source to the community and also a closed, commercial license of the same or similar software.

NetBorder

This is the trade name of a Sangoma SIP to PSTN gateway product. It includes several other functions in addition to the PSTN gateway function. The mass marketed version is known as NetBorder Express or NBE.

PBX

Private branch exchange. A PBX is a premised basis device to deliver calls from the PSTN or VOIP network to phones in a single or multiple locations.

PSTN

Public Switched Telephone Network: This is the standard telephone network that has been in operation for many decades. A telephone or FAX or PBX or other telephony device is generally connected to an analog line at a wall plug, which is connected by “last mile” cabling to the central office. The analog signal from the device is converted to a digital signal at the Telco central office and is multiplexed, 24 simultaneous voice channels per line (in North America) onto a T1 for onward transmission. At the other end of the line the digital channel is reconverted to analog for transmission over the “last mile” to the receiving phone or other device.

SBC

A Session Border Controller (“SBC”) is a device deployed in Voice over Internet Protocol (“VoIP”) networks to exert control over the signaling and usually also the media streams involved in setting up, conducting, and tearing down telephone calls or other interactive media communications. SBCs are deployed as demarcation points between enterprises and service providers and between service provider networks.

SD-WAN

A Software-defined Wide Area Network (“SD-WAN”) uses software to control and manage connectivity across a customers wide area network. While traditional wide area networks rely on physical routers to connect remote users, this centralized software solution can help customers monitor their performance of the network and manage traffic.

Signaling

Call setup and tear down is remarkably complicated, involving such things as responding to the different tones as well as generating them, caller identification, and handling the different features like hook-flash and voicemail properly. There are different signaling mechanisms for different types of circuits. Analog circuits use tones such as out-of-order, busy, ringing as well as the dialing tones. T1 lines often use a data protocol called ISDN PRI, where packets of control data are exchanged on a

separate data channel. ISDN PRI is a simplification of the general signaling protocol used internally by the telecommunications networks known as SS7. In all cases, signaling must be exactly compatible with what the Telco expects, so interoperability and standards are important.

SIP

Session Initiation Protocol: SIP is the emerging standard signaling protocol for VoIP, though it has much broader applications. SIP is responsible for setting up and teardown of two party and multiparty calls, as well as a host of management features. To a great and increasing extent, VoIP calls are SIP based. The term SIP Trunk is used to describe the provision of a SIP line to an end customer.

T1, E1

A T1 line is a circuit that simultaneously carries 24 digital telephone calls. At higher densities, 28 T1s are aggregated into a T3 line carrying 672 calls. Larger offices can also connect to the central office via T1 directly, so as to have only one circuit for up to 24 calls. T1 is standard in North America and Japan while E1 is the standard in the rest of the world. E1 carries 30 channels of digitized voice per line.

TDM

Time Division Multiplexing (“TDM”) is used in circuit switched networks to increase the number of calls carried simultaneously on any one circuit and formed the basis for the digital telephony networks.

TSD

A Technology Services Distributor (TSD) is a company that connects technology vendors and selling partners, and provides technology service solutions to IT sales agents. TSDs are also known as "master agents" or "telecom agents or brokers". TSDs play a key role in the technology advisory channel, and offer many benefits, including: quick access to solutions, generating sales volume, collecting commissions, industry experience and business solutions, enablement training, and marketing activities.

Unified Communications

Unified communications is a concept in which voice, email, messaging, video, and any other type of communication are all considered forms of data that can be combined, manipulated, and used in intelligent applications seamlessly.

VoIP

Voice over IP is the transfer of voice traffic over the Internet Protocol. IP is used universally for all networking, including local area networks and private networks, not just the Internet. VoIP is not necessarily voice over the Internet, but voice over general data networks.