What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

Fund name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|---|---|

iShares 0-3 Month Treasury Bond ETF | $9 | 0.08% |

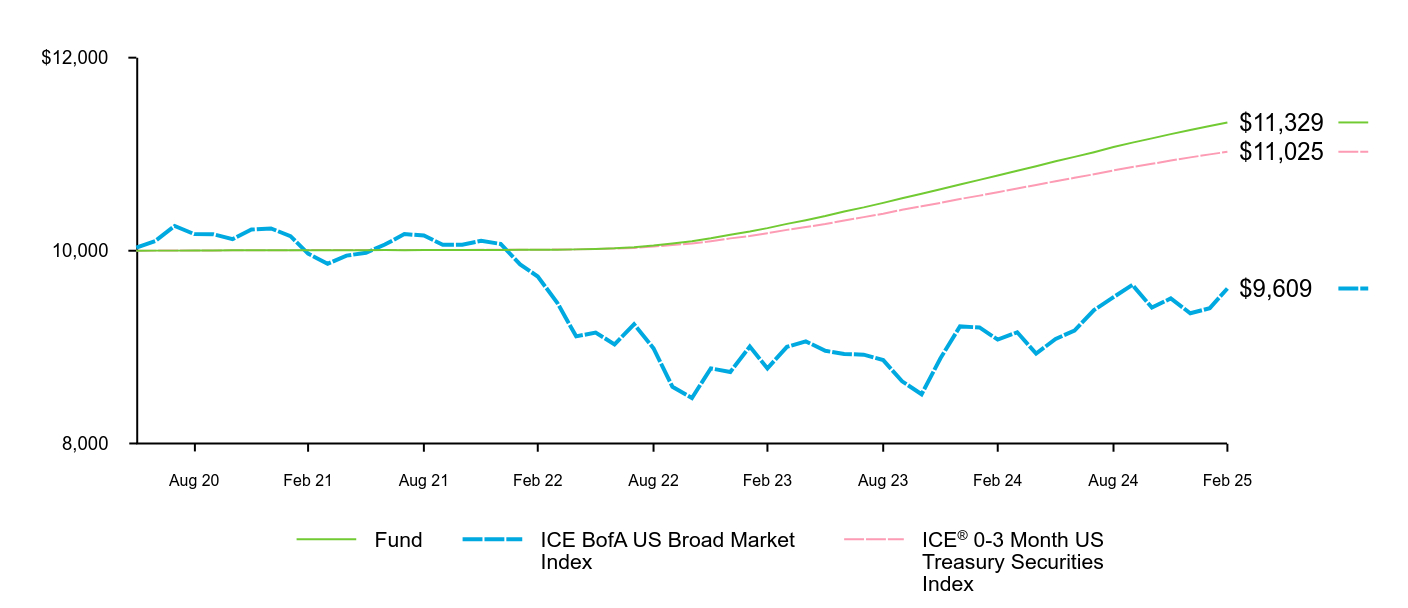

How did the Fund perform last year?

For the reporting period ended February 28, 2025, the Fund returned 5.11%.

For the same period, the ICE BofA US Broad Market Index returned 5.84% and the ICE® 0-3 Month US Treasury Securities Index returned 3.96%.

What contributed to performance?

Fixed income prices gained amid a generally positive economic backdrop, although the end of the reporting period saw increased volatility due to the presidential election and the economic implications of the new administration's policies. Slowing inflationary trends led the U.S. Federal Reserve Bank to lower the federal funds rate three times during the reporting period. However, the central bank hit pause at its January meeting, stating it needed to see further progress on inflation before cutting rates any further. The yield curve (the difference between a shorter-term bond and a longer-term bond, most often gauged by the two-year Treasury note and the 10-year Treasury note) normalized during the period as yields on longer-term bonds moved higher. (Bond yields move inversely to prices.) In this environment, shorter-term Treasuries outperformed their longer-dated counterparts.

What detracted from performance?

There were no meaningful detractors from the Fund's performance during the reporting period.

Fund | ICE BofA US Broad Market Index | ICE® 0-3 Month US Treasury Securities Index | |

|---|---|---|---|

May 20 | $10,000 | $10,033 | $10,000 |

Jun 20 | $10,001 | $10,101 | $10,001 |

Jul 20 | $10,001 | $10,257 | $10,002 |

Aug 20 | $10,003 | $10,172 | $10,003 |

Sep 20 | $10,003 | $10,171 | $10,003 |

Oct 20 | $10,004 | $10,120 | $10,004 |

Nov 20 | $10,004 | $10,219 | $10,005 |

Dec 20 | $10,005 | $10,231 | $10,005 |

Jan 21 | $10,005 | $10,151 | $10,006 |

Feb 21 | $10,005 | $9,970 | $10,007 |

Mar 21 | $10,006 | $9,865 | $10,007 |

Apr 21 | $10,006 | $9,949 | $10,007 |

May 21 | $10,005 | $9,979 | $10,007 |

Jun 21 | $10,007 | $10,064 | $10,007 |

Jul 21 | $10,006 | $10,172 | $10,008 |

Aug 21 | $10,007 | $10,158 | $10,008 |

Sep 21 | $10,007 | $10,061 | $10,008 |

Oct 21 | $10,008 | $10,063 | $10,008 |

Nov 21 | $10,008 | $10,103 | $10,009 |

Dec 21 | $10,008 | $10,070 | $10,009 |

Jan 22 | $10,009 | $9,858 | $10,010 |

Feb 22 | $10,009 | $9,733 | $10,010 |

Mar 22 | $10,011 | $9,461 | $10,012 |

Apr 22 | $10,014 | $9,113 | $10,014 |

May 22 | $10,019 | $9,152 | $10,017 |

Jun 22 | $10,025 | $9,030 | $10,022 |

Jul 22 | $10,036 | $9,238 | $10,028 |

Aug 22 | $10,054 | $8,988 | $10,043 |

Sep 22 | $10,076 | $8,591 | $10,059 |

Oct 22 | $10,098 | $8,474 | $10,075 |

Nov 22 | $10,129 | $8,781 | $10,099 |

Dec 22 | $10,166 | $8,744 | $10,128 |

Jan 23 | $10,199 | $9,007 | $10,153 |

Feb 23 | $10,234 | $8,781 | $10,182 |

Mar 23 | $10,278 | $9,004 | $10,216 |

Apr 23 | $10,316 | $9,061 | $10,245 |

May 23 | $10,359 | $8,963 | $10,276 |

Jun 23 | $10,407 | $8,930 | $10,314 |

Jul 23 | $10,449 | $8,923 | $10,348 |

Aug 23 | $10,496 | $8,867 | $10,384 |

Sep 23 | $10,544 | $8,647 | $10,424 |

Oct 23 | $10,591 | $8,513 | $10,460 |

Nov 23 | $10,637 | $8,886 | $10,496 |

Dec 23 | $10,687 | $9,216 | $10,536 |

Jan 24 | $10,734 | $9,205 | $10,571 |

Feb 24 | $10,779 | $9,079 | $10,606 |

Mar 24 | $10,828 | $9,155 | $10,645 |

Apr 24 | $10,875 | $8,934 | $10,681 |

May 24 | $10,927 | $9,086 | $10,720 |

Jun 24 | $10,972 | $9,173 | $10,755 |

Jul 24 | $11,021 | $9,385 | $10,792 |

Aug 24 | $11,074 | $9,519 | $10,832 |

Sep 24 | $11,120 | $9,646 | $10,867 |

Oct 24 | $11,164 | $9,411 | $10,900 |

Nov 24 | $11,208 | $9,506 | $10,934 |

Dec 24 | $11,251 | $9,352 | $10,967 |

Jan 25 | $11,293 | $9,405 | $10,998 |

Feb 25 | $11,329 | $9,609 | $11,025 |

Average Annual Total Returns | 1 Year | Since Fund

Inception |

|---|---|---|

Fund NAV........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 5.11% | 2.65% |

ICE BofA US Broad Market Index........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 5.84 | (0.83) |

ICE® 0-3 Month US Treasury Securities Index........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.96 | 2.07 |

Key Fund statistics

Net Assets........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $35,510,032,361 |

|---|---|

Number of Portfolio Holdings........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 19 |

Net Investment Advisory Fees........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $21,236,377 |

Portfolio Turnover Rate........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | -% |

Maturity allocation

Ten largest holdings

Maturity | Percent of TotaI InvestmentsFootnote Reference(a) |

|---|---|

0-1 Year........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 100.0% |

Security | Percent of Total InvestmentsFootnote Reference(a) |

|---|---|

U.S. Treasury Bills, 4.26%, 03/18/25........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 11.4% |

U.S. Treasury Bills, 4.27%, 03/11/25........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 10.6 |

U.S. Treasury Bills, 4.27%, 04/08/25........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 10.6 |

U.S. Treasury Bills, 4.27%, 04/15/25........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 10.1 |

U.S. Treasury Bills, 4.27%, 03/04/25........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 9.3 |

U.S. Treasury Bills, 4.32%, 04/29/25........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 8.9 |

U.S. Treasury Bills, 4.15%, 04/01/25........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 8.8 |

U.S. Treasury Bills, 4.28%, 04/03/25........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 5.7 |

U.S. Treasury Bills, 4.28%, 03/25/25........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.0 |

U.S. Treasury Bills, 4.41%, 03/06/25........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.0 |

| Footnote | Description |

Footnote(a) | Excludes money market funds. |

Material fund changes

This is a summary of certain changes to the Fund since February 29, 2024. For more complete information, you may review the Fund's next prospectus, which we expect to be available approximately 120 days after February 28, 2025 at blackrock.com/fundreports or upon request by contacting us at 1-800-iShares (1-800-474-2737).

Effective June 28, 2024, for its investment advisory services to the Fund, BlackRock Fund Advisors ("BFA") is entitled to an annual investment advisory fee of 0.09%, accrued daily and paid monthly by the Fund, based on the average daily net assets of the Fund. Prior to June 28, 2024, BFA was entitled to an annual investment advisory fee of 0.12%, accrued daily and paid monthly by the Fund, based on the average daily net assets of the Fund.

The net expense ratio increased from the prior fiscal year end primarily due to the contractual fee waiver expiring during the year.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

Fund name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|---|---|

iShares 1-3 Year Treasury Bond ETF | $15 | 0.15% |

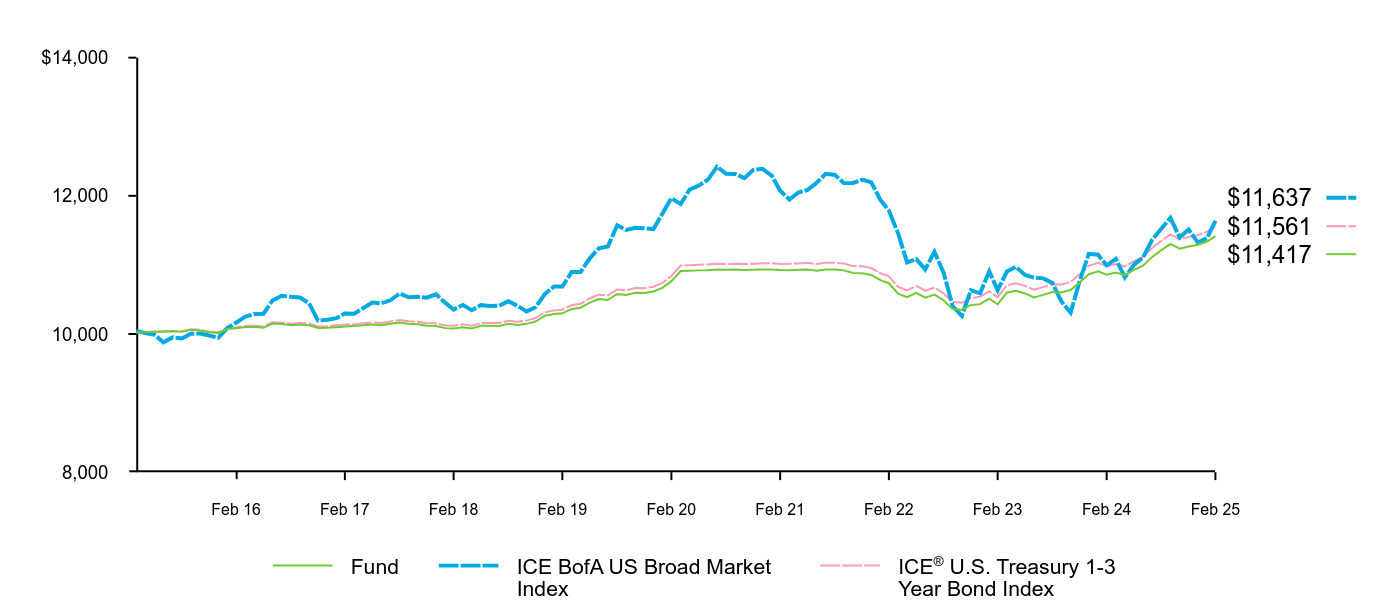

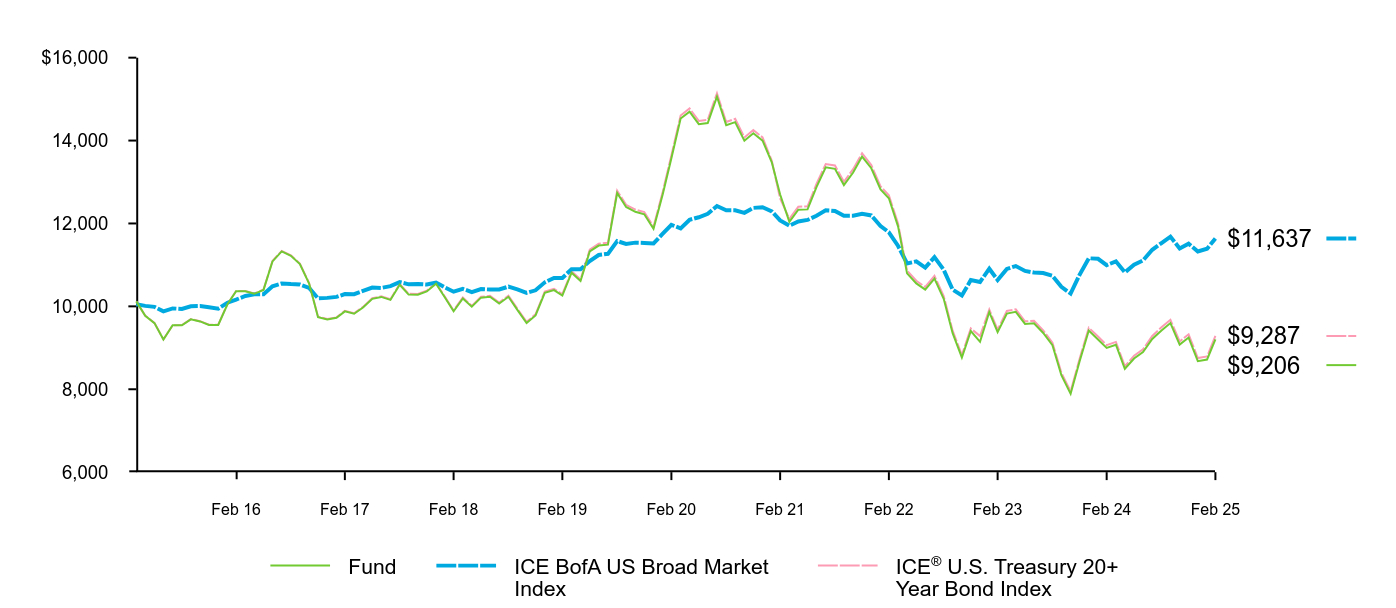

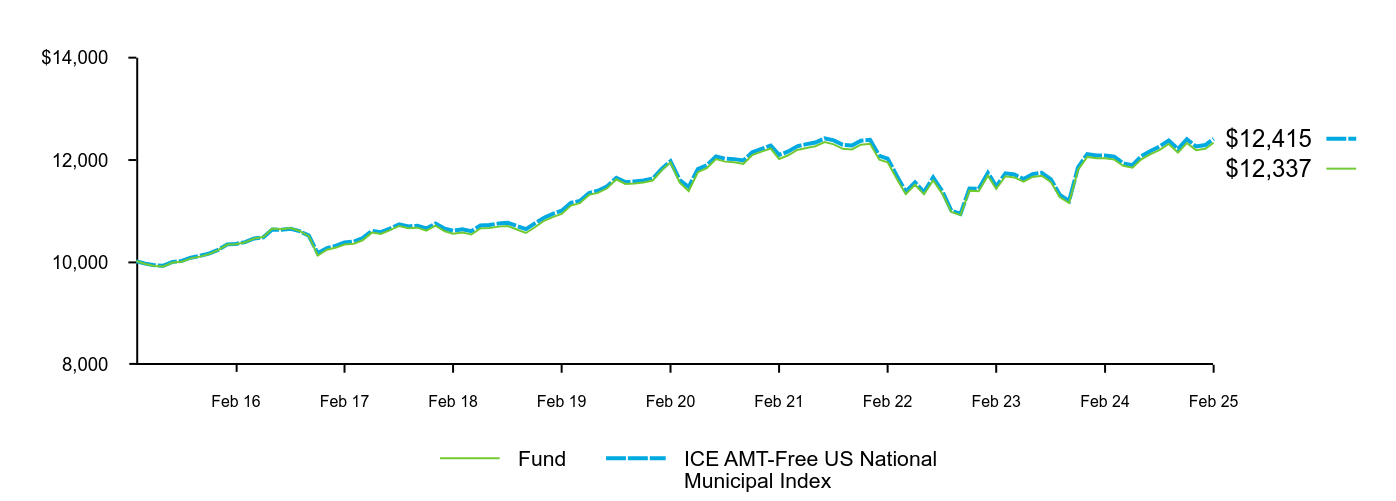

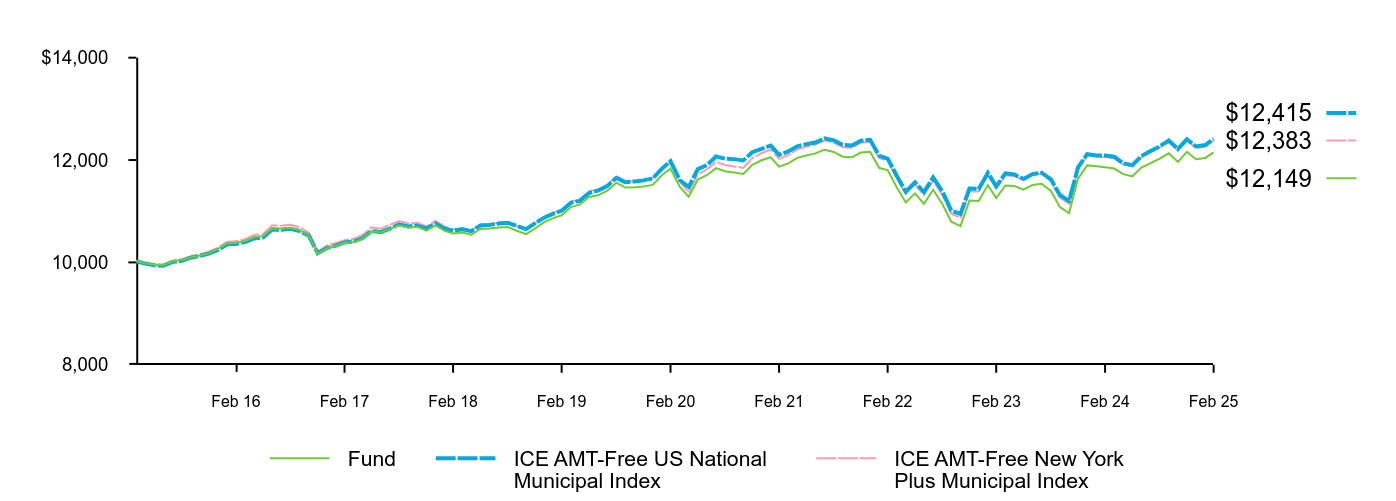

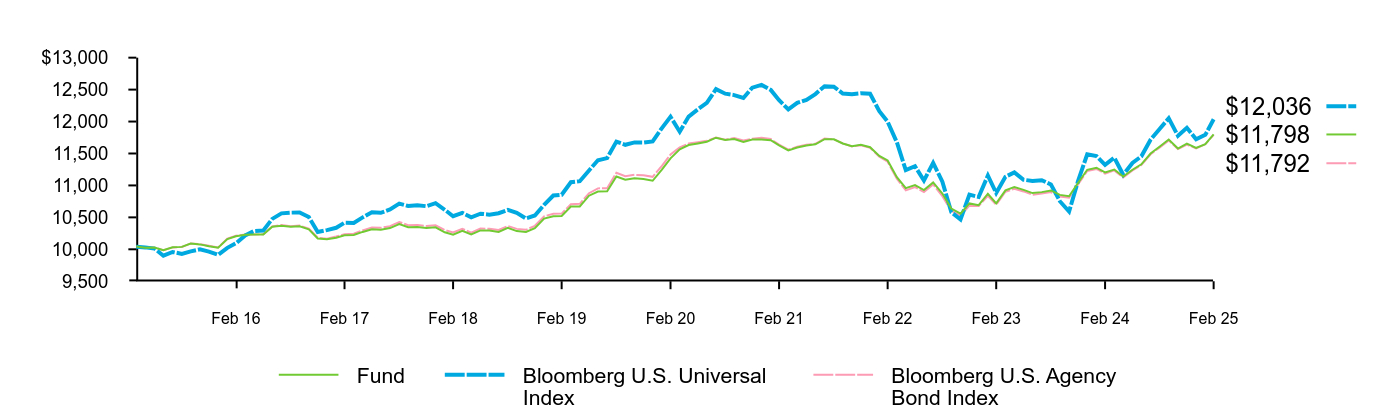

How did the Fund perform last year?

For the reporting period ended February 28, 2025, the Fund returned 5.15%.

For the same period, the ICE BofA US Broad Market Index returned 5.84% and the ICE® U.S. Treasury 1-3 Year Bond Index returned 5.28%.

What contributed to performance?

Fixed income prices gained amid a generally positive economic backdrop, although the end of the reporting period saw increased volatility due to the presidential election and the economic implications of the new administration's policies. Slowing inflationary trends led the U.S. Federal Reserve Bank to lower the federal funds rate three times during the reporting period. However, the central bank hit pause at its January meeting, stating it needed to see further progress on inflation before cutting rates any further. The yield curve (the difference between a shorter-term bond and a longer-term bond, most often gauged by the two-year Treasury note and the 10-year Treasury note) normalized during the period as yields on longer-term bonds moved higher. (Bond yields move inversely to prices.) In this environment, shorter-term Treasuries outperformed their longer-dated counterparts.

What detracted from performance?

There were no meaningful detractors from the Fund's performance during the reporting period.

Fund | ICE BofA US Broad Market Index | ICE® U.S. Treasury 1-3 Year Bond Index | |

|---|---|---|---|

Mar 15 | $10,023 | $10,050 | $10,024 |

Apr 15 | $10,026 | $10,012 | $10,029 |

May 15 | $10,032 | $9,988 | $10,036 |

Jun 15 | $10,033 | $9,880 | $10,039 |

Jul 15 | $10,038 | $9,951 | $10,044 |

Aug 15 | $10,033 | $9,936 | $10,039 |

Sep 15 | $10,062 | $10,003 | $10,070 |

Oct 15 | $10,050 | $10,007 | $10,060 |

Nov 15 | $10,024 | $9,978 | $10,035 |

Dec 15 | $10,014 | $9,945 | $10,026 |

Jan 16 | $10,072 | $10,088 | $10,087 |

Feb 16 | $10,083 | $10,163 | $10,099 |

Mar 16 | $10,101 | $10,251 | $10,116 |

Apr 16 | $10,102 | $10,289 | $10,120 |

May 16 | $10,092 | $10,294 | $10,109 |

Jun 16 | $10,150 | $10,485 | $10,169 |

Jul 16 | $10,143 | $10,553 | $10,164 |

Aug 16 | $10,125 | $10,538 | $10,147 |

Sep 16 | $10,137 | $10,529 | $10,159 |

Oct 16 | $10,127 | $10,444 | $10,151 |

Nov 16 | $10,086 | $10,194 | $10,109 |

Dec 16 | $10,089 | $10,205 | $10,113 |

Jan 17 | $10,098 | $10,229 | $10,125 |

Feb 17 | $10,108 | $10,298 | $10,136 |

Mar 17 | $10,114 | $10,294 | $10,140 |

Apr 17 | $10,125 | $10,372 | $10,155 |

May 17 | $10,138 | $10,454 | $10,167 |

Jun 17 | $10,127 | $10,445 | $10,158 |

Jul 17 | $10,147 | $10,488 | $10,181 |

Aug 17 | $10,167 | $10,586 | $10,201 |

Sep 17 | $10,148 | $10,532 | $10,183 |

Oct 17 | $10,141 | $10,539 | $10,176 |

Nov 17 | $10,118 | $10,526 | $10,154 |

Dec 17 | $10,117 | $10,574 | $10,155 |

Jan 18 | $10,085 | $10,452 | $10,123 |

Feb 18 | $10,079 | $10,354 | $10,119 |

Mar 18 | $10,099 | $10,421 | $10,139 |

Apr 18 | $10,080 | $10,345 | $10,121 |

May 18 | $10,118 | $10,418 | $10,159 |

Jun 18 | $10,118 | $10,406 | $10,160 |

Jul 18 | $10,115 | $10,408 | $10,159 |

Aug 18 | $10,147 | $10,475 | $10,192 |

Sep 18 | $10,131 | $10,408 | $10,179 |

Oct 18 | $10,147 | $10,327 | $10,194 |

Nov 18 | $10,181 | $10,387 | $10,231 |

Dec 18 | $10,264 | $10,579 | $10,314 |

Jan 19 | $10,290 | $10,687 | $10,342 |

Feb 19 | $10,299 | $10,686 | $10,351 |

Mar 19 | $10,361 | $10,896 | $10,416 |

Apr 19 | $10,381 | $10,897 | $10,437 |

May 19 | $10,455 | $11,095 | $10,514 |

Jun 19 | $10,507 | $11,239 | $10,569 |

Jul 19 | $10,494 | $11,268 | $10,556 |

Aug 19 | $10,579 | $11,575 | $10,643 |

Sep 19 | $10,565 | $11,506 | $10,631 |

Oct 19 | $10,598 | $11,537 | $10,666 |

Nov 19 | $10,593 | $11,531 | $10,662 |

Dec 19 | $10,615 | $11,519 | $10,684 |

Jan 20 | $10,672 | $11,752 | $10,744 |

Feb 20 | $10,765 | $11,966 | $10,839 |

Mar 20 | $10,911 | $11,881 | $10,990 |

Apr 20 | $10,916 | $12,089 | $10,995 |

May 20 | $10,921 | $12,150 | $11,003 |

Jun 20 | $10,924 | $12,232 | $11,005 |

Jul 20 | $10,934 | $12,421 | $11,017 |

Aug 20 | $10,930 | $12,318 | $11,014 |

Sep 20 | $10,932 | $12,317 | $11,017 |

Oct 20 | $10,926 | $12,256 | $11,012 |

Nov 20 | $10,930 | $12,376 | $11,017 |

Dec 20 | $10,934 | $12,390 | $11,023 |

Jan 21 | $10,935 | $12,293 | $11,024 |

Feb 21 | $10,928 | $12,074 | $11,014 |

Mar 21 | $10,924 | $11,946 | $11,016 |

Apr 21 | $10,929 | $12,049 | $11,022 |

May 21 | $10,935 | $12,085 | $11,030 |

Jun 21 | $10,917 | $12,187 | $11,012 |

Jul 21 | $10,935 | $12,318 | $11,032 |

Aug 21 | $10,933 | $12,302 | $11,030 |

Sep 21 | $10,921 | $12,184 | $11,019 |

Oct 21 | $10,883 | $12,186 | $10,983 |

Nov 21 | $10,879 | $12,234 | $10,979 |

Dec 21 | $10,855 | $12,194 | $10,955 |

Jan 22 | $10,779 | $11,938 | $10,879 |

Feb 22 | $10,735 | $11,787 | $10,834 |

Mar 22 | $10,585 | $11,457 | $10,682 |

Apr 22 | $10,534 | $11,036 | $10,631 |

May 22 | $10,595 | $11,084 | $10,695 |

Jun 22 | $10,527 | $10,935 | $10,626 |

Jul 22 | $10,571 | $11,188 | $10,671 |

Aug 22 | $10,486 | $10,884 | $10,586 |

Sep 22 | $10,363 | $10,404 | $10,463 |

Oct 22 | $10,351 | $10,262 | $10,452 |

Nov 22 | $10,418 | $10,634 | $10,520 |

Dec 22 | $10,432 | $10,589 | $10,540 |

Jan 23 | $10,511 | $10,908 | $10,615 |

Feb 23 | $10,430 | $10,634 | $10,533 |

Mar 23 | $10,598 | $10,904 | $10,706 |

Apr 23 | $10,625 | $10,973 | $10,734 |

May 23 | $10,587 | $10,854 | $10,696 |

Jun 23 | $10,530 | $10,815 | $10,640 |

Jul 23 | $10,566 | $10,805 | $10,678 |

Aug 23 | $10,607 | $10,738 | $10,719 |

Sep 23 | $10,602 | $10,471 | $10,716 |

Oct 23 | $10,637 | $10,309 | $10,752 |

Nov 23 | $10,746 | $10,761 | $10,863 |

Dec 23 | $10,865 | $11,160 | $10,986 |

Jan 24 | $10,907 | $11,147 | $11,029 |

Feb 24 | $10,858 | $10,994 | $10,981 |

Mar 24 | $10,890 | $11,087 | $11,014 |

Apr 24 | $10,853 | $10,819 | $10,978 |

May 24 | $10,927 | $11,003 | $11,054 |

Jun 24 | $10,988 | $11,108 | $11,117 |

Jul 24 | $11,116 | $11,365 | $11,248 |

Aug 24 | $11,215 | $11,528 | $11,349 |

Sep 24 | $11,305 | $11,682 | $11,442 |

Oct 24 | $11,235 | $11,396 | $11,372 |

Nov 24 | $11,266 | $11,512 | $11,405 |

Dec 24 | $11,291 | $11,325 | $11,431 |

Jan 25 | $11,339 | $11,390 | $11,481 |

Feb 25 | $11,417 | $11,637 | $11,561 |

Average Annual Total Returns | 1 Year | 5 years | 10 Years |

|---|---|---|---|

Fund NAV........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 5.15% | 1.18% | 1.33% |

ICE BofA US Broad Market Index........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 5.84 | (0.56) | 1.53 |

ICE® U.S. Treasury 1-3 Year Bond Index........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 5.28 | 1.30 | 1.46 |

Key Fund statistics

Net Assets........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $23,064,525,411 |

|---|---|

Number of Portfolio Holdings........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 127 |

Net Investment Advisory Fees........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $35,526,656 |

Portfolio Turnover Rate........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 55% |

Maturity allocation

Ten largest holdings

Maturity | Percent of TotaI InvestmentsFootnote Reference(a) |

|---|---|

0-1 Year........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1.2% |

1-2 Years........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 53.0 |

2-3 Years........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 45.8 |

Security | Percent of Total InvestmentsFootnote Reference(a) |

|---|---|

U.S. Treasury Notes, 0.75%, 05/31/26........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 2.5% |

U.S. Treasury Notes, 4.00%, 01/15/27........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 2.4 |

U.S. Treasury Notes, 4.25%, 03/15/27........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 2.2 |

U.S. Treasury Notes, 4.50%, 05/15/27........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1.9 |

U.S. Treasury Notes, 4.38%, 07/31/26........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1.9 |

U.S. Treasury Notes, 3.75%, 04/15/26........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1.8 |

U.S. Treasury Notes, 3.63%, 05/15/26........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1.7 |

U.S. Treasury Notes, 4.63%, 06/15/27........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1.7 |

U.S. Treasury Notes, 4.50%, 04/15/27........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1.6 |

U.S. Treasury Notes, 0.75%, 08/31/26........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1.6 |

| Footnote | Description |

Footnote(a) | Excludes money market funds. |

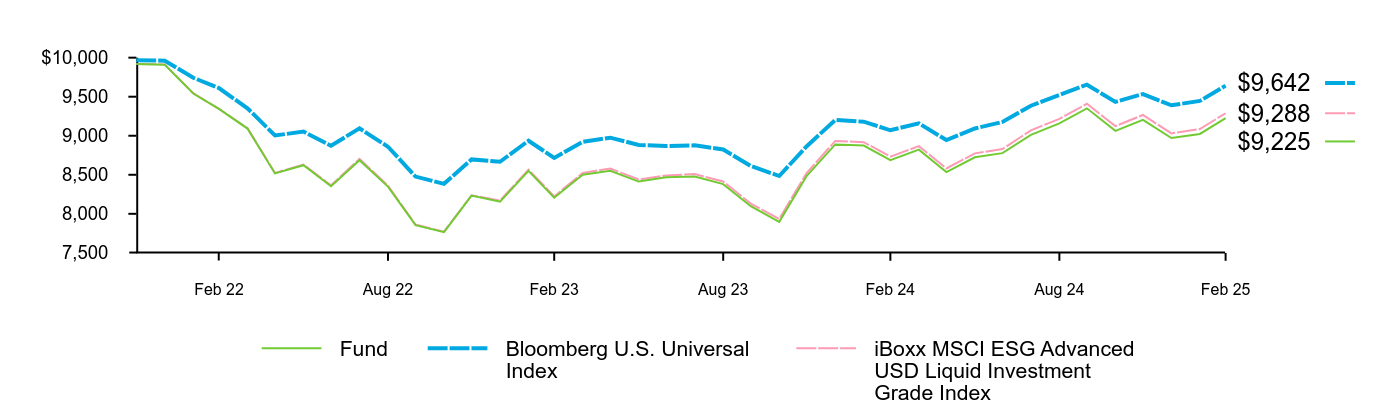

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

Fund name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|---|---|

iShares 3-7 Year Treasury Bond ETF | $15 | 0.15% |

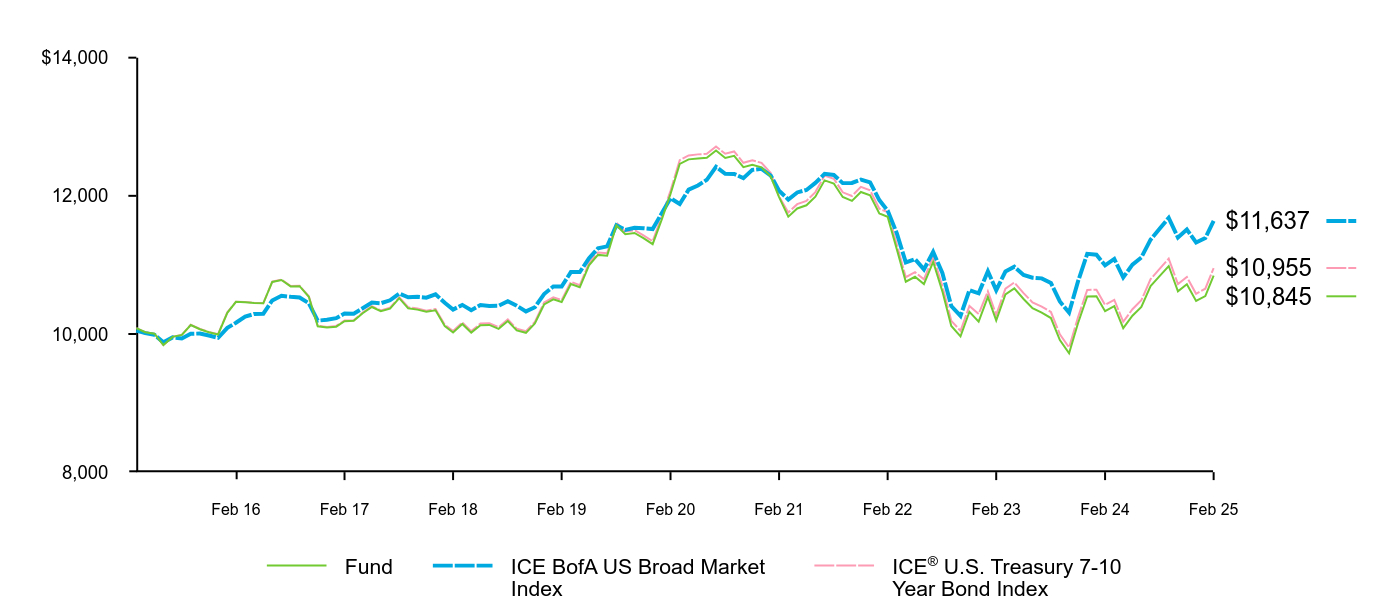

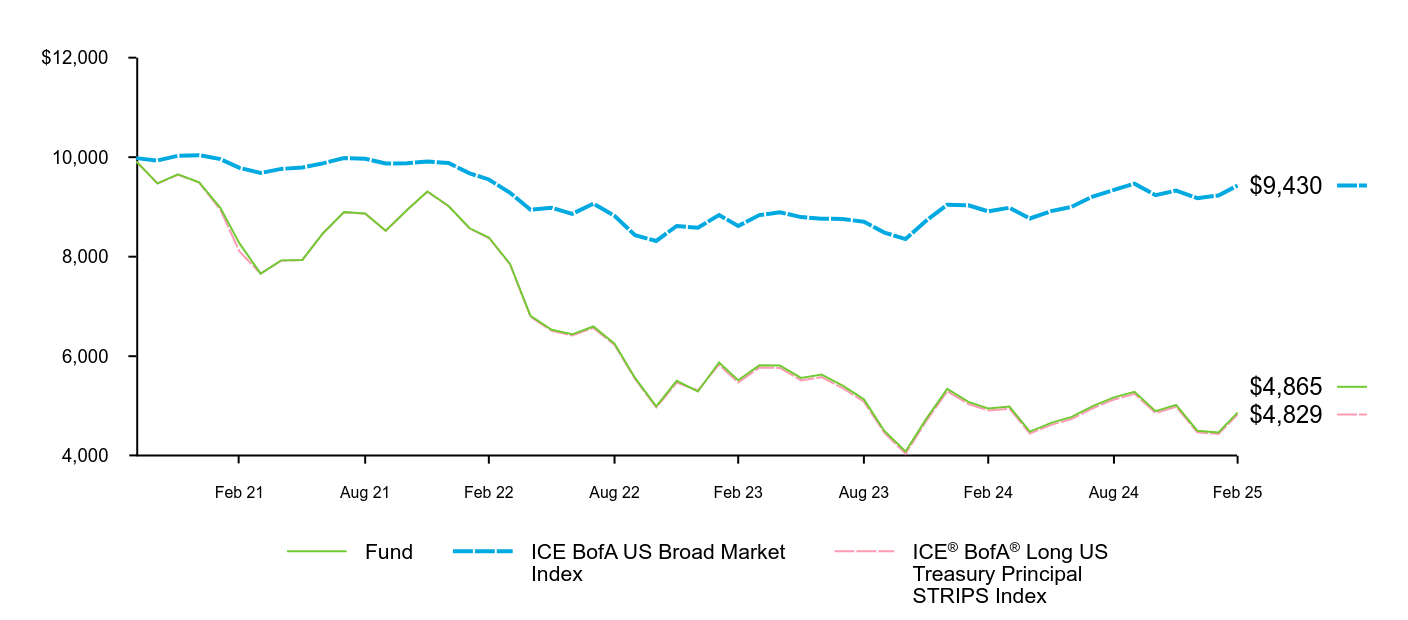

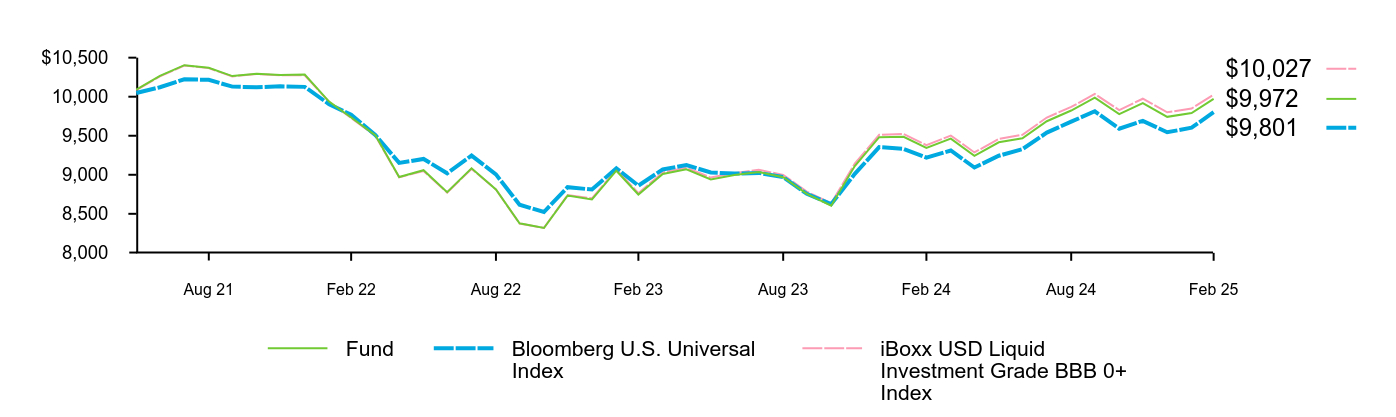

How did the Fund perform last year?

For the reporting period ended February 28, 2025, the Fund returned 5.27%.

For the same period, the ICE BofA US Broad Market Index returned 5.84% and the ICE® U.S. Treasury 3-7 Year Bond Index returned 5.40%.

What contributed to performance?

Fixed income prices gained amid a generally positive economic backdrop, although the end of the reporting period saw increased volatility due to the presidential election and the economic implications of the new administration's policies. Slowing inflationary trends led the U.S. Federal Reserve Bank to lower the federal funds rate three times during the reporting period. However, the central bank hit pause at its January meeting, stating it needed to see further progress on inflation before cutting rates any further. The yield curve (the difference between a shorter-term bond and a longer-term bond, most often gauged by the two-year Treasury note and the 10-year Treasury note) normalized during the period as yields on longer-term bonds moved higher. (Bond yields move inversely to prices.) In this environment, shorter-term Treasuries outperformed their longer-dated counterparts.

What detracted from performance?

There were no meaningful detractors from the Fund's performance during the reporting period.

Fund | ICE BofA US Broad Market Index | ICE® U.S. Treasury 3-7 Year Bond Index | |

|---|---|---|---|

Mar 15 | $10,078 | $10,050 | $10,078 |

Apr 15 | $10,064 | $10,012 | $10,065 |

May 15 | $10,070 | $9,988 | $10,074 |

Jun 15 | $10,018 | $9,880 | $10,021 |

Jul 15 | $10,074 | $9,951 | $10,077 |

Aug 15 | $10,081 | $9,936 | $10,087 |

Sep 15 | $10,183 | $10,003 | $10,189 |

Oct 15 | $10,135 | $10,007 | $10,140 |

Nov 15 | $10,094 | $9,978 | $10,100 |

Dec 15 | $10,070 | $9,945 | $10,076 |

Jan 16 | $10,278 | $10,088 | $10,287 |

Feb 16 | $10,338 | $10,163 | $10,346 |

Mar 16 | $10,364 | $10,251 | $10,373 |

Apr 16 | $10,353 | $10,289 | $10,365 |

May 16 | $10,333 | $10,294 | $10,345 |

Jun 16 | $10,514 | $10,485 | $10,527 |

Jul 16 | $10,516 | $10,553 | $10,531 |

Aug 16 | $10,453 | $10,538 | $10,468 |

Sep 16 | $10,478 | $10,529 | $10,495 |

Oct 16 | $10,416 | $10,444 | $10,435 |

Nov 16 | $10,195 | $10,194 | $10,215 |

Dec 16 | $10,192 | $10,205 | $10,212 |

Jan 17 | $10,217 | $10,229 | $10,238 |

Feb 17 | $10,250 | $10,298 | $10,271 |

Mar 17 | $10,256 | $10,294 | $10,277 |

Apr 17 | $10,325 | $10,372 | $10,348 |

May 17 | $10,374 | $10,454 | $10,399 |

Jun 17 | $10,338 | $10,445 | $10,363 |

Jul 17 | $10,378 | $10,488 | $10,404 |

Aug 17 | $10,452 | $10,586 | $10,481 |

Sep 17 | $10,374 | $10,532 | $10,403 |

Oct 17 | $10,356 | $10,539 | $10,385 |

Nov 17 | $10,314 | $10,526 | $10,345 |

Dec 17 | $10,313 | $10,574 | $10,345 |

Jan 18 | $10,188 | $10,452 | $10,218 |

Feb 18 | $10,150 | $10,354 | $10,182 |

Mar 18 | $10,213 | $10,421 | $10,248 |

Apr 18 | $10,136 | $10,345 | $10,170 |

May 18 | $10,215 | $10,418 | $10,250 |

Jun 18 | $10,208 | $10,406 | $10,244 |

Jul 18 | $10,179 | $10,408 | $10,216 |

Aug 18 | $10,251 | $10,475 | $10,289 |

Sep 18 | $10,180 | $10,408 | $10,219 |

Oct 18 | $10,183 | $10,327 | $10,224 |

Nov 18 | $10,266 | $10,387 | $10,308 |

Dec 18 | $10,453 | $10,579 | $10,497 |

Jan 19 | $10,504 | $10,687 | $10,549 |

Feb 19 | $10,488 | $10,686 | $10,533 |

Mar 19 | $10,640 | $10,896 | $10,689 |

Apr 19 | $10,643 | $10,897 | $10,690 |

May 19 | $10,829 | $11,095 | $10,879 |

Jun 19 | $10,933 | $11,239 | $10,985 |

Jul 19 | $10,905 | $11,268 | $10,956 |

Aug 19 | $11,141 | $11,575 | $11,193 |

Sep 19 | $11,074 | $11,506 | $11,128 |

Oct 19 | $11,105 | $11,537 | $11,160 |

Nov 19 | $11,068 | $11,531 | $11,123 |

Dec 19 | $11,057 | $11,519 | $11,115 |

Jan 20 | $11,250 | $11,752 | $11,310 |

Feb 20 | $11,465 | $11,966 | $11,528 |

Mar 20 | $11,753 | $11,881 | $11,822 |

Apr 20 | $11,775 | $12,089 | $11,846 |

May 20 | $11,804 | $12,150 | $11,877 |

Jun 20 | $11,820 | $12,232 | $11,894 |

Jul 20 | $11,861 | $12,421 | $11,938 |

Aug 20 | $11,838 | $12,318 | $11,916 |

Sep 20 | $11,844 | $12,317 | $11,924 |

Oct 20 | $11,789 | $12,256 | $11,870 |

Nov 20 | $11,808 | $12,376 | $11,889 |

Dec 20 | $11,818 | $12,390 | $11,901 |

Jan 21 | $11,785 | $12,293 | $11,862 |

Feb 21 | $11,651 | $12,074 | $11,704 |

Mar 21 | $11,557 | $11,946 | $11,639 |

Apr 21 | $11,614 | $12,049 | $11,699 |

May 21 | $11,648 | $12,085 | $11,738 |

Jun 21 | $11,636 | $12,187 | $11,724 |

Jul 21 | $11,748 | $12,318 | $11,839 |

Aug 21 | $11,721 | $12,302 | $11,812 |

Sep 21 | $11,623 | $12,184 | $11,714 |

Oct 21 | $11,528 | $12,186 | $11,620 |

Nov 21 | $11,564 | $12,234 | $11,656 |

Dec 21 | $11,521 | $12,194 | $11,615 |

Jan 22 | $11,353 | $11,938 | $11,445 |

Feb 22 | $11,294 | $11,787 | $11,386 |

Mar 22 | $10,941 | $11,457 | $11,032 |

Apr 22 | $10,725 | $11,036 | $10,815 |

May 22 | $10,803 | $11,084 | $10,896 |

Jun 22 | $10,718 | $10,935 | $10,812 |

Jul 22 | $10,902 | $11,188 | $11,000 |

Aug 22 | $10,614 | $10,884 | $10,711 |

Sep 22 | $10,303 | $10,404 | $10,398 |

Oct 22 | $10,246 | $10,262 | $10,342 |

Nov 22 | $10,473 | $10,634 | $10,572 |

Dec 22 | $10,416 | $10,589 | $10,533 |

Jan 23 | $10,638 | $10,908 | $10,739 |

Feb 23 | $10,402 | $10,634 | $10,501 |

Mar 23 | $10,699 | $10,904 | $10,801 |

Apr 23 | $10,772 | $10,973 | $10,876 |

May 23 | $10,674 | $10,854 | $10,777 |

Jun 23 | $10,543 | $10,815 | $10,644 |

Jul 23 | $10,551 | $10,805 | $10,655 |

Aug 23 | $10,546 | $10,738 | $10,651 |

Sep 23 | $10,415 | $10,471 | $10,518 |

Oct 23 | $10,355 | $10,309 | $10,459 |

Nov 23 | $10,627 | $10,761 | $10,736 |

Dec 23 | $10,877 | $11,160 | $10,990 |

Jan 24 | $10,910 | $11,147 | $11,023 |

Feb 24 | $10,760 | $10,994 | $10,872 |

Mar 24 | $10,808 | $11,087 | $10,922 |

Apr 24 | $10,624 | $10,819 | $10,736 |

May 24 | $10,761 | $11,003 | $10,876 |

Jun 24 | $10,864 | $11,108 | $10,982 |

Jul 24 | $11,101 | $11,365 | $11,223 |

Aug 24 | $11,229 | $11,528 | $11,354 |

Sep 24 | $11,347 | $11,682 | $11,475 |

Oct 24 | $11,103 | $11,396 | $11,229 |

Nov 24 | $11,169 | $11,512 | $11,297 |

Dec 24 | $11,073 | $11,325 | $11,201 |

Jan 25 | $11,138 | $11,390 | $11,268 |

Feb 25 | $11,327 | $11,637 | $11,459 |

Average Annual Total Returns | 1 Year | 5 years | 10 Years |

|---|---|---|---|

Fund NAV........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 5.27% | (0.24)% | 1.25% |

ICE BofA US Broad Market Index........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 5.84 | (0.56) | 1.53 |

ICE® U.S. Treasury 3-7 Year Bond Index........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 5.40 | (0.12) | 1.37 |

Key Fund statistics

Net Assets........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $15,920,674,051 |

|---|---|

Number of Portfolio Holdings........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 102 |

Net Investment Advisory Fees........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $21,438,853 |

Portfolio Turnover Rate........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 35% |

Maturity allocation

Ten largest holdings

Maturity | Percent of TotaI InvestmentsFootnote Reference(a) |

|---|---|

1-2 Years........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 0.0%Footnote Reference(b) |

2-3 Years........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 0.7 |

3-4 Years........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 33.8 |

4-5 Years........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 27.0 |

5-6 Years........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 20.4 |

6-7 Years........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 18.1 |

Security | Percent of Total InvestmentsFootnote Reference(a) |

|---|---|

U.S. Treasury Notes, 2.63%, 02/15/29........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 4.1% |

U.S. Treasury Notes, 1.38%, 10/31/28........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.7 |

U.S. Treasury Notes, 4.38%, 11/30/30........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.6 |

U.S. Treasury Notes, 1.25%, 09/30/28........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.4 |

U.S. Treasury Notes, 1.00%, 07/31/28........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.2 |