Shareholder Report |

12 Months Ended |

|---|---|

|

Feb. 28, 2025

USD ($)

Holding

| |

| Shareholder Report [Line Items] | |

| Document Type | N-CSR |

| Amendment Flag | false |

| Registrant Name | CM ADVISORS FAMILY OF FUNDS |

| Entity Central Index Key | 0001208252 |

| Entity Investment Company Type | N-1A |

| Document Period End Date | Feb. 28, 2025 |

| C000029067 | |

| Shareholder Report [Line Items] | |

| Fund Name | CM Advisors Fixed Income Fund |

| Trading Symbol | CMFIX |

| Annual or Semi-Annual Statement [Text Block] | This annual shareholder report contains important information about CM Advisors Fixed Income Fund (the "Fund") for the period of March 1, 2024 to February 28, 2025. |

| Shareholder Report Annual or Semi-Annual | Annual Shareholder Report |

| Additional Information [Text Block] | You can find additional information about the Fund at https://cmadvisorsfunds.com/our-fund/cm-advisors-fixed-income-fund. You can also request this information by contacting us at (888) 859-5856. |

| Additional Information Phone Number | (888) 859-5856 |

| Additional Information Website | <span style="font-weight: 700; box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; grid-area: auto; line-height: 18px; margin: 0px; overflow: visible; text-align: left; white-space-collapse: preserve-breaks;">https://cmadvisorsfunds.com/our-fund/cm-advisors-fixed-income-fund</span> |

| Expenses [Text Block] | |

| Expenses Paid, Amount | $ 90 |

| Expense Ratio, Percent | 0.87% |

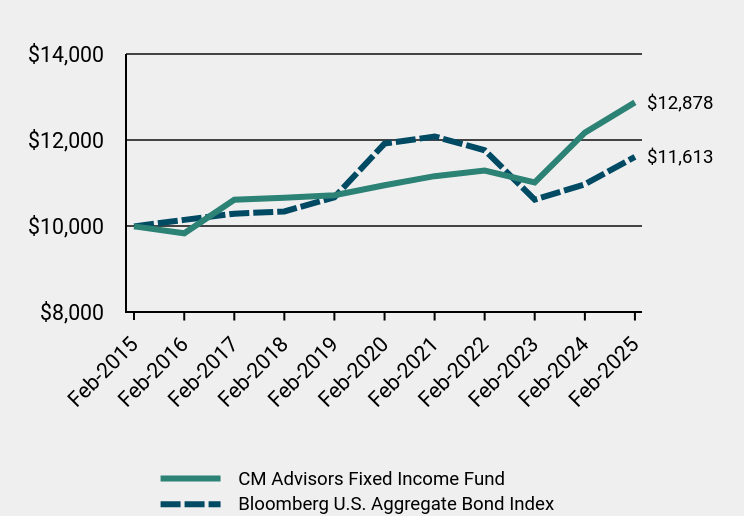

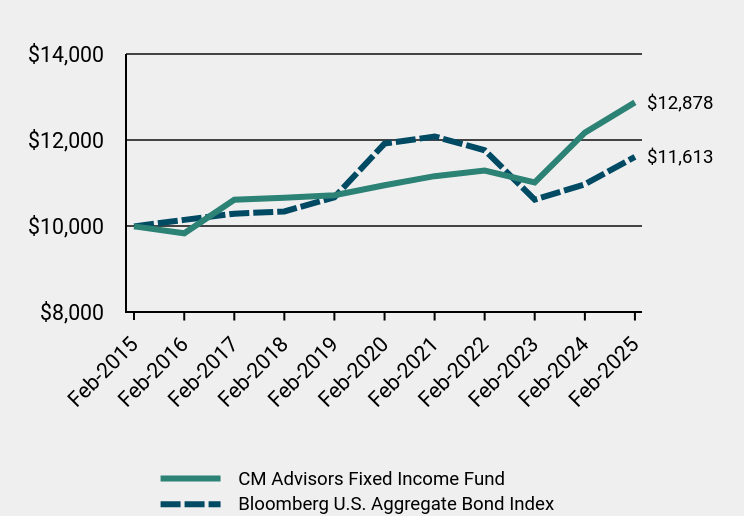

| Performance Past Does Not Indicate Future [Text] | The Fund's past performance is not a good predictor of how the Fund will perform in the future. |

| Line Graph [Table Text Block] |  |

| Average Annual Return [Table Text Block] | |

| No Deduction of Taxes [Text Block] | The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

| AssetsNet | $ 27,095,373 |

| Holdings Count | Holding | 73 |

| Advisory Fees Paid, Amount | $ 0 |

| InvestmentCompanyPortfolioTurnover | 40.00% |

| Additional Fund Statistics [Text Block] | |

| Holdings [Text Block] | |

| Material Fund Change [Text Block] |