Pay vs Performance Disclosure - USD ($)

|

12 Months Ended |

Feb. 02, 2025 |

Feb. 04, 2024 |

Feb. 05, 2023 |

Feb. 06, 2022 |

Jan. 31, 2021 |

| Pay vs Performance Disclosure |

|

|

|

|

|

| Pay vs Performance Disclosure, Table |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Average Summary Compensation Table Total for Non-PEO NEOs (d)($)(3) | Average Compensation Actually Paid to Non-PEO NEOs (e)($)(2) | | Value of Initial Fixed $100

Investment Based on: | | | Fiscal Year

(a) | Summary Compensation Table for PEO (b)($)(1) | Compensation Actually Paid to PEO (c)($)(2) | | Total

Shareholder

Return

(f)($) | Peer Group Total Shareholder Return (g)($)(4) | Net Income (Loss)

(in thousands)

(h)($) | Revenue

(in thousands)

(i)($) | | 2025 | 14,054,606 | | 45,732,638 | | 5,491,828 | | 14,660,598 | | | 381 | | 197 | | 106,739 | | 3,168,164 | | | 2024 | 36,650,048 | | 40,458,685 | | 13,349,070 | | 15,151,161 | | | 237 | | 166 | | 61,311 | | 2,830,621 | | | 2023 | 11,284,123 | | 15,303,936 | | 4,407,257 | | 6,151,443 | | | 168 | | 133 | | 73,071 | | 2,753,434 | | | 2022 | 9,794,382 | | 14,575,257 | | 3,961,982 | | 8,732,531 | | | 148 | | 141 | | (143,259) | | 2,180,848 | | | 2021 | 8,081,741 | | 14,452,520 | | 4,127,981 | | 8,083,765 | | | 130 | | 125 | | (282,076) | | 1,684,179 | |

|

|

|

|

|

| Company Selected Measure Name |

Revenue

|

|

|

|

|

| Named Executive Officers, Footnote |

Total Compensation as set forth in the Summary Compensation Table in this proxy statement. Mr. Giancarlo served as our Principal Executive Officer (PEO) in each of fiscal 2025, 2024, 2023, 2022 and 2021. Compensation in fiscal 2024 includes the incremental fair value of the PSU award earned by our PEO due to the modification of such award.Average of the Total Compensation as set forth in the Summary Compensation Table in the proxy statement for the applicable year for the named executive officers, other than our PEO, which are comprised of the following individuals: for 2023, 2024 and 2025, Messrs. Krysler, Colgrove, Singh and FitzSimons; for 2022, Messrs. Krysler, Colgrove and Singh; and for 2021, Messrs. Krysler, Colgrove and Paul Mountford. Compensation in fiscal 2024 includes the incremental fair value of the PSU awards earned by our NEOs due to the modification of such awards.

|

|

|

|

|

| Peer Group Issuers, Footnote |

Based on the NYSE Arca Tech 100 Index.

|

|

|

|

|

| PEO Total Compensation Amount |

$ 14,054,606

|

$ 36,650,048

|

$ 11,284,123

|

$ 9,794,382

|

$ 8,081,741

|

| PEO Actually Paid Compensation Amount |

$ 45,732,638

|

40,458,685

|

15,303,936

|

14,575,257

|

14,452,520

|

| Adjustment To PEO Compensation, Footnote |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | PEO | | 2025 ($) | | 2024 ($) | | 2023 ($) | | 2022 ($) | | 2021 ($) | | Summary Compensation Table (SCT) Total for PEO (column b) | | 14,054,606 | | | 36,650,048 | | | 11,284,123 | | | 9,794,382 | | | 8,081,741 | | | - Amounts reported in the SCT for equity awards (stock awards or options granted in the Covered Year) | | 12,143,667 | | | 35,023,555 | | | 9,469,212 | | | 7,735,478 | | | 6,695,186 | | | + Year-end fair value of unvested equity awards granted in the Covered Year | | 16,644,140 | | | 35,540,126 | | | 9,089,350 | | | 10,600,618 | | | 10,386,295 | | | + Fair value as of the vesting date for equity awards granted in the Covered Year that vested during the Covered Year | | — | | | — | | | — | | | — | | | — | | | +/- Change in fair value as of the end of the Covered Year (compared to the end of the prior fiscal year) for equity awards granted in prior fiscal years which are outstanding and unvested as of the end of the Covered Year | | 25,197,687 | | | 2,963,661 | | | 2,086,128 | | | 1,973,507 | | | 4,319,563 | | | +/- Change in fair value as of the vesting dates (compared to the end of the prior fiscal year) for equity awards granted in prior years that vested in the Covered Year | | 5,404,235 | | | 328,405 | | | 2,313,548 | | | (57,773) | | | (1,639,893) | | | - Fair value at the end of the prior fiscal year for equity awards granted in prior years that were forfeited during the Covered Year. | | 3,424,363 | | | — | | | — | | | — | | | — | | | CAP TO PEO (column c) | | 45,732,638 | | | 40,458,685 | | | 15,303,936 | | | 14,575,257 | | | 14,452,520 | |

|

|

|

|

|

| Non-PEO NEO Average Total Compensation Amount |

$ 5,491,828

|

13,349,070

|

4,407,257

|

3,961,982

|

4,127,981

|

| Non-PEO NEO Average Compensation Actually Paid Amount |

$ 14,660,598

|

15,151,161

|

6,151,443

|

8,732,531

|

8,083,765

|

| Adjustment to Non-PEO NEO Compensation Footnote |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | AVERAGE FOR NON-PEO NEOS | | 2025($) | | 2024($) | | 2023 ($) | | 2022 ($) | | 2021 ($) | | Summary Compensation Table (SCT) Total for PEO (column b) | | 5,491,828 | | | 13,349,070 | | | 4,407,257 | | | 3,961,982 | | | 4,127,981 | | | - Amounts reported in the SCT for equity awards (stock awards or options granted in the Covered Year) | | 4,320,343 | | | 12,258,207 | | | 3,195,871 | | | 2,642,954 | | | 3,050,029 | | | + Year-end fair value of unvested equity awards granted in the Covered Year | | 5,801,468 | | | 12,439,033 | | | 3,067,667 | | | 6,095,363 | | | 4,731,534 | | | + Fair value as of the vesting date for equity awards granted in the Covered Year that vested during the Covered Year | | 106,853 | | | — | | | — | | | — | | | — | | | +/- Change in fair value as of the end of the Covered Year (compared to the end of the prior fiscal year) for equity awards granted in prior fiscal years which are outstanding and unvested as of the end of the Covered Year | | 6,589,588 | | | 1,324,680 | | | 960,605 | | | 1,177,864 | | | 2,172,166 | | | +/- Change in fair value as of the vesting dates (compared to the end of the prior fiscal year) for equity awards granted in prior years that vested in the Covered Year | | 2,189,752 | | | 296,584 | | | 911,786 | | | 140,277 | | | 102,112 | | | - Fair value at the end of the prior fiscal year for equity awards granted in prior years that were forfeited during the Covered Year. | | 1,198,548 | | | — | | | — | | | — | | | — | | | AVERAGE CAP TO NON-PEO NEOs (column e) | | 14,660,598 | | | 15,151,161 | | | 6,151,443 | | | 8,732,531 | | | 8,083,765 | |

|

|

|

|

|

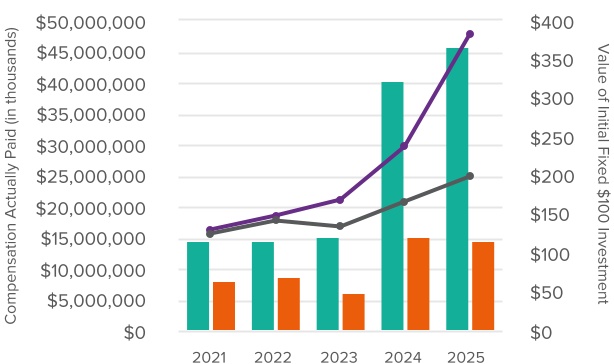

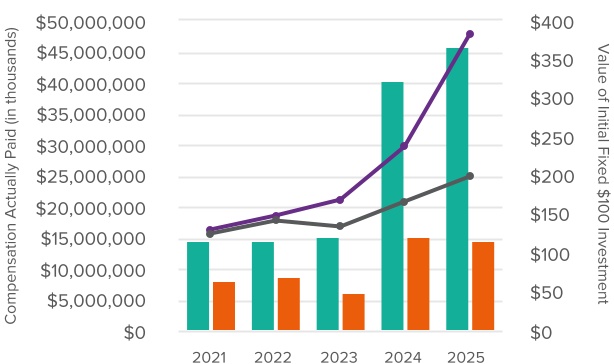

| Compensation Actually Paid vs. Total Shareholder Return |

Compensation Actually Paid vs. Company TSR & Peer Group TSR | | | | | | | | | | | | | | | | | | | | | | | | | PEO CAP | | Avg Non-PEO CAP | | Pure Storage TSR |  \ \ | Peer Group TSR |

|

|

|

|

|

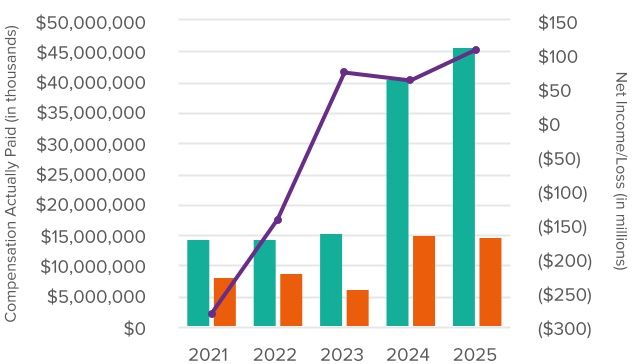

| Compensation Actually Paid vs. Net Income |

Compensation Actually Paid vs. Net Income | | | | | | | | | | | | | | | | | | | PEO CAP | | Avg Non-PEO CAP | | Net Income |

|

|

|

|

|

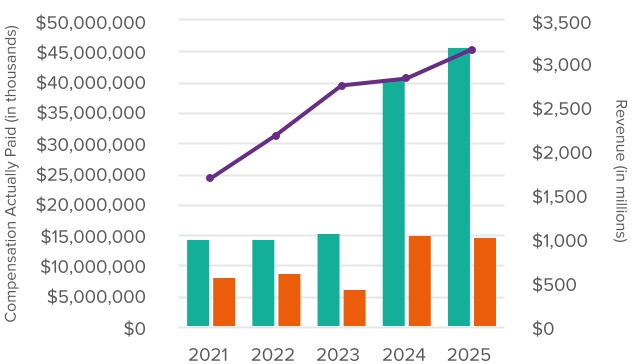

| Compensation Actually Paid vs. Company Selected Measure |

Compensation Actually Paid vs. Revenue | | | | | | | | | | | | | | | | | | | PEO CAP | | Avg Non-PEO CAP | | Revenue |

|

|

|

|

|

| Total Shareholder Return Vs Peer Group |

Compensation Actually Paid vs. Company TSR & Peer Group TSR | | | | | | | | | | | | | | | | | | | | | | | | | PEO CAP | | Avg Non-PEO CAP | | Pure Storage TSR |  \ \ | Peer Group TSR |

|

|

|

|

|

| Tabular List, Table |

| | | Revenue Non-GAAP Operating Profit Subscription Services Revenue Subscription ARR NPS |

|

|

|

|

|

| Total Shareholder Return Amount |

$ 381

|

237

|

168

|

148

|

130

|

| Peer Group Total Shareholder Return Amount |

197

|

166

|

133

|

141

|

125

|

| Net Income (Loss) |

$ 106,739,000

|

$ 61,311,000

|

$ 73,071,000

|

$ (143,259,000)

|

$ (282,076,000)

|

| Company Selected Measure Amount |

3,168,164,000

|

2,830,621,000

|

2,753,434,000

|

2,180,848,000

|

1,684,179,000

|

| PEO Name |

Mr. Giancarlo

|

Mr. Giancarlo

|

Mr. Giancarlo

|

Mr. Giancarlo

|

Mr. Giancarlo

|

| Additional 402(v) Disclosure |

We are providing the following information about the relationship between executive compensation actually paid (CAP), as defined under Item 402(v) of Regulation S-K, and certain financial performance measures of Pure. For further information concerning Pure’s variable pay-for-performance philosophy and how Pure aligns executive compensation with Pure’s performance, refer to “Executive Compensation – Compensation Discussion and Analysis.” The Compensation Actually Paid is determined in accordance with Item 402(v) of Regulation S-K. The fair value of stock options was determined using a Black-Scholes model, the fair value of PSUs reflect the probable outcome of the performance vesting conditions as of each measurement date, the fair value of RSUs was based on the stock price on the vesting date, and the fair value of the 5-Year PSU awards was determined using a Monte Carlo simulation model. For each covered year, the values included in column (c) for the CAP to our PEO and in column (e) for the average CAP to our non-PEO named executive officers reflect the adjustments set forth below. Pure does not maintain a pension plan and does not pay dividends on its common stock so no adjustments for these factors were necessary.

|

|

|

|

|

| Measure:: 1 |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Name |

Revenue

|

|

|

|

|

| Measure:: 2 |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Name |

Non-GAAP Operating Profit

|

|

|

|

|

| Measure:: 3 |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Name |

Subscription Services Revenue

|

|

|

|

|

| Measure:: 4 |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Name |

Subscription ARR

|

|

|

|

|

| Measure:: 5 |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Name |

NPS

|

|

|

|

|

| PEO | Aggregate Grant Date Fair Value of Equity Award Amounts Reported in Summary Compensation Table |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

$ (12,143,667)

|

$ (35,023,555)

|

$ (9,469,212)

|

$ (7,735,478)

|

$ (6,695,186)

|

| PEO | Year-end Fair Value of Equity Awards Granted in Covered Year that are Outstanding and Unvested |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

16,644,140

|

35,540,126

|

9,089,350

|

10,600,618

|

10,386,295

|

| PEO | Year-over-Year Change in Fair Value of Equity Awards Granted in Prior Years That are Outstanding and Unvested |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

25,197,687

|

2,963,661

|

2,086,128

|

1,973,507

|

4,319,563

|

| PEO | Vesting Date Fair Value of Equity Awards Granted and Vested in Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

0

|

0

|

0

|

0

|

0

|

| PEO | Change in Fair Value as of Vesting Date of Prior Year Equity Awards Vested in Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

5,404,235

|

328,405

|

2,313,548

|

(57,773)

|

(1,639,893)

|

| PEO | Prior Year End Fair Value of Equity Awards Granted in Any Prior Year that Fail to Meet Applicable Vesting Conditions During Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

(3,424,363)

|

0

|

0

|

0

|

0

|

| Non-PEO NEO | Aggregate Grant Date Fair Value of Equity Award Amounts Reported in Summary Compensation Table |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

(4,320,343)

|

(12,258,207)

|

(3,195,871)

|

(2,642,954)

|

(3,050,029)

|

| Non-PEO NEO | Year-end Fair Value of Equity Awards Granted in Covered Year that are Outstanding and Unvested |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

5,801,468

|

12,439,033

|

3,067,667

|

6,095,363

|

4,731,534

|

| Non-PEO NEO | Year-over-Year Change in Fair Value of Equity Awards Granted in Prior Years That are Outstanding and Unvested |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

6,589,588

|

1,324,680

|

960,605

|

1,177,864

|

2,172,166

|

| Non-PEO NEO | Vesting Date Fair Value of Equity Awards Granted and Vested in Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

106,853

|

0

|

0

|

0

|

0

|

| Non-PEO NEO | Change in Fair Value as of Vesting Date of Prior Year Equity Awards Vested in Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

2,189,752

|

296,584

|

911,786

|

140,277

|

102,112

|

| Non-PEO NEO | Prior Year End Fair Value of Equity Awards Granted in Any Prior Year that Fail to Meet Applicable Vesting Conditions During Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

$ (1,198,548)

|

$ 0

|

$ 0

|

$ 0

|

$ 0

|

\

\

\

\