What were the Fund costs for the period?

(based on a hypothetical $10,000 investment)

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|---|---|

Brendan Wood TopGun ETF | $48 | 0.95%¹ |

| ¹ | Annualized. The advisor waived part of its management fee to limit total expenses. Had the advisor not waived part of its management fee, costs would be higher. |

Key Fund Statistics

(as of February 28, 2025)

Fund Net Assets | $13,560,369 |

Number of Holdings | 25 |

Total Advisory Fee Paid | $49,286 |

Portfolio Turnover Rate | 10.49% |

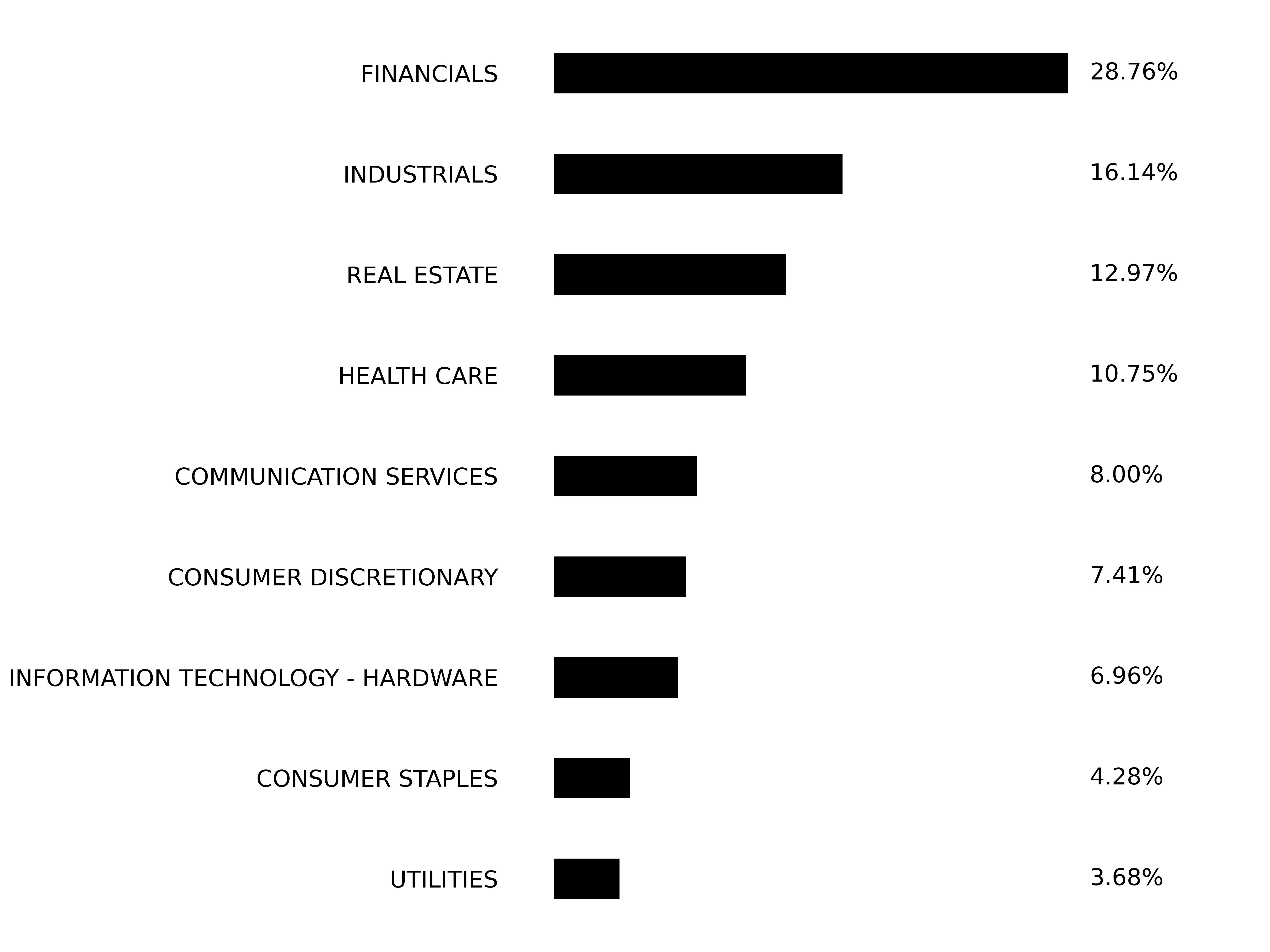

Sector Breakdown

Top Ten Holdings | |

|---|---|

Welltower, Inc. | |

T-Mobile US, Inc. | |

Prologis, Inc. | |

The Progressive Corp | |

Visa, Inc. Class A | |

Costco Wholesale Corp. | |

Marsh & McLennan Cos, Inc. | |

JPMorgan Chase & Co. | |

Waste Connections, Inc. | |

Mastercard, Inc. Class A |

| [1] | Annualized. The advisor waived part of its management fee to limit total expenses. Had the advisor not waived part of its management fee, costs would be higher. |