Shareholder Report

|

12 Months Ended |

|

Feb. 28, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

| Document Type |

N-CSR

|

| Amendment Flag |

false

|

| Registrant Name |

Schwab Investments

|

| Entity Central Index Key |

0000869365

|

| Entity Investment Company Type |

N-1A

|

| Document Period End Date |

Feb. 28, 2025

|

| Schwab Global Real Estate Fund [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Schwab Global Real Estate Fund

|

| Class Name |

Schwab Global Real Estate Fund

|

| Trading Symbol |

SWASX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the fund for the period of March 1, 2024, to February 28, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at www.schwabassetmanagement.com/prospectus . You can also request this information by calling or by sending an email request to orders@mysummaryprospectus.com .

|

| Additional Information Phone Number |

1-866-414-6349

|

| Additional Information Email |

orders@mysummaryprospectus.com

|

| Additional Information Website |

www.schwabassetmanagement.com/prospectus

|

| Expenses [Text Block] |

FUND COSTS FOR THE LAST year ENDED February 28, 2025 (BASED ON A HYPOTHETICAL $10,000 INVESTMENT)

|

|

|

Schwab Global Real Estate Fund |

|

|

|

| Expenses Paid, Amount |

$ 75

|

| Expense Ratio, Percent |

0.72%

|

| Factors Affecting Performance [Text Block] |

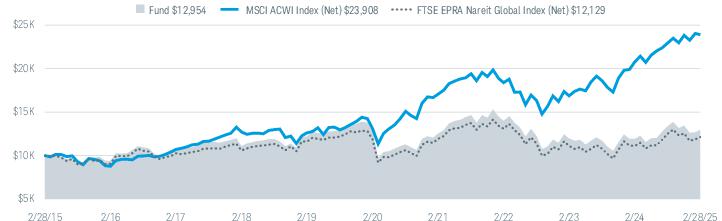

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE For the 12-month reporting period ended February 28, 2025, the fund returned 8.73%. The MSCI ACWI Index (Net) 1 , which serves as the fund’s regulatory index and provides a broad measure of market performance, returned 15.06%. The FTSE EPRA Nareit Global Index (Net) 1 which returned 9.22%, is the fund’s additional index, and is more representative of the fund’s investment universe than the regulatory index. ■ Real estate stocks underperformed the broader market ■ As of the end of the reporting period, the fund held securities in 21 countries ■ Top detractors from total return: ● Indonesian securities, including Ciputra Development Tbk. PT ■ Top contributors to total return: ● Securities from the United States, including Welltower, Inc. ● Securities from the United Arab Emirates ■ From an individual security perspective: ● Prologis, Inc. was the largest detractor from total return ● Welltower, Inc. was the largest contributor to total return Portfolio holdings may have changed since the report date. The net version of the index reflects reinvested dividends net of withholding taxes but reflects no deductions for expenses or other taxes. |

| Performance Past Does Not Indicate Future [Text] |

The performance data quoted represents past performance. Past performance does not guarantee future results.

|

| Line Graph [Table Text Block] |

Performance of Hypothetical $10,000 Investment (February 28, 2015 - February 28, 2025) All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized. For index definitions, please see www.schwabassetmanagement.com/glossary. Fund expenses may have been partially absorbed by the investment adviser and its affiliates. Without these reductions, the fund’s returns may have been lower. Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The fund’s performance relative to the index may be affected by fair-value pricing and timing differences in foreign exchange calculations. The net version of the index reflects reinvested dividends net of withholding taxes but reflects no deductions for expenses or other taxes. Due to new regulatory requirements, the fund’s regulatory index has changed from the FTSE EPRA Nareit Global Index (Net) to the MSCI ACWI Index (Net). The MSCI ACWI Index (Net) provides a broad measure of market performance. The FTSE EPRA Nareit Global Index (Net) is the fund’s additional index and is more representative of the fund’s investment universe than the regulatory index. |

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

|

|

|

|

Fund: Schwab Global Real Estate Fund (05/31/2007) 1,2 |

|

|

|

|

|

|

|

FTSE EPRA Nareit Global Index (Net) 3 |

|

|

| All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized. For index definitions, please see www.schwabassetmanagement.com/glossary. Fund expenses may have been partially absorbed by the investment adviser and its affiliates. Without these reductions, the fund’s returns may have been lower. Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The fund’s performance relative to the index may be affected by fair-value pricing and timing differences in foreign exchange calculations. The net version of the index reflects reinvested dividends net of withholding taxes but reflects no deductions for expenses or other taxes. Due to new regulatory requirements, the fund’s regulatory index has changed from the FTSE EPRA Nareit Global Index (Net) to the MSCI ACWI Index (Net). The MSCI ACWI Index (Net) provides a broad measure of market performance. The FTSE EPRA Nareit Global Index (Net) is the fund’s additional index and is more representative of the fund’s investment universe than the regulatory index. |

| Performance Inception Date |

May 31, 2007

|

| No Deduction of Taxes [Text Block] |

Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption of fund shares.

|

| Updated Performance Information Location [Text Block] |

To obtain performance information current to the most recent month end, please visit www.schwabassetmanagement.com/prospectus |

| Net Assets |

$ 290,391,000

|

| Holdings Count | Holding |

107

|

| Advisory Fees Paid, Amount |

$ 1,482,336

|

| Investment Company, Portfolio Turnover |

85.00%

|

| Additional Fund Statistics [Text Block] |

|

|

|

|

|

|

Advisory Fees Paid by the Fund |

|

Weighted Average Market Cap (millions) |

|

Price/Earnings Ratio (P/E) |

|

|

|

Qualified Dividend Income |

|

Qualified Business Income Deduction (199A) |

|

|

| Holdings [Text Block] |

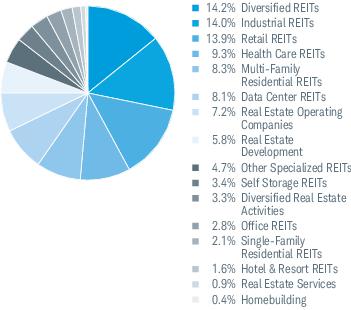

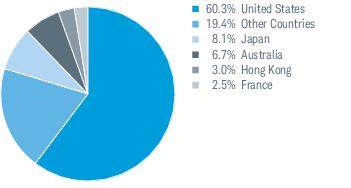

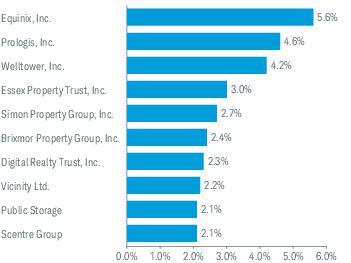

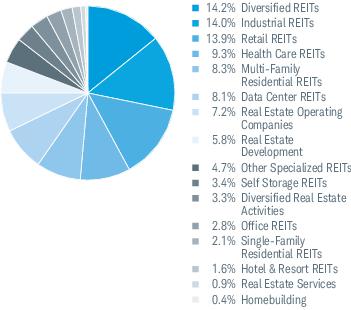

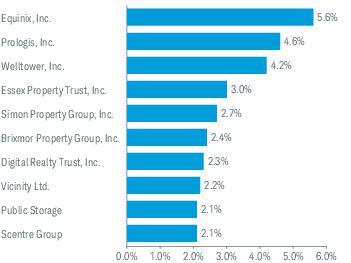

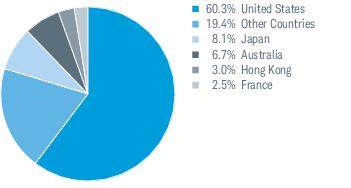

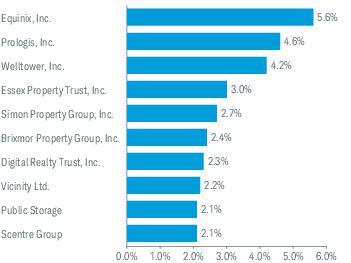

Industry Weightings % of Investments  Top Holdings % of Net Assets  Country Weightings % of Investments  Portfolio holdings may have changed since the report date . The Sector/Industry classifications in this report use the Global Industry Classification Standard (GICS) which was developed by and is the exclusive property of MSCI Inc. (MSCI) and Standard & Poor’s (S&P). GICS is a service mark of MSCI and S&P and has been licensed for use by Charles Schwab & Co., Inc. |

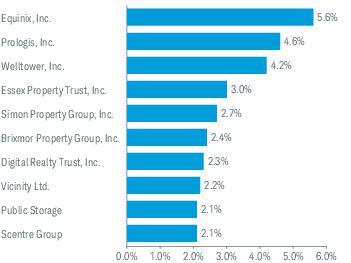

| Largest Holdings [Text Block] |

Top Holdings % of Net Assets  Portfolio holdings may have changed since the report date . |