Shareholder Report

|

6 Months Ended |

|

Feb. 28, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

|

| Document Type |

N-CSRS

|

|

| Amendment Flag |

false

|

|

| Registrant Name |

Invesco Exchange-Traded Fund Trust II

|

|

| Entity Central Index Key |

0001378872

|

|

| Entity Investment Company Type |

N-1A

|

|

| Document Period End Date |

Feb. 28, 2025

|

|

| C000053046 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Invesco Equal Weight 0-30 Year Treasury ETF

|

|

| Class Name |

Invesco Equal Weight 0-30 Year Treasury ETF

|

|

| Trading Symbol |

GOVI

|

|

| Security Exchange Name |

NASDAQ

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Invesco Equal Weight 0-30 Year Treasury ETF (the “Fund”) for the period September 1, 2024 to February 28, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

|

|

| Additional Information Phone Number |

(800) 983-0903

|

|

| Additional Information Website |

invesco.com/reports

|

|

| Expenses [Text Block] |

What Were The Fund Costs For The Last Six Months ?

(Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment* |

| Invesco Equal Weight 0-30 Year Treasury ETF |

$7 |

0.15% |

|

|

| Expenses Paid, Amount |

$ 7

|

|

| Expense Ratio, Percent |

0.15%

|

[1] |

| Net Assets |

$ 1,049,900,096

|

|

| Holdings Count | Holding |

31

|

|

| Investment Company Portfolio Turnover |

11.00%

|

|

| Additional Fund Statistics [Text Block] |

What Are Key Statistics About The Fund?

(as of February 28, 2025)

| Fund net assets |

$1,049,900,096 |

| Total number of portfolio holdings |

31 |

| Portfolio turnover rate |

11% |

|

|

| Holdings [Text Block] |

What Comprised The Fund's Holdings?

(as of February 28, 2025)

Top ten holdings*

(% of net assets)

| U.S. Treasury Bonds, 2.25%, 02/15/2052 |

3.35% |

| U.S. Treasury Bonds, 1.88%, 02/15/2051 |

3.35% |

| U.S. Treasury Bonds, 2.00%, 02/15/2050 |

3.35% |

| U.S. Treasury Bonds, 4.63%, 02/15/2055 |

3.35% |

| U.S. Treasury Bonds, 3.63%, 02/15/2053 |

3.35% |

| U.S. Treasury Bonds, 4.25%, 02/15/2054 |

3.35% |

| U.S. Treasury Bonds, 3.00%, 02/15/2049 |

3.34% |

| U.S. Treasury Bonds, 3.00%, 02/15/2048 |

3.34% |

| U.S. Treasury Bonds, 3.00%, 02/15/2047 |

3.34% |

| U.S. Treasury Bonds, 2.50%, 02/15/2046 |

3.34% |

| * Excluding money market fund holdings, if any. |

|

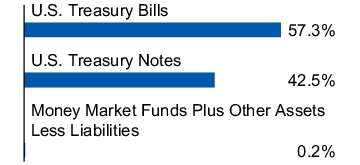

Duration allocation

(% of net assets)

|

|

| Largest Holdings [Text Block] |

Top ten holdings*

(% of net assets)

| U.S. Treasury Bonds, 2.25%, 02/15/2052 |

3.35% |

| U.S. Treasury Bonds, 1.88%, 02/15/2051 |

3.35% |

| U.S. Treasury Bonds, 2.00%, 02/15/2050 |

3.35% |

| U.S. Treasury Bonds, 4.63%, 02/15/2055 |

3.35% |

| U.S. Treasury Bonds, 3.63%, 02/15/2053 |

3.35% |

| U.S. Treasury Bonds, 4.25%, 02/15/2054 |

3.35% |

| U.S. Treasury Bonds, 3.00%, 02/15/2049 |

3.34% |

| U.S. Treasury Bonds, 3.00%, 02/15/2048 |

3.34% |

| U.S. Treasury Bonds, 3.00%, 02/15/2047 |

3.34% |

| U.S. Treasury Bonds, 2.50%, 02/15/2046 |

3.34% |

| * Excluding money market fund holdings, if any. |

|

|

|

| C000053049 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Invesco Preferred ETF

|

|

| Class Name |

Invesco Preferred ETF

|

|

| Trading Symbol |

PGX

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Invesco Preferred ETF (the “Fund”) for the period September 1, 2024 to February 28, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

|

|

| Additional Information Phone Number |

(800) 983-0903

|

|

| Additional Information Website |

invesco.com/reports

|

|

| Expenses [Text Block] |

What Were The Fund Costs For The Last Six Months ?

(Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment* |

| Invesco Preferred ETF |

$25 |

0.50% |

|

|

| Expenses Paid, Amount |

$ 25

|

|

| Expense Ratio, Percent |

0.50%

|

[2] |

| Net Assets |

$ 4,308,766,775

|

|

| Holdings Count | Holding |

261

|

|

| Investment Company Portfolio Turnover |

4.00%

|

|

| Additional Fund Statistics [Text Block] |

What Are Key Statistics About The Fund?

(as of February 28, 2025)

| Fund net assets |

$4,308,766,775 |

| Total number of portfolio holdings |

261 |

| Portfolio turnover rate |

4% |

|

|

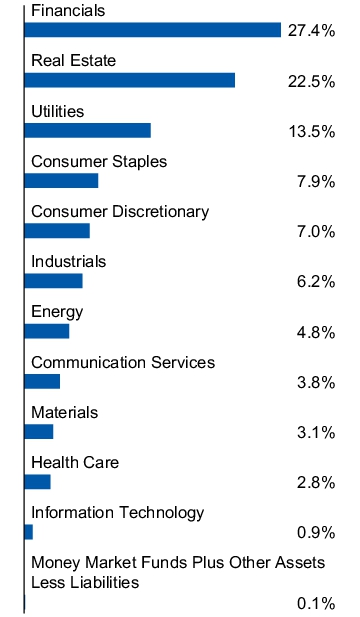

| Holdings [Text Block] |

What Comprised The Fund's Holdings?

(as of February 28, 2025)

Top ten holdings*

(% of net assets)

| JPMorgan Chase & Co., Series EE, Pfd., 6.00% |

1.77% |

| JPMorgan Chase & Co., Series DD, Pfd., 5.75% |

1.60% |

| Wells Fargo & Co., Series Z, Pfd., 4.75% |

1.56% |

| JPMorgan Chase & Co., Series MM, Pfd., 4.20% |

1.45% |

| JPMorgan Chase & Co., Series LL, Pfd., 4.63% |

1.45% |

| AT&T, Inc., Series C, Pfd., 4.75% |

1.31% |

| Bank of America Corp., Series GG, Pfd., 6.00% |

1.30% |

| Bank of America Corp., Series KK, Pfd., 5.38% |

1.25% |

| AT&T, Inc., Pfd., 5.35% 11/01/2066 |

1.19% |

| JPMorgan Chase & Co., Series JJ, Pfd., 4.55% |

1.16% |

| * Excluding money market fund holdings, if any. |

|

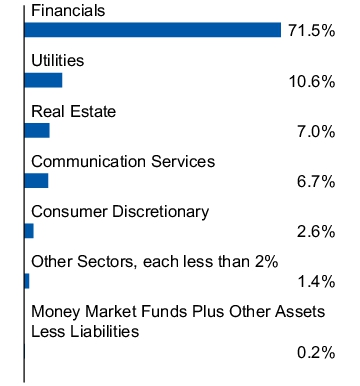

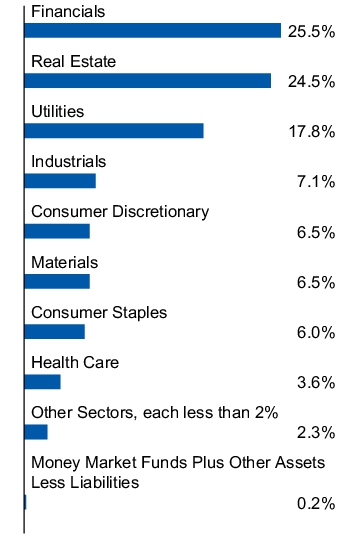

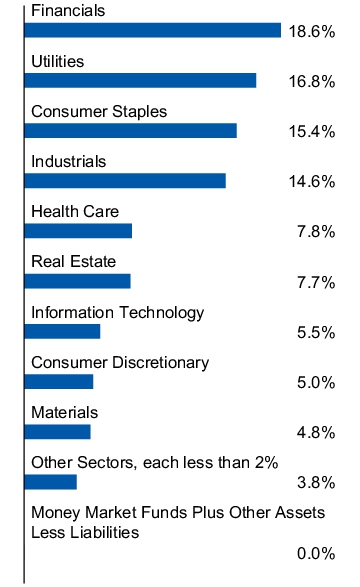

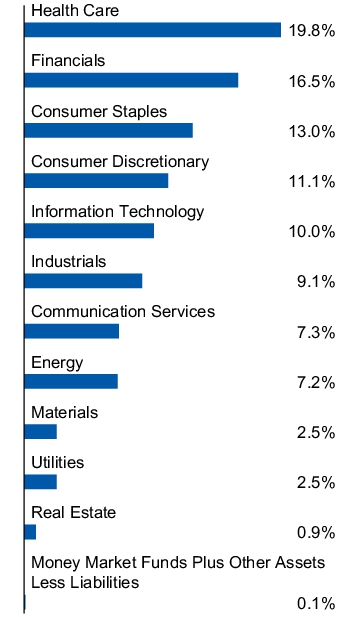

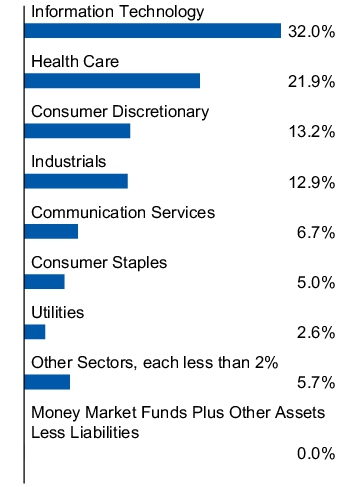

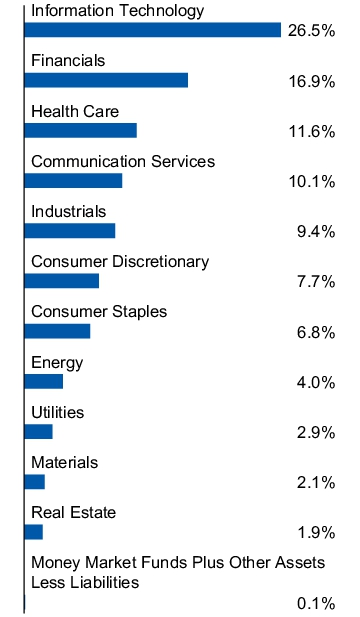

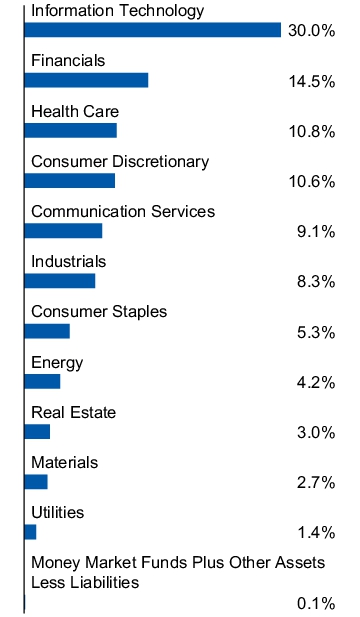

Sector allocation

(% of net assets)

|

|

| Largest Holdings [Text Block] |

Top ten holdings*

(% of net assets)

| JPMorgan Chase & Co., Series EE, Pfd., 6.00% |

1.77% |

| JPMorgan Chase & Co., Series DD, Pfd., 5.75% |

1.60% |

| Wells Fargo & Co., Series Z, Pfd., 4.75% |

1.56% |

| JPMorgan Chase & Co., Series MM, Pfd., 4.20% |

1.45% |

| JPMorgan Chase & Co., Series LL, Pfd., 4.63% |

1.45% |

| AT&T, Inc., Series C, Pfd., 4.75% |

1.31% |

| Bank of America Corp., Series GG, Pfd., 6.00% |

1.30% |

| Bank of America Corp., Series KK, Pfd., 5.38% |

1.25% |

| AT&T, Inc., Pfd., 5.35% 11/01/2066 |

1.19% |

| JPMorgan Chase & Co., Series JJ, Pfd., 4.55% |

1.16% |

| * Excluding money market fund holdings, if any. |

|

|

|

| C000053051 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Invesco Fundamental High Yield® Corporate Bond ETF

|

|

| Class Name |

Invesco Fundamental High Yield® Corporate Bond ETF

|

|

| Trading Symbol |

PHB

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Invesco Fundamental High Yield® Corporate Bond ETF (the “Fund”) for the period September 1, 2024 to February 28, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

|

|

| Additional Information Phone Number |

(800) 983-0903

|

|

| Additional Information Website |

invesco.com/reports

|

|

| Expenses [Text Block] |

What Were The Fund Costs For The Last Six Months ? (Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment* |

| Invesco Fundamental High Yield® Corporate Bond ETF |

$25 |

0.50% |

|

|

| Expenses Paid, Amount |

$ 25

|

|

| Expense Ratio, Percent |

0.50%

|

[3] |

| Net Assets |

$ 332,873,166

|

|

| Holdings Count | Holding |

262

|

|

| Investment Company Portfolio Turnover |

17.00%

|

|

| Additional Fund Statistics [Text Block] |

What Are Key Statistics About The Fund? (as of February 28, 2025)

| Fund net assets |

$332,873,166 |

| Total number of portfolio holdings |

262 |

| Portfolio turnover rate |

17% |

|

|

| Holdings [Text Block] |

What Comprised The Fund's Holdings? (as of February 28, 2025) Top ten holdings*

(% of net assets)

| Synchrony Financial, 7.25%, 02/02/2033 |

1.21% |

| United AirLines, Inc., 4.63%, 04/15/2029 |

1.10% |

| Windsor Holdings III LLC, 8.50%, 06/15/2030 |

0.99% |

| Ford Motor Credit Co. LLC, 3.38%, 11/13/2025 |

0.99% |

| Ford Motor Co., 3.25%, 02/12/2032 |

0.98% |

| PG&E Corp., 5.25%, 07/01/2030 |

0.87% |

| Walgreens Boots Alliance, Inc., 3.45%, 06/01/2026 |

0.85% |

| Tenet Healthcare Corp., 6.13%, 06/15/2030 |

0.81% |

| Walgreens Boots Alliance, Inc., 3.20%, 04/15/2030 |

0.80% |

| DPL, Inc., 4.13%, 07/01/2025 |

0.80% |

| * Excluding money market fund holdings, if any. |

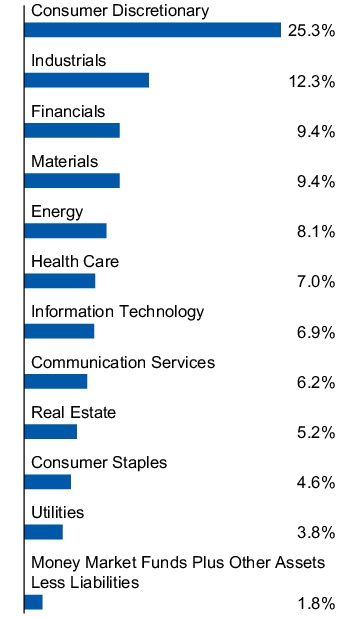

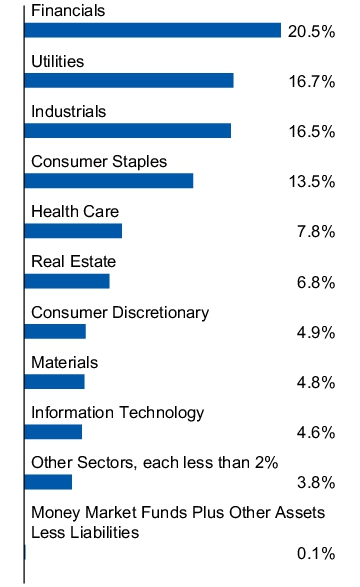

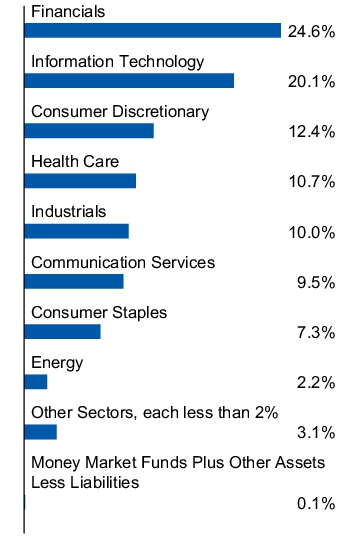

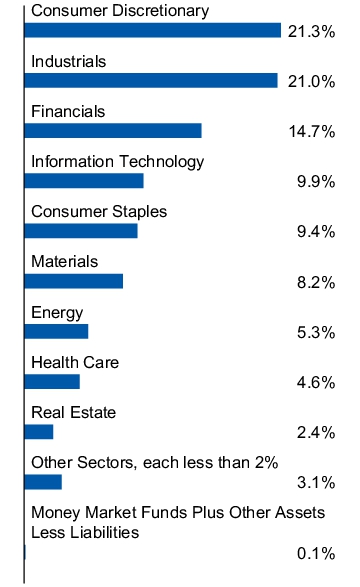

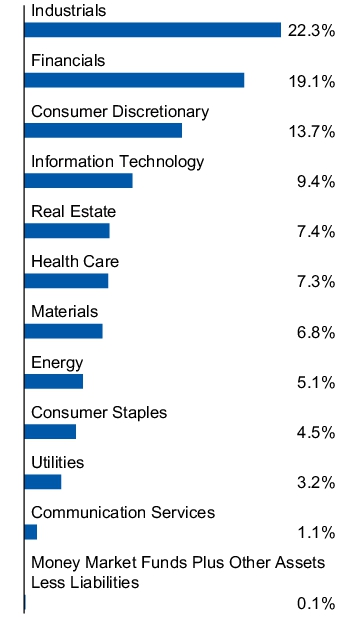

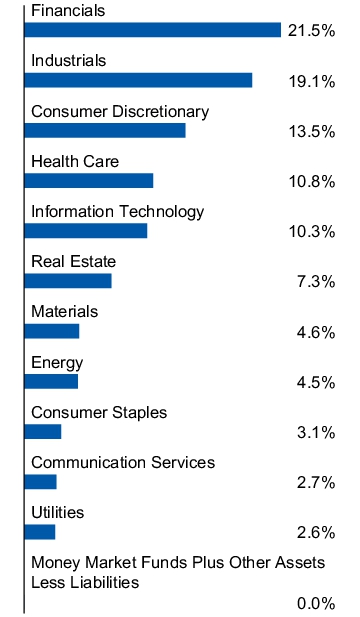

| Sector allocation

(% of net assets)

|

|

| Largest Holdings [Text Block] |

Top ten holdings*

(% of net assets)

| Synchrony Financial, 7.25%, 02/02/2033 |

1.21% |

| United AirLines, Inc., 4.63%, 04/15/2029 |

1.10% |

| Windsor Holdings III LLC, 8.50%, 06/15/2030 |

0.99% |

| Ford Motor Credit Co. LLC, 3.38%, 11/13/2025 |

0.99% |

| Ford Motor Co., 3.25%, 02/12/2032 |

0.98% |

| PG&E Corp., 5.25%, 07/01/2030 |

0.87% |

| Walgreens Boots Alliance, Inc., 3.45%, 06/01/2026 |

0.85% |

| Tenet Healthcare Corp., 6.13%, 06/15/2030 |

0.81% |

| Walgreens Boots Alliance, Inc., 3.20%, 04/15/2030 |

0.80% |

| DPL, Inc., 4.13%, 07/01/2025 |

0.80% |

| * Excluding money market fund holdings, if any. |

|

|

|

| C000053071 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Invesco National AMT-Free Municipal Bond ETF

|

|

| Class Name |

Invesco National AMT-Free Municipal Bond ETF

|

|

| Trading Symbol |

PZA

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Invesco National AMT-Free Municipal Bond ETF (the “Fund”) for the period September 1, 2024 to February 28, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

|

|

| Additional Information Phone Number |

(800) 983-0903

|

|

| Additional Information Website |

invesco.com/reports

|

|

| Expenses [Text Block] |

What Were The Fund Costs For The Last Six Months ?

(Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment* |

| Invesco National AMT-Free Municipal Bond ETF |

$14 |

0.28% |

|

|

| Expenses Paid, Amount |

$ 14

|

|

| Expense Ratio, Percent |

0.28%

|

[4] |

| Net Assets |

$ 3,122,085,403

|

|

| Holdings Count | Holding |

3,269

|

|

| Investment Company Portfolio Turnover |

0.00%

|

|

| Additional Fund Statistics [Text Block] |

What Are Key Statistics About The Fund? (as of February 28, 2025)

| Fund net assets |

$3,122,085,403 |

| Total number of portfolio holdings |

3,269 |

| Portfolio turnover rate |

0% |

|

|

| Holdings [Text Block] |

What Comprised The Fund's Holdings?

(as of February 28, 2025)

Top ten holdings

(% of net assets)

| Massachusetts (Commonwealth of), Series 2022 E, GO Bonds, 5.00%, 11/01/2048 |

0.59% |

| San Diego Unified School District (Election of 2012), Series 2020 M-2, GO Bonds, 4.00%, 07/01/2050 |

0.45% |

| Colorado (State of) Health Facilities Authority (Adventhealth Obligated Group), Series 2021 A, Ref. RB, 4.00%, 11/15/2050 |

0.45% |

| California (State of), Series 2023, Ref. GO Bonds, 5.00%, 09/01/2043 |

0.36% |

| Grand Parkway Transportation Corp. (TELA Supported), Series 2018 A, RB, 5.00%, 10/01/2043 |

0.34% |

| Triborough Bridge & Tunnel Authority (MTA Bridges & Tunnels), Series 2017 C-2, RB, 5.00%, 11/15/2042 |

0.32% |

| New York (City of), NY Municipal Water Finance Authority, Series 2021 BB-1, Ref. RB, 5.00%, 06/15/2044 |

0.31% |

| Licking Heights Local School District, Series 2022, GO Bonds, 5.50%, 10/01/2059 |

0.31% |

| Baltimore (City of), MD (Water), Series 2017 A, RB, 5.00%, 07/01/2046 |

0.31% |

| University of California, Series 2016 AR, Ref. RB, 5.00%, 05/15/2046 |

0.31% |

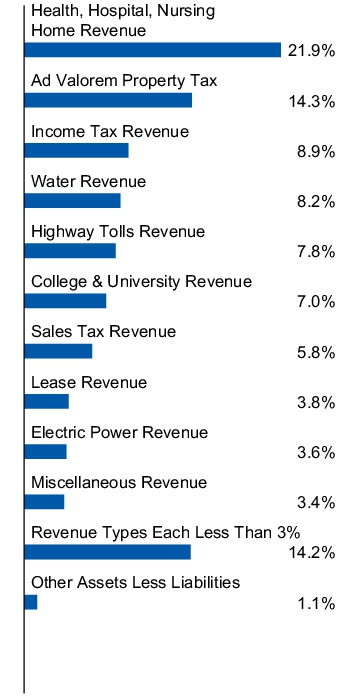

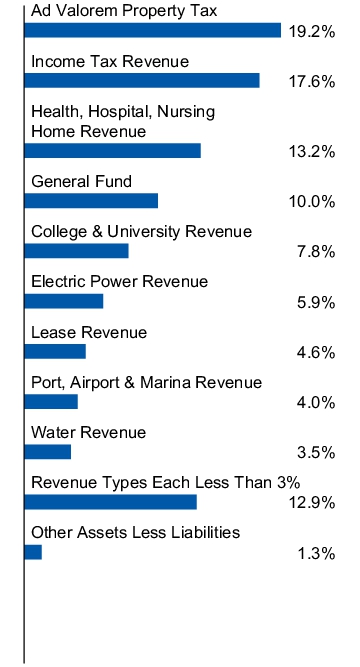

Revenue type allocation

(% of net assets)

|

|

| Largest Holdings [Text Block] |

Top ten holdings

(% of net assets)

| Massachusetts (Commonwealth of), Series 2022 E, GO Bonds, 5.00%, 11/01/2048 |

0.59% |

| San Diego Unified School District (Election of 2012), Series 2020 M-2, GO Bonds, 4.00%, 07/01/2050 |

0.45% |

| Colorado (State of) Health Facilities Authority (Adventhealth Obligated Group), Series 2021 A, Ref. RB, 4.00%, 11/15/2050 |

0.45% |

| California (State of), Series 2023, Ref. GO Bonds, 5.00%, 09/01/2043 |

0.36% |

| Grand Parkway Transportation Corp. (TELA Supported), Series 2018 A, RB, 5.00%, 10/01/2043 |

0.34% |

| Triborough Bridge & Tunnel Authority (MTA Bridges & Tunnels), Series 2017 C-2, RB, 5.00%, 11/15/2042 |

0.32% |

| New York (City of), NY Municipal Water Finance Authority, Series 2021 BB-1, Ref. RB, 5.00%, 06/15/2044 |

0.31% |

| Licking Heights Local School District, Series 2022, GO Bonds, 5.50%, 10/01/2059 |

0.31% |

| Baltimore (City of), MD (Water), Series 2017 A, RB, 5.00%, 07/01/2046 |

0.31% |

| University of California, Series 2016 AR, Ref. RB, 5.00%, 05/15/2046 |

0.31% |

|

|

| C000053072 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Invesco Taxable Municipal Bond ETF

|

|

| Class Name |

Invesco Taxable Municipal Bond ETF

|

|

| Trading Symbol |

BAB

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Invesco Taxable Municipal Bond ETF (the “Fund”) for the period September 1, 2024 to February 28, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

|

|

| Additional Information Phone Number |

(800) 983-0903

|

|

| Additional Information Website |

invesco.com/reports

|

|

| Expenses [Text Block] |

What Were The Fund Costs For The Last Six Months ? (Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment* |

| Invesco Taxable Municipal Bond ETF |

$14 |

0.28% |

|

|

| Expenses Paid, Amount |

$ 14

|

|

| Expense Ratio, Percent |

0.28%

|

[5] |

| Net Assets |

$ 982,967,405

|

|

| Holdings Count | Holding |

628

|

|

| Investment Company Portfolio Turnover |

3.00%

|

|

| Additional Fund Statistics [Text Block] |

What Are Key Statistics About The Fund? (as of February 28, 2025)

| Fund net assets |

$982,967,405 |

| Total number of portfolio holdings |

628 |

| Portfolio turnover rate |

3% |

|

|

| Holdings [Text Block] |

What Comprised The Fund's Holdings? (as of February 28, 2025) Top ten holdings

(% of net assets)

| California (State of), Series 2009, GO Bonds, 7.55%, 04/01/2039 |

1.32% |

| Illinois (State of), Series 2010 2, GO Bonds, 6.90%, 03/01/2035 |

1.03% |

| Board of Regents of the University of Texas System, Series 2010 C, RB, 4.64%, 08/15/2030 |

1.01% |

| California (State of), Series 2009, GO Bonds, 7.35%, 11/01/2039 |

0.99% |

| Metro, Series 2019, GO Bonds, 3.25%, 06/01/2028 |

0.99% |

| California (State of), Series 2010, GO Bonds, 7.60%, 11/01/2040 |

0.91% |

| New York (City of), NY, Series 2010 G-1, GO Bonds, 5.97%, 03/01/2036 |

0.90% |

| California (State of), Series 2009, GO Bonds, 7.50%, 04/01/2034 |

0.88% |

| California (State of), Series 2023, GO Bonds, 5.10%, 03/01/2029 |

0.84% |

| Massachusetts (Commonwealth of), Series 2010 A, GO Bonds, 4.91%, 05/01/2029 |

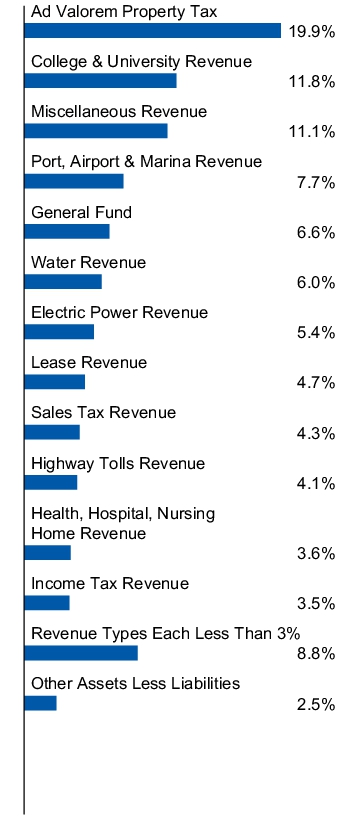

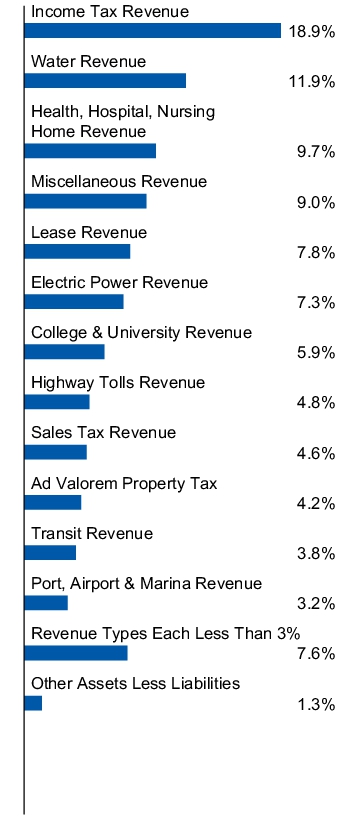

0.80% | Revenue type allocation

(% of net assets)

|

|

| Largest Holdings [Text Block] |

Top ten holdings

(% of net assets)

| California (State of), Series 2009, GO Bonds, 7.55%, 04/01/2039 |

1.32% |

| Illinois (State of), Series 2010 2, GO Bonds, 6.90%, 03/01/2035 |

1.03% |

| Board of Regents of the University of Texas System, Series 2010 C, RB, 4.64%, 08/15/2030 |

1.01% |

| California (State of), Series 2009, GO Bonds, 7.35%, 11/01/2039 |

0.99% |

| Metro, Series 2019, GO Bonds, 3.25%, 06/01/2028 |

0.99% |

| California (State of), Series 2010, GO Bonds, 7.60%, 11/01/2040 |

0.91% |

| New York (City of), NY, Series 2010 G-1, GO Bonds, 5.97%, 03/01/2036 |

0.90% |

| California (State of), Series 2009, GO Bonds, 7.50%, 04/01/2034 |

0.88% |

| California (State of), Series 2023, GO Bonds, 5.10%, 03/01/2029 |

0.84% |

| Massachusetts (Commonwealth of), Series 2010 A, GO Bonds, 4.91%, 05/01/2029 |

0.80% |

|

|

| C000053967 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Invesco California AMT-Free Municipal Bond ETF

|

|

| Class Name |

Invesco California AMT-Free Municipal Bond ETF

|

|

| Trading Symbol |

PWZ

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Invesco California AMT-Free Municipal Bond ETF (the “Fund”) for the period September 1, 2024 to February 28, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

|

|

| Additional Information Phone Number |

(800) 983-0903

|

|

| Additional Information Website |

invesco.com/reports

|

|

| Expenses [Text Block] |

What Were The Fund Costs For The Last Six Months ? (Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment* |

| Invesco California AMT-Free Municipal Bond ETF |

$14 |

0.28% |

|

|

| Expenses Paid, Amount |

$ 14

|

|

| Expense Ratio, Percent |

0.28%

|

[6] |

| Net Assets |

$ 724,107,226

|

|

| Holdings Count | Holding |

667

|

|

| Investment Company Portfolio Turnover |

1.00%

|

|

| Additional Fund Statistics [Text Block] |

What Are Key Statistics About The Fund? (as of February 28, 2025)

| Fund net assets |

$724,107,226 |

| Total number of portfolio holdings |

667 |

| Portfolio turnover rate |

1% |

|

|

| Holdings [Text Block] |

What Comprised The Fund's Holdings? (as of February 28, 2025) Top ten holdings

(% of net assets)

| California (State of) Health Facilities Financing Authority (Kaiser Permanente), Subseries 2017 A-2, RB, 5.00%, 11/01/2047 |

0.96% |

| California (State of) Health Facilities Financing Authority (Kaiser Permanente), Subseries 2017 A-2, RB, 4.00%, 11/01/2044 |

0.95% |

| Regents of the University of California Medical Center, Series 2022 P, RB, 5.00%, 05/15/2047 |

0.77% |

| California (State of) Health Facilities Financing Authority (Cedars-Sinai Medical Center), Series 2021 A, Ref. RB, 4.00%, 08/15/2048 |

0.73% |

| Los Angeles Unified School District, Series 2020 RYQ, GO Bonds, 4.00%, 07/01/2044 |

0.71% |

| Sacramento (City of), CA Area Flood Control Agency (Consolidated Capital Assessment District No.2), Series 2016, Ref. RB, 5.00%, 10/01/2047 |

0.71% |

| California (State of) Educational Facilities Authority (Stanford University), Series 2019 V-1, RB, 5.00%, 05/01/2049 |

0.70% |

| San Diego Unified School District (Election of 2012), Series 2019 L, GO Bonds, 4.00%, 07/01/2049 |

0.63% |

| California (State of), Series 2023, Ref. GO Bonds, 5.00%, 10/01/2042 |

0.63% |

| Sacramento (City of), CA Municipal Utility District (Green Bonds), Series 2020 H, RB, 5.00%, 08/15/2050 |

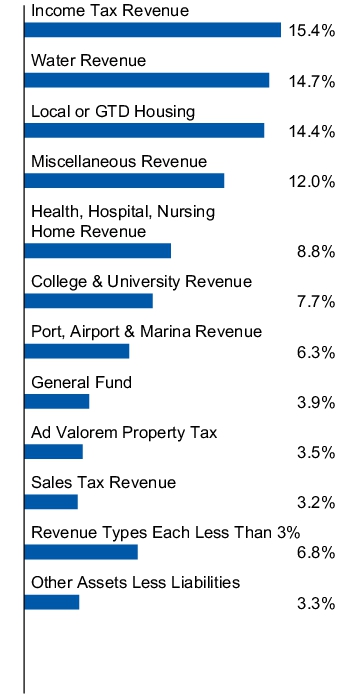

0.58% | Revenue type allocation

(% of net assets)

|

|

| Largest Holdings [Text Block] |

Top ten holdings

(% of net assets)

| California (State of) Health Facilities Financing Authority (Kaiser Permanente), Subseries 2017 A-2, RB, 5.00%, 11/01/2047 |

0.96% |

| California (State of) Health Facilities Financing Authority (Kaiser Permanente), Subseries 2017 A-2, RB, 4.00%, 11/01/2044 |

0.95% |

| Regents of the University of California Medical Center, Series 2022 P, RB, 5.00%, 05/15/2047 |

0.77% |

| California (State of) Health Facilities Financing Authority (Cedars-Sinai Medical Center), Series 2021 A, Ref. RB, 4.00%, 08/15/2048 |

0.73% |

| Los Angeles Unified School District, Series 2020 RYQ, GO Bonds, 4.00%, 07/01/2044 |

0.71% |

| Sacramento (City of), CA Area Flood Control Agency (Consolidated Capital Assessment District No.2), Series 2016, Ref. RB, 5.00%, 10/01/2047 |

0.71% |

| California (State of) Educational Facilities Authority (Stanford University), Series 2019 V-1, RB, 5.00%, 05/01/2049 |

0.70% |

| San Diego Unified School District (Election of 2012), Series 2019 L, GO Bonds, 4.00%, 07/01/2049 |

0.63% |

| California (State of), Series 2023, Ref. GO Bonds, 5.00%, 10/01/2042 |

0.63% |

| Sacramento (City of), CA Municipal Utility District (Green Bonds), Series 2020 H, RB, 5.00%, 08/15/2050 |

0.58% |

|

|

| C000053968 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Invesco New York AMT-Free Municipal Bond ETF

|

|

| Class Name |

Invesco New York AMT-Free Municipal Bond ETF

|

|

| Trading Symbol |

PZT

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Invesco New York AMT-Free Municipal Bond ETF (the “Fund”) for the period September 1, 2024 to February 28, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

|

|

| Additional Information Phone Number |

(800) 983-0903

|

|

| Additional Information Website |

invesco.com/reports

|

|

| Expenses [Text Block] |

What Were The Fund Costs For The Last Six Months ? (Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment* |

| Invesco New York AMT-Free Municipal Bond ETF |

$14 |

0.28% |

|

|

| Expenses Paid, Amount |

$ 14

|

|

| Expense Ratio, Percent |

0.28%

|

[7] |

| Net Assets |

$ 139,392,170

|

|

| Holdings Count | Holding |

409

|

|

| Investment Company Portfolio Turnover |

3.00%

|

|

| Additional Fund Statistics [Text Block] |

What Are Key Statistics About The Fund? (as of February 28, 2025)

| Fund net assets |

$139,392,170 |

| Total number of portfolio holdings |

409 |

| Portfolio turnover rate |

3% |

|

|

| Holdings [Text Block] |

What Comprised The Fund's Holdings? (as of February 28, 2025) Top ten holdings

(% of net assets)

| New York (State of) Power Authority (Green Transmission) (Green Bonds), Series 2022, RB, 4.00%, 11/15/2052 |

2.75% |

| Battery Park (City of), NY Authority (Green Bonds), Series 2019 A, RB, 5.00%, 11/01/2049 |

1.89% |

| Triborough Bridge & Tunnel Authority (MTA Bridges & Tunnels), Series 2021 A, RB, 5.00%, 11/15/2051 |

1.89% |

| New York (State of) Dormitory Authority (Bidding Group 3), Series 2017 B, Ref. RB, 4.00%, 02/15/2044 |

1.75% |

| Triborough Bridge & Tunnel Authority (MTA Bridges & Tunnels), Series 2022 A, Ref. RB, 5.00%, 05/15/2047 |

1.63% |

| New York (City of), NY Municipal Water Finance Authority, Series 2021 AA-1, RB, 5.00%, 06/15/2048 |

1.51% |

| Long Island (City of), NY Power Authority, Series 2016 B, Ref. RB, 5.00%, 09/01/2041 |

1.47% |

| New York Convention Center Development Corp. (Hotel Unit Fee Secured), Series 2015, Ref. RB, 5.00%, 11/15/2045 |

1.44% |

| New York (City of), NY Municipal Water Finance Authority, Series 2023 D, Ref. RB, 4.13%, 06/15/2047 |

1.43% |

| New York State Urban Development Corp. (Bidding Group 3), Series 2019 A, Ref. RB, 4.00%, 03/15/2044 |

1.40% | Revenue type allocation

(% of net assets)

|

|

| Largest Holdings [Text Block] |

Top ten holdings

(% of net assets)

| New York (State of) Power Authority (Green Transmission) (Green Bonds), Series 2022, RB, 4.00%, 11/15/2052 |

2.75% |

| Battery Park (City of), NY Authority (Green Bonds), Series 2019 A, RB, 5.00%, 11/01/2049 |

1.89% |

| Triborough Bridge & Tunnel Authority (MTA Bridges & Tunnels), Series 2021 A, RB, 5.00%, 11/15/2051 |

1.89% |

| New York (State of) Dormitory Authority (Bidding Group 3), Series 2017 B, Ref. RB, 4.00%, 02/15/2044 |

1.75% |

| Triborough Bridge & Tunnel Authority (MTA Bridges & Tunnels), Series 2022 A, Ref. RB, 5.00%, 05/15/2047 |

1.63% |

| New York (City of), NY Municipal Water Finance Authority, Series 2021 AA-1, RB, 5.00%, 06/15/2048 |

1.51% |

| Long Island (City of), NY Power Authority, Series 2016 B, Ref. RB, 5.00%, 09/01/2041 |

1.47% |

| New York Convention Center Development Corp. (Hotel Unit Fee Secured), Series 2015, Ref. RB, 5.00%, 11/15/2045 |

1.44% |

| New York (City of), NY Municipal Water Finance Authority, Series 2023 D, Ref. RB, 4.13%, 06/15/2047 |

1.43% |

| New York State Urban Development Corp. (Bidding Group 3), Series 2019 A, Ref. RB, 4.00%, 03/15/2044 |

1.40% |

|

|

| C000054223 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Invesco Floating Rate Municipal Income ETF

|

|

| Class Name |

Invesco Floating Rate Municipal Income ETF

|

|

| Trading Symbol |

PVI

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Invesco Floating Rate Municipal Income ETF (the “Fund”) for the period September 1, 2024 to February 28, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

|

|

| Additional Information Phone Number |

(800) 983-0903

|

|

| Additional Information Website |

invesco.com/reports

|

|

| Expenses [Text Block] |

What Were The Fund Costs For The Last Six Months ? (Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment* |

| Invesco Floating Rate Municipal Income ETF |

$12 |

0.25% |

|

|

| Expenses Paid, Amount |

$ 12

|

|

| Expense Ratio, Percent |

0.25%

|

[8] |

| Net Assets |

$ 28,522,643

|

|

| Holdings Count | Holding |

32

|

|

| Additional Fund Statistics [Text Block] |

What Are Key Statistics About The Fund? (as of February 28, 2025)

| Fund net assets |

$28,522,643 |

| Total number of portfolio holdings |

32 |

|

|

| Holdings [Text Block] |

What Comprised The Fund's Holdings? (as of February 28, 2025) Top ten holdings

(% of net assets)

| West Palm Beach (City of), FL, Series 2008 C, VRD RB, 2.30%, 10/01/2038 |

5.26% |

| Emmaus (Borough of), PA General Authority, Series 1996, VRD RB, 2.35%, 12/01/2028 |

4.91% |

| New York (City of), NY Municipal Water Finance Authority, Series 2012, VRD RB, 1.75%, 06/15/2046 |

4.82% |

| Texas (State of), Series 2015 B, VRD GO Bonds, 2.25%, 06/01/2046 |

4.24% |

| Florida Keys Aqueduct Authority, Series 2008, Ref. VRD RB, 2.35%, 09/01/2035 |

4.21% |

| New York (State of) Dormitory Authority (Rockefeller University), Series 2008 A, VRD RB, 1.80%, 07/01/2039 |

4.21% |

| New York (City of), NY Transitional Finance Authority, Subseries 2012 C-4, VRD RB, 1.45%, 11/01/2036 |

4.21% |

| Orlando (City of), FL Utilities Commission, Series 2015 B, Ref. VRD RB, 2.04%, 10/01/2039 |

4.21% |

| Connecticut (State of) Housing Finance Authority, Series 2020 E-3, Ref. VRD RB, 1.95%, 11/15/2050 |

4.21% |

| New York City Housing Development Corp., Series 2006 A, VRD RB, 2.30%, 10/15/2041 |

4.21% | Revenue type allocation

(% of net assets)

|

|

| Largest Holdings [Text Block] |

Top ten holdings

(% of net assets)

| West Palm Beach (City of), FL, Series 2008 C, VRD RB, 2.30%, 10/01/2038 |

5.26% |

| Emmaus (Borough of), PA General Authority, Series 1996, VRD RB, 2.35%, 12/01/2028 |

4.91% |

| New York (City of), NY Municipal Water Finance Authority, Series 2012, VRD RB, 1.75%, 06/15/2046 |

4.82% |

| Texas (State of), Series 2015 B, VRD GO Bonds, 2.25%, 06/01/2046 |

4.24% |

| Florida Keys Aqueduct Authority, Series 2008, Ref. VRD RB, 2.35%, 09/01/2035 |

4.21% |

| New York (State of) Dormitory Authority (Rockefeller University), Series 2008 A, VRD RB, 1.80%, 07/01/2039 |

4.21% |

| New York (City of), NY Transitional Finance Authority, Subseries 2012 C-4, VRD RB, 1.45%, 11/01/2036 |

4.21% |

| Orlando (City of), FL Utilities Commission, Series 2015 B, Ref. VRD RB, 2.04%, 10/01/2039 |

4.21% |

| Connecticut (State of) Housing Finance Authority, Series 2020 E-3, Ref. VRD RB, 1.95%, 11/15/2050 |

4.21% |

| New York City Housing Development Corp., Series 2006 A, VRD RB, 2.30%, 10/15/2041 |

4.21% |

|

|

| C000082591 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Invesco CEF Income Composite ETF

|

|

| Class Name |

Invesco CEF Income Composite ETF

|

|

| Trading Symbol |

PCEF

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Invesco CEF Income Composite ETF (the “Fund”) for the period September 1, 2024 to February 28, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

|

|

| Additional Information Phone Number |

(800) 983-0903

|

|

| Additional Information Website |

invesco.com/reports

|

|

| Expenses [Text Block] |

What Were The Fund Costs For The Last Six Months ? (Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment* |

| Invesco CEF Income Composite ETF |

$21 |

0.41%† |

| * |

Annualized. |

|

† |

Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

|

|

| Expenses Paid, Amount |

$ 21

|

|

| Expense Ratio, Percent |

0.41%

|

[9],[10] |

| Net Assets |

$ 829,157,988

|

|

| Holdings Count | Holding |

111

|

|

| Investment Company Portfolio Turnover |

9.00%

|

|

| Additional Fund Statistics [Text Block] |

What Are Key Statistics About The Fund? (as of February 28, 2025)

| Fund net assets |

$829,157,988 |

| Total number of portfolio holdings |

111 |

| Portfolio turnover rate |

9% |

|

|

| Holdings [Text Block] |

What Comprised The Fund's Holdings? (as of February 28, 2025) Top ten holdings*

(% of net assets)

| Eaton Vance Tax-Managed Global Diversified Equity Income Fund |

4.35% |

| BlackRock Health Sciences Term Trust |

3.00% |

| BlackRock Technology and Private Equity Term Trust |

2.85% |

| Eaton Vance Tax-Managed Diversified Equity Income Fund |

2.80% |

| Nuveen Preferred & Income Opportunities Fund |

2.61% |

| Nuveen S&P 500 Buy-Write Income Fund |

2.46% |

| Eaton Vance Tax-Managed Buy-Write Opportunities Fund |

2.46% |

| BlackRock Capital Allocation Term Trust |

2.43% |

| BlackRock ESG Capital Allocation Term Trust |

2.42% |

| BlackRock Enhanced Equity Dividend Trust |

2.40% |

| * Excluding money market fund holdings, if any. |

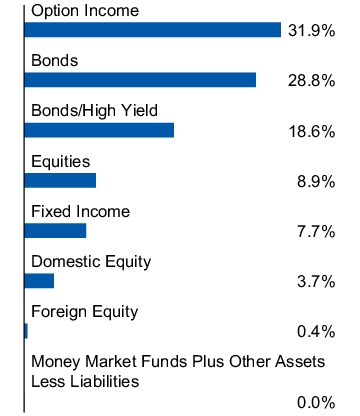

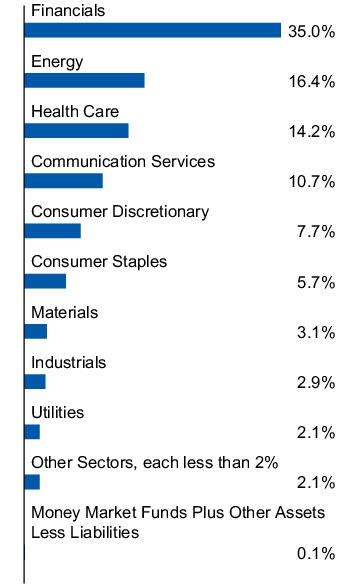

| Asset allocation

(% of net assets)

|

|

| Largest Holdings [Text Block] |

Top ten holdings*

(% of net assets)

| Eaton Vance Tax-Managed Global Diversified Equity Income Fund |

4.35% |

| BlackRock Health Sciences Term Trust |

3.00% |

| BlackRock Technology and Private Equity Term Trust |

2.85% |

| Eaton Vance Tax-Managed Diversified Equity Income Fund |

2.80% |

| Nuveen Preferred & Income Opportunities Fund |

2.61% |

| Nuveen S&P 500 Buy-Write Income Fund |

2.46% |

| Eaton Vance Tax-Managed Buy-Write Opportunities Fund |

2.46% |

| BlackRock Capital Allocation Term Trust |

2.43% |

| BlackRock ESG Capital Allocation Term Trust |

2.42% |

| BlackRock Enhanced Equity Dividend Trust |

2.40% |

| * Excluding money market fund holdings, if any. |

|

|

|

| C000086469 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Invesco S&P SmallCap Consumer Discretionary ETF

|

|

| Class Name |

Invesco S&P SmallCap Consumer Discretionary ETF

|

|

| Trading Symbol |

PSCD

|

|

| Security Exchange Name |

NASDAQ

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Invesco S&P SmallCap Consumer Discretionary ETF (the “Fund”) for the period September 1, 2024 to February 28, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

|

|

| Additional Information Phone Number |

(800) 983-0903

|

|

| Additional Information Website |

invesco.com/reports

|

|

| Expenses [Text Block] |

What Were The Fund Costs For The Last Six Months ? (Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment* |

| Invesco S&P SmallCap Consumer Discretionary ETF |

$14 |

0.29% |

|

|

| Expenses Paid, Amount |

$ 14

|

|

| Expense Ratio, Percent |

0.29%

|

[11] |

| Net Assets |

$ 24,799,192

|

|

| Holdings Count | Holding |

86

|

|

| Investment Company Portfolio Turnover |

17.00%

|

|

| Additional Fund Statistics [Text Block] |

What Are Key Statistics About The Fund? (as of February 28, 2025)

| Fund net assets |

$24,799,192 |

| Total number of portfolio holdings |

86 |

| Portfolio turnover rate |

17% |

|

|

| Holdings [Text Block] |

What Comprised The Fund's Holdings? (as of February 28, 2025) Top ten holdings*

(% of net assets)

| V.F. Corp. |

4.41% |

| Bath & Body Works, Inc. |

4.24% |

| Brinker International, Inc. |

3.91% |

| Group 1 Automotive, Inc. |

3.19% |

| Stride, Inc. |

3.13% |

| Etsy, Inc. |

3.07% |

| Champion Homes, Inc. |

2.89% |

| Asbury Automotive Group, Inc. |

2.81% |

| Meritage Homes Corp. |

2.80% |

| Shake Shack, Inc., Class A |

2.32% |

| * Excluding money market fund holdings, if any. |

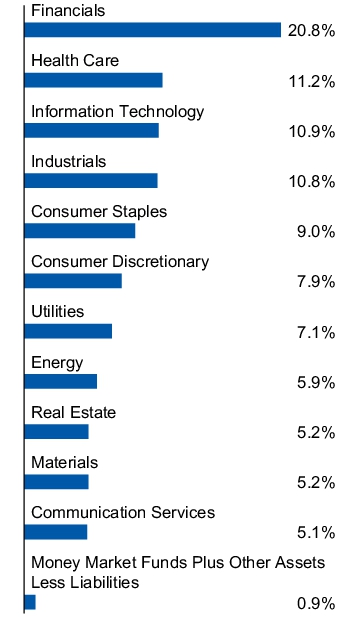

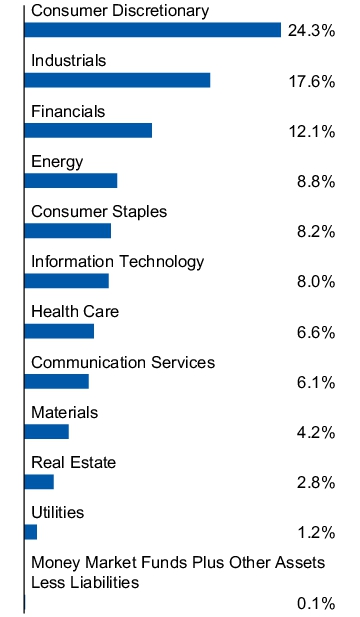

| Industry allocation

(% of net assets)

|

|

| Largest Holdings [Text Block] |

Top ten holdings*

(% of net assets)

| V.F. Corp. |

4.41% |

| Bath & Body Works, Inc. |

4.24% |

| Brinker International, Inc. |

3.91% |

| Group 1 Automotive, Inc. |

3.19% |

| Stride, Inc. |

3.13% |

| Etsy, Inc. |

3.07% |

| Champion Homes, Inc. |

2.89% |

| Asbury Automotive Group, Inc. |

2.81% |

| Meritage Homes Corp. |

2.80% |

| Shake Shack, Inc., Class A |

2.32% |

| * Excluding money market fund holdings, if any. |

|

|

|

| C000086470 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Invesco S&P SmallCap Utilities & Communication Services ETF

|

|

| Class Name |

Invesco S&P SmallCap Utilities & Communication Services ETF

|

|

| Trading Symbol |

PSCU

|

|

| Security Exchange Name |

NASDAQ

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Invesco S&P SmallCap Utilities & Communication Services ETF (the “Fund”) for the period September 1, 2024 to February 28, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

|

|

| Additional Information Phone Number |

(800) 983-0903

|

|

| Additional Information Website |

invesco.com/reports

|

|

| Expenses [Text Block] |

What Were The Fund Costs For The Last Six Months ? (Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment* |

| Invesco S&P SmallCap Utilities & Communication Services ETF |

$14 |

0.29% |

|

|

| Expenses Paid, Amount |

$ 14

|

|

| Expense Ratio, Percent |

0.29%

|

[12] |

| Net Assets |

$ 14,439,238

|

|

| Holdings Count | Holding |

38

|

|

| Investment Company Portfolio Turnover |

14.00%

|

|

| Additional Fund Statistics [Text Block] |

What Are Key Statistics About The Fund? (as of February 28, 2025)

| Fund net assets |

$14,439,238 |

| Total number of portfolio holdings |

38 |

| Portfolio turnover rate |

14% |

|

|

| Holdings [Text Block] |

What Comprised The Fund's Holdings? (as of February 28, 2025) Top ten holdings*

(% of net assets)

| Lumen Technologies, Inc. |

6.46% |

| EchoStar Corp., Class A |

5.10% |

| Telephone and Data Systems, Inc. |

4.75% |

| MDU Resources Group, Inc. |

4.75% |

| Madison Square Garden Sports Corp., Class A |

4.60% |

| Otter Tail Corp. |

4.50% |

| MGE Energy, Inc. |

4.49% |

| IAC, Inc. |

4.42% |

| Avista Corp. |

4.27% |

| Cogent Communications Holdings, Inc. |

4.17% |

| * Excluding money market fund holdings, if any. |

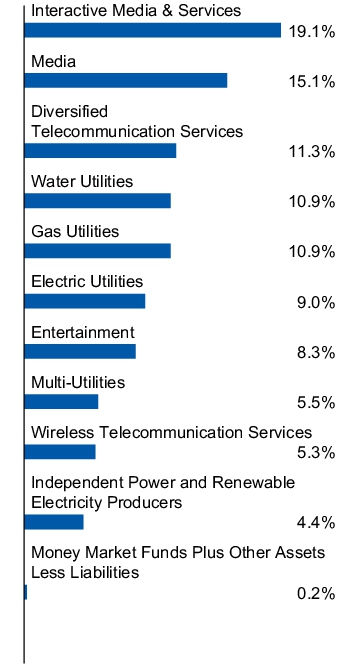

| Industry allocation

(% of net assets)

|

|

| Largest Holdings [Text Block] |

Top ten holdings*

(% of net assets)

| Lumen Technologies, Inc. |

6.46% |

| EchoStar Corp., Class A |

5.10% |

| Telephone and Data Systems, Inc. |

4.75% |

| MDU Resources Group, Inc. |

4.75% |

| Madison Square Garden Sports Corp., Class A |

4.60% |

| Otter Tail Corp. |

4.50% |

| MGE Energy, Inc. |

4.49% |

| IAC, Inc. |

4.42% |

| Avista Corp. |

4.27% |

| Cogent Communications Holdings, Inc. |

4.17% |

| * Excluding money market fund holdings, if any. |

|

|

|

| C000086471 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Invesco S&P SmallCap Consumer Staples ETF

|

|

| Class Name |

Invesco S&P SmallCap Consumer Staples ETF

|

|

| Trading Symbol |

PSCC

|

|

| Security Exchange Name |

NASDAQ

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Invesco S&P SmallCap Consumer Staples ETF (the “Fund”) for the period September 1, 2024 to February 28, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

|

|

| Additional Information Phone Number |

(800) 983-0903

|

|

| Additional Information Website |

invesco.com/reports

|

|

| Expenses [Text Block] |

What Were The Fund Costs For The Last Six Months ? (Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment* |

| Invesco S&P SmallCap Consumer Staples ETF |

$14 |

0.29% |

|

|

| Expenses Paid, Amount |

$ 14

|

|

| Expense Ratio, Percent |

0.29%

|

[13] |

| Net Assets |

$ 49,305,923

|

|

| Holdings Count | Holding |

29

|

|

| Investment Company Portfolio Turnover |

10.00%

|

|

| Additional Fund Statistics [Text Block] |

What Are Key Statistics About The Fund? (as of February 28, 2025)

| Fund net assets |

$49,305,923 |

| Total number of portfolio holdings |

29 |

| Portfolio turnover rate |

10% |

|

|

| Holdings [Text Block] |

What Comprised The Fund's Holdings? (as of February 28, 2025) Top ten holdings*

(% of net assets)

| Cal-Maine Foods, Inc. |

9.48% |

| Simply Good Foods Co. (The) |

8.88% |

| WD-40 Co. |

8.34% |

| Interparfums, Inc. |

6.42% |

| Chefs' Warehouse, Inc. (The) |

5.76% |

| PriceSmart, Inc. |

5.72% |

| United Natural Foods, Inc. |

4.78% |

| J&J Snack Foods Corp. |

4.74% |

| Energizer Holdings, Inc. |

4.17% |

| Edgewell Personal Care Co. |

4.10% |

| * Excluding money market fund holdings, if any. |

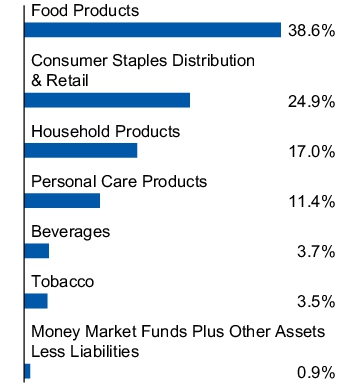

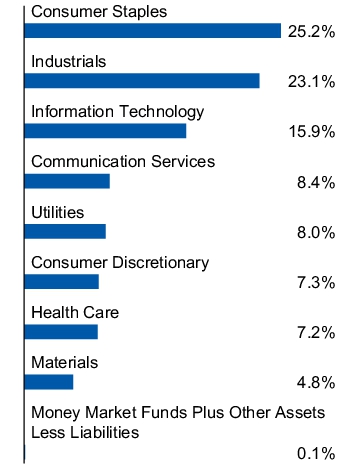

| Industry allocation

(% of net assets)

|

|

| Largest Holdings [Text Block] |

Top ten holdings*

(% of net assets)

| Cal-Maine Foods, Inc. |

9.48% |

| Simply Good Foods Co. (The) |

8.88% |

| WD-40 Co. |

8.34% |

| Interparfums, Inc. |

6.42% |

| Chefs' Warehouse, Inc. (The) |

5.76% |

| PriceSmart, Inc. |

5.72% |

| United Natural Foods, Inc. |

4.78% |

| J&J Snack Foods Corp. |

4.74% |

| Energizer Holdings, Inc. |

4.17% |

| Edgewell Personal Care Co. |

4.10% |

| * Excluding money market fund holdings, if any. |

|

|

|

| C000086472 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Invesco S&P SmallCap Energy ETF

|

|

| Class Name |

Invesco S&P SmallCap Energy ETF

|

|

| Trading Symbol |

PSCE

|

|

| Security Exchange Name |

NASDAQ

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Invesco S&P SmallCap Energy ETF (the “Fund”) for the period September 1, 2024 to February 28, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

|

|

| Additional Information Phone Number |

(800) 983-0903

|

|

| Additional Information Website |

invesco.com/reports

|

|

| Expenses [Text Block] |

What Were The Fund Costs For The Last Six Months ? (Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment* |

| Invesco S&P SmallCap Energy ETF |

$13 |

0.29% |

|

|

| Expenses Paid, Amount |

$ 13

|

|

| Expense Ratio, Percent |

0.29%

|

[14] |

| Net Assets |

$ 75,642,005

|

|

| Holdings Count | Holding |

35

|

|

| Investment Company Portfolio Turnover |

20.00%

|

|

| Additional Fund Statistics [Text Block] |

What Are Key Statistics About The Fund? (as of February 28, 2025)

| Fund net assets |

$75,642,005 |

| Total number of portfolio holdings |

35 |

| Portfolio turnover rate |

20% |

|

|

| Holdings [Text Block] |

What Comprised The Fund's Holdings? (as of February 28, 2025) Top ten holdings*

(% of net assets)

| Archrock, Inc. |

7.99% |

| Magnolia Oil & Gas Corp., Class A |

7.52% |

| SM Energy Co. |

6.29% |

| Core Natural Resources, Inc. |

6.01% |

| Cactus, Inc., Class A |

5.89% |

| California Resources Corp. |

5.37% |

| Northern Oil and Gas, Inc. |

5.26% |

| Patterson-UTI Energy, Inc. |

5.09% |

| Liberty Energy, Inc., Class A |

4.51% |

| Oceaneering International, Inc. |

3.85% |

| * Excluding money market fund holdings, if any. |

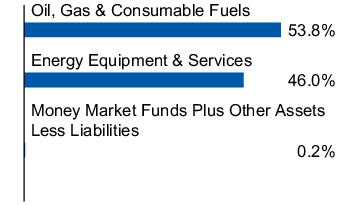

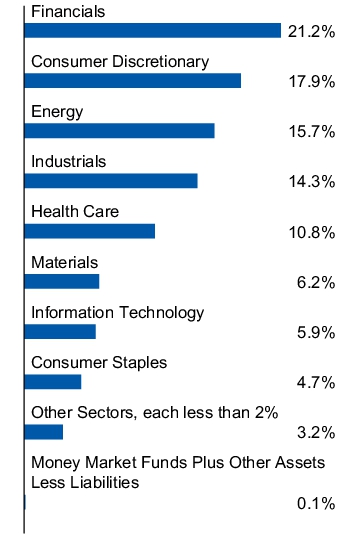

| Industry allocation

(% of net assets)

|

|

| Largest Holdings [Text Block] |

Top ten holdings*

(% of net assets)

| Archrock, Inc. |

7.99% |

| Magnolia Oil & Gas Corp., Class A |

7.52% |

| SM Energy Co. |

6.29% |

| Core Natural Resources, Inc. |

6.01% |

| Cactus, Inc., Class A |

5.89% |

| California Resources Corp. |

5.37% |

| Northern Oil and Gas, Inc. |

5.26% |

| Patterson-UTI Energy, Inc. |

5.09% |

| Liberty Energy, Inc., Class A |

4.51% |

| Oceaneering International, Inc. |

3.85% |

| * Excluding money market fund holdings, if any. |

|

|

|

| C000086473 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Invesco S&P SmallCap Financials ETF

|

|

| Class Name |

Invesco S&P SmallCap Financials ETF

|

|

| Trading Symbol |

PSCF

|

|

| Security Exchange Name |

NASDAQ

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Invesco S&P SmallCap Financials ETF (the “Fund”) for the period September 1, 2024 to February 28, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

|

|

| Additional Information Phone Number |

(800) 983-0903

|

|

| Additional Information Website |

invesco.com/reports

|

|

| Expenses [Text Block] |

What Were The Fund Costs For The Last Six Months ? (Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment* |

| Invesco S&P SmallCap Financials ETF |

$15 |

0.29% |

|

|

| Expenses Paid, Amount |

$ 15

|

|

| Expense Ratio, Percent |

0.29%

|

[15] |

| Net Assets |

$ 21,248,938

|

|

| Holdings Count | Holding |

169

|

|

| Investment Company Portfolio Turnover |

7.00%

|

|

| Additional Fund Statistics [Text Block] |

What Are Key Statistics About The Fund? (as of February 28, 2025)

| Fund net assets |

$21,248,938 |

| Total number of portfolio holdings |

169 |

| Portfolio turnover rate |

7% |

|

|

| Holdings [Text Block] |

What Comprised The Fund's Holdings? (as of February 28, 2025) Top ten holdings*

(% of net assets)

| Mr. Cooper Group, Inc. |

2.00% |

| Jackson Financial, Inc., Class A |

1.88% |

| Terreno Realty Corp. |

1.88% |

| Lincoln National Corp. |

1.85% |

| Essential Properties Realty Trust, Inc. |

1.60% |

| Moelis & Co., Class A |

1.39% |

| Radian Group, Inc. |

1.37% |

| CareTrust REIT, Inc. |

1.35% |

| Piper Sandler Cos. |

1.28% |

| ServisFirst Bancshares, Inc. |

1.28% |

| * Excluding money market fund holdings, if any. |

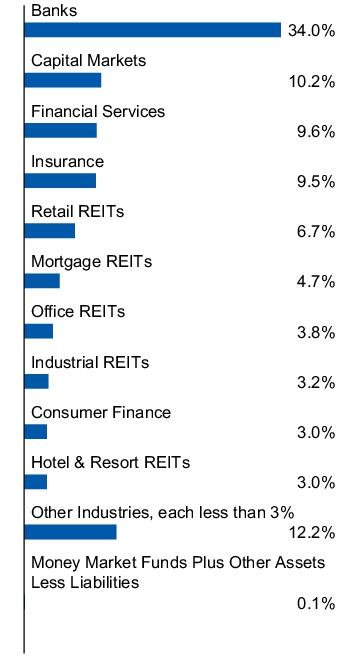

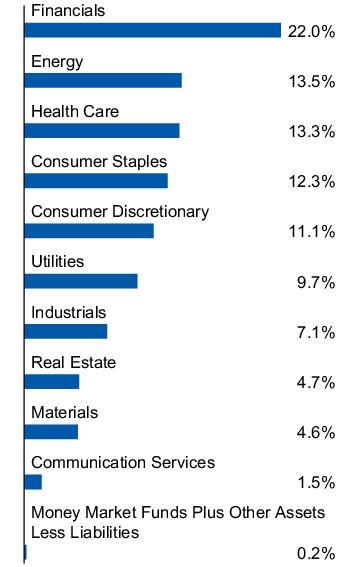

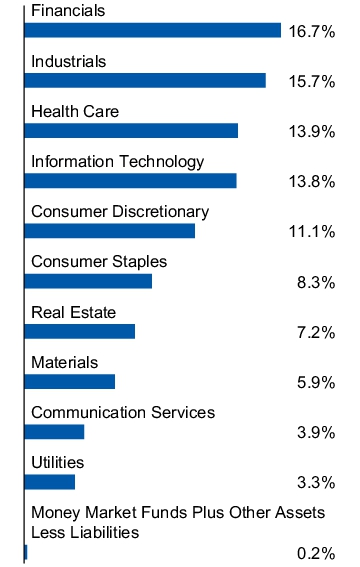

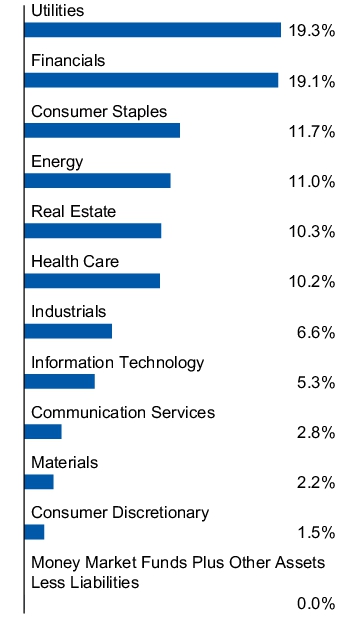

| Industry allocation

(% of net assets)

|

|

| Largest Holdings [Text Block] |

Top ten holdings*

(% of net assets)

| Mr. Cooper Group, Inc. |

2.00% |

| Jackson Financial, Inc., Class A |

1.88% |

| Terreno Realty Corp. |

1.88% |

| Lincoln National Corp. |

1.85% |

| Essential Properties Realty Trust, Inc. |

1.60% |

| Moelis & Co., Class A |

1.39% |

| Radian Group, Inc. |

1.37% |

| CareTrust REIT, Inc. |

1.35% |

| Piper Sandler Cos. |

1.28% |

| ServisFirst Bancshares, Inc. |

1.28% |

| * Excluding money market fund holdings, if any. |

|

|

|

| C000086474 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Invesco S&P SmallCap Health Care ETF

|

|

| Class Name |

Invesco S&P SmallCap Health Care ETF

|

|

| Trading Symbol |

PSCH

|

|

| Security Exchange Name |

NASDAQ

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Invesco S&P SmallCap Health Care ETF (the “Fund”) for the period September 1, 2024 to February 28, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

|

|

| Additional Information Phone Number |

(800) 983-0903

|

|

| Additional Information Website |

invesco.com/reports

|

|

| Expenses [Text Block] |

What Were The Fund Costs For The Last Six Months ? (Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment* |

| Invesco S&P SmallCap Health Care ETF |

$14 |

0.29% |

|

|

| Expenses Paid, Amount |

$ 14

|

|

| Expense Ratio, Percent |

0.29%

|

[16] |

| Net Assets |

$ 173,930,169

|

|

| Holdings Count | Holding |

77

|

|

| Investment Company Portfolio Turnover |

29.00%

|

|

| Additional Fund Statistics [Text Block] |

What Are Key Statistics About The Fund? (as of February 28, 2025)

| Fund net assets |

$173,930,169 |

| Total number of portfolio holdings |

77 |

| Portfolio turnover rate |

29% |

|

|

| Holdings [Text Block] |

What Comprised The Fund's Holdings? (as of February 28, 2025) Top ten holdings*

(% of net assets)

| Hims & Hers Health, Inc. |

5.57% |

| Glaukos Corp. |

4.28% |

| Merit Medical Systems, Inc. |

3.84% |

| Corcept Therapeutics, Inc. |

3.65% |

| Inspire Medical Systems, Inc. |

3.59% |

| Alkermes PLC |

3.59% |

| Krystal Biotech, Inc. |

2.93% |

| Prestige Consumer Healthcare, Inc. |

2.70% |

| Integer Holdings Corp. |

2.67% |

| TG Therapeutics, Inc. |

2.59% |

| * Excluding money market fund holdings, if any. |

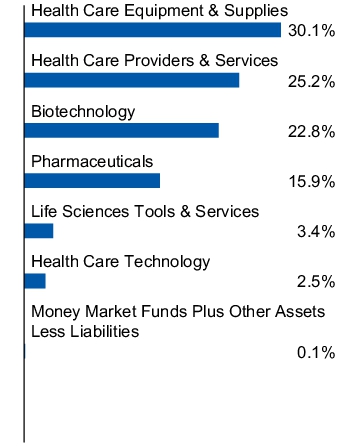

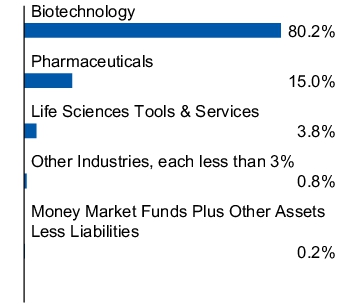

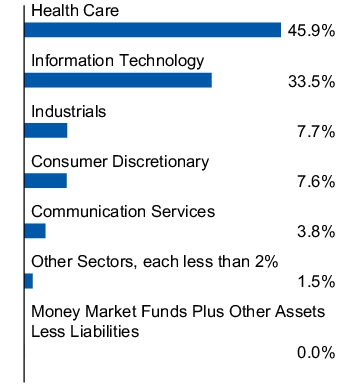

| Industry allocation

(% of net assets)

|

|

| Largest Holdings [Text Block] |

Top ten holdings*

(% of net assets)

| Hims & Hers Health, Inc. |

5.57% |

| Glaukos Corp. |

4.28% |

| Merit Medical Systems, Inc. |

3.84% |

| Corcept Therapeutics, Inc. |

3.65% |

| Inspire Medical Systems, Inc. |

3.59% |

| Alkermes PLC |

3.59% |

| Krystal Biotech, Inc. |

2.93% |

| Prestige Consumer Healthcare, Inc. |

2.70% |

| Integer Holdings Corp. |

2.67% |

| TG Therapeutics, Inc. |

2.59% |

| * Excluding money market fund holdings, if any. |

|

|

|

| C000086475 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Invesco S&P SmallCap Industrials ETF

|

|

| Class Name |

Invesco S&P SmallCap Industrials ETF

|

|

| Trading Symbol |

PSCI

|

|

| Security Exchange Name |

NASDAQ

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Invesco S&P SmallCap Industrials ETF (the “Fund”) for the period September 1, 2024 to February 28, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

|

|

| Additional Information Phone Number |

(800) 983-0903

|

|

| Additional Information Website |

invesco.com/reports

|

|

| Expenses [Text Block] |

What Were The Fund Costs For The Last Six Months ? (Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment* |

| Invesco S&P SmallCap Industrials ETF |

$14 |

0.29% |

|

|

| Expenses Paid, Amount |

$ 14

|

|

| Expense Ratio, Percent |

0.29%

|

[17] |

| Net Assets |

$ 208,660,801

|

|

| Holdings Count | Holding |

98

|

|

| Investment Company Portfolio Turnover |

16.00%

|

|

| Additional Fund Statistics [Text Block] |

What Are Key Statistics About The Fund? (as of February 28, 2025)

| Fund net assets |

$208,660,801 |

| Total number of portfolio holdings |

98 |

| Portfolio turnover rate |

16% |

|

|

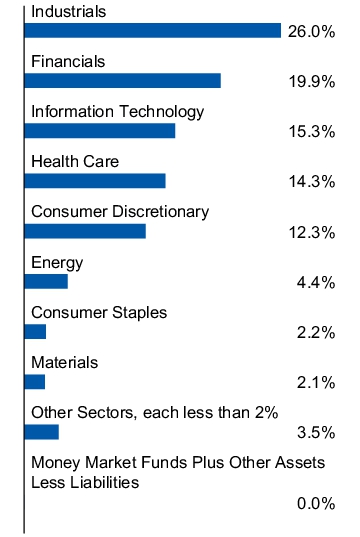

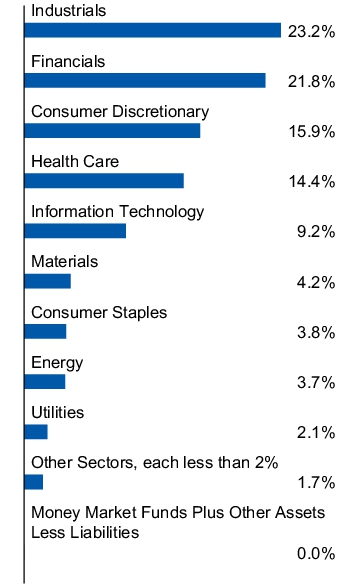

| Holdings [Text Block] |

What Comprised The Fund's Holdings? (as of February 28, 2025) Top ten holdings*

(% of net assets)

| Alaska Air Group, Inc. |

3.86% |

| SPX Technologies, Inc. |

2.84% |

| Armstrong World Industries, Inc. |

2.82% |

| JBT Marel Corp. |

2.58% |

| Robert Half, Inc. |

2.52% |

| CSW Industrials, Inc. |

2.17% |

| Zurn Elkay Water Solutions Corp. |

2.12% |

| Federal Signal Corp. |

2.09% |

| Air Lease Corp., Class A |

2.09% |

| Gates Industrial Corp. PLC |

2.06% |

| * Excluding money market fund holdings, if any. |

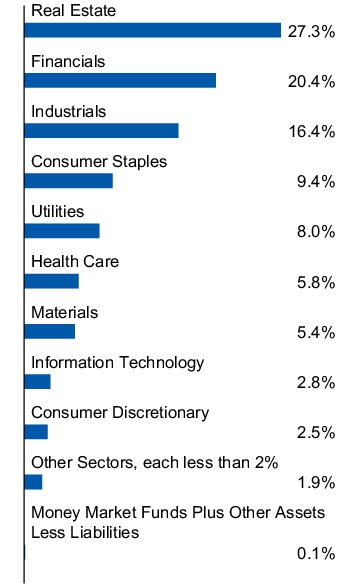

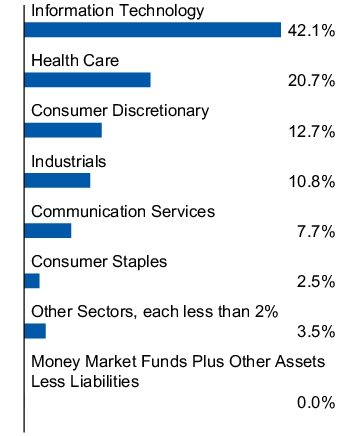

| Industry allocation

(% of net assets)

|

|

| Largest Holdings [Text Block] |

Top ten holdings*

(% of net assets)

| Alaska Air Group, Inc. |

3.86% |

| SPX Technologies, Inc. |

2.84% |

| Armstrong World Industries, Inc. |

2.82% |

| JBT Marel Corp. |

2.58% |

| Robert Half, Inc. |

2.52% |

| CSW Industrials, Inc. |

2.17% |

| Zurn Elkay Water Solutions Corp. |

2.12% |

| Federal Signal Corp. |

2.09% |

| Air Lease Corp., Class A |

2.09% |

| Gates Industrial Corp. PLC |

2.06% |

| * Excluding money market fund holdings, if any. |

|

|

|

| C000086476 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Invesco S&P SmallCap Information Technology ETF

|

|

| Class Name |

Invesco S&P SmallCap Information Technology ETF

|

|

| Trading Symbol |

PSCT

|

|

| Security Exchange Name |

NASDAQ

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Invesco S&P SmallCap Information Technology ETF (the “Fund”) for the period September 1, 2024 to February 28, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

|

|

| Additional Information Phone Number |

(800) 983-0903

|

|

| Additional Information Website |

invesco.com/reports

|

|

| Expenses [Text Block] |

What Were The Fund Costs For The Last Six Months ?

(Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment* |

| Invesco S&P SmallCap Information Technology ETF |

$14 |

0.29% |

|

|

| Expenses Paid, Amount |

$ 14

|

|

| Expense Ratio, Percent |

0.29%

|

[18] |

| Net Assets |

$ 273,538,561

|

|

| Holdings Count | Holding |

70

|

|

| Investment Company Portfolio Turnover |

20.00%

|

|

| Additional Fund Statistics [Text Block] |

What Are Key Statistics About The Fund?

(as of February 28, 2025)

| Fund net assets |

$273,538,561 |

| Total number of portfolio holdings |

70 |

| Portfolio turnover rate |

20% |

|

|

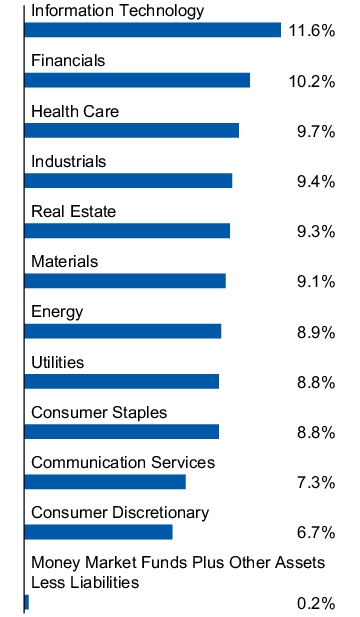

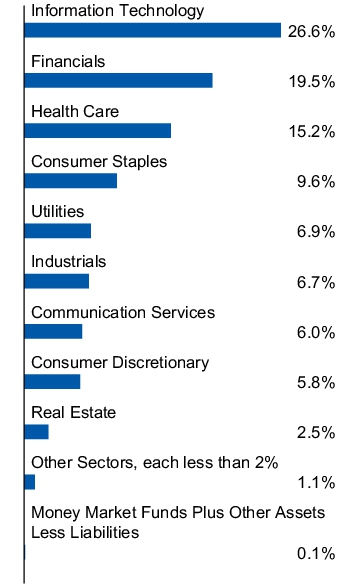

| Holdings [Text Block] |

What Comprised The Fund's Holdings?

(as of February 28, 2025)

Top ten holdings*

(% of net assets)

| Qorvo, Inc. |

4.42% |

| Badger Meter, Inc. |

3.98% |

| ACI Worldwide, Inc. |

3.87% |

| InterDigital, Inc. |

3.49% |

| Sandisk Corp. |

3.48% |

| SPS Commerce, Inc. |

3.22% |

| Itron, Inc. |

3.16% |

| Box, Inc., Class A |

3.01% |

| MARA Holdings, Inc. |

2.88% |

| Sanmina Corp. |

2.88% |

| * Excluding money market fund holdings, if any. |

|

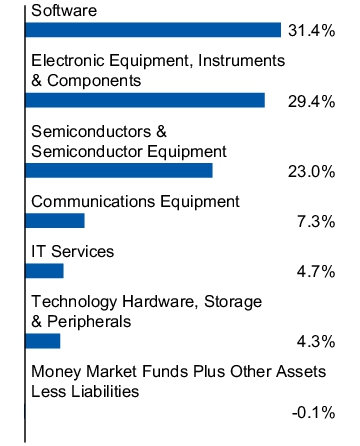

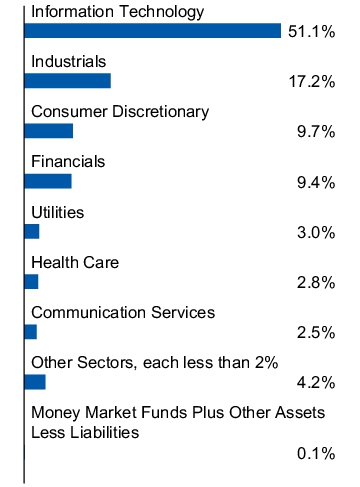

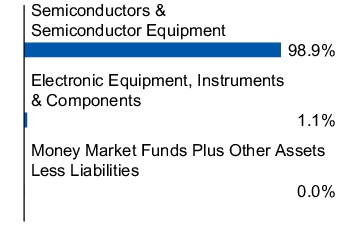

Industry allocation

(% of net assets)

|

|

| Largest Holdings [Text Block] |

Top ten holdings*

(% of net assets)

| Qorvo, Inc. |

4.42% |

| Badger Meter, Inc. |

3.98% |

| ACI Worldwide, Inc. |

3.87% |

| InterDigital, Inc. |

3.49% |

| Sandisk Corp. |

3.48% |

| SPS Commerce, Inc. |

3.22% |

| Itron, Inc. |

3.16% |

| Box, Inc., Class A |

3.01% |

| MARA Holdings, Inc. |

2.88% |

| Sanmina Corp. |

2.88% |

| * Excluding money market fund holdings, if any. |

|

|

|

| C000086477 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Invesco S&P SmallCap Materials ETF

|

|

| Class Name |

Invesco S&P SmallCap Materials ETF

|

|

| Trading Symbol |

PSCM

|

|

| Security Exchange Name |

NASDAQ

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Invesco S&P SmallCap Materials ETF (the “Fund”) for the period September 1, 2024 to February 28, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

|

|

| Additional Information Phone Number |

(800) 983-0903

|

|

| Additional Information Website |

invesco.com/reports

|

|

| Expenses [Text Block] |

What Were The Fund Costs For The Last Six Months ? (Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment* |

| Invesco S&P SmallCap Materials ETF |

$14 |

0.29% |

|

|

| Expenses Paid, Amount |

$ 14

|

|

| Expense Ratio, Percent |

0.29%

|

[19] |

| Net Assets |

$ 15,862,922

|

|

| Holdings Count | Holding |

28

|

|

| Investment Company Portfolio Turnover |

10.00%

|

|

| Additional Fund Statistics [Text Block] |

What Are Key Statistics About The Fund? (as of February 28, 2025)

| Fund net assets |

$15,862,922 |

| Total number of portfolio holdings |

28 |

| Portfolio turnover rate |

10% |

|

|

| Holdings [Text Block] |

What Comprised The Fund's Holdings? (as of February 28, 2025) Top ten holdings*

(% of net assets)

| ATI, Inc. |

14.88% |

| Balchem Corp. |

10.15% |

| Sealed Air Corp. |

8.93% |

| H.B. Fuller Co. |

5.56% |

| MP Materials Corp. |

5.26% |

| Sensient Technologies Corp. |

4.80% |

| Innospec, Inc. |

4.68% |

| Warrior Met Coal, Inc. |

4.52% |

| Sylvamo Corp. |

4.24% |

| Minerals Technologies, Inc. |

3.97% |

| * Excluding money market fund holdings, if any. |

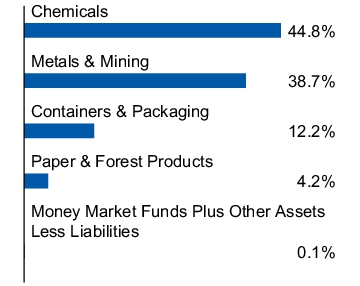

| Industry allocation

(% of net assets)

|

|

| Largest Holdings [Text Block] |

Top ten holdings*

(% of net assets)

| ATI, Inc. |

14.88% |

| Balchem Corp. |

10.15% |

| Sealed Air Corp. |

8.93% |

| H.B. Fuller Co. |

5.56% |

| MP Materials Corp. |

5.26% |

| Sensient Technologies Corp. |

4.80% |

| Innospec, Inc. |

4.68% |

| Warrior Met Coal, Inc. |

4.52% |

| Sylvamo Corp. |

4.24% |

| Minerals Technologies, Inc. |

3.97% |

| * Excluding money market fund holdings, if any. |

|

|

|

| C000093357 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Invesco KBW High Dividend Yield Financial ETF

|

|

| Class Name |

Invesco KBW High Dividend Yield Financial ETF

|

|

| Trading Symbol |

KBWD

|

|

| Security Exchange Name |

NASDAQ

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Invesco KBW High Dividend Yield Financial ETF (the “Fund”) for the period September 1, 2024 to February 28, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

|

|

| Additional Information Phone Number |

(800) 983-0903

|

|

| Additional Information Website |

invesco.com/reports

|

|

| Expenses [Text Block] |

What Were The Fund Costs For The Last Six Months ? (Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment* |

| Invesco KBW High Dividend Yield Financial ETF |

$18 |

0.35% |

|

|

| Expenses Paid, Amount |

$ 18

|

|

| Expense Ratio, Percent |

0.35%

|

[20] |

| Net Assets |

$ 436,667,802

|

|

| Holdings Count | Holding |

42

|

|

| Investment Company Portfolio Turnover |

45.00%

|

|

| Additional Fund Statistics [Text Block] |

What Are Key Statistics About The Fund? (as of February 28, 2025)

| Fund net assets |

$436,667,802 |

| Total number of portfolio holdings |

42 |

| Portfolio turnover rate |

45% |

|

|

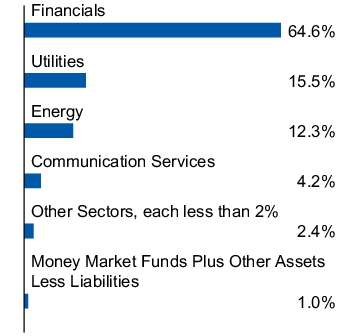

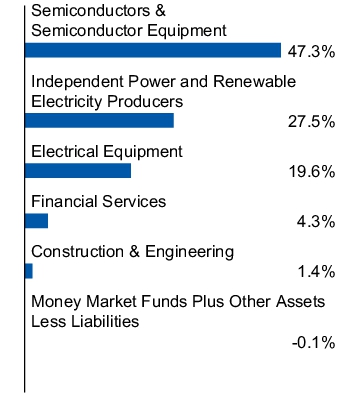

| Holdings [Text Block] |

What Comprised The Fund's Holdings? (as of February 28, 2025) Top ten holdings*

(% of net assets)

| Invesco Mortgage Capital, Inc. |

4.59% |

| Orchid Island Capital, Inc. |

4.52% |

| Two Harbors Investment Corp. |

4.18% |

| Dynex Capital, Inc. |

3.63% |

| AGNC Investment Corp. |

3.63% |

| ARMOUR Residential REIT, Inc. |

3.45% |

| New York Mortgage Trust, Inc. |

3.43% |

| Ellington Financial, Inc. |

3.32% |

| Annaly Capital Management, Inc. |

3.25% |

| Trinity Capital, Inc., BDC |

3.63% |

| * Excluding money market fund holdings, if any. |

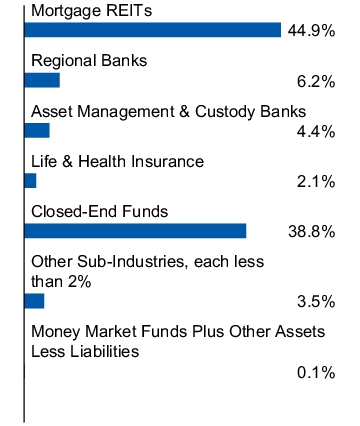

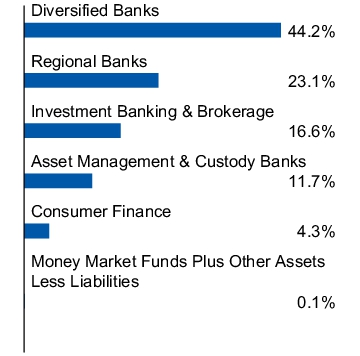

| Sub-industry allocation

(% of net assets)

|

|

| Largest Holdings [Text Block] |

Top ten holdings*

(% of net assets)

| Invesco Mortgage Capital, Inc. |

4.59% |

| Orchid Island Capital, Inc. |

4.52% |

| Two Harbors Investment Corp. |

4.18% |

| Dynex Capital, Inc. |

3.63% |

| AGNC Investment Corp. |

3.63% |

| ARMOUR Residential REIT, Inc. |

3.45% |

| New York Mortgage Trust, Inc. |

3.43% |

| Ellington Financial, Inc. |

3.32% |

| Annaly Capital Management, Inc. |

3.25% |

| Trinity Capital, Inc., BDC |

3.63% |

| * Excluding money market fund holdings, if any. |

|

|

|

| C000093358 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Invesco KBW Premium Yield Equity REIT ETF

|

|

| Class Name |

Invesco KBW Premium Yield Equity REIT ETF

|

|

| Trading Symbol |

KBWY

|

|

| Security Exchange Name |

NASDAQ

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Invesco KBW Premium Yield Equity REIT ETF (the “Fund”) for the period September 1, 2024 to February 28, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

|

|

| Additional Information Phone Number |

(800) 983-0903

|

|

| Additional Information Website |

invesco.com/reports

|

|

| Expenses [Text Block] |

What Were The Fund Costs For The Last Six Months ? (Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment* |

| Invesco KBW Premium Yield Equity REIT ETF |

$16 |

0.35% |

|

|

| Expenses Paid, Amount |

$ 16

|

|

| Expense Ratio, Percent |

0.35%

|

[21] |

| Net Assets |

$ 222,748,900

|

|

| Holdings Count | Holding |

33

|

|

| Investment Company Portfolio Turnover |

51.00%

|

|

| Additional Fund Statistics [Text Block] |

What Are Key Statistics About The Fund? (as of February 28, 2025)

| Fund net assets |

$222,748,900 |

| Total number of portfolio holdings |

33 |

| Portfolio turnover rate |

51% |

|

|

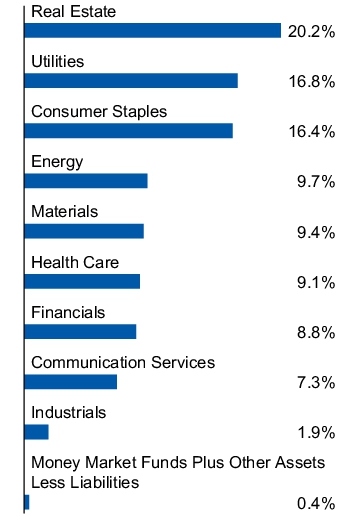

| Holdings [Text Block] |

What Comprised The Fund's Holdings? (as of February 28, 2025) Top ten holdings*

(% of net assets)

| Global Net Lease, Inc. |

7.70% |

| SITE Centers Corp. |

5.67% |

| Brandywine Realty Trust |

4.90% |

| Community Healthcare Trust, Inc. |

4.67% |

| NexPoint Diversified Real Estate Trust |

4.42% |

| Global Medical REIT, Inc. |

4.27% |

| EPR Properties |

4.27% |

| Easterly Government Properties, Inc. |

3.80% |

| CTO Realty Growth, Inc. |

3.43% |

| Clipper Realty, Inc. |

3.14% |

| * Excluding money market fund holdings, if any. |

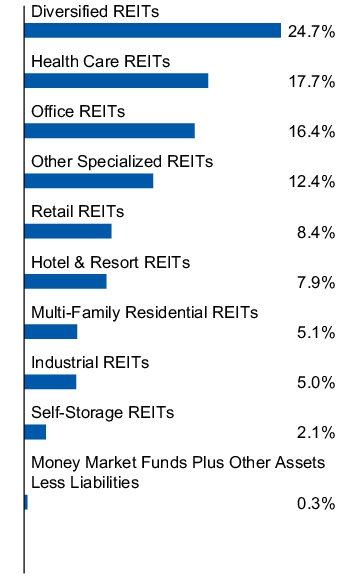

| Sub-industry allocation

(% of net assets)

|

|

| Largest Holdings [Text Block] |

Top ten holdings*

(% of net assets)

| Global Net Lease, Inc. |

7.70% |

| SITE Centers Corp. |

5.67% |

| Brandywine Realty Trust |

4.90% |

| Community Healthcare Trust, Inc. |

4.67% |

| NexPoint Diversified Real Estate Trust |

4.42% |

| Global Medical REIT, Inc. |

4.27% |

| EPR Properties |

4.27% |

| Easterly Government Properties, Inc. |

3.80% |

| CTO Realty Growth, Inc. |

3.43% |

| Clipper Realty, Inc. |

3.14% |

| * Excluding money market fund holdings, if any. |

|

|

|

| C000093359 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

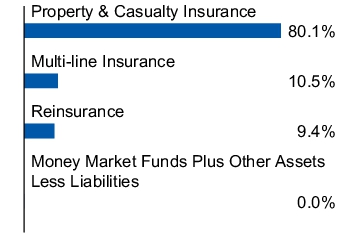

| Fund Name |

Invesco KBW Property & Casualty Insurance ETF

|

|

| Class Name |

Invesco KBW Property & Casualty Insurance ETF

|

|

| Trading Symbol |

KBWP

|

|

| Security Exchange Name |

NASDAQ

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Invesco KBW Property & Casualty Insurance ETF (the “Fund”) for the period September 1, 2024 to February 28, 2025.

|

|