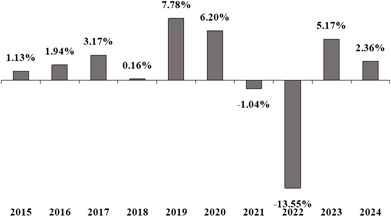

The bar chart below and the following table provide an indication of the risks of investing in the HIT by illustrating how returns can differ from one year to the next. The table also shows how the HIT’s average annual total returns for the one-, five-, and ten-year periods compare with those of the Bloomberg Aggregate. The HIT’s past performance is not necessarily an indication of how the HIT will perform in the future. Updated performance information is available on the HIT’s website at www.aflcio-hit.com.

During the ten-year period identified in the bar chart above, the highest return for a quarter was 6.82% (quarter ended December 31, 2023) and the lowest return for a quarter was -5.94% (quarter ended March 31, 2022).

AVERAGE ANNUAL TOTAL RETURNS

(for the periods ended December 31, 2024) | |||

| ONE YEAR | FIVE YEARS | TEN YEARS | |

AFL-CIO Housing

Investment Trust |

2.36% | -0.44% | 1.17% |

| Bloomberg U.S. Aggregate Bond Index (reflects no deductions for fees or expenses) | 1.25% | -0.33% | 1.35% |