| Label |

Element |

Value |

| Kensington Hedged Premium Income ETF |

|

|

|

| Prospectus [Line Items] |

rr_ProspectusLineItems |

|

|

| Risk/Return [Heading] |

rr_RiskReturnHeading |

Kensington Hedged Premium Income ETF

|

|

| Objective [Heading] |

rr_ObjectiveHeading |

Investment Objective:

|

|

| Objective, Primary [Text Block] |

rr_ObjectivePrimaryTextBlock |

The Kensington Hedged Premium Income ETF (the “Fund”) seeks current income with the potential for capital appreciation.

|

|

| Expense [Heading] |

rr_ExpenseHeading |

Fees and Expenses of the Fund:

|

|

| Expense Narrative [Text Block] |

rr_ExpenseNarrativeTextBlock |

This table describes the fees and expenses that you may pay if you buy, hold, and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table and Examples below.

|

|

| Operating Expenses Caption [Text] |

rr_OperatingExpensesCaption |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

|

|

| Portfolio Turnover [Heading] |

rr_PortfolioTurnoverHeading |

Portfolio Turnover:

|

|

| Portfolio Turnover [Text Block] |

rr_PortfolioTurnoverTextBlock |

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account at the shareholder level. These costs, which are not reflected in annual fund operating expenses or in the example above, affect the Fund’s performance. During the most recent fiscal period ended December 31, 2024, the Fund’s portfolio turnover rate was 7% of its average value.

|

|

| Portfolio Turnover, Rate |

rr_PortfolioTurnoverRate |

7.00%

|

|

| Expenses Not Correlated to Ratio Due to Acquired Fund Fees [Text] |

rr_ExpensesNotCorrelatedToRatioDueToAcquiredFundFees |

Acquired Fund Fees and Expenses (“AFFE”) are indirect costs of investing in other investment companies. The operating expenses in this fee table do not correlate to the expense ratio in the Fund’s financial highlights because the financial statements include only the direct operating expenses incurred by the Fund and not the indirect costs of investing in other investment companies.

|

|

| Expense Example [Heading] |

rr_ExpenseExampleHeading |

Example:

|

|

| Expense Example Narrative [Text Block] |

rr_ExpenseExampleNarrativeTextBlock |

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same.

|

|

| Expense Example by, Year, Caption [Text] |

rr_ExpenseExampleByYearCaption |

Although your actual costs may be higher or lower, based upon these assumptions your costs would be:

|

|

| Strategy [Heading] |

rr_StrategyHeading |

Principal Investment Strategies

|

|

| Strategy Narrative [Text Block] |

rr_StrategyNarrativeTextBlock |

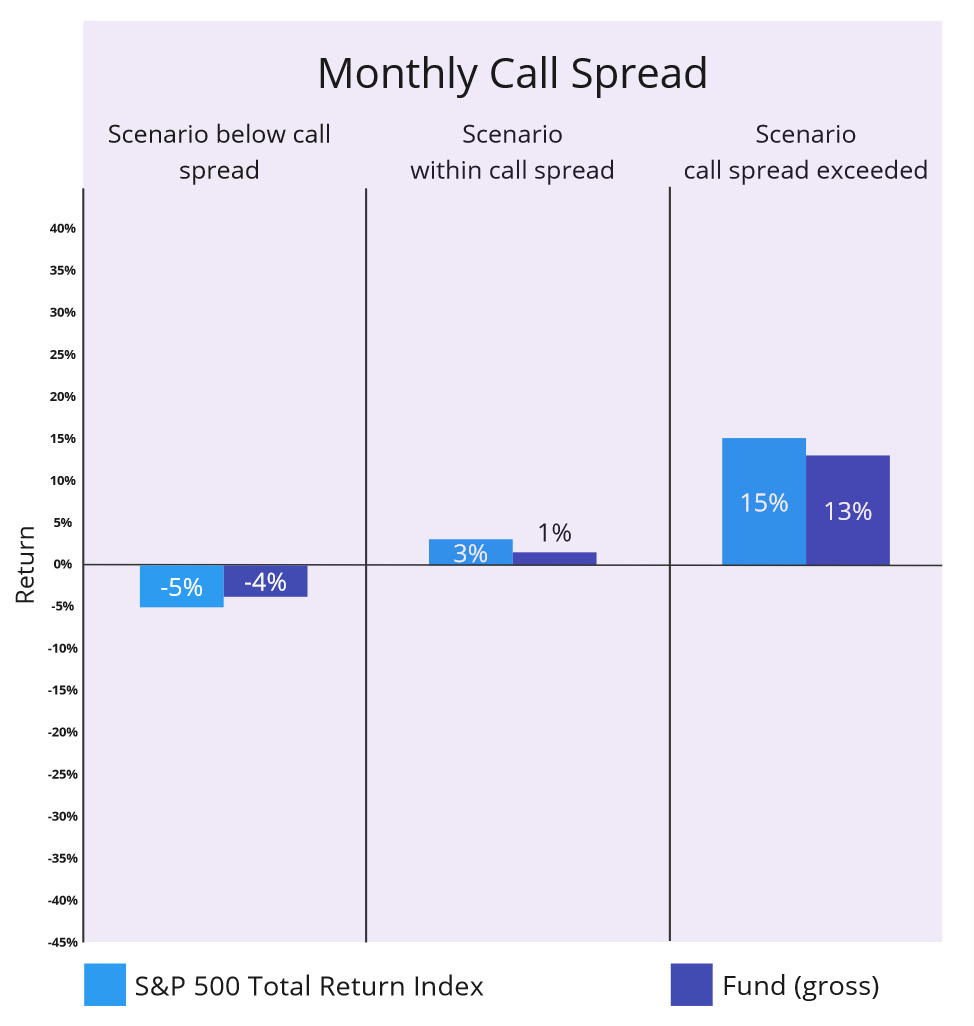

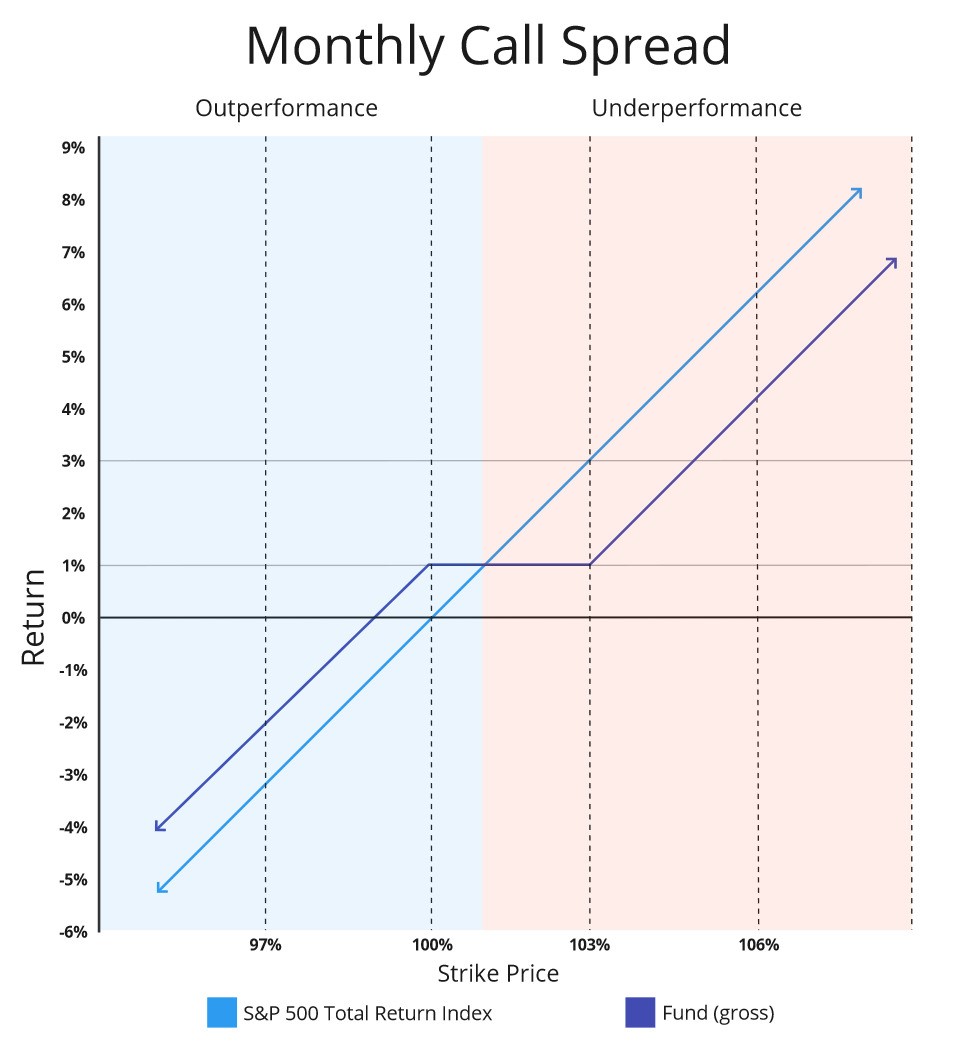

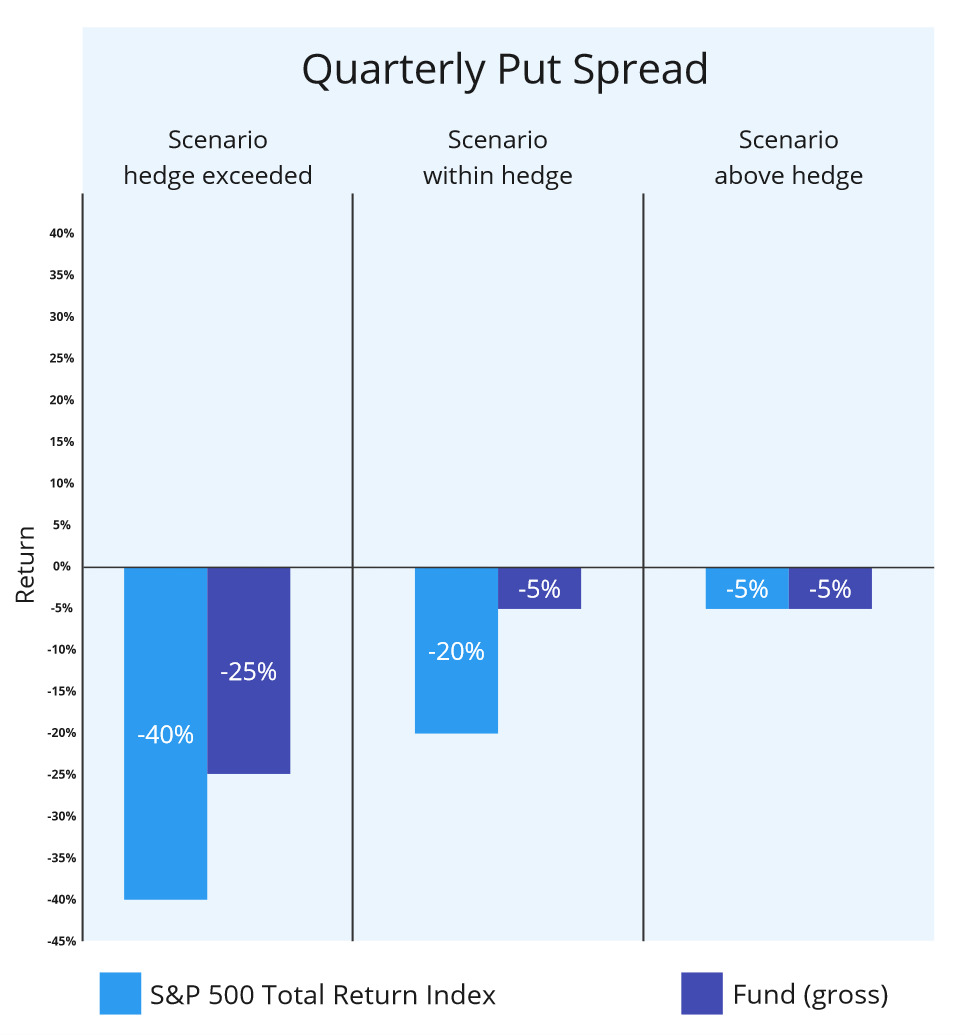

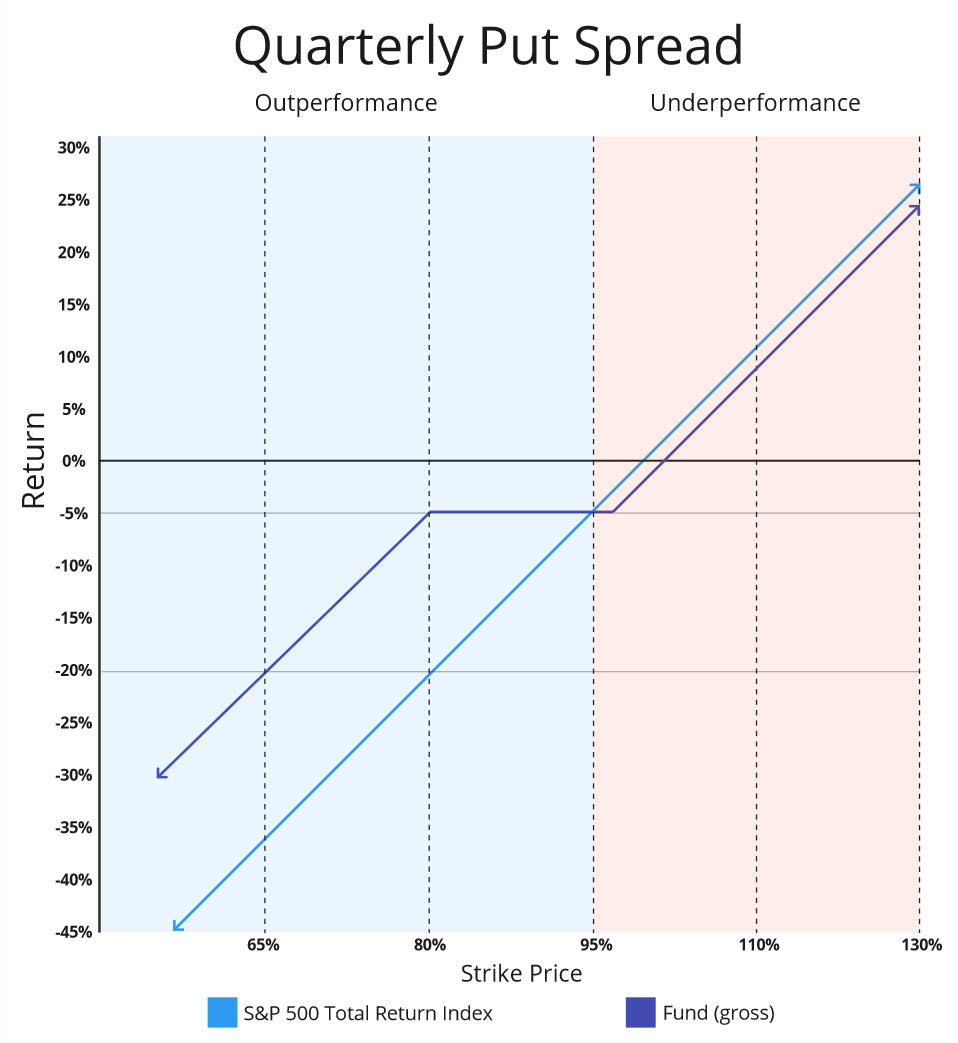

The Fund is an actively managed exchange-traded fund (“ETF”) that seeks to achieve its investment objective by gaining exposure to the S&P 500® Index (the “S&P 500”). The foundation of the Fund’s strategy involves buying shares of one or more cost-effective ETFs that track the S&P 500, providing direct exposure to the broad market's performance. The Fund simultaneously implements a monthly call option strategy to generate income and a quarterly put option strategy to protect against large declines in the S&P 500. In strategically buying and selling put and call options on the S&P 500, the Fund seeks to provide a partial buffer against market downturns, as well as provide additional income in flat to down markets, but resulting in lower upside potential during strong market rallies. In implementing its strategy, the Fund employs a methodology similar the MerQube Hedged Premium Income Index (the “MQKHPI”). The MQKHPI is designed to be 100% invested in the Vanguard S&P 500 ETF (VOO) while selling 1-Month call options and purchasing 3-Month put options on the SPDR S&P 500 ETF (SPY). The MQKHPI aims to generate income from selling call spreads while providing downside protection through the purchase of put spreads, maintaining exposure to the U.S. large-cap equity market. The Fund will operate similarly to the MQKHPI, but with several differences. For one, while the Fund may elect to purchase VOO and put and call options on SPY, the Fund will be more flexible in determining which cost-effective S&P 500 ETFs to purchase and what S&P 500 call and put options to buy and sell. Additionally, unlike the MQKHPI that holds options to expiration, the Fund will actively manage the risk-to-reward ratio of the Fund’s option strategies. If the perceived reward (premium or cost to close out a position) is not proportional to the risk (maximum potential loss), the Fund’s Sub-advisor will use its discretion to adjust or close the position if determined to be advantageous to the portfolio. The Fund’s Sub-adviser will also use independent judgement in determining what particular option spreads to buy and sell under various market conditions, unlike the fixed spreads used by the MQKHPI. Although the Fund’s strategy is not expected to materially change in different interest rate environments, varying levels of market volatility will impact the relative costs of downside protection and relative option spreads. Additionally, the sequence of investment returns will affect the various strikes prices, expiration dates, and intended purposes of the options used by the Fund, and could significantly impact Fund’s overall performance. The Fund, based on current market conditions, seeks to achieve the best balance of premium income/costs, downside protection, and upside potential to meet its investment objective of current income with the potential for capital appreciation. Monthly Call Options Strategy Call options are derivative instruments that allow the option purchaser to contractually purchase a particular security (or the security index) from the option issuer at a set price (the “strike price”) up to the expiration date of the options. When the issuer sells the call option, it receives a premium from the buyer in hopes that the option will not be exercised by the buyer. The monthly call options strategy consists of a mix of selling and purchasing call options on the S&P 500 (“S&P 500 call options”). The Fund seeks to generate income from the premiums earned from the sold S&P 500 call options. At the same time, the Fund seeks to realize capital appreciation from its S&P 500 ETF holdings as the S&P 500 increases in value, but with potentially reduced upside because of the sold S&P 500 call options it uses to generate premium income. The Fund’s purchased S&P 500 call options, however, are intended to offset this reduced upside potential and limit the risk of missing out on strong market rallies of the S&P 500. On a regular basis, typically monthly, the Fund sells S&P 500 call options to generate premium income while simultaneously buying “out of the money” long S&P 500 call options (i.e., options to purchase at a strike price that is higher than the current price of the reference security or index) to hedge against the possibility that the sold S&P 500 call options are exercised because the S&P 500 increases above the strike price of the sold S&P 500 call options. For example, as the S&P 500 increases in value during the month, the holders of the sold S&P 500 call options may be more incentivized to exercise their options which will create some losses for the Fund. However, if the price of the S&P 500 increases above the strike price of the purchased S&P 500 call options, the Fund will be protected from larger losses because the Fund will exercise its purchased S&P 500 call options, offsetting a portion of its losses on the sold S&P 500 call options. The call option strategy aims to profit from stable or declining S&P 500 prices, with the ideal scenario being the S&P 500 staying below the strike price of the sold S&P 500 call options. At the same time, the strategy seeks to control and cap the risk of loss from rapid gains of the S&P 500 with the purchased S&P 500 call options. While the strike prices of the S&P 500 call options may vary, the Fund will typically sell call options with a strike price between approximately 98-105% of the current value of the S&P 500, and purchase call options with a strike price between approximately 101-110% of the current value of the S&P 500. Once the S&P 500 appreciates by approximately 5% from its current level (the strike price of the sold call), such call spreads will begin to create a loss. This loss will, however, will typically be capped at approximately 3% (the difference in strike prices) after the net income from the call spreads. Because the call option strategy is typically executed every month, it may have a larger impact on the Fund’s returns than the put option strategy discussed below that is typically executed on a quarterly basis. For illustrative purposes only. Figures are approximate and subject to change. Charts assume a quarterly net premium gain of 3%, which results from three monthly call spreads and one quarterly put spread. Quarterly Put Options Strategy Put options are derivative instruments that allow the option purchaser to contractually sell a particular security (or the value of a security index) to the option issuer at a strike price up to the expiration date of the options. When the issuer sells the put option, it receives a premium from the buyer in hopes that the buyer will not exercise the option. The Fund’s put options strategy, typically executed on a quarterly basis, is designed to protect against large declines in the S&P 500. The quarterly put options strategy consists of a mix of purchased (or “long”) put options and sold (or “written”) put options on the S&P 500 Index (“S&P 500 put options”). While the strike prices of the put options may vary, each quarter the Fund typically purchases S&P 500 put options that are approximately 94-96% of the current S&P 500 level, paying a premium for downside protection from a large decline in the S&P 500. The Fund simultaneously sells S&P 500 put options with a strike price that is approximately 75-85% of the current price of the S&P 500 to generate some premium income to offset a portion of the cost of the purchased put options. The quarterly options strategy of buying a put slightly below the current market price and selling another put farther below the current market price is designed to protect against significant market downturns at a reduced cost. While the strike prices of the put options will vary, the put spreads will typically provide a payment to offset losses once the S&P 500 declines by approximately 5% (the strike price of the purchase put) but will no longer offset losses once the S&P 500 declines by more than an approximately 20% (the difference in strike prices) after the net costs of the put spreads. For illustrative purposes only. Figures are approximate and subject to change. Charts assume a quarterly net premium gain of 3%, which results from three monthly call spreads and one quarterly put spread. Expected Relative Performance of the Strategy The Fund’s performance will vary, at times substantially, from the performance of the MQKHPI and the S&P 500. In general, however, the Fund expects to perform somewhat in line with the MQKHPI, with the Fund’s active decisions around the implementation of its options strategies intended to improve the Fund’s performance relative to the MQKHPI. The Fund’s expected performance relative to the S&P 500 under various market conditions can be summarized as follows: When the S&P 500 is Flat or Declines: Expected Outperformance. In months and quarters where the S&P 500 shows minimal movement or decreases, the Fund’s overall performance is generally expected to also be flat to negative. However, the Fund would be positioned to outperform the S&P 500 primarily due to the monthly premium income generated from the monthly call options. •This anticipated relative outperformance is expected to increase during quarters where the S&P 500 declines by more than approximately 4-6%, due to the additional downside protection from the quarterly put options. •If the S&P 500 declines by more than approximately 20% from the purchase price of the put options, the Fund would have no further downside protection other than the call option premiums. The Fund would participate fully in the decline of the S&P 500 until new put options are purchased. When the S&P 500 is Up: Expected Underperformance. In months and quarters where the S&P 500 experiences an increase greater than approximately 1% (the estimated long-term average of option premiums collected), the Fund’s overall performance is generally expected to be positive. However, the Fund is likely to underperform the S&P 500 primarily be due to the Fund's option strategy that is intended to sacrifice a portion of the Fund’s upside potential in return for reduced volatility and additional income. •The underperformance for each monthly call option expiration cycle would be limited to the difference in call option strike prices (expected to be approximately 3%) and the approximate 1% premium collected. •If the S&P 500 rises above the strike prices of both call options, the Fund will no longer have capped appreciation until it sells new call options.” The Fund is considered to be non-diversified, which means it may invest a high percentage of its assets in a limited number of investments. Additionally, the Fund’s investment strategies will involve active and frequent purchases and sales of call and put options, but are not expected to result in high portfolio turnover.

|

|

| Risk [Heading] |

rr_RiskHeading |

Principal Investment Risks

|

|

| Bar Chart and Performance Table [Heading] |

rr_BarChartAndPerformanceTableHeading |

Performance:

|

|

| Performance Narrative [Text Block] |

rr_PerformanceNarrativeTextBlock |

As of the date of this Prospectus, the Fund does not have a full calendar year of performance as an ETF. When the Fund has been in operation for a full calendar year, performance information will be shown here. You should be aware that the Fund’s past performance (before and after taxes) may not be an indication of how the Fund will perform in the future. Updated performance information and daily NAV per share is available at no cost by calling toll-free 866-303-8623 and on the Fund’s website at https:// www.kensingtonassetmanagement.com/funds/documents.

|

|

| Performance One Year or Less [Text] |

rr_PerformanceOneYearOrLess |

As of the date of this Prospectus, the Fund does not have a full calendar year of performance as an ETF.

|

|

| Performance Availability Phone [Text] |

rr_PerformanceAvailabilityPhone |

866-303-8623

|

|

| Performance Availability Website Address [Text] |

rr_PerformanceAvailabilityWebSiteAddress |

https://www.kensingtonassetmanagement.com/funds/documents

|

|

| Performance Past Does Not Indicate Future [Text] |

rr_PerformancePastDoesNotIndicateFuture |

You should be aware that the Fund’s past performance (before and after taxes) may not be an indication of how the Fund will perform in the future.

|

|

| Kensington Hedged Premium Income ETF | Risk Lose Money [Member] |

|

|

|

| Prospectus [Line Items] |

rr_ProspectusLineItems |

|

|

| Risk Narrative [Text Block] |

rr_RiskTextBlock |

As with all funds, there is the risk that you could lose money through your investment in the Fund.

|

|

| Kensington Hedged Premium Income ETF | Management Risk Member |

|

|

|

| Prospectus [Line Items] |

rr_ProspectusLineItems |

|

|

| Risk Narrative [Text Block] |

rr_RiskTextBlock |

Management Risk. The Adviser’s strategies and judgments about the attractiveness, value, and potential appreciation of particular assets may prove to be incorrect and may not produce the desired results.

|

|

| Kensington Hedged Premium Income ETF | Equity Securities Risk Member |

|

|

|

| Prospectus [Line Items] |

rr_ProspectusLineItems |

|

|

| Risk Narrative [Text Block] |

rr_RiskTextBlock |

Equity Securities Risk. The Fund may invest in or have exposure to equity securities. Equity securities may experience sudden, unpredictable drops in value or long periods of decline in value. This may occur because of factors that affect securities markets generally or factors affecting specific industries, sectors, geographic markets, or companies in which the Fund invests.

|

|

| Kensington Hedged Premium Income ETF | ETF Risks Member |

|

|

|

| Prospectus [Line Items] |

rr_ProspectusLineItems |

|

|

| Risk Narrative [Text Block] |

rr_RiskTextBlock |

ETF Risks. The Fund is an ETF, and, as a result of an ETF’s structure, it is exposed to the following risks: ◦Authorized Participants, Market Makers, and Liquidity Providers Concentration Risk. The Fund has a limited number of financial institutions that may act as Authorized Participants (“APs”). In addition, there may be a limited number of market makers and/or liquidity providers in the marketplace. To the extent either of the following events occur, shares may trade at a material discount to NAV and possibly face delisting: (i) APs exit the business or otherwise become unable to process creation and/or redemption orders and no other APs step forward to perform these services, or (ii) market makers and/or liquidity providers exit the business or significantly reduce their business activities and no other entities step forward to perform their functions. ◦Cash Redemption Risk. While not expected to be a regular occurrence, the Fund’s investment strategy may require it to redeem shares for cash or to otherwise include cash as part of its redemption proceeds. The Fund may be required to sell or unwind portfolio investments to obtain the cash needed to distribute redemption proceeds. This may cause the Fund to recognize a capital gain that it might not have recognized if it had made a redemption in-kind. As a result, the Fund may pay out higher annual capital gain distributions than if the in-kind redemption process was used. ◦Costs of Buying or Selling Shares. Due to the costs of buying or selling shares, including brokerage commissions imposed by brokers and bid-ask spreads, frequent trading of shares may significantly reduce investment results and an investment in shares may not be advisable for investors who anticipate regularly making small investments. ◦Shares May Trade at Prices Other Than NAV. As with all ETFs, shares may be bought and sold in the secondary market at market prices. Although it is expected that the market price of shares will approximate the Fund’s NAV, there may be times when the market price of shares is more than the NAV intra-day (premium) or less than the NAV intra-day (discount) due to supply and demand of shares or during periods of market volatility. This risk is heightened in times of market volatility, periods of steep market declines, and periods when there is limited trading activity for shares in the secondary market, in which case such premiums or discounts may be significant. Because securities held by the Fund may trade on foreign exchanges that are closed when the Fund’s primary listing exchange is open, there are likely to be deviations between the current price of a security and the security’s last quoted price from the closed foreign market. This may result in premiums and discounts that are greater than those experienced by domestic ETFs. ◦Trading. Although shares are listed for trading on the NYSE Cboe BZX Exchange, Inc. (the “Exchange”) and may be traded on U.S. exchanges other than the Exchange, there can be no assurance that shares will trade with any volume, or at all, on any stock exchange. In stressed market conditions, the liquidity of shares may begin to mirror the liquidity of the Fund’s underlying portfolio holdings, which can be significantly less liquid than shares, and this could lead to differences between the market price of the shares and the underlying value of those shares.

|

|

| Kensington Hedged Premium Income ETF | ETF Risks, Authorized Participants, Market Makers And Liquidity Providers Concentration Risk Member |

|

|

|

| Prospectus [Line Items] |

rr_ProspectusLineItems |

|

|

| Risk Narrative [Text Block] |

rr_RiskTextBlock |

Authorized Participants, Market Makers, and Liquidity Providers Concentration Risk. The Fund has a limited number of financial institutions that may act as Authorized Participants (“APs”). In addition, there may be a limited number of market makers and/or liquidity providers in the marketplace. To the extent either of the following events occur, shares may trade at a material discount to NAV and possibly face delisting: (i) APs exit the business or otherwise become unable to process creation and/or redemption orders and no other APs step forward to perform these services, or (ii) market makers and/or liquidity providers exit the business or significantly reduce their business activities and no other entities step forward to perform their functions.

|

|

| Kensington Hedged Premium Income ETF | ETF Risks, Cash Redemption Risk Member |

|

|

|

| Prospectus [Line Items] |

rr_ProspectusLineItems |

|

|

| Risk Narrative [Text Block] |

rr_RiskTextBlock |

Cash Redemption Risk. While not expected to be a regular occurrence, the Fund’s investment strategy may require it to redeem shares for cash or to otherwise include cash as part of its redemption proceeds. The Fund may be required to sell or unwind portfolio investments to obtain the cash needed to distribute redemption proceeds. This may cause the Fund to recognize a capital gain that it might not have recognized if it had made a redemption in-kind. As a result, the Fund may pay out higher annual capital gain distributions than if the in-kind redemption process was used.

|

|

| Kensington Hedged Premium Income ETF | ETF Risks, Costs of Buying Or Selling Share Member |

|

|

|

| Prospectus [Line Items] |

rr_ProspectusLineItems |

|

|

| Risk Narrative [Text Block] |

rr_RiskTextBlock |

Costs of Buying or Selling Shares. Due to the costs of buying or selling shares, including brokerage commissions imposed by brokers and bid-ask spreads, frequent trading of shares may significantly reduce investment results and an investment in shares may not be advisable for investors who anticipate regularly making small investments.

|

|

| Kensington Hedged Premium Income ETF | ETF Risks, Shares May Trade At Prices Other Than NAV Risk Member |

|

|

|

| Prospectus [Line Items] |

rr_ProspectusLineItems |

|

|

| Risk Narrative [Text Block] |

rr_RiskTextBlock |

Shares May Trade at Prices Other Than NAV. As with all ETFs, shares may be bought and sold in the secondary market at market prices. Although it is expected that the market price of shares will approximate the Fund’s NAV, there may be times when the market price of shares is more than the NAV intra-day (premium) or less than the NAV intra-day (discount) due to supply and demand of shares or during periods of market volatility. This risk is heightened in times of market volatility, periods of steep market declines, and periods when there is limited trading activity for shares in the secondary market, in which case such premiums or discounts may be significant. Because securities held by the Fund may trade on foreign exchanges that are closed when the Fund’s primary listing exchange is open, there are likely to be deviations between the current price of a security and the security’s last quoted price from the closed foreign market. This may result in premiums and discounts that are greater than those experienced by domestic ETFs.

|

|

| Kensington Hedged Premium Income ETF | ETF Risks, Trading Risk Member |

|

|

|

| Prospectus [Line Items] |

rr_ProspectusLineItems |

|

|

| Risk Narrative [Text Block] |

rr_RiskTextBlock |

Trading. Although shares are listed for trading on the NYSE Cboe BZX Exchange, Inc. (the “Exchange”) and may be traded on U.S. exchanges other than the Exchange, there can be no assurance that shares will trade with any volume, or at all, on any stock exchange. In stressed market conditions, the liquidity of shares may begin to mirror the liquidity of the Fund’s underlying portfolio holdings, which can be significantly less liquid than shares, and this could lead to differences between the market price of the shares and the underlying value of those shares.

|

|

| Kensington Hedged Premium Income ETF | Tax Risk Member |

|

|

|

| Prospectus [Line Items] |

rr_ProspectusLineItems |

|

|

| Risk Narrative [Text Block] |

rr_RiskTextBlock |

Tax Risk. In order for the Fund to qualify as a regulated investment company under Subchapter M of the Code, the Fund must derive at least 90 percent of its gross income each taxable year from qualifying income. Income from certain commodity- linked derivative instruments in which the Fund invests is not considered qualifying income. The Fund will therefore restrict its income from direct investments in commodity-linked derivative instruments that do not generate qualifying income, such as commodity futures, to a maximum of 10 percent of its gross income.

|

|

| Kensington Hedged Premium Income ETF | Market Risk Member |

|

|

|

| Prospectus [Line Items] |

rr_ProspectusLineItems |

|

|

| Risk Narrative [Text Block] |

rr_RiskTextBlock |

Market Risk. Overall investment market risks affect the value of the Fund. Factors such as economic growth and market conditions, interest rate levels, and political events affect U.S. and international investment markets. Additionally, unexpected local, regional or global events, such as war; acts of terrorism; financial, political or social disruptions; natural, environmental or man-made disasters; the spread of infectious illnesses or other public health issues (such as the global pandemic coronavirus disease 2020 (COVID-19)); and recessions and depressions could have a significant impact on the Fund and its investments and may impair market liquidity. Such events can cause investor fear, which can adversely affect the economies of nations, regions and the market in general, in ways that cannot necessarily be foreseen.

|

|

| Kensington Hedged Premium Income ETF | Underlying Funds Risk Member |

|

|

|

| Prospectus [Line Items] |

rr_ProspectusLineItems |

|

|

| Risk Narrative [Text Block] |

rr_RiskTextBlock |

Underlying Funds Risk. Investments in underlying funds involve duplication of investment advisory fees and certain other expenses. Each underlying fund is subject to specific risks, depending on the nature of its investment strategy. The manager of an underlying fund may not be successful in implementing its strategy. ETF shares may trade at a market price that may be lower (a discount) or higher (a premium) than the ETF’s net asset value. ETFs are also subject to brokerage and/or other trading costs, which could result in greater expenses to the Fund. Because the value of ETF shares depends on the demand in the market, the Adviser may not be able to liquidate the Fund’s holdings at the most optimal time, adversely affecting performance.

|

|

| Kensington Hedged Premium Income ETF | Derivatives Risk Member |

|

|

|

| Prospectus [Line Items] |

rr_ProspectusLineItems |

|

|

| Risk Narrative [Text Block] |

rr_RiskTextBlock |

Derivatives Risk. In general, a derivative instrument typically involves leverage, i.e., it provides exposure to potential gain or loss from a change in the level of the market price of the underlying security (or a basket or index) in a notional amount that exceeds the amount of cash or assets required to establish or maintain the derivative instrument. Adverse changes in the value or level of the underlying asset or index, which the Fund may not directly own, can result in a loss to the Fund substantially greater than the amount invested in the derivative itself. The use of derivative instruments also exposes the Fund to additional risks and transaction costs. A risk of the Fund’s use of derivatives is that the fluctuations in their values may not correlate perfectly with the overall securities markets. ◦Options Risk. An option is an agreement that, for a premium payment or fee, gives the option holder (the purchaser) the right but not the obligation to buy (a “call option”) or sell (a “put option”) the underlying asset (or settle for cash an amount based on an underlying asset, rate, or index) at a specified price (the “exercise price”) during a period of time or on a specified date. Investments in options are considered speculative. When the Fund purchases an option, it may lose the premium paid for it if the price of the underlying security or other assets decreased or remained the same (in the case of a call option) or increased or remained the same (in the case of a put option). If a put or call option purchased by the Fund were permitted to expire without being sold or exercised, its premium would represent a loss to the Fund. By writing put options, the Fund takes on the risk of declines in the value of the underlying instrument, including the possibility of a loss up to the entire exercise price of each option it sells but without the corresponding opportunity to benefit from potential increases in the value of the underlying instrument. By writing a call option, the Fund may be obligated to deliver instruments underlying an option at less than the market price. In the case of an uncovered call option, there is a risk of unlimited loss.

|

|

| Kensington Hedged Premium Income ETF | Derivatives Risk, Options Risk Member |

|

|

|

| Prospectus [Line Items] |

rr_ProspectusLineItems |

|

|

| Risk Narrative [Text Block] |

rr_RiskTextBlock |

Options Risk. An option is an agreement that, for a premium payment or fee, gives the option holder (the purchaser) the right but not the obligation to buy (a “call option”) or sell (a “put option”) the underlying asset (or settle for cash an amount based on an underlying asset, rate, or index) at a specified price (the “exercise price”) during a period of time or on a specified date. Investments in options are considered speculative. When the Fund purchases an option, it may lose the premium paid for it if the price of the underlying security or other assets decreased or remained the same (in the case of a call option) or increased or remained the same (in the case of a put option). If a put or call option purchased by the Fund were permitted to expire without being sold or exercised, its premium would represent a loss to the Fund. By writing put options, the Fund takes on the risk of declines in the value of the underlying instrument, including the possibility of a loss up to the entire exercise price of each option it sells but without the corresponding opportunity to benefit from potential increases in the value of the underlying instrument. By writing a call option, the Fund may be obligated to deliver instruments underlying an option at less than the market price. In the case of an uncovered call option, there is a risk of unlimited loss.

|

|

| Kensington Hedged Premium Income ETF | Leverage Risk Member |

|

|

|

| Prospectus [Line Items] |

rr_ProspectusLineItems |

|

|

| Risk Narrative [Text Block] |

rr_RiskTextBlock |

Leverage Risk. As part of the Fund’s principal investment strategy, the Fund will make investments in derivative instruments. These derivative instruments provide the economic effect of financial leverage by creating additional investment exposure to the underlying asset, as well as the potential for greater loss. If the Fund uses leverage through activities such as entering into derivative instruments, the Fund has the risk that losses may exceed the net assets of the Fund. The net asset value of the Fund while employing leverage will be more volatile and sensitive to market movements.

|

|

| Kensington Hedged Premium Income ETF | Limited History Of Operations Risk Member |

|

|

|

| Prospectus [Line Items] |

rr_ProspectusLineItems |

|

|

| Risk Narrative [Text Block] |

rr_RiskTextBlock |

Limited History of Operations Risk. The Fund has a limited history of operations for investors to evaluate. The Fund may fail to attract sufficient assets to operate efficiently.

|

|

| Kensington Hedged Premium Income ETF | Risk Nondiversified Status [Member] |

|

|

|

| Prospectus [Line Items] |

rr_ProspectusLineItems |

|

|

| Risk Narrative [Text Block] |

rr_RiskTextBlock |

Non-Diversification Risk. As a non-diversified fund, the Fund may invest more than 5% of its total assets in the securities of one or more issuers. The Fund also invests in underlying funds that are non-diversified. The Fund’s performance may be more sensitive to any single economic, business, political or regulatory occurrence than the value of shares of a diversified investment company.

|

|

| Kensington Hedged Premium Income ETF | Kensington Hedged Premium Income ETF |

|

|

|

| Prospectus [Line Items] |

rr_ProspectusLineItems |

|

|

| Trading Symbol |

dei_TradingSymbol |

KHPI

|

|

| Management Fees (as a percentage of Assets) |

rr_ManagementFeesOverAssets |

0.95%

|

[1] |

| Distribution and Service (12b-1) Fees |

rr_DistributionAndService12b1FeesOverAssets |

none

|

|

| Other Expenses (as a percentage of Assets): |

rr_OtherExpensesOverAssets |

none

|

[2] |

| Acquired Fund Fees and Expenses |

rr_AcquiredFundFeesAndExpensesOverAssets |

0.01%

|

[2] |

| Expenses (as a percentage of Assets) |

rr_ExpensesOverAssets |

0.96%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 98

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

306

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

531

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

$ 1,178

|

|

|

|