UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 1-K

ANNUAL REPORT PURSUANT TO REGULATION A OF THE SECURITIES ACT OF 1933

For the fiscal year ended: December 31, 2024

Alternative Ballistics Corporation

(Exact name of issuer as specified in its charter)

| Nevada | 85-2764555 | |

| (State of other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification Number) |

5940 S. Rainbow Blvd.

Las Vegas, Nevada 89118

(Address, including zip code of principal executive office)

619-326-4411

(Issuer’s telephone number, including area code)

Common Stock

(Title of each class of securities issued pursuant to Regulation A)

Part II.

TABLE OF CONTENTS

Unless the context otherwise indicates, when used in this Annual Report on Form 1-K (this “Annual Report”), the terms “the Company,” “we,” “us,” “our” and similar terms refer to Alternative Ballistics Corporation, a Nevada corporation. We use a twelve-month fiscal year ending on December 31st. In a twelve-month fiscal year, each quarter includes three-months of operations; the first, second, third and fourth quarters end on March 31st, June 30th, September 30th, and December 31st, respectively.

The information contained on, or accessible through, our website at www.alternativeballistics.com are not part of, and are not incorporated by reference in, this Annual Report.

| i |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report contains certain forward-looking statements that are subject to various risks and uncertainties. Forward-looking statements are generally identifiable by use of forward-looking terminology such as “may,” “will,” “should,” “potential,” “plan,” “intend,” “expect,” “outlook,” “seek,” “anticipate,” “estimate,” “approximately,” “believe,” “could,” “project,” “predict,” or other similar words or expressions. Forward-looking statements are based on certain assumptions, discuss future expectations, describe future plans and strategies, or state other forward-looking information. Our ability to predict future events, actions, plans or strategies is inherently uncertain. Although we believe that the expectations reflected in our forward-looking statements are based on reasonable assumptions, actual outcomes could differ materially from those set forth or anticipated in our forward-looking statements. Factors that could cause our forward-looking statements to differ from actual outcomes include, but are not limited to, those described under the heading “Risk Factors.” Readers are cautioned not to place undue reliance on any of these forward-looking statements, which reflect our views as of the date of this Annual Report. Furthermore, except as required by law, we are under no duty to, and do not intend to, update any of our forward-looking statements after the date of this Annual Report, whether as a result of new information, future events or otherwise.

You should read thoroughly this Annual Report and the documents that we refer to herein with the understanding that our actual future results may be materially different from and/or worse than what we expect. We qualify all of our forward-looking statements by these cautionary statements including those made in Risk Factors appearing elsewhere in this Annual Report. Other sections of this Annual Report include additional factors which could adversely impact our business and financial performance. New risk factors emerge from time to time and it is not possible for our management to predict all risk factors, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Except for our ongoing obligations to disclose material information under the Federal securities laws, we undertake no obligation to release publicly any revisions to any forward-looking statements, to report events or to report the occurrence of unanticipated events. These forward-looking statements speak only as of the date of this Annual Report, and you should not rely on these statements without also considering the risks and uncertainties associated with these statements and our business.

| 1 |

Overview

Alternative Ballistics Corporation is a next generation less-lethal technology company that specializes in the production and distribution of a less-lethal impact round known as The Alternative® designed for the law enforcement industry. After several years of R&D, we completed an extensive series of ballistics testing of The Alternative® in the fourth quarter of 2022. In the first quarter of 2023, we completed our comprehensive training program with the recommendations based on ballistics data gained from the tests and introduced our product to the market through ongoing pilot programs with U.S. police departments and contracting internationally with agencies in foreign markets.

The technology that we designed is a bullet capture device that attaches to an officer’s service weapon. It was developed by a group of diverse individuals from law enforcement, military, and business backgrounds with the mission to design an effective tool to resolve certain types of “potential” lethal situations with a less-lethal force option that not only provides a de-escalation tool for the officer to attempt to preserve a life, but one that also optimizes the responding officer’s safety.

The Alternative® has evolved with multiple iterations over several years and is backed by several U.S. patents with patent applications filed in 16 additional countries through a combination of direct filings and subsequent filings through the PCT Application process. The current product iteration represents the safest, most accurate, and most effective model in the product’s history and has gone through several rounds of extensive ballistics testing to ensure its safety and efficacy when deployed in the field. While the current iteration was designed for the professional market and is being offered to law enforcement agencies, we plan to enter the commercial market as a product offering to consumers, depending on sufficient financing.

ABC Training and Certification Program

The “ABC Training and Certification Program” was developed by our legal advisors and our team of law enforcement professionals. It is a “train the trainer” program that is conducted by our team of law enforcement trainers, where we work with a department’s training team during a one-day course that involves a classroom session with a written exam and a range session with live fire activities and live fire qualification. The purpose of the training program is to certify a department’s training team and provide the necessary training tools, such as The Alternative® User Manual, Training Slides, Lesson Plan, Written Exam, Steps for Qualification, and Sample Policy. The program focuses on proper use and deployment protocols, including safe handling procedures and proper attachment, developing muscle memory for efficient deployment, and procedures to mitigate any associated risks. Every officer must complete the ABC Training and Certification Program, which is as important as the technology itself, before qualifying to carry The Alternative® on duty, and officers will be required to requalify at minimum on an annual basis while department trainers will be recertified on a bi-annual basis.

We plan to generate revenue from our training program and the initial sale of equipment, i.e., The Alternative® units and holsters. We plan to generate recurring revenue from the bi-annual recertification required for department trainers, replenishment of equipment after it is deployed, ongoing training equipment, and the equipment needed for annual requalification. Our target market includes law enforcement agencies at the local, state, and federal levels, military police, private security agencies, international law enforcement, and security agencies, and potentially the commercial market for consumers in the future.

Our Product

The Alternative® is a blunt force impact device that consists of a specialized alloy projectile, which is mounted onto the front of a bright orange docking unit, stored in an easily accessible pouch that fits on a duty belt, and uses an officer’s service weapon as its deployment platform. When being deployed, the unit is removed from the holster and attaches to the top of the firearm within seconds.

| 2 |

Once the weapon is fired, the bullet welds inside the projectile becoming one unit, and the new munition is propelled toward the target by the bullet’s kinetic energy. The docking unit will then automatically eject from the firearm, returning the weapon to its normal function as it cycles in a new round and is instantly ready for follow up with lethal force, if necessary. This feature allows the officer to remain in control of the situation, as The Alternative® projectile travels downrange at approximately 210 to 225 feet per second (fps), or roughly 20% of the speed of a normal bullet, impacting the targeted individual with non-penetrating energy. Ballistics testing data has determined that The Alternative® is expected to incapacitate an individual, while posing very little risk of death or critical injury.

The Alternative® is compatible with the most used firearms in U.S. police departments, such as the Glock 17, 19, 45, and pre-Gen 5 series of Glock 22 and 23. It is also compatible with the Sig Sauer P320, Smith & Wesson M&P, Taurus TH9, Springfield Echelon and CZ P-10, and the projectile is compatible with 9mm and .40 caliber ammunition. New docking unit molds can be designed and built for most semi-automatic pistols based on an appropriate level of demand.

Our Mission

We believe The Alternative® can play a critical role in the concept of a less-lethal community, where innovators work toward the common goal of addressing use of force challenges in modern policing. We believe that the use of less-lethal technologies, such as The Alternative® when applicable, not only has the potential to save lives while protecting officers but can also build trust between law enforcement and the communities that they serve and protect.

Our mission is simple, which is to save lives and protect officers in the line of duty. To do this, we intend to partner with law enforcement agencies throughout the world to equip and train officers with The Alternative® as an efficient and effective option.

Our Market Opportunity

Professional Market

We are in the LLA market of the law enforcement industry, although The Alternative® is technically not classified as ammunition by the Bureau of Alcohol Tobacco and Firearms. See “Commercial Market” below. This is a niche market with multiple tools and options available to officers for the deployment of various types of tools designed to temporarily incapacitate, stun, or cause temporary discomfort to a person without penetrating the body. Less-lethal technologies are continuously evolving, and law enforcement agencies are generally open to reviewing data, scheduling demonstrations, or procuring ammunition samples to conduct their own internal testing, which is influencing the growth of the LLA global market.

The LLA global market was roughly $850 million in 2022 and is projected to grow from $890 million in 2023 to $1.2 billion by 2030, registering a CAGR of 5.71% during the forecast period 2023 through 2030.1 The common types of weapons in this market are shotguns and launchers deploying multiple types of ammunition, such as rubber bullets, bean bag rounds, polyethylene/plastic bullets, and paintballs, and the end users are law enforcement, military, and security companies. Researchers have formulated several testing methodologies, which help in assessing less-lethal kinetic energy munitions, and the results from these tests are presented to end users to enable the assessment and informed decision-making in the procurement process.

The rubber bullets segment led the market and accounted for more than a 35% share of the global revenue in 2022 and is expected to witness a CAGR of 4.7% over the 2030 forecast period.2 These types of bullets are the most conventional less-lethal projectiles used by most peacekeeping agencies across the globe. The law enforcement end-user segment led the market and accounted for more than 58% share of the global revenue in 2022.3 Law enforcement agencies are looking for ways to reduce the risk of fatalities during various types of encounters, including with protesters and irritants during crowd control operations around the world.

1 Global Less Lethal Ammunition Market Overview, By: Sejar Akre, Market Research Future, July 2023.

2 Id.

3 Id.

| 3 |

North America dominated the LLA market and accounted for over 32% of the revenue share in 2022, and the U.S. is the major contributor to LLA sales in North America,4 since it exhibits a high defense-spending budget every year, thereby leading to a higher procurement of LLA for its law enforcement and military agencies. Asia Pacific is expected to witness notable growth over the 2030 forecast period with factors, such as the rise in China’s defense spending and the increase of political disputes and civil disorder in parts of India, that are expected to drive the demand for less-lethal ammunition this region. Middle East Asia is expected to witness the fastest CAGR of 7.8% over the 2030 forecast period,5 owing to a notable rise in crime rates in countries such as South Africa, Kenya, Nigeria, and Papua New Guinea.

The global LLA market is witnessing an increasing trend of organic and inorganic growth through expansion and mergers and acquisitions. Companies are trying to increase their sales through acquisition, investment, and innovation, and expanding capacities to facilitate the respective markets.

On a domestic level, the U.S. target markets include federal, state, and local law enforcement agencies, of which there are over 18,000 agencies, which include almost 700,000 full-time law enforcement officers combined.6 At the state level, we look to contract with state police and state highway patrol, and at the local level, we aim to contract with municipal, county, tribal, and regional police departments. At the deputy sheriffs’ level, the goal is to contract with patrol and correctional facilities. At the federal level, we look to contract with DHS agencies, such as Border Patrol, ICE, and Secret Service; also with DOJ agencies, such as ATF, DEA, FBI, U.S. Marshals, and the Federal Bureau of Prisons; with Department of Interior agencies, such as the Bureau of Land Management, U.S. Park Rangers, and the U.S. Park Police; and finally the Legislative Branch to contract with the U.S. Capitol Police.

We have taken various steps to launch our product in the LLA global market, which include ballistic testing to achieve compliance with industry standards for impact energy, establishing training protocols and deployment guidelines, and receiving product classification from the ATF. The first steps, with regard to ballistics testing, involved R&D to assess the functionality of the device including velocity, precision, and impact energy. The first round of tests was completed in June 2021, and additional tests were conducted throughout 2022. The testing methodologies and results are described in greater detail in the following sections, ‘Our Competitive Strengths’ and ‘Thorough Ballistics Testing of The Alternative®,’ and in the Sydor Technologies Report, attached as Exhibit 99.2.

Upon completion of the tests, we submitted a formal request to the ATF for product classification, which the Company received in August 2023 ruling that the product is not a controlled device under the agency’s regulatory purview over ammunition, firearms, and destructive devices. This ruling is further discussed in the ‘Product Classification’ section to follow, which explains how we expect the alleviation of licensing requirements on domestic sales and the removal of manufacturing restrictions to mitigate regulatory obstacles, which could have otherwise impeded our business objectives if the product was classified as ammunition and scheduled to be under the agency’s regulatory control.

The test results guided the process by which our team created our training program, established deployment guidelines, safe handling procedures, and optimal range. Our training program was designed by our team of law enforcement professionals and follows best practices in the law enforcement industry with a format and qualification cadence that is similar to other less lethal tools that are commonly used in the current market with regard to training, departments’ instructor certifications, and officers’ annual requalification.

Once the testing initiatives and training program were completed in Q2 2023, we were prepared to onboard our first pilot program with the Jackson County Sheriff’s Office in Texas. Since then, we have continued to exhibit at trade shows and have scheduled live demonstrations throughout the U.S. and Brazil. We have initiated a total of three U.S. pilot programs and have received non-binding letters of intent to purchase from a few departments in Brazil. We have remained steadfast in scheduling demonstrations with interested departments and seek to expand these efforts on a global scale by increasing the number and frequency of demonstrations, attending additional trade shows, joining national, state, and local associations, and engaging sales and distribution partners in international markets.

4 Id.

5 Id.

6 FBI; U.S. Bureau of Justice Statistics; Statista 2021.

| 4 |

In preparation of our global outreach, we expanded our patent protection in 2024 to 16 countries outside of the U.S. and have filed two continuation applications in the U.S. to strengthen and allow for the expansion of our family of patents. In the international markets, we used the PCT Application process, and one of 16 countries is the EPO that includes 39 countries under its umbrella of protection. Now that we have established protection in these additional countries, we can respond to the interest that we have been receiving from these markets. The full list of our patents can be found in the Intellectual Property section to follow.

As with any new law enforcement technology, especially one that is a pain compliance tool, the rate of adoption can be slow due to initial concerns and lack of general knowledge on new products. With wider adoption and demonstrable success in the field, we expect the sales cycle to be shortened. We have experienced positive feedback from department representatives in attendance for each demonstration once officers have a better understanding of use case application and the ease of use surrounding the functionality of the device, however, department concerns, such as being the first to carry, not having enough real-world deployment data, additional training requirements, and in some instances, budgetary or political concerns, have presented material obstacles that we plan to overcome.

In 2024, we significantly enhanced our marketing efforts, improved our training presentation format, and launched special projects to build awareness of our product. This included new video and website content, new email outreach campaigns, new training materials, and video productions of live demonstrations and actual training classes. Our Chief Executive Officer volunteered to be the first human to stand downrange and take a live shot from The Alternative®, which was documented as a professional video production, and as a further human effects study, we commissioned a video of live shots on an organic ballistic torso to demonstrate the safety and viability of our device. In all instances, The Alternative® performed as intended, and as a result of our team’s marketing efforts this year, we have significantly enhanced the interest in our product in the U.S. and abroad.

Commercial Market

We intend to introduce The Alternative® to the commercial market with the aim of making firearms safer and the goal of reducing gun deaths, specifically those caused by semi-automatic pistols. Whether it is an accidental round fired by a minor in the home or a deployment of lethal force in a self-defense encounter, The Alternative® exists to provide a potential alternative to fatal outcomes in these types of incidents.

We are aware that the U.S. makes up the largest global market of personally owned firearms, but it is difficult to know the exact count, however, some estimates from years ago7 have put the total number of guns in the U.S. higher than the total number of citizens. Based on recent reports, we can see that the last several years during and after the pandemic were record-breaking for firearms sales8 where Americans purchased approximately 60 million firearms from 2020 to 20229 with semi-automatic pistols being the most purchased.

Historically, rifles and shotguns have outsold pistols, but that began to change in the 1990s when a cultural shift saw more gun owners purchase firearms for self-protection10 rather than for sport or hunting. From 2019 to 2021, U.S. gun manufacturers produced almost double the number of semi-automatic pistols to the amount of rifles, at approximately 15 million compared to approximately 9 million,11 respectively. During this timeframe, predominantly as a response to events during the pandemic and a desire to protect life and property, if necessary, it is reported that 18% of U.S. households purchased firearms, and these related sales increased the number of armed homes to 46% up from 32% pre-pandemic.12

7 There are now more guns than people in the United States, Christopher Ingraham, The Washington Post, October 2015.

8 How Many Guns Are Circulating in the U.S.?, Jennifer Mascia and Chip Brownlee, The Trace, March 2023.

9 Americans bought almost 60 million guns during the pandemic, Daniel De Visé, The Hill, April 2023.

10 Fear of Other People Is Now the Primary Motivation for American Gun Ownership, a Landmark Survey Finds, Kate Masters, The Trace, September 2016.

11 The Trace: Gun Production from 1899 to Present.

12 Americans bought almost 60 million guns during the pandemic, Daniel De Visé, The Hill, April 2023.

| 5 |

Our goal is to leverage this prime market with The Alternative® as a compelling tool that seamlessly transitions the consumer’s firearm into a less lethal option. The consumer product iteration is approved and we intend to launch The Alternative® into the U.S. guns and accessories industry as the latest innovative protective tool for home and self-defense options.

The consumer version is compatible with 9mm and .40 caliber ammunition and the same models of firearms as the law enforcement version. In the commercial market, it is recommended that The Alternative® unit remain mounted to the firearm while it is safely stored in the home, where it would immediately be ready as a less-lethal option for home-defense. The recommendation of keeping the attachment mounted may also serve to make the gun safer, as mentioned above, for the possible prevention of unintentional gun deaths, which the U.S. sees on average approximately 500 per year.13

Unintentional gun deaths include a wide range of incidents, such as accidental discharge when cleaning or reloading, hunting mistakes, unintentional victims of a shootout and stray bullets, but perhaps the most preventable incidents are those involving children or young people observing or playing with a firearm in the house while unsupervised. A study looked at unintentional gun deaths in the U.S. from 2005 to 2015,14 and of the estimated 430 annual fatalities during this period, 28.3% of the incidents included playing with the gun, and 17.2% included thinking the gun was unloaded. In these incidents, the rates were highest in children and young adults, ages 10 to 29.

We have already received high interest from consumers in our product, as well as from potential distribution partners in the U.S. and abroad. To do this, we plan to start by developing, testing, and producing a consumer version of our product and engage experienced professionals with successful track records of bringing products to market in the home-defense and self-defense sectors. We believe that the Commercial Market will have less obstacles to entry, and therefore could result in a shorter sales cycle, than the Professional Market, Based on the size of the U.S. consumer market for semi-automatic pistols, compared to the number of officers in the U.S. law enforcement market, the Commercial Market could potentially represent a much larger opportunity for our product if there is a high demand by consumers.

Product Classification

In August 2023, we received a response from the ATF’s Firearm Technology Industry Services Branch (“FTISB”) for our request for a product classification of The Alternative®. The ATF refers to the Bureau of Alcohol, Tobacco, Firearms and Explosives, which is the federal agency responsible for investigating and preventing federal offenses involving the unlawful use, manufacture, and possession of firearms and explosives. The ATF also regulates, via licensing, the sale, possession, and transportation of firearms, ammunition, and explosives in interstate commerce. The FTISB is a branch of the ATF that is responsible for classifying firearms and ammunition, which concluded that The Alternative® does not constitute ammunition, as defined by the Gun Control Act of 1968 (“GCA”), is not a firearm, as defined by the GCA, and not a destructive device as defined by the National Firearms Act of 1934 (“NFA”) and is therefore not a listed product under the GCA or NFA. The conclusion reached by the FTISB, may remove critical restrictions related to various initiatives, such as manufacturing, importing/exporting, selling, and distribution, which we believe will have a significant positive impact for our growth efforts in the professional and commercial markets. For example, if The Alternative® would have been classified as a listed product, we would not be able to import components from certain countries designated with a weapons embargo. If The Alternative® was a listed product, we would also be required to carry specific ammunition licensing for the sale of our product in the professional and commercial markets, and only licensed distributors would be able to resell our product. While this ATF ruling allows us to sell the product in interstate commerce without licensing under the GCA or NFA, other countries may consider the product to be a controlled device by their regulatory bodies, where we may be subject to certain licensing requirements in those foreign markets to sell the product. A copy of the “ATF Final Opinion on The Alternative® Product Classification” is attached as an exhibit to this Annual Report.

13 How Often Are Guns Involved in Accidental Deaths?, Jennifer Mascia, The Trace, December 2022.

14 Unintentional firearm deaths in the United States 2005–2015, Sara J. Solnick and David Hemenway, Injury Epidemiology Journal, 2019.

| 6 |

Our Competitive Strengths

The Alternative® is a unique less lethal tool that is currently available to officers in the marketplace. We believe that our technology fills a critical safety gap in situations where officers encounter non-compliant subjects, who are presenting a potential lethal threat with a weapon other than a gun. Under current protocols with traditional options, officers may identify these situations as a less-lethal encounter and proceed to call for back-up to arrive with an appropriate tool, such as the beanbag shotgun or 40mm less-lethal launchers, which deploy impact rounds in an effort to change the subject’s behavior and gain compliance.

The “safety gap” referenced above relates to the time that it takes for an officer to arrive and get into position before deploying a less-lethal tool, commonly referred to by law enforcement professionals as a “planned event.” Since less-lethal launchers or rifles are generally carried in the officer’s vehicle or by a designated less-lethal task group, it is not an efficient option for situations where every moment is critical and the matter of life and death hangs in the balance. We acknowledge that less-lethal launchers are essential tools in these types of situations, but they are often minutes away when seconds count.

We also acknowledge that Axon Enterprise, Inc. (“Axon”) (formerly Taser, Inc. (“Taser”)), which manufactures one of the most well-known and successful less-lethal products on the market, the Taser conducted energy weapon, has been a major catalyst in establishing and growing the global market for less-lethal products. We believe that Taser, like less-lethal launchers, is an essential tool in policing for the purpose of safely affecting arrests. However, we do not regard Taser or other types of restraint devices as our direct competitors, due to the difference in use-case applications for various threat levels.

For example, The Alternative® is an intermediate force option for situations that involve a non-firearm weapon, which has escalated to a potential lethal threat, while Taser is widely used when dealing with non-compliant subjects who are resisting arrest and are combative, but who are generally unarmed. In cases where officers have lethal cover and time to put a plan in place, Taser is often deployed as an option to gain compliance, but movement, clothing, environment, and weather can alter effectiveness. This is a factor that departments must consider when writing policy for these types of critical incidents, and it is one of the main reasons why they opt for impact weapons to effectively address an elevated threat level. In contrast to those options that need to be called to the scene, such as less-lethal launchers, The Alternative® provides a tool that is readily available to every officer by remaining holstered on the duty belt and ready to deploy within seconds rather than minutes, and as evidenced by a comparative ballistics analysis that was conducted by NTS, The Alternative® kinetic impact energy is comparable to that of the 40mm impact rounds. We believe that this “availability” and efficiency to deploy, will save lives while protecting officers, as our solution does not require the officer to transition to a separate device.

Once The Alternative® is fired by the officer, it instantly detaches from the firearm and a new round is cycled into the chamber of the service weapon, allowing the officer to immediately retain lethal force for follow up shots if necessary to stop the threat. Our goal is not to replace any current tools, but instead, we hope to provide an additional critical option that saves lives and protects officers by allowing them to respond efficiently with appropriate force and remain in control of the situation.

Our technology has undergone extensive ballistics testing, including being the first unit in June 2021 to go through the newly published standard test method ASTM E3276, in addition to Penetration Assessment of Less Lethal Munitions (PALLM) and NIJ 0101.06 (Modified) Body Armor to assess intervening materials. All tests were conducted by NTS, one of the nation’s most prominent NIJ-accredited ballistic labs. In 2022, we began working with an independent ballistics’ science firm, Sydor Technologies, to assess the level of testing performed by NTS and advise on additional tests needed to prepare The Alternative® for introduction to the market.

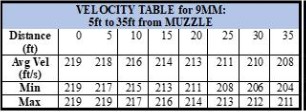

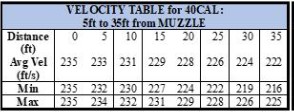

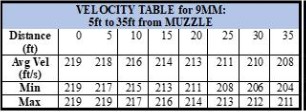

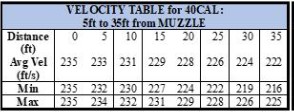

Through the work by Sydor, it was determined that we needed to modify the dimensions of our projectile to decrease velocity so that its impact energy aligns within the range of industry accepted levels of risk for blunt trauma. This modification resulted in reducing velocity by up to 70 feet per second (ft/s), from an average velocity of 275 to 280 ft/s down to an average velocity of 210 to 220 ft/s for the 9mm projectile and 220 to 235 ft/s for the .40 caliber projectile. All velocity testing was conducted by NTS in Belcamp, MD.

| 7 |

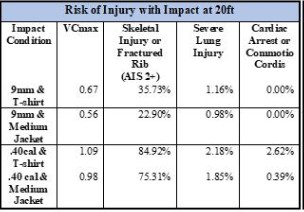

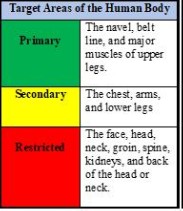

This modification to the projectile design caused delays in getting the product to market and incurred significant cost, however, the changes were critical, and our management team did what was necessary to ensure that The Alternative® would be safe and effective for use in the field. The additional tests conducted by NTS under Sydor’s observation included another ASTM-E3276 to assess the precision, velocity, and impact energy of the newly modified projectile, in which it performed extremely well in all categories. The new projectiles were also analyzed for injury assessment that was conducted by Dr. Cynthia Bir at Wayne State University Biomedical Engineering Research facilities. The tests at Wayne State included an f-BTTR surrogate that was previously validated to respond similarly to an average size male and was able to measure the maximum viscous criterion (VCmax), a blunt trauma injury metric and correlate it with a percent risk of certain injuries. As represented in the velocity and risk of injury tables below, it is clear that the modifications to the projectile were successful based on the lower velocities and low risk of severe blunt trauma injury. Based on the results of the ballistics data, we were able to develop its deployment protocols and establish primary, secondary, and restricted target areas of the human body.

|

|

Velocity testing was conducted by NTS and the Velocity Tables above were prepared by Sydor Technologies using the velocity measurements at muzzle and at 1 meter from the target. The drag curve was then used to calculate the velocities in 5 ft increments from muzzle to 35 ft.

|

|

|

VCmax measurements were completed at Wayne State University, and the risk of injury percentages were prepared by Sydor Technologies. The target areas of the Human Body were prepared by Alternative Ballistics Corporation, based on the cumulative results of all ballistics tests conducted and incorporated therein into the Company’s training program.

A copy of the Sydor Ballistics Report is attached as an exhibit to this Annual Report.

Our Historical Growth and Growth Strategy

We have a global growth strategy for domestic and international professional markets of the law enforcement and security industries. Once fully capitalized the Company intends to launch a consumer version for global commercial markets. Our team utilizes various methods to market The Alternative®, including direct sales efforts, exhibiting at trade shows, conducting live demonstrations, and various email and online marketing campaigns. We also try to leverage the networks of our law enforcement team and our advisory board, and we work with a government relations firm to build awareness and gain political traction at the federal, state, and local levels, and with national associations and federal agencies. We have made connections with departments across the country that have expressed high interest in The Alternative®, and we believe that the sales cycle may be shortened once The Alternative® is adopted by larger departments and becomes more prominent in the field with successful domestic and international deployments.

| 8 |

After spending the better part of two years in R&D, we completed our ballistics testing in the fourth quarter of 2022, our comprehensive training program in the first quarter of 2023, and have since been introducing The Alternative® to the market in the U.S. and abroad. In December 2022, shortly after completing our ballistics testing, we were invited by the U.S. Consulate in Brazil to present at a special “Law Enforcement Showcase” event where we were one of ten U.S. companies to receive the special invitation to meet with Sao Paulo Civil Police and several other law enforcement agencies in Brazil. In January 2023, we exhibited at our first major conference – the SHOT Show in Las Vegas, Nevada. We then exhibited at the National Sheriff’s Association Winter Conference in Washington, D.C. in February 2023, followed by exhibition at the International Association of Chiefs of Police (“IACP”) conference in October 2023 and the SHOT Show in Las Vegas in January 2024. These events coupled with our various marketing initiatives have built a large audience in the professional and commercial markets through brand awareness and product knowledge by conducting key demonstrations that led to engagement for multiple pilot programs in Texas and our first purchase order from a department in Florida, which we fulfilled in June 2023 with a non-material invoice amount of $2,300. Additionally, we have generated purchasing interest from departments in South America that has resulted in non-binding letters of intent to purchase, and in May 2024, we received a non-material invoice from our distribution partner totaling $4,375 as an initial purchase toward inventory.

In January 2024, we engaged a reputable marketing firm with the goal of enhancing our image and online presence through various initiatives on social media and website improvements. We have received positive feedback from our marketing campaigns with Police1, the premier media platform for the global law enforcement industry, and we have just extended the campaign for a new 12-month term in August 2024, where our new marketing team will have the opportunity to optimize our presence and engagement with our target market. Our Company page on the platform has been instrumental in building awareness and interest with U.S. departments through messaging campaigns and the hosting of our latest video content, published articles, and press releases, which will be a critical portal for news and updates as we gain traction with law enforcement agencies.

We plan to continue expanding our international presence through our contacts at the U.S. Commercial Service by building business relationships with vetted and well-established affiliates, representatives, and distributors in foreign markets, as determined by this division of the U.S. Department of Commerce, which will coincide with our international IP strategy. We filed a new utility patent with the U.S. Patents and Trademarks Office (USPTO) in December 2021, which issued on January 31, 2023, as Patent No. 11,566,876 along with a Continuation that’s been allowed to issue for the opportunity to build a new family of patents. In total, we own six U.S. patents and have extended protection to 16 countries outside of the U.S. See “—Intellectual Property.”

Another significant development in 2023 was the completion of our training program, where deployment guidelines and protocols have been developed and supported by the ballistics data obtained from the completed series of tests. We believe that the training program and protocols are a critical aspect when introducing a new technology in the field of law enforcement. This is why it was imperative for us to establish a reputable and credible team of instructors. After our first completed training course conducted by Chief Perez and lead trainer Jose Garcia, we received the following comment from the Chief Deputy David Johnson of the Jackson County Sheriff’s Office, our first pilot department in Texas, “Mr. LeBlanc, thanks for allowing me to be part of the Alternative Ballistics Trainer Program. The class and instructors were top notch. During my 35 years with Texas DPS I taught ‘general hazardous materials’ all over Texas and the U.S. so I know how hard it is to plan and carry out a successful class. I am now carrying the Dock and Projectile, and I talk about its use to everyone who asks about it. After that eight hour course, I became a believer, and now I’ve trained my deputies, and they’ve become believers as well. The Alternative® is a great product, and it has a place in my tool box.”

We expect the training program to be our most robust and cost intensive operation, as it will entail sending training teams throughout the country and potentially the world on multiple day trips to conduct presentations, demonstrations, and training. This will involve traveling with weapons, product inventory, and gear. We plan to expand the training team regionally with current and former law enforcement professionals. The program is built on repeatable practices and well-developed standard operating procedures to allow for scalability. After the initial training and qualification, deputies and officers will be required to requalify on an annual basis, and department instructors will be required to recertify on a bi-annual basis. These requirements for ongoing training, requalification, and replenishment are intended to drive our recurring revenue model.

| 9 |

Our commercialization strategy includes two phases:

| ● | Phase 1 is our monetization initiatives, which consist of conducting certain fundraising activities and introductions of our business and products into the domestic and international professional markets. | |

| ● | Phase 2 is continued expansion in professional markets and the launch of our consumer version in the commercial market. |

In Phase 1, we are looking to contract at the local level with private security companies and municipal, county, tribal, and regional police departments, including sheriffs’ departments comprising patrol, corrections, and school resource officer populations. At the state level, we are aiming for state police and highway patrol. At the federal level, we are aiming for DHS agencies, such as Border Patrol, ICE, and Secret Service; DOJ agencies, such as ATF, DEA, FBI Police, U.S. Marshals, and Federal Bureau of Prisons; Department of Interior agencies, such as Bureau of Land Management (BLM), U.S. Park Ranger, and U.S. Park Police; and Legislative Branch, the U.S. Capitol Police. Phase 1 objectives also include international strategies in discussions with countries around the world through the connection of USCS representatives.

In Phase 2, our focus will be on the continued expansion into the domestic and international professional markets, in addition to the proposed launch of our consumer version of The Alternative® in the commercial market.

As a unique less-lethal tool, we believe that The Alternative® is unlike any other option that is currently available to officers in the marketplace. Our technology fills a critical safety gap with an option that has not existed until now, however, we are unable to predict the market acceptance of our products or the level of future sales. We believe that The Alternative®, as a readily available option on the duty belt of an officer, provides a compelling tool to preserving life, optimizing officer safety, and mitigating the damage caused by firearm fatalities. Successful ballistics tests and high interest from law enforcement agencies in the U.S. and abroad indicate that we are on target to penetrate the professional market and supply demand in the commercial market, however, there can be no assurance of the quantity or timeframe of orders or sales in the future. See “Risk Factors.”

Thorough Ballistics Testing of The Alternative®

We have had The Alternative® evaluated through extensive ballistics testing conducted by third-party, independent ballistics laboratories, including National Technical Systems (“NTS”) at its Chesapeake testing facility in Belcamp, Maryland (which has an accredited firing range approved by the National Institute of Justice (“NIJ”) and Wayne State University in Detroit, Michigan.

We also retained one of the most respected independent data assessment and measurement companies in the United States, Sydor Technologies based in Fairport, New York, to review and analyze the data collected by NTS and Wayne State University.

Our goal in this rigorous third-party testing program was to confirm with solid empirical data that The Alternative® is truly a less-lethal option for police officers to use and, in particular, when deployed at close range (defined as zero to 35 feet) in an urgent tactical situation, The Alternative® will pose only modest but acceptable risk of serious bodily injury to a subject who has to be subdued and arrested.

Such detailed ballistics testing has thus measured and verified the precision and accuracy of the projectile when aimed at a subject within certain typical tactical distances from the officer, the velocity of the projectile at those distances from the officer, the delivered energy upon impact of the projectile, and the likelihood of the projectile’s penetration of the subject’s skin and injury to any vital organs within the subject’s body.

Sydor Technologies has reviewed and assessed a good deal of our ballistics testing data and prepared a report entitled “Analysis of Results from Testing at Wayne State University.” Full copies of our ballistics test reports are attached as an exhibit to this Annual Report.

| 10 |

Objectives, Strategies, and Related Business Risks

Products and Services

| ● | Future Trends: Establish proof of concept and demonstrate the value of our technology as a viable less-lethal application for the law enforcement industry. | |

| ● | Expectations: We expect that our technology can be recognized as a unique solution that fills a critical safety gap and provides an effective option for officers that has not been possible until now. | |

| ● | Objectives: Our goal is to establish proof of concept via pilot programs with several U.S. police departments and to generate revenue through full-paying contracts in the U.S. and abroad. | |

| ● | Strategies: Building infrastructure and workflows in our operations to create repeatable practices and provide scalability for growth. |

Marketing and Revenue

| ● | Future Trends: Work with partners to build brand awareness domestically and internationally. | |

| ● | Expectations: Continue to expand awareness and a strong following through multiple marketing campaigns, including through our law enforcement team’s professional credibility and expansive network, at the political level through our government relations firm, at the customer level through our media partners, at the global level through our international affiliates and distributors, and at the general public level through our social media campaigns, all of which may translate to revenue and gaining a foothold in the industry. | |

| ● | Objectives: Establish best in class marketing team to articulate our mission of saving lives and illustrate our vision for safer communities through law enforcement’s adoption of The Alternative®. | |

| ● | Strategies: Leverage our law enforcement team’s professional credibility and expansive network, our government relations firm for awareness at the congressional level, our media partners to build interest at the customer level (departments and agencies), our international affiliates and distributors for global expansion, and social media campaigns to build awareness with the general public. |

Research and Development

| ● | Future Trends: Continue investing in R&D to expand firearm compatibility and a launch of the consumer model for the commercial market. | |

| ● | Expectations: Strengthen our training program, expand our law enforcement team, and establish demand based on successful training and deployments. | |

| ● | Objectives: Utilize ongoing R&D initiatives to maximize product efficacy and safety. | |

| ● | Strategies: Continue working with our ballistics teams at NTS, Sydor Technologies, and Wayne State University for ongoing tests and data analysis on new models. |

Technology

| ● | Future Trends: Protect our current IP and expand our IP portfolio through additional U.S. patents and international protection; ongoing product testing, and implementation of automated assembly process. | |

| ● | Expectations: As we become known in the market and potentially expand globally, we will continue to conduct thorough testing, develop new designs for firearm models, and develop processes to enhance scalability. | |

| ● | Objectives: Be prepared to aggressively prosecute and enforce our IP protection, and for scalability, we will eventually need to implement an automated assembly process. | |

| ● | Strategies: Strengthen and expand our IP portfolio on a domestic and international scale, including the prosecution of new patents and the enforcement and litigation of our patents, should the need arise; automated assembly to yield an increase in productivity resulting in 20 units per minute on a sustained basis. |

| 11 |

Business Expansion or Restructuring

| ● | Future Trends: Create models for additional types of firearms in the law enforcement industry and models for the consumer market; ATF’s FITSB report (see “Our Business—Commercial Market,”) allows us to operate with limited manufacturing or selling/distribution restrictions; as we grow internationally, we may look to establish manufacturing in-country in given regions, however, product classifications in other countries may differ from the ATF’s FITSB product classification ruling. See “Risk Factors.” | |

| ● | Expectations: New models of firearms may gain popularity and the consumer market is significantly larger than the law enforcement segment of the professional market; we may be able to sell a consumer version as eCommerce, through distributors, and/or through general retail/sporting goods stores. If growth and margins can be optimized by a local presence, we would consider establishing operations in-country where there is high demand and opportunity for expansion. | |

| ● | Objectives: Optimize all manufacturing and sales initiatives; with additional capital, we can begin development on docking molds for firearms that are gaining popularity in the law enforcement industry; begin plans to launch the consumer version in the commercial market; and look for ways to optimize growth and margins with regard to production and order fulfillment. | |

| ● | Strategies: Work with design engineering teams to stay current on popular firearm models and establish cost effective methods to build new molds, and maximize production, fulfillment, and shipping strategies domestically and internationally. |

Employment or Compensation

| ● | Future Trends: We intend to scale relative to revenue growth, which we expect to result in the strategic hiring of key personnel in the areas of sales, marketing, operations, IT, accounting, legal, administration, and regional law enforcement representatives. | |

| ● | Expectations: The capacity to sustain key employees, as well as diversify and expand personnel, should result in our ability to maintain a full-time staff. | |

| ● | Objectives: Execute on growth initiatives in order to attract top tier talent to enhance our goals and objectives; this includes expanding our advisory board and independent board of directors with high level professionals with entrepreneurial, law enforcement, political, and business backgrounds. | |

| ● | Strategies: Align employment and compensation objectives to complement our vision and execution of our growth initiatives and to enhance our public appearance through strategic hiring. |

Smart Marketing Leveraging the Collective Wisdom of Our Consultants and Advisors

We actively engaged with marketing advisors and consultants seasoned in government relations, raising brand awareness and achieving strategic growth. Here is a summary of the active corporate consulting and advisory agreements we entered into with our consultants:

| ● | Cuento: On January 1, 2024, Alternative Ballistics Corporation (the “Company”) entered into a Marketing & Promotional Services Agreement (the “Original Cuento Agreement”) with Cuento LLC, a California limited liability company (“Cuento”), pursuant to which Cuento shall provide marketing and promotional services to the Company. On July 1, 2024, the Company entered into another agreement, in a substantially same form, with Cuento, to further extend the term of the Original Cuento Agreement (the “Extended Cuento Agreement”, together with the Original Cuento Agreement, the “Cuento Agreement”) The Company agreed to pay Cuento a monthly cash fee of $10,000 and reimbursement of pre-approved expenses. Additionally, the Company agreed to issue 30,000 shares of its restricted common stock, vesting in equal monthly installments of 5,000 shares from January 1, 2024 through the date of this Annual Report. The Cuento Agreement went into effect retroactively on January 1, 2024 and had an initial term through June 1, 2024. It remains in effect and may be extended by mutual written agreement. | |

| ● | Hanover One International: On November 1, 2023, the Company entered into a Advisory Service Agreement (the “Hanover Agreement”) with Hanover One International, Inc. (“Hanover”), pursuant to which Hanover shall provide strategic advisory services, including developing and maintaining investor relations and enhancing corporate outreach. The initial term of the Hanover Agreement was twelve (12) months, after which it should continue on a month-to-month basis. Pursuant to the Hanover Agreement, Hanover was entitled to a monthly cash retainer of $3,500, which was amended on November 1, 2024, to $2,500 per month. Additionally, Hanover was issued 3,300,000 shares of the Company’s common stock, vesting in quarterly tranches of 832,500 shares, with the first tranche vesting on January 1, 2024 and subsequent tranches vesting every 90 days thereafter. The Hanover Agreement may be terminated by either party with thirty (30) days’ prior written notice. |

| 12 |

| ● | Majority Advisors: On March 1, 2024, the Company entered into a Consulting Agreement (the “Majority Advisors Agreement”) with Majority Advisors (“Majority Advisors”), pursuant to which Majority Advisors shall provide government relations and strategic advisory services to the Company. Under the Majority Advisors Agreement, Majority Advisors receives a monthly compensation of 5,000 shares of the Company’s common stock. Upon the Company securing an aggregate of at least $2,500,000 in equity financing, Majority Advisors shall also receive a monthly cash fee of $10,000 in addition to the stock-based compensation. The Majority Advisors Agreement shall have an initial term of six (6) months and shall automatically renew for successive six-month periods unless terminated by either party with thirty (30) days’ prior written notice. | |

| ● | Kevin Faulconer: On August 14, 2023, the Company entered into an Advisory Board Agreement with Kevin Faulconer (“Faulconer”), pursuant to which Faulconer shall provide strategic market penetration advice, product introductions, and public policy guidance. The Company issued 100,000 shares of its common stock to Faulconer in the fourth quarter of 2023 and paid a quarterly cash retainer of $5,000 and $20,000 worth of shares of its common stock each quarter thereafter. On January 1, 2025, the Company entered into a revised agreement with Faulconer and changed the compensation Faulconer is entitled to to a quarterly cash payment of $5,000 and options to purchase 20,000 shares of the Company’s common stock, vesting in four equal quarterly installments of 5,000 shares. The options shall have a ten (10) year term and an exercise price of $2.00 per share. The Faulconer Agreement shall renew annually unless terminated by either party with ten (10) business days’ prior written notice. |

These agreements support the Company’s organic growth initiatives by leveraging the expertise of these advisors and consultants in various fields, ranging from government relations, brand awareness and strategic marketing.

Manufacturing and Production

We are currently able to manufacture the projectiles both domestically and internationally. The docking units are currently manufactured domestically. While there can be no guarantees regarding product costs and/or suppliers, our team continues to explore contingency options, should any disruptions occur with our current suppliers. We outsource via contract manufacturing (“CM”) to multiple vendors so that we limit our reliance on a sole source.

We have multiple suppliers for each component of our platform, which includes the alloy projectile, the plastic docking unit, and the custom holster. Once the projectiles and docking units are produced, we have an in-house assembly and shipping operation. Our goal is to have a significant volume of product ready to supply departments with necessary quantities in a timely manner, however, the volatility of the shipping industry, including freight and fuel costs, backlog, and delays may adversely impact our manufacturing, production, and supply operations.

Competition

Based on the LLA market in 2022 with a size of $850 million,15 some of the leading competitors in the space include, but are not limited to Combined Systems, Inc.; Amtech Less Lethal Systems; Nonlethal Technologies, Inc.; Wrap Technologies, Inc.; and Axon. Unlike us, these companies are not start-up companies and have significant operations and historical data upon which to evaluate their businesses.

All aforementioned companies produce standalone devices. In contrast, The Alternative® attaches to the firearm (an already held device on an officer’s duty belt), giving an operator the flexibility of a multi-purpose tool. We believe that this key differentiator allows us to not compete for market share but rather carve out a new segment of the market for our next generation technology.

15 Overview, Sejar Akre, Market Research Future, July 2023.

| 13 |

Intellectual Property

Patents

The following table gives details of our existing patents. In September 2020, we acquired the LP. Upon completion of the acquisition, the first four patents in the table below were transferred and assigned to us as the new owner of all rights to the intellectual property. In December 2021, we filed a new utility patent that was issued in January 2023 as patent number 11566876, which has since been directly filed in several other foreign markets as listed below, including a PCT Application that was filed in December 2022. Also in December 2022, we filed a continuation application on our latest U.S. patent, which issued in January 2023, to start a new family of patents. When the PCT filing window opened in June 2024, we filed in several new countries as listed in the table below.

| Patent Application No. |

Patent No. | Patent Name | Date Filed | Date Issued |

Expiration Date |

Location | ||||||

| 11/353875 | 7526999 | Less-Lethal Force Device | 2/13/2006 | 5/5/2009 | 10/21/2040 | USPTO | ||||||

| 14/183455 | 9612074 | Less-Lethal Force Device-Impact Ratio | 2/18/2014 | 4/4/2017 | 7/8/2035 | USPTO | ||||||

| 14/598555 (continuation of 14/183455) | 9823033 | Less-Lethal Force Device-Impact Ratio | 1/16/2015 | 11/21/2017 | 2/18/2034 | USPTO | ||||||

| 15/386281 | 10295291 | Less-Lethal Force Device | 12/12/2016 | 5/21/2019 | 12/30/2035 | USPTO | ||||||

| 17/644060 | 11566876 | Bullet Capturing Ballistic Slugs | 12/13/2021 | 1/31/2023 | 12/31/2041 | USPTO | ||||||

| BR 10 2022 008832 2 | 102022008832-2 | Bullet Capturing Ballistic Slugs | 5/13/2022 | 1/7/2025 | 2/6/2042 | Brazil | ||||||

| 1-2022-02498 | Pending | Bullet Capturing Slugs | 5/13/2022 | Pending | N/A | Vietnam | ||||||

| 20220103403 | AR127939B1 | Bullet Capturing Slugs | 12/13/2022 | 11/28/2024 | 12/13/2042 | Argentina | ||||||

| 2022-000260 | A060137 | Bullet Capturing Slugs | 12/13/2022 | 10/24/2024 | 10/24/2044 | Venezuela | ||||||

| 22107593 | Pending | Bullet Capturing Slugs | 12/13/2022 | Pending | N/A | Paraguay | ||||||

| PCT/US2022/81356 | N/A | International Patent Application for Bullet Capturing Slugs | 12/12/2022 | 2/1/2023 (International Artwork Search Complete) | N/A | USPTO/International Bureau | ||||||

| 18/146953 | 11835322 | Continuation Patent Application | 12/27/2022 | 12/5/2023 | 12/13/2041 | USPTO | ||||||

| 18/499714 | 12188750 | Continuation Patent Application | 11/1/2023 | 1/7/2025 | 12/13/2041 | USPTO | ||||||

| 18/977428 | Pending | Continuation Patent Application | 12/11/2024 | Pending | N/A | USPTO | ||||||

| A50485/2024 | Pending | Bullet Capturing Slugs | 6/13/2024 | Pending | N/A | Austria | ||||||

| 3240925 | Pending | Bullet Capturing Slugs | 6/12/2024 | Pending | N/A | Canada | ||||||

| 313532 | Pending | Bullet Capturing Slugs | 6/13/2024 | Pending | N/A | Israel | ||||||

| MX/a/2024/007289 | Pending | Bullet Capturing Slugs | 6/13/2024 | Pending | N/A | Mexico | ||||||

| 95022-01 | Pending | Bullet Capturing Slugs | 6/13/2024 | Pending | N/A | Panama | ||||||

| 1120243434 | Pending | Bullet Capturing Slugs | 6/8/2024 | Pending | N/A | Saudi Arabia | ||||||

| 202280091539.5 | Pending | Bullet Capturing Slugs | 8/12/2024 | Pending | N/A | China | ||||||

| 2022413959 | Pending | Bullet Capturing Slugs | 7/12/2024 | Pending | N/A | Australia | ||||||

| NC2024/0009084 | Pending | Bullet Capturing Slugs | 7/9/2024 | Pending | N/A | Colombia | ||||||

| 22908593.1 | Pending | Bullet Capturing Slugs | 7/11/2024 | Pending | N/A | Europe | ||||||

| 2024/05374 | 2024/05374 | Bullet Capturing Slugs | 7/10/2024 | 9/25/2024 | 12/12/2042 | South Africa |

| 14 |

Trademarks

The following table gives details of our existing trademarks.

| Matter Number | Title | Serial No. | Registration No. | G & S | ||||

| 534-00003 | THE ALTERNATIVE | 77410543 | 3519634 | Less-lethal projectile, namely, a rounded metal block encapsulated in rubber, discharged from a pistol to temporarily incapacitate a person | ||||

| 534-00004 |

ALTERNATIVE BALLISTICS LOGO (prior version) |

85667538 | 4712832 | Less-lethal projectile discharged from a pistol or other firearm | ||||

| 534-00005 |

ALTERNATIVE BALLISTICS LOGO 2 |

90411439 | Pending | Amended 4/8/2022 to: Firearm attachments having a mount for attaching bullet capturing projectiles and bullet capturing projectiles, sold as a unit or individually (Originally filed as: Weaponry, namely, less-lethal projectile discharged from a pistol or other firearm) | ||||

| 534-00006 | THE ALTERNATIVE | 97/352515 | Pending | Firearm attachments having a mount for attaching bullet capturing projectiles and bullet capturing projectiles, sold as a unit or individually | ||||

| 534-00007 | ALTERNATIVE BALLISTICS | 97/352517 | Pending | Firearm attachments having a mount for attaching bullet capturing projectiles and bullet capturing projectiles, sold as a unit or individually | ||||

| 534-00008 | ALTERNATIVE BALLISTICS LOGO B&W | 97/352524 | Pending | Firearm attachments having a mount for attaching bullet capturing projectiles and bullet capturing projectiles, sold as a unit or individually | ||||

| 534-00011 (Madrid System\WIPO) |

THE ALTERNATIVE | 1662198 | 1662198 | Firearm attachments having a mount for bullet capturing projectiles and bullet capturing projectiles, sold as a unit | ||||

| 534-00011 Brazil |

THE ALTERNATIVE | 501662198 | 501662198 | Firearm attachments having a mount for bullet capturing projectiles and bullet capturing projectiles, sold as a unit |

| 15 |

| 534-00011 Vietnam | THE ALTERNATIVE | 1662198 | 1662198 | Firearm attachments having a mount for bullet capturing projectiles and bullet capturing projectiles, sold as a unit | ||||

| 534-00012 (Madrid System\WIPO) |

ALTERNATIVE BALLISTICS | 1662593 | 1662593 | Firearm attachments having a mount for bullet capturing projectiles and bullet capturing projectiles, sold as a unit | ||||

| 534-00012 Brazil |

ALTERNATIVE BALLISTICS | 501662593 | 501662593 | Firearm attachments having a mount for bullet capturing projectiles and bullet capturing projectiles, sold as a unit | ||||

| 534-00012 Vietnam | ALTERNATIVE BALLISTICS | 1662593 | 1662593 | Firearm attachments having a mount for bullet capturing projectiles and bullet capturing projectiles, sold as a unit | ||||

| 534-00013 (Madrid System\WIPO) | ALTERNATIVE BALLISTICS LOGO B&W | 1662596 | 1662596 | Firearm attachments having a mount for bullet capturing projectiles and bullet capturing projectiles, sold as a unit | ||||

| 534-00013 Brazil |

ALTERNATIVE BALLISTICS LOGO B&W | 501662596 | 501662596 | Firearm attachments having a mount for bullet capturing projectiles and bullet capturing projectiles, sold as a unit | ||||

| 534-00013 Vietnam | ALTERNATIVE BALLISTICS LOGO B&W | 1662596 | 1662596 | Firearm attachments having a mount for bullet capturing projectiles and bullet capturing projectiles, sold as a unit |

Human Capital

As of the date of this Annual Report, we have six full-time employees. None of our employees are members of a labor union or covered by a collective bargaining agreement.

Properties

We currently do not own any real property. We lease office space at 5940 S. Rainbow Blvd, Las Vegas, Nevada 89118 for $1,952 per month for a term of one year, expiring on July 31, 2025. We also maintain office space at 12636 High Bluff Drive, Suite 400, San Diego, California 92130 for $90 per month on a month-to-month basis. We also lease office space at 16236 San Dieguito Road, Rancho Santa Fe, California 92091 for $5,229 per month with the lease expiring on December 31, 2025.

Seasonality

We do not experience seasonal variations in our quarterly operating results and capital requirements.

| 16 |

Legal Proceedings

We are not party to any legal proceedings the resolution of which we believe would have a material adverse effect on our business, prospects, financial condition, liquidity, or results of operation. However, we may from time to time after the date of this Annual Report become subject to claims and litigation arising in the ordinary course of business. One or more unfavorable outcomes in any claim or litigation against us could have a material adverse effect for the period in which such claim or litigation is resolved. In addition, regardless of their merits or their ultimate outcomes, such matters are costly, divert management’s attention, and may materially adversely affect our reputation, even if resolved in our favor.

Risk Factors

Investing in our securities involves risks. In addition to the other information contained in this Annual Report, you should carefully consider the following risks before deciding to purchase our securities. The occurrence of any of the following risks might cause you to lose all or a part of your investment. Some statements in this Annual Report, including statements in the following risk factors, constitute forward-looking statements. Please refer to “Cautionary Statement Regarding Forward-Looking Statements” for more information regarding forward-looking statements.

Below is a summary of material risks, uncertainties and other factors that could have a material effect on the Company and its operations, these risks include, but are not limited to the following:

| ● | We are an early-stage start-up with no operating history, and we may never become profitable. | |

| ● | We have a limited operating history on which you can evaluate our business; | |

| ● | Our independent audit firm has expressed in its report to our audited financial statements a substantial doubt about our ability to continue as a going concern; | |

| ● | We have a history of operating losses and we cannot guarantee that we will be able to achieve or sustain profitability; | |

| ● | We expect to require additional financing in the future to continue our development. If we do not obtain such additional financing, our business prospects, financial condition, and results of operations could be adversely affected; | |

| ● | If we are unable to successfully implement our business plan for the sale of The Alternative®, our potential revenue growth could be slower than we expect; | |

| ● | We are and continue to be a “controlled company” because our Chief Executive Officer beneficially owns more than 50% of our outstanding shares of voting stock; | |

| ● | We have only developed The Alternative® for certain firearm models; | |

| ● | We are dependent on our relationships with key source suppliers for our business; | |

| ● | We rely on a limited number of third parties for shipping, transportation, logistics, marketing and sales of our products and components. A loss of any of such third-party relationships would have a material adverse effect on our operating results; | |

| ● | If we deliver products with defects, we may be subject to product recalls or negative publicity, our credibility may be harmed, market acceptance of our products may decline, and we may be exposed to liability; | |

| ● | Lawsuits against us could cause us to incur substantial liabilities and to limit commercialization of any products that we may develop; | |

| ● | Our business depends on maintaining and strengthening our brand and generating and maintaining demand for our products; |

| 17 |

| ● | Our products and/or services may not gain market acceptance; | |

| ● | Our sales cycles can be long and unpredictable, and our sales efforts require considerable time and expense; | |

| ● | Due to our limited resources and access to capital, we must prioritize development of certain product candidates over other potential candidates. These decisions may prove to have been wrong and may adversely affect our revenues; | |

| ● | The market for LLA is in a state of rapid technological change which could have a material adverse impact on our business, financial condition, and results of operations; | |

| ● | Growth or expansion of sales of our product to schools, law enforcement, and other governmental or quasi-governmental entities may require expenditure of resources and lengthen our sale cycle; | |

| ● | Our performance is influenced by a variety of economic, social, and political factors; | |

| ● | We are subject to extensive regulation and could incur fines, penalties, and other costs and liabilities under such requirements; | |

| ● | We are exposed to operating hazards and uninsured risks that could adversely impact our operating results and financial condition; | |

| ● | If we are unable to protect our intellectual property, we may lose a competitive advantage or incur substantial litigation costs to protect our rights; | |

| ● | We have not paid dividends in the past and do not expect to pay dividends in the foreseeable future. |

Risks Related to Our Business

We have a limited operating history on which you can evaluate our business.

We have a limited operating history on which you can evaluate our business. Although our corporate entity has existed since 2020, we have only produced minimal revenue. We only officially launched our “pilot program” in 2023. As a result, our business is subject to many of the problems, expenses, delays, and risks inherent in the development of a relatively new business and the integration of key personnel and infrastructure.

Our independent audit firm has expressed in its report to our audited financial statements a substantial doubt about our ability to continue as a going concern.

We have not yet begun to generate material revenues from our operations to fund our activities and are therefore dependent upon external sources for financing our operations. There is a risk that we will be unable to obtain necessary financing to continue our operations on terms acceptable to us or at all. As a result, our independent audit firm has expressed in its auditors’ report on the financial statements a substantial doubt regarding our ability to continue as a going concern. Our financial statements do not include any adjustments that might result from the outcome of the uncertainty regarding our ability to continue as a going concern. This going concern opinion could materially limit our ability to raise additional funds through the issuance of equity or debt securities or otherwise. Future reports on our financial statements may include an explanatory paragraph with respect to our ability to continue as a going concern. If we cannot continue as a going concern, our shareholders may lose their entire investment.

| 18 |

We have a history of operating losses and we cannot guarantee that we will be able to achieve or sustain profitability.

We have recorded a net loss in all reporting periods since our inception through the date of this Annual Report. Our net loss for the years ended December 31, 2024, 2023 and 2022 was $15,323,704, $36,600,438 and $3,954,074, respectively. There can be no assurance that we will not experience net losses in the future and there can be no assurance of ever achieving profitability.

We expect to require additional financing in the future to continue our development. If we do not obtain such additional financing, our business prospects, financial condition, and results of operations could be adversely affected.

We expect to require additional financing in the future to continue our development. There can be no assurance that such financing will be available at all or on favorable terms. Failure to achieve revenue may accelerate our need to seek such additional financing, which could result in delay of our development and sale of our products. Subsequent financing may dilute the ownership interest of our stockholders at the time of the financing and may dilute the value of their stock.

If we are unable to successfully implement our business plan for the sale of The Alternative®, our potential revenue growth could be slower than we expect.

The Alternative® is a new less lethal solution and it is our flagship product and its long-term adoption by the U.S. law enforcement industry, and by potential other markets including government, military, private security, and international markets, remains unknown. Among other things, production delays, excessive costs, performance failures, new legislation or regulation, competition, or negative publicity could delay or prevent its acceptance in the market and generation of revenue. In particular, negative publicity could harm our reputation, which could in turn prohibit us from marketing or otherwise commercializing The Alternative®. In addition, we have increased and may further increase our operating expenses in order to fund increases in our manufacturing, distribution, and sales and marketing efforts and increase our administrative resources in anticipation of future growth. To the extent that increases in such expenses precede or are not subsequently followed by revenues, our business, operating results, and financial condition may be materially adversely affected.

We may not be able to effectively manage our growth.

As we grow our business, a lack of demand for our products, competition, a decrease in the growth rate of our overall market, failure to develop and successfully market our products, or the maturation of our business or market could harm our business. We expect to make significant investments in additional R&D and sales and marketing, expand our operations and infrastructure, design and develop or acquire new products, and enhance our existing products. If our sales do not increase at a sufficient rate to offset these increases in our operating expenses, our profitability may decline in future periods.

Since inception, our operations have expanded rapidly and the scope and complexity of our business have increased substantially. We have only a limited history operating our business at its current scale. Key members of our management team do not have substantial tenure working together. Consequently, if our operations continue to grow at a rapid pace, we may experience difficulties in managing this growth and building the appropriate processes and controls. Continued growth may increase the strain on our resources, and we could experience operating difficulties, including difficulties in sourcing, logistics, recruiting, maintaining internal controls, marketing, designing innovative products, and meeting customer needs. If we do not adapt to meet these evolving challenges, the strength of our brand may erode, the quality of our products may suffer, we may not be able to deliver products on a timely basis to our customers, and our corporate culture may be harmed.

We are and continue to be a “controlled company” because our Chief Executive Officer beneficially owns more than 50% of our outstanding shares of voting stock.

Steven Luna, our Chief Executive Officer, currently beneficially owns approximately 64.2% of our common stock by way of his ownership of 2,000,000 shares of our Series A Preferred Stock, which has 100 to one voting rights with the common stock. Accordingly, the Company is a “controlled company” meaning that more than 50% of our voting power is held by a single person, entity, or group.

| 19 |

Mr. Luna, as the controlling shareholder, can decide on all matters requiring shareholder approval or matters which are required to be approved by shareholders under our Bylaws by virtue of his controlling ownership of our voting stock, including the election of directors, amendment of our charter documents, and approval or disapproval of major corporate transactions, such as a change in control, a transaction with take-over effect, merger, consolidation, or sale of assets. Accordingly, our shares of common stock may be less attractive to certain investors who otherwise do not agree with Mr. Luna’s positions.

Our directors, executive officers, and significant stockholders may be able to influence us.

Our directors, executive officers, and other holders of more than 5% of our common stock, together with their affiliates, currently own, in the aggregate, 54.90% of our outstanding common stock and 100% of our voting stock. As a result, these stockholders, acting together, may have the ability to influence the outcome of matters submitted to our stockholders for approval, including the election of directors and any merger, consolidation, or sale of all or substantially all of our assets. In addition, these stockholders, acting together, may be able to influence the management and affairs of our company. Accordingly, this concentration of ownership might decrease the market price of our common stock by:

| ● | delaying, deferring, or preventing a change in control; | |

| ● | impeding a merger, consolidation, takeover, or other business combination involving us; or | |