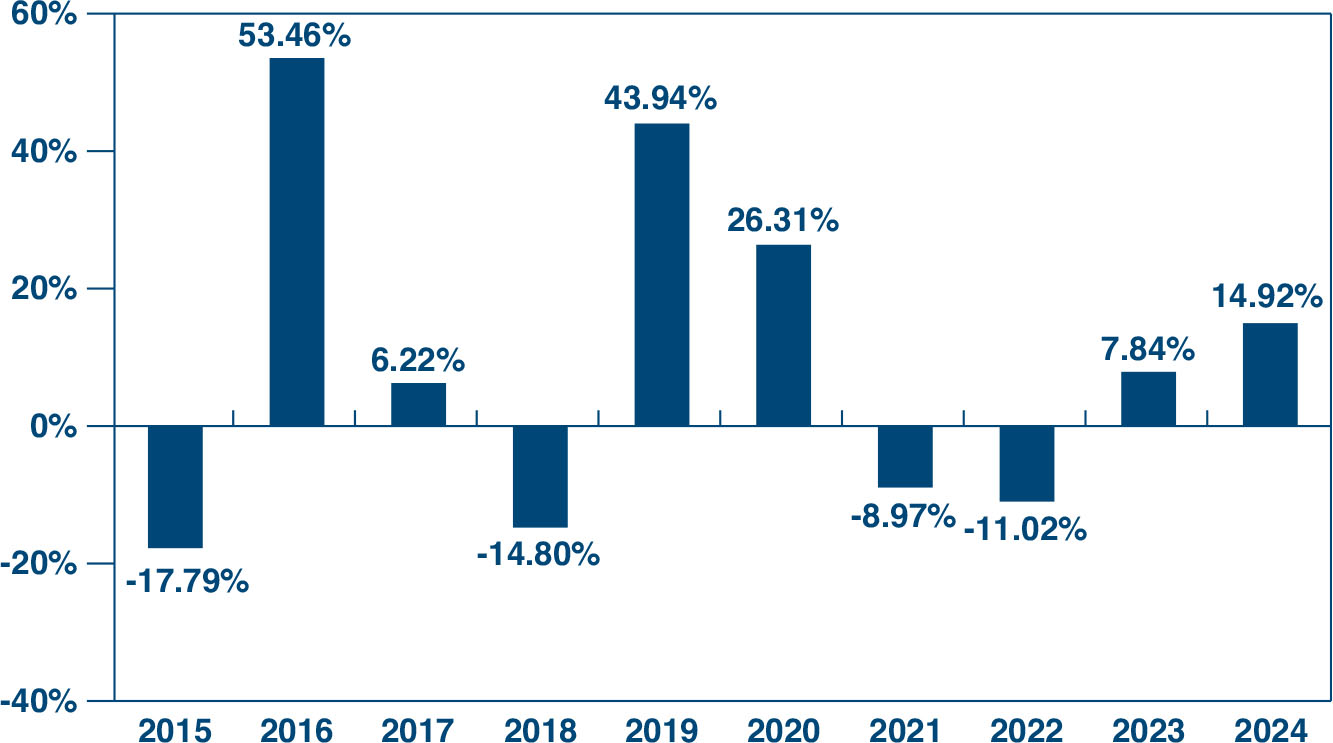

The bar chart and table that follow provide an indication of the risks of investing in the Fund by showing changes in the Fund’s performance from year to year, and by showing how the Fund’s average annual returns for one year, five years, and ten years compared with those of a broad based securities market index and additional style specific indices. As with all mutual funds, the Fund’s past performance (before and after taxes) does not predict how the Fund will perform in the future. Updated information on the Fund’s results can be obtained by visiting www.gabelli.com.

During the calendar years shown in the bar chart, the highest return for a quarter was 58.42% (quarter ended June 30, 2020) and the lowest return for a quarter was (22.20)% (quarter ended December 31, 2016).

| Average

Annual Total Returns (for the years ended December 31, 2024, with maximum sales charge, if applicable) |

Past One Year |

Past Five Years |

Past Ten Years |

|||||||||||||||

| Gabelli Gold Fund, Inc. Class AAA Shares | ||||||||||||||||||

| Return Before Taxes | 14.92 | % | 4.86 | % | 7.62 | % | ||||||||||||

| Return After Taxes on Distributions | 14.35 | % | 4.64 | % | 7.38 | % | ||||||||||||

| Return After Taxes on Distributions and Sale of Fund Shares | 9.20 | % | 3.78 | % | 6.15 | % | ||||||||||||

| Class A Shares | ||||||||||||||||||

| Return Before Taxes | 8.30 | % | 3.63 | % | 6.98 | % | ||||||||||||

| Class C Shares | ||||||||||||||||||

| Return Before Taxes | 13.09 | % | 4.08 | % | 6.81 | % | ||||||||||||

| Class I Shares | ||||||||||||||||||

| Return Before Taxes | 15.24 | % | 5.14 | % | 7.89 | % | ||||||||||||

| S&P 500 Index (reflects no deduction for fees, expenses, or taxes) |

25.02 | % | 14.53 | % | 13.10 | % | ||||||||||||

| Philadelphia

Gold & Silver (“XAU”) Index (reflects no deduction for fees, expenses, or taxes) |

10.80 | % | 6.76 | % | 8.41 | % | ||||||||||||

| NYSE

Arca Gold Miners Index (reflects no deduction for fees, expenses, or taxes) |

11.55 | % | 5.12 | % | 8.07 | % | ||||||||||||

| Lipper Precious Metals Fund Average | 14.05 | % | 3.93 | % | 6.21 | % | ||||||||||||

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. In some instances, the “Return After Taxes on Distributions and Sale of Fund Shares” may be greater than “Return Before Taxes” and “Return After Taxes on Distributions” because the investor is assumed to be able to use the capital loss from the sale of Fund shares to offset other taxable gains. Actual after-tax returns depend on the investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax deferred arrangements, such as 401(k) plans or individual retirement accounts, including Roth IRAs and SEP IRAs (collectively, “IRAs”). After-tax returns are shown only for Class AAA shares. After-tax returns for other classes will vary due to the differences in expenses.