|

Value of Initial

Fixed $100

Investment

Based on:

|

||||||||||

|

Year (1)

|

SCT Total

for PEO 1

($)

|

CAP to PEO

1 ($)(2)

|

SCT Total for

PEO 2 ($)

|

CAP to PEO

2 ($)(2)

|

Average

SCT Total for

non-PEO

NEOs ($)

|

Average

Compensation

Actually

Paid to

non-PEO

NEOs ($)(2)

|

TSR

$)(3)

|

Peer

Group

TSR

($)(4)

|

Net

Loss ($ millions

)(5)

|

Relative

TSR

Percentile

(%)(6)

|

|

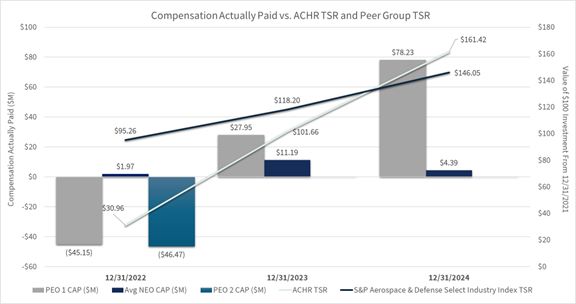

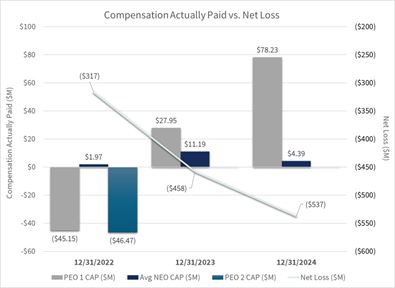

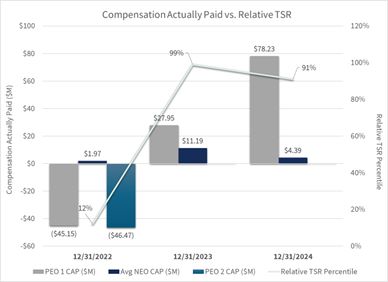

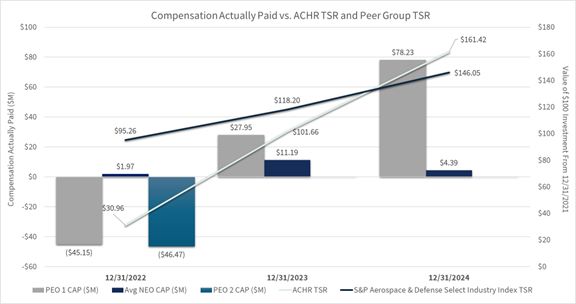

2024

|

17,763,000

|

78,229,739

|

-

|

-

|

1,905,415

|

4,386,896

|

161.42

|

148.05

|

(537)

|

91

|

|

2023

|

1,003,750

|

27,950,070

|

-

|

-

|

3,627,746

|

11,188,491

|

101.66

|

118.20

|

(458)

|

99

|

|

2022

|

1,200,000

|

(45,146,083)

|

4,846,372

|

(46,473,291)

|

4,426,452

|

1,965,114

|

30.96

|

95.20

|

(317)

|

12

|

|

(1) Adam Goldstein served as our Chief Executive Officer

(PEO 1) for the entirety of the applicable years. Brett Adcock served as our co-Chief Executive Officer (PEO

2) for a portion of 2022. Our non-PEO NEOs were Mark Mesler and Tosha Perkins for 2022, Tom Muniz and Andy Missan for 2023, and Mark Mesler, Priya Gupta, Eric Lentell, Tom Muniz and Tosha Perkins for 2024.

|

|

(2) Compensation Actually Paid reflects the exclusions and inclusions of certain amounts from the total compensation amount reported in the SCT for the PEOs and the Non-PEO

NEOs as required by Item 402(v) of Regulation S-K, as set forth in the tables below. In making each of these adjustments, the “value” of an option or stock award is the fair value of the award on the applicable date

determined in accordance with FASB ASC Topic 718 using the valuation assumptions we then used to calculate the fair value of our equity awards. For more information on the valuation of our equity awards, please see the

notes to our financial statements that appear in our applicable Annual Report on Form 10-K and the footnotes to the SCT that appear in our applicable definitive proxy statement.

|

|

PEO 1

|

|||||||||

|

2024 ($)

|

2023 ($)

|

2022 ($)

|

|||||||

|

SCT Total

|

17,763,000

|

1,003,750

|

1,200,000

|

||||||

|

- Grant Date Fair Value of Option Awards and Stock Awards Granted in Fiscal Year

|

(16,487,500)

|

-

|

-

|

||||||

|

+ Fair Value at Fiscal Year-End of Outstanding and Unvested Option Awards and Stock Awards Granted in Fiscal Year

|

17,852,500

|

-

|

-

|

||||||

|

+ Change in Fair Value of Outstanding and Unvested Option Awards and Stock Awards Granted in Prior Fiscal Years

|

50,315,432

|

25,605,759

|

(44,531,306)

|

||||||

|

+ Fair Value at Vesting of Option Awards and Stock Awards Granted in Fiscal Year That Vested During Fiscal Year

|

-

|

-

|

-

|

||||||

|

+ Change in Fair Value as of Vesting Date of Option Awards and Stock Awards Granted in Prior Fiscal Years For Which Applicable Vesting Conditions Were Satisfied During Fiscal

Year

|

8,786,307

|

1,340,561

|

(1,814,777)

|

||||||

|

- Fair Value as of Prior Fiscal Year-End of Option Awards and Stock Awards Granted in Prior Fiscal Years That Failed to Meet Applicable Vesting Conditions During Fiscal Year

|

- |

-

|

-

|

||||||

|

Compensation Actually Paid

|

78,229,739

|

27,950,070

|

(45,146,083)

|

||||||

|

PEO 2

|

|||||||||

|

2024 ($)

|

2023 ($)

|

2022 ($)

|

|||||||

|

SCT Total

|

-

|

-

|

4,846,372

|

||||||

|

- Grant Date Fair Value of Option Awards and Stock Awards Granted in Fiscal Year

|

-

|

-

|

-

|

||||||

|

+ Fair Value at Fiscal Year-End of Outstanding and Unvested Option Awards and Stock Awards Granted in Fiscal Year

|

-

|

-

|

-

|

||||||

|

+ Change in Fair Value of Outstanding and Unvested Option Awards and Stock Awards Granted in Prior Fiscal Years

|

-

|

-

|

(48,722,460)

|

||||||

|

+ Fair Value at Vesting of Option Awards and Stock Awards Granted in Fiscal Year That Vested During Fiscal Year

|

-

|

-

|

-

|

||||||

|

+ Change in Fair Value as of Vesting Date of Option Awards and Stock Awards Granted in Prior Fiscal Years For Which Applicable Vesting Conditions Were Satisfied During Fiscal

Year

|

-

|

-

|

(2,597,203)

|

||||||

|

- Fair Value as of Prior Fiscal Year-End of Option Awards and Stock Awards Granted in Prior Fiscal Years That Failed to Meet Applicable Vesting Conditions During Fiscal Year

|

-

|

-

|

-

|

||||||

|

Compensation Actually Paid

|

-

|

-

|

(46,473,291)

|

||||||

|

Non-PEO NEOs (average)

|

|||||||||

|

2024 ($)

|

2023 ($)

|

2022 ($)

|

|||||||

| SCT Total |

1,905,415

|

3,627,746 | 4,426,452 | ||||||

|

- Grant Date Fair Value of Option Awards and Stock Awards Granted in Fiscal Year

|

(1,155,588)

|

(3,400,000) | (3,707,912) | ||||||

|

+ Fair Value at Fiscal Year-End of Outstanding and Unvested Option Awards and Stock Awards Granted in Fiscal Year

|

2,332,535

|

7,963,942 | 1,724,824 | ||||||

|

+ Change in Fair Value of Outstanding and Unvested Option Awards and Stock Awards Granted in Prior Fiscal Years

|

2,122,257

|

2,058,096 | (364,875) | ||||||

|

+ Fair Value at Vesting of Option Awards and Stock Awards Granted in Fiscal Year That Vested During Fiscal Year

|

104,437

|

171,606 | - | ||||||

|

+ Change in Fair Value as of Vesting Date of Option Awards and Stock Awards Granted in Prior Fiscal Years For Which Applicable Vesting Conditions Were Satisfied During Fiscal

Year

|

(922,160)

|

767,101 | (113,375) | ||||||

|

- Fair Value as of Prior Fiscal Year-End of Option Awards and Stock Awards Granted in Prior Fiscal Years That Failed to Meet Applicable Vesting Conditions During Fiscal Year

|

-

|

- | - | ||||||

|

Compensation Actually Paid

|

4,386,896

|

11,188,491 | 1,965,114 | ||||||

|

(3) Archer’s TSR was determined based on the value of an initial fixed investment of $100, as of December 31, 2021, including the reinvestment of any dividends.

|

|

(4) The peer group used in this table is the S&P Aerospace & Defense Select Index, which is the same peer group that we use for purposes of the stock performance

graph contained in our Annual Report on Form 10-K for the year ended December 31, 2024.

|

|

(5) Represents the Company’s net loss reflected in the Company’s audited financial statements.

|

|

(6) Our Company-Selected Measure is Relative TSR consistent

with the peer group used in the PSU metric under our annual Long-Term Incentive Program. For illustrative purposes, calculations within this column are based on 1-year measurements (as opposed to the 1-, 2-, and 3-year

relative TSR performance period regarding the Company’s PSUs). For purposes of Relative TSR, the peer group used in the PSU metric under our annual Long-Term Incentive Program consists of: (i) the S&P 600 Index.

|

|

(1) Adam Goldstein served as our Chief Executive Officer

(PEO 1) for the entirety of the applicable years. Brett Adcock served as our co-Chief Executive Officer (PEO

2) for a portion of 2022. Our non-PEO NEOs were Mark Mesler and Tosha Perkins for 2022, Tom Muniz and Andy Missan for 2023, and Mark Mesler, Priya Gupta, Eric Lentell, Tom Muniz and Tosha Perkins for 2024.

|

|

(4) The peer group used in this table is the S&P Aerospace & Defense Select Index, which is the same peer group that we use for purposes of the stock performance

graph contained in our Annual Report on Form 10-K for the year ended December 31, 2024.

|

|

(2) Compensation Actually Paid reflects the exclusions and inclusions of certain amounts from the total compensation amount reported in the SCT for the PEOs and the Non-PEO

NEOs as required by Item 402(v) of Regulation S-K, as set forth in the tables below. In making each of these adjustments, the “value” of an option or stock award is the fair value of the award on the applicable date

determined in accordance with FASB ASC Topic 718 using the valuation assumptions we then used to calculate the fair value of our equity awards. For more information on the valuation of our equity awards, please see the

notes to our financial statements that appear in our applicable Annual Report on Form 10-K and the footnotes to the SCT that appear in our applicable definitive proxy statement.

|

|

PEO 1

|

|||||||||

|

2024 ($)

|

2023 ($)

|

2022 ($)

|

|||||||

|

SCT Total

|

17,763,000

|

1,003,750

|

1,200,000

|

||||||

|

- Grant Date Fair Value of Option Awards and Stock Awards Granted in Fiscal Year

|

(16,487,500)

|

-

|

-

|

||||||

|

+ Fair Value at Fiscal Year-End of Outstanding and Unvested Option Awards and Stock Awards Granted in Fiscal Year

|

17,852,500

|

-

|

-

|

||||||

|

+ Change in Fair Value of Outstanding and Unvested Option Awards and Stock Awards Granted in Prior Fiscal Years

|

50,315,432

|

25,605,759

|

(44,531,306)

|

||||||

|

+ Fair Value at Vesting of Option Awards and Stock Awards Granted in Fiscal Year That Vested During Fiscal Year

|

-

|

-

|

-

|

||||||

|

+ Change in Fair Value as of Vesting Date of Option Awards and Stock Awards Granted in Prior Fiscal Years For Which Applicable Vesting Conditions Were Satisfied During Fiscal

Year

|

8,786,307

|

1,340,561

|

(1,814,777)

|

||||||

|

- Fair Value as of Prior Fiscal Year-End of Option Awards and Stock Awards Granted in Prior Fiscal Years That Failed to Meet Applicable Vesting Conditions During Fiscal Year

|

- |

-

|

-

|

||||||

|

Compensation Actually Paid

|

78,229,739

|

27,950,070

|

(45,146,083)

|

||||||

|

PEO 2

|

|||||||||

|

2024 ($)

|

2023 ($)

|

2022 ($)

|

|||||||

|

SCT Total

|

-

|

-

|

4,846,372

|

||||||

|

- Grant Date Fair Value of Option Awards and Stock Awards Granted in Fiscal Year

|

-

|

-

|

-

|

||||||

|

+ Fair Value at Fiscal Year-End of Outstanding and Unvested Option Awards and Stock Awards Granted in Fiscal Year

|

-

|

-

|

-

|

||||||

|

+ Change in Fair Value of Outstanding and Unvested Option Awards and Stock Awards Granted in Prior Fiscal Years

|

-

|

-

|

(48,722,460)

|

||||||

|

+ Fair Value at Vesting of Option Awards and Stock Awards Granted in Fiscal Year That Vested During Fiscal Year

|

-

|

-

|

-

|

||||||

|

+ Change in Fair Value as of Vesting Date of Option Awards and Stock Awards Granted in Prior Fiscal Years For Which Applicable Vesting Conditions Were Satisfied During Fiscal

Year

|

-

|

-

|

(2,597,203)

|

||||||

|

- Fair Value as of Prior Fiscal Year-End of Option Awards and Stock Awards Granted in Prior Fiscal Years That Failed to Meet Applicable Vesting Conditions During Fiscal Year

|

-

|

-

|

-

|

||||||

|

Compensation Actually Paid

|

-

|

-

|

(46,473,291)

|

||||||

|

Non-PEO NEOs (average)

|

|||||||||

|

2024 ($)

|

2023 ($)

|

2022 ($)

|

|||||||

| SCT Total |

1,905,415

|

3,627,746 | 4,426,452 | ||||||

|

- Grant Date Fair Value of Option Awards and Stock Awards Granted in Fiscal Year

|

(1,155,588)

|

(3,400,000) | (3,707,912) | ||||||

|

+ Fair Value at Fiscal Year-End of Outstanding and Unvested Option Awards and Stock Awards Granted in Fiscal Year

|

2,332,535

|

7,963,942 | 1,724,824 | ||||||

|

+ Change in Fair Value of Outstanding and Unvested Option Awards and Stock Awards Granted in Prior Fiscal Years

|

2,122,257

|

2,058,096 | (364,875) | ||||||

|

+ Fair Value at Vesting of Option Awards and Stock Awards Granted in Fiscal Year That Vested During Fiscal Year

|

104,437

|

171,606 | - | ||||||

|

+ Change in Fair Value as of Vesting Date of Option Awards and Stock Awards Granted in Prior Fiscal Years For Which Applicable Vesting Conditions Were Satisfied During Fiscal

Year

|

(922,160)

|

767,101 | (113,375) | ||||||

|

- Fair Value as of Prior Fiscal Year-End of Option Awards and Stock Awards Granted in Prior Fiscal Years That Failed to Meet Applicable Vesting Conditions During Fiscal Year

|

-

|

- | - | ||||||

|

Compensation Actually Paid

|

4,386,896

|

11,188,491 | 1,965,114 | ||||||

|

(2) Compensation Actually Paid reflects the exclusions and inclusions of certain amounts from the total compensation amount reported in the SCT for the PEOs and the Non-PEO

NEOs as required by Item 402(v) of Regulation S-K, as set forth in the tables below. In making each of these adjustments, the “value” of an option or stock award is the fair value of the award on the applicable date

determined in accordance with FASB ASC Topic 718 using the valuation assumptions we then used to calculate the fair value of our equity awards. For more information on the valuation of our equity awards, please see the

notes to our financial statements that appear in our applicable Annual Report on Form 10-K and the footnotes to the SCT that appear in our applicable definitive proxy statement.

|

|

-

|

Goals related to advancing manufacturing objectives

|

|

-

|

Goals related to advancing flight test program

|

|

-

|

Goals related to advancing FAA certification

|

|

-

|

Goals related to advancing commercialization objectives

|

|

-

|

Annual cash burn relative to board-approved budget

|

|

-

|

Relative TSR compared to the S&P 600 Index

|