Pay Versus Performance

As required by Section 953(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act and with Item 402(v) of Regulation S-K, we provide the following disclosure regarding “executive compensation actually paid” (CAP), calculated in accordance with the SEC rules, and certain Company performance for the years listed below.

This disclosure was prepared in accordance with the requirements of Item 402(v) and does not necessarily reflect the value actually realized by our executives, how our executives’ compensation relates to Company performance, or how the Compensation Committee evaluates compensation decisions in light of Company or individual performance. For example, the Compensation Committee does not use CAP as a basis for making

compensation decisions, nor does it use net income (as reflected below) for purposes of determining our executive’s incentive compensation. Please refer to our Compensation Discussion and Analysis for a complete description of how executive compensation relates to Company performance and how the Compensation Committee makes its compensation decisions.

The information provided under this Pay versus Performance section will not be deemed to be incorporated by reference into any filing made by the Company under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent the Company specifically incorporates it by reference.

|

|

|

|

|

Value of Initial Fixed $100 Investment Based On: |

|

|

|

Year |

Summary |

Compensation |

Average Summary |

Average |

Total |

Peer Group |

After Tax |

Adjusted |

2024 |

$35,873,916 |

$44,261,401 |

$4,413,675 |

$4,568,815 |

$155 |

$73 |

$683 |

$2,004 |

2023 |

29,111,039 |

27,390,527 |

3,736,527 |

3,436,887 |

147 |

60 |

270 |

1,469 |

2022 |

39,318,892 |

44,590,917 |

2,405,595 |

3,205,364 |

159 |

66 |

944 |

2,223 |

2021 |

21,145,853 |

36,963,649 |

2,395,200 |

4,041,589 |

135 |

89 |

830 |

1,905 |

2020 |

23,564,264 |

17,368,770 |

3,934,418 |

3,771,789 |

95 |

88 |

808 |

1,996 |

2024 |

2023 |

2022 |

2021 |

2020 |

Michael Biard(5) |

Michael Biard(5) |

Thomas E. Carter(5) |

Thomas E. Carter |

Thomas E. Carter |

Lee Ann Gliha |

Lee Ann Gliha |

Lee Ann Gliha |

Lee Ann Gliha |

Timothy C. Bush(6) |

Sean Compton |

Dana Zimmer |

Dana Zimmer |

Dana Zimmer |

Dana Zimmer |

Dana Zimmer |

Michael Strober(8) |

Andrew Alford |

Andrew Alford |

Gregory R. Raifman(7) |

|

|

Sean Compton |

Sean Compton |

|

|

2024 |

|

|

PEO |

Non-PEO NEOs |

|

|

|

Summary Compensation Table |

$35,873,916 |

$4,413,675 |

Less: Grant date fair value of equity awards made during the applicable year and unvested at applicable year end |

(27,746,271) |

(1,797,215) |

Plus: Year-end fair value of equity awards made during the applicable year and unvested at applicable year end |

26,798,441 |

1,809,334 |

Change in fair value of equity awards made in prior years and unvested at applicable year end |

3,698,638 |

11,071 |

Change in fair value of equity awards made in prior years and vested during applicable year |

5,636,677 |

131,950 |

Less: Fair value of equity awards made in prior years that are forfeited during applicable year |

— |

— |

|

|

|

Compensation Actually Paid |

$44,261,401 |

$4,568,815 |

2024 |

2023 |

2022 |

2021 |

2020 |

Michael Biard(5) |

Michael Biard(5) |

Thomas E. Carter(5) |

Thomas E. Carter |

Thomas E. Carter |

Lee Ann Gliha |

Lee Ann Gliha |

Lee Ann Gliha |

Lee Ann Gliha |

Timothy C. Bush(6) |

Sean Compton |

Dana Zimmer |

Dana Zimmer |

Dana Zimmer |

Dana Zimmer |

Dana Zimmer |

Michael Strober(8) |

Andrew Alford |

Andrew Alford |

Gregory R. Raifman(7) |

|

|

Sean Compton |

Sean Compton |

|

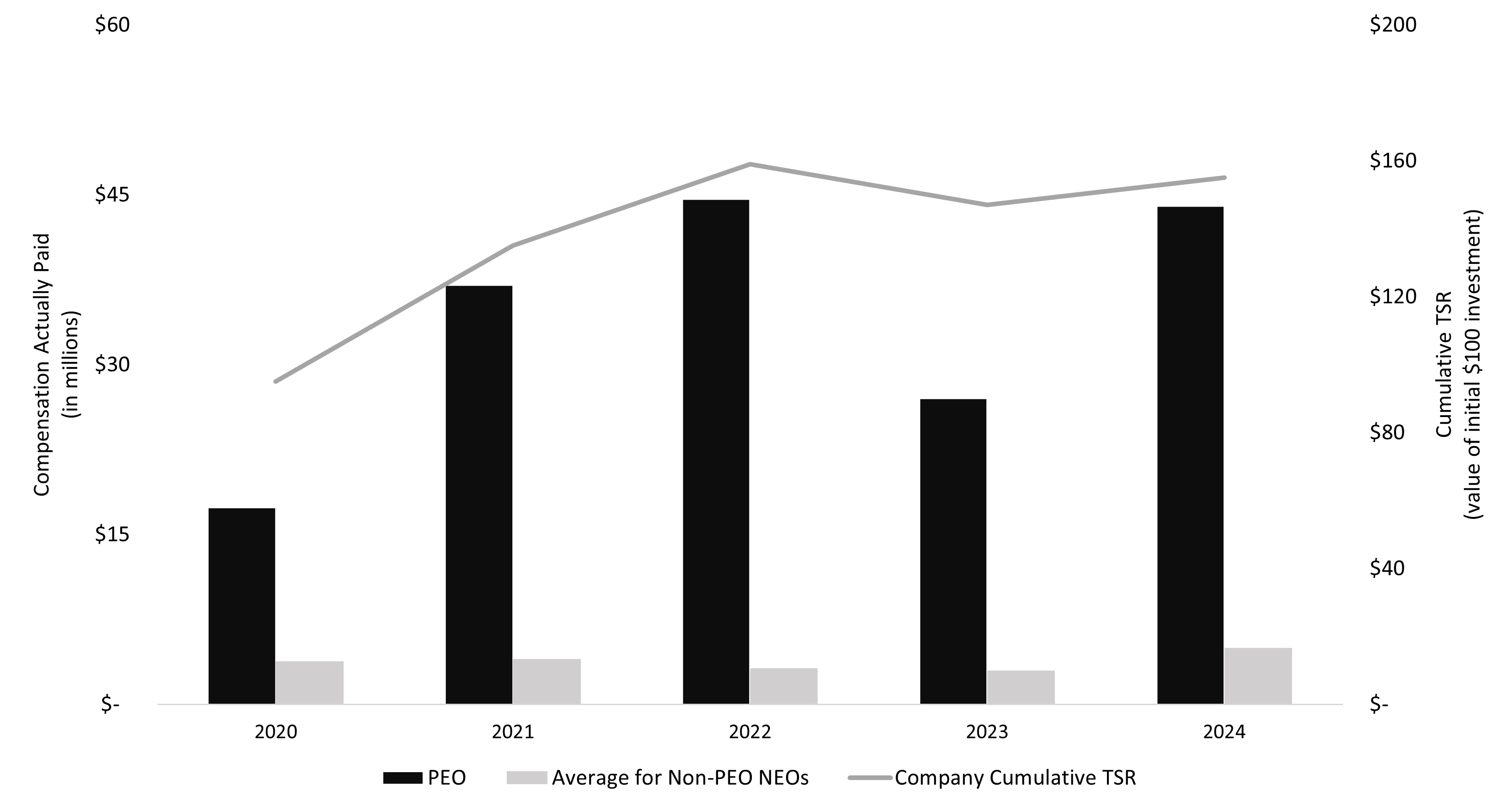

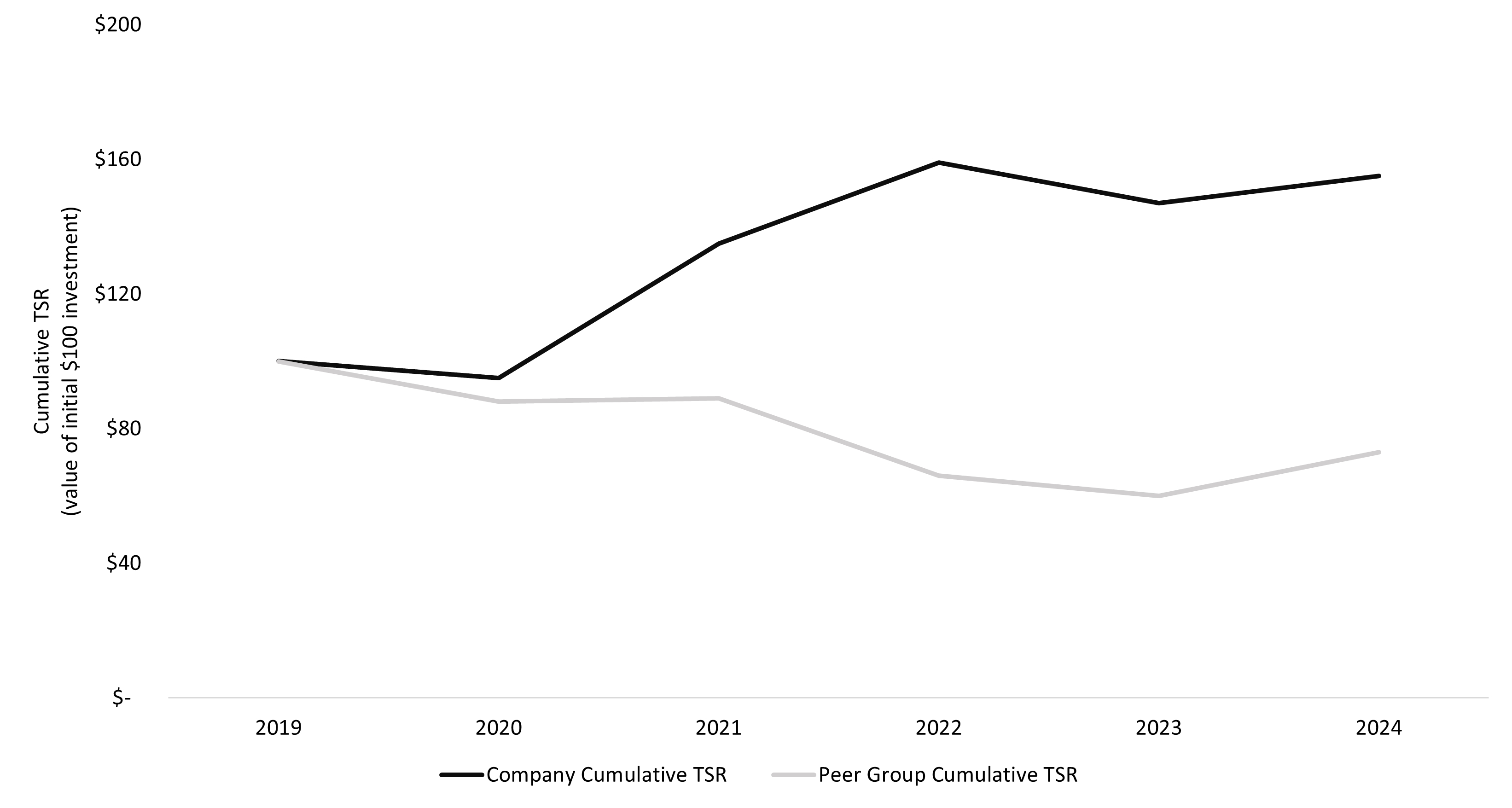

Compensation Actually Paid (in millions) $- $15 $30 $45 $60 2020 2021 2022 2023 2024 $-$40 $80 $120 $160 $200 PEO Average for Non-PEO NEOs Company Cumulative TSR Company Cumulative TSR (Value of Initial $100 investment)

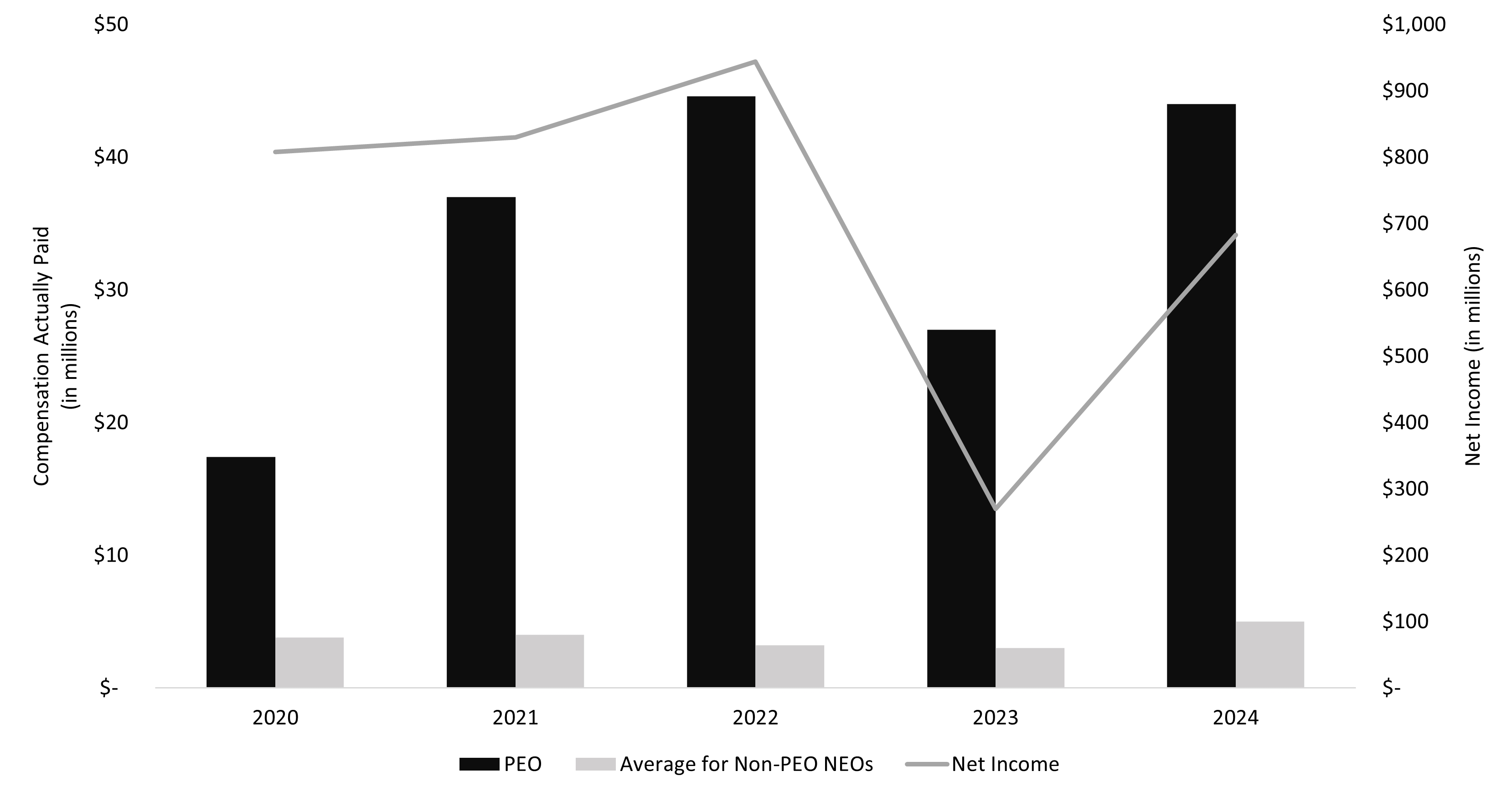

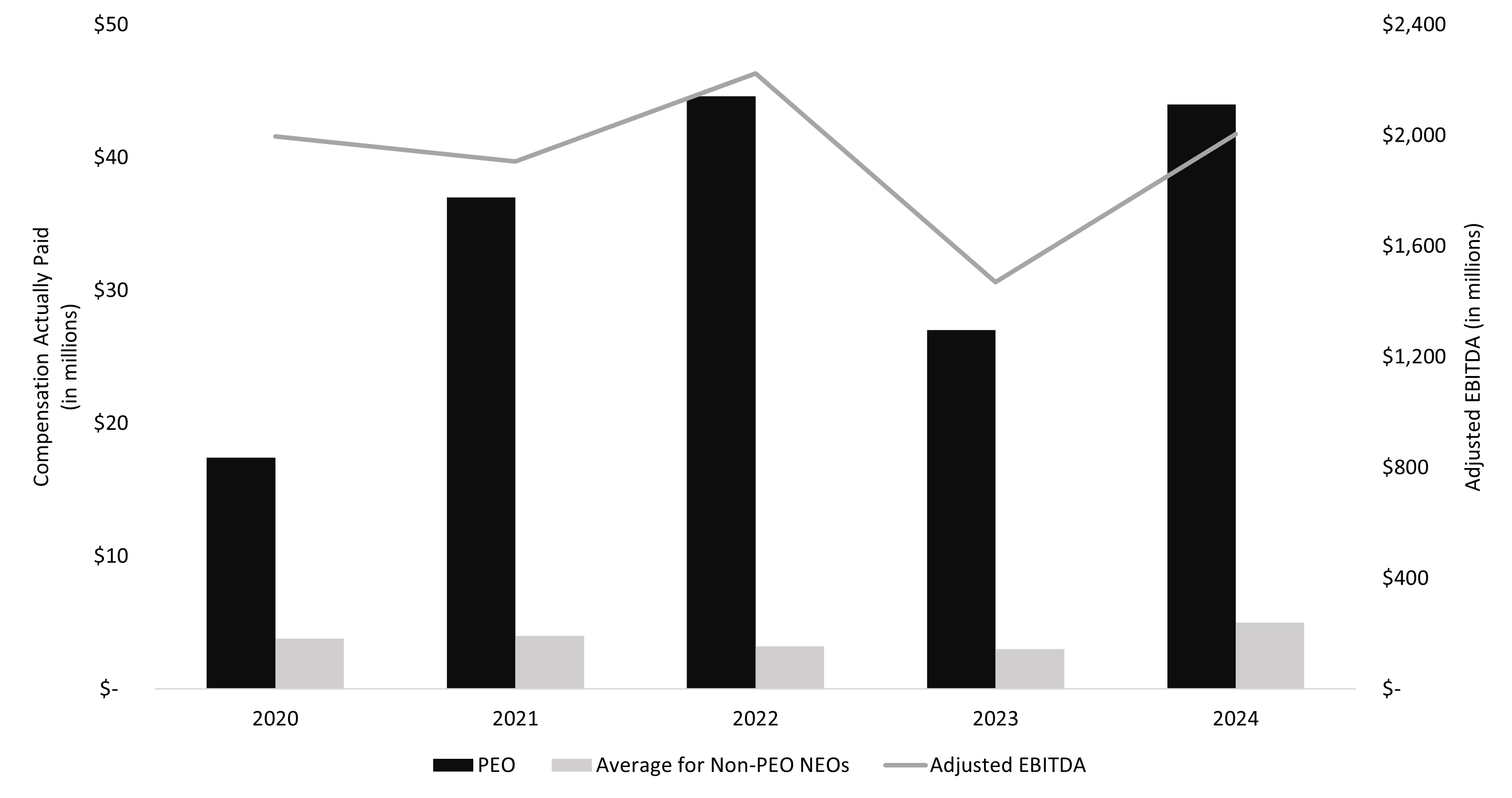

Compensation Actually Paid (in millions) $- $10 $20 $30 $40 $50 2020 2021 2022 2023 2024 PEO Average for Non-PEO NEOs Adjusted EBITDA $- $400 $800 $1200 $1600 $2000 $2400 Adjusted EBITDA (in millions)

|

2024 |

|

|

PEO |

Non-PEO NEOs |

|

|

|

Summary Compensation Table |

$35,873,916 |

$4,413,675 |

Less: Grant date fair value of equity awards made during the applicable year and unvested at applicable year end |

(27,746,271) |

(1,797,215) |

Plus: Year-end fair value of equity awards made during the applicable year and unvested at applicable year end |

26,798,441 |

1,809,334 |

Change in fair value of equity awards made in prior years and unvested at applicable year end |

3,698,638 |

11,071 |

Change in fair value of equity awards made in prior years and vested during applicable year |

5,636,677 |

131,950 |

Less: Fair value of equity awards made in prior years that are forfeited during applicable year |

— |

— |

|

|

|

Compensation Actually Paid |

$44,261,401 |

$4,568,815 |

In our assessment, the most important financial performance measures used to link CAP (as calculated in accordance with the SEC rules) to our NEOs in 2024 to our performance were Adjusted EBITDA and Net Revenue.

As described herein, the Company considers a number of other operating metrics in determining performance but Adjusted EBITDA and Net Revenue are the most important performance measures used by us to link CAP to the NEOs to company performance for 2024.