EXHIBIT 10.2

Donald Allan

President & Chief Executive Officer

Stanley Black & Decker

1000 Stanley Drive, New Britain, CT 06053

Date: March 2025

Re: 2025 - 2027 Long-Term Incentive Program

It is my pleasure to congratulate you for being selected to participate in the Long-Term Performance Award Program (the “Program”) under The Stanley Black & Decker 2024 Omnibus Award Plan (the “2024 Plan”). This Program is intended to provide substantial, equity-based awards for specified full-time members of our senior executive team, provided specific Corporate goals are achieved during the Program’s 36 month measurement period (January 2025 - December 2027).

In conjunction with our short-term incentive compensation program (MICP) and our time-vesting equity award program, the Program is an important element of your total compensation package and provides a strong additional incentive to continue increasing shareholder value.

Award Opportunity

Each participant will have an opportunity to earn a number of Performance Shares (PS) based upon achievement of corporate financial goals and may earn additional performance shares if the corporate financial goals are exceeded, up to the maximum number of 200% of target shares. Each PS unit represents one share of Stanley Black & Decker Common Stock and, accordingly, the potential value of a participant’s performance award under the Program may change as our stock price changes.

Your target award is reflected in Merrill Lynch. The threshold number of PS units is ½ of the target and maximum number of PS units is 2x the target. The number of PS units are calculated using a $87.5705 fair value stock price.

Performance awards will become vested at the time of settlement to the extent that the applicable performance metrics have been achieved and provided the participant is continuously employed by Stanley Black & Decker until such time, as more fully set forth in the Terms and Conditions applicable to Long Term Performance Awards.

Financial Measurements

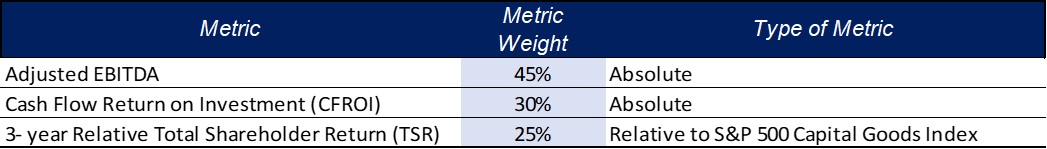

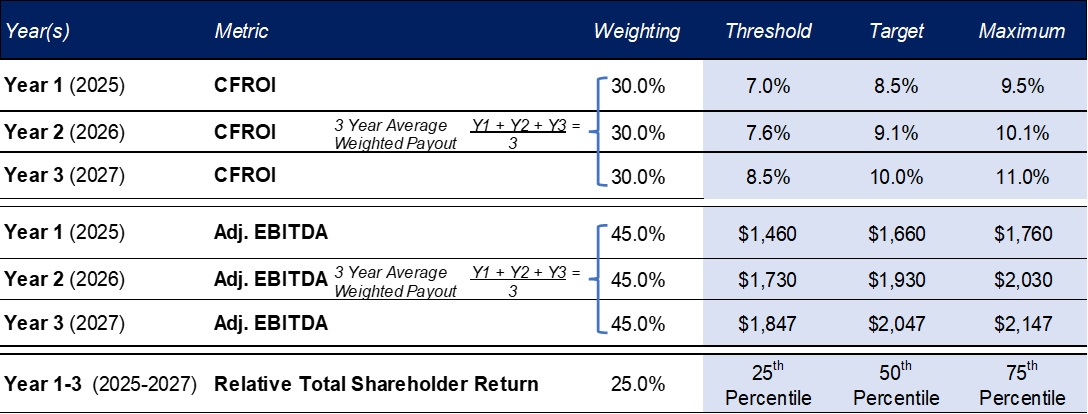

The Corporate financial goals for this Program consist of three metrics: two absolute goals (CFROI, or Cash Flow Return on Investment, and Adjusted EBITDA) and one relative goal (Total Shareholder Return vs. the S&P 500 Capital Goods Index.) as more fully described in Appendix 1.

Although this summary includes the key aspects of the Program, it is not intended to represent a full accounting of the rules and regulations applicable to the Program and is subject to the terms described in the Terms and Conditions Applicable to Long Term Performance Awards in Appendix 2 and The Stanley Black & Decker 2024 Omnibus Award Plan (available on request), which together with this document govern the Program.

Once again, thank you for your continued support and congratulations on being selected to participate in this important Program.

Best regards,

Don Allan

President & Chief Executive Officer

APPENDIX 1

LTIP 2025 – 2027: Goals and Plan Overview

Performance Goals:

Adjusted EBITDA: refers to the Non-GAAP EBITDA including normal adjustments between GAAP and non-GAAP

•Adjusted EBITDA, or Earnings Before Interest, Taxes, Depreciation and Amortization is a financial metric used to evaluate SBD's operating performance. By excluding interest, taxes, depreciation and amortization the metric provides a clearer picture of SBD's operational profitability as it focuses on earnings generated from core business activities without the effects of ancillary financial & accounting decisions. Lastly, Adjusted EBITDA allows for comparisons of a company and its peers within similar industries on how efficiently the company is generating profits from its operations.

CFROI Calculation

Calculation methodology:

Numerator = Cash from Operations Plus After-Tax Interest Expense

Denominator = Two Point Average (beginning and end of year) of Debt + Equity

•The threshold CFROI metric is set equal to the target CFROI less 100 basis points and the maximum CFROI metric is set equal to the target CFROI plus 100 basis points, consistent with the prior LTIP cycles. For acquisitions occurring during the plan years, CFROI actual performance may be adjusted to remove the acquired entities for comparability to established goals. Actual CFROI may be similarly adjusted for material divestitures. The cash outflow for “special” payments may be added back to the numerator. If so, the end of period Equity shall include an add-back for current period special charges

•Actual results may be recast to remove the impact of items that materially affect results but were not contemplated at time of goal development, subject to Board approval

TSR Calculation

•rTSR Goal – SWK percentile performance: Calculated based on an annualized rate of return reflecting share price appreciation and dividend reinvestment during the 36-month measurement period as compared with the S&P 500 Capital Goods Index.

oS&P 500 Capital Goods Index as comprised of 48 companies at the beginning of the performance period will be used to measure performance

oIf SWK TSR is negative over the three-year measurement period, there will be a cap on the payout at Target, regardless of whether the Company’s stock performs better than the 50th percentile of the S&P 500 Capital Goods Index

•rTSR Defined: Annualized rate of return reflecting share price appreciation and dividend reinvestment to purchase additional shares during the measurement period. Starting and ending share prices, respectively, will be measured based on the average of the closing price for each of the first (and last) 20 trading days of the performance period to smooth for daily volatility. The results of each company are ranked to determine SBD performance relative to the Index.

APPENDIX 2

LONG-TERM PERFORMANCE AWARD TERMS

Grant of Performance Shares. This certifies that Stanley Black & Decker, Inc. (the “Company”) has on the Grant Date specified in this Award Certificate granted to the Participant named above a performance award (the “Performance Award”) of that number of Performance Shares indicated in this Award Certificate, subject to certain restrictions and on the terms and conditions contained in this Award Certificate and the Company’s 2024 Omnibus Award Plan, as amended from time to time (the “Plan”). A copy of the Plan is available upon request. In the event of any conflict between the terms of the Plan and this Award Certificate, the terms of the Plan shall govern. This Performance Award represents the right of the Participant to receive a number of shares of Common Stock equal to the number of earned Performance Shares based on the Company’s achievement of the Performance Goals for the Measurement Period, provided the employment requirements below are satisfied. For purposes of this Award Certificate, if the Participant is not employed by the Company, “Employer” means the Affiliate that employs the Participant. All capitalized terms used in this Award Certificate which are not defined in this Award Certificate (including Section 17 herein) shall have the meanings given them in the Plan unless the context clearly requires otherwise.

No Shareholder Rights. The Participant shall not have any rights of a shareholder, including but not limited to, the right to vote or to receive dividends, with respect to the Performance Award or any shares of Common Stock subject to the Performance Shares, until stock certificates, if any, have been issued to the Participant or Participant’s ownership has been otherwise recorded in settlement of earned Performance Shares.

Determination of Earned Performance Shares; Vesting.

General. As soon as reasonably practicable following the completion of the Measurement Period, the Committee will determine (i) whether and to what extent the Performance Goals have been achieved, and (ii) the number of Performance Shares that are deemed “earned” in respect of the Measurement Period as a result of such performance, with the number of earned Performance Shares to be linearly interpolated on a straight-line basis between specified levels of performance (i.e., for performance that falls above “threshold” level but below “target” level, or above “target” level but below “maximum” level). In order for any Performance Shares to be earned in respect of a Performance Goal, the “threshold” level of achievement with respect to such Performance Goal must be achieved, and in no event will more than the maximum number of Performance Shares be earned.

Adjustments. Notwithstanding any other provision hereof, the Performance Award and the Performance Goals may be adjusted up or down, at the sole discretion of the Committee, based upon any factors determined by the Committee to be appropriate, including without limitation (i) the impact of pandemics, war, or severe weather on the Company’s results of operations, (ii) any other unforeseen, unusual or extraordinary gains, losses, expenses, revenues, charges or credits not contemplated at the time of the determination of the Performance Goal establishment, and/or (iii) individual, business or regional performance.

Vesting. Any earned Performance Shares will become vested if, except as set forth below, the Participant remains continuously employed by the Company or an Affiliate until the Settlement Date (as defined below).

Termination of Employment.

General. Unless determined otherwise by the Committee, if the Participant’s employment with the Company or an Affiliate terminates prior to the Settlement Date for any reason other than as provided below in this Section 3, then the Participant will forfeit all rights in respect of the Performance Award and will not be entitled to receive any Common Stock or other payment under the Performance Award.

Death and Disability. Upon the Participant’s death or if the Participant’s employment is terminated as a result of the Participant’s Disability, the Performance Award will be settled pursuant to Section 5 at the same time as performance awards for active participants are settled, to the extent the Performance Goals have been achieved; except that, if the termination

occurs prior to December 31 of the first year of the Measurement Period, any earned Performance Award shall be prorated based on the number of complete months in the Measurement Period that the Participant was employed by the Company.

Retirement. Upon the Participant’s Retirement, the Performance Award will be settled pursuant to Section 5 at the same time as performance awards for active participants are settled, to the extent the Performance Goals have been achieved; except that, if the termination occurs prior to December 31 of the first year of the Measurement Period, any earned Performance Award shall be prorated based on the number of complete months in the Measurement Period that the Participant was employed by the Company.

Divestiture. If, prior to the Settlement Date, the Participant’s employment with the Company and its Affiliates terminates as a result of a Qualifying Divestiture Termination, the Performance Award will be settled pursuant to Section 5 at the same time as performance awards for active participants are settled, to the extent the Performance Goals have been achieved; except that, if the termination occurs prior to the last day of the Measurement Period, any earned Performance Award shall be prorated based on the number of complete months in the Measurement Period that the Participant was employed by the Company.

Release. In the event of a termination of employment as described in Sections 4(b), 4(c) or 4(d), the Company may require the Participant to execute an effective release of claims in the form provided by the Company to receive the benefit of such provisions.

Restrictive Covenants. Notwithstanding anything herein, to be eligible to receive settlement of the Performance Award following a termination of employment as described in Sections 4(b) or 4(c), the Participant understands and agrees that (i) the Participant must comply with all Restrictive Covenants during the Restriction Period (notwithstanding any provisions of the Restrictive Covenants which by their original terms may terminate prior to the Settlement Date), and (ii) in the event the Participant fails to comply with any Restrictive Covenants, the Participant will forfeit any and all rights under the Performance Award, in each case, to the fullest extent permitted under applicable law.

Settlement of Performance Shares. The earned and vested Performance Shares will be settled as soon as practicable, and by no later than March 15th of the year, following the end of the Measurement Period (the date of such settlement, the “Settlement Date”). The Committee may, in its sole discretion, settle each earned and vested Performance Share in the form of: (a) cash, to the extent settlement in shares of Common Stock (x) becomes prohibited under applicable laws, (y) would require the Participant, the Company or the Employer to obtain the approval of any governmental and/or regulatory body in the Participant’s country of residence (and country of employment, if different), or (z) is administratively burdensome or (b) shares of Common Stock, but the Company may require the Participant to immediately sell such shares of Common Stock if necessary to comply with applicable laws (in which case, the Participant hereby expressly authorizes the Company to issue sales instructions in relation to such shares of Common Stock on the Participant’s behalf).

Restriction on Transfer. Performance Shares shall not be assignable, alienable, saleable, or transferable. The Performance Award shall be transferable only by will or the laws of descent and distribution. If the Participant purports to make any transfer of the Performance Award, except as aforesaid, the Performance Award and all rights thereunder shall terminate immediately. Notwithstanding the foregoing, the Participant may, in the manner established by the Committee, designate a beneficiary or beneficiaries to receive shares of Common Stock (or cash in lieu thereof as provided in Section 5) with respect to the Performance Shares upon the death of the Participant.

Income Tax Matters.

Regardless of any action the Company or the Employer takes with respect to any or all income tax (including U.S. federal, state and local taxes or non-U.S. taxes), social insurance, payroll tax, payment on account or other tax-related withholding (“Tax-Related Items”), the Participant acknowledges and agrees that the ultimate liability for all Tax-Related Items legally due by the Participant is and remains the Participant’s responsibility and that the Company and the Employer (i) make no representations or undertakings regarding the treatment of any Tax-Related Items in connection with any aspect of the Performance Award, including the grant of the Performance Award, the vesting and settlement of the Performance Award, and the subsequent sale of any shares of Common Stock acquired pursuant to the Performance Award and (ii) do not commit to

structure the terms of the grant or any aspect of the Performance Award to reduce or eliminate the Participant’s liability for Tax-Related Items.

Prior to settlement upon the vesting of the Performance Award, if the Participant’s country of residence (and country of employment, if different) requires withholding of Tax-Related Items, the Company may withhold a sufficient number of whole shares of Common Stock otherwise issuable upon the vesting of the Performance Award that have an aggregate Fair Market Value sufficient to pay the Tax-Related Items required to be withheld with respect to the shares of Common Stock (or cash otherwise payable thereunder in the event of cash settlement). Depending on the withholding method specified in the Plan, the Company may withhold or account for Tax-Related Items by considering applicable statutory withholding rates or other applicable withholding rates, including maximum applicable rates. The cash equivalent of the shares of Common Stock withheld will be used to settle the obligation to withhold the Tax-Related Items. In the event that the withholding of shares of Common Stock becomes prohibited under applicable law or otherwise may trigger adverse consequences to the Company or the Employer, the Company and the Employer may withhold the Tax-Related Items required to be withheld with respect to the shares of Common Stock in cash from the Participant’s regular salary and/or wages or any other amounts payable to the Participant, or may require the Participant to personally make payment of the Tax-Related Items required to be withheld. In the event the withholding requirements are not satisfied through the withholding of shares of Common Stock by the Company or through the withholding of cash from the Participant’s regular salary and/or wages or other amounts payable to the Participant, no shares of Common Stock will be issued to the Participant (or the Participant’s estate) upon vesting or settlement of the Performance Award unless and until satisfactory arrangements (as determined by the Committee) have been made by the Participant with respect to the payment of any Tax-Related Items that the Company or the Employer determines, in its sole discretion, must be withheld or collected with respect to such Performance Award. If the obligation for the Participant’s Tax-Related Items is satisfied by withholding a number of shares of Common Stock as described herein, the Participant shall be deemed to have been issued the full number of shares of Common Stock issuable upon vesting, notwithstanding that a number of the shares of Common Stock is held back solely for the purpose of paying the Tax-Related Items due as a result of the vesting or any other aspect of the Performance Award.

The Participant will pay to the Company or the Employer any amount of Tax-Related Items that the Company or the Employer may be required to withhold as a result of the Participant’s participation in the Plan or the Participant’s acquisition of shares of Common Stock that cannot be satisfied by the means described herein. The Company may refuse to deliver any shares of Common Stock due upon settlement of the Performance Award if the Participant fails to comply with the Participant’s obligations in connection with the Tax-Related Items as described herein. If the Participant is subject to taxation in more than one country, the Participant acknowledges that the Company, the Employer or one or more of their respective Affiliates may be required to withhold or account for Tax-Related Items in more than one country. The Participant hereby consents to any action reasonably taken by the Company and the Employer to meet the Participant’s obligation for Tax-Related Items. By accepting this Performance Award, the Participant expressly consents to the withholding of shares of Common Stock and/or withholding from the Participant’s regular salary and/or wages or other amounts payable to the Participant as provided for hereunder. All other Tax-Related Items related to the Performance Award and any shares of Common Stock delivered in payment thereof shall be the Participant’s sole responsibility.

Legal and Tax Compliance; Cooperation. If the Participant is a resident and/or employed outside of the United States, the Participant agrees, as a condition of the grant of the Performance Award, to repatriate all payments attributable to the shares of Common Stock acquired under the Plan (including, but not limited to, any proceeds derived from the sale of the shares of Common Stock acquired pursuant to the Performance Award) if required by and in accordance with local foreign exchange rules and regulations in the Participant’s country of residence (and/or country of employment, if different). In addition, the Participant also agrees to take any and all actions, and consents to any and all actions taken by the Company and its Affiliates, as may be required to allow the Company and its Affiliates to comply with local laws, rules and regulations in the Participant’s country of residence (and/or country of employment, if different). Finally, the Participant agrees to take any and all actions as may be required to comply with the Participant’s personal legal and tax obligations under local laws, rules and regulations in the Participant’s country of residence (and/or country of employment, if different).

Data Privacy. The Company is located at 1000 Stanley Drive, New Britain, Connecticut 06053 U.S.A. and grants Awards to acquire shares of Common Stock under the Plan to employees of the Company and its Affiliates, at its sole discretion. In accepting the Performance Award granted under the Plan, the Participant should carefully review the following information about the Company’s data processing practices.

Data Collection, Processing and Usage. The Company collects, processes and uses personal data of employees, including name, home address, email address and telephone number, date of birth, social insurance, passport or other identification number, salary, citizenship, job title, any shares of Common Stock or directorships held in the Company, and details of all Awards to acquire shares of Common Stock canceled, vested, or outstanding in the Participant’s favor, which the Company receives from the Participant or, if different, the Employer (“Personal Information”). If the Company grants the Participant an Award under the Plan, then the Company will collect the Participant’s Personal Information for purposes of allocating shares of Common Stock and implementing, administering and managing the Plan. The Company’s legal basis for collecting, processing and using the Participant’s Personal Information will be the Company’s necessity to execute its contractual obligations under this Award Certificate and to comply with its legal obligations.

Stock Plan Administration Service Providers. The Company transfers the Participant’s Personal Information as necessary and appropriate to Bank of America Merrill Lynch and its affiliates (“BAML”), an independent service provider based in the United States which assists the Company with the implementation, administration and management of the Plan. In the future, the Company may select a different service provider and share the Participant’s data with another company that serves in a similar manner. BAML will open an account for the Participant to receive and trade shares of Common Stock the Participant acquires under the Plan. The Participant will be asked to agree to separate terms and data processing practices with BAML, which is a condition of the Participant’s ability to participate in the Plan.

International Data Transfers. The Participant’s Personal Information may be transferred to or otherwise processed in the United States or other jurisdictions besides the Participant’s own. The Participant should note that the Participant’s country of residence (and country of employment, if different) may have enacted data privacy laws that are different from those of the recipient country. Such transfers will be made pursuant to Company policies and data protection measures as detailed in the Company’s Employee Privacy Policy, available by contacting Participant’s local HR manager or Global Privacy Office.

Data Retention. The Company will use the Participant’s Personal Information as long as is necessary to implement, administer and manage the Participant’s participation in the Plan or as required to comply with legal or regulatory obligations, including under tax and security laws. When the Company no longer needs the Participant’s Personal Information, the Company will remove it from its systems.

Voluntariness. The Participant’s participation in the Plan is purely voluntary. If the Participant elects not to participate in the Plan, the Participant’s decision would not affect the Participant’s salary as an employee of the Employer or the Participant’s career; the Participant would merely forfeit the opportunities associated with the Plan.

Individual Rights. The Participant may have a number of rights under data privacy laws in the Participant’s country of residence (and country of employment, if different). Depending on where the Participant is based, the Participant’s rights may include the right to (i) request access or copies of Personal Information the Company processes pursuant to this Award Certificate, (ii) request to rectify incorrect Personal Information, (iii) request to delete Personal Information, (iv) request to restrict Personal Information processing, and/or (v) lodge complaints with competent authorities in the Participant’s country of residence (and country of employment, if different). To receive clarification regarding the Participant’s rights or to exercise the Participant’s rights, the Participant should contact the Participant’s local HR department. A response to the Participant’s request will be provided consistent with applicable law.

SBD Employee Privacy Notice. All collection and use of the Participant’s Personal Information under this notice is made pursuant to the Company’s Employee Privacy Notice (the “Privacy Notice”), which the Participant has previously received. Please see the Privacy Notice for additional information on the Company’s policies regarding data retention, data security and other important information.

| | |

| By accepting the Performance Award as granted under the Plan, the Participant explicitly declares that the Participant has been informed about the collection, processing and use of the Participant’s Personal Information by the Company and the transfer of the Participant’s Personal Information to the recipients mentioned above, including recipients located in countries that have different data protection rules than in the Participant’s country of residence. |

Insider Trading/Market Abuse Laws. By participating in the Plan, the Participant agrees to comply with the Company’s policy on insider trading (to the extent that it is applicable to the Participant). The Participant further acknowledges that, depending on the Participant’s or the Participant’s broker’s country of residence or where the shares of Common Stock are listed, the Participant may be subject to insider trading restrictions and/or market abuse laws which may affect the Participant’s ability to accept, acquire, sell or otherwise dispose of shares of Common Stock, rights to shares of Common Stock (e.g., the Performance Award) or rights linked to the value of shares of Common Stock, during such times the Participant is considered to have “inside information” regarding the Company as defined by the laws or regulations in the Participant’s country of residence (or country of employment, if different). Local insider trading laws and regulations may prohibit the cancellation or amendment of orders the Participant places before the Participant possessed inside information. Furthermore, the Participant could be prohibited from (a) disclosing the inside information to any third party (other than on a “need to know” basis) and (b) “tipping” third parties or causing them otherwise to buy or sell securities. The Participant understands that third parties include fellow employees. Any restrictions under these laws or regulations are separate from and in addition to any restrictions that may be imposed under any applicable Company’s insider trading policy. The Participant acknowledges that it is the Participant’s personal responsibility to comply with any applicable restrictions, and that the Participant should consult with the Participant’s personal advisor on this matter.

Private Placement. If the Participant is a resident and/or employed outside of the United States, the Participant acknowledges that the grant of the Performance Award is not intended to be a public offering of securities in the Participant’s country of residence (country of employment, if different). The Participant further acknowledges that the Company has not submitted any registration statement, prospectus or other filing with any securities authority other than the U.S. Securities and Exchange Commission with respect to the grant of the Performance Award, unless otherwise required under local law. No employee of the Company is permitted to advise the Participant on whether the Participant should acquire shares of Common Stock under the Plan or provide the Participant with any legal, tax or financial advice with respect to the grant of the Performance Award. The acquisition of shares of Common Stock involves certain risks, and the Participant should carefully consider all risk factors and tax considerations relevant to the acquisition of shares of Common Stock under the Plan and the disposition of them. Further, the Participant should carefully review all of the materials related to the Performance Award and the Plan, and the Participant should consult with the Participant’s personal legal, tax and financial advisors for professional advice in relation to the Participant’s personal circumstances.

Other. The Company shall not be required to issue any certificate or certificates for shares of Common Stock upon settlement of the earned Performance Shares (i) if the Common Stock is not listed on any national securities exchange, (ii) prior to the completion of any registration or other qualification of such shares of Common Stock under any state or federal law or rulings or regulations of any governmental regulatory body, and (iii) prior to the Company obtaining any consent or approval or other clearance from any governmental agency which the Company shall, in its sole discretion, determine to be necessary or advisable. Shares of Common Stock to be issued in respect of earned Performance Shares will be issued only in compliance with the Securities Act of 1933, as amended (the “Act”), and any other applicable securities laws, and the Participant shall comply with any requirements imposed by the Committee under such laws. If the Participant qualifies as an “affiliate” (as that term is defined in Rule 144 (“Rule 144”) promulgated under the Act), upon demand by the Company, the Participant (or any person acting on the Participant’s behalf) shall deliver to the Treasurer at the time of settlement of the earned Performance Shares a written representation that the Participant will acquire shares of Common Stock pursuant to the Plan for the Participant’s own account, that the Participant is not taking the shares of Common Stock with a view to distribution and that the Participant will dispose of the shares of Common Stock only in compliance with Rule 144.

No Right to Continued Employment. This Performance Award does not confer on the Participant any right with respect to the continuation of employment with the Company or any Affiliate, nor will it interfere in any way with the right of the Company or any Affiliate to terminate the Participant’s employment at any time.

Governing Law; Venue. The Plan, this Award Certificate and all determinations made and actions taken pursuant to the Plan or Award Certificate shall be determined in accordance with the laws of the State of Connecticut and applicable Federal law. Any disputes regarding this Performance Award, the Award Certificate or the Plan shall be brought only in the United States in the state or federal courts of the State of Connecticut.

Electronic Delivery. The Company may, in its sole discretion, decide to deliver any documents related to the Performance Award or other awards granted to the Participant under the Plan by electronic means. The Participant hereby consents to receive such documents by electronic delivery and agrees to participate in the Plan through an on-line or electronic system established and maintained by the Company or a third party designated by the Company.

Binding Effect. The grant of this Performance Award shall be binding and effective only if this Award Certificate is executed by or delivered on behalf of the Company.

Definitions. As used in this Award Certificate:

“Disability” has the meaning provided in Section 22(e)(3) of the Code, or any successor provision.

“Divestiture” means the consummation of a sale or other disposition of a subsidiary, division, business unit, or other organizational unit, whether such disposition is effected by means of a sale of assets, a sale of subsidiary equity or other ownership interest, or otherwise, in each case that is designated by the Company, in its sole discretion, as a “Divestiture.” For the avoidance of doubt, any transaction that is a Change in Control shall not constitute a Divestiture.

“Measurement Period” means the period during which performance is measured against the Performance Goals, as set forth in the Award Certificate.

“Performance Goals” means the goals established by the Committee or, pursuant to an appropriate delegation of authority, the Chief Executive Officer, for performance of the Company as a whole and/or specific businesses or functions during the Measurement Period. The Performance Goals applicable to this Performance Awards are as set forth in this Award Certificate.

“Qualifying Divestiture Termination” means a termination of the Participant’s employment with the Company and its Affiliates in connection with a Divestiture as a result of (i) the Participant becoming employed by the purchaser in such Divestiture or its affiliate immediately following the Divestiture; (ii) the Participant not receiving qualifying offer of employment from the purchaser in such Divestiture or its affiliate, as determined by the Company, in its sole discretion; or (iii) Participant’s employing entity ceasing to be an Affiliate of the Company as a result of the Divestiture.

“Restriction Period” means the period of time between the date upon which the Participant cease to be an employee of the Company and its Affiliates and the Settlement Date, or the period of restriction contained in any Restrictive Covenant Agreement executed by the Participant with respect to Participant’s employment with the Company, whichever is longer.

“Restrictive Covenants” means any restrictive covenants contained in any Restrictive Covenant Agreement executed by the Participant regarding his or her employment with the Company or an Affiliate.

“Retirement” means the Participant’s termination of employment with the Company and each of its Affiliates after (i) attaining the age of 55 and completing 10 years of service, or (ii) attaining the age of 65 and completing one or more years of service.

English Language. If the Participant is resident and/or employed outside of the United States, the Participant acknowledges and agrees that it is the Participant’s express intent that this Award Certificate, the Plan and all other documents, notices and legal proceedings entered into, given or instituted pursuant to the Performance Award, be drawn up in English. If the Participant has received this Award Certificate, the Plan or any other documents related to the Performance Award translated into a language other than English, and if the meaning of the translated version is different from the English version, the meaning of the English version shall control.

Clawback/Recoupment Policy. Notwithstanding any other provision of this Award Certificate to the contrary, the Participant acknowledges and agrees that all shares of Common Stock acquired pursuant to the Plan shall be and remain subject to any incentive compensation clawback or recoupment policy of the Company currently in effect or as may be adopted by the Company (including, without limitation, the Stanley Black & Decker, Inc. Financial Statement Compensation Recoupment Policy) and, in each case, as may be amended from time to time. No such policy adoption or amendment shall require the Participant’s prior consent. For purposes of the foregoing, the Participant expressly and explicitly authorizes (i) the Company to issue instructions, on the Participant’s behalf, to any brokerage firm and/or third party administrator engaged by the Committee to hold the Participant’s shares of Common Stock, and other amounts acquired under the Plan to re-convey, transfer or otherwise return such shares of Common Stock and/or other amounts to the Company, and (ii) the Company’s recovery of any covered compensation through any method of recovery that the Company deems appropriate, including without limitation by reducing any amount that is or may become payable to the Participant. The Participant further agrees to comply with any request or demand for repayment by any Affiliate in order to comply with such policies or applicable law. To the extent that the terms of this Award Certificate and any Company recoupment policy conflict, the terms of the recoupment policy shall prevail. The Committee or the Board may provide for the cancellation or forfeiture of the Performance Award or the forfeiture and repayment to the Company of any gain related to the Performance Award, or other provisions intended to have a similar effect, upon such other terms and conditions as may be determined by the Committee or the Board from time to time, including, without limitation, in the event that a Participant, during employment or other service with the Company or an Affiliate, engages in activity detrimental to the business of the Company.

Addendum. Notwithstanding any provisions of this Award Certificate to the contrary, the Performance Award shall be subject to any special terms and conditions for the Participant’s country of residence (and country of employment, if different), as are set forth in an applicable Addendum to this Award Certificate. Further, if the Participant transfers residence and/or employment to another country reflected in an Addendum to this Award Certificate, the special terms and conditions for such country will apply to the Participant to the extent the Company determines, in its discretion, that the application of such terms and conditions is necessary or advisable in order to comply with local laws, rules, and regulations or to facilitate the operation and administration of the Performance Award and the Plan (or the Company may establish alternative terms and conditions as may be necessary or advisable to accommodate the Participant’s transfer). Any applicable Addendum shall constitute part of this Award Certificate.

Additional Requirements; Amendments. The Company reserves the right to impose other requirements on the Performance Award, any shares of Common Stock acquired pursuant to the Performance Award and the Participant’s participation in the Plan to the extent the Company determines, in its sole discretion, that such other requirements are necessary or advisable in order to comply with local law, rules and regulations or to facilitate the operation and administration of the Performance Award and the Plan. Such requirements may include (but are not limited to) requiring the Participant to sign any agreements or undertakings that may be necessary to accomplish the foregoing. In addition, the Company reserves the right to amend the terms and conditions reflected in this Award Certificate, without the Participant’s consent, either prospectively or retroactively, to the extent that such amendment does not materially affect the Participant’s rights under the Performance Award except as otherwise permitted under the Plan or this Award Certificate.

Nature of the Grant. In accepting the Performance Award, the Participant hereby acknowledges that:

the Plan is established voluntarily by the Company, is discretionary in nature and may be terminated, suspended or amended by the Company at any time, to the extent permitted by the Plan;

the grant of the Performance Award is voluntary and does not create any contractual or other right to receive future Performance Awards or benefits in lieu of a Performance Award, even if Performance Awards have been granted in the past;

all decisions with respect to future Performance Awards or other grants, if any, will be at the sole discretion of the Company;

the grant of the Performance Award and the Participant’s participation in the Plan shall not create a right to employment or be interpreted as forming an employment or service contract with the Company, the Employer or any other Affiliate shall not interfere with the ability of the Company, the Employer or any other Affiliate to terminate the Participant’s employment relationship (if any);

the Participant is voluntarily participating in the Plan;

the Performance Award and any shares of Common Stock acquired under the Plan, and the income from and value of same, are not intended to replace any pension rights or compensation;

the Performance Award and any shares of Common Stock acquired under the Plan, and the income from and value of same, are extraordinary items that do not constitute compensation of any kind for services of any kind rendered to the Company or the Employer, and which are outside the scope of the Participant’s employment and the Participant’s employment contract, if any;

the Performance Award and any shares of Common Stock acquired under the Plan, and the income from and value of same, are not part of normal or expected compensation or salary for any purpose, including, without limitation, calculating any severance, resignation, termination, redundancy, dismissal, end-of-service payments, holiday pay, bonuses, long-service awards, leave-related payments, holiday top-up, pension or retirement or welfare benefits or similar mandatory payments;

the future value of the underlying shares of Common Stock is unknown, indeterminable and cannot be predicted with certainty and the value of such shares of Common Stock acquired under the Plan may increase or decrease in the future;

no claim or entitlement to compensation or damages shall arise from forfeiture of the Performance Award resulting from termination of the Participant’s status as an employee (regardless of the reason for the termination and whether or not the termination is later found to be invalid or in breach of employment laws in the jurisdiction where the Participant is employed or the terms of the Participant’s employment agreement, if any);

on the date of termination of the Participant’s status as an employee (regardless of the reason for the termination and whether or not the termination is later found to be invalid or in breach of employment laws in the jurisdiction where the Participant is employed or the terms of the Participant’s employment agreement, if any), the Participant’s right to participate in the Plan, if any, will terminate (for purposes of the foregoing, the Committee shall have exclusive discretion to determine the effective date the Participant is no longer an employee);

neither the Company, the Employer nor any other Affiliate shall be liable for any foreign exchange rate fluctuation between the Participant’s local currency and the United States Dollar that may affect the value of the shares of Common Stock acquired or sold under the Plan;

in consideration of the grant of the Performance Award, no claim or entitlement to compensation or damages shall arise from termination of the Performance Award, or recoupment of any shares of Common Stock acquired under the Plan, or diminution in value of the Performance Award or shares of Common Stock acquired upon vesting of the Performance Award resulting from (A) termination of employment by the Company or the Employer, as applicable (for any reason whatsoever and whether or not in breach of applicable labor laws), and / or (B) the application of any recoupment policy or any recovery or clawback policy otherwise required by law, and the Participant hereby irrevocably releases the Company, the Employer and any Affiliates from any such claim that may arise; if, notwithstanding the foregoing, any such claim is found by a court of competent jurisdiction to have arisen, then, by acceptance of the Performance Award, the Participant shall be deemed irrevocably to have waived the Participant’s entitlement to pursue such claim; and

in the event of termination of the Participant’s employment with the Company (whether or not in breach of local labor laws), the Participant’s right to receive the Performance Award and vest in the Performance Award under the Plan, if any, will terminate effective as of the date of termination of the Participant’s active employment as determined in the discretion of the Committee unless otherwise provided in this Award Certificate or the Plan; furthermore, in the event of termination of the Participant’s employment (regardless of any contractual or local law requirements), the Participant’s right to vest in the Performance Award after such termination, if any, will be measured by the date of termination of the Participant’s active employment; the Committee will have the discretion to determine the date of termination of the Participant’s active employment for purposes of the Performance Award.

Section 409A. For the avoidance of doubt, if the Participant is subject to U.S. income taxation and is a “specified employee” (within the meaning of Section 409A of the Code) at the time of the Participant’s separation from service, and the

Company makes a good faith determination that an amount payable hereunder constitutes deferred compensation (within the meaning of Section 409A of the Code) the payment of which is required to be delayed pursuant to the six-month delay rule set forth in Section 409A of the Code, then the Company will not pay such amount on the otherwise scheduled settlement date, but will instead pay it, without interest, on the first business day of the seventh month after the Participant’s separation from service or, if earlier, on the Participant’s death. In addition, if the Participant is subject to U.S. income taxation and the Company makes a good faith determination that an amount payable hereunder constitutes deferred compensation, any vesting and settlement acceleration of such deferred compensation upon the Participant’s termination of employment shall not be effective unless such termination of employment also constitutes a separation from service under Section 409A of the Code.

Acceptance. By electronically accepting the grant of this Performance Award, the Participant affirmatively and expressly acknowledges that the Participant has read this Award Certificate, the Addendum to the Award Certificate (as applicable), and the Plan, and specifically accepts and agrees to the provisions therein. The Participant also affirmatively and expressly acknowledges that the Company, in its sole discretion, may amend the terms and conditions reflected in this Award Certificate without the Participant’s consent, either prospectively or retroactively, to the extent that such amendment does not materially impair the Participant’s rights under the Performance Award, and the Participant agrees to be bound by such amendment regardless of whether notice is given to the Participant of such change.

Miscellaneous. All decisions or interpretations of the Committee with respect to any question arising under the Plan or this Performance Award shall be binding, conclusive and final. The waiver by the Company of any provision of this Performance Award shall not operate as or be construed to be a subsequent waiver of the same provision or of any other provision of this Performance Award. The Participant agrees to execute such other agreements, documents or assignments as may be necessary or desirable to effect the purposes of this Performance Award.

*********************************************