• | total compensation, as calculated in the Summary Compensation Table, for our CEO and an average for our other NEOs; |

• | compensation actually paid (“CAP”) to the NEOs, an SEC prescribed calculation which adjusts total compensation for the items described below and which does not equate to realized compensation; |

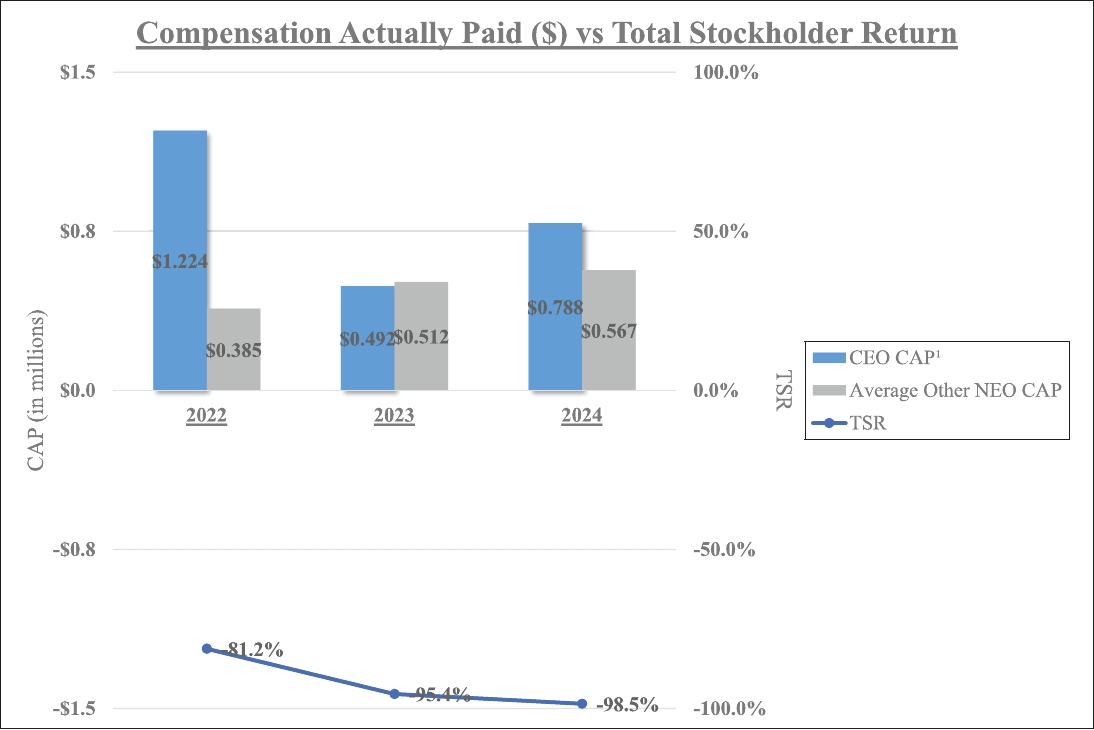

• | our cumulative total stockholder return (“TSR”) since the last trading day before the earliest year presented; and |

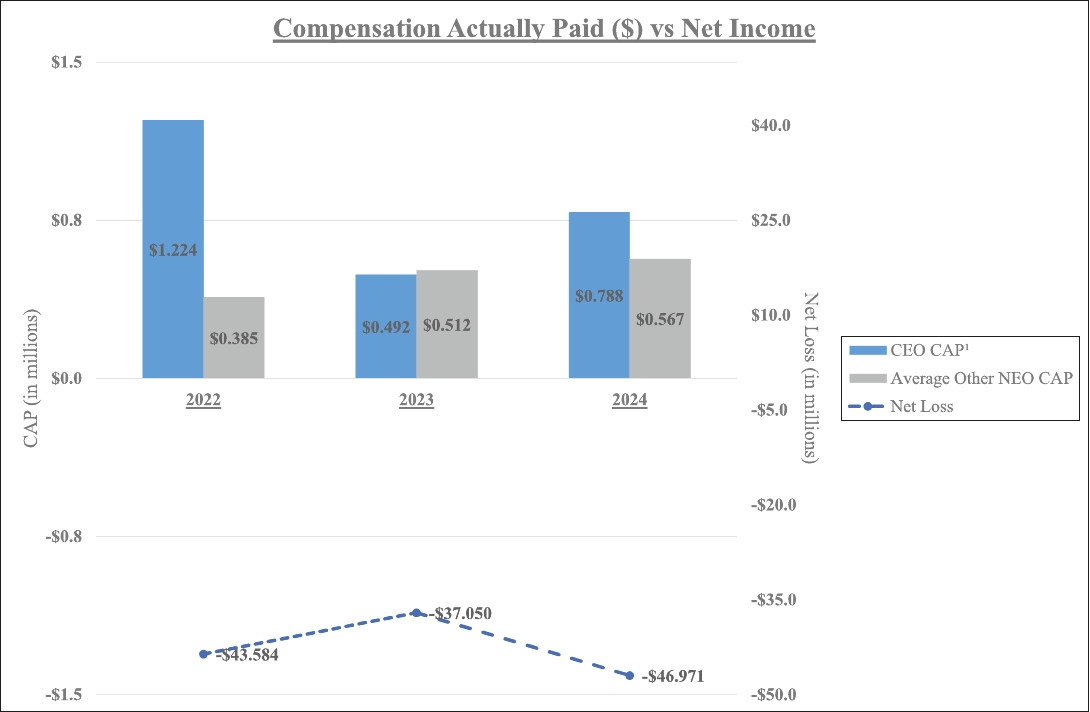

• | our net income. |

Year | Summary Compensation Table Total for Domenic Serafino (Former CEO)(1) | Compensation Actually Paid to Domenic Serafino (Former CEO)(2) | Summary Compensation Table Total for Rajiv De Silva (Current CEO) | Compensation Actually Paid to Rajiv De Silva (Current CEO) | Average Summary Compensation Table Total for Non-CEO NEOs(3) | Average Compensation Actually Paid to Non-CEO NEOs | Value of Initial Fixed $100 Investment Based on Total Stockholder Return(4) | Net Loss | ||||||||||||||||

Dollars in thousands | ||||||||||||||||||||||||

2024 | $842,625 | $788,400 | $580,117 | $566,604 | $1.45 | (46,971) | ||||||||||||||||||

2023 | — | — | $842,625 | $491,718 | $592,336 | $511,688 | $4.50 | (37,050) | ||||||||||||||||

2022 | $765,187 | $513,274 | $898,655 | $710,885 | $586,398 | $384,940 | $18.50 | (43,584) | ||||||||||||||||

(1) | For details regarding Mr. Serafino’s total compensation during 2022 and 2021, please refer to the Summary Compensation Table section and related disclosure contained in the Company’s definitive proxy statement filed with the SEC on April 10, 2023. |

(2) | For details regarding Mr. Serafino’s total compensation during 2022 and 2021, please refer to the Pay Versus Performance section and related disclosure contained in the Company’s definitive proxy statement filed with the SEC on April 10, 2023. |

(3) | The fiscal year 2021 figure is an average of the summary compensation table totals for Domenic Della Penna, Executive Vice President & Chief Financial Officer and Soeren Maor Sinay, former Chief Operations Officer of the Company; the fiscal year 2022 figure is an average of the summary compensation table totals for Domenic Della Penna, Executive Vice President & Chief Financial Officer and Ross Portaro, Executive Vice President & General Manager, Global Sales & Marketing; the fiscal year 2023 figure is an average of the summary compensation table totals for Dr. Hemanth Varghese, President and Chief Operating Officer and Ross Portaro, Executive Vice President & General Manager, Global Sales & Marketing; the fiscal year 2024 figure is an average of the summary compensation table totals for Dr. Hemanth Varghese, former President and Chief Operating Officer and Ross Portaro, Executive Vice President & General Manager, Global Sales & Marketing. |

(4) | Our cumulative TSR is based on a fixed investment of one hundred dollars in our common stock measured from the market close on December 31, 2021 (the last trading day of 2021) through and including the end of the fiscal year for each year reported in the table, and reinvestment of all dividends during such period. |

Deductions | Additions | |||||||||||

Year | Summary Compensation Total ($) | Amounts Reported in the Summary Compensation Table for Stock Awards and Stock Options Awards ($) | Fair Value of Stock Awards as Determined in Accordance with the SEC’s CAP Methodology ($) | Compensation Actually Paid ($) | ||||||||

Rajiv De Silva | ||||||||||||

2024 | 842,625 | — | -54,225(1) | 788,400 | ||||||||

2023 | 842,625 | — | -350,907(2) | 491,718 | ||||||||

2022 | 898,655 | 684,090 | 496,320(3) | 710,885 | ||||||||

Deductions | Additions | |||||||||||

Year | Summary Compensation Total ($) | Amounts Reported in the Summary Compensation Table for Stock Awards and Stock Options Awards ($) | Fair Value of Stock Awards as Determined in Accordance with the SEC’s CAP Methodology ($) | Compensation Actually Paid ($) | ||||||||

Average for Other NEOs | ||||||||||||

2024 | 580,117 | — | -13,513(4) | 566,604 | ||||||||

2023 | 592,336 | 8,691 | -71,957(5) | 511,688 | ||||||||

2022 | 586,398 | 117,974 | -83,484(6) | 384,940 | ||||||||

(1) | Mr. De Silva’s 2024 add back adjustment is the sum of (i) the fair value of all unvested and outstanding awards granted in 2024 as of December 31, 2024 ($0), (ii) the change in fair value of all unvested and outstanding options issued prior to 2024 with the change measured from December 31, 2023 to December 31, 2024 (-$42,381), (iii) the fair value of awards granted and vested in 2024 ($0), and (iv) the change in fair value of awards vested in 2024 but issued in a prior year with the change measured from December 31, 2023 to the vesting date (-$11,844). |

(2) | Mr. De Silva’s 2023 add back adjustment is the sum of (i) the fair value of all unvested and outstanding awards granted in 2023 as of December 31, 2023 ($0), (ii) the change in fair value of all unvested and outstanding options issued prior to 2023 with the change measured from December 31, 2022 to December 31, 2023 (-$278,784), (iii) the fair value of awards granted and vested in 2023 ($0), and (iv) the change in fair value of awards vested in 2023 but issued in a prior year with the change measured from December 31, 2022 to the vesting date (-$72,123). |

(3) | Mr. De Silva’s 2022 add back adjustment is the sum of (i) the fair value of all unvested and outstanding awards granted in 2022 as of December 31, 2022 ($496,320), (ii) the change in fair value of all unvested and outstanding options issued prior to 2022 with the change measured from December 31, 2021 to December 31, 2022 ($0), (iii) the fair value of awards granted and vested in 2022 ($0), and (iv) the change in fair value of awards vested in 2022 but issued in a prior year with the change measured from December 31, 2021 to the vesting date ($0). |

(4) | The add back adjustment for the 2024 Other NEOs (Mr. Varghese and Mr. Portaro) is the sum of (i) the average fair value of all unvested and outstanding awards granted in 2024 to the 2024 Other NEOs as of December 31, 2024 ($0), (ii) the average change in fair value of all unvested and outstanding options issued to the 2024 Other NEOs prior to 2024 with the change measured from December 31, 2023 to December 31, 2024 (-$10,211), (iii) the average fair value of awards granted to the 2024 Other NEOs and vested in 2024 ($0), and (iv) the average change in fair value of awards vested in 2024 but issued in a prior year to the 2024 Other NEOs with the change measured from December 31, 2023 to the vesting date (-$3,302). |

(5) | The add back adjustment for the 2023 Other NEOs (Mr. Varghese and Mr. Portaro) is the sum of (i) the average fair value of all unvested and outstanding awards granted in 2023 to the 2023 Other NEOs as of December 31, 2023 ($3,067), (ii) the average change in fair value of all unvested and outstanding options issued to the 2023 Other NEOs prior to 2023 with the change measured from December 31, 2022 to December 31, 2023 (-$60,683), (iii) the average fair value of awards granted to the 2023 Other NEOs and vested in 2023 ($1,016), and (iv) the average change in fair value of awards vested in 2023 but issued in a prior year to the 2023 Other NEOs with the change measured from December 31, 2022 to the vesting date (-$15,357). |

(6) | The add back adjustment for the 2022 Other NEOs (Mr. Della Penna and Mr. Portaro) is the sum of (i) the average fair value of all unvested and outstanding awards granted in 2022 to the 2022 Other NEOs as of December 31, 2022 ($47,776), (ii) the average change in fair value of all unvested and outstanding options issued to the 2022 Other NEOs prior to 2022 with the change measured from December 31, 2021 to December 31, 2022 (-$100,108), (iii) the average fair value of awards granted to the 2022 Other NEOs and vested in 2022 ($3,349), and (iv) the average change in fair value of awards vested in 2022 but issued in a prior year to the 2022 Other NEOs with the change measured from December 31, 2021 to the vesting date (-$34,501). |

(1) | For details regarding Mr. Serafino’s total compensation during 2022 and 2021, please refer to the Summary Compensation Table section and related disclosure contained in the Company’s definitive proxy statement filed with the SEC on April 10, 2023. |

(2) | For details regarding Mr. Serafino’s total compensation during 2022 and 2021, please refer to the Pay Versus Performance section and related disclosure contained in the Company’s definitive proxy statement filed with the SEC on April 10, 2023. |

(3) | The fiscal year 2021 figure is an average of the summary compensation table totals for Domenic Della Penna, Executive Vice President & Chief Financial Officer and Soeren Maor Sinay, former Chief Operations Officer of the Company; the fiscal year 2022 figure is an average of the summary compensation table totals for Domenic Della Penna, Executive Vice President & Chief Financial Officer and Ross Portaro, Executive Vice President & General Manager, Global Sales & Marketing; the fiscal year 2023 figure is an average of the summary compensation table totals for Dr. Hemanth Varghese, President and Chief Operating Officer and Ross Portaro, Executive Vice President & General Manager, Global Sales & Marketing; the fiscal year 2024 figure is an average of the summary compensation table totals for Dr. Hemanth Varghese, former President and Chief Operating Officer and Ross Portaro, Executive Vice President & General Manager, Global Sales & Marketing. |

Deductions | Additions | |||||||||||

Year | Summary Compensation Total ($) | Amounts Reported in the Summary Compensation Table for Stock Awards and Stock Options Awards ($) | Fair Value of Stock Awards as Determined in Accordance with the SEC’s CAP Methodology ($) | Compensation Actually Paid ($) | ||||||||

Rajiv De Silva | ||||||||||||

2024 | 842,625 | — | -54,225(1) | 788,400 | ||||||||

2023 | 842,625 | — | -350,907(2) | 491,718 | ||||||||

2022 | 898,655 | 684,090 | 496,320(3) | 710,885 | ||||||||

Deductions | Additions | |||||||||||

Year | Summary Compensation Total ($) | Amounts Reported in the Summary Compensation Table for Stock Awards and Stock Options Awards ($) | Fair Value of Stock Awards as Determined in Accordance with the SEC’s CAP Methodology ($) | Compensation Actually Paid ($) | ||||||||

Average for Other NEOs | ||||||||||||

2024 | 580,117 | — | -13,513(4) | 566,604 | ||||||||

2023 | 592,336 | 8,691 | -71,957(5) | 511,688 | ||||||||

2022 | 586,398 | 117,974 | -83,484(6) | 384,940 | ||||||||

(1) | Mr. De Silva’s 2024 add back adjustment is the sum of (i) the fair value of all unvested and outstanding awards granted in 2024 as of December 31, 2024 ($0), (ii) the change in fair value of all unvested and outstanding options issued prior to 2024 with the change measured from December 31, 2023 to December 31, 2024 (-$42,381), (iii) the fair value of awards granted and vested in 2024 ($0), and (iv) the change in fair value of awards vested in 2024 but issued in a prior year with the change measured from December 31, 2023 to the vesting date (-$11,844). |

(2) | Mr. De Silva’s 2023 add back adjustment is the sum of (i) the fair value of all unvested and outstanding awards granted in 2023 as of December 31, 2023 ($0), (ii) the change in fair value of all unvested and outstanding options issued prior to 2023 with the change measured from December 31, 2022 to December 31, 2023 (-$278,784), (iii) the fair value of awards granted and vested in 2023 ($0), and (iv) the change in fair value of awards vested in 2023 but issued in a prior year with the change measured from December 31, 2022 to the vesting date (-$72,123). |

(3) | Mr. De Silva’s 2022 add back adjustment is the sum of (i) the fair value of all unvested and outstanding awards granted in 2022 as of December 31, 2022 ($496,320), (ii) the change in fair value of all unvested and outstanding options issued prior to 2022 with the change measured from December 31, 2021 to December 31, 2022 ($0), (iii) the fair value of awards granted and vested in 2022 ($0), and (iv) the change in fair value of awards vested in 2022 but issued in a prior year with the change measured from December 31, 2021 to the vesting date ($0). |

(4) | The add back adjustment for the 2024 Other NEOs (Mr. Varghese and Mr. Portaro) is the sum of (i) the average fair value of all unvested and outstanding awards granted in 2024 to the 2024 Other NEOs as of December 31, 2024 ($0), (ii) the average change in fair value of all unvested and outstanding options issued to the 2024 Other NEOs prior to 2024 with the change measured from December 31, 2023 to December 31, 2024 (-$10,211), (iii) the average fair value of awards granted to the 2024 Other NEOs and vested in 2024 ($0), and (iv) the average change in fair value of awards vested in 2024 but issued in a prior year to the 2024 Other NEOs with the change measured from December 31, 2023 to the vesting date (-$3,302). |

(5) | The add back adjustment for the 2023 Other NEOs (Mr. Varghese and Mr. Portaro) is the sum of (i) the average fair value of all unvested and outstanding awards granted in 2023 to the 2023 Other NEOs as of December 31, 2023 ($3,067), (ii) the average change in fair value of all unvested and outstanding options issued to the 2023 Other NEOs prior to 2023 with the change measured from December 31, 2022 to December 31, 2023 (-$60,683), (iii) the average fair value of awards granted to the 2023 Other NEOs and vested in 2023 ($1,016), and (iv) the average change in fair value of awards vested in 2023 but issued in a prior year to the 2023 Other NEOs with the change measured from December 31, 2022 to the vesting date (-$15,357). |

(6) | The add back adjustment for the 2022 Other NEOs (Mr. Della Penna and Mr. Portaro) is the sum of (i) the average fair value of all unvested and outstanding awards granted in 2022 to the 2022 Other NEOs as of December 31, 2022 ($47,776), (ii) the average change in fair value of all unvested and outstanding options issued to the 2022 Other NEOs prior to 2022 with the change measured from December 31, 2021 to December 31, 2022 (-$100,108), (iii) the average fair value of awards granted to the 2022 Other NEOs and vested in 2022 ($3,349), and (iv) the average change in fair value of awards vested in 2022 but issued in a prior year to the 2022 Other NEOs with the change measured from December 31, 2021 to the vesting date (-$34,501). |

Deductions | Additions | |||||||||||

Year | Summary Compensation Total ($) | Amounts Reported in the Summary Compensation Table for Stock Awards and Stock Options Awards ($) | Fair Value of Stock Awards as Determined in Accordance with the SEC’s CAP Methodology ($) | Compensation Actually Paid ($) | ||||||||

Rajiv De Silva | ||||||||||||

2024 | 842,625 | — | -54,225(1) | 788,400 | ||||||||

2023 | 842,625 | — | -350,907(2) | 491,718 | ||||||||

2022 | 898,655 | 684,090 | 496,320(3) | 710,885 | ||||||||

Deductions | Additions | |||||||||||

Year | Summary Compensation Total ($) | Amounts Reported in the Summary Compensation Table for Stock Awards and Stock Options Awards ($) | Fair Value of Stock Awards as Determined in Accordance with the SEC’s CAP Methodology ($) | Compensation Actually Paid ($) | ||||||||

Average for Other NEOs | ||||||||||||

2024 | 580,117 | — | -13,513(4) | 566,604 | ||||||||

2023 | 592,336 | 8,691 | -71,957(5) | 511,688 | ||||||||

2022 | 586,398 | 117,974 | -83,484(6) | 384,940 | ||||||||

(1) | Mr. De Silva’s 2024 add back adjustment is the sum of (i) the fair value of all unvested and outstanding awards granted in 2024 as of December 31, 2024 ($0), (ii) the change in fair value of all unvested and outstanding options issued prior to 2024 with the change measured from December 31, 2023 to December 31, 2024 (-$42,381), (iii) the fair value of awards granted and vested in 2024 ($0), and (iv) the change in fair value of awards vested in 2024 but issued in a prior year with the change measured from December 31, 2023 to the vesting date (-$11,844). |

(2) | Mr. De Silva’s 2023 add back adjustment is the sum of (i) the fair value of all unvested and outstanding awards granted in 2023 as of December 31, 2023 ($0), (ii) the change in fair value of all unvested and outstanding options issued prior to 2023 with the change measured from December 31, 2022 to December 31, 2023 (-$278,784), (iii) the fair value of awards granted and vested in 2023 ($0), and (iv) the change in fair value of awards vested in 2023 but issued in a prior year with the change measured from December 31, 2022 to the vesting date (-$72,123). |

(3) | Mr. De Silva’s 2022 add back adjustment is the sum of (i) the fair value of all unvested and outstanding awards granted in 2022 as of December 31, 2022 ($496,320), (ii) the change in fair value of all unvested and outstanding options issued prior to 2022 with the change measured from December 31, 2021 to December 31, 2022 ($0), (iii) the fair value of awards granted and vested in 2022 ($0), and (iv) the change in fair value of awards vested in 2022 but issued in a prior year with the change measured from December 31, 2021 to the vesting date ($0). |

(4) | The add back adjustment for the 2024 Other NEOs (Mr. Varghese and Mr. Portaro) is the sum of (i) the average fair value of all unvested and outstanding awards granted in 2024 to the 2024 Other NEOs as of December 31, 2024 ($0), (ii) the average change in fair value of all unvested and outstanding options issued to the 2024 Other NEOs prior to 2024 with the change measured from December 31, 2023 to December 31, 2024 (-$10,211), (iii) the average fair value of awards granted to the 2024 Other NEOs and vested in 2024 ($0), and (iv) the average change in fair value of awards vested in 2024 but issued in a prior year to the 2024 Other NEOs with the change measured from December 31, 2023 to the vesting date (-$3,302). |

(5) | The add back adjustment for the 2023 Other NEOs (Mr. Varghese and Mr. Portaro) is the sum of (i) the average fair value of all unvested and outstanding awards granted in 2023 to the 2023 Other NEOs as of December 31, 2023 ($3,067), (ii) the average change in fair value of all unvested and outstanding options issued to the 2023 Other NEOs prior to 2023 with the change measured from December 31, 2022 to December 31, 2023 (-$60,683), (iii) the average fair value of awards granted to the 2023 Other NEOs and vested in 2023 ($1,016), and (iv) the average change in fair value of awards vested in 2023 but issued in a prior year to the 2023 Other NEOs with the change measured from December 31, 2022 to the vesting date (-$15,357). |

(6) | The add back adjustment for the 2022 Other NEOs (Mr. Della Penna and Mr. Portaro) is the sum of (i) the average fair value of all unvested and outstanding awards granted in 2022 to the 2022 Other NEOs as of December 31, 2022 ($47,776), (ii) the average change in fair value of all unvested and outstanding options issued to the 2022 Other NEOs prior to 2022 with the change measured from December 31, 2021 to December 31, 2022 (-$100,108), (iii) the average fair value of awards granted to the 2022 Other NEOs and vested in 2022 ($3,349), and (iv) the average change in fair value of awards vested in 2022 but issued in a prior year to the 2022 Other NEOs with the change measured from December 31, 2021 to the vesting date (-$34,501). |

(1) | Fiscal year 2022 represents an aggregate of CAP to Mr. Serafino and Mr. De Silva, inclusive of certain separation payments made to Mr. Serafino and certain inducements provided to Mr. De Silva as an incentive to accept employment with the Company. |

(1) | Fiscal year 2022 represents an aggregate of CAP to Mr. Serafino and Mr. De Silva, inclusive of certain separation payments made to Mr. Serafino and certain inducements provided to Mr. De Silva as an incentive to accept employment with the Company. |