Pay vs Performance Disclosure - USD ($)

|

5 Months Ended |

7 Months Ended |

12 Months Ended |

Dec. 31, 2022 |

Jul. 26, 2022 |

Dec. 31, 2024 |

Dec. 31, 2023 |

Dec. 31, 2022 |

Dec. 31, 2021 |

Dec. 31, 2020 |

| Pay vs Performance Disclosure |

|

|

|

|

|

|

|

| Pay vs Performance Disclosure, Table |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Year | SCT Total | | CAP(2) | Average SCT Total for non PEO NEOs ($) | Average CAP(2) to non PEO NEOs ($) | Value of Initial Fixed $100 Investment Based On: | Net Income (Loss)

($) | Adjusted EBITDA ($)(3) | Comp. Adjusted EBITDA ($)(3) | | | | | | | | | | | | | | | Prior PEO ($)(1) | Current PEO ($)(1) | | Prior PEO ($)(1) | Current PEO ($)(1) | TSR

($) | Peer Group TSR (S&P Health Care Services Select Industry Index) ($) | | | | | | | | | | | | | | 2024(4) | N/A | 2,520,122 | | | N/A | (829,015) | | 1,237,767 | | (59,346) | | 20.01 | 126.92 | (201,278,000) | | 161,134,000 | | 123,407,000 | | 2023(5) | N/A | 2,692,762 | | | N/A | 2,248,512 | | 1,482,510 | | 1,529,281 | | 74.33 | 124.34 | (204,460,000) | | 204,439,000 | | 164,583,000 | | 2022(6) | 5,373,333 | | 2,266,785 | | | (9,416,369) | | 1,256,475 | | 1,475,719 | | 955,828 | | 151.62 | 118.22 | (31,806,000) | | 221,902,000 | | 192,969,000 | | 2021(7) | 3,637,550 | | N/A | | 4,708,503 | | N/A | 1,092,956 | | 802,089 | | 250.57 | 147.19 | (6,585,000) | | 205,008,000 | | 205,008,000 | | 2020(8) | 4,691,139 | | N/A | | 16,436,594 | | N/A | 925,246 | | 2,192,785 | | 234.25 | 133.81 | 88,836,000 | | 189,190,000 | | 189,190,000 | |

|

|

|

|

|

| Company Selected Measure Name |

|

|

Compensation Adjusted EBITDA

|

|

|

|

|

| Named Executive Officers, Footnote |

|

|

For fiscal year 2022, Daniel Greenleaf served as our CEO until his employment ended in July 2022. From July 27, 2022, L. Heath Sampson, our then-CFO, served as our CEO for the remainder of the fiscal year and for all of fiscal year 2023 and thereafter. Mr. Greenleaf is identified in the table as the “Prior PEO” and Mr. Sampson is identified as the “Current PEO.” Amounts earned by Mr. Sampson in fiscal year 2021 in his role as CFO are included in the NEO averages for 2021.For fiscal year 2024, our named executive officers, excluding the PEO, included (i) Barbara Gutierrez, our Chief Financial Officer, (ii) Chelsey Berstler, our Executive Vice President of Personal Care Services, (iii) Jessica Kral, our Chief Information Officer, (iv) Henry Toledo, our Chief People Officer, (v) Anne Bailey, our former President of ModivCare Home and (vi) Ilias Simpson, our former President of ModivCare Mobility.For fiscal year 2023, our named executive officers, excluding the PEO, included (i) Barbara Gutierrez, our Chief Financial Officer, (ii) Anne Bailey, our President of ModivCare Home, (iii) Ilias Simpson, who served as our President of ModivCare Mobility, and (iv) Henry Toledo, our Chief People Officer.For fiscal year 2022, our named executive officers, excluding the PEOs, included (i) Ilias Simpson, who served as our President of ModivCare Mobility, (ii) Jason Anderson, our former President of ModivCare Home (iii) Brett Hickman, our former Chief Commercial Officer, and (iv) Grover N. Wray, our former Chief Human Resources Officer.For fiscal year 2021, our named executive officers, excluding the PEO, included (i) L. Heath Sampson, who served as our Chief Financial Officer, (ii) Walt Meffert, who served as our Chief Information Officer, (iii) Grover N. Wray, who served as our Chief Human Resources Officer, (iv) Kevin M. Dotts, our former Chief Financial Officer, and (v) Kenneth W. Wilson, our former Chief Operating Officer.For fiscal year 2020, our named executive officers, excluding the PEO, included (i) John McMahon, who served as our Chief Accounting Officer, (ii) Kathryn Stalmack, who served as our Senior Vice President, General Counsel and Corporate Secretary, (iii) Kenneth W. Wilson, who served as our Chief Operating Officer, (iv) Kevin M. Dotts, who served as our Chief Financial Officer, and (v) Suzanne G. Smith, our former Chief Accounting Officer.

|

|

|

|

|

| Adjustment To PEO Compensation, Footnote |

|

|

The following reflects adjustments made to total compensation in the Summary Compensation Table (“SCT”), reported in columns (b) and (d) in the table above, to calculate CAP, reported in columns (c) and (e) in the table above, for each fiscal year: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Prior PEO(1) | | Current PEO(1) | | Average non-PEO NEOs(2) | | | 2020 ($) | 2021

($) | 2022

($) | | 2022

($) | 2023

($) | 2024 ($) | | 2020

($) | 2021

($) | 2022

($) | 2023

($) | 2024 ($) | | | Summary Compensation Total | 4,691,139 | | 3,637,550 | | 5,373,333 | | | 2,266,785 | | 2,692,762 | | 2,520,122 | | | 925,246 | | 1,092,956 | | 1,475,719 | | 1,482,510 | | 1,237,767 | | | (-) Grant Date Fair Value of Option Awards and Stock Awards Granted in Fiscal Year(3) | (1,699,645) | | (1,699,947) | | (4,762,378) | | | (1,360,941) | | (1,516,933) | | (1,685,011) | | | (149,701) | | (420,720) | | (850,727) | | (990,063) | | (687,634) | | | (+) Fair Value at Fiscal Year-End of Outstanding and Unvested Option Awards and Stock Awards Granted in Fiscal Year(4) | 5,066,337 | | 1,291,121 | | — | | | 936,226 | | 1,997,762 | | 329,417 | | | 516,965 | | 390,666 | | 356,906 | | 1,113,307 | | 98,084 | | | (+/-) Change in Fair Value of Outstanding and Unvested Option Awards and Stock Awards Granted in Prior Fiscal Years(5) | 6,271,922 | | 858,909 | | — | | | (347,599) | | (713,297) | | (1,355,643) | | | 668,570 | | 40,318 | | (11,584) | | (63,371) | | (290,213) | | | (+) Fair Value at Vesting of Option Awards and Stock Awards Granted in Fiscal Year That Vested During Fiscal Year(6) | — | | — | | — | | | — | | — | | — | | | — | | — | | — | | — | | — | | | (+/-) Change in Fair Value as of Vesting Date of Option Awards and Stock Awards Granted in Prior Fiscal Years For Which Applicable Vesting Conditions Were Satisfied During Fiscal Year(7) | 2,106,841 | | 620,870 | | (825,821) | | | (237,996) | | (211,782) | | (637,900) | | | 269,160 | | 24,657 | | (14,486) | | (13,102) | | (86,841) | | | (-) Fair Value as of Prior Fiscal Year-End of Option Awards and Stock Awards Granted in Prior Fiscal Years That Failed to Meet Applicable Vesting Conditions During Fiscal Year(8) | — | | — | | (9,201,503) | | | — | | — | | — | | | (37,455) | | (325,788) | | — | | — | | (330,509) | | | | Compensation Actually Paid | 16,436,594 | | 4,708,503 | | (9,416,369) | | | 1,256,475 | | 2,248,512 | | (829,015) | | | 2,192,785 | | 802,089 | | 955,828 | | 1,529,281 | | (59,346) | | |

1.Refer to footnote 1 of the pay versus performance table above for information regarding who served as PEO during fiscal years 2020, 2021 and, partially, 2022, and who served as PEO for the remainder of fiscal year 2022 and all of 2023 and 2024. 2.Refer to footnotes 4, 5, 6, 7 and 8 above for the NEOs included in the average for each of 2024, 2023, 2022, 2021 and 2020, respectively. 3.Represents the grant date fair value of the stock option and stock awards granted during the indicated fiscal year, computed in accordance with the methodology used for financial reporting purposes. 4.Represents the fair value as of the indicated fiscal year-end of the outstanding and unvested option awards and stock awards granted during such fiscal year, computed in accordance with the methodology used for financial reporting purposes. 5.Represents the change in fair value during the indicated fiscal year of each option award and stock award that was granted in a prior fiscal year and that remained outstanding and unvested as of the last day of the indicated fiscal year, computed in accordance with the methodology used for financial reporting purposes and, for awards subject to performance-based vesting conditions, based on the probable outcome of such performance-based vesting conditions as of the last day of the fiscal year. 6.Represents the fair value at vesting of the option awards and stock awards that were granted and vested during the indicated fiscal year, computed in accordance with the methodology used for financial reporting purposes. 7.Represents the change in fair value, measured from the prior fiscal year-end to the vesting date, of each option award and stock award that was granted in a prior fiscal year and which vested during the indicated fiscal year, computed in accordance with the methodology used for financial reporting purposes. 8.Represents the fair value as of the last day of the prior fiscal year of the option award and stock awards that were granted in a prior fiscal year and which failed to meet the applicable vesting conditions in the indicated fiscal year, computed in accordance with the methodology used for financial reporting purposes.

|

|

|

|

|

| Non-PEO NEO Average Total Compensation Amount |

|

|

$ 1,237,767

|

$ 1,482,510

|

$ 1,475,719

|

$ 1,092,956

|

$ 925,246

|

| Non-PEO NEO Average Compensation Actually Paid Amount |

|

|

$ (59,346)

|

1,529,281

|

955,828

|

802,089

|

2,192,785

|

| Adjustment to Non-PEO NEO Compensation Footnote |

|

|

The following reflects adjustments made to total compensation in the Summary Compensation Table (“SCT”), reported in columns (b) and (d) in the table above, to calculate CAP, reported in columns (c) and (e) in the table above, for each fiscal year: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Prior PEO(1) | | Current PEO(1) | | Average non-PEO NEOs(2) | | | 2020 ($) | 2021

($) | 2022

($) | | 2022

($) | 2023

($) | 2024 ($) | | 2020

($) | 2021

($) | 2022

($) | 2023

($) | 2024 ($) | | | Summary Compensation Total | 4,691,139 | | 3,637,550 | | 5,373,333 | | | 2,266,785 | | 2,692,762 | | 2,520,122 | | | 925,246 | | 1,092,956 | | 1,475,719 | | 1,482,510 | | 1,237,767 | | | (-) Grant Date Fair Value of Option Awards and Stock Awards Granted in Fiscal Year(3) | (1,699,645) | | (1,699,947) | | (4,762,378) | | | (1,360,941) | | (1,516,933) | | (1,685,011) | | | (149,701) | | (420,720) | | (850,727) | | (990,063) | | (687,634) | | | (+) Fair Value at Fiscal Year-End of Outstanding and Unvested Option Awards and Stock Awards Granted in Fiscal Year(4) | 5,066,337 | | 1,291,121 | | — | | | 936,226 | | 1,997,762 | | 329,417 | | | 516,965 | | 390,666 | | 356,906 | | 1,113,307 | | 98,084 | | | (+/-) Change in Fair Value of Outstanding and Unvested Option Awards and Stock Awards Granted in Prior Fiscal Years(5) | 6,271,922 | | 858,909 | | — | | | (347,599) | | (713,297) | | (1,355,643) | | | 668,570 | | 40,318 | | (11,584) | | (63,371) | | (290,213) | | | (+) Fair Value at Vesting of Option Awards and Stock Awards Granted in Fiscal Year That Vested During Fiscal Year(6) | — | | — | | — | | | — | | — | | — | | | — | | — | | — | | — | | — | | | (+/-) Change in Fair Value as of Vesting Date of Option Awards and Stock Awards Granted in Prior Fiscal Years For Which Applicable Vesting Conditions Were Satisfied During Fiscal Year(7) | 2,106,841 | | 620,870 | | (825,821) | | | (237,996) | | (211,782) | | (637,900) | | | 269,160 | | 24,657 | | (14,486) | | (13,102) | | (86,841) | | | (-) Fair Value as of Prior Fiscal Year-End of Option Awards and Stock Awards Granted in Prior Fiscal Years That Failed to Meet Applicable Vesting Conditions During Fiscal Year(8) | — | | — | | (9,201,503) | | | — | | — | | — | | | (37,455) | | (325,788) | | — | | — | | (330,509) | | | | Compensation Actually Paid | 16,436,594 | | 4,708,503 | | (9,416,369) | | | 1,256,475 | | 2,248,512 | | (829,015) | | | 2,192,785 | | 802,089 | | 955,828 | | 1,529,281 | | (59,346) | | |

1.Refer to footnote 1 of the pay versus performance table above for information regarding who served as PEO during fiscal years 2020, 2021 and, partially, 2022, and who served as PEO for the remainder of fiscal year 2022 and all of 2023 and 2024. 2.Refer to footnotes 4, 5, 6, 7 and 8 above for the NEOs included in the average for each of 2024, 2023, 2022, 2021 and 2020, respectively. 3.Represents the grant date fair value of the stock option and stock awards granted during the indicated fiscal year, computed in accordance with the methodology used for financial reporting purposes. 4.Represents the fair value as of the indicated fiscal year-end of the outstanding and unvested option awards and stock awards granted during such fiscal year, computed in accordance with the methodology used for financial reporting purposes. 5.Represents the change in fair value during the indicated fiscal year of each option award and stock award that was granted in a prior fiscal year and that remained outstanding and unvested as of the last day of the indicated fiscal year, computed in accordance with the methodology used for financial reporting purposes and, for awards subject to performance-based vesting conditions, based on the probable outcome of such performance-based vesting conditions as of the last day of the fiscal year. 6.Represents the fair value at vesting of the option awards and stock awards that were granted and vested during the indicated fiscal year, computed in accordance with the methodology used for financial reporting purposes. 7.Represents the change in fair value, measured from the prior fiscal year-end to the vesting date, of each option award and stock award that was granted in a prior fiscal year and which vested during the indicated fiscal year, computed in accordance with the methodology used for financial reporting purposes. 8.Represents the fair value as of the last day of the prior fiscal year of the option award and stock awards that were granted in a prior fiscal year and which failed to meet the applicable vesting conditions in the indicated fiscal year, computed in accordance with the methodology used for financial reporting purposes.

|

|

|

|

|

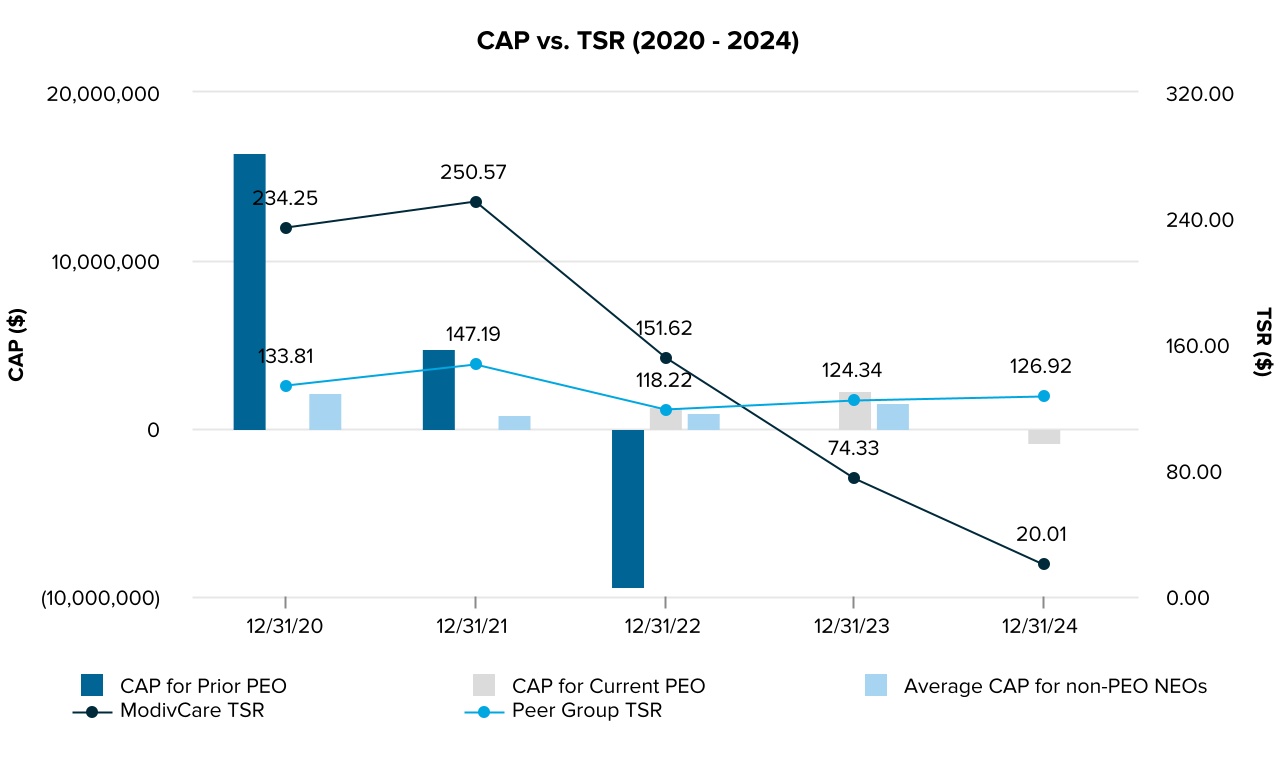

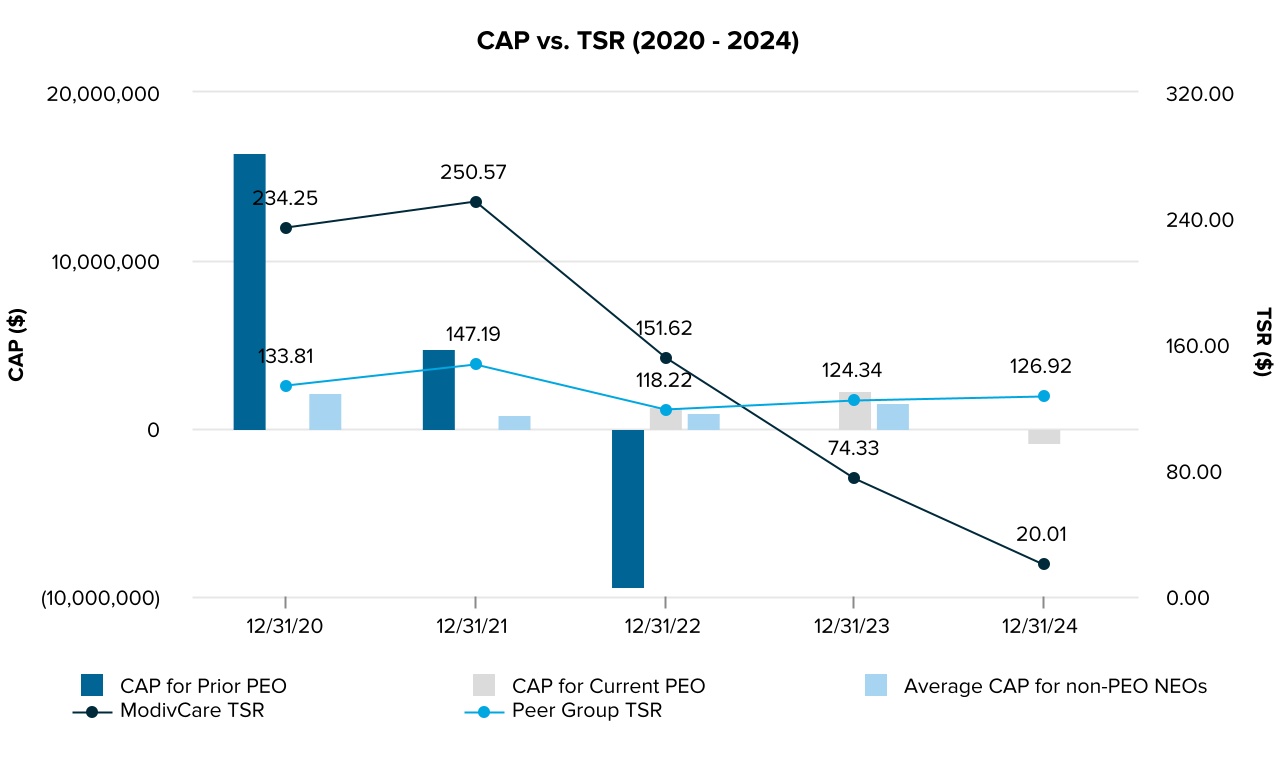

| Compensation Actually Paid vs. Total Shareholder Return |

|

|

|

|

|

|

|

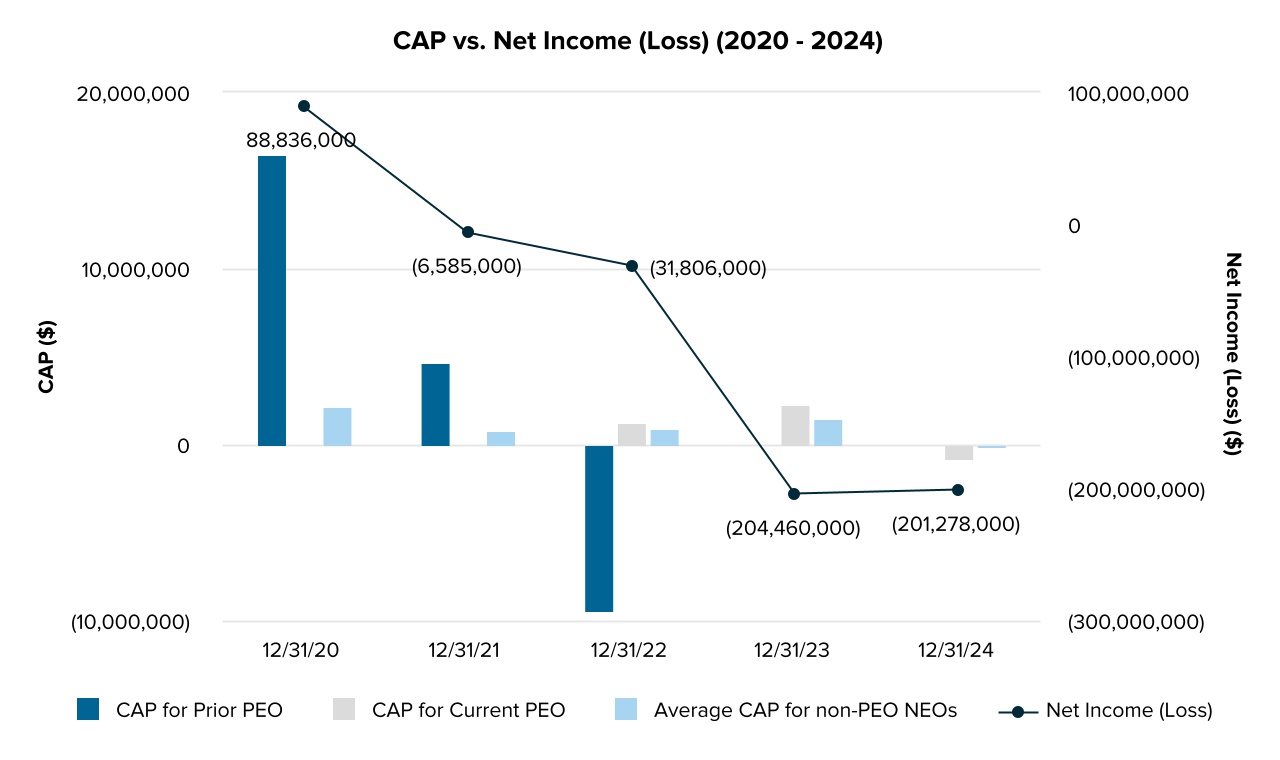

| Compensation Actually Paid vs. Net Income |

|

|

|

|

|

|

|

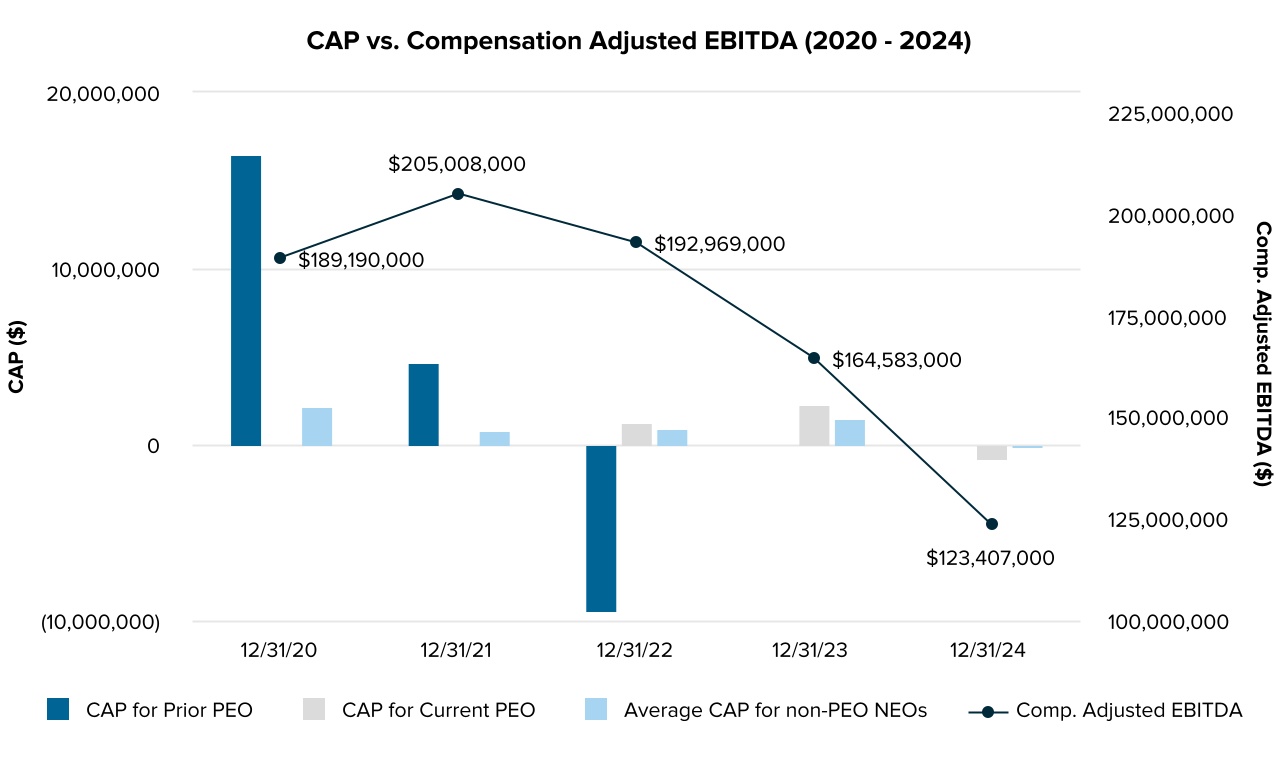

| Compensation Actually Paid vs. Company Selected Measure |

|

|

|

|

|

|

|

| Total Shareholder Return Vs Peer Group |

|

|

|

|

|

|

|

| Tabular List, Table |

|

|

Compensation Adjusted EBITDA •EBITDA •Relative Total Shareholder Return (rTSR)

|

|

|

|

|

| Total Shareholder Return Amount |

|

|

$ 20.01

|

74.33

|

151.62

|

250.57

|

234.25

|

| Peer Group Total Shareholder Return Amount |

|

|

126.92

|

124.34

|

118.22

|

147.19

|

133.81

|

| Net Income (Loss) |

|

|

$ (201,278,000)

|

$ (204,460,000)

|

$ (31,806,000)

|

$ (6,585,000)

|

$ 88,836,000

|

| Company Selected Measure Amount |

|

|

123,407,000

|

164,583,000

|

192,969,000

|

205,008,000

|

189,190,000

|

| PEO Name |

L. Heath Sampson

|

Daniel Greenleaf

|

L. Heath Sampson

|

L. Heath Sampson

|

|

Daniel Greenleaf

|

Daniel Greenleaf

|

| Additional 402(v) Disclosure |

|

|

The following disclosure illustrates the relationship between the compensation actually paid to our executive officers and the performance of the Company. The table below presents information for each of the last five fiscal years regarding (i) the total compensation for our principal executive officers serving in that capacity during the applicable fiscal year (each, a “PEO”) and the average total compensation of our other NEOs (excluding the PEO(s)) who were serving in that capacity during the applicable fiscal year as disclosed in the Summary Compensation Table (“SCT”), (ii) total compensation actually paid (“CAP”) to each PEO and the CAP to the other NEOs on average, (iii) total shareholder return (“TSR”) for the Company and its peer group, (iv) the Company’s net income (loss), and (v) the Company’s Compensation Adjusted EBITDA, which is the most important financial measure used by the Company in determining executive compensation. To calculate compensation actually paid, adjustments were made to the amounts reported in the Summary Compensation Table for the applicable year. A reconciliation of the adjustments for each of the PEOs and for the average of the non-PEO NEOs is set forth following the footnotes to this table.

|

|

|

|

|

| Measure:: 1 |

|

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

|

| Name |

|

|

Compensation Adjusted EBITDA

|

|

|

|

|

| Non-GAAP Measure Description |

|

|

Compensation Adjusted EBITDA is the metric used by the Compensation Committee to determine the STI payouts and is calculated by increasing the Company’s publicly disclosed EBITDA by impacts from the impairment of goodwill recorded, loss on the extinguishment of debt recorded and loss on an asset disposal, all occurring during 2024. For 2023, Compensation Adjusted EBITDA was calculated by increasing the Company’s publicly disclosed EBITDA by impacts from the impairment of goodwill recorded, settlement related costs from executive departure and transaction and integration costs from an investment in innovation, all occurring during 2023. For 2022, Compensation Adjusted EBITDA was calculated by reducing the Company’s publicly disclosed Adjusted EBITDA by the amount by which the operating expenses identified in such reconciliation exceeded the Company’s Board approved 2022 operating budget. For 2021 and 2020, it was determined that no adjustments were required and the Compensation Committee determined the STI payouts using the Adjusted EBITDA value for such years. Compensation Adjusted EBITDA and Adjusted EBITDA are financial measures that are not presented in accordance with GAAP. A reconciliation of Compensation Adjusted EBITDA and Adjusted EBITDA are provided in Appendix A to this Proxy Statement.

|

|

|

|

|

| Measure:: 2 |

|

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

|

| Other Performance Measure, Amount |

|

|

161,134,000

|

204,439,000

|

221,902,000

|

205,008,000

|

189,190,000

|

| Name |

|

|

EBITDA

|

|

|

|

|

| Measure:: 3 |

|

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

|

| Name |

|

|

Relative Total Shareholder Return (rTSR)

|

|

|

|

|

| Sampson [Member] |

|

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

|

| PEO Total Compensation Amount |

|

|

$ 2,520,122

|

$ 2,692,762

|

$ 2,266,785

|

|

|

| PEO Actually Paid Compensation Amount |

|

|

(829,015)

|

2,248,512

|

1,256,475

|

|

|

| Greenleaf [Member] |

|

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

|

| PEO Total Compensation Amount |

|

|

|

|

5,373,333

|

$ 3,637,550

|

$ 4,691,139

|

| PEO Actually Paid Compensation Amount |

|

|

|

|

(9,416,369)

|

4,708,503

|

16,436,594

|

| PEO | Sampson [Member] | Aggregate Grant Date Fair Value of Equity Award Amounts Reported in Summary Compensation Table |

|

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

(1,685,011)

|

(1,516,933)

|

(1,360,941)

|

|

|

| PEO | Sampson [Member] | Year-end Fair Value of Equity Awards Granted in Covered Year that are Outstanding and Unvested |

|

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

329,417

|

1,997,762

|

936,226

|

|

|

| PEO | Sampson [Member] | Year-over-Year Change in Fair Value of Equity Awards Granted in Prior Years That are Outstanding and Unvested |

|

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

(1,355,643)

|

(713,297)

|

(347,599)

|

|

|

| PEO | Sampson [Member] | Vesting Date Fair Value of Equity Awards Granted and Vested in Covered Year |

|

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

0

|

0

|

0

|

|

|

| PEO | Sampson [Member] | Change in Fair Value as of Vesting Date of Prior Year Equity Awards Vested in Covered Year |

|

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

(637,900)

|

(211,782)

|

(237,996)

|

|

|

| PEO | Sampson [Member] | Prior Year End Fair Value of Equity Awards Granted in Any Prior Year that Fail to Meet Applicable Vesting Conditions During Covered Year |

|

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

0

|

0

|

0

|

|

|

| PEO | Greenleaf [Member] | Aggregate Grant Date Fair Value of Equity Award Amounts Reported in Summary Compensation Table |

|

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

|

|

(4,762,378)

|

(1,699,947)

|

(1,699,645)

|

| PEO | Greenleaf [Member] | Year-end Fair Value of Equity Awards Granted in Covered Year that are Outstanding and Unvested |

|

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

|

|

0

|

1,291,121

|

5,066,337

|

| PEO | Greenleaf [Member] | Year-over-Year Change in Fair Value of Equity Awards Granted in Prior Years That are Outstanding and Unvested |

|

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

|

|

0

|

858,909

|

6,271,922

|

| PEO | Greenleaf [Member] | Vesting Date Fair Value of Equity Awards Granted and Vested in Covered Year |

|

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

|

|

0

|

0

|

0

|

| PEO | Greenleaf [Member] | Change in Fair Value as of Vesting Date of Prior Year Equity Awards Vested in Covered Year |

|

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

|

|

(825,821)

|

620,870

|

2,106,841

|

| PEO | Greenleaf [Member] | Prior Year End Fair Value of Equity Awards Granted in Any Prior Year that Fail to Meet Applicable Vesting Conditions During Covered Year |

|

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

|

|

(9,201,503)

|

0

|

0

|

| Non-PEO NEO | Aggregate Grant Date Fair Value of Equity Award Amounts Reported in Summary Compensation Table |

|

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

(687,634)

|

(990,063)

|

(850,727)

|

(420,720)

|

(149,701)

|

| Non-PEO NEO | Year-end Fair Value of Equity Awards Granted in Covered Year that are Outstanding and Unvested |

|

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

98,084

|

1,113,307

|

356,906

|

390,666

|

516,965

|

| Non-PEO NEO | Year-over-Year Change in Fair Value of Equity Awards Granted in Prior Years That are Outstanding and Unvested |

|

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

(290,213)

|

(63,371)

|

(11,584)

|

40,318

|

668,570

|

| Non-PEO NEO | Vesting Date Fair Value of Equity Awards Granted and Vested in Covered Year |

|

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

0

|

0

|

0

|

0

|

0

|

| Non-PEO NEO | Change in Fair Value as of Vesting Date of Prior Year Equity Awards Vested in Covered Year |

|

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

(86,841)

|

(13,102)

|

(14,486)

|

24,657

|

269,160

|

| Non-PEO NEO | Prior Year End Fair Value of Equity Awards Granted in Any Prior Year that Fail to Meet Applicable Vesting Conditions During Covered Year |

|

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

$ (330,509)

|

$ 0

|

$ 0

|

$ (325,788)

|

$ (37,455)

|