Welcome to Our Annual Meeting Exhibit 99.1

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements are not historical facts and may include expressions about Management’s strategies and Management’s expectations about financial results, new and existing programs and products, investments, relationships, opportunities and market conditions. These statements may be identified by such forward-looking terminology as “expect,” “look,” “believe,” “anticipate,” “may,” or similar statements or variations of such terms. Actual results may differ materially from such forward-looking statements. Factors that may cause actual results to differ materially from those contemplated by such forward-looking statements include, but are not limited to: 1) our ability to successfully grow our business and implement our strategic plan including our entry into New York City, and our ability to generate revenues to offset the increased personnel and other costs related to the strategic plan; 2) the current or anticipated impact of military conflict, terrorism or other geopolitical events; 3) the impact of anticipated higher operating expenses in 2025 and beyond; 4) our ability to successfully integrate wealth management firm and team acquisitions; 5) our ability to manage our growth; 6) a decline in the economy, in particular in our New Jersey and New York market areas, including potential recessionary conditions; 7) declines in our net interest margin caused by the interest rate environment (including the shape of the yield curve) and our highly competitive market; 8) declines in the value in our investment portfolio; 9) higher than expected increases in our allowance for credit losses; 10) higher than expected increases in credit losses or in the level of nonperforming, classified or criticized loans or charge-offs; 11) changes in interest rates and the effects of inflation; 12) a decline in real estate values within our market areas; 13) legislative and regulatory actions; 14) changes in monetary policy by the Federal Reserve Board; 15) changes to tax or accounting matters; 16) successful cyberattacks against our IT infrastructure and that of our IT providers; 17) higher than expected FDIC insurance premiums; 18) adverse weather conditions; 19) a reduction in our lower-cost funding sources; 20) changes in liquidity, including the size and composition of our deposit portfolio and the percentage of uninsured deposits in the portfolio; 21) our ability to adapt to technological changes; 22) claims and litigation pertaining to fiduciary responsibility, environmental laws and other matters; 23) the imposition of tariffs or other domestic or international governmental policies; 24) our ability to retain key employees; 25) demands for loans and deposits in our market areas; 26) adverse changes in securities markets; 27) changes in New York City rent regulation law; and 28) other unexpected material adverse changes in our operations or earnings. The Company undertakes no duty to update any forward-looking statement to conform the statement to actual results or changes in the Company’s expectations. Although we believe that the expectations reflected in the forward-looking statements are reasonable, the Company cannot guarantee future results, levels of activity, performance or achievements. Statement Regarding Forward-Looking Information

NYC – 300 Park Avenue Branch

NYC – 300 Park Avenue Branch

2024 Performance Highlights Strategic Update Rebranded to “Peapack Private Bank & Trust” on January 1, 2025, a pivotal step in our private banking journey. Balance sheet continues to transform while fully absorbing 100+ new team members as we expand more broadly into metro New York. Metro NY expansion has performed significantly above plan; opened 550+ new relationships, totaling $948MM in deposits. Based on results and a robust pipeline, we anticipate adding additional teams in 2025. Balance Sheet Core relationship deposits grew to $1.2B (30%) for the year. Noninterest-bearing deposits increased $155MM (16%) for the year. Balance sheet liquidity totaled 17% of total assets as of year-end3. Total available liquidity of $4.4B4. Loans grew $85MM (2%) for the year. Asset quality headwinds with no evidence of systemic deterioration in asset quality. Allowance for credit losses is 1.32% of total loans. Earnings 2024 net income was $33MM, a decline of $15.9MM, as we navigated a difficult interest rate environment and continued to invest and expand our franchise. Successful core deposit growth combined with rate cuts led to net interest income growth of $5.2MM (14%) year over year. Net interest margin decreased 16 basis points in 2024 to 2.32%; In Q4, NIM increased 12 basis points QOQ to 2.46%. Loan originations of $1.2B in 2024 carried a coupon of 7.14%, comfortably above our cost of funds. Total fee income for the year represented 35% of total revenue, driven by wealth management fee income. 2024 new business inflows totaled $710MM. See page 17 for notes and important information. 30% Core Relationship Deposit1 Growth $1.85 Earnings Per Share 16% Noninterest-bearing Deposit Growth 14% Net Interest Income Growth2 (11% Q4 Increase) 17% Balance Sheet Liquidity3 Financial Results

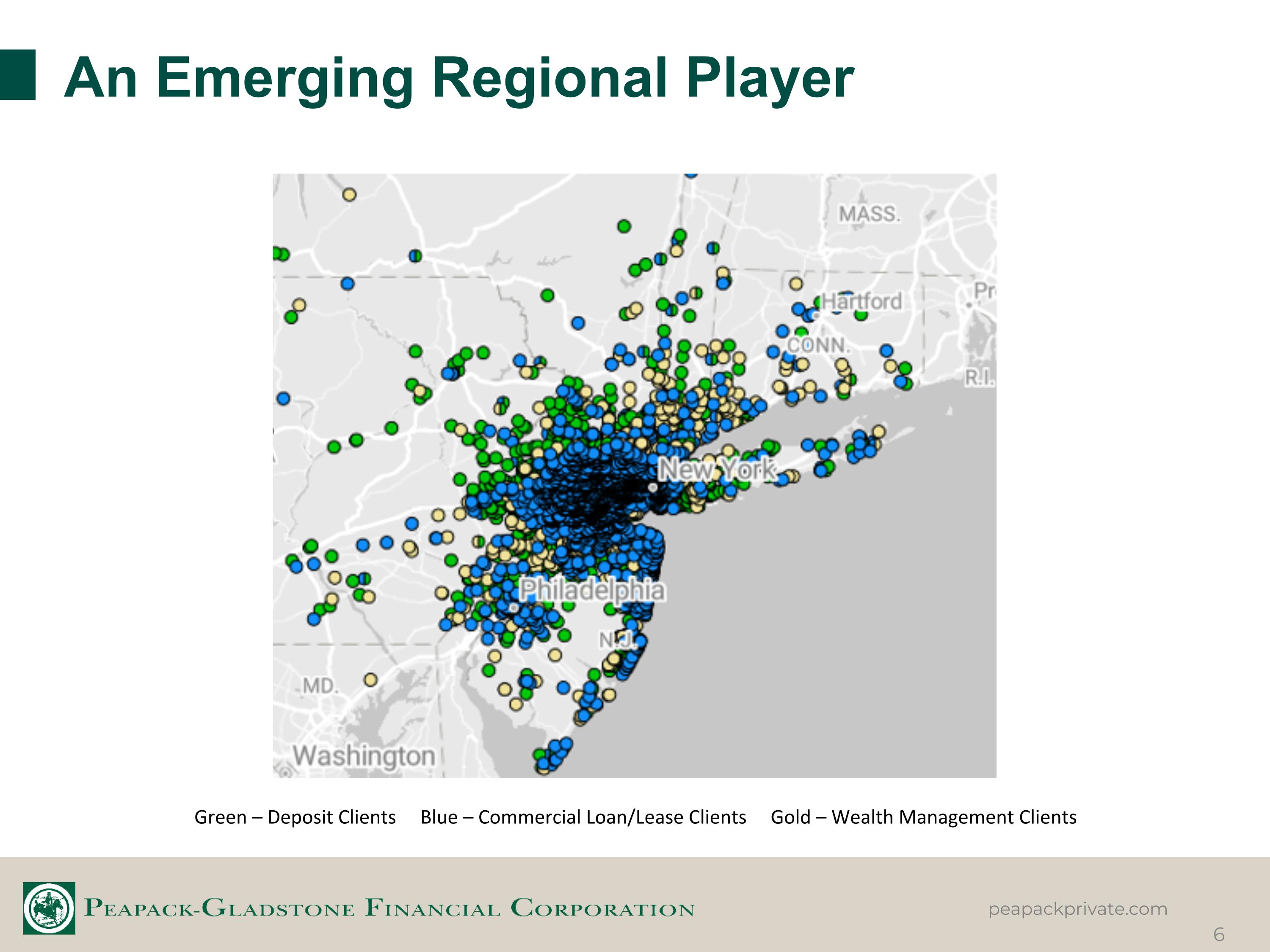

An Emerging Regional Player Green – Deposit Clients Blue – Commercial Loan/Lease Clients Gold – Wealth Management Clients

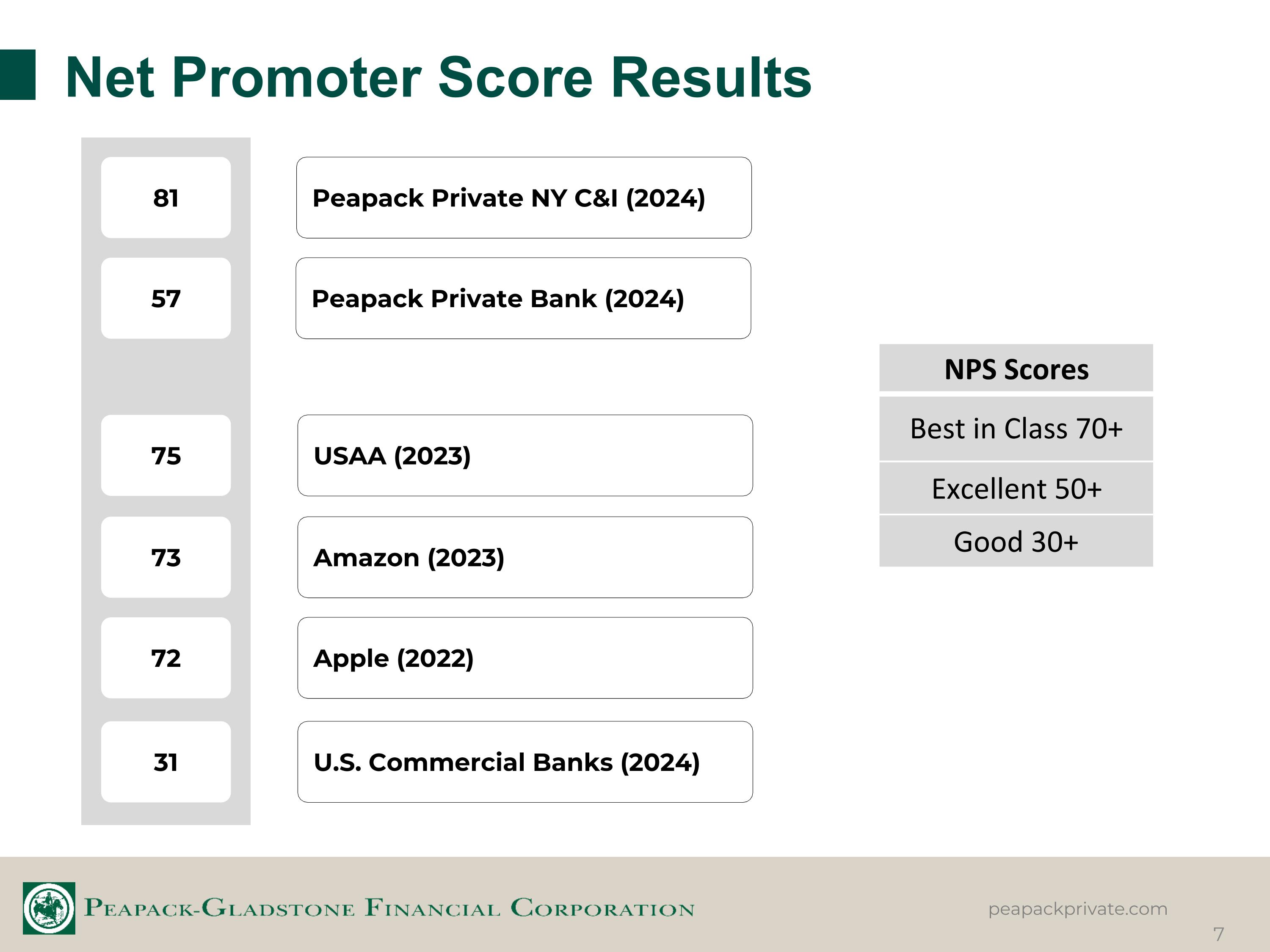

Net Promoter Score Results 81 57 Peapack Private NY C&I (2024) Peapack Private Bank (2024) NPS Scores Best in Class 70+ Excellent 50+ Good 30+ 75 USAA (2023) 73 Amazon (2023) 72 Apple (2022) 31 U.S. Commercial Banks (2024)

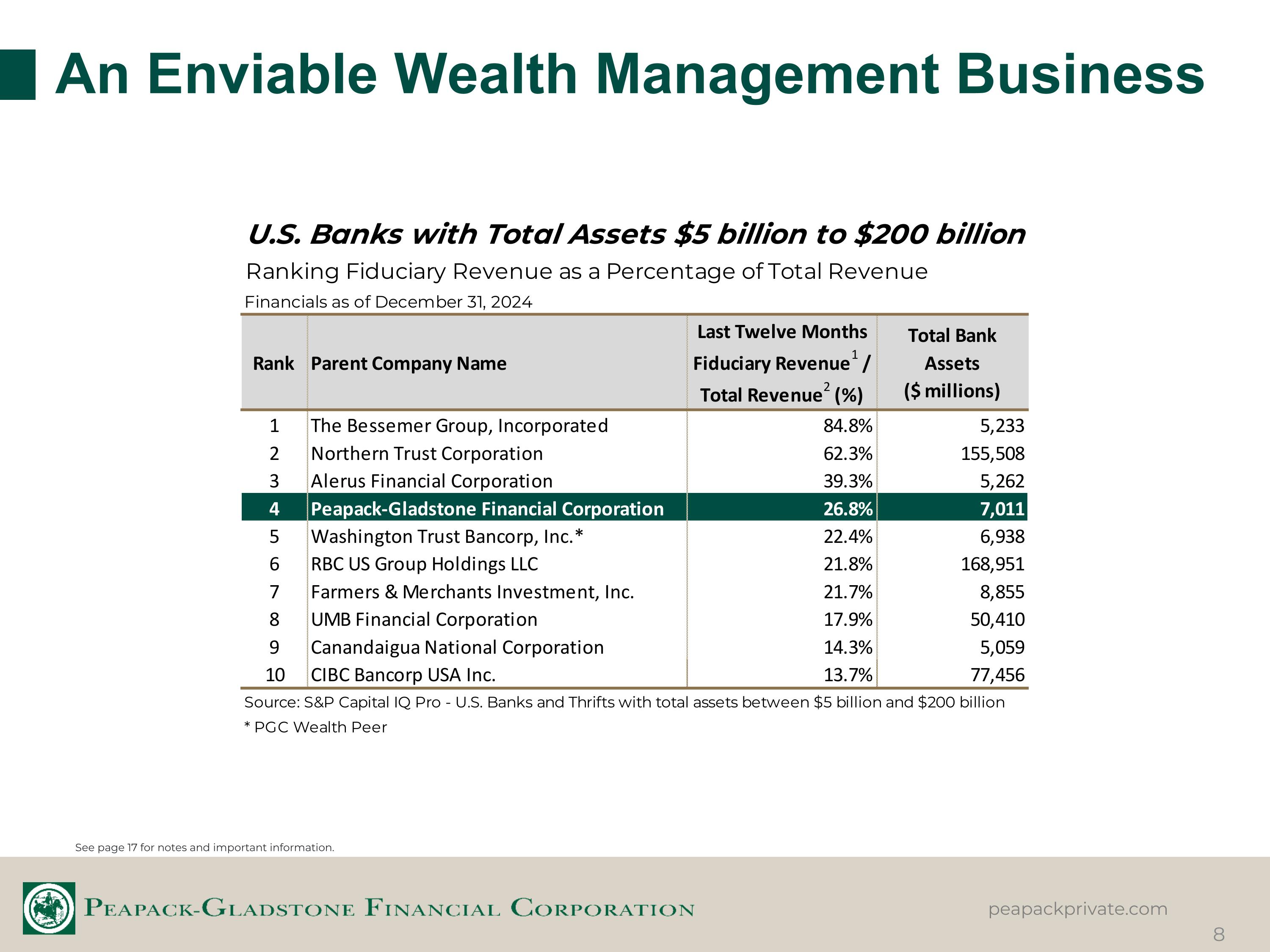

An Enviable Wealth Management Business See page 17 for notes and important information.

Metro NY Expansion Results through Year-End Hiring across critical support areas to support our growth. Investments in products, technology and enhanced processes focused on reducing client friction points and supporting our “branch light” model. 550+ Relationships $948MM Total Deposits 28% Noninterest-bearing1 $311MM Outstanding Loans Our Metro New York expansion continues to deliver solid results. Onboarding fully-banked core relationships. Average relationship size $1.7MM. Noninterest-bearing deposits1 were 28% of total deposits. Vast majority of clients are utilizing our Treasury Management platform. $311MM of outstanding loans plus an additional $83MM of commitments. Strong loan and deposit pipelines going into 2025. Continue to explore additional regional locations with opportunistic hires. Strong Net Promoter Score & Employee Engagement Continuous Improvement Creating Franchise Value Client feedback is validating our best-in-class service culture. New York teams have received an 81 Net Promoter Score, in-line with world-class service organizations like The Ritz Carlton, USAA, and Nordstrom. Strong NYC employee engagement – voted one of “Crain’s 2024 Best Places to Work in NYC”. Our expansion is building a strong foundation for future value creation. Higher growth trajectory. Vastly improved liquidity profile. Ability to re-trade higher cost funds for core relationships, establishing a strong foundation to capitalize on rate reductions. Greater operating leverage and profitability. See page 17 for notes and important information.

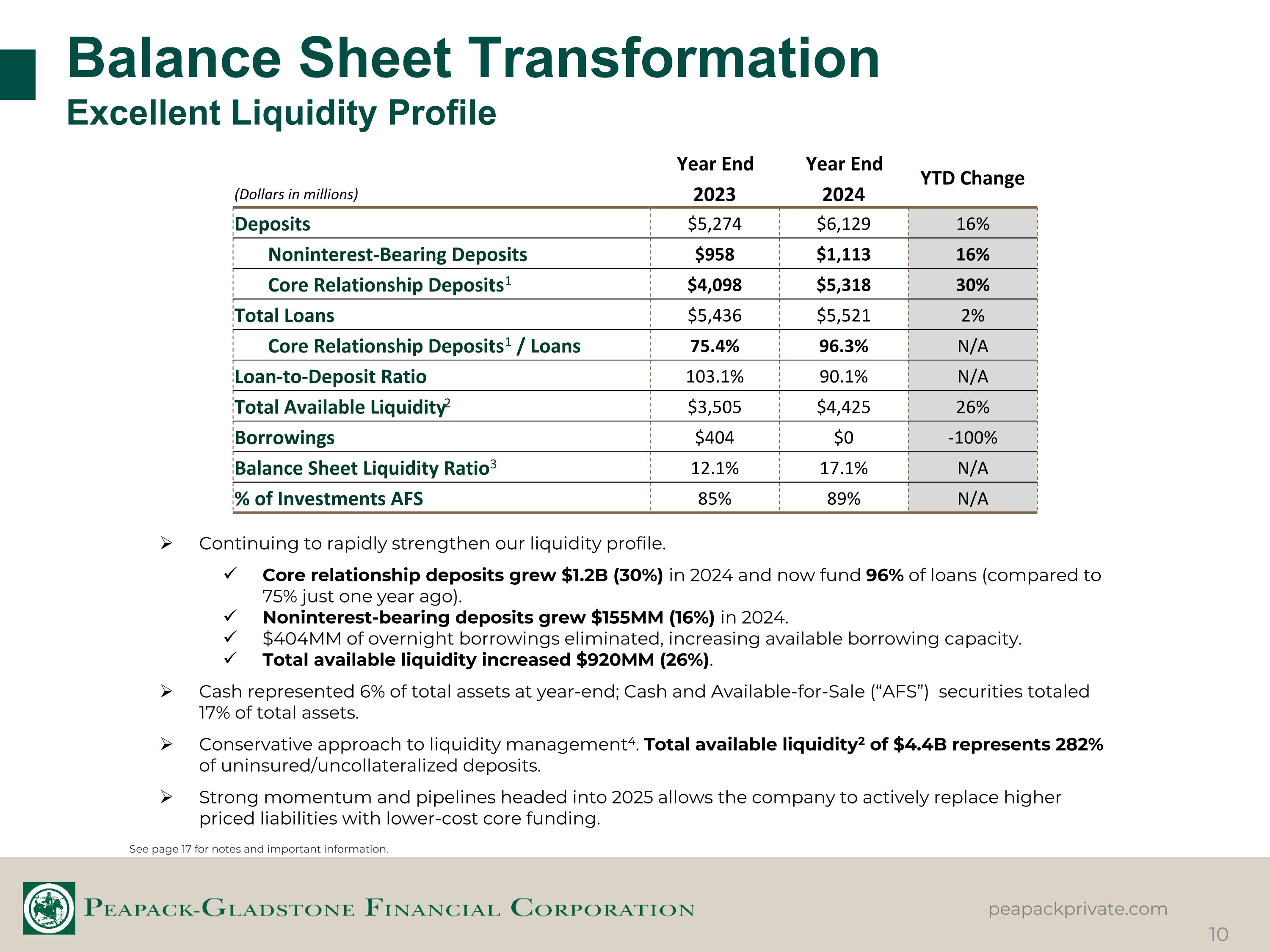

Balance Sheet Transformation Excellent Liquidity Profile Continuing to rapidly strengthen our liquidity profile. Core relationship deposits grew $1.2B (30%) in 2024 and now fund 96% of loans (compared to 75% just one year ago). Noninterest-bearing deposits grew $155MM (16%) in 2024. $404MM of overnight borrowings eliminated, increasing available borrowing capacity. Total available liquidity increased $920MM (26%). Cash represented 6% of total assets at year-end; Cash and Available-for-Sale (“AFS”) securities totaled 17% of total assets. Conservative approach to liquidity management4. Total available liquidity2 of $4.4B represents 282% of uninsured/uncollateralized deposits. Strong momentum and pipelines headed into 2025 allows the company to actively replace higher priced liabilities with lower-cost core funding. See page 17 for notes and important information. Year End Year End YTD Change (Dollars in millions) 2023 2024 Deposits $5,274 $6,129 16% Noninterest-Bearing Deposits $958 $1,113 16% Core Relationship Deposits1 $4,098 $5,318 30% Total Loans $5,436 $5,521 2% Core Relationship Deposits1 / Loans 75.4% 96.3% N/A Loan-to-Deposit Ratio 103.1% 90.1% N/A Total Available Liquidity2 $3,505 $4,425 26% Borrowings $404 $0 -100% Balance Sheet Liquidity Ratio3 12.1% 17.1% N/A % of Investments AFS 85% 89% N/A

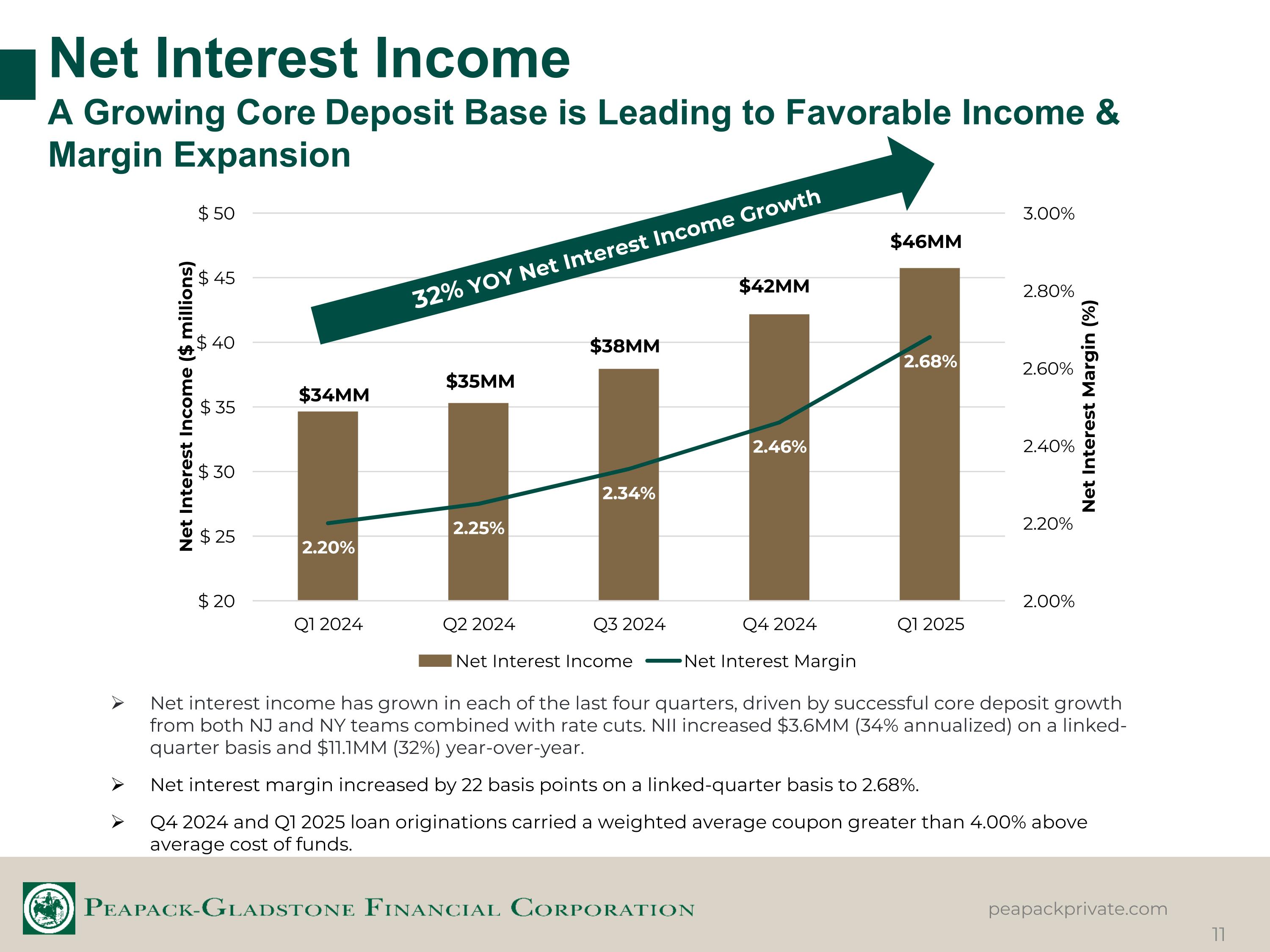

Net Interest Income A Growing Core Deposit Base is Leading to Favorable Income & Margin Expansion Net interest income has grown in each of the last four quarters, driven by successful core deposit growth from both NJ and NY teams combined with rate cuts. NII increased $3.6MM (34% annualized) on a linked-quarter basis and $11.1MM (32%) year-over-year. Net interest margin increased by 22 basis points on a linked-quarter basis to 2.68%. Q4 2024 and Q1 2025 loan originations carried a weighted average coupon greater than 4.00% above average cost of funds. $34MM $35MM $38MM $42MM $46MM 32% YOY Net Interest Income Growth

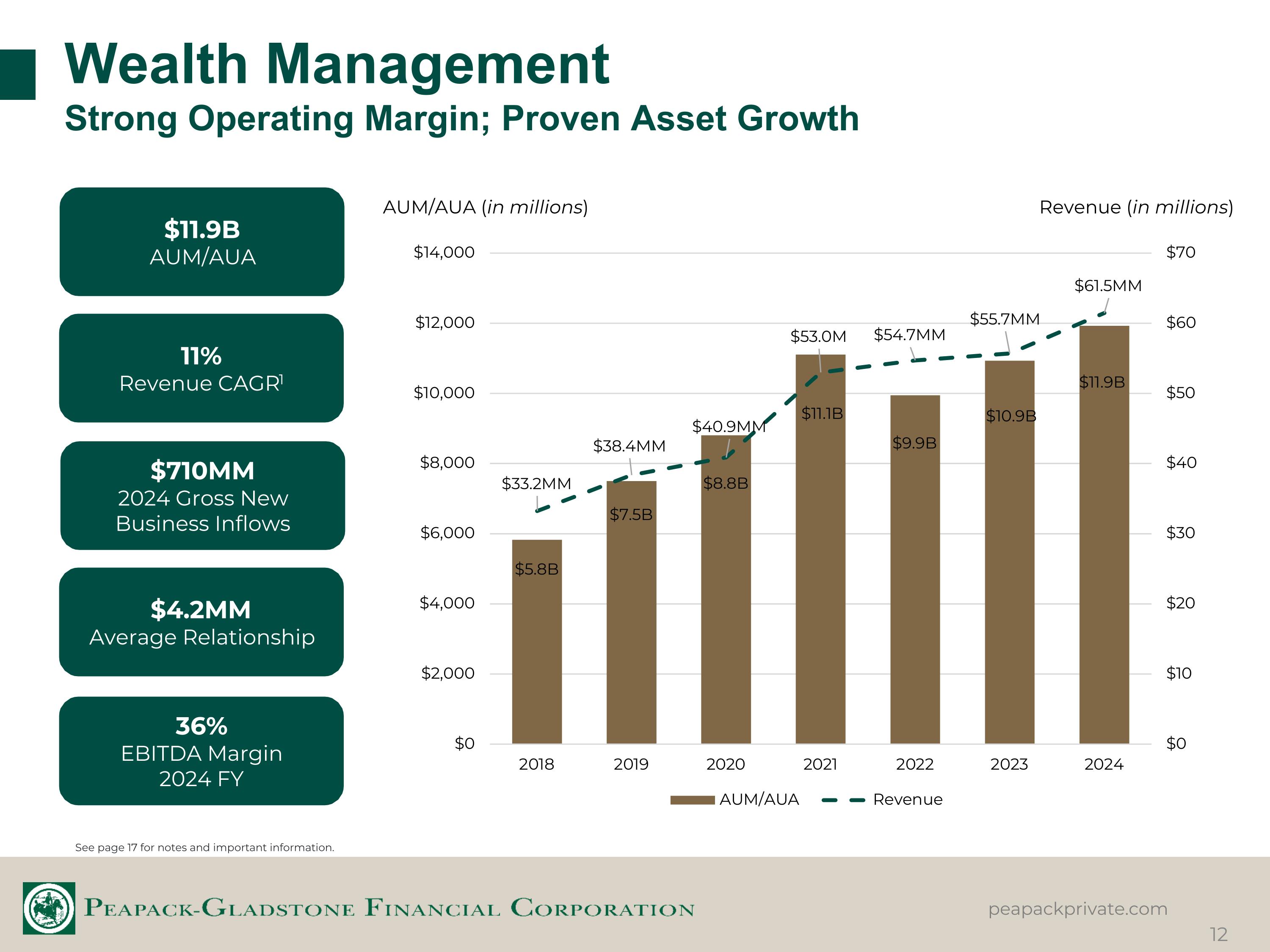

Wealth Management Strong Operating Margin; Proven Asset Growth AUM/AUA (in millions) Revenue (in millions) $11.9B AUM/AUA 36% EBITDA Margin 2024 FY 11% Revenue CAGR1 $4.2MM Average Relationship $710MM 2024 Gross New Business Inflows See page 17 for notes and important information.

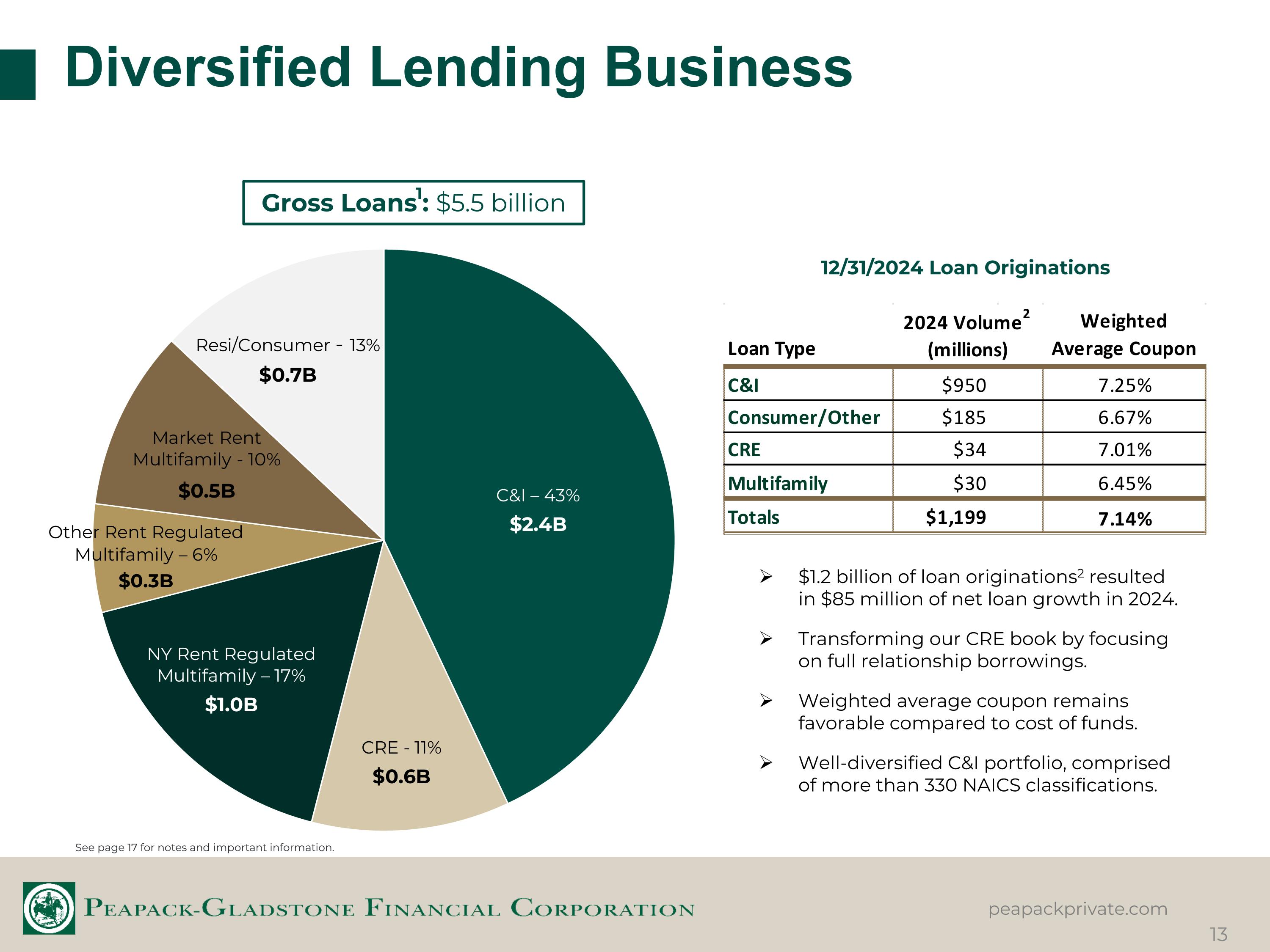

Diversified Lending Business Gross Loans1: $5.5 billion See page 17 for notes and important information. $1.2 billion of loan originations2 resulted in $85 million of net loan growth in 2024. Transforming our CRE book by focusing on full relationship borrowings. Weighted average coupon remains favorable compared to cost of funds. Well-diversified C&I portfolio, comprised of more than 330 NAICS classifications. 12/31/2024 Loan Originations

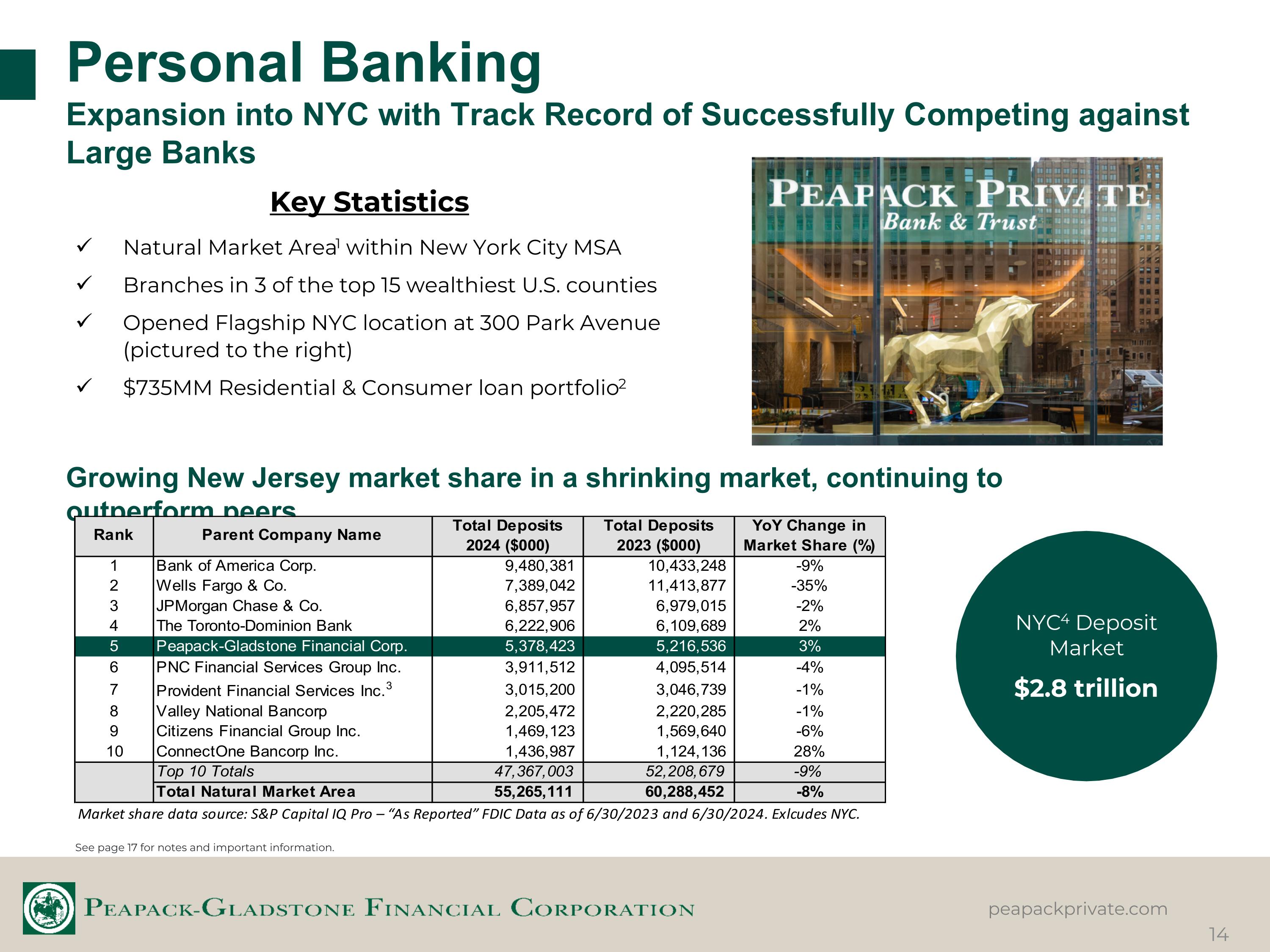

Personal Banking Expansion into NYC with Track Record of Successfully Competing against Large Banks Growing New Jersey market share in a shrinking market, continuing to outperform peers NYC4 Deposit Market $2.8 trillion See page 17 for notes and important information. Key Statistics Natural Market Area1 within New York City MSA Branches in 3 of the top 15 wealthiest U.S. counties Opened Flagship NYC location at 300 Park Avenue (pictured to the right) $735MM Residential & Consumer loan portfolio2

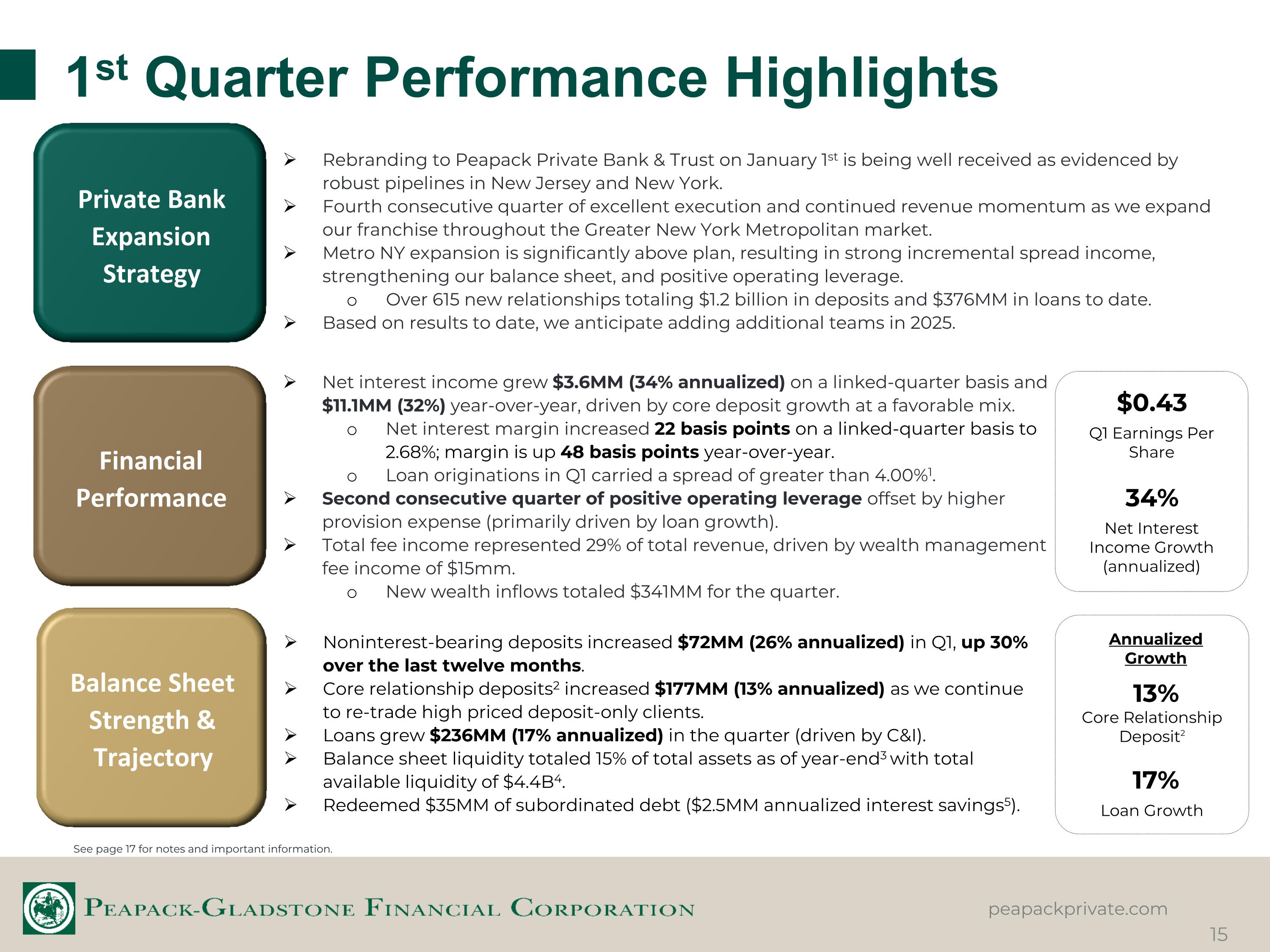

Net interest income grew $3.6MM (34% annualized) on a linked-quarter basis and $11.1MM (32%) year-over-year, driven by core deposit growth at a favorable mix. Net interest margin increased 22 basis points on a linked-quarter basis to 2.68%; margin is up 48 basis points year-over-year. Loan originations in Q1 carried a spread of greater than 4.00%1. Second consecutive quarter of positive operating leverage offset by higher provision expense (primarily driven by loan growth). Total fee income represented 29% of total revenue, driven by wealth management fee income of $15mm. New wealth inflows totaled $341MM for the quarter. 1st Quarter Performance Highlights Rebranding to Peapack Private Bank & Trust on January 1st is being well received as evidenced by robust pipelines in New Jersey and New York. Fourth consecutive quarter of excellent execution and continued revenue momentum as we expand our franchise throughout the Greater New York Metropolitan market. Metro NY expansion is significantly above plan, resulting in strong incremental spread income, strengthening our balance sheet, and positive operating leverage. Over 615 new relationships totaling $1.2 billion in deposits and $376MM in loans to date. Based on results to date, we anticipate adding additional teams in 2025. See page 17 for notes and important information. $0.43 Q1 Earnings Per Share 34% Net Interest Income Growth (annualized) Annualized Growth 13% Core Relationship Deposit2 17% Loan Growth Private Bank Expansion Strategy Financial Performance Balance Sheet Strength & Trajectory Noninterest-bearing deposits increased $72MM (26% annualized) in Q1, up 30% over the last twelve months. Core relationship deposits2 increased $177MM (13% annualized) as we continue to re-trade high priced deposit-only clients. Loans grew $236MM (17% annualized) in the quarter (driven by C&I). Balance sheet liquidity totaled 15% of total assets as of year-end3 with total available liquidity of $4.4B4. Redeemed $35MM of subordinated debt ($2.5MM annualized interest savings5).

Summary & Conclusion Q & A

Notes 2024 Performance Highlights slide 1) Core relationship deposits defined as deposit relationships that are not custodial, brokered, or listing service. 2) Q4 2024 compared to prior year quarter (Q4 2023). 3) Cash + Cash Equivalents + AFS Securities / Total Assets. 4) Cash + Cash Equivalents + AFS Securities + Remaining Borrowing Capacity, Letters of Credit, and Pledged AFS securities. An Enviable Wealth Management Business slide 1) Fiduciary revenue: Last Twelve Months (Gross income from services rendered by the institutions trust department or by any of its consolidated subsidiaries acting in any fiduciary capacity) 2) Total revenue: Last Twelve Months (Total Revenue = Net Interest Income (Pre-Provision) + Total Noninterest Income Metro NY Expansion Results slide 1) Noninterest-bearing deposits on this slide are defined as all deposits paid 0% interest, including reciprocal insured cash sweeps. Balance Sheet Transformation slide 1) Core relationship deposits defined as deposit relationships that are not custodial, brokered, or listing service. 2) Cash + Cash Equivalents + AFS Securities + Remaining Borrowing Capacity, Letters of Credit, and Pledged AFS Securities. 3) (Cash + Cash Equivalents + AFS Securities) / Total Assets. 4) Majority of the loan and securities portfolios are pledged to either the FHLBNY or FRB. Wealth Management slide 1) Compound annual growth rate calculated from December 31, 2018 through December 31, 2024. Diversified Lending Business slide Gross loans include loans held for sale. Origination volumes include funded loans and unfunded commitments. Personal Banking slide 1) Natural Market Area defined within boundaries in map as geography within 5 miles of all NJ branch locations. 2) Loans as of 12/31/2024. 3) Provident Financial Services Inc. acquired Lakeland Bancorp Inc. between the referenced time periods. 2023 deposits reflect the combination of the two entities pre-merger. 4) NYC Deposit Market defined as New York County. Total market share defined utilizing S&P Capital IQ Pro “As Reported” FDIC data as of 6/30/2024. 1st Quarter Performance Highlights slide 1) Spread is defined as the weighted average loan coupon of loans originated in the quarter less the average cost of funds for the quarter. 2) Core relationship deposits defined as deposit relationships that are not custodial, brokered, or listing service. 3) Cash + Cash Equivalents + AFS Securities / Total Assets. 4) Cash + Cash Equivalents + AFS Securities + Remaining Borrowing Capacity, Letters of Credit, and Pledged AFS securities. 5) Annualized interest expense calculated using the interest rate at time of redemption (SOFR Index = 4.36% plus 2.80% = 7.16%).