YEAR |

SUMMARY COMPENSATION TABLE TOTAL FOR PEO ($) |

COMPENSATION ACTUALLY PAID TO PEO (1) ($) |

AVERAGE SUMMARY COMPENSATION TABLE TOTAL FOR NON-PEO NEOS ($) |

AVERAGE COMPENSATION ACTUALLY PAID TO NON-PEO (1) NEOS ($) |

VALUE OF INITIAL FIXED $100 INVESTMENT BASED ON: |

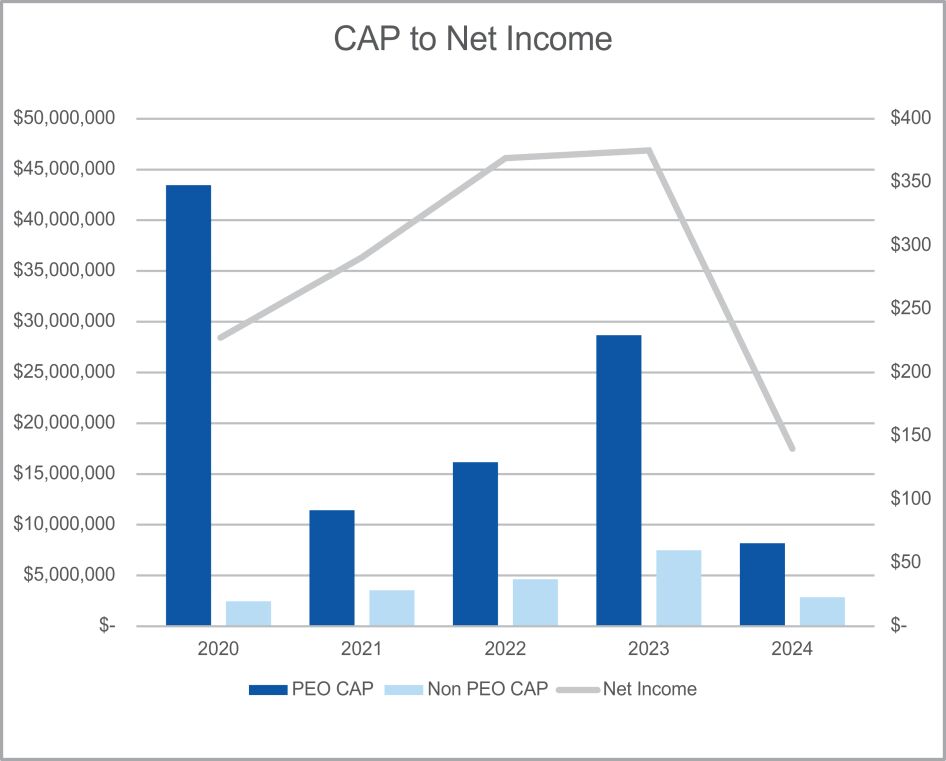

NET INCOME ($ IN MILLIONS) |

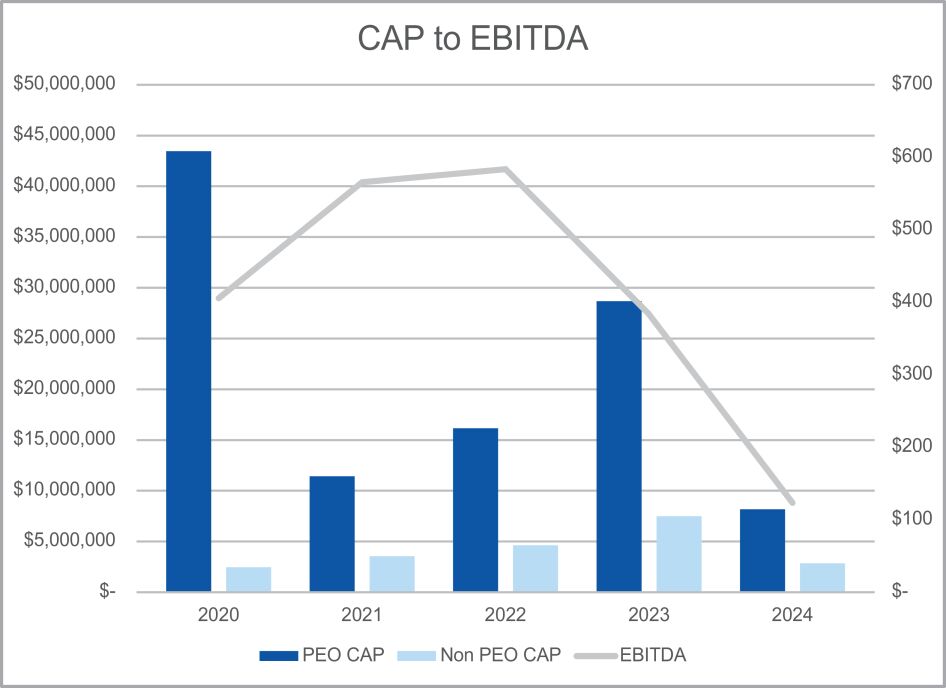

EBITDA ($ IN MILLIONS) | ||||||||||||||||||||||||||||||||||||||

TOTAL SHAREHOLDER RETURN ($) |

PEER GROUP TOTAL SHAREHOLDER RETURN (2) ($) |

PEER GROUP TOTAL SHAREHOLDER RETURN (3) ($) | |||||||||||||||||||||||||||||||||||||||||||

2024 |

$ | 37,393,960 | $ | 8,220,790 | $ | 8,229,951 | $ | 2,855,473 | $ | 119.66 | $ | 118.76 | $ | 121.05 | $ | 138.7 | $ | 123.0 | |||||||||||||||||||||||||||

2023 |

$ | 29,176,180 | $ | 28,622,960 | $ | 7,289,696 | $ | 7,416,214 | $ | 146.06 | $ | 112.65 | $ | 119.55 | $ | 374.7 | $ | 389.8 | |||||||||||||||||||||||||||

2022 |

$ | 19,420,514 | $ | 16,180,113 | $ | 5,633,566 | $ | 4,583,956 | $ | 129.17 | $ | 101.00 | $ | 102.47 | $ | 369.5 | $ | 582.7 | |||||||||||||||||||||||||||

2021 |

$ | 22,164,341 | $ | 11,430,937 | $ | 6,616,193 | $ | 3,506,869 | $ | 132.09 | $ | 137.09 | $ | 133.08 | $ | 292.6 | $ | 565.0 | |||||||||||||||||||||||||||

2020 |

$ | 21,304,754 | $ | 43,421,540 | $ | 5,349,361 | $ | 2,432,888 | $ | 154.48 | $ | 95.75 | $ | 116.09 | $ | 227.1 | $ | 406.1 | |||||||||||||||||||||||||||

| (1) | The amounts shown represent CAP to our Principal Executive Officer (“PEO”) and the average CAP to our remaining NEOs for the relevant fiscal year, as determined under SEC rules (and described below), which includes the individuals indicated in the table below for each fiscal year: |

YEAR |

PEO |

NON-PEO NEOS | ||

2024 |

Andrew C. Florance | Christian M. Lown, Scott Wheeler, Lisa C. Ruggles, Frederick G. Saint, and Frank A. Simuro | ||

2023 |

Andrew C. Florance | Scott T. Wheeler, Lisa C. Ruggles, Frederick G. Saint, and Frank A. Simuro | ||

2022 |

Andrew C. Florance | Scott T. Wheeler, Lisa C. Ruggles, Frederick G. Saint, and Frank A. Simuro | ||

2021 |

Andrew C. Florance | Scott T. Wheeler, Lisa C. Ruggles, and Frederick G. Saint | ||

2020 |

Andrew C. Florance | Scott T. Wheeler, Lisa C. Ruggles, Frederick G. Saint, and Matthew F.W. Linnington | ||

ADJUSTMENTS |

PEO | ||||||||||||||||||||||||

2024 |

2023 |

2022 |

2021 |

2020 | |||||||||||||||||||||

Deduction for Amounts Reported under the “Stock Awards” and “Option Awards” Columns in the 2024 Summary Compensation Table for Applicable Year |

-$ | 33,192,850 | -$ | 25,345,219 | -$ | 15,526,424 | -$ | 18,710,768 | -$ | 18,492,242 | |||||||||||||||

Increase based on ASC 718 Fair Value of Awards Granted during Applicable Year that Remain Unvested as of Applicable Year End, determined as of Applicable Year End |

$ | 22,403,392 | $ | 24,240,807 | $ | 18,416,210 | $ | 14,435,844 | $ | 20,330,911 | |||||||||||||||

Increase based on ASC 718 Fair Value of Awards Granted during Applicable Year that Vested during Applicable Year, determined as of Vesting Date |

$ | 0 | $ | 0 | $ | 3,551 | $ | 0 | $ | 0 | |||||||||||||||

Increase/deduction for Awards Granted during Prior Year(s) that were Outstanding and Unvested as of Applicable Year End, determined based on change in ASC 718 Fair Value from Prior Year End to Applicable Year End |

-$ | 13,423,536 | $ | 2,965,451 | $ | 756,384 | -$ | 3,584,582 | $ | 18,080,010 | |||||||||||||||

Increase/deduction for Awards Granted during Prior Year(s) that Vested During Applicable Year, determined based on change in ASC 718 Fair Value from Prior Year End to Vesting Date |

-$ | 4,960,176 | -$ | 2,414,259 | -$ | 6,890,122 | -$ | 2,873,898 | $ | 2,198,107 | |||||||||||||||

Total Adjustments |

-$ | 29,173,170 | -$ | 553,220 | -$ | 3,240,401 | -$ | 10,733,404 | $ | 22,116,786 | |||||||||||||||

ADJUSTMENTS |

AVERAGE NON-PEO NEOS | ||||||||||||||||||||||||

2024 |

2023 |

2022 |

2021 |

2020 | |||||||||||||||||||||

Deduction for Amounts Reported under the “Stock Awards” and “Option Awards” Columns in the 2024 Summary Compensation Table for Applicable Year |

-$ | 5,320,293 | -$ | 5,755,090 | -$ | 4,293,321 | -$ | 5,277,307 | -$ | 4,670,083 | |||||||||||||||

Increase based on ASC 718 Fair Value of Awards Granted during Applicable Year that Remain Unvested as of Applicable Year End, determined as of Applicable Year End |

$ | 4,751,991 | $ | 5,567,668 | $ | 4,567,643 | $ | 3,840,076 | $ | 3,667,266 | |||||||||||||||

Increase based on ASC 718 Fair Value of Awards Granted during Applicable Year that Vested during Applicable Year, determined as of Vesting Date |

$ | 0 | $ | 0 | $ | 0 | $ | 301 | $ | 530 | |||||||||||||||

Increase/deduction for Awards Granted during Prior Year(s) that were Outstanding and Unvested as of Applicable Year End, determined based on change in ASC 718 Fair Value from Prior Year End to Applicable Year End |

-$ | 1,899,128 | $ | 738,930 | $ | 183,671 | -$ | 849,736 | $ | 3,382,952 | |||||||||||||||

Increase/deduction for Awards Granted during Prior Year(s) that Vested During Applicable Year, determined based on change in ASC 718 Fair Value from Prior Year End to Vesting Date |

-$ | 463,526 | -$ | 424,990 | -$ | 1,507,603 | -$ | 822,658 | $ | 573,190 | |||||||||||||||

Deduction of ASC 718 Fair Value of Awards Granted during Prior Year(s) that were Forfeited during Applicable Year, determined as of Prior Year End |

-$ | 2,443,522 | $ | 0 | $ | 0 | $ | 0 | -$ | 5,870,328 | |||||||||||||||

Total Adjustments |

-$ | 5,374,478 | $ | 126,518 | -$ | 1,049,610 | -$ | 3,109,324 | -$ | 2,916,473 | |||||||||||||||

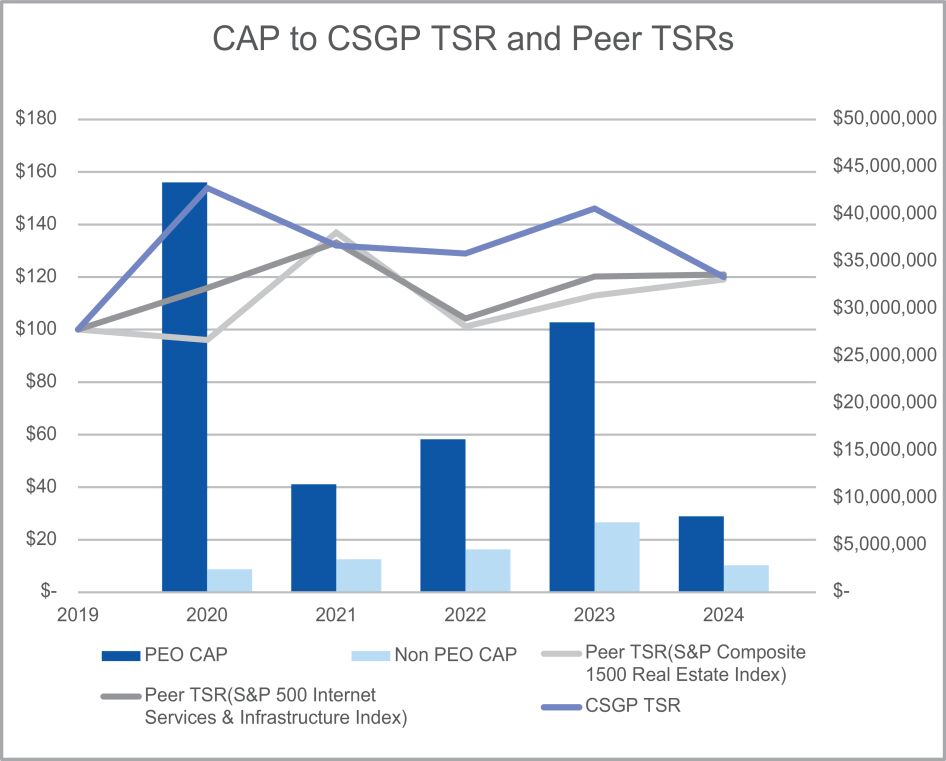

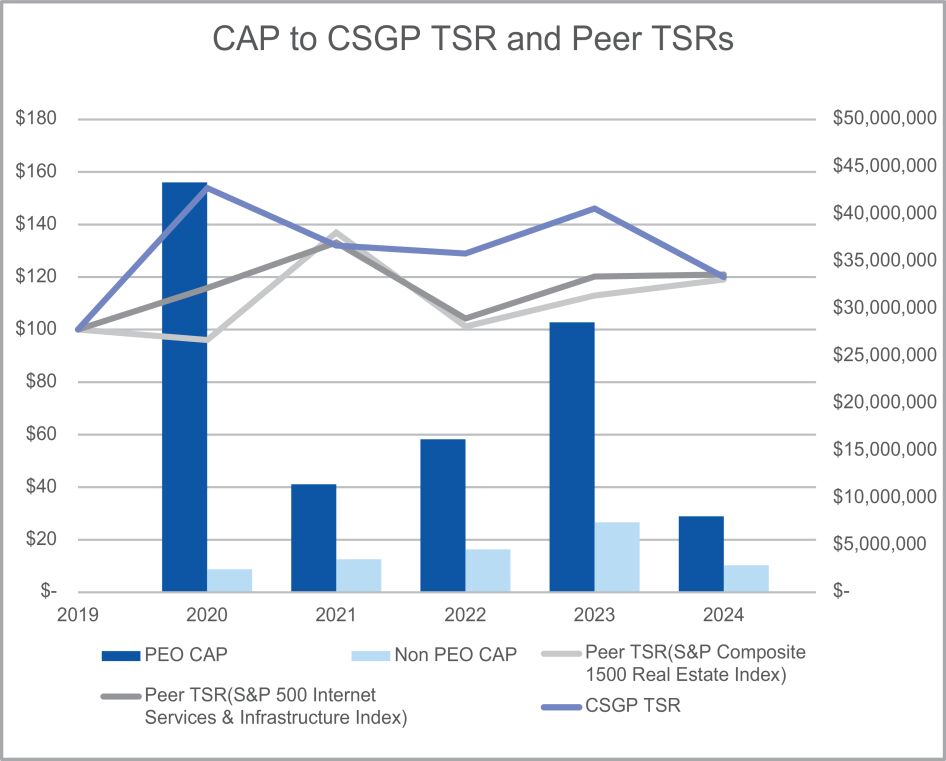

| (2) | Pursuant to SEC rules, the TSR amounts assume an initial investment of $100 on December 31, 2019. As permitted by SEC rules, the peer group referenced for purposes of the TSR comparison is the group of companies included in the S&P Composite 1500 Real Estate Index, which is the industry peer group used for purposes of Item 201(e) of Regulation S-K. The Company changed its peer group in its 2024 Form 10-K as it believes the S&P Composite 1500 Real Estate Index provides a more accurate, diverse, and useful measure to the Company’s performance. The separate peer group used by the Compensation Committee for purposes of determining compensation paid to our executive officers is described in the “Determining Executive Compensation” section of this Proxy Statement. |

| (3) | The peer group referenced for purposes of the TSR comparison is the group of companies included in the S&P 500 Internet Services and Infrastructure Index. |

| (1) | The amounts shown represent CAP to our Principal Executive Officer (“PEO”) and the average CAP to our remaining NEOs for the relevant fiscal year, as determined under SEC rules (and described below), which includes the individuals indicated in the table below for each fiscal year: |

YEAR |

PEO |

NON-PEO NEOS | ||

2024 |

Andrew C. Florance | Christian M. Lown, Scott Wheeler, Lisa C. Ruggles, Frederick G. Saint, and Frank A. Simuro | ||

2023 |

Andrew C. Florance | Scott T. Wheeler, Lisa C. Ruggles, Frederick G. Saint, and Frank A. Simuro | ||

2022 |

Andrew C. Florance | Scott T. Wheeler, Lisa C. Ruggles, Frederick G. Saint, and Frank A. Simuro | ||

2021 |

Andrew C. Florance | Scott T. Wheeler, Lisa C. Ruggles, and Frederick G. Saint | ||

2020 |

Andrew C. Florance | Scott T. Wheeler, Lisa C. Ruggles, Frederick G. Saint, and Matthew F.W. Linnington | ||

| (2) | Pursuant to SEC rules, the TSR amounts assume an initial investment of $100 on December 31, 2019. As permitted by SEC rules, the peer group referenced for purposes of the TSR comparison is the group of companies included in the S&P Composite 1500 Real Estate Index, which is the industry peer group used for purposes of Item 201(e) of Regulation S-K. The Company changed its peer group in its 2024 Form 10-K as it believes the S&P Composite 1500 Real Estate Index provides a more accurate, diverse, and useful measure to the Company’s performance. The separate peer group used by the Compensation Committee for purposes of determining compensation paid to our executive officers is described in the “Determining Executive Compensation” section of this Proxy Statement. |

| (3) | The peer group referenced for purposes of the TSR comparison is the group of companies included in the S&P 500 Internet Services and Infrastructure Index. |

ADJUSTMENTS |

PEO | ||||||||||||||||||||||||

2024 |

2023 |

2022 |

2021 |

2020 | |||||||||||||||||||||

Deduction for Amounts Reported under the “Stock Awards” and “Option Awards” Columns in the 2024 Summary Compensation Table for Applicable Year |

-$ | 33,192,850 | -$ | 25,345,219 | -$ | 15,526,424 | -$ | 18,710,768 | -$ | 18,492,242 | |||||||||||||||

Increase based on ASC 718 Fair Value of Awards Granted during Applicable Year that Remain Unvested as of Applicable Year End, determined as of Applicable Year End |

$ | 22,403,392 | $ | 24,240,807 | $ | 18,416,210 | $ | 14,435,844 | $ | 20,330,911 | |||||||||||||||

Increase based on ASC 718 Fair Value of Awards Granted during Applicable Year that Vested during Applicable Year, determined as of Vesting Date |

$ | 0 | $ | 0 | $ | 3,551 | $ | 0 | $ | 0 | |||||||||||||||

Increase/deduction for Awards Granted during Prior Year(s) that were Outstanding and Unvested as of Applicable Year End, determined based on change in ASC 718 Fair Value from Prior Year End to Applicable Year End |

-$ | 13,423,536 | $ | 2,965,451 | $ | 756,384 | -$ | 3,584,582 | $ | 18,080,010 | |||||||||||||||

Increase/deduction for Awards Granted during Prior Year(s) that Vested During Applicable Year, determined based on change in ASC 718 Fair Value from Prior Year End to Vesting Date |

-$ | 4,960,176 | -$ | 2,414,259 | -$ | 6,890,122 | -$ | 2,873,898 | $ | 2,198,107 | |||||||||||||||

Total Adjustments |

-$ | 29,173,170 | -$ | 553,220 | -$ | 3,240,401 | -$ | 10,733,404 | $ | 22,116,786 | |||||||||||||||

ADJUSTMENTS |

AVERAGE NON-PEO NEOS | ||||||||||||||||||||||||

2024 |

2023 |

2022 |

2021 |

2020 | |||||||||||||||||||||

Deduction for Amounts Reported under the “Stock Awards” and “Option Awards” Columns in the 2024 Summary Compensation Table for Applicable Year |

-$ | 5,320,293 | -$ | 5,755,090 | -$ | 4,293,321 | -$ | 5,277,307 | -$ | 4,670,083 | |||||||||||||||

Increase based on ASC 718 Fair Value of Awards Granted during Applicable Year that Remain Unvested as of Applicable Year End, determined as of Applicable Year End |

$ | 4,751,991 | $ | 5,567,668 | $ | 4,567,643 | $ | 3,840,076 | $ | 3,667,266 | |||||||||||||||

Increase based on ASC 718 Fair Value of Awards Granted during Applicable Year that Vested during Applicable Year, determined as of Vesting Date |

$ | 0 | $ | 0 | $ | 0 | $ | 301 | $ | 530 | |||||||||||||||

Increase/deduction for Awards Granted during Prior Year(s) that were Outstanding and Unvested as of Applicable Year End, determined based on change in ASC 718 Fair Value from Prior Year End to Applicable Year End |

-$ | 1,899,128 | $ | 738,930 | $ | 183,671 | -$ | 849,736 | $ | 3,382,952 | |||||||||||||||

Increase/deduction for Awards Granted during Prior Year(s) that Vested During Applicable Year, determined based on change in ASC 718 Fair Value from Prior Year End to Vesting Date |

-$ | 463,526 | -$ | 424,990 | -$ | 1,507,603 | -$ | 822,658 | $ | 573,190 | |||||||||||||||

Deduction of ASC 718 Fair Value of Awards Granted during Prior Year(s) that were Forfeited during Applicable Year, determined as of Prior Year End |

-$ | 2,443,522 | $ | 0 | $ | 0 | $ | 0 | -$ | 5,870,328 | |||||||||||||||

Total Adjustments |

-$ | 5,374,478 | $ | 126,518 | -$ | 1,049,610 | -$ | 3,109,324 | -$ | 2,916,473 | |||||||||||||||

| (1) | Revenue; |

| (2) | EBITDA; |

| (3) | Relative TSR; and |

| (4) | Net Income. |