Firsthand Technology Opportunities Fund seeks long-term growth of capital.

The table below describes the fees and expenses that you may pay if you buy and hold shares of Firsthand Technology Opportunities Fund.

Example—This example is meant to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. It assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. The cost of investing in the Fund reflects the net expenses of the Fund that result from the contractual expense limitation in the first year only. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

Portfolio Turnover—The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 14% of the average value of its portfolio.

Under normal circumstances, we invest at least 80% of the Fund’s assets in high-technology companies. We consider a high-technology company to be one that employs a relatively high degree of engineering and/or scientific intensity to deliver its products or services. We invest the Fund’s assets primarily in equity securities of high-technology companies in the industries and markets that we believe hold the most growth potential within the technology sector. Because there are no market capitalization restrictions on the Fund’s investments, the Fund may purchase stocks of small-, mid-, and large-cap companies. There is also no percentage limit on the Fund’s ability to invest in foreign securities. Due to the Fund’s focus on emerging opportunities within the technology sector, its investments tend to include younger companies with market capitalizations in the small- or mid-cap categories.

Our analysis of a potential investment focuses on valuing a company and purchasing securities of that company if we believe its intrinsic value exceeds its current market price. Conversely, we sell securities of a company when its market price exceeds its intrinsic value or when alternative investments present better potential for capital appreciation. When assessing a company’s intrinsic value, we consider a number of factors that may influence its earnings potential, including: strength of technology, breadth of product line, barriers to entry (including patents and other intellectual property rights), the competitive environment, product development, marketing acumen, and management strength and vision.

The Fund is non-diversified, which means that it invests in fewer companies than a diversified fund. Although some of the Fund’s holdings may produce dividends, interest, or other income, current income is not a consideration when selecting the Fund’s investments.

The Fund is subject to the following principal risks.

General Securities Market Risk—Because the return on and value of an investment in the Fund will fluctuate in response to stock market movements, the most significant risk of investing in the Fund is that you may lose money. Stocks and other equity securities are subject to market risks and fluctuations in value due to earnings, economic conditions, and other factors beyond our control. We designed the Fund for long-term investors who can accept the risks of investing in a fund with significant equity holdings in high-technology industries.

Technology Investment Risk—The Fund concentrates its investments in the technology sector, which is a very volatile segment of the market. Technology companies face competition and potentially rapid product obsolescence, and products or services that may initially look promising may subsequently fail. They are also heavily dependent on intellectual property rights and may be adversely affected by the loss or impairment of those rights. Companies in the technology sector are facing increased government and regulatory scrutiny and may be subject to adverse government or regulatory action. In addition, many technology companies are younger, smaller and unseasoned companies that may not have established products, an experienced management team, or earnings history.

Non-Diversification Risk—A risk of being non-diversified is that a significant change in the value of one company will have a greater impact on the Fund than it would if the Fund diversified its investments. You should also be aware that because a non-diversified investment strategy may expose you to greater-than-average financial and market risk, an investment in the Fund is not a balanced investment program.

Illiquid Securities Risk—This Fund has held more than 5% of its assets, and up to approximately 10% of its assets, in illiquid securities for extended periods. A high level of illiquid assets can impair the Adviser’s ability to manage the Fund’s portfolio when faced with greater than expected redemptions. Redemptions by shareholders can increase the level of illiquid holdings if total assets decrease as a result. Additionally, illiquid securities are more difficult to value accurately and may be worth less than expected when ultimately sold, which would decrease the value of the Fund’s shares.

Small-Cap Companies Risk—The Fund may invest a substantial portion of its assets in small-capitalization companies. Although smaller companies may have potential for rapid growth, they are subject to wider price fluctuations due to factors inherent in their size, such as lack of management experience and financial resources and limited trade volume and frequency. To make a large sale of securities of smaller companies that trade in limited volumes, the Fund may need to sell portfolio holdings at a discount or make a series of small sales over an extended period of time.

Foreign Securities Risk—The Fund may invest in companies that trade on U.S. exchanges as American Depositary Receipts, on foreign exchanges, or on foreign over-the-counter markets. Investments in foreign securities involve greater risks compared to domestic investments. Foreign companies may not be subject to the regulatory requirements of U.S. companies, so there may be less publicly available information about foreign issuers than about U.S. companies. Foreign companies generally are not subject to uniform accounting, auditing, and financial reporting standards. Dividends and interest on foreign securities may be subject to foreign withholding taxes. Such taxes may reduce the net return to the Fund’s shareholders. Foreign securities are often denominated in a currency other than the U.S. dollar. Accordingly, the Fund will be subject to the risks associated with fluctuations in currency values, which may decline against the U.S. dollar. The Fund is permitted to hedge that currency risk but it normally does not intend to do so. Although the Fund generally will invest only in foreign securities of issuers that are domiciled in nations considered to have stable and friendly governments, issuers of foreign securities still may be subject to the risk of expropriation, confiscation, taxation, currency blockage, or political or social instability, any of which could negatively affect the Fund.

Emerging Markets Risk—The Fund may also invest a substantial portion of its assets in foreign securities of issuers in countries with emerging securities markets. Investments in such emerging securities markets present greater risks than investing in foreign issuers in general. The risk of political or social upheaval is greater in emerging securities markets. Inflation and rapid fluctuations in inflation rates have had and may continue to have negative effects on the economies and securities markets of certain emerging market countries. Moreover, many of the emerging securities markets are relatively small, have low trading volumes, suffer periods of relative illiquidity and are characterized by significant price volatility and high transaction costs.

Cash Strategy Risk—The Fund may, from time to time, invest a substantial portion of its assets in cash or cash equivalents. If the stock market were to appreciate substantially during the time when the Fund is holding a substantial portion of its assets in cash, the Fund may underperform the market.

SPAC Investment Risk—The Fund may invest in securities issued by special purpose acquisition companies, known as “SPACs.” SPACs (also known as “blank check companies”) are companies with no commercial operations that are established solely to raise capital from investors for the purpose of acquiring one or more operating businesses. SPACs are generally formed by investors, or sponsors, with expertise in a particular industry or business sector, with the intention of pursuing deals in that area.

Unless and until an acquisition is completed, a SPAC generally invests its assets in U.S. government securities, money market securities and cash. A SPAC generally has two years to complete a deal or face liquidation. Because SPACs have no operating history or ongoing business other than seeking acquisitions, the value of their securities is particularly dependent on the ability of the entity’s management to identify and complete a profitable acquisition. There is no guarantee that the SPACs in which the Fund invests will complete an acquisition or that any acquisitions that are completed will be profitable. Public stockholders of SPACs may not be afforded a meaningful opportunity to vote on a proposed initial business combination because certain stockholders, including stockholders affiliated with the management of the SPAC, may have sufficient voting power, and a financial incentive, to approve such a transaction without support from public stockholders. As a result, a SPAC may complete a business combination even though a majority of its public stockholders do not support such a combination. SPACs may also encounter intense competition from other entities having a similar business objective, such as private investors or investment vehicles and other SPACs, competing for the same acquisition opportunities, which could make completing an attractive business combination more difficult or impossible.

Companies acquired by a SPAC may be unseasoned and lack a trading history, a track record of reporting to investors, and widely available research coverage. SPAC-derived companies are thus often subject to extreme price volatility and speculative trading. In addition, SPAC-derived companies may share similar illiquidity risks of private equity and venture capital. The free float shares held by the public in a SPAC-derived company are typically a small percentage of the market capitalization. The ownership of many SPAC-derived companies often includes large holdings by venture capital and private equity investors who seek to sell their shares in the public market in the months following a business combination transaction when shares restricted by lock-up are released, causing greater volatility and possible downward pressure during the time that locked-up shares are released.

U.S. Trade Policy Risk—The Trump administration recently enacted and proposed to enact significant new tariffs on imports from certain countries. Additionally, President Trump has directed various federal agencies to further evaluate key aspects of U.S. trade policy and there has been ongoing discussion and commentary regarding potential significant changes to U.S. trade policies, treaties and tariffs. There continues to exist significant uncertainty about the future relationship between the U.S. and other countries with respect to such trade policies, treaties and tariffs. These developments, or the perception that any of them could occur, may have a material adverse effect on global economic conditions and the stability of global financial markets, and may significantly reduce global trade and, in particular, trade between the impacted nations and the U.S. Any of these factors could depress economic activity and restrict a portfolio company's access to suppliers or customers and have a material adverse effect on its business, financial condition or operations, which in turn could negatively impact the Fund.

Regulatory Risk—Governments, agencies or other regulatory bodies may adopt or change laws or regulations that could adversely affect the issuer, or market value, of an instrument held by the Fund or that could adversely impact the Fund's performance.

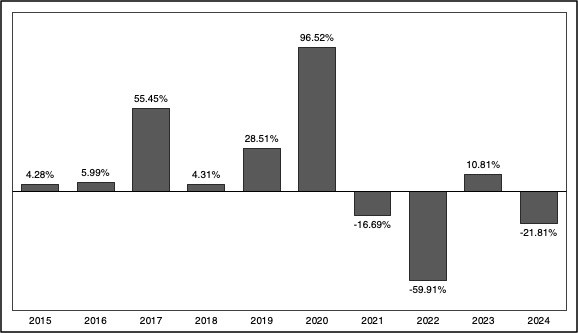

The following bar chart and performance table provide an indication of the risks of investing in the Fund. The bar chart shows the changes in the performance of the Fund from year to year over a period of 10 years. The performance table shows how the average annual total returns of the Fund, over certain periods of time, compared to those of a broad-based market index (the Standard & Poor’s 500 Index) and a technology sector-heavy index (the NASDAQ Composite Index). Though not explicitly a technology sector index, the NASDAQ Composite Index was selected for comparison because it is widely recognized as a technology sector benchmark, given the concentration of technology companies in the index. The Fund’s past performance (before and after taxes) is no guarantee of how it will perform in the future.

* Does not reflect deduction of fees, expenses, or taxes.

After-tax returns are calculated using the highest individual federal income tax rates in effect each year and do not reflect the impact of state and local taxes. Your actual after-tax returns depend on your individual tax situation and likely will differ from the results shown above, and after-tax returns shown are not relevant if you hold your Fund shares through a tax-deferred arrangement, such as a 401(k) plan or an individual retirement account (IRA).

Firsthand Alternative Energy Fund seeks long-term growth of capital.

The table below describes the fees and expenses that you may pay if you buy and hold shares of Firsthand Alternative Energy Fund.

Shareholder Fees - Firsthand Alternative Energy Fund |

Firsthand Alternative Energy Fund |

Total |

|

|---|---|---|---|

| Operating Expenses Caption [Text] | Annual Fund Operating Expenses | ||

| Management Fee | 1.33% | ||

| Other Expenses | 0.74% | ||

| Acquired Fund Fees and Expenses | 0.01% | ||

| Total Annual Fund Operating Expenses | 2.08% | ||

| Fee Waiver and/or Expense Reimbursement | [1] | (0.90%) | |

| Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement1 | 1.99% | ||

| Fee Waiver or Reimbursement over Assets, Date of Termination | April 30, 2026 | ||

| [1] | Firsthand Capital Management, Inc. (the |

Example—This example is meant to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. It assumes that you invest

$10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. The cost of investing in the Fund reflects the net expenses of the Fund that result from the contractual expense limitation in the first year only. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

Expense Example - Firsthand Alternative Energy Fund - USD ($) |

Expense Example, with Redemption, 1 Year |

Expense Example, with Redemption, 3 Years |

Expense Example, with Redemption, 5 Years |

Expense Example, with Redemption, 10 Years |

Portfolio Turnover, Rate |

Strategy Portfolio Concentration [Text] |

Performance Information Illustrates Variability of Returns [Text] |

Performance Additional Market Index [Text] |

Performance Past Does Not Indicate Future [Text] |

|---|---|---|---|---|---|---|---|---|---|

| Firsthand Alternative Energy Fund | 202 | 643 | 1,100 | 2,403 | |||||

| Share Class Domain | 400.00% | Under normal circumstances, we invest at least 80% of the Fund’s assets in alternative energy and alternative energy technology companies, both U.S. and international. | The following bar chart and performance table provide an indication of the risks of investing in the Fund. The bar chart shows the changes in the performance of the Fund from year to year over a period of 10 years. | Though not explicitly a technology sector index, the NASDAQ Composite Index was selected for comparison because it is widely recognized as a technology sector benchmark, given the concentration of technology companies in the index. The WilderHill Clean Energy Index was selected for comparison because it is an index of companies involved in clean energy (e.g., solar, wind, geothermal) and energy conservation. | The Fund’s past performance (before and after taxes) is no guarantee of how it will perform in the future. |

Portfolio Turnover—The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 4% of the average value of its portfolio.

Under normal circumstances, we invest at least 80% of the Fund’s assets in alternative energy and alternative energy technology companies, both U.S. and international. Alternative energy currently includes energy generated through solar, hydrogen, wind, geothermal, hydroelectric, tidal, biofuel, and biomass. Alternative energy technologies currently include, but are not limited to, technologies that enable energies to be tapped, stored, or transported, such as fuel cells; services or technologies that conserve or enable more efficient utilization of energy; and technologies that help minimize harmful emissions from existing energy sources, such as helping reduce carbon emissions. Because there are no market capitalization restrictions on the Fund’s investments, the Fund may purchase stocks of any capitalization, including, but not limited to, large-cap, mid-cap or small-cap stocks. There is also no percentage limit on the Fund’s ability to invest in foreign and emerging markets securities. The Fund’s international stock investments may include stocks of companies based in or doing substantial business in both developed markets and emerging markets. The Fund may also from time to time, as part of its principal investment strategies, invest a substantial portion of its assets in cash or cash equivalents.

Our analysis of a potential investment focuses on valuing a company and purchasing securities of that company if we believe its intrinsic value exceeds its current market price. Conversely, we sell securities of a company when its market price exceeds its intrinsic value or when alternative investments present better potential for capital appreciation. When assessing a company’s intrinsic value, we consider a number of factors that may influence its earnings potential, including: strength of technology, breadth of product line, barriers to entry (including patents and other intellectual property rights), the competitive environment, product development, marketing acumen, and management strength and vision.

The Fund is non-diversified, which means that it invests in fewer companies than a diversified fund. In addition, the Fund has a policy of concentrating its investments in alternative energy and clean technology industries. Although some of the Fund’s holdings may produce dividends, interest, or other income, current income is not a consideration when selecting the Fund’s investments.

The Fund is subject to the following principal risks.

General Securities Market Risk—Because the return on and value of an investment in the Fund will fluctuate in response to stock market movements, the most significant risk of investing in the Fund is that you may lose money. Stocks and other equity securities are subject to market risks and fluctuations in value due to earnings, economic conditions, and other factors beyond our control. We designed the Fund for long-term investors who can accept the risks of investing in a fund with significant equity holdings in alternative energy and clean technology industries.

Alternative Energy Industries Concentration Risk—The alternative energy and clean technology industries can be significantly affected by obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants, and general economic conditions. Further, these industries can be significantly affected by intense competition and legislation resulting in more strict government regulations and enforcement policies. They can also be significantly affected by fluctuations in energy prices and the change in alternative energy needs, energy conservation efforts, the success of exploration projects, tax incentives, subsidies and other government regulations, as well as world events and economic conditions.

Non-Diversification Risk—A risk of being non-diversified is that a significant change in the value of one company will have a greater impact on the Fund than it would if the Fund diversified its investments. You should also be aware that because a non-diversified investment strategy may expose you to greater-than-average financial and market risk, an investment in the Fund is not a balanced investment program.

Small-Cap Companies Risk—The Fund may invest a substantial portion of its assets in small-capitalization companies. Although smaller companies may have potential for rapid growth, they are subject to wider price fluctuations due to factors inherent in their size, such as lack of management experience and financial resources and limited trade volume and frequency. To make a large sale of securities of smaller companies that trade in limited volumes, the Fund may need to sell portfolio holdings at a discount or make a series of smaller sales over an extended period of time.

Foreign Securities Risk—The Fund may invest in companies that trade on U.S. exchanges as American Depositary Receipts, on foreign exchanges, or on foreign over-the-counter markets. Investments in foreign securities involve greater risks compared to domestic investments. Foreign companies may not be subject to the regulatory requirements of U.S. companies, so there may be less publicly available information about foreign issuers than about U.S. companies. Foreign companies generally are not subject to uniform accounting, auditing, and financial reporting standards. Dividends and interest on foreign securities may be subject to foreign withholding taxes. Such taxes may reduce the net return to the Fund’s shareholders. Foreign securities are often denominated in a currency other than the U.S. dollar. Accordingly, the Fund will be subject to the risks associated with fluctuations in currency values, which may decline against the U.S. dollar. The Fund is permitted to hedge that currency risk, but it normally does not intend to do so. Although the Fund generally will invest only in foreign securities of issuers that are domiciled in nations considered to have stable and friendly governments, issuers of foreign securities still may be subject to the risk of expropriation, confiscation, taxation, currency blockage, or political or social instability, any of which could negatively affect the Fund.

Emerging Markets Risk—The Fund may also invest a substantial portion of its assets in foreign securities of issuers in countries with emerging securities markets. Investments in such emerging securities markets present greater risks than investing in foreign issuers in general. The risk of political or social upheaval is greater in emerging securities markets. Inflation and rapid fluctuations in inflation rates have had and may continue to have negative effects on the economies and securities markets of certain emerging market countries. Moreover, many of the emerging securities markets are relatively small, have low trading volumes, suffer periods of relative illiquidity and are characterized by significant price volatility and high transaction costs.

Cash Strategy Risk—The Fund may, from time to time, invest a substantial portion of its assets in cash or cash equivalents. If the stock market were to appreciate substantially during the time when the Fund is holding a substantial portion of its assets in cash, the Fund may underperform the market.

SPAC Investment Risk—The Fund may invest in securities issued by special purpose acquisition companies, known as “SPACs.” SPACs (also known as “blank check companies”) are companies with no commercial operations that are established solely to raise capital from investors for the purpose of acquiring one or more operating businesses. SPACs are generally formed by investors, or sponsors, with expertise in a particular industry or business sector, with the intention of pursuing deals in that area.

Unless and until an acquisition is completed, a SPAC generally invests its assets in U.S. government securities, money market securities and cash. A SPAC generally has two years to complete a deal or face liquidation. Because SPACs have no operating history or ongoing business other than seeking acquisitions, the value of their securities is particularly dependent on the ability of the entity’s management to identify and complete a profitable acquisition. There is no guarantee that the SPACs in which the Fund invests will complete an acquisition or that any acquisitions that are completed will be profitable. Public stockholders of SPACs may not be afforded a meaningful opportunity to vote on a proposed initial business combination because certain stockholders, including stockholders affiliated with the management of the SPAC, may have sufficient voting power, and a financial incentive, to approve such a transaction without support from public stockholders. As a result, a SPAC may complete a business combination even though a majority of its public stockholders do not support such a combination. SPACs may also encounter intense competition from other entities having a similar business objective, such as private investors or investment vehicles and other SPACs, competing for the same acquisition opportunities, which could make completing an attractive business combination more difficult or impossible.

Companies acquired by a SPAC may be unseasoned and lack a trading history, a track record of reporting to investors, and widely available research coverage. SPAC-derived companies are thus often subject to extreme price volatility and speculative trading. In addition, SPAC-derived companies may share similar illiquidity risks of private equity and venture capital. The free float shares held by the public in a SPAC-derived company are typically a small percentage of the market capitalization. The ownership of many SPAC-derived companies often includes large holdings by venture capital and private equity investors who seek to sell their shares in the public market in the months following a business combination transaction when shares restricted by lock-up are released, causing greater volatility and possible downward pressure during the time that locked-up shares are released.

U.S. Trade Policy Risk—The Trump administration recently enacted and proposed to enact significant new tariffs on imports from certain countries. Additionally, President Trump has directed various federal agencies to further evaluate key aspects of U.S. trade policy and there has been ongoing discussion and commentary regarding potential significant changes to U.S. trade policies, treaties and tariffs. There continues to exist significant uncertainty about the future relationship between the U.S. and other countries with respect to such trade policies, treaties and tariffs. These developments, or the perception that any of them could occur, may have a material adverse effect on global economic conditions and the stability of global financial markets, and may significantly reduce global trade and, in particular, trade between the impacted nations and the U.S. Tariffs can also affect alternative energy and clean technology companies, impacting global value chains for clean technologies. Any of these factors could depress economic activity and restrict a portfolio company's access to suppliers or customers and have a material adverse effect on its business, financial condition or operations, which in turn could negatively impact the Fund.

Regulatory Risk—Governments, agencies or other regulatory bodies may adopt or change laws or regulations that could adversely affect the issuer, or market value, of an instrument held by the Fund or that could adversely impact the Fund's performance.

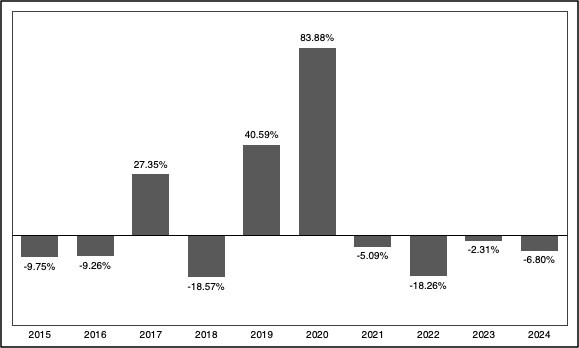

The following bar chart and performance table provide an indication of the risks of investing in the Fund. The bar chart shows the changes in the performance of the Fund from year to year over a period of 10 years. The performance table shows how the average annual total returns of the Fund, over certain periods of time, compared to those of a broad-based market index (the Standard & Poor’s 500 Index), as well as a technology sector-heavy index (the NASDAQ Composite Index) and an alternative energy sector-focused index (the WilderHill Clean Energy Index). Though not explicitly a technology sector index, the NASDAQ Composite Index was selected for comparison because it is widely recognized as a technology sector benchmark, given the concentration of technology companies in the index. The WilderHill Clean Energy Index was selected for comparison because it is an index of companies involved in clean energy (e.g., solar, wind, geothermal) and energy conservation. The Fund’s past performance (before and after taxes) is no guarantee of how it will perform in the future.

Annual Total Returns |

Firsthand Alternative Energy Fund

Firsthand Alternative Energy Fund

|

|---|---|

| Highest Quarterly Return, Label | Best Quarter |

| Highest Quarterly Return | 40.61% |

| Lowest Quarterly Return, Label | Worst Quarter |

| Lowest Quarterly Return | 24.01% |

Average Annual Total Returns - Firsthand Alternative Energy Fund |

1 Year |

5 Years |

10 Years |

Index No Deduction for Fees, Expenses, Taxes [Text] |

Performance Table Uses Highest Federal Rate |

Performance Table Not Relevant to Tax Deferred |

|---|---|---|---|---|---|---|

| Firsthand Alternative Energy Fund | (6.80%) | 5.37% | 4.48% | |||

| Firsthand Alternative Energy Fund | After Taxes on Distributions | (7.11%) | 5.13% | 4.36% | |||

| Firsthand Alternative Energy Fund | After Taxes on Distributions and Sales | (3.78%) | 4.20% | 3.57% | |||

| Firsthand Alternative Energy Fund | Standard And Poors 500 Index [Member] | 25.02% | 14.53% | 13.10% | |||

| Firsthand Alternative Energy Fund | N A S D A Q Composite Index [Member] | 29.57% | 17.49% | 16.20% | |||

| Firsthand Alternative Energy Fund | Wilder Hill Clean Energy Index [Member] | (31.72%) | (9.56%) | (2.17%) | |||

| Performance Measure Domain | Does not reflect deduction of fees, expenses, or taxes. | After-tax returns are calculated using the highest individual federal income tax rates in effect each year and do not reflect the impact of state and local taxes. | Your actual after-tax returns depend on your individual tax situation and likely will differ from the results shown above, and after-tax returns shown are not relevant if you hold your Fund shares through a tax-deferred arrangement, such as a 401(k) plan or an individual retirement account (IRA). |

* Does not reflect deduction of fees, expenses, or taxes.

After-tax returns are calculated using the highest individual federal income tax rates in effect each year and do not reflect the impact of state and local taxes. Your actual after-tax returns depend on your individual tax situation and likely will differ from the results shown above, and after-tax returns shown are not relevant if you hold your Fund shares through a tax-deferred arrangement, such as a 401(k) plan or an individual retirement account (IRA).