The IDX Risk-Managed Digital Assets Strategy Fund (the “Fund” or “Digital Assets Fund”) seeks long-term capital appreciation. There can be no assurance that the Fund will achieve its investment objective.

This table describes the fees and expenses that you may pay if you buy, hold, and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below.

Shareholder Fees |

IDX Risk-Managed Digital Assets Strategy Fund

IDX Risk-Managed Digital Assets Strategy Fund - Institutional Class Shares

USD ($)

|

|---|---|

| Shareholder Fees (fees paid directly from your investment) | none |

Annual Fund Operating Expenses |

IDX Risk-Managed Digital Assets Strategy Fund

IDX Risk-Managed Digital Assets Strategy Fund - Institutional Class Shares

|

|

|---|---|---|

| Management Fees | 1.99% | |

| Distribution and Service (12b-1) Fees | none | |

| Shareholder Services Fees | 0.15% | |

| Other Expenses | 1.71% | |

| Acquired Fund Fees and Expenses | none | [1] |

| Total Annual Fund Operating Expenses | 3.85% | |

| Fee Waivers and Expense Reimbursement | (1.22%) | [2] |

| Total Annual Fund Operating Expenses After Waivers and/or Expense Reimbursements | 2.63% | |

| [1] | Acquired fund fees and expenses are indirect costs of investing in other investment companies. |

| [2] | IDX Advisors, LLC (the “Adviser”) has entered into an Expense Limitation Agreement with the Fund under which it has agreed to waive or reduce its fees and to assume other expenses of the Fund, if necessary, in an amount that limits the Fund’s annual operating expenses (exclusive of interest, borrowing expenses, Shareholder service fees pursuant to a shareholder service plan, taxes, acquired fund fees and expenses, brokerage fees and commissions, dividend expenses on short sales, litigation expenses, and other expenditures which are capitalized following generally accepted accounting principles (“GAAP”) and other extraordinary expenses not incurred in the ordinary course of the Funds’ business) to not more than 2.49% through at least April 30, 2026. Subject to approval by the Fund’s Board of Trustees, any waiver under the Expense Limitation Agreement is subject to repayment by the Fund for three years after such fee waiver or expense reimbursements were incurred, if the Fund can make the repayment without exceeding the expense limitation in place at the time of the waiver or reimbursement and at the time of recoupment. The current contractual agreement cannot be terminated for at least one year after the effective date without the Board of Trustees’ approval. |

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in the Fund for the periods indicated and then redeem all your shares at the end of those periods. The expense example also assumes that your investment has a 5% return each year and the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions, your cost would be:

Expense Example |

Expense Example, with Redemption, 1 Year |

Expense Example, with Redemption, 3 Years |

Expense Example, with Redemption, 5 Years |

Expense Example, with Redemption, 10 Years |

|---|---|---|---|---|

| IDX Risk-Managed Digital Assets Strategy Fund | IDX Risk-Managed Digital Assets Strategy Fund - Institutional Class Shares | USD ($) | 266 | 1,063 | 1,879 | 4,002 |

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 0.00% of the average value of its portfolio.

The Fund seeks long-term capital appreciation. The Fund pursues its investment strategy through actively managed investments with indirect (e.g., futures or operating companies) exposure to bitcoin, ether, or other digital assets (collectively, “Digital Assets”). The Fund defines “other digital assets” as cryptocurrencies and blockchain-based or decentralized assets that are traded on a digital exchange. These assets include, but are not limited to, digital currencies such as bitcoin and ethereum, as well as other tokens and digital representations of value created, stored, and exchanged on blockchain networks. These assets are characterized by their decentralized nature, meaning any single entity does not control them, and their transactions are recorded on a distributed ledger technology known as blockchain. The Fund does not invest in bitcoin, ether, or other Digital Assets directly and will not invest in any Digital Assets that are traded over-the-counter (“OTC”), such as pooled investment vehicles or other OTC trusts. Investors seeking direct exposure to Digital Assets should consider investments other than the Fund.

Specifically, the Fund will invest in bitcoin, ether, U.S. Treasury, or other digital asset futures contracts (collectively, “Digital Asset Futures”), exchange-traded products (“ETPs”) that provide direct exposure to spot bitcoin or ether, and exchange-traded funds (“ETFs”) that provide indirect exposure to bitcoin or ether through Digital Asset Futures. The Fund notes that, unlike ETFs, ETPs are not investment companies under the Investment Company Act of 1940 (the “1940 Act”) and do not provide the protections of that act. The Fund may also invest in Digital Asset-related operating companies whose securities are registered under the Securities Act of 1933 (“1933 Act”). Digital Asset-related operating companies are businesses that hold significant assets in blockchain, web3, or Digital Asset-related activities or derive at least 50% of their revenues from Digital Asset-related activities, such as mining, holding, or trading these assets, developing blockchain hardware and software, or providing services to such companies. These companies might have direct exposure to Digital Assets such as bitcoin and ether.

The ownership and operation of bitcoin and ether is determined by the participants in an online, peer-to-peer network (“Network”). The Network connects computers that run publicly accessible, or “open source,” software that follows the rules and procedures governing the Bitcoin or Ethereum Network. This is commonly referred to as the Bitcoin or Ethereum Protocol (and is described in more detail in the section entitled “Bitcoin Network,” “Bitcoin Protocol,” “Ethereum Network,” and “Smart Contracts and Development on the Ethereum Network” in the Fund’s Prospectus). The value of Digital Assets is not backed by any government, corporation, or other identified body. Instead, its value is partly determined by the supply and demand in markets created to facilitate the trading of Digital Assets.

Digital Assets such as bitcoin and ether are issued and transferred using blockchain technology. Blockchain is a decentralized, distributed ledger technology that records transactions across many computers, ensuring that the record cannot be altered retroactively without altering all subsequent blocks and the network consensus. The Bitcoin blockchain was primarily designed to support bitcoin as a decentralized crypto asset, and neither it nor ether is widely accepted as a means of payment. Bitcoin’s main use case is a peer-to-peer electronic trading system that allows for secure, transparent, and irreversible transactions without a central authority or intermediary. The Ethereum blockchain, while ether can also be used as a crypto asset, the Ethereum blockchain was designed with broader functionality. It supports decentralized applications and smart contracts, which are self-executing contracts with the terms directly written into code. This flexibility allows Ethereum to support various applications, including decentralized finance (“DeFi”), non-fungible tokens (“NFTs”), and other Digital Assets that require programmable features.

Futures are financial contracts, whose value depends on, or is derived from, the underlying reference asset. For Digital Asset Futures, the underlying reference asset is bitcoin or ether, respectively. Futures may be physically- or cash-settled. When investing in Digital Asset Futures, the Fund invests only in cash-settled bitcoin or ether Futures traded on the Chicago Mercantile Exchange (the “CME”) or in ETPs or ETFs that invest directly in bitcoin or ether Futures. The value of bitcoin Futures is determined by reference to the CME CF Bitcoin Reference Rate (“BBR”), which indicates the price of bitcoin across certain bitcoin trading platforms. The value of ether Futures is determined by reference to the CME CF Ether-Dollar Reference Rate (“ETHUSD_RR”), which indicates the price of ether across certain ether trading platforms. Additionally, the Fund intends to invest in U.S. Treasury futures. The Fund seeks to invest in front and near-month Futures. The Fund does not expect to hold any Futures with longer than 90 days to maturity. A high degree of leverage is typical of a futures trading account. As a result, a relatively small price movement in a futures contract may result in substantial losses to the Fund, exceeding the amount of the margin paid.

The Fund’s investment in other investment companies registered under the 1940 Act is known as a fund-of-funds strategy in which a fund invests in a diversified portfolio of other investment companies rather than directly in individual securities. The Fund aims to gain diversified exposure to Digital Assets by including investments in other investment companies with direct or indirect exposure to Digital Assets, such as spot bitcoin and ether funds. By allocating a portion of its assets to other investment companies, the Fund seeks to diversify its portfolio and capitalize on the potential growth and returns that Digital Assets offer.

Over time, the Fund seeks to capture most of the upside participation in Digital Assets while limiting the downside by managing its Digital Assets exposure to 25% and 125% of the Fund’s net asset, depending on the market conditions. While investments in Digital Asset Futures are a form of leverage, the Fund will not have Digital Asset Futures exposure greater than 125% of its net assets; this means that the Fund may seek more than 100% exposure to the price performance of bitcoin or ether through its investments in Digital Asset Futures. Under normal market conditions, the Fund expects to maintain Digital Assets exposure of between 50% and 125% over time. During stressed or abnormal market conditions, including periods when IDX Advisors, LLC (the “Adviser”) believes it is prudent to take a temporary defensive position, the Fund will reduce its Digital Assets exposure significantly, but in no situation will its exposure to bitcoin or bitcoin Futures be less than 25% of the Fund’s net assets. The Fund defines stressed or abnormal market conditions as a significant drop in the price of Digital Assets over a short trading period. Further, the Fund’s collective investments in ether or ether Futures will not exceed 25% or more of the Fund’s net assets.

The Fund will gain exposure to Digital Assets by investing a portion of its assets in a wholly-owned subsidiary organized under the laws of the Cayman Islands and managed by the Adviser (“Digital Asset Subsidiary”). The Fund generally expects to invest approximately 25% of its total assets in the Digital Asset Subsidiary, but it may exceed this amount if the Adviser believes doing so is in the best interest of the Fund, such as to help the Fund achieve its investment objective or manage its tax efficiency. Exceeding this amount may have tax consequences; see “Tax Risk” in the Fund’s Prospectus for more information. References to investments by the Fund should be read to mean investments by either the Fund or the Digital Asset Subsidiary. Because the Digital Asset Subsidiary invests in Futures, considered a form of leverage, the Fund’s exposure to Digital Assets price volatility exceeds the 25% of the Fund’s assets allocated to the Digital Asset Subsidiary.

To enhance the Digital Asset Fund’s returns, it may borrow for investment purposes, subject to the limits of the 1940 Act and the rules and regulations thereunder. To the extent the Fund borrows more money than it has cash or short-term cash equivalents and invests the proceeds, it will create financial leverage. Borrowing for investment purposes increases investment opportunity and risk.

The Fund expects to have significant holdings of cash and U.S. government securities, money market funds, repurchase agreements, and investment grade fixed-income securities (the “Cash and Fixed Income Investments”). The Fund does not target a specific maturity but will generally have an average portfolio duration of one year or less. Each debt security held by the Fund must be high quality at the time of purchase, which is defined as being rated no lower than the A category by Standard & Poor’s Ratings Group, Moody’s Investors Service, or Fitch Ratings, Inc. The Cash and Fixed Income Investments are intended to provide liquidity, to serve as collateral for the Fund’s futures contracts, and to support its use of leverage.

The Adviser uses proprietary quantitative models that incorporate various information in determining the allocation to Digital Assets. The models use publicly available information (including but not limited to price, volatility, volume, and blockchain-based metrics) to allocate Fund assets based on the model outputs, the Adviser will adjust the Fund’s Digital Assets Futures exposure from 25% to 100% of the Fund’s net assets.

The Fund generally does not intend to close out or sell, its indirect investments in Digital Assets except (i) to meet redemptions or (ii) when a Futures is nearing expiration, at which point the Fund will generally sell it and use the proceeds to buy a Futures with a later expiration date to maintain its exposure. This is commonly referred to as “rolling.” Currently, most of the open interest in CME Digital Asset Futures is in front-month contracts (i.e., contracts that expire in 30 days); therefore, the Fund expects to invest in such contracts over the foreseeable future, but it may also invest in back-month Futures. Over time, as the CME Digital Asset Futures market expands, the Fund will use a multi-day, laddered roll process. Because of this rolling, the Fund engages in frequent trading to achieve its investment objective, resulting in portfolio turnover greater than 100%.

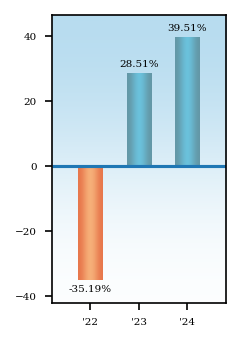

The bar chart and table below indicate the risks of investing in the Fund by showing changes in the Fund’s performance and comparing that performance to a broad-based securities market index. In August 2024, the Fund expanded its investment strategy to include principal investments in digital assets and increased its investments in non-commodity related asset classes. Before this change, the Fund’s investment strategy focused on bitcoin and bitcoin Futures. The Fund’s past performance, before and after taxes, does not necessarily indicate how the Fund will perform in the future. Updated performance information will be available at no cost by calling 216-329-4271 or by visiting its website at www.idx-funds.com.

| Best Quarter: | 39.25% | th quarter 2023 |

| Worst Quarter: | (16.97)% | nd quarter 2024 |

Average Annual Total Returns - IDX Risk-Managed Digital Assets Strategy Fund |

1 Year |

Since Inception |

Inception Date |

|---|---|---|---|

| IDX Risk-Managed Digital Assets Strategy Fund - Institutional Class Shares | 39.51% | 2.85% | Nov. 15, 2021 |

| IDX Risk-Managed Digital Assets Strategy Fund - Institutional Class Shares | After Taxes on Distributions | 23.39% | 1.69% | Nov. 15, 2021 |

| IDX Risk-Managed Digital Assets Strategy Fund - Institutional Class Shares | After Taxes on Distributions and Sales | 23.39% | 1.69% | Nov. 15, 2021 |

| Bloomberg Global-Aggregate Total Return Index | (1.69%) | (4.18%) | Nov. 15, 2021 |

| ICE BofA SOFR Overnight Rate Index | 5.40% | 4.07% | Nov. 15, 2021 |

| CME CF Bitcoin Reference Rate | 123.43% | 12.69% | Nov. 15, 2021 |

| CME CF Ether-Dollar Reference Rate | 45.10% | (9.06%) | Nov. 15, 2021 |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the effect of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and after-tax returns shown are not relevant to investors who hold shares of the Fund through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts (“IRAs”).

Bitcoin Risk – Bitcoin is a relatively new financial innovation, and the market for bitcoin is subject to rapid price swings, changes, and uncertainty. The value of bitcoin has been and may continue to be, substantially dependent on speculation, such that trading and investing bitcoin generally may not be based on fundamental analysis. The further development of the Bitcoin Network and the acceptance and use of bitcoin are subject to various factors that are difficult to evaluate. The slowing, stopping, or reversing of the development of the Bitcoin Network or the acceptance of bitcoin may adversely affect the price of bitcoin. Bitcoin is subject to the risk of fraud, theft, manipulation, security failures, operational, or other problems that impact bitcoin trading venues. Unlike the exchanges for more traditional assets, such as equity securities and futures contracts, bitcoin and bitcoin trading platforms are largely unregulated. As a result of the lack of regulation, individuals or groups may engage in fraud or market manipulation, and investors may be more exposed to the risk of theft, fraud, and market manipulation than when investing in more traditional asset classes. Legal or regulatory changes may negatively impact the operation of the Bitcoin Network or restrict the use of bitcoin. Realizing any of these risks could result in a decline in the acceptance of bitcoin and, consequently, a reduction in the value of bitcoin, bitcoin futures, and the Fund.

The Bitcoin blockchain faces significant challenges from competing public blockchains designed as alternative payment systems, many of which offer greater privacy, faster transaction processing, and lower fees. Additionally, the Bitcoin network has inherent drawbacks, such as slow transaction processing, variable transaction fees, and high price volatility, which may hinder its adoption as a payment method. These factors could reduce the demand for Bitcoin, negatively affecting its value and the performance of the Fund’s investments in bitcoin and related assets.

The continued development and widespread use of the Bitcoin blockchain as a payment network increasingly relies on “Layer 2” solutions like the Lightning Network, which are designed to improve scalability, speed, and efficiency. However, these solutions pose risks, including challenges in widespread adoption, potential security vulnerabilities, increased complexity, and the possibility of centralization. Any issues with these Layer 2 networks could negatively impact the Bitcoin blockchain’s scalability and effectiveness, potentially affecting its value and the performance of the Fund’s investments in bitcoin and related assets.

Additionally, the Bitcoin protocol, maintained by a decentralized group of developers, is open-source, which allows for continuous review but also means it may contain undiscovered vulnerabilities. If attackers exploit these flaws, it could disrupt the Bitcoin network, compromise transaction security, and create instability, potentially undermining trust in the network and negatively impacting the value of bitcoin and the Fund’s investments in bitcoin. Similarly, if one or a coordinated group of miners were to gain control of 51% of the Bitcoin Network or the concentration of a majority of bitcoin in one ore a few holders (i.e., “whales”) could manipulate transactions, halt payments and fraudulently obtain bitcoin.

Finally, bitcoin and bitcoin Futures are also exposed to the instability of other speculative parts of the crypto assets industry. Events such as the collapse of TerraUSD in May 2022 and FTX Trading Ltd. in November 2022, while not directly related to the security or utility of the Bitcoin blockchain, can nonetheless trigger significant declines in the price of bitcoin or bitcoin Futures.

Ether Risk – Ether is a relatively new innovation, and the ether market is subject to rapid price swings, changes and uncertainty and is a largely unregulated marketplace, which may be attributable to a possible lack of regulatory compliance. The value of ether has been and may continue to be, substantially dependent on speculation, such that trading and investing ether generally may not be based on fundamental analysis. The further development of the Ethereum Network and the acceptance and use of ether are subject to various factors that are difficult to evaluate. The slowing, stopping, or reversing of the development of the Ethereum Network or the acceptance of ether may adversely affect the price of ether. Ether is subject to the risk of fraud, theft, manipulation or security failures, operational, or other problems that impact ether trading venues. Unlike the exchanges for more traditional assets, such as equity securities and futures contracts, ether and ether trading platforms are largely unregulated. As a result of the lack of regulation, individuals or groups may engage in fraud or market manipulation, and investors may be more exposed to the risk of theft, fraud, and market manipulation than when investing in more traditional asset classes. Legal or regulatory changes may negatively impact the operation of the Ethereum Network or restrict the use of ether. Realizing any of these risks could result in a decline in the acceptance of ether and, consequently, a reduction in the value of ether, ether futures, and the Fund.

Investors should also know that the Ethereum blockchain faces increased vulnerability to attacks if ownership or staking of ether becomes concentrated in one participant. Like the Bitcoin blockchain, the Ethereum blockchain may be at risk of attacks if there is a high concentration of ether ownership or staking. If an entity controls 33% or more of staked ether, it could execute attacks, with greater risks, including transaction censorship and block reordering, occurring if more than 50% is controlled. Such attacks could negatively impact ether futures and, in turn, the value of the Fund’s investments. The risk of such attacks increases as the concentration of staked ether grows. Whales could manipulate transactions, halt payments, and fraudulently obtain ether.

Although the price movements of ether and bitcoin have generally been correlated, with both assets experiencing similar trends, ether has historically been more volatile. This means that it tends to rise more than bitcoin during market upswings and fall more sharply during downturns. The differences in the design and use cases of the bitcoin and Ethereum blockchains contribute to these distinct risk profiles. Bitcoin is more established as a store of value and crypto assets, while ether’s value is closely tied to its broader use in powering decentralized applications and smart contracts.

Investors should be aware that these differences in the characteristics and design of bitcoin and ether present different risks. While both are subject to the volatility and uncertainty of the crypto assets markets, the factors driving the performance of each asset may differ significantly, leading to varied investment outcomes.

Legal or regulatory changes could negatively impact the Ethereum Network or restrict the use of ether. Although the Commodity Futures Trading Commission (“CFTC”) currently classifies ether as a commodity, a future determination by a court or regulator that ether is a security could lead to the halting of ether trading on certain platforms, increased volatility in ether futures, and a significant decline in the Fund’s value, potentially to zero. Such a determination could also affect the Fund’s investment strategy, including its use of the Subsidiary.

Finally, ether and ether Futures are also exposed to the instability of other speculative parts of the crypto industry, such as the collapse of TerraUSD in May 2022 and FTX Trading Ltd. In November 2022, which may not be necessarily related to the security or utility of the Ethereum blockchain but can nonetheless precipitate a significant decline in the price of ether or ether Futures.

Digital Asset Trading Platform Risk – Bitcoin, the Bitcoin Network, ether, the Ethereum Network, and Digital Asset trading venues are relatively new and, in most cases, largely unregulated. As a result of this lack of regulation, individuals, or groups may engage in insider trading, fraud, or market manipulation with respect to Digital Assets. Such manipulation could cause investors in Digital Assets to lose money, possibly the entire value of their investments. Additionally, some Digital Asset trading platforms may not comply with applicable law, and such non-compliance may cause such platforms to close operations in certain jurisdictions or be subject to regulatory investigations.

Digital Asset trading platforms, where bitcoin and ether are traded, are not regulated as exchanges under federal securities laws and may lack consistent regulatory oversight. As a result, these platforms are more susceptible to fraud, manipulation, and operational issues. Additionally, these crypto trading platforms are or may become subject to enforcement actions by regulatory authorities, which could impact their operations, liquidity, and the overall stability of the markets for these digital assets. Such enforcement actions may result in restrictions, fines, or other penalties that could adversely affect the trading of crypto assets, leading to increased volatility and potential losses for investors.

Over the past several years, some digital asset trading venues have been closed due to fraud, failure, or security breaches. The nature of the assets held at digital asset trading venues makes them appealing targets for hackers, and several digital asset trading venues have been victims of cybercrimes and other fraudulent activities. These activities have caused significant, in some cases total, losses for Digital Asset investors. Investors in Digital Assets may have little or no recourse should such theft, fraud, or manipulation occur. No central registry shows which individuals or entities own Digital Assets or the quantity of Digital Assets owned by any particular person or entity. No regulations in place would prevent a large holder of Digital Assets or a group of holders from selling their Digital Assets, which could depress the price of Digital Assets, or otherwise attempt to manipulate the price of Digital Assets. Events that reduce user confidence in Digital Assets and the fairness of digital asset trading venues could harm the price of Digital Assets and the value of an investment in the Fund.

If the crypto asset trading venues, which may serve as a pricing source for the calculation of the BBR or ETHUSD_RR that is used to value the Fund’s investments, become subject to onerous regulations or are subject to enforcement actions by regulatory authorities (including the Financial Crimes Enforcement Network (“FinCEN”), the U.S. Securities and Exchange Commission (“SEC”), CFTC, Financial Industry Regulatory Authority, Inc. (“FINRA”), the Consumer Financial Protection Bureau, the Department of Justice, the Department of Homeland Security, the Federal Bureau of Investigation, the Internal Revenue Service (“IRS”), the Office of the Comptroller of the Currency, the Federal Deposit Insurance Corporation, the Federal Reserve and state financial institution regulators), among other things, trading in bitcoin and ether may be concentrated in a smaller number of trading venues, which may materially impact the price, volatility, and trading volumes of bitcoin and ether. Additionally, the trading venues may be required to comply with tax, anti-money laundering, know-your-customer, and other regulatory requirements, compliance, and reporting obligations that may make it more costly to transact in or trade bitcoin and ether (which may materially impact price, volatility, or trading of bitcoin and ether more generally). Each of these events could harm bitcoin and ether Futures and the value of an investment in the Fund.

Digital Asset trading is fragmented across numerous crypto trading platforms, many of which are not regulated as exchanges under federal securities laws. This fragmentation can lead to higher volatility and price discrepancies across different platforms, increasing the likelihood of price differences and market manipulation. The lack of centralized oversight and regulation also heightens the risk of fraud and manipulation, as these platforms may not adhere to consistent standards for security, transparency, or market integrity. Market participants trading digital assets may seek to hedge or manage their exposure by taking offsetting positions in Digital Assets on these platforms. However, the fragmented nature of the market may require participants to analyze multiple prices, which may be inconsistent, quickly changing, and potentially subject to manipulation. This fragmentation also may require participants to fill their positions through multiple transactions on different platforms, increasing the cost, uncertainty, and risk of trading. These factors may reduce the effectiveness of using Digital Asset transactions to manage or offset positions in Digital Assets. Market participants who cannot fully or effectively hedge their positions in Digital Asset may widen bid-ask spreads on such contracts, potentially decreasing the trading volume and liquidity of these contracts and negatively impacting their price.

Digital Asset-Related Operating Company Risk – The Fund may invest in Digital Asset-related companies, which are companies that derive a significant portion of their revenue or hold substantial assets related to Digital Assets such as bitcoin, ether, or blockchain technology. However, the extent to which these companies have economic exposure to bitcoin, ether, or other Digital Assets may vary significantly. Some companies may derive a substantial portion of their revenue or assets from Digital Asset-related activities, while others may have limited exposure to these markets. This variability can affect the Fund’s exposure to Digital Assets and may influence its performance based on these companies’ underlying activities.

Investing in Digital Asset-related companies involves several risks, including variability in the economic exposure to bitcoin, ether, or other Digital Assets, non-blockchain or crypto-related activities, and operational and regulatory risks.

| ● | Companies with greater exposure to Digital Assets will be more directly affected by the volatility and regulatory risks associated with the Digital Asset markets. Conversely, companies with limited exposure may not benefit as much from positive developments in the Digital Asset space, potentially reducing the Fund’s overall exposure to the growth of these assets. |

| ● | Many Digital Asset-related companies may also engage in non-blockchain or non-crypto-related activities, which could introduce additional risks and uncertainties that are not directly related to Digital Assets. For example, a company that operates a crypto trading platform may also be involved in unrelated business ventures, such as traditional financial services or technology development. These non-crypto activities could negatively impact the company’s overall performance and, by extension, the performance of the Fund. Moreover, adverse developments in these other business areas could detract from the company’s focus on its Digital Asset-related operations, further affecting its financial results. |

| ● | Companies involved in the Digital Asset ecosystem may face operational challenges like technological issues, cybersecurity threats, and regulatory scrutiny. These risks can be amplified by the company’s involvement in Digital Assets, where the regulatory environment is still evolving, and the technology is complex and rapidly changing. Additionally, companies that diversify their operations across blockchain-related and traditional sectors may face difficulties managing these diverse business activities, adversely affecting their overall operational effectiveness. |

| ● | Many Digital Asset-related companies may operate in a rapidly evolving and uncertain regulatory environment, which could result in non-compliance with existing regulations and potential enforcement actions by regulatory authorities. Such actions, including fines, penalties, or business restrictions, could significantly impact these companies’ operations and, in turn, negatively affect the Fund’s performance. |

The IDX Adaptive Opportunities Fund (the “Fund” or “Adaptive Fund”) seeks total return, which includes long-term capital appreciation. There can be no assurance that the Fund will achieve its investment objective.

This table describes the fees and expenses that you may pay if you buy, hold, and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below.

Shareholder Fees |

IDX Adaptive Opportunities Fund

IDX Adaptive Opportunities Fund - Institutional Class Shares

USD ($)

|

|---|---|

| Shareholder Fees (fees paid directly from your investment) | none |

Annual Fund Operating Expenses |

IDX Adaptive Opportunities Fund

IDX Adaptive Opportunities Fund - Institutional Class Shares

|

|

|---|---|---|

| Management Fees | 1.49% | |

| Distribution and Service (12b-1) Fees | none | |

| Shareholder Services Fees | 0.15% | |

| Other Expenses | 0.95% | |

| Acquired Fund Fees and Expenses | 0.12% | [1] |

| Total Annual Fund Operating Expenses | 2.71% | |

| Fee Waivers and Expense Reimbursement | (0.65%) | [2] |

| Total Annual Fund Operating Expenses After Waivers and/or Expense Reimbursements | 2.06% | |

| [1] | Acquired fund fees and expenses are indirect costs of investing in other investment companies. |

| [2] | IDX Advisors, LLC (the “Adviser”) has entered into an Expense Limitation Agreement with the Fund under which it has agreed to waive or reduce its fees and to assume other expenses of the Fund, if necessary, in an amount that limits the Fund’s annual operating expenses (exclusive of interest, borrowing expenses, Shareholder service fees pursuant to a shareholder service plan, taxes, acquired fund fees and expenses, brokerage fees and commissions, dividend expenses on short sales, litigation expenses, and other expenditures which are capitalized in accordance with GAAP and other extraordinary expenses not incurred in the ordinary course of the Funds’ business) to not more than 1.79% through at least April 30, 2026. Subject to approval by the Fund’s Board of Trustees, any waiver under the Expense Limitation Agreement is subject to repayment by the Fund for three years after such fee waiver or expense reimbursements were incurred, if the Fund can make the repayment without exceeding the expense limitation in place at the time of the waiver or reimbursement and at the time of recoupment. The current contractual agreement cannot be terminated for at least one year after the effective date without the Board of Trustees’ approval. |

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in the Fund for the periods indicated and then redeem all your shares at the end of those periods. The expense example also assumes that your investment has a 5% return each year and the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions, your cost would be:

Expense Example |

Expense Example, with Redemption, 1 Year |

Expense Example, with Redemption, 3 Years |

Expense Example, with Redemption, 5 Years |

Expense Example, with Redemption, 10 Years |

|---|---|---|---|---|

| IDX Adaptive Opportunities Fund | IDX Adaptive Opportunities Fund - Institutional Class Shares | USD ($) | 209 | 780 | 1,377 | 2,994 |

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 290.55% of the average value of its portfolio.

The Fund pursues its investment objective by investing globally across a wide range of asset classes, including commodities, equities, fixed income, digital assets, and currencies, and may take both long and short positions in each asset class or Instrument (as defined below). While the Fund expects to invest about 30% to 50% in long and short positions of commodity-related companies, as defined below, its tactical allocation will include investments in other sectors. The Fund can invest in U.S. and foreign companies of any size, including issuers from emerging markets.

The Fund is actively managed and has flexibility to over- or underweight sectors, at the Adviser’s discretion. There is no stated limit on the percentage of assets the Fund can invest in any one sector, and at times the Fund may focus on a small number of sectors.

The Fund does not invest in commodities directly, rather, it invests in the equity and fixed-income securities of commodity-related companies whose operations relate to commodities, natural resources, energy, real estate, or other “hard assets,” and companies that provide services or have exposure to such businesses, and commodity-related derivatives and Instruments. The Fund can shift its allocation across asset classes and markets worldwide by assessing their relative attractiveness, as determined by IDX Advisors, LLC (the “Adviser”). This means the Fund may concentrate its investments in any one asset class or geographic region, subject to any limitations imposed by the federal securities and tax laws, including the 1940 Act.

Digital assets include indirect (e.g., futures or operating companies) exposure to bitcoin, ether, or other digital assets (collectively, “Digital Assets”). The Fund defines “other digital assets” as cryptocurrencies and blockchain-based or decentralized assets that are traded on a digital exchange. These assets include, but are not limited to, digital currencies such as bitcoin and ethereum, as well as other tokens and digital representations of value created, stored, and exchanged on blockchain networks. These assets are characterized by their decentralized nature, meaning any single entity does not control them, and their transactions are recorded on a distributed ledger technology known as blockchain. The Fund does not directly invest in bitcoin, ether, or other digital assets or in any digital assets traded OTC, such as pooled investment vehicles or other OTC trusts.

Portfolio Construction

The Adviser uses a bottom-up analysis process that considers quantitative and qualitative investment factors, including price and volume data (e.g., momentum and/or mean-reversion), macroeconomic data, fundamental valuation, term structure (e.g., carry), and other factors. The statutory prospectus describes each of these factors in more detail.

The Adviser uses a proprietary, systematic, and quantitative investment process that seeks to benefit from price trends in commodity, currency, equity, volatility, and fixed-income Instruments. As part of this process, the Fund will take either a long or short position in each Instrument. The owner of a long position in an Instrument will benefit from an increase in the underlying instrument’s price. The owner of a short position in an Instrument will benefit from a decrease in the underlying instrument’s price. The Adviser will generally seek to allocate among instruments and asset classes to enhance the risk-adjusted return relative to a long-only allocation. The Adviser expects this approach will reduce volatility and drawdowns while capturing the majority of the upside of the underlying markets.

The Fund will invest across sectors. In allocating assets among sectors, the Adviser will largely employ a trend-following approach that seeks to balance the allocation of risk (as measured by proprietary and established risk measures such as annualized standard deviation) over time. The Adviser uses its proprietary quantitative model to statistically gauge the strength of price trends. The model uses publicly available daily price information to evaluate momentum measures and determine appropriate allocations. The Adviser will also use its models to manage the allocation of investments across sectors based on the Adviser’s assessment of a sector’s risk and prevailing market conditions. Shifts in allocations among sectors will be determined following various quantitative signals based upon the Adviser’s research, that rely on the evaluation of technical and fundamental indicators, such as trends in historical prices, spreads between futures’ prices of differing expiration dates, supply/demand data, momentum, and macroeconomic data of commodity consuming countries.

During stressed or abnormal market conditions, including periods when the Adviser believes it is prudent to take a temporary defensive position, the Fund will reduce its exposure to certain asset classes significantly, including eliminating the asset class from the portfolio. The Fund defines stressed or abnormal market conditions as a significant drop in the price of the underlying assets over a short trading period. The targeted risk at any given time can vary based on several factors, including the Adviser’s systematic tactical views. The desired overall risk level of the Fund may be increased or decreased by the Adviser, subject to the Adviser’s risk controls which may result in the Adviser’s targeted risk level not being achieved in certain circumstances.

Derivatives and Instruments

In seeking to achieve its investment objective, the Fund will enter into both long and short positions using derivative instruments such as futures, forwards, options, and swaps, including equity index futures, swaps on equity index futures, equity swaps, and options on equity indices, fixed income futures, bond and interest rate futures, and credit default index swaps (collectively, “Derivatives”).

The Fund may also invest in fixed-income securities, including U.S. Government securities, U.S. Government agency securities (including inflation-linked bonds, such as Treasury Inflation-Protected Securities (“TIPS”)), short-term fixed-income securities, overnight or fixed-term repurchase agreements, money market fund shares corporate bonds, exchange-traded funds (“ETFs”) and exchange-traded notes (“ETNs”), foreign government bonds, and repurchase (“repo”) and reverse repo agreements. (collectively with Derivatives, the “Instruments”). Leverage may be created when the Fund enters into reverse repo agreements, as noted in the Principal Risks below. The Fund will primarily invest in Derivatives for investment purposes, although it may do so for tax purposes.

The Fund may invest in Instruments listed on U.S. or non-U.S. exchanges, some of which could be denominated in currencies other than the U.S. dollar. Although the Fund is not required to hedge against currency value changes, it expects to hedge its non-U.S. currency exposure. The Fund may invest in or have exposure to issuers of any size. The Fund may invest in or have exposure to U.S. or non-U.S. issuers. The Fund will either invest directly in the Instruments or indirectly by investing in the Subsidiary (as described below) that invests in the Instruments.

The Fund’s use of Derivatives will have the economic effect of financial leverage. Leverage will magnify exposure to the price movements of an asset class underlying a Derivative, which will result in increased volatility. This means the Fund will have the potential for greater gains, as well as the potential for greater losses, than if the Fund did not use Derivatives that have a leveraging effect. While the Fund normally does not engage in any direct borrowing, leverage is implicit in the futures and other derivatives it trades. There is no assurance that the Fund’s use of Derivatives providing enhanced exposure will enable it to achieve its investment objective.

The Fund intends to make investments through a wholly-owned and controlled subsidiary of the Fund (the “Adaptive Subsidiary”), and may invest up to 25% of its total assets in the Adaptive Subsidiary, which is organized under the laws of the Cayman Islands as an exempted company. Generally, the Adaptive Subsidiary will invest primarily in Derivatives and other investments intended to serve as margin or collateral for the Adaptive Subsidiary’s Derivative positions. The Fund will invest in the Adaptive Subsidiary to gain exposure to the commodities, digital assets, and derivatives markets within the limitations of the federal tax laws, rules, and regulations that apply to registered investment companies. Unlike the Fund, the Adaptive Subsidiary may invest without limitation in derivatives; however, the Adaptive Subsidiary will comply with the same 1940 Act asset coverage requirements for its investments in derivatives that apply to the Fund’s transactions in derivatives. In addition, the Fund and the Adaptive Subsidiary will be subject to the same fundamental investment restrictions on a consolidated basis, and to the extent applicable to the investment activities of the Adaptive Subsidiary, it will follow the same compliance policies and procedures as the Fund. Unlike the Fund, the Adaptive Subsidiary will not seek to qualify as a RIC under Subchapter M of the Internal Revenue Code (the “Code”). The Fund is the sole shareholder of the Adaptive Subsidiary and does not expect shares of it to be offered or sold to other investors.

Commodity Investments

The Fund (including its Subsidiary) pursues its investment objective by allocating assets among various commodity sectors (including agricultural, energy, livestock, softs (e.g., non-grain agricultural products such as coffee, sugar, cocoa, etc.), and precious and base metals). The Fund will obtain exposure to commodity sectors by investing in commodity-linked Derivatives, directly or through the Adaptive Subsidiary, not through direct investments in physical commodities. The Fund may also invest in ETFs, ETPs, ETNs, and commodity pools that provide exposure to such sectors. The Fund will limit its investments in other pooled investment vehicles so that no single pool represents more than 25% of the Fund’s total assets to satisfy asset diversification requirements under the Code.

Equity Investments

The Fund may invest directly or indirectly in equity securities of issuers in any sector, including the commodity, financial, and technology sectors. While the Fund can hold equity securities such as common stocks, preferred stocks, convertible securities, warrants, depositary receipts, and other instruments whose price is linked to the value of common stock, the Fund will gain most of its equity exposure through ETFs.

For commodities, the Fund will invest in commodity-related companies whose operations relate to commodities, natural resources, energy, real estate, or other “hard assets,” and companies that provide services or have exposure to such businesses. These companies include companies engaged in the exploration, ownership, production, refinement, processing, transportation, distribution, or marketing of commodities and use them extensively in their products and companies that provide technology and services to commodity-related companies. This includes companies that are engaged in businesses such as integrated oil, oil, and gas exploration and production, energy services and technology, chemicals and oil products, coal, and other consumable fuels, gold and precious metals, metals and minerals, forest products, agricultural chemicals and services, farmland, alternative energy sources, environmental services, and agricultural products (including crop growers, owners of plantations, and companies that produce and process foods), as well as related transportation companies, equipment manufacturers, service providers and engineering, procurement and construction. companies.

Fixed Income Investments

A significant portion of the assets of the Fund may be invested directly or indirectly in investment-grade fixed-income securities, cash, and cash equivalents with one year or less term to maturity and an average portfolio duration of one year or less. The Fund defines “investment grade” as fixed-income securities being rated no lower than the A category by Standard & Poor’s Ratings Group, Moody’s Investors Service, or Fitch Ratings, Inc. The fixed income portion of the Fund is intended to provide liquidity, preserve capital, and serve as margin or collateral for the Fund’s or Subsidiary’s derivative positions. These cash or cash equivalent holdings also serve as collateral for the positions the Fund takes and earn income for the Fund. The Adviser seeks to develop an appropriate fixed-income portfolio by considering the differences in yields among securities of different maturities, market sectors, and issuers.

Additional Portfolio Information

The Fund generally does not intend to close out, sell, or redeem its Instruments except (i) to meet redemptions or (ii) when an Instrument is nearing expiration, at which point the Fund will generally sell it and use the proceeds to buy another Instrument with a later expiration date to maintain its commodities exposure. This is commonly referred to as “rolling.”

The Fund’s strategy involves frequent portfolio trading, which may result in a higher portfolio turnover rate than a fund with less frequent trading and correspondingly greater transactional expenses. These expenses are borne by the Fund and its shareholders and may have adverse tax consequences on them. The Adviser considers the transaction costs associated with trading each Instrument and takes this into consideration when determining the appropriate frequency for trading. The Fund also employs sophisticated proprietary trading techniques to mitigate trading costs and the execution impact on the Fund.

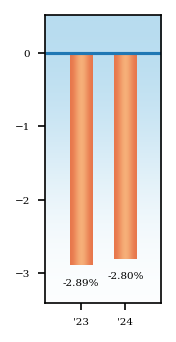

The bar chart and table below indicate the risks of investing in the Fund by showing changes in the Fund’s performance and comparing that performance to a broad-based securities market index. On April 30, 2025, the Fund expanded its investment strategy to include principal investments in ether, ether Futures, and other Digital Assets, including Digital Asset-related operating companies. Before this change, the Fund’s investment strategy focused on bitcoin and bitcoin Futures. The Fund’s past performance, before and after taxes, does not necessarily indicate how the Fund will perform in the future. Updated performance information will be available at no cost by calling 216-329-4271 or by visiting its website at www.idx-funds.com.

| Best Quarter: | 3.80% | st Quarter 2024 |

| Worst Quarter: | (5.19)% | nd Quarter 2024 |

Average Annual Total Returns - IDX Adaptive Opportunities Fund |

1 Year |

Since Inception |

Inception Date |

|---|---|---|---|

| IDX Adaptive Opportunities Fund - Institutional Class Shares | (2.80%) | (2.83%) | Nov. 01, 2022 |

| IDX Adaptive Opportunities Fund - Institutional Class Shares | After Taxes on Distributions | (2.80%) | (2.83%) | Nov. 01, 2022 |

| IDX Adaptive Opportunities Fund - Institutional Class Shares | After Taxes on Distributions and Sales | (2.80%) | (2.83%) | Nov. 01, 2022 |

| Bloomberg Global-Aggregate Total Return Index | (1.69%) | 4.25% | Nov. 01, 2022 |

| ICE BofA SOFR Overnight Rate Index | 5.40% | 5.34% | Nov. 01, 2022 |

| SGA CTA Index | 2.36% | (2.75%) | Nov. 01, 2022 |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the effect of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and after-tax returns shown are not relevant to investors who hold shares of the Fund through tax-deferred arrangements, such as 401(k) plans or IRAs.

Bitcoin Risk – Bitcoin is a relatively new financial innovation, and the market for bitcoin is subject to rapid price swings, changes, and uncertainty. The value of bitcoin has been and may continue to be, substantially dependent on speculation, such that trading and investing bitcoin generally may not be based on fundamental analysis. The further development of the Bitcoin Network and the acceptance and use of bitcoin are subject to various factors that are difficult to evaluate. The slowing, stopping, or reversing of the development of the Bitcoin Network or the acceptance of bitcoin may adversely affect the price of bitcoin. Bitcoin is subject to the risk of fraud, theft, manipulation, security failures, operational, or other problems that impact bitcoin trading venues. Unlike the exchanges for more traditional assets, such as equity securities and futures contracts, bitcoin and bitcoin trading platforms are largely unregulated. As a result of the lack of regulation, individuals or groups may engage in fraud or market manipulation, and investors may be more exposed to the risk of theft, fraud, and market manipulation than when investing in more traditional asset classes. Legal or regulatory changes may negatively impact the operation of the Bitcoin Network or restrict the use of bitcoin. Realizing any of these risks could result in a decline in the acceptance of bitcoin and, consequently, a reduction in the value of bitcoin, bitcoin futures, and the Fund.

The Bitcoin blockchain faces significant challenges from competing public blockchains designed as alternative payment systems, many of which offer greater privacy, faster transaction processing, and lower fees. Additionally, the Bitcoin network has inherent drawbacks, such as slow transaction processing, variable transaction fees, and high price volatility, which may hinder its adoption as a payment method. These factors could reduce the demand for Bitcoin, negatively affecting its value and the performance of the Fund’s investments in bitcoin and related assets.

The continued development and widespread use of the Bitcoin blockchain as a payment network increasingly relies on “Layer 2” solutions like the Lightning Network, which are designed to improve scalability, speed, and efficiency. However, these solutions pose risks, including challenges in widespread adoption, potential security vulnerabilities, increased complexity, and the possibility of centralization. Any issues with these Layer 2 networks could negatively impact the Bitcoin blockchain’s scalability and effectiveness, potentially affecting its value and the performance of the Fund’s investments in bitcoin and related assets.

Additionally, the Bitcoin protocol, maintained by a decentralized group of developers, is open-source, which allows for continuous review but also means it may contain undiscovered vulnerabilities. If attackers exploit these flaws, it could disrupt the Bitcoin network, compromise transaction security, and create instability, potentially undermining trust in the network and negatively impacting the value of bitcoin and the Fund’s investments in bitcoin. Similarly, if one or a coordinated group of miners were to gain control of 51% of the Bitcoin Network or the concentration of a majority of bitcoin in one ore a few holders (i.e., “whales”) could manipulate transactions, halt payments and fraudulently obtain bitcoin.

Finally, bitcoin and bitcoin Futures are also exposed to the instability of other speculative parts of the crypto assets industry. Events such as the collapse of TerraUSD in May 2022 and FTX Trading Ltd. in November 2022, while not directly related to the security or utility of the Bitcoin blockchain, can nonetheless trigger significant declines in the price of bitcoin or bitcoin Futures.

Ether Risk – Ether is a relatively new innovation, and the ether market is subject to rapid price swings, changes and uncertainty and is a largely unregulated marketplace, which may be attributable to a possible lack of regulatory compliance. The value of ether has been and may continue to be, substantially dependent on speculation, such that trading and investing ether generally may not be based on fundamental analysis. The further development of the Ethereum Network and the acceptance and use of ether are subject to various factors that are difficult to evaluate. The slowing, stopping, or reversing of the development of the Ethereum Network or the acceptance of ether may adversely affect the price of ether. Ether is subject to the risk of fraud, theft, manipulation or security failures, operational, or other problems that impact ether trading venues. Unlike the exchanges for more traditional assets, such as equity securities and futures contracts, ether and ether trading platforms are largely unregulated. As a result of the lack of regulation, individuals or groups may engage in fraud or market manipulation, and investors may be more exposed to the risk of theft, fraud, and market manipulation than when investing in more traditional asset classes. Legal or regulatory changes may negatively impact the operation of the Ethereum Network or restrict the use of ether. Realizing any of these risks could result in a decline in the acceptance of ether and, consequently, a reduction in the value of ether, ether futures, and the Fund.

Investors should also know that the Ethereum blockchain faces increased vulnerability to attacks if ownership or staking of ether becomes concentrated in one participant. Like the Bitcoin blockchain, the Ethereum blockchain may be at risk of attacks if there is a high concentration of ether ownership or staking. If an entity controls 33% or more of staked ether, it could execute attacks, with greater risks, including transaction censorship and block reordering, occurring if more than 50% is controlled. Such attacks could negatively impact ether futures and, in turn, the value of the Fund’s investments. The risk of such attacks increases as the concentration of staked ether grows. Whales could manipulate transactions, halt payments, and fraudulently obtain ether.

Although the price movements of ether and bitcoin have generally been correlated, with both assets experiencing similar trends, ether has historically been more volatile. This means that it tends to rise more than bitcoin during market upswings and fall more sharply during downturns. The differences in the design and use cases of the bitcoin and Ethereum blockchains contribute to these distinct risk profiles. Bitcoin is more established as a store of value and crypto assets, while ether’s value is closely tied to its broader use in powering decentralized applications and smart contracts.

Investors should be aware that these differences in the characteristics and design of bitcoin and ether present different risks. While both are subject to the volatility and uncertainty of the crypto assets markets, the factors driving the performance of each asset may differ significantly, leading to varied investment outcomes.

Legal or regulatory changes could negatively impact the Ethereum Network or restrict the use of ether. Although the Commodity Futures Trading Commission (“CFTC”) currently classifies ether as a commodity, a future determination by a court or regulator that ether is a security could lead to the halting of ether trading on certain platforms, increased volatility in ether futures, and a significant decline in the Fund’s value, potentially to zero. Such a determination could also affect the Fund’s investment strategy, including its use of the Subsidiary.

Finally, ether and ether Futures are also exposed to the instability of other speculative parts of the crypto industry, such as the collapse of TerraUSD in May 2022 and FTX Trading Ltd. In November 2022, which may not be necessarily related to the security or utility of the Ethereum blockchain but can nonetheless precipitate a significant decline in the price of ether or ether Futures.

Blockchain Forks Risk – A blockchain fork occurs when protocol changes create two separate, incompatible versions, each with its own digital assets. This can lead to market disruption, price volatility, and competition between the resulting blockchains. Forks have occurred in both the Bitcoin and Ethereum Networks, creating new assets like Bitcoin Cash and Ethereum Classic. These events can negatively impact the value and liquidity of the original assets and their related futures, posing significant risks to investors.

Digital Asset Trading Platform Risk – Bitcoin, the Bitcoin Network, ether, the Ethereum Network, and Digital Asset trading venues are relatively new and, in most cases, largely unregulated. As a result of this lack of regulation, individuals, or groups may engage in insider trading, fraud, or market manipulation with respect to Digital Assets. Such manipulation could cause investors in Digital Assets to lose money, possibly the entire value of their investments. Additionally, some Digital Asset trading platforms may not comply with applicable law, and such non-compliance may cause such platforms to close operations in certain jurisdictions or be subject to regulatory investigations.

Digital Asset trading platforms, where bitcoin and ether are traded, are not regulated as exchanges under federal securities laws and may lack consistent regulatory oversight. As a result, these platforms are more susceptible to fraud, manipulation, and operational issues. Additionally, these crypto trading platforms are or may become subject to enforcement actions by regulatory authorities, which could impact their operations, liquidity, and the overall stability of the markets for these digital assets. Such enforcement actions may result in restrictions, fines, or other penalties that could adversely affect the trading of crypto assets, leading to increased volatility and potential losses for investors.

Over the past several years, some digital asset trading venues have been closed due to fraud, failure, or security breaches. The nature of the assets held at digital asset trading venues makes them appealing targets for hackers, and several digital asset trading venues have been victims of cybercrimes and other fraudulent activities. These activities have caused significant, in some cases total, losses for Digital Asset investors. Investors in Digital Assets may have little or no recourse should such theft, fraud, or manipulation occur. No central registry shows which individuals or entities own Digital Assets or the quantity of Digital Assets owned by any particular person or entity. No regulations in place would prevent a large holder of Digital Assets or a group of holders from selling their Digital Assets, which could depress the price of Digital Assets, or otherwise attempt to manipulate the price of Digital Assets. Events that reduce user confidence in Digital Assets and the fairness of digital asset trading venues could harm the price of Digital Assets and the value of an investment in the Fund.

If the crypto asset trading venues, which may serve as a pricing source for the calculation of the BBR or ETHUSD_RR that is used to value the Fund’s investments, become subject to onerous regulations or are subject to enforcement actions by regulatory authorities (including the Financial Crimes Enforcement Network (“FinCEN”), the U.S. Securities and Exchange Commission (“SEC”), CFTC, Financial Industry Regulatory Authority, Inc. (“FINRA”), the Consumer Financial Protection Bureau, the Department of Justice, the Department of Homeland Security, the Federal Bureau of Investigation, the Internal Revenue Service (“IRS”), the Office of the Comptroller of the Currency, the Federal Deposit Insurance Corporation, the Federal Reserve and state financial institution regulators), among other things, trading in bitcoin and ether may be concentrated in a smaller number of trading venues, which may materially impact the price, volatility, and trading volumes of bitcoin and ether. Additionally, the trading venues may be required to comply with tax, anti-money laundering, know-your-customer, and other regulatory requirements, compliance, and reporting obligations that may make it more costly to transact in or trade bitcoin and ether (which may materially impact price, volatility, or trading of bitcoin and ether more generally). Each of these events could harm bitcoin and ether Futures and the value of an investment in the Fund.

Digital Asset trading is fragmented across numerous crypto trading platforms, many of which are not regulated as exchanges under federal securities laws. This fragmentation can lead to higher volatility and price discrepancies across different platforms, increasing the likelihood of price differences and market manipulation. The lack of centralized oversight and regulation also heightens the risk of fraud and manipulation, as these platforms may not adhere to consistent standards for security, transparency, or market integrity. Market participants trading digital assets may seek to hedge or manage their exposure by taking offsetting positions in Digital Assets on these platforms. However, the fragmented nature of the market may require participants to analyze multiple prices, which may be inconsistent, quickly changing, and potentially subject to manipulation. This fragmentation also may require participants to fill their positions through multiple transactions on different platforms, increasing the cost, uncertainty, and risk of trading. These factors may reduce the effectiveness of using Digital Asset transactions to manage or offset positions in Digital Assets. Market participants who cannot fully or effectively hedge their positions in Digital Asset may widen bid-ask spreads on such contracts, potentially decreasing the trading volume and liquidity of these contracts and negatively impacting their price.

Digital Asset-Related Operating Company Risk – The Fund may invest in Digital Asset-related companies, which are companies that derive a significant portion of their revenue or hold substantial assets related to Digital Assets such as bitcoin, ether, or blockchain technology. However, the extent to which these companies have economic exposure to bitcoin, ether, or other Digital Assets may vary significantly. Some companies may derive a substantial portion of their revenue or assets from Digital Asset-related activities, while others may have limited exposure to these markets. This variability can affect the Fund’s exposure to Digital Assets and may influence its performance based on these companies’ underlying activities.

Investing in Digital Asset-related companies involves several risks, including variability in the economic exposure to bitcoin, ether, or other Digital Assets, non-blockchain or crypto-related activities, and operational and regulatory risks.

| ● | Companies with greater exposure to Digital Assets will be more directly affected by the volatility and regulatory risks associated with the Digital Asset markets. Conversely, companies with limited exposure may not benefit as much from positive developments in the Digital Asset space, potentially reducing the Fund’s overall exposure to the growth of these assets. |

| ● | Many Digital Asset-related companies may also engage in non-blockchain or non-crypto-related activities, which could introduce additional risks and uncertainties that are not directly related to Digital Assets. For example, a company that operates a crypto trading platform may also be involved in unrelated business ventures, such as traditional financial services or technology development. These non-crypto activities could negatively impact the company’s overall performance and, by extension, the performance of the Fund. Moreover, adverse developments in these other business areas could detract from the company’s focus on its Digital Asset-related operations, further affecting its financial results. |

| ● | Companies involved in the Digital Asset ecosystem may face operational challenges like technological issues, cybersecurity threats, and regulatory scrutiny. These risks can be amplified by the company’s involvement in Digital Assets, where the regulatory environment is still evolving, and the technology is complex and rapidly changing. Additionally, companies that diversify their operations across blockchain-related and traditional sectors may face difficulties managing these diverse business activities, adversely affecting their overall operational effectiveness. |

| ● | Many Digital Asset-related companies may operate in a rapidly evolving and uncertain regulatory environment, which could result in non-compliance with existing regulations and potential enforcement actions by regulatory authorities. Such actions, including fines, penalties, or business restrictions, could significantly impact these companies’ operations and, in turn, negatively affect the Fund’s performance. |