| 1. | Company’s Operations |

BRF S.A. (“BRF”), and its subsidiaries (collectively the “Company”) is a publicly traded company, listed on the segment Novo Mercado of Brasil, Bolsa, Balcão (“B3”), under the ticker BRFS3, and listed on the New York Stock Exchange (“NYSE”), under the ticker BRFS. The Company’s registered office is at 475 Jorge Tzachel Street, Fazenda District, Itajaí - Santa Catarina and the main business office is in São Paulo city.

BRF is a Brazilian multinational company, with global presence, which owns a comprehensive portfolio of products, and it is one of the world’s largest companies of food products. The Company operates by raising, producing and slaughtering poultry and pork for processing, production and sale of fresh meat, processed products, pasta, margarine, pet food and others.

The Company holds as main brands Sadia, Perdigão, Qualy, Chester®, Kidelli, Perdix, Banvit, Biofresh and Gran Plus, present mainly in Brazil, Turkey and Middle Eastern countries.

| 1.1. | Equity interest |

| % equity interest | |||||||||

| Entity | Main activity | Country | 12.31.24 | 12.31.23 | |||||

| Direct subsidiaries | |||||||||

| BRF Energia S.A. | Commercialization of eletric energy | Brazil | 100.00 | 100.00 | |||||

| BRF Foods UK Ltd. | Administrative and marketing services | England | 100.00 | 100.00 | |||||

| BRF GmbH | Holding | Austria | 100.00 | 100.00 | |||||

| BRF Pet S.A. | Industrialization, commercialization and distribution of feed and nutrients for animals | Brazil | 100.00 | 100.00 | |||||

| MBR Investimentos Ltda. | (f) | Holding, management of companies and assets | Brazil | 100.00 | 100.00 | ||||

| Sadia Alimentos S.A.U. | Holding | Argentina | 100.00 | 100.00 | |||||

| Sadia Uruguay S.A. | (g) | Import and commercialization of products | Uruguay | 100.00 | 100.00 | ||||

| Vip S.A. Empreendimentos e Participações Imobiliárias | (f) | Commercialization of owned real state | Brazil | - | 100.00 | ||||

| Indirect subsidiaries | |||||||||

| Al Khan Foodstuff LLC ("AKF") | (b) | Import, commercialization and distribution of products | Oman | 70.00 | 70.00 | ||||

| Al-Wafi Al-Takamol International for Foods Products | Import and commercialization of products | Saudi Arabia | 100.00 | 100.00 | |||||

| Al-Wafi Food Products Factory LLC | Import, export, industrialization and commercialization of products | UAE (1) | 100.00 | 100.00 | |||||

| Badi Ltd. | Holding | UAE (1) | 100.00 | 100.00 | |||||

| Banvit Bandirma Vitaminli | Import, industrialization and commercialization of products | Turkey | 91.71 | 91.71 | |||||

| Banvit Enerji ve Elektrik Üretim Ltd. Sti. | (a) | Generation and commercialization of electric energy | Turkey | - | 100.00 | ||||

| BRF Arabia Holding Company JCS | Holding | Saudi Arabia | 70.00 | 70.00 | |||||

| BRF Arabia Food Industry Ltd. | (l) | Preparation and preservation of meat, fish, crustaceans and mollusks and production of oils and animal and plant based fats | Saudi Arabia | 100.00 | - | ||||

| BRF Foods GmbH | (h) | Industrialization, import and commercialization of products | Austria | 100.00 | 100.00 | ||||

| BRF Foods LLC | (h) | Industrialization, import and commercialization of products | UAE (1) | 100.00 | - | ||||

| BRF Foods LLC | (d) | Import, industrialization and commercialization of products | Russia | - | 100.00 | ||||

| BRF Global Company Nigeria Ltd. | Marketing and logistics services | Nigeria | 100.00 | 100.00 | |||||

| BRF Global Company South Africa Proprietary Ltd. | Administrative, marketing and logistics services | South Africa | 100.00 | 100.00 | |||||

| BRF Global GmbH | Holding and trading | Austria | 100.00 | 100.00 | |||||

| BRF Japan KK | Marketing and logistics services, import, export, industrialization and commercialization of products | Japan | 100.00 | 100.00 | |||||

| BRF Korea LLC | Marketing and logistics services | Korea | 100.00 | 100.00 | |||||

| BRF Kuwait Food Supply Management Co. | (b) | Import, commercialization and distribution of products | Kuwait | 49.00 | 49.00 | ||||

| BRF Shanghai Management Consulting Co. Ltd. | Provision of consultancy and marketing services | China | 100.00 | 100.00 | |||||

| BRF Shanghai Trading Co. Ltd. | Import, export and commercialization of products | China | 100.00 | 100.00 | |||||

| BRF Singapore Foods PTE Ltd. | Administrative, marketing and logistics services | Singapore | 100.00 | 100.00 | |||||

| Buenos Aires Fortune S.A. | (e) | Holding | Argentina | - | 100.00 | ||||

| Eclipse Holding Cöoperatief U.A. | Holding | The Netherlands | 100.00 | 100.00 | |||||

| Eclipse Latam Holdings | (k) | Holding | Spain | - | 100.00 | ||||

| Federal Foods LLC | (b) | Import, commercialization and distribution of products | UAE (1) | 49.00 | 49.00 | ||||

| Federal Foods Qatar | (b) | Import, commercialization and distribution of products | Qatar | 49.00 | 49.00 | ||||

| Hercosul Alimentos Ltda. | (m) | Manufacturing and sale of animal feed | Brazil | 100.00 | 100.00 | ||||

| Hercosul Distribuição Ltda. | (m) | Import, export, wholesale and retail sale of food products for animals | Brazil | 100.00 | 100.00 | ||||

| Hercosul International S.R.L. | Manufacturing, export, import and sale of feed and nutrients for animals | Paraguay | 100.00 | 100.00 | |||||

| Hercosul Soluções em Transportes Ltda. | Road freight | Brazil | 100.00 | 100.00 | |||||

| Joody Al Sharqiya Food Production Factory LLC | Import and commercialization of products | Saudi Arabia | 100.00 | 100.00 | |||||

| Mogiana Alimentos S.A. | Manufacturing, distribution and sale of Pet Food products | Brazil | 100.00 | 100.00 | |||||

| Nutrinvestments BV | (j) | Holding | The Netherlands | - | 100.00 | ||||

| One Foods Holdings Ltd. | Holding | UAE (1) | 100.00 | 100.00 | |||||

| Perdigão Europe Lda. | (i) | Import, export of products and administrative services | Portugal | - | 100.00 | ||||

| ProudFood Lda. | Import and commercialization of products | Angola | 100.00 | 100.00 | |||||

| PSA Laboratório Veterinário Ltda. | (f) | Veterinary activities | Brazil | - | 100.00 | ||||

| Sadia Chile SpA | Import, export and commercialization of products | Chile | 100.00 | 100.00 | |||||

| TBQ Foods GmbH | Holding | Austria | 60.00 | 60.00 | |||||

| Affiliated | |||||||||

| Potengi Holdings S.A. | (c) | Holding | Brazil | 50.00 | 50.00 | ||||

| PR-SAD Administração de Bem Próprio S.A. | Management of assets | Brazil | 33.33 | 33.33 | |||||

| (1) | UAE – United Arab Emirates |

| (a) | On September 09, 2024, the subsidiary Banvit Enerji ve Elektric Üretim Ltd. Sti. was dissolved. |

| (b) | For these entities, the Company has agreements that ensure full economic rights, except for AKF, in which the economic rights are of 99%. |

| (c) | Affiliated with a subsidiary of Auren Energia S.A., whose economic stake is 24% (note 12). On October 9, 2024 a share capital increase was approved in the total amount of R$94,221, of which R$22,613 by BRF S.A. And on December 11, 2024. a share capital increase was approved in the total amount of R$94,000, of which R$22,560 by BRF S.A. |

| (d) | On January 15, 2024, the subsidiary BRF Foods LLC (Russia) was dissolved. |

| (e) | On March 19, 2024, the subsidiary Buenos Aires Fortune S.A. was dissolved. |

| (f) | On March 28, 2024, the subsidiaries VIP S.A. Empreendimentos e Participações Imobiliárias and PSA Laboratório Veterinário Ltda. were merged into BRF S.A. and the indirect subsidiary BRF Investimentos Ltda. became direct subsidiary of the BRF S.A. On December 23, 2024, the name of BRF Investimentos Ltda. became MBR Investimentos Ltda. |

| (g) | On March 31, 2024, the share capital of the subsidiary Sadia Uruguay S.A. was reduced by UYU 415,000 (R$55,365), and on June 17, 24 there was a further capital reduction of UYU 415,000 (R$58,515). |

| (h) | The BRF Foods GmbH, an Austrian company, had a subsidiary in the United Arab Emirates, which on April 05, 24 was converted into a limited company called BRF Foods LLC (UAE). On February 01, 2025, this subsidiary was merged into BRF GmbH. |

| (i) | On April 29, 2024, the subsidiary Perdigão Europe Lda. was dissolved. |

| (j) | On July 19, 2024, the subsidiary Nutrinvestments BV was dissolved. |

| (k) | On November 08, 2024, the subsidiary Eclipse Latam Holdings was dissolved. |

| (l) | On November 28, 2024, the company BRF Arabia Food Industry Ltd. was incorporated, a wholly owned subsidiary of the company BRF Arabia Holding Company JCS. |

| (m) | On January 02, 2025, the subsidiaries Hercosul Alimentos Ltda. and Hercosul Distribuição Ltda. were merged into Mogiana Alimentos S.A. |

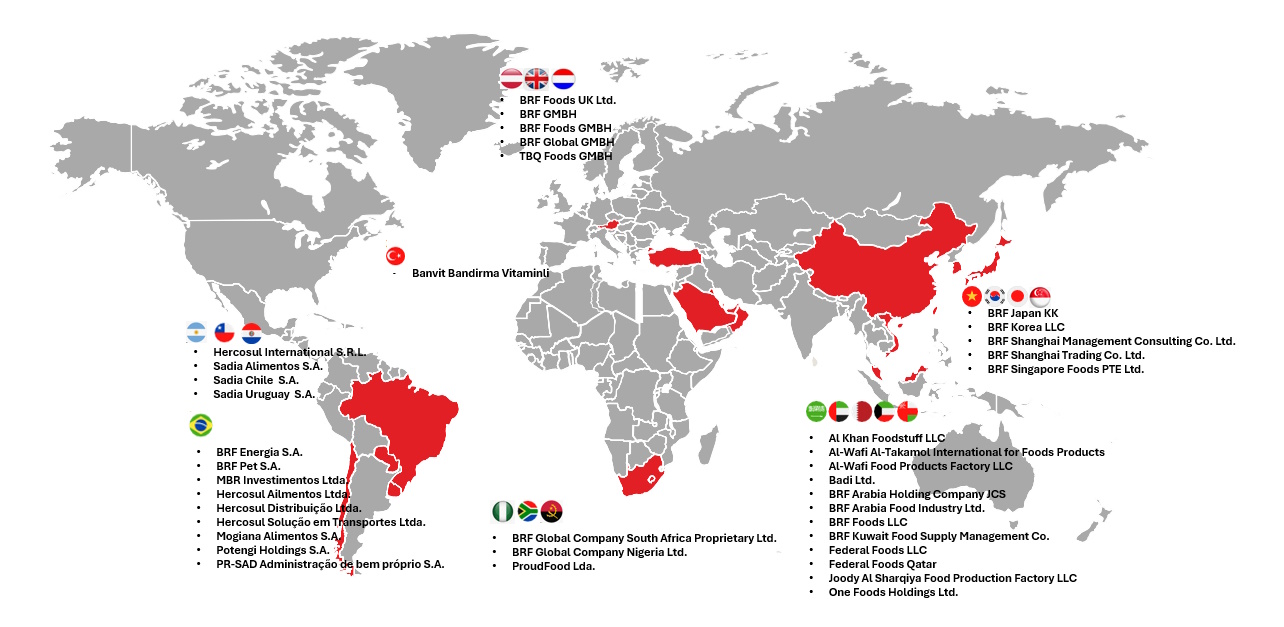

Location of Subsidiaries and Affiliates

| 1.2. | Climate events in Rio Grande do Sul |

On May 1st, 2024, Rio Grande do Sul declared a state of public calamity throughout its territory affected by extreme weather events causing material and environmental damage, with the destruction of homes, roads and bridges, as well as the compromise of the functioning of local and regional public and private institutions and the closure of public roads.

The Company was affected by total and partial shutdowns in its regional operations, industrial complexes, distribution centers and support offices, and made the necessary efforts to resume operations.

Due to these weather events, the Company incurred losses and additional expenses, mainly related to the agricultural and industrial production process, structural and equipment repairs and expenses with donations, which are presented in the financial statements, net of partial advances, under the following items:

| 12.31.24 | ||||

| Cost of sales | (104,418) | |||

| Selling expenses | (3,774) | |||

| General and administrative expenses | (4,509) | |||

| Total expenses | (112,701) |

The Company has insurance policies for events of this nature and continue in the process of regulating this claim in Rio Grande do Sul.

| 1.3. | Incident at the plant in Carambeí - PR |

On August 1st, 2024, the Company informed its shareholders and the market in general that a fire had occurred in part of its Carambeí - PR unit. There were no fatalities and all employees were safe. In the same month, the Company was able to gradually resume operations at the unit.

Due to the fire, the Company recognized in its income statement for the period expenses mainly related to losses in the production process, expenses for structural and equipment repairs, as well as partial reimbursement of the loss, generating a practically neutral impact up to the date of approval of these financial statements.

The Company has insurance policies for events of this nature and continue in the process of regulating this claim in Carambeí - PR.

| 1.4. | Acquisition of stake in Addoha Poultry Company |

On October 31, 2024, BRF Arabia Holding Company (“BRF Arabia”), joint venture 70% owned by BRF and 30% by Halal Products Development Company, a wholly owned subsidiary of the Public Investment Fund da Arabia Saudita (“PIF”), has entered into a binding agreement to acquire 26% da Addoha Poultry Company, a company that operates in the slaughtering of poultry in the Kingdom of Saudi Arabia.

The transaction has a total value of SAR316,200 equivalent to R$511,105, of which SAR216,200 equivalent to R$349,466 will be paid into Addoha. On January 14, 2025, a shareholders' agreement was signed between BRF Arabia and the current shareholders of Addoha, ensuring effective participation in the company's management and allowing the know-how of BRF and HPDC to contribute to maximizing synergies between the entities.

On the same date the company completed the acquisition, Addoha being an associate of BRF, which will have its investment accounted for using the equity method.

| 1.5. | Acquisition of processed foods factory in Henan Province in China |

On November 20, 2024, BRF GmbH, a wholly owned subsidiary of the Company, has signed a binding agreement with Henan Best Foods Co. Ltd., a subsidiary of the OSI Group, a U.S.-based company specializing in food processing, to acquire a processed foods factory in Henan Province, China.

The total value of the transaction is U$ equivalent to R$. The Factory has two food processing lines with an annual capacity of 28,000 tons and the potential to expand to two additional lines.

On April 30, 2025, the operation was closed. The acquisition consolidates the Company's presence in the Chinese market and its ability to serve customers in the region.

| 1.6. | Term sheet Gelprime |

On December 17, 2024, MBR Investimentos Ltda., a company controlled by BRF, has signed a term sheet with the companies Viposa Participações Ltda., Indústria e Comércio de Couros Britali Ltda. and Vanz Holding Ltda., holders of 100% (one hundred percent) of the capital stock of Gelprime Indústria e Comércio de Produtos Alimentos Ltda. ("Gelprime"), a company that produces, sells and distributes gelatin and collagen through the processing of animal origin raw material.

The Term Sheet establishes the main terms and conditions for the acquisition, by MBR, of 50% of Gelprime capital stock ("Acquisition") for the value of R$ 312,500, subject to possible adjustment.

On March 14, 2025, the Company advanced the amount of R$60,000 to the sellers using the resource coming from an advance for the future capital increase in the same amount made by its parent company BRF S.A.

The closing of the transaction is subject to the negotiation and execution of the definitive documents and the approval by the Brazilian antitrust authorities.

| 1.7. | Acquisition of stake in joint venture PlantPlus Foods, LLC. |

On November 7, 2009, Marfrig Global Foods (“Marfrig”) and Archer-Daniels-Midland Company (“ADM”) mutually agreed to dissolve their partnership through a joint venture called PlantPlus Foods, LLC (“PlantPlus LLC”) located in the United States, in which Marfrig held a 70% stake, responsible for the operation, production and distribution of the products, and ADM held a 30% stake, through the supply of ingredients and technical know-how for the development of plant-based products.

Considering that ADM expressed an interest in discontinuing its participation in the joint venture and the existence of synergies between PlantPlus LLC's product portfolio and BRF's, the Company took over ADM's 30% stake in PlantPlus LLC and 0.10% in PlantPlus Foods Brasil Ltda., with no cash disbursement to BRF, nor assumption of obligations.

The operation was approved without reservations by the Administrative Council for Economic Defense (“CADE”) and, on January 23, 2025, the transfer of the shares of Plant Plus LLC from ADM to BRF was completed.

The investment in the joint venture PlantPlus LLC will be accounted for using the equity method.