UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 1-K

Annual Report Pursuant To

Regulation A of the Securities Act of 1933

For the fiscal year ended December 31, 2024

Roots Real Estate Investment Community I, LLC

(Exact name of issuer as specified in its charter)

| Georgia | 86-2608144 | |

(State or other jurisdiction of organization) |

(IRS Employer Identification No.) |

| 1344 La France Street NE, Atlanta, GA | 30307 | |

(Address of principal executive offices) |

(ZIP Code) |

(404)-965-4162

(Issuer’s telephone number, including area code)

Units

(Title of each class of securities issued pursuant to Regulation A)

TABLE OF CONTENTS

| 2 |

STATEMENTS REGARDING FORWARD-LOOKING INFORMATION

The Company makes statements in this Annual Report on the Form 1-K (“Annual Report”) that are forward-looking statements within the meaning of the federal securities laws. The words “believe,” “estimate,” “expect,” “anticipate,” “intend,” “plan,” “seek,” “may,” “continue,” “could,” “might,” “potential,” “predict,” “should,” “will,” “would,” and similar expressions or statements regarding future periods or the negative of these terms are intended to identify forward-looking statements. These forward-looking statements involve known and unknown risks, uncertainties and other important factors that could cause actual results, performance or achievements, or industry results, to differ materially from any predictions of future results, performance or achievements that the Company expresses or implies in this Annual Report or in the information incorporated by reference into this Annual Report.

The forward-looking statements included in this Annual Report are based upon the Company’s current expectations, plans, estimates, assumptions and beliefs that involve numerous risks and uncertainties. Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond the Company’s control. Although the Company believes that the expectations reflected in such forward-looking statements are based on reasonable assumptions, actual results and performance could differ materially from those set forth in the forward-looking statements. Factors which could have a material adverse effect on Company operations and future prospects include, but are not limited to:

| ● | the Company’s ability to effectively deploy the proceeds raised in the offering of its Units pursuant to Regulation A promulgated under the Securities Act of 1933, as amended (the “Securities Act”); | |

| ● | the Company’s ability to effectively deploy the proceeds raised in the offering; | |

| ● | the Company’s ability to attract and retain investors to the investment portal on the RootsCom portal; | |

| ● | risks associated with breaches of data security; | |

| ● | changes in economic conditions generally and the real estate and securities markets specifically; | |

| ● | expected rates of return provided to investors; | |

| ● | the Company’s ability to retain and hire competent individuals who will provide services to the Company and appropriately staff its operations; | |

| ● | legislative or regulatory changes impacting our business or assets (including changes to the laws governing the taxation of REITs and SEC guidance related to Regulation A or the JOBS Act); | |

| ● | changes in business conditions and the market value of assets, including changes in interest rates, prepayment risk, operator or borrower defaults or bankruptcy, and generally the increased risk of loss if investments fail to perform as expected; | |

| ● | the Company’s ability to implement effective conflicts of interest policies and procedures among various real estate investment opportunities; | |

| ● | the Company’s ability to access sources of liquidity when it needs to fund redemptions of Units in excess of the proceeds from the sales of Units in the continuous offering and the consequential risk that the Company may not have the resources to satisfy redemption requests; | |

| ● | the Company’s failure to maintain its status as a REIT; | |

| ● | the Company’s compliance with applicable local, state and federal laws, including the Investment Advisers Act of 1940, as amended, or the Advisers Act, the Investment Company Act and other laws; and | |

| ● | changes to U.S. generally accepted accounting principles, or GAAP. |

Any of the assumptions underlying forward-looking statements could be inaccurate. Investors are cautioned not to place undue reliance on any forward-looking statements included in this Annual Report. All forward-looking statements are made as of the date of this Annual Report and the risk that actual results will differ materially from the expectations expressed in this Annual Report will increase with the passage of time. Except as otherwise required by the federal securities laws, the Company undertakes no obligation to publicly update or revise any forward-looking statements after the date of this Annual Report, whether as a result of new information, future events, changed circumstances or any other reason. In light of the significant uncertainties inherent in the forward-looking statements included in this Annual Report, including, without limitation, the risks described under “Risk Factors,” the inclusion of such forward-looking statements should not be regarded as a representation by the Company or any other person that the objectives and plans set forth in this Annual Report will be achieved.

| 3 |

The Company

The Company’s purpose is to create a real estate investment portfolio, leveraging professional real estate expertise with technology, scale, and local market insights to generate attractive returns for its Members and unique opportunities and value to the communities that it serves. The Company began substantive operations in May 2021.

Roots Real Estate Investment Community I, LLC (the “Company, “we”, “our”, “us”, or “RootsCom”)1 was formed on December 8, 2020 as a Georgia limited liability company and has elected to be taxed as a real estate investment trust (“REIT”) for U.S. federal income tax purposes. The Company was formed to originate, invest in and manage a diversified portfolio primarily consisting of investments in single family and multifamily residential real estate properties and development projects. Initially, the Company has targeted real estate in the Atlanta-Sandy Springs-Alpharetta Metropolitan Statistical Area (the “Atlanta MSA”) in the State of Georgia that has value-add potential. However, the Company may also invest in other major MSAs across the United States. The Company believes that its targeted properties and geographies have displayed strong performance and are expected to be well positioned to see continued healthy rent growth and value appreciation moving forward. While the Company intends primarily to continue to invest in the targeted properties and target geographies outlined above, it may invest in other asset classes as well as other locations, depending on the availability of suitable investment opportunities that meet its investment guidelines. The Manager (defined below) is not limited to searching only in the Atlanta MSA, and the Company may invest in various major MSAs throughout the United States. The Company may make its investments through majority-owned or wholly-owned subsidiaries, and it may acquire minority interests or joint venture interests in subsidiaries. Additionally, affiliates of the Company may be interest holders in the joint ventures and subsidiaries in which the Company holds a majority or minority interest, which could cause potential conflicts of interests.

The Company is externally managed by Roots REIT Management, LLC, a Georgia limited liability company (the “Manager”) which is a wholly owned subsidiary of the sponsor, Seed InvestCo, LLC, a Georgia limited liability company (the “Sponsor”). The Manager manages the Company’s day-to-day operations, including providing advisory and acquisition services (including performing due diligence on the Company’s investments), offering services, asset management services, marketing and advertising services, accounting and other administrative services, Member services, financing services, and disposition services, among others. In addition, a team of real estate professionals, acting through our Manager, will make all the decisions regarding the selection, negotiation, financing and disposition of our investments, subject to the limitations in the Company’s operating agreement.

The Manager also manages and operates an online investment portal and educational community that allows investors to become equity holders in real estate opportunities that may have been historically difficult to access for some investors. Through the use of the investment portal on the RootsCom website, investors can view details of an investment in RootsCom and sign legal documents online. This portal also allows tenants of the Company’s real estate assets unprecedented ways to engage with the community and the indirect owners of their residence. The primary mission of the Company is to create attractive returns while making a significant positive impact in the lives of the human beings who invest in, provide to, and rent from the Company, as well as on the communities that it serves.

The Company is offering through the RootsCom Platform, www.investwithroots.com, a maximum of $75,000,000 of units of membership interests (“Units” or “Member Units”) to the public on a “best efforts” basis at the current NAV price per Unit of $140, and on the terms and conditions described herein and, in the Company’s operating agreement. When the Units are offered to the public on a “best efforts” basis, the Company is only required to use its best efforts to sell Units. The Sponsor currently owns approximately two thousand two hundred seventy (2,270). No party, including the Manager, has a firm commitment or obligation to purchase any additional Units. Upon formation, the Company issued 500 Units to the Sponsor for a nominal $1,000 in exchange for organization and formation costs incurred on behalf of the Company. The Company commenced a private placement offering and sold approximately 63,735 Units at prices ranging from $100.00 to $110.00 per Unit, for a total of approximately $6,525,654, prior to the initial offering being declared “qualified” by the SEC. As of December 31, 2024, the aggregate Units outstanding totaled approximately 399,489, for total net offering proceeds of approximately $49,354,223.

1 The use of the terms “RootsCom,” “Company,” “Roots,” “the REIT,” “we,” “us,” or “our” in this Annual Report refer to Roots Real Estate Investment Community I, LLC, unless the context indicates otherwise.

| 4 |

Employees

As of December 31, 2024, no employees were employed by the Company. The Company does not currently intend to hire any employees who will be compensated directly by the Company. Certain of the executive officers of the Sponsor also serve as executive officers of the Manager. Each of these individuals, and other employees of the Sponsor, receives compensation for his or her services, including services performed for the Company on behalf of the Manager, from the Sponsor. As executive officers and/or employees of the Manager and/or Sponsor, these individuals will manage the Company’s day-to-day affairs, oversee the review, selection and recommendation of investment opportunities, service acquired investments and monitor the performance of these investments to ensure that they are consistent with our investment objectives. Although the Company will indirectly bear some of the costs of the compensation paid to these individuals, through fees the Company pays to the Manager or reimbursement for specific duties done by their employees that are directly related to the business operations of the Company, the Company does not intend to pay any compensation directly to these individuals.

Investment Strategy and Market Opportunity

The Company’s investment strategy is to acquire and manage a portfolio consisting primarily of single family and multifamily residential real estate investments. The Company targets real estate in the Atlanta-Sandy Springs-Alpharetta Metropolitan Statistical Area (the “Atlanta MSA”) in the State of Georgia that has value-add potential. However, the Manager may also invest in other major MSAs across the United States. The Manager believes that the Company’s targeted properties and geographies have displayed strong performance and are expected to be well positioned to see continued healthy rent growth and value appreciation moving forward. While the Manager intends primarily to continue to invest in residential real estate in the Atlanta MSA, it may invest in other asset classes as well as other locations, depending on the availability of suitable investment opportunities that meet its investment guidelines. The Company may make its investments through wholly- or majority-owned subsidiaries, and it may acquire minority interests or joint venture interests in subsidiaries.

The primary business purpose of Roots Real Estate Investment Community I, LLC, a Georgia limited liability company (“RootsCom”, the “Company”, “we”, “our”, “us”), is to leverage professional real estate expertise and experienced business management with technology, scale, and local market insights to generate attractive returns for its Members and the future members of RootsCom and unique opportunities and value to the communities that it serves. The Manager’s and/or Sponsor’s employees, officers and management personnel will be responsible for the general oversight, administration and implementation of RootsCom, as well as identifying, selecting and procuring targeted assets for the RootsCom portfolio.

RootsCom is a “Commercially Motivated, Community Inspired” real estate fund. We want to create attractive returns while making a significant positive impact on the lives of the human beings who invest in, provide to, and rent from the Company, as well as on the communities that it serves.

| 5 |

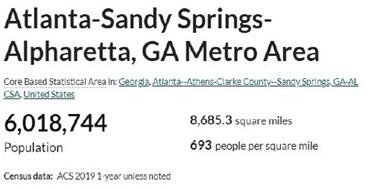

The Manager targets real estate in the Atlanta MSA that has value-add potential, however, the Manager is not limited to searching only in the Atlanta MSA. The general concept of a metropolitan statistical area is that of a core area containing a substantial population nucleus, together with adjacent communities having a high degree of economic and social integration with that core.2 Currently delineated metropolitan statistical areas are based on application of 2010 standards (which appeared in the Federal Register on June 28, 2010) to 2010 Census and 2011-2015 American Community Survey data, as well as 2018 Population Estimates Program data.3 Current metropolitan statistical area delineations were announced by the United States Office of Management and Budget (“OMB”) effective March 2020.4 The Atlanta MSA consists of four (4) principal cities: Atlanta, Sandy Springs, Alpharetta, and Marietta, and twenty-nine (29) counties: Barrow, Bartow, Butts, Carroll, Cherokee, Clayton, Cobb, Coweta, Dawson, DeKalb, Douglas, Fayette, Forsyth, Fulton, Gwinnett, Haralson, Heard, Henry, Jasper, Lamar, Meriwether, Morgan, Newton, Paulding, Pickens, Pike, Rockdale, Spalding and Walton.5

The Manager intends to continue to acquire the properties, facilitate the necessary renovations, repairs, upgrades and/or capital expenditures, as applicable per property, obtain or retain, as applicable, renters, get a third-party certified real property appraisal, and then sell and/or transfer such properties to the Company at or below the appraised fair market value. The Manager may forego payment for up to five percent (5%) of the value of each property in exchange for equity in the Company. The Company’s Members will get the benefit of rental income and portfolio appreciation. The Company’s intention is to hold each asset for as little as one (1) and as many as five (5) years, however market conditions will determine if and when the Company can sell each of its assets. The Company also intends to utilize 1031 exchanges wherever possible when certain assets are liquidated. “Final” liquidation will occur when a 1031 exchange is either not able, or not chosen, to be utilized.

2 https://www.census.gov/programs-surveys/metro-micro/about.html

3 Id.

4 Id.

5 United States Office of Management and Budget Bulletin No. 20-01.

| 6 |

The Company will loan proceeds from the Offering to the Manager to facilitate the acquisitions of the properties, at an interest rate of at least seven percent (7%) per annum, with reasonable repayment terms.

The Manager will also receive a set monthly fee out of rents payable to the Company to fund repairs and maintenance for each property. The Company will not have to bear the financial responsibility of unexpected repairs and maintenance above and beyond this set monthly fee out of rents payable, which will allow RootsCom to have greater predictability and consistency with respect to cash flow per property. The Manager will be responsible for the coordination and implementation of such repairs and maintenance and the payment for any repairs and maintenance that exceed the monthly fee received out of rents payable.

The Sponsor, and the Manager’s management team, has invested side-by-side with the RootsCom Members, so that there is both a shared common interest in attractive investment returns and a contribution to the wellbeing of the communities where the real estate assets are located.

Almost forty-five million (45,000,000) American households are currently renting.6 The median income for a family who rents in the State of Georgia is $40,524, and the average rent, according to the Prosperity Now report is $1,050, but that was in 2018.7 Average rents are now up well over $1,200 and rising. The average renting family has less than $650 in savings, so less than half a month’s rent. Most people in this category have not, and will never have the chance to actually own their own home or invest in real estate. RootsCom plans to open the doors to real estate investment to these residents and thousands of other “non-accredited” individuals who have never had the opportunity to own real estate, not even their own homes.

RootsCom intends to incentivize our renters (the “Residents”) to care for each rental property as if it was their own by providing unique financial incentives in the renter’s lease that will be tied directly to the Resident renter partnering with the Company to take care of the property and proving, on a quarterly basis, that they are living in it like they own it. This program is called “Live in it Like You Own It” and is an essential aspect of the overall business model. We believe it will enhance both the lives of our residents, and the long-term values of the properties. The Company believes that homeownership does not have to be defined by “owning the home you live in.” It can be expanded to “Living In It Like You Own It.” The Company has also coined the term “Rentership” in relation to this concept.

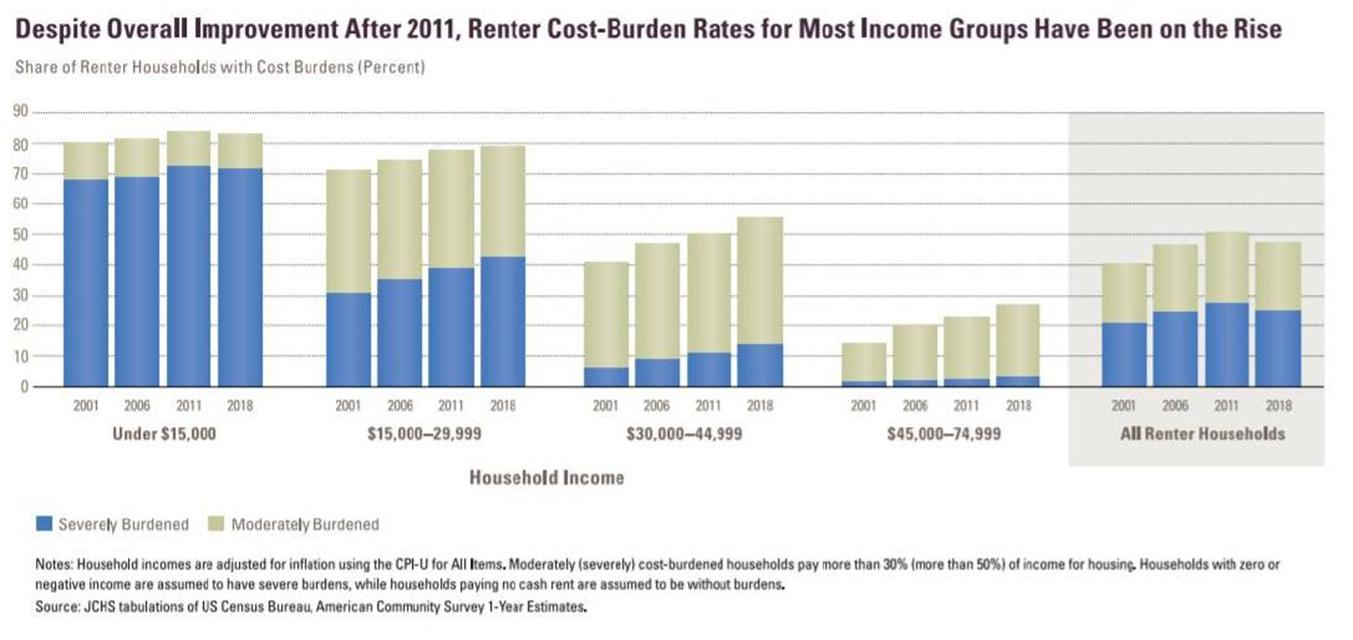

The share of middle-income renters paying more than 30% of income for housing has steadily risen.8 The largest jump has been among renters earning $30,000 – $44,999 annually, with their cost-burdened share up 5.4% in 2011–2018, to 55.7%.9 The increase among households earning $45,000 – $74,999 is nearly as large at 4.3%, to a share of 27%.10 While occurring across the country, the growing incidence of cost burdens among middle-income renters is most apparent in larger, high-cost metropolitan areas.11

6 U.S. Households: Renters and Owners, National Multifamily Housing Council, https://www.nmhc.org/research-insight/quick-facts-figures/quick-facts-resident-demographics/renters-and-owners/.

7 Cost of Living Report, Georgia, Prosperity Now Scorecard, https://scorecard.prosperitynow.org/reports#report-state-cost-of-living.

8 American’s Rental Housing 2020, Joint Center for Housing Studies of Harvard University, https://www.jchs.harvard.edu/sites/default/files/reports/files/Harvard_JCHS_Americas_Rental_Housing_2020.pdf, at page 4.

9 Id.

10 Id.

11 Id.

| 7 |

The Atlanta MSA statistics show a population of over 6 million people, with a median age of 36.8 years old, with almost 75% of those people of legal renting age (18 years of age or older).12 Approximately 42% of those people fall within the age range of 20 years old and 49 years old (evenly split between each decade of age).13

The total number of households is over 2.1 million, and the number of “housing units” is over 2.3 million, and roughly 35% of these units are renter-occupied.14 The median household income in the Atlanta MSA is $71,742, with 35% of households making $100,000 or greater, and the per capital income is $37,331.15 As previously mentioned, the median income of households that rent is approximately $40,500. Based on inflation since the previously cited report, it is estimated that current income of renting households in 2022 is approximately $44,500 and average rent in the Atlanta MSA is approximately $1,250 outside the City of Atlanta and considerably more in the city limits.

RootsCom permits its Residents to pay a fee to opt into the “Live In It Like You Own It” program, that provides the Residents incentives to take good care of the property while they are in it. The Residents can (i) earn reimbursement of their opt-in fee, and (ii) receive additional payments from the Company, for a Resident’s successful performance of certain monthly tasks and upkeep to the property. The “Live In It Like You Own It” program provides a mutually beneficial scenario for both the Resident and the Company. A Resident is incentivized to truly care about the property he or she lives in by performing routine upkeep, including timely reporting of any damage or maintenance needs, which are commonly found to be tenant responsibilities in leases between landlords and tenants in residential and multifamily leases, but that typically get ignored or deferred by tenants. The Company incentivizes its Residents to not ignore or defer these important tasks that preserve the value of the properties and minimizes the short- and long-term costs associated with deferred maintenance and repairs, by reimbursing the Residents the opt-in fee and making additional payments to the Residents, so long as the Residents successfully perform these tasks. The Residents benefit, because they have the opportunity to earn back their opt-in fee through reimbursement and to receive additional payments from the Company, and the Company benefits knowing that its real estate assets are being cared for. Many Residents believe in the mission and alignment of the “Live In It Like You Own It” program so much, that they have purchased Units in the Offering.

12 Census Reporter: https://censusreporter.org/profiles/31000US12060-atlanta-sandy-springs-alpharetta-ga-metro-area/

13 Id.

14 Id.

15 Id.

| 8 |

Over the period of time from June 1, 2021 through December 31, 2021, the Manager tested the “Live in it Like You Own It” model on properties with an average of 60 residential doors. The results of that test showed that almost 80% of the Residents were fully engaged and earned their Rental Rebates over that time frame. The Manager continued to utilize and execute the “Live in it Like You Own It” model, and as of the fourth quarter of 2024, over 78% of the Residents were fully engaged.

The Company seeks to earn above market rates of return for its Investors, while also positively impacting the community. To achieve this goal, the Manager is guided by an investment strategy that focuses on:

| ● | A unique approach to purchasing real estate that allows purchasing assets under market value; | |

| ● | Part of the Company’s strategy is to look for undervalued assets in inefficient markets; | |

| ● | Acquiring assets at a discount to their intrinsic value; | |

| ● | Utilizing event driven sales to create value for sellers and investors; | |

| ● | Actively managing the assets to create value for the Investors; and | |

| ● | Having Residents who are active participants in their properties, earning rental credits for living in them like they own them, and being responsible for helping care for the property. The Company believes this will drive less tenant turnover, which saves significant costs, and drives higher appreciation value based on a better cared for property. |

| 9 |

| 10 |

When evaluating acquisitions, the Manager conducts a detailed analysis of the property as well as other factors. If a property substantially meets the investment criteria, given economic, market, and other circumstances, the Manager will pursue it further if it believes it is well positioned to compete for it. Because in most scenarios the Manager does not require traditional financing to purchase properties and can pay cash and close quickly, it believes it will be in an advantageous position to purchase at attractive prices. The Manager believes it has positive working relationships with many industry participants, including banks, prospective sellers, and financing sources, which enable it to become aware of acquisition opportunities. The Manager takes the front-end purchasing risks, and no property is offered to the Company for purchase until it is fully tenanted and producing a minimum acceptable cashflow from rents. This substantially lowers the Company’s and the Members’ risk as it relates to early vacancy and unexpected repairs, and results in more consistent returns overall.

| 11 |

The Company holds a portfolio asset until it determines that the sale of such property is advantageous in view of the Company’s investment objectives. In deciding whether to acquire or sell a portfolio asset, the Manager may consider factors such as potential capital appreciation, net cash flow, tenant credit quality, rental rates, potential use of sale proceeds and federal income tax considerations. In evaluating a particular portfolio asset, the Manager may consider a variety of factors, including:

| ● | Geographic area and demographic characteristics of the community, as well as the local real estate market; | |

| ● | Purchase price; | |

| ● | Availability of funds or other consideration for the proposed acquisition and the cost thereof; | |

| ● | Quality of construction and design and the current physical condition of the property; | |

| ● | Terms of any existing leases; | |

| ● | Amount of rent to be paid by tenants as compared to market rates; and | |

| ● | Ability of current tenants to pay the amount of rent needed to assure an acceptable return. |

In line with the Company’s policies, RootsCom does not believe in displacing current residents who have been good tenants simply because they are unable to pay an increased rent that may be needed to drive a return acceptable to the Company. Therefore, the Company has partnered with a 501(c)(3) entity that is able to provide “Rental Assistance” and more to individual tenants who show a significant need for such assistance for specific periods of time. A resident tenant who indicates he or she cannot pay the full new rent needed, and fills out an application for rental assistance that clearly indicates that they, for any number of reasons, cannot cover the additional rent, may be eligible for short or long term assistance from the 501(c)(3) entity. If approved the entity pays the amount of rental assistance, they are approved for to the Company directly and, as a result of that assistance and the rent paid by the Resident, the company is paid in full on the rental amount each month. RootsCom is in the business of “humans helping humans” and is built to combine the attributes of a real estate investment, including recurring cash flow, asset appreciation, and tax benefits, to achieve an attractive investment while making an immediate and long-term positive impact on the communities we invest in. RootsCom is “Real Estate Reimagined.”

Through the “Rentership” and “Rental Assistance” programs, the Company believes that it will retain more tenants who take better care of their residence, thereby increasing the overall returns of the properties in the Company, and potentially have a positive impact on the community the home is located in.

Real Estate Portfolio

Since the commencement of the Offering, the Company has acquired 244 total properties, 226 of which were curated properties purchased from the Sponsor directly or through the purchase of wholly-owned subsidiaries of our Sponsor.

The real estate portfolio consists of single and multifamily homes in Georgia, particularly in the Atlanta-Sandy Springs-Alpharetta Metropolitan Statistical Area (the “Atlanta MSA”), that are leased to individual tenants. The aggregate acquisition cost for the entire real estate portfolio was $76,355,996. All properties are owned in fee simple by the Company or its wholly owned subsidiaries, subject to financing in certain circumstances, as set forth in the Offering Circular. The Company ensures that all of the residential properties in which it invests are adequately insured against casualty losses. When the Company acquires additional properties, it will continue to provide this information in an offering circular supplement, as it has historically done.

| 12 |

The following table provides an overview of the Company’s Real Estate Portfolio as of December 31, 2024.

| Acquisition Year | State | County | Multi-Family Properties | Multi-Family Units | Multi-Family Average Unit Size (Sq. Ft.) | Single-Family Properties | Single-Family Units | Single-Family Average Unit Size (Sq. Ft.) | Total Properties | Total # of Units | ||||||||||||||||||||||||||

| 2021 | Georgia | Cobb | 9 | 18 | 1,560 | 0 | 0 | 9 | 18 | |||||||||||||||||||||||||||

| 2021 | Georgia | Dekalb | 0 | 0 | 1 | 2 | 1,295 | 1 | 2 | |||||||||||||||||||||||||||

| 2021 | Georgia | Fulton | 1 | 8 | 1,803 | 0 | 0 | 1 | 8 | |||||||||||||||||||||||||||

| 2021 TOTAL: | 10 | 26 | 1,682 | 1 | 2 | 1,295 | 11 | 28 | ||||||||||||||||||||||||||||

| 2022 | Georgia | Cobb | 0 | 0 | - | 6 | 9 | 1,456 | 6 | 9 | ||||||||||||||||||||||||||

| 2022 | Georgia | Dekalb | 0 | 0 | - | 5 | 11 | 1,599 | 5 | 11 | ||||||||||||||||||||||||||

| 2022 | Georgia | Fayette | 0 | 0 | - | 1 | 2 | 2,997 | 1 | 2 | ||||||||||||||||||||||||||

| 2022 | Georgia | Fulton | 0 | 0 | - | 4 | 9 | 1,392 | 4 | 9 | ||||||||||||||||||||||||||

| 2022 | Georgia | Gwinnett | 0 | 0 | - | 3 | 6 | 1,989 | 3 | 6 | ||||||||||||||||||||||||||

| 2022 TOTAL | 0 | 0 | - | 19 | 37 | 1,887 | 19 | 37 | ||||||||||||||||||||||||||||

| 2023 | Georgia | Clayton | 0 | 0 | - | 7 | 8 | 1,165 | 7 | 8 | ||||||||||||||||||||||||||

| 2023 | Georgia | Cobb | 0 | 0 | - | 1 | 2 | 1,972 | 1 | 2 | ||||||||||||||||||||||||||

| 2023 | Georgia | Dekalb | 0 | 0 | - | 8 | 16 | 1,584 | 8 | 16 | ||||||||||||||||||||||||||

| 2023 | Georgia | Douglas | 1 | 2 | 1,379 | 0 | 0 | 1 | 2 | |||||||||||||||||||||||||||

| 2023 | Georgia | Fulton | 8 | 26 | 2,842 | 31 | 33 | 1,517 | 39 | 59 | ||||||||||||||||||||||||||

| 2023 | Georgia | Newton | 0 | 0 | - | 2 | 3 | 1,489 | 2 | 3 | ||||||||||||||||||||||||||

| 2023 TOTAL | 9 | 28 | 2,111 | 49 | 62 | 1,545 | 58 | 90 | ||||||||||||||||||||||||||||

| 2024 | Georgia | Cherokee | 0 | 0 | - | 1 | 1 | 1,288 | 1 | 1 | ||||||||||||||||||||||||||

| 2024 | Georgia | Clayton | 0 | 0 | - | 17 | 17 | 1,245 | 17 | 17 | ||||||||||||||||||||||||||

| 2024 | Georgia | Cobb | 0 | 0 | - | 1 | 1 | 1,200 | 1 | 1 | ||||||||||||||||||||||||||

| 2024 | Georgia | Dekalb | 2 | 43 | 890 | 18 | 18 | 1,458 | 20 | 61 | ||||||||||||||||||||||||||

| 2024 | Georgia | Fayette | 0 | 0 | - | 1 | 1 | 1,004 | 1 | 1 | ||||||||||||||||||||||||||

| 2024 | Georgia | Fulton | 9 | 49 | 1,235 | 33 | 34 | 1,185 | 42 | 83 | ||||||||||||||||||||||||||

| 2024 | Georgia | Gwinnett | 5 | 10 | 1,929 | 2 | 2 | 1,694 | 7 | 12 | ||||||||||||||||||||||||||

| 2024 | Georgia | Henry | 0 | 0 | - | 1 | 1 | 923 | 1 | 1 | ||||||||||||||||||||||||||

| 2024 | Georgia | Newton | 0 | 0 | - | 6 | 6 | 1,455 | 6 | 6 | ||||||||||||||||||||||||||

| 2024 | Georgia | Rockdale | 0 | 0 | - | 4 | 4 | 1,343 | 4 | 4 | ||||||||||||||||||||||||||

| 2024 TOTAL | 16 | 102 | 1,351 | 84 | 85 | 1,280 | 100 | 187 | ||||||||||||||||||||||||||||

| Grand Total: | 35 | 156 | 1,715 | 153 | 186 | 1,373 | 188 | 342 | ||||||||||||||||||||||||||||

Investment Objectives

The Company’s investment objectives are:

| ● | to pay attractive and consistent cash distributions; and | |

| ● | to preserve, protect, increase and return your capital contribution. |

We cannot assure you that we will attain these objectives or that the value of our assets will not decrease. Furthermore, within our investment objectives and policies, our Manager will have substantial discretion with respect to the selection of specific investments and the purchase and sale of our assets.

Competition

Although we believe our investment strategy is differentiated by our “Live In It Like You Own It” Resident management focus, there are numerous REITs with asset acquisition objectives similar to ours, and others may be organized in the future, which may increase competition for the investments suitable for us. Competitive variables include market presence and visibility, size of investments offered and underwriting standards. To the extent that a competitor is willing to risk larger amounts of capital in a particular transaction than we are, our investment volume and profit margins for our investment portfolio could be impacted. Our competitors may also be willing to accept lower returns on their investments and may succeed in buying the assets that we have targeted for acquisition. Although we believe that we are well positioned to compete effectively in each facet of our business, there is competition in our market sector and there can be no assurance that we will compete effectively or that we will not encounter increased competition in the future that could limit our ability to conduct our business effectively.

Risk Factors

We have risks and uncertainties that could affect us and our business, as well as the real estate industry generally. These risks are outlined under the heading “Risk Factors” contained in our offering Circular dated March 27, 2024, as amended and/or supplemented from time to time (the “Offering Circular”), which may be accessed here and may be updated from time to time by our future filings under Regulation A. In addition, new risks may emerge at any time, and we cannot predict such risks or estimate the extent to which they may affect our financial performance. These risks could result in a decrease in the value of our Units.

| 13 |

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis of our financial condition and results of operations should be read together with our consolidated financial statements and related notes appearing at the end of this Annual Report. This discussion and analysis contains forward-looking statements reflecting our current expectations that involve risks and uncertainties. Actual results and the timing of events may differ materially from those contained in these forward-looking statements due to a number of factors, including those discussed in the section entitled “Risk Factors” as disclosed in our Offering Circular, as amended or supplemented from time to time, which may be accessed here and may be updated from time to time by our future filings under Regulation A.

Overview

Roots Real Estate Investment Community I, LLC, a Georgia limited liability company (the “Company”, “we”, “our”, “us”, or “RootsCom”), was formed on December 8, 2020 for the purpose of finding and acquiring residential real estate in the Atlanta-Sandy Springs-Alpharetta Metropolitan Statistical Area (the “Atlanta MSA”), that has value-add potential; however, the Manager (defined below) is not limited to searching only in the Atlanta MSA. Substantially all the Company’s business is managed by Roots REIT Management, LLC, a Georgia limited liability company (the “Manager”).

On May 27, 2022, the Company filed an offering statement on Form 1-A with the SEC with respect to an offering (the “Offering”) of up to $75,000,000 of the Company’s units of membership interest (“Units”), for an initial price of $110.00 per Unit. Prior to the offering statement being qualified by the SEC, the Company sold approximately 63,735 Units at prices ranging from $100.00 to $110.00 per Unit for a total of $6,525,654, through a private placement.

Our Investments

During the year ended December 31, 2024, the Company acquired one hundred (100) residential properties located in the Atlanta MSA for an aggregate purchase price of $34,751,129. During the year ended December 31, 2023, the Company acquired fifty-eight (58) residential properties located in the Atlanta MSA for an aggregate purchase price of $18,248,755. See Item 1, “Acquisitions” for additional information regarding the property acquisitions we made during the year ended December 31, 2024.

Liquidity and Capital Resources

We obtain the capital required to purchase real estate investments and conduct our operations from the proceeds of the Offering and any future offerings we may conduct, from secured or unsecured financings from banks and other lenders and from any undistributed funds from our operations. As of December 31, 2024 and December 31, 2023, we had cash and cash equivalents of $1,134,637 and $780,323, respectively, that are available to provide capital for operations and investments. We anticipate that proceeds from the Offering, cash flow from operations and available cash will provide sufficient liquidity to meet future funding commitments for at least one year from the date of the financial statements filed herewith.

We selectively employ leverage to enhance total returns to our Members through a combination of senior financing and other financing transactions. We seek to secure conservatively structured leverage that is long term and non-recourse to the extent obtainable on a cost-effective basis.

We expect to continue to use leverage at the portfolio level, and may use asset-level leverage, which, in the aggregate across the portfolio, we do not expect to exceed 75% of the cost (before deducting depreciation or other non-cash reserves) of total assets, capital expenditures and closing costs. The debt may be borrowed from institutional lenders, private lenders, or affiliates, in order to facilitate the acquisition of residential real property and value-add renovations. As of December 31, 2024 and 2023, we had outstanding mortgage loans payable of approximately $31,148,548 and $13,485,954, respectively, net of unamortized deferred financing costs of $825,050 and $140,226, respectively.

In the normal course of business, the Company encounters economic risk, including interest rate risk, credit risk, market risk and inflation risk. Interest rate risk is the result of movements in the underlying variable component of the mortgage financing rates. Credit risk is the risk of default on the Company’s real estate assets that results from an underlying resident’s inability or unwillingness to make contractually required payments. Market risk reflects changes in the valuation of real estate assets held by the Company. Inflation risk is the risk that rising prices could increase the Company’s operating expenses and impact residents.

| 14 |

Distributions

For the year ended December 31, 2024, distributions in the amount of $1,697,678 have been declared, of which $597,398 was accrued and included in distributions payable in the accompanying consolidated financial statements for the year ended December 31, 2024. For the year ended December 31, 2023, distributions in the amount of $894,626 were declared, of which $295,531 was accrued and included in distributions payable in the accompanying consolidated financial statements. We expect that distributions declared by our Manager will be made on a quarterly basis, or less frequently as determined by our Manager. Any future distributions by the Company will be at the discretion of our Manager, and will be based on, among other factors, our present and reasonably projected future cash flow.

Unit Redemptions

We have adopted a Unit redemption program as described in detail in our Offering Circular, which may be accessed here. Our Manager reserves the right, in its sole and absolute discretion, to suspend the Company’s offer for redemption at any time, without notice, for any reason or no reason. We also may make redemptions upon the death of a Member, or in special circumstances as determined by the Manager (referred to as “exception redemptions”; all other redemptions are referred to as “ordinary redemptions”). Furthermore, the Manager reserves the right, in its sole and absolute discretion, to redeem some or all of a Member’s Units at any time, without notice, for any reason or no reason

The Company offers partial liquidity for its Members on a quarterly basis in the form of a partial redemption by the Company of a Member’s Units. Each quarter, no more than 5% of the issued and outstanding Units may be redeemed (the “Aggregate Redemption Cap”), and no more than $100,000 of an individual Member’s Units may be redeemed in any one quarter. In the event that a redemption request is made by multiple Members, so that the total redemptions requested would be greater than the applicable Aggregate Redemption Cap, the requested redemptions will be maxed at the Aggregate Redemption Cap and will be split among each requesting Member pro rata based on such Member’s redemption request compared to the aggregate redemptions requested for that quarter. The window to request a redemption will begin on the fifteenth (15th) calendar day prior to the end of the applicable quarter and will end on the last day of such quarter. The redemption price per Unit will be the established net asset value (“NAV”) per Unit for the quarter then-ending. NAV is calculated by taking the total non real estate assets plus fair market value of real estate minus total liabilities. The redemption price per Unit may be decreased by 6% if a Member requests a redemption (and participates in such redemption) within the first year of such Member’s ownership of Units.

For the year ended December 31, 2024, the Company redeemed a total of approximately 22,266 Units at prices ranging from $128.00 to $137.00 per Unit, for a total of $2,963,173. For the year ended December 31, 2023, the Company redeemed a total of approximately 3,914 Units at prices ranging from $115.00 to $126.00 per Unit, for a total of $483,875. In aggregate, the Sponsor redeemed approximately 150 Units at a price of $133.00 per Unit, for a total of $20,000.

Sources of Operating Revenues and Cash Flows

Refer to our Consolidated Statements of Cash Flows in our consolidated financial statements.

We expect to primarily generate operating revenues and cash flows from the operations of our real estate investments. See Note 2, Summary of Significant Accounting Policies, in our consolidated financial statements for further detail.

Cash Flows from Operating Activities

For the years ended December 31, 2024 and 2023, net cash provided by operating activities was $1,149,656 and $99,605, respectively. For the year ended December 31, 2024, net cash flow from operating activities increased primarily due to an increase in depreciation.

Cash Flows from Investing Activities

For the years ended December 31, 2024 and 2023, net cash used in investing activities was $42,128,342 and $20,197,177 respectively. For the year ended December 31, 2024, net cash used in investing activities increased due to the acquisition of one hundred properties during the year and an increase of the related party note receivable.

Cash Flows from Financing Activities

For the years ended December 31, 2024 and 2023, net cash provided by financing activities was $41,754,012 and $20,465,268, respectively. For the year ended December 31, 2024, net cash provided by financing activities increased due to proceeds from mortgage loans payable and proceeds from the issuance of Units.

| 15 |

Results of Operations

Refer to our Consolidated Statements of Operations in our consolidated financial statements.

For the year ended December 31, 2024, we had net income attributable to Roots Real Estate Investment Community I, LLC in the amount of $126,978. This was driven by rental income from acquired properties and interest income from a related party offset by operating expenses, depreciation, and interest expense. For the year ended December 31, 2023, we had net income attributable to Roots Real Estate Investment Community I, LLC in the amount of $98,603. This was driven by rental income from acquired properties and interest income from a related party offset by operating expenses, depreciation, and interest expense.

Based on a comparison of the years ended December 31, 2024 versus 2023, total revenues increased by $2,358,647. Operating expenses increased by $1,255,387, which is primarily attributable to property management fees, real estate taxes, and insurance. Nonoperating expense increased by $1,074,885, which was primarily attributable to related party interest income offset by depreciation and interest expense.

We expect that rental income, operating and maintenance, property management fees, real estate taxes and insurance, general and administration, depreciation and interest expense will increase as we continue to acquire additional properties. Nonoperating expenses are expected to remain stable, as the increase in related party interest income will be offset by higher depreciation and interest expenses resulting from the acquisition of additional properties.

Capital Expenditures

During the year ended December 31, 2024, the Company incurred approximately $690,459 in capital expenditures, primarily related to property improvements, tenant turnover costs, and standard wear-and-tear items across the portfolio. This compares to approximately $328,163 in capital expenditures for the year ended December 31, 2023. The increase was driven by renovation activity at certain properties and more robust resident improvement packages provided in connection with lease renewals and new leasing activity. The Company anticipates similar or moderately elevated levels of capital spending in 2025, and expects to fund these expenditures through cash generated from operations.

Capital Investments

In addition to recurring capital expenditures, the Company may pursue selective capital investment opportunities consistent with its strategic growth plan. As of the date of this Annual Report, no significant capital investments have been approved or committed. Any future investments will be evaluated based on projected returns, alignment with long-term objectives, and available financing options. Such investments may be funded through internal cash, joint venture equity partnerships, or third-party financing as appropriate.

Operating Expenses

Total operating expenses were $2,332,346 for the year ended December 31, 2024, compared to $1,066,959 for the year ended December 31, 2023. The increase is primarily attributable to current year acquisitions, as well as higher apartment turnover and maintenance expenses, an increase in property taxes due to reassessments in key jurisdictions, and elevated property insurance premiums amid broader market hardening. Management anticipates continued pressure on insurance costs and is actively exploring mitigation strategies.

Debt Obligations

As of December 31, 2024, the Company had total outstanding debt of $31,148,548, consisting entirely of mortgage loans, compared to $13,485,954 as of December 31, 2023. The increase is primarily due to debt incurred in connection with new property acquisitions completed during 2024. Scheduled maturities over the next 12 months total $3,109,602, which the Company intends to address through refinancing, available liquidity, or operating cash flow. The Company’s weighted average interest rate as of year-end was 6.62%. Management regularly monitors debt service coverage ratios and prevailing market conditions to manage refinancing risk and interest rate exposure. The Company remains focused on maintaining flexibility in its capital structure and intends to proactively address upcoming maturities.

Outlook and Recent Trends

During the year ended December 31, 2024, financial markets and interest rates fluctuated significantly, with rates continuing to climb. The residential real estate market continued to cool off and we anticipate this will continue as rates continue to stay high and median home prices have peaked in the short term. Management believes that our unique, disciplined acquisition process will allow us to continue to access properties in our market at below market pricing and allow us to continue to execute on our value-add strategy of building a real estate investment opportunity that delivers to our investors and our residents.

Critical Accounting Policies

See Note 2, Summary of Significant Accounting Policies, in our consolidated financial statements for further detail.

Off-Balance Sheet Arrangements

As of December 31, 2024 and December 31, 2023, we had no off-balance sheet arrangements.

Related Party Arrangements

For further information regarding Related Party Arrangements, please see Note 5 in the accompanying consolidated financial statements below.

Recent Developments

Between December 31, 2024 and April 22, 2025, the Company sold approximately 87,452 Units for a total of approximately $12,213,490. The Company redeemed approximately 14,401 Units for a total of approximately $2,016,131. As of April 22, 2025, aggregate Units outstanding totaled approximately 473,572, for total net offering proceeds of approximately $59,551,582.

| 16 |

Item 3. Directors and Managers

Our Manager

The Company operates under the direction of the Board of Managers (the “Board”), which is currently composed of a single Manager, Roots REIT Management, LLC, a Georgia limited liability company, which is a wholly-owned subsidiary of our sponsor, Seed InvestCo, LLC, a Georgia limited liability company (“Manager”). Our Sponsor and our Manager are currently controlled and managed by Daniel Dorfman and Larry Dorfman. The Manager manages the Company’s day to day operations, including providing investment advisory and acquisition services (including performing due diligence on the Company’s investments), offering services, asset management services, marketing and advertising services, accounting and other administrative services, Member services, financing services, disposition services, and manages the RootsCom Platform, among others. In addition, the Manager will make all the decisions regarding the selection, negotiation, financing and disposition of the Company’s investments.

The Company will follow investment guidelines adopted by the Manager and the investment and borrowing policies set forth in the Offering Circular unless they are modified by the Manager. The Manager may establish further written policies on investments and borrowings and will monitor the Company’s administrative procedures, investment operations and performance to ensure that the policies are fulfilled. The Manager may change the Company’s investment objectives at any time without the approval of investors.

The Manager performs its duties and responsibilities pursuant to the Company’s operating agreement (the “Company Operating Agreement”) and the property management agreement entered into by us and the Manager effective as of April 15, 2025. The Company has agreed to limit the liability and to indemnify the Manager (and certain other persons accorded such limited liability and indemnification by the Manager, in its sole discretion) against certain liabilities.

Executive Officers of our Sponsor and Manager

Seed InvestCo is led by a management team of professionals who together have extensive experience in real estate and company management. These professionals also serve as the executive officers of the Manager.

| Name of Executive | Age | Position | Term of Office | |||

| Daniel Dorfman | 37 | Manager of Sponsor Principal Executive Officer of Manager |

Since inception. | |||

| Larry Dorfman | 69 | Manager of Sponsor Principal Financial Officer of Manager |

Since inception. | |||

| Scott Jacobsen | 36 | Chief Operating Officer of Manager | March 2021 | |||

| Mel Myrie | 53 |

Chief Financial Officer of Manager |

June 2021 |

Daniel Dorfman, Manager of Sponsor, Principal Executive Officer of Manager

In 2012 Daniel and his wife, Rosanne, created a real estate community where they could help everyday people better understand how to buy their first home, or to upgrade to their last, and along the way they have been committed to leveraging their business and the relationships they have built to help the communities they serve. A portion of all of their commissions have gone to different local charities around the markets they, and their clients, work and live in. They have helped lead over 50 syndicated real estate transactions and managed the properties in each of those over the last 10 years.

Larry Dorfman, Manager of Sponsor, Principal Financial Officer of Manager

Larry founded APCO Holdings, Inc, one of Atlanta’s Top 100 privately held companies. He started the company in 1984 with five other people and they grew it to an organization of over 560 team members with a valuation of almost a billion dollars. Along the way they took the company public on NASDAQ in 1988, sold it to Ford Motor Company in 1999, bought it back with the rest of management and an equity firm in 2007, and did another significant transaction to another equity group in 2014. Larry stepped down as Chairman/CEO in mid-2019 to focus on family and charitable work.

| 17 |

Scott Jacobsen, Chief Operating Officer of Manager

Scott graduated from the University of South Carolina and was employed shortly thereafter by APCO Holdings, Inc where he quickly developed into an expert operations and implementation manager. His last 5 years at APCO he was a National Program Manager building and launching new products across the U.S.

Mel Myrie, Chief Financial Officer of Manager

Mel graduated from North Carolina A&T State University and has 20+ years in the finance and accounting industry. Just prior to joining the Company, Mel was managing a team of 30 accounting professionals for a company with a multi-billion-dollar real estate portfolio.

Compensation of Executive Officers

We do not currently have any employees, nor do we currently intend to hire any employees who will be compensated directly by us. As described above, certain of the executive officers of our Sponsor also serve as executive officers of our Manager. Each of these individuals, and other employees of our Sponsor, receives compensation for his or her services, including services performed for us on behalf of our Manager, from the Sponsor. As executive officers and/or employees of our Manager and/or Sponsor, these individuals will manage our day-to-day affairs, oversee the review, selection and recommendation of investment opportunities, service acquired investments and monitor the performance of these investments to ensure that they are consistent with our investment objectives. Although we will indirectly bear some of the costs of the compensation paid to these individuals, through fees we pay to our Manager or reimbursement for specific duties done by their employees that are directly related to the business operations of the Company, we do not intend to pay any compensation directly to these individuals.

Compensation of our Manager

For information regarding the compensation of our Manager, please see “Management Compensation” in our Offering Circular, which may be accessed here, which such section is incorporated herein by reference.

| 18 |

Item 4. Security Ownership of Management and Certain Securityholders

The following table sets forth the beneficial ownership of our Units as of December 31, 2024 for each person or group that holds more than 5% of our Units, for each executive officer of our Manager and for the executive officers of our Manager as a group. To our knowledge, each person that beneficially owns our Units has sole voting and disposition power with regard to such Units.

Unless otherwise indicated below, each person or entity has an address in care of our principal executive offices at 1344 La France Street NE, Atlanta, Georgia 30307.

| Name of Beneficial Owner(1) | Number of Units Beneficially Owned | Percent of All Units | ||||||

| Larry Dorfman (Manager of Sponsor) | 8,363.10 | 1.82 | % | |||||

| Daniel Dorfman (Manager of Sponsor) | 3,647.25 | 0.82 | % | |||||

| Scott Jacobsen (COO of Sponsor) | 1,094.53 | 0.24 | % | |||||

| Mel Myrie (CFO of Sponsor) | 603.25 | 0.13 | % | |||||

| Total: | 13,708.13 | 3.02 | % | |||||

| (1) | Under SEC rules, a person is deemed to be a “beneficial owner” of a security if that person has or shares “voting power,” which includes the power to dispose of or to direct the disposition of such security. A person also is deemed to be a beneficial owner of any securities which that person has a right to acquire within 60 days. Under these rules, more than one person may be deemed to be a beneficial owner of the same securities and a person may be deemed to be a beneficial owner of securities as to which he or she has no economic or pecuniary interest. |

Item 5. Interest of Management and Others in Certain Transactions

For further details, please see Note 5, Related Party Arrangements in our consolidated financial statements.

None.

| 19 |

Index to Consolidated Financial Statements

of Roots Real Estate Investment Community I, LLC and Subsidiaries

| F-1 |

|

600 Galleria Pkwy SE Suite 600 Atlanta, GA 30339 |

To the Members of

Roots Real Estate Investment Community I, LLC and Subsidiaries

Opinion

We have audited the accompanying consolidated financial statements of Roots Real Estate Investment Community I, LLC and Subsidiaries (the “Company”), which comprise the consolidated balance sheets as of December 31, 2024 and 2023, and the related consolidated statements of operations, members’ equity, and cash flows for the years then ended, and the related notes to the consolidated financial statements.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of the Company as of December 31, 2024 and 2023, and the results of its operations and its cash flows for the years then ended in accordance with U.S. generally accepted accounting principles.

Basis for Opinion

We conducted our audits in accordance with auditing standards generally accepted in the United States of America. Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Consolidated Financial Statements section of our report. We are required to be independent of the Company and to meet our other ethical responsibilities in accordance with the relevant ethical requirements relating to our audits. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Responsibilities of Management for the Consolidated Financial Statements

Management is responsible for the preparation and fair presentation of the consolidated financial statements in accordance with U.S. generally accepted accounting principles, and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of consolidated financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the consolidated financial statements, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern within one year after the date that the consolidated financial statements are available to be issued.

moorecolson.com

information@moorecolson.com

770.989.0028

| F-2 |

Auditor’s Responsibilities for the Audit of the Consolidated Financial Statements

Our objectives are to obtain reasonable assurance about whether the consolidated financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with generally accepted auditing standards will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are considered material if there is a substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a reasonable user based on the consolidated financial statements.

In performing an audit in accordance with generally accepted auditing standards, we:

| ● | Exercise professional judgment and maintain professional skepticism throughout the audit. | |

| ● | Identify and assess the risks of material misstatement of the consolidated financial statements, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the consolidated financial statements. | |

| ● | Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control. Accordingly, no such opinion is expressed. | |

| ● | Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the consolidated financial statements. | |

| ● | Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern for a reasonable period of time. |

We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control related matters that we identified during the audit.

Other Information Included in the Company’s 2024 Annual Report

Management is responsible for the other information included in the Company’s 2024 Annual Report. The other information comprises the 2024 Annual Report but it does not include the consolidated financial statements and our auditor’s report thereon. Our opinion on the consolidated financial statements does not cover the other information, and we do not express an opinion or any form of assurance on it.

In connection with our audit of the consolidated financial statements, our responsibility is to read the other information and consider whether a material inconsistency exists between the other information and the consolidated financial statements, or the other information otherwise appears to be materially misstated. If, based on the work performed, we conclude that an uncorrected material misstatement of the other information exists, we are required to describe it in our report.

/s/ Moore Colson & Company

Atlanta, Georgia

April 29, 2025

| F-3 |

ROOTS REAL ESTATE INVESTMENT COMMUNITY I, LLC AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

| December 31, | December 31, | |||||||

| 2024 | 2023 | |||||||

| ASSETS: | ||||||||

| Real Estate: | ||||||||

| Land | $ | 13,683,679 | $ | 7,401,919 | ||||

| Buildings and improvements | 45,662,941 | 17,995,601 | ||||||

| Total real estate | 59,346,620 | 25,397,520 | ||||||

| Less: Accumulated depreciation and amortization | (1,486,273 | ) | (454,616 | ) | ||||

| Real estate, net | 57,860,347 | 24,942,904 | ||||||

| Cash and cash equivalents | 1,134,637 | 780,323 | ||||||

| Restricted cash | 475,605 | 54,593 | ||||||

| Resident receivables | 113,405 | 52,882 | ||||||

| Due from related party, net | 259,333 | 401,538 | ||||||

| Note receivable - related party | 14,467,006 | 7,465,015 | ||||||

| Prepaid expenses and other assets | 452,322 | 121,503 | ||||||

| Total assets | $ | 74,762,655 | $ | 33,818,758 | ||||

| LIABILITIES: | ||||||||

| Mortgage loans payable, net of unamortized deferred financing costs of $825,050 and $140,226 as of December 31, 2024 and December 31, 2023, respectively | $ | 31,148,548 | $ | 13,485,954 | ||||

| Accounts payable and accrued expenses | 97,659 | 61,550 | ||||||

| Distributions payable | 597,398 | 295,531 | ||||||

| Deposits | 176,018 | 86,298 | ||||||

| Deferred income | 5,310 | 14,215 | ||||||

| Total liabilities | 32,024,933 | 13,943,548 | ||||||

| Commitments and contingencies (Note 6) | ||||||||

| MEMBERS’ EQUITY: | ||||||||

| Members’ equity (399,489 and 203,042 membership units issued and outstanding as of December 31, 2024 and December 31, 2023, respectively) | 49,354,223 | 23,428,523 | ||||||

| Distributions in excess of cumulative net income | (6,616,501 | ) | (3,553,313 | ) | ||||

| Total members’ equity | 42,737,722 | 19,875,210 | ||||||

| Total liabilities and members’ equity | $ | 74,762,655 | $ | 33,818,758 | ||||

See notes to the consolidated financial statements

| F-4 |

ROOTS REAL ESTATE INVESTMENT COMMUNITY I, LLC AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

| For the Years Ended December 31, | ||||||||

| 2024 | 2023 | |||||||

| REVENUES: | ||||||||

| Rental income | $ | 3,568,694 | $ | 1,405,388 | ||||

| Other income | 353,115 | 157,774 | ||||||

| Total revenues | 3,921,809 | 1,563,162 | ||||||

| EXPENSES: | ||||||||

| Operating and maintenance | 924,339 | 452,037 | ||||||

| Property management fees - related party | 146,567 | 130,545 | ||||||

| Property management fees | 222,258 | 11,699 | ||||||

| Real estate taxes and insurance | 598,434 | 240,782 | ||||||

| General and administrative | 430,748 | 231,896 | ||||||

| Total operating expenses | 2,322,346 | 1,066,959 | ||||||

| Net operating income | 1,599,463 | 496,203 | ||||||

| NONOPERATING INCOME (EXPENSES): | ||||||||

| Interest income - related party | 766,060 | 442,058 | ||||||

| Gain on sale of real estate | — | 91,627 | ||||||

| Depreciation expense | (1,031,658 | ) | (346,772 | ) | ||||

| Interest expense | (1,206,887 | ) | (584,513 | ) | ||||

| Total nonoperating expense, net | (1,472,485 | ) | (397,600 | ) | ||||

| Net income | $ | 126,978 | $ | 98,603 | ||||

See notes to the consolidated financial statements

| F-5 |

ROOTS REAL ESTATE INVESTMENT COMMUNITY I, LLC AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF MEMBERS’ EQUITY

FOR THE YEARS ENDED DECEMBER 31, 2024 AND 2023

| Member Units | Members’ Equity | Distributions in Excess of Cumulative Net Income | Total Members’ Equity | |||||||||||||

| Balance at December 31, 2022 | 82,169 | $ | 8,546,232 | $ | (993,008 | ) | $ | 7,553,224 | ||||||||

| Proceeds from issuance of member units | 124,787 | 15,366,166 | — | 15,366,166 | ||||||||||||

| Redemptions of member units | (3,914 | ) | (483,875 | ) | — | (483,875 | ) | |||||||||

| Capital reductions | — | — | (1,764,282 | ) | (1,764,282 | ) | ||||||||||

| Distributions | — | — | (894,626 | ) | (894,626 | ) | ||||||||||

| Net income | — | — | 98,603 | 98,603 | ||||||||||||

| Balance at December 31, 2023 | 203,042 | 23,428,523 | (3,553,313 | ) | 19,875,210 | |||||||||||

| Proceeds from issuance of member units | 218,713 | 28,888,873 | — | 28,888,873 | ||||||||||||

| Redemptions of member units | (22,266 | ) | (2,963,173 | ) | — | (2,963,173 | ) | |||||||||

| Capital reductions | — | — | (1,492,488 | ) | (1,492,488 | ) | ||||||||||

| Distributions | — | — | (1,697,678 | ) | (1,697,678 | ) | ||||||||||

| Net income | — | — | 126,978 | 126,978 | ||||||||||||

| Balance at December 31, 2024 | 399,489 | $ | 49,354,223 | $ | (6,616,501 | ) | $ | 42,737,722 | ||||||||

See notes to the consolidated financial statements

| F-6 |

ROOTS REAL ESTATE INVESTMENT COMMUNITY I, LLC AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

| For the Years Ended December 31, | ||||||||

| 2024 | 2023 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | ||||||||

| Net income | $ | 126,978 | $ | 98,603 | ||||

| Gain on sale of real estate | — | (91,627 | ) | |||||

| Depreciation | 1,031,658 | 346,772 | ||||||

| Amortization of deferred financing costs | 40,430 | 63,253 | ||||||

| Changes in assets and liabilities: | ||||||||

| Resident receivables | (60,523 | ) | (52,882 | ) | ||||

| Due from related party, net | 154,625 | (318,971 | ) | |||||

| Prepaid expenses and other assets | (330,819 | ) | (72,004 | ) | ||||

| Accounts payable and accrued expenses | 36,109 | 49,900 | ||||||

| Deposits | 160,103 | 73,899 | ||||||

| Deferred income | (8,905 | ) | 2,662 | |||||

| Net cash provided by operating activities | 1,149,656 | 99,605 | ||||||

| CASH FLOWS FROM INVESTING ACTIVITIES: | ||||||||

| Proceeds from sale of real estate | — | 320,868 | ||||||

| Acquisitions of real estate | (13,993,682 | ) | (185,194 | ) | ||||

| Additions to real estate | (690,459 | ) | (328,163 | ) | ||||

| Additions to note receivable - related party | (34,694,201 | ) | (20,004,688 | ) | ||||

| Payments on note receivable - related party | 7,250,000 | — | ||||||

| Net cash used in investing activities | (42,128,342 | ) | (20,197,177 | ) | ||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | ||||||||

| Proceeds from mortgage loans payable | 25,906,469 | 6,905,250 | ||||||

| Payments on mortgage loans payable | (7,888,583 | ) | (440,750 | ) | ||||

| Payment of financing costs | (725,259 | ) | (26,230 | ) | ||||

| Proceeds from issuance of member units | 27,567,805 | 14,591,828 | ||||||

| Redemptions of member units | (2,963,173 | ) | (483,875 | ) | ||||

| Distributions | (143,247 | ) | (80,955 | ) | ||||

| Net cash provided by financing activities | 41,754,012 | 20,465,268 | ||||||

| Net increase in cash, cash equivalents and restricted cash | 775,326 | 367,696 | ||||||

| Cash, cash equivalents and restricted cash, beginning of year | 834,916 | 467,220 | ||||||

| Cash, cash equivalents and restricted cash, end of year | $ | 1,610,242 | $ | 834,916 | ||||

| Supplemental disclosure of cash flow information: | ||||||||

| Cash paid for interest | $ | (1,166,457 | ) | $ | (521,260 | ) | ||

| Supplemental disclosure of noncash operating, investing and financing activities: | ||||||||

| Acquisitions of real estate | $ | (19,264,959 | ) | $ | (16,299,279 | ) | ||

| Reductions of note receivable - related party | $ | 20,442,210 | $ | 14,644,764 | ||||

| Increase in due from related party, net - deposits | $ | (12,420 | ) | $ | (48,893 | ) | ||

| Increase in deposits from related party | $ | 12,420 | $ | 48,893 | ||||

| Assumption of deferred financing costs | $ | — | $ | (60,835 | ) | |||

| Assumption of mortgage loans payable | $ | 329,537 | $ | 3,448,250 | ||||

| Deposits used for issuance of member units | $ | (70,383 | ) | $ | (105,684 | ) | ||

| Distributions payable used for issuance of member units | $ | (445,114 | ) | $ | (39,256 | ) | ||

| Distributions payable | $ | 597,398 | $ | 295,531 | ||||

| Increase in other liabilities used for issuance of member units | $ | — | $ | 1,079 | ||||

| Issuance of member units from distributions reinvested | $ | 1,321,068 | $ | 774,338 | ||||

| Increase in capital reductions | $ | (3,190,167 | ) | $ | (2,658,908 | ) | ||

See notes to the consolidated financial statements

| F-7 |

Roots Real Estate Investment Community I, LLC and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2024 and 2023

| 1. | Formation and Organization |

Roots Real Estate Investment Community I, LLC (the “Company”) was formed on December 8, 2020, as a Georgia Limited Liability Company and has elected to be taxed as a real estate investment trust (“REIT”) for U.S. federal income tax purposes. The Company’s purpose is to create a real estate investment portfolio, leveraging professional real estate expertise with technology, scale, and local market insights to generate attractive returns for its Members and unique opportunities and value to the communities that it serves. The Company began substantive operations in May 2021.

Substantially all the Company’s business is managed by Roots REIT Management, LLC (the “Manager”), a Georgia limited liability company. The Manager uses its resources to find and acquire residential real estate in the Atlanta-Sandy Springs-Alpharetta Metropolitan Statistical Area (the “Atlanta MSA”), that has value-add potential; however, the Manager is not limited to searching only in the Atlanta MSA.

On May 27, 2022, the Company filed an offering statement on Form 1-A with the SEC with respect to an offering (the “Offering”) of up to $75,000,000 of the Company’s units of membership interest (“Units” or “Member Units”), for an initial price of $110.00 per Unit.

A maximum of $75,000,000 of the Company’s Units may be sold to the public in this Offering. The Manager has the authority to issue an unlimited number of Units. Seed InvestCo, LLC (the “Sponsor”), the owner of the Manager, received 500 Units for $1,000 in exchange for organization and formation costs incurred on behalf of the Company. Prior to the Offering receiving qualification by the SEC, the Company sold approximately 63,735 Units at prices ranging from $100.00 to $110.00 per Unit for a total of $6,525,654. The Offering received qualification on June 21, 2022. Between June 22, 2022 and December 31, 2022, the Company sold approximately 20,279 Units at prices ranging from $100.00 to $115.00 per Unit, for a total of $2,289,000. Between January 1, 2023 and December 31, 2023, the Company sold approximately 124,787 Units at prices ranging from $108.00 to $126.00 per Unit, for a total of $15,366,166. Between January 1, 2024, and December 31, 2024, the Company sold approximately 218,713 Units at prices ranging from $126.00 to $137.00 per Unit, for a total of $28,888,873. In aggregate, the Sponsor purchased approximately 2,420 Units at prices ranging from $100.00 to $133.00 per Unit, for a total of $204,047.

| 2. | Summary of Significant Accounting Policies |

Basis of Presentation

The accompanying consolidated financial statements of the Company are prepared on the accrual basis of accounting in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”).

The consolidated financial statements of the Company include the accounts of the Company and its wholly owned subsidiaries, Joe Jerkins LLC, Dobis Delaware LLC, Natti’s Properties LLC, XYZ Westchase Townhomes LLC, Roots TRX Tranche 1 SFR LLC, Roots TRX Tranche 2 SFR LLC, and Roots TRX Tranche 3 SFR LLC, Seed Curation LLC, Seed Curation 2 LLC, Roots Vestige, Roots Vestige II, Roots 2127 White Oak MF LLC, Roots 401 Clifton MF LLC, Roots 2124 Park Terrace MF LLC, Roots 1984 Wellbourne MF LLC, Roots 1744 Cambridge MF LLC, Roots 34 Tranche 1 LLC, Roots 34 Tranche 2 LLC, Roots 34 Tranche 3 LLC, Roots 34 Tranche 4 LLC, Flipside 1 Tranche 1, Flipside 1 Tranche 2, Flipside 1 Tranche 3, Flipside 1 Tranche 4, Woodward 8 LLC, Lipman 28 Tranche 1, Lipman 28 Tranche 2, Lipman 28 Tranche 3, and Lipman 28 Tranche 4. All significant intercompany accounts and transactions among the Company and its subsidiaries have been eliminated in consolidation.

| F-8 |

Estimates

The preparation of the consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the consolidated financial statements, and the reported amounts of revenues and expenses during the reporting period. These estimates and assumptions are based on management’s best judgment. Actual results could materially differ from those estimates.

Real Estate Acquisitions

The Company acquires real estate assets from its Manager or Sponsor, both of which are related parties of the Company. As a result of the related party nature of the transactions, the Company is required to record the real estate assets acquired at the related party’s historical cost, or carryover basis. The difference between the purchase price to acquire the real estate assets and the carryover basis in the real estate assets results in a reduction of the Company’s capital (see Note 3). The Company recognizes an asset acquired from the Manager or Sponsor and begins recording activity related to the asset as of the execution of the deed transfer. The Company also acquires real estate assets from third parties which are recorded at cost as of the date of closing.

Depreciation