Item 402(v) Pay Versus Performance

The disclosure included in this section is prescribed by SEC rules and does not necessarily align with how the Company or the Compensation Committee view the link between the Company’s performance and named executive officer (“NEO”) pay. For additional information about our pay for performance compensation philosophy and how we seek to align executive compensation with the Company’s performance, refer to “Executive and Director Compensation” beginning on page 48.

Required Tabular Disclosure of Pay Versus Performance

The table below shows compensation actually paid (as defined by the SEC in Item 402(v) of Regulation S-K) for our NEOs and the required financial performance measures for the years shown in the table. Use of the term “compensation actually paid” (“CAP”) is required by the SEC’s rules and as a result of the calculation methodology required by the SEC, such amounts differ from compensation actually received by the individuals and the compensation decisions described in the “Executive and Director Compensation” section above. For purposes of this discussion, our Chief Executive Officer is also referred to as our principal executive officer or “PEO” and our other NEOs are referred to as our “Non-PEO NEOs”.

Fiscal Year |

|

Summary |

|

|

Compensation |

|

|

Average |

|

|

Average |

|

|

Value of |

|

|

Net Income |

|

||||||

2024 |

|

$ |

684,392 |

|

|

$ |

754,068 |

|

|

$ |

512,832 |

|

|

$ |

541,557 |

|

|

$ |

19.85 |

|

|

$ |

(8,067 |

) |

2023 |

|

$ |

1,348,215 |

|

|

$ |

1,029,248 |

|

|

$ |

806,380 |

|

|

$ |

671,536 |

|

|

$ |

19.18 |

|

|

$ |

(13,335 |

) |

2022 |

|

$ |

1,678,838 |

|

|

$ |

606,129 |

|

|

$ |

909,863 |

|

|

$ |

442,017 |

|

|

$ |

28.12 |

|

|

$ |

(62,428 |

) |

Year |

|

PEO |

|

Non-PEO NEOs |

|

||

2024 |

|

|

Bruce D. Steel |

|

|

Stephen Connelly, Ph. D., Christine Zedelmayer |

|

2023 |

|

|

Bruce D. Steel |

|

|

Stephen Connelly, Ph. D., Christine Zedelmayer |

|

2022 |

|

|

Bruce D. Steel |

|

|

Stephen Connelly, Ph. D., Christine Zedelmayer |

|

Fiscal Year 2024 Reconciliation of SCT Total to CAP* |

|

PEO ($) |

|

Average |

SCT Total |

|

$684,392 |

|

$512,832 |

(Minus): Grant Date Fair Value of the “Option Awards” Column in the SCT for Applicable Fiscal Year |

|

$213,052 |

|

$90,937 |

Plus: Add: Fair Value at Applicable Fiscal Year End of Awards Granted during Applicable Fiscal Year that Remain Unvested as of Applicable Fiscal Year End |

|

$206,189 |

|

$88,008 |

Plus: Change in Fair Value from the end of the Prior Fiscal Year to the end of the Applicable Fiscal Year of Awards Granted during Prior Fiscal Years that were Outstanding and Unvested as of Applicable Fiscal Year End |

|

$(8,556) |

|

$(3,522) |

Plus: Vesting Date Fair Value of Awards Granted during Prior Fiscal Years that Vested During Applicable Fiscal Year |

|

$85,095 |

|

$35,176 |

CAP |

|

$754,068 |

|

$541,557 |

* For purposes of the above adjustments, the fair value of equity awards on the applicable date were determined in accordance with FASB’s ASC Topic 718, using valuation methodologies that are generally consistent with those used to determine the grant-date fair value for accounting purposes.

The table below contains ranges of assumptions used in the valuation of outstanding equity awards for the relevant fiscal year(s). For more information, please see the notes to our financial statements in our Annual Report on Form 10-K and the footnotes to the Summary Compensation Table of this Proxy Statement.

Stock Options |

|

Fiscal Year |

Expected Term |

|

1.1 – 5.4 years |

Strike Price |

|

$0.73 - $0.79 |

Volatility |

|

76.0% - 82.9% |

Dividend Yield |

|

0.0% - 0.0% |

Risk-Free Interest Rate |

|

3.4% - 5.2% |

Year |

|

PEO |

|

Non-PEO NEOs |

|

||

2024 |

|

|

Bruce D. Steel |

|

|

Stephen Connelly, Ph. D., Christine Zedelmayer |

|

2023 |

|

|

Bruce D. Steel |

|

|

Stephen Connelly, Ph. D., Christine Zedelmayer |

|

2022 |

|

|

Bruce D. Steel |

|

|

Stephen Connelly, Ph. D., Christine Zedelmayer |

|

Fiscal Year 2024 Reconciliation of SCT Total to CAP* |

|

PEO ($) |

|

Average |

SCT Total |

|

$684,392 |

|

$512,832 |

(Minus): Grant Date Fair Value of the “Option Awards” Column in the SCT for Applicable Fiscal Year |

|

$213,052 |

|

$90,937 |

Plus: Add: Fair Value at Applicable Fiscal Year End of Awards Granted during Applicable Fiscal Year that Remain Unvested as of Applicable Fiscal Year End |

|

$206,189 |

|

$88,008 |

Plus: Change in Fair Value from the end of the Prior Fiscal Year to the end of the Applicable Fiscal Year of Awards Granted during Prior Fiscal Years that were Outstanding and Unvested as of Applicable Fiscal Year End |

|

$(8,556) |

|

$(3,522) |

Plus: Vesting Date Fair Value of Awards Granted during Prior Fiscal Years that Vested During Applicable Fiscal Year |

|

$85,095 |

|

$35,176 |

CAP |

|

$754,068 |

|

$541,557 |

Fiscal Year 2024 Reconciliation of SCT Total to CAP* |

|

PEO ($) |

|

Average |

SCT Total |

|

$684,392 |

|

$512,832 |

(Minus): Grant Date Fair Value of the “Option Awards” Column in the SCT for Applicable Fiscal Year |

|

$213,052 |

|

$90,937 |

Plus: Add: Fair Value at Applicable Fiscal Year End of Awards Granted during Applicable Fiscal Year that Remain Unvested as of Applicable Fiscal Year End |

|

$206,189 |

|

$88,008 |

Plus: Change in Fair Value from the end of the Prior Fiscal Year to the end of the Applicable Fiscal Year of Awards Granted during Prior Fiscal Years that were Outstanding and Unvested as of Applicable Fiscal Year End |

|

$(8,556) |

|

$(3,522) |

Plus: Vesting Date Fair Value of Awards Granted during Prior Fiscal Years that Vested During Applicable Fiscal Year |

|

$85,095 |

|

$35,176 |

CAP |

|

$754,068 |

|

$541,557 |

The table below contains ranges of assumptions used in the valuation of outstanding equity awards for the relevant fiscal year(s). For more information, please see the notes to our financial statements in our Annual Report on Form 10-K and the footnotes to the Summary Compensation Table of this Proxy Statement.

Stock Options |

|

Fiscal Year |

Expected Term |

|

1.1 – 5.4 years |

Strike Price |

|

$0.73 - $0.79 |

Volatility |

|

76.0% - 82.9% |

Dividend Yield |

|

0.0% - 0.0% |

Risk-Free Interest Rate |

|

3.4% - 5.2% |

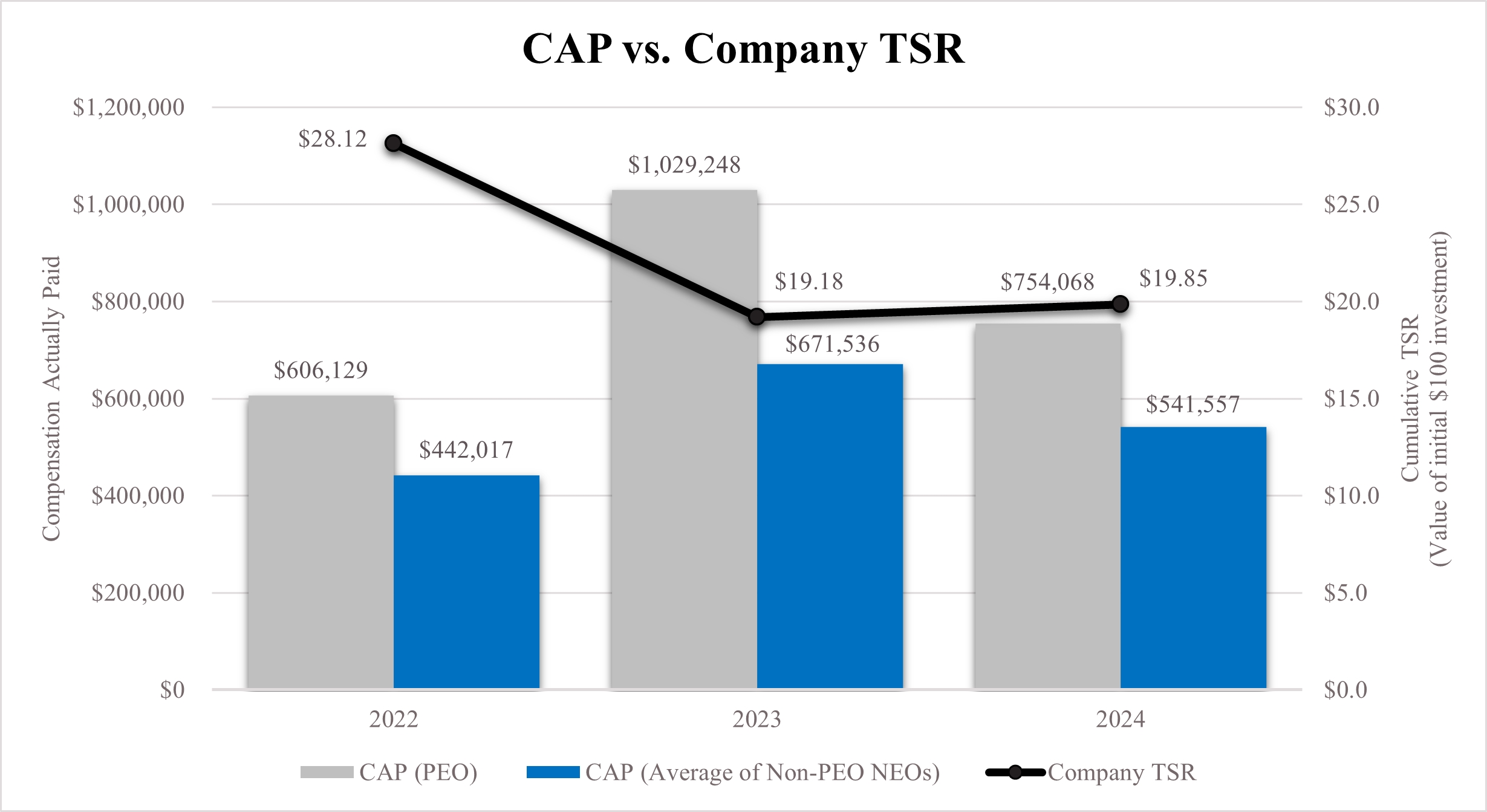

The following chart illustrates the relationship between CAP for our PEO and the average CAP for our Non-PEO NEOs against the Company’s TSR:

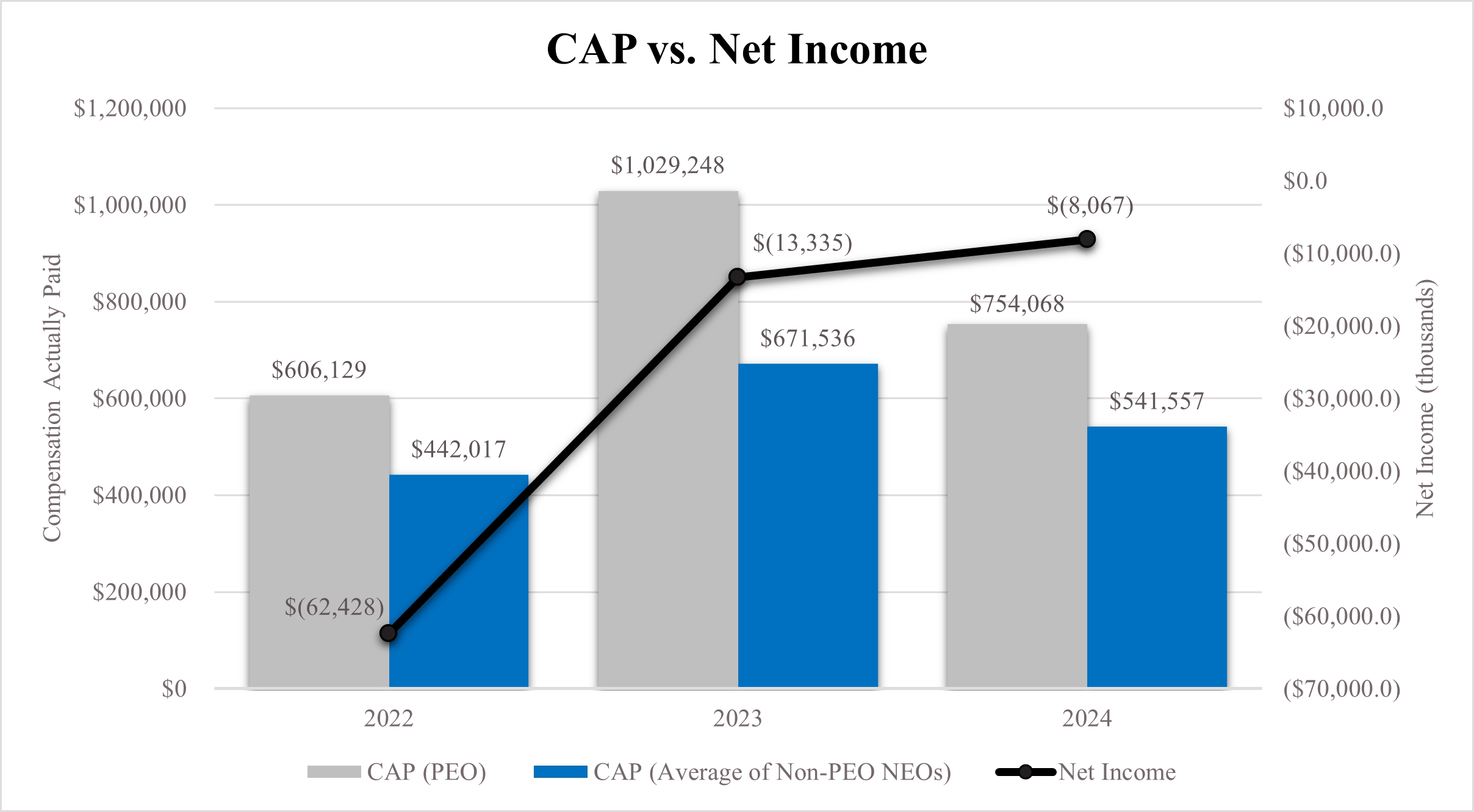

The following chart illustrates the relationship between CAP for our PEO and the average CAP for our Non-PEO NEOs against the Company’s net income: