Pay vs Performance Disclosure - USD ($)

|

12 Months Ended |

Dec. 31, 2024 |

Dec. 31, 2023 |

Dec. 31, 2022 |

| Pay vs Performance Disclosure |

|

|

|

| Pay vs Performance Disclosure, Table |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Pay-Versus-Performance | Year(1) (a) | | Summary Compensation Table Total for PEO 1 (Faga) (2) (b) | | Compensation Actually Paid for PEO 1 (Faga) (3) (c) | | Summary Compensation Table Total for PEO 2 (Suria) (2) (b) | | Compensation Actually Paid for PEO 2 (Suria) (3) (c) | | Average Summary Compensation Table Total for Non-PEO NEOs (2) (d) | | Average Compensation Actually Paid for Non-PEO NEOs (3) (e) | | Value of Initial Fixed $100 Investment Based on Total Shareholder Return (4) (f) | | Net Income

(g) | | 2024 | | $13,630,292 | | $9,160,362 | | N/A | | N/A | | $3,911,208 | | $1,844,033 | | $38 | | $(145,231,000) | | 2023 | | $7,461,920 | | $(1,737,869) | | N/A | | N/A | | $2,349,651 | | $544,250 | | $62 | | $(163,619,000) | | 2022 | | $24,440,350 | | $28,514,763 | | $7,250,583 | | $3,714,536 | | $3,827,145 | | $2,228,110 | | $89 | | $(128,724,000) |

|

|

|

| Named Executive Officers, Footnote |

The Company’s PEOs and NEOs for the applicable fiscal years were as follows: | | | | | | | | | | | | | Year | PEO 1 | PEO 2 | Non-PEO NEOs | | 2024 | Daniel Faga | N/A | Dennis Mulroy, Paul Lizzul | | 2023 | Daniel Faga | N/A | Eric Loumeau, Paul Lizzul | | 2022 | Daniel Faga | Hamza Suria | Eric Loumeau, Paul Lizzul |

|

|

|

| PEO Total Compensation Amount |

$ 13,630,292

|

$ 7,461,920

|

|

| PEO Actually Paid Compensation Amount |

$ 9,160,362

|

(1,737,869)

|

|

| Adjustment To PEO Compensation, Footnote |

The dollar amounts reported in these columns represent (i) the amount of total compensation reported in the Summary Compensation Table for the applicable fiscal year for each of our PEOs and (ii) the average dollar amounts of total compensation reported in the Summary Compensation Table for the applicable fiscal year for our others NEOs as a group (excluding our PEOs). –2022 Summary Compensation Table total for Mr. Faga includes fees paid for service as a non-employee director during 2022 ($10,000 cash retainer and $200,618 stock option grant). The dollar amounts reported in these columns represent (i) the “compensation actually paid” to our PEOs and (ii) the average “compensation actually paid” to our other NEOs as a group (excluding our PEOs), based on their total compensation reported in the Summary Compensation Table for the applicable fiscal years and adjusted in accordance with Item 402(v) of Regulation S-K. The dollar amounts reported in this column for the latest fiscal year are adjusted as shown in the table below: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 2024

(PEO 1) | | 2024

(NEO Average) | | Summary Compensation Table - Total Compensation | | | | | | $ | 13,630,292 | | | $ | 3,911,208 | | | - | Grant Date Fair Value of Stock Awards and Option Awards Granted in Fiscal Year | | | | | | $ | (12,612,583) | | | $ | (3,218,111) | | | + | Fair Value at Fiscal Year End of Outstanding and Unvested Stock Awards and Option Awards Granted in Fiscal Year | | | | | | $ | 6,463,650 | | | $ | 1,710,780 | | | + | Change in Fair Value of Outstanding and Unvested Stock Awards and Option Awards Granted in Prior Fiscal Years | | | | | | $ | (1,013,905) | | | $ | (450,902) | | | + | Fair Value at Vesting of Stock Awards and Option Awards Granted in Fiscal Year That Vested During Fiscal Year | | | | | | $ | — | | | $ | — | | | + | Change in Fair Value as of Vesting Date of Stock Awards and Option Awards Granted in Prior Fiscal Years For Which Applicable Vesting Conditions Were Satisfied During Fiscal Year | | | | | | $ | 2,692,908 | | | $ | 117,525 | | | - | Fair Value as of Prior Fiscal Year End of Stock Awards and Option Awards Granted in Prior Fiscal Years That Failed to Meet Applicable Vesting Conditions During Fiscal Year | | | | | | $ | — | | | $ | (226,467) | | | = | Compensation Actually Paid | | | | | | $ | 9,160,362 | | | $ | 1,844,033 | |

The fair value or change in fair value, as applicable, of equity awards in the “Compensation Actually Paid” columns has been estimated pursuant to the guidance in ASC Topic 718, and the valuation assumptions used to calculate fair values did not materially differ from those disclosed at the time of the grant.

|

|

|

| Non-PEO NEO Average Total Compensation Amount |

$ 3,911,208

|

2,349,651

|

$ 3,827,145

|

| Non-PEO NEO Average Compensation Actually Paid Amount |

$ 1,844,033

|

544,250

|

2,228,110

|

| Adjustment to Non-PEO NEO Compensation Footnote |

The dollar amounts reported in these columns represent (i) the “compensation actually paid” to our PEOs and (ii) the average “compensation actually paid” to our other NEOs as a group (excluding our PEOs), based on their total compensation reported in the Summary Compensation Table for the applicable fiscal years and adjusted in accordance with Item 402(v) of Regulation S-K. The dollar amounts reported in this column for the latest fiscal year are adjusted as shown in the table below: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 2024

(PEO 1) | | 2024

(NEO Average) | | Summary Compensation Table - Total Compensation | | | | | | $ | 13,630,292 | | | $ | 3,911,208 | | | - | Grant Date Fair Value of Stock Awards and Option Awards Granted in Fiscal Year | | | | | | $ | (12,612,583) | | | $ | (3,218,111) | | | + | Fair Value at Fiscal Year End of Outstanding and Unvested Stock Awards and Option Awards Granted in Fiscal Year | | | | | | $ | 6,463,650 | | | $ | 1,710,780 | | | + | Change in Fair Value of Outstanding and Unvested Stock Awards and Option Awards Granted in Prior Fiscal Years | | | | | | $ | (1,013,905) | | | $ | (450,902) | | | + | Fair Value at Vesting of Stock Awards and Option Awards Granted in Fiscal Year That Vested During Fiscal Year | | | | | | $ | — | | | $ | — | | | + | Change in Fair Value as of Vesting Date of Stock Awards and Option Awards Granted in Prior Fiscal Years For Which Applicable Vesting Conditions Were Satisfied During Fiscal Year | | | | | | $ | 2,692,908 | | | $ | 117,525 | | | - | Fair Value as of Prior Fiscal Year End of Stock Awards and Option Awards Granted in Prior Fiscal Years That Failed to Meet Applicable Vesting Conditions During Fiscal Year | | | | | | $ | — | | | $ | (226,467) | | | = | Compensation Actually Paid | | | | | | $ | 9,160,362 | | | $ | 1,844,033 | |

The fair value or change in fair value, as applicable, of equity awards in the “Compensation Actually Paid” columns has been estimated pursuant to the guidance in ASC Topic 718, and the valuation assumptions used to calculate fair values did not materially differ from those disclosed at the time of the grant.

|

|

|

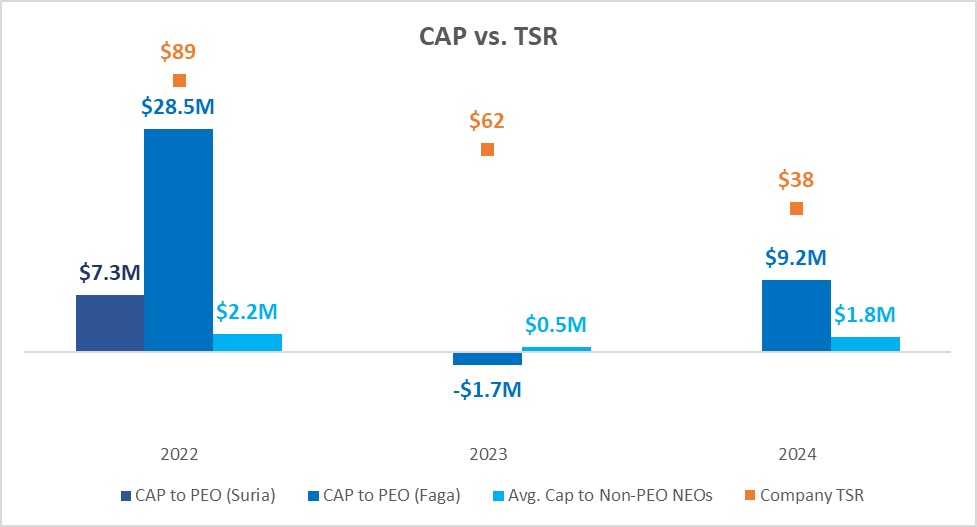

| Compensation Actually Paid vs. Total Shareholder Return |

The following graph displays our compensation actually paid (CAP) vs. our cumulative TSR. The CAP to our PEOs in 2022 was non-standard as it reflects a new hire compensation package for Mr. Faga and partial year employment for Hamza Suria, our former President and Chief Executive Officer. 1. Cumulative TSR is calculated by dividing the sum of the cumulative amount of dividends for the measurement period, assuming dividend reinvestment, and the difference between the Company’s share price at the end and the beginning of the measurement period by the Company’s share price at the beginning of the measurement period.

|

|

|

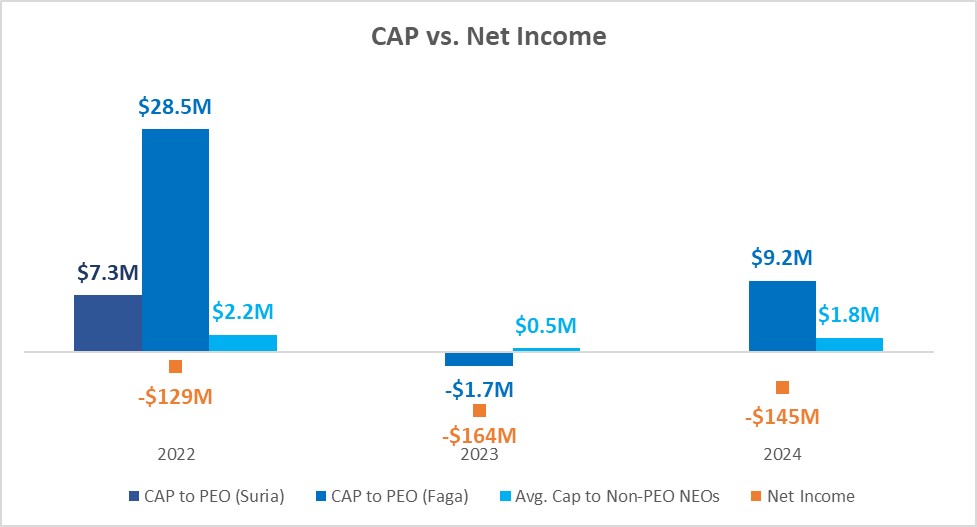

| Compensation Actually Paid vs. Net Income |

The following graph displays our compensation actually paid vs. Net Income. As a pre-commercial biotechnology company, we do not believe Net Income is yet a reasonable metric to measure our financial performance. 1. Net Income is calculated by subtracting expenses, interest, and taxes from revenue. The dollar amounts reported represent the amount of Net Income reflected in the Company’s audited financial statements for the applicable year.

|

|

|

| Total Shareholder Return Amount |

$ 38

|

62

|

89

|

| Net Income (Loss) |

$ (145,231,000)

|

$ (163,619,000)

|

(128,724,000)

|

| PEO Name |

Daniel Faga

|

Daniel Faga

|

|

| Additional 402(v) Disclosure |

Pursuant to Item 402(v) of Regulation S-K, the comparison assumes $100 was invested on December 31, 2021 in our common stock. Historic stock price performance is not necessarily indicative of future stock price performance.

|

|

|

| Daniel Faga [Member] |

|

|

|

| Pay vs Performance Disclosure |

|

|

|

| PEO Total Compensation Amount |

|

|

24,440,350

|

| PEO Actually Paid Compensation Amount |

|

|

$ 28,514,763

|

| PEO Name |

|

|

Daniel Faga

|

| Daniel Faga [Member] | Fees Paid For Service, Non-employee Director, Retainer [Member] |

|

|

|

| Pay vs Performance Disclosure |

|

|

|

| Adjustment to Compensation, Amount |

|

|

$ 10,000

|

| Daniel Faga [Member] | Fees Paid For Service, Non-employee Director, Stock Option Grant [Member] |

|

|

|

| Pay vs Performance Disclosure |

|

|

|

| Adjustment to Compensation, Amount |

|

|

200,618

|

| Hamza Suria [Member] |

|

|

|

| Pay vs Performance Disclosure |

|

|

|

| PEO Total Compensation Amount |

|

|

7,250,583

|

| PEO Actually Paid Compensation Amount |

|

|

$ 3,714,536

|

| PEO Name |

|

|

Hamza Suria

|

| PEO | Aggregate Grant Date Fair Value of Equity Award Amounts Reported in Summary Compensation Table |

|

|

|

| Pay vs Performance Disclosure |

|

|

|

| Adjustment to Compensation, Amount |

$ (12,612,583)

|

|

|

| PEO | Year-end Fair Value of Equity Awards Granted in Covered Year that are Outstanding and Unvested |

|

|

|

| Pay vs Performance Disclosure |

|

|

|

| Adjustment to Compensation, Amount |

6,463,650

|

|

|

| PEO | Year-over-Year Change in Fair Value of Equity Awards Granted in Prior Years That are Outstanding and Unvested |

|

|

|

| Pay vs Performance Disclosure |

|

|

|

| Adjustment to Compensation, Amount |

(1,013,905)

|

|

|

| PEO | Vesting Date Fair Value of Equity Awards Granted and Vested in Covered Year |

|

|

|

| Pay vs Performance Disclosure |

|

|

|

| Adjustment to Compensation, Amount |

0

|

|

|

| PEO | Change in Fair Value as of Vesting Date of Prior Year Equity Awards Vested in Covered Year |

|

|

|

| Pay vs Performance Disclosure |

|

|

|

| Adjustment to Compensation, Amount |

2,692,908

|

|

|

| PEO | Prior Year End Fair Value of Equity Awards Granted in Any Prior Year that Fail to Meet Applicable Vesting Conditions During Covered Year |

|

|

|

| Pay vs Performance Disclosure |

|

|

|

| Adjustment to Compensation, Amount |

0

|

|

|

| Non-PEO NEO | Aggregate Grant Date Fair Value of Equity Award Amounts Reported in Summary Compensation Table |

|

|

|

| Pay vs Performance Disclosure |

|

|

|

| Adjustment to Compensation, Amount |

(3,218,111)

|

|

|

| Non-PEO NEO | Year-end Fair Value of Equity Awards Granted in Covered Year that are Outstanding and Unvested |

|

|

|

| Pay vs Performance Disclosure |

|

|

|

| Adjustment to Compensation, Amount |

1,710,780

|

|

|

| Non-PEO NEO | Year-over-Year Change in Fair Value of Equity Awards Granted in Prior Years That are Outstanding and Unvested |

|

|

|

| Pay vs Performance Disclosure |

|

|

|

| Adjustment to Compensation, Amount |

(450,902)

|

|

|

| Non-PEO NEO | Vesting Date Fair Value of Equity Awards Granted and Vested in Covered Year |

|

|

|

| Pay vs Performance Disclosure |

|

|

|

| Adjustment to Compensation, Amount |

0

|

|

|

| Non-PEO NEO | Change in Fair Value as of Vesting Date of Prior Year Equity Awards Vested in Covered Year |

|

|

|

| Pay vs Performance Disclosure |

|

|

|

| Adjustment to Compensation, Amount |

117,525

|

|

|

| Non-PEO NEO | Prior Year End Fair Value of Equity Awards Granted in Any Prior Year that Fail to Meet Applicable Vesting Conditions During Covered Year |

|

|

|

| Pay vs Performance Disclosure |

|

|

|

| Adjustment to Compensation, Amount |

$ (226,467)

|

|

|