Shareholder Report

|

12 Months Ended |

|

Feb. 28, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

|

| Document Type |

N-CSR

|

|

| Amendment Flag |

false

|

|

| Registrant Name |

MFS SERIES TRUST XIII

|

|

| Entity Central Index Key |

0000356349

|

|

| Entity Investment Company Type |

N-1A

|

|

| Document Period End Date |

Feb. 28, 2025

|

|

| C000002007 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

MFS® Government Securities Fund

|

|

| Class Name |

Class A

|

|

| Trading Symbol |

MFGSX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about MFS Government Securities Fund for the period of March 1, 2024 to February 28, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at funds.mfs.com. You can also request this information by contacting us at 1‑800‑225‑2606 or by sending an e-mail request to orderliterature@mfs.com.

|

|

| Additional Information Phone Number |

1‑800‑225‑2606

|

|

| Additional Information Email |

orderliterature@mfs.com

|

|

| Additional Information Website |

funds.mfs.com

|

|

| Expenses [Text Block] |

FUND EXPENSES What were the fund costs for the last year?

| (based on a hypothetical $10,000 investment) |

|

|

| Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| A |

$79 |

0.77% |

|

|

| Expenses Paid, Amount |

$ 79

|

|

| Expense Ratio, Percent |

0.77%

|

|

| Factors Affecting Performance [Text Block] |

MANAGEMENT'S DISCUSSION OF FUND PERFORMANCE

-

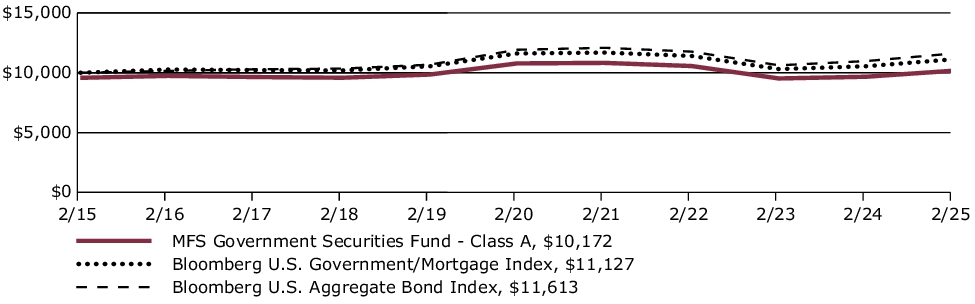

For the twelve months ended February 28, 2025, Class A shares of the MFS Government Securities Fund (fund) provided a total return of 5.23%, at net asset value. This compares with a return of 5.81% for the fund’s benchmark, the Bloomberg U.S. Aggregate Bond Index. The fund's other benchmark, the Bloomberg U.S. Government/Mortgage Index, generated a return of 5.53%.

-

Moderating inflation pressures allowed many global central banks to ease monetary policy during the period. However, the pace of disinflation slowed toward the end of the period, particularly in the US.

-

Geopolitical strains remained high amid ongoing conflicts in Ukraine and in the Middle East, while relations between China and the US remained tense, especially regarding trade. At the end of the period, China unveiled a sizable stimulus package aimed at shoring up its property sector and the finances of highly indebted local governments while the Trump administration threatened to impose considerable tariffs on its trading partners.

-

Global equity markets reached record levels late in the period as they withstood the adversity of the unsettled geopolitical climate and a higher interest rate environment but eased back from those highs as policy uncertainty rose. Healthy earnings growth continued though advances in artificial intelligence called into question, at least temporarily, the need for extraordinary levels of infrastructure investment to support the technology.

-

Global bond yields climbed off mid-period lows on the back of the US election results, resilient economic growth, concerns that global disinflationary progress may have stalled and a rising term premium. Reflecting increased inflation uncertainty, market expectations for future Federal Reserve interest rate cuts in 2025 were largely pared back while other major global central banks, notably the ECB, Bank of Canada and Bank of England, continued their gradual easing cycles. Already compressed credit spreads tightened further as corporate fundamentals remained sound. Bond market volatility, as measured by the Merrill Lynch Option Volatility Estimate (MOVE) index, declined in the fourth quarter after peaking before the US election, but climbed late February amongst heightened tariff uncertainty.

|

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a good predictor of the fund’s future performance.

|

|

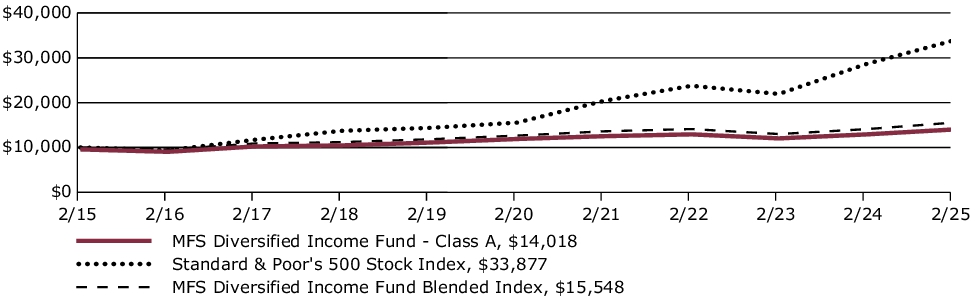

| Line Graph [Table Text Block] |

FUND PERFORMANCE The fund’s past performance is not a good predictor of the fund’s future performance. The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The graph and table below assume reinvestment of dividends and capital gain distributions. Growth of a Hypothetical $10,000 Investment This graph shows the performance of a hypothetical $10,000 investment in Class A over a ten year period or since inception, if shorter, in comparison to (i) a broad measure of market performance and (ii) an additional index that MFS believes more closely reflects the market segments in which the fund invests. This graph includes the deduction of the maximum applicable sales charge.

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns through 2/28/25 This table shows the average annual total returns of the class of shares noted for the periods shown, both with (if any) and without sales charges. It also shows the average annual total returns of (i) a broad measure of market performance and (ii) an additional index that MFS believes more closely reflects the market segments in which the fund invests, over the same periods.

| Share Class |

1-yr |

5-yr |

10-yr |

| A without sales charge |

5.23% |

(1.15)% |

0.61% |

| A with initial sales charge (4.25%) |

0.75% |

(2.01)% |

0.17% |

| Comparative Benchmark(s) |

|

|

|

| Bloomberg U.S. Aggregate Bond Index +∆ |

5.81% |

(0.52)% |

1.51% |

| Bloomberg U.S. Government/Mortgage Index +∆ |

5.53% |

(0.85)% |

1.07% |

|

+ |

Effective May 1, 2024, the Bloomberg U.S. Aggregate Bond Index replaced the Bloomberg U.S. Government/Mortgage Index as a broad measure of market performance in accordance with new regulatory disclosure requirements. The fund continues to use the Bloomberg U.S. Government/Mortgage Index as an additional benchmark that MFS believes more closely reflects the market segments in which the fund invests. |

|

∆ |

Source: FactSet Research Systems Inc. |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

|

|

| Performance Table Market Index Changed [Text Block] |

Effective May 1, 2024, the Bloomberg U.S. Aggregate Bond Index replaced the Bloomberg U.S. Government/Mortgage Index as a broad measure of market performance in accordance with new regulatory disclosure requirements. The fund continues to use the Bloomberg U.S. Government/Mortgage Index as an additional benchmark that MFS believes more closely reflects the market segments in which the fund invests.

|

|

| Updated Performance Information Location [Text Block] |

Visit mfs.com/perf/a for more recent performance information.

|

|

| Net Assets |

$ 2,002,629,208

|

|

| Holdings Count | Holding |

822

|

|

| Advisory Fees Paid, Amount |

$ 7,481,801

|

[1] |

| Investment Company Portfolio Turnover |

195.00%

|

|

| Additional Fund Statistics [Text Block] |

FUND STATISTICS AS OF 2/28/25

| Net Assets ($): |

2,002,629,208 |

|

Average Effective Maturity (yrs): |

6.5 |

| Total Number of Holdings: |

822 |

|

Average Effective Duration (yrs): |

6.3 |

| Total Management Fee ($)#: |

7,481,801 |

|

|

|

| Portfolio Turnover Rate (%): |

195 |

|

|

| # Includes the effect of any management fee waivers, if applicable. Where the fund holds derivatives, they are not included in the total number of portfolio holdings.

|

|

| Holdings [Text Block] |

PORTFOLIO COMPOSITION (BASED ON TOTAL INVESTMENTS AS OF 2/28/25) Portfolio structure

| Fixed Income |

98.9% |

| Money Market Funds |

1.1% | Composition including fixed income credit quality

| AAA |

7.2% |

| AA |

1.0% |

| A |

0.5% |

| BBB |

0.0% |

| U.S. Government |

25.2% |

| Federal Agencies |

65.0% |

| Money Market Funds |

1.1% | Ratings are assigned using Moody’s, Fitch, and Standard & Poor’s and applying a hierarchy: If all 3 agencies rate a security, the middle rating is assigned; if 2 agencies rate a security, the lower rating is assigned. If none of the 3 agencies rate a security, we use DBRS Morningstar. If none of the 4 agencies rate a security, we use Kroll Bond Rating Agency. Ratings are shown in the S&P and Fitch scale (e.g., AAA). All ratings are subject to change.

|

|

| Credit Ratings Selection [Text Block] |

Ratings are assigned using Moody’s, Fitch, and Standard & Poor’s and applying a hierarchy: If all 3 agencies rate a security, the middle rating is assigned; if 2 agencies rate a security, the lower rating is assigned. If none of the 3 agencies rate a security, we use DBRS Morningstar. If none of the 4 agencies rate a security, we use Kroll Bond Rating Agency. Ratings are shown in the S&P and Fitch scale (e.g., AAA). All ratings are subject to change.

|

|

| C000002012 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

MFS® GovernmentSecurities Fund

|

|

| Class Name |

Class B

|

|

| Trading Symbol |

MFGBX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about MFS Government Securities Fund for the period of March 1, 2024 to February 28, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at funds.mfs.com. You can also request this information by contacting us at 1‑800‑225‑2606 or by sending an e-mail request to orderliterature@mfs.com.

|

|

| Additional Information Phone Number |

1‑800‑225‑2606

|

|

| Additional Information Email |

orderliterature@mfs.com

|

|

| Additional Information Website |

funds.mfs.com

|

|

| Expenses [Text Block] |

FUND EXPENSES

What were the fund costs for the last year?

| (based on a hypothetical $10,000 investment) |

|

|

| Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| B |

$155 |

1.52% |

|

|

| Expenses Paid, Amount |

$ 155

|

|

| Expense Ratio, Percent |

1.52%

|

|

| Factors Affecting Performance [Text Block] |

MANAGEMENT'S DISCUSSION OF FUND PERFORMANCE

-

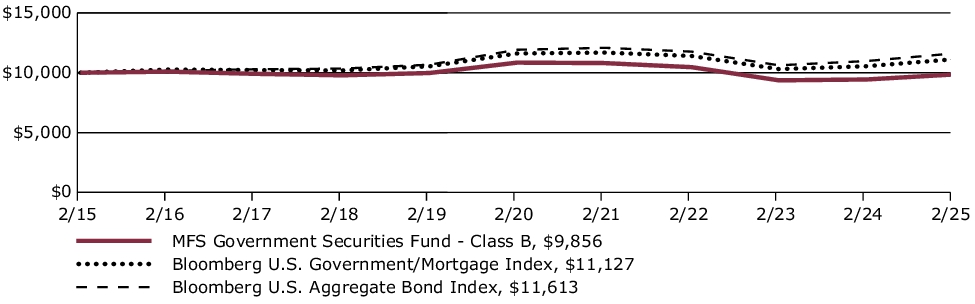

For the twelve months ended February 28, 2025, Class B shares of the MFS Government Securities Fund (fund) provided a total return of 4.45%, at net asset value. This compares with a return of 5.81% for the fund’s benchmark, the Bloomberg U.S. Aggregate Bond Index. The fund's other benchmark, the Bloomberg U.S. Government/Mortgage Index, generated a return of 5.53%.

-

Moderating inflation pressures allowed many global central banks to ease monetary policy during the period. However, the pace of disinflation slowed toward the end of the period, particularly in the US.

-

Geopolitical strains remained high amid ongoing conflicts in Ukraine and in the Middle East, while relations between China and the US remained tense, especially regarding trade. At the end of the period, China unveiled a sizable stimulus package aimed at shoring up its property sector and the finances of highly indebted local governments while the Trump administration threatened to impose considerable tariffs on its trading partners.

-

Global equity markets reached record levels late in the period as they withstood the adversity of the unsettled geopolitical climate and a higher interest rate environment but eased back from those highs as policy uncertainty rose. Healthy earnings growth continued though advances in artificial intelligence called into question, at least temporarily, the need for extraordinary levels of infrastructure investment to support the technology.

-

Global bond yields climbed off mid-period lows on the back of the US election results, resilient economic growth, concerns that global disinflationary progress may have stalled and a rising term premium. Reflecting increased inflation uncertainty, market expectations for future Federal Reserve interest rate cuts in 2025 were largely pared back while other major global central banks, notably the ECB, Bank of Canada and Bank of England, continued their gradual easing cycles. Already compressed credit spreads tightened further as corporate fundamentals remained sound. Bond market volatility, as measured by the Merrill Lynch Option Volatility Estimate (MOVE) index, declined in the fourth quarter after peaking before the US election, but climbed late February amongst heightened tariff uncertainty.

|

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a good predictor of the fund’s future performance.

|

|

| Line Graph [Table Text Block] |

FUND PERFORMANCE

The fund’s past performance is not a good predictor of the fund’s future performance. The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The graph and table below assume reinvestment of dividends and capital gain distributions.

Growth of a Hypothetical $10,000 Investment

This graph shows the performance of a hypothetical $10,000 investment in Class B over a ten year period or since inception, if shorter, in comparison to (i) a broad measure of market performance and (ii) an additional index that MFS believes more closely reflects the market segments in which the fund invests.

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns through 2/28/25

This table shows the average annual total returns of the class of shares noted for the periods shown, both with (if any) and without sales charges. It also shows the average annual total returns of (i) a broad measure of market performance and (ii) an additional index that MFS believes more closely reflects the market segments in which the fund invests, over the same periods.

| Share Class |

1-yr |

5-yr |

10-yr |

| B without sales charge |

4.45% |

(1.90)% |

(0.15)% |

| B with CDSC (declining over six years from 4% to 0%)× |

0.45% |

(2.26)% |

(0.15)% |

| Comparative Benchmark(s) |

|

|

|

| Bloomberg U.S. Aggregate Bond Index +∆ |

5.81% |

(0.52)% |

1.51% |

| Bloomberg U.S. Government/Mortgage Index +∆ |

5.53% |

(0.85)% |

1.07% |

|

+

|

Effective May 1, 2024, the Bloomberg U.S. Aggregate Bond Index replaced the Bloomberg U.S. Government/Mortgage Index as a broad measure of market performance in accordance with new regulatory disclosure requirements. The fund continues to use the Bloomberg U.S. Government/Mortgage Index as an additional benchmark that MFS believes more closely reflects the market segments in which the fund invests.

|

|

∆

|

Source: FactSet Research Systems Inc.

|

|

×

|

Assuming redemption at the end of the applicable period.

|

|

|

| No Deduction of Taxes [Text Block] |

The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

|

|

| Performance Table Market Index Changed [Text Block] |

Effective May 1, 2024, the Bloomberg U.S. Aggregate Bond Index replaced the Bloomberg U.S. Government/Mortgage Index as a broad measure of market performance in accordance with new regulatory disclosure requirements. The fund continues to use the Bloomberg U.S. Government/Mortgage Index as an additional benchmark that MFS believes more closely reflects the market segments in which the fund invests.

|

|

| Updated Performance Information Location [Text Block] |

Visit mfs.com/perf/b for more recent performance information.

|

|

| Net Assets |

$ 2,002,629,208

|

|

| Holdings Count | Holding |

822

|

|

| Advisory Fees Paid, Amount |

$ 7,481,801

|

[2] |

| Investment Company Portfolio Turnover |

195.00%

|

|

| Additional Fund Statistics [Text Block] |

FUND STATISTICS AS OF 2/28/25

| Net Assets ($): |

2,002,629,208 |

|

Average Effective Maturity (yrs): |

6.5 |

| Total Number of Holdings: |

822 |

|

Average Effective Duration (yrs): |

6.3 |

| Total Management Fee ($)#: |

7,481,801 |

|

|

|

| Portfolio Turnover Rate (%): |

195 |

|

|

|

# Includes the effect of any management fee waivers, if applicable.

Where the fund holds derivatives, they are not included in the total number of portfolio holdings.

|

|

| Holdings [Text Block] |

PORTFOLIO COMPOSITION (BASED ON TOTAL INVESTMENTS AS OF 2/28/25)

Portfolio structure

| Fixed Income |

98.9% |

| Money Market Funds |

1.1% |

Composition including fixed income credit quality

| AAA |

7.2% |

| AA |

1.0% |

| A |

0.5% |

| BBB |

0.0% |

| U.S. Government |

25.2% |

| Federal Agencies |

65.0% |

| Money Market Funds |

1.1% |

Ratings are assigned using Moody’s, Fitch, and Standard & Poor’s and applying a hierarchy: If all 3 agencies rate a security, the middle rating is assigned; if 2 agencies rate a security, the lower rating is assigned. If none of the 3 agencies rate a security, we use DBRS Morningstar. If none of the 4 agencies rate a security, we use Kroll Bond Rating Agency. Ratings are shown in the S&P and Fitch scale (e.g., AAA). All ratings are subject to change.

|

|

| Credit Ratings Selection [Text Block] |

Ratings are assigned using Moody’s, Fitch, and Standard & Poor’s and applying a hierarchy: If all 3 agencies rate a security, the middle rating is assigned; if 2 agencies rate a security, the lower rating is assigned. If none of the 3 agencies rate a security, we use DBRS Morningstar. If none of the 4 agencies rate a security, we use Kroll Bond Rating Agency. Ratings are shown in the S&P and Fitch scale (e.g., AAA). All ratings are subject to change.

|

|

| C000002013 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

MFS® GovernmentSecurities Fund

|

|

| Class Name |

Class C

|

|

| Trading Symbol |

MFGDX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about MFS Government Securities Fund for the period of March 1, 2024 to February 28, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at funds.mfs.com. You can also request this information by contacting us at 1‑800‑225‑2606 or by sending an e-mail request to orderliterature@mfs.com.

|

|

| Additional Information Phone Number |

1‑800‑225‑2606

|

|

| Additional Information Email |

orderliterature@mfs.com

|

|

| Additional Information Website |

funds.mfs.com

|

|

| Expenses [Text Block] |

FUND EXPENSES

What were the fund costs for the last year?

| (based on a hypothetical $10,000 investment) |

|

|

| Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| C |

$155 |

1.52% |

|

|

| Expenses Paid, Amount |

$ 155

|

|

| Expense Ratio, Percent |

1.52%

|

|

| Factors Affecting Performance [Text Block] |

MANAGEMENT'S DISCUSSION OF FUND PERFORMANCE

-

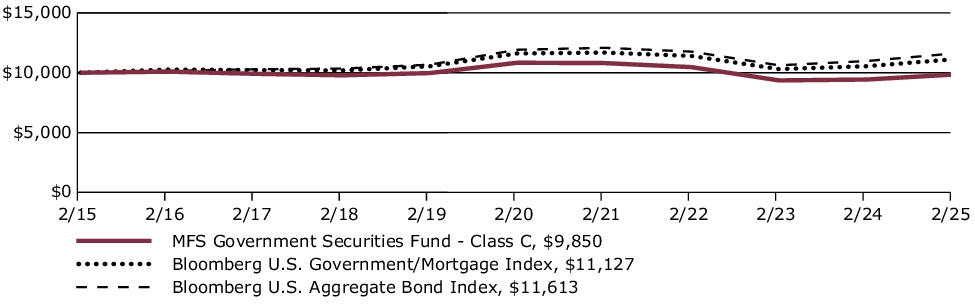

For the twelve months ended February 28, 2025, Class C shares of the MFS Government Securities Fund (fund) provided a total return of 4.44%, at net asset value. This compares with a return of 5.81% for the fund’s benchmark, the Bloomberg U.S. Aggregate Bond Index. The fund's other benchmark, the Bloomberg U.S. Government/Mortgage Index, generated a return of 5.53%.

-

Moderating inflation pressures allowed many global central banks to ease monetary policy during the period. However, the pace of disinflation slowed toward the end of the period, particularly in the US.

-

Geopolitical strains remained high amid ongoing conflicts in Ukraine and in the Middle East, while relations between China and the US remained tense, especially regarding trade. At the end of the period, China unveiled a sizable stimulus package aimed at shoring up its property sector and the finances of highly indebted local governments while the Trump administration threatened to impose considerable tariffs on its trading partners.

-

Global equity markets reached record levels late in the period as they withstood the adversity of the unsettled geopolitical climate and a higher interest rate environment but eased back from those highs as policy uncertainty rose. Healthy earnings growth continued though advances in artificial intelligence called into question, at least temporarily, the need for extraordinary levels of infrastructure investment to support the technology.

-

Global bond yields climbed off mid-period lows on the back of the US election results, resilient economic growth, concerns that global disinflationary progress may have stalled and a rising term premium. Reflecting increased inflation uncertainty, market expectations for future Federal Reserve interest rate cuts in 2025 were largely pared back while other major global central banks, notably the ECB, Bank of Canada and Bank of England, continued their gradual easing cycles. Already compressed credit spreads tightened further as corporate fundamentals remained sound. Bond market volatility, as measured by the Merrill Lynch Option Volatility Estimate (MOVE) index, declined in the fourth quarter after peaking before the US election, but climbed late February amongst heightened tariff uncertainty.

|

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a good predictor of the fund’s future performance.

|

|

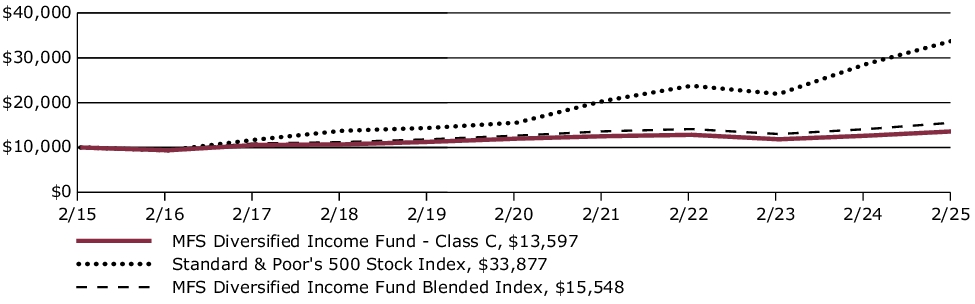

| Line Graph [Table Text Block] |

FUND PERFORMANCE

The fund’s past performance is not a good predictor of the fund’s future performance. The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The graph and table below assume reinvestment of dividends and capital gain distributions.

Growth of a Hypothetical $10,000 Investment

This graph shows the performance of a hypothetical $10,000 investment in Class C over a ten year period or since inception, if shorter, in comparison to (i) a broad measure of market performance and (ii) an additional index that MFS believes more closely reflects the market segments in which the fund invests.

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns through 2/28/25

This table shows the average annual total returns of the class of shares noted for the periods shown, both with (if any) and without sales charges. It also shows the average annual total returns of (i) a broad measure of market performance and (ii) an additional index that MFS believes more closely reflects the market segments in which the fund invests, over the same periods.

| Share Class |

1-yr |

5-yr |

10-yr |

| C without sales charge |

4.44% |

(1.89)% |

(0.15)% |

| C with CDSC (1% for 12 months)× |

3.44% |

(1.89)% |

(0.15)% |

| Comparative Benchmark(s) |

|

|

|

| Bloomberg U.S. Aggregate Bond Index +∆ |

5.81% |

(0.52)% |

1.51% |

| Bloomberg U.S. Government/Mortgage Index +∆ |

5.53% |

(0.85)% |

1.07% |

|

+

|

Effective May 1, 2024, the Bloomberg U.S. Aggregate Bond Index replaced the Bloomberg U.S. Government/Mortgage Index as a broad measure of market performance in accordance with new regulatory disclosure requirements. The fund continues to use the Bloomberg U.S. Government/Mortgage Index as an additional benchmark that MFS believes more closely reflects the market segments in which the fund invests.

|

|

∆

|

Source: FactSet Research Systems Inc.

|

|

×

|

Assuming redemption at the end of the applicable period.

|

|

|

| No Deduction of Taxes [Text Block] |

The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

|

|

| Performance Table Market Index Changed [Text Block] |

Effective May 1, 2024, the Bloomberg U.S. Aggregate Bond Index replaced the Bloomberg U.S. Government/Mortgage Index as a broad measure of market performance in accordance with new regulatory disclosure requirements. The fund continues to use the Bloomberg U.S. Government/Mortgage Index as an additional benchmark that MFS believes more closely reflects the market segments in which the fund invests.

|

|

| Updated Performance Information Location [Text Block] |

Visit mfs.com/perf/c for more recent performance information.

|

|

| Net Assets |

$ 2,002,629,208

|

|

| Holdings Count | Holding |

822

|

|

| Advisory Fees Paid, Amount |

$ 7,481,801

|

[3] |

| Investment Company Portfolio Turnover |

195.00%

|

|

| Additional Fund Statistics [Text Block] |

FUND STATISTICS AS OF 2/28/25

| Net Assets ($): |

2,002,629,208 |

|

Average Effective Maturity (yrs): |

6.5 |

| Total Number of Holdings: |

822 |

|

Average Effective Duration (yrs): |

6.3 |

| Total Management Fee ($)#: |

7,481,801 |

|

|

|

| Portfolio Turnover Rate (%): |

195 |

|

|

|

# Includes the effect of any management fee waivers, if applicable.

Where the fund holds derivatives, they are not included in the total number of portfolio holdings.

|

|

| Holdings [Text Block] |

PORTFOLIO COMPOSITION (BASED ON TOTAL INVESTMENTS AS OF 2/28/25)

Portfolio structure

| Fixed Income |

98.9% |

| Money Market Funds |

1.1% |

Composition including fixed income credit quality

| AAA |

7.2% |

| AA |

1.0% |

| A |

0.5% |

| BBB |

0.0% |

| U.S. Government |

25.2% |

| Federal Agencies |

65.0% |

| Money Market Funds |

1.1% |

Ratings are assigned using Moody’s, Fitch, and Standard & Poor’s and applying a hierarchy: If all 3 agencies rate a security, the middle rating is assigned; if 2 agencies rate a security, the lower rating is assigned. If none of the 3 agencies rate a security, we use DBRS Morningstar. If none of the 4 agencies rate a security, we use Kroll Bond Rating Agency. Ratings are shown in the S&P and Fitch scale (e.g., AAA). All ratings are subject to change.

|

|

| Credit Ratings Selection [Text Block] |

Ratings are assigned using Moody’s, Fitch, and Standard & Poor’s and applying a hierarchy: If all 3 agencies rate a security, the middle rating is assigned; if 2 agencies rate a security, the lower rating is assigned. If none of the 3 agencies rate a security, we use DBRS Morningstar. If none of the 4 agencies rate a security, we use Kroll Bond Rating Agency. Ratings are shown in the S&P and Fitch scale (e.g., AAA). All ratings are subject to change.

|

|

| C000002006 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

MFS® Government Securities Fund

|

|

| Class Name |

Class I

|

|

| Trading Symbol |

MGSIX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about MFS Government Securities Fund for the period of March 1, 2024 to February 28, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at funds.mfs.com. You can also request this information by contacting us at 1‑800‑225‑2606 or by sending an e-mail request to orderliterature@mfs.com.

|

|

| Additional Information Phone Number |

1‑800‑225‑2606

|

|

| Additional Information Email |

orderliterature@mfs.com

|

|

| Additional Information Website |

funds.mfs.com

|

|

| Expenses [Text Block] |

FUND EXPENSES What were the fund costs for the last year?

| (based on a hypothetical $10,000 investment) |

|

|

| Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| I |

$53 |

0.52% |

|

|

| Expenses Paid, Amount |

$ 53

|

|

| Expense Ratio, Percent |

0.52%

|

|

| Factors Affecting Performance [Text Block] |

MANAGEMENT'S DISCUSSION OF FUND PERFORMANCE

-

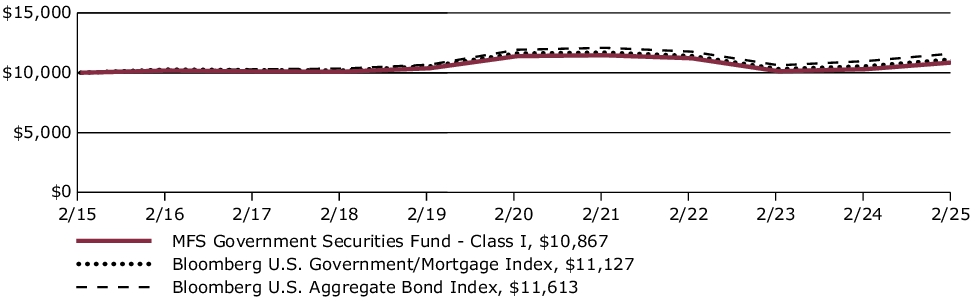

For the twelve months ended February 28, 2025, Class I shares of the MFS Government Securities Fund (fund) provided a total return of 5.49%, at net asset value. This compares with a return of 5.81% for the fund’s benchmark, the Bloomberg U.S. Aggregate Bond Index. The fund's other benchmark, the Bloomberg U.S. Government/Mortgage Index, generated a return of 5.53%.

-

Moderating inflation pressures allowed many global central banks to ease monetary policy during the period. However, the pace of disinflation slowed toward the end of the period, particularly in the US.

-

Geopolitical strains remained high amid ongoing conflicts in Ukraine and in the Middle East, while relations between China and the US remained tense, especially regarding trade. At the end of the period, China unveiled a sizable stimulus package aimed at shoring up its property sector and the finances of highly indebted local governments while the Trump administration threatened to impose considerable tariffs on its trading partners.

-

Global equity markets reached record levels late in the period as they withstood the adversity of the unsettled geopolitical climate and a higher interest rate environment but eased back from those highs as policy uncertainty rose. Healthy earnings growth continued though advances in artificial intelligence called into question, at least temporarily, the need for extraordinary levels of infrastructure investment to support the technology.

-

Global bond yields climbed off mid-period lows on the back of the US election results, resilient economic growth, concerns that global disinflationary progress may have stalled and a rising term premium. Reflecting increased inflation uncertainty, market expectations for future Federal Reserve interest rate cuts in 2025 were largely pared back while other major global central banks, notably the ECB, Bank of Canada and Bank of England, continued their gradual easing cycles. Already compressed credit spreads tightened further as corporate fundamentals remained sound. Bond market volatility, as measured by the Merrill Lynch Option Volatility Estimate (MOVE) index, declined in the fourth quarter after peaking before the US election, but climbed late February amongst heightened tariff uncertainty.

|

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a good predictor of the fund’s future performance.

|

|

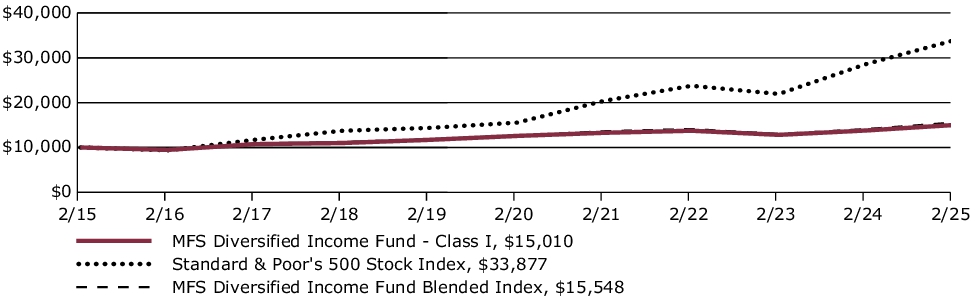

| Line Graph [Table Text Block] |

FUND PERFORMANCE The fund’s past performance is not a good predictor of the fund’s future performance. The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The graph and table below assume reinvestment of dividends and capital gain distributions. Growth of a Hypothetical $10,000 Investment This graph shows the performance of a hypothetical $10,000 investment in Class I over a ten year period or since inception, if shorter, in comparison to (i) a broad measure of market performance and (ii) an additional index that MFS believes more closely reflects the market segments in which the fund invests.

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns through 2/28/25 This table shows the average annual total returns of the class of shares noted for the periods shown, both with (if any) and without sales charges. It also shows the average annual total returns of (i) a broad measure of market performance and (ii) an additional index that MFS believes more closely reflects the market segments in which the fund invests, over the same periods.

| Share Class |

1-yr |

5-yr |

10-yr |

| I without sales charge |

5.49% |

(0.93)% |

0.84% |

| Comparative Benchmark(s) |

|

|

|

| Bloomberg U.S. Aggregate Bond Index +∆ |

5.81% |

(0.52)% |

1.51% |

| Bloomberg U.S. Government/Mortgage Index +∆ |

5.53% |

(0.85)% |

1.07% |

|

+ |

Effective May 1, 2024, the Bloomberg U.S. Aggregate Bond Index replaced the Bloomberg U.S. Government/Mortgage Index as a broad measure of market performance in accordance with new regulatory disclosure requirements. The fund continues to use the Bloomberg U.S. Government/Mortgage Index as an additional benchmark that MFS believes more closely reflects the market segments in which the fund invests. |

|

∆ |

Source: FactSet Research Systems Inc. |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

|

|

| Performance Table Market Index Changed [Text Block] |

Effective May 1, 2024, the Bloomberg U.S. Aggregate Bond Index replaced the Bloomberg U.S. Government/Mortgage Index as a broad measure of market performance in accordance with new regulatory disclosure requirements. The fund continues to use the Bloomberg U.S. Government/Mortgage Index as an additional benchmark that MFS believes more closely reflects the market segments in which the fund invests.

|

|

| Updated Performance Information Location [Text Block] |

Visit mfs.com/perf/i for more recent performance information.

|

|

| Net Assets |

$ 2,002,629,208

|

|

| Holdings Count | Holding |

822

|

|

| Advisory Fees Paid, Amount |

$ 7,481,801

|

[4] |

| Investment Company Portfolio Turnover |

195.00%

|

|

| Additional Fund Statistics [Text Block] |

FUND STATISTICS AS OF 2/28/25

| Net Assets ($): |

2,002,629,208 |

|

Average Effective Maturity (yrs): |

6.5 |

| Total Number of Holdings: |

822 |

|

Average Effective Duration (yrs): |

6.3 |

| Total Management Fee ($)#: |

7,481,801 |

|

|

|

| Portfolio Turnover Rate (%): |

195 |

|

|

| # Includes the effect of any management fee waivers, if applicable. Where the fund holds derivatives, they are not included in the total number of portfolio holdings.

|

|

| Holdings [Text Block] |

PORTFOLIO COMPOSITION (BASED ON TOTAL INVESTMENTS AS OF 2/28/25) Portfolio structure

| Fixed Income |

98.9% |

| Money Market Funds |

1.1% | Composition including fixed income credit quality

| AAA |

7.2% |

| AA |

1.0% |

| A |

0.5% |

| BBB |

0.0% |

| U.S. Government |

25.2% |

| Federal Agencies |

65.0% |

| Money Market Funds |

1.1% | Ratings are assigned using Moody’s, Fitch, and Standard & Poor’s and applying a hierarchy: If all 3 agencies rate a security, the middle rating is assigned; if 2 agencies rate a security, the lower rating is assigned. If none of the 3 agencies rate a security, we use DBRS Morningstar. If none of the 4 agencies rate a security, we use Kroll Bond Rating Agency. Ratings are shown in the S&P and Fitch scale (e.g., AAA). All ratings are subject to change.

|

|

| Credit Ratings Selection [Text Block] |

Ratings are assigned using Moody’s, Fitch, and Standard & Poor’s and applying a hierarchy: If all 3 agencies rate a security, the middle rating is assigned; if 2 agencies rate a security, the lower rating is assigned. If none of the 3 agencies rate a security, we use DBRS Morningstar. If none of the 4 agencies rate a security, we use Kroll Bond Rating Agency. Ratings are shown in the S&P and Fitch scale (e.g., AAA). All ratings are subject to change.

|

|

| C000002015 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

MFS® Government Securities Fund

|

|

| Class Name |

Class R1

|

|

| Trading Symbol |

MFGGX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about MFS Government Securities Fund for the period of March 1, 2024 to February 28, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at funds.mfs.com. You can also request this information by contacting us at 1‑800‑225‑2606 or by sending an e-mail request to orderliterature@mfs.com.

|

|

| Additional Information Phone Number |

1‑800‑225‑2606

|

|

| Additional Information Email |

orderliterature@mfs.com

|

|

| Additional Information Website |

funds.mfs.com

|

|

| Expenses [Text Block] |

FUND EXPENSES What were the fund costs for the last year?

| (based on a hypothetical $10,000 investment) |

|

|

| Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| R1 |

$155 |

1.52% |

|

|

| Expenses Paid, Amount |

$ 155

|

|

| Expense Ratio, Percent |

1.52%

|

|

| Factors Affecting Performance [Text Block] |

MANAGEMENT'S DISCUSSION OF FUND PERFORMANCE

-

For the twelve months ended February 28, 2025, Class R1 shares of the MFS Government Securities Fund (fund) provided a total return of 4.45%, at net asset value. This compares with a return of 5.81% for the fund’s benchmark, the Bloomberg U.S. Aggregate Bond Index. The fund's other benchmark, the Bloomberg U.S. Government/Mortgage Index, generated a return of 5.53%.

-

Moderating inflation pressures allowed many global central banks to ease monetary policy during the period. However, the pace of disinflation slowed toward the end of the period, particularly in the US.

-

Geopolitical strains remained high amid ongoing conflicts in Ukraine and in the Middle East, while relations between China and the US remained tense, especially regarding trade. At the end of the period, China unveiled a sizable stimulus package aimed at shoring up its property sector and the finances of highly indebted local governments while the Trump administration threatened to impose considerable tariffs on its trading partners.

-

Global equity markets reached record levels late in the period as they withstood the adversity of the unsettled geopolitical climate and a higher interest rate environment but eased back from those highs as policy uncertainty rose. Healthy earnings growth continued though advances in artificial intelligence called into question, at least temporarily, the need for extraordinary levels of infrastructure investment to support the technology.

-

Global bond yields climbed off mid-period lows on the back of the US election results, resilient economic growth, concerns that global disinflationary progress may have stalled and a rising term premium. Reflecting increased inflation uncertainty, market expectations for future Federal Reserve interest rate cuts in 2025 were largely pared back while other major global central banks, notably the ECB, Bank of Canada and Bank of England, continued their gradual easing cycles. Already compressed credit spreads tightened further as corporate fundamentals remained sound. Bond market volatility, as measured by the Merrill Lynch Option Volatility Estimate (MOVE) index, declined in the fourth quarter after peaking before the US election, but climbed late February amongst heightened tariff uncertainty.

|

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a good predictor of the fund’s future performance.

|

|

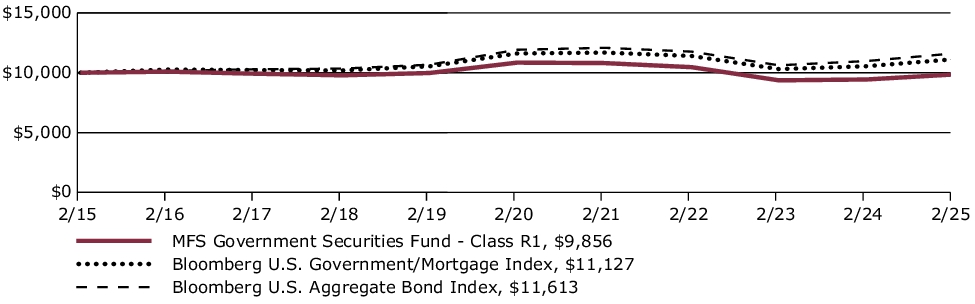

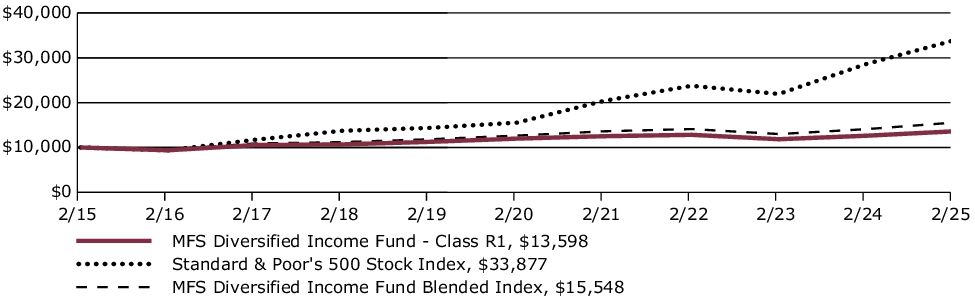

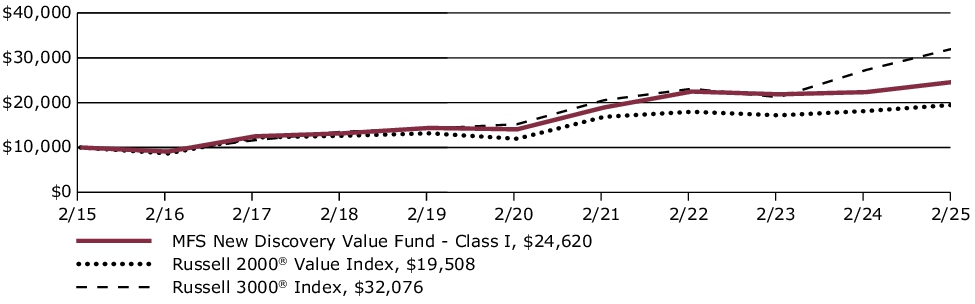

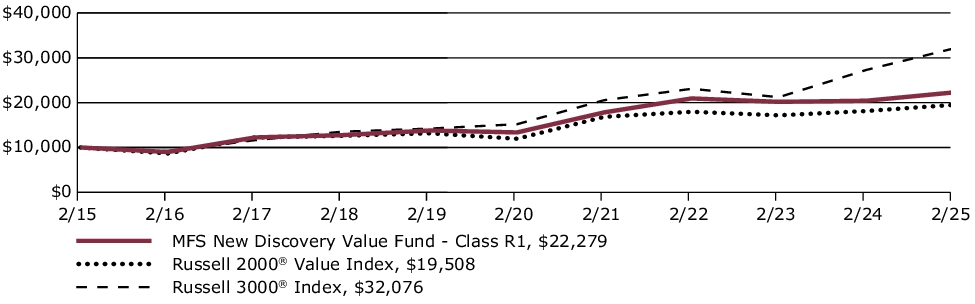

| Line Graph [Table Text Block] |

FUND PERFORMANCE The fund’s past performance is not a good predictor of the fund’s future performance. The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The graph and table below assume reinvestment of dividends and capital gain distributions. Growth of a Hypothetical $10,000 Investment This graph shows the performance of a hypothetical $10,000 investment in Class R1 over a ten year period or since inception, if shorter, in comparison to (i) a broad measure of market performance and (ii) an additional index that MFS believes more closely reflects the market segments in which the fund invests.

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns through 2/28/25 This table shows the average annual total returns of the class of shares noted for the periods shown, both with (if any) and without sales charges. It also shows the average annual total returns of (i) a broad measure of market performance and (ii) an additional index that MFS believes more closely reflects the market segments in which the fund invests, over the same periods.

| Share Class |

1-yr |

5-yr |

10-yr |

| R1 without sales charge |

4.45% |

(1.90)% |

(0.15)% |

| Comparative Benchmark(s) |

|

|

|

| Bloomberg U.S. Aggregate Bond Index +∆ |

5.81% |

(0.52)% |

1.51% |

| Bloomberg U.S. Government/Mortgage Index +∆ |

5.53% |

(0.85)% |

1.07% |

|

+ |

Effective May 1, 2024, the Bloomberg U.S. Aggregate Bond Index replaced the Bloomberg U.S. Government/Mortgage Index as a broad measure of market performance in accordance with new regulatory disclosure requirements. The fund continues to use the Bloomberg U.S. Government/Mortgage Index as an additional benchmark that MFS believes more closely reflects the market segments in which the fund invests. |

|

∆ |

Source: FactSet Research Systems Inc. |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

|

|

| Performance Table Market Index Changed [Text Block] |

Effective May 1, 2024, the Bloomberg U.S. Aggregate Bond Index replaced the Bloomberg U.S. Government/Mortgage Index as a broad measure of market performance in accordance with new regulatory disclosure requirements. The fund continues to use the Bloomberg U.S. Government/Mortgage Index as an additional benchmark that MFS believes more closely reflects the market segments in which the fund invests.

|

|

| Updated Performance Information Location [Text Block] |

Visit mfs.com/perf/r1 for more recent performance information.

|

|

| Net Assets |

$ 2,002,629,208

|

|

| Holdings Count | Holding |

822

|

|

| Advisory Fees Paid, Amount |

$ 7,481,801

|

[5] |

| Investment Company Portfolio Turnover |

195.00%

|

|

| Additional Fund Statistics [Text Block] |

FUND STATISTICS AS OF 2/28/25

| Net Assets ($): |

2,002,629,208 |

|

Average Effective Maturity (yrs): |

6.5 |

| Total Number of Holdings: |

822 |

|

Average Effective Duration (yrs): |

6.3 |

| Total Management Fee ($)#: |

7,481,801 |

|

|

|

| Portfolio Turnover Rate (%): |

195 |

|

|

| # Includes the effect of any management fee waivers, if applicable. Where the fund holds derivatives, they are not included in the total number of portfolio holdings.

|

|

| Holdings [Text Block] |

PORTFOLIO COMPOSITION (BASED ON TOTAL INVESTMENTS AS OF 2/28/25) Portfolio structure

| Fixed Income |

98.9% |

| Money Market Funds |

1.1% | Composition including fixed income credit quality

| AAA |

7.2% |

| AA |

1.0% |

| A |

0.5% |

| BBB |

0.0% |

| U.S. Government |

25.2% |

| Federal Agencies |

65.0% |

| Money Market Funds |

1.1% | Ratings are assigned using Moody’s, Fitch, and Standard & Poor’s and applying a hierarchy: If all 3 agencies rate a security, the middle rating is assigned; if 2 agencies rate a security, the lower rating is assigned. If none of the 3 agencies rate a security, we use DBRS Morningstar. If none of the 4 agencies rate a security, we use Kroll Bond Rating Agency. Ratings are shown in the S&P and Fitch scale (e.g., AAA). All ratings are subject to change.

|

|

| Credit Ratings Selection [Text Block] |

Ratings are assigned using Moody’s, Fitch, and Standard & Poor’s and applying a hierarchy: If all 3 agencies rate a security, the middle rating is assigned; if 2 agencies rate a security, the lower rating is assigned. If none of the 3 agencies rate a security, we use DBRS Morningstar. If none of the 4 agencies rate a security, we use Kroll Bond Rating Agency. Ratings are shown in the S&P and Fitch scale (e.g., AAA). All ratings are subject to change.

|

|

| C000002017 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

MFS® Government Securities Fund

|

|

| Class Name |

Class R2

|

|

| Trading Symbol |

MGVSX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about MFS Government Securities Fund for the period of March 1, 2024 to February 28, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at funds.mfs.com. You can also request this information by contacting us at 1‑800‑225‑2606 or by sending an e-mail request to orderliterature@mfs.com.

|

|

| Additional Information Phone Number |

1‑800‑225‑2606

|

|

| Additional Information Email |

orderliterature@mfs.com

|

|

| Additional Information Website |

funds.mfs.com

|

|

| Expenses [Text Block] |

FUND EXPENSES What were the fund costs for the last year?

| (based on a hypothetical $10,000 investment) |

|

|

| Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| R2 |

$105 |

1.02% |

|

|

| Expenses Paid, Amount |

$ 105

|

|

| Expense Ratio, Percent |

1.02%

|

|

| Factors Affecting Performance [Text Block] |

MANAGEMENT'S DISCUSSION OF FUND PERFORMANCE

-

For the twelve months ended February 28, 2025, Class R2 shares of the MFS Government Securities Fund (fund) provided a total return of 4.97%, at net asset value. This compares with a return of 5.81% for the fund’s benchmark, the Bloomberg U.S. Aggregate Bond Index. The fund's other benchmark, the Bloomberg U.S. Government/Mortgage Index, generated a return of 5.53%.

-

Moderating inflation pressures allowed many global central banks to ease monetary policy during the period. However, the pace of disinflation slowed toward the end of the period, particularly in the US.

-

Geopolitical strains remained high amid ongoing conflicts in Ukraine and in the Middle East, while relations between China and the US remained tense, especially regarding trade. At the end of the period, China unveiled a sizable stimulus package aimed at shoring up its property sector and the finances of highly indebted local governments while the Trump administration threatened to impose considerable tariffs on its trading partners.

-

Global equity markets reached record levels late in the period as they withstood the adversity of the unsettled geopolitical climate and a higher interest rate environment but eased back from those highs as policy uncertainty rose. Healthy earnings growth continued though advances in artificial intelligence called into question, at least temporarily, the need for extraordinary levels of infrastructure investment to support the technology.

-

Global bond yields climbed off mid-period lows on the back of the US election results, resilient economic growth, concerns that global disinflationary progress may have stalled and a rising term premium. Reflecting increased inflation uncertainty, market expectations for future Federal Reserve interest rate cuts in 2025 were largely pared back while other major global central banks, notably the ECB, Bank of Canada and Bank of England, continued their gradual easing cycles. Already compressed credit spreads tightened further as corporate fundamentals remained sound. Bond market volatility, as measured by the Merrill Lynch Option Volatility Estimate (MOVE) index, declined in the fourth quarter after peaking before the US election, but climbed late February amongst heightened tariff uncertainty.

|

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a good predictor of the fund’s future performance.

|

|

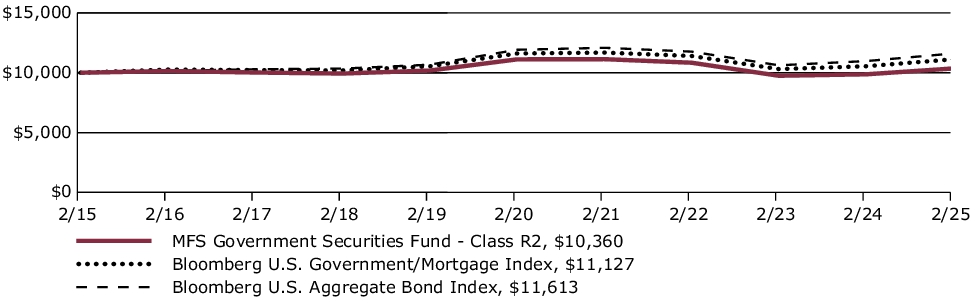

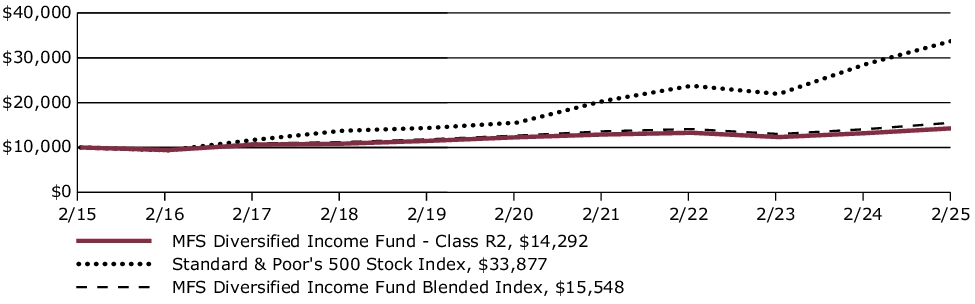

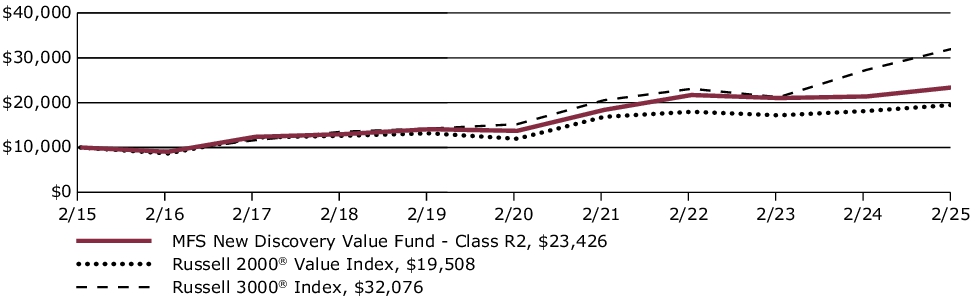

| Line Graph [Table Text Block] |

FUND PERFORMANCE The fund’s past performance is not a good predictor of the fund’s future performance. The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The graph and table below assume reinvestment of dividends and capital gain distributions. Growth of a Hypothetical $10,000 Investment This graph shows the performance of a hypothetical $10,000 investment in Class R2 over a ten year period or since inception, if shorter, in comparison to (i) a broad measure of market performance and (ii) an additional index that MFS believes more closely reflects the market segments in which the fund invests.

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns through 2/28/25 This table shows the average annual total returns of the class of shares noted for the periods shown, both with (if any) and without sales charges. It also shows the average annual total returns of (i) a broad measure of market performance and (ii) an additional index that MFS believes more closely reflects the market segments in which the fund invests, over the same periods.

| Share Class |

1-yr |

5-yr |

10-yr |

| R2 without sales charge |

4.97% |

(1.41)% |

0.35% |

| Comparative Benchmark(s) |

|

|

|

| Bloomberg U.S. Aggregate Bond Index +∆ |

5.81% |

(0.52)% |

1.51% |

| Bloomberg U.S. Government/Mortgage Index +∆ |

5.53% |

(0.85)% |

1.07% |

|

+ |

Effective May 1, 2024, the Bloomberg U.S. Aggregate Bond Index replaced the Bloomberg U.S. Government/Mortgage Index as a broad measure of market performance in accordance with new regulatory disclosure requirements. The fund continues to use the Bloomberg U.S. Government/Mortgage Index as an additional benchmark that MFS believes more closely reflects the market segments in which the fund invests. |

|

∆ |

Source: FactSet Research Systems Inc. |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

|

|

| Performance Table Market Index Changed [Text Block] |

Effective May 1, 2024, the Bloomberg U.S. Aggregate Bond Index replaced the Bloomberg U.S. Government/Mortgage Index as a broad measure of market performance in accordance with new regulatory disclosure requirements. The fund continues to use the Bloomberg U.S. Government/Mortgage Index as an additional benchmark that MFS believes more closely reflects the market segments in which the fund invests.

|

|

| Updated Performance Information Location [Text Block] |

Visit mfs.com/perf/r2 for more recent performance information.

|

|

| Net Assets |

$ 2,002,629,208

|

|

| Holdings Count | Holding |

822

|

|

| Advisory Fees Paid, Amount |

$ 7,481,801

|

[6] |

| Investment Company Portfolio Turnover |

195.00%

|

|

| Additional Fund Statistics [Text Block] |

FUND STATISTICS AS OF 2/28/25

| Net Assets ($): |

2,002,629,208 |

|

Average Effective Maturity (yrs): |

6.5 |

| Total Number of Holdings: |

822 |

|

Average Effective Duration (yrs): |

6.3 |

| Total Management Fee ($)#: |

7,481,801 |

|

|

|

| Portfolio Turnover Rate (%): |

195 |

|

|

| # Includes the effect of any management fee waivers, if applicable. Where the fund holds derivatives, they are not included in the total number of portfolio holdings.

|

|

| Holdings [Text Block] |

PORTFOLIO COMPOSITION (BASED ON TOTAL INVESTMENTS AS OF 2/28/25) Portfolio structure

| Fixed Income |

98.9% |

| Money Market Funds |

1.1% | Composition including fixed income credit quality

| AAA |

7.2% |

| AA |

1.0% |

| A |

0.5% |

| BBB |

0.0% |

| U.S. Government |

25.2% |

| Federal Agencies |

65.0% |

| Money Market Funds |

1.1% | Ratings are assigned using Moody’s, Fitch, and Standard & Poor’s and applying a hierarchy: If all 3 agencies rate a security, the middle rating is assigned; if 2 agencies rate a security, the lower rating is assigned. If none of the 3 agencies rate a security, we use DBRS Morningstar. If none of the 4 agencies rate a security, we use Kroll Bond Rating Agency. Ratings are shown in the S&P and Fitch scale (e.g., AAA). All ratings are subject to change.

|

|

| Credit Ratings Selection [Text Block] |

Ratings are assigned using Moody’s, Fitch, and Standard & Poor’s and applying a hierarchy: If all 3 agencies rate a security, the middle rating is assigned; if 2 agencies rate a security, the lower rating is assigned. If none of the 3 agencies rate a security, we use DBRS Morningstar. If none of the 4 agencies rate a security, we use Kroll Bond Rating Agency. Ratings are shown in the S&P and Fitch scale (e.g., AAA). All ratings are subject to change.

|

|

| C000002018 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

MFS® Government Securities Fund

|

|

| Class Name |

Class R3

|

|

| Trading Symbol |

MFGHX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about MFS Government Securities Fund for the period of March 1, 2024 to February 28, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at funds.mfs.com. You can also request this information by contacting us at 1‑800‑225‑2606 or by sending an e-mail request to orderliterature@mfs.com.

|

|

| Additional Information Phone Number |

1‑800‑225‑2606

|

|

| Additional Information Email |

orderliterature@mfs.com

|

|

| Additional Information Website |

funds.mfs.com

|

|

| Expenses [Text Block] |

FUND EXPENSES What were the fund costs for the last year?

| (based on a hypothetical $10,000 investment) |

|

|

| Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| R3 |

$79 |

0.77% |

|

|

| Expenses Paid, Amount |

$ 79

|

|

| Expense Ratio, Percent |

0.77%

|

|

| Factors Affecting Performance [Text Block] |

MANAGEMENT'S DISCUSSION OF FUND PERFORMANCE

-

For the twelve months ended February 28, 2025, Class R3 shares of the MFS Government Securities Fund (fund) provided a total return of 5.23%, at net asset value. This compares with a return of 5.81% for the fund’s benchmark, the Bloomberg U.S. Aggregate Bond Index. The fund's other benchmark, the Bloomberg U.S. Government/Mortgage Index, generated a return of 5.53%.

-

Moderating inflation pressures allowed many global central banks to ease monetary policy during the period. However, the pace of disinflation slowed toward the end of the period, particularly in the US.

-

Geopolitical strains remained high amid ongoing conflicts in Ukraine and in the Middle East, while relations between China and the US remained tense, especially regarding trade. At the end of the period, China unveiled a sizable stimulus package aimed at shoring up its property sector and the finances of highly indebted local governments while the Trump administration threatened to impose considerable tariffs on its trading partners.

-

Global equity markets reached record levels late in the period as they withstood the adversity of the unsettled geopolitical climate and a higher interest rate environment but eased back from those highs as policy uncertainty rose. Healthy earnings growth continued though advances in artificial intelligence called into question, at least temporarily, the need for extraordinary levels of infrastructure investment to support the technology.

-

Global bond yields climbed off mid-period lows on the back of the US election results, resilient economic growth, concerns that global disinflationary progress may have stalled and a rising term premium. Reflecting increased inflation uncertainty, market expectations for future Federal Reserve interest rate cuts in 2025 were largely pared back while other major global central banks, notably the ECB, Bank of Canada and Bank of England, continued their gradual easing cycles. Already compressed credit spreads tightened further as corporate fundamentals remained sound. Bond market volatility, as measured by the Merrill Lynch Option Volatility Estimate (MOVE) index, declined in the fourth quarter after peaking before the US election, but climbed late February amongst heightened tariff uncertainty.

|

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a good predictor of the fund’s future performance.

|

|

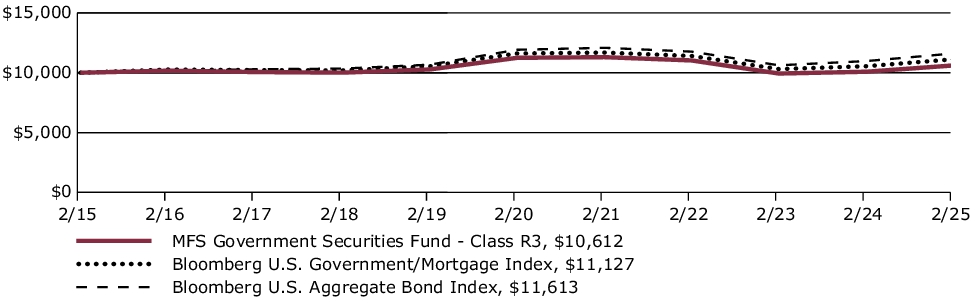

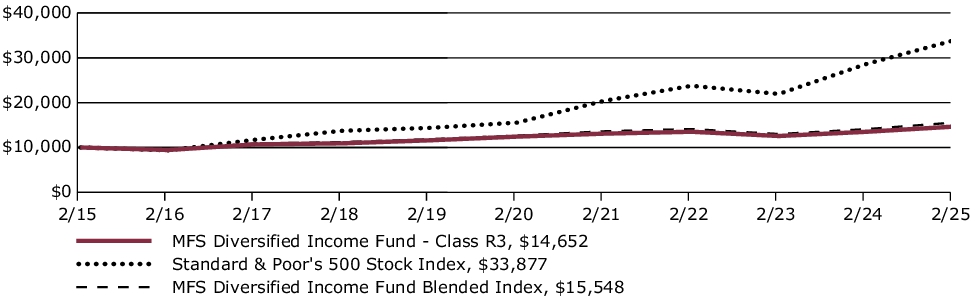

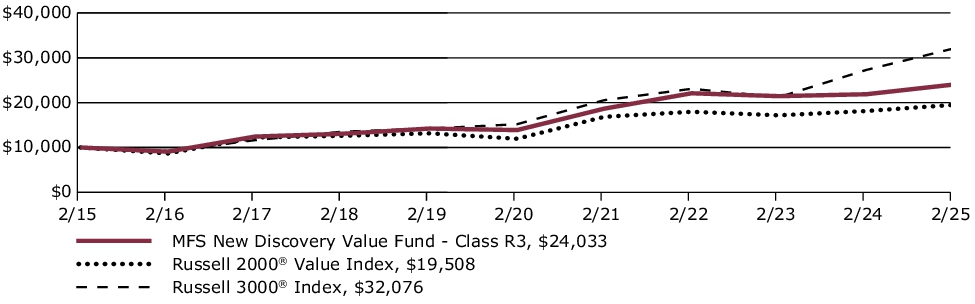

| Line Graph [Table Text Block] |

FUND PERFORMANCE The fund’s past performance is not a good predictor of the fund’s future performance. The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The graph and table below assume reinvestment of dividends and capital gain distributions. Growth of a Hypothetical $10,000 Investment This graph shows the performance of a hypothetical $10,000 investment in Class R3 over a ten year period or since inception, if shorter, in comparison to (i) a broad measure of market performance and (ii) an additional index that MFS believes more closely reflects the market segments in which the fund invests.

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns through 2/28/25 This table shows the average annual total returns of the class of shares noted for the periods shown, both with (if any) and without sales charges. It also shows the average annual total returns of (i) a broad measure of market performance and (ii) an additional index that MFS believes more closely reflects the market segments in which the fund invests, over the same periods.

| Share Class |

1-yr |

5-yr |

10-yr |

| R3 without sales charge |

5.23% |

(1.16)% |

0.60% |

| Comparative Benchmark(s) |

|

|

|

| Bloomberg U.S. Aggregate Bond Index +∆ |

5.81% |

(0.52)% |

1.51% |

| Bloomberg U.S. Government/Mortgage Index +∆ |

5.53% |

(0.85)% |

1.07% |

|

+ |

Effective May 1, 2024, the Bloomberg U.S. Aggregate Bond Index replaced the Bloomberg U.S. Government/Mortgage Index as a broad measure of market performance in accordance with new regulatory disclosure requirements. The fund continues to use the Bloomberg U.S. Government/Mortgage Index as an additional benchmark that MFS believes more closely reflects the market segments in which the fund invests. |

|

∆ |

Source: FactSet Research Systems Inc. |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

|

|

| Performance Table Market Index Changed [Text Block] |

Effective May 1, 2024, the Bloomberg U.S. Aggregate Bond Index replaced the Bloomberg U.S. Government/Mortgage Index as a broad measure of market performance in accordance with new regulatory disclosure requirements. The fund continues to use the Bloomberg U.S. Government/Mortgage Index as an additional benchmark that MFS believes more closely reflects the market segments in which the fund invests.

|

|

| Updated Performance Information Location [Text Block] |

Visit mfs.com/perf/r3 for more recent performance information.

|

|

| Net Assets |

$ 2,002,629,208

|

|

| Holdings Count | Holding |

822

|

|

| Advisory Fees Paid, Amount |

$ 7,481,801

|

[7] |

| Investment Company Portfolio Turnover |

195.00%

|

|

| Additional Fund Statistics [Text Block] |

FUND STATISTICS AS OF 2/28/25

| Net Assets ($): |

2,002,629,208 |

|

Average Effective Maturity (yrs): |

6.5 |

| Total Number of Holdings: |

822 |

|

Average Effective Duration (yrs): |

6.3 |

| Total Management Fee ($)#: |

7,481,801 |

|

|

|

| Portfolio Turnover Rate (%): |

195 |

|

|

| # Includes the effect of any management fee waivers, if applicable. Where the fund holds derivatives, they are not included in the total number of portfolio holdings.

|

|

| Holdings [Text Block] |

PORTFOLIO COMPOSITION (BASED ON TOTAL INVESTMENTS AS OF 2/28/25) Portfolio structure

| Fixed Income |

98.9% |

| Money Market Funds |

1.1% | Composition including fixed income credit quality

| AAA |

7.2% |

| AA |

1.0% |

| A |

0.5% |

| BBB |

0.0% |

| U.S. Government |

25.2% |

| Federal Agencies |

65.0% |

| Money Market Funds |

1.1% | Ratings are assigned using Moody’s, Fitch, and Standard & Poor’s and applying a hierarchy: If all 3 agencies rate a security, the middle rating is assigned; if 2 agencies rate a security, the lower rating is assigned. If none of the 3 agencies rate a security, we use DBRS Morningstar. If none of the 4 agencies rate a security, we use Kroll Bond Rating Agency. Ratings are shown in the S&P and Fitch scale (e.g., AAA). All ratings are subject to change.

|

|

| Credit Ratings Selection [Text Block] |

Ratings are assigned using Moody’s, Fitch, and Standard & Poor’s and applying a hierarchy: If all 3 agencies rate a security, the middle rating is assigned; if 2 agencies rate a security, the lower rating is assigned. If none of the 3 agencies rate a security, we use DBRS Morningstar. If none of the 4 agencies rate a security, we use Kroll Bond Rating Agency. Ratings are shown in the S&P and Fitch scale (e.g., AAA). All ratings are subject to change.

|

|

| C000002008 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

MFS® Government Securities Fund

|

|

| Class Name |

Class R4

|

|

| Trading Symbol |

MFGJX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about MFS Government Securities Fund for the period of March 1, 2024 to February 28, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at funds.mfs.com. You can also request this information by contacting us at 1‑800‑225‑2606 or by sending an e-mail request to orderliterature@mfs.com.

|

|

| Additional Information Phone Number |

1‑800‑225‑2606

|

|

| Additional Information Email |

orderliterature@mfs.com

|

|

| Additional Information Website |

funds.mfs.com

|

|

| Expenses [Text Block] |

FUND EXPENSES What were the fund costs for the last year?

| (based on a hypothetical $10,000 investment) |

|

|

| Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| R4 |

$53 |

0.52% |

|

|

| Expenses Paid, Amount |

$ 53

|

|

| Expense Ratio, Percent |

0.52%

|

|

| Factors Affecting Performance [Text Block] |

MANAGEMENT'S DISCUSSION OF FUND PERFORMANCE

-

For the twelve months ended February 28, 2025, Class R4 shares of the MFS Government Securities Fund (fund) provided a total return of 5.49%, at net asset value. This compares with a return of 5.81% for the fund’s benchmark, the Bloomberg U.S. Aggregate Bond Index. The fund's other benchmark, the Bloomberg U.S. Government/Mortgage Index, generated a return of 5.53%.

-

Moderating inflation pressures allowed many global central banks to ease monetary policy during the period. However, the pace of disinflation slowed toward the end of the period, particularly in the US.

-

Geopolitical strains remained high amid ongoing conflicts in Ukraine and in the Middle East, while relations between China and the US remained tense, especially regarding trade. At the end of the period, China unveiled a sizable stimulus package aimed at shoring up its property sector and the finances of highly indebted local governments while the Trump administration threatened to impose considerable tariffs on its trading partners.

-

Global equity markets reached record levels late in the period as they withstood the adversity of the unsettled geopolitical climate and a higher interest rate environment but eased back from those highs as policy uncertainty rose. Healthy earnings growth continued though advances in artificial intelligence called into question, at least temporarily, the need for extraordinary levels of infrastructure investment to support the technology.

-

Global bond yields climbed off mid-period lows on the back of the US election results, resilient economic growth, concerns that global disinflationary progress may have stalled and a rising term premium. Reflecting increased inflation uncertainty, market expectations for future Federal Reserve interest rate cuts in 2025 were largely pared back while other major global central banks, notably the ECB, Bank of Canada and Bank of England, continued their gradual easing cycles. Already compressed credit spreads tightened further as corporate fundamentals remained sound. Bond market volatility, as measured by the Merrill Lynch Option Volatility Estimate (MOVE) index, declined in the fourth quarter after peaking before the US election, but climbed late February amongst heightened tariff uncertainty.

|

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a good predictor of the fund’s future performance.

|

|

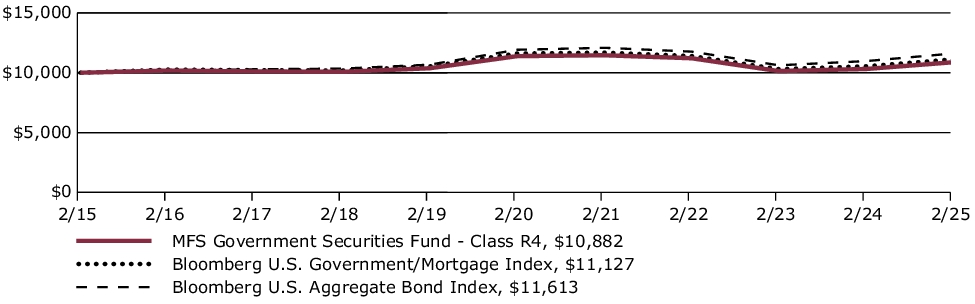

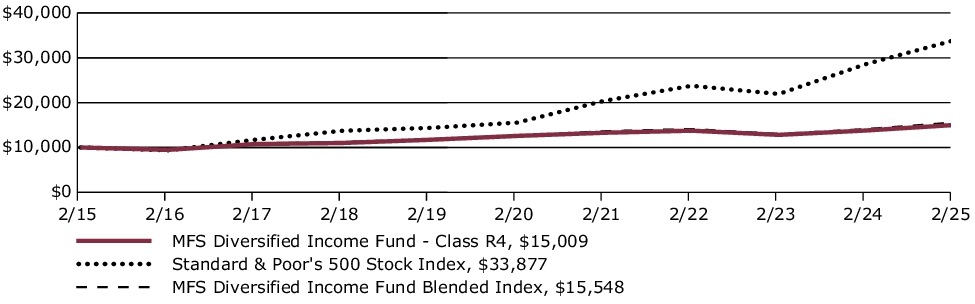

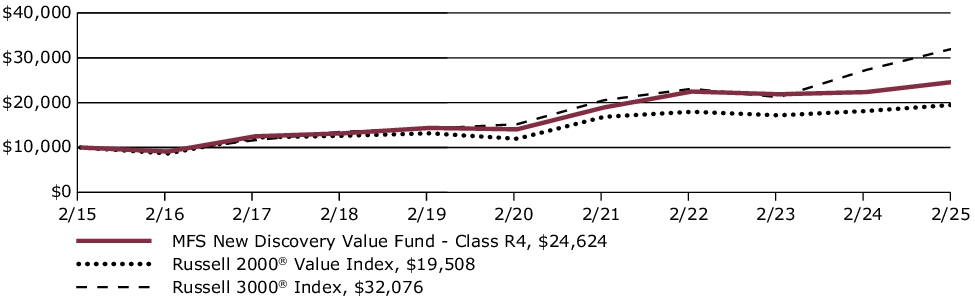

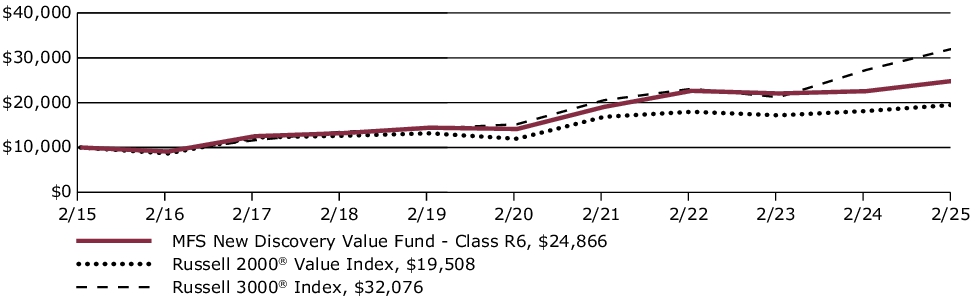

| Line Graph [Table Text Block] |

FUND PERFORMANCE The fund’s past performance is not a good predictor of the fund’s future performance. The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The graph and table below assume reinvestment of dividends and capital gain distributions. Growth of a Hypothetical $10,000 Investment This graph shows the performance of a hypothetical $10,000 investment in Class R4 over a ten year period or since inception, if shorter, in comparison to (i) a broad measure of market performance and (ii) an additional index that MFS believes more closely reflects the market segments in which the fund invests.

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns through 2/28/25 This table shows the average annual total returns of the class of shares noted for the periods shown, both with (if any) and without sales charges. It also shows the average annual total returns of (i) a broad measure of market performance and (ii) an additional index that MFS believes more closely reflects the market segments in which the fund invests, over the same periods.

| Share Class |

1-yr |

5-yr |

10-yr |

| R4 without sales charge |

5.49% |

(0.91)% |

0.85% |

| Comparative Benchmark(s) |

|

|

|

| Bloomberg U.S. Aggregate Bond Index +∆ |

5.81% |

(0.52)% |

1.51% |

| Bloomberg U.S. Government/Mortgage Index +∆ |

5.53% |

(0.85)% |

1.07% |

|

+ |

Effective May 1, 2024, the Bloomberg U.S. Aggregate Bond Index replaced the Bloomberg U.S. Government/Mortgage Index as a broad measure of market performance in accordance with new regulatory disclosure requirements. The fund continues to use the Bloomberg U.S. Government/Mortgage Index as an additional benchmark that MFS believes more closely reflects the market segments in which the fund invests. |

|

∆ |

Source: FactSet Research Systems Inc. |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

|

|

| Performance Table Market Index Changed [Text Block] |

Effective May 1, 2024, the Bloomberg U.S. Aggregate Bond Index replaced the Bloomberg U.S. Government/Mortgage Index as a broad measure of market performance in accordance with new regulatory disclosure requirements. The fund continues to use the Bloomberg U.S. Government/Mortgage Index as an additional benchmark that MFS believes more closely reflects the market segments in which the fund invests.

|

|

| Updated Performance Information Location [Text Block] |

Visit mfs.com/perf/r4 for more recent performance information.

|

|

| Net Assets |

$ 2,002,629,208

|

|

| Holdings Count | Holding |

822

|

|

| Advisory Fees Paid, Amount |

$ 7,481,801

|

[8] |

| Investment Company Portfolio Turnover |

195.00%

|

|

| Additional Fund Statistics [Text Block] |

FUND STATISTICS AS OF 2/28/25

| Net Assets ($): |

2,002,629,208 |

|

Average Effective Maturity (yrs): |

6.5 |

| Total Number of Holdings: |

822 |

|

Average Effective Duration (yrs): |

6.3 |

| Total Management Fee ($)#: |

7,481,801 |

|

|

|

| Portfolio Turnover Rate (%): |

195 |

|

|

| # Includes the effect of any management fee waivers, if applicable. Where the fund holds derivatives, they are not included in the total number of portfolio holdings.

|

|

| Holdings [Text Block] |

PORTFOLIO COMPOSITION (BASED ON TOTAL INVESTMENTS AS OF 2/28/25) Portfolio structure

| Fixed Income |

98.9% |

| Money Market Funds |

1.1% | Composition including fixed income credit quality

| AAA |

7.2% |

| AA |

1.0% |

| A |

0.5% |

| BBB |

0.0% |

| U.S. Government |

25.2% |

| Federal Agencies |

65.0% |

| Money Market Funds |

1.1% | Ratings are assigned using Moody’s, Fitch, and Standard & Poor’s and applying a hierarchy: If all 3 agencies rate a security, the middle rating is assigned; if 2 agencies rate a security, the lower rating is assigned. If none of the 3 agencies rate a security, we use DBRS Morningstar. If none of the 4 agencies rate a security, we use Kroll Bond Rating Agency. Ratings are shown in the S&P and Fitch scale (e.g., AAA). All ratings are subject to change.

|

|

| Credit Ratings Selection [Text Block] |

Ratings are assigned using Moody’s, Fitch, and Standard & Poor’s and applying a hierarchy: If all 3 agencies rate a security, the middle rating is assigned; if 2 agencies rate a security, the lower rating is assigned. If none of the 3 agencies rate a security, we use DBRS Morningstar. If none of the 4 agencies rate a security, we use Kroll Bond Rating Agency. Ratings are shown in the S&P and Fitch scale (e.g., AAA). All ratings are subject to change.

|

|

| C000117927 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

MFS® Government Securities Fund

|

|

| Class Name |

Class R6

|

|

| Trading Symbol |

MFGKX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about MFS Government Securities Fund for the period of March 1, 2024 to February 28, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at funds.mfs.com. You can also request this information by contacting us at 1‑800‑225‑2606 or by sending an e-mail request to orderliterature@mfs.com.

|

|

| Additional Information Phone Number |

1‑800‑225‑2606

|

|

| Additional Information Email |

orderliterature@mfs.com

|

|

| Additional Information Website |

funds.mfs.com

|

|

| Expenses [Text Block] |

FUND EXPENSES What were the fund costs for the last year?

| (based on a hypothetical $10,000 investment) |

|

|

| Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| R6 |

$43 |

0.42% |

|

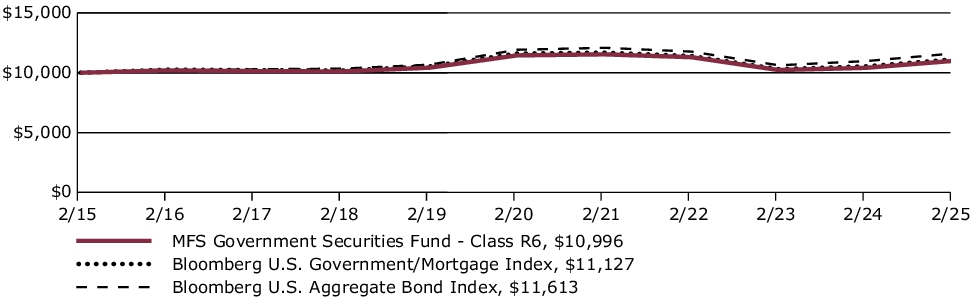

|