Pay vs Performance Disclosure

|

12 Months Ended |

|

Dec. 31, 2024

USD ($)

$ / shares

|

Dec. 31, 2023

USD ($)

$ / shares

|

Dec. 31, 2022

USD ($)

$ / shares

|

Dec. 31, 2021

USD ($)

$ / shares

|

Dec. 31, 2020

USD ($)

$ / shares

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Pay vs Performance Disclosure, Table |

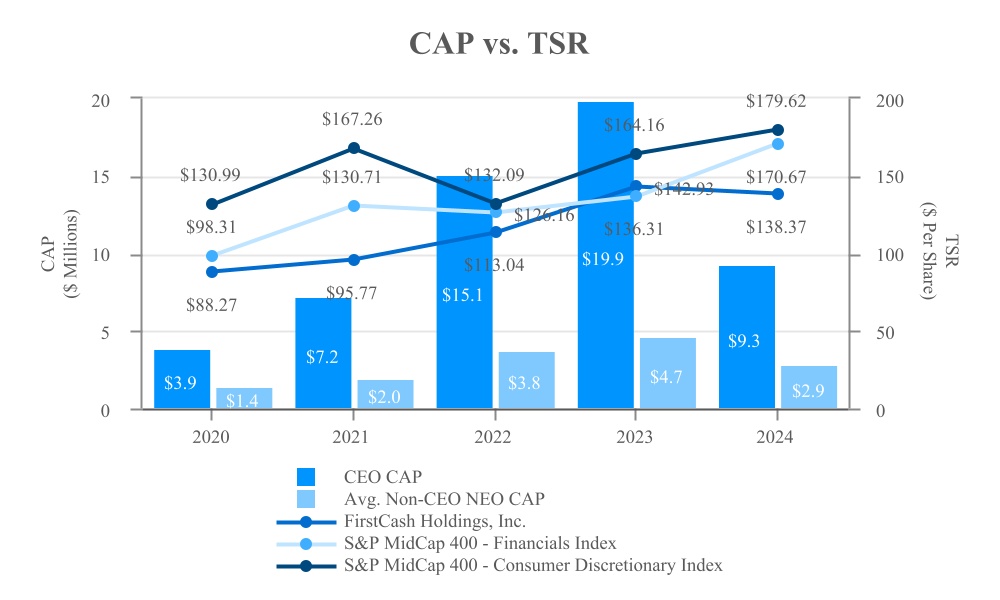

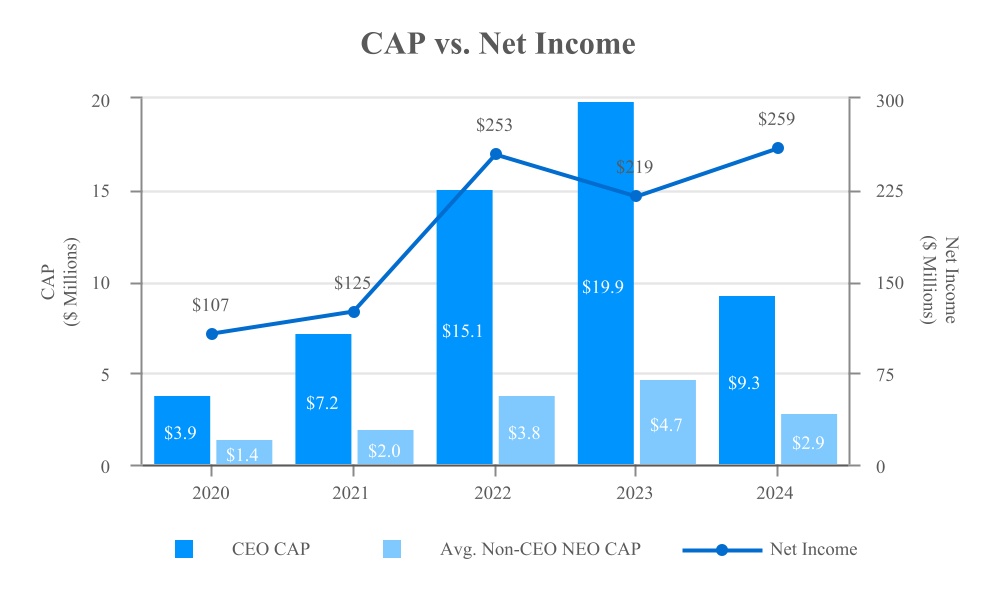

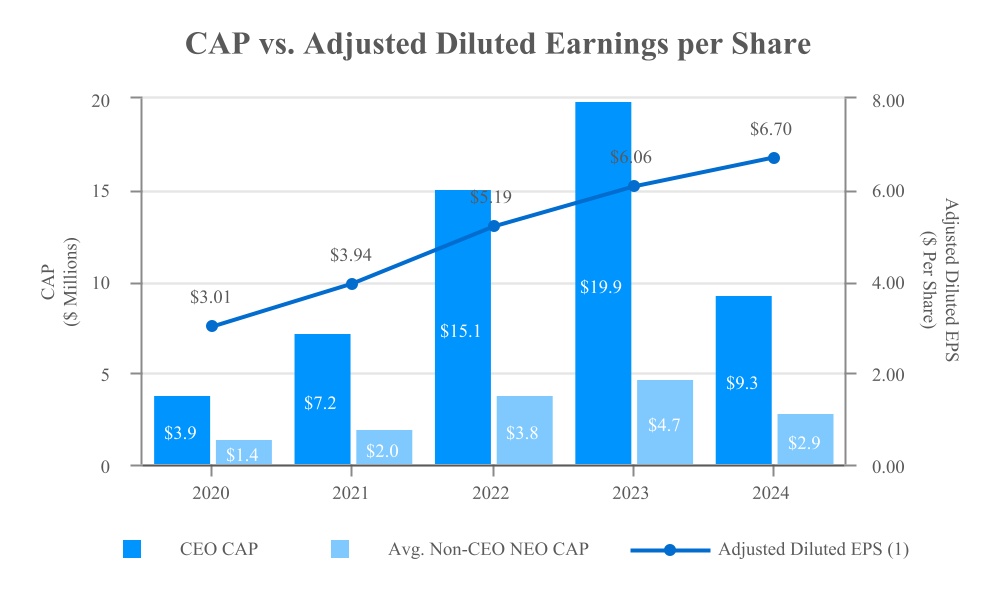

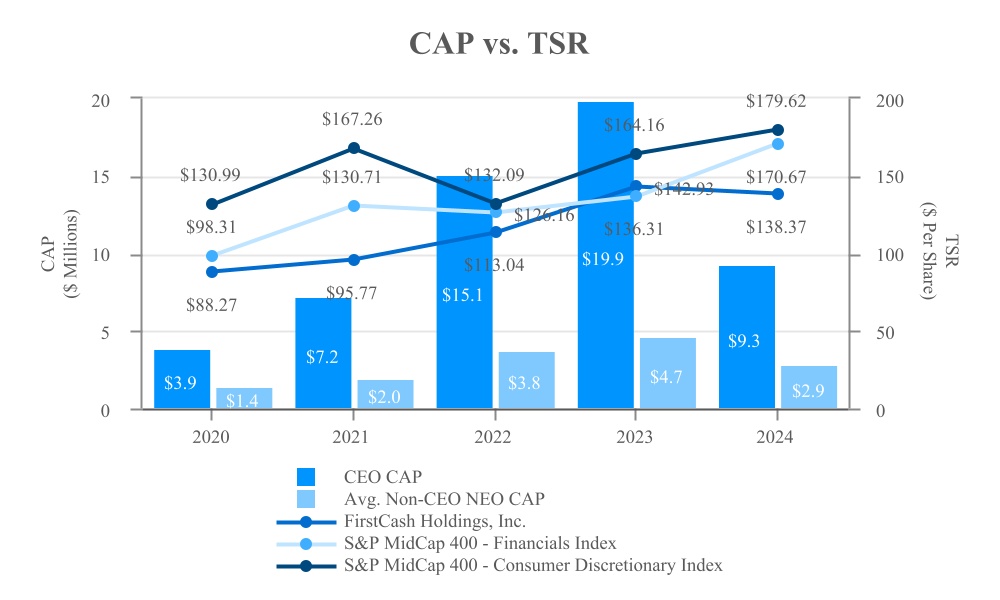

As required by SEC rules, the Company is providing the following information about the relationship between “compensation actually paid” (as computed in accordance with SEC rules) to its Principal Executive Officer (“PEO”) and to its other NEOs and certain financial performance of the Company for the most recently completed fiscal years:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Average | | | | | | | | | | | | | | | | | Summary | | Average | | | | | | | | | | | | | | | Compen- | | Compen- | | | | | | | | | | | | | | | sation | | sation | | | | | | | | | | | Summary | | | | Table | | Actually | | Value of Initial Fixed $100 | | | | | | | Compen- | | Compen- | | Total for | | Paid to | | Investment Based On: | | | | | | | sation | | sation | | Non-PEO | | Non-PEO | | | | Peer Group | | | | Adjusted | | | Table | | Actually | | Named | | Named | | Total | | Total | | | | Diluted | | | Total for | | Paid to | | Executive | | Executive | | Shareholder | | Shareholder | | | | Earnings | | | PEO (1) | | PEO (2) | | Officers (3) | | Officers (2) | | Return (4) | | Return (4) | | Net Income | | Per Share (5) | | Year | | ($) | | ($) | | ($) | | ($) | | ($) | | ($) | | ($) | | ($) | | 2024 | | 12,069,657 | | | 9,287,053 | | | 3,579,331 | | | 2,882,113 | | | 138.37 | | | 170.67 | | | 258,815,000 | | | 6.70 | | | 2023 | | 12,256,895 | | | 19,930,731 | | | 3,574,925 | | | 4,683,793 | | | 142.93 | | | 136.31 | | | 219,301,000 | | | 6.06 | | | 2022 | | 9,836,835 | | | 15,114,505 | | | 2,834,198 | | | 3,793,799 | | | 113.04 | | | 126.16 | | | 253,495,000 | | | 5.19 | | | 2021 | | 7,175,467 | | | 7,215,249 | | | 2,014,574 | | | 1,972,295 | | | 95.77 | | | 130.71 | | | 124,909,000 | | | 3.94 | | | 2020 | | 10,488,603 | | | 3,853,657 | | | 2,791,299 | | | 1,398,643 | | | 88.27 | | | 98.31 | | | 106,579,000 | | | 3.01 | |

|

|

|

|

|

| Named Executive Officers, Footnote |

Rick Wessel was the Company’s PEO in 2020, 2021, 2022, 2023 and 2024.The non-PEO NEOs included in the averages are the following individuals for each of the years shown: | | | | | | | | | | | | | | | | | | | | | | | | | | | | 2024 | | 2023 | | 2022 | | 2021 | | 2020 | | T. Brent Stuart | | T. Brent Stuart | | T. Brent Stuart | | T. Brent Stuart | | T. Brent Stuart | | R. Douglas Orr | | R. Douglas Orr | | R. Douglas Orr | | R. Douglas Orr | | R. Douglas Orr | Howard F. Hambleton | | Howard F. Hambleton | | Howard F. Hambleton (i) | | Anna M. Alvarado (ii) | | Anna M. Alvarado | | Raul R. Ramos | | Raul R. Ramos | | Raul R. Ramos | | Raul R. Ramos | | Raul R. Ramos |

(i)Mr. Hambleton joined the Company in December 2021, in conjunction with the AFF acquisition, as the AFF president.

(ii)Ms. Alvarado resigned from the Company effective October 8, 2021.

|

|

|

|

|

| Peer Group Issuers, Footnote |

For the relevant year, represents the cumulative TSR of the Company and the S&P MidCap 400 – Financials Index from December 31, 2019 though the respective measurement periods ending on December 31 of 2024, 2023, 2022, 2021 and 2020. Each year reflects what the cumulative value of $100 would be, including the reinvestment of dividends, if such amount were invested on December 31, 2019. For purposes of reporting comparative stockholder returns per Item 201(e) of Regulation S-K under the Exchange Act in the Company’s Annual Report on Form 10-K for the year ended December 31, 2024, both the S&P MidCap 400 – Financials Index and the S&P MidCap 400 – Consumer Discretionary Index are used by the Company. Given that more than 50% of the Company’s earnings in 2024 were from consumer finance-related activities, the Company has elected to use the S&P MidCap 400 – Financials Index Returns as the peer group benchmark in this table. For informational purposes, the stockholder returns for the S&P MidCap 400 – Consumer Discretionary Index were $179.62, $164.16, $132.09, $167.26 and 130.99 for 2024, 2023, 2022, 2021 and 2020, respectively.

|

|

|

|

|

| PEO Total Compensation Amount |

$ 12,069,657

|

$ 12,256,895

|

$ 9,836,835

|

$ 7,175,467

|

$ 10,488,603

|

| PEO Actually Paid Compensation Amount |

$ 9,287,053

|

19,930,731

|

15,114,505

|

7,215,249

|

3,853,657

|

| Adjustment To PEO Compensation, Footnote |

To calculate compensation actually paid (“CAP”), the following amounts were deducted from and added to SCT total compensation: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | PEO | | 2024 | | 2023 | | 2022 | | 2021 | | 2020 | | SCT total compensation | | $ | 12,069,657 | | | $ | 12,256,895 | | | $ | 9,836,835 | | | $ | 7,175,467 | | | $ | 10,488,603 | | | Less fair value of stock awards reported in the SCT | | (8,343,435) | | | (7,016,337) | | | (5,155,277) | | | (3,453,904) | | | (7,478,258) | | | Plus fair value as of year end of stock awards granted in current year | | 6,853,347 | | | 9,361,536 | | | 8,103,054 | | | 5,177,226 | | | 3,741,817 | | | Change in fair value of stock awards granted in prior years that are outstanding and unvested as of year end | | (903,943) | | | 2,201,800 | | | 2,287,279 | | | 840,071 | | | (2,148,575) | | | Change in fair value of stock awards granted in prior years that vested during the current year | | (388,573) | | | 3,126,837 | | | 42,614 | | | (2,523,611) | | | (749,930) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | CAP | | $ | 9,287,053 | | | $ | 19,930,731 | | | $ | 15,114,505 | | | $ | 7,215,249 | | | $ | 3,853,657 | |

|

|

|

|

|

| Non-PEO NEO Average Total Compensation Amount |

$ 3,579,331

|

3,574,925

|

2,834,198

|

2,014,574

|

2,791,299

|

| Non-PEO NEO Average Compensation Actually Paid Amount |

$ 2,882,113

|

4,683,793

|

3,793,799

|

1,972,295

|

1,398,643

|

| Adjustment to Non-PEO NEO Compensation Footnote |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Average of Non-PEO NEO | | 2024 | | 2023 | | 2022 | | 2021 | | 2020 | | SCT total compensation | | $ | 3,579,331 | | | $ | 3,574,925 | | | $ | 2,834,198 | | | $ | 2,014,574 | | | $ | 2,791,299 | | | Less fair value of stock awards reported in the SCT | | (1,882,974) | | | (1,615,710) | | | (1,161,314) | | | (744,532) | | | (1,458,714) | | | Plus fair value as of year end of stock awards granted in current year | | 1,531,161 | | | 2,141,786 | | | 1,678,775 | | | 1,083,099 | | | 798,701 | | | Change in fair value of stock awards granted in prior years that are outstanding and unvested as of year end | | (277,176) | | | 568,670 | | | 443,809 | | | 156,478 | | | (605,031) | | | Change in fair value of stock awards granted in prior years that vested during the current year | | (68,229) | | | 14,122 | | | (1,669) | | | (278,176) | | | (127,612) | | | Less fair value of stock awards forfeited during the current year | | — | | | — | | | — | | | (259,148) | | | — | | | | | | | | | | | | | | | | | | | | | | | | | CAP | | $ | 2,882,113 | | | $ | 4,683,793 | | | $ | 3,793,799 | | | $ | 1,972,295 | | | $ | 1,398,643 | |

|

|

|

|

|

| Compensation Actually Paid vs. Total Shareholder Return |

|

|

|

|

|

| Compensation Actually Paid vs. Net Income |

|

|

|

|

|

| Compensation Actually Paid vs. Company Selected Measure |

(1)Non-GAAP financial measure. See detailed reconciliation of non-GAAP financial measures provided in Appendix A.

|

|

|

|

|

| Total Shareholder Return Vs Peer Group |

|

|

|

|

|

| Total Shareholder Return Amount |

$ 138.37

|

142.93

|

113.04

|

95.77

|

88.27

|

| Peer Group Total Shareholder Return Amount |

170.67

|

136.31

|

126.16

|

130.71

|

98.31

|

| Net Income (Loss) |

$ 258,815,000

|

$ 219,301,000

|

$ 253,495,000

|

$ 124,909,000

|

$ 106,579,000

|

| Company Selected Measure Amount | $ / shares |

6.70

|

6.06

|

5.19

|

3.94

|

3.01

|

| PEO Name |

Rick Wessel

|

|

|

|

|

| Measure:: 1 |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Name |

Adjusted diluted earnings per share

|

|

|

|

|

| Non-GAAP Measure Description |

Non-GAAP financial measure. See detailed reconciliation of non-GAAP financial measures provided in Appendix A.

|

|

|

|

|

| Measure:: 2 |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Name |

Adjusted net income

|

|

|

|

|

| Measure:: 3 |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Name |

Adjusted EBITDA

|

|

|

|

|

| Measure:: 4 |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Name |

Net revenue (gross profit)

|

|

|

|

|

| Measure:: 5 |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Name |

TSR relative to compensation peers

|

|

|

|

|

| PEO | Aggregate Grant Date Fair Value of Equity Award Amounts Reported in Summary Compensation Table |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

$ (8,343,435)

|

$ (7,016,337)

|

$ (5,155,277)

|

$ (3,453,904)

|

$ (7,478,258)

|

| PEO | Year-end Fair Value of Equity Awards Granted in Covered Year that are Outstanding and Unvested |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

6,853,347

|

9,361,536

|

8,103,054

|

5,177,226

|

3,741,817

|

| PEO | Year-over-Year Change in Fair Value of Equity Awards Granted in Prior Years That are Outstanding and Unvested |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

(903,943)

|

2,201,800

|

2,287,279

|

840,071

|

(2,148,575)

|

| PEO | Change in Fair Value as of Vesting Date of Prior Year Equity Awards Vested in Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

(388,573)

|

3,126,837

|

42,614

|

(2,523,611)

|

(749,930)

|

| Non-PEO NEO | Aggregate Grant Date Fair Value of Equity Award Amounts Reported in Summary Compensation Table |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

(1,882,974)

|

(1,615,710)

|

(1,161,314)

|

(744,532)

|

(1,458,714)

|

| Non-PEO NEO | Year-end Fair Value of Equity Awards Granted in Covered Year that are Outstanding and Unvested |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

1,531,161

|

2,141,786

|

1,678,775

|

1,083,099

|

798,701

|

| Non-PEO NEO | Year-over-Year Change in Fair Value of Equity Awards Granted in Prior Years That are Outstanding and Unvested |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

(277,176)

|

568,670

|

443,809

|

156,478

|

(605,031)

|

| Non-PEO NEO | Change in Fair Value as of Vesting Date of Prior Year Equity Awards Vested in Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

(68,229)

|

14,122

|

(1,669)

|

(278,176)

|

(127,612)

|

| Non-PEO NEO | Prior Year End Fair Value of Equity Awards Granted in Any Prior Year that Fail to Meet Applicable Vesting Conditions During Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

$ 0

|

$ 0

|

$ 0

|

$ (259,148)

|

$ 0

|