The Global Women’s Fund’s investment objective is to seek long-term growth of capital.

The tables below describe the fees and expenses that you may pay if you buy, hold, and sell Institutional Class or Investor Class shares of the Global Women’s Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below.

Shareholder Fees - Impax Ellevate Global Women's Leadership Fund |

Institutional Class |

Investor Class |

|---|---|---|

| Maximum sales charge (load) imposed on purchases (as a % of offering price) | none | none |

| Maximum deferred sales charge (load) imposed on redemptions (as a % of the lower of original purchase price or net asset value) | none | none |

Annual Fund Operating Expenses - Impax Ellevate Global Women's Leadership Fund |

Institutional Class |

Investor Class |

|

|---|---|---|---|

| Management Fee | [1] | 0.52% | 0.52% |

| Distribution and/or Service (12b-1) Fees | none | 0.25% | |

| Total Annual Fund Operating Expenses | 0.52% | 0.77% | |

| [1] | The management fee is a unified fee that includes all of the operating costs and expenses of the Fund (other than taxes, charges of governmental agencies, interest, brokerage commissions incurred in connection with portfolio transactions, distribution and/or service fees payable under a plan pursuant to Rule 12b-1 under the Investment Company Act of 1940, acquired fund fees and expenses and extraordinary expenses), including accounting expenses, administrator, transfer agent and custodian fees, Fund legal fees and other expenses. |

This example is intended to help you compare the cost of investing in Institutional Class or Investor Class shares of the Global Women’s Fund with the cost of investing in other mutual funds.

The table assumes that an investor invests $10,000 in Institutional Class or Investor Class shares of the Global Women’s Fund for the time periods indicated and then redeems all of his or her shares at the end of those periods. The table also assumes that the investment has a 5% return each year, that all dividends and distributions are reinvested and that the Global Women’s Fund’s operating expenses remain the same throughout those periods. Although an investor’s actual expenses may be higher or lower than those shown in the table, based on these assumptions his or her expenses would be:

Expense Example - Impax Ellevate Global Women's Leadership Fund - USD ($) |

Expense Example, with Redemption, 1 Year |

Expense Example, with Redemption, 3 Years |

Expense Example, with Redemption, 5 Years |

Expense Example, with Redemption, 10 Years |

|---|---|---|---|---|

| Institutional Class | 53 | 167 | 291 | 653 |

| Investor Class | 79 | 246 | 428 | 954 |

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when shares are held in a taxable account. These transaction costs, which are not reflected in “Annual Fund Operating Expenses” or in the “Example of Expenses,” affect the Global Women’s Fund’s performance. During the Global Women’s Fund’s most recent fiscal year, the Global Women’s Fund’s portfolio turnover rate was 63% of the average value of the portfolio.

The Global Women’s Fund follows a sustainable investing approach, investing in companies that the Adviser believes are well positioned to benefit from the transition to a more sustainable global economy, integrating environmental, social and governance (“ESG”) analysis into portfolio construction and managing the portfolio within certain risk parameters (e.g., sector and regional exposure) relative to the Fund’s benchmark universe of MSCI World Index companies.

The Global Women’s Fund seeks to construct a universe of companies around the world that advance and empower women through gender diversity on boards and in senior management, and that promote gender equity in the workplace through policies and practices focused on advancing gender diversity, inclusion and equity. From this universe, the Adviser selects portfolio companies for the Fund using a systematic process that strives to weight the portfolio toward companies with strong gender diversity and leadership while maintaining desired risk characteristics.

Under normal market conditions, the Global Women’s Fund invests at least 80% of its net assets (plus borrowings for investment purposes) in equity securities of companies that the Adviser has determined are “global women’s leaders.” To identify these companies, the Adviser constructs an investment universe by (1) ranking companies in developed markets that meet a minimum market cap

threshold of $8 billion as of the date of this Prospectus according to the Adviser’s proprietary gender leadership score; (2) excluding companies ranking in the bottom 50% based on gender leadership scores; (3) excluding companies that fail to meet certain ESG or sustainability criteria; and (4) applying quantitative screens consisting of valuation and quality metrics. The Adviser’s gender leadership score measures a company’s gender diversity on its board and in senior management as well as a company’s policies and practices focused on advancing gender diversity, inclusion and equity in the workplace.

From this universe, the Adviser employs a systematic investment approach to select a portfolio of approximately 100 – 150 companies that the Adviser determines to be “global women’s leaders.” At least 80% of the Fund’s portfolio weight will be comprised of companies that rank in the top 25% of the investment universe, as ranked by the Adviser’s gender leadership score. The Fund may own securities in the second quartile of the investment universe according to the gender leadership score if, through its systematic investment process, those companies are determined by the Adviser to meet its ESG or sustainability criteria, as well as valuation and quality metrics.

Under normal market conditions, the Fund will invest primarily in equity securities (such as common stocks, preferred stocks and securities convertible into common and preferred stocks) of companies located around the world, including at least 40% of its net assets (unless market conditions are not deemed favorable, in which case the Global Women’s Fund would normally invest at least 30% of its assets) in securities of companies organized or located outside the United States or doing a substantial amount of business outside the United States. The Fund’s investments in securities of non-US issuers may include American Depositary Receipts, Global Depositary Receipts and Euro Depositary Receipts and generally will be diversified across multiple countries or geographic regions. The Fund’s investments in securities of non-U.S. issuers also may be denominated in currencies other than the US dollar. The Fund is not constrained by any particular investment style, and may therefore invest in “growth” stocks, “value” stocks or a combination of both. Additionally, it may buy stocks in any sector or industry, and it is not limited to investing in securities of a specific market capitalization.

Under normal market conditions, and as a result of the Adviser’s focus on the risks and opportunities accompanying the transition to a more sustainable economy, the Fund adheres to the Impax Funds’ fossil fuel policy, under which the Fund will not invest in securities of companies that the Adviser determines derive revenues or profits from fossil fuel exploration and production, or derive significant (more than 5%) revenues or profits from fossil fuel refining, processing, storage, transportation and distribution. However, a company that derives significant revenues or profits from fossil fuel refining, processing, storage, transportation and distribution may be included in the Fund’s portfolio if the Adviser determines that such company has credible plans for climate risk mitigation aligned with the transition to net zero.

Prior to March 28, 2024, the strategy of the Global Women’s Fund differed from its current strategy. Accordingly, performance of the Fund for periods prior to March 28, 2024 may not be representative of the performance the Fund would have achieved had the Fund been following its current strategy.

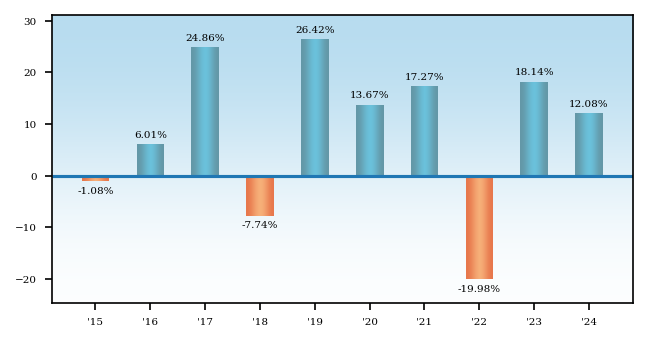

The bar chart below presents the calendar year total returns for Investor Class shares of the Global Women’s Fund before taxes. The bar chart is intended to provide some indication of the risk of investing in the Global Women’s Fund by showing changes in the Global Women’s Fund’s performance from year to year. As with all mutual funds, past performance (before and after taxes) is not necessarily an indication of future performance.

For the periods shown in the bar chart: |

2nd quarter 2020, |

|

1st quarter 2020, |

Average Annual Total Returns The performance table below presents the average annual total returns for Institutional Class and Investor Class shares of the Global Women’s Fund. The performance table is intended to provide some indication of the risk of investing in the Global Women’s Fund by showing how the Global Women’s Fund’s average annual total returns compare with the returns of a broad-based securities market index, as well as a performance average of other similar mutual funds, over a one-year, five-year and ten-year period. After-tax performance is presented only for Investor Class shares of the Fund. After-tax returns for Institutional Class shares may vary. After-tax returns are estimated using the highest historical individual federal marginal income tax rates and do not reflect the effect of local, state or foreign taxes. Actual after-tax returns will depend on a shareholder’s own tax situation and may differ from those shown. After-tax returns may not be relevant to investors who hold shares of the Global Women’s Fund through tax-advantaged arrangements (such as 401(k) plans or individual retirement accounts). As with all mutual funds, past performance (before and after taxes) is not necessarily an indication of future performance.

Average Annual Total Returns - Impax Ellevate Global Women's Leadership Fund |

1 Year |

5 Years |

10 Years |

|

|---|---|---|---|---|

| Investor Class | [1] | 12.08% | 7.14% | 7.98% |

| Investor Class | After Taxes on Distributions | [1] | 9.73% | 6.33% | 7.21% |

| Investor Class | After Taxes on Distributions and Sales | [1] | 8.81% | 5.55% | 6.36% |

| Institutional Class | [1] | 12.35% | 7.40% | 8.25% |

| MSCI World (Net) Index (reflects no deduction for fees, expenses or taxes) | [2],[3] | 18.67% | 11.17% | 9.95% |

| Lipper Global Multi-Cap Core Funds Index | [3],[4] | 11.96% | 8.31% | 8.10% |

| [1] | For more recent month-end performance data, please visit www.impaxam.com or call us at 800.767.1729. |

| [2] | The MSCI World (Net) Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The MSCI World Index consists of the following 23 developed market country indices: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom, and the United States. Performance for the MSCI World Index is shown “net,” which includes dividend reinvestments after deduction of foreign withholding taxes. |

| [3] | Unlike the Global Women’s Fund, the MSCI World (Net) Index and the Lipper Global Multi-Cap Core Funds Index are not investments, are not professionally managed and have no policy of sustainable investing. One cannot invest directly in an index. |

| [4] | The Lipper Global Multi-Cap Core Funds Index tracks the results of the 30 largest mutual funds in the Global Multi-Cap Core Funds Index Average. The Global Multi-Cap Core Funds Index Average is a total return performance average of mutual funds tracked by Lipper, Inc. that track the results of funds that, by portfolio practice, invest in a variety of market capitalization ranges without concentrating 75% of their equity assets in any one market capitalization range over an extended period of time. Global multi-cap core funds typically have characteristics (i.e., price-to-earnings ratio, price-to-book ratio) that resemble the “average” of the common stocks of the MSCI World Index. The Lipper Global Multi-Cap Core Funds Index is not what is typically considered to be an “index” because it tracks the performance of other mutual funds rather than the changes in the value of a group of securities, a securities index, or some other traditional economic indicator. The Lipper Global Multi-Cap Core Funds Index reflects deductions for fees and expenses of the constituent funds. |

|

● |

Market Risk Conditions in a broad or specialized market, a sector thereof or an individual industry or other factors including terrorism, war, natural disasters and the spread of infectious disease including epidemics or pandemics may adversely affect security prices, thereby reducing the value of the Fund’s investments. To the extent the Fund takes significant positions in one or more specific sectors, countries or regions, the Fund will be subject to the risks associated with such sector(s), country(ies) or region(s) to a greater extent than would be a more broadly diversified fund. |

|

● |

Management Risk The Fund is actively managed. The investment techniques and decisions of the investment adviser and the Fund’s portfolio manager(s), including the investment adviser’s assessment of a company’s ESG profile when selecting investments for the Fund, may not produce the desired results and may adversely impact the Fund’s performance, including relative to other funds that do not consider ESG factors or come to different conclusions regarding such factors. Further, in evaluating a company, the Adviser is often dependent upon information and data obtained from the company itself or from third-party data providers that may be incomplete, inaccurate or unavailable, which could cause the investment adviser or the Fund’s portfolio manager(s) to incorrectly assess a company’s ESG profile. |

|

● |

Equity Securities Risk The market price of equity securities may fluctuate significantly, rapidly and unpredictably, causing the Fund to experience losses. The prices of equity securities generally are more volatile than the prices of debt securities. |

|

● |

Non-US Securities Risk Non-US securities may have less liquidity and more volatile prices than domestic securities, which can make it difficult for the Fund to sell such securities at desired times or prices. Non-US markets may differ from US markets in material and adverse ways. For example, securities transaction expenses generally are higher, transaction settlement may be slower, recourse in the event of default may be more limited and taxes and currency exchange controls may limit amounts available for distribution to shareholders. Non-US investments are also subject to the effects of local political, social, diplomatic or economic events. |

|

● |

Growth Securities Risk The values of growth securities may be more sensitive to changes in current or expected earnings than the values of other securities. |

|

● |

Small- and Medium-Sized Company Risk Securities of small- and medium-sized companies may have less liquidity and more volatile prices than securities of larger companies, which can make it difficult for the Fund to sell such securities at desired times or prices. |

|

● |

Value Securities Risk Value securities are securities the investment adviser believes are selling at a price lower than their true value, perhaps due to adverse business developments or special risks. If that belief is wrong or remains unrecognized by the market, the price of the securities may decline or may not appreciate as anticipated. |

|

● |

Currency Risk The US dollar value of your investment in the Fund may go down if the value of the local currency of the non-US markets in which the Fund invests depreciates against the US dollar. |

|

● |

Issuer Risk The value of a security may fluctuate due to factors affecting only the entity that issued the security. |