Pay Versus Performance Disclosure

In accordance with rules adopted by the Securities and Exchange Commission pursuant to the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, we provide the following disclosure regarding executive compensation for our principal executive officer, or PEO, and our non-PEO named executive officers, or Non-PEO NEOs, and our performance for the fiscal years listed below. This disclosure has been prepared in accordance with Item 402(v) of Regulation S-K under the Exchange Act and does not necessarily reflect value actually realized by the executives or how our compensation committee evaluates compensation decisions in light of company or individual performance.

Year |

|

Summary |

|

Compensation |

|

Average |

|

Average |

|

Value of |

|

Net |

2024 |

|

1,393,921 |

|

294,833 |

|

1,138,725 |

|

528,183 |

|

9.64 |

|

(41) |

2023 |

|

3,015,480 |

|

1,356,650 |

|

1,202,503 |

|

117,009 |

|

23.34 |

|

(51) |

2022 |

|

1,373,850 |

|

(610,573) |

|

1,112,289 |

|

(996,435) |

|

25.20 |

|

(53) |

Year |

|

Summary |

|

Exclusion of |

|

Inclusion of |

|

Compensation |

2024 |

|

1,393,921 |

|

(711,195) |

|

(387,893) |

|

294,833 |

2023 |

|

3,015,480 |

|

(2,407,500) |

|

748,670 |

|

1,356,650 |

2022 |

|

1,373,850 |

|

(388,130) |

|

(1,596,293) |

|

(610,573) |

Year |

|

Average Summary |

|

Average Exclusion |

|

Average Inclusion of |

|

Average |

2024 |

|

1,138,725 |

|

(589,023) |

|

(21,519) |

|

528,183 |

2023 |

|

1,202,503 |

|

(736,514) |

|

(348,980) |

|

117,009 |

2022 |

|

1,112,289 |

|

(511,782) |

|

(1,596,942) |

|

(996,435) |

The amounts in the Inclusion of Equity Values in the tables above are derived from the amounts set forth in the following tables:

Year |

|

Year-End Fair |

|

Change in Fair |

|

Vesting- |

|

Change in Fair |

|

Fair Value |

|

Total – |

2024 |

|

524,484 |

|

(543,213) |

|

13,195 |

|

(382,359) |

|

— |

|

(387,893) |

2023 |

|

1,190,794 |

|

(245,681) |

|

247,336 |

|

(443,779) |

|

— |

|

748,670 |

2022 |

|

172,343 |

|

(825,671) |

|

18,280 |

|

(961,245) |

|

— |

|

(1,596,293) |

Year |

|

Average Year- |

|

Average Change |

|

Average |

|

Average |

|

Average |

|

Total – |

2024 |

|

226,194 |

|

(157,584) |

|

17,572 |

|

(107,701) |

|

— |

|

(21,519) |

2023 |

|

439,267 |

|

(199,605) |

|

88,258 |

|

(676,900) |

|

— |

|

(348,980) |

2022 |

|

159,862 |

|

(970,523) |

|

20,142 |

|

(806,423) |

|

— |

|

(1,596,942) |

Valuation assumptions used to calculate fair values did not materially differ from those used to calculate fair values at the time of grant as reflected in the amounts set forth in the Summary Compensation Table.

(4) Assumes $100 was invested for the period starting December 31, 2021 through the end of the listed year in our common stock. Historical stock performance is not necessarily indicative of future stock performance.

Year |

|

Summary |

|

Exclusion of |

|

Inclusion of |

|

Compensation |

2024 |

|

1,393,921 |

|

(711,195) |

|

(387,893) |

|

294,833 |

2023 |

|

3,015,480 |

|

(2,407,500) |

|

748,670 |

|

1,356,650 |

2022 |

|

1,373,850 |

|

(388,130) |

|

(1,596,293) |

|

(610,573) |

Year |

|

Average Summary |

|

Average Exclusion |

|

Average Inclusion of |

|

Average |

2024 |

|

1,138,725 |

|

(589,023) |

|

(21,519) |

|

528,183 |

2023 |

|

1,202,503 |

|

(736,514) |

|

(348,980) |

|

117,009 |

2022 |

|

1,112,289 |

|

(511,782) |

|

(1,596,942) |

|

(996,435) |

The amounts in the Inclusion of Equity Values in the tables above are derived from the amounts set forth in the following tables:

Year |

|

Year-End Fair |

|

Change in Fair |

|

Vesting- |

|

Change in Fair |

|

Fair Value |

|

Total – |

2024 |

|

524,484 |

|

(543,213) |

|

13,195 |

|

(382,359) |

|

— |

|

(387,893) |

2023 |

|

1,190,794 |

|

(245,681) |

|

247,336 |

|

(443,779) |

|

— |

|

748,670 |

2022 |

|

172,343 |

|

(825,671) |

|

18,280 |

|

(961,245) |

|

— |

|

(1,596,293) |

Year |

|

Average Year- |

|

Average Change |

|

Average |

|

Average |

|

Average |

|

Total – |

2024 |

|

226,194 |

|

(157,584) |

|

17,572 |

|

(107,701) |

|

— |

|

(21,519) |

2023 |

|

439,267 |

|

(199,605) |

|

88,258 |

|

(676,900) |

|

— |

|

(348,980) |

2022 |

|

159,862 |

|

(970,523) |

|

20,142 |

|

(806,423) |

|

— |

|

(1,596,942) |

Valuation assumptions used to calculate fair values did not materially differ from those used to calculate fair values at the time of grant as reflected in the amounts set forth in the Summary Compensation Table.

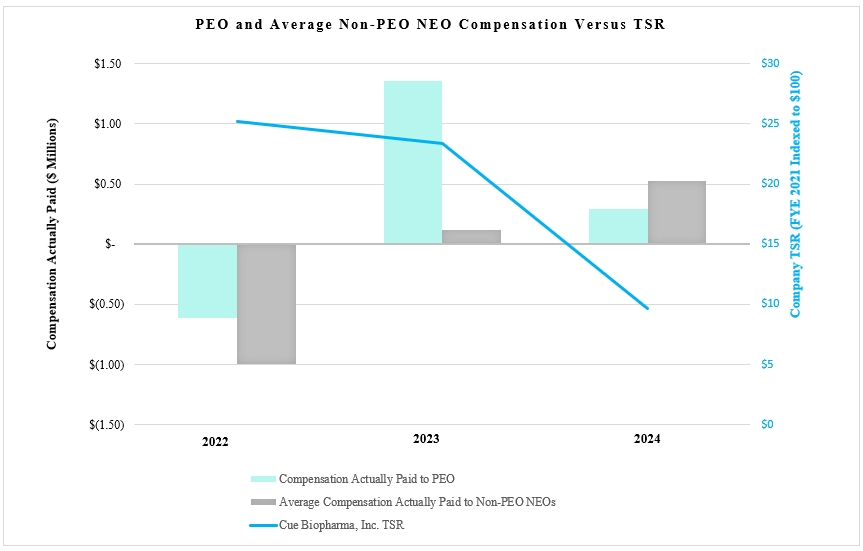

Description of Relationship Between PEO and Average Non-PEO NEO Compensation Actually Paid and Company Total Shareholder Return (“TSR”)

The following chart sets forth the relationship between Compensation Actually Paid to our PEO, the average Compensation Actually Paid to our Non-PEO NEOs, and the Company’s cumulative TSR over the three most recently completed fiscal years.

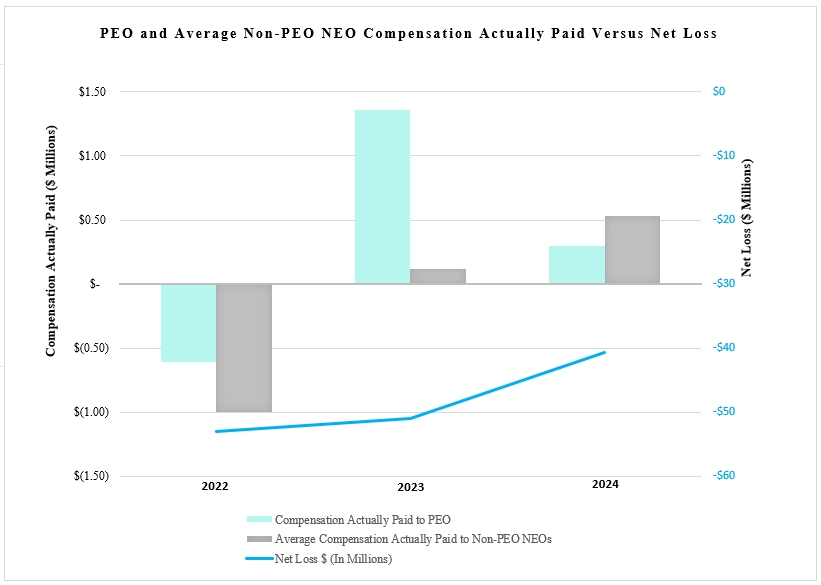

Description of Relationship Between PEO and Average Non-PEO NEO Compensation Actually Paid and Net Loss

The following chart sets forth the relationship between Compensation Actually Paid to our PEO, the average Compensation Actually Paid to our Non-PEO NEOs, and our Net Loss during the three most recently completed fiscal years.