Summary Compensation Table Total for ($): |

Compensation Actually Paid to ($): |

Average Summary Compensation Table Total for Non-PEO Named Executive Officers ($) (1),(2) |

Average Compensation Actually Paid to Non-PEO Named Executive Officers ($) (1),(2) |

Value of Initial Fixed $100 Investment Based on: |

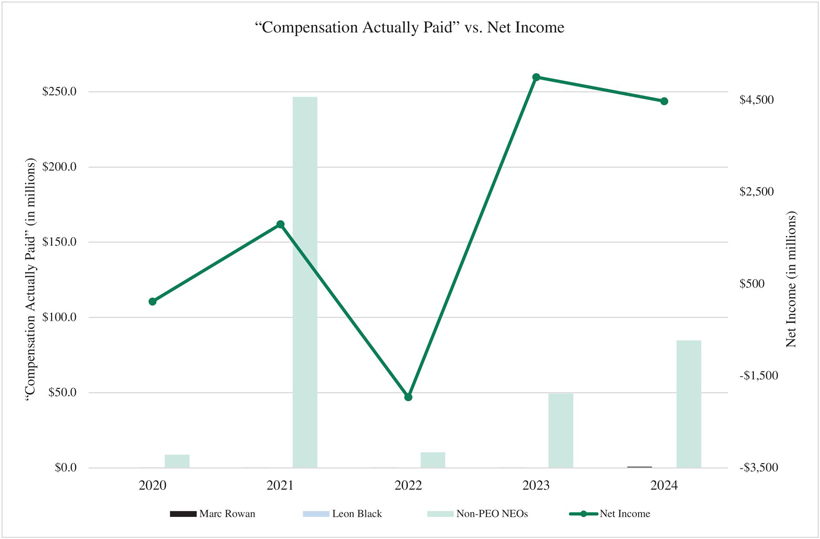

Net Income (in millions) ($) |

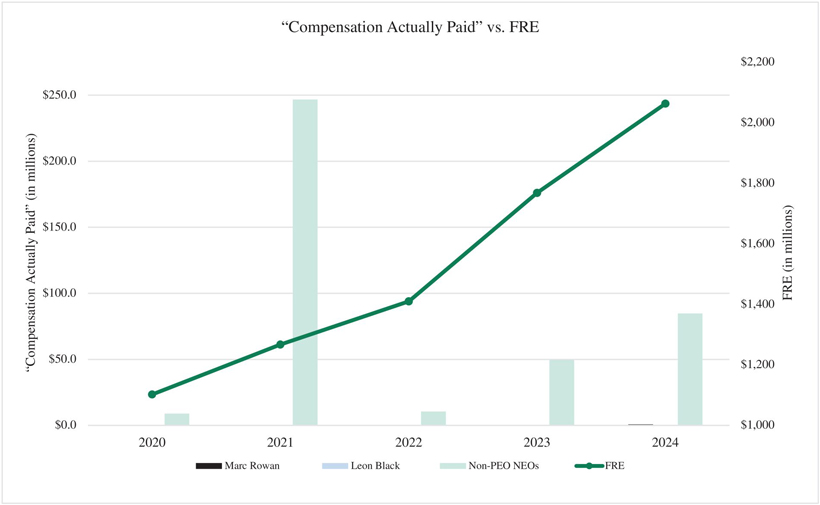

Fee Related Earnings (FRE) (in millions) ($) (4) |

||||||||||||||||||||||||||||||||||

Year |

Marc Rowan |

Leon Black |

Marc Rowan |

Leon Black |

Total Shareholder Return ($) |

Peer Group Total Shareholder Return($) (3) |

||||||||||||||||||||||||||||||||||

2024 |

763,381 | — | 763,381 | — | 23,485,050 | 84,829,420 | 402 | 215 | 4,480 | 2,063 | ||||||||||||||||||||||||||||||

2023 |

320,760 | — | 320,760 | — | 19,897,799 | 49,502,529 | 224 | 156 | 5,001 | 1,768 | ||||||||||||||||||||||||||||||

2022 |

310,011 | — | 310,011 | — | 17,204,252 | 10,539,452 | 150 | 127 | (1,961 | ) | 1,410 | |||||||||||||||||||||||||||||

2021 |

302,310 | 356,713 | 302,310 | 356,713 | 223,067,825 | 246,673,294 | 166 | 162 | 1,802 | 1,267 | ||||||||||||||||||||||||||||||

2020 |

— | 423,687 | — | 423,687 | 8,846,958 | 8,881,144 | 108 | 115 | 120 | 1,102 | ||||||||||||||||||||||||||||||

| (1) | The non-PEO named executive officers in 2024 consist of Messrs. Belardi, Kelly and Kleinman and Ms. Chatterjee, in 2023 and 2022 consist of Messrs. Belardi, Kelly, Kleinman and Suydam, and in 2021 and 2020 consist of Messrs. Civale, Kelly, Kleinman and Zelter (as applicable, the “Non-PEO NEOs”). |

| (2) | “Compensation actually paid” has been calculated in accordance with the requirements of Item 402(v)(2)(iii) of Regulation S-K and does not reflect compensation actually earned, realized or received. To calculate the “compensation actually paid,” the following amounts were deducted from and added to the applicable “Summary Compensation Table Total” set forth above. |

| (3) | The Peer Group for these purposes is the Dow Jones U.S. Asset Manager Index. |

| (4) | Our company-selected measure is Fee Related Earnings (“FRE”). FRE is further described in our Annual Report on Form 10-K, including a reconciliation of non-GAAP measures to the corresponding GAAP measure within “Management’s Discussion and Analysis of Financial Condition and Results of Operations-Managing Business Performance-Key Segment and Non-U.S. GAAP Performance Measures-Fee Related Earnings, Spread Related Earnings and Principal Investing Income.” |

Summary Compensation Table Total ($) |

Deductions of Reported Equity Values from Summary Compensation Table Total (a) ($) |

Equity Award Adjustments to Summary Compensation Table Total (b) ($) |

“Compensation Actually Paid” ($) |

|||||||||||||

Marc Rowan |

||||||||||||||||

2024 |

763,381 | — | — | 763,381 | ||||||||||||

2023 |

320,760 | — | — | 320,760 | ||||||||||||

2022 |

310,011 | — | — | 310,011 | ||||||||||||

2021 |

302,310 | — | — | 302,310 | ||||||||||||

Leon Black |

||||||||||||||||

2021 |

356,713 | — | — | 356,713 | ||||||||||||

2020 |

423,687 | — | — | 423,687 | ||||||||||||

Average of Non-PEO Named Executive Officers |

||||||||||||||||

2024 |

23,485,050 | (5,992,848 | ) | 67,337,219 | 84,829,420 | |||||||||||

2023 |

19,897,799 | (4,119,833 | ) | 33,724,563 | 49,502,529 | |||||||||||

2022 |

17,204,252 | (3,862,211 | ) | (2,802,589 | ) | 10,539,452 | ||||||||||

2021 |

223,067,825 | (206,199,646 | ) | 229,805,115 | 246,673,294 | |||||||||||

2020 |

8,846,958 | (6,008,009 | ) | 6,042,195 | 8,881,144 | |||||||||||

| (a) | Represents the grant date fair value of equity-based awards granted in each year, as reflected in the “Stock Awards” column of the Summary Compensation Table above. |

| (b) | Reflects adjustments to the value of Stock Awards, as calculated in accordance with the rules prescribed under Item 402(v) and in accordance with ASC Topic 718, which included the categories of adjustments for each year as set forth below. For additional information regarding the determination of fair value, see Note 7 to our consolidated financial statements in our Annual Report on Form 10-K for the fiscal year ended December 31, 2024 . |

Year End Fair Value of Awards Granted During Year that Remained Outstanding and Unvested at Year End ($) |

Year Over Year Change in Fair Value of Outstanding and Unvested Equity Awards Granted in a Prior Year that Remained Outstanding and Unvested at Year End ($) |

Fair Value as of Vesting Date of Equity Awards Granted and Vested in Same Year ($) |

Year Over Year Change in Fair Value of Equity Awards Granted in a Prior Year that Vested in the Year ($) |

Fair Value at the End of the Prior Year of Equity Awards that Failed to Meet Vesting Conditions During Year ($) |

Value of Dividends or Other Earnings Paid on Equity Awards not Otherwise Reflected in Fair Value or Total Compensation ($) |

Total Equity Award Adjustments ($) |

||||||||||||||||||||||

Marc Rowan |

||||||||||||||||||||||||||||

2024 |

— | — | — | — | — | — | — | |||||||||||||||||||||

2023 |

— | — | — | — | — | — | — | |||||||||||||||||||||

2022 |

— | — | — | — | — | — | — | |||||||||||||||||||||

2021 |

— | — | — | — | — | — | — | |||||||||||||||||||||

Leon Black |

||||||||||||||||||||||||||||

2021 |

— | — | — | — | — | — | — | |||||||||||||||||||||

2020 |

— | — | — | — | — | — | — | |||||||||||||||||||||

Average of Non-PEO Named Executive Officers |

||||||||||||||||||||||||||||

2024 |

6,436,156 | 54,099,951 | 1,264,578 | 3,146,111 | — | 2,390,423 | 67,337,219 | |||||||||||||||||||||

2023 |

3,221,302 | 25,586,288 | 1,838,687 | 792,835 | — | 2,285,451 | 33,724,563 | |||||||||||||||||||||

2022 |

2,418,692 | (8,434,175 | ) | 1,512,065 | (480,597 | ) | — | 2,181,426 | (2,802,589 | ) | ||||||||||||||||||

2021 |

118,424,882 | 13,410,784 | 95,087,132 | 1,483,123 | — | 1,399,194 | 229,805,115 | |||||||||||||||||||||

2020 |

5,460,830 | (1,438,855 | ) | 351,787 | (120,870 | ) | — | 1,789,302 | 6,042,195 | |||||||||||||||||||

Summary Compensation Table Total ($) |

Deductions of Reported Equity Values from Summary Compensation Table Total (a) ($) |

Equity Award Adjustments to Summary Compensation Table Total (b) ($) |

“Compensation Actually Paid” ($) |

|||||||||||||

Marc Rowan |

||||||||||||||||

2024 |

763,381 | — | — | 763,381 | ||||||||||||

2023 |

320,760 | — | — | 320,760 | ||||||||||||

2022 |

310,011 | — | — | 310,011 | ||||||||||||

2021 |

302,310 | — | — | 302,310 | ||||||||||||

Leon Black |

||||||||||||||||

2021 |

356,713 | — | — | 356,713 | ||||||||||||

2020 |

423,687 | — | — | 423,687 | ||||||||||||

Average of Non-PEO Named Executive Officers |

||||||||||||||||

2024 |

23,485,050 | (5,992,848 | ) | 67,337,219 | 84,829,420 | |||||||||||

2023 |

19,897,799 | (4,119,833 | ) | 33,724,563 | 49,502,529 | |||||||||||

2022 |

17,204,252 | (3,862,211 | ) | (2,802,589 | ) | 10,539,452 | ||||||||||

2021 |

223,067,825 | (206,199,646 | ) | 229,805,115 | 246,673,294 | |||||||||||

2020 |

8,846,958 | (6,008,009 | ) | 6,042,195 | 8,881,144 | |||||||||||

Year End Fair Value of Awards Granted During Year that Remained Outstanding and Unvested at Year End ($) |

Year Over Year Change in Fair Value of Outstanding and Unvested Equity Awards Granted in a Prior Year that Remained Outstanding and Unvested at Year End ($) |

Fair Value as of Vesting Date of Equity Awards Granted and Vested in Same Year ($) |

Year Over Year Change in Fair Value of Equity Awards Granted in a Prior Year that Vested in the Year ($) |

Fair Value at the End of the Prior Year of Equity Awards that Failed to Meet Vesting Conditions During Year ($) |

Value of Dividends or Other Earnings Paid on Equity Awards not Otherwise Reflected in Fair Value or Total Compensation ($) |

Total Equity Award Adjustments ($) |

||||||||||||||||||||||

Marc Rowan |

||||||||||||||||||||||||||||

2024 |

— | — | — | — | — | — | — | |||||||||||||||||||||

2023 |

— | — | — | — | — | — | — | |||||||||||||||||||||

2022 |

— | — | — | — | — | — | — | |||||||||||||||||||||

2021 |

— | — | — | — | — | — | — | |||||||||||||||||||||

Leon Black |

||||||||||||||||||||||||||||

2021 |

— | — | — | — | — | — | — | |||||||||||||||||||||

2020 |

— | — | — | — | — | — | — | |||||||||||||||||||||

Average of Non-PEO Named Executive Officers |

||||||||||||||||||||||||||||

2024 |

6,436,156 | 54,099,951 | 1,264,578 | 3,146,111 | — | 2,390,423 | 67,337,219 | |||||||||||||||||||||

2023 |

3,221,302 | 25,586,288 | 1,838,687 | 792,835 | — | 2,285,451 | 33,724,563 | |||||||||||||||||||||

2022 |

2,418,692 | (8,434,175 | ) | 1,512,065 | (480,597 | ) | — | 2,181,426 | (2,802,589 | ) | ||||||||||||||||||

2021 |

118,424,882 | 13,410,784 | 95,087,132 | 1,483,123 | — | 1,399,194 | 229,805,115 | |||||||||||||||||||||

2020 |

5,460,830 | (1,438,855 | ) | 351,787 | (120,870 | ) | — | 1,789,302 | 6,042,195 | |||||||||||||||||||

Summary Compensation Table Total ($) |

Deductions of Reported Equity Values from Summary Compensation Table Total (a) ($) |

Equity Award Adjustments to Summary Compensation Table Total (b) ($) |

“Compensation Actually Paid” ($) |

|||||||||||||

Marc Rowan |

||||||||||||||||

2024 |

763,381 | — | — | 763,381 | ||||||||||||

2023 |

320,760 | — | — | 320,760 | ||||||||||||

2022 |

310,011 | — | — | 310,011 | ||||||||||||

2021 |

302,310 | — | — | 302,310 | ||||||||||||

Leon Black |

||||||||||||||||

2021 |

356,713 | — | — | 356,713 | ||||||||||||

2020 |

423,687 | — | — | 423,687 | ||||||||||||

Average of Non-PEO Named Executive Officers |

||||||||||||||||

2024 |

23,485,050 | (5,992,848 | ) | 67,337,219 | 84,829,420 | |||||||||||

2023 |

19,897,799 | (4,119,833 | ) | 33,724,563 | 49,502,529 | |||||||||||

2022 |

17,204,252 | (3,862,211 | ) | (2,802,589 | ) | 10,539,452 | ||||||||||

2021 |

223,067,825 | (206,199,646 | ) | 229,805,115 | 246,673,294 | |||||||||||

2020 |

8,846,958 | (6,008,009 | ) | 6,042,195 | 8,881,144 | |||||||||||

Year End Fair Value of Awards Granted During Year that Remained Outstanding and Unvested at Year End ($) |

Year Over Year Change in Fair Value of Outstanding and Unvested Equity Awards Granted in a Prior Year that Remained Outstanding and Unvested at Year End ($) |

Fair Value as of Vesting Date of Equity Awards Granted and Vested in Same Year ($) |

Year Over Year Change in Fair Value of Equity Awards Granted in a Prior Year that Vested in the Year ($) |

Fair Value at the End of the Prior Year of Equity Awards that Failed to Meet Vesting Conditions During Year ($) |

Value of Dividends or Other Earnings Paid on Equity Awards not Otherwise Reflected in Fair Value or Total Compensation ($) |

Total Equity Award Adjustments ($) |

||||||||||||||||||||||

Marc Rowan |

||||||||||||||||||||||||||||

2024 |

— | — | — | — | — | — | — | |||||||||||||||||||||

2023 |

— | — | — | — | — | — | — | |||||||||||||||||||||

2022 |

— | — | — | — | — | — | — | |||||||||||||||||||||

2021 |

— | — | — | — | — | — | — | |||||||||||||||||||||

Leon Black |

||||||||||||||||||||||||||||

2021 |

— | — | — | — | — | — | — | |||||||||||||||||||||

2020 |

— | — | — | — | — | — | — | |||||||||||||||||||||

Average of Non-PEO Named Executive Officers |

||||||||||||||||||||||||||||

2024 |

6,436,156 | 54,099,951 | 1,264,578 | 3,146,111 | — | 2,390,423 | 67,337,219 | |||||||||||||||||||||

2023 |

3,221,302 | 25,586,288 | 1,838,687 | 792,835 | — | 2,285,451 | 33,724,563 | |||||||||||||||||||||

2022 |

2,418,692 | (8,434,175 | ) | 1,512,065 | (480,597 | ) | — | 2,181,426 | (2,802,589 | ) | ||||||||||||||||||

2021 |

118,424,882 | 13,410,784 | 95,087,132 | 1,483,123 | — | 1,399,194 | 229,805,115 | |||||||||||||||||||||

2020 |

5,460,830 | (1,438,855 | ) | 351,787 | (120,870 | ) | — | 1,789,302 | 6,042,195 | |||||||||||||||||||

(1) |

The “Compensation Actually Paid” to Mr. Rowan in 2021, 2022, 2023 and 2024 and to Mr. Black in 2020 and 2021 was too low compared to that paid to the Non-PEO |

(1) |

The “Compensation Actually Paid” to Mr. Rowan in 2021, 2022, 2023 and 2024 and to Mr. Black in 2020 and 2021 was too low compared to that paid to the Non-PEO |

(1) |

The “Compensation Actually Paid” to Mr. Rowan in 2021, 2022, 2023 and 2024 and to Mr. Black in 2020 and 2021 was too low compared to that paid to the Non-PEO |

(1) |

The “Compensation Actually Paid” to Mr. Rowan in 2021, 2022, 2023 and 2024 and to Mr. Black in 2020 and 2021 was too low compared to that paid to the Non-PEO |

• |

Fee Related Earnings |

• |

Adjusted Net Income |

• |

Realized Performance Fees |

• |

Spread Related Earnings |