Summary Compensation Table Total for PEO ($) |

Compensation Actually Paid to PEO ($) (1)(2)(3) |

Average Summary Compensation Table Total for Non-PEO NEOs ($) |

Average Compensation Actually Paid to Non-PEO NEOs ($) (1)(2)(3) |

Value of Initial Fixed $100 Investment Based on: |

Net Income ($) |

Adjusted EBITDA ($) (5) |

||||||||||||||||||||||||||

Fiscal Year |

Total Shareholder Return ($) (4) |

Peer Group Index Total Shareholder Return ($) (4) |

||||||||||||||||||||||||||||||

2024 |

18,129,271 | 40,619,413 | 16,534,551 | 21,399,404 | 143.18 | 150.64 | 6,377,088 | 1,251,238,529 | ||||||||||||||||||||||||

| 2023 | 64,912,560 | 56,578,222 | 8,435,228 | 7,963,553 | 82.19 | 107.00 | 175,722,864 | 809,087,712 | ||||||||||||||||||||||||

| (1) | Amounts represent compensation actually paid (“CAP”) to our CEO, who was our Principal Executive Officer or “PEO” for fiscal years 2023 and 2024, and the average CAP to our remaining NEOs or “Non-PEO NEOs” for fiscal years 2023 and 2024, as determined under SEC rules, which includes the individuals indicated below for fiscal years 2023 and 2024: |

Year |

PEO |

Non-PEO NEOs | ||||||||||

2024 |

Ariel Emanuel | Mark Shapiro, Andrew Schleimer and Seth Krauss | ||||||||||

2023 |

Ariel Emanuel |

Mark Shapiro, Andrew Schleimer and Seth Krauss | ||||||||||

| (2) | Amounts represent the Summary Compensation Table Total Compensation for the applicable fiscal year adjusted as follows: |

Applicable Fiscal Year (“FY”) |

2023 |

2024 |

||||||||||||||

PEO |

Average non-PEO NEOs |

PEO |

Average non-PEO NEOs |

|||||||||||||

| Deduction for Amounts Reported under the “Stock Awards” and “Option Awards” Columns in the Summary Compensation Table for Applicable FY | (40,000,094 | ) | (3,133,767 | ) | (2,502,864 | ) | (8,429,236 | ) | ||||||||

| Increase based on ASC 718 Fair Value of Awards Granted during Applicable FY that Remain Unvested as of Applicable FY End, determined as of Applicable FY End | 31,666,256 | 2,662,091 | 4,130,285 | 11,867,180 | ||||||||||||

| Increase/deduction for Awards Granted during Prior FY that were Outstanding and Unvested as of Applicable FY End, determined based on change in ASC 718 Fair Value from Prior FY End to Applicable FY End | — | — | 17,621,615 | 500,987 | ||||||||||||

| Increase/deduction for Awards Granted during Prior FY that Vested During Applicable FY, determined based on change in ASC 718 Fair Value from Prior FY End to Vesting Date | — | — | 3,242,106 | 925,923 | ||||||||||||

Total Adjustments |

(8,333,838 | ) | (471,675 | ) | 22,490,143 | 4,864,853 | ||||||||||

| (3) | The fair values of restricted stock units included in the CAP to our PEO and the Average CAP to our Non-PEO NEOs are calculated at the required measurement dates, consistent with the approach used to value the awards at the grant date as described in our Annual Report. Any changes to the fair values of our restricted stock units from the grant date are based on our updated stock price at the applicable measurement date. For the year presented, the increases or decreases in the year-end restricted stock unit fair value from the fair value on the grant date were affected by changes in the stock price. For additional information on the assumptions used to calculate the valuation of the awards, see Note 13 to our audited consolidated financial statements included in our Annual Report. |

| (4) | Reflects the period from September 12, 2023, the date of consummation of the TKO Transactions, through the end of the applicable fiscal year. |

| (5) | Adjusted EBITDA is a non-GAAP measure and is calculated from our audited financial statements as follows: net income, excluding income taxes, net interest expense, depreciation and amortization, equity-based compensation, merger and acquisition costs, certain legal costs, restructuring, severance and impairment charges, and certain other items when applicable. For a reconciliation of the differences between Adjusted EBITDA and the most directly comparable financial measure calculated and presented in accordance with GAAP, see Part II, Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operation—Non-GAAP Financial Measures” on page 54 and 55 of our Annual Report. |

| (1) | Amounts represent compensation actually paid (“CAP”) to our CEO, who was our Principal Executive Officer or “PEO” for fiscal years 2023 and 2024, and the average CAP to our remaining NEOs or “Non-PEO NEOs” for fiscal years 2023 and 2024, as determined under SEC rules, which includes the individuals indicated below for fiscal years 2023 and 2024: |

Year |

PEO |

Non-PEO NEOs | ||||||||||

2024 |

Ariel Emanuel | Mark Shapiro, Andrew Schleimer and Seth Krauss | ||||||||||

2023 |

Ariel Emanuel |

Mark Shapiro, Andrew Schleimer and Seth Krauss | ||||||||||

| (2) | Amounts represent the Summary Compensation Table Total Compensation for the applicable fiscal year adjusted as follows: |

Applicable Fiscal Year (“FY”) |

2023 |

2024 |

||||||||||||||

PEO |

Average non-PEO NEOs |

PEO |

Average non-PEO NEOs |

|||||||||||||

| Deduction for Amounts Reported under the “Stock Awards” and “Option Awards” Columns in the Summary Compensation Table for Applicable FY | (40,000,094 | ) | (3,133,767 | ) | (2,502,864 | ) | (8,429,236 | ) | ||||||||

| Increase based on ASC 718 Fair Value of Awards Granted during Applicable FY that Remain Unvested as of Applicable FY End, determined as of Applicable FY End | 31,666,256 | 2,662,091 | 4,130,285 | 11,867,180 | ||||||||||||

| Increase/deduction for Awards Granted during Prior FY that were Outstanding and Unvested as of Applicable FY End, determined based on change in ASC 718 Fair Value from Prior FY End to Applicable FY End | — | — | 17,621,615 | 500,987 | ||||||||||||

| Increase/deduction for Awards Granted during Prior FY that Vested During Applicable FY, determined based on change in ASC 718 Fair Value from Prior FY End to Vesting Date | — | — | 3,242,106 | 925,923 | ||||||||||||

Total Adjustments |

(8,333,838 | ) | (471,675 | ) | 22,490,143 | 4,864,853 | ||||||||||

| (2) | Amounts represent the Summary Compensation Table Total Compensation for the applicable fiscal year adjusted as follows: |

Applicable Fiscal Year (“FY”) |

2023 |

2024 |

||||||||||||||

PEO |

Average non-PEO NEOs |

PEO |

Average non-PEO NEOs |

|||||||||||||

| Deduction for Amounts Reported under the “Stock Awards” and “Option Awards” Columns in the Summary Compensation Table for Applicable FY | (40,000,094 | ) | (3,133,767 | ) | (2,502,864 | ) | (8,429,236 | ) | ||||||||

| Increase based on ASC 718 Fair Value of Awards Granted during Applicable FY that Remain Unvested as of Applicable FY End, determined as of Applicable FY End | 31,666,256 | 2,662,091 | 4,130,285 | 11,867,180 | ||||||||||||

| Increase/deduction for Awards Granted during Prior FY that were Outstanding and Unvested as of Applicable FY End, determined based on change in ASC 718 Fair Value from Prior FY End to Applicable FY End | — | — | 17,621,615 | 500,987 | ||||||||||||

| Increase/deduction for Awards Granted during Prior FY that Vested During Applicable FY, determined based on change in ASC 718 Fair Value from Prior FY End to Vesting Date | — | — | 3,242,106 | 925,923 | ||||||||||||

Total Adjustments |

(8,333,838 | ) | (471,675 | ) | 22,490,143 | 4,864,853 | ||||||||||

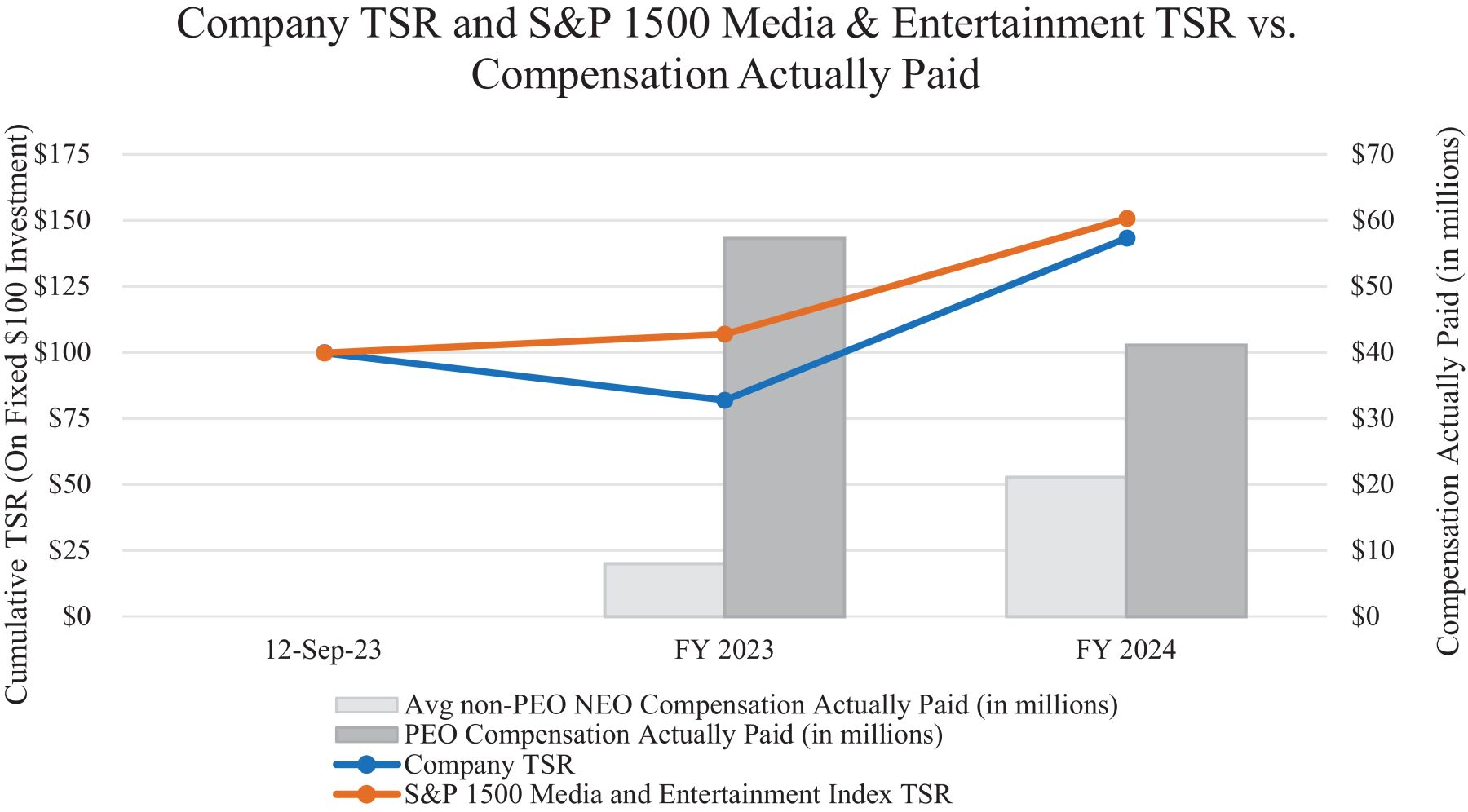

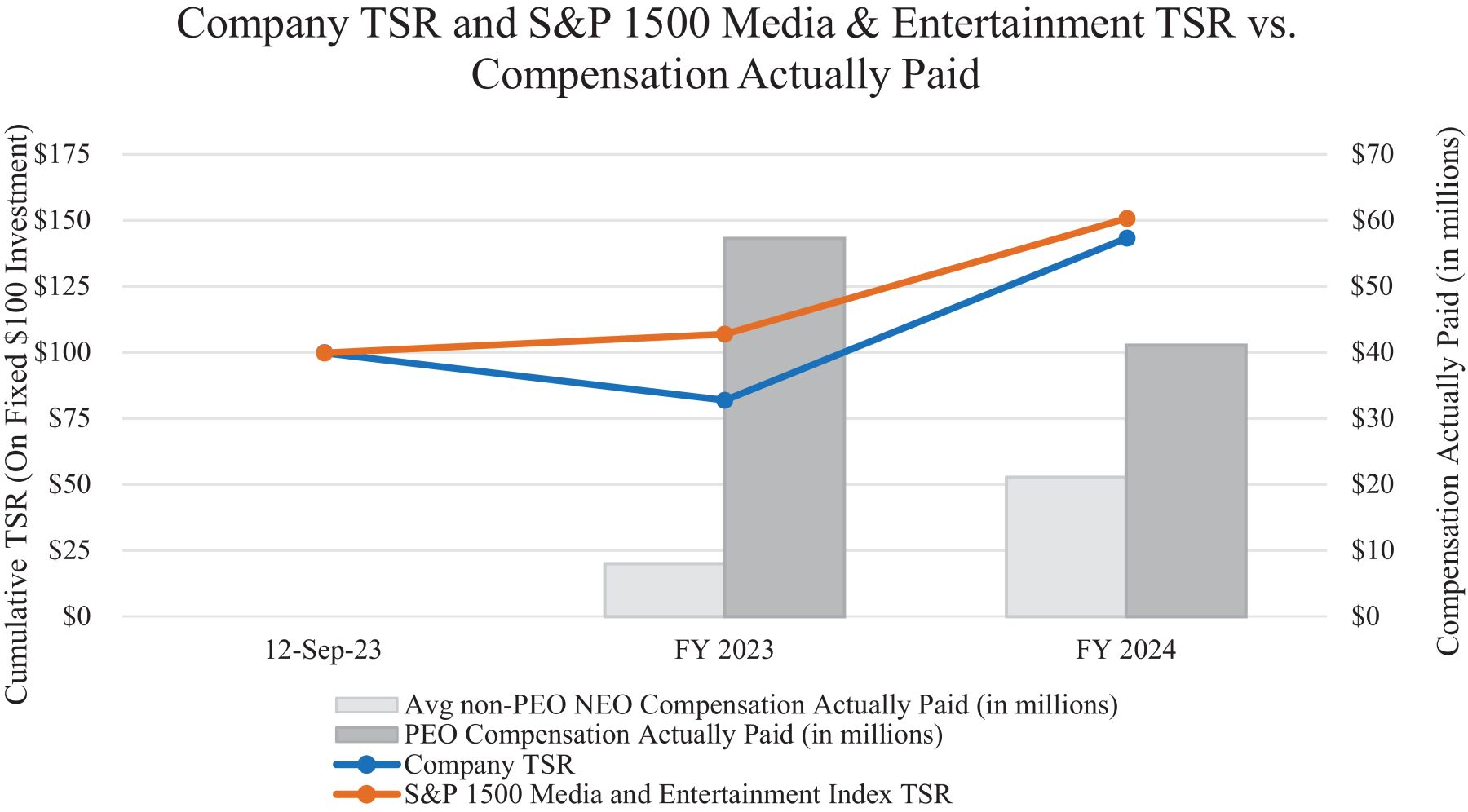

September 12, 2023 |

FY 2023 |

FY 2024 |

||||||||||

Company TSR |

$ | 100 | $ | 82.19 | $ | 143.18 | ||||||

S&P 1500 Media and Entertainment Index TSR |

$ | 100 | $ | 107.00 | $ | 150.64 | ||||||

PEO Compensation Actually Paid (in millions) |

— | $ | 57 | $ | 41 | |||||||

Avg. non-PEO NEO Compensation Actually Paid (in millions) |

$ | 8 | $ | 21 | ||||||||

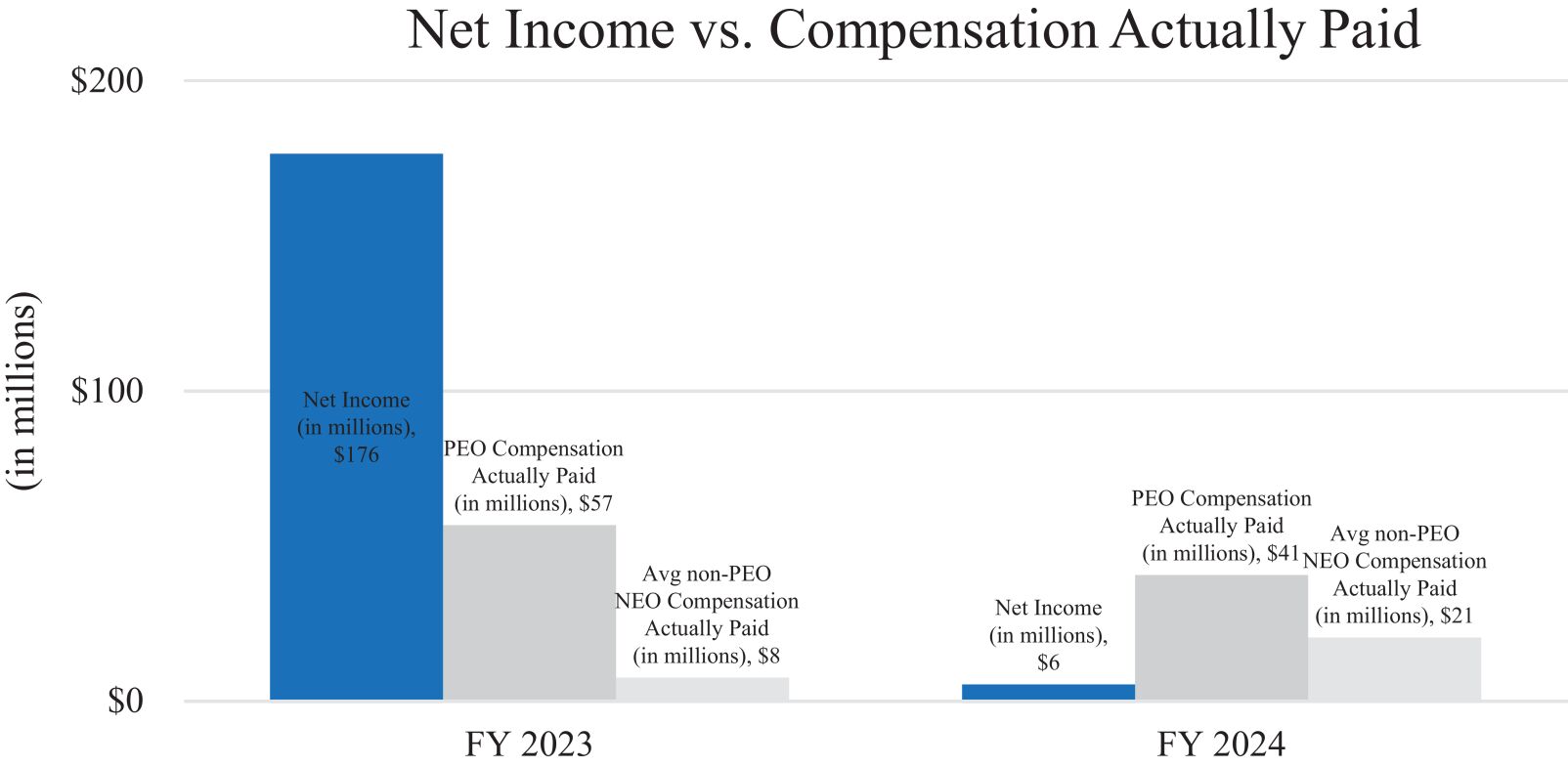

FY 2023 |

FY 2024 |

|||||||

Net Income (in millions) |

$ | 176 | $ | 6 | ||||

PEO Compensation Actually Paid (in millions) |

$ | 57 | $ | 41 | ||||

Avg. non-PEO NEO Compensation Actually Paid (in millions) |

$ | 8 | $ | 21 | ||||

FY 2023 |

FY 2024 |

|||||||

Adjusted EBITDA (in millions) (1) |

$ | 809 | $ | 1,251 | ||||

PEO Compensation Actually Paid (in millions) |

$ | 57 | $ | 41 | ||||

Avg. non-PEO NEO Compensation Actually Paid (in millions) |

$ | 8 | $ | 21 | ||||

| (1) | Adjusted EBITDA is a non-GAAP measure and is calculated from our audited financial statements as follows: net income, excluding income taxes, net interest expense, depreciation and amortization, equity-based compensation, merger and acquisition costs, certain legal |

costs, restructuring, severance and impairment charges, and certain other items when applicable. For a reconciliation of the differences between Adjusted EBITDA and the most directly comparable financial measure calculated and presented in accordance with GAAP, see Part II, Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operation—Non -GAAP Financial Measures” on page 54 and 55 of our Annual Report. |

September 12, 2023 |

FY 2023 |

FY 2024 |

||||||||||

Company TSR |

$ | 100 | $ | 82.19 | $ | 143.18 | ||||||

S&P 1500 Media and Entertainment Index TSR |

$ | 100 | $ | 107.00 | $ | 150.64 | ||||||

PEO Compensation Actually Paid (in millions) |

— | $ | 57 | $ | 41 | |||||||

Avg. non-PEO NEO Compensation Actually Paid (in millions) |

$ | 8 | $ | 21 | ||||||||