The investment objective of the Fund is to achieve as high a level of current income as is consistent with the preservation of capital and maintenance of liquidity.

This table describes the fees and expenses that you may pay if you buy, hold and sell shares of the Fund.

You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below.

Annual Fund Operating Expenses - JNL Government Money Market Fund |

Class I |

Class SL |

|||

|---|---|---|---|---|---|

| Management Fee | 0.08% | 0.08% | |||

| Distribution and/or Service (12b-1) Fees | none | none | |||

| Other Expenses | 0.11% | [1] | 0.11% | [2] | |

| Total Annual Fund Operating Expenses | 0.19% | 0.19% | |||

| Less Waiver/Reimbursement | [3] | 0.10% | |||

| Total Annual Fund Operating Expenses After Waiver/Reimbursement | 0.09% | ||||

| [1] | “Other Expenses” include an Administrative Fee of 0.10% which is payable to Jackson National Asset Management, LLC (“JNAM” or “Adviser”). |

| [2] | “Other Expenses” include an Administrative Fee of 0.10% which is payable to Jackson National Asset Management, LLC (“JNAM” or “Adviser”). |

| [3] | JNAM has contractually agreed to waive 100.00% of the administrative fees of the Class. The fee waiver will continue for at least one year from the date of the current Prospectus, and continue thereafter unless the Board of Trustees approves a change in or elimination of the waiver. This fee waiver is subject to yearly review and approval by the Board of Trustees. |

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The table below shows the expenses you would pay on a $10,000 investment, assuming (1) 5% annual return; (2) redemption at the end of each time period; and (3) that the Fund operating expenses remain the same. The example also assumes that the Class SL administrative fee waiver is discontinued after one year. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

Expense Example - JNL Government Money Market Fund - USD ($) |

Expense Example, with Redemption, 1 Year |

Expense Example, with Redemption, 3 Years |

Expense Example, with Redemption, 5 Years |

Expense Example, with Redemption, 10 Years |

|---|---|---|---|---|

| Class I | 19 | 61 | 107 | 243 |

| Class SL | 9 | 51 | 97 | 233 |

Under normal circumstances, the Fund seeks to achieve its investment objective by investing at least 99.5% of its total assets in cash, U.S. Government securities, and/or repurchase agreements that are “collateralized fully” (i.e., collateralized by cash or government securities). The government securities typically have a maximum remaining maturity of 397 calendar days and the repurchase agreements are collateralized by cash or government securities. Under normal circumstances, the Fund will invest at least 80% of its assets (net assets plus the amount of any borrowings made for investment purposes) in government securities or repurchase agreements collateralized by government securities. As a government money market fund, the Fund is exempt from requirements that permit money market funds to impose a liquidity fee. While the Fund’s Board of Trustees may elect to subject the Fund to liquidity fee requirements in the future, the Board of Trustees has not elected to do so at this time.

The Fund seeks to maintain a stable net asset value of $1.00 per share, neither the Federal Deposit Insurance Company, nor any other government agency insures or protects your investment.

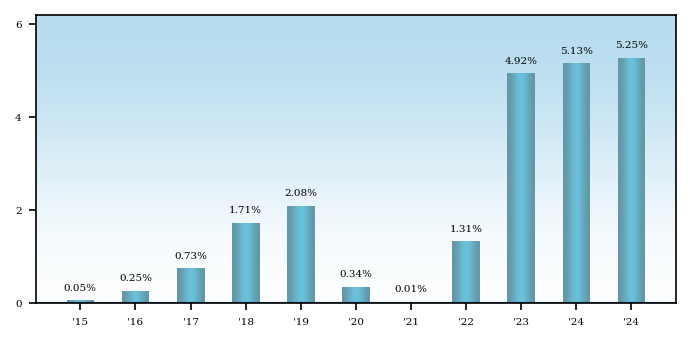

The performance information shown provides some indication of the risks of investing in the Fund by showing changes in the Fund’s performance from year to year and by showing how the Fund’s average annual returns compared with those of a broad-based securities market index and an additional index that the Adviser believes more closely reflects the market segments in which the Fund invests. Performance results include the effect of expense waiver/reduction arrangements for some or all of the periods shown. If such arrangements had not been in place, performance for those periods would have been lower. The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future.

Prior to September 19, 2016, the Fund was operated as a prime money market fund. Effective September 19, 2016, the Fund operates as a government money market fund and, as such, invests at least 99.5% of its total assets in cash, government securities and/or repurchase agreements that are “collateralized fully” (i.e., backed by cash or government securities). Performance prior to February 1, 2024 reflects the Fund’s results when managed by the former sub-adviser, Wellington Management Company LLP.

Effective December 31, 2024, for consistency with the Fund’s principal investment strategies, the Fund added the Bloomberg U.S. Aggregate Index as the Fund’s primary benchmark and the Bloomberg USD 1 Month Cash Deposit Index as the Fund’s secondary benchmark.

was %.

was %.

(ended ): %; (ended ): %

(ended ): %; (ended ): %

Average Annual Total Returns - JNL Government Money Market Fund |

1 Year |

5 Years |

10 Years |

Since Inception |

Inception Date |

|

|---|---|---|---|---|---|---|

| Class I | 5.13% | 2.32% | 1.64% | |||

| Class I | Bloomberg U.S. Aggregate Index (reflects no deduction for fees, expenses, or taxes) | 1.25% | (0.33%) | 1.35% | |||

| Class I | Bloomberg USD 1 Month Cash Deposit Index SPLICE (reflects no deduction for fees, expenses, or taxes) | [1] | 5.40% | 2.53% | 1.77% | ||

| Class SL | 5.25% | 5.25% | May 01, 2023 | |||

| Class SL | Bloomberg U.S. Aggregate Index (reflects no deduction for fees, expenses, or taxes) | 1.25% | 1.87% | ||||

| Class SL | Bloomberg USD 1 Month Cash Deposit Index SPLICE (reflects no deduction for fees, expenses, or taxes) | [2] | 5.40% | 5.42% | |||

| [1] | Index performance through December 30, 2020 reflects the performance of the FTSE U.S. Treasury Bill Index (1-month). Index performance beginning December 31, 2020 reflects the performance of the Bloomberg USD 1 Month Cash Deposit Index SPLICE. |

| [2] | Index performance through December 30, 2020 reflects the performance of the FTSE U.S. Treasury Bill Index (1-month). Index performance beginning December 31, 2020 reflects the performance of the Bloomberg USD 1 Month Cash Deposit Index SPLICE. |

| ● | Fixed-income risk – The price of fixed-income securities responds to economic developments, particularly interest rate changes, as well as to perceptions about the credit risk of individual issuers. Rising interest rates generally will cause the price of bonds and other fixed-income debt securities to fall. Falling interest rates may cause an issuer to redeem, call or refinance a security before its stated maturity, which may result in the Fund having to reinvest the proceeds in lower yielding securities. Bonds and other fixed-income debt securities are subject to credit risk, which is the possibility that the credit strength of an issuer will weaken and/or an issuer of a fixed-income security will fail to make timely payments of principal or interest and the security will go into default. Debt instruments typically do not provide any voting rights, except in cases when interest payments have not been made and the issuer is in default. |

| ● | Income risk – The Fund is subject to the risk that the income generated from the Fund’s investments may decline in the event of falling interest rates. Income risk may be high if the Fund’s income is predominantly based on short-term interest rates, which can fluctuate significantly over short periods. The Fund’s distributions to shareholders may decline when interest rates fall. |

| ● | Interest rate risk – When interest rates increase, fixed-income securities generally will decline in value. Long-term fixed income securities normally have more price volatility than short-term fixed income securities. The value of certain equity investments, such as utilities and real estate-related securities, may also be sensitive to interest rate changes. |

| ● | Repurchase agreements, purchase and sale contracts risk – If the other party to a repurchase agreement or purchase and sale contract defaults on its obligation under the agreement, the Fund may suffer delays and incur costs or lose money in exercising its rights under the agreement. If the seller fails to repurchase the security under a repurchase agreement or purchase and sale contract, and the market value of the security declines, the Fund may lose money. |

| ● | U.S. Government securities risk – Obligations issued by agencies and instrumentalities of the U.S. Government vary in the level of support they receive from the U.S. Government. They may be: (i) supported by the full faith and credit of the U.S. Treasury; (ii) supported by the right of the issuer to borrow from the U.S. Treasury; (iii) supported by the discretionary authority of the U.S. Government to purchase the issuer’s obligations; or (iv) supported only by the credit of the issuer. The maximum potential liability of the issuers of some U.S. Government securities may greatly exceed their current resources, or their legal right to receive support from the U.S. Treasury. |