PAY VERSUS PERFORMANCE

As required by Section 953(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act and Item 402(v) of Regulation S-K, the following table reports the compensation of our Principal Executive Officer (“PEO”), and the average compensation of our other Named Executive Officers (“Non-PEO NEOs”) as reported in the Summary Compensation Table for the past three fiscal years, as well as their “compensation actually paid” (“CAP”) as calculated pursuant to the applicable SEC rules and certain performance measures required by such rules.

The following table sets forth certain information with respect to the Company’s financial performance and the compensation paid to each of our Named Executive Officers for each of the fiscal years ended December 31, 2021, 2022, 2023 and 2024:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Value of Initial Fixed |

|

|

|

|

|

|

|

|||||||||||||

Year |

|

Summary |

|

|

Compensation |

|

|

Summary |

|

|

Compensation |

|

|

Average |

|

|

Average |

|

|

Total |

|

|

Peer Group |

|

|

Net |

|

|

Adjusted |

|

||||||||||

2024 |

|

|

6,066,502 |

|

|

|

12,553,964 |

|

|

|

— |

|

|

|

— |

|

|

|

2,605,810 |

|

|

|

4,787,225 |

|

|

|

197.19 |

|

|

|

147.73 |

|

|

|

72,864 |

|

|

|

112,076 |

|

2023 |

|

|

5,884,805 |

|

|

|

11,308,693 |

|

|

|

— |

|

|

|

— |

|

|

|

2,389,907 |

|

|

|

4,011,726 |

|

|

|

139.05 |

|

|

|

122.39 |

|

|

|

(2,974 |

) |

|

|

89,192 |

|

2022 |

|

|

6,542,743 |

|

|

|

6,070,680 |

|

|

|

— |

|

|

|

— |

|

|

|

2,589,267 |

|

|

|

2,423,449 |

|

|

|

92.01 |

|

|

|

92.42 |

|

|

|

53,159 |

|

|

|

50,384 |

|

2021 |

|

|

5,203,488 |

|

|

|

(1,745,320 |

) |

|

|

289,990 |

|

|

|

(1,874,864 |

) |

|

|

1,942,076 |

|

|

|

378,855 |

|

|

|

98.82 |

|

|

|

124.52 |

|

|

|

(68,522 |

) |

|

|

(18,946 |

) |

Year |

|

Current PEO |

|

Former PEO |

|

Non-PEO NEOs |

2024 |

|

Leonard Fluxman |

|

— |

|

Stephen B. Lazarus, Susan Bonner |

2023 |

|

Leonard Fluxman |

|

— |

|

Stephen B. Lazarus, Susan Bonner |

2022 |

|

Leonard Fluxman |

|

— |

|

Stephen B. Lazarus, Susan Bonner |

2021 |

|

Leonard Fluxman |

|

Glenn J. Fusfield |

|

Stephen B. Lazarus, Susan Bonner |

|

|

2021 |

|

|

2022 |

|

|

2023 |

|

|||||||||||||||||||

Adjustments |

|

Former |

|

|

Current |

|

|

Average |

|

|

Current |

|

|

Average |

|

|

PEO |

|

|

Average |

|

|||||||

Deduction for Amounts Reported under the |

|

$ |

(99,801 |

) |

|

$ |

(2,648,410 |

) |

|

$ |

(838,771 |

) |

|

$ |

(3,668,933 |

) |

|

$ |

(1,213,288 |

) |

|

$ |

(2,606,729 |

) |

|

$ |

(899,798 |

) |

Increase based on ASC 718 Fair Value of Awards Granted during Applicable FY that Remain Unvested as of Applicable FY End, determined as of Applicable FY End |

|

$ |

102,354 |

|

|

$ |

2,609,348 |

|

|

$ |

826,400 |

|

|

$ |

2,361,255 |

|

|

$ |

747,827 |

|

|

$ |

2,947,464 |

|

|

$ |

1,017,421 |

|

Increase based on ASC 718 Fair Value of Awards Granted during Applicable FY that Vested during Applicable FY, determined as of Vesting Date |

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

1,096,093 |

|

|

$ |

400,087 |

|

|

$ |

0 |

|

|

$ |

0 |

|

Increase/deduction for Awards Granted during Prior FY that were Outstanding and Unvested as of Applicable FY End, determined based on change in ASC 718 Fair Value from Prior FY End to Applicable FY End |

|

$ |

(4,606 |

) |

|

$ |

699,174 |

|

|

$ |

157,148 |

|

|

$ |

(123,347 |

) |

|

$ |

(27,628 |

) |

|

$ |

2,085,957 |

|

|

$ |

660,631 |

|

Increase/deduction for Awards Granted during Prior FY that Vested During Applicable FY, determined based on change in ASC 718 Fair Value from Prior FY End to Vesting Date |

|

$ |

1,707,917 |

|

|

$ |

864,688 |

|

|

$ |

237,081 |

|

|

$ |

(137,131 |

) |

|

$ |

(72,817 |

) |

|

$ |

2,997,196 |

|

|

$ |

843,566 |

|

Deduction of ASC 718 Fair Value of Awards Granted during Prior FY that were Forfeited during Applicable FY, determined as of Prior FY End |

|

$ |

(3,870,718 |

) |

|

$ |

(8,473,608 |

) |

|

$ |

(1,945,078 |

) |

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

Increase Based on Dividends or Other Earnings Paid during Applicable FY prior to Vesting Date |

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

Increase Based on Incremental Fair Value of Options/SARs Modified during Applicable FY |

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

Deduction for Change in the Actuarial |

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

Increase for Service Cost and, if applicable, |

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

TOTAL ADJUSTMENTS |

|

$ |

(2,164,854 |

) |

|

$ |

(6,948,808 |

) |

|

$ |

(1,563,221 |

) |

|

$ |

(472,063 |

) |

|

$ |

(165,818 |

) |

|

$ |

5,423,888 |

|

|

$ |

1,621,819 |

|

Current Peer Group (2024) |

Choice Hotels International |

e.l.f. Beauty |

European Wax Center |

Frontdoor |

Healthcare Services Group |

Hilton Grand Vacations |

Life Time Group |

Marriott Vacations Worldwide |

National Vision Holdings |

Olaplex |

Planet Fitness |

Playa Hotels & Resorts |

Travel + Leisure |

USANA Health Sciences |

Viad Corp |

Wyndham Hotels & Resorts |

Xponential Fitness |

For purposes of satisfying regulatory requirements under the Pay Versus Performance rule, in fiscal year 2024, the Company removed from its 2023 peer group (the “Old Peer Group”) Inter Parfums due to a different industry sector, Lindblad Expeditions for a different business model, Medifast, Nature’s Sunshine Products, The Beauty Health Company, and WW International for a low market capitalization, and Target Hospitality for different services. The Company also added Frontdoor, Healthcare Services Group, Hilton Grand Vacations, Life Time Group, Marriott Vacations Worldwide, Olaplex, Travel + Leisure, and Viad Corp. In fiscal years 2022 and 2021, we compared ourselves to the Dow Jones U.S. Travel & Leisure Index. For fiscal year 2023, we decided to use the Old Peer Group as it was more comparable to our business than the general U.S. Travel & Leisure Index. If we had been using the Old Peer Group, the Peer Group Total Shareholder Return would have been $111.49, $88.90, $100.01 and $104.72, for years 2021 through 2024, respectively.

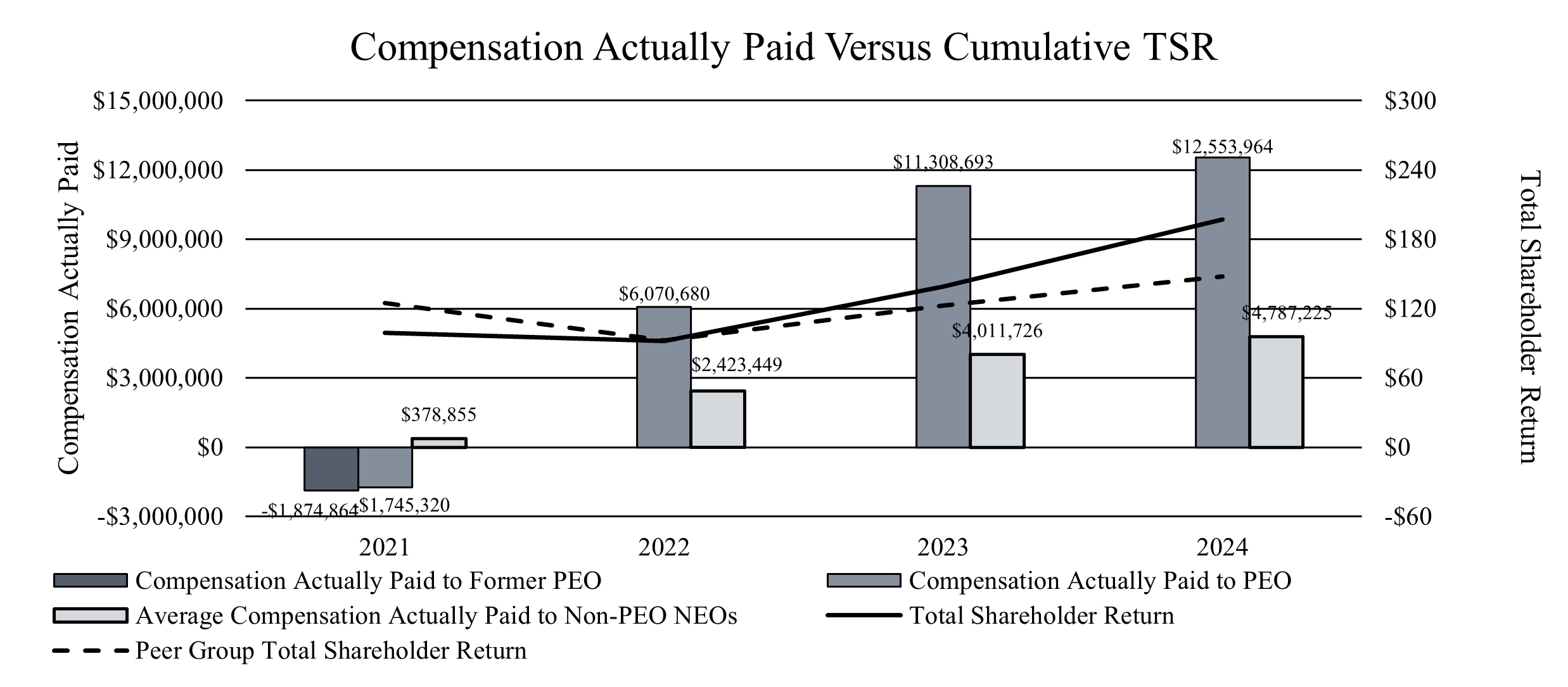

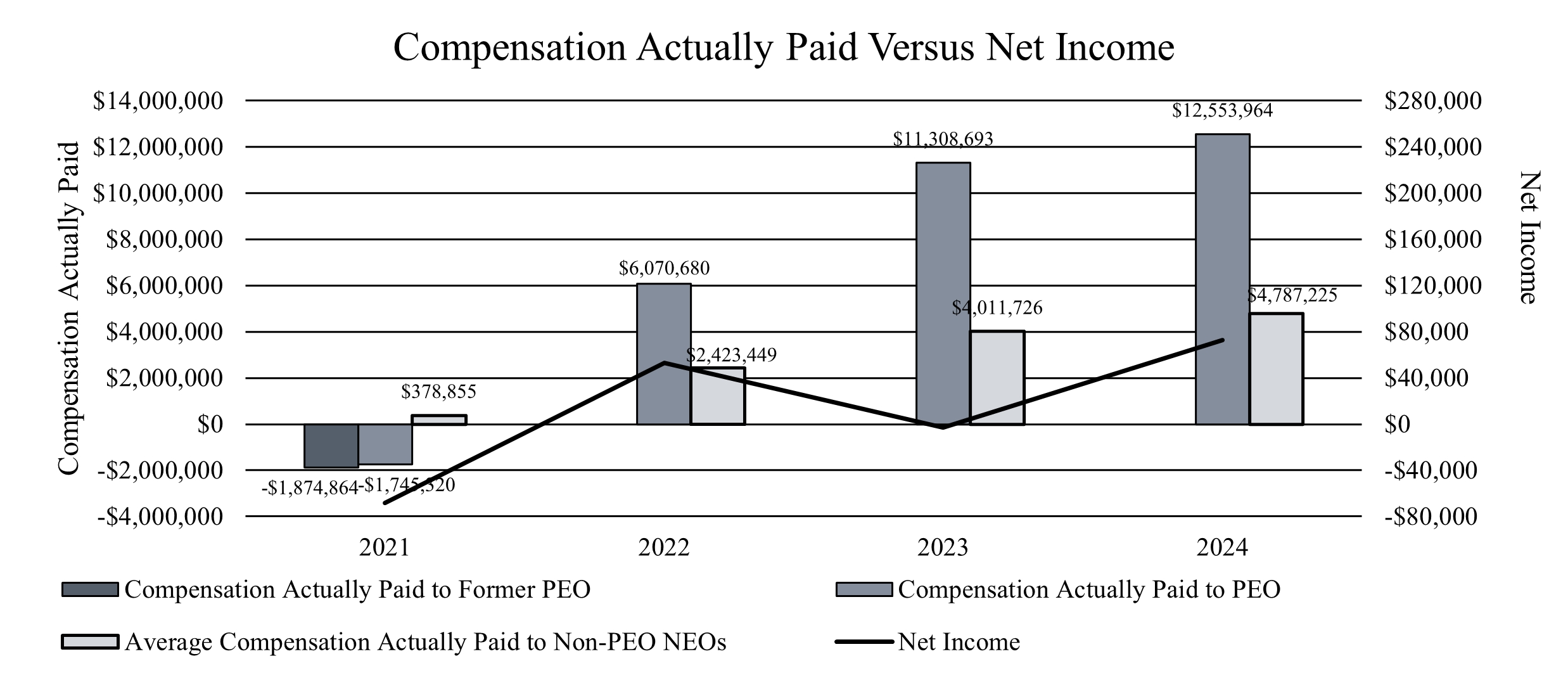

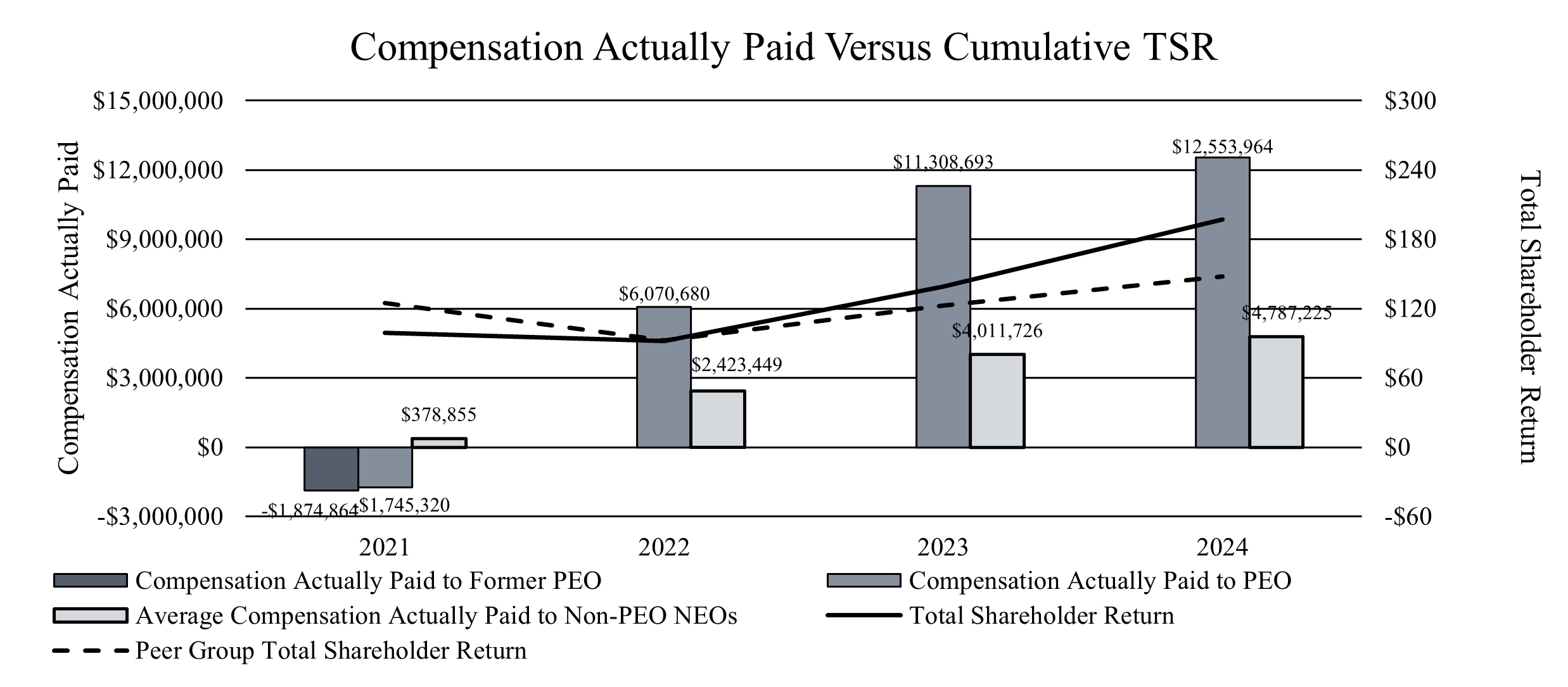

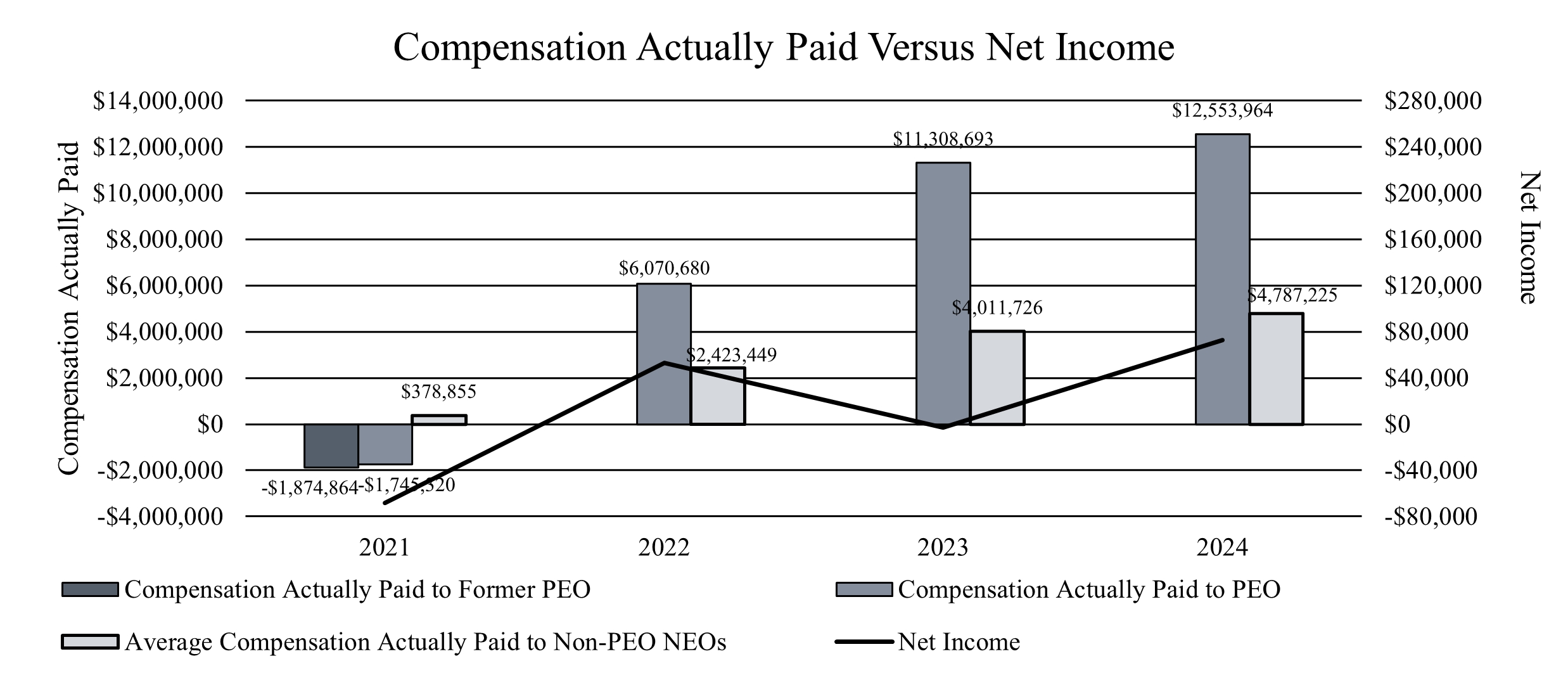

Pay versus Performance Comparative Disclosure

The graphs below compare the CAP to our PEO and the average of the CAP to Non-PEO NEOs, with (i) our cumulative Total Shareholder Return against our Peer Group Total Shareholder Return, (ii) our Net Income, and (iii) our Adjusted EBITDA, in each case, for the fiscal years ended December 31, 2021, 2022, 2023 and 2024. Total Shareholder Return amounts reported in the graph assume an initial fixed investment of $100, and that all dividends, if any, were reinvested.

Compensation Actually Paid and Company TSR

Compensation Actually Paid and Net Income

Compensation Actually Paid and Adjusted EBITDA

Pay Versus Performance Tabular List

We design our executive compensation plans to help attract, motivate, reward, and retain highly qualified executives who can create and sustain value for our shareholders. The following table lists the most important and only performance measure that we use to link CAP to our Named Executive Officers to company performance for the fiscal year ended December 31, 2024.

|

Most Important Performance Measure |

|

|

Adjusted EBITDA |

|

Year |

|

Current PEO |

|

Former PEO |

|

Non-PEO NEOs |

2024 |

|

Leonard Fluxman |

|

— |

|

Stephen B. Lazarus, Susan Bonner |

2023 |

|

Leonard Fluxman |

|

— |

|

Stephen B. Lazarus, Susan Bonner |

2022 |

|

Leonard Fluxman |

|

— |

|

Stephen B. Lazarus, Susan Bonner |

2021 |

|

Leonard Fluxman |

|

Glenn J. Fusfield |

|

Stephen B. Lazarus, Susan Bonner |

Current Peer Group (2024) |

Choice Hotels International |

e.l.f. Beauty |

European Wax Center |

Frontdoor |

Healthcare Services Group |

Hilton Grand Vacations |

Life Time Group |

Marriott Vacations Worldwide |

National Vision Holdings |

Olaplex |

Planet Fitness |

Playa Hotels & Resorts |

Travel + Leisure |

USANA Health Sciences |

Viad Corp |

Wyndham Hotels & Resorts |

Xponential Fitness |

For purposes of satisfying regulatory requirements under the Pay Versus Performance rule, in fiscal year 2024, the Company removed from its 2023 peer group (the “Old Peer Group”) Inter Parfums due to a different industry sector, Lindblad Expeditions for a different business model, Medifast, Nature’s Sunshine Products, The Beauty Health Company, and WW International for a low market capitalization, and Target Hospitality for different services. The Company also added Frontdoor, Healthcare Services Group, Hilton Grand Vacations, Life Time Group, Marriott Vacations Worldwide, Olaplex, Travel + Leisure, and Viad Corp. In fiscal years 2022 and 2021, we compared ourselves to the Dow Jones U.S. Travel & Leisure Index. For fiscal year 2023, we decided to use the Old Peer Group as it was more comparable to our business than the general U.S. Travel & Leisure Index. If we had been using the Old Peer Group, the Peer Group Total Shareholder Return would have been $111.49, $88.90, $100.01 and $104.72, for years 2021 through 2024, respectively.

|

|

2021 |

|

|

2022 |

|

|

2023 |

|

|||||||||||||||||||

Adjustments |

|

Former |

|

|

Current |

|

|

Average |

|

|

Current |

|

|

Average |

|

|

PEO |

|

|

Average |

|

|||||||

Deduction for Amounts Reported under the |

|

$ |

(99,801 |

) |

|

$ |

(2,648,410 |

) |

|

$ |

(838,771 |

) |

|

$ |

(3,668,933 |

) |

|

$ |

(1,213,288 |

) |

|

$ |

(2,606,729 |

) |

|

$ |

(899,798 |

) |

Increase based on ASC 718 Fair Value of Awards Granted during Applicable FY that Remain Unvested as of Applicable FY End, determined as of Applicable FY End |

|

$ |

102,354 |

|

|

$ |

2,609,348 |

|

|

$ |

826,400 |

|

|

$ |

2,361,255 |

|

|

$ |

747,827 |

|

|

$ |

2,947,464 |

|

|

$ |

1,017,421 |

|

Increase based on ASC 718 Fair Value of Awards Granted during Applicable FY that Vested during Applicable FY, determined as of Vesting Date |

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

1,096,093 |

|

|

$ |

400,087 |

|

|

$ |

0 |

|

|

$ |

0 |

|

Increase/deduction for Awards Granted during Prior FY that were Outstanding and Unvested as of Applicable FY End, determined based on change in ASC 718 Fair Value from Prior FY End to Applicable FY End |

|

$ |

(4,606 |

) |

|

$ |

699,174 |

|

|

$ |

157,148 |

|

|

$ |

(123,347 |

) |

|

$ |

(27,628 |

) |

|

$ |

2,085,957 |

|

|

$ |

660,631 |

|

Increase/deduction for Awards Granted during Prior FY that Vested During Applicable FY, determined based on change in ASC 718 Fair Value from Prior FY End to Vesting Date |

|

$ |

1,707,917 |

|

|

$ |

864,688 |

|

|

$ |

237,081 |

|

|

$ |

(137,131 |

) |

|

$ |

(72,817 |

) |

|

$ |

2,997,196 |

|

|

$ |

843,566 |

|

Deduction of ASC 718 Fair Value of Awards Granted during Prior FY that were Forfeited during Applicable FY, determined as of Prior FY End |

|

$ |

(3,870,718 |

) |

|

$ |

(8,473,608 |

) |

|

$ |

(1,945,078 |

) |

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

Increase Based on Dividends or Other Earnings Paid during Applicable FY prior to Vesting Date |

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

Increase Based on Incremental Fair Value of Options/SARs Modified during Applicable FY |

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

Deduction for Change in the Actuarial |

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

Increase for Service Cost and, if applicable, |

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

TOTAL ADJUSTMENTS |

|

$ |

(2,164,854 |

) |

|

$ |

(6,948,808 |

) |

|

$ |

(1,563,221 |

) |

|

$ |

(472,063 |

) |

|

$ |

(165,818 |

) |

|

$ |

5,423,888 |

|

|

$ |

1,621,819 |

|

|

|

2021 |

|

|

2022 |

|

|

2023 |

|

|||||||||||||||||||

Adjustments |

|

Former |

|

|

Current |

|

|

Average |

|

|

Current |

|

|

Average |

|

|

PEO |

|

|

Average |

|

|||||||

Deduction for Amounts Reported under the |

|

$ |

(99,801 |

) |

|

$ |

(2,648,410 |

) |

|

$ |

(838,771 |

) |

|

$ |

(3,668,933 |

) |

|

$ |

(1,213,288 |

) |

|

$ |

(2,606,729 |

) |

|

$ |

(899,798 |

) |

Increase based on ASC 718 Fair Value of Awards Granted during Applicable FY that Remain Unvested as of Applicable FY End, determined as of Applicable FY End |

|

$ |

102,354 |

|

|

$ |

2,609,348 |

|

|

$ |

826,400 |

|

|

$ |

2,361,255 |

|

|

$ |

747,827 |

|

|

$ |

2,947,464 |

|

|

$ |

1,017,421 |

|

Increase based on ASC 718 Fair Value of Awards Granted during Applicable FY that Vested during Applicable FY, determined as of Vesting Date |

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

1,096,093 |

|

|

$ |

400,087 |

|

|

$ |

0 |

|

|

$ |

0 |

|

Increase/deduction for Awards Granted during Prior FY that were Outstanding and Unvested as of Applicable FY End, determined based on change in ASC 718 Fair Value from Prior FY End to Applicable FY End |

|

$ |

(4,606 |

) |

|

$ |

699,174 |

|

|

$ |

157,148 |

|

|

$ |

(123,347 |

) |

|

$ |

(27,628 |

) |

|

$ |

2,085,957 |

|

|

$ |

660,631 |

|

Increase/deduction for Awards Granted during Prior FY that Vested During Applicable FY, determined based on change in ASC 718 Fair Value from Prior FY End to Vesting Date |

|

$ |

1,707,917 |

|

|

$ |

864,688 |

|

|

$ |

237,081 |

|

|

$ |

(137,131 |

) |

|

$ |

(72,817 |

) |

|

$ |

2,997,196 |

|

|

$ |

843,566 |

|

Deduction of ASC 718 Fair Value of Awards Granted during Prior FY that were Forfeited during Applicable FY, determined as of Prior FY End |

|

$ |

(3,870,718 |

) |

|

$ |

(8,473,608 |

) |

|

$ |

(1,945,078 |

) |

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

Increase Based on Dividends or Other Earnings Paid during Applicable FY prior to Vesting Date |

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

Increase Based on Incremental Fair Value of Options/SARs Modified during Applicable FY |

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

Deduction for Change in the Actuarial |

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

Increase for Service Cost and, if applicable, |

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

TOTAL ADJUSTMENTS |

|

$ |

(2,164,854 |

) |

|

$ |

(6,948,808 |

) |

|

$ |

(1,563,221 |

) |

|

$ |

(472,063 |

) |

|

$ |

(165,818 |

) |

|

$ |

5,423,888 |

|

|

$ |

1,621,819 |

|

Compensation Actually Paid and Company TSR

Compensation Actually Paid and Net Income

Compensation Actually Paid and Adjusted EBITDA

Pay Versus Performance Tabular List

We design our executive compensation plans to help attract, motivate, reward, and retain highly qualified executives who can create and sustain value for our shareholders. The following table lists the most important and only performance measure that we use to link CAP to our Named Executive Officers to company performance for the fiscal year ended December 31, 2024.

|

Most Important Performance Measure |

|

|

Adjusted EBITDA |

|